| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811-21777 |

| |

| John Hancock Funds III |

| (Exact name of registrant as specified in charter) |

| |

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

| |

| Salvatore Schiavone |

| Treasurer |

| |

| 601 Congress Street |

| |

| Boston, Massachusetts 02210 |

| |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: 617-663-4497 |

| |

| Date of fiscal year end: | March 31 |

| |

| Date of reporting period: | March 31, 2013 |

ITEM 1. REPORTS TO STOCKHOLDERS.

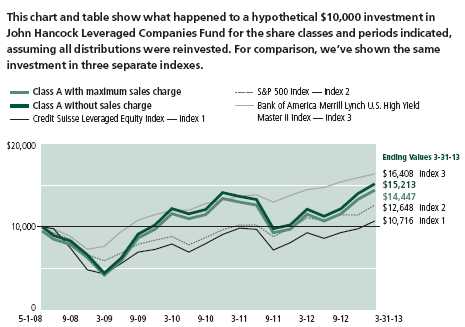

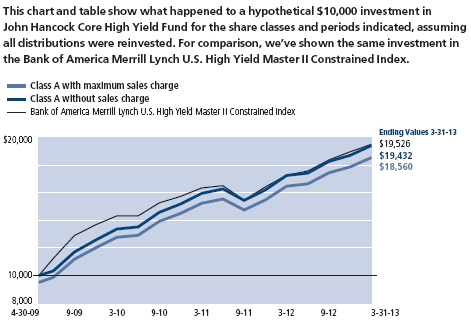

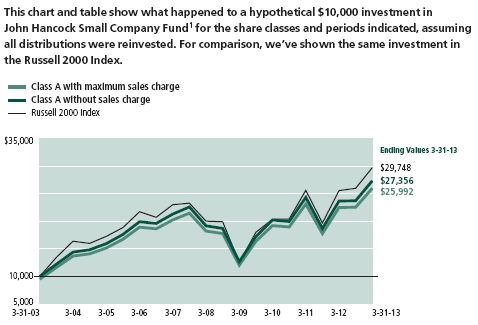

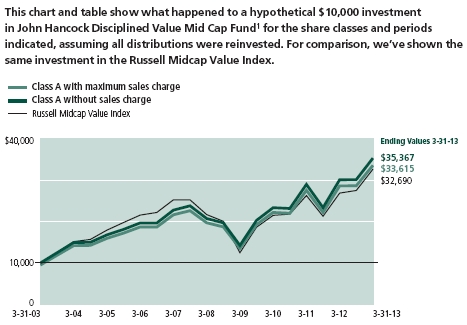

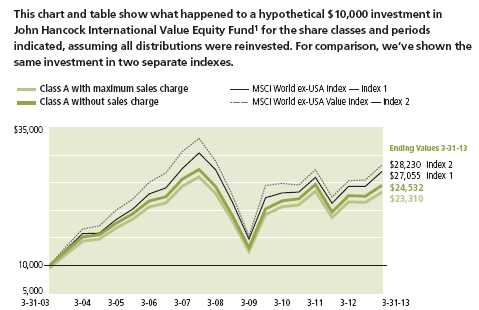

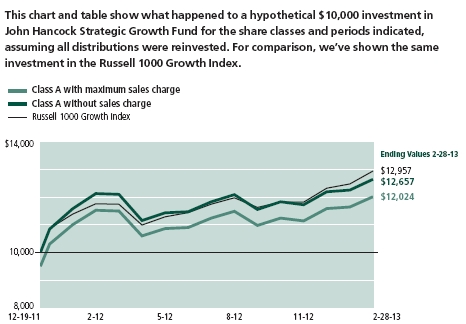

A look at performance

Total returns for the period ended March 31, 2013

| | | | | | | |

| | Average annual total returns (%) | | | Cumulative total returns (%) | |

| | with maximum sales charge | | | with maximum sales charge | |

|

| | 1-year | 5-year | 10-year | | 1-year | 5-year | 10-year |

|

| Class A1 | 1.16 | 2.02 | 7.72 | | 1.16 | 10.50 | 110.38 |

|

| Class B1 | 0.58 | 1.87 | 7.14 | | 0.58 | 9.70 | 99.29 |

|

| Class C1 | 4.58 | 2.23 | 7.13 | | 4.58 | 11.65 | 99.20 |

|

| Class I1,2 | 6.81 | 3.46 | 8.64 | | 6.81 | 18.55 | 129.04 |

|

| Class R11,2 | 5.99 | 2.62 | 7.56 | | 5.99 | 13.82 | 107.16 |

|

| Class R21,2 | 6.23 | 1.79 | 6.74 | | 6.23 | 9.25 | 92.03 |

|

| Class R31,2 | 6.09 | 2.74 | 7.67 | | 6.09 | 14.45 | 109.34 |

|

| Class R41,2 | 6.50 | 3.05 | 8.00 | | 6.50 | 16.24 | 115.81 |

|

| Class R51,2 | 6.74 | 3.35 | 8.31 | | 6.74 | 17.93 | 122.25 |

|

| Class R61,2 | 6.86 | 3.49 | 8.69 | | 6.86 | 18.71 | 130.04 |

|

| Class T1,2 | 1.05 | 1.67 | 7.16 | | 1.05 | 8.64 | 99.66 |

|

| Class ADV1,2 | 6.59 | 3.21 | 8.37 | | 6.59 | 17.09 | 123.42 |

|

| Class NAV1,2 | 6.94 | 3.54 | 8.73 | | 6.94 | 18.98 | 131.02 |

|

Performance figures assume all distributions have been reinvested. Figures reflect maximum sales charge on Class A and Class T shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1 to 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charges are not applicable to Class I, Class R1, Class R2, Class R3, Class R4, Class R5, Class R6, Class ADV and Class NAV shares.

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from those disclosed in the Financial highlights tables in this report. The fee waivers and expense limitations are contractual until at least 6-30-14 for Class R1, Class R2, Class R3, Class R4, Class R5, Class R6 and Class ADV shares. Had the fee waivers and expense limitations not been in place, gross expenses would apply. For all other classes, the net expenses equal the gross expenses. The expense ratios are as follows:

| | | | | | | | | | | | | |

| | Class A | Class B | Class C | Class I | Class R1 | Class R2* | Class R3 | Class R4 | Class R5 | Class R6 | Class T | Class ADV | Class NAV |

| Net (%) | 1.25 | 2.05 | 2.09 | 0.89 | 1.70 | 1.45 | 1.60 | 1.20 | 1.00 | 0.86 | 1.35 | 1.14 | 0.78 |

| Gross (%) | 1.25 | 2.05 | 2.09 | 0.89 | 7.01 | 2.73 | 15.84 | 15.34 | 15.05 | 1.56 | 1.35 | 1.33 | 0.78 |

* Expenses have been estimated for the Class’s first full year of operations.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month end, please call 1-800-225-5291 or visit the Fund’s Web site at www.jhfunds.com.

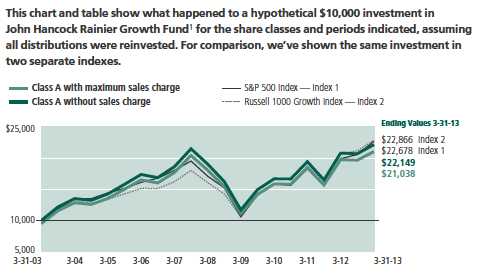

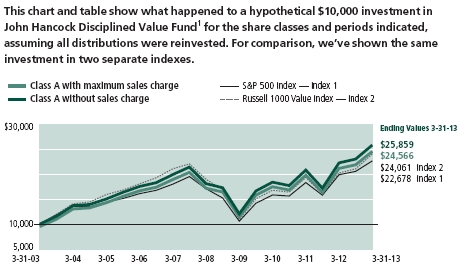

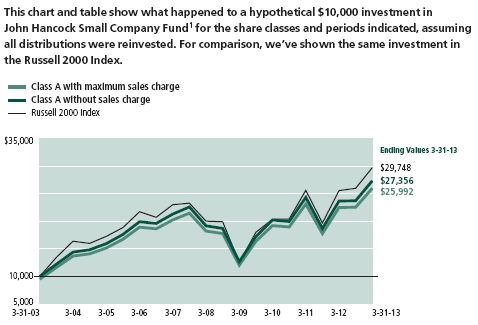

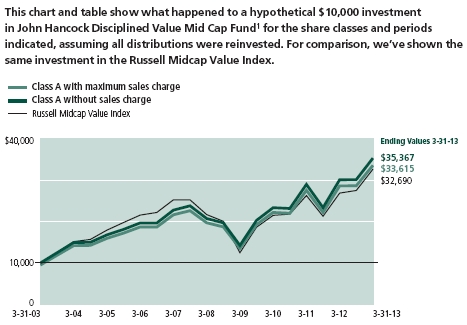

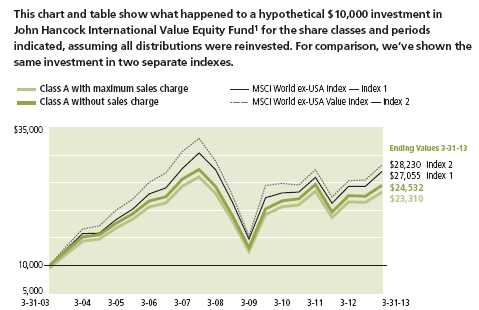

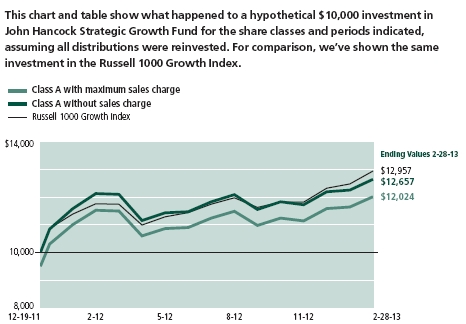

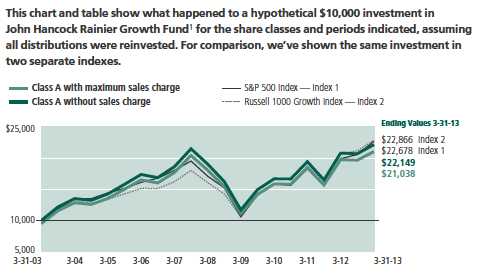

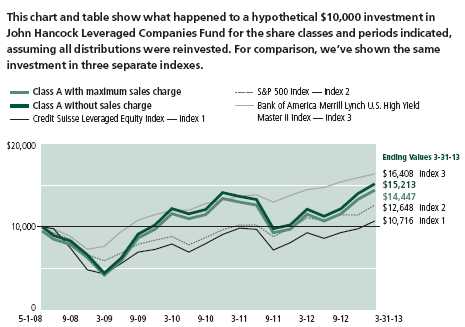

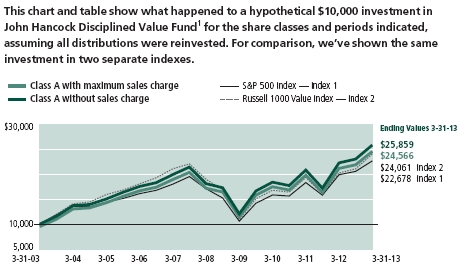

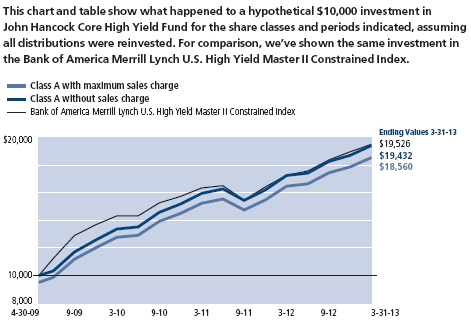

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

See the following page for footnotes.

| |

| 6 | Rainier Growth Fund | Annual report |

| | | | | |

| | | With maximum | Without | | |

| | Start date | sales charge | sales charge | Index 1 | Index 2 |

|

| Class B3 | 3-31-03 | $19,929 | $19,929 | $22,678 | $22,866 |

|

| Class C3 | 3-31-03 | 19,920 | 19,920 | 22,678 | 22,866 |

|

| Class I2 | 3-31-03 | 22,904 | 22,904 | 22,678 | 22,866 |

|

| Class R12 | 3-31-03 | 20,716 | 20,716 | 22,678 | 22,866 |

|

| Class R22 | 3-31-03 | 19,203 | 19,203 | 22,678 | 22,866 |

|

| Class R32 | 3-31-03 | 20,934 | 20,934 | 22,678 | 22,866 |

|

| Class R42 | 3-31-03 | 21,581 | 21,581 | 22,678 | 22,866 |

|

| Class R52 | 3-31-03 | 22,225 | 22,225 | 22,678 | 22,866 |

|

| Class R62 | 3-31-03 | 23,004 | 23,004 | 22,678 | 22,866 |

|

| Class T2 | 3-31-03 | 19,966 | 21,021 | 22,678 | 22,866 |

|

| Class ADV2 | 3-31-03 | 22,342 | 22,342 | 22,678 | 22,866 |

|

| Class NAV2 | 3-31-03 | 23,102 | 23,102 | 22,678 | 22,866 |

|

S&P 500 Index is an unmanaged index that includes 500 widely traded common stocks.

Russell 1000 Growth Index is an unmanaged index containing those securities in the Russell 1000 Index with a greater-than-average growth orientation.

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would have resulted in lower values if they did.

Footnotes related to performance pages

1 On 4-25-08, through a reorganization, the Fund acquired all of the assets of Rainier Large Cap Growth Equity Portfolio (the Predecessor Fund). On that date, the Predecessor Fund’s Original class shares and Institutional class shares were exchanged for Class A and Class I shares, respectively, of John Hancock Rainier Growth Fund. Class A, Class B, Class C, Class I, Class R1, Class R3, Class R4, Class R5, Class ADV and Class NAV shares of John Hancock Rainier Growth Fund were first offered on 4-28-08; Class R2 shares were first offered on 3-1-12. The returns prior to these dates are those of the Predecessor fund’s Original shares that have been recalculated to reflect the gross fees and expenses of Class A, Class B, Class C, Class I, Class R1, Class R3, Class R4, Class R5, Class ADV, Class NAV and Class R2 shares, as applicable. Class T shares were first offered on 10-6-08. The returns prior to this date are those of Class A shares that have been recalculated to apply the gross fees and expenses of Class T shares. Class R6 shares were first offered on 9-1-11. The returns prior to this date are those of the Predecessor Funds Original class shares, first offered on 6-15-00, and the returns of the fund’s Class A shares (from inception, 4-28-08) which have been recalculated to apply the estimated fees and expenses of Class R6 shares.

2 For certain types of investors, as described in the Fund’s prospectuses.

3 The contingent deferred sales charge is not applicable.

| |

| Annual report | Rainier Growth Fund | 7 |

Management’s discussion of

Fund performance

From the Portfolio Management Team

Rainier Investment Management, Inc.

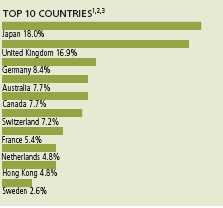

U.S. equities posted strong returns for the year ended March 31, 2013. Gains came in the third quarter of 2012 upon further intervention by central banks to help stimulate global economic growth, and again in early 2013, following a legislative agreement to stave off automatic federal tax increases and spending cuts in the U.S. Improving U.S. economic data, continued low interest rates and reasonable stock valuations also helped. The S&P 500 Index finished the 12-month period up 13.96%. For the 12 months ended March 31, 2013, John Hancock Rainier Growth Fund’s Class A shares returned 6.48%, excluding sales charges. Over the same period, the Fund’s benchmark, the Russell 1000 Growth Index, climbed 10.09%, and its peer group, the Morningstar, Inc. large growth funds category, advanced 8.43%.†

Security selection detracted versus the benchmark index, particularly in the information technology sector. Individual disappointments included social networking site Facebook, Inc., whose stock sank amid worries over a drop in user activity, and shares of data storage leader EMC Corp., which fell as corporate spending on technology slowed. An investment in wide area network optimization company Riverbed Technology, Inc. also detracted from performance due to an earnings miss and a large acquisition. We sold the position before period end. Stock picks in the consumer discretionary sector further hindered performance. By contrast, investments in financials and materials aided relative performance. Top individual contributors included biotechnology leader Gilead Sciences, Inc. within health care, whose shares rallied sharply thanks to positive test results for its new hepatitis C treatment. The stock of online retailer eBay, Inc. within consumer discretionary gained from shifting to a pay-it-now format and expanding its PayPal payment system.

This commentary reflects the views of the portfolio management team through the end of the period discussed in this report. The team’s statements reflect its own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Past performance is no guarantee of future results.

Growth stocks may be subject to greater price fluctuations because their prices tend to place more emphasis on earnings expectations. Foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. Large company stocks as a group could fall out of favor with the market, causing the Fund to underperform. Hedging and other strategic transactions may increase volatility of a fund and, if the transaction is not successful, could result in a significant loss. Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors and investments focused in one sector may fluctuate more widely than investments diversified across sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

† Figures from Morningstar, Inc. include reinvested dividends and do not take into account sales charges. Actual load-adjusted performance is lower.

| |

| 8 | Rainier Growth Fund | Annual report |

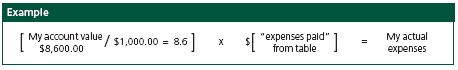

Your expenses

These examples are intended to help you understand your ongoing operating expenses of investing in the Fund so you can compare these costs with the ongoing costs of investing in other mutual funds.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

▪ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

▪ Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about the Fund’s actual ongoing operating expenses, and is based on the Fund’s actual return. It assumes an account value of $1,000.00 on October 1, 2012 with the same investment held until March 31, 2013.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 10-1-12 | on 3-31-13 | period ended 3-31-131 |

|

| Class A | $1,000.00 | $1,070.00 | $6.40 |

|

| Class B | 1,000.00 | 1,064.90 | 10.71 |

|

| Class C | 1,000.00 | 1,064.90 | 10.71 |

|

| Class I | 1,000.00 | 1,071.40 | 4.70 |

|

| Class R1 | 1,000.00 | 1,067.40 | 8.76 |

|

| Class R2 | 1,000.00 | 1,068.30 | 7.48 |

|

| Class R3 | 1,000.00 | 1,068.00 | 8.25 |

|

| Class R4 | 1,000.00 | 1,069.70 | 6.19 |

|

| Class R5 | 1,000.00 | 1,071.10 | 5.16 |

|

| Class R6 | 1,000.00 | 1,071.40 | 4.44 |

|

| Class T | 1,000.00 | 1,069.10 | 6.91 |

|

| Class ADV | 1,000.00 | 1,070.10 | 5.88 |

|

| Class NAV | 1,000.00 | 1,072.10 | 4.08 |

|

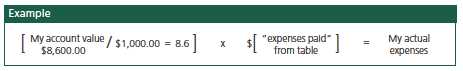

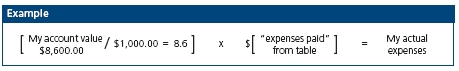

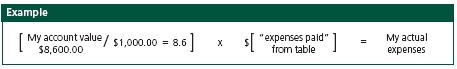

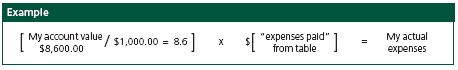

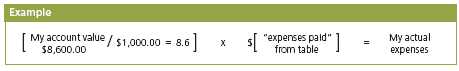

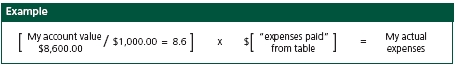

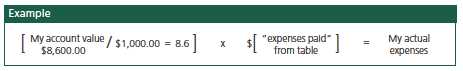

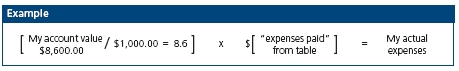

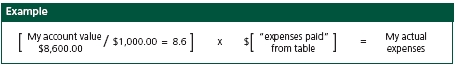

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at March 31, 2013, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| |

| Annual report | Rainier Growth Fund | 9 |

Your expenses

Hypothetical example for comparison purposes

This table allows you to compare the Fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not the Fund’s actual return). It assumes an account value of $1,000.00 on October 1, 2012, with the same investment held until March 31, 2013. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses. Please remember that these hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 10-1-12 | on 3-31-13 | period ended 3-31-131 |

|

| Class A | $1,000.00 | $1,018.70 | $6.24 |

|

| Class B | 1,000.00 | 1,014.60 | 10.45 |

|

| Class C | 1,000.00 | 1,014.60 | 10.45 |

|

| Class I | 1,000.00 | 1,020.40 | 4.58 |

|

| Class R1 | 1,000.00 | 1,016.50 | 8.55 |

|

| Class R2 | 1,000.00 | 1,017.70 | 7.29 |

|

| Class R3 | 1,000.00 | 1,017.00 | 8.05 |

|

| Class R4 | 1,000.00 | 1,018.90 | 6.04 |

|

| Class R5 | 1,000.00 | 1,019.90 | 5.04 |

|

| Class R6 | 1,000.00 | 1,020.60 | 4.33 |

|

| Class T | 1,000.00 | 1,018.20 | 6.74 |

|

| Class ADV | 1,000.00 | 1,019.20 | 5.74 |

|

| Class NAV | 1,000.00 | 1,021.00 | 3.98 |

|

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.24%, 2.08%, 2.08%, 0.91%, 1.70%, 1.45%, 1.60%, 1.20%, 1.00% 0.86%, 1.34%, 1.14% and 0.79% for Class A, Class B, Class C, Class I, Class R1, Class R2, Class R3, Class R4, Class R5, Class R6, Class T, Class ADV and Class NAV shares, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

| |

| 10 | Rainier Growth Fund | Annual report |

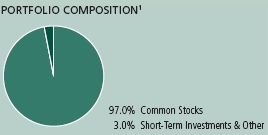

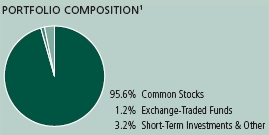

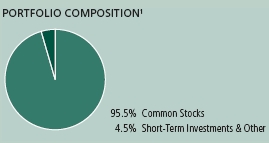

Portfolio summary

| | | | |

| Top 10 Holdings (27.5% of Net Assets on 3-31-13)1,2 | | | |

|

| Google, Inc., Class A | 4.4% | | QUALCOMM, Inc. | 2.5% |

| |

|

| Apple, Inc. | 3.8% | | Visa, Inc., Class A | 2.3% |

| |

|

| Amazon.com, Inc. | 2.8% | | Accenture PLC, Class A | 2.3% |

| |

|

| Gilead Sciences, Inc. | 2.7% | | Anheuser-Busch InBev NV, ADR | 2.1% |

| |

|

| Comcast Corp., Class A | 2.5% | | The Walt Disney Company | 2.1% |

| |

|

| |

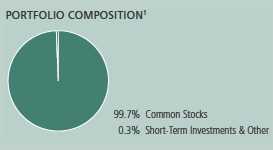

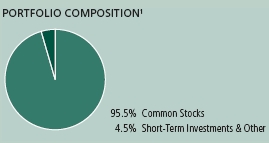

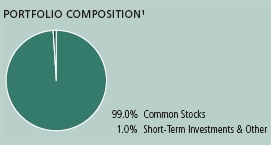

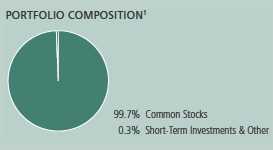

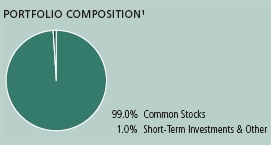

| Sector Composition1,3 | | | | |

|

| Information Technology | 28.7% | | Materials | 5.6% |

| |

|

| Consumer Discretionary | 20.3% | | Financials | 4.4% |

| |

|

| Health Care | 13.7% | | Energy | 3.5% |

| |

|

| Industrials | 11.5% | | Telecommunication Services | 2.5% |

| |

|

| Consumer Staples | 9.5% | | Short-Term Investments & Other | 0.3% |

| |

|

1 As a percentage of net assets on 3-31-13.

2 Cash and cash equivalents not included.

3 Growth stocks may be subject to greater price fluctuations because their prices tend to place more emphasis on earnings expectations. Foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. Large company stocks as a group could fall out of favor with the market, causing the Fund to underperform. Hedging and other strategic transactions may increase volatility of a fund and, if the transaction is not successful, could result in a significant loss. Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors and investments focused in one sector may fluctuate more widely than investments diversified across sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

| |

| Annual report | Rainier Growth Fund | 11 |

Fund’s investments

As of 3-31-13

| | |

| | Shares | Value |

| Common Stocks 99.7% | $1,063,697,410 |

|

| (Cost $868,440,998) | | |

| | | |

| Consumer Discretionary 20.3% | | 217,170,997 |

| | | |

| Hotels, Restaurants & Leisure 0.6% | | |

|

| Starwood Hotels & Resorts Worldwide, Inc. | 100,180 | 6,384,470 |

| | | |

| Internet & Catalog Retail 3.8% | | |

|

| Amazon.com, Inc. (I) | 110,570 | 29,465,799 |

|

| priceline.com, Inc. (I) | 16,740 | 11,515,948 |

| | | |

| Media 8.4% | | |

|

| CBS Corp., Class B | 444,280 | 20,743,433 |

|

| Comcast Corp., Class A | 632,420 | 26,567,964 |

|

| Discovery Communications, Inc., Class A (I) | 194,430 | 15,309,418 |

|

| Liberty Global, Inc., Class A (I) | 72,370 | 5,311,958 |

|

| The Walt Disney Company | 387,780 | 22,025,904 |

| | | |

| Multiline Retail 0.9% | | |

|

| Nordstrom, Inc. | 181,740 | 10,037,500 |

| | | |

| Specialty Retail 2.6% | | |

|

| The Home Depot, Inc. | 259,750 | 18,125,355 |

|

| Tractor Supply Company | 90,960 | 9,471,665 |

| | | |

| Textiles, Apparel & Luxury Goods 4.0% | | |

|

| Michael Kors Holdings, Ltd. (I) | 215,890 | 12,260,393 |

|

| NIKE, Inc., Class B | 264,370 | 15,600,474 |

|

| Ralph Lauren Corp. | 84,760 | 14,350,716 |

| | | |

| Consumer Staples 9.5% | | 101,290,389 |

| | | |

| Beverages 3.6% | | |

|

| Anheuser-Busch InBev NV, ADR | 222,210 | 22,121,006 |

|

| Diageo PLC, ADR | 128,800 | 16,208,192 |

| | | |

| Food & Staples Retailing 4.0% | | |

|

| Costco Wholesale Corp. | 159,940 | 16,971,233 |

|

| CVS Caremark Corp. | 275,240 | 15,135,448 |

|

| Whole Foods Market, Inc. | 126,690 | 10,990,358 |

| | | |

| Household Products 0.2% | | |

|

| Church & Dwight Company, Inc. | 33,290 | 2,151,533 |

| | | |

| Personal Products 1.7% | | |

|

| The Estee Lauder Companies, Inc., Class A (L) | 276,630 | 17,712,619 |

| | |

| 12 | Rainier Growth Fund | Annual report | See notes to financial statements |

| | |

| | Shares | Value |

| Energy 3.5% | | $36,988,038 |

| | | |

| Energy Equipment & Services 2.6% | | |

|

| Cameron International Corp. (I) | 157,920 | 10,296,384 |

|

| Schlumberger, Ltd. | 226,410 | 16,955,845 |

| | | |

| Oil, Gas & Consumable Fuels 0.9% | | |

|

| Anadarko Petroleum Corp. | 111,330 | 9,735,809 |

| | | |

| Financials 4.4% | | 46,576,374 |

| | | |

| Capital Markets 2.9% | | |

|

| T. Rowe Price Group, Inc. | 192,220 | 14,391,511 |

|

| The Goldman Sachs Group, Inc. | 109,720 | 16,145,298 |

| | | |

| Diversified Financial Services 1.5% | | |

|

| IntercontinentalExchange, Inc. (I)(L) | 98,360 | 16,039,565 |

| | | |

| Health Care 13.7% | | 146,700,719 |

| | | |

| Biotechnology 5.1% | | |

|

| BioMarin Pharmaceutical, Inc. (I) | 157,420 | 9,800,969 |

|

| Celgene Corp. (I) | 140,720 | 16,310,855 |

|

| Gilead Sciences, Inc. (I)(L) | 589,190 | 28,829,067 |

| | | |

| Health Care Equipment & Supplies 0.9% | | |

|

| Intuitive Surgical, Inc. (I) | 19,400 | 9,529,086 |

| | | |

| Health Care Providers & Services 1.3% | | |

|

| Catamaran Corp. (I) | 258,800 | 13,724,164 |

| | | |

| Life Sciences Tools & Services 1.0% | | |

|

| Illumina, Inc. (I)(L) | 197,990 | 10,691,460 |

| | | |

| Pharmaceuticals 5.4% | | |

|

| Actavis, Inc. (I) | 114,420 | 10,539,226 |

|

| Allergan, Inc. (L) | 186,635 | 20,834,065 |

|

| Novo Nordisk A/S, ADR | 120,660 | 19,486,590 |

|

| Shire PLC, ADR | 76,130 | 6,955,237 |

| | | |

| Industrials 11.5% | | 122,824,905 |

| | | |

| Aerospace & Defense 3.6% | | |

|

| Honeywell International, Inc. | 229,730 | 17,310,156 |

|

| Precision Castparts Corp. | 110,810 | 21,011,792 |

| | | |

| Electrical Equipment 3.3% | | |

|

| AMETEK, Inc. | 452,035 | 19,600,238 |

|

| Eaton Corp. PLC | 253,890 | 15,550,763 |

| | | |

| Machinery 1.9% | | |

|

| Cummins, Inc. | 173,950 | 20,145,150 |

| | | |

| Professional Services 1.1% | | |

|

| Verisk Analytics, Inc., Class A (I) | 185,760 | 11,448,389 |

| | | |

| Road & Rail 1.6% | | |

|

| Kansas City Southern | 160,130 | 17,758,417 |

| | |

| See notes to financial statements | Annual report | Rainier Growth Fund | 13 |

| | | |

| | | Shares | Value |

| Information Technology 28.7% | | | $306,037,582 |

| | | | |

| Communications Equipment 2.5% | | | |

|

| BancTec, Inc. (I)(S) | | 197,026 | 321,152 |

|

| QUALCOMM, Inc. | | 394,700 | 26,425,165 |

| | | | |

| Computers & Peripherals 5.2% | | | |

|

| Apple, Inc. | | 91,500 | 40,500,645 |

|

| EMC Corp. (I) | | 650,755 | 15,546,537 |

| | | | |

| Electronic Equipment, Instruments & Components 0.7% | | |

|

| Trimble Navigation, Ltd. (I) | | 250,720 | 7,511,571 |

| | | | |

| Internet Software & Services 6.7% | | | |

|

| eBay, Inc. (I) | | 225,090 | 12,204,380 |

|

| Facebook, Inc., Class A (I) | | 481,060 | 12,305,515 |

|

| Google, Inc., Class A (I) | | 59,110 | 46,935,113 |

| | | | |

| IT Services 7.6% | | | |

|

| Accenture PLC, Class A | | 328,620 | 24,965,261 |

|

| Mastercard, Inc., Class A (L) | | 40,040 | 21,666,845 |

|

| Teradata Corp. (I)(L) | | 154,540 | 9,042,135 |

|

| Visa, Inc., Class A (L) | | 147,255 | 25,009,789 |

| | | | |

| Software 6.0% | | | |

|

| Citrix Systems, Inc. (I) | | 146,850 | 10,596,696 |

|

| Intuit, Inc. (L) | | 173,550 | 11,393,558 |

|

| Red Hat, Inc. (I) | | 200,430 | 10,133,741 |

|

| Salesforce.com, Inc. (I)(L) | | 86,780 | 15,518,867 |

|

| SAP AG, ADR (L) | | 198,170 | 15,960,612 |

| | | | |

| Materials 5.6% | | | 59,446,672 |

| | | | |

| Chemicals 4.7% | | | |

|

| Ecolab, Inc. | | 143,190 | 11,480,974 |

|

| LyondellBasell Industries NV, Class A | | 171,850 | 10,876,387 |

|

| Monsanto Company | | 183,000 | 19,330,290 |

|

| Praxair, Inc. | | 75,060 | 8,372,192 |

| | | | |

| Metals & Mining 0.9% | | | |

|

| Freeport-McMoRan Copper & Gold, Inc. | | 283,590 | 9,386,829 |

| | | | |

| Telecommunication Services 2.5% | | | 26,661,734 |

| | | | |

| Diversified Telecommunication Services 1.1% | | | |

|

| American Tower Corp. | | 151,150 | 11,626,458 |

| | | | |

| Wireless Telecommunication Services 1.4% | | | |

|

| Crown Castle International Corp. (I) | | 215,900 | 15,035,276 |

| |

| | Yield (%) | Shares | Value |

| Securities Lending Collateral 12.3% | | | $131,096,084 |

|

| (Cost $131,083,568) | | | |

| | | | |

| John Hancock Collateral Investment Trust (W) | 0.2481 (Y) | 13,098,213 | 131,096,084 |

| | |

| 14 | Rainier Growth Fund | Annual report | See notes to financial statements |

| | | |

| | Yield (%) | Shares | Value |

| Short-Term Investments 0.5% | | | $5,829,607 |

|

| (Cost $5,829,607) | | | |

| | | | |

| Money Market Funds 0.5% | | | 5,829,607 |

| | | | |

| State Street Institutional US Government | | | |

| Money Market Fund | 0.0241 (Y) | 5,829,607 | 5,829,607 |

| |

| Total investments (Cost $1,005,354,173)† 112.5% | $1,200,623,101 |

|

| Other assets and liabilities, net (12.5%) | | | ($133,162,578) |

|

| Total net assets 100.0% | | $1,067,460,523 |

|

The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the Fund.

ADR American Depositary Receipts

(I) Non-income producing security.

(L) A portion of this security is on loan as of 3-31-13.

(S) These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration.

(W) Investment is an affiliate of the Fund, the advisor and/or subadvisor. This investment represents collateral recieved for securities lending.

(Y) The rate shown is the annualized seven-day yield as of 3-31-13.

† At 3-31-13, the aggregate cost of investment securities for federal income tax purposes was $1,010,395,877. Net unrealized appreciation aggregated $190,227,224, of which $200,796,581 related to appreciated investment securities and $10,569,357 related to depreciated investment securities.

| | |

| See notes to financial statements | Annual report | Rainier Growth Fund | 15 |

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 3-31-13

This Statement of assets and liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum public offering price per share.

| |

| Assets | |

|

| Investments in unaffiliated issuers, at value (Cost $874,270,605) including | |

| $126,109,699 of securities loaned | $1,069,527,017 |

| Investments in affiliated issuers, at value (Cost $131,083,568) | 131,096,084 |

| | |

| Total investments, at value (Cost $1,005,354,173) | 1,200,623,101 |

| Receivable for investments sold | 9,312,302 |

| Receivable for fund shares sold | 841,937 |

| Dividends and interest receivable | 778,539 |

| Receivable for securities lending income | 14,334 |

| Receivable due from advisor | 2,282 |

| Other receivables and prepaid expenses | 160,493 |

| | |

| Total assets | 1,211,732,988 |

| |

| Liabilities | |

|

| Payable for investments purchased | 11,987,538 |

| Payable for fund shares repurchased | 858,592 |

| Payable upon return of securities loaned | 131,088,795 |

| Payable to affiliates | |

| Accounting and legal services fees | 20,509 |

| Transfer agent fees | 80,015 |

| Trustees’ fees | 52,449 |

| Other liabilities and accrued expenses | 184,567 |

| | |

| Total liabilities | 144,272,465 |

| | |

| Net assets | 1,067,460,523 |

| |

| Net assets consist of | |

|

| Paid-in capital | $905,704,568 |

| Undistributed net investment income | 540,400 |

| Accumulated net realized gain (loss) on investments | (34,053,373) |

| Net unrealized appreciation (depreciation) on investments | 195,268,928 |

| | |

| Net assets | $1,067,460,523 |

| | |

| 16 | Rainier Growth Fund | Annual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T S

Statement of assets and liabilities (continued)

| |

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($355,873,849 ÷ 14,635,671 shares)1 | $24.32 |

| Class B ($20,255,902 ÷ 863,384 shares)1 | $23.46 |

| Class C ($17,372,688 ÷ 740,849 shares)1 | $23.45 |

| Class I ($112,651,238 ÷ 4,542,364 shares) | $24.80 |

| Class R1 ($388,320 ÷ 16,249 shares) | $23.90 |

| Class R2 ($110,133 ÷ 4,454.34 shares) | $24.72 |

| Class R3 ($106,975 ÷ 4,452 shares) | $24.03 |

| Class R4 ($109,271 ÷ 4,478 shares) | $24.40 |

| Class R5 ($110,186 ÷ 4,460 shares) | $24.71 |

| Class R6 ($4,122,236 ÷ 165,927 shares) | $24.84 |

| Class T ($72,926,416 ÷ 3,021,867 shares) | $24.13 |

| Class ADV ($20,374,314 ÷ 829,382 shares) | $24.57 |

| Class NAV ($463,058,995 ÷ 18,625,094 shares) | $24.86 |

| |

| Maximum offering price per share | |

|

| Class A (net asset value per share ÷ 95%)2 | $25.60 |

| Class T (net asset value per share ÷ 95%)2 | $25.40 |

1 Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge.

2 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

| | |

| See notes to financial statements | Annual report | Rainier Growth Fund | 17 |

F I N A N C I A L S T A T E M E N T S

Statement of operations For the year ended 3-31-13

This Statement of operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Dividends | $13,208,382 |

| Securities lending | 233,184 |

| Interest | 1,247 |

| Less foreign taxes withheld | (75,267) |

| | |

| Total investment income | 13,367,546 |

| |

| Expenses | |

|

| Investment management fees | 8,250,073 |

| Distribution and service fees | 1,531,734 |

| Accounting and legal services fees | 222,673 |

| Transfer agent fees | 1,085,704 |

| Trustees’ fees | 73,155 |

| State registration fees | 193,968 |

| Printing and postage | 91,919 |

| Professional fees | 102,553 |

| Custodian fees | 130,899 |

| Registration and filing fees | 58,988 |

| Other | 49,534 |

| | |

| Total expenses | 11,791,200 |

| Less expense reductions | (127,752) |

| | |

| Net expenses | 11,663,448 |

| | |

| Net investment income | 1,704,098 |

| |

| Realized and unrealized gain (loss) | |

|

| Net realized gain (loss) on | |

| Investments in unaffiliated issuers | 157,793,592 |

| Investments in affiliated issuers | (3,963) |

| | |

| | 157,789,629 |

| Change in net unrealized appreciation (depreciation) of | |

| Investments in unaffiliated issuers | (99,636,272) |

| Investments in affiliated issuers | (2,680) |

| | |

| | (99,638,952) |

| | |

| Net realized and unrealized gain | 58,150,677 |

| | |

| Increase in net assets from operations | $59,854,775 |

| | |

| 18 | Rainier Growth Fund | Annual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T S

Statements of changes in net assets

These Statements of changes in net assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | |

| | Year | Year |

| | ended | ended |

| | 3-31-13 | 3-31-12 |

| |

| Increase (decrease) in net assets | | |

|

| From operations | | |

| Net investment income (loss) | $1,704,098 | ($2,801,661) |

| Net realized gain | 157,789,629 | 120,269,463 |

| Change in net unrealized appreciation (depreciation) | (99,638,952) | (57,579,735) |

| | | |

| Increase in net assets resulting from operations | 59,854,775 | 59,888,067 |

| | | |

| Distributions to shareholders | | |

| From net investment income | | |

| Class I | (133,627) | — |

| Class R5 | (50) | — |

| Class R6 | (4,078) | — |

| Class NAV | (612,300) | — |

| | | |

| Total distributions | (750,055) | — |

| | | |

| From Fund share transactions | (250,750,666) | (422,108,385) |

| | | |

| Total decrease | (191,645,946) | (362,220,318) |

| |

| Net assets | | |

|

| Beginning of year | 1,259,106,469 | 1,621,326,787 |

| | | |

| End of year | $1,067,460,523 | $1,259,106,469 |

| | | |

| Undistributed (accumulated distributions in excess of) net | | |

| investment income | $540,400 | ($746,014) |

| | |

| See notes to financial statements | Annual report | Rainier Growth Fund | 19 |

Financial highlights

The Financial highlights show how the Fund’s net asset value for a share has changed during the period.

| | | | | |

| CLASS A SHARES Period ended | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $22.84 | $21.32 | $18.31 | $12.84 | $20.91 |

| Net investment income (loss)2 | (0.01) | (0.09) | (0.06) | (0.03) | (0.01) |

| Net realized and unrealized gain (loss) on investments | 1.49 | 1.61 | 3.07 | 5.50 | (8.06) |

| Total from investment operations | 1.48 | 1.52 | 3.01 | 5.47 | (8.07) |

| Net asset value, end of period | $24.32 | $22.84 | $21.32 | $18.31 | $12.84 |

| Total return (%)3,4 | 6.48 | 7.13 | 16.44 | 42.60 | (38.59) |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | $356 | $369 | $413 | $384 | $193 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 1.25 | 1.27 | 1.30 | 1.45 | 1.47 |

| Expenses net of fee waivers | 1.25 | 1.27 | 1.30 | 1.38 | 1.18 |

| Expenses net of fee waivers and credits | 1.25 | 1.27 | 1.30 | 1.34 | 1.18 |

| Net investment loss | (0.04) | (0.45) | (0.33) | (0.18) | (0.04) |

| Portfolio turnover (%) | 92 | 90 | 90 | 102 | 101 |

1 After the close of business on 4-25-08, holders of Original Shares of the former Rainier Large Cap Growth Equity Portfolio (the Predecessor Fund) became owners of an equal number of full and fractional Class A shares of the John Hancock Rainier Growth Fund. These shares were first offered on 4-28-08. Additionally, the accounting and performance history of the Original Shares of the Predecessor Fund was redesignated as that of John Hancock Rainier Growth Fund Class A.

2 Based on the average daily shares outstanding.

3 Does not reflect the effect of sales charges, if any.

4 Total returns would have been lower had certain expenses not been reduced during the applicable periods shown.

| | | | | |

| CLASS B SHARES Period ended | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $22.22 | $20.90 | $18.10 | $12.79 | $22.46 |

| Net investment loss2 | (0.19) | (0.25) | (0.21) | (0.15) | (0.09) |

| Net realized and unrealized gain (loss) on investments | 1.43 | 1.57 | 3.01 | 5.46 | (9.58) |

| Total from investment operations | 1.24 | 1.32 | 2.80 | 5.31 | (9.67) |

| Net asset value, end of period | $23.46 | $22.22 | $20.90 | $18.10 | $12.79 |

| Total return (%)3,4 | 5.58 | 6.32 | 15.47 | 41.52 | (43.05)5 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | $20 | $25 | $31 | $37 | $27 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 2.06 | 2.07 | 2.13 | 2.45 | 2.826 |

| Expenses net of fee waivers | 2.06 | 2.07 | 2.10 | 2.11 | 2.056 |

| Expenses net of fee waivers and credits | 2.06 | 2.07 | 2.10 | 2.09 | 2.046 |

| Net investment loss | (0.86) | (1.24) | (1.13) | (0.94) | (0.75)6 |

| Portfolio turnover (%) | 92 | 90 | 90 | 102 | 1017 |

1 The inception date for Class B shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Does not reflect the effect of sales charges, if any.

4 Total returns would have been lower had certain expenses not been reduced during the applicable periods shown.

5 Not annualized.

6 Annualized.

7 Portfolio turnover is shown for the period from 4-1-08 to 3-31-09.

| | |

| 20 | Rainier Growth Fund | Annual report | See notes to financial statements |

| | | | | |

| CLASS C SHARES Period ended | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $22.21 | $20.90 | $18.10 | $12.79 | $22.46 |

| Net investment loss2 | (0.19) | (0.26) | (0.21) | (0.15) | (0.09) |

| Net realized and unrealized gain (loss) on investments | 1.43 | 1.57 | 3.01 | 5.46 | (9.58) |

| Total from investment operations | 1.24 | 1.31 | 2.80 | 5.31 | (9.67) |

| Net asset value, end of period | $23.45 | $22.21 | $20.90 | $18.10 | $12.79 |

| Total return (%)3,4 | 5.58 | 6.27 | 15.47 | 41.52 | (43.05)5 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | $17 | $20 | $22 | $24 | $15 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 2.07 | 2.11 | 2.16 | 2.34 | 2.826 |

| Expenses net of fee waivers | 2.07 | 2.10 | 2.10 | 2.21 | 2.056 |

| Expenses net of fee waivers and credits | 2.07 | 2.10 | 2.10 | 2.09 | 2.046 |

| Net investment loss | (0.88) | (1.27) | (1.13) | (0.93) | (0.77)6 |

| Portfolio turnover (%) | 92 | 90 | 90 | 102 | 1017 |

1 The inception date for Class C shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Does not reflect the effect of sales charges, if any.

4 Total returns would have been lower had certain expenses not been reduced during the applicable periods shown.

5 Not annualized.

6 Annualized.

7 Portfolio turnover is shown for the period from 4-1-08 to 3-31-09.

| | | | | |

| CLASS I SHARES Period ended | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $23.24 | $21.61 | $18.50 | $12.92 | $20.98 |

| Net investment income (loss)2 | 0.06 | (0.02) | 0.02 | 0.04 | 0.04 |

| Net realized and unrealized gain (loss) on investments | 1.52 | 1.65 | 3.11 | 5.54 | (8.09) |

| Total from investment operations | 1.58 | 1.63 | 3.13 | 5.58 | (8.05) |

| Less distributions | | | | | |

| From net investment income | (0.02) | — | (0.02) | —3 | (0.01) |

| Net asset value, end of period | $24.80 | $23.24 | $21.61 | $18.50 | $12.92 |

| Total return (%)4 | 6.81 | 7.54 | 16.93 | 43.20 | (38.36) |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | $113 | $256 | $237 | $208 | $133 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 0.91 | 0.91 | 0.86 | 0.90 | 0.86 |

| Expenses net of fee waivers and credits | 0.91 | 0.91 | 0.86 | 0.90 | 0.86 |

| Net investment income (loss) | 0.25 | (0.08) | 0.10 | 0.26 | 0.22 |

| Portfolio turnover (%) | 92 | 90 | 90 | 102 | 101 |

1 After the close of business on 4-25-08, holders of Institutional Shares of the former Rainier Large Cap Growth Equity Portfolio (the Predecessor Fund) became owners of an equal number of full and fractional Class I shares of the John Hancock Rainier Growth Fund. These shares were first offered on 4-28-08. Additionally, the accounting and performance history of the Institutional Shares of the Predecessor Fund was redesignated as that of John Hancock Rainier Growth Fund Class I.

2 Based on the average daily shares outstanding.

3 Less than $0.005 per share.

4 Total returns would have been lower had certain expenses not been reduced during the applicable periods shown.

| | |

| See notes to financial statements | Annual report | Rainier Growth Fund | 21 |

| | | | | |

| CLASS R1 SHARES Period ended | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $22.55 | $21.14 | $18.23 | $12.84 | $22.46 |

| Net investment loss2 | (0.11) | (0.17) | (0.14) | (0.11) | (0.08) |

| Net realized and unrealized gain (loss) on investments | 1.46 | 1.58 | 3.05 | 5.50 | (9.54) |

| Total from investment operations | 1.35 | 1.41 | 2.91 | 5.39 | (9.62) |

| Net asset value, end of period | $23.90 | $22.55 | $21.14 | $18.23 | $12.84 |

| Total return (%)3 | 5.99 | 6.67 | 15.96 | 41.98 | (42.83)4 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | —5 | —5 | —5 | —5 | —5 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 5.79 | 7.03 | 8.39 | 13.91 | 8.706 |

| Expenses net of fee waivers and credits | 1.70 | 1.70 | 1.72 | 1.78 | 1.646 |

| Net investment loss | (0.49) | (0.86) | (0.75) | (0.65) | (0.50)6 |

| Portfolio turnover (%) | 92 | 90 | 90 | 102 | 1017 |

1 The inception date for Class R1 shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the applicable periods shown.

4 Not annualized.

5 Less than $500,000.

6 Annualized.

7 Portfolio turnover is shown for the period from 4-1-08 to 3-31-09.

| | | | | |

| CLASS R2 SHARES Period ended | | | | 3-31-13 | 3-31-121 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | | | | $23.27 | $22.45 |

| Net investment income (loss)2 | | | | (0.06) | —3 |

| Net realized and unrealized gain on investments | | | | 1.51 | 0.82 |

| Total from investment operations | | | | 1.45 | 0.82 |

| Net asset value, end of period | | | | $24.72 | $23.27 |

| Total return (%)4 | | | | 6.23 | 3.655 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | | | | —6 | —6 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | | | | 20.41 | 15.967 |

| Expenses net of fee waivers and credits | | | | 1.45 | 1.457 |

| Net investment loss | | | | (0.24) | (0.12)7 |

| Portfolio turnover (%) | | | | 92 | 908 |

1 The inception date for Class R2 shares is 3-1-12.

2 Based on the average daily shares outstanding.

3 Less than $0.005 per share.

4 Total returns would have been lower had certain expenses not been reduced during the applicable periods shown.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

8 Portfolio turnover is shown for the period from 4-1-11 to 3-31-12.

| | |

| 22 | Rainier Growth Fund | Annual report | See notes to financial statements |

| | | | | |

| CLASS R3 SHARES Period ended | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $22.65 | $21.21 | $18.27 | $12.85 | $22.46 |

| Net investment loss2 | (0.09) | (0.16) | (0.12) | (0.07) | (0.06) |

| Net realized and unrealized gain (loss) on investments | 1.47 | 1.60 | 3.06 | 5.49 | (9.55) |

| Total from investment operations | 1.38 | 1.44 | 2.94 | 5.42 | (9.61) |

| Net asset value, end of period | $24.03 | $22.65 | $21.21 | $18.27 | $12.85 |

| Total return (%)3 | 6.09 | 6.79 | 16.09 | 42.18 | (42.79)4 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | —5 | —5 | —5 | —5 | —5 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 15.02 | 15.86 | 16.72 | 13.68 | 8.576 |

| Expenses net of fee waivers and credits | 1.60 | 1.59 | 1.61 | 1.62 | 1.546 |

| Net investment loss | (0.39) | (0.76) | (0.64) | (0.46) | (0.40)6 |

| Portfolio turnover (%) | 92 | 90 | 90 | 102 | 1017 |

1 The inception date for Class R3 shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the applicable periods shown.

4 Not annualized.

5 Less than $500,000.

6 Annualized.

7 Portfolio turnover is shown for the period from 4-1-08 to 3-31-09.

| | | | | |

| CLASS R4 SHARES Period ended | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $22.91 | $21.40 | $18.38 | $12.88 | $22.46 |

| Net investment income (loss)2 | —3 | (0.10) | (0.06) | (0.03) | (0.02) |

| Net realized and unrealized gain (loss) on investments | 1.49 | 1.61 | 3.08 | 5.53 | (9.56) |

| Total from investment operations | 1.49 | 1.51 | 3.02 | 5.50 | (9.58) |

| Net asset value, end of period | $24.40 | $22.91 | $21.40 | $18.38 | $12.88 |

| Total return (%)4 | 6.50 | 7.06 | 16.43 | 42.70 | (42.65)5 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | —6 | —6 | —6 | —6 | —6 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 14.55 | 15.46 | 16.45 | 13.33 | 8.267 |

| Expenses net of fee waivers and credits | 1.22 | 1.29 | 1.31 | 1.32 | 1.247 |

| Net investment income (loss) | 0.01 | (0.46) | (0.34) | (0.16) | (0.10)7 |

| Portfolio turnover (%) | 92 | 90 | 90 | 102 | 1018 |

1 The inception date for Class R4 shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Less than $0.005 per share.

4 Total returns would have been lower had certain expenses not been reduced during the applicable periods shown.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

8 Portfolio turnover is shown for the period from 4-1-08 to 3-31-09.

| | |

| See notes to financial statements | Annual report | Rainier Growth Fund | 23 |

| | | | | |

| CLASS R5 SHARES Period ended | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $23.16 | $21.56 | $18.47 | $12.91 | $22.46 |

| Net investment income (loss)2 | 0.05 | (0.03) | (0.02) | 0.02 | 0.03 |

| Net realized and unrealized gain (loss) on investments | 1.51 | 1.63 | 3.12 | 5.54 | (9.57) |

| Total from investment operations | 1.56 | 1.60 | 3.10 | 5.56 | (9.54) |

| Less distributions | | | | | |

| From net investment income | (0.01) | — | (0.01) | —3 | (0.01) |

| Net asset value, end of period | $24.71 | $23.16 | $21.56 | $18.47 | $12.91 |

| Total return (%)4 | 6.74 | 7.42 | 16.78 | 43.07 | (42.48)5 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | —6 | —6 | —6 | —6 | —6 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 14.16 | 15.07 | 16.17 | 12.97 | 7.957 |

| Expenses net of fee waivers and credits | 1.00 | 0.99 | 1.01 | 1.02 | 0.947 |

| Net investment income | 0.21 | (0.16) | (0.03) | 0.14 | 0.207 |

| Portfolio turnover (%) | 92 | 90 | 90 | 102 | 1018 |

1 The inception date for Class R5 shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Less than $0.005 per share.

4 Total returns would have been lower had certain expenses not been reduced during the applicable periods shown.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

8 Portfolio turnover is shown for the period from 4-1-08 to 3-31-09.

| | | | | |

| CLASS R6 SHARES Period ended | | | | 3-31-13 | 3-31-121 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | | | | $23.27 | $20.01 |

| Net investment income2 | | | | 0.08 | 0.03 |

| Net realized and unrealized gain on investments | | | | 1.51 | 3.23 |

| Total from investment operations | | | | 1.59 | 3.26 |

| Less distributions | | | | | |

| From net investment income | | | | (0.02) | — |

| Net asset value, end of period | | | | $24.84 | $23.27 |

| Total return (%)3 | | | | 6.86 | 16.294 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | | | | $4 | $4 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | | | | 1.33 | 1.585 |

| Expenses net of fee waivers and credits | | | | 0.86 | 0.865 |

| Net investment income | | | | 0.34 | 0.205 |

| Portfolio turnover (%) | | | | 92 | 906 |

1 The inception date for Class R6 shares is 9-1-11.

2 Based on the average daily shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the applicable periods shown.

4 Not annualized.

5 Annualized.

6 Portfolio turnover is shown for the period from 4-1-11 to 3-31-12.

| | |

| 24 | Rainier Growth Fund | Annual report | See notes to financial statements |

| | | | | |

| CLASS T SHARES Period ended | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $22.69 | $21.20 | $18.24 | $12.86 | $16.59 |

| Net investment loss2 | (0.03) | (0.11) | (0.09) | (0.11) | (0.05) |

| Net realized and unrealized gain (loss) on investments | 1.47 | 1.60 | 3.05 | 5.49 | (3.68) |

| Total from investment operations | 1.44 | 1.49 | 2.96 | 5.38 | (3.73) |

| Net asset value, end of period | $24.13 | $22.69 | $21.20 | $18.24 | $12.86 |

| Total return (%)3,4 | 6.35 | 7.03 | 16.23 | 41.84 | (22.48)5 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | $73 | $77 | $83 | $83 | $72 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 1.33 | 1.37 | 1.47 | 1.84 | 2.076 |

| Expenses net of fee waivers | 1.33 | 1.37 | 1.47 | 1.84 | 1.996 |

| Expenses net of fee waivers and credits | 1.33 | 1.37 | 1.47 | 1.84 | 1.986 |

| Net investment loss | (0.13) | (0.54) | (0.50) | (0.69) | (0.74)6 |

| Portfolio turnover (%) | 92 | 90 | 90 | 102 | 1017 |

1 The inception date for Class T shares is 10-6-08.

2 Based on the average daily shares outstanding.

3 Does not reflect the effect of sales charges, if any.

4 Total returns would have been lower had certain expenses not been reduced during the applicable periods shown.

5 Not annualized.

6 Annualized.

7 Portfolio turnover is shown for the period from 4-1-08 to 3-31-09.

| | | | | |

| CLASS ADV SHARES Period ended | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $23.05 | $21.49 | $18.43 | $12.90 | $22.46 |

| Net investment income (loss)2 | 0.02 | (0.06) | (0.03) | —3 | (0.01) |

| Net realized and unrealized gain (loss) on investments | 1.50 | 1.62 | 3.09 | 5.53 | (9.55) |

| Total from investment operations | 1.52 | 1.56 | 3.06 | 5.53 | (9.56) |

| Net asset value, end of period | $24.57 | $23.05 | $21.49 | $18.43 | $12.90 |

| Total return (%)4 | 6.59 | 7.26 | 16.60 | 42.87 | (42.56)5 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | $20 | $20 | $22 | $18 | $17 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 1.33 | 1.35 | 1.37 | 1.25 | 1.146 |

| Expenses net of fee waivers and credits | 1.14 | 1.14 | 1.14 | 1.14 | 1.146 |

| Net investment income (loss) | 0.08 | (0.31) | (0.17) | 0.01 | (0.04)6 |

| Portfolio turnover (%) | 92 | 90 | 90 | 102 | 1017 |

1 The inception date for Class ADV shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Less than $0.005 per share.

4 Total returns would have been lower had certain expenses not been reduced during the applicable periods shown.

5 Not annualized.

6 Annualized.

7 Portfolio turnover is shown for the period from 4-1-08 to 3-31-09.

| | |

| See notes to financial statements | Annual report | Rainier Growth Fund | 25 |

| | | | | |

| CLASS NAV SHARES Period ended | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 | 3-31-091 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $23.28 | $21.63 | $18.51 | $12.91 | $22.46 |

| Net investment income2 | 0.09 | 0.01 | 0.03 | 0.05 | 0.04 |

| Net realized and unrealized gain (loss) on investments | 1.52 | 1.64 | 3.11 | 5.55 | (9.57) |

| Total from investment operations | 1.61 | 1.65 | 3.14 | 5.60 | (9.53) |

| Less distributions | | | | | |

| From net investment income | (0.03) | — | (0.02) | —3 | (0.02) |

| Net asset value, end of period | $24.86 | $23.28 | $21.63 | $18.51 | $12.91 |

| Total return (%)4 | 6.94 | 7.63 | 17.00 | 43.38 | (42.44)5 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | $463 | $487 | $813 | $708 | $400 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 0.79 | 0.80 | 0.80 | 0.82 | 0.836 |

| Expenses net of fee waivers and credits | 0.79 | 0.80 | 0.80 | 0.82 | 0.836 |

| Net investment income | 0.39 | 0.05 | 0.16 | 0.33 | 0.266 |

| Portfolio turnover (%) | 92 | 90 | 90 | 102 | 1017 |

1 The inception date for Class NAV shares is 4-28-08.

2 Based on the average daily shares outstanding.

3 Less than $0.005 per share.

4 Total returns would have been lower had certain expenses not been reduced during the applicable periods shown.

5 Not annualized.

6 Annualized.

7 Portfolio turnover is shown for the period from 4-1-08 to 3-31-09.

| | |

| 26 | Rainier Growth Fund | Annual report | See notes to financial statements |

Notes to financial statements

Note 1 — Organization

John Hancock Rainier Growth Fund (the Fund) is a series of John Hancock Funds III (the Trust), an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the Fund is to seek to maximize long-term capital appreciation.

The Fund may offer multiple classes of shares. The shares currently offered are detailed in the Statement of assets and liabilities. Class A and Class C shares are offered to all investors. Class I shares are offered to institutions and certain investors. Class R1, Class R2, Class R3, Class R4 and Class R5 shares are available only to certain retirement plans. Class R6 shares are only available to certain retirement plans, institutions and other investors. Class B, Class T and Class ADV shares are closed to new investors. Class NAV shares are offered to John Hancock affiliated funds of funds and certain 529 plans. Shareholders of each class have exclusive voting rights to matters that affect that class. Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees, if any, transfer agent fees, printing and postage and state registration fees for each class may differ.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates and those differences could be significant. Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. In order to value the securities, the Fund uses the following valuation techniques: Equity securities held by the Fund are valued at the last sale price or official closing price on the principal securities exchange on which they trade. In the event there were no sales during the day or closing prices are not available, then the securities are valued using the last quoted bid or evaluated price. Investments by the Fund in open-end mutual funds, including John Hancock Collateral Investment Trust (JHCIT), are valued at their respective net asset values each business day. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rates supplied by an independent pricing service. Certain securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Other portfolio securities and assets, where reliable market quotations are not available, are valued at fair value as determined in good faith by the Fund’s Pricing Committee following procedures established by the Board of Trustees, which include price verification procedures. The frequency with which these fair valuation procedures are used cannot be predicted.

The Fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities. Level 2 includes securities valued using other significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of

| |

| Annual report | Rainier Growth Fund | 27 |

the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the Fund’s own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events or trends, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy.

The following is a summary of the values by input classification of the Fund’s investments as of March 31, 2013, by major security category or type:

| | | | |

| | | | | LEVEL 3 |

| | | | LEVEL 2 | SIGNIFICANT |

| | TOTAL MARKET | LEVEL 1 | SIGNIFICANT | UNOBSERVABLE |

| | VALUE AT 3-31-13 | QUOTED PRICE | OBSERVABLE INPUTS | INPUTS |

|

| Common Stocks | | | | |

| Consumer Discretionary | $217,170,997 | $217,170,997 | — | — |

| Consumer Staples | 101,290,389 | 101,290,389 | — | — |

| Energy | 36,988,038 | 36,988,038 | — | — |

| Financials | 46,576,374 | 46,576,374 | — | — |

| Health Care | 146,700,719 | 146,700,719 | — | — |

| Industrials | 122,824,905 | 122,824,905 | — | — |

| Information Technology | 306,037,582 | 305,716,430 | — | $321,152 |

| Materials | 59,446,672 | 59,446,672 | — | — |

| Telecommunication | | | | |

| Services | 26,661,734 | 26,661,734 | — | — |

| Securities Lending | | | | |

| Collateral | 131,096,084 | 131,096,084 | — | — |

| Short-Term Investments | 5,829,607 | 5,829,607 | — | — |

| |

|

| Total Investments in | | | | |

| Securities | $1,200,623,101 | $1,200,301,949 | — | $321,152 |

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Dividend income is recorded on the ex-date, except for dividends of foreign securities where the dividend may not be known until after the ex-date. In those cases, dividend income, net of withholding taxes, is recorded when the Fund becomes aware of the dividends. Foreign taxes are provided for based on the Fund’s understanding of the tax rules and rates that exist in the foreign markets in which it invests. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation.

Securities lending. The Fund may lend its securities to earn additional income. It receives cash collateral from the borrower in an amount not less than the market value of the loaned securities. The Fund will invest its collateral in JHCIT, an affiliate of the Fund, which has a floating net asset value (NAV) and invests in short-term investments as part of the securities lending program, and as a result, the Fund will receive the benefit of any gains and bear any losses generated by JHCIT. Although risk of the loss of the securities lent is mitigated by holding the collateral and through securities lending provider indemnification, the Fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities or if collateral investments decline in value or possible loss of rights in the collateral should the borrower fail financially. The Fund may receive compensation for lending its securities by retaining a portion of the return on the investment of the collateral and compensation from fees earned from borrowers of the securities. Net income received from JHCIT is a component of securities lending income as recorded on the Statement of operations.

| |

| 28 | Rainier Growth Fund | Annual report |

Foreign taxes. The Fund may be subject to withholding tax on income or capital gains or repatriation taxes as imposed by certain countries in which the Fund invests. Taxes are accrued based upon investment income, realized gains or unrealized appreciation.

Line of credit. The Fund may borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the custodian agreement, the custodian may loan money to the Fund to make properly authorized payments. The Fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian may have a lien, security interest or security entitlement in any Fund property that is not otherwise segregated or pledged, to the maximum extent permitted by law, to the extent of any overdraft.

In addition, the Fund and other affiliated funds have entered into an agreement with Citibank N.A. that enables them to participate in a $300 million unsecured committed line of credit. A commitment fee, payable at the end of each calendar quarter, based on the average daily unused portion of the line of credit, is charged to each participating fund on a pro rata basis and is reflected in other expenses on the Statement of operations. Prior to March 27, 2013, the Fund participated in a $100 million unsecured line of credit, also with Citibank, with terms otherwise similar to the existing agreement. Commitment fees for the year ended March 31, 2013 were $2,289. For the year ended March 31, 2013, the Fund had no borrowings under the line of credit.

Expenses. Within the John Hancock Funds complex, expenses that are directly attributable to an individual fund are allocated to such fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund’s relative net assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations. Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the net assets of the class. Class-specific expenses, such as distribution and service fees, if any, transfer agent fees, printing and postage and state registration fees, for all classes, are calculated daily at the class level based on the appropriate net assets of each class and the specific expense rates applicable to each class.

Federal income taxes. The Fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

Under the Regulated Investment Company Modernization Act of 2010, the Fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. Any losses incurred during those taxable years will be required to be utilized prior to the losses incurred in pre-enactment taxable years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

For federal income tax purposes, the Fund has a capital loss carryforward of $34,031,547 available to offset future net realized capital gains as of March 31, 2013. The following details the capital loss carryforward available as of March 31, 2013:

| | | | | |

| CAPITAL LOSS CARRYFORWARD EXPIRING AT MARCH 31 | | | | |

| 2016 | 2017 | 2018 | | | |

| | | |

| $10,450,734 | $8,874,309 | $14,706,504 | | | |

| |

| Annual report | Rainier Growth Fund | 29 |

Availability of a certain amount of the loss carryforwards, which was acquired in a merger, may be limited in a given year.

As of March 31, 2013, the Fund had no uncertain tax positions that would require financial statement recognition, derecognition or disclosure. The Fund’s federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The Fund generally declares and pays dividends and capital gain distributions, if any, annually. The tax character of distributions for the years ended March 31, 2013 and March 31, 2012 was as follows:

| | | | | |

| | MARCH 31, 2013 | MARCH 31, 2012 | | | |

| | | |

| Ordinary Income | $750,055 | — | | | |

Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and in the same amount, except for the effect of class level expenses that may be applied differently to each class. As of March 31, 2013, the components of distributable earnings on a tax basis consisted of $591,111 and $5,019,878 of undistributed ordinary income and long-term capital gain, respectively.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Material distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. Book-tax differences are primarily attributable to wash sale loss deferrals and litigation proceeds.

Note 3 — Guarantees and indemnifications

Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust, including the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss from such claims is considered remote.

Note 4 — Fees and transactions with affiliates

John Hancock Investment Management Services, LLC (the Advisor) serves as investment advisor for the Trust. John Hancock Funds, LLC (the Distributor), an affiliate of the Advisor, serves as principal underwriter of the Trust. The Advisor and the Distributor are indirect, wholly owned subsidiaries of Manulife Financial Corporation (MFC).

Management fee. The Fund has an investment management contract with the Advisor under which the Fund pays a daily management fee to the Advisor based on aggregate net assets of the Fund and John Hancock Growth Equity Trust (Growth Equity). Growth Equity is a series of John Hancock Variable Insurance Trust (JHVIT), an affiliate of the Fund, managed by the Advisor. The management fee is equivalent, on an annual basis, to the sum of: (a) 0.730% of the first $3,000,000,000 of the Funds’ aggregate net assets; (b) 0.725% of the next $3,000,000,000; and (c) 0.700% of the Funds’ aggregate net assets in excess of $6,000,000,000. The Advisor has a subadvisory agreement with Rainier Investment Management, Inc. The Fund is not responsible for payment of the subadvisory fees.

| |

| 30 | Rainier Growth Fund | Annual report |

The Advisor has agreed to reimburse or limit certain expenses for each share class of the Fund. This agreement excludes certain expenses such as taxes, brokerage commissions, interest expense, litigation and indemnification expenses and other extraordinary expenses, acquired fund fees and expenses paid indirectly and short dividend expense. The fee waivers and/or expense reimbursements are such that these expenses will not exceed 1.35%, 2.10%, 2.10%, 1.70%, 1.45%, 1.60%, 1.20%, 1.00%, 0.86%, 1.40% and 1.14% for Class A, Class B, Class C, Class R1, Class R2, Class R3, Class R4, Class R5, Class R6, Class T and Class ADV shares, respectively. The fee waivers and/or expense reimbursements will continue in effect until June 30, 2013 for Class A, Class B, Class C and Class T shares and June 30, 2014 for Class R1, Class R2, Class R3, Class R4, Class R5, Class R6 and Class ADV shares, unless renewed by mutual agreement of the Fund and the Advisor based upon a determination that this is appropriate under the circumstances at the time. Prior to July 1, 2012, the fee waivers and/or reimbursements were such that the above expenses would not exceed 1.04% and 1.30% for Class I and Class R4 shares, respectively.

For the year ended March 31, 2013, expense reductions amounted to the following:

| | | | | |

| | EXPENSE | | | | |

| CLASS | REDUCTIONS | | | | |

| | | | |

| Class A | — | | | | |

| Class B | — | | | | |

| Class C | — | | | | |

| Class I | — | | | | |

| Class R1 | $12,665 | | | | |

| Class R2 | 19,348 | | | | |

| Class R3 | 13,313 | | | | |

| Class R4 | 13,359 | | | | |

| Class R5 | 13,407 | | | | |

| Class R6 | 18,671 | | | | |

| Class T | — | | | | |

| Class ADV | 36,905 | | | | |

| Class NAV | — | | | | |

| Total | $127,668 | | | | |

The investment management fees, including the impact of the waivers and expense reimbursements described above, incurred for the year ended March 31, 2013 were equivalent to a net annual effective rate of 0.72% of the Fund’s average daily net assets.

Accounting and legal services. Pursuant to a service agreement, the Fund reimburses the Advisor for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services to the Fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports, among other services. These expenses are allocated to each share class based on its relative net assets at the time the expense was incurred. These accounting and legal services fees incurred for the year ended March 31, 2013 amounted to an annual rate of 0.02% of the Fund’s average daily net assets.

Distribution and service plans. The Fund has a distribution agreement with the Distributor. The Fund has adopted distribution and service plans with respect to Class A, Class B, Class C, Class R1, Class R2, Class R3, Class R4, Class R5, Class T and Class ADV shares pursuant to Rule 12b-1 under the 1940 Act, to pay the Distributor for services provided as the distributor of shares of the Fund. In addition, under a service plan for Class R1 and Class R2 shares, the Fund pays for certain other services. The Fund pays the following contractual rates of distribution fees and may pay up to the following contractual rates of service fees under these arrangements, expressed as an annual percentage of average daily net assets for each class of the Fund’s shares. Currently, only 0.25% is charged to Class A shares for Rule 12b-1 fees.

| |

| Annual report | Rainier Growth Fund | 31 |

| | | | | |

| CLASS | 12b–1 FEES | SERVICE FEE | | | |

| | | |

| Class A | 0.30% | — | | | |

| Class B | 1.00% | — | | | |

| Class C | 1.00% | — | | | |

| Class R1 | 0.50% | 0.25% | | | |

| Class R2 | 0.25% | 0.25% | | | |

| Class R3 | 0.50% | 0.15% | | | |

| Class R4 | 0.25% | 0.10% | | | |

| Class R5 | — | 0.05% | | | |

| Class T | 0.30% | — | | | |

| Class ADV | 0.25% | — | | | |

The Fund’s distributor has contractually agreed to waive 0.10% of Rule 12b-1 fees of Class R4 shares. This expense limitation agreement will remain in effect through June 30, 2014, unless renewed by mutual agreement of the Fund and the distributor based upon a determination that this is appropriate under the circumstances at the time. Reimbursements related to this contractual waiver amounted to $84 for the year ended March 31, 2013.

Sales charges. Class A shares are assessed up-front sales charges, which resulted in payments to the Distributor amounting to $270,525 for the year ended March 31, 2013. Of this amount, $43,482 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $206,523 was paid as sales commissions to broker-dealers and $20,520 was paid as sales commissions to sales personnel of Signator Investors, Inc., a broker-dealer affiliate of the Advisor.