Exhibit 99.2

Proposed Acquisition of XLNT Veterinary Care, Inc. (dba Pet DRx) February 21, 2007byEcho Healthcare Acquisition Corporation

1 Presentation Agenda Cautionary Legends and Safe Harbor Introduction Transaction Overview Industry Overview Pet DRx Strategy Investment Highlights

2 Cautionary Legends The attached presentation was filed with the Securities and Exchange Commission (“SEC”) as part of the Form 8-K filed by Echo Healthcare Acquisition Corporation (“Echo Healthcare” or “Echo”) on February 20, 2007. Echo is presenting at the Roth Capital Partners Conference regarding its purchase of XLNT Veterinary Care, Inc. (“Pet DRx”). A copy of the complete presentation is available at the SEC’s website (http://www.sec.gov) and the Company’s website (http://www.echohealthcare.com) under the “News Releases” tab. Morgan Joseph & Co. Inc. (“Morgan Joseph”), the managing underwriter of Echo’s initial public offering (“IPO”) consummated March 2006, is assisting Echo in these efforts and will receive an advisory fee equal to $750,000. Echo, Pet DRx and their directors, executive officers, affiliates, Morgan Joseph and Roth Capital Partners, LLC (“Roth”) may be deemed to be participants in the solicitation of proxies for the special meeting of Echo’s stockholders to be held to approve this transaction. Stockholders of Echo and other interested persons are advised to read, when available, Echo’s preliminary proxy statement and definitive proxy statement in connection with Echo’s solicitation of proxies for the special meeting to approve the acquisition because these proxy statements will contain important information. Such persons can also read Echo’s final prospectus, dated March 17, 2006, as well as periodic reports filed with the SEC, for more information about Echo, its officers and directors, Morgan Joseph and Roth and their interests in the successful consummation of this business combination. Information about the directors and officers of Pet DRX as well as updated information about Morgan Joseph, Roth and the directors and officers of Echo and Pet DRx will be included in the definitive proxy statement. Morgan Joseph, Roth, the directors and officers of Echo and Pet DRX have interests in the merger, some of which may differ from, or may be in addition to those of the respective stockholders of Echo generally. Those interests will be described in greater detail in the definitive proxy statement with respect to the merger, which may include potential fees to Morgan Joseph and Roth, employment relationships, potential membership on the Echo Board of Directors, option and stock holdings and indemnification. The definitive proxy statement will be mailed to stockholders as of a record date to be established for the purpose of convening a special meeting to vote on this transaction. Stockholders and other interested persons will also be able to obtain a copy of the definitive proxy statement, the final prospectus and other periodic reports filed with the SEC, without charge, by visiting the SEC’s Internet site at (http://www.sec.gov).

3 Safe Harbor This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, about Echo, Pet DRx and their combined business after completion of the proposed transaction. Forward-looking statements are statements that are not historical facts. Such forward-looking statements, based upon the current beliefs and expectations of Echo’s management, are subject to risks and uncertainties, which could cause actual results to differ from the forward-looking statements. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: veterinary services trends, including factors affecting supply and demand; Pet DRx’s dependence on acquisitions for growth; labor and personnel relations; credit or currency risks affecting Pet DRx’s revenue and profitability; conditions in financial markets that impact Pet DRx’s ability to obtain capital to finance acquisitions; changing interpretations of generally accepted accounting principles; and general economic conditions, as well as other relevant risks detailed in Echo’s filings with the SEC, including the final prospectus relating to Echo’s IPO dated March 17, 2006. The information set forth herein should be read in light of such risks. Neither Echo nor Pet DRx assumes any obligation to update the information contained in this presentation. This presentation contains disclosures of EBITDA and hospital EBITDA for certain periods, which may be deemed to be non-GAAP financial measures within the meaning of Regulation G promulgated by the SEC. Management believes that EBITDA, or earnings before interest, taxes, depreciation and amortization, and hospital EBITDA, which is EBITDA before corporate expenses, are appropriate measures of evaluating operating performance and liquidity, because they reflect the resources available for strategic opportunities including, among others, investments in the business and strategic acquisitions. The disclosure of EBITDA and hospital EBITDA may not be comparable to similarly titled measures reported by other companies. EBITDA and hospital EBITDA should be considered in addition to, and not as a substitute for, or superior to, operating income, cash flows, revenue, or other measures of financial performance prepared in accordance with generally accepted accounting principles.

5 Parties to the Transaction: Echo Healthcare Echo Healthcare Acquisition Corp. (“Echo”)Echo Healthcare Acquisition Corp. (“Echo”)Echo is a special purpose acquisition corp. (“SPAC”) that announced its proposed acquisition of a leading provider of veterinary primary care services Echo’s Board of Directors has significant experience building successful healthcare companies Mar 2006: Completed IPO; raised net proceeds of $54.9 million through sale of 7.2 million units @ $8.00 per unit (unit = 1 share of common stock + 1 warrant exercisable @ $6.00)At 12/31/06: Had $56.4 million in trust; about $7.84 per unit

6 Parties to the Transaction: Pet DRxXLNT Veterinary Care (“Pet DRx”)XLNT Veterinary Care (“Pet DRx”)Owner/Operator of 20 primary care veterinary hospitals -Focused in four regional markets in California Has agreements to acquire eight to ten additional facilities (scheduled to close in first quarter) in California Transaction requires XLNT to achieve minimum of $57.5 million in 2006 year-end pro forma revenues; currently on target 399 employee Headquartered in San Jose, CA

7 Investment Rationale Acquisition platform to take advantage of:-Fragmented industry-Attractive industry fundamentals-Attractive unit economics-Growth oriented capital structure Experienced management team and hands-on directors Goals: -To be a dominant provider of high quality veterinary care-Achieve $1 billion+ of revenues

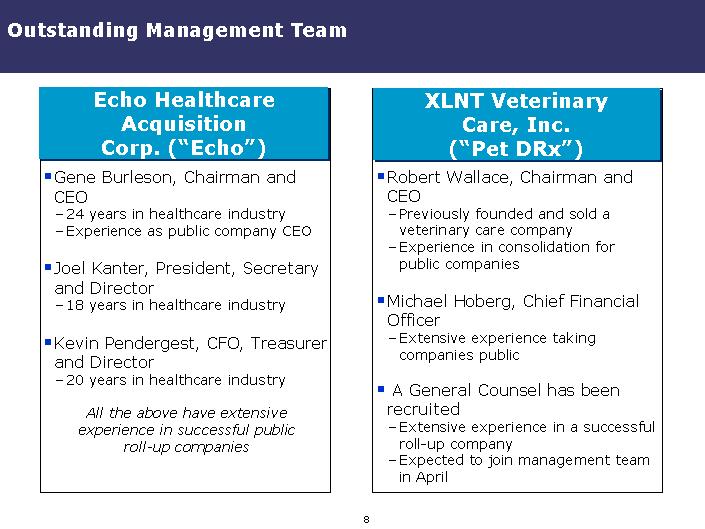

8 Outstanding Management Team XLNT Veterinary Care, Inc. (“Pet DRx”)XLNT Veterinary XLNT Veterinary Care, Inc. Care, Inc. (“Pet DRx”)Echo Healthcare Acquisition Corp. (“Echo”)Echo Healthcare Echo Healthcare Acquisition Corp. (Corp. (“Echo”) Gene Burleson, Chairman and CEO-24 years in healthcare industry-Experience as public company CEO Joel Kanter, President, Secretary and Director-18 years in healthcare industry Kevin Pendergest, CFO, Treasurer and Director-20 years in healthcare industry All the above have extensive experience in successful public roll-up companies Robert Wallace, Chairman and CEO-Previously founded and sold a veterinary care company-Experience in consolidation for public companies Michael Hoberg, Chief Financial Officer-Extensive experience taking companies public A General Counsel has been recruited-Extensive experience in a successful roll-up company-Expected to join management team in April

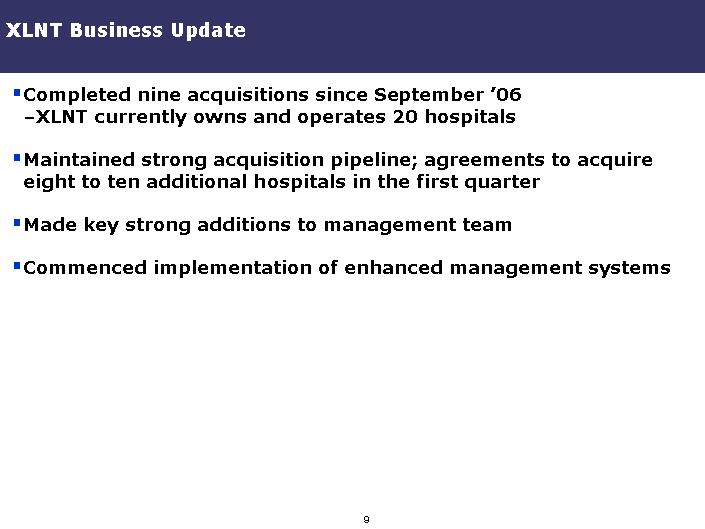

9 XLNT Business Update Completed nine acquisitions since September ’06-XLNT currently owns and operates 20 hospitals Maintained strong acquisition pipeline; agreements to acquire eight to ten additional hospitals in the first quarter Made key strong additions to management team Commenced implementation of enhanced management systems

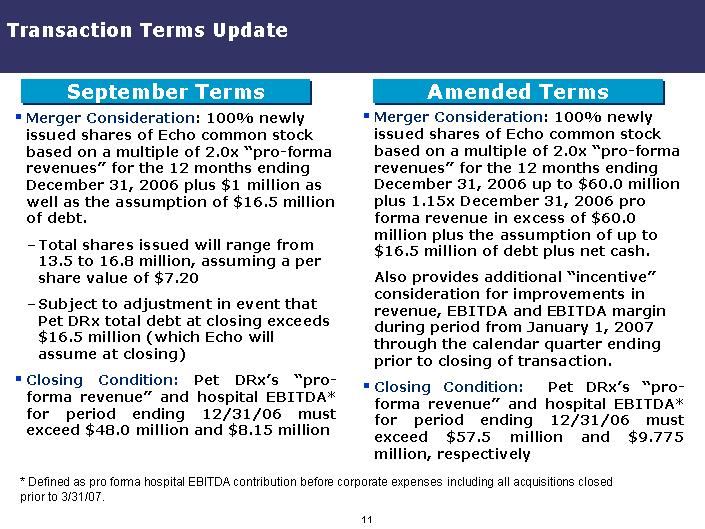

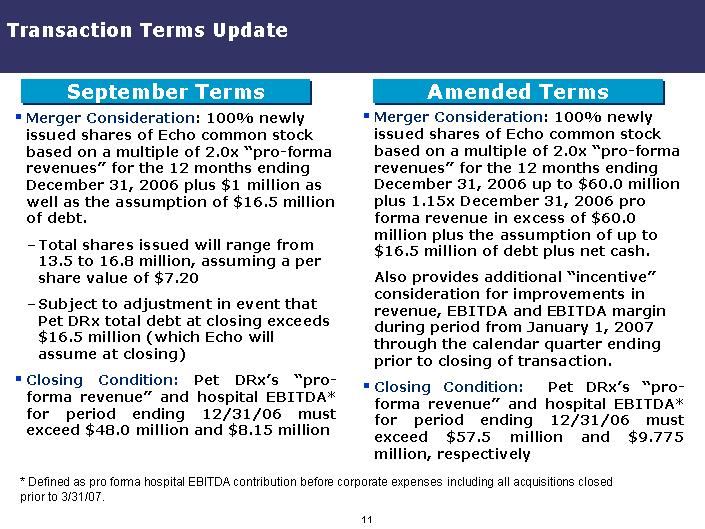

11 Transaction Terms Update Merger Consideration: 100% newly issued shares of Echo common stock based on a multiple of 2.0x “pro-forma revenues” for the 12 months ending December 31, 2006 up to $60.0 million plus 1.15x December 31, 2006 pro forma revenue in excess of $60.0 million plus the assumption of up to $16.5 million of debt plus net cash. Also provides additional “incentive” consideration for improvements in revenue, EBITDA and EBITDA margin during period from January 1, 2007 through the calendar quarter ending prior to closing of transaction. Closing Condition Pet DRx’s “pro-forma revenue” and hospital EBITDA* for period ending 12/31/06 must exceed $57.5 million and $9.775 million, respectively* Defined as pro forma hospital EBITDA contribution before corporate expenses including all acquisitions closed prior to 3/31/07.September Terms September Terms September Terms Amended Term Amended Terms Amended Terms Merger Consideration: 100% newly issued shares of Echo common stock based on a multiple of 2.0x “pro-forma revenues ”for the 12 months ending December 31, 2006 plus $1 million as well as the assumption of $16.5 million of debt. -Total shares issued will range from 13.5 to 16.8 million, assuming a per share value of $7.20-Subject to adjustment in event that Pet DRx total debt at closing exceeds $16.5 million (which Echo will assume at closing)Closing Condition Pet DRx’s “pro-forma revenue” and hospital EBITDA* for period ending 12/31/06 must exceed $48.0 million and $8.15 million

12 Calculation of Merger Consideration Merger Consideration:-Pro Forma Revenue as of 12/31/2006 up to $60.0 million x 2-Pro Forma Revenue as of 12/31/2006 in excess of $60.0 million x 1.15-Minimum pro forma revenue of $57.5 million-Dollar-for-dollar credit for net cash to the extent of positive working capital reduced dollar-for-dollar by proceeds in Echo’s trust fund in excess of $52.0 million*-Assumption of up to $16.5 million of PetDRx debt**-Incentive consideration*Net trust proceeds after payment of transaction expenses, certain deferred IPO expenses and amounts paid, if any, to Echo stockholders who elect redemption. **Debt in excess of $16.5 million will result in dollar-for-dollar reduction in merger consideration.

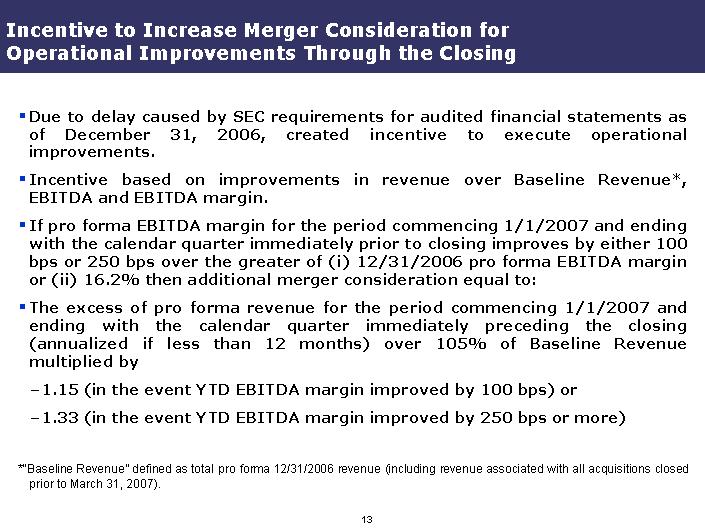

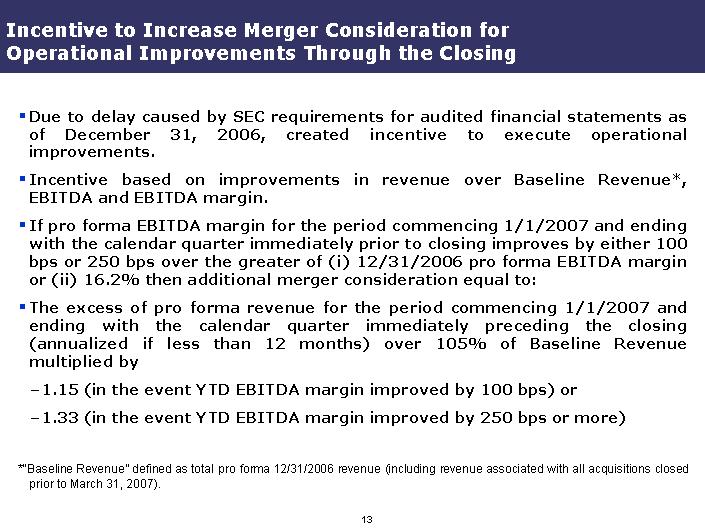

13 Incentive to Increase Merger Consideration for Operational Improvements Through the Closing Due to delay caused by SEC requirements for audited financial statements as of December 31, 2006, created incentive to execute operational improvements. Incentive based on improvements in revenue over Baseline Revenue*, EBITDA and EBITDA margin. If pro forma EBITDA margin for the period commencing 1/1/2007 and ending with the calendar quarter immediately prior to closing improves by either 100 bps or 250 bps over the greater of (i) 12/31/2006 pro forma EBITDA margin or (ii) 16.2% then additional merger consideration equal to: The excess of pro forma revenue for the period commencing 1/1/2007 and ending with the calendar quarter immediately preceding the closing (annualized if less than 12 months) over 105% of Baseline Revenue multiplied by-1.15 (in the event YTD EBITDA margin improved by 100 bps) or-1.33 (in the event YTD EBITDA margin improved by 250 bps or more)*“Baseline Revenue” defined as total pro forma 12/31/2006 revenue (including revenue associated with all acquisitions closed prior to March 31, 2007).

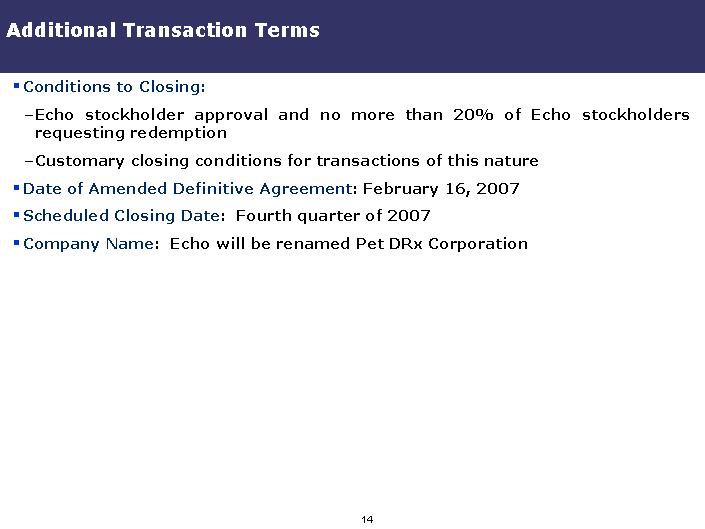

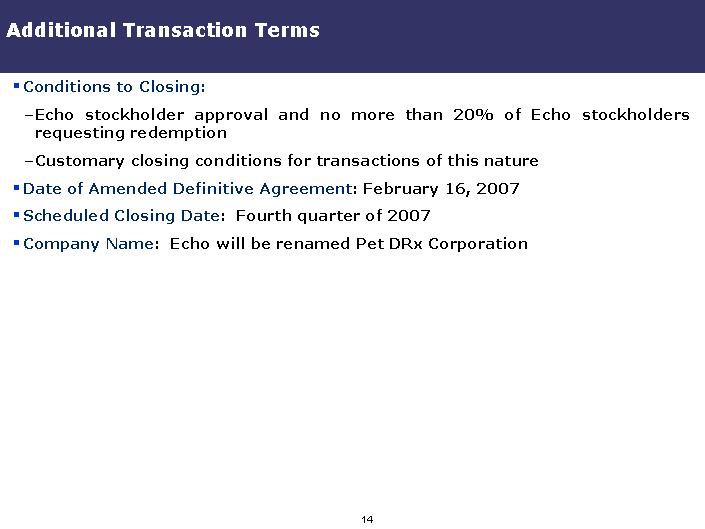

14 Additional Transaction Terms Conditions to Closing:-Echo stockholder approval and no more than 20% of Echo stockholders requesting redemption-Customary closing conditions for transactions of this nature Date of Amended Definitive Agreement: February 16, 2007Scheduled Closing Date: Fourth quarter of 2007Company Name: Echo will be renamed Pet DRx Corporation

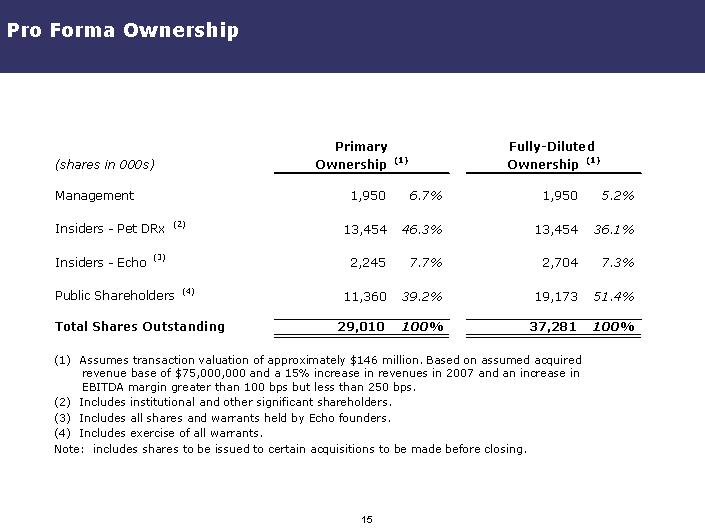

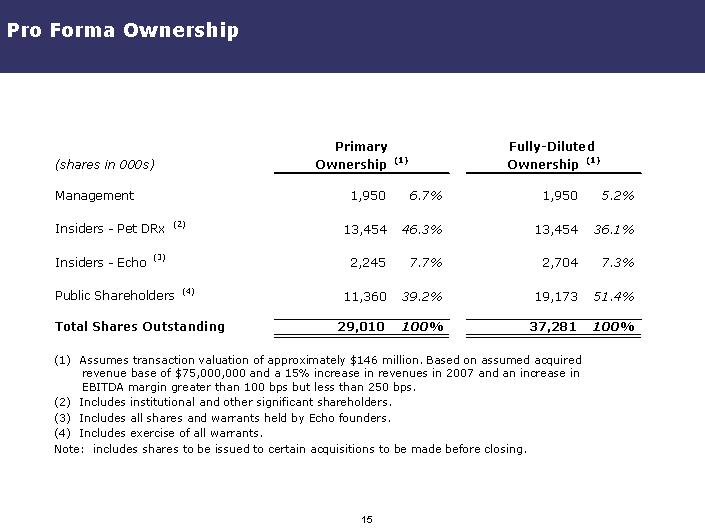

15 Pro Forma Ownership(shares in 000s)Management1,9506.7%1,9505.2%Insiders -Pet DRx (2)13,454 46.3% 13,454 36.1% Insiders -Echo (3) 2,245 7.7% 2,704 7.3% Public Shareholders (4) 11,360 39.2% 19,173 51.4%Total Shares Outstanding 29,010 100% 37,281 100% (1) Assumes transaction valuation of approximately $146 million. Based on assumed acquired revenue base of $75,000,000 and a 15% increase in revenues in 2007 and an increase in EBITDA margin greater than 100 bps but less than 250 bps.(2) Includes institutional and other significant shareholders. (3) Includes all shares and warrants held by Echo founders.(4) Includes exercise of all warrants. Note: includes shares to be issued to certain acquisitions to be made before closing. Ownership (1)Fully-Diluted Primary Ownership (1)

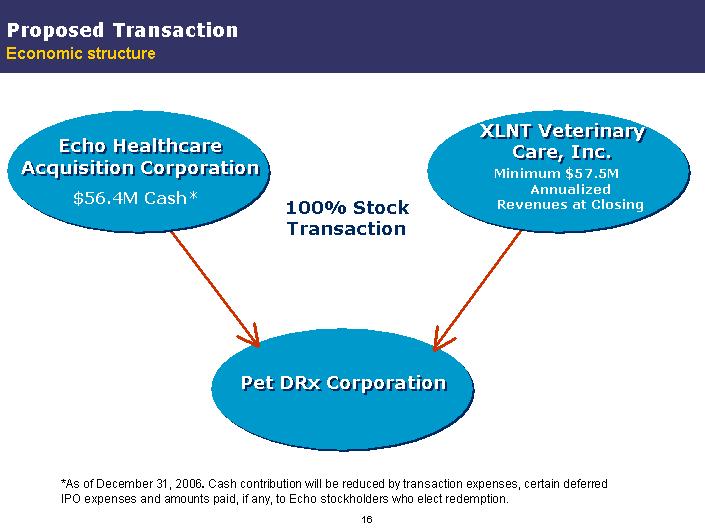

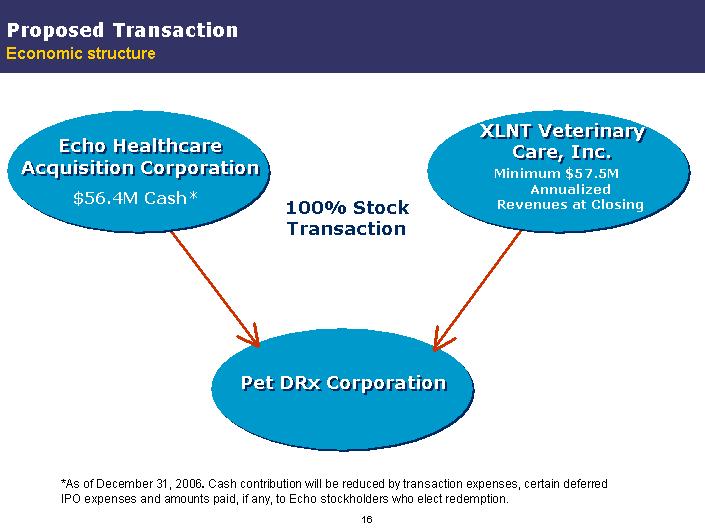

Proposed Transaction Economic structure 16 Echo Healthcare Acquisition Corporation Echo Healthcare Acquisition Corporation XLNT Veterinary Care, Inc. XLNT Veterinary Care, Inc. Minimum $57.5M Annualized Revenues at Closing $56.4M Cash* 100% Stock Transaction Pet DRx Corporation Pet DRx Corporation*As of December 31, 2006. Cash contribution will be reduced by transaction expenses, certain deferred IPO expenses and amounts paid, if any, to Echo stockholders who elect redemption.

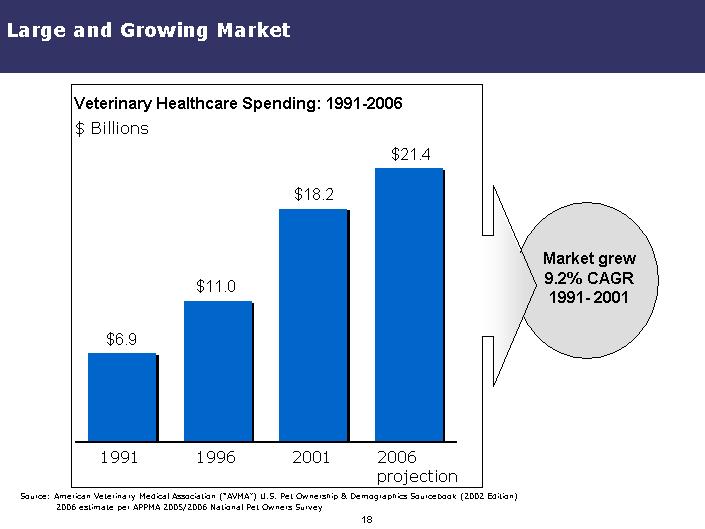

18 Large and Growing Market20012006 projection1996 1991 $ Billions Veterinary Healthcare Spending: 1991-2006 Market grew 9.2% CAGR 1991-2001 Source: American Veterinary Medical Association (“AVMA”) U.S. Pet Ownership & Demographics Sourcebook (2002 Edition) 2006 estimate per APPMA 2005/2006 National Pet Owners Survey $6.9 $11.0 $18.2 $21.4

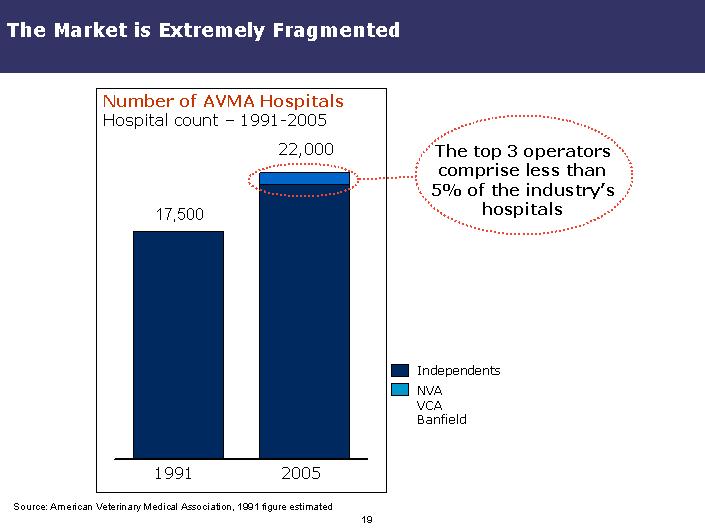

19 17,500 The Market is Extremely Fragmented 1991 2005 Number of AVMA Hospitals Hospital count -1991-200 522,000 Independents NVAVCA Banfield The top 3 operators comprise less than 5% of the industry’s hospitals Source: American Veterinary Medical Association, 1991 figure estimated

20 Additional Favorable Industry Characteristics Primary Care Services Delivered in One Location Emotionally Driven Customer-Pets often treated like family members100% Private Pay-Nominal presence of pet health insurance Cash Business-Payment typically at time of service Limited Liability-Low potential for litigation

22 PET DRx Opportunity Drivers Advances in Science and Medical Technology-More treatments and diagnostic capabilities for pets Favorable Pet Population / Demographics-More pets -62% of U.S. households own a pet and 46% own more than one pet Fragmented Delivery Systems-Not capable of delivering state of the art care Lack of Liquidity for the Aging Veterinarian Practice Owners-Demographic shifts to younger practitioners -Scale of veterinary practices requires more financial resources to acquire Consumer Demand for Broader Scope of Services Revenue and Margin Enhancement Opportunities

23 Acquisition Criteria Ability to gain significant market share in highly populated geographic regions Target facilities with high profile, high quality vets Underperforming facilities with opportunities to enhance revenue and margins Favorable demographic characteristics (dense population, strong suburban locations, educated population, warm weather climates)Immediately accretive acquisitions

24 Revenue and Margin Opportunities Increase Revenues& Margins Proactive Marketing Cluster Strategy Enhance Doctor Productivity Economies of Scale Ancillary Products Personnel Training

26 Investment Highlights Large, growing and highly fragmented market-$18B+ and high single digit growth-Top 3 hospital operators own <5% of total hospitals Ideal acquisition platform-Proven model-Critical mass-Acquisition pipeline-Great people Arbitrage between private and public market values Management has executed consolidation strategy in this market before