UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington DC.20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number

Global Crossing (UK) Telecommunications Limited

(Exact name of Registrant as specified in its charter)

Global Crossing (UK) Finance Plc

Fibernet Group Limited

Fibernet UK Limited

Fibernet Limited

(Additional Registrant)

England and Wales

(Jurisdiction of incorporation or organization)

1 London Bridge, London, SE1 9BG, United Kingdom

(Address of principal executive offices)

Bernard Keogh

Telephone: +44 (0) 845 000 1000, Facsimile: +44 (0) 207 904 2930

1 London Bridge, London, SE1 9BG, United Kingdom

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act: None

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

11.75% pound sterling-denominated senior secured notes due 2014

10.75% US dollar-denominated senior secured notes due 2014

Guarantees relating to 10.75% senior secured notes due 2014 and 11.75% senior secured notes due 2014

(Title of Class)

Indicate the number of outstanding shares of each of the Issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Ordinary shares, nominal value £1.00 per share: 101,000 shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in rule 405 of the Securities Act. Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark which basis of accountancy the registrant has used to prepare the financial statements including in this filing:

| | | | |

US GAAP ¨ | | International Financial Reporting Standards as issued by the International Accounting Standards Board x | | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

TABLE OF CONTENTS

PART I

PRESENTATION OF INFORMATION

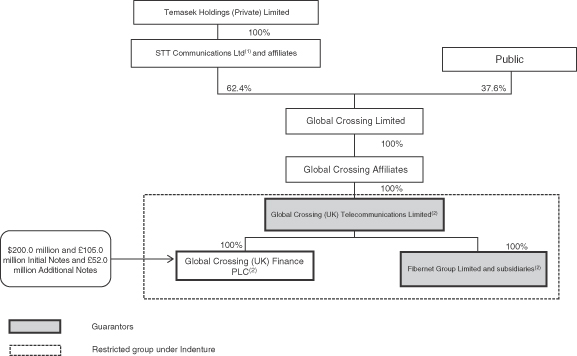

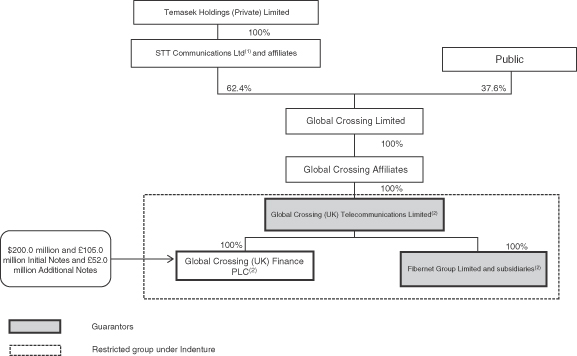

Corporate Organization

All references in this annual report on Form 20-F to:

| | • | | “we,” “us,” “our,” the “Company,” and “GCUK” are to Global Crossing (UK) Telecommunications Limited and its consolidated subsidiaries, including the Issuer, except where expressly stated otherwise or the context otherwise requires; |

| | • | | “Guarantors” are to GCUK, Fibernet Group Limited (formerly Fibernet Group plc), Fibernet UK Limited and Fibernet Limited; |

| | • | | “Guarantees” are to the guarantees by the Guarantors of the Notes on a senior basis; |

| | • | | “Fibernet Group” are to, collectively, Fibernet Group Limited, a company incorporated in England and Wales, and its consolidated subsidiaries at such time; |

| | • | | “Fibernet” are to Fibernet Group, excluding Fibernet Holdings Limited and Fibernet GmbH, which were transferred to Global Crossing International Ltd, one of our affiliates, prior to our acquisition of Fibernet Group Limited on December 28, 2006; |

| | • | | “GC Acquisitions” are to GC Acquisitions UK Limited, a wholly owned subsidiary of GCL formed for the purpose of acquiring Fibernet Group plc; |

| | • | | “GCI” are to Global Crossing International Ltd, a wholly owned subsidiary of GCL; |

| | • | | the “Issuer” and “GC Finance” are to Global Crossing (UK) Finance Plc, a company organized under the laws of England and Wales, and our direct, wholly owned finance subsidiary that is the Issuer of the Notes guaranteed by the Guarantors and which has had no trading activity, except where expressly stated otherwise or the context otherwise requires; |

| | • | | “GCL,” “Global Crossing,” “our parent” and “our parent company” are to Global Crossing Limited, a company organized under the laws of Bermuda and our indirect parent company by which we are indirectly wholly owned; |

| | • | | “old parent company” or “old parent” are to Global Crossing Ltd., a company formed under the laws of Bermuda and our parent company’s predecessor; |

| | • | | “Bidco,” “our immediate parent” and “our immediate parent company” are to Global Crossing (Bidco) Limited, a company organized under the laws of England and Wales and our direct parent company by whom we are directly wholly owned and which is indirectly wholly owned by GCL; |

| | • | | “Group Companies” and “GC Group” are to the group of companies owned directly or indirectly by GCL, including us; |

| | • | | “STT” are to STT Communications Ltd, a Singapore company, a subsidiary of Temasek Holdings (Private) Limited regarded as our ultimate parent company; and |

| | • | | “Network Rail” are to Network Rail Infrastructure Limited, the successor to Railtrack plc, as the operator of the UK national railway infrastructure network. |

Financial and Other Information

All references in this annual report on Form 20-F to:

| | • | | the “UK” are to the United Kingdom; |

| | • | | “pounds sterling,” “sterling,” “£” or “pence” are to the lawful currency of the United Kingdom; |

| | • | | the “United States” or the “US” are to the United States of America; |

| | • | | “US$,” “US Dollars,” “dollars” or “$” are to the lawful currency of the United States; |

| | • | | the “EU” are to the European Union; |

| | • | | “euro” or “€” are to a lawful currency of the European Union; |

1

| | • | | the “Initial Notes” are to the 10.75% dollar-denominated senior secured notes and the 11.75% pounds sterling-denominated senior secured notes issued by the Issuer on December 23, 2004 and to the exchange notes that the Issuer issued pursuant to a registered exchange offer in respect of such notes; |

| | • | | the “Additional Notes” are to the 11.75% pounds sterling-denominated senior secured notes issued by the Issuer on December 28, 2006, and to the exchange notes issued by the Issuer pursuant to a registered exchange offer in respect of such notes; |

| | • | | the “Notes” and “Senior Secured Notes” are to, collectively, the Initial Notes and the Additional Notes; and |

| | • | | the “Indenture” are to the indenture, dated December 23, 2004, governing the Notes. |

The consolidated financial statements and the related notes in this annual report on Form 20-F have been prepared in conformity with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and IFRS as adopted by the EU. IFRS as adopted by the EU differ in certain respects from IFRS as issued by the IASB, however, the differences have no impact on the Company’s consolidated financial statements for the years presented. References to “IFRS” hereafter should be construed as reference to IFRS as issued by the IASB.

Some financial information has been rounded and, as a result, the numerical figures shown as totals in this annual report on Form 20-F may vary slightly from the exact arithmetic aggregation of figures that precede them.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

The following table sets forth, for the periods indicated, certain information concerning the noon buying rate in the City of New York for cable transfers in pounds sterling as certified by the Federal Reserve Board for customs purposes, or the “noon buying rate,” for pounds sterling expressed in dollars per £1.00. As of April 10, 2009, the noon buying rate for pounds sterling expressed in dollars per £1.00 was 1.464.

| | | | | | | | | | | | |

| | | Dollars per £1.00 |

| | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009

(through

April 10) |

Exchange rate at end of period (Year ended December 31, except 2009) | | 1.916 | | 1.719 | | 1.959 | | 1.961 | | 1.462 | | 1.464 |

Average exchange rate during period* | | 1.836 | | 1.815 | | 1.858 | | 2.007 | | 1.842 | | 1.441 |

Highest exchange rate during period | | 1.948 | | 1.929 | | 1.979 | | 2.110 | | 2.031 | | 1.525 |

Lowest exchange rate during period | | 1.754 | | 1.714 | | 1.726 | | 1.924 | | 1.440 | | 1.366 |

| * | The average of the noon buying rates for cable transfer in pound sterling as certified for customs purposes by the Federal Reserve Bank of New York on the last business day of each month during the applicable period (through April 10 in the case of 2009). |

| | | | |

Month | | Highest exchange

rate

during the month | | Lowest exchange

rate

during the month |

October 2008 | | 1.780 | | 1.547 |

November 2008 | | 1.616 | | 1.479 |

December 2008 | | 1.546 | | 1.440 |

January 2009 | | 1.525 | | 1.366 |

February 2009 | | 1.494 | | 1.422 |

March 2009 | | 1.473 | | 1.376 |

April 2009 | | 1.480 | | 1.440 |

MARKET AND INDUSTRY DATA

In this annual report on Form 20-F, we rely on and refer to information and statistics regarding our industry. We obtained these market data from independent industry publications or other publicly available information. Although we believe that these sources are reliable, we have not independently verified and do not guarantee the accuracy and completeness of this information.

2

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F contains certain “forward-looking statements,” as such term is defined in Section 21E of the Securities Exchange Act of 1934, as amended. These statements set forth anticipated results based on management’s plans and assumptions. From time to time, we also provide forward-looking statements in other materials we release to the public as well as oral forward-looking statements. Such statements give our current expectations or forecasts of future events; they do not relate strictly to historical or current facts. We have attempted to identify such statements by using words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will”, “could” and similar expressions in connection with any discussion of future events or future operating or financial performance or strategies or trends. Such forward-looking statements include, but are not limited to, statements regarding:

| | • | | our services, including the development and deployment of data products and services based on Internet Protocol (“IP”) and other technologies and strategies to expand our targeted customer base and broaden our sales channels and the opening and expansion of our data center and collocation services; |

| | • | | the operation and maintenance of our network, including with respect to the development of IP-based services and data center and collocation services; |

| | • | | our liquidity and financial resources, including anticipated capital expenditures, funding of capital expenditures and anticipated levels of indebtedness and the ability to raise capital through financing activities, including capital leases and similar financings; |

| | • | | trends related to and management’s expectations regarding capital expenditures, results of operations, required capital expenditures, revenues from existing and new lines of business and sales channels, adjusted earnings before interest, tax and depreciation, order volumes and cash flows including but not limited to those statements set forth below in Item 5 in “Operating and Financial Review and Prospects”; and |

| | • | | sales efforts, expenses, interest rates, foreign exchange rates, and the outcome of contingencies, such as legal proceedings. |

We cannot guarantee that any forward-looking statement will be realized. Achievement of future results is subject to risks, uncertainties and potentially inaccurate assumptions. Should known or unknown risks or uncertainties materialize, or should underlying assumptions prove inaccurate, actual results could vary materially from past results and those anticipated, estimated or projected. Investors should bear this in mind as they consider forward-looking statements.

We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any further disclosures we make on related subjects in our quarterly and current reports on Form 6-K or that GCL makes regarding us in its current reports on Form 8-K. Also note that we provide the following cautionary discussion of risks and uncertainties related to our businesses. These are factors that we believe, individually or in the aggregate, could cause our actual results to differ materially from expected and historical results. We note these factors for investors as permitted by Section 21E of the Securities Exchange Act of 1934. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider the following to be a complete discussion of all potential risks or uncertainties.

Our forward-looking statements are subject to a variety of factors that could cause actual results to differ significantly from current beliefs and expectations. In addition to the risk factors identified in Item 3.D. “Key Information—Risk Factors”, the operations and results of our business are subject to risks and uncertainties identified elsewhere in this annual report on Form 20-F as well as general risks and uncertainties such as those relating to general economic conditions and demand for telecommunications services.

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

3

| A. | Selected Financial Data |

You should read the following selected financial data together with the Item 5 “Operating and Financial Review and Prospects” and our financial statements and the accompanying notes thereto included elsewhere in this annual report on Form 20-F.

The selected financial data as at December 31, 2004, 2005 and 2006 and for the years ended December 31, 2004 and 2005 were derived from our financial statements which are not included in this annual report on Form 20-F. The selected financial data as at December 31, 2007 and 2008 and for each of the years ended December 31, 2006, 2007 and 2008 have been derived from our consolidated financial statements and related notes thereto included elsewhere in this annual report on Form 20-F.

The historical financial data has been prepared in conformity with IFRS (see note 2 “accounting policies” within the accompanying consolidated financial statements).

In reading the selected historical financial data, please note the following:

| | • | | On December 28, 2006, we announced that our subsidiary, GC Finance, had completed its offering of the Additional Notes. The £52.0 million aggregate principal amount of the Additional Notes was priced at 109.25 percent of par value and the issue raised £56.8 million in gross proceeds. The Additional Notes were issued under the Indenture pursuant to which GC Finance issued the Initial Notes. |

| | • | | On December 28, 2006, proceeds from the offering were used to acquire Fibernet from GC Acquisitions, and to pay fees and expenses incurred in connection with the acquisition of Fibernet by GCUK and the offering of the Additional Notes. Upon completion of the acquisition by GCUK, Fibernet guaranteed the Additional Notes and all other obligations under the Indenture. Prior to the acquisition by GCUK, Fibernet Group transferred its German business operations to GCI, by way of a transfer of Fibernet Holdings Limited, and its wholly owned subsidiary Fibernet GmbH, to GCI, for consideration of £1 and the assumption, by GCI, of £3.6 million of debt outstanding to Fibernet. See note 4 (“business combinations”) within the accompanying consolidated financial statements included elsewhere in this annual report on Form 20-F. |

4

| | • | | Fibernet results from December 28, 2006 only are included within the following income statement data. |

| | • | | Fibernet’s position as of December 31, 2006, 2007 and 2008 only is included within the following balance sheet data. |

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2004 | | | 2005 | | | 2006(3) | | | 2007 | | | 2008 | |

Profit and Loss Account Data: | | | | | | | | | | | | | | | | | | | | |

Revenue | | £ | 271,096 | | | £ | 239,498 | | | £ | 240,612 | | | £ | 296,620 | | | £ | 322,832 | |

Cost of sales | | | (156,735 | ) | | | (136,317 | ) | | | (147,481 | ) | | | (177,665 | ) | | | (200,487 | ) |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 114,361 | | | | 103,181 | | | | 93,131 | | | | 118,955 | | | | 122,345 | |

| | | | | | | | | | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | | | | | | | | | |

Distribution costs | | | (10,504 | ) | | | (10,009 | ) | | | (10,385 | ) | | | (15,710 | ) | | | (18,361 | ) |

Administrative expenses | | | (40,258 | ) | | | (47,738 | ) | | | (53,683 | ) | | | (69,468 | ) | | | (75,037 | ) |

Net gain arising from acquisition of Fibernet | | | — | | | | — | | | | 7,755 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| | | (50,762 | ) | | | (57,747 | ) | | | (56,313 | ) | | | (85,178 | ) | | | (93,398 | ) |

| | | | | | | | | | | | | | | | | | | | |

Operating profit | | | 63,599 | | | | 45,434 | | | | 36,818 | | | | 33,777 | | | | 28,947 | |

Finance costs, net | | | (613 | ) | | | (39,919 | ) | | | (14,688 | ) | | | (29,021 | ) | | | (58,360 | ) |

Tax benefit/(charge) | | | 11,364 | | | | 2,477 | | | | (9,377 | ) | | | (6,297 | ) | | | (432 | ) |

| | | | | | | | | | | | | | | | | | | | |

Profit/(loss) | | £ | 74,350 | | | £ | 7,992 | | | £ | 12,753 | | | £ | (1,541 | ) | | £ | (29,845 | ) |

| | | | | | | | | | | | | | | | | | | | |

Balance Sheet Data (at period end): | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | £ | 21,193 | | | £ | 44,847 | | | £ | 40,309 | | | £ | 23,954 | | | £ | 36,100 | |

Trade and other receivables(1) | | | 64,633 | | | | 59,954 | | | | 59,182 | | | | 66,237 | | | | 56,276 | |

Working capital/(deficit)(2) | | | 6,897 | | | | (8,532 | ) | | | (18,399 | ) | | | 618 | | | | (25,633 | ) |

Intangible assets, net | | | 1,634 | | | | 1,296 | | | | 14,241 | | | | 13,351 | | | | 11,955 | |

Property, plant and equipment, net | | | 135,593 | | | | 129,005 | | | | 182,556 | | | | 185,719 | | | | 179,544 | |

Total assets | | | 241,092 | | | | 255,382 | | | | 336,877 | | | | 318,933 | | | | 324,866 | |

Senior secured notes | | | (195,335 | ) | | | (209,094 | ) | | | (249,631 | ) | | | (248,946 | ) | | | (286,928 | ) |

Obligations under finance leases | | | (39,615 | ) | | | (30,342 | ) | | | (32,423 | ) | | | (32,187 | ) | | | (24,225 | ) |

Other debt obligations | | | — | | | | — | | | | (399 | ) | | | (893 | ) | | | (980 | ) |

Total shareholders’ deficit | | | (219,105 | ) | | | (204,718 | ) | | | (196,272 | ) | | | (194,952 | ) | | | (217,212 | ) |

Other data: | | | | | | | | | | | | | | | | | | | | |

Depreciation and amortization | | £ | 21,193 | | | £ | 20,104 | | | £ | 24,551 | | | £ | 42,161 | | | £ | 44,699 | |

Capital expenditures | | | 7,811 | | | | 9,452 | | | | 20,435 | | | | 32,531 | | | | 21,860 | |

EBITDA(4) | | | 84,792 | | | | 65,538 | | | | 60,319 | | | | 75,938 | | | | 73,646 | |

(1) | Trade and other receivables are due in less than one year and include operating and non-operating receivables from other Group Companies. Excluding the receivables from other Group Companies, trade and other receivables due in less than one year are £63.6 million and £53.7 million at December 31, 2007 and 2008, respectively. |

(2) | Working capital/(deficit) consists of the current portion of trade and other receivables, less trade and other payables. Working capital/(deficit) includes operating and non-operating receivables and payables from other Group Companies. Excluding all receivables and payables from other Group Companies, there was a working capital surplus of £5.8 million at December 31, 2007 and a working capital deficit of £17.6 at December 31, 2008. |

(3) | Initial accounting for the acquisition of Fibernet was determined only provisionally as at December 31, 2006. In accordance with IFRS 3 “Business Combinations” (“IFRS 3”), any adjustment to the provisional values as a result of completing the initial accounting requires restatement of comparative financial statements. During the year ended December 31, 2007, an adjustment to increase the liabilities assumed in the acquisition was recorded which resulted in a change in the amount of negative goodwill and resulting gain recorded at the acquisition date. This adjustment has been reflected in the consolidated income statement for the year ended as at December 31, 2006. |

5

(4) | EBITDA, calculated using IFRS financial information, consists of profit/loss for the period before tax benefit/(charge), net finance costs, depreciation and amortization. Although EBITDA is not a measure of operating profit/(loss), operating performance or liquidity under IFRS, we have presented EBITDA in accordance with Section 4.17 of the Indenture governing the Senior Secured Notes. Some investors may consider EBITDA a relevant indicator of operating performance and of the ability to service indebtedness and fund on-going capital expenditures, especially in a capital intensive industry such as telecommunications. You should not use EBITDA as a substitute for the analysis provided in our income statements or in our cash flow statements. Our calculation of EBITDA may not be consistent with the EBITDA measures of other companies and is not consistent with GCL’s calculation of Adjusted cash EBITDA. The following table reconciles EBITDA to profit/loss: |

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2004 | | | 2005 | | | 2006(1) | | | 2007 | | | 2008 | |

Profit/(loss) | | £ | 74,350 | | | £ | 7,992 | | | £ | 12,753 | | | £ | (1,541 | ) | | £ | (29,845 | ) |

Finance costs, net | | | 613 | | | | 39,919 | | | | 14,688 | | | | 29,021 | | | | 58,360 | |

Tax (benefit)/charge | | | (11,364 | ) | | | (2,477 | ) | | | 9,377 | | | | 6,297 | | | | 432 | |

Recognition of negative goodwill | | | — | | | | — | | | | (1,050 | ) | | | — | | | | — | |

Depreciation | | | 14,217 | | | | 15,444 | | | | 19,041 | | | | 31,730 | | | | 32,910 | |

Amortization | | | 6,976 | | | | 4,660 | | | | 5,510 | | | | 10,431 | | | | 11,789 | |

| | | | | | | | | | | | | | | | | | | | |

EBITDA | | £ | 84,792 | | | £ | 65,538 | | | £ | 60,319 | | | £ | 75,938 | | | £ | 73,646 | |

| | | | | | | | | | | | | | | | | | | | |

(1) | Initial accounting for the acquisition of Fibernet was determined only provisionally as at December 31, 2006. In accordance with IFRS 3, any adjustment to the provisional values as a result of completing the initial accounting requires restatement of comparative financial statements. During the year ended December 31, 2007, an adjustment to increase the liabilities assumed in the acquisition was recorded which resulted in a change in the amount of negative goodwill and resulting gain recorded at the acquisition date. This adjustment has been reflected in the consolidated income statement for the year ended as at December 31, 2006. |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

Our business, and any investment in us, is subject to a number of significant risks, including those described below. Additional risks and uncertainties not presently known to us, or that we currently believe are immaterial, could also impair our business, financial condition, results of operations and our ability to fulfill our obligations under the Notes. See Item 5.B. “Operating and Financial Review and Prospects—Liquidity and Capital Resources—Indebtedness—Senior Secured Notes.”

In addition to the risk factors identified under the captions below, the operations and results of our business are subject to risks and uncertainties identified elsewhere in this annual report on Form 20-F as well as general risks and uncertainties such as those relating to general economic conditions and demand for telecommunications services.

Risks related to Our Business and Industry

We face a number of risks related to current global economic conditions and the severe tightening in the global credit markets.

Recently, the global economy and capital and credit markets have been experiencing exceptional turmoil and upheaval. Many major economies entered significant recessions in 2008 which continue into 2009. Ongoing concerns about the systemic impact of potential long-term and wide-spread recession, volatile energy costs, geopolitical issues, the availability, cost and terms of credit, consumer and business confidence, substantially increased unemployment and the crisis in the global housing and mortgage markets have contributed to increased market volatility and diminished expectations for both established and emerging economies, including those in which we operate. In the second half of 2008, added concerns fueled by government interventions in financial systems led to increased market uncertainty and instability in the US, UK and other international capital and credit markets. These conditions have contributed to economic uncertainty of unprecedented levels. The availability, cost and terms of credit have also been and may continue to be adversely affected by illiquid markets

6

and wider credit spreads. Concern about the stability of the markets generally and the strength of counterparties specifically has led many lenders and institutional investors to reduce, and in many cases cease to provide, credit to businesses and consumers. These factors have led to a substantial and continuing decrease in spending by businesses and consumers, and a corresponding decrease in global infrastructure spending. Continued turbulence in the US, UK and other international markets and economies and prolonged declines in business and consumer spending may adversely affect our liquidity and financial condition, including our ability to refinance maturing debt instruments and to access the capital markets and obtain capital lease financing to meet liquidity needs. This financial crisis may have an impact on our business and financial condition in the following ways as well as others that we currently cannot predict:

| | • | | Negative impacts from increased financial pressures on customers: Uncertainty about current and future global economic conditions and credit markets may cause consumers, business and governments to defer purchases in response to tighter credit, decreased availability of cash and credit and declining business and consumer confidence, and may affect the solvency of our customers. Accordingly, future demand for our products and services could differ from our current expectations. Similarly, our customers may experience liquidity issues of their own that adversely affect our ability to collect amounts due from them in a timely fashion, or at all. In addition, if the global economy and credit markets continue to deteriorate and our future sales decline, our financial condition and results of operations would be adversely impacted; and |

| | • | | Negative impacts from increased financial pressures on our ability to maintain and further enhance our network: We plan to arrange financing with vendors and third parties for a significant portion of the capital expenditures that we plan for 2009 for the maintenance and upgrade of capacity and services for our telecommunication systems. The lack of credit in the global capital markets may constrain our ability to obtain such financing on commercially reasonable terms or at all. To the extent we are not able to obtain appropriate financing, we may not be able to implement certain of our growth investments budgeted for 2009 and thereby not realize additional revenues to support our business. |

We may not be able to achieve anticipated economies of scale.

We expect that economies of scale will allow us to grow revenues while incurring incremental costs that are proportionately lower than those applicable to our existing business. If the increased costs required to support our revenue growth turn out to be greater than anticipated, we may be unable to improve our profitability and/or cash flows even if revenue growth goals are achieved. The current downturn in the world economy could temper our growth, although the value we offer prospective customers could attract business in a cost-saving environment.

Improvements in our cost structure in the short term become more difficult as the amount of potential savings decreases due to the success of past savings initiatives. Cost savings initiatives put a strain on our existing employees and make it more challenging to foster an engaged and enthusiastic workforce. Customer service, which is a critical component of our value proposition, could suffer if employee engagement were to deteriorate.

Future cash flows may not meet our expectations.

Our cash flow expectations are predicated on significant revenue growth in our target enterprise and carrier data sales channels, including economies of scale expected from such growth, and the success of ongoing cost reduction initiatives. Our expectations are also based in part on arranging capital leases and other forms of equipment financing. Our ability to arrange such financing will depend on credit market conditions, which have continued to tighten due to the ongoing crisis in global capital markets. If we are unable to arrange such financings, we may not be able to make all necessary or desirable capital and other expenditures to run and grow our business and/or to comply with certain provisions of the Indenture which requires us to offer to repurchase outstanding Notes upon occurrence of certain events under the Indenture.

Access vendors could force us to accelerate payments to them, which would adversely impact our working capital and liquidity.

Cost of access represents our single largest expense and gives rise to material current liabilities. In the past, certain telecommunications carriers from whom we purchase access services demanded that we pay for access services on a timelier basis, which resulted in increased demands on our liquidity. If such demands were to continue to a greater degree than anticipated, or if access vendors were to insist on significant deposits to secure our access payment obligations, we could be prevented from meeting our cash flow projections and our long-term liquidity requirements. The current downturn in the world economy and tightening of global credit markets could cause access vendors to insist upon timelier payment or the provision of security deposits.

7

The restrictive covenants in the Indenture limit and future debt instruments may limit our financial and operational flexibility.

The Indenture contains covenants and events of default that are customary for high-yield debt and senior secured credit facilities, including limitations on:

| | • | | incurring or guaranteeing additional indebtedness; |

| | • | | dividend and other payments to holders of equity and subordinated debt; |

| | • | | investments or other restricted payments; |

| | • | | asset sales, consolidations, and mergers; |

| | • | | creating or assuming liens; and |

| | • | | transactions with affiliates. |

These covenants impose significant restrictions on our operations.

A significant portion of our assets have been pledged to secure our indebtedness under the Indenture and under certain lease facilities secured by the assets being leased (the “Capital Lease Facilities”). A failure to comply with the covenants contained in the Indenture or the Capital Lease Facilities could result in an event of default, which, if not cured or waived, could result in an acceleration of such debts, which would have a material adverse effect on our business, results of operations and financial condition. For example, certain of our capital lease agreements contain non-financial covenants which require specific tracking and reporting procedures for the physical location of the leased assets. The failure to satisfy these covenants allows the lessor to accelerate payments under the lease. If the indebtedness under the Indenture or the Capital Lease Facilities were to be accelerated, we would have to raise funds from alternative sources, which may not be available on favorable terms, on a timely basis or at all.

For a further discussion of these issues and our indebtedness, see Item 5.B. “Operating and Financial Review and Prospects—Liquidity and Capital Resources—Indebtedness”.

Risks related to our operations

Our revenue and operating results may vary significantly from quarter to quarter due to a number of factors, many of which are outside of our control.

Our revenue and operating results may vary significantly from quarter to quarter due to a number of factors, many of which are outside of our control. The primary factors, among other things, that may affect our results of operations include the following:

| | • | | changes in pricing policies or the pricing policies of our competitors; |

| | • | | general economic conditions as well as those specific to our industry; |

| | • | | demand for our higher margin services; |

| | • | | costs of acquisitions, including the integration of such acquisitions; and |

| | • | | changes in regulations and regulatory rulings. |

A delay in generating revenue or the timing of recognizing revenue and expenses could cause significant variations in our operating results from quarter to quarter. It is possible that in future quarters our results may be below analysts’ and investors’ expectations.

Our rights to the use of the fiber that make up our network may be affected by the financial health of our fiber providers.

A significant part of our network and some of our other transmission facilities are held by us through long-term leases or indefeasible rights to use (“IRU”) agreements with various companies that provide us access to facilities or fiber owned by them. A bankruptcy or financial collapse of one of these providers could result in a loss of our rights under such leases and agreements with the provider, which in turn could have a negative impact on the integrity of our network and ultimately on our results of operations.

8

We may not be able to continue to connect our network to incumbent carriers’ networks or maintain Internet peering arrangements on favorable terms.

We must be party to interconnection agreements with incumbent carriers and certain independent carriers in order to connect our customers to the public switched telephone network (“PSTN”). If we are unable to renegotiate or maintain interconnection agreements on favorable terms, it could adversely affect our ability to provide services. New IP-based networking technologies are becoming more generally adopted within the industry and new commercial and charging models are being developed for interworking between these networks. The extent to which such new models may affect our business is currently uncertain.

Peering agreements with Internet service providers allow us to access the Internet and exchange transit for free with these providers. Depending on the relative size of the carriers involved, these exchanges may be made without settlement charge. Recently, many Internet service providers that previously offered peering have reduced or eliminated peering relationships or are establishing new, more restrictive criteria for peering and an increasing number of these service providers are seeking to impose charges for transit. Increases in costs associated with Internet and exchange transit could have a material adverse effect on our margins for our products that require Internet access. We may not be able to renegotiate or maintain peering arrangements on favorable terms, which would impair our growth and performance.

It is expensive and difficult to switch new customers to our network, and lack of cooperation of incumbent carriers can slow the new customer connection process.

It is expensive and difficult for us to switch a new customer to our network because:

| | • | | we usually charge the potential customer certain one-time installation fees, and, although the fees may be less than the cost to install a new customer, such fees may deter a potential customer from switching to our network; and |

| | • | | we require cooperation from the incumbent carrier in instances where there is no direct connection between the customer and our network, which can complicate and delay provision of a new customer’s service. |

Many of our principal competitors, the domestic and international incumbent carriers, are already established providers of local telephone services to all or virtually all telephone subscribers within their respective service areas. Their physical connections from their premises to those of their customers are expensive and difficult to duplicate. To complete the new customer provisioning process, we rely on the incumbent carrier to process certain information. The incumbent carriers have a financial interest in retaining their customers, which could reduce their willingness to cooperate with our new customer provisioning requests, thereby adversely impacting our ability to compete and grow revenues. Further consolidation of incumbent carriers with other telecommunications service providers may make these problems more acute.

The operation, administration, maintenance and repair of our systems require significant expenses and are subject to risks that could lead to disruptions in our services and the failure of our systems to operate as intended for their full design life.

Our telecommunications systems, and those of our parent, are subject to the risks inherent in large-scale, complex fiber-optic telecommunications systems. The operation, administration, maintenance and repair of these systems require the coordination and integration of sophisticated and highly specialized hardware and software technologies and equipment located throughout the world and require significant operating and capital expenses. These systems may not continue to function as expected in a cost-effective manner. For example, as our network elements become obsolete or reach their design life capacity, our operating expenses could significantly increase depending on the nature and extent of repairs or replacements. The failure of the hardware or software to function as required could render a cable system unable to perform at design specifications.

Interruptions in service or performance problems, for whatever reason, could undermine confidence in our services and cause us to lose customers or make it more difficult to attract new ones. In addition, because many of our services are critical to our customers’ businesses, a significant interruption in service could result in lost profits or other losses to customers. Although we attempt to disclaim liability for these losses in our service agreements, a court might not enforce a limitation on liability under certain conditions, which could expose us to financial loss. Also, we often provide customers with guaranteed service level commitments. If we are unable to meet these guaranteed service level commitments for whatever reason, we may be obligated to provide our customers with credits, generally in the form of free service for a short period of time, which could negatively affect our operating results.

9

The failure of our operations support systems (“OSS”) to perform as we expect could impair our ability to retain customers and obtain new customers, or provision their services, or result in increased capital expenditures.

Our business depends on our ability to continue to develop effective business support systems. This is a complicated undertaking requiring significant resources and expertise and support from third-party vendors. We need business support systems for:

| | • | | implementing customer orders for services; |

| | • | | provisioning, installing and delivering these services; |

| | • | | timely and accurate billing for these services; and |

| | • | | ensuring that we manage access costs efficiently. |

We need these business support systems to expand and adapt to our continued growth. We have generally been successful in moving customers to new services, and we therefore face a continuing challenge as business support systems become outdated and expensive to maintain, and the support available to them becomes limited. We have utilized and will continue to utilize the business support systems developed or maintained by our parent and its affiliates. Our parent and its affiliates are developing and upgrading the business support systems globally. We are closely involved in this effort and will benefit from certain of the enhancements in the global business support systems in our business in the UK. We cannot assure you, however, that the development and upgrade of the global business support systems will be successful, will be completed on a timely basis, or will satisfy the specific needs of our business. This could have a material adverse effect on our business, results of operations and financial condition. In particular, a failure of our operations support systems could adversely affect our ability to process orders and provision sales, and to bill for services efficiently and accurately, all of which could cause us to suffer customer dissatisfaction, loss of business, loss of revenue or the inability to add customers on a timely basis, any of which would adversely affect our revenues.

Recent capital expenditure levels may not be sustainable.

While capital expenditures have remained relatively stable in recent years, such levels may not be sustainable in the future, particularly as our business continues to grow. Our ability to fund future capital expenditures may be limited by our ability to generate sufficient cash flow, including raising any necessary financings, which could prove to be difficult if the adverse conditions in the credit markets continue.

Intellectual property and proprietary rights of others could prevent us from using necessary technology.

While we do not believe that there exists any technology patented by others, or other intellectual property owned by others, that is necessary for us to provide our services and that is not now subject to a license allowing us to use it, from time to time we receive claims from third parties in this regard and there can be no assurances as to our ability to defend against those claims successfully. If such intellectual property is owned by others and not licensed by us, we would have to negotiate a license for the use of that intellectual property. We may not be able to negotiate such a license at a price that is acceptable or at all. This could force us to cease offering products and services incorporating such intellectual property, thereby adversely affecting operating results.

We are exposed to significant currency exchange rate risks and our results of operations may suffer due to currency translations.

Commencing in September 2008, the pound sterling has weakened considerably against both the US Dollar, in which a significant portion of Senior Secured Notes are denominated, and the Euro. This depreciation has had an adverse impact on our finance costs. If this weakening continues, it could have an adverse impact on our results going forward. In addition, the further weakening of the pound sterling against those currencies would increase the pound sterling equivalent of liabilities held by us in those currencies.

In addition, where we issue invoices for our services in currencies other than pounds sterling, our operating results may suffer due to currency translations in the event that such currencies depreciate relative to the pound sterling and we cannot or do not elect to enter into currency hedging arrangements in respect of those payment obligations. Declines in the value of foreign currencies relative to the pound sterling could adversely affect our ability to market our services to customers whose revenues are denominated in those currencies.

10

Many of our government customers have the right either to terminate their contracts with us, or to reduce the services they purchase from us if a change of control occurs.

Many of our government contracts contain broad change of control provisions that permit the customer to terminate the contract in the event that we undergo a change of control. A termination in many instances gives rise to other rights of the customer, including, in some cases, the right to purchase certain of our assets used in servicing those contracts. Certain change of control provisions may be triggered when any lender (other than a bank lender in the normal course of business) or one or a group of holders of the Notes would have the right to control us or the majority of our assets upon any event, including upon bankruptcy. If the holders of the Notes have the right to control us or the majority of our assets upon such event, it could be deemed to be a change of control of the Company. Similarly, if STT’s ownership interest in GCL falls below certain levels, it could be deemed to be an indirect change of control of us. In addition, most of our government contracts do not include significant minimum usage guarantees. Thus the applicable customers could simply choose not to use our services and move to another telecommunications provider. If any of our significant government contracts are terminated as a result of a change of control or otherwise, or if the applicable customers were to significantly reduce the services they purchase under these contracts, we could experience a material adverse effect on our business, results of operations and financial condition.

Our dependence on a number of key personnel.

Our business is managed by a number of key personnel, including our directors, the loss of any of whom could have a material adverse effect on our business. In addition to our senior management, we rely upon key personnel of GCL, our parent company. Many of our key personnel spend time working for our parent or its affiliates and the amount of time they spend doing so is often out of our control. Our business and operations depend upon qualified personnel successfully implementing our business plan. We can offer no assurances that we will be able to attract and retain skilled and qualified personnel for senior management positions. The loss of key personnel employed by our parent or their need to spend additional time working for our parent or its affiliates or our failure to recruit and retain key personnel or qualified employees could have a material adverse effect on our business, results of operations and financial condition.

Our revenue is concentrated in a limited number of customers.

A significant portion of our revenue comes from a limited number of customers. For example, 52.9% (2007: 52.9%) of our revenue for the year ended December 31, 2008 came from our ten top customers. The public sector generated 45.6% (2007: 32.1%) of our revenue for the year ended December 31, 2008.

If we lose one or more of our major customers, or if one or more of our major customers significantly decreases use of our services, it may materially adversely affect our business, operations and financial condition. Our future operating results will depend on the success of these customers and our other large customers, and our success in selling services to them. If we were to lose a significant portion of the revenue from any of our top customers, we would not be able to replace that revenue in the short term.

The absence of firm commitments to purchase minimum levels of revenue or services in the majority of our customer contracts.

With few exceptions, our contracts with our customers do not provide for committed minimum revenues or service usage thresholds. Moreover, many of them contain benchmarking or similar provisions permitting or requiring the periodic renegotiation or adjustment of prices for our services based upon, among other things, changes in market prices within the industry. Accordingly, we cannot assure you that, even with respect to customer contracts of significant duration, we will be able to maintain per-unit pricing or overall revenue streams at current levels. If unit pricing declines and we are unable to sell additional services to such customers or services to new customers, or commensurately reduce costs, there could be a material adverse effect on our business, results of operations and financial condition.

We rely on a limited number of third party suppliers.

We depend on a limited number of suppliers and vendors for equipment and services relating to our network infrastructure. If these suppliers or vendors:

| | • | | experience financial or technical problems; |

| | • | | develop favorable relationships with our competitors; |

11

| | • | | experience interruptions or other problems in their own businesses; or |

| | • | | cannot or do not deliver these network components or services on a timely basis. |

Then our ability to obtain sufficient quantities of the products and services we require to operate our business successfully may be diminished, and our business and operating results could suffer significantly. In certain instances, we may rely on a single supplier that has proprietary technology and/or provides key services that has become core to our infrastructure and business. As a result, we have come to rely upon a limited number of network equipment manufacturers, service providers and other suppliers, including BT, Ericsson, Network Rail, telent, Dimension Data and Siemens. If we needed to seek alternative suppliers, we may be unable to obtain satisfactory replacement suppliers on economically attractive terms, on a timely basis or at all, which could have a material adverse effect on our business, results of operations and financial condition.

Insolvency could lead to termination of certain of our contracts.

The lease to us by Network Rail (which owns the United Kingdom’s railway infrastructure) of fiber optic cable and ancillary equipment and our capacity purchase agreement with them which enables our use of the copper cable and private automatic branch exchange equipment (“PABXs”) which we use to deliver managed voice services to the train operating companies, comprise a key set of contractual documents in our relationship with Network Rail. The deed of grant is a related agreement that gives us wayleave rights until at least 2046 that permit us to maintain existing leased and owned fiber and network equipment and to lay new fiber and install new equipment, subject to specified payments to Network Rail. If we become insolvent, Network Rail becomes entitled, but not obligated, with certain exceptions, to terminate the lease, the capacity purchase agreement and the related deed of grant described above. Certain of our other customer contracts, including many of our government contracts, contain clauses entitling the counterparty to terminate should we become insolvent. Some of these contracts contain similar termination provisions that would apply if a direct or indirect parent company of us, including GCL, becomes insolvent. The loss of rights under the lease with Network Rail, the deed of grant, the capacity purchase agreement or any of the significant customer contracts containing similar termination provisions could have a material adverse effect on our business, results of operations and financial condition.

Risks related to Competition and our Industry

We face significant competition in the marketplace.

In the enterprise and carrier data and voice channels, we compete chiefly with various divisions of BT, Cable & Wireless and Verizon, which, on a combined basis, have a majority of the market share for these services. Concerning the government and rail sectors in particular, our principal competitors are BT and Cable & Wireless. Other competitors include COLT, Virgin Media, KCOM and Geo. Depending on the type of customer, we will compete on the basis of level of service, quality of technology and price. Our network reach, which includes not only the ability to connect with customers but also the ability to decrease the distance between enterprise entities and their point of interconnection with our network, is also a significant factor that determines our ability to compete for customers in the enterprise sector. The level of competition we face could lead to a reduction in our revenues and margins as well as other material adverse effects on our business, operations and financial condition.

The prices that we charge for our services have been decreasing, and we expect that such decreases will continue over time.

We expect overall price erosion in our industry to continue at varying rates based on our service portfolio and reflective of marketplace demand and competition relative to existing capabilities and availability and general macroeconomic conditions. Accordingly, our historical revenues are not indicative of our future revenues based on comparable traffic volumes. If the prices for our services decrease for whatever reason and we are unable to increase profitable sales volumes through additional services or otherwise or correspondingly reduce operational costs, our operating results would be adversely affected. Similarly, future price decreases could be greater than we are anticipating.

Technological advances and regulatory changes are eroding traditional barriers between formerly distinct telecommunications markets, which could increase the competition we face and put downward pressure on prices.

New technologies, such as voice over internet protocol (“VoIP”), and regulatory changes are blurring the distinctions between traditional and emerging telecommunications markets. As a result, a competitor in any of our business areas could potentially compete in our other business areas.

12

We face competition in each of our markets from the incumbent carrier in that market and from more recent market entrants. In addition, we could face competition from other companies, such as other competitive carriers, cable television companies, microwave carriers, wireless telephone system operators and private networks built by large end-users or municipalities. The introduction of new technologies may reduce the cost of services similar to those that we plan to provide and create significant new competitors with superior cost structures. If we are not able to compete effectively with any of these industry participants, or if this competition places excessive downward pressure on prices, our operating results will be adversely affected.

The Office of Communications (“Ofcom”) is encouraging new operators to build their own infrastructures to compete with BT. At the same time, BT is constructing a new, IP-based network which it refers to as a “21st Century” network. At present, it is not clear how operators will connect with this network. There are currently no proposals as to how and at what level BT will charge for access to the network. Regulation has historically provided for the expansion of competition in the marketplace and the subsequent lowering of tariffs charged across the industry. However, there is no way to know with certainty what regulatory actions Ofcom and other governmental and regulatory agencies may take in the future. Individually and collectively, these matters could have negative effects on our business, which could materially and adversely affect our consolidated business, operations and financial condition.

Many of our competitors have superior resources, which could place us at a cost and price disadvantage.

Many of our existing and potential competitors have significant competitive advantages, including greater market presence, name recognition and financial, technological and personnel resources, superior engineering and marketing capabilities, more ubiquitous network reach, and significantly larger installed customer bases. As a result, many of our competitors can raise capital at a lower cost than we can, and they may be able to adapt more swiftly to new or emerging technologies and changes in customer requirements, take advantage of acquisition and other opportunities (including regulatory changes) more readily, and devote greater resources to the development, marketing and sale of products and services than we can. Also, our competitors’ greater brand name recognition may require us to price our services at lower levels in order to win business. Our competitors’ financial advantages may give them the ability to reduce their prices for an extended period of time if they so choose. Many of these advantages are expected to increase with the trend toward consolidation by large industry participants.

Our selection of technology could prove to be incorrect, ineffective or unacceptably costly, which would limit our ability to compete effectively.

The telecommunications industry is subject to rapid and significant changes in technology, evolving industry standards, changing customer needs, emerging competition and frequent new product and service introductions. The future success of our business will depend, in part, on our ability to adapt to these factors in a timely and cost-effective manner. If we do not replace or upgrade technology and equipment that becomes obsolete, or if the technology choices we make prove to be incorrect, ineffective or unacceptably costly, we will be unable to compete effectively because we will not be able to meet the expectations of our customers, which would cause our results to suffer.

UK regulations require us to maintain a number of licenses and permits, the loss of any of which could affect our ability to conduct our business.

If we fail to comply with regulatory requirements or to obtain and maintain certain licenses and permits, including payment of related fees, we may not be able to conduct our business. In addition, we have obtained rights-of-way from utilities, railroads, incumbent carriers and other persons. These regulatory requirements, or the terms attaching to such rights-of-way, could change in a manner that significantly increases our costs or otherwise adversely affects our operations.

Terrorist attacks and other acts of violence or war may adversely affect the financial markets and our business and operations.

Significant terrorist attacks against the UK, the US or other countries in which we or other Group Companies operate are possible. It is possible that our physical facilities or network control systems could be the target of such attacks or that such attacks could impact other telecommunications companies or infrastructure or the Internet in a manner that disrupts our operations. Terrorist attacks (or threats of attack) also could lead to volatility or illiquidity in world financial markets and could otherwise adversely affect the economy. These events could adversely affect our business and our ability to obtain financing on favorable terms. In addition, it is

13

becoming increasingly difficult and expensive to obtain adequate insurance for losses due to terrorist attacks. Uninsured losses as a result of such attacks could have a material adverse effect on our business, results of operations and financial condition.

Other risks

Our real estate restructuring provision represents a material liability, the calculation of which involves significant estimation.

As of December 31, 2008, our real estate restructuring reserve aggregated £31.0 million of continuing building lease obligations and broker commissions, offset by anticipated receipts of £20.6 million from existing subleases and £5.8 million from subleases projected to be entered into in the future. Although we believe these estimates to be reasonable, actual sublease receipts could be materially less than we have estimated which could in turn have a material adverse effect on our business, results of operations and financial condition.

The influence of our parent, actions our parent takes, or actions we are obliged to take as a result of our parent’s actions, together with the interest of certain of our directors due to ownership of, or options to purchase, our parent’s stock, may conflict with our interests.

Our parent company indirectly owns 100% of our share capital. Because our parent’s interests may differ from ours, actions our parent takes as a stockholder with respect to us may not be favorable to us or to holders of our Notes. Although we put into place upon the closing of the offering of the Initial Notes operational agreements to address the relationship between us and our parent, we remain dependent on our parent’s decisions regarding corporate strategies, its financial performance and other factors which may affect our parent as our sole stockholder. Also, the interests of our parent’s controlling stockholder, STT, may differ from ours. STT might impose certain strategic and other decisions on us through their control of our parent. We can offer no assurance that the interests of our parent or STT will not conflict with the interests of the holders of our Notes regarding these matters.

In addition to our operational agreements, our parent company can influence what we do with available cash flow. For example, during 2003 and 2004, we periodically upstreamed a portion of our cash on hand and operating cash flow to our parent company and its affiliates to repay loans. Although we did not upstream any cash in 2005, in 2006 we upstreamed $80.8 million via intercompany loans, $30.4 million of which were repaid in 2006. A further $5.0 million was upstreamed and repaid in 2007. We did not upstream any cash in 2008. It is possible that our parent company may use us as a source of funding, subject to the terms of the Indenture and applicable restrictions under English law, and that we will continue to upstream available cash to fund our parent’s and its subsidiaries’ operations. The terms of the Indenture permit certain upstream payments including, subject to certain restrictions, upstreaming up to 50% of our Operating Cash Flow, as defined in the Indenture.

Some of our directors and officers own or have options to purchase or other rights to receive our parent’s common stock and participate in our parent company’s incentive compensation programs. This could create, or appear to create, potential conflicts of interest when our directors and officers are faced with decisions that could have different implications for our parent than they do for us. Such directors and officers may not be liable to us or our stockholders for a breach of any fiduciary duty as one of our directors and officers by reason of the fact that our parent or any of its affiliates pursues or acquires a corporate opportunity for itself, directs a corporate opportunity to another person or such director or officer does not communicate information regarding such corporate opportunity to us, each of which could eventuality could have a material adverse effect on our business, results of operations and financial condition.

Our business may be disrupted due to the sharing of corporate and operational services with our parent.

We are a wholly-owned, indirect subsidiary of our parent and have received, and will receive in the future, corporate and operational services from our parent and its affiliates. In connection with the offering of the Initial Notes, we entered into a series of agreements formalizing the agreements under which we receive these services. See Item 7.B. “Major Shareholders and Related Party Transactions—Related Party Transactions—Inter-company Agreements.” We rely, and will continue to rely, on our parent and its affiliates to maintain the integrity of these services. Under certain circumstances, the pricing formulas for these services may change and, in other instances, our parent may cease to provide these services, including by terminating the agreements on one year’s prior notice. In the event our parent discontinues providing these services, there can be no assurance that we could obtain them on the same terms. Moreover, deterioration in the financial situation of our parent may adversely affect our ability to operate due to our reliance on our parent and its affiliates in some of these areas. This could have a material adverse effect on our business, results of operations and financial condition.

14

Risk Related to the Notes and our Organizational Structure

Our ability to generate cash depends on many factors beyond our control.

The ability to make payments on our indebtedness, including the Notes, and to fund planned operating and capital expenditures will depend on our ability to generate cash in the future. This, to a certain extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors, including other factors discussed above under “—Risks Related to Our Business and Industry”, that are beyond our control. This has led to limited access to the capital markets by companies in our industry. Our access to the capital markets may also be limited in the future if our parent were to become financially distressed.

If our future cash flow from operations are insufficient to pay our debt obligations or to fund other liquidity needs, we may be forced to sell assets or attempt to restructure or refinance our existing indebtedness. We may also be required to raise additional debt or equity financing in amounts that could be substantial. We cannot assure our holders of the Notes that our business will generate sufficient cash flow from operations or that future borrowings will be available to us in an amount sufficient to enable us to pay our indebtedness, including principal, interest and other amounts due in respect of the Notes. Nor can we assure holders of our Notes that we will generate sufficient cash flow to fund our other liquidity needs. We may need to refinance all or a portion of its debt, including the Notes, on or before maturity, and our ability to refinance such debt is generally dependent upon the availability and cost of credit. A disruption in the capital markets, such as the type of disruption that emerged in Europe and the United States during 2007, and has continued through the date of this report, could limit our ability to obtain credit at a reasonable cost. We cannot assure holders of the Notes that we will be able to refinance any of our debt, including the Notes, on commercially reasonable terms if at all.

The holders of the Notes should not rely upon funds from our parent company or its affiliates to service obligations under the Notes.

We have historically served, and in the future may serve, as a source of funding for our parent company and its affiliates. Prior to 2003, we incurred substantial amounts of intercompany indebtedness owed to our parent company and its affiliates. Since the second quarter of 2003, we have periodically made repayments on this indebtedness from our positive cash flow. Moreover, we upstreamed substantially all of the net proceeds of the offering of the Initial Notes on December 20, 2004, through repayment of debt or otherwise, to our parent company and its subsidiaries with the result that as at December 31, 2004 we had a zero intercompany balance. The intercompany debt balance remained zero as of December 31, 2005. As of December 31, 2007 there were loans due from affiliates of £25.3 million, comprising a $50.4 million loan due from Global Crossing Europe Limited (“GCE”). See note 26 “related parties” within the accompanying consolidated financial statements for the year ended December 31, 2008 included elsewhere in this annual report on Form 20-F. As of December 21, 2008 there were loans due from affiliates of £34.9 million, comprising a $50.4 million loan due from GCE.

We expect that our parent company may use us as a source of funding, subject to the terms of the Indenture and applicable English law, and that we may, accordingly, upstream available cash to fund our parent’s operations. This may happen in the form of loans or dividends or other distributions. However, it will not be possible for us to pay dividends to our shareholder, an indirect subsidiary of our parent, until such time as our accumulated realized profits exceed our accumulated realized losses. It is anticipated, therefore, that we will not be in a position to pay dividends for some time, and any funds to be upstreamed to our parent would be made by us by way of an intercompany loan. To the extent that these amounts take the form of loans, we are subject to the risk that our parent company and its affiliates will be unable to repay these amounts. The ability of our parent to repay these amounts is predicated upon, among other things, its financial condition and solvency.

On May 9, 2007, GCL entered into a $250.0 million five-year senior secured term credit facility (as amended, the “Term Loan Agreement”) with certain subsidiaries of GCL under which Goldman Sachs Credit Partners L.P. acts as administrative and collateral agent for a group of lenders. The term loan was increased to $350.0 million pursuant to an amendment to the Term Loan Agreement executed on June 1, 2007. In addition, under the terms of the GCL Term Loan Agreement, loans that we make to our parent or its subsidiaries are required to be subordinated to their payment obligations under the GCL Term Loan Agreement. Such subordination would restrict our ability to recover amounts under such intercompany loans during periods in which our parent would be experiencing financial difficulties. To the extent that these amounts take the form of dividends or other corporate distributions, there will be no obligation at all on the part of our parent company or its affiliates to repay these amounts. Although the terms of the Indenture restrict our ability to upstream amounts to our parent company and its affiliates in the future, these restrictions are subject to a number of important qualifications and exceptions that are described in the Indenture. The terms of the Indenture permit certain upstream payments including, subject to certain restrictions, upstreaming up to 50% of our Operating Cash Flow, as defined in the Indenture.

15

Accordingly, we cannot assure holders of our Notes that we will have any access to funds from our parent company or its affiliates and the holders of the Notes, therefore, should not rely upon funds from them to service obligations under the Notes.

The restrictive covenants in the Indenture or future debt instruments may limit our operating flexibility. Our failure to comply with these covenants could result in defaults under the Indenture and any future debt instruments even though we may be able to meet our debt service obligations.

The Indenture imposes significant operating and financial restrictions on us. These restrictions significantly limit, among other things, our ability to:

| | • | | incur or guarantee additional indebtedness and issue certain preferred stock; |

| | • | | engage in layering of debt; |

| | • | | make certain payments, including dividends or other distributions, with respect to our shares or our restricted subsidiaries’ shares (save for dividends or other distributions by a restricted subsidiary to us or another restricted subsidiary); |

| | • | | prepay or redeem subordinated debt or equity; |

| | • | | make certain investments; |

| | • | | create encumbrances or restrictions on the payment of dividends or other distributions, loans or advances to us by our restricted subsidiaries or on the transfer of assets to us by any of our restricted subsidiaries; |

| | • | | sell, lease or transfer certain assets, including stock of restricted subsidiaries; |

| | • | | engage in certain transactions with affiliates; |

| | • | | enter into unrelated businesses; and |

| | • | | consolidate or merge with other entities. |

All these limitations are subject to significant exceptions and qualifications. See Item 5.B. “Operating and Financial Review and Prospects—Liquidity and Capital Resources—Indebtedness”. These covenants could limit our ability to finance our future operations and capital needs and our ability to pursue business opportunities and activities that may be in our interest. Any future debt instruments may also contain similar or more restrictive provisions that may affect our ability to engage in certain transactions in the future.

The restrictions in the Indenture governing the Notes and such other restrictions could limit our ability to obtain future financing, incur capital expenditures, withstand a future downturn in our business or the economy in general or otherwise take advantage of business opportunities that may arise. If we fail to comply with these restrictions, the holders of our Notes, or lenders under any future debt instrument, could declare a default under the terms of the relevant debt, even though we are able to meet debt service obligations and this could cause certain of our debt to become immediately due and payable. If our parent company or the guarantors of the GCL Term Loan Agreement fail to comply with the terms of that facility, then the lenders under that facility could declare a default. A declaration of default under the GCL Term Loan Agreement would have a material adverse effect on our parent, and consequently, would be likely to have a material adverse effect on us.

If a creditor accelerated any debt, we cannot assure holders of our Notes that we would have sufficient funds available, or that we would have access to sufficient capital from other sources, to repay the debt. Even if we could obtain additional financing, we cannot assure holders of our Notes that the terms would be favorable to us. If we default on any secured debt, the secured creditors could foreclose on their liens. As a result, any event of default could have a material adverse effect on our business and financial condition and could prevent us from paying amounts due under the Notes.

The Issuer is a subsidiary that was initially formed for the purpose of facilitating the issuance of the Initial Notes and has limited assets and revenue generating operations. The Issuer will be dependent upon GCUK to provide it with funds sufficient to meet its obligations under the Notes.

The Issuer was formed as a wholly owned subsidiary of GCUK for the purpose of facilitating the issuance of the Initial Notes. The Issuer has no operations and does not serve as a holding company for any operating subsidiaries. The intercompany loans funded with the proceeds from the Initial Notes and with the proceeds of the Additional Notes are the Issuer’s only significant assets. As such, the Issuer will be wholly dependent upon us to make payments on the inter-company loan or to make other funding arrangements in order for it to pay amounts due on the Notes.

16

A significant portion of our assets will not be pledged for the benefit of the holders of the Notes. The collateral securing the Notes and the Guarantees may be diluted under certain circumstances. The value of the collateral securing the Notes and the Guarantees may not be sufficient to satisfy our obligations with regards to the holders of our Notes.

The Notes will be secured by certain of our assets and the assets of the Issuer, including the capital stock of GCUK’s subsidiaries, the Issuer and Fibernet. However, a significant portion of our assets will not serve as collateral for the Notes. In particular, we will not pledge:

| | • | | certain parts of the network leased by us, including any telecommunications cables and other equipment under a finance lease with Network Rail under which we lease approximately 20% of our lit fiber (calculated by fiber kilometers); |

| | • | | any rights, title, interest or obligations under certain specified excluded contracts, including (i) any contract in which our counterparty is a UK governmental entity; and (ii) any contract in which our counterparty is a contractor or subcontractor to a UK governmental entity (these excluded contracts include those with the Foreign and Commonwealth Office (“FCO”), OGCbuying.solutions and other important customers); |

| | • | | any equipment or assets owned by us located on the premises of the parties to excluded contracts and any equipment or assets used exclusively by us in connection with the provision of services and the performance of obligations under such contracts; |