| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811-21777 |

| |

| John Hancock Funds III |

| (Exact name of registrant as specified in charter) |

| |

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

| |

| Salvatore Schiavone |

| Treasurer |

| |

| 601 Congress Street |

| |

| Boston, Massachusetts 02210 |

| |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: 617-663-4497 |

| |

| Date of fiscal year end: | March 31 |

| |

| Date of reporting period: | March 31, 2014 |

ITEM 1. REPORTS TO STOCKHOLDERS.

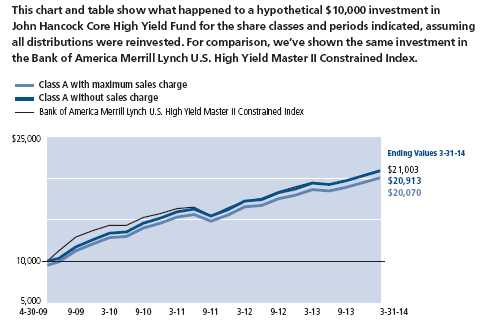

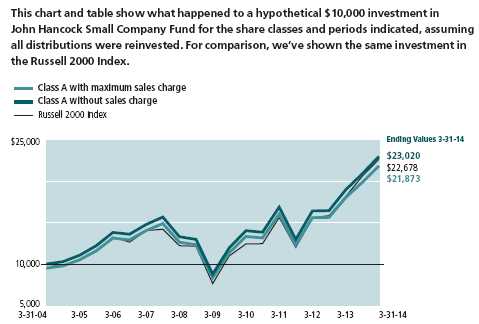

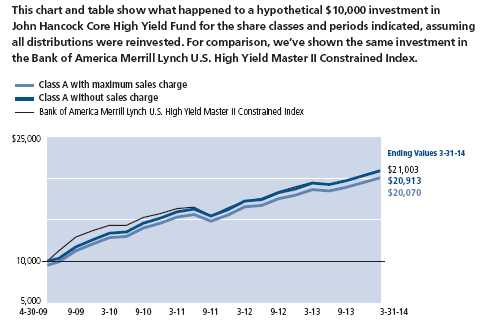

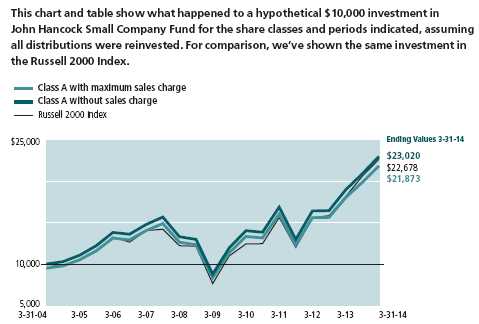

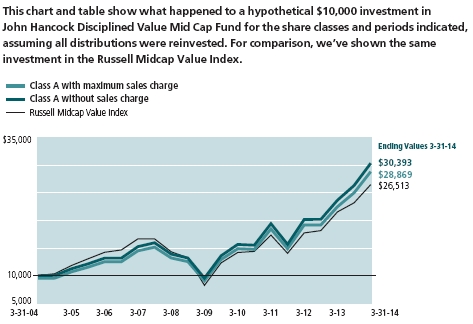

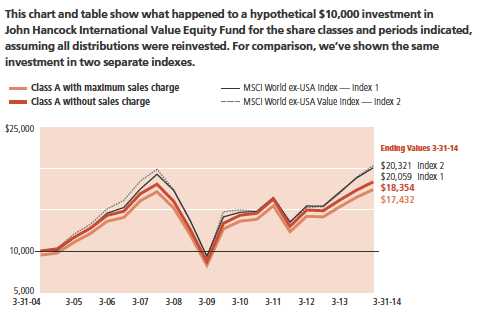

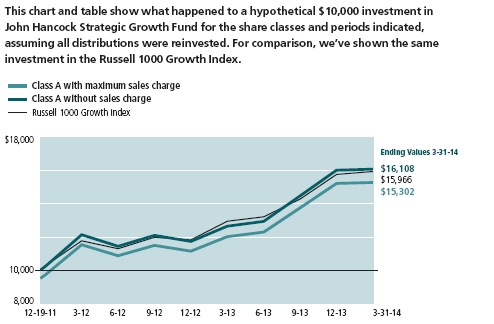

A look at performance

Total returns for the period ended March 31, 2014

| | | | | | | | |

| | | Average annual total returns (%) | | | Cumulative total returns (%) | |

| | | with maximum sales charge | | | with maximum sales charge | |

|

| | | 1-year | 5-year | 10-year | | 1-year | 5-year | 10-year |

|

| Class A1 | | 15.31 | 16.90 | 6.58 | | 15.31 | 118.34 | 89.11 |

|

| Class B1 | | 15.38 | 16.95 | 6.05 | | 15.38 | 118.81 | 79.95 |

|

| Class C1 | | 19.35 | 17.15 | 6.04 | | 19.35 | 120.65 | 79.82 |

|

| Class I1,2 | | 21.71 | 18.54 | 7.48 | | 21.71 | 134.08 | 105.80 |

|

| Class R11,2 | | 20.77 | 17.59 | 6.45 | | 20.77 | 124.80 | 86.92 |

|

| Class R21,2 | | 21.10 | 16.97 | 5.75 | | 21.10 | 118.99 | 74.96 |

|

| Class R31,2 | | 20.87 | 17.72 | 6.56 | | 20.87 | 126.03 | 88.85 |

|

| Class R41,2 | | 21.39 | 18.12 | 6.90 | | 21.39 | 129.96 | 94.94 |

|

| Class R51,2 | | 21.58 | 18.43 | 7.20 | | 21.58 | 132.93 | 100.48 |

|

| Class R61,2 | | 21.82 | 18.60 | 7.53 | | 21.82 | 134.68 | 106.77 |

|

| Class T1,2 | | 15.23 | 16.67 | 6.09 | | 15.23 | 116.16 | 80.61 |

|

| Class ADV1,2 | | 21.40 | 18.25 | 7.22 | | 21.40 | 131.23 | 100.75 |

|

| Class NAV1,2 | | 21.92 | 18.67 | 7.58 | | 21.92 | 135.39 | 107.72 |

|

| Index 1† | | 23.22 | 21.68 | 7.86 | | 23.22 | 166.70 | 113.16 |

|

| Index 2† | | 21.86 | 21.16 | 7.42 | | 21.86 | 161.07 | 104.52 |

|

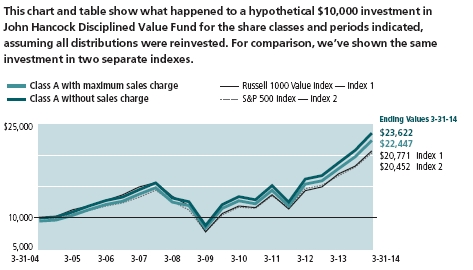

Performance figures assume all distributions have been reinvested. Figures reflect maximum sales charge on Class A and Class T shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The Class B shares’ CDSC declines annually between years 1 to 6 according to the following schedule: 5%, 4%, 3%, 3%, 2%, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charges are not applicable to Class I, Class R1, Class R2, Class R3, Class R4, Class R5, Class R6, Class ADV, and Class NAV shares.

The expense ratios of the fund, both net (including any fee waivers and/or expense limitations) and gross (excluding any fee waivers and/or expense limitations), are set forth according to the most recent publicly available prospectuses for the fund and may differ from those disclosed in the Financial highlights tables in this report. The fee waivers and/or expense limitations are contractual at least until 6-30-14 for Class R1, Class R2, Class R3, Class R4, Class R5 and Class ADV shares and at least until 6-30-15 for Class R6 shares. Had the fee waivers and expense limitations not been in place, gross expenses would apply. For all other classes, the net expenses equal the gross expenses. The expense ratios are as follows:

| | | | | | | | | | | | | |

| | Class A | Class B | Class C | Class I | Class R1 | Class R2 | Class R3 | Class R4* | Class R5 | Class R6 | Class T | Class ADV | Class NAV |

| Net (%) | 1.25 | 2.06 | 2.07 | 0.91 | 1.70 | 1.45 | 1.60 | 1.20 | 1.00 | 0.79 | 1.33 | 1.14 | 0.79 |

| Gross (%) | 1.25 | 2.06 | 2.07 | 0.91 | 5.97 | 20.66 | 15.17 | 14.65 | 14.21 | 1.33 | 1.33 | 1.33 | 0.79 |

* The fund’s distributor has contractually agreed to waive 0.10% of Rule 12b-1 fees for Class R4 shares. The current waiver agreement will remain in effect through 6-30-15.

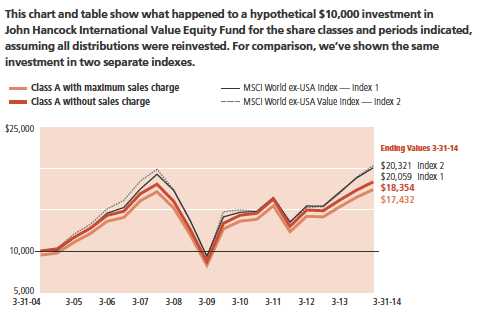

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the fund’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month end, please call 800-225-5291 or visit the fund’s website at jhinvestments.com.

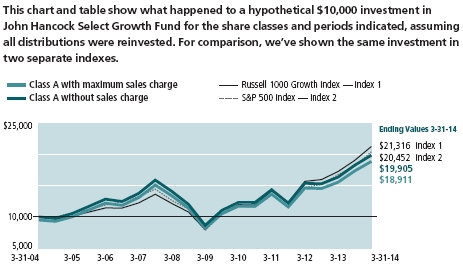

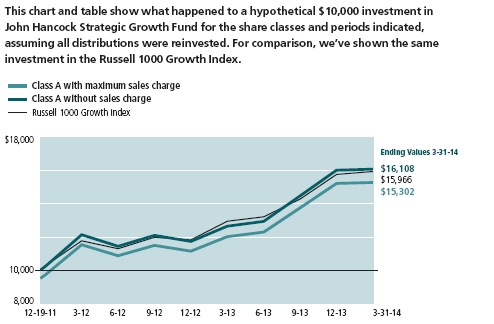

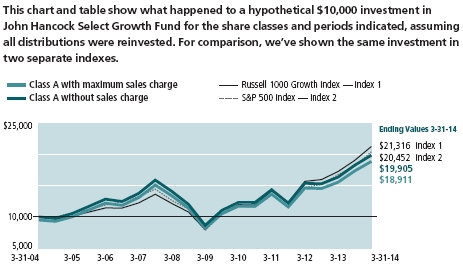

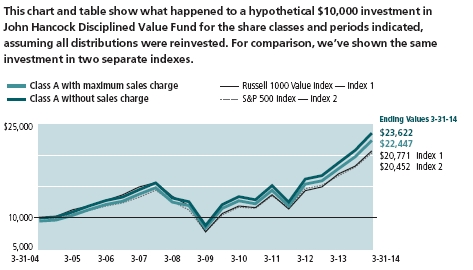

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The fund’s performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

† Index 1 is the Russell 1000 Growth Index; Index 2 is the S&P 500 Index.

See the following page for footnotes.

| |

| 6 | Select Growth Fund | Annual report |

| | | | | |

| | | With maximum | Without | | |

| | Start date | sales charge | sales charge | Index 1 | Index 2 |

|

| Class B3 | 3-31-04 | $17,995 | $17,995 | $21,316 | $20,452 |

|

| Class C3 | 3-31-04 | 17,982 | 17,982 | 21,316 | 20,452 |

|

| Class I2 | 3-31-04 | 20,580 | 20,580 | 21,316 | 20,452 |

|

| Class R12 | 3-31-04 | 18,692 | 18,692 | 21,316 | 20,452 |

|

| Class R22 | 3-31-04 | 17,496 | 17,496 | 21,316 | 20,452 |

|

| Class R32 | 3-31-04 | 18,885 | 18,885 | 21,316 | 20,452 |

|

| Class R42 | 3-31-04 | 19,494 | 19,494 | 21,316 | 20,452 |

|

| Class R52 | 3-31-04 | 20,048 | 20,048 | 21,316 | 20,452 |

|

| Class R62 | 3-31-04 | 20,677 | 20,677 | 21,316 | 20,452 |

|

| Class T2 | 3-31-04 | 18,061 | 19,011 | 21,316 | 20,452 |

|

| Class ADV2 | 3-31-04 | 20,075 | 20,075 | 21,316 | 20,452 |

|

| Class NAV2 | 3-31-04 | 20,772 | 20,772 | 21,316 | 20,452 |

|

Russell 1000 Growth Index is an unmanaged index containing those securities in the Russell 1000 Index with a greater-than-average growth orientation.

S&P 500 Index is an unmanaged index that includes 500 widely traded common stocks.

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would have resulted in lower values.

Footnotes related to performance pages

1 On 4-25-08, through a reorganization, the fund acquired all of the assets of Rainier Large Cap Growth Equity Portfolio (the predecessor fund). On that date, the predecessor fund’s original class shares and institutional class shares were exchanged for Class A and Class I shares, respectively, of John Hancock Select Growth (formerly, Rainier Growth) Fund. Class A, Class B, Class C, Class I, Class R1, Class R3, Class R4, Class R5, Class ADV, and Class NAV shares of John Hancock Rainier Growth Fund were first offered on 4-28-08; Class T shares were first offered on 10-6-08; Class R6 shares were first offered on 9-1-11; Class R2 shares were first offered on 3-1-12. The returns prior to these dates are those of the predecessor fund’s original shares that have been recalculated to reflect the gross fees and expenses of Class A, Class B, Class C, Class I, Class R1, Class R3, Class R4, Class R5, Class ADV, Class NAV, Class T, Class R6, and Class R2 shares, as applicable.

2 For certain types of investors, as described in the fund’s prospectuses.

3 The contingent deferred sales charge is not applicable.

| |

| Annual report | Select Growth Fund | 7 |

Management’s discussion of

Fund performance

From the Portfolio Management Team

Rainier Investment Management, Inc.

Stocks rose to record highs in the 12 months ended March 31, 2014. Signs of economic improvement in the United States and the low interest-rate environment supported stock prices. Nevertheless, the period was not without bouts of volatility, largely relating to questions about the direction of monetary policy.

In the 12 months ended March 31, 2014, John Hancock Select Growth Fund’s Class A shares had a total return of 21.38%, excluding sales charges. By comparison, the fund’s benchmark, the Russell 1000 Growth Index returned 23.22%.

The fund produced solid gains but trailed its benchmark. Stock selection and a modest underweight position detracted from relative performance in the industrials sector. The leading individual detractor in the sector was railroad Kansas City Southern. Other notable underperformers in the sector were risk assessment service provider Verisk Analytics, Inc. and renewable energy services provider SolarCity Corp. Independent oil and gas exploration and producer Anadarko Petroleum Corp. also underperformed. Several other key individual detractors came from the technology sector, including Citrix Systems, Inc., Yandex NV, Equinix, Inc., and LinkedIn Corp. We eliminated positions in Anadarko and Citrix.

Stock choices and an overweight position made the consumer discretionary sector the leading contributor to relative returns. Gaming company Las Vegas Sands Corp. contributed most. Elsewhere in the sector, online travel company The Priceline Group, Inc., clothing and accessory designer Michael Kors Holdings, Ltd., and entertainment giant The Walt Disney Company were other sources of strength. The leading relative contributor for the 12 months was Facebook, Inc. We took profits and sold Michael Kors.

Effective at the close of business on April 17, 2014, the fund’s investment advisor, Rainier Investment Management, Inc., was replaced as subadvisor by Baillie Gifford & Co. In connection with this change, John Hancock Rainier Growth Fund’s name was changed to John Hancock Select Growth Fund. The fund’s investment objective of seeking to maximize long-term capital appreciation remains the same, and the fund will continue to invest primarily in large-cap growth companies traded in the U.S. The ticker symbol for Class A shares remains RGROX.

This commentary reflects the views of the portfolio management team through the end of the period discussed in this report. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Past performance does not guarantee future results.

| |

| 8 | Select Growth Fund | Annual report |

Your expenses

These examples are intended to help you understand your ongoing operating expenses of investing in the fund so you can compare these costs with the ongoing costs of investing in other mutual funds.

Understanding fund expenses

As a shareholder of the fund, you incur two types of costs:

▪ Transaction costs, which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

▪ Ongoing operating expenses, including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about the fund’s actual ongoing operating expenses and is based on the fund’s actual return. It assumes an account value of $1,000.00 on October 1, 2013, with the same investment held until March 31, 2014.

| | | | |

| | | | Expenses paid | |

| | Account value | Ending value | during period | Annualized |

| | on 10-1-2013 | on 3-31-2014 | ended 3-31-20141 | expense ratio |

|

| Class A | $1,000.00 | $1,087.30 | $6.09 | 1.17% |

|

| Class B | 1,000.00 | 1,082.50 | 10.33 | 1.99% |

|

| Class C | 1,000.00 | 1,082.10 | 10.38 | 2.00% |

|

| Class I | 1,000.00 | 1,088.10 | 4.79 | 0.92% |

|

| Class R1 | 1,000.00 | 1,084.30 | 8.83 | 1.70% |

|

| Class R2 | 1,000.00 | 1,085.40 | 7.49 | 1.43% |

|

| Class R3 | 1,000.00 | 1,084.60 | 8.32 | 1.60% |

|

| Class R4 | 1,000.00 | 1,086.90 | 6.24 | 1.20% |

|

| Class R5 | 1,000.00 | 1,087.70 | 5.20 | 1.00% |

|

| Class R6 | 1,000.00 | 1,088.90 | 4.48 | 0.86% |

|

| Class T | 1,000.00 | 1,086.40 | 6.45 | 1.24% |

|

| Class ADV | 1,000.00 | 1,087.10 | 5.88 | 1.13% |

|

| Class NAV | 1,000.00 | 1,089.50 | 3.96 | 0.76% |

|

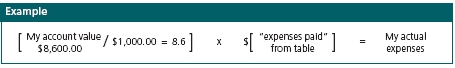

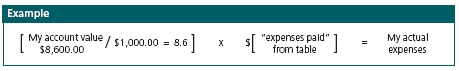

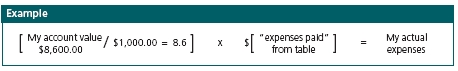

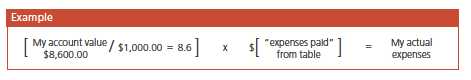

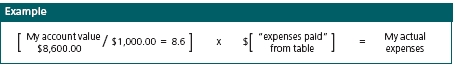

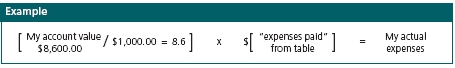

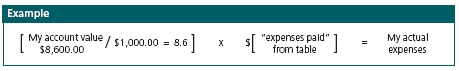

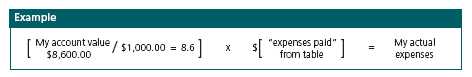

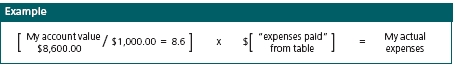

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at March 31, 2014, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| |

| Annual report | Select Growth Fund | 9 |

Your expenses

Hypothetical example for comparison purposes

This table allows you to compare the fund’s ongoing operating expenses with those of any other fund. It provides an example of the fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not the fund’s actual return). It assumes an account value of $1,000.00 on October 1, 2013, with the same investment held until March 31, 2014. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses. Please remember that these hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

| | | | |

| | | | Expenses paid | |

| | Account value | Ending value | during period | Annualized |

| | on 10-1-2013 | on 3-31-2014 | ended 3-31-20141 | expense ratio |

|

| Class A | $1,000.00 | $1,019.10 | $5.89 | 1.17% |

|

| Class B | 1,000.00 | 1,015.00 | 10.00 | 1.99% |

|

| Class C | 1,000.00 | 1,015.00 | 10.05 | 2.00% |

|

| Class I | 1,000.00 | 1,020.30 | 4.63 | 0.92% |

|

| Class R1 | 1,000.00 | 1,016.50 | 8.55 | 1.70% |

|

| Class R2 | 1,000.00 | 1,017.80 | 7.19 | 1.43% |

|

| Class R3 | 1,000.00 | 1,017.00 | 8.05 | 1.60% |

|

| Class R4 | 1,000.00 | 1,018.90 | 6.04 | 1.20% |

|

| Class R5 | 1,000.00 | 1,019.90 | 5.04 | 1.00% |

|

| Class R6 | 1,000.00 | 1,020.60 | 4.33 | 0.86% |

|

| Class T | 1,000.00 | 1,018.70 | 6.24 | 1.24% |

|

| Class ADV | 1,000.00 | 1,019.30 | 5.69 | 1.13% |

|

| Class NAV | 1,000.00 | 1,021.10 | 3.83 | 0.76% |

|

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectuses for details regarding transaction costs.

1 Expenses are equal to the fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

| |

| 10 | Select Growth Fund | Annual report |

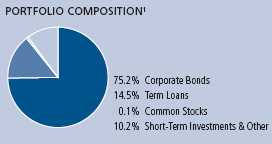

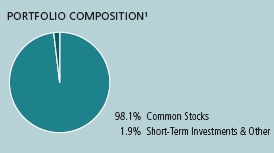

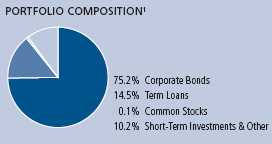

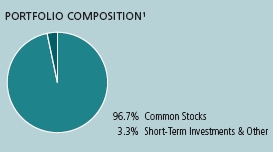

Portfolio summary

| | | | |

| Top 10 Holdings (31.6% of Total Net Assets on 3-31-14)1,2 | |

|

| Apple, Inc. | 5.0% | | Yahoo!, Inc. | 2.9% |

| |

|

| Google, Inc., Class A | 4.5% | | Gilead Sciences, Inc. | 2.6% |

| |

|

| Visa, Inc., Class A | 3.2% | | Salesforce.com, Inc. | 2.5% |

| |

|

| Facebook, Inc., Class A | 3.1% | | The Walt Disney Company | 2.4% |

| |

|

| Amazon.com, Inc. | 3.0% | | Las Vegas Sands Corp. | 2.4% |

| |

|

| | | | |

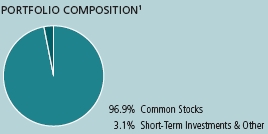

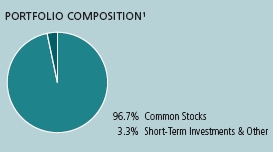

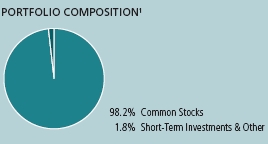

| Sector Composition1,3 | | | | |

|

| Information Technology | 31.2% | | Energy | 5.0% |

| |

|

| Consumer Discretionary | 21.6% | | Consumer Staples | 4.6% |

| |

|

| Health Care | 11.9% | | Materials | 2.3% |

| |

|

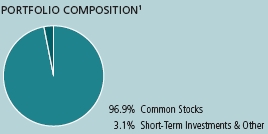

| Industrials | 11.2% | | Short-Term Investments & Other | 3.1% |

| |

|

| Financials | 9.1% | | | |

| | |

1 As a percentage of net assets on 3-31-14.

2 Cash and cash equivalents not included.

3 Growth stocks may be more susceptible to earning disappointments. Foreign investing has additional risks, such as currency and market volatility and political and social instability. Large company stocks could fall out of favor. Sector investing is subject to greater risks than the market as a whole. Because the fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors and investments focused in one sector may fluctuate more widely than investments diversified across sectors. Please see the fund’s prospectuses for additional risks.

| |

| Annual report | Select Growth Fund | 11 |

Fund’s investments

As of 3-31-14

| | |

| | Shares | Value |

| |

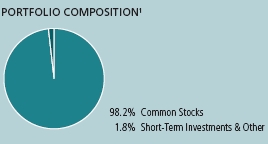

| Common Stocks 96.9% | | $980,182,044 |

|

| (Cost $767,773,115) | | |

| | | |

| Consumer Discretionary 21.6% | | 218,749,864 |

| | | |

| Hotels, Restaurants & Leisure 3.6% | | |

|

| Las Vegas Sands Corp. | 298,980 | 24,151,604 |

|

| Wynn Resorts, Ltd. | 55,410 | 12,309,332 |

| | | |

| Household Durables 1.2% | | |

|

| Jarden Corp. (I) | 199,310 | 11,924,717 |

| | | |

| Internet & Catalog Retail 7.1% | | |

|

| Amazon.com, Inc. (I) | 90,170 | 30,344,008 |

|

| Expedia, Inc. | 298,080 | 21,610,800 |

|

| The Priceline Group, Inc. (I) | 16,560 | 19,737,698 |

| | | |

| Media 6.1% | | |

|

| Discovery Communications, Inc., Class A (I) | 169,630 | 14,028,401 |

|

| Liberty Global PLC, Series C (I) | 568,890 | 23,159,512 |

|

| The Walt Disney Company | 303,820 | 24,326,867 |

| | | |

| Textiles, Apparel & Luxury Goods 3.6% | | |

|

| Kate Spade & Company (I) | 396,180 | 14,694,316 |

|

| Ralph Lauren Corp. | 139,580 | 22,462,609 |

| | | |

| Consumer Staples 4.6% | | 46,858,398 |

| | | |

| Beverages 1.4% | | |

|

| Monster Beverage Corp. (I) | 212,870 | 14,783,822 |

| | | |

| Food & Staples Retailing 1.5% | | |

|

| Costco Wholesale Corp. | 136,050 | 15,194,064 |

| | | |

| Personal Products 1.7% | | |

|

| The Estee Lauder Companies, Inc., Class A | 252,400 | 16,880,512 |

| | | |

| Energy 5.0% | | 49,961,409 |

| | | |

| Energy Equipment & Services 2.6% | | |

|

| FMC Technologies, Inc. (I) | 220,530 | 11,531,514 |

|

| Halliburton Company | 246,340 | 14,506,963 |

| | | |

| Oil, Gas & Consumable Fuels 2.4% | | |

|

| EOG Resources, Inc. | 121,950 | 23,922,932 |

| | |

| 12 | Select Growth Fund | Annual report | See notes to financial statements |

| | |

| | Shares | Value |

| | | |

| Financials 9.1% | | $92,307,362 |

| | | |

| Capital Markets 5.3% | | |

|

| Affiliated Managers Group, Inc. (I) | 85,870 | 17,178,294 |

|

| Morgan Stanley | 739,620 | 23,053,955 |

|

| The Goldman Sachs Group, Inc. | 84,690 | 13,876,457 |

| | | |

| Consumer Finance 2.0% | | |

|

| Discover Financial Services | 348,500 | 20,279,215 |

| | | |

| Diversified Financial Services 1.8% | | |

|

| IntercontinentalExchange Group, Inc. | 90,580 | 17,919,441 |

| | | |

| Health Care 11.9% | | 120,182,137 |

| | | |

| Biotechnology 8.3% | | |

|

| Biogen Idec, Inc. (I) | 56,090 | 17,156,248 |

|

| BioMarin Pharmaceutical, Inc. (I) | 178,300 | 12,161,843 |

|

| Celgene Corp. (I) | 120,650 | 16,842,740 |

|

| Gilead Sciences, Inc. (I) | 369,290 | 26,167,889 |

|

| Regeneron Pharmaceuticals, Inc. (I) | 38,940 | 11,692,903 |

| | | |

| Health Care Providers & Services 1.6% | | |

|

| Catamaran Corp. (I) | 365,000 | 16,337,400 |

| | | |

| Pharmaceuticals 2.0% | | |

|

| Allergan, Inc. | 159,735 | 19,823,114 |

| | | |

| Industrials 11.2% | | 113,375,593 |

| | | |

| Aerospace & Defense 4.1% | | |

|

| B/E Aerospace, Inc. (I) | 226,670 | 19,672,689 |

|

| Precision Castparts Corp. | 86,060 | 21,752,526 |

| | | |

| Building Products 1.4% | | |

|

| Fortune Brands Home & Security, Inc. | 329,420 | 13,861,994 |

| | | |

| Electrical Equipment 3.0% | | |

|

| Eaton Corp. PLC | 266,870 | 20,047,274 |

|

| SolarCity Corp. (I) | 171,240 | 10,723,049 |

| | | |

| Professional Services 1.0% | | |

|

| Verisk Analytics, Inc., Class A (I) | 166,490 | 9,982,740 |

| | | |

| Road & Rail 0.7% | | |

|

| Kansas City Southern | 69,370 | 7,079,902 |

| | | |

| Trading Companies & Distributors 1.0% | | |

|

| United Rentals, Inc. (I) | 108,020 | 10,255,419 |

| | | |

| Information Technology 31.2% | | 315,353,864 |

| | | |

| Communications Equipment 0.0% | | |

|

| BancTec, Inc. (I)(S) | 197,026 | 443,309 |

| | | |

| Internet Software & Services 16.1% | | |

|

| eBay, Inc. (I) | 219,360 | 12,117,446 |

|

| Equinix, Inc. (I) | 79,930 | 14,774,261 |

|

| Facebook, Inc., Class A (I) | 518,510 | 31,235,042 |

|

| Google, Inc., Class A (I) | 40,990 | 45,683,765 |

|

| LinkedIn Corp., Class A (I) | 107,050 | 19,797,827 |

|

| Yahoo!, Inc. (I) | 804,390 | 28,877,601 |

|

| Yandex NV, Class A (I) | 329,210 | 9,938,850 |

| | |

| See notes to financial statements | Annual report | Select Growth Fund | 13 |

| | | |

| | | Shares | Value |

| | | | |

| IT Services 6.7% | | | |

|

| FleetCor Technologies, Inc. (I) | | 103,710 | $11,937,021 |

|

| MasterCard, Inc., Class A | | 307,840 | 22,995,648 |

|

| Visa, Inc., Class A | | 150,255 | 32,434,044 |

| | | | |

| Software 3.4% | | | |

|

| Salesforce.com, Inc. (I) | | 448,190 | 25,587,167 |

|

| ServiceNow, Inc. (I) | | 155,180 | 9,298,386 |

| | | | |

| Technology Hardware, Storage & Peripherals 5.0% | | | |

|

| Apple, Inc. | | 93,590 | 50,233,497 |

| | | | |

| Materials 2.3% | | | 23,393,417 |

| | | | |

| Chemicals 2.3% | | | |

|

| The Sherwin-Williams Company | | 118,670 | 23,393,417 |

| |

| | Yield (%) | Shares | Value |

| |

| Short-Term Investments 2.3% | | | $22,965,401 |

|

| (Cost $22,965,401) | | | |

| | | | |

| Money Market Funds 2.3% | | | 22,965,401 |

| State Street Institutional U.S. Government | | | |

| Money Market Fund | 0.0000 (Y) | 22,965,401 | 22,965,401 |

|

| |

| Total investments (Cost $790,738,516)† 99.2% | | $1,003,147,445 |

|

| |

| Other assets and liabilities, net 0.8% | | | $7,959,724 |

|

| |

| Total net assets 100.0% | | $1,011,107,169 |

|

The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the fund.

(I) Non-income producing security.

(S) These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration.

(Y) The rate shown is the annualized seven-day yield as of 3-31-14.

† At 3-31-14, the aggregate cost of investment securities for federal income tax purposes was $792,932,409. Net unrealized appreciation aggregated $210,215,036, of which $221,458,025 related to appreciated investment securities and $11,242,989 related to depreciated investment securities.

| | |

| 14 | Select Growth Fund | Annual report | See notes to financial statements |

FINANCIAL STATEMENTS

Financial statements

Statement of assets and liabilities 3-31-14

This Statement of assets and liabilities is the fund’s balance sheet. It shows the value of what the fund owns, is due and owes. You’ll also find the net asset value and the maximum public offering price per share.

| |

| Assets | |

|

| Investments, at value (Cost $790,738,516) | $1,003,147,445 |

| Receivable for investments sold | 27,326,666 |

| Receivable for fund shares sold | 786,213 |

| Dividends and interest receivable | 112,552 |

| Receivable for securities lending income | 1,971 |

| Receivable due from advisor | 2,115 |

| Other receivables and prepaid expenses | 106,545 |

| | |

| Total assets | 1,031,483,507 |

| |

| Liabilities | |

|

| Payable for investments purchased | 19,207,835 |

| Payable for fund shares repurchased | 926,923 |

| Payable to affiliates | |

| Accounting and legal services fees | 50,498 |

| Transfer agent fees | 67,122 |

| Distribution and service fees | 160 |

| Trustees’ fees | 581 |

| Other liabilities and accrued expenses | 123,219 |

| | |

| Total liabilities | 20,376,338 |

| | |

| Net assets | $1,011,107,169 |

| |

| Net assets consist of | |

|

| Paid-in capital | $752,525,500 |

| Accumulated net realized gain (loss) on investments | 46,172,740 |

| Net unrealized appreciation (depreciation) on investments | 212,408,929 |

| | |

| Net assets | $1,011,107,169 |

| | |

| See notes to financial statements | Annual report | Select Growth Fund | 15 |

FINANCIAL STATEMENTSStatement of assets and liabilities (continued)

| |

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — the fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($356,155,378 ÷ 13,498,264 shares)1 | $26.39 |

| Class B ($19,568,114 ÷ 778,878 shares)1 | $25.12 |

| Class C ($19,461,650 ÷ 775,232 shares)1 | $25.10 |

| Class I ($71,926,533 ÷ 2,660,616 shares) | $27.03 |

| Class R1 ($592,725 ÷ 23,030 shares) | $25.74 |

| Class R2 ($119,759 ÷ 4,467 shares) | $26.81 |

| Class R3 ($123,334 ÷ 4,758 shares) | $25.92 |

| Class R4 ($161,154 ÷ 6,083 shares) | $26.49 |

| Class R5 ($119,980 ÷ 4,460 shares) | $26.90 |

| Class R6 ($7,606,753 ÷ 280,713 shares) | $27.10 |

| Class T ($77,860,946 ÷ 2,978,209 shares) | $26.14 |

| Class ADV ($18,979,104 ÷ 710,739 shares) | $26.70 |

| Class NAV ($438,431,739 ÷ 16,156,345 shares) | $27.14 |

| |

| Maximum offering price per share | |

|

| Class A (net asset value per share ÷ 95%)2 | $27.78 |

| Class T (net asset value per share ÷ 95%)2 | $27.52 |

1 Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge.

2 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

| | |

| 16 | Select Growth Fund | Annual report | See notes to financial statements |

FINANCIAL STATEMENTS

Statement of operations For the year ended 3-31-14

This Statement of operations summarizes the fund’s investment income earned and expenses incurred in operating the fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Dividends | $6,355,330 |

| Securities lending | 160,649 |

| Interest | 156 |

| Less foreign taxes withheld | (99,252) |

| | |

| Total investment income | 6,416,883 |

| |

| Expenses | |

|

| Investment management fees | 7,677,902 |

| Distribution and service fees | 1,572,371 |

| Accounting and legal services fees | 182,503 |

| Transfer agent fees | 838,762 |

| Trustees’ fees | 38,757 |

| State registration fees | 193,426 |

| Printing and postage | 87,272 |

| Professional fees | 71,111 |

| Custodian fees | 99,066 |

| Registration and filing fees | 46,282 |

| Other | 25,781 |

| | |

| Total expenses | 10,833,233 |

| Less expense reductions | (156,904) |

| | |

| Net expenses | 10,676,329 |

| | |

| Net investment loss | (4,259,446) |

| |

| Realized and unrealized gain (loss) | |

|

| Net realized gain (loss) on | |

| Investments in unaffiliated issuers | 192,544,975 |

| Investments in affiliated issuers | (3,428) |

| | |

| | 192,541,547 |

| Change in net unrealized appreciation (depreciation) of | |

| Investments in unaffiliated issuers | 17,152,517 |

| Investments in affiliated issuers | (12,516) |

| | |

| | 17,140,001 |

| | |

| Net realized and unrealized gain | 209,681,548 |

| | |

| Increase in net assets from operations | $205,422,102 |

| | |

| See notes to financial statements | Annual report | Select Growth Fund | 17 |

FINANCIAL STATEMENTSStatements of changes in net assets

These Statements of changes in net assets show how the value of the fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of fund share transactions.

| | |

| | Year | Year |

| | ended | ended |

| | 3-31-14 | 3-31-13 |

|

| |

| Increase (decrease) in net assets | | |

|

| From operations | | |

| Net investment income (loss) | ($4,259,446) | $1,704,098 |

| Net realized gain | 192,541,547 | 157,789,629 |

| Change in net unrealized appreciation (depreciation) | 17,140,001 | (99,638,952) |

| | | |

| Increase in net assets resulting from operations | 205,422,102 | 59,854,775 |

| | | |

| Distributions to shareholders | | |

| From net investment income | | |

| Class I | (64,935) | (133,627) |

| Class R5 | (56) | (50) |

| Class R6 | (7,092) | (4,078) |

| Class NAV | (520,067) | (612,300) |

| From net realized gain | | |

| Class A | (37,507,368) | — |

| Class B | (2,216,885) | — |

| Class C | (2,125,586) | — |

| Class I | (8,992,315) | — |

| Class R1 | (64,246) | — |

| Class R2 | (13,688) | — |

| Class R3 | (14,056) | — |

| Class R4 | (18,019) | — |

| Class R5 | (13,704) | — |

| Class R6 | (790,768) | — |

| Class T | (8,578,092) | — |

| Class ADV | (2,113,395) | — |

| Class NAV | (45,556,116) | — |

| | | |

| Total distributions | (108,596,388) | (750,055) |

| | | |

| From fund share transactions | (153,179,068) | (250,750,666) |

| | | |

| Total decrease | (56,353,354) | (191,645,946) |

| |

| Net assets | | |

|

| Beginning of year | 1,067,460,523 | 1,259,106,469 |

| | | |

| End of year | $1,011,107,169 | $1,067,460,523 |

| | | |

| Undistributed net investment income | — | $540,400 |

| | |

| 18 | Select Growth Fund | Annual report | See notes to financial statements |

Financial highlights

The Financial highlights show how the fund’s net asset value for a share has changed during the period.

| | | | | |

| CLASS A SHARES Period ended | 3-31-14 | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $24.32 | $22.84 | $21.32 | $18.31 | $12.84 |

| Net investment loss1 | (0.15) | (0.01) | (0.09) | (0.06) | (0.03) |

| Net realized and unrealized gain on investments | 5.29 | 1.49 | 1.61 | 3.07 | 5.50 |

| Total from investment operations | 5.14 | 1.48 | 1.52 | 3.01 | 5.47 |

| Less distributions | | | | | |

| From net realized gain | (3.07) | — | — | — | — |

| Net asset value, end of period | $26.39 | $24.32 | $22.84 | $21.32 | $18.31 |

| Total return (%)2,3 | 21.38 | 6.48 | 7.13 | 16.44 | 42.60 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | $356 | $356 | $369 | $413 | $384 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 1.19 | 1.25 | 1.27 | 1.30 | 1.45 |

| Expenses net of fee waivers | 1.19 | 1.25 | 1.27 | 1.30 | 1.38 |

| Expenses net of fee waivers and credits | 1.19 | 1.25 | 1.27 | 1.30 | 1.34 |

| Net investment loss | (0.58) | (0.04) | (0.45) | (0.33) | (0.18) |

| Portfolio turnover (%) | 81 | 92 | 90 | 90 | 102 |

1 Based on the average daily shares outstanding.

2 Does not reflect the effect of sales charges, if any.

3 Total returns would have been lower had certain expenses not been reduced during the applicable periods.

| | | | | |

| CLASS B SHARES Period ended | 3-31-14 | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $23.46 | $22.22 | $20.90 | $18.10 | $12.79 |

| Net investment loss1 | (0.35) | (0.19) | (0.25) | (0.21) | (0.15) |

| Net realized and unrealized gain on investments | 5.08 | 1.43 | 1.57 | 3.01 | 5.46 |

| Total from investment operations | 4.73 | 1.24 | 1.32 | 2.80 | 5.31 |

| Less distributions | | | | | |

| From net realized gain | (3.07) | — | — | — | — |

| Net asset value, end of period | $25.12 | $23.46 | $22.22 | $20.90 | $18.10 |

| Total return (%)2,3 | 20.38 | 5.58 | 6.32 | 15.47 | 41.52 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | $20 | $20 | $25 | $31 | $37 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 2.00 | 2.06 | 2.07 | 2.13 | 2.45 |

| Expenses net of fee waivers | 2.00 | 2.06 | 2.07 | 2.10 | 2.11 |

| Expenses net of fee waivers and credits | 2.00 | 2.06 | 2.07 | 2.10 | 2.09 |

| Net investment loss | (1.39) | (0.86) | (1.24) | (1.13) | (0.94) |

| Portfolio turnover (%) | 81 | 92 | 90 | 90 | 102 |

1 Based on the average daily shares outstanding.

2 Does not reflect the effect of sales charges, if any.

3 Total returns would have been lower had certain expenses not been reduced during the applicable periods.

| | |

| See notes to financial statements | Annual report | Select Growth Fund | 19 |

| | | | | |

| CLASS C SHARES Period ended | 3-31-14 | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $23.45 | $22.21 | $20.90 | $18.10 | $12.79 |

| Net investment loss1 | (0.36) | (0.19) | (0.26) | (0.21) | (0.15) |

| Net realized and unrealized gain on investments | 5.08 | 1.43 | 1.57 | 3.01 | 5.46 |

| Total from investment operations | 4.72 | 1.24 | 1.31 | 2.80 | 5.31 |

| Less distributions | | | | | |

| From net realized gain | (3.07) | — | — | — | — |

| Net asset value, end of period | $25.10 | $23.45 | $22.21 | $20.90 | $18.10 |

| Total return (%)2,3 | 20.35 | 5.58 | 6.27 | 15.47 | 41.52 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | $19 | $17 | $20 | $22 | $24 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 2.03 | 2.07 | 2.11 | 2.16 | 2.34 |

| Expenses net of fee waivers | 2.02 | 2.07 | 2.10 | 2.10 | 2.21 |

| Expenses net of fee waivers and credits | 2.02 | 2.07 | 2.10 | 2.10 | 2.09 |

| Net investment loss | (1.42) | (0.88) | (1.27) | (1.13) | (0.93) |

| Portfolio turnover (%) | 81 | 92 | 90 | 90 | 102 |

1 Based on the average daily shares outstanding.

2 Does not reflect the effect of sales charges, if any.

3 Total returns would have been lower had certain expenses not been reduced during the applicable periods.

| | | | | |

| CLASS I SHARES Period ended | 3-31-14 | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $24.80 | $23.24 | $21.61 | $18.50 | $12.92 |

| Net investment income (loss)1 | (0.08) | 0.06 | (0.02) | 0.02 | 0.04 |

| Net realized and unrealized gain on investments | 5.41 | 1.52 | 1.65 | 3.11 | 5.54 |

| Total from investment operations | 5.33 | 1.58 | 1.63 | 3.13 | 5.58 |

| Less distributions | | | | | |

| From net investment income | (0.03) | (0.02) | — | (0.02) | —2 |

| From net realized gain | (3.07) | — | — | — | — |

| Total distributions | (3.10) | (0.02) | — | (0.02) | —2 |

| Net asset value, end of period | $27.03 | $24.80 | $23.24 | $21.61 | $18.50 |

| Total return (%)3 | 21.71 | 6.81 | 7.54 | 16.93 | 43.20 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | $72 | $113 | $256 | $237 | $208 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 0.91 | 0.91 | 0.91 | 0.86 | 0.90 |

| Expenses net of fee waivers | 0.91 | 0.91 | 0.91 | 0.86 | 0.90 |

| Net investment income (loss) | (0.28) | 0.25 | (0.08) | 0.10 | 0.26 |

| Portfolio turnover (%) | 81 | 92 | 90 | 90 | 102 |

1 Based on the average daily shares outstanding.

2 Less than $0.005 per share.

3 Total returns would have been lower had certain expenses not been reduced during the applicable periods.

| | |

| 20 | Select Growth Fund | Annual report | See notes to financial statements |

| | | | | |

| CLASS R1 SHARES Period ended | 3-31-14 | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $23.90 | $22.55 | $21.14 | $18.23 | $12.84 |

| Net investment loss1 | (0.29) | (0.11) | (0.17) | (0.14) | (0.11) |

| Net realized and unrealized gain on investments | 5.20 | 1.46 | 1.58 | 3.05 | 5.50 |

| Total from investment operations | 4.91 | 1.35 | 1.41 | 2.91 | 5.39 |

| Less distributions | | | | | |

| From net realized gain | (3.07) | — | — | — | — |

| Total distributions | (3.07) | — | — | — | — |

| Net asset value, end of period | $25.74 | $23.90 | $22.55 | $21.14 | $18.23 |

| Total return (%)2 | 20.77 | 5.99 | 6.67 | 15.96 | 41.98 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | $1 | —3 | —3 | —3 | —3 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 4.13 | 5.79 | 7.03 | 8.39 | 13.91 |

| Expenses net of fee waivers | 1.70 | 1.70 | 1.70 | 1.72 | 1.78 |

| Net investment loss | (1.12) | (0.49) | (0.86) | (0.75) | (0.65) |

| Portfolio turnover (%) | 81 | 92 | 90 | 90 | 102 |

1 Based on the average daily shares outstanding.

2 Total returns would have been lower had certain expenses not been reduced during the applicable periods.

3 Less than $500,000.

| | | | | |

| CLASS R2 SHARES Period ended | | | 3-31-14 | 3-31-13 | 3-31-121 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | | | $24.72 | $23.27 | $22.45 |

| Net investment income (loss)2 | | | (0.23) | (0.06) | —3 |

| Net realized and unrealized gain on investments | | | 5.39 | 1.51 | 0.82 |

| Total from investment operations | | | 5.16 | 1.45 | 0.82 |

| Less distributions | | | | | |

| From net realized gain | | | (3.07) | — | — |

| Total distributions | | | (3.07) | — | — |

| Net asset value, end of period | | | $26.81 | $24.72 | $23.27 |

| Total return (%)4 | | | 21.10 | 6.23 | 3.655 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | | | —6 | —6 | —6 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | | | 15.50 | 20.41 | 15.967 |

| Expenses net of fee waivers | | | 1.45 | 1.45 | 1.457 |

| Net investment loss | | | (0.85) | (0.24) | (0.12)7 |

| Portfolio turnover (%) | | | 81 | 92 | 908 |

1 The inception date for Class R2 shares is 3-1-12.

2 Based on the average daily shares outstanding.

3 Less than $0.005 per share.

4 Total returns would have been lower had certain expenses not been reduced during the applicable periods.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

8 Portfolio turnover is shown for the period from 4-1-11 to 3-31-12.

| | |

| See notes to financial statements | Annual report | Select Growth Fund | 21 |

| | | | | |

| CLASS R3 SHARES Period ended | 3-31-14 | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $24.03 | $22.65 | $21.21 | $18.27 | $12.85 |

| Net investment loss1 | (0.26) | (0.09) | (0.16) | (0.12) | (0.07) |

| Net realized and unrealized gain on investments | 5.22 | 1.47 | 1.60 | 3.06 | 5.49 |

| Total from investment operations | 4.96 | 1.38 | 1.44 | 2.94 | 5.42 |

| Less distributions | | | | | |

| From net realized gain | (3.07) | — | — | — | — |

| Net asset value, end of period | $25.92 | $24.03 | $22.65 | $21.21 | $18.27 |

| Total return (%)2 | 20.87 | 6.09 | 6.79 | 16.09 | 42.18 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | —3 | —3 | —3 | —3 | —3 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 12.99 | 15.02 | 15.86 | 16.72 | 13.68 |

| Expenses net of fee waivers | 1.60 | 1.60 | 1.59 | 1.61 | 1.62 |

| Net investment loss | (1.00) | (0.39) | (0.76) | (0.64) | (0.46) |

| Portfolio turnover (%) | 81 | 92 | 90 | 90 | 102 |

1 Based on the average daily shares outstanding.

2 Total returns would have been lower had certain expenses not been reduced during the applicable periods.

3 Less than $500,000.

| | | | | |

| CLASS R4 SHARES Period ended | 3-31-14 | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $24.40 | $22.91 | $21.40 | $18.38 | $12.88 |

| Net investment income (loss)1 | (0.17) | —2 | (0.10) | (0.06) | (0.03) |

| Net realized and unrealized gain on investments | 5.33 | 1.49 | 1.61 | 3.08 | 5.53 |

| Total from investment operations | 5.16 | 1.49 | 1.51 | 3.02 | 5.50 |

| Less distributions | | | | | |

| From net realized gain | (3.07) | — | — | — | — |

| Total distributions | (3.07) | — | — | — | — |

| Net asset value, end of period | $26.49 | $24.40 | $22.91 | $21.40 | $18.38 |

| Total return (%)3 | 21.39 | 6.50 | 7.06 | 16.43 | 42.70 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | —4 | —4 | —4 | —4 | —4 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 10.91 | 14.55 | 15.46 | 16.45 | 13.33 |

| Expenses net of fee waivers | 1.20 | 1.22 | 1.29 | 1.31 | 1.32 |

| Net investment income (loss) | (0.62) | 0.01 | (0.46) | (0.34) | (0.16) |

| Portfolio turnover (%) | 81 | 92 | 90 | 90 | 102 |

1 Based on the average daily shares outstanding.

2 Less than $0.005 per share.

3 Total returns would have been lower had certain expenses not been reduced during the applicable periods.

4 Less than $500,000.

| | |

| 22 | Select Growth Fund | Annual report | See notes to financial statements |

| | | | | |

| CLASS R5 SHARES Period ended | 3-31-14 | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $24.71 | $23.16 | $21.56 | $18.47 | $12.91 |

| Net investment income (loss)1 | (0.11) | 0.05 | (0.03) | (0.02) | 0.02 |

| Net realized and unrealized gain on investments | 5.39 | 1.51 | 1.63 | 3.12 | 5.54 |

| Total from investment operations | 5.28 | 1.56 | 1.60 | 3.10 | 5.56 |

| Less distributions | | | | | |

| From net investment income | (0.02) | (0.01) | — | (0.01) | —2 |

| From net realized gain | (3.07) | — | — | — | — |

| Total distributions | (3.09) | (0.01) | — | (0.01) | —2 |

| Net asset value, end of period | $26.90 | $24.71 | $23.16 | $21.56 | $18.47 |

| Total return (%)3 | 21.58 | 6.74 | 7.42 | 16.78 | 43.07 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | —4 | —4 | —4 | —4 | —4 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 12.38 | 14.16 | 15.07 | 16.17 | 12.97 |

| Expenses net of fee waivers | 1.00 | 1.00 | 0.99 | 1.01 | 1.02 |

| Net investment income | (0.40) | 0.21 | (0.16) | (0.03) | 0.14 |

| Portfolio turnover (%) | 81 | 92 | 90 | 90 | 102 |

1 Based on the average daily shares outstanding.

2 Less than $0.005 per share.

3 Total returns would have been lower had certain expenses not been reduced during the applicable periods.

4 Less than $500,000.

| | | | | |

| CLASS R6 SHARES Period ended | | | 3-31-14 | 3-31-13 | 3-31-121 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | | | $24.84 | $23.27 | $20.01 |

| Net investment income (loss)2 | | | (0.07) | 0.08 | 0.03 |

| Net realized and unrealized gain on investments | | | 5.43 | 1.51 | 3.23 |

| Total from investment operations | | | 5.36 | 1.59 | 3.26 |

| Less distributions | | | | | |

| From net investment income | | | (0.03) | (0.02) | — |

| From net realized gain | | | (3.07) | — | — |

| Total distributions | | | (3.10) | (0.02) | — |

| Net asset value, end of period | | | $27.10 | $24.84 | $23.27 |

| Total return (%)3 | | | 21.82 | 6.86 | 16.294 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | | | $8 | $4 | $4 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | | | 1.09 | 1.33 | 1.585 |

| Expenses net of fee waivers | | | 0.86 | 0.86 | 0.865 |

| Net investment income (loss) | | | (0.27) | 0.34 | 0.205 |

| Portfolio turnover (%) | | | 81 | 92 | 906 |

1 The inception date for Class R6 shares is 9-1-11.

2 Based on the average daily shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the applicable periods.

4 Not annualized.

5 Annualized.

6 Portfolio turnover is shown for the period from 4-1-11 to 3-31-12.

| | |

| See notes to financial statements | Annual report | Select Growth Fund | 23 |

| | | | | |

| CLASS T SHARES Period ended | 3-31-14 | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $24.13 | $22.69 | $21.20 | $18.24 | $12.86 |

| Net investment loss1 | (0.17) | (0.03) | (0.11) | (0.09) | (0.11) |

| Net realized and unrealized gain on investments | 5.25 | 1.47 | 1.60 | 3.05 | 5.49 |

| Total from investment operations | 5.08 | 1.44 | 1.49 | 2.96 | 5.38 |

| Less distributions | | | | | |

| From net realized gain | (3.07) | — | — | — | — |

| Total distributions | (3.07) | — | — | — | — |

| Net asset value, end of year | $26.14 | $24.13 | $22.69 | $21.20 | $18.24 |

| Total return (%)2,3 | 21.29 | 6.35 | 7.03 | 16.23 | 41.84 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of year (in millions) | $78 | $73 | $77 | $83 | $83 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 1.27 | 1.33 | 1.37 | 1.47 | 1.84 |

| Expenses net of fee waivers | 1.26 | 1.33 | 1.37 | 1.47 | 1.84 |

| Net Investment loss | (0.66) | (0.13) | (0.54) | (0.50) | (0.69) |

| Portfolio turnover (%) | 81 | 92 | 90 | 90 | 102 |

1 Based on the average daily shares outstanding.

2 Does not reflect the effect of sales charges, if any.

3 Total returns would have been lower had certain expenses not been reduced during the applicable periods.

| | | | | |

| CLASS ADV SHARES Period ended | 3-31-14 | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $24.57 | $23.05 | $21.49 | $18.43 | $12.90 |

| Net investment income (loss)1 | (0.14) | 0.02 | (0.06) | (0.03) | —2 |

| Net realized and unrealized gain on investments | 5.34 | 1.50 | 1.62 | 3.09 | 5.53 |

| Total from investment operations | 5.20 | 1.52 | 1.56 | 3.06 | 5.53 |

| Less distributions | | | | | |

| From net realized gain | (3.07) | — | — | — | — |

| Total distributions | (3.07) | — | — | — | — |

| Net asset value, end of period | $26.70 | $24.57 | $23.05 | $21.49 | $18.43 |

| Total return (%)3 | 21.40 | 6.59 | 7.26 | 16.60 | 42.87 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | $19 | $20 | $20 | $22 | $18 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 1.26 | 1.33 | 1.35 | 1.37 | 1.25 |

| Expenses net of fee waivers | 1.14 | 1.14 | 1.14 | 1.14 | 1.14 |

| Net investment income (loss) | (0.53) | 0.08 | (0.31) | (0.17) | 0.01 |

| Portfolio turnover (%) | 81 | 92 | 90 | 90 | 102 |

1 Based on the average daily shares outstanding.

2 Less than $0.005 per share.

3 Total returns would have been lower had certain expenses not been reduced during the applicable periods.

| | |

| 24 | Select Growth Fund | Annual report | See notes to financial statements |

| | | | | |

| CLASS NAV SHARES Period ended | 3-31-14 | 3-31-13 | 3-31-12 | 3-31-11 | 3-31-10 |

| |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $24.86 | $23.28 | $21.63 | $18.51 | $12.91 |

| Net investment income (loss)1 | (0.04) | 0.09 | 0.01 | 0.03 | 0.05 |

| Net realized and unrealized gain on investments | 5.43 | 1.52 | 1.64 | 3.11 | 5.55 |

| Total from investment operations | 5.39 | 1.61 | 1.65 | 3.14 | 5.60 |

| Less distributions | | | | | |

| From net investment income | (0.04) | (0.03) | — | (0.02) | —2 |

| From net realized gain | (3.07) | — | — | — | — |

| Total distributions | (3.11) | (0.03) | — | (0.02) | —2 |

| Net asset value, end of period | $27.14 | $24.86 | $23.28 | $21.63 | $18.51 |

| Total return (%)3 | 21.92 | 6.94 | 7.63 | 17.00 | 43.38 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | $438 | $463 | $487 | $813 | $708 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 0.77 | 0.79 | 0.80 | 0.80 | 0.82 |

| Expenses net of fee waivers | 0.77 | 0.79 | 0.80 | 0.80 | 0.82 |

| Net investment income (loss) | (0.16) | 0.39 | 0.05 | 0.16 | 0.33 |

| Portfolio turnover (%) | 81 | 92 | 90 | 90 | 102 |

1 Based on the average daily shares outstanding.

2 Less than $0.005 per share.

3 Total returns would have been lower had certain expenses not been reduced during the applicable periods.

| | |

| See notes to financial statements | Annual report | Select Growth Fund | 25 |

Notes to financial statements

Note 1 — Organization

John Hancock Select Growth Fund (the fund) is a series of John Hancock Funds III (the Trust), an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the fund is to seek to maximize long-term capital appreciation.

The fund may offer multiple classes of shares. The shares currently offered are detailed in the Statement of assets and liabilities. Class A and Class C shares are offered to all investors. Class I shares are offered to institutions and certain investors. Class R1, Class R2, Class R3, Class R4 and Class R5 shares are available only to certain retirement plans. Class R6 shares are available only to certain retirement plans, institutions and other investors. Class B, Class T and Class ADV shares are closed to new investors. Class NAV shares are offered to John Hancock affiliated funds of funds and certain 529 plans. Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees, if any, transfer agent fees, printing and postage and state registration fees for each class may differ. Class B shares convert to Class A shares eight years after purchase.

Effective April 17, 2014, John Hancock Select Growth Fund changed its name from John Hancock Rainier Growth Fund.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions as of the date of the financial statements. Actual results could differ from those estimates and those differences could be significant. Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time (ET). In order to value the securities, the fund uses the following valuation techniques: Equity securities held by the fund are valued at the last sale price or official closing price on the exchange where the security was acquired or most likely will be sold. In the event there were no sales during the day or closing prices are not available, the securities are valued using the last available bid price. Investments by the fund in open-end mutual funds are valued at their respective net asset values each business day. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rates supplied by an independent pricing vendor. Securities that trade only in the over-the-counter (OTC) market are valued using bid prices. Other portfolio securities and assets, for which reliable market quotations are not readily available, are valued at fair value as determined in good faith by the fund’s Pricing Committee following procedures established by the Board of Trustees. The frequency with which these fair valuation procedures are used cannot be predicted and fair value of securities may differ significantly from the value that would have been used had a ready market for such securities existed.

The fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities. Level 2 includes securities valued using other significant

| |

| 26 | Select Growth Fund | Annual report |

observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the fund’s own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events or trends, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy.

| | | | | |

| | | | | | LEVEL 3 |

| | | | | LEVEL 2 | SIGNIFICANT |

| | | TOTAL MARKET | LEVEL 1 | SIGNIFICANT | UNOBSERVABLE |

| | | VALUE AT 3-31-14 | QUOTED PRICE | OBSERVABLE INPUTS | INPUTS |

|

| Common Stocks | | | | | |

| Consumer Discretionary | | $218,749,864 | $218,749,864 | — | — |

| Consumer Staples | | 46,858,398 | 46,858,398 | — | — |

| Energy | | 49,961,409 | 49,961,409 | — | — |

| Financials | | 92,307,362 | 92,307,362 | — | — |

| Health Care | | 120,182,137 | 120,182,137 | — | — |

| Industrials | | 113,375,593 | 113,375,593 | — | — |

| Information Technology | | 315,353,864 | 314,910,555 | — | $443,309 |

| Materials | | 23,393,417 | 23,393,417 | — | — |

| Short-Term Investments | | 22,965,401 | 22,965,401 | — | — |

| | |

|

| Total Investments in | | | | | |

| Securities | | $1,003,147,445 | $1,002,704,136 | — | $443,309 |

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Dividend income is recorded on the ex-date, except for dividends of foreign securities where the dividend may not be known until after the ex-date. In those cases, dividend income, net of withholding taxes, is recorded when the fund becomes aware of the dividends. Foreign taxes are provided for based on the fund’s understanding of the tax rules and rates that exist in the foreign markets in which it invests. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation.

Securities lending. The fund may lend its securities to earn additional income. The fund receives cash collateral from the borrower in an amount not less than the market value of the loaned securities. The fund will invest its collateral in John Hancock Collateral Investment Trust (JHCIT), an affiliate of the fund, which has a floating net asset value (NAV) and is registered with the Securities and Exchange Commission as an investment company. JHCIT invests cash received as collateral as part of the securities lending program in short-term money market investments. The fund will receive the benefit of any gains and bear any losses generated by JHCIT with respect to the cash collateral.

If a borrower fails to return loaned securities when due, then the lending agent is responsible to and indemnifies the fund for the lent securities. The lending agent uses the collateral received from the borrower to purchase replacement securities of the same issue, type, class and series of the loaned securities. If the value of the collateral is less than the purchase cost of replacement securities, the lending agent is responsible for satisfying the shortfall but only to the extent that the shortfall is not due to any decrease in the value of JHCIT.

| |

| Annual report | Select Growth Fund | 27 |

Although the risk of the loss of the securities lent is mitigated by receiving collateral from the borrower and through lending agent indemnification, the fund could experience a delay in recovering securities or could experience a lower than expected return if the borrower fails to return the securities on a timely basis. The fund may receive compensation for lending its securities by retaining a portion of the return on the investment of the collateral and compensation from fees earned from borrowers of the securities. Net income received from JHCIT is a component of securities lending income as recorded on the Statement of operations.

Obligations to repay collateral received by the fund is shown on the Statement of assets and liabilities as Payable upon return of securities loaned.

Foreign taxes. The fund may be subject to withholding tax on income and/or capital gains or repatriation taxes imposed by certain countries in which the fund invests. Taxes are accrued based upon investment income, realized gains or unrealized appreciation.

Line of credit. The fund may borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the fund’s custodian agreement, the custodian may loan money to the fund to make properly authorized payments. The fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian may have a lien, security interest or security entitlement in any fund property that is not otherwise segregated or pledged, to the maximum extent permitted by law, to the extent of any overdraft.

In addition, the fund and other affiliated funds have entered into an agreement with Citibank N.A. that enables them to potentially participate in a $300 million unsecured committed line of credit. A commitment fee, payable at the end of each calendar quarter, based on the average daily unused portion of the line of credit, is charged to each participating fund on a pro rata basis and is reflected in other expenses on the Statement of operations. Commitment fees for the year ended March 31, 2014 were $1,129. For the year ended March 31, 2014, the fund had no borrowings under the line of credit.

Expenses. Within the John Hancock group of funds complex, expenses that are directly attributable to an individual fund are allocated to such fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund’s relative net assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations. Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the net assets of the class. Class-specific expenses, such as distribution and service fees, if any, transfer agent fees, state registration fees and printing and postage expenses, for all classes, are calculated daily at the class level based on the appropriate net assets of each class and the specific expense rates applicable to each class.

Federal income taxes. The fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

Under the Regulated Investment Company Modernization Act of 2010, the fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. Any losses incurred during those taxable years will be required to be utilized prior to the losses incurred in pre-enactment taxable years. As a result of this ordering rule,

| |

| 28 | Select Growth Fund | Annual report |

pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

For federal income tax purposes, as of March 31, 2014, the fund has a capital loss carryfoward of $19,834,897 available to offset future net realized capital gains. The following table details the capital loss carryforward available as of March 31, 2014:

CAPITAL LOSS CARRYFORWARD EXPIRING AT MARCH 31

| | | | |

| 2016 | 2017 | 2018 | | |

| | |

| $5,365,684 | $5,342,835 | $9,126,378 | | |

Availability of a certain amount of the loss carryforward, which was acquired in a merger, may be limited in a given year.

As of March 31, 2014, the fund had no uncertain tax positions that would require financial statement recognition, derecognition or disclosure. The fund’s federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The fund generally declares and pays dividends and capital gain distributions, if any, annually. The tax character of distributions for the years ended March 31, 2014 and 2013 was as follows:

| | | | |

| | MARCH 31, 2014 | MARCH 31, 2013 | | |

| | |

| Ordinary Income | $21,462,352 | $750,055 | | |

| Long-Term Capital Gain | $87,134,036 | — | | |

| Total | $108,596,388 | $750,055 | | |

Distributions paid by the fund with respect to each class of shares are calculated in the same manner, at the same time and in the same amount, except for the effect of class level expenses that may be applied differently to each class. As of March 31, 2014, the components of distributable earnings on a tax basis consisted of $36,005,215 of undistributed ordinary income and $32,196,315 of undistributed long-term capital gain.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Material distributions in excess of tax basis earnings and profits, if any, are reported in the fund’s financial statements as a return of capital.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. Book-tax differences are primarily attributable to net operating losses and wash sale loss deferrals.

Note 3 — Guarantees and indemnifications

Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust, including the fund. Additionally, in the normal course of business, the fund enters into contracts with service providers that contain general indemnification clauses. The fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the fund that have not yet occurred. The risk of material loss from such claims is considered remote.

| |

| Annual report | Select Growth Fund | 29 |

Note 4 — Fees and transactions with affiliates

John Hancock Advisers, LLC (the Advisor or JHA) serves as investment advisor for the fund. Prior to January 1, 2014, John Hancock Investment Management Services, LLC (JHIMS) served as investment advisor for the fund. JHIMS and JHA have identical officers, directors and other personnel, and share common facilities and resources. Terms of the investment management contract with JHA are substantially identical to the former contract with JHIMS. In this report, depending on the context, the term “Advisor” shall refer to either JHA in its current capacity as investment advisor, or to JHIMS in its capacity as investment advisor prior to January 1, 2014. John Hancock Funds, LLC (the Distributor), an affiliate of the Advisor, serves as principal underwriter of the fund. The Advisor and the Distributor are indirect, wholly owned subsidiaries of Manulife Financial Corporation (MFC).

Management fee. The fund has an investment management contract with the Advisor under which the fund pays a daily management fee to the Advisor equivalent, on an annual basis, to the sum of: (a) 0.730% of the first $3,000,000,000 of the fund’s average daily net assets; (b) 0.725% of the next $3,000,000,000 of the fund’s average daily net assets; and (c) 0.700% of the fund’s average daily net assets in excess of $6,000,000,000. The Advisor has a subadvisory agreement with Baille Gifford Overseas Limited. Prior to April 18, 2014, the Advisor had a subadvisory agreement with Rainier Investment Management, Inc. The fund is not responsible for payment of the subadvisory fees.

Effective June 1, 2013, The Advisor has contractually agreed to waive a portion of its management fee and/or reimburse expenses for certain funds of the John Hancock complex, including the fund (the participating portfolios). The waiver equals, on an annualized basis, 0.01% of that portion of the aggregate net assets of all the participating portfolios that exceeds $75 billion but is less than or equal to $125 billion; 0.0125% of that portion of the aggregate net assets of all the participating portfolios that exceeds $125 billion but is less than or equal to $150 billion; and 0.015% of that portion of the aggregate net assets of all the participating portfolios that exceeds $150 billion. The amount of the reimbursement is calculated daily and allocated among all the participating portfolios in proportion to the daily net assets of each fund. This arrangement may be amended or terminated at any time by the Advisor upon notice to the fund and with the approval of the Board of Trustees.

Prior to July 1, 2013, the Advisor contractually agreed to reduce its management fee or, if necessary, make payment to the fund to the extent necessary to maintain the fund’s total operating expenses at 1.35%, 2.10%, 2.10% and 1.40% for Class A, Class B, Class C, and Class T shares, respectively. This agreement excluded certain expenses such as taxes, brokerage commissions, interest expense, litigation and indemnification expenses, and other extraordinary expenses not incurred in the ordinary course of the fund’s business, acquired fund fees and expenses paid indirectly and short dividend expense.

The Advisor has contractually agreed to reduce its management fee or, if necessary, make payment to the fund to the extent necessary to maintain the fund’s total operating expenses at 1.70%, 1.45%, 1.60% 1.20%, 1.00%, 0.86% and 1.14% for Class R1, Class R2, Class R3, Class R4, Class R5, Class R6 and Class ADV shares, respectively. This agreement excludes certain expenses such as taxes, brokerage commissions, interest expense, litigation and indemnification expenses, and other extraordinary expenses not incurred in the ordinary course of the fund’s business, acquired fund fees and expenses paid indirectly and short dividend expense. For all the classes indicated, this expense limitation shall remain in effect through June 30, 2015, unless renewed by mutual agreement of the fund and the Advisor based upon a determination that is appropriate under the circumstances at that time.

| |

| 30 | Select Growth Fund | Annual report |

Effective February 1, 2014, for Class R6 shares, the Advisor has contractually agreed to waive and/or reimburse all class specific expense of the fund, including transfer agency fees and service fees, blue sky fees, and printing and postage, as applicable, to the extent they exceed 0.00% of average annual net assets. The fee waiver and/or reimbursement will continue in effect until June 30, 2015, unless renewed by mutual agreement of the fund and Advisor based upon a determination of that this is appropriate under the circumstances at the time. This waiver was in effect on a voluntary basis from January 1, 2014 to January 31, 2014.

The expense reductions for the year ended March 31, 2014, amounted to the following:

| | | | | | |

| | EXPENSE | | | | | |

| CLASS | REDUCTION | | | | | |

| | | | | |

| Class A | $17,632 | | | | | |

| Class B | 964 | | | | | |

| Class C | 911 | | | | | |

| Class I | 4,573 | | | | | |

| Class R1 | 12,781 | | | | | |

| Class R2 | 16,806 | | | | | |

| Class R3 | 13,539 | | | | | |

| Class R4 | 13,554 | | | | | |

| Class R5 | 13,654 | | | | | |

| Class R6 | 12,689 | | | | | |

| Class T | 3,799 | | | | | |

| Class ADV | 24,136 | | | | | |

| Class NAV | 21,725 | | | | | |

| | | | | | |

| Total | $156,763 | | | | | |

The investment management fees, including the impact of waivers and reimbursements as described above, incurred for the year ended March 31, 2014 were equivalent to a net annual effective rate of 0.72% of the fund’s average daily net assets.

Accounting and legal services. Pursuant to a service agreement, the fund reimburses the Advisor for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services to the fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports, among other services. These expenses are allocated to each share class based on its relative net assets at the time the expense was incurred. These accounting and legal services fees incurred for the year ended March 31, 2014 amounted to an annual rate of 0.02% of the fund’s average daily net assets.

Distribution and service plans. The fund has a distribution agreement with the Distributor. The fund has adopted distribution and service plans with respect to Class A, Class B, Class C, Class R1, Class R2, Class R3, Class R4, Class T and Class ADV pursuant to Rule 12b-1 under the 1940 Act, to pay the Distributor for services provided as the distributor of shares of the fund. In addition, under a service plan for Class R1, Class R2, Class R3, Class R4 and Class R5, the fund pays for certain other services. The fund may pay up to the following contractual rates of distribution and service fees under these arrangements, expressed as an annual percentage of average daily net assets for each class of the fund’s shares. Currently, only 0.25% is charged to Class A shares for Rule 12b-1 fees.

| |

| Annual report | Select Growth Fund | 31 |

| | | | | | | |

| CLASS | RULE 12b-1 FEE | SERVICE FEE | | | | | |

| | | | | |

| Class A | 0.30% | — | | | | | |

| Class B | 1.00% | — | | | | | |

| Class C | 1.00% | — | | | | | |

| Class R1 | 0.50% | 0.25% | | | | | |

| Class R2 | 0.25% | 0.25% | | | | | |

| Class R3 | 0.50% | 0.15% | | | | | |

| Class R4 | 0.25% | 0.10% | | | | | |

| Class R5 | — | 0.05% | | | | | |

| Class T | 0.30% | — | | | | | |

| Class ADV | 0.25% | — | | | | | |

The fund’s Distributor has contractually agreed to waive 0.10% of 12b-1 fees for Class R4 shares to limit the 12b-1 fees on Class R4 shares to 0.15% of the average daily net assets of Class R4 shares, until at least June 30, 2015, unless renewed by mutual agreement of the fund and the Distributor based upon a determination that this is appropriate under the circumstances at the time. Reimbursements related to this contractual waiver amounted to $141 for Class R4 shares for the period ended March 31, 2014.

Sales charges. Class A and Class T shares are assessed up-front sales charges of up to 5% of net asset value of such shares. The following summarizes the net up-front sales charges received by the Distributor during the year ended March 31, 2014:

| | |

| | CLASS A | CLASS T |

|

| Retained for printing prospectuses, advertising, sales | $139,072 | $4,417 |

| literature and other purposes | | |

| Sales commissions to broker-dealers | 655,031 | 15,904 |

| Sales commissions to sales personnel of Signator | 24,945 | 8,235 |

| Investors, Inc., a broker-dealer affiliate of the Advisor | | |

| Net sales charges | 819,048 | 28,556 |

Class A, Class B, Class C and Class T shares may be subject to contingent deferred sales charges (CDSCs). Certain Class A and Class T shares that are acquired through purchases of $1 million or more and are redeemed within one year of purchase are subject to a 1.00% sales charge. Class B shares that are redeemed within six years of purchase are subject to CDSCs, at declining rates, beginning at 5.00%. Class C shares that are redeemed within one year of purchase are subject to a 1.00% CDSC. CDSCs are applied to the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from CDSCs are used to compensate the Distributor for providing distribution-related services in connection with the sale of these shares. During the year ended March 31, 2014, CDSCs received by the Distributor amounted to $1,036, $25,117, $2,955 and $204 for Class A, Class B, Class C and Class T shares, respectively.