ITEM 1. REPORTS TO STOCKHOLDERS.

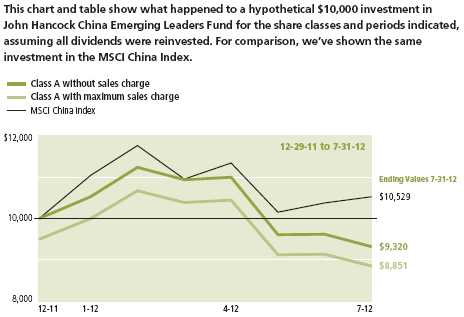

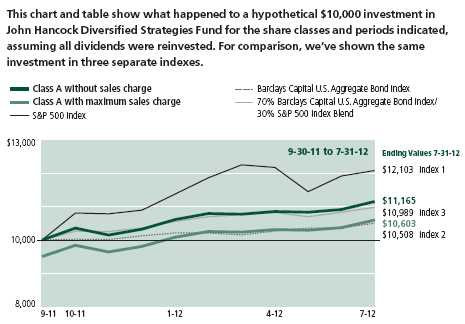

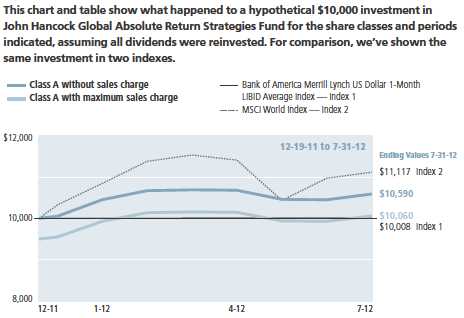

The Registrant prepared ten annual reports to shareholders for the year ended July 31, 2012 for series of John Hancock Funds II with July 31 fiscal year end. The first report applies to the Technical Opportunities Fund, the second report applies to the Global High Yield Fund, the third report applies to Multi Sector Bond Fund, the fourth report applies to Currency Strategies Fund, the fifth report applies Fundamental All Cap Core Fund, the sixth report applies to Fundamental Large Cap Core Fund, the seventh report applies to Fundamental Large Cap Value Fund, the eight report applies to the China Emerging Leaders Fund, the ninth report applies to the Diversified Strategies Fund and the tenth report applies to the global Absolute Return Strategy Fund. China Emerging Leaders Fund, Diversified Strategies Fund, and Global Absolute Return Strategy Fund began operations during the fiscal year ended July 31, 2012.

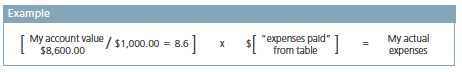

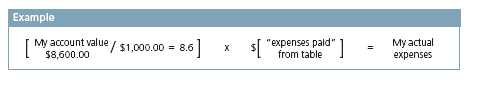

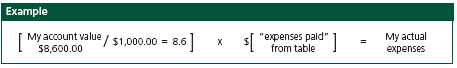

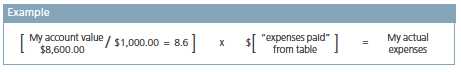

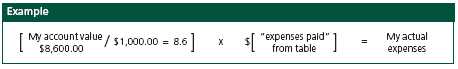

We are going to present only your ongoing operating expenses here.

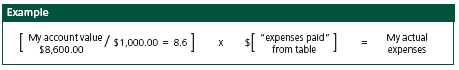

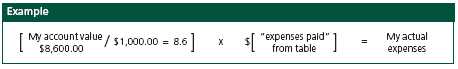

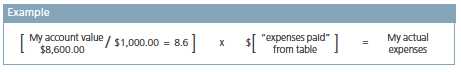

This example is intended to provide information about the Fund’s actual ongoing operating expenses, and is based on the Fund’s actual return. It assumes an account value of $1,000.00 on February 1, 2012 with the same investment held until July 31, 2012.

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at July 31, 2012, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

IO Interest Only Security – Interest Tranche of Stripped Mortgage Pool. Rate shown is the annualized yield at the end of the period.

(C) Security purchased on a when-issued or delayed delivery.

(D) Par value of foreign bonds is expressed in local currency as shown parenthetically in security description.

(H) Non-income producing - Issuer is in default.

(I) Non-income producing security.

(K) Underlying issuer is shown parenthetically in security description.

(M) Term loans are variable rate obligations. The coupon rate shown represents the rate at period end.

(P) Variable rate obligation. The coupon rate shown represents the rate at period end.

(Q) Perpetual bonds have no stated maturity date. Date shown is next call date.

(S) These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration. Rule 144A securities amounted to $184,411,111 or 17.2% of the Fund's net assets as of 7-31-12.

(T) A portion of this position represents unsettled loan commitment at period end where the coupon rate will be determined at time of settlement.

(Y) The rate shown is the annualized seven-day yield as of 7-31-12.

(Z) Zero coupon bonds are issued at a discount from their principal amount in lieu of paying interest periodically.

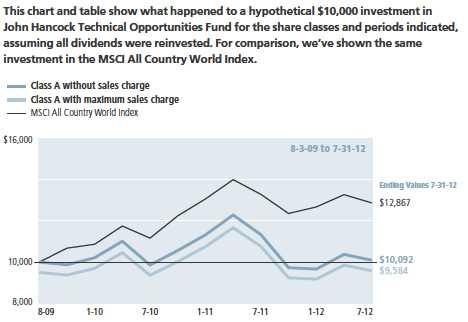

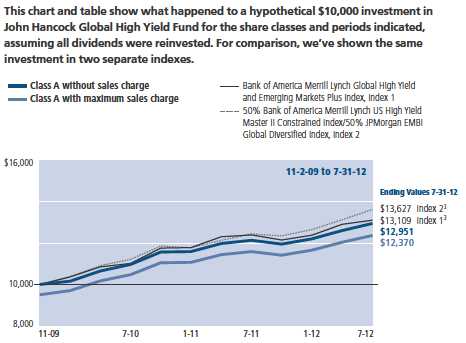

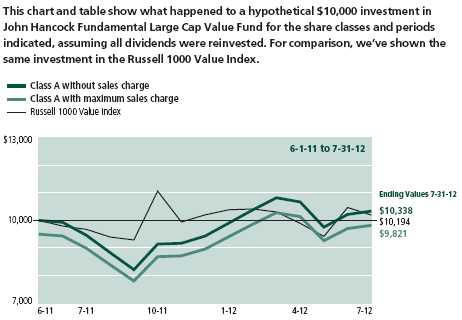

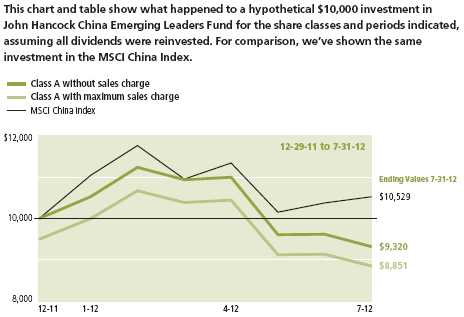

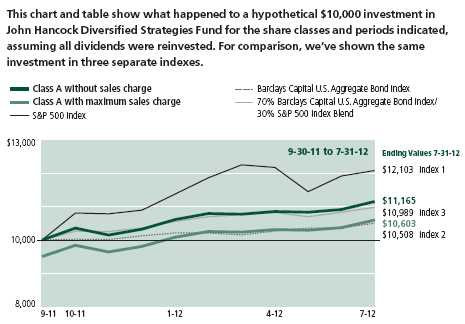

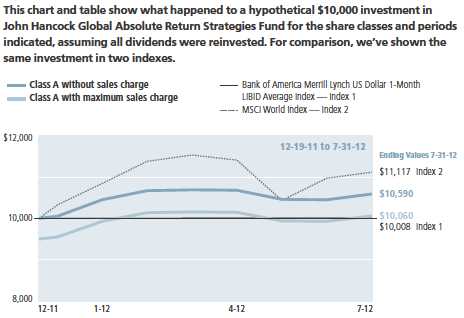

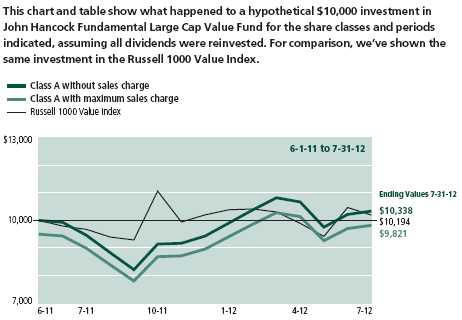

It is not possible to invest directly in an index. Index figures do not reflect expenses, which would have resulted in lower values if they did.

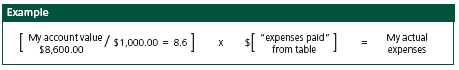

We are going to present only your ongoing operating expenses here.

This example is intended to provide information about the Fund’s actual ongoing operating expenses, and is based on the Fund’s actual return. It assumes an account value of $1,000.00 on February 1, 2012 with the same investment held until July 31, 2012.

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at July 31, 2012, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Financial statements

Statement of assets and liabilities 7-31-12

This Statement of assets and liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum offering price per share.

| |

| Assets | |

|

| Investments, at value (Cost $4,698,396) | $4,757,645 |

| Cash | 149,863 |

| Dividends receivable | 2,359 |

| Receivable due from adviser | 900 |

| Other receivables and prepaid expenses | 16,858 |

| | |

| Total assets | 4,927,625 |

| |

| Liabilities | |

|

| Payable to affiliates | |

| Accounting and legal services fees | 12 |

| Transfer agent fees | 1,281 |

| Trustees’ fees | 5 |

| Other liabilities and accrued expenses | 101,667 |

| | |

| Total liabilities | 102,965 |

| |

| Net assets | |

|

| Paid-in capital | $4,813,275 |

| Undistributed net investment income | 2,274 |

| Accumulated net realized gain (loss) on investments and foreign | |

| currency transactions | (50,138) |

| Net unrealized appreciation (depreciation) on investments | 59,249 |

| | |

| Net assets | $4,824,660 |

| |

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($3,772,561 ÷ 378,925 shares) | $9.96 |

| Class I ($1,052,099 ÷ 105,363 shares) | $9.99 |

| |

| Maximum offering price per share | |

|

| Class A (net asset value per share ÷ 95%)1 | $10.48 |

1 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

| |

| See notes to financial statements | Annual report | Fundamental All Cap Core Fund 15 |

F I N A N C I A L S T A T E M E N T S

Statement of operations For the year ended 7-31-12

This Statement of operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Dividends | $56,870 |

| Less foreign taxes withheld | (47) |

| |

| Total investment income | 56,823 |

| |

| Expenses | |

|

| Investment management fees | 24,658 |

| Distribution and service fees | 7,953 |

| Accounting and legal services fees | 484 |

| Transfer agent fees | 6,571 |

| Trustees’ fees | 29 |

| State registration fees | 55,504 |

| Printing and postage | 3,514 |

| Professional fees | 43,019 |

| Custodian fees | 12,028 |

| Registration and filing fees | 57,651 |

| Other | 7,650 |

| | |

| Total expenses | 219,061 |

|

| Less expense reductions | (176,180) |

| | |

| Net expenses | 42,881 |

| | |

| Net investment income | 13,942 |

| |

| Realized and unrealized gain (loss) | |

|

| Net realized gain (loss) on | |

| Investments | (48,230) |

| Foreign currency transactions | 12 |

| | (48,218) |

| Change in net unrealized appreciation (depreciation) of | |

| Investments | 157,874 |

| | |

| Net realized and unrealized gain | 109,656 |

| | |

| Increase in net assets from operations | $123,598 |

| | |

| 16 Fundamental All Cap Core Fund | Annual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T S

Statements of changes in net assets

These Statements of changes in net assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | |

| | Year | Period |

| | ended | ended |

| | 7-31-12 | 7-31-111 |

| |

| Increase (decrease) in net assets | | |

|

| From operations | | |

| Net investment income (loss) | $13,942 | ($821) |

| Net realized gain (loss) | (48,218) | 14,007 |

| Change in net unrealized appreciation (depreciation) | 157,874 | (98,625) |

| | | |

| Increase (decrease) in net assets resulting from operations | 123,598 | (85,439) |

| | | |

| Distributions to shareholders | | |

| From net investment income | | |

| Class A | (5,690) | — |

| Class I | (5,560) | — |

| From net realized gain | | |

| Class A | (11,479) | — |

| Class I | (5,456) | — |

| | | |

| Total distributions | (28,185) | — |

| | | |

| From Fund share transactions | 1,550,539 | 3,264,147 |

| | | |

| Total increase | 1,645,952 | 3,178,708 |

| |

| Net assets | | |

|

| Beginning of period | 3,178,708 | — |

| | | |

| End of period | $4,824,660 | $3,178,708 |

| | | |

| Undistributed net investment income | $2,274 | $124 |

1 Period from 6-1-11 (commencement of operations) to 7-31-11.

| | |

| See notes to financial statements | Annual report | Fundamental All Cap Core Fund 17 |

Financial highlights

The Financial highlights show how the Fund’s net asset value for a share has changed since the end of the previous period.

| | |

| CLASS A SHARES Period ended | 7-31-12 | 7-31-111 |

| | | |

| Per share operating performance | | |

|

| Net asset value, beginning of period | $9.73 | $10.00 |

| Net investment income (loss)2 | 0.02 | (0.01) |

| Net realized and unrealized gain (loss) on investments | 0.28 | (0.26) |

| Total from investment operations | 0.30 | (0.27) |

| Less distributions | | |

| From net investment income | (0.02) | — |

| From net realized gain | (0.05) | — |

| Total distributions | (0.07) | — |

| Net asset value, end of period | $9.96 | $9.73 |

| Total return (%)3,4 | 3.15 | (2.70)5 |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period (in millions) | $4 | $2 |

| Ratios (as a percentage of average net assets): | | |

| Expenses before reductions and amounts recaptured | 5.62 | 5.776 |

| Expenses including reductions and amounts recaptured | 1.30 | 1.306 |

| Net investment income (loss) | 0.24 | (0.33)6 |

| Portfolio turnover (%) | 47 | 8 |

| |

1 Period from 6-1-11 (commencement of operations) to 7-31-11.

2 Based on the average daily shares outstanding.

3 Does not reflect the effect of sales charges, if any.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Annualized.

| | |

| 18 Fundamental All Cap Core Fund | Annual report | See notes to financial statements |

| | |

| CLASS I SHARES Period ended | 7-31-12 | 7-31-111 |

| |

| Per share operating performance | | |

|

| Net asset value, beginning of period | $9.74 | $10.00 |

| Net investment income2 | 0.07 | —3 |

| Net realized and unrealized gain (loss) on investments | 0.28 | (0.26) |

| Total from investment operations | 0.35 | (0.26) |

| Less distributions | | |

| From net investment income | (0.05) | — |

| From net realized gain | (0.05) | — |

| Total distributions | (0.10) | — |

| Net asset value, end of period | $9.99 | $9.74 |

| Total return (%)4 | 3.63 | (2.60)5 |

| |

| Ratios and supplemental data | | |

|

| Net assets, end of period (in millions) | $1 | $1 |

| Ratios (as a percentage of average net assets): | | |

| Expenses before reductions and amounts recaptured | 7.00 | 5.456 |

| Expenses including reductions and amounts recaptured | 0.84 | 0.846 |

| Net investment income | 0.75 | 0.146 |

| Portfolio turnover (%) | 47 | 8 |

| |

1 Period from 6-1-11 (commencement of operations) to 7-31-11.

2 Based on the average daily shares outstanding.

3 Less than $0.005 per share.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Annualized.

| | |

| See notes to financial statements | Annual report | Fundamental All Cap Core Fund 19 |

Notes to financial statements

Note 1 — Organization

John Hancock Fundamental All Cap Core Fund (the Fund) is a series of John Hancock Funds II (the Trust), an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the Fund is to seek long-term capital appreciation.

The Fund may offer multiple classes of shares. The shares currently offered are detailed in the Statement of assets and liabilities. Class A shares are offered to all investors. Class I shares are offered to institutions and certain investors. Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees, if any, transfer agent fees, printing and postage and state registration fees for each class may differ.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. In order to value the securities, the Fund uses the following valuation techniques: Equity securities held by the Fund are valued at the last sale price or official closing price on the principal securities exchange on which they trade. In the event there were no sales during the day or closing prices are not available, then securities are valued using the last quoted bid or evaluated price. Certain securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Other portfolio securities and assets, where market quotations are not readily available, are valued at fair value, as determined in good faith by the Fund’s Pricing Committee, following procedures established by the Board of Trustees.

The Fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities. Level 2 includes securities valued using significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the Fund’s own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy.

| |

| 20 Fundamental All Cap Core Fund | Annual report |

The following is a summary of the values by input classification of the Fund’s investments as of July 31, 2012, by major security category or type:

| | | | |

| | | | | LEVEL 3 |

| | | | LEVEL 2 | SIGNIFICANT |

| | TOTAL MARKET | LEVEL 1 | SIGNIFICANT | UNOBSERVABLE |

| | VALUE AT 7-31-12 | QUOTED PRICE | OBSERVABLE INPUTS | INPUTS |

|

| Common Stocks | | | | |

| Consumer Discretionary | $887,868 | $887,868 | — | — |

| Consumer Staples | 241,358 | 114,870 | $126,488 | — |

| Energy | 422,417 | 422,417 | — | — |

| Financials | 935,492 | 935,492 | — | — |

| Health Care | 275,840 | 275,840 | — | — |

| Industrials | 498,636 | 498,636 | — | — |

| Information Technology | 1,414,800 | 1,414,800 | — | — |

| Materials | 81,234 | 81,234 | — | — |

| |

|

| Total Investments in | | | | |

| Securities | $4,757,645 | $4,631,157 | $126,488 | — |

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Dividend income is recorded on the ex-date. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation.

Line of credit. The Fund may borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the custodian agreement, the custodian may loan money to the Fund to make properly authorized payments. The Fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian may have a lien, security interest or security entitlement in any Fund property that is not otherwise segregated or pledged, to the maximum extent permitted by law, to the extent of any overdraft.

In addition, the Fund and other affiliated funds have entered into an agreement with Citibank N.A. which enables them to participate in a $200 million unsecured committed line of credit. A commitment fee, payable at the end of each calendar quarter, based on the average daily unused portion of the line of credit, is charged to each participating fund on a pro rata basis and is reflected in other expenses on the Statement of operations. For the year ended July 31, 2012, the Fund had no borrowings under the line of credit.

Expenses. Within the John Hancock Funds complex, expenses that are directly attributable to an individual fund are allocated to such fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund’s relative net assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations. Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the net assets of the class. Class-specific expenses, such as distribution and service fees, if any, transfer agent fees, state registration fees and printing and postage, for all classes, are calculated daily at the class level based on the appropriate net assets of each class and the specific expense rates applicable to each class.

| |

| Annual report | Fundamental All Cap Core Fund 21 |

Federal income taxes. The Fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

Under the Regulated Investment Company Modernization Act of 2010, the Fund is permitted to carry forward capital losses for an unlimited period. Capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

For federal income tax purposes, as of July 31, 2012, the Fund had $3,924 of long-term capital loss carryforward available to offset future net realized capital gains.

As of July 31, 2012, the Fund had no uncertain tax positions that would require financial statement recognition, derecognition or disclosure. The Fund’s federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The Fund generally declares and pays dividends and capital gain distributions, if any, annually.

The tax character of distributions for the year ended July 31, 2012 was $28,185 of ordinary income.

Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and in the same amount, except for the effect of class level expenses that may be applied differently to each class. As of July 31, 2012, the components of distributable earnings on a tax basis included $2,274 of undistributed ordinary income.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Material distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. Book-tax differences are primarily attributable to wash sale loss deferrals.

Note 3 — Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss from such claims is considered remote.

Note 4 — Fees and transactions with affiliates

John Hancock Investment Management Services, LLC (the Adviser) serves as investment adviser for the Fund. John Hancock Funds, LLC (the Distributor), an affiliate of the Adviser, serves as principal underwriter of the Fund. The Adviser and the Distributor are indirect wholly owned subsidiaries of Manulife Financial Corporation (MFC).

| |

| 22 Fundamental All Cap Core Fund | Annual report |

Management fee. The Fund has an investment management agreement with the Adviser under which the Fund pays a daily management fee to the Adviser equivalent, on an annual basis, to the sum of: a) 0.675% of the first $2,500,000,000 of the Fund’s aggregate average daily net assets together with the assets of Fundamental All Cap Core Trust, a series of John Hancock Variable Insurance Trust (combined aggregate average daily net assets); and b) 0.650% of the combined aggregate average daily net assets in excess of $2,500,000,000. Prior to September 26, 2011, the Fund paid a daily management fee to the Adviser equivalent, on an annual basis, to the sum of a) 0.675% of the first $2,500,000,000 of the Fund’s average daily net assets; and b) 0.650% of the Fund’s average daily net assets in excess of $2,500,000,000. The Adviser has a subadvisory agreement with John Hancock Asset Management a division of Manulife Asset Management (US) LLC, an indirectly owned subsidiary of MFC and an affiliate of the Adviser. The Fund is not responsible for payment of the subadvisory fees.

The Adviser has contractually agreed to waive a portion of its management fee for certain funds (the Participating Portfolios) of the Trust and John Hancock Variable Insurance Trust. The waiver equals, on an annualized basis, 0.01% of that portion of the aggregate net assets of all the Participating Funds that exceeds $75 billion but is less than $100 billion; and 0.015% of that portion of the aggregate net assets of all the Participating Portfolios that equals or exceeds $100 billion. The amount of the reimbursement is calculated daily and allocated among all the Participating Portfolios in proportion to the daily net assets of each fund. This arrangement may be amended or terminated at any time by the Adviser upon notice to the funds and with the approval of the Board of Trustees.

The Adviser has contractually agreed to waive all or a portion of its management fee and reimburse or pay operating expenses of the Fund to the extent necessary to maintain the Fund’s total operating expenses at 1.30% and 0.84% for Class A and Class I shares, excluding certain expenses such as taxes, brokerage commissions, interest expense, litigation and indemnification expenses and other extraordinary expenses. The current expense limitation agreement expires on December 31, 2012, unless renewed by mutual agreement of the Fund and the Adviser based upon a determination that this is appropriate under the circumstances at the time.

Additionally, the Adviser has voluntarily agreed to waive other Fund level expenses excluding advisory fees, 12b-1 fees, service fees, transfer agent fees, blue sky fees, taxes, printing and postage, brokerage commissions, interest expenses, acquired fund fees, litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of business. The waivers are such that these expenses will not exceed 0.20% of average net assets. This voluntary expense reimbursement may be terminated at any time by the Adviser on notice to the Fund.

Accordingly, these expense reductions described above amounted to $114,490 and $61,690 for Class A and Class I shares, respectively, for the year ended July 31, 2012.

The investment management fees, including the input of the waivers and reimbursements described above, incurred for the year ended July 31, 2012 were equivalent to a net effective rate of 0.00% the Fund’s average daily net assets.

Expense recapture. The Adviser may recapture operating expenses reimbursed or fees waived under previous expense limitation or waiver arrangements for a period of three years following the beginning of the month in which such reimbursements or waivers originally occurred to the extent that the Fund is below its expense limitation during this period. The table below outlines the amounts recovered during the year ended July 31, 2012, and the amount of waived or reimbursed expenses subject to potential recovery and the respective expiration dates. Certain reimbursements or waivers are not subject to recapture.

| |

| Annual report | Fundamental All Cap Core Fund 23 |

| | | | |

| | AMOUNTS | AMOUNTS | AMOUNTS | AMOUNTS |

| | ELIGIBLE FOR | ELIGIBLE FOR | ELIGIBLE FOR | ELIGIBLE FOR |

| | RECOVERY | RECOVERY | RECOVERY | RECOVERY |

| | THROUGH | THROUGH | THROUGH | THROUGH |

| FUND | JULY 1, 2013 | JULY 1, 2014 | JULY 1, 2015 | JULY 31, 2012 |

|

| Fundamental All Cap Core | — | $22,975 | $176,057 | — |

Accounting and legal services. Pursuant to a service agreement, the Fund reimburses the Adviser for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services to the Fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports, among other services. These expenses are allocated to each share class based on its relative net assets at the time the expense was incurred. These accounting and legal services fees incurred for the year ended July 31, 2012 amounted to an annual rate of 0.01% of the Fund’s average daily net assets.

Distribution and service plans. The Fund has a distribution agreement with the Distributor. The Fund has adopted distribution and service plans with respect to Class A shares pursuant to Rule 12b-1 under the 1940 Act, to pay the Distributor for services provided as the distributor of shares of the Fund. The Fund pays 0.30% for Class A shares for distribution and service fees under these arrangements, expressed as an annual percentage of average daily net assets for each class of the Fund’s shares.

Sales charges. Class A shares are assessed up-front sales charges, which resulted in payments to the Distributor amounting to $5,431 for the year ended July 31, 2012. Of this amount, $855 was retained and used for printing prospectuses, advertising, sales literature and other purposes and $4,576 was paid as sales commissions to broker-dealers.

Transfer agent fees. The Fund has a transfer agent agreement with John Hancock Signature Services, Inc. (Signature Services), an affiliate of the Adviser. The transfer agent fees paid to Signature Services are determined based on the cost to Signature Services (Signature Services Cost) of providing recordkeeping services. The Signature Services Cost includes a component of allocated John Hancock corporate overhead for providing transfer agent services to the Fund and to all other John Hancock affiliated funds. It also includes out-of-pocket expenses that are comprised of payments made to third-parties for recordkeeping services provided to their clients who invest in one or more John Hancock funds. In addition, Signature Services Cost may be reduced by certain fees that Signature Services receives in connection with retirement and small accounts. Signature Services Cost is calculated monthly and allocated, as applicable, to four categories of share classes: Institutional Share Classes, Retirement Share Classes, Municipal Bond Classes and all other Retail Share Classes. Within each of these categories, the applicable costs are allocated to the affected John Hancock affiliated funds and/or classes, based on the relative average daily net assets.

Class level expenses. Class level expenses for the year ended July 31, 2012 were:

| | | | |

| | DISTRIBUTION | TRANSFER | STATE | PRINTING AND |

| CLASS | AND SERVICE FEES | AGENT FEES | REGISTRATION FEES | POSTAGE FEES |

|

| A | $7,953 | $5,411 | $27,752 | $2,231 |

| I | — | 1,160 | 27,752 | 1,283 |

| Total | $7,953 | $6,571 | $55,504 | $3,514 |

Trustee expenses. The Fund compensates each Trustee who is not an employee of the Adviser or its affiliates. The costs of paying Trustee compensation and expenses are allocated to the Fund based on its average daily net assets.

| |

| 24 Fundamental All Cap Core Fund | Annual report |

Note 5 — Fund share transactions

Transactions in Fund shares for the year ended July 31, 2012 and for the period ended July 31, 2011 were as follows:

| | | | |

| | Year ended 7-31-12 | Period ended 7-31-111 |

| | Shares | Amount | Shares | Amount |

| Class A shares | | | | |

|

| Sold | 199,274 | $1,931,654 | 210,437 | $2,101,647 |

| Distributions reinvested | 416 | 3,789 | — | — |

| Repurchased | (31,202) | (299,324) | — | — |

| | | | | |

| Net increase | 168,488 | $1,636,119 | 210,437 | $2,101,647 |

| |

| Class I shares | | | | |

|

| Sold | 25,743 | $266,173 | 116,250 | $1,162,500 |

| Distributions reinvested | 1,106 | 10,068 | — | — |

| Repurchased | (37,736) | (361,821) | — | — |

| | | | | |

| Net increase (decrease) | (10,887) | ($85,580) | 116,250 | $1,162,500 |

| |

| Net increase | 157,601 | $1,550,539 | 326,687 | $3,264,147 |

|

1 Period from 6-1-11 (commencement of operations) to 7-31-11.

Affiliates of the Fund owned 53% and 100% of shares of beneficial interest of Class A and Class I shares on July 31, 2012.

Note 6 — Purchase and sale of securities

Purchases and sales of securities, other than short-term securities, aggregated $3,325,113 and $1,723,293, respectively, for the year ended July 31, 2012.

| |

| Annual report | Fundamental All Cap Core Fund 25 |

Auditor’s report

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of John Hancock Funds II and Shareholders of

John Hancock Fundamental All Cap Core Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of John Hancock Fundamental All Cap Core Fund (the “Fund”) at July 31, 2012, and the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at July 31, 2012 by correspondence with the custodian, and the application of alternative auditing procedures where securities purchased confirmations had not been received, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

September 24, 2012

| |

| 26 Fundamental All Cap Core Fund | Annual report |

Tax information

Unaudited

For federal income tax purposes, the following information is furnished with respect to the distributions of the Fund, if any, paid during its taxable year ended July 31, 2012.

The Fund reports the maximum amount allowable of its net taxable income as eligible for the corporate dividends-received deduction.

The Fund reports the maximum amount allowable of its net taxable income as qualified dividend income as provided in the Jobs and Growth Tax Relief Reconciliation Act of 2003.

Eligible shareholders will be mailed a 2012 Form 1099-DIV in early 2013. This will reflect the tax character of all distributions paid in calendar year 2012.

| |

| Annual report | Fundamental All Cap Core Fund 27 |

Evaluation of Advisory and Subadvisory Agreements by the Board of Trustees

This section describes the evaluation by the Board of Trustees (the Board) of the Advisory Agreement (the Advisory Agreement) and each of the Subadvisory Agreements and the Sub-Subadvisory Agreements (collectively, the Subadvisory Agreements) for each of the portfolios (the Funds) of John Hancock Funds II (the Trust) discussed in this report.

At in-person meetings held on May 24–25, 2012, the Board, including all of the Trustees who are not considered to be “interested persons” of the Trust under the Investment Company Act of 1940, as amended (the 1940 Act) (the Independent Trustees), approved for an annual period the continuation of the Advisory and Subadvisory Agreements with respect to each of the Funds.

Evaluation by the Board of Trustees

The Board, including the Independent Trustees, is responsible for selecting the Trust’s adviser, John Hancock Investment Management Services, LLC (the Adviser or JHIMS), approving the Adviser’s selection of subadvisers for each of the Funds (each a Subadviser, and collectively, the Subadvisers) and approving the Trust’s advisory and subadvisory (and any sub-subadvisory) agreements, their periodic continuation and any amendments. Consistent with Securities and Exchange Commission rules, the Board regularly evaluates the Trust’s advisory and subadvisory arrangements, including consideration of the factors listed below. The Board may also consider other factors (including conditions and trends prevailing generally in the economy, the securities markets and the industry) and does not treat any single factor as determinative, and each Trustee may attribute different weights to different factors. The Board is furnished with an analysis of its fiduciary obligations in connection with its evaluation and, throughout the evaluation process, the Board is assisted by counsel for the Trust and the Independent Trustees are also separately assisted by independent legal counsel. The factors considered by the Board are:

1. the nature, extent and quality of the services to be provided by the Adviser to the Trust and by the Subadvisers to the Funds;

2. the investment performance of the Funds and their Subadvisers;

3. the extent to which economies of scale would be realized as a Fund grows and whether fee levels reflect these economies of scale for the benefit of Fund shareholders;

4. the costs of the services to be provided and the profits to be realized by the Adviser and its affiliates (including any subadvisers that are affiliated with the Adviser) from the Adviser’s relationship with the Trust; and

5. comparative services rendered and comparative advisory and subadvisory fee rates.

The Board believes that information relating to all of these factors is relevant to its evaluation of the Trust’s advisory agreement. The Board also takes into account any indirect benefits expected to be derived by the Adviser and its affiliates and the Subadvisers and their affiliates from their relationships with the Funds. With respect to its evaluation of subadvisory agreements (including any sub-subadvisory agreements) with subadvisers not affiliated with the Adviser, the Board believes that, in view of the Trust’s “manager-of-managers” advisory structure, the costs of the services to be provided and the profits to be realized by those subadvisers that are not affiliated with the Adviser from their relationship with the Trust generally are not a material factor in the Board’s consideration of these subadvisory agreements because such fees are paid by the Adviser and not by the Funds and the Board relies on the ability of the Adviser to negotiate the subadvisory fees at arm’s length.

| |

| 28 Fundamental All Cap Core Fund | Annual report |

In evaluating subadvisory arrangements, the Board also considers other material business relationships that unaffiliated Subadvisers and their affiliates have with the Adviser or its affiliates, including the involvement by certain affiliates of certain Subadvisers in the distribution of financial products, including shares of the Trust, offered by the Adviser and other affiliates of the Adviser (Material Relationships).

Approval of Advisory and Subadvisory Agreements

At in-person meetings held on May 24–25, 2012, the Board, including all of the Independent Trustees, re-approved the Advisory Agreement and the applicable Subadvisory Agreements with respect to each of the Funds.

In considering the Advisory Agreement and the Subadvisory Agreements, the Board received in advance of the meeting a variety of materials relating to each Fund, the Adviser and each Subadviser, including comparative performance, fee and expense information for a peer group of similar mutual funds prepared by an independent third party provider of mutual fund data, including performance information for relevant benchmark indices and other information provided by the Adviser and the Subadvisers regarding the nature, extent and quality of services provided by the Adviser and the Subadvisers under their respective Agreements. The Board also took into account discussions with management and information provided to the Board in its meetings throughout the year with respect to the services provided by the Adviser and the Subadvisers to the Funds, including quarterly performance reports prepared by management containing reviews of investment results, and periodic presentations from the Subadvisers with respect to the Funds they manage. The Board noted the affiliation of certain of the Subadvisers with JHIMS, noting any potential conflicts of interest.

Throughout the process, the Trustees were afforded the opportunity to ask questions of and request additional information from management. The Independent Trustees also received a memorandum from their independent counsel discussing the legal standards for their consideration of the proposed continuation of the Agreements and discussed the proposed continuation of the Agreements in private sessions with their independent legal counsel at which no representatives of management were present.

Approval of Advisory Agreement

Among the information received by the Board from the Adviser relating to the nature, extent and quality of services provided to the Funds, the Board reviewed information provided by JHIMS relating to its operations and personnel and information regarding JHIMS’s compliance and regulatory history. The Board also noted that on a regular basis it receives and reviews information from the Trust’s Chief Compliance Officer (CCO) regarding the Funds’ compliance policies and procedures established pursuant to Rule 38a-1 under the 1940 Act. The Board also considers the Adviser’s risk management processes. The Board considered that JHIMS is responsible for the management of the day-to-day operations of the Funds, including but not limited to, general supervision of and coordination of the services provided by the Subadvisers, and is also responsible for monitoring and reviewing the activities of the Subadvisers and other third-party service providers.

In considering the nature, extent and quality of the services provided by the Adviser, the Trustees also took into account their knowledge of JHIMS’ management and the quality of the performance of its duties, through Board meetings, discussions and reports during the preceding year and through each Trustee’s experience as a Trustee of the Trust and of another trust in the complex.

| |

| Annual report | Fundamental All Cap Core Fund 29 |

In approving the renewal of the Advisory Agreement, and with reference to the factors that it regularly considers when considering approval of advisory and subadvisory agreements as listed above, the Board:

(1) — (a) considered the high value to the Trust of continuing its relationship with JHIMS as the Trust’s adviser, the skills and competency with which JHIMS has in the past managed the Trust’s affairs and its subadvisory relationships, JHIMS’s oversight and monitoring of the Subadvisers’ investment performance and compliance programs including its timeliness in responding to performance issues and the qualifications of JHIMS’s personnel;

(b) considered JHIMS’s compliance policies and procedures and noted its responsiveness to regulatory changes and mutual fund industry developments;

(c) considered JHIMS’s administrative capabilities, including its ability to supervise the other service providers for the Funds;

(d) considered the financial condition of JHIMS and whether it had the financial wherewithal to provide a high level and quality of services to the Funds; and

(e) recognized JHIMS’s reputation and experience in serving as an investment adviser to the Trust, and considered the benefit to shareholders of investing in funds that are part of a family of funds offering a variety of investments.

The Board concluded that JHIMS may reasonably be expected to continue to provide a high quality of services under the Advisory Agreement with respect to the Funds;

(2) — (a) reviewed the investment performance of each of the Funds;

(b) reviewed the comparative performance of their respective benchmarks;

(c) considered the performance of comparable funds as included in a report prepared by an independent third party provider of mutual fund data (i.e., funds underlying variable insurance products having approximately the same investment classification/objective), if any. Such report included each Fund’s ranking within a smaller group of peer funds and the Fund’s ranking within broader groups of funds, as well as a description of the methodology used to determine the similarity of each Fund with the funds included in each group; and

(d) took into account JHIMS’s analysis of each Fund’s performance and its plans and recommendations regarding the Trust’s subadvisory arrangements generally and with respect to particular Funds.

The Board concluded that the performance of each of the Funds has generally been in-line with or generally outperformed the historical performance of comparable funds and the Fund’s respective benchmarks with the exceptions noted in Appendix A and in such cases, that appropriate action is being taken to address performance, if necessary, or that such performance is reasonable in light of all factors considered, and that JHIMS may reasonably be expected to continue ably to monitor the performance of the Funds and each of their Subadvisers;

(3) — (a) with respect to each Fund (except those listed below), considered that the Adviser has agreed to waive its management fee for each of these Funds and each of the funds of John Hancock Variable Insurance Trust (except those listed below) (the Participating Portfolios) or otherwise reimburse the expenses of the Participating Portfolios as follows (the Reimbursement) and that, at the request of the Board, the Reimbursement rate was

| |

| 30 Fundamental All Cap Core Fund | Annual report |

increased effective May 31, 2011. The current Reimbursement rate is as follows: The Reimbursement shall equal, on an annualized basis, 0.01% of that portion of the aggregate net assets of all the Participating Portfolios that exceed $75 billion but is less than $100 billion and 0.015% of that portion of the aggregate net assets of all the Participating Portfolios that equals or exceeds $100 billion. The amount of the Reimbursement shall be calculated daily and allocated among all the Participating Portfolios in proportion to the daily net assets of each Participating Portfolio, and that Reimbursement may be terminated or modified by the Adviser only upon notice to the Trust and approval of the Board of Trustees of the Trust. (The Funds that are not Participating Portfolios as of the date of this annual report are each of the funds of funds, money market funds and index funds of the Trust and John Hancock Variable Insurance Trust.)

(b) reviewed the Trust’s advisory fee structure and the incorporation therein of any subadvisory fee breakpoints in the advisory fees charged and concluded that (i) most of the Funds contain breakpoints at the subadvisory fee level and that such breakpoints are reflected as breakpoints in the advisory fees for Funds and (ii) although economies of scale cannot be measured with precision, these arrangements permit shareholders of Funds with advisory fee breakpoints to benefit from economies of scale if those Funds grow. The Board also took into account management’s discussion of the Funds’ advisory fee structure, including with respect to those Funds that did not currently have breakpoints, and also noted that management had agreed to add breakpoints or implement additional breakpoints to the advisory fee structure of certain of the Funds; and

(c) The Board also considered the effect of the Funds’ growth in size on their performances and fees.

The Board also noted that if the Funds’ assets increase over time, the Funds may realize other economies of scale if assets increase proportionally more than certain other fixed expenses;

(4) — (a) reviewed the financial statements of JHIMS and considered an analysis presented by JHIMS regarding the net profitability to JHIMS and Manulife Financial Corporation, the Adviser’s parent, of each Fund;

(b) reviewed and considered an analysis presented by JHIMS regarding the profitability of JHIMS’s relationship with each Fund and whether JHIMS has the financial ability to continue to provide a high level of services to the Fund;

(c) considered that JHIMS also provides administrative services to the Funds on a cost basis pursuant to an administrative services agreement and took into account information prepared by JHIMS indicating the allocation of such costs;

(d) noted that certain of the Funds’ Subadvisers are affiliates of the Adviser;

(e) noted that John Hancock Signature Services, LLC and John Hancock Funds, LLC, affiliates of the Adviser, provide transfer agency services and distribution services to the Funds, respectively, and that JHIMS also derives reputational and other indirect benefits from providing advisory services to the Funds;

(f) noted that the subadvisory fees for the Funds are paid by JHIMS and are negotiated at arm’s length with respect to the unaffiliated Subadvisers; and

(g) considered that the Adviser should be entitled to earn a reasonable level of profits in exchange for the level of services it provides to each Fund and the entrepreneurial risk that it assumes as Adviser.

| |

| Annual report | Fundamental All Cap Core Fund 31 |

Based upon its review, the Board concluded that the Adviser and its affiliates’ level of profitability, if any, from their relationship with each Fund was reasonable and not excessive; and

(5) reviewed comparative information prepared by an independent third party provider of mutual fund data including, among other data, each Fund’s contractual and actual advisory and subadvisory fees and total expenses as compared to similarly situated investment companies underlying variable insurance products deemed to be comparable to the Funds. The Board considered each Fund’s ranking within a smaller group of peer funds chosen by the independent third party provider, as well as the Fund’s ranking within broader groups of funds. In comparing each Fund’s actual and contractual management fee to that of comparable funds, the Board noted that such fee includes both advisory and administrative costs.

The Board determined that the Trust’s advisory fees are generally within a competitive range of those incurred by other comparable funds. In this regard, the Board took into account management’s discussion with respect to the advisory/subadvisory fee structure, including the amount of the advisory fee retained by the Adviser after payment of the subadvisory fee. The Board also noted that JHIMS is currently waiving fees and/or reimbursing expenses with respect to certain of the Funds. The Board also noted that the Adviser pays the subadvisory fees of the Funds, and that such fees are negotiated at arm’s length with respect to unaffiliated Subadvisers. In addition, the Board noted that the Adviser effected advisory and subadvisory fee reductions in the past year with respect to several Funds. The Board also noted management’s discussion of the Funds’ expenses, as well as certain actions taken over the past several years to reduce the Funds’ operating expenses. The Board also took into account the level and quality of services provided by JHIMS with respect to the Funds, as well as the other factors considered. The Board concluded that the advisory fees paid by the Trust with respect to the Funds are reasonable.

Additional information relating to each Fund’s fees and expenses and performance that the Board considered in approving the Advisory Agreement is set forth in Appendix A.

Approval of Subadvisory Agreements

In making its determination with respect to the factors that it considers in considering approval of the Subadvisory Agreements, the Board reviewed:

(1) information relating to each Subadviser’s business, including current subadvisory services to the Trust (and other funds in the John Hancock family of funds);

(2) the historical and current performance of each Fund and comparative performance information relating to the Fund’s benchmark and comparable funds;

(3) the subadvisory fee for each Fund, including any breakpoints, and comparative fee information prepared by an independent third party of mutual fund data; and

(4) information relating to the nature and scope of Material Relationships and their significance to the Trust’s Adviser and unaffiliated Subadvisers.

With respect to the services provided by each of the Subadvisers, the Board received information provided to the Board by each Subadviser, including each Subadviser’s Form ADV, as well as considered information presented throughout the past year. The Board considered the Subadviser’s current level of staffing and its overall resources, as well as its compensation program. The Board reviewed each Subadviser’s history and investment experience, as well as information regarding the qualifications, background and responsibilities of the Subadviser’s investment and compliance personnel who provide services to the Funds. The Board also considered, among other things, the Subadviser’s compliance program and any disciplinary history. The Board also considered the Subadviser’s risk assessment and monitoring process. The Board noted each Subadviser’s regulatory

| |

| 32 Fundamental All Cap Core Fund | Annual report |

history, including whether it was currently involved in any regulatory actions or investigations as well as material litigation, and any settlements and amelioratory actions undertaken, as appropriate. The Board also noted that the CCO and his staff conduct regular, periodic compliance reviews with each of the Subadvisers and present reports to the Independent Trustees regarding the same, which includes evaluating the regulatory compliance systems of the Subadvisers and procedures reasonably designed by them to assure compliance with the federal securities laws. The Board also took into account the financial condition of each Subadviser.

The Board considered each Subadviser’s investment process and philosophy. The Board took into account that each Subadviser’s responsibilities include the development and maintenance of an investment program for the applicable Fund which is consistent with the Fund’s investment objectives, the selection of investment securities and the placement of orders for the purchase and sale of such securities, as well as the implementation of compliance controls related to performance of these services. The Board also received information with respect to each Subadviser’s brokerage policies and practices, including with respect to best execution and soft dollars. The Board also reviewed information relating to the nature and scope of Material Relationships and their significance to the Adviser and its affiliates and to unaffiliated Subadvisers.

The Board also took into account the sub-advisory fees paid by the Adviser to fees charged by each Fund’s Subadviser to manage other sub-advised portfolios and portfolios not subject to regulation under the 1940 Act, as applicable.

The Board also received information regarding any Material Relationships with respect to the unaffiliated Subadvisers, which include arrangements in which unaffiliated Subadvisers or their affiliates provide advisory, distribution or management services in connection with financial products sponsored by the Trust’s Adviser or its affiliates, and may include other registered investment companies, a 529 education savings plan, managed separate accounts and exempt group annuity contracts sold to qualified plans. The Board also received information and took into account any other potential conflicts of interests the Adviser might have in connection with the Subadvisory Agreements.

The Board’s decision to approve each Subadvisory Agreement was based on a number of determinations, including the following:

(1) The Subadviser has extensive experience and demonstrated skills as a manager;

(2) Although not without variation, the performance of each Fund managed by a Subadviser has generally been in-line with or generally outperformed the historical performance of comparable funds and the Fund’s respective benchmarks with the exceptions noted in Appendix A (with respect to such exceptions, the Board concluded that appropriate action was being taken to address such Fund’s performance, if necessary, or that performance was reasonable in light of all factors considered);

(3) The subadvisory fees generally are (i) competitive and within the range of industry norms and (ii) are paid by JHIMS out of its advisory fees it receives from the Fund (in the case of each sub-subadvisory agreement, that the sub-subadvisory fee would be paid by the Subadviser out of the subadvisory fee) and would not be an expense of the Fund, and, with respect to each Subadviser that is not affiliated with the Adviser, are a product of arm’s length negotiation between the Adviser and the Subadviser; and the Board concluded that each Fund’s subadvisory fees are reasonable; and

(4) With respect to those Funds that have subadvisory fees that contain breakpoints, such breakpoints are reflected as breakpoints in the advisory fees for the Funds in order to permit shareholders to benefit from economies of scale if those Funds grow.

| |

| Annual report | Fundamental All Cap Core Fund 33 |

Additional information relating to each Fund’s fees and expenses and performance that the Board considered for a particular Fund is set forth in Appendix A.

Based on their evaluation of all factors that they deemed to be material, including those factors described above, and assisted by the advice of independent counsel, the Board, including the Independent Trustees, concluded that renewal of the Advisory Agreement and each of the Subadvisory Agreements would be in the best interest of each of the Funds and its respective shareholders. Accordingly, the Board, and the Independent Trustees voting separately, approved the Advisory Agreement and each of the Subadvisory Agreements for an additional one-year period.

| | | |

| Appendix A |

|

| |

| Portfolio | Performance of Fund, | | |

| (Subadviser) | as of March 31, 2012 | Fees and Expenses | Other Comments |

|

| |

| Fundamental All | Benchmark Index — | The subadvised peer | The Board noted |

| Cap Core Fund | The Fund launched | group is too small for | that the inception |

| | June 1st of 2011. | comparative purposes. | date for this Fund |

| (John Hancock | | | was June 1, 2011. |

| Asset Management | Lipper Peer Group — | | |

| a division of | The Fund launched | Net management fees | |

| Manulife Asset | June 1st of 2011. | for this Fund are | |

| Management | | lower than the peer | |

| (US) LLC) | | group median. | |

| | | |

| | Total expenses for | |

| | this Fund are slightly | |

| | | lower than the peer | |

| | | group median. | |

|

| |

| 34 Fundamental All Cap Core Fund | Annual report |

Trustees and Officers

This chart provides information about the Trustees and Officers of John Hancock Funds II who oversee your John Hancock fund. Officers elected by the Trustees manage the day-to-day operations of the Portfolio and execute policies formulated by the Trustees.

Independent Trustees

| | |

| Name, Year of Birth | Trustee | Number of |

| Position(s) held with Fund | of the | John Hancock |

| Principal occupation(s) and other | Trust | funds overseen |

| directorships during past 5 years | since1 | by Trustee |

| |

| Charles L. Bardelis, Born: 1941 | 2005 | 198 |

|

| Director, Island Commuter Corp. (Marine Transport). Trustee of John Hancock Variable Insurance |

| Trust (since 1988), John Hancock Funds II (since 2005) and former Trustee of John Hancock | |

| Funds III (2005–2006). | | |

| |

| Peter S. Burgess, Born: 1942 | 2005 | 198 |

|

| Consultant (financial, accounting and auditing matters) (since 1999); Certified Public Accountant. |

| Partner, Arthur Andersen (independent public accounting firm) (prior to 1999). Director of the following |

| publicly traded companies: Lincoln Educational Services Corporation (since 2004), Symetra Financial |

| Corporation (since 2010) and PMA Capital Corporation (2004–2010). Trustee of John Hancock Variable |

| Insurance Trust (since 2005), John Hancock Funds II (since 2005), and former Trustee of John Hancock |

| Funds III (2005–2006). | | |

| |

| Grace K. Fey, Born: 1946 | 2008 | 198 |

|

| Chief Executive Officer, Grace Fey Advisors (since 2007); Director & Executive Vice President, Frontier |

| Capital Management Company (1988–2007); Director, Fiduciary Trust (since 2009). Trustee of |

| John Hancock Variable Insurance Trust (since 2008) and John Hancock Funds II (since 2008). |

| |

| Theron S. Hoffman, Born: 1947 | 2008 | 198 |

|

| Chief Executive Officer, T. Hoffman Associates, LLC (consulting firm) (since 2003); Director, The Todd |

| Organization (consulting firm) (2003–2010); President, Westport Resources Management (investment |

| management consulting firm) (2006–2008); Partner/Operating Head & Senior Managing Director, |

| Putnam Investments (2000–2003); Executive Vice President, Thomson Corp. (1997–2000) (financial |

| and legal information publishing). Trustee of John Hancock Variable Insurance Trust (since 2008) and |

| John Hancock Funds II (since 2008). | | |

| |

| Hassell H. McClellan, Born: 1945 | 2005 | 198 |

|

| Associate Professor, The Graduate School of The Wallace E. Carroll School of Management, Boston |

| College (since 1984). Trustee of John Hancock Variable Insurance Trust (since 2005), John Hancock |

| Funds II (since 2005), Trustee of Virtus Variable Insurance Trust (formerly, Phoenix Edge Series Funds) |

| (since 2008), and Director of the Barnes Group (since 2010). | | |

| |

| James M. Oates, Born: 1946 | 2005 | 198 |

|

| Managing Director, Wydown Group (financial consulting firm) (since 1994); Chairman, Emerson |

| Investment Management, Inc. (since 2000); Chairman, Hudson Castle Group, Inc. (formerly IBEX |

| Capital Markets, Inc.) (financial services company) (1997–2011). Director of the following publicly traded |

| companies: Stifel Financial (since 1996); Investor Financial Services Corporation (1995–2007); and |

| Connecticut River Bancorp (since 1998). Director of the following Mutual Funds: Virtus Funds (formerly, |

| Phoenix Mutual Funds) (since 1988). Chairman of the Boards of John Hancock Variable Insurance Trust |

| and John Hancock Funds II (since 2005) and former Trustee of John Hancock Funds III (2005–2006). |

| |

| Annual report | Fundamental All Cap Core Fund 35 |

Non-Independent Trustee2

| | |

| Name, Year of Birth | Trustee | Number of |

| Position(s) held with Fund | of the | John Hancock |

| Principal occupation(s) and other | Trust | funds overseen |

| directorships during past 5 years | since1 | by Trustee |

| |

| James R. Boyle,3 Born: 1959 | 2005 | 198 |

|

| Senior Executive Vice President, John Hancock Financial Services (since 1999, including prior positions); |

| Chairman and Director, John Hancock Advisers, LLC, John Hancock Funds, LLC, and John Hancock |

| Investment Management Services, LLC (2005–2010); Trustee, John Hancock Variable Insurance Trust |

| (since 2005), John Hancock Funds II (since 2005), and John Hancock retail funds (2005–2010). |

1 Because the Trust does not hold regular annual shareholders meetings, each Trustee holds office for an indefinite term until his/her successor is duly elected and qualified or until he/she dies, retires, resigns, is removed or becomes disqualified.

2 Non-Independent Trustees hold positions or are affiliated with the Fund’s investment adviser, subadviser, underwriter or their affiliates.

3 Mr. Boyle is an “interested person” (as defined in the 1940 Act) due to his position with Manulife Financial Corporation (or its affiliates), the ultimate parent of the Adviser.

Principal officers who are not Trustees

| |

| Name, Year of Birth | Officer |

| Position(s) held with Fund | of the |

| Principal occupation(s) and other | Trust |

| directorships during past 5 years | since |

| |

| Hugh McHaffie, Born: 1959 | 2009 |

|

| President | |

| Executive Vice President, John Hancock Financial Services (since 2006, including prior positions); | |

| President of John Hancock Variable Insurance Trust and John Hancock Funds II (since 2009); Trustee, |

| John Hancock retail funds (since 2010); Chairman and Director, John Hancock Advisers, LLC, | |

| John Hancock Investment Management Services, LLC and John Hancock Funds, LLC (since 2010). | |

| |

| Thomas M. Kinzler, Born: 1955 | 2008 |

|

| Secretary and Chief Legal Officer | |

| Vice President, John Hancock Financial Services (since 2006); Secretary and Chief Legal Counsel, | |

| John Hancock Funds, LLC (since 2007); Secretary and Chief Legal Officer, John Hancock retail funds, |

| John Hancock Variable Insurance Trust and John Hancock Funds II (since 2006). | |

| |

| Francis V. Knox, Jr., Born: 1947 | 2008 |

|

| Chief Compliance Officer | |

| Vice President, John Hancock Financial Services (since 2005); Chief Compliance Officer, John Hancock |

| retail funds, John Hancock Funds II, John Hancock Variable Insurance Trust, John Hancock Advisers, |

| LLC and John Hancock Investment Management Services, LLC (since 2005); Vice President and Chief |

| Compliance Officer, John Hancock Asset Management a division of Manulife Asset Management (US) |

| LLC (2005–2008). | |

| |

| Michael J. Leary, Born: 1965 | 2008 |

|

| Treasurer | |

| Assistant Vice President, John Hancock Financial Services (since 2007); Treasurer, John Hancock Funds II |

| and John Hancock Variable Insurance Trust (since 2009); Treasurer, John Hancock retail funds (2009– |

| 2010); Vice President, John Hancock Advisers, LLC and John Hancock Investment Management Services, |

| LLC (since 2007); Assistant Treasurer, John Hancock retail funds (2007–2009 & 2010), John Hancock |

| Funds II and John Hancock Variable Insurance Trust (2007–2009) and John Hancock Funds III (since |

| 2009); Vice President and Director of Fund Administration, JP Morgan (2004–2007). | |

| |

| 36 Fundamental All Cap Core Fund | Annual report |

Principal officers who are not Trustees (continued)

| |

| Name, Year of Birth | Officer |

| Position(s) held with Fund | of the |

| Principal occupation(s) and other | Trust |

| directorships during past 5 years | since |

|

| |

| Charles A. Rizzo, Born: 1957 | 2008 |

|

| Chief Financial Officer | |

| Vice President, John Hancock Financial Services (since 2008); Senior Vice President, John Hancock | |

| Advisers, LLC and John Hancock Investment Management Services, LLC (since 2008); Chief Financial |

| Officer, John Hancock retail funds, John Hancock Funds II and John Hancock Variable Insurance Trust |

| (since 2007); Assistant Treasurer, Goldman Sachs Mutual Fund Complex (2005–2007); Vice President, |

| Goldman Sachs (2005–2007). | |

| |

| John G. Vrysen, Born: 1955 | 2008 |

|

| Chief Operating Officer | |

| Senior Vice President, John Hancock Financial Services (since 2006); Director, Executive Vice President |

| and Chief Operating Officer, John Hancock Advisers, LLC, John Hancock Investment Management | |

| Services, LLC and John Hancock Funds, LLC (since 2005); Chief Operating Officer, John Hancock Funds |

| II and John Hancock Variable Insurance Trust (since 2007); Chief Operating Officer, John Hancock retail |

| funds (until 2009); Trustee, John Hancock retail funds (since 2009). | |

The business address for all Trustees and Officers is 601 Congress Street, Boston, Massachusetts 02210-2805.

The Statement of Additional Information of the Fund includes additional information about members of the Board of Trustees of the Fund and is available without charge, upon request, by calling 1-800-225-5291.

| |

| Annual report | Fundamental All Cap Core Fund 37 |

More information

| |

| Trustees | Investment adviser |

| James M. Oates, Chairman | John Hancock Investment Management |

| James R. Boyle† | Services, LLC |

| Charles L. Bardelis* | |

| Peter S. Burgess* | Subadviser |

| Grace K. Fey | John Hancock Asset Management a division of |

| Theron S. Hoffman | Manulife Asset Management (US) LLC |

| Hassell H. McClellan | |

| | Principal distributor |

| Officers | John Hancock Funds, LLC |

| Hugh McHaffie | |

| President | Custodian |

| | State Street Bank and Trust Company |

| Thomas M. Kinzler | |

| Secretary and Chief Legal Officer | Transfer agent |

| | John Hancock Signature Services, Inc. |

| Francis V. Knox, Jr. | |

| Chief Compliance Officer | Legal counsel |

| | K&L Gates LLP |

| Michael J. Leary | |

| Treasurer | Independent registered |

| | public accounting firm |

| Charles A. Rizzo | PricewaterhouseCoopers LLP |

| Chief Financial Officer | |

| | |

| John G. Vrysen | |

| Chief Operating Officer | |

| |

| *Member of the Audit Committee | |

| †Non-Independent Trustee | |

The Fund’s proxy voting policies and procedures, as well as the Fund’s proxy voting record for the most recent twelve-month period ended June 30, are available free of charge on the Securities and Exchange Commission (SEC) Web site at www.sec.gov or on our Web site.

The Fund’s complete list of portfolio holdings, for the first and third fiscal quarters, is filed with the SEC on Form N-Q. The Fund’s Form N-Q is available on our Web site and the SEC’s Web site, www.sec.gov, and can be reviewed and copied (for a fee) at the SEC’s Public Reference Room in Washington, DC. Call 1-202-551-8090 to receive information on the operation of the SEC’s Public Reference Room.

We make this information on your fund, as well as monthly portfolio holdings, and other fund details available on our Web site at www.jhfunds.com or by calling 1-800-225-5291.

| | |

| You can also contact us: | | |

| 1-800-225-5291 | Regular mail: | Express mail: |

| jhfunds.com | John Hancock Signature Services, Inc. | John Hancock Signature Services, Inc. |

| | P.O. Box 55913 | Mutual Fund Image Operations |

| | Boston, MA 02205-5913 | 30 Dan Road |

| | | Canton, MA 02021 |

| |

| 38 Fundamental All Cap Core Fund | Annual report |

1-800-225-5291

1-800-554-6713 TDD

1-800-338-8080 EASI-Line

www.jhfunds.com

Now available: electronic delivery

www.jhfunds.com/edelivery

| |

| This report is for the information of the shareholders of John Hancock Fundamental All Cap Core Fund. | 376A 7/12 |

| It is not authorized for distribution to prospective investors unless preceded or accompanied by a prospectus. | 9/12 |

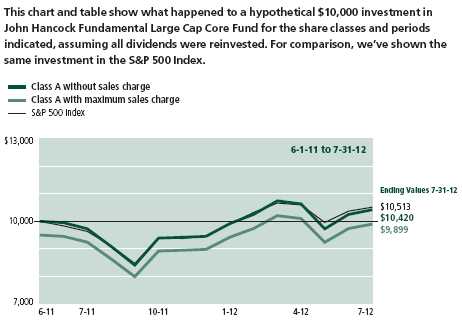

A look at performance

Total returns for the period ended July 31, 2012

| | | | | | | | | |

| | Average annual total returns (%) | | Cumulative total returns (%) | |

| | with maximum sales charge | | | with maximum sales charge | |

|

| | | | Since | | | | | Since |

| | 1-year | 5-year | 10-year | inception 1 | | 1-year | 5-year | 10-year | inception 1 |

|

| Class A | 1.74 | — | — | –0.86 | | 1.74 | — | — | –1.01 |

|

| Class I2 | 7.58 | — | — | 4.08 | | 7.58 | — | — | 4.78 |

|

Performance figures assume all distributions are reinvested. Figures reflect maximum sales charges on Class A shares of 5.00%.

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from those disclosed in the Financial highlights tables in this report. The fee waivers and expense limitations are contractual at least until 12-31-12 for Class A and Class I shares. Had the fee waivers and expense limitations not been in place gross expenses would apply. The expense ratios are as follows:

| | | | | | | | |

| | Class A | Class I | | | | | | |

| Net (%) | 1.30 | 0.84 | | | | | | |

| Gross (%) | 3.82 | 3.99 | | | | | | |

Expenses have been estimated for the Fund’s first full year of operations.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For current to the most recent month-end performance data, please call 1-800-225-5291 or visit the Fund’s Web site at www.jhfunds.com.

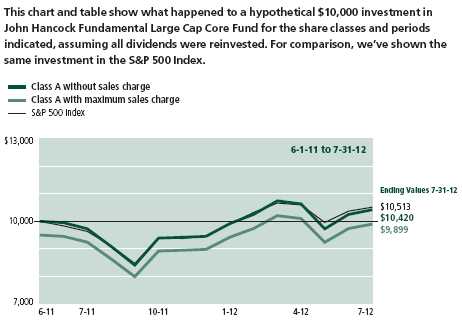

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares. The Fund’s performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

| |

| 6 | Fundamental Large Cap Core Fund | Annual report |

| | | | | | |

| | | Without | With maximum | | | |

| | Start date | sales charge | sales charge | Index | | |

| | |

| Class I 2 | 6-1-11 | $10,478 | $10,478 | $10,513 | | |

| | |

S&P 500 Index is an unmanaged index that includes 500 widely traded common stocks.

It is not possible to invest directly in an index. Index figures do not reflect expenses, which would have resulted in lower values if they did.

1 From 6-1-11.

2 For certain types of investors as described in the Fund’s Class I share prospectus.

| |

| Annual report | Fundamental Large Cap Core Fund | 7 |

Management’s discussion of

Fund performance

By John Hancock Asset Management a division of Manulife Asset Management (US) LLC

The stock market finished the year ended July 31, 2012 with a solid gain, despite a rough start last summer when double-dip recession fears, Europe’s sovereign debt crisis, the federal budget deficit debate and Standard & Poor’s historic U.S. credit rating downgrade pushed the market sharply lower. Subsequent signs of stabilization in Europe and encouraging economic data at home triggered a market rally from October into the early months of the new year. By spring, however, mounting concerns about Europe were pressuring markets worldwide. Stocks rebounded in late June as the European Central Bank took steps to avert a financial crisis, but then bounced around for much of July. Despite the year’s gyrations, the S&P 500 Index managed a 9.13% return for the 12-month period.

Over the same period, John Hancock Fundamental Large Cap Core Fund’s Class A shares returned 7.09%, excluding sales charges, trailing its benchmark, the S&P 500 Index, but beating the 2.56% average return of its peer group, the Morningstar, Inc. large growth category. Sector allocations — particularly not having exposure to the better performing telecommunications and utilities sectors — hampered results versus the benchmark index. Individual detractors included shale gas producer Ultra Petroleum Corp. and exploration and production company Apache Corp., whose stocks were hurt by the decline in energy commodity prices. The Fund also lost ground from not owning leading index component Apple, Inc. as the success of its strong product line drove steep stock price gains. We later added a position in the stock. Top contributors included biotechnology leader Amgen, Inc., whose dividend increase and share buyback program attracted investors and drove the stock sharply higher. Housing-related stocks, including home-builder Lennar Corp., also rallied nicely, benefiting from a pickup in housing orders and real estate prices in the second half of the period.

This commentary reflects the views of the portfolio managers through the end of the period discussed in this report. The managers’ statements reflect their own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Past performance is no guarantee of future results.

Large company stocks as a group could fall out of favor with the market, causing the Fund to underperform. The prices of medium and small company stocks can change more frequently and dramatically than those of large company stocks. Foreign investing, especially in emerging markets, has additional risks such as currency and market volatility and political and social instability. Hedging and other strategic transactions may increase volatility of a fund and, if the transaction is not successful, could result in a significant loss. If the fund invests in illiquid securities, it may be difficult to sell them at a price approximating their value. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| |