Risk information

This fund is not suitable for all investors due to the speculative nature of an investment based upon the fund’s trading which takes place in very volatile markets. Because an investment in futures contracts is volatile, such frequency in the movement in market prices of the underlying futures contracts could cause large losses. Please see the prospectus for additional risk disclosures.

The shares of the fund are not deposits, interests in or obligations of Deutsche Bank AG, Deutsche Bank AG London Branch, Deutsche Bank Securities Inc., DWS Investment Management Americas Inc. or any of their respective subsidiaries or affiliates or any other bank (collectively, the “DB Parties”) and are not guaranteed by the DB Parties.

Shares are not individually redeemable and owners of the shares may acquire those shares from the fund and tender those shares for redemption to the fund in creation unit aggregations only, typically consisting of 200,000 shares.

DBIQ Optimum Yield Diversified Commodity Index Excess Return™ (the “Index”) is a product of Deutsche Bank AG and/or its affiliates. Information regarding this Index is reprinted with permission. ©Copyright 2018. Deutsche Bank®, DB™, DBIQ®, and DBIQ Optimum Yield Diversified Commodity Index Excess Return™ are trademarks or service marks of Deutsche Bank AG and have been licensed for use for certain purposes by Invesco Capital Management LLC, an affiliate of Invesco Distributors, Inc. The fund is not sponsored, endorsed, sold or promoted by DB Parties or their third party licensors and none of such parties makes any representation, express or implied, regarding the advisability of investing in the fund, nor do such parties have any liability for errors, omissions, or interruptions in the Index. As the index provider, Deutsche Bank AG is licensing certain trademarks, the underlying Index and trade names which are composed by Deutsche Bank AG without regard to the Index, this product or any investor.

Invesco Capital Management LLC and Invesco Distributors, Inc. are not affiliated with DWS Investment Management Americas Inc.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

Beta is a measure of risk representing how a security is expected to respond to general market movements. Smart Beta represents an alternative and selection index based methodology that seeks to outperform a benchmark or reduce portfolio risk, both in active or passive vehicles.

Smart beta funds may underperformcap-weighted benchmarks and increase portfolio risk. Diversification does not ensure a profit or eliminate the risk of loss.

Invesco Capital Management LLC, investment adviser and Invesco Distributors, Inc., ETF distributor, are indirect, wholly owned subsidiaries of Invesco Ltd.

Commodities and futures generally are volatile and are not suitable for all investors.

Please review the prospectus for break-even figures for the fund.

Shares in the fund are not FDIC insured, may lose value and have no bank guarantee.

The value of the shares of the fund relate directly to the value of the futures contracts and other assets held by the fund and any fluctuation in the value of these assets could adversely affect an investment in the fund’s shares.

The fund is speculative and involves a high degree of risk. An investor may lose all or substantially all of an investment in the fund.

The fund is not a mutual fund or any other type of Investment Company within the meaning of the Investment Company Act of 1940, as amended, and is not subject to regulation thereunder.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1 800 983 0903.

NOT FDIC INSURED MAY LOSE VALUE NO BANK GUARANTEE

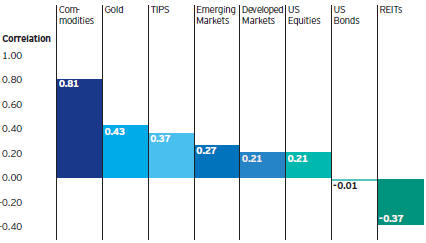

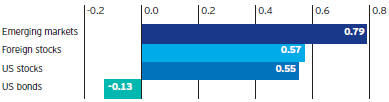

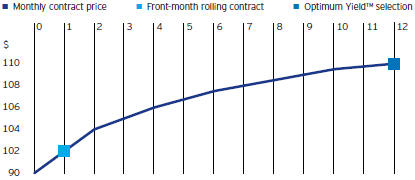

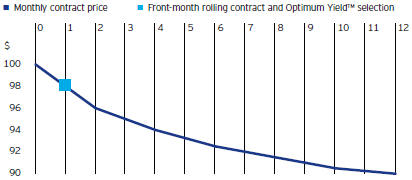

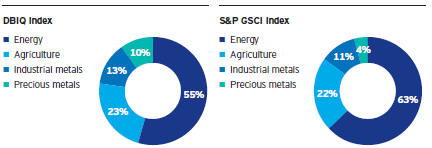

TheDBIQ Optimum Yield Diversified Commodity Index Excess ReturnTM is composed of futures contracts on 14 heavily traded commodities across the energy, precious metals, industrial metals and agriculture sectors. TheS&P GSCI Index measures the performance of commodities over time. TheConsumer Price Index (CPI) measures the prices consumers pay for a basket of consumer-based goods and services. TheBloomberg Barclays US Aggregate Bond Index represents the US investment-grade, fixed-rate bond market. TheGold Spot Fix PM establishes the price per ounce of gold at 3 p.m. London time as deemed by the five members of the London Gold Pool. The five members determine where supply meets demand for the bank’s entire pending buy and sell orders to find a price balance. TheICE BofAML US Inflation-Linked Treasury Index is an unmanaged index comprised of US Treasury Inflation-Protected Securities with at least $1 billion in outstanding face value and a remaining term to final maturity of greater than one year. TheMSCI Emerging Markets Index represents stocks of developing countries. TheMSCI EAFE Index represents stocks of Europe, Australasia and the Far East. TheMSCI US REIT Index is an unmanaged index considered representative of real estate equity performance. The index is computed using the gross return, which does not withhold taxes fornon-resident investors.

Note: Not all products available through all firms or in all jurisdictions.

invesco.com/us P-DBC-FIF-1 08/19 Invesco Distributors, Inc. NA7655