| UNITED STATES | |

| SECURITIES AND EXCHANGE COMMISSION | |

| Washington, D.C. 20549 | |

| FORM N-CSR | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT | |

| COMPANIES | |

| Investment Company Act file number 811-21779 | |

| JOHN HANCOCK FUNDS II | |

| --------------------------------------------------------- | |

| (Exact name of registrant as specified in charter) | |

| 601 CONGRESS STREET, BOSTON, MA 02210-2805 | |

| ------------------------------------------------------------- | |

| (Address of principal executive offices) (Zip code) | |

| MICHAEL J. LEARY, 601 CONGRESS STREET, BOSTON, MA 02210-2805 | |

| ------------------------------------------------------------------------------------------ | |

| (Name and address of agent for service) | |

| Registrant's telephone number, including area code: | (617) 663-4490 |

| ------------------- | |

| Date of fiscal year end: 7/31 | |

| Date of reporting period: 1/31/12 | |

ITEM 1. REPORTS TO STOCKHOLDERS.

The Registrant prepared ten semiannual reports to shareholders for the period ended January 31, 2012. The first report applies to the Technical Opportunities Fund, the second report applies to the Global High Yield Fund, the third report applies to the Multi Sector Bond Fund, the fourth report applies to the Currency Strategies Fund, the fifth report applies to the Fundamental All Cap Core Fund, the sixth report applies to the Fundamental Large Cap Core Fund, the seventh report applies to the Fundamental Large Cap Value Fund, the eighth report applies to the Diversified Strategies Fund, the ninth report applies to the China Emerging Leaders Fund and the tenth report applies to the Global Absolute Return Strategies Fund.

A look at performance

Total returns for the period ended January 31, 2012

| Average annual total returns (%) | Cumulative total returns (%) | |||||||||

| with maximum sales charge | with maximum sales charge | |||||||||

| Since | Since | |||||||||

| 1-year | 5-year | 10-year | inception1 | 6-months | 1-year | 5-year | 10-year | inception1 | ||

| Class A | –18.93 | — | — | –3.37 | –19.00 | –18.93 | — | — | –8.23 | |

| Class I2 | –14.38 | — | — | –1.00 | –14.60 | –14.38 | — | — | –2.48 | |

| Class NAV2 | –14.26 | — | — | –0.87 | –14.56 | –14.26 | — | — | –2.17 | |

Performance figures assume all distributions are reinvested. Figures reflect maximum sales charges on Class A shares of 5.00%.

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from those disclosed in the Financial highlights tables in this report. For all classes the net expenses equal the gross expenses. The expense ratios are as follows:

| Class A | Class I | Class NAV | |||

| Net/Gross (%) | 1.91 | 1.55 | 1.38 |

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For current to the most recent month-end performance data, please call 1–800–225–5291 or visit the Fund’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares. The Fund’s performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

| 6 | Technical Opportunities Fund | Semiannual report |

| Without | With maximum | |||

| Start date | sales charge | sales charge | Index | |

| Class I2 | 8-3-09 | $9,752 | $9,752 | $12,670 |

| Class NAV2 | 8-3-09 | 9,783 | 9,783 | 12,670 |

MSCI All Country World Index (gross of foreign withholding tax on dividends) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

It is not possible to invest directly in an index. Index figures do not reflect expenses, which would have resulted in lower values if they did.

1 From 8-3-09.

2 For certain types of investors, as described in the Fund’s Class I and Class NAV shares prospectuses.

| Semiannual report | Technical Opportunities Fund | 7 |

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

▪ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

▪ Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about the Fund’s actual ongoing operating expenses, and is based on the Fund’s actual return. It assumes an account value of $1,000.00 on August 1, 2011 with the same investment held until January 31, 2012.

| Account value | Ending value on | Expenses paid during | |

| on 8-1-11 | 1-31-12 | period ended 1-31-121 | |

| Class A | $1,000.00 | $852.90 | $8.99 |

| Class I | 1,000.00 | 854.00 | 7.04 |

| Class NAV | 1,000.00 | 854.40 | 6.43 |

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at January 31, 2012, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| 8 | Technical Opportunities Fund | Semiannual report |

Hypothetical example for comparison purposes

This table allows you to compare the Fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not the Fund’s actual return). It assumes an account value of $1,000.00 on August 1, 2011, with the same investment held until January 31, 2012. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| Account value | Ending value on | Expenses paid during | |

| on 8-1-11 | 1-31-12 | period ended 1-31-121 | |

| Class A | $1,000.00 | $1,015.40 | $9.78 |

| Class I | 1,000.00 | 1,017.50 | 7.66 |

| Class NAV | 1,000.00 | 1,018.20 | 7.00 |

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.93%, 1.51% and 1.38% for Class A, Class I and Class NAV shares, respectively, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

| Semiannual report | Technical Opportunities Fund | 9 |

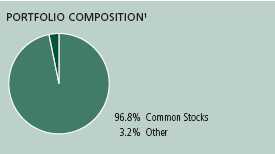

Portfolio summary

| Top 10 Holdings (17.1% of Net Assets on 1-31-12)1,2 | ||||

| Apple, Inc. | 2.6% | Pall Corp. | 1.6% | |

| Monsanto Company | 1.8% | Hexcel Corp. | 1.6% | |

| Oceaneering International, Inc. | 1.8% | Polaris Industries, Inc. | 1.5% | |

| Biogen Idec, Inc. | 1.7% | TransDigm Group, Inc. | 1.5% | |

| NewMarket Corp. | 1.6% | Amazon.com, Inc. | 1.4% | |

| Sector Composition1,3 | ||||

| Consumer Discretionary | 26.6% | Materials | 8.2% | |

| Industrials | 16.2% | Financials | 3.6% | |

| Information Technology | 13.0% | Consumer Staples | 2.9% | |

| Health Care | 8.8% | Utilities | 0.4% | |

| Energy | 8.7% | Short-Term Investments & Other | 11.6% | |

| Country Composition1,3 | ||||

| United States | 72.9% | Japan | 1.1% | |

| Brazil | 3.0% | Australia | 1.0% | |

| Canada | 2.2% | Hong Kong | 1.0% | |

| China | 2.0% | Other Countries | 2.1% | |

| Ireland | 1.6% | Short-Term Investments & Other | 11.6% | |

| United Kingdom | 1.5% | |||

1 As a percentage of net assets on 1-31-12.

2 Cash and cash equivalents not included.

3 International investing involves special risks such as political, economic and currency risks and differences in accounting standards and financial reporting. These risks are more significant in emerging markets. Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| 10 | Technical Opportunities Fund | Semiannual report |

Fund’s investments

As of 1-31-12 (unaudited)

| Shares | Value | |

| Common Stocks 87.39% | $466,280,138 | |

| (Cost $443,607,778) | ||

| Consumer Discretionary 26.62% | 142,013,737 | |

| Automobiles 1.43% | ||

| Brilliance China Automotive Holdings, Ltd. (I) | 2,274,000 | 2,433,424 |

| Ford Motor Company | 252,300 | 3,133,566 |

| Great Wall Motor Company, Ltd., H Shares (L) | 1,214,500 | 2,078,465 |

| Distributors 1.55% | ||

| LKQ Corp. (I) | 166,400 | 5,424,640 |

| Pool Corp. | 83,100 | 2,827,893 |

| Hotels, Restaurants & Leisure 4.31% | ||

| Caribou Coffee Company, Inc. (I)(L) | 66,993 | 1,136,201 |

| Chipotle Mexican Grill, Inc. (I)(L) | 18,300 | 6,721,407 |

| Las Vegas Sands Corp. (I) | 81,400 | 3,997,554 |

| Sands China, Ltd. (I) | 1,173,200 | 3,960,396 |

| Six Flags Entertainment Corp. | 41,500 | 1,818,945 |

| Starbucks Corp. | 112,200 | 5,377,746 |

| Household Durables 0.60% | ||

| iRobot Corp. (I) | 97,000 | 3,204,880 |

| Internet & Catalog Retail 2.72% | ||

| Amazon.com, Inc. (I) | 39,000 | 7,583,160 |

| Expedia, Inc. (L) | 213,400 | 6,907,758 |

| Leisure Equipment & Products 1.50% | ||

| Polaris Industries, Inc. | 124,300 | 8,004,920 |

| Media 2.17% | ||

| News Corp., Class A | 285,100 | 5,368,433 |

| Sirius XM Radio, Inc. (I)(L) | 2,956,100 | 6,178,249 |

| Specialty Retail 5.03% | ||

| Chow Tai Fook Jewellery Group Ltd. (I) | 1,397,200 | 2,637,552 |

| Fast Retailing Company, Ltd. | 29,100 | 5,784,193 |

| Genesco, Inc. (I)(L) | 30,300 | 1,850,421 |

| PetSmart, Inc. | 74,000 | 3,938,280 |

| Rent-A-Center, Inc. | 99,600 | 3,368,472 |

| Select Comfort Corp. (I) | 157,400 | 3,947,592 |

| Tractor Supply Company | 65,900 | 5,322,743 |

| See notes to financial statements | Semiannual report | Technical Opportunities Fund | 11 |

| Shares | Value | |

| Textiles, Apparel & Luxury Goods 7.31% | ||

| Cia Hering | 88,800 | $2,134,615 |

| Liz Claiborne, Inc. (I) | 309,800 | 2,881,140 |

| Lululemon Athletica, Inc. (I) | 85,700 | 5,410,241 |

| Oxford Industries, Inc. (L) | 70,700 | 3,600,751 |

| PVH Corp. | 85,600 | 6,607,464 |

| Ralph Lauren Corp. | 44,500 | 6,764,000 |

| Steven Madden, Ltd. (I) | 101,800 | 4,188,052 |

| Under Armour, Inc., Class A (I) | 93,200 | 7,420,584 |

| Consumer Staples 1.91% | 10,190,741 | |

| Food & Staples Retailing 1.17% | ||

| Rite Aid Corp. (I) | 1,739,100 | 2,417,349 |

| Whole Foods Market, Inc. | 51,700 | 3,827,351 |

| Food Products 0.30% | ||

| Cal-Maine Foods, Inc. | 42,200 | 1,601,912 |

| Personal Products 0.44% | ||

| Elizabeth Arden, Inc. (I) | 65,169 | 2,344,129 |

| Energy 8.69% | 46,367,916 | |

| Energy Equipment & Services 3.45% | ||

| Cameron International Corp. (I) | 122,800 | 6,532,960 |

| Hornbeck Offshore Services, Inc. (I) | 77,280 | 2,526,283 |

| Oceaneering International, Inc. | 192,900 | 9,373,011 |

| Oil, Gas & Consumable Fuels 5.24% | ||

| Alpha Natural Resources, Inc. (I) | 123,300 | 2,480,796 |

| Anadarko Petroleum Corp. | 67,100 | 5,416,312 |

| Cabot Oil & Gas Corp. (L) | 164,400 | 5,244,360 |

| Concho Resources, Inc. (I) | 63,700 | 6,794,242 |

| Gulfport Energy Corp. (I) | 136,800 | 4,496,616 |

| World Fuel Services Corp. | 77,200 | 3,503,336 |

| Financials 3.55% | 18,927,179 | |

| Consumer Finance 0.63% | ||

| Discover Financial Services | 124,000 | 3,370,320 |

| Real Estate Investment Trusts 1.93% | ||

| American Tower Corp. | 55,400 | 3,518,454 |

| Digital Realty Trust, Inc. (L) | 39,823 | 2,821,858 |

| Taubman Centers, Inc. | 58,900 | 3,948,067 |

| Real Estate Management & Development 0.99% | ||

| BR Malls Participacoes SA | 482,700 | 5,268,480 |

| Health Care 8.84% | 47,178,853 | |

| Biotechnology 3.58% | ||

| Biogen Idec, Inc. (I) | 77,500 | 9,138,800 |

| Cubist Pharmaceuticals, Inc. (I) | 139,800 | 5,706,636 |

| Onyx Pharmaceuticals, Inc. (I) | 104,000 | 4,257,760 |

| 12 | Technical Opportunities Fund | Semiannual report | See notes to financial statements |

| Shares | Value | |

| Health Care Equipment & Supplies 1.56% | ||

| Cantel Medical Corp. | 14,000 | $441,980 |

| Endologix, Inc. (I)(L) | 171,300 | 2,223,474 |

| Intuitive Surgical, Inc. (I) | 12,300 | 5,656,893 |

| Pharmaceuticals 3.70% | ||

| Bristol-Myers Squibb Company | 89,800 | 2,895,152 |

| Elan Corp. PLC, ADR (I) | 389,900 | 5,306,539 |

| Eli Lilly & Company | 75,400 | 2,996,396 |

| Jazz Pharmaceuticals PLC (I) | 69,500 | 3,231,750 |

| Viropharma, Inc. (I)(L) | 178,700 | 5,323,473 |

| Industrials 16.15% | 86,186,731 | |

| Aerospace & Defense 5.84% | ||

| BE Aerospace, Inc. (I) | 96,800 | 4,084,960 |

| Cubic Corp. | 93,603 | 4,328,203 |

| Hexcel Corp. (I) | 333,900 | 8,370,873 |

| TransDigm Group, Inc. (I) | 76,520 | 7,998,636 |

| Triumph Group, Inc. (L) | 101,600 | 6,357,112 |

| Building Products 0.37% | ||

| Simpson Manufacturing Company, Inc. | 61,500 | 1,991,370 |

| Commercial Services & Supplies 1.67% | ||

| Aggreko PLC | 80,831 | 2,674,421 |

| Clean Harbors, Inc. (I)(L) | 98,400 | 6,243,480 |

| Machinery 5.37% | ||

| Barnes Group, Inc. | 184,000 | 4,653,360 |

| Chart Industries, Inc. (I)(L) | 85,602 | 4,773,168 |

| Lincoln Electric Holdings, Inc. | 56,900 | 2,443,855 |

| Pall Corp. | 140,500 | 8,385,040 |

| RBC Bearings, Inc. (I) | 38,600 | 1,747,808 |

| Wabtec Corp. | 66,000 | 4,540,140 |

| Woodward, Inc. | 50,300 | 2,111,594 |

| Professional Services 1.52% | ||

| Intertek Group PLC | 79,706 | 2,657,787 |

| On Assignment, Inc. (I) | 139,100 | 1,559,311 |

| Verisk Analytics, Inc., Class A (I) | 96,700 | 3,874,769 |

| Road & Rail 0.26% | ||

| QR National, Ltd. | 358,809 | 1,411,736 |

| Trading Companies & Distributors 1.12% | ||

| GATX Corp. | 48,600 | 2,086,884 |

| MSC Industrial Direct Company, Inc., Class A | 51,200 | 3,892,224 |

| Information Technology 13.05% | 69,613,158 | |

| Communications Equipment 1.02% | ||

| Cisco Systems, Inc. | 276,500 | 5,427,695 |

| Computers & Peripherals 4.04% | ||

| Apple, Inc. (I) | 30,900 | 14,105,232 |

| Imagination Technologies Group PLC (I) | 298,288 | 2,724,387 |

| SanDisk Corp. (I) | 103,000 | 4,725,640 |

| See notes to financial statements | Semiannual report | Technical Opportunities Fund | 13 |

| Shares | Value | ||

| Electronic Equipment, Instruments & Components 0.99% | |||

| FEI Company (I)(L) | 120,100 | $5,291,606 | |

| Internet Software & Services 2.93% | |||

| Equinix, Inc. (I) | 300 | 35,988 | |

| MercadoLibre, Inc. | 45,200 | 3,950,480 | |

| Netease.com, Inc., ADR (I) | 55,000 | 2,630,650 | |

| SINA Corp. (I) | 82,900 | 5,825,383 | |

| Zillow, Inc. (I) | 109,100 | 3,217,359 | |

| IT Services 1.46% | |||

| Cardtronics, Inc. (I) | 196,800 | 5,028,240 | |

| Cielo SA | 92,400 | 2,752,644 | |

| Semiconductors & Semiconductor Equipment 0.69% | |||

| Marvell Technology Group, Ltd. (I) | 236,000 | 3,665,080 | |

| Software 1.92% | |||

| Aspen Technology, Inc. (I) | 136,400 | 2,456,564 | |

| Intuit, Inc. | 48,100 | 2,714,764 | |

| Nuance Communications, Inc. (I) | 82,300 | 2,347,196 | |

| Sourcefire, Inc. (I)(L) | 87,500 | 2,714,250 | |

| Materials 8.18% | 43,663,223 | ||

| Chemicals 4.89% | |||

| Innophos Holdings, Inc. | 58,700 | 2,930,304 | |

| Monsanto Company | 114,900 | 9,427,545 | |

| NewMarket Corp. (L) | 39,200 | 8,474,648 | |

| Stepan Company | 31,400 | 2,698,516 | |

| Westlake Chemical Corp. | 44,100 | 2,577,645 | |

| Metals & Mining 2.01% | |||

| Iluka Resources, Ltd. | 214,959 | 4,170,135 | |

| Yamana Gold, Inc. | 380,300 | 6,567,781 | |

| Paper & Forest Products 1.28% | |||

| Buckeye Technologies, Inc. | 203,300 | 6,816,649 | |

| Utilities 0.40% | 2,138,600 | ||

| Multi-Utilities 0.40% | |||

| Wisconsin Energy Corp. | 62,900 | 2,138,600 | |

| Preferred Securities 0.98% | $5,243,799 | ||

| (Cost $5,101,544) | |||

| Consumer Staples 0.98% | 5,243,799 | ||

| Companhia de Bebidas das Americas, ADR | 144,100 | 5,243,799 | |

| Yield | Shares | Value | |

| Securities Lending Collateral 7.09% | $37,843,203 | ||

| (Cost $37,831,565) | |||

| John Hancock Collateral Investment Trust (W) | 0.389% (Y) | 3,780,842 | 37,843,203 |

| 14 | Technical Opportunities Fund | Semiannual report | See notes to financial statements |

| Par value | Value | |

| Short-Term Investments 14.96% | $79,800,000 | |

| (Cost $79,800,000) | ||

| Repurchase Agreement 14.96% | 79,800,000 | |

| Bank of America Tri-Party Repurchase Agreement dated 1-31-12 at | ||

| 0.2200% to be repurchased at $24,600,150 on 2-1-12, collateralized | ||

| by $19,050,904 Federal Loan Mortgage Corp., due 6-15-12 | ||

| (valued at $19,050,904 including interest) and $6,041,973 | ||

| Federal Home Loan Mortgage Corp., due 7-2-12 (valued at | ||

| $6,041,973 including interest) | $24,600,000 | 24,600,000 |

| BNP Paribas Tri-Party Repurchase Agreement dated 1-31-12 at | ||

| 0.240% to be repurchased at $33,400,223 on 2-1-12, collateralized | ||

| by $13,991,153, Federal National Mortgage Association, 3.500% | ||

| due 7-1-26 (valued at $14,029,611, including interest) and $19,982,864 | ||

| Federal National Mortgage Association, 3.500% due 1-1-32 (valued at | ||

| $20,038,389, including interest) | 33,400,000 | 33,400,000 |

| JPMorgan Tri-Party Repurchase Agreement dated 1-31-12 at 0.230% | ||

| to be repurchased at $21,800,139 on 2-1-12, collateralized | ||

| by $22,150,222, Federal Home Loan Mortgage, 3.042% to 5.761% | ||

| due 11-1-36 to 2-1-41 (valued at $22,237,533 including interest) | 21,800,000 | 21,800,000 |

| Total investments (Cost $566,340,887)† 110.42% | $589,167,140 | |

| Other assets and liabilities, net (10.42%) | ($55,609,679) | |

| Total net assets 100.00% | $533,557,461 | |

The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the Fund.

ADR American Depositary Receipts

(I) Non-income producing security.

(L) All or a portion of this security is on loan as of 1-31-12.

(W) Investment is an affiliate of the Fund, the adviser and/or subadviser. Also, it represents the investment of securities lending collateral received.

(Y) The rate shown is the annualized seven-day yield as of 1-31-12.

† At 1-31-12, the aggregate cost of investment securities for federal income tax purposes was $569,997,418. Net unrealized appreciation aggregated $19,169,722, of which $26,735,436 related to appreciated investment securities and $7,565,714 related to depreciated investment securities.

The Fund had the following country concentration as a percentage of net assets on 1-31-12:

| United States | 72.9% | ||

| Brazil | 3.0% | ||

| Canada | 2.2% | ||

| China | 2.0% | ||

| Ireland | 1.6% | ||

| United Kingdom | 1.5% | ||

| Japan | 1.1% | ||

| Australia | 1.0% | ||

| Hong Kong | 1.0% | ||

| Other Countries | 2.1% | ||

| Short-Term Investments & Other | 11.6% |

| See notes to financial statements | Semiannual report | Technical Opportunities Fund | 15 |

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 1-31-12 (unaudited)

This Statement of assets and liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum offering price per share.

| Assets | |

| Investments in unaffiliated issuers, at value (Cost $448,709,322) including | |

| $36,548,040 of securities loaned (Note 2) | $471,523,937 |

| Investments in affiliated issuers, at value (Cost $37,831,565) (Note 2) | 37,843,203 |

| Repurchase agreements, at value (Cost $79,800,000) (Note 2) | 79,800,000 |

| Total investments, at value (Cost $566,340,887) | 589,167,140 |

| Cash | 85,844 |

| Receivable for investments sold | 3,499,548 |

| Receivable for fund shares sold | 156,321 |

| Dividends and interest receivable | 151,083 |

| Receivable for securities lending income | 17,191 |

| Other receivables and prepaid expenses | 24,209 |

| Total assets | 593,101,336 |

| Liabilities | |

| Payable for investments purchased | 20,779,900 |

| Payable for fund shares repurchased | 756,079 |

| Payable upon return of securities loaned (Note 2) | 37,885,850 |

| Payable to affiliates | |

| Accounting and legal services fees | 2,732 |

| Transfer agent fees | 17,898 |

| Trustees’ fees | 810 |

| Other liabilities and accrued expenses | 100,606 |

| Total liabilities | 59,543,875 |

| Net assets | |

| Paid-in capital | $590,266,935 |

| Accumulated net investment loss | (2,108,779) |

| Accumulated net realized loss on investments and foreign | |

| currency transactions | (77,420,942) |

| Net unrealized appreciation (depreciation) on investments and translation | |

| of assets and liabilities in foreign currencies | 22,820,247 |

| Net assets | $533,557,461 |

| 16 | Technical Opportunities Fund | Semiannual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T S

Statement of assets and liabilities (continued)

| Net asset value per share | |

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($71,333,638 ÷ 7,722,333 shares) | $9.24 |

| Class I ($27,828,174 ÷ 2,981,278 shares) | $9.33 |

| Class NAV ($434,395,649 ÷ 46,393,083 shares) | $9.36 |

| Maximum offering price per share | |

| Class A (net asset value per share ÷ 95%)1 | $9.73 |

1 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

| See notes to financial statements | Semiannual report | Technical Opportunities Fund | 17 |

F I N A N C I A L S T A T E M E N T S

Statement of operations For the six-month period ended 1-31-12

(unaudited)

This Statement of operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| Investment income | |

| Dividends | $1,972,688 |

| Securities lending | 115,170 |

| Interest | 107,921 |

| Less foreign taxes withheld | (6,847) |

| Total investment income | 2,188,932 |

| Expenses | |

| Investment management fees (Note 4) | 3,827,349 |

| Distribution and service fees (Note 4) | 134,836 |

| Accounting and legal services fees (Note 4) | 40,628 |

| Transfer agent fees (Note 4) | 124,742 |

| Trustees’ fees (Note 4) | 3,525 |

| State registration fees (Note 4) | 21,471 |

| Printing and postage (Note 4) | 6,277 |

| Professional fees | 34,582 |

| Custodian fees | 92,483 |

| Registration and filing fees | 37,880 |

| Other | 8,106 |

| Total expenses | 4,331,879 |

| Less expense reductions (Note 4) | (19,674) |

| Net expenses | 4,312,205 |

| Net investment loss | (2,123,273) |

| Realized and unrealized gain (loss) | |

| Net realized gain (loss) on | |

| Investments in unaffiliated issuers | (73,003,085) |

| Investments in affiliated issuers | (19,652) |

| Capital gain distributions received from affiliated underlying funds | 1,602 |

| Foreign currency transactions | (280,971) |

| (73,302,106) | |

| Change in net unrealized appreciation (depreciation) of | |

| Investments in unaffiliated issuers | (30,633,296) |

| Investments in affiliated issuers | (2,805) |

| Translation of assets and liabilities in foreign currencies | 2,731 |

| (30,633,370) | |

| Net realized and unrealized loss | (103,935,476) |

| Decrease in net assets from operations | ($106,058,749) |

| 18 | Technical Opportunities Fund | Semiannual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T S

Statements of changes in net assets

These Statements of changes in net assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| Six months | ||

| ended | Year | |

| 1-31-12 | ended | |

| (Unaudited) | 7-31-11 | |

| Increase (decrease) in net assets | ||

| From operations | ||

| Net investment loss | ($2,123,273) | ($2,889,268) |

| Net realized gain (loss) | (73,302,106) | 71,675,755 |

| Change in net unrealized appreciation (depreciation) | (30,633,370) | 19,889,467 |

| Increase (decrease) in net assets resulting from operations | (106,058,749) | 88,675,954 |

| Distributions to shareholders | ||

| From net realized gain | ||

| Class A | (3,359,268) | — |

| Class I | (1,477,257) | — |

| Class NAV | (18,131,169) | — |

| Total distributions | (22,967,694) | — |

| From Fund share transactions (Note 5) | (60,061,504) | 41,487,315 |

| Total increase (decrease) | (189,087,947) | 130,163,269 |

| Net assets | ||

| Beginning of period | 722,645,408 | 592,482,139 |

| End of period | $533,557,461 | $722,645,408 |

| Undistributed net investment income (accumulated net | ||

| investment loss) | ($2,108,779) | $14,494 |

| See notes to financial statements | Semiannual report | Technical Opportunities Fund | 19 |

Financial highlights

The Financial highlights show how the Fund’s net asset value for a share has changed since the beginning of the period.

| CLASS A SHARES Period ended | 1-31-122 | 7-31-11 | 7-31-101 | |||

| Per share operating performance | ||||||

| Net asset value, beginning of period | $11.33 | $9.86 | $10.00 | |||

| Net investment loss3 | (0.06) | (0.09) | (0.13) | |||

| Net realized and unrealized gain (loss) on investments | (1.62) | 1.56 | (0.01) | |||

| Total from investment operations | (1.68) | 1.47 | (0.14) | |||

| Less distributions | ||||||

| From net realized gain | (0.41) | — | — | |||

| Net asset value, end of period | $9.24 | $11.33 | $9.86 | |||

| Total return (%)4,5 | (14.71)6 | 14.91 | (1.40)6 | |||

| Ratios and supplemental data | ||||||

| Net assets, end of period (in millions) | $71 | $125 | $165 | |||

| Ratios (as a percentage of average net assets): | ||||||

| Expenses before reductions | 1.937 | 1.90 | 1.877 | |||

| Expenses net of fee waivers | 1.937 | 1.90 | 1.877 | |||

| Net investment loss | (1.18)7 | (0.79) | (1.23)7 | |||

| Portfolio turnover (%) | 316 | 361 | 389 | |||

1 Period from 8-3-09 (commencement of operations) to 7-31-10.

2 Semiannual period from 8-1-11 to 1-31-12. Unaudited.

3 Based on the average daily shares outstanding.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Does not reflect the effect of sales charges, if any.

6 Not annualized.

7 Annualized.

| CLASS I SHARES Period ended | 1-31-122 | 7-31-11 | 7-31-101 | |||

| Per share operating performance | ||||||

| Net asset value, beginning of period | $11.42 | $9.89 | $10.00 | |||

| Net investment loss3 | (0.04) | (0.04) | (0.09) | |||

| Net realized and unrealized gain (loss) on investments | (1.64) | 1.57 | (0.02) | |||

| Total from investment operations | (1.68) | 1.53 | (0.11) | |||

| Less distributions | ||||||

| From net realized gain | (0.41) | — | — | |||

| Net asset value, end of period | $9.33 | $11.42 | $9.89 | |||

| Total return (%)4 | (14.60)5 | 15.47 | (1.10)5 | |||

| Ratios and supplemental data | ||||||

| Net assets, end of period (in millions) | $28 | $63 | $79 | |||

| Ratios (as a percentage of average net assets): | ||||||

| Expenses before reductions | 1.566 | 1.49 | 1.526 | |||

| Expenses net of fee waivers | 1.516 | 1.49 | 1.526 | |||

| Net investment loss | (0.76)6 | (0.37) | (0.89)6 | |||

| Portfolio turnover (%) | 316 | 361 | 389 | |||

1 Period from 8-3-09 (commencement of operations) to 7-31-10.

2 Semiannual period from 8-1-11 to 1-31-12. Unaudited.

3 Based on the average daily shares outstanding.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Annualized.

| 20 | Technical Opportunities Fund | Semiannual report | See notes to financial statements |

| CLASS NAV SHARES Period ended | 1-31-122 | 7-31-11 | 7-31-101 | |||

| Per share operating performance | ||||||

| Net asset value, beginning of period | $11.45 | $9.90 | $10.00 | |||

| Net investment loss3 | (0.03) | (0.03) | (0.07) | |||

| Net realized and unrealized gain (loss) on investments | (1.65) | 1.58 | (0.03) | |||

| Total from investment operations | (1.68) | 1.55 | (0.10) | |||

| Less distributions | ||||||

| From net realized gain | (0.41) | — | — | |||

| Net asset value, end of period | $9.36 | $11.45 | $9.90 | |||

| Total return (%)4 | (14.56)5 | 15.66 | (1.00)5 | |||

| Ratios and supplemental data | ||||||

| Net assets, end of period (in millions) | $434 | $535 | $349 | |||

| Ratios (as a percentage of average net assets): | ||||||

| Expenses before reductions | 1.396 | 1.37 | 1.396 | |||

| Expenses net of fee waivers | 1.386 | 1.37 | 1.396 | |||

| Net investment loss | (0.63)6 | (0.31) | (0.72)6 | |||

| Portfolio turnover (%) | 316 | 361 | 389 | |||

1 Period from 8-3-09 (commencement of operations) to 7-31-10.

2 Semiannual period from 8-1-11 to 1-31-12. Unaudited.

3 Based on the average daily shares outstanding.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Annualized.

| See notes to financial statements | Semiannual report | Technical Opportunities Fund | 21 |

Notes to financial statements

(unaudited)

Note 1 — Organization

John Hancock Technical Opportunities Fund (the Fund) is a series of John Hancock Funds II (the Trust), an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the Fund is to seek long-term capital appreciation.

The Fund may offer multiple classes of shares. The shares currently offered are detailed in the Statement of assets and liabilities. Class A shares are offered to all investors. Class I shares are offered to institutions and certain investors. Class NAV shares are sold to John Hancock affiliated funds of funds. Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees, if any, transfer agent, printing and postage and state registration fees for each class may differ.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. The Fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities. Level 2 includes securities valued using significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the Fund’s own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

| 22 | Technical Opportunities Fund | Semiannual report |

The following is a summary of the values by input classification of the Fund’s investments as of January 31, 2012, by major security category or type:

| LEVEL 3 | ||||

| LEVEL 2 | SIGNIFICANT | |||

| TOTAL MARKET | LEVEL 1 | SIGNIFICANT | UNOBSERVABLE | |

| VALUE AT 1-31-12 | QUOTED PRICE | OBSERVABLE INPUTS | INPUTS | |

| Common Stocks | ||||

| Consumer Discretionary | $142,013,737 | $125,119,707 | $16,894,030 | — |

| Consumer Staples | 10,190,741 | 10,190,741 | — | — |

| Energy | 46,367,916 | 46,367,916 | — | — |

| Financials | 18,927,179 | 18,927,179 | — | — |

| Health Care | 47,178,853 | 47,178,853 | — | — |

| Industrials | 86,186,731 | 79,442,787 | 6,743,944 | — |

| Information Technology | 69,613,158 | 66,888,771 | 2,724,387 | — |

| Materials | 43,663,223 | 39,493,088 | 4,170,135 | — |

| Utilities | 2,138,600 | 2,138,600 | — | — |

| Preferred Securities | ||||

| Consumer Staples | 5,243,799 | 5,243,799 | — | — |

| Securities Lending | ||||

| Collateral | 37,843,203 | 37,843,203 | — | — |

| Short-Term Investments | ||||

| Repurchase Agreement | 79,800,000 | — | 79,800,000 | — |

| Total Investments in | ||||

| Securities | $589,167,140 | $478,834,644 | $110,332,496 | — |

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. During the six months ended January 31, 2012, there were no significant transfers into or out of Level 1, Level 2 or Level 3.

In order to value the securities, the Fund uses the following valuation techniques. Equity securities held by the Fund are valued at the last sale price or official closing price on the principal securities exchange on which they trade. In the event there were no sales during the day or closing prices are not available, then securities are valued using the last quoted bid or evaluated price. Investments by the Funds in open-end mutual funds, including John Hancock Collateral Investment Trust (JHCIT), are valued at their respective net asset values each business day. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rates supplied by an independent pricing service. Certain securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Certain short-term securities are valued at amortized cost.

Other portfolio securities and assets, where market quotations are not readily available, are valued at fair value, as determined in good faith by the Fund’s Pricing Committee, following procedures established by the Board of Trustees. Generally, trading in non-U.S. securities is substantially completed each day at various times prior to the close of trading on the NYSE. Significant market events that affect the values of non-U.S. securities may occur between the time when the valuation of the securities is generally determined and the close of the NYSE. During significant market events, these securities will be valued at fair value, as determined in good faith, following procedures established by the Board of Trustees. The Fund may use a fair valuation model to value non-U.S. securities in order to adjust for events which may occur between the close of foreign exchanges and the close of the NYSE.

Repurchase agreements. The Fund may enter into repurchase agreements. When the Fund enters into a repurchase agreement, it receives collateral which is held in a segregated account by the Fund’s custodian. The collateral amount is marked-to-market and monitored on a daily basis to

| Semiannual report | Technical Opportunities Fund | 23 |

ensure that the collateral held is in an amount not less than the principal amount of the repurchase agreement plus any accrued interest. In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the collateral value may decline. Collateral for certain tri-party repurchase agreements is held at a third-party custodian bank in a segregated account for the benefit of the Fund.

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Dividend income is recorded on the ex-date, except for dividends of foreign securities where the dividend may not be known until after the ex-date. In those cases, dividend income is recorded when the Fund becomes aware of the dividends. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation.

Securities lending. The Fund may lend its securities to earn additional income. It receives cash collateral from the borrower in an amount not less than the market value of the loaned securities. The Fund will invest its collateral in JHCIT, an affiliate of the Fund and as a result, the Fund will receive the benefit of any gains and bear any losses generated by JHCIT. Although risk of the loss of the securities lent is mitigated by holding the collateral, the Fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities or if collateral investments decline in value. The Fund may receive compensation for lending its securities by retaining a portion of the return on the investment of the collateral and compensation from fees earned from borrowers of the securities. Net income received from JHCIT is a component of securities lending income as recorded on the Statement of operations.

Foreign currency translation. Assets, including investments and liabilities denominated in foreign currencies, are translated into U.S. dollar values each day at the prevailing exchange rate. Purchases and sales of securities, income and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on the value of securities is reflected as a component of the realized and unrealized gains (losses) on investments.

Funds that invest internationally generally carry more risk than funds that invest strictly in U.S. securities. Risks can result from differences in economic and political conditions, regulations, market practices (including higher transaction costs) and accounting standards. Foreign investments are also subject to a decline in the value of a foreign currency versus the U.S. dollar, which reduces the dollar value of securities denominated in that currency.

Foreign taxes. The Fund may be subject to capital gains and repatriation taxes as imposed by certain countries in which it invests. Such taxes are generally based upon income and/or capital gains earned or repatriated. Taxes are accrued based upon net investment income, net realized gains and net unrealized appreciation.

Line of credit. The Fund may borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the custodian agreement, the custodian may loan money to the Fund to make properly authorized payments. The Fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian may have a lien, security interest or security entitlement in any Fund property that is not otherwise segregated or pledged, to the maximum extent permitted by law, to the extent of any overdraft.

In addition, the Fund and other affiliated funds have entered into an agreement with Citibank N.A. which enables them to participate in a $200 million unsecured committed line of credit. A commitment fee, payable at the end of each calendar quarter, based on the average daily unused

| 24 | Technical Opportunities Fund | Semiannual report |

portion of the line of credit, is charged to each participating fund on a pro rata basis and is reflected in other expenses on the Statement of operations. For the six months ended January 31, 2012, the Fund had no borrowings under the line of credit.

Expenses. Expenses that are directly attributable to an individual fund are allocated to the Fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund’s relative net assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations. Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the net assets of the class. Class-specific expenses, such as distribution and service fees, if any, transfer agent fees, state registration fees and printing and postage, for all classes, are calculated daily at the class level based on the appropriate net assets of each class and the specific expense rates applicable to each class.

Federal income taxes. The Fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

As of July 31, 2011, the Fund had no uncertain tax positions that would require financial statement recognition, derecognition or disclosure. The Fund’s federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The Fund generally declares and pays dividends and capital gain distributions, if any, at least annually.

Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. Book-tax differences are primarily attributable to foreign currency transactions, wash sales and net operating losses.

New accounting pronouncement. In May 2011, Accounting Standards Update 2011-04 (ASU 2011-04), Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs, was issued and is effective during interim and annual periods beginning after December 15, 2011. ASU 2011-04 amends Financial Accounting Standards Board (FASB) Topic 820, Fair Value Measurement. The amendments are the result of the work by the FASB and the International Accounting Standards Board to develop common requirements for measuring fair value and for disclosing information about fair value measurements in accordance with GAAP. The update may require additional disclosures related to transfers between Levels 1, 2, and 3. Also, the update requires additional disclosures related to quantitative and qualitative information regarding unobservable inputs and valuation techniques utilized in the valuation process. Management is currently evaluating the application of ASU 2011-04 and its impact, if any, on the Fund’s financial statement disclosure.

Note 3 — Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain

| Semiannual report | Technical Opportunities Fund | 25 |

general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss from such claims is considered remote.

Note 4 — Fees and transactions with affiliates

John Hancock Investment Management Services, LLC (the Adviser) serves as investment adviser for the Fund. John Hancock Funds, LLC (the Distributor), an affiliate of the Adviser, serves as principal underwriter of the Fund. The Adviser and the Distributor are indirect wholly owned subsidiaries of Manulife Financial Corporation (MFC).

Management fee. The Fund has an investment management agreement with the Adviser under which the Fund pays a daily management fee to the Adviser equivalent, on an annual basis, to the sum of: a) 1.35% of the first $250,000,000 of the Fund’s average daily net assets; b) 1.30% of the next $250,000,000; c) 1.20% of the next $250,000,000; and d) 1.15% of the Fund’s average daily net assets in excess of $750,000,000. Prior to September 27, 2011, the Fund paid this fee monthly, equivalent, on an annual basis, to the sum of: a) 1.35% of the first $250,000,000 of the Fund’s average daily net assets; b) 1.30% of the next $250,000,000; and c) 1.25% of the Fund’s average daily net assets in excess of $500,000,000. The Adviser has a subadvisory agreement with Wellington Management Company, LLP. The Fund is not responsible for payment of the subadvisory fees.

The investment management fees incurred for the six months ended January 31, 2012 were equivalent to a gross annual rate of 1.31% of the Fund’s average daily net assets.

The Adviser has contractually agreed to waive a portion of its management fee for certain funds (the Participating Fund) of the Trust and John Hancock Variable Insurance Trust. The waiver equals, on an annualized basis, 0.01% of that portion of the aggregate net assets of all the Participating Funds that exceeds $75 billion but is less than $100 billion; and 0.015% of that portion of the aggregate net assets of all the Participating Funds that equals or exceeds $100 billion. The amount of the reimbursement is calculated daily and allocated among all the Participating Funds in proportion to the daily net assets of each fund. This arrangement may be amended or terminated at any time by the Adviser upon notice to the funds and with the approval of the Board of Trustees.

The Adviser has contractually agreed to waive fees and/or reimburse certain expenses for each share class of the Fund excluding certain expenses such as taxes, portfolio brokerage commissions, interest expense, litigation and indemnification and other extraordinary expenses not incurred in the ordinary course of the Fund’s business. The fee waivers and/or reimbursements are such that these expenses will not exceed 1.95% and 1.59% for Class A and Class I shares, respectively. The fee waivers and/or reimbursements will continue in effect until November 30, 2012 unless renewed by mutual agreement of the Fund and the Adviser based upon a determination that this is appropriate under the circumstances at the time. Prior to November 30, 2011, the fee waiver and/or reimbursement was such that the expenses would not exceed 1.95% and 1.49% for Class A and Class I shares, respectively.

Additionally, the Adviser has voluntarily agreed to waive other fund level expenses excluding advisory fees, 12b-1 fees, service fees, transfer agent fees, printing and postage, blue sky fees, taxes, brokerage commissions, interest expenses, acquired fund fees, litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of business. This voluntary expense reimbursement will continue in effect until terminated at any time by the Adviser on notice to the Fund. The waivers are such that these expenses will not exceed 0.20% of average net assets.

| 26 | Technical Opportunities Fund | Semiannual report |

Accordingly, these expense reductions described above amounted to $1,449, $10,903 and $7,322 for Class A, Class I and Class NAV shares, respectively, for the six months ended January 31, 2012.

The investment management fees, including the impact of the waivers and reimbursements described above, incurred for the six months ended January 31, 2012 were equivalent to the net annual effective rate of 1.30% of the Fund’s average daily net assets.

Accounting and legal services. Pursuant to a service agreement the Fund reimburses the Adviser for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services to the Fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports, among other services. These expenses are allocated to each share class based on its relative net assets at the time the expense was incurred. These accounting and legal services fees incurred for the six months ended January 31, 2012, amounted to an annual rate of 0.01% of the Fund’s average daily net assets.

Distribution and service plans. The Fund has a distribution agreement with the Distributor. The Fund has adopted distribution and service plans with respect to Class A shares pursuant to Rule 12b-1 under the 1940 Act, to pay the Distributor for services provided as the distributor of shares of the Fund. The Fund may pay up to 0.30% for Class A shares for distribution and service fees, expressed as an annual percentage of average daily net assets.

Sales charges. Class A shares are assessed up-front sales charges, which resulted in payments to the Distributor amounting to $22,256 for the six months ended January 31, 2012. Of this amount, $3,625 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $18,442 was paid as sales commissions to broker-dealers and $189 was paid as sales commissions to sales personnel of Signator Investors, Inc., a broker-dealer affiliate of the Adviser.

Transfer agent fees. The Fund has a transfer agent agreement with John Hancock Signature Services, Inc. (Signature Services), an affiliate of the Adviser. The transfer agent fees paid to Signature Services are determined based on the cost to Signature Services (Signature Services Cost) of providing recordkeeping services. The Signature Services Cost includes a component of allocated John Hancock corporate overhead for providing transfer agent services to the Fund and to all other John Hancock affiliated funds. It also includes out-of-pocket expenses that are comprised of payments made to third-parties for recordkeeping services provided to their clients who invest in one or more John Hancock funds. In addition, Signature Services Cost may be reduced by certain fees that Signature Services receives in connection with retirement and small accounts. Signature Services Cost is calculated monthly and allocated, as applicable, to four categories of share classes: Institutional Share Classes, Retirement Share Classes, Municipal Bond Classes and all other Retail Share Classes. Within each of these categories, the applicable costs are allocated to the affected John Hancock affiliated funds and/or classes, based on the relative average daily net assets.

Class level expenses. Class level expenses for the six months ended January 31, 2012 were:

| DISTRIBUTION | TRANSFER | STATE | PRINTING AND | |

| CLASS | AND SERVICE FEES | AGENT FEES | REGISTRATION FEES | POSTAGE |

| A | $134,836 | $100,154 | $10,825 | $2,510 |

| I | — | 24,588 | 10,646 | 3,767 |

| Total | $134,836 | $124,742 | $21,471 | $6,277 |

Trustee expenses. The Fund compensates each Trustee who is not an employee of the Adviser or its affiliates. The costs of paying Trustee compensation and expenses are allocated to each Fund based on its average daily net assets.

| Semiannual report | Technical Opportunities Fund | 27 |

Note 5 — Fund share transactions

Transactions in Fund shares for the six months ended January 31, 2012 and for the year ended July 31, 2011 were as follows:

| Six months ended 1-31-12 | Year ended 7-31-11 | |||

| Shares | Amount | Shares | Amount | |

| Class A shares | ||||

| Sold | 398,168 | $3,903,616 | 3,507,440 | $38,725,185 |

| Distributions reinvested | 360,725 | 3,253,738 | — | — |

| Repurchased | (4,068,108) | (39,462,409) | (9,187,216) | (101,786,213) |

| Net decrease | (3,309,215) | ($32,305,055) | (5,679,776) | ($63,061,028) |

| Class I shares | ||||

| Sold | 368,450 | $3,664,138 | 2,858,405 | $31,984,512 |

| Distributions reinvested | 111,925 | 1,020,757 | — | — |

| Repurchased | (2,984,294) | (29,059,697) | (5,382,102) | (59,745,319) |

| Net decrease | (2,503,919) | ($24,374,802) | (2,523,697) | ($27,760,807) |

| Class NAV shares | ||||

| Sold | 3,177,697 | $32,976,062 | 12,569,529 | $143,742,559 |

| Distributions reinvested | 1,983,717 | 18,131,169 | — | — |

| Repurchased | (5,508,083) | (54,488,878) | (1,015,276) | (11,433,409) |

| Net increase (decrease) | (346,669) | ($3,381,647) | 11,554,253 | $132,309,150 |

| Net increase (decrease) | (6,159,803) | ($60,061,504) | 3,350,780 | $41,487,315 |

Affiliates of the Fund owned 100% of shares of beneficial interest of Class NAV on January 31, 2012.

Note 6 — Purchase and sale of securities

Purchases and sales of securities, other than short-term securities, aggregated $1,202,075,988 and $1,298,786,798, respectively, for the six months ended January 31, 2012.

Note 7 — Investment by affiliated funds

Certain investors in the Fund are affiliated funds and are managed by the Adviser and its affiliates. The affiliated funds do not invest in the Fund for the purpose of exercising management or control; however, this investment may represent a significant portion of the Fund’s net assets. For the six months ended January 31, 2012, the following funds had an affiliate ownership concentration of 5% or more of the Fund’s net assets:

| FUND | AFFILIATE CONCENTRATION | ||

| John Hancock Lifestyle Aggressive Portfolio | 13.0% | ||

| John Hancock Lifestyle Balanced Portfolio | 27.6% | ||

| John Hancock Lifestyle Growth Portfolio | 37.3% | ||

| 28 | Technical Opportunities Fund | Semiannual report |

More information

| Trustees | Investment adviser |

| James M. Oates, Chairman | John Hancock Investment Management |

| James R. Boyle† | Services, LLC |

| Charles L. Bardelis* | |

| Peter S. Burgess* | Subadviser |

| Grace K. Fey | Wellington Management Company, LLP |

| Theron S. Hoffman | |

| Hassell H. McClellan | Principal distributor |

| Steven M. Roberts* | John Hancock Funds, LLC |

| Officers | Custodian |

| Hugh McHaffie | State Street Bank and Trust Company |

| President | |

| Transfer agent | |

| Thomas M. Kinzler | John Hancock Signature Services, Inc. |

| Secretary and Chief Legal Officer | |

| Legal counsel | |

| Francis V. Knox, Jr. | K&L Gates LLP |

| Chief Compliance Officer | |

| Michael J. Leary | |

| Treasurer | |

| Charles A. Rizzo | |

| Chief Financial Officer | |

| John G. Vrysen | |

| Chief Operating Officer | |

| *Member of the Audit Committee | |

| †Non-Independent Trustee |

The Fund’s proxy voting policies and procedures, as well as the Fund’s proxy voting record for the most recent twelve-month period ended June 30, are available free of charge on the Securities and Exchange Commission (SEC) Web site at www.sec.gov or on our Web site.

The Fund’s complete list of portfolio holdings, for the first and third fiscal quarters, is filed with the SEC on Form N-Q. The Fund’s Form N-Q is available on our Web site and the SEC’s Web site, www.sec.gov, and can be reviewed and copied (for a fee) at the SEC’s Public Reference Room in Washington, DC. Call 1-800-SEC-0330 to receive information on the operation of the SEC’s Public Reference Room.

We make this information on your fund, as well as monthly portfolio holdings, and other fund details available on our Web site at www.jhfunds.com or by calling 1-800-225-5291.

| You can also contact us: | ||

| 1-800-225-5291 | Regular mail: | Express mail: |

| jhfunds.com | John Hancock Signature Services, Inc. | John Hancock Signature Services, Inc. |

| P.O. Box 55913 | Mutual Fund Image Operations | |

| Boston, MA 02205-5913 | 30 Dan Road | |

| Canton, MA 02021 |

| Semiannual report | Technical Opportunities Fund | 29 |

1-800-225-5291

1-800-554-6713 TDD

1-800-338-8080 EASI-Line

www.jhfunds.com

Now available: electronic delivery

www.jhfunds.com/edelivery

| This report is for the information of the shareholders of John Hancock Technical Opportunities Fund. | 347SA 1/12 |

| It is not authorized for distribution to prospective investors unless preceded or accompanied by a prospectus. | 3/12 |

| John Hancock Global High Yield Fund | |

| Table of Contents | |

| Your expenses | Page 3 |

| Portfolio summary | Page 4 |

| Portfolio of investments | Page 5 |

| Financial statements | Page 21 |

| Financial highlights | Page 24 |

| Notes to financial statements | Page 27 |

| More information | Page 36 |

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding your fund expenses

As a shareholder of the Fund, you incur two types of costs:

• Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

• Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on August 1, 2011, with the same investment held until January 31, 2012.

| Account value | Ending value | Expenses paid during | |

| on 8-1-11 | on 1-31-12 | period ended 1-31-121 | |

| Class A | $1,000.00 | $1,005.90 | $6.55 |

| Class I | 1,000.00 | 1,007.30 | 5.10 |

| Class NAV | 1,000.00 | 1,007.80 | 4.59 |

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at January 31, 2012, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Example

[ My account value $8,600.00 / $1,000.00 = 8.6 ] x $[ “expenses paid” from table ] = My actual expenses

Hypothetical example for comparison purposes

This table allows you to compare the Fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not the Fund’s actual return). It assumes an account value of $1,000.00 on August 1, 2011, with the same investment held until January 31, 2012. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| Account value | Ending value | Expenses paid during | |

| on 8-1-11 | on 1-31-12 | period ended 1-31-122 | |

| Class A | $1,000.00 | $1,018.60 | $6.60 |

| Class I | 1,000.00 | 1,020.10 | 5.13 |

| Class NAV | 1,000.00 | 1,020.60 | 4.62 |

Remember, these examples do not include any transaction costs; therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund's annualized expense ratio of 1.30%, 1.01% and 0.91% for Class A, Class I and Class NAV shares, respectively, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

2 Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

| 3 |

Global High Yield Fund

As of 1-31-12 (Unaudited)

| Portfolio Composition | |

| Value as a | |

| percentage of | |

| Portfolio Summary | Fund's net assets |

| Corporate Bonds | 65.3% |

| Foreign Government Obligations1 | 26.0% |

| Structured Notes | 1.7% |

| Term Loans | 1.2% |

| Convertible Bonds | 1.0% |

| Preferred Securities | 0.1% |

| Capital Preferred Securities | 0.1% |

| Short-Term Investments & Other | 4.6% |

| Value as a | |

| percentage of | |

| Sector Composition2 | Fund's net assets |

| Foreign Government Obligations1 | 26.0% |

| Consumer Discretionary | 14.4% |

| Energy | 13.2% |

| Materials | 7.5% |

| Telecommunication Services | 7.1% |

| Consumer Staples | 5.7% |

| Industrials | 5.5% |

| Health Care | 4.8% |

| Utilities | 3.6% |

| Financials | 3.4% |

| Information Technology | 2.6% |

| Structured Notes | 1.6% |

| Short-Term Investments & Other | 4.6% |

| Value as a | |

| percentage of Fund's | |

| Quality distribution3 | net assets |

| AA | 1.5% |

| A | 7.5% |

| BBB | 16.5% |

| BB | 13.0% |

| B | 41.2% |

| CCC & Below | 11.5% |

| Not Rated | 4.2% |

| Short-Term Investments and Other | 4.6% |

1 Typically, sovereign debt of developing countries may involve a high degree of risk and may be in default or present the risk of default, however, sovereign debt of developed counties may also present these risks.

2 Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

3 Ratings are from Moody’s Investors Services, Inc. If not available, we have used S&P ratings. In the absence of ratings from these agencies, we have used Fitch, Inc. ratings. Not Rated securities are those with no ratings available from these agencies. All are as of 1-31-12 and do not reflect subsequent downgrades or upgrades, if any.

| 4 |

Global High Yield Fund

As of 1-31-12 (Unaudited)

| Maturity | Par value | |||

| Rate (%) | date | Value | ||

| Corporate Bonds 65.31% | $262,316,585 | |||

| (Cost $262,819,296) | ||||

| American Samoa 0.14% | 551,960 | |||

| QGOG Atlantic/Alaskan Rigs, Ltd. (S) | 5.250 | 07/30/18 | $543,803 | 551,960 |

| Argentina 0.19% | 748,437 | |||

| Capex SA (S) | 10.000 | 03/10/18 | 195,000 | 166,238 |

| Empresa Distribuidora y Comercializadora Norte (S) | 9.750 | 10/25/22 | 264,000 | 219,120 |

| IRSA Inversiones y Representaciones SA (S) | 11.500 | 07/20/20 | 284,000 | 300,326 |

| Tarjeta Naranja SA (S) | 9.000 | 01/28/17 | 64,000 | 62,753 |

| Australia 0.38% | 1,536,518 | |||

| FMG Resources August 2006 Pty, Ltd. (S) | 8.250 | 11/01/19 | 1,255,000 | 1,345,988 |

| Mirabela Nickel, Ltd. (S) | 8.750 | 04/15/18 | 219,000 | 190,530 |

| Barbados 0.07% | 261,326 | |||

| Columbus International, Inc. | 11.500 | 11/20/14 | 247,000 | 261,326 |

| Bermuda 0.27% | 1,075,393 | |||

| Qtel International Finance, Ltd. | 5.000 | 10/19/25 | 200,000 | 201,500 |

| Qtel International Finance, Ltd. (S) | 5.000 | 10/19/25 | 409,000 | 412,068 |

| Qtel International Finance, Ltd. | 4.750 | 02/16/21 | 250,000 | 253,750 |

| Qtel International Finance, Ltd. (S) | 4.750 | 02/16/21 | 205,000 | 208,075 |

| Brazil 0.92% | 3,676,075 | |||

| Banco Cruzeiro do Sul SA | 8.875 | 09/22/20 | 101,000 | 77,770 |

| Banco Cruzeiro do Sul SA (S) | 8.875 | 09/22/20 | 369,000 | 284,130 |

| BM&FBovespa SA | 5.500 | 07/16/20 | 100,000 | 106,000 |

| BM&FBovespa SA (S) | 5.500 | 07/16/20 | 475,000 | 503,500 |

| BR Malls International Finance, Ltd. (S) | 8.500 | 01/29/49 | 137,000 | 140,425 |

| BR Properties SA (S) | 9.000 | 12/31/49 | 153,000 | 156,060 |

| Globo Comunicacao E Participacoes SA | 6.250 | 12/31/49 | 100,000 | 106,500 |

| Hypermarcas SA (S) | 6.500 | 04/20/21 | 434,000 | 405,790 |

| Net Servicos de Comunicacao SA | 7.500 | 01/27/20 | 200,000 | 232,500 |

| OGX Petroleo e Gas Participacoes SA (S) | 8.500 | 06/01/18 | 608,000 | 628,064 |

| Telemar Norte Leste SA (S) | 5.500 | 10/23/20 | 531,000 | 530,336 |

| Votorantim Cimentos SA (S) | 7.250 | 04/05/41 | 500,000 | 505,000 |

| Canada 1.89% | 7,603,113 | |||

| Ainsworth Lumber Company, Ltd., PIK (S) | 11.000 | 07/29/15 | 824,608 | 610,210 |

| Cascades, Inc. | 7.875 | 01/15/20 | 475,000 | 488,063 |

| Cascades, Inc. | 7.750 | 12/15/17 | 700,000 | 722,750 |

| Catalyst Paper Corp. (H)(S) | 11.000 | 12/15/16 | 720,000 | 424,800 |

| Kodiak Oil & Gas Corp. (S) | 8.125 | 12/01/19 | 530,000 | 561,800 |

| MEG Energy Corp. (S) | 6.500 | 03/15/21 | 750,000 | 783,750 |

| Mercer International, Inc. | 9.500 | 12/01/17 | 920,000 | 954,500 |

| NOVA Chemicals Corp. | 8.375 | 11/01/16 | 1,000,000 | 1,110,000 |

| Taseko Mines, Ltd. | 7.750 | 04/15/19 | 1,075,000 | 989,000 |

| Trinidad Drilling, Ltd. (S) | 7.875 | 01/15/19 | 904,000 | 958,240 |

| Cayman Islands 1.37% | 5,514,689 | |||

| DP World Sukuk, Ltd. | 6.250 | 07/02/17 | 290,000 | 299,425 |

| Dubai Holding Commercial Operations MTN, Ltd. (GBP) (D) | 6.000 | 02/01/17 | 350,000 | 430,194 |

| Dubai Holding Commercial Operations MTN, Ltd. (EUR) (D) | 4.750 | 01/30/14 | 50,000 | 57,960 |

| General Shopping Finance, Ltd. (S) | 10.000 | 11/09/15 | 398,000 | 402,194 |

| Grupo Aval Ltd. (S) | 5.250 | 02/01/17 | 200,000 | 202,077 |

See notes to financial statements

| 5 |

Global High Yield Fund

As of 1-31-12 (Unaudited)

| Maturity | Par value | |||

| Rate (%) | date | Value | ||

| Cayman Islands (continued) | ||||

| Gruposura Finance (S) | 5.700 | 05/18/21 | $401,000 | $411,025 |

| Hutchison Whampoa International, Ltd. (S) | 4.625 | 01/13/22 | 200,000 | 201,280 |

| IPIC GMTN, Ltd. (S) | 6.875 | 11/01/41 | 200,000 | 206,000 |

| IPIC GMTN, Ltd. (S) | 3.750 | 03/01/17 | 350,000 | 349,125 |

| Odebrecht Drilling Norbe VIII/IX, Ltd. (S) | 6.350 | 06/30/21 | 336,140 | 349,249 |

| Odebrecht Drilling Norbe VIII/IX, Ltd. | 6.350 | 06/30/21 | 196,000 | 203,644 |

| Odebrecht Finance, Ltd. | 7.000 | 04/21/20 | 101,000 | 109,333 |

| Offshore Group Investments, Ltd. | 11.500 | 08/01/15 | 1,103,000 | 1,221,573 |

| Pemex Finance, Ltd. | 9.150 | 11/15/18 | 520,000 | 638,744 |

| Petrobras International Finance Company | 5.375 | 01/27/21 | 64,000 | 67,116 |

| UPCB Finance V, Ltd. (S) | 7.250 | 11/15/21 | 350,000 | 365,750 |

| Chile 0.31% | 1,245,154 | |||

| Cencosud SA (S) | 5.500 | 01/20/21 | 200,000 | 210,932 |

| Corporacion Nacional del Cobre de Chile | 6.150 | 10/24/36 | 569,000 | 714,104 |

| Corporacion Nacional del Cobre de Chile (S) | 6.150 | 10/24/36 | 255,000 | 320,118 |

| China 0.24% | 950,738 | |||

| China Liansu Group Holdings, Ltd. (S) | 7.875 | 05/13/16 | 335,000 | 302,338 |

| Evergrande Real Estate Group, Ltd. | 13.000 | 01/27/15 | 102,000 | 93,840 |

| Kaisa Group Holdings, Ltd. | 13.500 | 04/28/15 | 100,000 | 93,500 |

| MIE Holdings Corp. (S) | 9.750 | 05/12/16 | 318,000 | 292,560 |

| West China Cement, Ltd. (S) | 7.500 | 01/25/16 | 200,000 | 168,500 |

| Cyprus 0.04% | 176,003 | |||

| Mriya Agro Holding PLC (S) | 10.950 | 03/30/16 | 200,000 | 176,003 |

| Dominican Republic 0.03% | 119,572 | |||

| Cap Cana SA (H) | 10.000 | 04/30/16 | 364,220 | 72,844 |

| Cap Cana SA, PIK | 10.000 | 04/30/16 | 311,518 | 46,728 |

| Germany 0.20% | 817,000 | |||

| Deutsche Bank AG/London (S) | 10.576 | 12/22/12 | 250,000 | 250,000 |

| Unitymedia Hessen GmbH & Company KG (S) | 8.125 | 12/01/17 | 525,000 | 567,000 |

| Hong Kong 0.18% | 713,542 | |||

| Central China Real Estate, Ltd. (S) | 12.250 | 10/20/15 | 104,000 | 100,360 |

| Mega Advance Investments, Ltd. (S) | 5.000 | 05/12/21 | 200,000 | 206,826 |

| PCCW-HKT Capital No. 4, Ltd. | 4.250 | 02/24/16 | 400,000 | 406,356 |

| India 0.03% | 140,151 | |||

| ICICI Bank, Ltd. (S) | 5.750 | 11/16/20 | 143,000 | 140,151 |

| Indonesia 0.06% | 224,618 | |||

| Adaro Indonesia PT | 7.625 | 10/22/19 | 201,000 | 224,618 |

| Ireland 1.21% | 4,856,672 | |||

| Alfa Bank OJSC (S) | 7.875 | 09/25/17 | 317,000 | 319,378 |

| Ardagh Packaging Finance PLC (EUR) (D) | 9.250 | 10/15/20 | 300,000 | 382,605 |

| Ardagh Packaging Finance PLC (S) | 9.125 | 10/15/20 | 1,200,000 | 1,224,000 |

| Metalloinvest Finance, Ltd. (S) | 6.500 | 07/21/16 | 574,000 | 547,453 |

| Nara Cable Funding, Ltd. (EUR) (D) | 8.875 | 12/01/18 | 100,000 | 120,668 |

| Nara Cable Funding, Ltd. (S) | 8.875 | 12/01/18 | 1,075,000 | 1,023,540 |

| Novatek Finance, Ltd. (S) | 6.604 | 02/03/21 | 558,000 | 585,203 |

| Ono Finance II PLC (S) | 10.875 | 07/15/19 | 335,000 | 299,825 |

| SCF Capital, Ltd. (S) | 5.375 | 10/27/17 | 400,000 | 354,000 |

See notes to financial statements

| 6 |

Global High Yield Fund

As of 1-31-12 (Unaudited)

| Maturity | Par value | |||

| Rate (%) | date | Value | ||

| Jamaica 0.20% | $820,440 | |||

| Digicel Group, Ltd. | 10.500 | 04/15/18 | $372,000 | 391,530 |

| Digicel Group, Ltd. (S) | 9.125 | 01/15/15 | 171,000 | 172,710 |

| Digicel, Ltd. | 8.250 | 09/01/17 | 244,000 | 256,200 |

| Jersey, C.I. 0.02% | 91,598 | |||

| Bank of India (P)(Q) | 6.994 | 03/29/49 | 102,000 | 91,598 |

| Kazakhstan 1.05% | 4,216,843 | |||

| BTA Bank JSC (10.750% to 01/01/2013, then 12.500%) (H) | 10.750 | 07/01/18 | 506,337 | 94,938 |

| BTA Bank JSC (10.750% to 01/01/2013, then 12.500%) | �� | |||

| (H)(S) | 10.750 | 07/01/18 | 534,480 | 100,215 |

| BTA Bank JSC (Recovery Units) (H)(S)(Z) | Zero | 06/30/20 | 860,400 | 43,020 |

| KazMunayGas National Company (S) | 9.125 | 07/02/18 | 131,000 | 158,353 |

| KazMunayGas National Company | 8.375 | 07/02/13 | 1,520,000 | 1,622,904 |

| KazMunayGas National Company | 7.000 | 05/05/20 | 850,000 | 932,960 |

| KazMunayGas National Company (S) | 7.000 | 05/05/20 | 325,000 | 356,720 |

| KazMunayGas National Company (S) | 6.375 | 04/09/21 | 433,000 | 455,733 |

| Zhaikmunai LLP (S) | 10.500 | 10/19/15 | 152,000 | 152,000 |

| Zhaikmunai LLP | 10.500 | 10/19/15 | 300,000 | 300,000 |

| Luxembourg 1.47% | 5,922,591 | |||

| ALROSA Finance SA | 7.750 | 11/03/20 | 200,000 | 206,750 |

| APERAM (S) | 7.750 | 04/01/18 | 550,000 | 470,250 |

| APERAM (S) | 7.375 | 04/01/16 | 350,000 | 306,250 |

| ARD Finance SA, PIK (S) | 11.125 | 06/01/18 | 344,383 | 303,057 |

| Cemex Espana Luxembourg | 9.250 | 05/12/20 | 280,000 | 235,200 |

| Cemex Espana Luxembourg (EUR) (D) | 8.875 | 05/12/17 | 51,000 | 52,701 |

| CHC Helicopter SA (S) | 9.250 | 10/15/20 | 900,000 | 884,250 |

| ConvaTec Healthcare E SA (S) | 10.500 | 12/15/18 | 775,000 | 756,594 |

| Evraz Group SA (S) | 6.750 | 04/27/18 | 279,000 | 262,958 |

| Intelsat Jackson Holdings SA | 11.250 | 06/15/16 | 650,000 | 689,000 |

| Intelsat Jackson Holdings SA | 8.500 | 11/01/19 | 250,000 | 270,625 |

| Vimpel Communications Via VIP Finance Ireland, Ltd. (S) | 7.748 | 02/02/21 | 274,000 | 264,410 |

| Wind Acquisition Holdings Finance SA, PIK (S) | 12.250 | 07/15/17 | 1,564,803 | 1,220,546 |

| Malaysia 1.39% | 5,563,323 | |||

| Petronas Capital, Ltd. | 7.875 | 05/22/22 | 3,729,000 | 5,069,997 |

| Petronas Capital, Ltd. | 5.250 | 08/12/19 | 232,000 | 261,860 |

| Petronas Global Sukuk, Ltd. (S) | 4.250 | 08/12/14 | 220,000 | 231,466 |

| Mexico 0.49% | 1,980,013 | |||

| America Movil SAB de CV | 2.375 | 09/08/16 | 400,000 | 405,267 |

| Axtel SAB de CV | 9.000 | 09/22/19 | 407,000 | 321,530 |

| Axtel SAB de CV (S) | 7.625 | 02/01/17 | 98,000 | 74,480 |

| Bank of New York Mellon SA Institucion de Banca Multiple | ||||

| (S) | 9.625 | 05/02/21 | 645,125 | 570,936 |

| Cemex SAB de CV | 9.000 | 01/11/18 | 170,000 | 147,900 |

| Cemex SAB de CV (S) | 5.579 | 09/30/15 | 296,000 | 245,680 |

| Grupo Bimbo SAB de CV (S) | 4.875 | 06/30/20 | 200,000 | 211,740 |

| Hipotecaria Su Casita SA de CV (S) | 7.500 | 06/29/18 | 8,266 | 2,480 |

| Netherlands 1.62% | 6,501,223 | |||

| BLT Finance BV | 7.500 | 05/15/14 | 102,000 | 27,540 |

| Indosat Palapa Company BV (S) | 7.375 | 07/29/20 | 136,000 | 152,320 |

| LyondellBasell Industries NV (S) | 6.000 | 11/15/21 | 960,000 | 1,044,000 |

| Metinvest BV (S) | 8.750 | 02/14/18 | 410,000 | 356,700 |

See notes to financial statements

| 7 |

Global High Yield Fund

As of 1-31-12 (Unaudited)

| Maturity | Par value | |||

| Rate (%) | date | Value | ||

| Netherlands (continued) | ||||

| Myriad International Holding BV | 6.375 | 07/28/17 | $490,000 | $534,100 |

| Myriad International Holding BV (S) | 6.375 | 07/28/17 | 304,000 | 331,360 |

| NXP BV (S) | 9.750 | 08/01/18 | 1,100,000 | 1,229,250 |

| Sensata Technologies BV (S) | 6.500 | 05/15/19 | 450,000 | 459,000 |

| UPC Holding BV (S) | 9.875 | 04/15/18 | 150,000 | 163,125 |

| UPC Holding BV (EUR) (D) | 9.750 | 04/15/18 | 550,000 | 751,802 |

| UPC Holding BV (EUR) (D) | 8.375 | 08/15/20 | 150,000 | 193,264 |

| VimpelCom Holdings BV | 6.255 | 03/01/17 | 380,000 | 368,144 |

| Ziggo Bond Company BV (EUR) (D) | 8.000 | 05/15/18 | 650,000 | 890,618 |

| Panama 0.05% | 197,250 | |||

| Banco de Credito del Peru (S) | 5.375 | 09/16/20 | 200,000 | 197,250 |

| Peru 0.08% | 333,059 | |||

| Inkia Energy, Ltd. (S) | 8.375 | 04/04/21 | 206,000 | 206,000 |

| Volcan Cia Minera SAA (S) | 5.375 | 02/02/22 | 126,000 | 127,059 |

| Singapore 0.09% | 356,343 | |||

| Axis Bank (P) | 7.125 | 06/28/22 | 101,000 | 90,963 |

| Bakrie Telecom Pte, Ltd. | 11.500 | 05/07/15 | 300,000 | 195,000 |

| STATS ChipPAC, Ltd. (S) | 5.375 | 03/31/16 | 69,000 | 70,380 |

| South Korea 0.18% | 732,604 | |||

| Export-Import Bank of Korea | 4.375 | 09/15/21 | 315,000 | 310,876 |

| Korea Gas Corp. (S) | 6.250 | 01/20/42 | 206,000 | 216,433 |

| Korea Hydro & Nuclear Power Co Ltd. | 4.750 | 07/13/21 | 200,000 | 205,295 |

| Spain 0.09% | 372,304 | |||