Issuer Free Writing Prospectus dated November 16, 2018

2018 Filed Pursuant to Rule 433

Registration No. 333-223891

Invesco DB Commodity Index Tracking Fund

As of Sept. 30, 2018

Fund Description

The Invesco DB Commodity Index Tracking Fund seeks to track changes, whether positive or negative, in the level of the DBIQ Optimum Yield Diversified Commodity Index Excess Return™ (DBIQ Opt Yield Diversified Comm Index ER) (the “Index”) over time plus the income from the Fund’s holdings of US Treasury securities, money market funds andT-Bill ETFs, less the Fund’s expenses. The Fund is designed for investors who want a cost-effective and convenient way to invest in commodity futures. The Index is a rules-based index composed of futures contracts on 14 of the most heavily traded and important physical commodities in the world. The Fund and the Index are rebalanced and reconstituted annually in November.

This Fund is not suitable for all investors due to the speculative nature of an investment based upon the Fund’s trading which takes place in very volatile markets. Because an investment in futures contracts is volatile, such frequency in the movement in market prices of the underlying futures contracts could cause large losses. Please see “Risk and Other Information” and the Prospectus for additional risk disclosures.

Fund Data

Fund Symbol DBC

Intraday NAV (IIV) DBCIIV

Share Price $17.97

NAV Price $17.95

Management Fee 0.85%

Estimated Futures Brokerage Expenses 0.04%

Total Expense Ratio 0.89%

CUSIP 46138B103

Listing Exchange NYSE Arca

Index Data

DBIQ Opt Yield Diversified Comm Index DBLCDBCE

ER

Index Provider Deutsche Bank

A Smart Beta Portfolio

Fund Inception: Feb. 3, 2006

Index history has certain inherent limitations and does not represent actual trading performance or returns of the Fund. Index history does not represent trades that have actually been executed and therefore may under or over compensate for the impact, if any, of certain market factors, such as illiquidity. No representation is being made that the Fund will or is likely to achieve profits or losses similar to the Index history.

From Feb. 3, 2006 (the Fund’s exchange listing date) to May 24, 2006, the Fund sought to track thenon-Optimum Yield version of the Deutsche Bank Liquid Commodity Index™ Excess Return. From May 24, 2006, to Oct. 16, 2009, the Fund sought to track the Optimum Yield version of the Deutsche Bank Liquid Commodity Index™ Excess Return. As of Oct. 19, 2009, the Fund commenced tracking the Deutsche Bank Liquid Commodity Index–Optimum Yield Diversified Excess Return™ (the “Interim Index”).

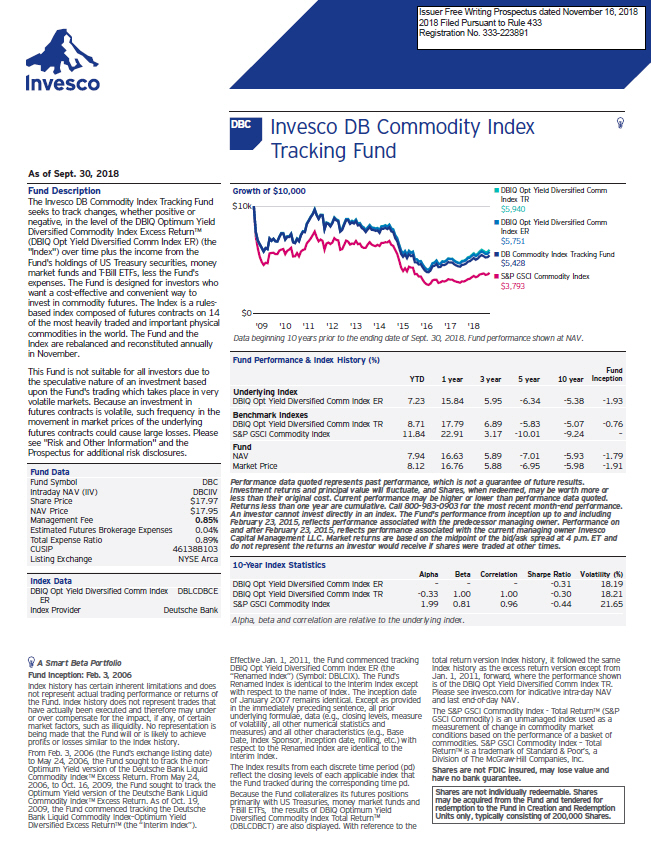

Data beginning 10 years prior to the ending date of Sept. 30, 2018. Fund performance shown at NAV.

Fund Performance & Index History (%)

YTD

1 year

3 year

5 year

10 year

Fund Inception

Underlying Index

DBIQ Opt Yield Diversified Comm Index ER

7.23

15.84

5.95

-6.34

-5.38

-1.93

Benchmark Indexes

DBIQ Opt Yield Diversified Comm Index TR

8.71

17.79

6.89

-5.83

-5.07

-0.76

S&P GSCI Commodity Index

11.84

22.91

3.17

-10.01

-9.24

—

Fund

NAV

7.94

16.63

5.89

-7.01

-5.93

-1.79

Market Price

8.12

16.76

5.88

-6.95

-5.98

-1.91

Performance data quoted represents past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, and Shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than performance data quoted. Returns less than one year are cumulative. Call800-983-0903 for the most recentmonth-end performance. An investor cannot invest directly in an index. The Fund’s performance from inception up to and including February 23, 2015, reflects performance associated with the predecessor managing owner. Performance on and after February 23, 2015, reflects performance associated with the current managing owner Invesco Capital Management LLC. Market returns are based on the midpoint of the bid/ask spread at 4 p.m. ET and do not represent the returns an investor would receive if shares were traded at other times.

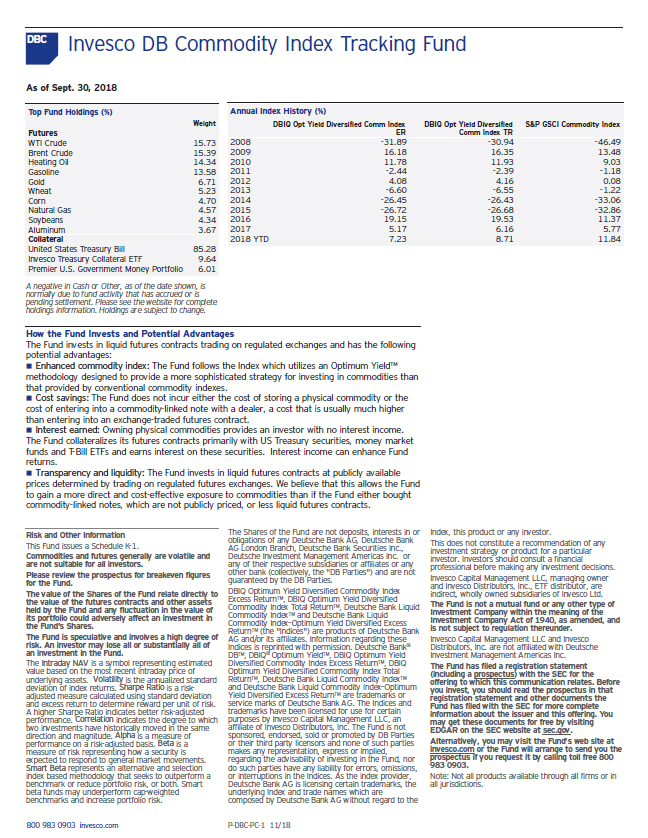

10-Year Index Statistics

Alpha

Beta

Correlation

Sharpe Ratio

Volatility (%)

DBIQ Opt Yield Diversified Comm Index ER

—

—

—

-0.31

18.19

DBIQ Opt Yield Diversified Comm Index TR

-0.33

1.00

1.00

-0.30

18.21

S&P GSCI Commodity Index

1.99

0.81

0.96

-0.44

21.65

Alpha, beta and correlation are relative to the underlying index.

Effective Jan. 1, 2011, the Fund commenced tracking DBIQ Opt Yield Diversified Comm Index ER (the “Renamed Index”) (Symbol: DBLCIX). The Fund’s Renamed Index is identical to the Interim Index except with respect to the name of Index. The inception date of January 2007 remains identical. Except as provided in the immediately preceding sentence, all prior underlying formulae, data (e.g., closing levels, measure of volatility, all other numerical statistics and measures) and all other characteristics (e.g., Base Date, Index Sponsor, inception date, rolling, etc.) with respect to the Renamed Index are identical to the Interim Index.

The Index results from each discrete time period (pd) reflect the closing levels of each applicable index that the Fund tracked during the corresponding time pd. Because the Fund collateralizes its futures positions primarily with US Treasuries, money market funds andT-Bill ETFs, the results of DBIQ Optimum Yield Diversified Commodity Index Total ReturnTM

(DBLCDBCT) are also displayed. With reference to the total return version Index history, it followed the same Index history as the excess return version except from Jan. 1, 2011, forward, where the performance shown is of the DBIQ Opt Yield Diversified Comm Index TR. Please see invesco.com for indicativeintra-day NAV and lastend-of-day NAV.

The S&P GSCI Commodity Index—Total Return™ (S&P GSCI Commodity) is an unmanaged index used as a measurement of change in commodity market conditions based on the performance of a basket of commodities. S&P GSCI Commodity Index — Total Return™ is a trademark of Standard & Poor’s, a Division of The McGraw-Hill Companies, Inc.

Shares are not FDIC insured, may lose value and have no bank guarantee.

Shares are not individually redeemable. Shares may be acquired from the Fund and tendered for redemption to the Fund in Creation and Redemption Units only, typically consisting of 200,000 Shares.