|

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT |

| COMPANIES |

| Investment Company Act file number 811-21779 |

| |

| JOHN HANCOCK FUNDS II |

| --------------------------------------------------------- |

| (Exact name of registrant as specified in charter) |

| |

| 601 CONGRESS STREET, BOSTON, MA 02210-2805 |

| ------------------------------------------------------------- |

| (Address of principal executive offices) (Zip code) |

| |

| SALVATORE SCHIAVONE, 601 CONGRESS STREET, BOSTON, MA 02210-2805 |

| ------------------------------------------------------------------------------------------ |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: (617) 663-4497 |

| -------------- |

|

| Date of fiscal year end: 7/31 |

| ------ |

| |

| Date of reporting period: 7/31/13 |

| ------- |

ITEM 1. REPORTS TO STOCKHOLDERS.

The Registrant prepared eleven annual reports to shareholders for the year ended July 31, 2013 for series of John Hancock Funds II with July 31 fiscal year end. The first report applies to the Technical Opportunities Fund, the second report applies to the Global High Yield Fund, the third report applies to Short Duration Credit Opportunities Fund, the fourth report applies to Currency Strategies Fund, the fifth report applies Fundamental All Cap Core Fund, the sixth report applies to Fundamental Large Cap Core Fund, the seventh report applies to Fundamental Large Cap Value Fund, the eight report applies to the China Emerging Leaders Fund, the ninth report applies to the Diversified Strategies Fund, the tenth report applies to the Global Absolute Return Strategy Fund, and the eleventh report applies to the International Growth Equity Fund. International Growth Equity Fund is the successor of the Turner International Growth Fund which was acquired January 11, 2013.

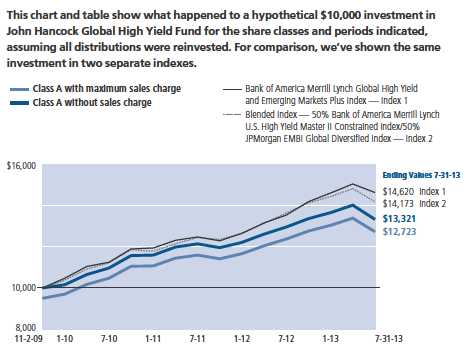

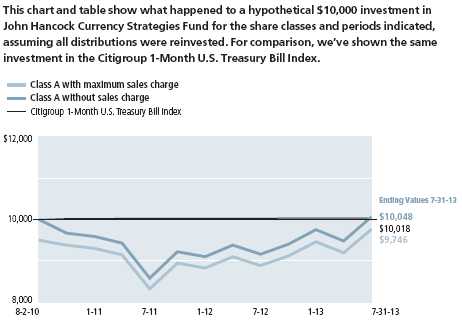

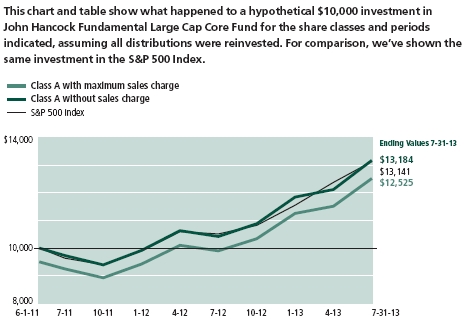

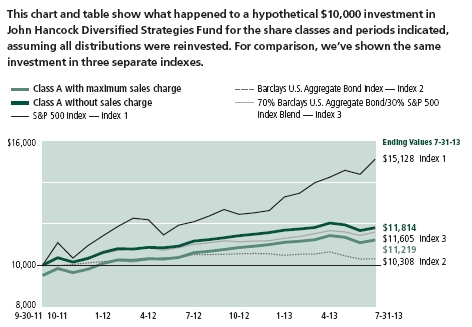

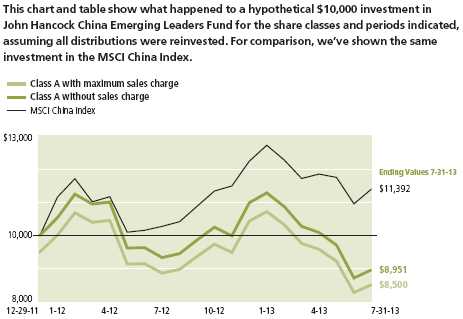

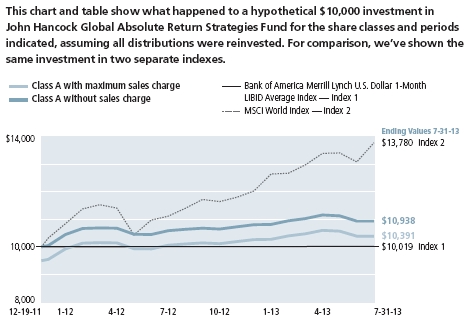

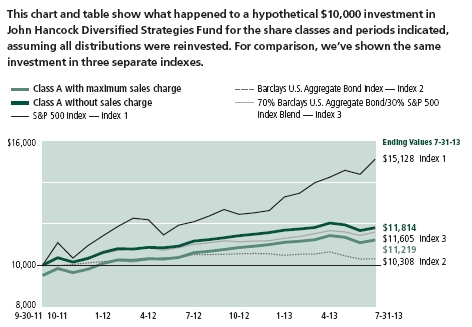

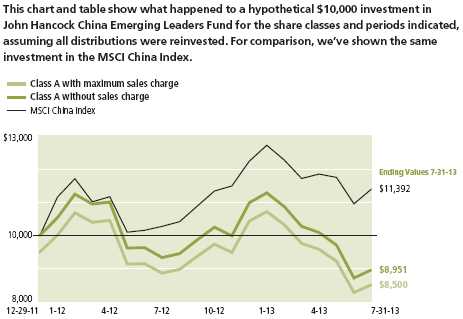

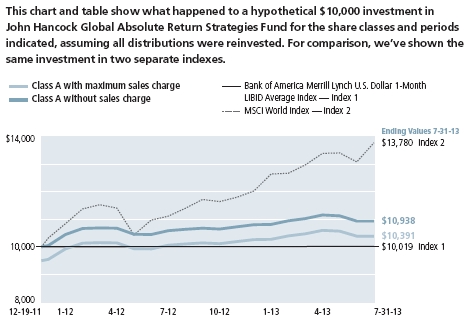

A look at performance

Total returns for the period ended July 31, 2013

| | | | | | | | |

| | Average annual total returns (%) | Cumulative total returns (%) | |

| | with maximum sales charge | | with maximum sales charge | |

|

| | 1-year | 5-year | 10-year | Since

inception1 | 1-year | 5-year | 10-year | Since

inception1 |

|

| Class A | 29.43 | — | — | 6.90 | 29.43 | — | — | 30.60 |

|

| Class I2 | 36.64 | — | — | 8.69 | 36.64 | — | — | 39.55 |

|

| Class NAV2 | 37.00 | — | — | 8.87 | 37.00 | — | — | 40.47 |

|

| Index† | 21.16 | — | — | 11.76 | 21.16 | — | — | 55.91 |

|

Performance figures assume all distributions have been reinvested. Figures reflect maximum sales charges on Class A shares of 5.00%.

The expense ratios of the fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the fund and may differ from those disclosed in the Financial highlights tables in this report. For all classes, the net expenses equal the gross expenses. The expense ratios are as follows:

| | | |

| | Class A | Class I | Class NAV |

| Net/Gross (%) | 1.78 | 1.45 | 1.22 |

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the fund’s current performance may be higher or lower than the performance shown. For current to the most recent month-end performance data, please call 800-225-5291 or visit the fund’s website at jhinvestments.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares. The fund’s performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

† Index is the MSCI All Country World Index

See the following page for footnotes.

| |

| 6 | Technical Opportunities Fund | Annual report |

| | | | |

| | | With maximum | Without | |

| | Start date | sales charge | sales charge | Index |

|

| Class I2 | 8-3-09 | $13,955 | $13,955 | $15,591 |

|

| Class NAV2 | 8-3-09 | 14,047 | 14,047 | 15,591 |

|

MSCI All Country World Index (gross of foreign withholding tax on dividends) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would have resulted in lower values if they did.

Footnotes related to performance pages

1 From 8-3-09.

2 For certain types of investors as described in the fund’s prospectuses.

| |

| Annual report | Technical Opportunities Fund | 7 |

Management’s discussion of

Fund performance

Wellington Management Company, LLP

Global equities climbed higher during the 12-month period ended July 31, 2013, as measured by the MSCI All Country World Index. Stocks rebounded strongly leading into the period after an equity sell-off in the second quarter of 2012. This trend continued into the first quarter of 2013 as solid corporate earnings results and favorable global liquidity dynamics lifted enthusiasm for stocks. Following a dramatic shift in monetary policy to a more aggressive management of a 2% inflation target by the Bank of Japan, Japanese equities rose sharply. U.S. equities also outperformed global indexes as the U.S. economy appeared relatively stable compared to other countries. Although investors initially reacted negatively to news in May that the U.S. Federal Reserve might slow its bond-buying program sooner than expected, U.S. equities recovered into the end of the period. Ongoing challenges in resolving European sovereign debt issues weighed on investors during the period as did political unrest in Turkey, Egypt, and Brazil.

For the 12-month period ended July 31, 2013, John Hancock Technical Opportunities Fund’s Class A shares posted a total return of 36.27%, excluding sales charges, outperforming both the 21.16% return of the fund’s benchmark, the MSCI All Country World Index, and the 22.79% average return of its Morningstar, Inc. world stock fund peer group.† The fund’s position in Regeneron Pharmaceuticals, Inc. was the largest contributor to relative results during the 12-month period. Regeneron Pharmaceuticals is a biopharmaceutical company that discovers, develops, and commercializes pharmaceutical products for the treatment of serious medical conditions, including cancer, eye diseases, and inflammatory diseases. The company continued to maintain a bullish trend throughout the period and remained a top position in the fund at period end. Onyx Pharmaceuticals, Inc., also contributed to relative performance. The company discovers and develops novel therapeutics based upon the genetics of human disease, with an emphasis on cancer. After a stock price breakout in June 2012, on positive news on its latest myeloma drug, there was a larger stock price jump in June 2013, which was driven by potential takeover interests by Amgen, Inc. and other drugmakers. The fund’s cash positioning, while averaging less than 4% over the period, detracted as the markets trended upward.

This commentary reflects the views of the portfolio manager through the end of the period discussed in this report. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Wellington Management is an independent and unaffiliated investment subadvisor.

Past performance is no guarantee of future results.

† Figures from Morningstar, Inc. include distributions reinvested and do not take into account sales charges. Actual load-adjusted performance is lower.

| |

| 8 | Technical Opportunities Fund | Annual report |

Your expenses

These examples are intended to help you understand your ongoing operating expenses of investing in the fund so you can compare these costs with the ongoing costs of investing in other mutual funds.

Understanding fund expenses

As a shareholder of the fund, you incur two types of costs:

■ Transaction costs, which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■ Ongoing operating expenses, including management fees, distribution and service fees (if applicable) and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about the fund’s actual ongoing operating expenses and is based on the fund’s actual return. It assumes an account value of $1,000.00 on February 1, 2013, with the same investment held until July 31, 2013.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 2-1-13 | on 7-31-13 | period ended 7-31-131 |

|

| Class A | $1,000.00 | $1,192.20 | $9.46 |

|

| Class I | 1,000.00 | 1,194.10 | 7.78 |

|

| Class NAV | 1,000.00 | 1,194.70 | 6.69 |

|

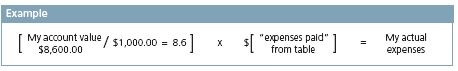

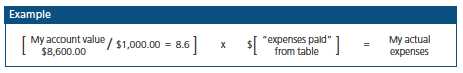

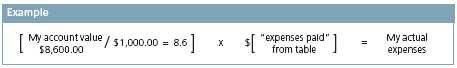

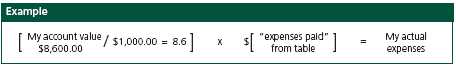

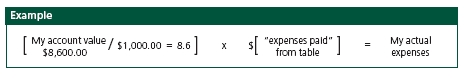

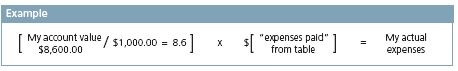

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at July 31, 2013, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| |

| Annual report | Technical Opportunities Fund | 9 |

Your expenses

Hypothetical example for comparison purposes

This table allows you to compare the fund’s ongoing operating expenses with those of any other fund. It provides an example of the fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not the fund’s actual return). It assumes an account value of $1,000.00 on February 1, 2013, with the same investment held until July 31, 2013. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses. Please remember that these hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 2-1-13 | on 7-31-13 | period ended 7-31-131 |

|

| Class A | $1,000.00 | $1,016.20 | $8.70 |

|

| Class I | 1,000.00 | 1,017.70 | 7.15 |

|

| Class NAV | 1,000.00 | 1,018.70 | 6.16 |

|

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the fund’s annualized expense ratio of 1.74%, 1.43%, and 1.23% for Class A, Class I, and Class NAV shares, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

| |

| 10 | Technical Opportunities Fund | Annual report |

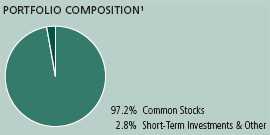

Portfolio summary

| | | | |

| Top 10 Holdings (25.2% of Net Assets on 7-31-13)1,2 | | | |

|

| Regeneron Pharmaceuticals, Inc. | 4.8% | | Vertex Pharmaceuticals, Inc. | 1.9% |

| |

|

| Onyx Pharmaceuticals, Inc. | 4.2% | | Guidewire Software, Inc. | 1.8% |

| |

|

| Jazz Pharmaceuticals PLC | 3.1% | | LinkedIn Corp., Class A | 1.8% |

| |

|

| Cubist Pharmaceuticals, Inc. | 2.2% | | Gilead Sciences, Inc. | 1.8% |

| |

|

| Pharmacyclics, Inc. | 1.9% | | Biogen Idec, Inc. | 1.7% |

| |

|

| |

| |

| Sector Composition1,3 | | | | |

|

| Health Care | 41.2% | | Energy | 3.1% |

| |

|

| Consumer Discretionary | 16.2% | | Consumer Staples | 2.1% |

| |

|

| Financials | 13.1% | | Materials | 0.5% |

| |

|

| Information Technology | 12.5% | | Short-Term Investments & Other | 1.9% |

| |

|

| Industrials | 9.4% | | | |

| | |

1 As a percentage of net assets on 7-31-13.

2 Cash and cash equivalents not included.

3 Foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. Hedging and other strategic transactions may increase volatility of a fund and, if the transaction is not successful, could result in a significant loss. The fund may invest its assets in a small number of issuers. Performance could suffer significantly from adverse events affecting these issuers. Investments concentrated in one sector may fluctuate more widely than investments diversified across sectors. Frequently trading securities may increase transaction costs (thus lowering performance) and taxable distributions. Owning an ETF generally reflects the risks of owning the underlying securities it is designed to track, which may cause a lack of liquidity, more volatility and increased management fees. The fund may invest in IPOs, which are frequently volatile in price and may lead to increased portfolio turnover. The fund can invest up to 100% of its assets in cash, which may cause the fund to not meet its investment objective. For additional information on these and other risk considerations, please see the fund’s prospectuses.

| |

| Annual report | Technical Opportunities Fund | 11 |

Fund’s investments

As of 7-31-13

| | |

| | Shares | Value |

| Common Stocks 98.1% | | $657,244,197 |

|

| (Cost $548,448,032) | | |

| | | |

| Consumer Discretionary 16.2% | | 108,564,099 |

| | | |

| Diversified Consumer Services 0.5% | | |

|

| Service Corp. International | 183,700 | 3,484,790 |

| | | |

| Hotels, Restaurants & Leisure 5.0% | | |

|

| Bally Technologies, Inc. (I)(L) | 91,000 | 6,522,880 |

|

| Chuy’s Holdings, Inc. (I)(L) | 86,900 | 3,066,702 |

|

| Denny’s Corp. (I) | 692,600 | 3,940,894 |

|

| Galaxy Entertainment Group, Ltd. (I) | 713,000 | 3,738,130 |

|

| Sands China, Ltd. | 694,000 | 3,755,242 |

|

| Starbucks Corp. | 94,600 | 6,739,304 |

|

| The Wendy’s Company (L) | 831,000 | 5,908,410 |

| | | |

| Household Durables 1.2% | | |

|

| Harman International Industries, Inc. | 84,900 | 5,138,997 |

|

| Sony Corp. | 149,700 | 3,145,586 |

| | | |

| Internet & Catalog Retail 1.1% | | |

|

| HomeAway, Inc. (I) | 82,100 | 2,472,031 |

|

| Rakuten, Inc. | 358,200 | 4,827,440 |

| | | |

| Media 1.0% | | |

|

| DISH Network Corp., Class A | 156,900 | 7,005,585 |

| | | |

| Multiline Retail 1.9% | | |

|

| J Front Retailing Company, Ltd. | 319,000 | 2,534,925 |

|

| Marks & Spencer Group PLC | 489,456 | 3,576,805 |

|

| Nordstrom, Inc. | 105,300 | 6,448,572 |

| | | |

| Specialty Retail 2.8% | | |

|

| Cabela’s, Inc. (I)(L) | 53,500 | 3,672,240 |

|

| DSW, Inc., Class A | 106,200 | 8,048,898 |

|

| The Gap, Inc. | 147,800 | 6,784,020 |

| | | |

| Textiles, Apparel & Luxury Goods 2.7% | | |

|

| Fifth & Pacific Companies, Inc. (I) | 199,500 | 4,752,090 |

|

| Michael Kors Holdings, Ltd. (I) | 108,737 | 7,322,350 |

|

| Steven Madden, Ltd. (I) | 110,428 | 5,678,208 |

| | | |

| Consumer Staples 2.1% | | 13,747,574 |

| | | |

| Beverages 0.4% | | |

|

| Asahi Group Holdings, Ltd. | 101,800 | 2,595,010 |

| | |

| 12 | Technical Opportunities Fund | Annual report | See notes to financial statements |

| | |

| | Shares | Value |

| Food & Staples Retailing 0.9% | | |

|

| Seven & I Holdings Company, Ltd. | 160,700 | $6,052,660 |

| | | |

| Food Products 0.8% | | |

|

| The Hain Celestial Group, Inc. (I)(L) | 69,900 | 5,099,904 |

| | | |

| Energy 3.1% | | 20,678,936 |

| | | |

| Energy Equipment & Services 1.0% | | |

|

| Atwood Oceanics, Inc. (I) | 59,000 | 3,324,060 |

|

| Oceaneering International, Inc. | 38,700 | 3,138,183 |

| | | |

| Oil, Gas & Consumable Fuels 2.1% | | |

|

| Cobalt International Energy, Inc. (I) | 189,900 | 5,478,615 |

|

| Pioneer Natural Resources Company | 26,340 | 4,076,378 |

|

| Tesoro Corp. | 82,000 | 4,661,700 |

| | | |

| Financials 13.1% | | 87,478,145 |

| | | |

| Capital Markets 0.6% | | |

|

| TD Ameritrade Holding Corp. | 133,600 | 3,611,208 |

| | | |

| Commercial Banks 3.6% | | |

|

| Bank of the Ozarks, Inc. | 100,400 | 4,797,112 |

|

| Community Bank Systems, Inc. (L) | 61,400 | 2,059,356 |

|

| Mitsubishi UFJ Financial Group | 795,800 | 4,970,458 |

|

| Mizuho Financial Group, Inc. | 2,221,000 | 4,665,463 |

|

| Synovus Financial Corp. | 1,016,000 | 3,383,280 |

|

| Texas Capital Bancshares, Inc. (I) | 33,400 | 1,519,366 |

|

| The Bank of Yokohama, Ltd. | 426,000 | 2,335,819 |

| | | |

| Diversified Financial Services 0.6% | | |

|

| Osaka Securities Exchange Company, Ltd. | 44,400 | 4,158,682 |

| | | |

| Insurance 4.3% | | |

|

| American International Group, Inc. (I) | 141,600 | 6,444,216 |

|

| Marsh & McLennan Companies, Inc. | 97,700 | 4,090,699 |

|

| MS&AD Insurance Group Holdings | 149,800 | 3,877,890 |

|

| T&D Holdings, Inc. | 313,400 | 3,963,088 |

|

| Tokio Marine Holdings, Inc. | 166,100 | 5,304,237 |

|

| Unum Group | 160,000 | 5,062,400 |

| | | |

| Real Estate Investment Trusts 0.6% | | |

|

| Unibail-Rodamco SE | 17,359 | 4,225,759 |

| | | |

| Real Estate Management & Development 1.5% | | |

|

| Hulic Company, Ltd. (I) | 391,300 | 4,681,696 |

|

| Mitsui Fudosan Company, Ltd. | 179,000 | 5,396,400 |

| | | |

| Thrifts & Mortgage Finance 1.9% | | |

|

| MGIC Investment Corp. (I) | 645,400 | 4,930,856 |

|

| Ocwen Financial Corp. (I) | 168,000 | 8,000,160 |

| | | |

| Health Care 41.2% | | 275,979,002 |

| | | |

| Biotechnology 23.9% | | |

|

| Alkermes PLC (I) | 283,529 | 9,520,904 |

|

| Amgen, Inc. | 61,400 | 6,649,006 |

|

| Biogen Idec, Inc. (I) | 53,000 | 11,560,890 |

|

| Cubist Pharmaceuticals, Inc. (I) | 235,300 | 14,666,249 |

| | |

| See notes to financial statements | Annual report | Technical Opportunities Fund | 13 |

| | |

| | Shares | Value |

| Biotechnology (continued) | | |

|

| Gilead Sciences, Inc. (I) | 196,500 | $12,074,925 |

|

| Medivation, Inc. (I) | 101,500 | 5,873,805 |

|

| Onyx Pharmaceuticals, Inc. (I)(L) | 214,370 | 28,146,781 |

|

| Pharmacyclics, Inc. (I) | 115,700 | 12,568,491 |

|

| Regeneron Pharmaceuticals, Inc. (I) | 117,830 | 31,821,170 |

|

| Sarepta Therapeutics, Inc. (I)(L) | 76,200 | 2,820,924 |

|

| Seattle Genetics, Inc. (I)(L) | 207,930 | 8,425,324 |

|

| TESARO, Inc. (I) | 76,200 | 2,599,944 |

|

| United Therapeutics Corp. (I) | 17,600 | 1,317,184 |

|

| Vertex Pharmaceuticals, Inc. (I) | 155,300 | 12,392,940 |

| | | |

| Health Care Equipment & Supplies 2.8% | | |

|

| Boston Scientific Corp. (I) | 761,200 | 8,312,304 |

|

| HeartWare International, Inc. (I) | 52,200 | 4,824,324 |

|

| ICU Medical, Inc. (I) | 79,700 | 5,713,693 |

| | | |

| Health Care Providers & Services 3.7% | | |

|

| Brookdale Senior Living, Inc. (I) | 99,200 | 2,888,704 |

|

| HCA Holdings, Inc. | 181,900 | 7,094,100 |

|

| LifePoint Hospitals, Inc. (I) | 73,900 | 3,632,924 |

|

| Molina Healthcare, Inc. (I) | 164,800 | 6,117,376 |

|

| Universal Health Services, Inc., Class B | 67,700 | 4,735,615 |

| | | |

| Life Sciences Tools & Services 0.7% | | |

|

| Illumina, Inc. (I) | 59,600 | 4,757,272 |

| | | |

| Pharmaceuticals 10.1% | | |

|

| Actavis, Inc. (I) | 38,800 | 5,209,676 |

|

| Bristol-Myers Squibb Company | 204,400 | 8,838,256 |

|

| Eli Lilly & Company | 172,100 | 9,140,231 |

|

| Hisamitsu Pharmaceutical Company, Inc. | 47,100 | 2,594,052 |

|

| Jazz Pharmaceuticals PLC (I) | 275,500 | 20,803,005 |

|

| Merck & Company, Inc. | 185,800 | 8,949,986 |

|

| Mylan, Inc. (I) | 240,700 | 8,077,892 |

|

| Pacira Pharmaceuticals, Inc. (I)(L) | 113,500 | 3,851,055 |

| | | |

| Industrials 9.4% | | 63,277,696 |

| | | |

| Aerospace & Defense 5.4% | | |

|

| BAE Systems PLC | 852,061 | 5,796,762 |

|

| Cubic Corp. | 75,443 | 3,813,644 |

|

| DigitalGlobe, Inc. (I) | 150,400 | 4,872,960 |

|

| Rolls-Royce Holdings PLC | 485,693 | 8,660,169 |

|

| Safran SA | 165,479 | 9,749,887 |

|

| Thales SA | 66,977 | 3,447,608 |

| | | |

| Airlines 1.2% | | |

|

| United Continental Holdings, Inc. (I) | 234,000 | 8,154,900 |

| | | |

| Electrical Equipment 2.0% | | |

|

| Hubbell, Inc., Class B | 75,000 | 8,051,250 |

|

| Mitsubishi Electric Corp. | 574,000 | 5,568,059 |

| | | |

| Machinery 0.8% | | |

|

| Makita Corp. | 36,100 | 1,879,503 |

|

| SMC Corp. | 15,500 | 3,282,954 |

| | |

| 14 | Technical Opportunities Fund | Annual report | See notes to financial statements |

| | | |

| | | Shares | Value |

| Information Technology 12.5% | | | $83,966,185 |

| | | | |

| Computers & Peripherals 3.1% | | | |

|

| 3D Systems Corp. (I)(L) | | 123,100 | 5,814,013 |

|

| NetApp, Inc. (L) | | 132,400 | 5,444,288 |

|

| Seagate Technology PLC | | 93,100 | 3,808,721 |

|

| Stratasys, Ltd. (I)(L) | | 62,000 | 5,496,300 |

| | | | |

| Electronic Equipment, Instruments & Components 0.8% | | |

|

| FEI Company | | 70,240 | 5,440,088 |

| | | | |

| Internet Software & Services 2.9% | | | |

|

| Facebook, Inc., Class A (I) | | 97,500 | 3,590,925 |

|

| Internet Initiative Japan, Inc. (I) | | 61,000 | 2,100,209 |

|

| LinkedIn Corp., Class A (I) | | 59,470 | 12,119,391 |

|

| United Internet AG | | 57,743 | 1,884,730 |

| | | | |

| IT Services 1.2% | | | |

|

| Cap Gemini SA | | 80,510 | 4,421,812 |

|

| Nomura Research Institute, Ltd. | | 72,300 | 2,367,654 |

|

| Otsuka Corp. | | 13,700 | 1,546,223 |

| | | | |

| Software 4.5% | | | |

|

| Adobe Systems, Inc. (I) | | 81,100 | 3,834,408 |

|

| Guidewire Software, Inc. (I) | | 277,900 | 12,160,904 |

|

| Infoblox, Inc. (I) | | 120,100 | 3,927,270 |

|

| Informatica Corp. (I) | | 142,700 | 5,446,859 |

|

| ServiceNow, Inc. (I) | | 104,690 | 4,562,390 |

| | | | |

| Materials 0.5% | | | 3,552,560 |

| | | | |

| Metals & Mining 0.5% | | | |

|

| U.S. Silica Holdings, Inc. (L) | | 146,800 | 3,552,560 |

| |

| | Yield (%) | Shares | Value |

| Securities Lending Collateral 9.8% | | | $65,352,785 |

|

| (Cost $65,345,337) | | | |

| John Hancock Collateral Investment Trust (W) | 0.1995 (Y) | 6,530,511 | 65,352,785 |

| |

| | | Par Value | Value |

|

| Short-Term Investments 0.8% | | | $5,600,000 |

|

| (Cost $5,600,000) | | | |

| | | | |

| Repurchase Agreement 0.8% | | | 5,600,000 |

|

| Bank of America Tri-Party Repurchase Agreement dated 7-31-13 at 0.070% | | |

| to be repurchased at $5,600,011 on 8-1-13, collateralized by $5,592,232 | | |

| Government National Mortgage Association, 3.500% due 10-20-42 | | |

| (valued at $5,712,001, including interest) | | $5,600,000 | 5,600,000 |

| |

| Total investments (Cost $619,393,369)† 108.7% | | $728,196,982 |

|

| |

| Other assets and liabilities, net (8.7%) | | | ($58,378,974) |

|

| |

| Total net assets 100.0% | | | $669,818,008 |

|

The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the fund.

| | |

| See notes to financial statements | Annual report | Technical Opportunities Fund | 15 |

Notes to Schedule of Investments

(I) Non-income producing security.

(L) A portion of this security is on loan as of 7-31-13.

(W) Investment is an affiliate of the fund, the advisor and/or subadvisor. This investment represents collateral received for securities lending.

(Y) The rate shown is the annualized seven-day yield as of 7-31-13.

† At 7-31-13, the aggregate cost of investment securities for federal income tax purposes was $620,750,864. Net unrealized appreciation aggregated $107,446,118, of which $110,350,011 related to appreciated investment securities and $2,903,893 related to depreciated investment securities.

The fund had the following country concentration as a percentage of net assets on 7-31-13:

| | |

| United States | 74.8% | |

| Japan | 11.6% | |

| Ireland | 5.1% | |

| France | 3.3% | |

| United Kingdom | 2.7% | |

| Hong Kong | 1.6% | |

| Macau | 0.6% | |

| Germany | 0.3% | |

| | |

| |

| Total | 100.0% | |

| | |

| 16 | Technical Opportunities Fund | Annual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 7-31-13

This Statement of assets and liabilities is the fund’s balance sheet. It shows the value of what the fund owns, is due and owes. You’ll also find the net asset value and the maximum offering price per share.

| |

| Assets | |

|

| Investments in unaffiliated issuers, at value (Cost $554,048,032) including | |

| $64,033,042 of securities loaned | $662,844,197 |

| Investments in affiliated issuers, at value (Cost $65,345,337) | 65,352,785 |

| | |

| Total investments, at value (Cost $619,393,369) | 728,196,982 |

| Cash | 80,358 |

| Receivable for investments sold | 23,477,997 |

| Receivable for fund shares sold | 165,995 |

| Dividends and interest receivable | 147,512 |

| Receivable for securities lending income | 32,127 |

| Other receivables and prepaid expenses | 25,131 |

| | |

| Total assets | 752,126,102 |

| |

| Liabilities | |

|

| Payable for investments purchased | 16,492,985 |

| Payable for fund shares repurchased | 307,480 |

| Payable upon return of securities loaned | 65,395,014 |

| Payable to affiliates | |

| Accounting and legal services fees | 13,473 |

| Transfer agent fees | 7,727 |

| Trustees’ fees | 508 |

| Other liabilities and accrued expenses | 90,907 |

| | |

| Total liabilities | 82,308,094 |

| | |

| Net assets | $669,818,008 |

| |

| Net assets consist of | |

|

| Paid-in capital | $524,411,075 |

| Accumulated net investment loss | (3,517) |

| Accumulated net realized gain (loss) on investments and foreign | |

| currency transactions | 36,610,101 |

| Net unrealized appreciation (depreciation) on investments and translation | |

| of assets and liabilities in foreign currencies | 108,800,349 |

| | |

| Net assets | $669,818,008 |

| | |

| See notes to financial statements | Annual report | Technical Opportunities Fund | 17 |

F I N A N C I A L S T A T E M E N T S

Statement of assets and liabilities (continued)

| |

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — the fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($45,494,030 ÷ 3,458,543 shares)1 | $13.15 |

| Class I ($18,285,863 ÷ 1,369,474 shares) | $13.35 |

| Class NAV ($606,038,115 ÷ 45,078,568 shares) | $13.44 |

| |

| Maximum offering price per share | |

|

| Class A (net asset value per share ÷ 95%)2 | $13.84 |

1 Redemption price is equal to net asset value less any applicable contingent deferred sales change.

2 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

| | |

| 18 | Technical Opportunities Fund | Annual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T S

Statement of operations For the year ended 7-31-13

This Statement of operations summarizes the fund’s investment income earned and expenses incurred in operating the fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Dividends | $5,266,075 |

| Securities lending | 754,167 |

| Interest | 24,998 |

| Less foreign taxes withheld | (194,283) |

| | |

| Total investment income | 5,850,957 |

| |

| Expenses | |

|

| Investment management fees | 6,385,493 |

| Distribution and service fees | 132,767 |

| Accounting and legal services fees | 70,891 |

| Transfer agent fees | 94,736 |

| Trustees’ fees | 5,529 |

| State registration fees | 38,673 |

| Printing and postage | 16,286 |

| Professional fees | 55,724 |

| Custodian fees | 166,734 |

| Registration and filing fees | 33,316 |

| Other | 11,534 |

| | |

| Total expenses | 7,011,683 |

| Less expense reductions | (21,453) |

| | |

| Net expenses | 6,990,230 |

| | |

| Net investment loss | (1,139,273) |

| |

| Realized and unrealized gain (loss) | |

|

| |

| Net realized gain (loss) on | |

| Investments in unaffiliated issuers | 114,877,827 |

| Investments in affiliated issuers | 4,429 |

| Foreign currency transactions | 8,984 |

| | 114,891,240 |

| Change in net unrealized appreciation (depreciation) of | |

| Investments in unaffiliated issuers | 61,349,851 |

| Investments in affiliated issuers | (22,594) |

| Translation of assets and liabilities in foreign currencies | (2,830) |

| | 61,324,427 |

| Net realized and unrealized gain | 176,215,667 |

| | |

| Increase in net assets from operations | $175,076,394 |

| | |

| See notes to financial statements | Annual report | Technical Opportunities Fund | 19 |

F I N A N C I A L S T A T E M E N T S

Statements of changes in net assets

These Statements of changes in net assets show how the value of the fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of fund share transactions.

| | |

| | Year | Year |

| | ended | ended |

| | 7-31-13 | 7-31-12 |

| Increase (decrease) in net assets | | |

|

| From operations | | |

| Net investment loss | ($1,139,273) | ($3,104,066) |

| Net realized gain (loss) | 114,891,240 | (71,816,856) |

| Change in net unrealized appreciation (depreciation) | 61,324,427 | (5,977,695) |

| | | |

| Increase (decrease) in net assets resulting from operations | 175,076,394 | (80,898,617) |

| | | |

| Distributions to shareholders | | |

| From net realized gain | | |

| Class A | — | (3,359,268) |

| Class I | — | (1,477,257) |

| Class NAV | — | (18,131,169) |

| | | |

| Total distributions | — | (22,967,694) |

| | | |

| From fund share transactions | (5,916,914) | (118,120,569) |

| | | |

| Total increase (decrease) | 169,159,480 | (221,986,880) |

| |

| Net assets | | |

|

| Beginning of year | 500,658,528 | 722,645,408 |

| | | |

| End of year | $669,818,008 | $500,658,528 |

| | | |

| Accumulated net investment loss | ($3,517) | ($1,414,427) |

| | |

| 20 | Technical Opportunities Fund | Annual report | See notes to financial statements |

Financial highlights

The Financial highlights show how the fund’s net asset value for a share has changed during the period.

| | | | |

| CLASS A SHARES Period ended | 7-31-13 | 7-31-12 | 7-31-11 | 7-31-101 |

| |

| Per share operating performance | | | | |

|

| Net asset value, beginning of period | $9.65 | $11.33 | $9.86 | $10.00 |

| Net investment loss2 | (0.08) | (0.10) | (0.09) | (0.13) |

| Net realized and unrealized gain (loss) on investments | 3.58 | (1.17) | 1.56 | (0.01) |

| Total from investment operations | 3.50 | (1.27) | 1.47 | (0.14) |

| Less distributions | | | | |

| From net realized gain | — | (0.41) | — | — |

| Net asset value, end of period | $13.15 | $9.65 | $11.33 | $9.86 |

| Total return (%)3 | 36.27 | (10.93) | 14.91 | (1.40)4 |

| |

| Ratios and supplemental data | | | | |

|

| Net assets, end of period (in millions) | $45 | $51 | $125 | $165 |

| Ratios (as a percentage of average net assets): | | | | |

| Expenses before reductions | 1.78 | 1.88 | 1.90 | 1.875 |

| Expenses including reductions and amounts recaptured | 1.78 | 1.88 | 1.90 | 1.875 |

| Net investment loss | (0.69) | (1.04) | (0.79) | (1.23)5 |

| Portfolio turnover (%) | 391 | 507 | 361 | 389 |

| |

1 Period from 8-3-09 (commencement of operations) to 7-31-10.

2 Based on the average daily shares outstanding.

3 Does not reflect the effect of sales charges, if any.

4 Not annualized.

5 Annualized.

| | | | |

| CLASS I SHARES Period ended | 7-31-13 | 7-31-12 | 7-31-11 | 7-31-101 |

| |

| Per share operating performance | | | | |

|

| Net asset value, beginning of period | $9.77 | $11.42 | $9.89 | $10.00 |

| Net investment loss2 | (0.04) | (0.07) | (0.04) | (0.09) |

| Net realized and unrealized gain (loss) on investments | 3.62 | (1.17) | 1.57 | (0.02) |

| Total from investment operations | 3.58 | (1.24) | 1.53 | (0.11) |

| Less distributions | | | | |

| From net realized gain | — | (0.41) | — | — |

| Net asset value, end of period | $13.35 | $9.77 | $11.42 | $9.89 |

| Total return (%)3 | 36.64 | (10.57) | 15.47 | (1.10)4 |

| |

| Ratios and supplemental data | | | | |

|

| Net assets, end of period (in millions) | $18 | $17 | $63 | $79 |

| Ratios (as a percentage of average net assets): | | | | |

| Expenses before reductions | 1.48 | 1.55 | 1.49 | 1.525 |

| Expenses including reductions and amounts recaptured | 1.47 | 1.51 | 1.49 | 1.525 |

| Net investment loss | (0.39) | (0.69) | (0.37) | (0.89)5 |

| Portfolio turnover (%) | 391 | 507 | 361 | 389 |

| |

1 Period from 8-3-09 (commencement of operations) to 7-31-10.

2 Based on the average daily shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the applicable periods shown.

4 Not annualized.

5 Annualized.

| | |

| See notes to financial statements | Annual report | Technical Opportunities Fund | 21 |

| | | | |

| CLASS NAV SHARES Period ended | 7-31-13 | 7-31-12 | 7-31-11 | 7-31-101 |

| |

| Per share operating performance | | | | |

|

| Net asset value, beginning of period | $9.81 | $11.45 | $9.90 | $10.00 |

| Net investment loss2 | (0.02) | (0.04) | (0.03) | (0.07) |

| Net realized and unrealized gain (loss) on investments | 3.65 | (1.19) | 1.58 | (0.03) |

| Total from investment operations | 3.63 | (1.23) | 1.55 | (0.10) |

| Less distributions | | | | |

| From net realized gain | — | (0.41) | — | — |

| Net asset value, end of period | $13.44 | $9.81 | $11.45 | $9.90 |

| Total return (%)3 | 37.00 | (10.45) | 15.66 | (1.00)4 |

| |

| Ratios and supplemental data | | | | |

|

| Net assets, end of period (in millions) | $606 | $433 | $535 | $349 |

| Ratios (as a percentage of average net assets): | | | | |

| Expenses before reductions | 1.24 | 1.32 | 1.37 | 1.395 |

| Expenses including reductions and amounts recaptured | 1.23 | 1.32 | 1.37 | 1.395 |

| Net investment loss | (0.16) | (0.46) | (0.31) | (0.72)5 |

| Portfolio turnover (%) | 391 | 507 | 361 | 389 |

| |

1 Period from 8-3-09 (commencement of operations) to 7-31-10.

2 Based on the average daily shares outstanding.

3 Total returns would have been lower had certain expenses not been reduced during the applicable periods shown.

4 Not annualized.

5 Annualized.

| | |

| 22 | Technical Opportunities Fund | Annual report | See notes to financial statements |

Notes to financial statements

Note 1 — Organization

John Hancock Technical Opportunities Fund (the fund) is a series of John Hancock Funds II (the Trust), an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the fund is to seek long-term capital appreciation.

The fund may offer multiple classes of shares. The shares currently offered are detailed in the Statement of assets and liabilities. Class A shares are offered to all investors. Class I shares are offered to institutions and certain investors. Class NAV shares are offered to John Hancock affiliated funds of funds and certain 529 plans. Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees, if any, and transfer agent fees, printing and postage and state registration fees for each class may differ.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions as of the date of the financial statements. Actual results could differ from those estimates and those differences could be significant. Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. In order to value the securities, the fund uses the following valuation techniques: Equity securities held by the fund are valued at the last sale price or official closing price on the principal securities exchange on which they trade. In the event there were no sales during the day or closing prices are not available, the securities are valued using the last quoted bid or evaluated price. Investments by the funds in open-end mutual funds, including John Hancock Collateral Investment Trust (JHCIT), are valued at their respective net asset values each business day. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rates supplied by an independent pricing service. Certain securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Certain short-term securities are valued at amortized cost.

Other portfolio securities and assets, for which reliable market quotations are not readily available, are valued at fair value as determined in good faith by the fund’s Pricing Committee following procedures established by the Board of Trustees, which include price verification procedures. The frequency with which these fair valuation procedures are used cannot be predicted and fair value of securities may differ significantly from the value that would have been used had a ready market for such securities existed. Generally, trading in foreign securities is substantially completed each day at various times prior to the close of trading on the NYSE. Significant market events that affect the values of foreign securities may occur between the time when the valuation of the securities is generally determined and the close of the NYSE. During significant market events, these securities will be valued at fair value, as determined in good faith, following procedures established by the Board of Trustees. The fund may use a fair valuation model to value foreign securities in order to adjust for events that may occur between the close of foreign exchanges and the close of the NYSE.

| |

| Annual report | Technical Opportunities Fund | 23 |

The fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities. Level 2 includes securities valued using other significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the fund’s own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events or trends, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy.

The following is a summary of the values by input classification of the fund’s investments as of July 31, 2013, by major security category or type:

| | | | |

| | | | | LEVEL 3 |

| | | | LEVEL 2 | SIGNIFICANT |

| | TOTAL MARKET | LEVEL 1 | SIGNIFICANT | UNOBSERVABLE |

| | VALUE AT 7-31-13 | QUOTED PRICE | OBSERVABLE INPUTS | INPUTS |

|

| Common Stocks | | | | |

| Consumer Discretionary | $108,564,099 | $86,985,971 | $21,578,128 | — |

| Consumer Staples | 13,747,574 | 5,099,904 | 8,647,670 | — |

| Energy | 20,678,936 | 20,678,936 | — | — |

| Financials | 87,478,145 | 43,898,653 | 43,579,492 | — |

| Health Care | 275,979,002 | 273,384,950 | 2,594,052 | — |

| Industrials | 63,277,696 | 24,892,754 | 38,384,942 | — |

| Information Technology | 83,966,185 | 71,645,557 | 12,320,628 | — |

| Materials | 3,552,560 | 3,552,560 | — | — |

| Securities Lending | | | | |

| Collateral | 65,352,785 | 65,352,785 | — | — |

| Short-Term Investments | 5,600,000 | — | 5,600,000 | — |

| |

|

| Total Investments in | | | | |

| Securities | $728,196,982 | $595,492,070 | $132,704,912 | — |

Repurchase agreements. The fund may enter into repurchase agreements. When the fund enters into a repurchase agreement, it receives collateral that is held in a segregated account by the fund’s custodian. The collateral amount is marked-to-market and monitored on a daily basis to ensure that the collateral held is in an amount not less than the principal amount of the repurchase agreement plus any accrued interest. Collateral for certain tri-party repurchase agreements is held at a third-party custodian bank in a segregated account for the benefit of the fund.

Repurchase agreements are typically governed by the terms and conditions of the Master Repurchase Agreement and/or Global Master Repurchase Agreement (collectively, MRA). Upon an event of default, the non-defaulting party may close out all transactions traded under the MRA and net amounts owed. Absent an event of default, the MRA does not result in an offset of the reported amounts of assets and liabilities in the Statement of assets and liabilities. In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the collateral value may decline or the counterparty may have insufficient assets to pay back claims resulting from close-out of the transactions. Collateral received by the fund for repurchase agreements is disclosed in the fund’s investments as part of the caption related to the repurchase agreement.

| |

| 24 | Technical Opportunities Fund | Annual report |

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Dividend income is recorded on the ex-date, except for dividends of foreign securities where the dividend may not be known until after the ex-date. In those cases, dividend income, net of withholding taxes, is recorded when the fund becomes aware of the dividends. Foreign taxes are provided for based on the fund’s understanding of the tax rules and rates that exist in the foreign markets in which it invests. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation.

Securities lending. The fund may lend its securities to earn additional income. It receives cash collateral from the borrower in an amount not less than the market value of the loaned securities. The fund will invest its collateral in JHCIT, an affiliate of the fund, which has a floating net asset value (NAV) and is registered with the SEC as an investment company. JHCIT invests cash received as collateral as part of the securities lending program in short term money-market investments. The fund will receive the benefit of any gains and bear any losses generated by JHCIT with respect to the cash collateral.

If a borrower fails to return loaned securities when due, then the lending agent is responsible to and indemnifies the fund for the lent securities. The lending agent uses the collateral received from the borrower to purchase replacement securities of the same issue, type, class and series of the loaned securities. If the value of the collateral is less than the purchase cost of replacement securities, the lending agent is responsible for satisfying the shortfall but only to the extent that the shortfall is not due to any decrease in JHCIT.

Although the risk of the loss of the securities lent is mitigated by receiving collateral from the borrower and through lending agent indemnification, the fund could experience a delay in recovering its securities or could experience a lower than expected return, if the borrower fails to return the securities on a timely basis. The fund may receive compensation for lending its securities by retaining a portion of the return on the investment of the collateral and compensation from fees earned from borrowers of the securities. Net income received from JHCIT is a component of securities lending income as recorded on the Statement of operations.

Collateral received by the fund is shown on the Statement of assets and liabilities as Payable upon return of securities loaned.

Foreign currency translation. Assets, including investments and liabilities denominated in foreign currencies, are translated into U.S. dollar values each day at the prevailing exchange rate. Purchases and sales of securities, income and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on the value of securities is reflected as a component of the realized and unrealized gains (losses) on investments.

Funds that invest internationally generally carry more risk than funds that invest strictly in U.S. securities. Risks can result from differences in economic and political conditions, regulations, market practices (including higher transaction costs), accounting standards and other factors. Foreign investments are also subject to a decline in the value of a foreign currency versus the U.S. dollar, which reduces the dollar value of securities denominated in that currency.

Foreign taxes. The fund may be subject to withholding tax on income and/or capital gains or repatriation taxes imposed by certain countries in which the fund invests. Taxes are accrued based upon investment income, realized gains or unrealized appreciation.

| |

| Annual report | Technical Opportunities Fund | 25 |

Line of credit. The fund may borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the fund custodian agreement, the custodian may loan money to the fund to make properly authorized payments. The fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian may have a lien, security interest or security entitlement in any fund property that is not otherwise segregated or pledged, to the maximum extent permitted by law, to the extent of any overdraft.

In addition, the fund and other affiliated funds have entered into an agreement with Citibank N.A. that enables them to participate in a $300 million unsecured committed line of credit. A commitment fee, payable at the end of each calendar quarter, based on the average daily unused portion of the line of credit, is charged to each participating fund on a pro rata basis and is reflected in other expenses on the Statement of operations. Prior to March 27, 2013, the fund participated in a $200 million unsecured line of credit, also with Citibank, with terms otherwise similar to the existing agreement. Commitment fees for the year ended July 31, 2013 were $485. For the year ended July 31, 2013, the fund had no borrowings under either line of credit.

Expenses. Within the John Hancock funds complex, expenses that are directly attributable to an individual fund are allocated to such fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund’s relative net assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations. Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the net assets of the class. Class-specific expenses, such as distribution and service fees, if any, transfer agent fees, state registration fees and printing and postage expenses, for all classes, are calculated daily at the class level based on the appropriate net assets of each class and the specific expense rates applicable to each class.

Federal income taxes. The fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

As of July 31, 2013, the fund had no uncertain tax positions that would require financial statement recognition, derecognition or disclosure. The fund’s federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The fund generally declares and pays dividends and capital gain distributions, if any, annually.

The tax character of distributions for the years ended July 31, 2013 and 2012 was as follows:

| | | | |

| | JULY 31, 2013 | JULY 31, 2012 | | |

| | |

| Ordinary Income | — | $9,254,484 | | |

| Long-Term Capital Gain | — | $13,713,210 | | |

| Total | — | $22,967,694 | | |

Distributions paid by the fund with respect to each class of shares are calculated in the same manner, at the same time and in the same amount, except for the effect of class level expenses that may be applied differently to each class. As of July 31, 2013, the components of distributable

| |

| 26 | Technical Opportunities Fund | Annual report |

earnings on a tax basis consisted of $14,269,840 of undistributed ordinary income and $23,697,756 of long-term capital gains.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Material distributions in excess of tax basis earnings and profits, if any, are reported in the fund’s financial statements as a return of capital.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. Book-tax differences are primarily attributable to net operating losses and wash sale loss deferrals.

Note 3 — Guarantees and indemnifications

Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust, including the fund. Additionally, in the normal course of business, the fund enters into contracts with service providers that contain general indemnification clauses. The fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the fund that have not yet occurred. The risk of material loss from such claims is considered remote.

Note 4 — Fees and transactions with affiliates

John Hancock Advisers, LLC (the Advisor) serves as investment advisor for the fund. John Hancock Funds, LLC (the Distributor), an affiliate of the Advisor, serves as principal underwriter of the fund. The Advisor and the Distributor are indirect, wholly owned subsidiaries of Manulife Financial Corporation (MFC).

Management fee. The fund has an investment management agreement with the Advisor under which the fund pays a daily management fee to the Advisor equivalent, on an annual basis, to the sum of: a) 1.20% of the first $250,000,000 of the fund’s average daily net assets and b) 1.15% of the fund’s average daily net assets in excess of $250,000,000.

Effective June 1, 2013, the Advisor has contractually agreed to waive a portion of its management fee for certain funds (the Participating portfolios) of the Trust, John Hancock Funds, John Hancock Funds III and John Hancock Variable Insurance Trust. The waiver equals, on an annualized basis, 0.01% of that portion of the aggregate net assets of all the Participating portfolios that exceeds $75 billion but is less than or equal to $125 billion; 0.0125% of that portion of the aggregate net assets of all the Participating portfolios that exceeds $125 billion but is less than or equal to $150 billion; and 0.015% of that portion of the aggregate net assets of all the Participating portfolios that exceeds $150 billion. The amount of the reimbursement is calculated daily and allocated among all the Participating portfolios in proportion to the daily net assets of each fund. This arrangement may be amended or terminated at any time by the Advisor upon notice to the fund and with the approval of the Board of Trustees.

Prior to June 1, 2013, the advisor had contractually agreed to waive a portion of its management fee for certain funds (the Participating Portfolios) of the Trust and John Hancock Variable Insurance Trust. The waiver equaled, on an annualized basis, 0.01% of that portion of the aggregate net assets of all the Participating Portfolios that exceeded $75 billion but was less than $100 billion; and 0.015% of that portion of the aggregate net assets of all the Participating Portfolios that equaled or exceeded $100 billion. The amount of the reimbursement was calculated daily and allocated among all the Participating Portfolios in proportion to the daily net assets of each fund.

| |

| Annual report | Technical Opportunities Fund | 27 |

Prior to December 1, 2012, the Advisor contractually agreed to waive fees and/or reimburse certain expenses for each share class of the fund excluding certain expenses such as taxes, brokerage commissions, interest expense, acquired fund fees, litigation and indemnification expenses, and other extraordinary expenses not incurred in the ordinary course of the fund’s business. The fee waivers and/or reimbursements were such that these expenses would not exceed 1.95% and 1.59% for Class A and Class I shares, respectively. This contractual expense limitation is no longer in effect for the fund.

Additionally, the Advisor has voluntarily agreed to waive other fund level expenses excluding advisory fees, 12b-1 fees, service fees, transfer agent fees, printing and postage, blue sky fees, taxes, brokerage commissions, interest expense, acquired fund fees, litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of business. This voluntary expense reimbursement will continue in effect until terminated at any time by the Advisor on notice to the fund. The waivers are such that these expenses will not exceed 0.20% of average net assets.

Accordingly, these expense reductions amounted to $1,696, $712 and $19,045 for Class A, Class I and Class NAV shares, respectively, for the year ended July 31, 2013.

The investment management fees incurred for the year ended July 31, 2013 were equivalent to a net annual effective rate of 1.17% of the fund’s average daily net assets.

Expense recapture. The Advisor may recapture operating expenses reimbursed or fees waived under previous expense limitation or waiver arrangements for a period of three years following the beginning of the month in which such reimbursements or waivers originally occurred to the extent that the fund is below its expense limitation during this period. For the year ended July 31, 2013, the fund did not recapture any expenses. As of July 31, 2013, the fund has no amounts waived or reimbursed subject to recovery going forward.

Accounting and legal services. Pursuant to a service agreement, the fund reimburses the Advisor for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services to the fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports, among other services. These expenses are allocated to each share class based on its relative net assets at the time the expense was incurred. These accounting and legal services fees incurred for the year ended July 31, 2013 amounted to an annual rate of 0.01% of the fund’s average daily net assets.

Distribution and service plans. The fund has a distribution agreement with the Distributor. The fund has adopted distribution and service plans with respect to Class A pursuant to Rule 12b-1 under the 1940 Act, to pay the Distributor for services provided as the distributor of shares of the fund. The fund pays 0.30% for Class A shares distribution and service fees under these arrangements, expressed as an annual percentage of average daily net assets for the fund’s Class A shares.

Sales charges. Class A shares are assessed up-front sales charges, which resulted in payments to the Distributor amounting to $42,239 for the year ended July 31, 2013. Of this amount, $6,823 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $35,026 was paid as sales commissions to broker-dealers and $390 was paid as sales commissions to sales personnel of Signator Investors, Inc., a broker-dealer affiliate of the Advisor.

Class A shares may be subject to contingent deferred sales charges (CDSCs). Certain Class A shares that are acquired through purchases of $1 million or more and are redeemed within one year of purchase are subject to a 1.00% CDSC. CDSCs are applied to the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds

| |

| 28 | Technical Opportunities Fund | Annual report |

from CDSCs are used to compensate the Distributor for providing distribution-related services in connection with the sale of these shares. During the year ended July 31, 2013, there were no CDSCs received by the Distributor for Class A shares.

Transfer agent fees. The fund has a transfer agent agreement with John Hancock Signature Services, Inc. (Signature Services), an affiliate of the Advisor. The transfer agent fees paid to Signature Services are determined based on the cost to Signature Services (Signature Services Cost) of providing recordkeeping services. The Signature Services Cost includes a component of allocated John Hancock corporate overhead for providing transfer agent services to the fund and to all other John Hancock affiliated funds. It also includes out-of-pocket expenses that are comprised of payments made to third-parties for recordkeeping services provided to their clients who invest in one or more John Hancock funds. In addition, Signature Services Cost may be reduced by certain fees that Signature Services receives in connection with retirement and small accounts. Signature Services Cost is calculated monthly and allocated, as applicable, to four categories of share classes: Institutional Share Classes, Retirement Share Classes, Municipal Bond Classes and all other Retail Share Classes. Within each of these categories, the applicable costs are allocated to the affected John Hancock affiliated funds and/or classes, based on the relative average daily net assets.

Class level expenses. Class level expenses for the year ended July 31, 2013 were:

| | | | |

| | DISTRIBUTION | TRANSFER | STATE | PRINTING AND |

| CLASS | AND SERVICE FEES | AGENT FEES | REGISTRATION FEES | POSTAGE |

|

| A | $132,767 | $78,121 | $19,510 | $13,305 |

| I | — | 16,615 | 19,163 | 2,981 |

| Total | $132,767 | $94,736 | $38,673 | $16,286 |

Trustee expenses. The fund compensates each Trustee who is not an employee of the Advisor or its affiliates. The costs of paying Trustee compensation and expenses are allocated to each fund based on its average daily net assets.

Note 5 — Fund share transactions

Transactions in fund shares for the years ended July 31, 2013 and 2012 were as follows:

| | | | |

| | Year ended 7-31-13 | | Year ended 7-31-12 |

| | Shares | Amount | Shares | Amount |

| Class A shares | | | | |

|

| Sold | 665,826 | $7,731,533 | 574,825 | $5,603,251 |

| Distributions reinvested | — | — | 360,725 | 3,253,738 |

| Repurchased | (2,509,969) | (26,860,100) | (6,664,412) | (64,322,341) |

| | | | | |

| Net decrease | (1,844,143) | ($19,128,567) | (5,728,862) | ($55,465,352) |

| |

| Class I shares | | | | |

|

| Sold | 625,607 | $7,282,687 | 546,121 | $5,379,169 |

| Distributions reinvested | — | — | 111,925 | 1,020,757 |

| Repurchased | (963,137) | (10,567,533) | (4,436,239) | (43,097,390) |

| | | | | |

| Net decrease | (337,530) | ($3,284,846) | (3,778,193) | ($36,697,464) |

| |

| Class NAV shares | | | | |

|

| Sold | 7,047,702 | $84,734,367 | 7,413,399 | $74,029,581 |

| Distributions reinvested | — | — | 1,983,717 | 18,131,169 |

| Repurchased | (6,069,547) | (68,237,868) | (12,036,455) | (118,118,503) |

| | | | | |

| Net increase (decrease) | 978,155 | $16,496,499 | (2,639,339) | ($25,957,753) |

| |

| Total net decrease | (1,203,518) | ($5,916,914) | (12,146,394) | ($118,120,569) |

|

| |

| Annual report | Technical Opportunities Fund | 29 |

Affiliates of the fund owned 100% of shares of beneficial interest of Class NAV on July 31, 2013.

Note 6 — Purchase and sale of securities

Purchases and sales of securities, other than short-term securities, amounted to $2,062,305,500 and $2,070,425,640, respectively, for the year ended July 31, 2013.

Note 7 — Investment by affiliated funds

Certain investors in the fund are affiliated funds that are managed by the Advisor and its affiliates. The affiliated funds do not invest in the fund for the purpose of exercising management or control; however, affiliated fund investments may represent a significant portion of the fund’s net assets. At July 31, 2013, the following funds had an affiliate ownership of 5% or more of the fund’s net assets:

| | |

| FUND | AFFILIATE CONCENTRATION | |

| |

| John Hancock Lifestyle Aggressive Portfolio | 15.9% | |

| John Hancock Lifestyle Growth Portfolio | 42.1% | |

| John Hancock Lifestyle Balanced Portfolio | 24.4% | |

| |

| 30 | Technical Opportunities Fund | Annual report |

Auditor’s report

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of John Hancock Funds II and Shareholders of

John Hancock Technical Opportunities Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of John Hancock Technical Opportunities Fund (the “Fund”) at July 31, 2013, and the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at July 31, 2013 by correspondence with the custodians and brokers and the application of alternative auditing procedures where securities purchased confirmations had not been received, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

September 20, 2013

| |

| Annual report | Technical Opportunities Fund | 31 |

Evaluation of Advisory and Subadvisory Agreements by the Board of Trustees

This section describes the evaluation by the Board of Trustees (the Board) of John Hancock Funds II (the Trust) of the Advisory Agreement (the Advisory Agreement) with John Hancock Investment Management Services, LLC (the Advisor) and the Subadvisory Agreement (the Subadvisory Agreement) with Wellington Management Company, LLP (the Subadvisor) for Technical Opportunities Fund (the fund). The Advisory Agreement and Subadvisory Agreement are collectively referred to as the Agreements.

Approval of Advisory and Subadvisory Agreements

At in-person meetings held on May 16-17, 2013, the Board, including the Trustees who are not considered to be interested persons of the Trust under the Investment Company Act of 1940, as amended (the 1940 Act) (the Independent Trustees), reapproved for an annual period the continuation of the Advisory Agreement between the Trust and the Advisor and the Subadvisory Agreement between the Advisor and the Subadvisor with respect to the fund.

In considering the Advisory Agreement and the Subadvisory Agreement, the Board received in advance of the meeting a variety of materials relating to the fund, the Advisor, and the Subadvisor, including comparative performance, fee and expense information for peer groups of similar mutual funds prepared by an independent third-party provider of mutual fund data; performance information for the fund’s benchmark index; and, with respect to the Subadvisor, comparative performance information for comparably managed accounts; and other information provided by the Advisor and the Subadvisor regarding the nature, extent, and quality of services provided by the Advisor and the Subadvisor under their respective Agreements, as well as information regarding the Advisor’s revenues and costs of providing services to the fund and any compensation paid to affiliates of the Advisor. At the meeting at which the renewal of the Advisory Agreement and Subadvisory Agreement is considered, particular focus is given to information concerning fund performance, comparability of fees and total expenses and profitability. However, the Board notes that the evaluation process with respect to the Advisor and the Subadvisor is an ongoing one. In this regard, the Board also took into account discussions with management and information provided to the Board at prior meetings with respect to the services provided by the Advisor and the Subadvisor to the fund, including quarterly performance reports prepared by management containing reviews of investment results and prior presentations from the Subadvisor with respect to the fund. The Board also considered the nature, quality, and extent of non-advisory services, if any, to be provided to the fund by the Advisor’s affiliates, including distribution services.

Throughout the process, the Board asked questions of and requested additional information from management. The Board is assisted by counsel for the Trust and the Independent Trustees are also separately assisted by independent legal counsel throughout the process. The Independent Trustees also received a memorandum from their independent counsel discussing the legal standards for their consideration of the proposed continuation of the Agreements and discussed the proposed continuation of the Agreements in private sessions with their independent legal counsel at which no representatives of management were present.

Approval of Advisory Agreement

In approving the Advisory Agreement with respect to the fund, the Board, including the Independent Trustees, considered a variety of factors, including those discussed below. The Board also considered other factors (including conditions and trends prevailing generally in the economy, the securities markets, and the industry) and does not treat any single factor as determinative and each Trustee may attribute different weights to different factors. The Board’s conclusions may be based in part on its consideration of the Advisory and Subadvisory Agreements in prior years and on the Board’s ongoing regular review of fund performance and operations throughout the year.

| |

| 32 | Technical Opportunities Fund | Annual report |

Nature, extent, and quality of services. Among the information received by the Board from the Advisor relating to the nature, extent, and quality of services provided to the fund, the Board reviewed information provided by the Advisor relating to its operations and personnel, descriptions of its organizational and management structure, and information regarding the Advisor’s compliance and regulatory history, including its Form ADV. The Board also noted that on a regular basis it receives and reviews information from the Trust’s Chief Compliance Officer (CCO) regarding the fund’s compliance policies and procedures established pursuant to Rule 38a-1 under the 1940 Act. The Board also considered the Advisor’s risk management processes. The Board considered that the Advisor is responsible for the management of the day-to-day operations of the fund, including, but not limited to, general supervision of and coordination of the services provided by the Subadvisor, and is also responsible for monitoring and reviewing the activities of the Subadvisor and other third-party service providers.

In considering the nature, extent, and quality of the services provided by the Advisor, the Trustees also took into account their knowledge of the Advisor’s management and the quality of the performance of the Advisor’s duties through Board meetings, discussions, and reports during the preceding year and through each Trustee’s experience as a Trustee of the Trust and of the other trusts in the complex.

In the course of their deliberations regarding the Advisory Agreement, the Board considered, among other things:

(a) the skills and competency with which the Advisor has in the past managed the Trust’s affairs and its subadvisory relationship, the Advisor’s oversight and monitoring of the Subadvisor’s investment performance and compliance programs, such as the Subadvisor’s compliance with fund policies and objective; review of brokerage matters, including with respect to trade allocation and best execution; and the Advisor’s timeliness in responding to performance issues;

(b) the background, qualifications and skills of the Advisor’s personnel;

(c) the Advisor’s compliance policies and procedures and its responsiveness to regulatory changes and mutual fund industry developments;

(d) the Advisor’s administrative capabilities, including its ability to supervise the other service providers for the fund;

(e) the financial condition of the Advisor and whether it has the financial wherewithal to provide a high level and quality of services to the fund; and

(f) the Advisor’s reputation and experience in serving as an investment adviser to the Trust and the benefit to shareholders of investing in funds that are part of a family of funds offering a variety of investments.

The Board concluded that the Advisor may reasonably be expected to continue to provide a high quality of services under the Advisory Agreement with respect to the fund.

Investment performance. In considering the fund’s performance, the Board noted that it reviews at its regularly scheduled meetings information about the fund’s performance results. In connection with the consideration of the Advisory Agreement, the Board:

(a) reviewed information prepared by management regarding the fund’s performance;

(b) considered the comparative performance of the fund’s benchmark;

| |

| Annual report | Technical Opportunities Fund | 33 |

(c) considered the performance of comparable funds, if any, as included in the report prepared by an independent third-party provider of mutual fund data. Such report included the fund’s ranking within a smaller group of peer funds and the fund’s ranking within broader groups of funds; and

(d) took into account the Advisor’s analysis of the fund’s performance and its plans and recommendations regarding the Trust’s subadvisory arrangements generally.

The Board noted that the fund underperformed its benchmark index for the one- and three-year periods ended December 31, 2012. The Board also noted that the fund had outperformed its peer group average for the one-year period and underperformed the peer group average for the three-year period ended December 31, 2012.

The Board noted that the fund’s performance is being closely monitored. The Board took into account management’s discussion of the fund’s performance and noted the fund’s recent relative performance improvements.

The Board concluded that the fund’s performance is being reasonably addressed.

Fees and expenses. The Board reviewed comparative information prepared by an independent third-party provider of mutual fund data, including, among other data, the fund’s contractual and net management fees and total expenses as compared to similarly situated investment companies deemed to be comparable to the fund. The Board considered the fund’s ranking within a smaller group of peer funds chosen by the independent third-party provider, as well as the fund’s ranking within a broader group of funds. In comparing the fund’s contractual and net management fees to those of comparable funds, the Board noted that such fees include both advisory and administrative costs.

The Board noted that net management fees for this fund are higher than the peer group median and that total expenses for this fund are higher than the peer group median. The Board took into account management’s discussion of the fund’s expenses.