| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT |

| COMPANIES |

| Investment Company Act file number 811-21779 |

| |

| JOHN HANCOCK FUNDS II |

| --------------------------------------------------------- |

| (Exact name of registrant as specified in charter) |

| |

| 601 CONGRESS STREET, BOSTON, MA 02210-2805 |

| ------------------------------------------------------------- |

| (Address of principal executive offices) (Zip code) |

| |

| MICHAEL J. LEARY, 601 CONGRESS STREET, BOSTON, MA 02210-2805 |

| ------------------------------------------------------------------------------------------ |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: (617) 663-4490 |

| -------------- |

| Date of fiscal year end: 8/31 | |

| ------ | |

| |

| Date of reporting period: 2/28/11 | |

| ------- |

ITEM 1. REPORTS TO STOCKHOLDERS.

The Registrant prepared six semiannual reports to shareholders for the period ended February 28, 2011. The first report applies to the Floating Rate Income Fund, the second report applies to the Natural Resources Fund, the third report applies to the Strategic Income Opportunities Fund, the fourth report applies to the Alternative Asset Allocation Fund, the fifth report applies to the 8 Lifecycle Portfolios and the sixth report applies to 68 of the Registrant’s Funds.

A look at performance

For the period ended February 28, 2011

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | SEC 30-day | | SEC 30-day |

| | Average annual total returns (%) | | Cumulative total returns (%) | | yield (%) | | yield (%) |

| | with maximum sales charge (POP) | | with maximum sales charge (POP) | | subsidized | | unsubsidized1 |

|

| | | | | Since | | | | | | Since | | as of | | as of |

| | 1-year | 5-year | 10-year | inception2 | | 6-months | 1-year | 5-year | 10-year | inception2 | | 2-28-11 | | 2-28-11 |

|

| Class A | 7.22 | — | — | 4.83 | | 4.84 | 7.22 | — | — | 16.09 | | 3.19 | | 3.16 |

|

| Class B | 4.83 | — | — | 4.24 | | 2.79 | 4.83 | — | — | 14.02 | | 2.52 | | 2.42 |

|

| Class C | 8.84 | — | — | 5.16 | | 6.78 | 8.84 | — | — | 17.23 | | 2.53 | | 2.52 |

|

| Class I3 | 11.10 | — | — | 6.28 | | 8.41 | 11.10 | — | — | 21.24 | | 3.74 | | 3.74 |

|

| Class 13 | 11.13 | — | — | 6.31 | | 8.43 | 11.13 | — | — | 21.33 | | 3.73 | | 3.72 |

|

| Class NAV 3 | 11.18 | — | — | 6.37 | | 8.45 | 11.18 | — | — | 21.56 | | 3.78 | | 3.78 |

|

Performance figures assume all distributions are reinvested. Public offering price (POP) figures reflect maximum sales charges on Class A shares of 3%, and the applicable contingent deferred sales charge (CDSC) on Class B shares and Class C shares. The Class B shares’ CDSC declines annually between years 1 to 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charges are not applicable for Class I, Class 1 and Class NAV shares.

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The waivers and expense limitations are contractual at least until 12-31-11. The net expenses are as follows: Class A — 1.20%, Class B — 1.95% and Class C — 1.95%. Had the fee waivers and expense limitations not been in place, the gross expenses would be as follows: Class A — 1.29%, Class B — 2.10% and Class C — 1.99%. For the other classes, the net expenses equal the gross expenses and are as follows: Class I — 0.81%, Class 1 — 0.78%, Class NAV — 0.73%.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For current to the most recent month end performance data, please call 1–800–225–5291 or visit the Fund’s Web site at www.jhfunds.com.

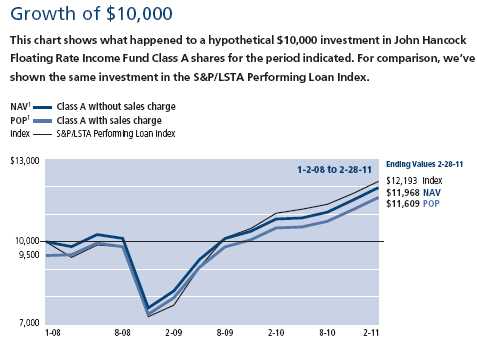

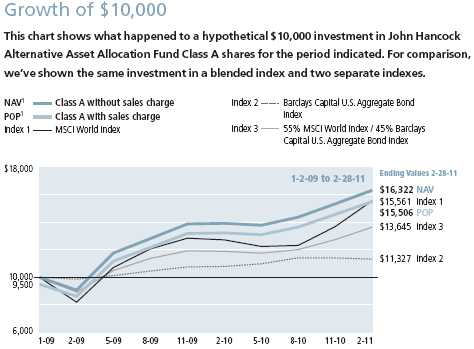

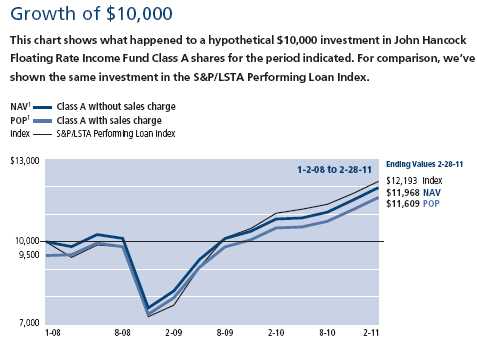

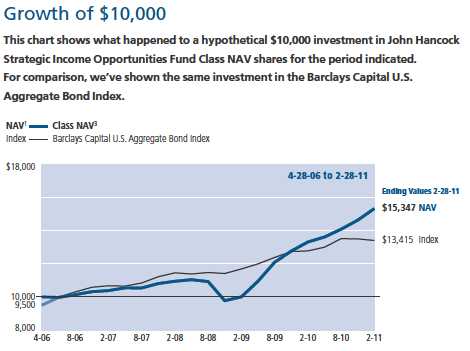

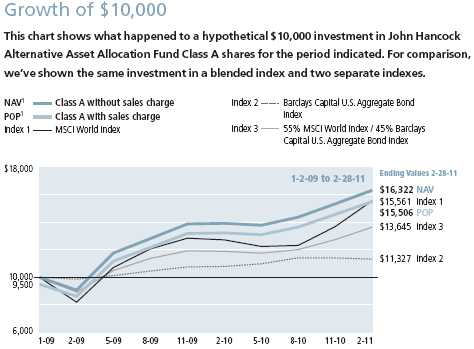

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Fund’s performance results reflect any applicable expense reductions, without which the expenses increase and results would have been less favorable.

1 Unsubsidized yields reflect what the yields would have been without the effect of reimbursements and waivers.

2 From 1-2-08.

3 For certain types of investors, as described in the Fund’s Class I, Class 1 and Class NAV shares prospectuses.

| |

| 6 | Floating Rate Income Fund | Semiannual report |

| | | | |

| | Period | Without | With maximum | |

| | beginning | sales charge | sales charge | Index |

|

| Class B | 1-2-08 | $11,692 | $11,402 | $12,193 |

|

| Class C2 | 1-2-08 | 11,723 | 11,723 | 12,193 |

|

| Class I3 | 1-2-08 | 12,124 | 12,124 | 12,193 |

|

| Class 13 | 1-2-08 | 12,133 | 12,133 | 12,193 |

|

| Class NAV3 | 1-2-08 | 12,156 | 12,156 | 12,193 |

|

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the fund’s Class B, Class C, Class I, Class 1 and Class NAV shares, respectively, as of 2-28-11. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

S&P/LSTA Performing Loan Index is a subset of the S&P/LSTA Leveraged Loan Index tracking returns in the leveraged loan market and capturing a broad cross-section of the U.S. leveraged loan market, including dollar-denominated, U.S.-syndicated loans to overseas issuers and excluding those in default.

It is not possible to invest directly in an index. Index figures do not reflect sales charges, which would have resulted in lower values if they did.

1 NAV represents net asset value and POP represents public offering price.

2 The contingent deferred sales charge, if any, is not applicable.

3 For certain types of investors, as described in the Fund’s Class I, Class 1 and Class NAV shares prospectuses.

| | |

| | Semiannual report | Floating Rate Income Fund | 7 |

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

■ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■ Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about the Fund’s actual ongoing operating expenses, and is based on the Fund’s actual return. It assumes an account value of $1,000.00 on September 1, 2010 with the same investment held until February 28, 2011.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 9-1-10 | on 2-28-11 | period ended 2-28-111 |

|

| Class A | $1,000.00 | $1,080.80 | $6.19 |

|

| Class B | 1,000.00 | 1,077.90 | 10.05 |

|

| Class C | 1,000.00 | 1,077.80 | 9.94 |

|

| Class I | 1,000.00 | 1,084.10 | 4.08 |

|

| Class 1 | 1,000.00 | 1,084.30 | 3.98 |

|

| Class NAV | 1,000.00 | 1,084.50 | 3.72 |

|

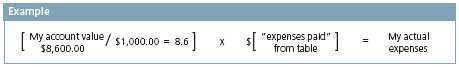

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at February 28, 2011, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| |

| 8 | Floating Rate Income Fund | Semiannual report |

Hypothetical example for comparison purposes

This table allows you to compare the Fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not the Fund’s actual return). It assumes an account value of $1,000.00 on September 1, 2010, with the same investment held until February 28, 2011. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 9-1-10 | on 2-28-11 | period ended 2-28-111 |

|

| Class A | $1,000.00 | $1,018.80 | $6.01 |

|

| Class B | 1,000.00 | 1,015.10 | 9.74 |

|

| Class C | 1,000.00 | 1,015.20 | 9.64 |

|

| Class I | 1,000.00 | 1,020.90 | 3.96 |

|

| Class 1 | 1,000.00 | 1,021.00 | 3.86 |

|

| Class NAV | 1,000.00 | 1,021.20 | 3.61 |

|

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.20%, 1.95%, 1.93%, 0.79%, 0.77% and 0.72% for Class A, Class B, Class C, Class I, Class 1 and Class NAV shares, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

| | |

| | Semiannual report | Floating Rate Income Fund | 9 |

Portfolio summary

| | | | |

| Top 10 Issuers1 | | | | |

|

| Visant Corp. | 2.7% | | Freescale Semiconductor, Inc. | 1.9% |

| |

|

| Texas Competitive Electric Holdings | | | First Data Corp. | 1.9% |

| Company LLC | 2.6% | |

|

| | Charter Communications | |

| Harrah’s Operating Company, Inc. | 2.5% | | Operating LLC | 1.6% |

| |

|

| Community Health Systems, Inc. | 2.2% | | Cengage Learning, Inc. | 1.6% |

| |

|

| Univision Communications, Inc. | 2.0% | | Intelsat Jackson Holdings SA | 1.6% |

| |

|

| |

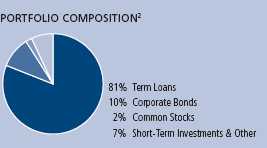

| Sector Composition2,3 | | | | |

|

| Consumer Discretionary | 33% | | Financials | 6% |

| |

|

| Health Care | 14% | | Consumer Staples | 5% |

| |

|

| Industrials | 9% | | Telecommunication Services | 5% |

| |

|

| Information Technology | 7% | | Energy | 2% |

| |

|

| Materials | 6% | | Short-Term Investments & Other | 7% |

| |

|

| Utilities | 6% | | | |

| | |

| |

| Quality Composition2,4 | | | | |

|

| A | 1% | | CCC & Below | 7% |

| |

|

| BBB | 3% | | Equity | 2% |

| |

|

| BB | 27% | | Not Rated | 3% |

| |

|

| B | 50% | | Short-Term Investments & Other | 7% |

| |

|

1 As a percentage of net assets on 2-28-11. Cash and cash equivalents are not included in Top 10 Issuers.

2 As a percentage of net assets on 2-28-11.

3 Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

4 Ratings are from Moody’s Investor Services, Inc. If not available, we have used S&P ratings. In the absence of ratings from these agencies, we have used Fitch, Inc. ratings. “Not Rated” securities are those with no ratings available. They may have internal ratings similar to those shown. All are as of 2-28-11 and do not reflect subsequent downgrades, if any.

| |

| 10 | Floating Rate Income Fund | Semiannual report |

Fund’s investments

As of 2-28-11 (unaudited)

| | | | | |

| | | | Maturity | | |

| | Rate (%) | | date | Par value | Value |

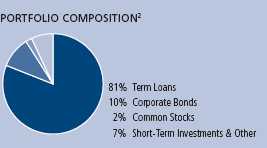

| Term Loans (M) 81.10% | | | | $1,635,913,820 |

|

| (Cost $1,591,269,266) | | | | | |

| | | | | | |

| Consumer Discretionary 31.54% | | | | | 636,312,477 |

| | | | | | |

| Auto Components 1.49% | | | | | |

|

| Allison Transmission, Inc. | 3.020 | | 08-07-14 | $25,125,728 | 25,031,506 |

|

| UCI International, Inc. | 5.500 | | 07-26-17 | 5,000,000 | 5,017,190 |

| | | | | | |

| Automobiles 0.25% | | | | | |

|

| Ford Motor Company | 3.020 | | 12-16-13 | 5,105,461 | 5,103,307 |

| | | | | | |

| Diversified Consumer Services 1.58% | | | | | |

|

| Cengage Learning, Inc. | 2.550 | | 07-03-14 | 33,041,906 | 31,794,574 |

| | | | | | |

| Hotels, Restaurants & Leisure 10.19% | | | | | |

|

| Burger King Corp. | 4.500 | | 10-19-16 | 9,500,000 | 9,543,539 |

|

| CCM Merger, Inc. | 8.500 | | 07-13-12 | 19,264,376 | 19,384,778 |

|

| CCM Merger, Inc. (T) | — | | 02-11-17 | 2,844,839 | 2,879,512 |

|

| CityCenter Holdings LLC (T) | — | | 01-13-15 | 17,540,778 | 17,719,834 |

|

| Denny’s, Inc. | 6.500 | | 09-20-16 | 7,200,000 | 7,258,320 |

|

| DineEquity, Inc. (T) | — | | 10-19-17 | 18,500,000 | 18,638,750 |

|

| Dunkin Brands, Inc. | 4.250 | | 11-23-17 | 15,000,000 | 15,093,750 |

|

| Golden Nugget, Inc. | 3.270 | | 06-30-14 | 1,725,726 | 1,489,876 |

|

| Harrah’s Operating Company, Inc. | 9.500 | | 10-31-16 | 21,273,659 | 22,544,165 |

|

| Harrah’s Operating Company, Inc. | 3.303 | | 01-28-15 | 29,119,753 | 26,977,384 |

|

| Las Vegas Sands LLC | 3.040 | | 11-23-16 | 17,259,183 | 17,175,977 |

|

| Quiznos Corp. | 5.010 | | 05-05-13 | 18,010,747 | 17,050,180 |

|

| Sugarhouse HSP Gaming Prop. Mezz. LP | 11.250 | | 09-23-14 | 9,027,375 | 9,170,305 |

|

| VML US Finance LLC | 4.790 | | 05-25-12 | 2,292,777 | 2,295,629 |

|

| VML US Finance LLC | 4.790 | | 05-27-13 | 5,934,425 | 5,941,807 |

|

| Wynn Las Vegas LLC | 3.270 | | 08-17-15 | 12,500,000 | 12,427,088 |

| | | | | | |

| Leisure Equipment & Products 1.00% | | | | | |

|

| Amscan Holdings, Inc. | 6.750 | | 12-04-17 | 19,950,000 | 20,134,338 |

| | | | | | |

| Media 12.80% | | | | | |

|

| Acosta, Inc. (T) | — | | 02-15-18 | 7,500,000 | 7,556,250 |

|

| Advantage Sales & Marketing LLC | 5.250 | | 12-18-17 | 5,500,000 | 5,534,337 |

|

| Affinion Group, Inc. | 5.000 | | 10-09-16 | 5,000,000 | 5,025,000 |

|

| AMC Entertainment Holdings, Inc. | 3.510 | | 12-16-16 | 13,000,000 | 13,077,194 |

|

| Carmike Cinemas, Inc. | 5.500 | | 01-27-16 | 12,198,571 | 12,310,395 |

|

| Charter Communications Operating LLC | 3.560 | | 09-06-16 | 30,189,254 | 30,260,017 |

|

| Charter Communications Operating LLC | 2.270 | | 03-06-14 | 2,440,273 | 2,460,405 |

| | |

| See notes to financial statements | Semiannual report | Floating Rate Income Fund | 11 |

| | | | | |

| | | | Maturity | | |

| | Rate (%) | | date | Par value | Value |

| Media (continued) | | | | | |

|

| Citadel Broadcasting Corp. | 4.250 | | 12-30-16 | $6,930,000 | $6,951,656 |

|

| Dex Media West, Inc. | 7.000 | | 10-24-14 | 10,699,117 | 9,801,150 |

|

| Getty Images, Inc. | 5.250 | | 11-07-16 | 7,980,000 | 8,077,260 |

|

| Insight Midwest Holdings LLC | 2.024 | | 04-07-14 | 2,068,519 | 2,060,089 |

|

| Newsday LLC | 10.500 | | 08-01-13 | 10,000,000 | 10,631,250 |

|

| Nielsen Finance LLC | 3.764 | | 05-02-16 | 14,536,565 | 14,575,930 |

|

| Regal Cinemas Corp. (T) | — | | 08-23-17 | 15,000,000 | 15,075,000 |

|

| Sinclair Television Group, Inc. | 5.500 | | 10-29-15 | 11,904,620 | 12,033,583 |

|

| Tribune Company (H) | 3.230 | | 06-07-11 | 2,462,857 | 1,728,106 |

|

| Tribune Company (H) | 3.460 | | 06-04-14 | 10,000,000 | 7,142,860 |

|

| Univision Communications, Inc. | 4.512 | | 03-31-17 | 36,699,189 | 35,797,012 |

|

| UPC Broadband Holding BV | 2.010 | | 12-31-14 | 3,565,583 | 3,538,841 |

|

| Visant Corp. | 7.000 | | 12-22-16 | 54,190,625 | 54,675,631 |

| | | | | | |

| Multiline Retail 2.29% | | | | | |

|

| Michaels Stores, Inc. | 4.834 | | 07-31-16 | 24,317,193 | 24,514,770 |

|

| Savers, Inc. | 5.750 | | 03-11-16 | 2,481,250 | 2,493,656 |

|

| The Neiman Marcus Group, Inc. | 4.303 | | 04-06-16 | 19,135,439 | 19,223,041 |

| | | | | | |

| Specialty Retail 1.94% | | | | | |

|

| Bass Pro Group LLC | 5.006 | | 04-09-15 | 6,942,563 | 6,979,449 |

|

| General Nutrition Centers, Inc. | 3.296 | | 09-16-13 | 5,868,534 | 5,839,191 |

|

| Gymboree Corp. | 5.000 | | 02-23-18 | 26,200,000 | 26,278,595 |

| | | | | | |

| Consumer Staples 5.19% | | | | | 104,655,494 |

| | | | | | |

| Food Products 2.98% | | | | | |

|

| Bolthouse Farms, Inc. | 7.500 | | 08-11-16 | 17,500,000 | 17,718,750 |

|

| Bolthouse Farms, Inc. | 5.501 | | 02-11-16 | 2,937,370 | 2,955,728 |

|

| Brickman Group Holdings, Inc. | 7.250 | | 10-14-16 | 6,500,000 | 6,635,415 |

|

| Del Monte Corp. (T) | — | | 02-26-18 | 25,000,000 | 25,156,250 |

|

| Dole Food Company, Inc. | 5.059 | | 03-02-17 | 2,193,953 | 2,208,433 |

|

| Dole Food Company, Inc. | 5.039 | | 03-02-17 | 5,449,231 | 5,485,196 |

| | | | | | |

| Household Products 1.77% | | | | | |

|

| Reynolds Group Holdings, Inc. | 4.250 | | 02-09-18 | 27,000,000 | 27,140,616 |

|

| Spectrum Brands, Inc. | 5.013 | | 06-17-16 | 8,434,953 | 8,515,786 |

| | | | | | |

| Personal Products 0.44% | | | | | |

|

| NBTY, Inc. | 6.250 | | 10-02-17 | 8,750,000 | 8,839,320 |

| | | | | | |

| Energy 0.60% | | | | | 12,101,470 |

| | | | | | |

| Energy Equipment & Services 0.46% | | | | | |

|

| Cie Generale de Geophysique-Veritas | 4.500 | | 01-12-14 | 1,065,222 | 1,058,565 |

|

| Hercules Offshore, Inc. | 6.000 | | 07-11-13 | 8,227,563 | 8,164,145 |

| | | | | | |

| Oil, Gas & Consumable Fuels 0.14% | | | | | |

|

| SemGroup Corp. | 0.572 | | 11-30-12 | 2,866,814 | 2,878,760 |

| | | | | | |

| Financials 3.92% | | | | | 78,959,415 |

| | | | | | |

| Capital Markets 0.60% | | | | | |

|

| Pinafore LLC | 4.250 | | 09-29-15 | 4,933,107 | 4,933,107 |

|

| Pinafore LLC | 4.250 | | 09-26-16 | 7,029,678 | 7,056,039 |

| | |

| 12 | Floating Rate Income Fund | Semiannual report | See notes to financial statements |

| | | | | |

| | | | Maturity | | |

| | Rate (%) | | date | Par value | Value |

| Diversified Financial Services 1.42% | | | | | |

|

| BLB Management Services, Inc. (T) | — | | 11-05-15 | $6,004,660 | $6,039,685 |

|

| Fifth Third Processing Solutions | 5.500 | | 11-03-16 | 16,000,000 | 16,124,000 |

|

| International Lease Finance Corp. | 6.750 | | 03-17-15 | 6,409,615 | 6,449,675 |

| | | | | | |

| Insurance 0.85% | | | | | |

|

| Asurion Corp. | 6.750 | | 03-31-15 | 5,000,000 | 5,063,395 |

|

| Asurion Corp. | 3.271 | | 07-03-14 | 8,421,237 | 8,283,079 |

|

| First American Corp. | 4.750 | | 04-12-16 | 3,731,250 | 3,754,570 |

| | | | | | |

| Real Estate Management & Development 1.05% | | | | |

|

| Realogy Corp. | 4.562 | | 10-10-16 | 20,267,348 | 19,442,183 |

|

| Realogy Corp. | 3.260 | | 10-10-16 | 1,890,658 | 1,813,682 |

| | | | | | |

| Health Care 14.20% | | | | | 286,498,420 |

| | | | | | |

| Biotechnology - 0.95% | | | | | |

|

| Grifols SA (T) | — | | 11-23-16 | 19,000,000 | 19,221,673 |

| | | | | | |

| Health Care Equipment & Supplies 1.64% | | | | | |

|

| Bausch & Lomb, Inc. | 3.543 | | 04-24-15 | 11,710,771 | 11,630,259 |

|

| Bausch & Lomb, Inc. | 3.512 | | 04-24-15 | 16,364,886 | 16,385,342 |

|

| ConvaTec, Ltd. | 5.750 | | 12-22-16 | 5,000,000 | 5,022,915 |

| | | | | | |

| Health Care Providers & Services 9.50% | | | | | |

|

| Alliance Healthcare Services, Inc. | 5.500 | | 06-01-16 | 4,950,000 | 4,974,750 |

|

| Cardinal Health, Inc. | 2.512 | | 04-10-14 | 10,382,281 | 10,252,502 |

|

| Community Health Systems, Inc. | 3.810 | | 01-25-17 | 15,323,984 | 15,357,405 |

|

| Community Health Systems, Inc. | 2.560 | | 07-25-14 | 28,432,461 | 28,201,448 |

|

| CRC Health Corp. | 4.803 | | 11-16-15 | 22,168,928 | 22,113,506 |

|

| Hanger Orthopedic Group, Inc. | 5.250 | | 11-17-16 | 8,400,000 | 8,494,500 |

|

| HCA, Inc. | 2.553 | | 11-18-13 | 18,207,967 | 18,147,280 |

|

| Health Management Associates, Inc. | 2.053 | | 02-28-14 | 4,377,000 | 4,342,956 |

|

| IASIS Healthcare LLC | 2.266 | | 03-14-14 | 477,216 | 474,979 |

|

| IASIS Healthcare LLC | 2.262 | | 03-14-14 | 9,725,664 | 9,680,079 |

|

| Manor Care, Inc. | 2.762 | | 12-22-14 | 4,920,010 | 4,901,511 |

|

| MultiPlan, Inc. | 4.750 | | 07-16-17 | 19,962,132 | 20,055,715 |

|

| National Mentor Holdings, Inc. | 7.000 | | 01-18-17 | 14,000,000 | 13,784,162 |

|

| Renal Advantage Holdings, Inc. | 5.750 | | 12-16-16 | 3,000,000 | 3,041,250 |

|

| Universal Health Services, Inc. | 5.500 | | 11-15-16 | 16,000,000 | 16,140,000 |

|

| Vanguard Health Holding Company I LLC | 5.000 | | 01-29-16 | 11,562,843 | 11,638,002 |

| | | | | | |

| Health Care Technology 0.91% | | | | | |

|

| MedAssets, Inc. | 5.250 | | 11-16-16 | 18,200,000 | 18,336,500 |

| | | | | | |

| Pharmaceuticals 1.20% | | | | | |

|

| Warner Chilcott Company LLC | 6.500 | | 02-22-16 | 2,489,804 | 2,508,089 |

|

| Warner Chilcott Company LLC | 6.250 | | 04-30-15 | 14,090,452 | 14,174,468 |

|

| Warner Chilcott Company LLC | 6.000 | | 10-30-14 | 7,615,954 | 7,619,129 |

| | | | | | |

| Industrials 7.89% | | | | | 159,159,739 |

| | | | | |

| Aerospace & Defense 2.38% | | | | | |

|

| DAE Aviation Holdings, Inc. | 5.310 | | 07-31-14 | 16,450,066 | 16,573,442 |

|

| Delos Aircraft, Inc. | 7.000 | | 03-17-16 | 22,700,385 | 22,894,950 |

| | |

| See notes to financial statements | Semiannual report | Floating Rate Income Fund | 13 |

| | | | | |

| | | | Maturity | | |

| | Rate (%) | | date | Par value | Value |

| Aerospace & Defense (continued) | | | | | |

|

| Hawker Beechcraft Acquisition Company LLC | 2.303 | | 03-26-14 | $434,187 | $387,987 |

|

| Hawker Beechcraft Acquisition Company LLC | 2.273 | | 03-26-14 | 5,243,689 | 4,685,729 |

|

| Transdigm, Inc. | 5.250 | | 02-14-17 | 3,500,000 | 3,519,250 |

| | | | | | |

| Airlines 0.55% | | | | | |

|

| Delta Air Lines, Inc. | 8.750 | | 09-27-13 | 9,137,757 | 9,170,388 |

|

| Delta Air Lines, Inc. | 2.254 | | 04-30-12 | 2,075,698 | 2,060,130 |

| | | | | | |

| Building Products 1.05% | | | | | |

|

| Goodman Global, Inc. | 5.750 | | 10-28-16 | 20,967,425 | 21,121,410 |

| | | | | | |

| Commercial Services & Supplies 2.25% | | | | | |

|

| Affinion Group, Inc. | 5.000 | | 10-10-16 | 4,950,031 | 4,974,782 |

|

| ARAMARK Corp. | 3.553 | | 07-26-16 | 8,766,291 | 8,788,207 |

|

| ARAMARK Corp. | 3.511 | | 07-26-16 | 576,513 | 577,954 |

|

| ARAMARK Corp. | 2.178 | | 01-27-14 | 1,171,857 | 1,170,027 |

|

| ARAMARK Corp. | 2.136 | | 01-27-14 | 64,096 | 63,996 |

|

| Brand Energy Services | 2.563 | | 02-07-14 | 2,503,880 | 2,452,758 |

|

| Language Line LLC | 6.250 | | 06-20-16 | 8,000,000 | 8,095,000 |

|

| U.S. Investigations Services, Inc. | 7.750 | | 02-21-15 | 5,970,000 | 6,089,400 |

|

| U.S. Investigations Services, Inc. | 3.054 | | 02-21-15 | 13,296,906 | 13,163,937 |

| | | | | | |

| Machinery 0.59% | | | | | |

|

| Intelligrated, Inc. | 7.500 | | 02-16-17 | 12,000,000 | 11,880,000 |

| | | | | | |

| Marine 0.04% | | | | | |

|

| Trico Shipping AS | 13.500 | | 09-21-11 | 763,841 | 763,841 |

| | | | | | |

| Professional Services 1.03% | | | | | |

|

| Fenwal, Inc. | 2.544 | | 02-28-14 | 22,049,523 | 20,726,551 |

| | | | | | |

| Information Technology 6.22% | | | | | 125,439,984 |

| | | | | | |

| Communications Equipment 0.15% | | | | | |

|

| CommScope, Inc. | 5.000 | | 01-14-18 | 3,000,000 | 3,043,749 |

| | | | | | |

| IT Services 0.61% | | | | | |

|

| Fidelity National Information Services, Inc. | 5.250 | | 07-18-16 | 8,948,163 | 9,024,517 |

|

| Global Cash Access Holdings, Inc. (T) | — | | 02-17-16 | 3,250,000 | 3,274,375 |

| | | | | | |

| Semiconductors & Semiconductor Equipment 2.01% | | | | |

|

| Freescale Semiconductor, Inc. | 4.510 | | 12-01-16 | 38,586,797 | 38,510,742 |

|

| Sensata Technologies | 2.054 | | 04-26-13 | 1,962,205 | 1,956,687 |

| | | | | | |

| Software 3.45% | | | | | |

|

| Aspect Software, Inc. | 6.250 | | 04-19-16 | 7,940,000 | 7,979,700 |

|

| Dealer Computer Services, Inc. | 5.250 | | 04-21-17 | 10,434,066 | 10,494,062 |

|

| First Data Corp. | 3.012 | | 09-24-14 | 40,302,578 | 38,159,206 |

|

| SunGard Data Systems, Inc. | 3.933 | | 02-26-16 | 12,971,470 | 12,996,946 |

| | | | | | |

| Materials 3.01% | | | | | 60,763,263 |

| | | | | | |

| Chemicals 0.30% | | | | | |

|

| Nalco Company | 4.500 | | 10-05-17 | 5,985,000 | 6,037,369 |

| | | | | | |

| Containers & Packaging 1.22% | | | | | |

|

| Berry Plastics Corp. | 2.314 | | 04-03-15 | 12,551,593 | 12,201,190 |

|

| Graham Packaging Company LP | 6.750 | | 04-05-14 | 8,489,524 | 8,542,584 |

|

| Graham Packaging Company LP | 6.000 | | 09-23-16 | 1,995,000 | 2,010,320 |

|

| Graphic Packaging International Corp. | 2.303 | | 05-16-14 | 1,917,389 | 1,912,862 |

| | |

| 14 | Floating Rate Income Fund | Semiannual report | See notes to financial statements |

| | | | | |

| | | | Maturity | | |

| | Rate (%) | | date | Par value | Value |

| Metals & Mining 1.48% | | | | | |

|

| Fairmount Minerals, Ltd. | 6.253 | | 08-05-16 | $13,312,075 | $13,456,285 |

|

| Global Brass and Copper, Inc. | 10.251 | | 07-29-15 | 7,979,048 | 8,298,210 |

|

| Novelis, Inc. | 5.250 | | 12-19-16 | 8,000,000 | 8,094,288 |

| | | | | | |

| Paper & Forest Products 0.01% | | | | | |

|

| Georgia-Pacific Corp. | 2.302 | | 12-21-12 | 210,107 | 210,155 |

| | | | | | |

| Telecommunication Services 3.82% | | | | | 77,127,775 |

| | | | | | |

| Diversified Telecommunication Services 3.38% | | | | |

|

| FairPoint Communications, Inc. | 6.500 | | 01-22-16 | 15,000,000 | 14,802,090 |

|

| Intelsat Jackson Holdings SA | 5.250 | | 04-02-18 | 31,000,000 | 31,208,289 |

|

| Level 3 Financing, Inc. | 11.500 | | 03-13-14 | 4,000,000 | 4,290,000 |

|

| Level 3 Financing, Inc. | 2.553 | | 03-13-14 | 13,000,000 | 12,675,000 |

|

| Telesat Canada | 3.270 | | 10-31-14 | 5,337,193 | 5,327,187 |

| | | | | | |

| Wireless Telecommunication Services 0.44% | | | | |

|

| MetroPCS Wireless, Inc. | 3.813 | | 11-04-16 | 6,687,364 | 6,713,833 |

|

| MetroPCS Wireless, Inc. | 2.563 | | 11-04-13 | 90,818 | 90,542 |

|

| Syniverse Technologies, Inc. | 5.250 | | 12-21-17 | 2,000,000 | 2,020,834 |

| | | | | | |

| Utilities 4.71% | | | | | 94,895,783 |

| | | | | | |

| Electric Utilities 2.95% | | | | | |

|

| EquiPower Resources Corp. | 5.750 | | 01-26-18 | 7,000,000 | 7,052,500 |

|

| Texas Competitive Electric Holdings | | | | | |

| Company LLC | 3.787 | | 10-10-14 | 18,428,090 | 15,530,273 |

|

| Texas Competitive Electric Holdings | | | | | |

| Company LLC | 3.766 | | 10-10-14 | 43,890,314 | 36,900,782 |

| | | | | | |

| Independent Power Producers & Energy Traders 1.76% | | | | |

|

| GenOn Energy, Inc. | 6.000 | | 09-08-17 | 11,221,875 | 11,352,801 |

|

| New Development Holdings, Inc. | 7.000 | | 07-03-17 | 11,376,775 | 11,483,432 |

|

| NRG Energy, Inc. | 3.553 | | 08-31-15 | 10,841,515 | 10,909,275 |

|

| NRG Energy, Inc. | 2.053 | | 02-01-13 | 1,103 | 1,098 |

|

| NRG Energy, Inc. | 2.039 | | 02-01-13 | 1,672,792 | 1,665,622 |

| |

| Corporate Bonds 9.70% | | | | | $195,749,890 |

|

| (Cost $181,588,403) | | | | | |

| | | | | | |

| Consumer Discretionary 0.96% | | | | | 19,422,082 |

| | | | | | |

| Hotels, Restaurants & Leisure 0.08% | | | | | |

|

| Caesars Entertainment Operating | | | | | |

| Company, Inc. | 11.250 | | 06-01-17 | $1,500,000 | 1,702,500 |

| | | | | | |

| Media 0.83% | | | | | |

|

| CCO Holdings LLC/CCO Holdings Capital Corp. | 8.125 | | 04-30-20 | 2,300,000 | 2,481,125 |

|

| CCO Holdings LLC/CCO Holdings Capital Corp. | 7.875 | | 04-30-18 | 2,970,000 | 3,170,475 |

|

| CCO Holdings LLC/CCO Holdings Capital Corp. | 7.000 | | 01-15-19 | 6,000,000 | 6,105,000 |

|

| Univision Communications, Inc. (S) | 7.875 | | 11-01-20 | 4,720,000 | 5,062,200 |

| | | | | | |

| Multiline Retail 0.05% | | | | | |

|

| The Neiman Marcus Group, Inc., PIK | 9.000 | | 10-15-15 | 859,935 | 900,782 |

| | | | | | |

| Consumer Staples 0.05% | | | | | 1,011,850 |

| | | | | | |

| Tobacco 0.05% | | | | | |

|

| Alliance One International, Inc. | 10.000 | | 07-15-16 | 980,000 | 1,011,850 |

| | |

| See notes to financial statements | Semiannual report | Floating Rate Income Fund | 15 |

| | | | | |

| | | | Maturity | | |

| | Rate (%) | | date | Par value | Value |

| Energy 1.03% | | | | | $20,814,018 |

| | | | | | |

| Energy Equipment & Services 0.30% | | | | | |

|

| Hercules Offshore, Inc. (S) | 10.500 | | 10-15-17 | $6,151,000 | 6,104,868 |

| | | | | | |

| Oil, Gas & Consumable Fuels 0.73% | | | | | |

|

| Murray Energy Corp. (S) | 10.250 | | 10-15-15 | 8,580,000 | 9,159,150 |

|

| SandRidge Energy, Inc. (S) | 9.875 | | 05-15-16 | 5,000,000 | 5,550,000 |

| | | | | | |

| Financials 1.53% | | | | | 30,892,256 |

| | | | | | |

| Consumer Finance 0.59% | | | | | |

|

| SLM Corp. | 8.000 | | 03-25-20 | 11,210,000 | 11,896,613 |

| | | | | | |

| Diversified Financial Services 0.59% | | | | | |

|

| Citigroup, Inc. | 6.375 | | 08-12-14 | 7,500,000 | 8,368,268 |

|

| International Lease Finance Corp. (S) | 7.125 | | 09-01-18 | 3,300,000 | 3,601,125 |

| | | | | | |

| Real Estate Management & Development 0.35% | | | | |

|

| Realogy Corp. (S) | 7.875 | | 02-15-19 | 7,000,000 | 7,026,250 |

| | | | | | |

| Industrials 1.57% | | | | | 31,723,642 |

| | | | | | |

| Airlines 0.45% | | | | | |

|

| Continental Airlines, Inc. | 9.250 | | 05-10-17 | 2,374,652 | 2,517,132 |

|

| Continental Airlines, Inc. | 6.900 | | 01-02-18 | 1,053,027 | 1,121,474 |

|

| Continental Airlines, Inc. | 6.545 | | 02-02-19 | 304,417 | 321,160 |

|

| Continental Airlines, Inc. | 6.503 | | 06-15-11 | 1,030,000 | 1,040,300 |

|

| United Air Lines, Inc. | 9.750 | | 01-15-17 | 3,534,522 | 4,073,536 |

| | | | | | |

| Electrical Equipment 0.62% | | | | | |

|

| NXP BV/NXP Funding LLC (P) | 3.053 | | 10-15-13 | 12,655,000 | 12,591,725 |

| | | | | | |

| Road & Rail 0.50% | | | | | |

|

| RailAmerica, Inc. | 9.250 | | 07-01-17 | 9,082,000 | 10,058,315 |

| | | | | | |

| Information Technology 0.29% | | | | | 5,878,800 |

| | | | | | |

| Software 0.29% | | | | | |

|

| Aspect Software, Inc. (S) | 10.625 | | 05-15-17 | 5,520,000 | 5,878,800 |

| | | | | | |

| Materials 2.22% | | | | | 44,761,987 |

| | | | | | |

| Chemicals 1.04% | | | | | |

|

| Georgia Gulf Corp. (S) | 9.000 | | 01-15-17 | 5,000,000 | 5,562,500 |

|

| Lyondell Chemical Company | 11.000 | | 05-01-18 | 7,730,049 | 8,870,231 |

|

| Lyondell Chemical Company (S) | 8.000 | | 11-01-17 | 5,850,000 | 6,584,906 |

| | | | | | |

| Containers & Packaging 0.16% | | | | | |

|

| Ardagh Packaging Finance PLC (S) | 7.375 | | 10-15-17 | 3,000,000 | 3,195,000 |

| | | | | | |

| Metals & Mining 0.36% | | | | | |

|

| Midwest Vanadium Pty, Ltd. (S) | 11.500 | | 02-15-18 | 7,000,000 | 7,210,000 |

| | | | | | |

| Paper & Forest Products 0.66% | | | | | |

|

| Appleton Papers, Inc. (S) | 10.500 | | 06-15-15 | 5,660,000 | 5,858,100 |

|

| NewPage Corp. | 11.375 | | 12-31-14 | 7,500,000 | 7,481,250 |

| | | | | | |

| Telecommunication Services 0.77% | | | | | 15,430,625 |

| | | | | | |

| Diversified Telecommunication Services 0.42% | | | | |

|

| Wind Acquisition Finance SA (S) | 7.250 | | 02-15-18 | 8,250,000 | 8,518,125 |

| | | | | | |

| Wireless Telecommunication Services 0.35% | | | | |

|

| iPCS, Inc. (P) | 2.429 | | 05-01-13 | 7,000,000 | 6,912,500 |

| | |

| 16 | Floating Rate Income Fund | Semiannual report | See notes to financial statements |

| | | | | |

| | | | Maturity | | |

| | Rate (%) | | date | Par value | Value |

| Utilities 1.28% | | | | | $25,814,630 |

| | | | | | |

| Independent Power Producers & Energy Traders 1.28% | | | | |

|

| Calpine Construction Finance Company LP (S) | 8.000 | | 06-01-16 | $7,000,000 | 7,595,000 |

|

| Calpine Corp. (S) | 7.875 | | 07-31-20 | 3,000,000 | 3,172,500 |

|

| Calpine Corp. (S) | 7.500 | | 02-15-21 | 6,000,000 | 6,135,000 |

|

| Calpine Corp. (S) | 7.250 | | 10-15-17 | 8,508,000 | 8,912,130 |

| |

| | | | | Shares | Value |

| | |

| Common Stocks 1.92% | | $38,700,157 |

|

| (Cost $17,773,402) | | |

| | | |

| Consumer Discretionary 0.72% | | 14,576,450 |

| | |

| Hotels, Restaurants & Leisure 0.06% | | |

|

| Tropicana Entertainment, Inc. (I) | 72,338 | 1,220,704 |

| | | |

| Media 0.66% | | |

|

| Citadel Broadcasting Corp., Class A (I) | 53,412 | 1,856,067 |

|

| Citadel Broadcasting Corp., Class B (I) | 330,926 | 11,499,679 |

| | | |

| Energy 0.14% | | 2,884,018 |

| | | |

| Oil, Gas & Consumable Fuels 0.14% | | |

|

| Express Energy Services LLC (I) | 117,715 | 2,884,018 |

| | | |

| Industrials 0.01% | | 111,250 |

| | |

| Building Products 0.01% | | |

|

| Nortek, Inc. (I) | 2,500 | 111,250 |

| | |

| Materials 1.05% | | 21,128,439 |

| | | |

| Chemicals 1.05% | | |

|

| Georgia Gulf Corp. (I) | 74,111 | 2,365,623 |

|

| LyondellBasell Industries, Class A (I) | 492,721 | 18,762,816 |

| |

| Preferred Securities 0.39% | | $7,936,775 |

|

| (Cost $7,460,535) | | |

| | |

| Financials 0.39% | | 7,936,775 |

| | | |

| Diversified Financial Services 0.39% | | |

|

| Citigroup Capital XII (8.500% to 03-30-15, then 3 month LIBOR + 5.870%) | 298,375 | 7,936,775 |

| | | |

| | Par value | Value |

|

| Short-Term Investments 15.54% | | $313,469,994 |

|

| (Cost $313,469,994) | | |

| | | |

| Repurchase Agreement 15.54% | | $313,469,994 |

| Bank of America Tri-Party Repurchase Agreement dated 2-28-11 at | | |

| 0.150% to be repurchased at $136,229,568 on 3-1-11, collateralized | | |

| by $132,242,000 U.S. Treasury Notes, 3.375% due 11-15-19 (valued at | | |

| $51,777,344, including interest) and U.S. Treasury Notes, 4.875% due | | |

| 6-30-12 (valued at $87,176,653, including interest) | $136,229,000 | 136,229,000 |

|

| Deutsche Bank Tri-Party Repurchase Agreement dated 2-28-11 at | | |

| 0.160% to be repurchased at $84,708,376 on 3-1-11, | | |

collateralized by $89,330,000 Federal Home Loan Mortgage Corp., | | |

| 3.500% due 8-17-20 (valued at $86,402,156, including interest) | 84,708,000 | 84,708,000 |

| | |

| See notes to financial statements | Semiannual report | Floating Rate Income Fund | 17 |

| | |

| | Par value | Value |

| Repurchase Agreement (continued) | | |

| Goldman Sachs Tri-Party Repurchase Agreement dated 2-28-11 at | | |

| 0.180% to be repurchased at $91,963,460 on 3-1-11, collateralized by | | |

| $93,945,000 Federal Home Loan Mortgage Corp., 0.850% due 2-8-13 | | |

| (valued at $93,827,569, including interest) | $91,963,000 | $91,963,000 |

|

| Repurchase Agreement with State Street Corp. dated 2-28-11 at 0.010% | | |

| to be repurchased at $569,994 on 3-1-11, collateralized by $575,000 | | |

| U.S. Treasury Notes, 1.375% due 5-15-13 (valued at $582,504, | | |

| including interest) | 569,994 | 569,994 |

| |

| Total investments (Cost $2,111,561,600)† 108.65% | $2,191,770,636 |

|

| |

| Other assets and liabilities, net (8.65%) | | ($174,543,014) |

|

| |

| Total net assets 100.00% | $2,017,227,622 |

|

The percentage shown for each investment category is the total value of that category as a percentage of the net assets of the Fund.

LIBOR London Interbank Offered Rate

PIK Paid in Kind

(H) Non-income producing — Issuer is in default.

(I) Non-income producing security.

(M) Term loans are variable rate obligations. The coupon rate shown represents the rate at period end unless the investment is unsettled.

(P) Variable rate obligation. The coupon rate shown represents the rate at period end.

(S) These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration.

(T) All or a portion of this position represents unsettled loan commitment. The coupon rate will be determined at time of settlement.

† At 2-28-11, the aggregate cost of investment securities for federal income tax purposes was $2,114,966,497. Net unrealized appreciation aggregated $76,804,139, of which $81,605,429 related to appreciated investment securities and $4,801,290 related to depreciated investment securities.

| | |

| 18 | Floating Rate Income Fund | Semiannual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 2-28-11 (unaudited)

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum offering price per share.

| |

| Assets | |

|

| Investments, at value (Cost $1,798,091,606) | $1,878,300,642 |

| Repurchase agreements, at value (Cost $313,469,994) (Note 2) | 313,469,994 |

| | |

| Total investments, at value (Cost $2,111,561,600) | 2,191,770,636 |

| Cash | 36,384,480 |

| Receivable for investments sold | 101,155,823 |

| Receivable for fund shares sold | 16,774,724 |

| Interest receivable | 9,892,811 |

| Receivable for securities lending income | 149 |

| Receivable due from adviser | 412 |

| Other receivables and prepaid expenses | 93,997 |

| | |

| Total assets | 2,356,073,032 |

| |

| Liabilities | |

|

| Payable for investments purchased | 336,552,873 |

| Payable for fund shares repurchased | 1,379,705 |

| Distributions payable | 496,763 |

| Payable to affiliates | |

| Accounting and legal services fees | 41,905 |

| Transfer agent fees | 188,346 |

| Trustees’ fees | 1,919 |

| Other liabilities and accrued expenses | 183,899 |

| | |

| Total liabilities | 338,845,410 |

| |

| Net assets | |

|

| Capital paid-in | $1,924,420,958 |

| Undistributed net investment income | (3,191,217) |

| Accumulated net realized gain (loss) on investments and investments | 15,788,845 |

| Net unrealized appreciation (depreciation) on investments | 80,209,036 |

| | |

| Net assets | $2,017,227,622 |

| | |

| See notes to financial statements | Semiannual report | Floating Rate Income Fund | 19 |

F I N A N C I A L S T A T E M E N T S

Statement of assets and liabilities (continued)

| |

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($481,568,254 ÷ 49,940,727 shares) | $9.64 |

| Class B ($15,677,587 ÷ 1,625,887 shares)1 | $9.64 |

| Class C ($164,514,587 ÷ 16,995,790 shares)1 | $9.68 |

| Class I ($188,430,504 ÷ 19,552,875 shares) | $9.64 |

| Class 1 ($121,330 ÷ 12,603 shares) | $9.63 |

| Class NAV ($1,166,915,360 ÷ 121,064,557 shares) | $9.64 |

| |

| Maximum offering price per share | |

|

| Class A (net asset value per share ÷ 97%)2 | $9.94 |

1 Redemption price is equal to net asset value less any applicable contingent deferred sales charge.

2 On single retail sales of less than $100,000. On sales of $100,000 or more and on group sales the offering price is reduced.

| | |

| 20 | Floating Rate Income Fund | Semiannual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T S

Statement of operations For the six-month period ended 2-28-11 (unaudited)

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Interest | $53,042,454 |

| Dividends | 317,023 |

| Securities lending | 1,392 |

| | |

| Total investment income | 53,360,869 |

| |

| Expenses | |

|

| Investment management fees (Note 4) | 5,830,012 |

| Distribution and service fees (Note 4) | 1,128,091 |

| Accounting and legal services fees (Note 4) | 121,821 |

| Transfer agent fees (Note 4) | 440,978 |

| Trustees’ fees (Note 4) | 7,880 |

| State registration fees (Note 4) | 53,258 |

| Printing and postage (Note 4) | 16,346 |

| Professional fees | 36,015 |

| Custodian fees | 104,048 |

| Registration and filing fees | 17,665 |

| Other | 9,314 |

| | |

| Total expenses | 7,765,428 |

| Less expense reductions (Note 4) | (62,049) |

| | |

| Net expenses | 7,703,379 |

| |

| Net investment income | 45,657,490 |

|

| Realized and unrealized gain (loss) | |

|

| Net realized gain (loss) on | |

| Investments in unaffiliated issuers | 36,782,693 |

| Investments in affiliated issuers | (886) |

| | 36,781,807 |

| Change in net unrealized appreciation (depreciation) of | |

| Investments in unaffiliated issuers | 51,967,708 |

| Investments in affiliated issuers | (65) |

| | 51,967,643 |

| | |

| Net realized and unrealized gain | 88,749,450 |

| | |

| Increase in net assets from operations | $134,406,940 |

| | |

| See notes to financial statements | Semiannual report | Floating Rate Income Fund | 21 |

F I N A N C I A L S T A T E M E N T S

Statements of changes in net assets

These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | |

| | Six months | |

| | ended | Year |

| | 2-28-11 | ended |

| | (unaudited) | 8-31-10 |

|

| |

| Increase (decrease) in net assets | | |

| |

| From operations | | |

| Net investment income | $45,657,490 | $85,484,540 |

| Net realized gain | 36,781,807 | 45,380,345 |

| Change in net unrealized appreciation (depreciation) | 51,967,643 | (9,389,879) |

| | | |

| Increase in net assets resulting from operations | 134,406,940 | 121,475,006 |

| | |

| Distributions to shareholders | | |

| From net investment income | | |

| Class A | (9,508,274) | (10,427,556) |

| Class B | (274,651) | (274,644) |

| Class C | (2,870,117) | (2,665,145) |

| Class I | (3,332,837) | (4,335,325) |

| Class 1 | (3,579) | (6,792) |

| Class NAV | (34,860,569) | (69,768,491) |

| From net realized gain | | |

| Class A | (9,189,596) | — |

| Class B | (301,900) | — |

| Class C | (3,109,546) | — |

| Class I | (2,717,408) | — |

| Class 1 | (3,165) | — |

| Class NAV | (30,510,487) | — |

| Total distributions | (96,682,129) | (87,477,953) |

| | | |

| From Fund share transactions (Note 6) | 403,677,792 | 403,913,148 |

| | | |

| Total increase | 441,402,603 | 437,910,201 |

| |

| Net assets | | |

|

| Beginning of period | 1,575,825,019 | 1,137,914,818 |

| | | |

| End of period | $2,017,227,622 | $1,575,825,019 |

| | | |

| Undistributed net investment income | ($3,191,217) | $2,001,320 |

| | |

| 22 | Floating Rate Income Fund | Semiannual report | See notes to financial statements |

Financial highlights

The Financial Highlights show how the Fund’s net asset value for a share has changed since the beginning of the period.

| | | | |

| CLASS A SHARES Period ended | 2-28-111 | 8-31-10 | 8-31-09 | 8-31-082 |

| | | | | |

| Per share operating performance | | | | |

|

| Net asset value, beginning of period | $9.43 | $9.13 | $9.79 | $10.00 |

| Net investment income3 | 0.25 | 0.52 | 0.56 | 0.37 |

| Net realized and unrealized gain (loss) on investments | 0.50 | 0.33 | (0.66) | (0.25) |

| Total from investment operations | 0.75 | 0.85 | (0.10) | 0.12 |

| Less distributions | | | | |

| From net investment income | (0.28) | (0.55) | (0.56) | (0.33) |

| From net realized gain | (0.26) | — | —4 | — |

| Total distributions | (0.54) | (0.55) | (0.56) | (0.33) |

| Net asset value, end of period | $9.64 | $9.43 | $9.13 | $9.79 |

| Total return (%)5,6 | 8.087 | 9.47 | (0.07) | 1.237 |

| |

| Ratios and supplemental data | | | | |

|

| Net assets, end of period (in millions) | $482 | $267 | $110 | $11 |

| Ratios (as a percentage of average net assets): | | | | |

| Expenses before reductions and amounts recaptured | 1.238 | 1.20 | 1.23 | 1.528 |

| Expenses including reductions and amounts recaptured | 1.208 | 1.209 | 1.20 | 1.188 |

| Net investment income | 5.218 | 5.58 | 6.16 | 5.708 |

| Portfolio turnover (%) | 44 | 57 | 36 | 11 |

| |

|

| 1 Semiannual period from 9-1-10 to 2-28-11. Unaudited. |

| 2 The inception date for Class A shares is 1-2-08. |

| 3 Based on the average daily shares outstanding. |

| 4 Less than ($0.005) per share. |

| 5 Total returns would have been lower had certain expenses not been reduced during the periods shown. |

| 6 Does not reflect the effect of sales charges, if any. |

| 7 Not annualized. |

| 8 Annualized. |

| 9 Includes the impact of expense recapture which amounted to 0.01% of average net assets. See Note 4. |

| | |

| See notes to financial statements | Semiannual report | Floating Rate Income Fund | 23 |

| | | | |

| CLASS B SHARES Period ended | 2-28-111 | 8-31-10 | 8-31-09 | 8-31-082 |

| | | | | |

| Per share operating performance | | | | |

|

| Net asset value, beginning of period | $9.42 | $9.13 | $9.79 | $10.00 |

| Net investment income3 | 0.21 | 0.45 | 0.49 | 0.31 |

| Net realized and unrealized gain (loss) on investments | 0.51 | 0.32 | (0.65) | (0.24) |

| Total from investment operations | 0.72 | 0.77 | (0.16) | 0.07 |

| Less distributions | | | | |

| From net investment income | (0.24) | (0.48) | (0.50) | (0.28) |

| From net realized gain | (0.26) | — | —4 | — |

| Total distributions | (0.50) | (0.48) | (0.50) | (0.28) |

| Net asset value, end of period | $9.64 | $9.42 | $9.13 | $9.79 |

| Total return (%)5,6 | 7.797 | 8.52 | (0.80) | 0.767 |

| |

| Ratios and supplemental data | | | | |

|

| Net assets, end of period (in millions) | $16 | $9 | $3 | $1 |

| Ratios (as a percentage of average net assets): | | | | |

| Expense before reductions and amounts recaptured | 2.078 | 2.08 | 3.86 | 4.768 |

| Expenses including reductions and amounts recaptured | 1.958 | 1.959 | 1.95 | 1.938 |

| Net investment income | 4.438 | 4.77 | 5.53 | 4.788 |

| Portfolio turnover (%) | 44 | 57 | 36 | 11 |

| |

1 Semiannual period from 9-1-10 to 2-28-11. Unaudited.

2 The inception date for Class B shares is 1-2-08.

3 Based on the average daily shares outstanding.

4 Less than ($0.005) per share.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Does not reflect the effect of sales charges, if any.

7 Not annualized.

8 Annualized.

9 Includes the impact of expense recapture which amounted to less than 0.005% of average net assets. See Note 4.

| | | | |

| CLASS C SHARES Period ended | 2-28-111 | 8-31-10 | 8-31-09 | 8-31-082 |

| | | | | |

| Per share operating performance | | | | |

|

| Net asset value, beginning of period | $9.46 | $9.16 | $9.80 | $10.00 |

| Net investment income3 | 0.21 | 0.45 | 0.47 | 0.32 |

| Net realized and unrealized gain (loss) on investments | 0.51 | 0.33 | (0.62) | (0.24) |

| Total from investment operations | 0.72 | 0.78 | (0.15) | 0.08 |

| Less distributions | | | | |

| From net investment income | (0.24) | (0.48) | (0.49) | (0.28) |

| From net realized gain | (0.26) | — | —4 | — |

| Total distributions | (0.50) | (0.48) | (0.49) | (0.28) |

| Net asset value, end of period | $9.68 | $9.46 | $9.16 | $9.80 |

| Total return (%)5,6 | 7.787 | 8.65 | (0.69) | 0.817 |

| |

| Ratios and supplemental data | | | | |

|

| Net assets, end of period (in millions) | $165 | $95 | $23 | $2 |

| Ratios (as a percentage of average net assets): | | | | |

| Expenses before reductions | 1.938 | 1.91 | 2.09 | 2.328 |

| Expenses net of fee waivers and credits | 1.938 | 1.939 | 1.95 | 1.958 |

| Net investment income | 4.468 | 4.77 | 5.39 | 4.968 |

| Portfolio turnover (%) | 44 | 57 | 36 | 11 |

| |

1 Semiannual period from 9-1-10 to 2-28-11. Unaudited.

2 The inception date for Class C shares is 1-2-08.

3 Based on the average daily shares outstanding.

4 Less than ($0.005) per share.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Does not reflect the effect of sales charges, if any.

7 Not annualized.

8 Annualized.

9 Includes the impact of expense recapture which amounted to 0.02% of average net assets. See Note 4.

| | |

| 24 | Floating Rate Income Fund | Semiannual report | See notes to financial statements |

| | | | |

| CLASS I SHARES Period ended | 2-28-111 | 8-31-10 | 8-31-09 | 8-31-082 |

| | | | | |

| Per share operating performance | | | | |

|

| Net asset value, beginning of period | $9.42 | $9.12 | $9.79 | $10.00 |

| Net investment income3 | 0.27 | 0.56 | 0.60 | 0.37 |

| Net realized and unrealized gain (loss) on investments | 0.51 | 0.32 | (0.68) | (0.22) |

| Total from investment operations | 0.78 | 0.88 | (0.08) | 0.15 |

| Less distributions | | | | |

| From net investment income | (0.30) | (0.58) | (0.59) | (0.36) |

| From net realized gain | (0.26) | — | —4 | — |

| Total distributions | (0.56) | (0.58) | (0.59) | (0.36) |

| Net asset value, end of period | $9.64 | $9.42 | $9.12 | $9.79 |

| Total return (%)5,6 | 8.417 | 9.88 | 0.25 | 1.527 |

| |

| Ratios and supplemental data | | | | |

|

| Net assets, end of period (in millions) | $188 | $86 | $40 | $1 |

| Ratios (as a percentage of average net assets): | | | | |

| Expenses before reductions | 0.798 | 0.81 | 0.95 | 4.488 |

| Expenses net of fee waivers and credits | 0.798 | 0.829 | 0.85 | 0.828 |

| Net investment income | 5.738 | 5.94 | 6.36 | 5.788 |

| Portfolio turnover (%) | 44 | 57 | 36 | 11 |

| |

1 Semiannual period from 9-1-10 to 2-28-11. Unaudited.

2 The inception date for Class I shares is 1-2-08.

3 Based on the average daily shares outstanding.

4 Less than ($0.005) per share.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Assumes dividend reinvestment (if applicable).

7 Not annualized.

8 Annualized.

9 Includes the impact of expense recapture which amounted to 0.01% of average net assets. See Note 4.

| | | | |

| CLASS 1 SHARES Period ended | 2-28-111 | 8-31-10 | 8-31-09 | 8-31-082 |

| | | | | |

| Per share operating performance | | | | |

|

| Net asset value, beginning of period | $9.41 | $9.12 | $9.78 | $10.00 |

| Net investment income3 | 0.26 | 0.57 | 0.59 | 0.38 |

| Net realized and unrealized gain (loss) on investments | 0.52 | 0.31 | (0.65) | (0.23) |

| Total from investment operations | 0.78 | 0.88 | (0.06) | (0.15) |

| Less distributions | | | | |

| From net investment income | (0.30) | (0.59) | (0.60) | (0.37) |

| From net realized gain | (0.26) | — | —4 | — |

| Total distributions | (0.56) | (0.59) | (0.60) | (0.37) |

| Net asset value, end of period | $9.63 | $9.41 | $9.12 | $9.78 |

| Total return (%)5 | 8.436,7 | 9.827 | 0.40 | 1.486 |

| |

| Ratios and supplemental data | | | | |

|

| Net assets, end of period (in thousands) | $121 | $112 | $102 | $102 |

| Ratios (as a percentage of average net assets): | | | | |

Expenses before reductions | 0.778 | 0.78 | 0.80 | 0.788 |

| Expenses net of all fee waivers and credits | 0.778 | 0.78 | 0.80 | 0.788 |

| Net investment income | 5.508 | 6.11 | 7.13 | 5.838 |

| Portfolio turnover (%) | 44 | 57 | 36 | 11 |

| |

1 Semiannual period from 9-1-10 to 2-28-11. Unaudited.2 The inception date for Class I shares is 1-2-08.3 Based on the average daily shares outstanding.4 Less than ($0.005) per share.5 Assumes dividend reinvestment (if applicable).6 Not annualized.7 Total returns would have been lower had certain expenses not been reduced during the periods shown.8 Annualized. | | |

| See notes to financial statements | Semiannual report | Floating Rate Income Fund | 25 |

| | | | |

| CLASS NAV SHARES Period ended | 2-28-111 | 8-31-10 | 8-31-09 | 8-31-082 |

| | | | | |

| Per share operating performance | | | | |

|

| Net asset value, beginning of period | $9.42 | $9.12 | $9.79 | $10.00 |

| Net investment income3 | 0.26 | 0.58 | 0.60 | 0.40 |

| Net realized and unrealized gain (loss) on investments | 0.52 | 0.31 | (0.67) | (0.24) |

| Total from investment operations | 0.78 | 0.89 | (0.07) | 0.16 |

| Less distributions | | | | |

| From net investment income | (0.30) | (0.59) | (0.60) | (0.37) |

| From net realized gain | (0.26) | — | —4 | — |

| Total distributions | (0.56) | (0.59) | (0.60) | (0.37) |

| Net asset value, end of period | $9.64 | $9.42 | $9.12 | $9.79 |

| Total return (%) | 8.455,6 | 9.996 | 0.31 | 1.595 |

| |

| Ratios and supplemental data | | | | |

|

| Net assets, end of period (in millions) | $1,167 | $1,119 | $962 | $510 |

| Ratios (as a percentage of average net assets): | | | | |

| Expenses before reductions | 0.727 | 0.73 | 0.75 | 0.757 |

| Expenses net of fee waivers and credits | 0.727 | 0.73 | 0.75 | 0.757 |

| Net investment income | 5.547 | 6.16 | 7.08 | 6.167 |

| Portfolio turnover (%) | 44 | 57 | 36 | 11 |

| |

1 Semiannual period from 9-1-10 to 2-28-11. Unaudited.2 The inception date for Class NAV shares is 1-2-08.3 Based on the average daily shares outstanding.4 Less than $0.005 per share.5 Not annualized.6 Total returns would have been lower had certain expenses not been reduced during the periods shown.7 Annualized. | | |

| 26 | Floating Rate Income Fund | Semiannual report | See notes to financial statements |

Notes to financial statements

(unaudited)

Note 1 — Organization

John Hancock Floating Rate Income Fund (the Fund) is a non-diversified series of John Hancock Funds II (the Trust), an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the Fund is to seek a high level of current income.

The Fund may offer multiple classes of shares. The shares currently offered are detailed in the Statement of Assets and Liabilities. Class A, Class B and Class C shares are offered to all investors. Class I shares are offered to institutions and certain investors. Class 1 shares are offered only to certain affiliates of Manulife Financial Corporation (MFC). Class NAV shares are offered to the John Hancock Lifestyle and Lifecycle Funds, and other affiliated John Hancock funds. Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees, transfer agent fees, printing and postage and state registration fees for each class may differ. Class B shares convert to Class A shares eight years after purchase.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 p.m., Eastern Time. The Fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities. Level 2 includes securities valued using significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the Fund’s own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

| | |

| | Semiannual report | Floating Rate Income Fund | 27 |

The following is a summary of the values by input classification of the Fund’s investments as of February 28, 2011, by major security category or type:

| | | | |

| | | | | LEVEL 3 |

| | | | LEVEL 2 | SIGNIFICANT |

| | TOTAL MARKET | LEVEL 1 | SIGNIFICANT | UNOBSERVABLE |

| | VALUE AT 2-28-11 | QUOTED PRICE | OBSERVABLE INPUTS | INPUTS |

|

| Term Loans | | | | |

| Consumer Discretionary | $636,312,477 | — | $636,312,477 | — |

| Consumer Staples | 104,655,494 | — | 104,655,494 | — |

| Energy | 12,101,470 | — | 12,101,470 | — |

| Financials | 78,959,415 | — | 78,959,415 | — |

| Health Care | 286,498,420 | — | 286,498,420 | — |

| Industrials | 159,159,739 | — | 159,159,739 | — |

| Information Technology | 125,439,984 | — | 125,439,984 | — |

| Materials | 60,763,263 | — | 60,763,263 | — |

| Telecommunication | | | | |

| Services | 77,127,775 | — | 77,127,775 | — |

| Utilities | 94,895,783 | — | 94,895,783 | — |

| Corporate Bonds | | | | |

| Consumer Discretionary | 19,422,082 | — | 19,422,082 | — |

| Consumer Staples | 1,011,850 | — | 1,011,850 | — |

| Energy | 20,814,018 | — | 20,814,018 | — |

| Financials | 30,892,256 | — | 30,892,256 | — |

| Industrials | 31,723,642 | — | 31,723,642 | — |

| Information Technology | 5,878,800 | — | 5,878,800 | — |

| Materials | 44,761,987 | — | 44,761,987 | — |

| Telecommunication | | | | |

| Services | 15,430,625 | — | 15,430,625 | — |

| Utilities | 25,814,630 | — | 25,814,630 | — |

| Common Stocks | | | | |

| Consumer Discretionary | 14,576,450 | — | 14,576,450 | — |

| Energy | 2,884,018 | — | 2,884,018 | — |

| Industrials | 111,250 | $111,250 | — | — |

| Materials | 21,128,439 | 21,128,439 | — | — |

| Preferred Securities | | | | |

| Financials | 7,936,775 | 7,936,775 | — | — |

| Short-Term Investments | | | | |

| Repurchase Agreement | 313,469,994 | — | 313,469,994 | — |

|

| Total Investments in | | | | |

| Securities | $2,191,770,636 | $29,176,464 | $2,162,594,172 | — |

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. During the six months ended February 28, 2011, there were no significant transfers in or out of Level 1 or Level 2 assets.

In order to value the securities, the Fund uses the following valuation techniques. Equity securities held by the Fund are valued at the last sale price or official closing price on the principal securities exchange on which they trade. In the event there were no sales during the day or closing prices are not available, then securities are valued using the last quoted bid or evaluated price. Debt obligations are valued based on the evaluated prices provided by an independent pricing service, which utilizes both dealer-supplied and electronic data processing techniques, taking into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data. Investments in open-end mutual funds, including John Hancock Collateral Investment Trust (JHCIT), are valued at their

| |

| 28 | Floating Rate Income Fund | Semiannual report |

closing net asset values each day. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rates supplied by an independent pricing service. Certain securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Certain short-term securities are valued at amortized cost.

Other portfolio securities and assets, where market quotations are not readily available, are valued at fair value, as determined in good faith by the Fund’s Pricing Committee, following procedures established by the Board of Trustees.

Repurchase agreements. The Fund may enter into repurchase agreements. When a Fund enters into a repurchase agreement, it receives collateral which is held in a segregated account by the Fund’s custodian. The collateral amount is marked-to-market and monitored on a daily basis to ensure that the collateral held is in an amount not less than the principal amount of the repurchase agreement plus any accrued interest. In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the collateral value may decline. Collateral for certain tri-party repurchase agreements is held at a third-party custodian bank in a segregated account for the benefit of the Fund.

Term loans (Floating rate loans). The Fund may invest in term loans, which often include debt securities that are rated below investment grade at the time of purchase. Term loans are generally subject to legal or contractual restrictions on resale. The liquidity of term loans, including the volume and frequency of secondary market trading in such loans, varies significantly over time and among individual loans. During periods of infrequent trading, valuing a term loan can be more difficult and buying and selling a term loan at an acceptable price can be more difficult and delayed, which could result in a loss.

A Fund’s ability to receive payments of principal, interest and other amounts in connection with term loans will depend primarily on the financial condition of the borrower. A Fund’s failure to receive scheduled payments on a term loan due to a default, bankruptcy or other reason, would adversely affect the Fund’s income and would likely reduce the value of its assets. Because many term loans are not rated by independent credit rating agencies, a decision to invest in a particular loan could depend exclusively on the subadviser’s credit analysis of the borrower and/or term loan agents. A Fund may have limited rights to enforce the terms of an underlying loan.

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation. Dividend income is recorded on the ex-date, except for dividends of foreign securities where the dividend may not be known until after the ex-date. In those cases, dividend income is recorded when the Fund becomes aware of the dividends. Interest income includes coupon interest and amortization/accretion of premiums/discounts on debt securities. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by stopping current accruals and writing off interest receivable when the collection of all or a portion of interest has become doubtful.

Securities lending. The Fund may lend its securities to earn additional income. It receives and maintains cash collateral received from the borrower in an amount not less than the market value of the loaned securities. The Fund will invest its collateral in John Hancock Collateral Investment Trust (JHCIT), an affiliate of the Fund, which has a floating net asset value (NAV) and invests in short term investments as part of the securities lending program. Although risk of the loss of the securities lent is mitigated by holding the collateral, the Fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the

| | |

| | Semiannual report | Floating Rate Income Fund | 29 |

securities or if collateral investments decline in value. The Fund may receive compensation for lending its securities by retaining a portion of the return on the investment of the collateral and compensation from fees earned from borrowers of the securities. Income received from JHCIT is a component of securities lending income as recorded on the Statement of Operations.

Line of credit. The Fund may borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the custodian agreement, the custodian may loan money to a Fund to make properly authorized payments. The Fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian has a lien, security interest or security entitlement in any Fund property that is not segregated, to the maximum extent permitted by law for any overdraft.

In addition, the Fund and other affiliated funds have entered into an agreement with State Street Bank and Trust Company (SSBT) which enables them to participate in a $200 million unsecured committed line of credit. Prior to March 31, 2010, the amount of the line of credit was $300 million. A commitment fee, payable at the end of each calendar quarter, based on the average daily unused portion of the line of credit, is charged to each participating fund on a pro rata basis and is reflected in other expenses on the Statement of Operations. For the six months ended February 28, 2011, the Fund had no borrowings under the line of credit.

Effective March 30, 2011, the line of credit with SSBT expired, and a similar arrangement was established with Citibank N.A.

Expenses. The majority of expenses are directly attributable to an individual fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund’s relative assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations. Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the net asset value of the class. Class-specific expenses, such as distribution and service fees, if any, transfer agent fees, state registration fees and printing and postage, for all classes, are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rates applicable to each class.

Federal income taxes. The Fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

As of August 31, 2010, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure. The Fund’s federal tax return is subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The Fund generally declares dividends daily and pays them monthly. Capital gain distributions, if any, are paid annually.

Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class.

Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America.

| |

| 30 | Floating Rate Income Fund | Semiannual report |

Capital accounts within financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. Permanent book-tax differences are primarily attributable to defaulted bonds.

Note 3 — Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss from such claims is considered remote.

Note 4 — Fees and transactions with affiliates

John Hancock Investment Management Services, LLC (the Adviser), serves as investment adviser for the Funds. John Hancock Funds, LLC (the Distributor), an affiliate of the Adviser, serves as principal underwriter of the Funds. The Adviser and the Distributor are indirect wholly owned subsidiaries of Manulife Financial Corporation (MFC).

Management fee. The Fund has an investment management contract with the Adviser under which the Fund pays a daily management fee to the Adviser equivalent, on an annual basis, to the sum of: (a) 0.70% of the first $1,100,000,000 of the Fund’s aggregate daily net assets, (b) 0.675% of the next $900,000,000 and (c) 0.65% of the Fund’s aggregate net assets in excess of $2,000,000,000. Aggregate net assets include the net assets of the Fund and Floating Rate Income Trust, a series of John Hancock Trust. The Adviser has a subadvisory agreement with Western Asset Management Company. The Fund is not responsible for payment of the subadvisory fees.

The investment management fees incurred for the six months ended February 28, 2011 were equivalent to an annual effective rate of 0.69% of the Fund’s average daily net assets.

Expense reimbursements. The Adviser has voluntarily agreed to waive a portion of its management fee if certain expenses of the Fund exceed 0.15% of average net assets. Expenses excluded from this waiver are taxes, portfolio brokerage commissions, interest, litigation and indemnification expenses, and extraordinary expenses not incurred in the ordinary course of the Fund’s business, advisory fees, Rule 12b-1 fees, service fees, transfer agency fees, blue sky fees, printing and postage and fees under any agreements or plans of the Fund dealing with services for shareholders and others with beneficial interests in shares of the Fund. This expense reduction will continue in effect until terminated by the Adviser.

The Adviser has contractually agreed to limit the Fund’s total expenses, excluding interest and other extraordinary expenses not incurred in the ordinary course of the Fund’s business, to 1.20% for Class A, 1.95% for Class B, 1.95% for Class C and 0.85% for Class I shares of the Fund’s average daily net asset value, on an annual basis. Accordingly, these expense reductions amounted to $40,969 and $6,219 for Class A and Class B shares, respectively, for the period ended February 28, 2011. The expense reimbursements and limits will continue in effect until December 31, 2011, and thereafter until terminated by the Adviser on notice to the Trust.

The Adviser has voluntarily agreed to waive a portion of its management fee for certain Funds of the Trust and JHT (the Participating Funds), including Floating Rate Income Fund. The waiver equals, on an annualized basis, 0.01% of that portion of the aggregate net assets of all the Participating Funds that exceeds $85 billion. The amount of the reimbursement is calculated daily and allocated among all the Participating Funds in proportion to the daily net assets of each Fund. Accordingly, the expense reduction related to this agreement was $17,750.

| | |

| | Semiannual report | Floating Rate Income Fund | 31 |

Expense recapture. The Adviser may recapture operating expenses reimbursed or fees waived under previous expense limitation or waiver arrangements made subsequent to January 1, 2009, for a period of three years following the beginning of the month in which such reimbursements or waivers originally occurred. The table below outlines the amounts recovered during the six months ended February 28, 2011, and the amount of waived or reimbursed expenses subject to potential recovery and the respective expiration dates. Certain reimbursements or waivers are not subject to recapture.

| | | |

| AMOUNTS ELIGIBLE | AMOUNTS ELIGIBLE | AMOUNTS ELIGIBLE | AMOUNT RECOVERED |

| FOR RECOVERY | FOR RECOVERY | FOR RECOVERY | DURING THE PERIOD |

| THROUGH 8-1-12 | THROUGH 8-1-13 | THROUGH 2-1-14 | ENDED 2-28-11 |

|