As a shareholder of a John Hancock Funds II Multimanager Lifestyle Portfolio, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchases or redemptions, and (2) ongoing costs, including management fees, distribution and service (Rule 12b-1) fees, and other portfolio expenses. In addition to the operating expenses which each portfolio bears directly, the portfolio indirectly bears a pro rata share of the operating expenses of the underlying funds in which each portfolio invests. Because underlying funds have varied operating expenses and transaction costs and the portfolio may own different proportions of the underlying funds at different times, the amount of expenses incurred indirectly by the portfolio will vary. Had these indirect expenses been reflected in the following analysis, total expenses would have been higher than the amounts shown.

These examples are intended to help you understand your ongoing costs (in dollars) of investing in a portfolio so you can compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 at the beginning of the period and held for the entire period (January 1, 2018 through June 30, 2018).

Actual expenses:

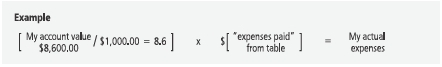

The first line of each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses paid during period ended” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes:

The second line of each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio for the share class and an assumed annualized rate of return of 5% per year before expenses, which is not the actual return of the share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please remember that these hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. See the portfolios’ prospectuses for details regarding transaction costs.

| SEMIANNUAL REPORT | JOHN HANCOCK MULTIMANAGER LIFESTYLE PORTFOLIOS 14 |

| |

| SHAREHOLDER EXPENSE EXAMPLE CHART |

|

| | | | | | | | | | |

| | | | | | | | Expenses | | |

| | | | Account | | Ending | | paid during | | Annualized |

| | | | value on | | value on | | period ended | | expense |

| | | | 1-1-2018 | | 6-30-2018 | | 6-30-20181 | | ratio2 |

| Multimanager Lifestyle Aggressive Portfolio |

| Class A | | Actual expenses/actual returns | | $1,000.00 | | $1,010.30 | | $2.34 | | 0.47% |

| | Hypothetical example | | 1,000.00 | | 1,022.50 | | 2.36 | | 0.47% |

| Class B | | Actual expenses/actual returns | | 1,000.00 | | 1,006.60 | | 5.82 | | 1.17% |

| | Hypothetical example | | 1,000.00 | | 1,019.00 | | 5.86 | | 1.17% |

| Class C | | Actual expenses/actual returns | | 1,000.00 | | 1,006.60 | | 5.82 | | 1.17% |

| | Hypothetical example | | 1,000.00 | | 1,019.00 | | 5.86 | | 1.17% |

| Class I | | Actual expenses/actual returns | | 1,000.00 | | 1,011.50 | | 0.85 | | 0.17% |

| | Hypothetical example | | 1,000.00 | | 1,024.00 | | 0.85 | | 0.17% |

| Class R1 | | Actual expenses/actual returns | | 1,000.00 | | 1,008.50 | | 4.08 | | 0.82% |

| | Hypothetical example | | 1,000.00 | | 1,020.70 | | 4.11 | | 0.82% |

| Class R2 | | Actual expenses/actual returns | | 1,000.00 | | 1,009.70 | | 2.99 | | 0.60% |

| | Hypothetical example | | 1,000.00 | | 1,021.80 | | 3.01 | | 0.60% |

| Class R3 | | Actual expenses/actual returns | | 1,000.00 | | 1,008.50 | | 3.59 | | 0.72% |

| | Hypothetical example | | 1,000.00 | | 1,021.20 | | 3.61 | | 0.72% |

| Class R4 | | Actual expenses/actual returns | | 1,000.00 | | 1,010.90 | | 1.65 | | 0.33% |

| | Hypothetical example | | 1,000.00 | | 1,023.20 | | 1.66 | | 0.33% |

| Class R5 | | Actual expenses/actual returns | | 1,000.00 | | 1,011.50 | | 0.65 | | 0.13% |

| | Hypothetical example | | 1,000.00 | | 1,024.10 | | 0.65 | | 0.13% |

| Class R6 | | Actual expenses/actual returns | | 1,000.00 | | 1,012.10 | | 0.40 | | 0.08% |

| | Hypothetical example | | 1,000.00 | | 1,024.40 | | 0.40 | | 0.08% |

| Class 1 | | Actual expenses/actual returns | | 1,000.00 | | 1,011.60 | | 0.55 | | 0.11% |

| | Hypothetical example | | 1,000.00 | | 1,024.20 | | 0.55 | | 0.11% |

| Multimanager Lifestyle Growth Portfolio |

| Class A | | Actual expenses/actual returns | | $1,000.00 | | $1,003.70 | | $2.33 | | 0.47% |

| | Hypothetical example | | 1,000.00 | | 1,022.50 | | 2.36 | | 0.47% |

| Class B | | Actual expenses/actual returns | | 1,000.00 | | 1,000.60 | | 5.80 | | 1.17% |

| | Hypothetical example | | 1,000.00 | | 1,019.00 | | 5.86 | | 1.17% |

| Class C | | Actual expenses/actual returns | | 1,000.00 | | 1,000.60 | | 5.80 | | 1.17% |

| | Hypothetical example | | 1,000.00 | | 1,019.00 | | 5.86 | | 1.17% |

| Class I | | Actual expenses/actual returns | | 1,000.00 | | 1,005.00 | | 0.89 | | 0.18% |

| | Hypothetical example | | 1,000.00 | | 1,023.90 | | 0.90 | | 0.18% |

| Class R1 | | Actual expenses/actual returns | | 1,000.00 | | 1,001.80 | | 4.07 | | 0.82% |

| | Hypothetical example | | 1,000.00 | | 1,020.70 | | 4.11 | | 0.82% |

| Class R2 | | Actual expenses/actual returns | | 1,000.00 | | 1,003.10 | | 2.73 | | 0.55% |

| | Hypothetical example | | 1,000.00 | | 1,022.10 | | 2.76 | | 0.55% |

| Class R3 | | Actual expenses/actual returns | | 1,000.00 | | 1,002.50 | | 3.28 | | 0.66% |

| | Hypothetical example | | 1,000.00 | | 1,021.50 | | 3.31 | | 0.66% |

| Class R4 | | Actual expenses/actual returns | | 1,000.00 | | 1,004.30 | | 1.64 | | 0.33% |

| | Hypothetical example | | 1,000.00 | | 1,023.20 | | 1.66 | | 0.33% |

| Class R5 | | Actual expenses/actual returns | | 1,000.00 | | 1,005.60 | | 0.65 | | 0.13% |

| | Hypothetical example | | 1,000.00 | | 1,024.10 | | 0.65 | | 0.13% |

| Class R6 | | Actual expenses/actual returns | | 1,000.00 | | 1,005.60 | | 0.40 | | 0.08% |

| | Hypothetical example | | 1,000.00 | | 1,024.40 | | 0.40 | | 0.08% |

| Class 1 | | Actual expenses/actual returns | | 1,000.00 | | 1,005.60 | | 0.60 | | 0.12% |

| | Hypothetical example | | 1,000.00 | | 1,024.20 | | 0.60 | | 0.12% |

| Class 5 | | Actual expenses/actual returns | | 1,000.00 | | 1,005.60 | | 0.35 | | 0.07% |

| | Hypothetical example | | 1,000.00 | | 1,024.40 | | 0.35 | | 0.07% |

| SEMIANNUAL REPORT | JOHN HANCOCK MULTIMANAGER LIFESTYLE PORTFOLIOS 15 |

| |

| SHAREHOLDER EXPENSE EXAMPLE CHART (continued) |

|

| | | | | | | | | | |

| | | | | | | | Expenses | | |

| | | | Account | | Ending | | paid during | | Annualized |

| | | | value on | | value on | | period ended | | expense |

| | | | 1-1-2018 | | 6-30-2018 | | 6-30-20181 | | ratio2 |

| Multimanager Lifestyle Balanced Portfolio |

| Class A | | Actual expenses/actual returns | | $1,000.00 | | $ 998.70 | | $2.38 | | 0.48% |

| | Hypothetical example | | 1,000.00 | | 1,022.40 | | 2.41 | | 0.48% |

| Class B | | Actual expenses/actual returns | | 1,000.00 | | 995.50 | | 5.84 | | 1.18% |

| | Hypothetical example | | 1,000.00 | | 1,018.90 | | 5.91 | | 1.18% |

| Class C | | Actual expenses/actual returns | | 1,000.00 | | 994.80 | | 5.84 | | 1.18% |

| | Hypothetical example | | 1,000.00 | | 1,018.90 | | 5.91 | | 1.18% |

| Class I | | Actual expenses/actual returns | | 1,000.00 | | 1,000.10 | | 0.94 | | 0.19% |

| | Hypothetical example | | 1,000.00 | | 1,023.90 | | 0.95 | | 0.19% |

| Class R1 | | Actual expenses/actual returns | | 1,000.00 | | 996.90 | | 4.06 | | 0.82% |

| | Hypothetical example | | 1,000.00 | | 1,020.70 | | 4.11 | | 0.82% |

| Class R2 | | Actual expenses/actual returns | | 1,000.00 | | 998.20 | | 2.87 | | 0.58% |

| | Hypothetical example | | 1,000.00 | | 1,021.90 | | 2.91 | | 0.58% |

| Class R3 | | Actual expenses/actual returns | | 1,000.00 | | 997.50 | | 3.52 | | 0.71% |

| | Hypothetical example | | 1,000.00 | | 1,021.30 | | 3.56 | | 0.71% |

| Class R4 | | Actual expenses/actual returns | | 1,000.00 | | 999.40 | | 1.69 | | 0.34% |

| | Hypothetical example | | 1,000.00 | | 1,023.10 | | 1.71 | | 0.34% |

| Class R5 | | Actual expenses/actual returns | | 1,000.00 | | 1,000.40 | | 0.69 | | 0.14% |

| | Hypothetical example | | 1,000.00 | | 1,024.10 | | 0.70 | | 0.14% |

| Class R6 | | Actual expenses/actual returns | | 1,000.00 | | 1,000.00 | | 0.45 | | 0.09% |

| | Hypothetical example | | 1,000.00 | | 1,024.30 | | 0.45 | | 0.09% |

| Class 1 | | Actual expenses/actual returns | | 1,000.00 | | 1,000.50 | | 0.64 | | 0.13% |

| | Hypothetical example | | 1,000.00 | | 1,024.10 | | 0.65 | | 0.13% |

| Class 5 | | Actual expenses/actual returns | | 1,000.00 | | 1,000.70 | | 0.40 | | 0.08% |

| | Hypothetical example | | 1,000.00 | | 1,024.40 | | 0.40 | | 0.08% |

| Multimanager Lifestyle Moderate Portfolio |

| Class A | | Actual expenses/actual returns | | $1,000.00 | | $ 990.30 | | $2.42 | | 0.49% |

| | Hypothetical example | | 1,000.00 | | 1,022.40 | | 2.46 | | 0.49% |

| Class B | | Actual expenses/actual returns | | 1,000.00 | | 986.70 | | 5.86 | | 1.19% |

| | Hypothetical example | | 1,000.00 | | 1,018.90 | | 5.96 | | 1.19% |

| Class C | | Actual expenses/actual returns | | 1,000.00 | | 987.50 | | 5.86 | | 1.19% |

| | Hypothetical example | | 1,000.00 | | 1,018.90 | | 5.96 | | 1.19% |

| Class I | | Actual expenses/actual returns | | 1,000.00 | | 991.70 | | 0.99 | | 0.20% |

| | Hypothetical example | | 1,000.00 | | 1,023.80 | | 1.00 | | 0.20% |

| Class R1 | | Actual expenses/actual returns | | 1,000.00 | | 988.50 | | 4.04 | | 0.82% |

| | Hypothetical example | | 1,000.00 | | 1,020.70 | | 4.11 | | 0.82% |

| Class R2 | | Actual expenses/actual returns | | 1,000.00 | | 989.70 | | 3.01 | | 0.61% |

| | Hypothetical example | | 1,000.00 | | 1,021.80 | | 3.06 | | 0.61% |

| Class R3 | | Actual expenses/actual returns | | 1,000.00 | | 989.00 | | 3.50 | | 0.71% |

| | Hypothetical example | | 1,000.00 | | 1,021.30 | | 3.56 | | 0.71% |

| Class R4 | | Actual expenses/actual returns | | 1,000.00 | | 990.90 | | 1.78 | | 0.36% |

| | Hypothetical example | | 1,000.00 | | 1,023.00 | | 1.81 | | 0.36% |

| Class R5 | | Actual expenses/actual returns | | 1,000.00 | | 991.90 | | 0.74 | | 0.15% |

| | Hypothetical example | | 1,000.00 | | 1,024.10 | | 0.75 | | 0.15% |

| Class R6 | | Actual expenses/actual returns | | 1,000.00 | | 992.20 | | 0.49 | | 0.10% |

| | Hypothetical example | | 1,000.00 | | 1,024.30 | | 0.50 | | 0.10% |

| Class 1 | | Actual expenses/actual returns | | 1,000.00 | | 992.00 | | 0.69 | | 0.14% |

| | Hypothetical example | | 1,000.00 | | 1,024.10 | | 0.70 | | 0.14% |

| Class 5 | | Actual expenses/actual returns | | 1,000.00 | | 992.20 | | 0.44 | | 0.09% |

| | Hypothetical example | | 1,000.00 | | 1,024.30 | | 0.45 | | 0.09% |

| SEMIANNUAL REPORT | JOHN HANCOCK MULTIMANAGER LIFESTYLE PORTFOLIOS 16 |

| |

| SHAREHOLDER EXPENSE EXAMPLE CHART (continued) |

|

| | | | | | | | | | |

| | | | | | | | Expenses | | |

| | | | Account | | Ending | | paid during | | Annualized |

| | | | value on | | value on | | period ended | | expense |

| | | | 1-1-2018 | | 6-30-2018 | | 6-30-20181 | | ratio2 |

| Multimanager Lifestyle Conservative Portfolio |

| Class A | | Actual expenses/actual returns | | $1,000.00 | | $ 984.10 | | $2.46 | | 0.50% |

| | Hypothetical example | | 1,000.00 | | 1,022.30 | | 2.51 | | 0.50% |

| Class B | | Actual expenses/actual returns | | 1,000.00 | | 980.60 | | 5.89 | | 1.20% |

| | Hypothetical example | | 1,000.00 | | 1,018.80 | | 6.01 | | 1.20% |

| Class C | | Actual expenses/actual returns | | 1,000.00 | | 980.60 | | 5.89 | | 1.20% |

| | Hypothetical example | | 1,000.00 | | 1,018.80 | | 6.01 | | 1.20% |

| Class I | | Actual expenses/actual returns | | 1,000.00 | | 985.50 | | 1.03 | | 0.21% |

| | Hypothetical example | | 1,000.00 | | 1,023.80 | | 1.05 | | 0.21% |

| Class R1 | | Actual expenses/actual returns | | 1,000.00 | | 982.30 | | 4.13 | | 0.84% |

| | Hypothetical example | | 1,000.00 | | 1,020.60 | | 4.21 | | 0.84% |

| Class R2 | | Actual expenses/actual returns | | 1,000.00 | | 984.30 | | 3.20 | | 0.65% |

| | Hypothetical example | | 1,000.00 | | 1,021.60 | | 3.26 | | 0.65% |

| Class R3 | | Actual expenses/actual returns | | 1,000.00 | | 983.10 | | 3.29 | | 0.67% |

| | Hypothetical example | | 1,000.00 | | 1,021.50 | | 3.36 | | 0.67% |

| Class R4 | | Actual expenses/actual returns | | 1,000.00 | | 984.70 | | 1.77 | | 0.36% |

| | Hypothetical example | | 1,000.00 | | 1,023.00 | | 1.81 | | 0.36% |

| Class R5 | | Actual expenses/actual returns | | 1,000.00 | | 985.70 | | 0.79 | | 0.16% |

| | Hypothetical example | | 1,000.00 | | 1,024.00 | | 0.80 | | 0.16% |

| Class R6 | | Actual expenses/actual returns | | 1,000.00 | | 986.00 | | 0.54 | | 0.11% |

| | Hypothetical example | | 1,000.00 | | 1,024.20 | | 0.55 | | 0.11% |

| Class 1 | | Actual expenses/actual returns | | 1,000.00 | | 985.80 | | 0.74 | | 0.15% |

| | Hypothetical example | | 1,000.00 | | 1,024.10 | | 0.75 | | 0.15% |

| 1 | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| 2 | Ratios do not include expenses indirectly incurred by the underlying funds and can vary based on the mix of underlying funds held by the portfolios. The range of expense ratios of the underlying funds held by the portfolios for the period ended 6-30-2018 was as follows: |

| Portfolio | | Range | | Portfolio | | Range |

| Multimanager Lifestyle Aggressive Portfolio | | 0.53% - 1.62% | | Multimanager Lifestyle Moderate Portfolio | | 0.38% - 1.56% |

| Multimanager Lifestyle Growth Portfolio | | 0.38% - 1.56% | | Multimanager Lifestyle Conservative Portfolio | | 0.38% - 1.56% |

| Multimanager Lifestyle Balanced Portfolio | | 0.38% - 1.56% | | | | |

| SEMIANNUAL REPORT | JOHN HANCOCK MULTIMANAGER LIFESTYLE PORTFOLIOS 17 |

| | INVESTMENT COMPANIES | | | |

| Underlying Funds’ Investment Managers | | | |

| Allianz Global Investors U.S. LLC | | (Allianz) | |

| Barrow, Hanley, Mewhinney & Strauss, LLC | | (Barrow Hanley) | |

| Boston Partners Global Investors, Inc. | | (Boston Partners) | |

| Brandywine Asset Management, Inc. | | (Brandywine) | |

| Deutsche Investment Management Americas, Inc. | | (Deutsche) | |

| Dimensional Fund Advisors LP | | (DFA) | |

| Epoch Investment Partners, Inc. | | (Epoch) | |

| First Quadrant, L.P. | | (First Quadrant) | |

| Franklin Templeton Investments Corp. | | (Franklin Templeton) | |

| GW&K Investment Management, LLC | | (GW&K) | |

| Invesco Advisers, Inc. | | (Invesco) | |

| Jennison Associates LLC | | (Jennison) | |

| John Hancock Asset Management | | (JHAM) | |

| Pacific Investment Management Company LLC | | (PIMCO) | |

| Redwood Investments, LLC | | (Redwood) | |

| Standard Life Investments (Corporate Funds) Limited | | (Standard Life) | |

| Stone Harbor Investment Partners LP | | (Stone Harbor) | |

| T. Rowe Price Associates, Inc. | | (T. Rowe Price) | |

| Templeton Investment Counsel, LLC | | (Templeton) | |

| Wellington Management Company, LLP | | (Wellington) | |

| Wells Capital Management, Incorporated | | (Wells Capital) | |

| Western Asset Management Company | | (WAMCO) | |

| | | | | |

| MULTIMANAGER LIFESTYLE AGGRESSIVE PORTFOLIO |

| |

| As of 6-30-18 (unaudited) | | | | |

| | | Shares or | | |

| | Principal | | |

| | Amount | | Value |

| AFFILIATED INVESTMENT COMPANIES (A) - 100.0% | | |

| Equity - 88.4% | | | | |

| Blue Chip Growth, Class NAV, JHF II | | | | |

| (T. Rowe Price) | | 3,493,236 | | $141,476,047 |

| Capital Appreciation, Class NAV, JHF II | | | | |

| (Jennison) | | 7,739,832 | | 137,691,614 |

| Capital Appreciation Value, Class NAV, JHF II | | | | |

| (T. Rowe Price) | | 14,888,512 | | 174,344,477 |

| Disciplined Value, Class NAV, JHF III | | | | |

| (Boston Partners) | | 7,811,403 | | 167,164,024 |

| Disciplined Value International, Class NAV, | | | | |

| JHIT (Boston Partners) | | 2,340,381 | | 31,805,771 |

| Emerging Markets, Class NAV, JHF II (DFA) | | 14,283,394 | | 158,545,673 |

| Emerging Markets Equity, Class NAV, JHIT | | | | |

| (JHAM) (B)(C) | | 13,941,347 | | 159,628,428 |

| Equity Income, Class NAV, JHF II | | | | |

| (T. Rowe Price) | | 10,727,816 | | 216,165,500 |

| Fundamental Global Franchise, Class NAV, JHF | | | | |

| II (JHAM) (B)(C) | | 2,606,424 | | 32,997,329 |

| Fundamental Large Cap Core, Class NAV, JHIT | | | | |

| (JHAM) (B)(C) | | 3,589,245 | | 184,702,547 |

| Global Equity, Class NAV, JHF II (JHAM) (B)(C) | | 6,227,293 | | 70,119,323 |

| Global Shareholder Yield, Class NAV, JHF III | | | | |

| (Epoch) | | 4,015,473 | | 44,290,660 |

| Greater China Opportunities, Class NAV, JHIT | | | | |

| III (JHAM) (B)(C) | | 389,425 | | 9,871,930 |

| International Growth, Class NAV, JHF III | | | | |

| (Wellington) | | 4,798,451 | | 135,124,382 |

| International Growth Stock, Class NAV, JHF II | | | | |

| (Invesco) | | 8,265,203 | | 110,257,805 |

| International Small Cap, Class NAV, JHF II | | | | |

| (Franklin Templeton) | | 3,618,197 | | 80,360,161 |

| International Small Company, Class NAV, JHF II | | | | |

| (DFA) | | 6,384,892 | | 80,577,335 |

| International Strategic Equity Allocation, | | | | |

| Class NAV, JHF II (JHAM) (B)(C) | | 28,816,116 | | 323,028,665 |

| International Value, Class NAV, JHF II | | | | |

| (Templeton) | | 8,411,470 | | 139,125,722 |

| International Value Equity, Class NAV, JHF III | | | | |

| (JHAM) (B)(C) | | 8,996,068 | | 75,207,130 |

| Mid Cap Stock, Class NAV, JHF II (Wellington) | | 7,735,697 | | 188,054,788 |

| Mid Value, Class NAV, JHF II (T. Rowe Price) | | 13,494,626 | | 226,844,662 |

| New Opportunities, Class NAV, JHF II | | | | |

| (Brandywine/DFA/GW&K) | | 1,259,027 | | 38,198,879 |

| Small Cap Core, Class NAV, JHIT (JHAM) (B)(C) | | 2,984,253 | | 37,601,589 |

| Small Cap Growth, Class NAV, JHF II | | | | |

| (Redwood) (D) | | 2,217,843 | | 39,566,311 |

| Small Cap Stock, Class NAV, JHF II | | | | |

| (Wellington) (E) | | 3,509,093 | | 39,056,207 |

| Small Cap Value, Class NAV, JHF II | | | | |

| (Wellington) | | 2,450,244 | | 53,464,324 |

| Small Company Value, Class NAV, JHF II | | | | |

| (T. Rowe Price) | | 1,218,648 | | 35,803,877 |

| Strategic Growth, Class NAV, JHF III (JHAM) | | | | |

| (B)(C) | | 7,397,146 | | 141,063,580 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK MULTIMANAGER LIFESTYLE PORTFOLIOS 18 |

| |

MULTIMANAGER LIFESTYLE AGGRESSIVE PORTFOLIO

(continued) |

| | | | | | |

| | Shares or | | | |

| | Principal | | | |

| | Amount | | Value | |

| Equity - (continued) | | | | | |

| U.S. Strategic Equity Allocation, Class NAV, JHF | | | | | |

| II (JHAM) (B)(C) | | 21,079,391 | | $259,276,510 | |

| Value Equity, Class NAV, JHIT (Barrow Hanley) | | 7,883,483 | | 96,257,332 | |

| Alternative and specialty - 11.6% | | | | | |

| Absolute Return Currency, Class NAV, JHF II | | | | | |

| (First Quadrant) (F) | | 3,282,600 | | 29,576,229 | |

| Diversified Real Assets, Class NAV, JHIT | | | | | |

| (Deutsche/JHAM/Wellington) (B)(F)(G) | | 12,500,568 | | 132,881,033 | |

| Financial Industries, Class NAV, JHIT II (JHAM) | | | | | |

| (B)(C) | | 3,606,114 | | 71,328,937 | |

| Global Focused Strategies, Class NAV, JHIT | | | | | |

| (Standard Life) | | 4,133,814 | | 39,188,552 | |

| Health Sciences, Class NAV, JHF II | | | | | |

| (T. Rowe Price) | | 11,848,393 | | 54,858,059 | |

| Science & Technology, Class NAV, JHF II | | | | | |

| (T. Rowe Price/Allianz) | | 7,168,951 | | 40,934,711 | |

| Seaport Long/Short, Class NAV, JHIT | | | | | |

| (Wellington) | | 1,472,116 | | 16,841,012 | |

| Technical Opportunities, Class NAV, JHF II | | | | | |

| (Wellington) | | 7,015,145 | | 91,407,334 | |

| TOTAL AFFILIATED INVESTMENT COMPANIES (Cost | | | | | |

| $3,083,856,245) | | | | $4,104,688,449 | |

| SHORT-TERM INVESTMENTS - 0.0% | | | | | |

| Money market funds - 0.0% | | | | | |

| State Street Institutional U.S. Government | | | | | |

| Money Market Fund, Premier Class, | | | | | |

| 1.8098% (H) | | 1,156 | | 1,156 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $1,156) | | | | $1,156 | |

| |

| Total Investments (Multimanager Lifestyle | | | |

| Aggressive Portfolio) | | | | | |

| (Cost $3,083,857,401) - 100.0% | | | | $4,104,689,605 | |

| Other assets and liabilities, net - 0.0% | | | | (80,461 | ) |

| TOTAL NET ASSETS - 100.0% | | | | $4,104,609,144 | |

| |

| MULTIMANAGER LIFESTYLE GROWTH PORTFOLIO |

| |

| As of 6-30-18 (unaudited) |

| | | Shares or | | | |

| | | Principal | | | |

| | Amount | | Value | |

| AFFILIATED INVESTMENT COMPANIES (A) - 99.9% |

| Equity - 71.9% | | | | | |

| Blue Chip Growth, Class NAV, JHF II | | | | | |

| (T. Rowe Price) | | 8,325,008 | | $337,162,832 | |

| Capital Appreciation, Class NAV, JHF II | | | | | |

| (Jennison) | | 18,383,076 | | 327,034,915 | |

| Capital Appreciation Value, Class NAV, JHF II | | | | | |

| (T. Rowe Price) | | 45,339,727 | | 530,928,205 | |

| Disciplined Value, Class NAV, JHF III | | | | | |

| (Boston Partners) | | 18,896,132 | | 404,377,217 | |

| Disciplined Value International, Class NAV, | | | | | |

| JHIT (Boston Partners) | | 5,385,894 | | 73,194,298 | |

MULTIMANAGER LIFESTYLE GROWTH PORTFOLIO

(continued) |

| |

| | Shares or | | |

| | Principal | | |

| | Amount | | Value |

| Equity - (continued) | | | | |

| Emerging Markets, Class NAV, JHF II (DFA) | | 27,597,685 | | $306,334,300 |

| Emerging Markets Equity, Class NAV, JHIT | | | | |

| (JHAM) (B)(C) | | 26,995,724 | | 309,101,036 |

| Equity Income, Class NAV, JHF II | | | | |

| (T. Rowe Price) | | 25,990,863 | | 523,715,898 |

| Fundamental Global Franchise, Class NAV, JHF | | | | |

| II (JHAM) (B)(C) | | 9,195,524 | | 116,415,340 |

| Fundamental Large Cap Core, Class NAV, JHIT | | | | |

| (JHAM) (B)(C) | | 7,802,058 | | 401,493,880 |

| Global Equity, Class NAV, JHF II (JHAM) (B)(C) | | 18,943,479 | | 213,303,577 |

| Global Shareholder Yield, Class NAV, JHF III | | | | |

| (Epoch) | | 14,529,414 | | 160,259,442 |

| International Growth, Class NAV, JHF III | | | | |

| (Wellington) | | 10,825,395 | | 304,843,121 |

| International Growth Stock, Class NAV, JHF II | | | | |

| (Invesco) | | 21,798,802 | | 290,796,015 |

| International Small Cap, Class NAV, JHF II | | | | |

| (Franklin Templeton) | | 8,210,423 | | 182,353,489 |

| International Small Company, Class NAV, JHF II | | | | |

| (DFA) | | 14,547,411 | | 183,588,322 |

| International Strategic Equity Allocation, | | | | |

| Class NAV, JHF II (JHAM) (B)(C) | | 72,928,816 | | 817,532,026 |

| International Value, Class NAV, JHF II | | | | |

| (Templeton) | | 19,092,061 | | 315,782,690 |

| International Value Equity, Class NAV, JHF III | | | | |

| (JHAM) (B)(C) | | 25,126,577 | | 210,058,180 |

| Mid Cap Stock, Class NAV, JHF II (Wellington) | | 17,992,942 | | 437,408,410 |

| Mid Value, Class NAV, JHF II (T. Rowe Price) | | 31,899,011 | | 536,222,379 |

| New Opportunities, Class NAV, JHF II | | | | |

| (Brandywine/DFA/GW&K) | | 2,828,428 | | 85,814,512 |

| Small Cap Core, Class NAV, JHIT (JHAM) (B)(C) | | 6,743,007 | | 84,961,888 |

| Small Cap Growth, Class NAV, JHF II | | | | |

| (Redwood) (D) | | 4,279,265 | | 76,342,088 |

| Small Cap Stock, Class NAV, JHF II | | | | |

| (Wellington) (E) | | 6,751,308 | | 75,142,062 |

| Small Cap Value, Class NAV, JHF II | | | | |

| (Wellington) | | 4,836,453 | | 105,531,396 |

| Small Company Value, Class NAV, JHF II | | | | |

| (T. Rowe Price) | | 2,415,598 | | 70,970,276 |

| Strategic Growth, Class NAV, JHF III (JHAM) | | | | |

| (B)(C) | | 17,573,890 | | 335,134,075 |

| U.S. Strategic Equity Allocation, Class NAV, JHF | | | | |

| II (JHAM) (B)(C) | | 56,617,660 | | 696,397,223 |

| Value Equity, Class NAV, JHIT (Barrow Hanley) | | 19,062,832 | | 232,757,177 |

| Fixed income - 17.3% | | | | |

| Asia Pacific Total Return Bond, Class NAV, JHF | | | | |

| II (JHAM) (B)(C) | | 7,471,585 | | 70,531,764 |

| Bond, Class NAV, JHSB (JHAM) (B)(C) | | 21,006,914 | | 323,086,337 |

| Core Bond, Class NAV, JHF II (Wells Capital) | | 8,867,386 | | 111,463,039 |

| Emerging Markets Debt, Class NAV, JHF II | | | | |

| (JHAM) (B)(C) | | 21,536,144 | | 192,748,490 |

| Floating Rate Income, Class NAV, JHF II | | | | |

| (WAMCO) | | 18,289,091 | | 153,994,150 |

| Global Bond, Class NAV, JHF II (PIMCO) | | 2,772,000 | | 35,259,834 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK MULTIMANAGER LIFESTYLE PORTFOLIOS 19 |

| |

MULTIMANAGER LIFESTYLE GROWTH PORTFOLIO

(continued) |

| | | | | |

| | Shares or | | |

| | Principal | | |

| | Amount | | Value |

| Fixed income - (continued) | | | | |

| Global Short Duration Credit, Class NAV, JHBT | | | | |

| (JHAM) (B)(C) | | 6,684,413 | | $58,822,838 |

| High Yield, Class NAV, JHBT (JHAM) (B)(C) | | 16,023,640 | | 54,480,375 |

| High Yield, Class NAV, JHF II (WAMCO) | | 3,488,290 | | 27,627,259 |

| Real Return Bond, Class NAV, JHF II (PIMCO) | | 19,375,166 | | 211,383,059 |

| Short Duration Credit Opportunities, | | | | |

| Class NAV, JHF II (Stone Harbor) | | 13,322,273 | | 125,629,035 |

| Short Term Government Income, Class NAV, | | | | |

| JHF II (JHAM) (B)(C) | | 3,297,366 | | 30,566,587 |

| Spectrum Income, Class NAV, JHF II | | | | |

| (T. Rowe Price) | | 14,387,627 | | 150,062,951 |

| Strategic Income Opportunities, Class NAV, JHF | | | | |

| II (JHAM) (B)(C) | | 26,074,115 | | 270,127,827 |

| Total Return, Class NAV, JHF II (PIMCO) | | 18,724,354 | | 247,348,715 |

| U.S. High Yield Bond, Class NAV, JHF II (Wells | | | | |

| Capital) | | 3,607,982 | | 39,832,121 |

| Alternative and specialty - 10.7% | | | | |

| Absolute Return Currency, Class NAV, JHF II | | | | |

| (First Quadrant) (F) | | 18,118,702 | | 163,249,504 |

| Diversified Real Assets, Class NAV, JHIT | | | | |

| (Deutsche/JHAM/Wellington) (B)(F)(G) | | 31,500,978 | | 334,855,395 |

| Financial Industries, Class NAV, JHIT II (JHAM) | | | | |

| (B)(C) | | 9,204,825 | | 182,071,447 |

| Global Absolute Return Strategies, Class NAV, | | | | |

| JHF II (Standard Life) (F) | | 16,452,402 | | 166,827,351 |

| Health Sciences, Class NAV, JHF II | | | | |

| (T. Rowe Price) | | 23,873,604 | | 110,534,787 |

| Science & Technology, Class NAV, JHF II | | | | |

| (T. Rowe Price/Allianz) | | 15,935,346 | | 90,990,823 |

| Seaport Long/Short, Class NAV, JHIT | | | | |

| (Wellington) | | 2,523,963 | | 28,874,140 |

| Technical Opportunities, Class NAV, JHF II | | | | |

| (Wellington) | | 16,817,003 | | 219,125,548 |

| TOTAL AFFILIATED INVESTMENT COMPANIES (Cost | | | | |

| $9,708,944,820) | | | | $12,144,449,645 |

| COMMON STOCKS - 0.0% | | | | |

| Consumer discretionary - 0.0% | | | | |

| Boardriders, Inc. (I)(J) | | 1,984 | | 68,807 |

| TOTAL COMMON STOCKS (Cost $62,580) | | | | $68,807 |

| ESCROW CERTIFICATES - 0.0% | | | | |

| Midstates Petroleum Company, Inc., 10.750%, | | | | |

| 10/01/2020 (I)(J) | | 186,995 | | 167 |

| TOTAL ESCROW CERTIFICATES (Cost $167) | | | | $167 |

| SHORT-TERM INVESTMENTS - 0.1% | | | | |

| U.S. Government - 0.1% | | | | |

| U.S. Treasury Bill, 1.875%, 09/13/2018 * | | 8,484,500 | | 8,452,284 |

| Money market funds - 0.0% | | | | |

| State Street Institutional U.S. Government | | | | |

| Money Market Fund, Premier Class, | | | | |

| 1.8098% (H) | | 1,474 | | 1,474 |

| TOTAL SHORT-TERM INVESTMENTS (Cost $8,453,273) | | $8,453,758 |

MULTIMANAGER LIFESTYLE GROWTH PORTFOLIO

(continued) |

| | | | | |

| Total Investments (Multimanager Lifestyle Growth | | | |

| Portfolio) | | | | |

| (Cost $9,717,460,840) - 100.0% | $12,152,972,377 | |

| Other assets and liabilities, net - 0.0% | | | (1,196,609 | ) |

| TOTAL NET ASSETS - 100.0% | $12,151,775,768 | |

| |

| MULTIMANAGER LIFESTYLE BALANCED PORTFOLIO |

| |

| As of 6-30-18 (unaudited) | | | | |

| Shares or | | | |

| Principal | | | |

| Amount | | Value | |

| AFFILIATED INVESTMENT COMPANIES (A) - 99.4% | | | |

| Equity - 53.5% | | | | |

| Blue Chip Growth, Class NAV, JHF II | | | | |

| (T. Rowe Price) | 5,924,765 | | $239,952,985 | |

| Capital Appreciation, Class NAV, JHF II | | | | |

| (Jennison) | 13,112,345 | | 233,268,615 | |

| Capital Appreciation Value, Class NAV, JHF II | | | | |

| (T. Rowe Price) | 45,518,618 | | 533,023,018 | |

| Disciplined Value, Class NAV, JHF III | | | | |

| (Boston Partners) | 13,332,756 | | 285,320,969 | |

| Disciplined Value International, Class NAV, | | | | |

| JHIT (Boston Partners) | 3,668,794 | | 49,858,908 | |

| Emerging Markets, Class NAV, JHF II (DFA) | 16,923,592 | | 187,851,874 | |

| Emerging Markets Equity, Class NAV, JHIT | | | | |

| (JHAM) (B)(C) | 16,835,117 | | 192,762,087 | |

| Equity Income, Class NAV, JHF II | | | | |

| (T. Rowe Price) | 18,353,935 | | 369,831,793 | |

| Fundamental Global Franchise, Class NAV, JHF | | | | |

| II (JHAM) (B)(C) | 10,584,794 | | 134,003,487 | |

| Fundamental Large Cap Core, Class NAV, JHIT | | | | |

| (JHAM) (B)(C) | 5,603,012 | | 288,330,976 | |

| Global Equity, Class NAV, JHF II (JHAM) (B)(C) | 17,905,295 | | 201,613,625 | |

| Global Shareholder Yield, Class NAV, JHF III | | | | |

| (Epoch) | 13,960,726 | | 153,986,804 | |

| International Growth, Class NAV, JHF III | | | | |

| (Wellington) | 7,686,870 | | 216,462,265 | |

| International Growth Stock, Class NAV, JHF II | | | | |

| (Invesco) | 14,033,500 | | 187,206,890 | |

| International Small Cap, Class NAV, JHF II | | | | |

| (Franklin Templeton) | 5,036,661 | | 111,864,249 | |

| International Small Company, Class NAV, JHF II | | | | |

| (DFA) | 8,924,069 | | 112,621,754 | |

| International Strategic Equity Allocation, | | | | |

| Class NAV, JHF II (JHAM) (B)(C) | 47,252,159 | | 529,696,698 | |

| International Value, Class NAV, JHF II | | | | |

| (Templeton) | 13,487,460 | | 223,082,585 | |

| International Value Equity, Class NAV, JHF III | | | | |

| (JHAM) (B)(C) | 15,887,853 | | 132,822,452 | |

| Mid Cap Stock, Class NAV, JHF II (Wellington) | 11,560,315 | | 281,031,253 | |

| Mid Value, Class NAV, JHF II (T. Rowe Price) | 20,497,455 | | 344,562,217 | |

| New Opportunities, Class NAV, JHF II | | | | |

| (Brandywine/DFA/GW&K) | 1,591,038 | | 48,272,107 | |

| Small Cap Core, Class NAV, JHIT (JHAM) (B)(C) | 3,794,760 | | 47,813,975 | |

| Small Cap Growth, Class NAV, JHF II | | | | |

| (Redwood) (D) | 3,139,303 | | 56,005,167 | |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK MULTIMANAGER LIFESTYLE PORTFOLIOS 20 |

| |

MULTIMANAGER LIFESTYLE BALANCED PORTFOLIO

(continued) |

| | | | | |

| | Shares or | | |

| | Principal | | |

| | Amount | | Value |

| Equity - (continued) | | | | |

| Small Cap Stock, Class NAV, JHF II | | | | |

| (Wellington) (E) | | 5,044,924 | | $56,150,001 |

| Small Cap Value, Class NAV, JHF II | | | | |

| (Wellington) | | 3,635,364 | | 79,323,639 |

| Small Company Value, Class NAV, JHF II | | | | |

| (T. Rowe Price) | | 1,795,932 | | 52,764,495 |

| Strategic Growth, Class NAV, JHF III (JHAM) | | | | |

| (B)(C) | | 12,512,048 | | 238,604,751 |

| U.S. Strategic Equity Allocation, Class NAV, JHF | | | | |

| II (JHAM) (B)(C) | | 51,293,618 | | 630,911,498 |

| Value Equity, Class NAV, JHIT (Barrow Hanley) | | 13,419,544 | | 163,852,629 |

| Fixed income - 37.1% | | | | |

| Asia Pacific Total Return Bond, Class NAV, JHF | | | | |

| II (JHAM) (B)(C) | | 12,430,732 | | 117,346,111 |

| Bond, Class NAV, JHSB (JHAM) (B)(C) | | 48,846,082 | | 751,252,741 |

| Core Bond, Class NAV, JHF II (Wells Capital) | | 20,077,049 | | 252,368,503 |

| Emerging Markets Debt, Class NAV, JHF II | | | | |

| (JHAM) (B)(C) | | 34,525,205 | | 309,000,588 |

| Floating Rate Income, Class NAV, JHF II | | | | |

| (WAMCO) | | 38,323,865 | | 322,686,941 |

| Global Bond, Class NAV, JHF II (PIMCO) | | 4,612,194 | | 58,667,109 |

| Global Short Duration Credit, Class NAV, JHBT | | | | |

| (JHAM) (B)(C) | | 12,883,400 | | 113,373,921 |

| High Yield, Class NAV, JHBT (JHAM) (B)(C) | | 30,875,769 | | 104,977,615 |

| High Yield, Class NAV, JHF II (WAMCO) | | 6,719,724 | | 53,220,214 |

| Real Return Bond, Class NAV, JHF II (PIMCO) | | 39,443,300 | | 430,326,399 |

| Short Duration Credit Opportunities, | | | | |

| Class NAV, JHF II (Stone Harbor) | | 32,781,460 | | 309,129,165 |

| Short Term Government Income, Class NAV, | | | | |

| JHF II (JHAM) (B)(C) | | 4,429,966 | | 41,065,787 |

| Spectrum Income, Class NAV, JHF II | | | | |

| (T. Rowe Price) | | 31,476,542 | | 328,300,335 |

| Strategic Income Opportunities, Class NAV, JHF | | | | |

| II (JHAM) (B)(C) | | 57,040,599 | | 590,940,603 |

| Total Return, Class NAV, JHF II (PIMCO) | | 43,104,780 | | 569,414,137 |

| U.S. High Yield Bond, Class NAV, JHF II (Wells | | | | |

| Capital) | | 6,950,385 | | 76,732,250 |

| Alternative and specialty - 8.8% | | | | |

| Absolute Return Currency, Class NAV, JHF II | | | | |

| (First Quadrant) (F) | | 19,476,359 | | 175,481,998 |

| Diversified Real Assets, Class NAV, JHIT | | | | |

| (Deutsche/JHAM/Wellington) (B)(F)(G) | | 25,586,111 | | 271,980,361 |

| Financial Industries, Class NAV, JHIT II (JHAM) | | | | |

| (B)(C) | | 7,391,227 | | 146,198,467 |

| Global Absolute Return Strategies, Class NAV, | | | | |

| JHF II (Standard Life) (F) | | 17,657,076 | | 179,042,750 |

| Health Sciences, Class NAV, JHF II | | | | |

| (T. Rowe Price) | | 16,874,496 | | 78,128,917 |

| Science & Technology, Class NAV, JHF II | | | | |

| (T. Rowe Price/Allianz) | | 10,397,646 | | 59,370,560 |

| Seaport Long/Short, Class NAV, JHIT | | | | |

| (Wellington) | | 2,562,184 | | 29,311,380 |

| Technical Opportunities, Class NAV, JHF II | | | | |

| (Wellington) | | 8,395,880 | | 109,398,317 |

MULTIMANAGER LIFESTYLE BALANCED PORTFOLIO

(continued) |

| |

| Shares or | | | |

| Principal | | | |

| | Amount | | Value | |

| TOTAL AFFILIATED INVESTMENT COMPANIES (Cost | | | | |

| $10,078,718,691) | | | $11,860,568,935 | |

| COMMON STOCKS - 0.0% |

| Consumer discretionary - 0.0% | | | | |

| Boardriders, Inc. (I)(J) | 3,882 | | $134,629 | |

| TOTAL COMMON STOCKS (Cost $122,433) | | | $134,629 | |

| ESCROW CERTIFICATES - 0.0% |

| Midstates Petroleum Company, Inc., 10.750%, | | | | |

| 10/01/2020 (I)(J) | 365,847 | | 328 | |

| TOTAL ESCROW CERTIFICATES (Cost $328) | | | $328 | |

| SHORT-TERM INVESTMENTS - 0.6% |

| U.S. Government - 0.6% | | | | |

| U.S. Treasury Bill, 1.871%, 08/30/2018 * | 30,418,000 | | 30,325,400 | |

| U.S. Treasury Bill, 1.875%, 09/13/2018 * | 16,818,300 | | 16,754,441 | |

| U.S. Treasury Bill, 1.880%, 08/30/2018 * | 30,418,000 | | 30,325,400 | |

| Money market funds - 0.0% | | | | |

| State Street Institutional U.S. Government | | | | |

| Money Market Fund, Premier Class, | | | | |

| 1.8098% (H) | 1,565 | | 1,565 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $77,400,881) | | $77,406,806 | |

| |

| Total Investments (Multimanager Lifestyle | | | |

| Balanced Portfolio) | | | | |

| (Cost $10,156,242,333) - 100.0% | $11,938,110,698 | |

| Other assets and liabilities, net - 0.0% | | | (1,638,804 | ) |

| TOTAL NET ASSETS - 100.0% | $11,936,471,894 | |

| |

| MULTIMANAGER LIFESTYLE MODERATE PORTFOLIO |

| |

| As of 6-30-18 (unaudited) |

| |

| Shares or | | | |

| Principal | | | |

| Amount | | Value | |

| AFFILIATED INVESTMENT COMPANIES (A) - 99.3% | |

| Equity - 36.1% | | | | |

| Blue Chip Growth, Class NAV, JHF II | | | | |

| (T. Rowe Price) | 862,190 | | $34,918,692 | |

| Capital Appreciation, Class NAV, JHF II | | | | |

| (Jennison) | 1,920,017 | | 34,157,101 | |

| Capital Appreciation Value, Class NAV, JHF II | | | | |

| (T. Rowe Price) | 13,226,850 | | 154,886,417 | |

| Disciplined Value, Class NAV, JHF III | | | | |

| (Boston Partners) | 1,957,998 | | 41,901,162 | |

| Disciplined Value International, Class NAV, | | | | |

| JHIT (Boston Partners) | 919,386 | | 12,494,458 | |

| Emerging Markets, Class NAV, JHF II (DFA) | 2,255,956 | | 25,041,108 | |

| Emerging Markets Equity, Class NAV, JHIT | | | | |

| (JHAM) (B)(C) | 2,223,836 | | 25,462,919 | |

| Equity Income, Class NAV, JHF II | | | | |

| (T. Rowe Price) | 2,705,913 | | 54,524,156 | |

| Fundamental Global Franchise, Class NAV, JHF | | | | |

| II (JHAM) (B)(C) | 3,423,955 | | 43,347,265 | |

| Fundamental Large Cap Core, Class NAV, JHIT | | | | |

| (JHAM) (B)(C) | 2,042,535 | | 105,108,854 | |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK MULTIMANAGER LIFESTYLE PORTFOLIOS 21 |

| |

| MULTIMANAGER LIFESTYLE MODERATE PORTFOLIO |

| (continued) |

| | | Shares or | | |

| | Principal | | |

| | Amount | | Value |

| Equity - (continued) | | | | |

| Global Equity, Class NAV, JHF II (JHAM) (B)(C) | | 5,518,964 | | $62,143,533 |

| Global Shareholder Yield, Class NAV, JHF III | | | | |

| (Epoch) | | 4,261,694 | | 47,006,488 |

| International Growth, Class NAV, JHF III | | | | |

| (Wellington) | | 1,078,535 | | 30,371,538 |

| International Growth Stock, Class NAV, JHF II | | | | |

| (Invesco) | | 3,191,160 | | 42,570,078 |

| International Small Cap, Class NAV, JHF II | | | | |

| (Franklin Templeton) | | 848,001 | | 18,834,093 |

| International Small Company, Class NAV, JHF II | | | | |

| (DFA) | | 1,506,121 | | 19,007,251 |

| International Strategic Equity Allocation, | | | | |

| Class NAV, JHF II (JHAM) (B)(C) | | 10,751,632 | | 120,525,797 |

| International Value, Class NAV, JHF II | | | | |

| (Templeton) | | 2,103,875 | | 34,798,093 |

| International Value Equity, Class NAV, JHF III | | | | |

| (JHAM) (B)(C) | | 3,149,865 | | 26,332,869 |

| Mid Cap Stock, Class NAV, JHF II (Wellington) | | 2,087,969 | | 50,758,538 |

| Mid Value, Class NAV, JHF II (T. Rowe Price) | | 3,498,901 | | 58,816,531 |

| Small Cap Growth, Class NAV, JHF II | | | | |

| (Redwood) (D) | | 633,704 | | 11,305,282 |

| Small Cap Stock, Class NAV, JHF II | | | | |

| (Wellington) (E) | | 1,018,162 | | 11,332,146 |

| Small Cap Value, Class NAV, JHF II | | | | |

| (Wellington) | | 1,344,768 | | 29,342,844 |

| Strategic Growth, Class NAV, JHF III (JHAM) | | | | |

| (B)(C) | | 1,795,303 | | 34,236,425 |

| U.S. Strategic Equity Allocation, Class NAV, JHF | | | | |

| II (JHAM) (B)(C) | | 9,755,837 | | 119,996,796 |

| Value Equity, Class NAV, JHIT (Barrow Hanley) | | 1,965,188 | | 23,994,951 |

| Fixed income - 56.6% | | | | |

| Asia Pacific Total Return Bond, Class NAV, JHF | | | | |

| II (JHAM) (B)(C) | | 6,712,384 | | 63,364,906 |

| Bond, Class NAV, JHSB (JHAM) (B)(C) | | 19,455,591 | | 299,226,990 |

| Core Bond, Class NAV, JHF II (Wells Capital) | | 22,643,034 | | 284,622,933 |

| Emerging Markets Debt, Class NAV, JHF II | | | | |

| (JHAM) (B)(C) | | 13,466,170 | | 120,522,219 |

| Floating Rate Income, Class NAV, JHF II | | | | |

| (WAMCO) | | 16,096,258 | | 135,530,493 |

| Global Bond, Class NAV, JHF II (PIMCO) | | 3,874,514 | | 49,283,816 |

| Global Short Duration Credit, Class NAV, JHBT | | | | |

| (JHAM) (B)(C) | | 4,917,581 | | 43,274,711 |

| High Yield, Class NAV, JHBT (JHAM) (B)(C) | | 12,016,554 | | 40,856,283 |

| High Yield, Class NAV, JHF II (WAMCO) | | 2,615,314 | | 20,713,284 |

| Real Return Bond, Class NAV, JHF II (PIMCO) | | 16,125,373 | | 175,927,817 |

| Short Duration Credit Opportunities, | | | | |

| Class NAV, JHF II (Stone Harbor) | | 11,869,254 | | 111,927,066 |

| Short Term Government Income, Class NAV, | | | | |

| JHF II (JHAM) (B)(C) | | 1,455,578 | | 13,493,205 |

| Spectrum Income, Class NAV, JHF II | | | | |

| (T. Rowe Price) | | 11,184,544 | | 116,654,792 |

| Strategic Income Opportunities, Class NAV, JHF | | | | |

| II (JHAM) (B)(C) | | 20,267,731 | | 209,973,697 |

| Total Return, Class NAV, JHF II (PIMCO) | | 21,461,778 | | 283,510,088 |

| MULTIMANAGER LIFESTYLE MODERATE PORTFOLIO |

| (continued) |

| | Shares or | | | |

| | Principal | | | |

| | Amount | | Value | |

| Fixed income - (continued) | | | | | |

| U.S. High Yield Bond, Class NAV, JHF II (Wells | | | | | |

| Capital) | | 2,705,253 | | $29,865,992 | |

| Alternative and specialty - 6.6% | | | | | |

| Absolute Return Currency, Class NAV, JHF II | | | | | |

| (First Quadrant) (F) | | 7,700,360 | | 69,380,243 | |

| Diversified Real Assets, Class NAV, JHIT | | | | | |

| (Deutsche/JHAM/Wellington) (B)(F)(G) | | 6,068,327 | | 64,506,320 | |

| Enduring Assets, Class NAV, JHIT (Wellington) | | 1,478,843 | | 17,568,659 | |

| Global Absolute Return Strategies, Class NAV, | | | | | |

| JHF II (Standard Life) (F) | | 6,975,601 | | 70,732,592 | |

| Seaport Long/Short, Class NAV, JHIT | | | | | |

| (Wellington) | | 832,769 | | 9,526,881 | |

| TOTAL AFFILIATED INVESTMENT COMPANIES (Cost | | | | | |

| $3,213,247,736) | | | | $3,503,678,372 | |

| COMMON STOCKS - 0.0% | | | | | |

| Consumer discretionary - 0.0% | | | | | |

| Boardriders, Inc. (I)(J) | | 1,476 | | 51,189 | |

| TOTAL COMMON STOCKS (Cost $46,561) | | | | $51,189 | |

| ESCROW CERTIFICATES - 0.0% | | | | | |

| Midstates Petroleum Company, Inc., 10.750%, | | | | | |

| 10/01/2020 (I)(J) | | 139,130 | | 125 | |

| TOTAL ESCROW CERTIFICATES (Cost $125) | | | | $125 | |

| SHORT-TERM INVESTMENTS - 0.7% | | | | | |

| U.S. Government - 0.7% | | | | | |

| U.S. Treasury Bill, 1.871%, 08/30/2018 * | | 8,963,000 | | 8,935,714 | |

| U.S. Treasury Bill, 1.875%, 09/13/2018 * | | 6,229,600 | | 6,205,946 | |

| U.S. Treasury Bill, 1.880%, 08/30/2018 * | | 8,963,000 | | 8,935,714 | |

| Money market funds - 0.0% | | | | | |

| State Street Institutional U.S. Government | | | | | |

| Money Market Fund, Premier Class, | | | | | |

| 1.8098% (H) | | 1,151 | | 1,151 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $24,076,707) | | $24,078,525 | |

| | | | | | |

| Total Investments (Multimanager Lifestyle | | | | | |

| Moderate Portfolio) | | | | | |

| (Cost $3,237,371,129) - 100.0% | | | | $3,527,808,211 | |

| Other assets and liabilities, net - 0.0% | | | | (782,366 | ) |

| TOTAL NET ASSETS - 100.0% | | | | $3,527,025,845 | |

| MULTIMANAGER LIFESTYLE CONSERVATIVE PORTFOLIO |

As of 6-30-18 (unaudited)

| | Shares or | | |

| | Principal | | |

| | Amount | | Value |

| AFFILIATED INVESTMENT COMPANIES (A) - 99.3% | | |

| Equity - 16.2% | | | | |

| Blue Chip Growth, Class NAV, JHF II | | | | |

| (T. Rowe Price) | | 116,012 | | $4,698,472 |

| Capital Appreciation, Class NAV, JHF II | | | | |

| (Jennison) | | 252,323 | | 4,488,828 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK MULTIMANAGER LIFESTYLE PORTFOLIOS 22 |

| |

| MULTIMANAGER LIFESTYLE CONSERVATIVE PORTFOLIO |

| (continued) |

| | Shares or | | |

| | Principal | | |

| | Amount | | Value |

| Equity - (continued) | | | | |

| Capital Appreciation Value, Class NAV, JHF II | | | | |

| (T. Rowe Price) | | 6,455,118 | | $75,589,426 |

| Disciplined Value, Class NAV, JHF III | | | | |

| (Boston Partners) | | 354,607 | | 7,588,598 |

| Disciplined Value International, Class NAV, | | | | |

| JHIT (Boston Partners) | | 440,405 | | 5,985,109 |

| Emerging Markets, Class NAV, JHF II (DFA) | | 775,111 | | 8,603,727 |

| Emerging Markets Equity, Class NAV, JHIT | | | | |

| (JHAM) (B)(C) | | 770,100 | | 8,817,647 |

| Equity Income, Class NAV, JHF II | | | | |

| (T. Rowe Price) | | 492,532 | | 9,924,511 |

| Fundamental Global Franchise, Class NAV, JHF | | | | |

| II (JHAM) (B)(C) | | 1,656,725 | | 20,974,136 |

| Fundamental Large Cap Core, Class NAV, JHIT | | | | |

| (JHAM) (B)(C) | | 530,269 | | 27,287,630 |

| Global Equity, Class NAV, JHF II (JHAM) (B)(C) | | 2,532,501 | | 28,515,964 |

| Global Shareholder Yield, Class NAV, JHF III | | | | |

| (Epoch) | | 1,863,366 | | 20,552,924 |

| International Growth, Class NAV, JHF III | | | | |

| �� (Wellington) | | 419,832 | | 11,822,479 |

| International Growth Stock, Class NAV, JHF II | | | | |

| (Invesco) | | 939,017 | | 12,526,492 |

| International Strategic Equity Allocation, | | | | |

| Class NAV, JHF II (JHAM) (B)(C) | | 5,243,283 | | 58,777,201 |

| International Value, Class NAV, JHF II | | | | |

| (Templeton) | | 766,765 | | 12,682,288 |

| International Value Equity, Class NAV, JHF III | | | | |

| (JHAM) (B)(C) | | 698,488 | | 5,839,356 |

| Mid Cap Stock, Class NAV, JHF II (Wellington) | | 627,298 | | 15,249,611 |

| Mid Value, Class NAV, JHF II (T. Rowe Price) | | 1,133,934 | | 19,061,427 |

| Small Cap Stock, Class NAV, JHF II | | | | |

| (Wellington) (E) | | 640,882 | | 7,133,017 |

| Small Cap Value, Class NAV, JHF II | | | | |

| (Wellington) | | 481,630 | | 10,509,166 |

| Strategic Growth, Class NAV, JHF III (JHAM) | | | | |

| (B)(C) | | 236,066 | | 4,501,776 |

| U.S. Strategic Equity Allocation, Class NAV, JHF | | | | |

| II (JHAM) (B)(C) | | 2,799,998 | | 34,439,979 |

| Value Equity, Class NAV, JHIT (Barrow Hanley) | | 357,225 | | 4,361,722 |

| Fixed income - 73.4% | | | | |

| Asia Pacific Total Return Bond, Class NAV, JHF | | | | |

| II (JHAM) (B)(C) | | 5,193,671 | | 49,028,259 |

| Bond, Class NAV, JHSB (JHAM) (B)(C) | | 18,250,455 | | 280,691,999 |

| Core Bond, Class NAV, JHF II (Wells Capital) | | 20,773,605 | | 261,124,216 |

| Emerging Markets Debt, Class NAV, JHF II | | | | |

| (JHAM) (B)(C) | | 10,548,662 | | 94,410,522 |

| Floating Rate Income, Class NAV, JHF II | | | | |

| (WAMCO) | | 15,323,246 | | 129,021,733 |

| Global Bond, Class NAV, JHF II (PIMCO) | | 4,361,584 | | 55,479,345 |

| Global Short Duration Credit, Class NAV, JHBT | | | | |

| (JHAM) (B)(C) | | 3,604,985 | | 31,723,864 |

| High Yield, Class NAV, JHBT (JHAM) (B)(C) | | 7,660,096 | | 26,044,327 |

| High Yield, Class NAV, JHF II (WAMCO) | | 1,667,182 | | 13,204,084 |

| Real Return Bond, Class NAV, JHF II (PIMCO) | | 17,035,154 | | 185,853,535 |

| MULTIMANAGER LIFESTYLE CONSERVATIVE PORTFOLIO |

| (continued) |

| | | Shares or | | | |

| | Principal | | | |

| | Amount | | Value | |

| Fixed income - (continued) | | | | | |

| Short Duration Credit Opportunities, | | | | | |

| Class NAV, JHF II (Stone Harbor) | | 11,536,705 | | $108,791,125 | |

| Short Term Government Income, Class NAV, | | | | | |

| JHF II (JHAM) (B)(C) | | 12,519,423 | | 116,055,049 | |

| Spectrum Income, Class NAV, JHF II | | | | | |

| (T. Rowe Price) | | 9,330,139 | | 97,313,352 | |

| Strategic Income Opportunities, Class NAV, JHF | | | | | |

| II (JHAM) (B)(C) | | 16,907,825 | | 175,165,066 | |

| Total Return, Class NAV, JHF II (PIMCO) | | 19,813,272 | | 261,733,321 | |

| U.S. High Yield Bond, Class NAV, JHF II (Wells | | | | | |

| Capital) | | 1,724,263 | | 19,035,866 | |

| Alternative and specialty - 9.7% | | | | | |

| Absolute Return Currency, Class NAV, JHF II | | | | | |

| (First Quadrant) (F) | | 8,714,969 | | 78,521,869 | |

| Diversified Real Assets, Class NAV, JHIT | | | | | |

| (Deutsche/JHAM/Wellington) (B)(F)(G) | | 4,333,890 | | 46,069,256 | |

| Enduring Assets, Class NAV, JHIT (Wellington) | | 3,784,009 | | 44,954,023 | |

| Global Absolute Return Strategies, Class NAV, | | | | | |

| JHF II (Standard Life) (F) | | 7,876,017 | | 79,862,815 | |

| Seaport Long/Short, Class NAV, JHIT | | | | | |

| (Wellington) | | 361,088 | | 4,130,847 | |

| TOTAL AFFILIATED INVESTMENT COMPANIES (Cost | | | | | |

| $2,510,366,764) | | | | $2,578,145,959 | |

| COMMON STOCKS - 0.0% | | | | | |

| Consumer discretionary - 0.0% | | | | | |

| Boardriders, Inc. (I)(J) | | 1,226 | | 42,517 | |

| TOTAL COMMON STOCKS (Cost $38,672) | | | | $42,517 | |

| ESCROW CERTIFICATES - 0.0% | | | | | |

| Midstates Petroleum Company, Inc., 10.750%, | | | | | |

| 10/01/2020 (I)(J) | | 115,555 | | 103 | |

| TOTAL ESCROW CERTIFICATES (Cost $103) | | | | $103 | |

| SHORT-TERM INVESTMENTS - 0.7% | | | | | |

| U.S. Government - 0.7% | | | | | |

| U.S. Treasury Bill, 1.871%, 08/30/2018 * | | 6,611,000 | | 6,590,875 | |

| U.S. Treasury Bill, 1.875%, 09/13/2018 * | | 5,057,000 | | 5,037,799 | |

| U.S. Treasury Bill, 1.880%, 08/30/2018 * | | 6,611,000 | | 6,590,875 | |

| Money market funds - 0.0% | | | | | |

| State Street Institutional U.S. Government | | | | | |

| Money Market Fund, Premier Class, | | | | | |

| 1.8098% (H) | | 1,175 | | 1,175 | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $18,219,355) | | $18,220,724 | |

| | | | |

| Total Investments (Multimanager Lifestyle | | | |

| Conservative Portfolio) | | | | | |

| (Cost $2,528,624,894) - 100.0% | | | | $2,596,409,303 | |

| Other assets and liabilities, net - 0.0% | | | | (569,320 | ) |

| TOTAL NET ASSETS - 100.0% | | | | $2,595,839,983 | |

| |

Percentages are based upon net assets. |

| |

| Security Abbreviations and Legend |

|

| JHF II | John Hancock Funds II |

| JHF III | John Hancock Funds III |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK MULTIMANAGER LIFESTYLE PORTFOLIOS 23 |

| |

| MULTIMANAGER LIFESTYLE CONSERVATIVE PORTFOLIO |

| (continued) |

| JHIT | John Hancock Investment Trust |

| JHIT III | John Hancock Investment Trust III |

| JHIT II | John Hancock Investment Trust II |

| JHSB | John Hancock Sovereign Bond Fund |

| JHBT | John Hancock Bond Trust |

| (A) | The underlying funds’ subadvisor is shown parenthetically. |

| (B) | The subadvisor is an affiliate of the advisor. |

| (C) | Manulife Asset Management (US) LLC is doing business as John Hancock Asset Management. |

| (D) | Formerly known as Small Company Growth Fund. |

| (E) | Formerly known as Small Cap Growth Fund. |

| (F) | Non-income producing. |

| (G) | Manulife Asset Management (North America) Limited is doing business as John Hancock Asset Management. |

| (H) | The rate shown is the annualized seven-day yield as of 6-30-18. |

| (I) | Security is valued using significant unobservable inputs and is classified as Level 3 in the fair value hierarchy. |

| (J) | Non-income producing security. |

| * | Yield represents either the annualized yield at the date of purchase, the stated coupon rate or, for floating rate securities, the rate at period end. |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK MULTIMANAGER LIFESTYLE PORTFOLIOS 24 |

| | | | | | | | | |

| STATEMENTS OF ASSETS AND LIABILITIES 6-30-18 (unaudited) | | | | | | | | |

| | Multimanager | | Multimanager | | Multimanager | | Multimanager | | Multimanager |

| | Lifestyle | | Lifestyle | | Lifestyle | | Lifestyle | | Lifestyle |

| | Aggressive | | Growth | | Balanced | | Moderate | | Conservative |

| | Portfolio | | Portfolio | | Portfolio | | Portfolio | | Portfolio |

| Assets | | | | | | | | | | |

| Unaffiliated investments, at value | | — | | $8,521,258 | | $77,540,198 | | $24,128,688 | | $18,262,169 |

| Unaffiliated funds, at value | | $1,156 | | 1,474 | | 1,565 | | 1,151 | | 1,175 |

| Affiliated funds, at value | | 4,104,688,449 | | 12,144,449,645 | | 11,860,568,935 | | 3,503,678,372 | | 2,578,145,959 |

| Total investments, at value | | 4,104,689,605 | | 12,152,972,377 | | 11,938,110,698 | | 3,527,808,211 | | 2,596,409,303 |

| Dividends and interest receivable | | 64,818 | | 199,021 | | 218,523 | | 68,409 | | 43,619 |

| Receivable for fund shares sold | | 763,802 | | 1,193,810 | | 979,660 | | 574,773 | | 521,941 |

| Receivable for investments sold | | 10,310,203 | | 35,404,388 | | 28,986,525 | | 7,904,127 | | 10,249,707 |

| Other assets | | 79,876 | | 108,501 | | 103,645 | | 79,431 | | 76,531 |

| Total assets | | 4,115,908,304 | | 12,189,878,097 | | 11,968,399,051 | | 3,536,434,951 | | 2,607,301,101 |

| Liabilities | | | | | | | | | | |

| Distributions payable | | — | | — | | 85,989 | | 119,168 | | 216,394 |

| Payable for fund shares repurchased | | 10,956,780 | | 37,138,384 | | 30,868,078 | | 8,955,464 | | 10,976,798 |

| Payable to affiliates | | | | | | | | | | |

| Accounting and legal services fees | | 228,451 | | 671,132 | | 656,174 | | 193,052 | | 141,865 |

| Transfer agent fees | | 58,662 | | 206,714 | | 223,203 | | 84,513 | | 72,759 |

| Distribution and service fees | | 9,533 | | 18,437 | | 20,097 | | 7,035 | | 5,309 |

| Trustees’ fees | | 1,260 | | 3,599 | | 4,134 | | 1,633 | | 1,427 |

| Other liabilities and accrued expenses | | 44,474 | | 64,063 | | 69,482 | | 48,241 | | 46,566 |

| Total liabilities | | 11,299,160 | | 38,102,329 | | 31,927,157 | | 9,409,106 | | 11,461,118 |

| Net assets | | $4,104,609,144 | | $12,151,775,768 | | $11,936,471,894 | | $3,527,025,845 | | $2,595,839,983 |

| Net assets consist of | | | | | | | | | | |

| Paid-in capital | | $2,894,385,249 | | $9,256,876,752 | | $9,903,576,531 | | $3,179,777,996 | | $2,534,969,572 |

| Undistributed net investment income (loss) | | (1,386,582) | | 28,780,318 | | 1,524,562 | | 589,329 | | 518,361 |

| Accumulated net realized gain (loss) on investments | | 190,778,273 | | 430,607,161 | | 249,502,436 | | 56,221,438 | | (7,432,359) |

| Net unrealized appreciation (depreciation) on investments | | 1,020,832,204 | | 2,435,511,537 | | 1,781,868,365 | | 290,437,082 | | 67,784,409 |

| Net assets | | $4,104,609,144 | | $12,151,775,768 | | $11,936,471,894 | | $3,527,025,845 | | $2,595,839,983 |

| Unaffiliated investments, including repurchase agreements, at cost | | — | | 8,514,546 | | 77,522,077 | | 24,122,242 | | 18,256,955 |

| Unaffiliated funds, at cost | | 1,156 | | 1,474 | | 1,565 | | 1,151 | | 1,175 |

| Affiliated funds, at cost | | 3,083,856,245 | | 9,708,944,820 | | 10,078,718,691 | | 3,213,247,736 | | $2,510,366,764 |

| Net asset value per share | | | | | | | | | | |

| The portfolios have an unlimited number of shares authorized with par value of $0.01 per share. Net asset value is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class. | | | | | | | | | |

| Class A1 | | | | | | | | | | |

| Net assets | | $511,712,130 | | $1,713,977,290 | | $1,814,600,415 | | $669,626,362 | | $576,432,477 |

| Shares outstanding | | 30,661,673 | | 105,685,744 | | 119,305,494 | | 49,190,299 | | 45,205,032 |

| Net asset value and redemption price per share | | $16.69 | | $16.22 | | $15.21 | | $13.61 | | $12.75 |

| Class B1 | | | | | | | | | | |

| Net assets | | $7,958,984 | | $36,232,721 | | $36,727,304 | | $15,797,819 | | $13,055,267 |

| Shares outstanding | | 477,697 | | 2,235,770 | | 2,416,871 | | 1,161,499 | | 1,023,196 |

| Net asset value, offering price and redemption price per share | | $16.66 | | $16.21 | | $15.20 | | $13.60 | | $12.76 |

| Class C1 | | | | | | | | | | |

| Net assets | | $115,546,137 | | $510,473,307 | | $591,231,891 | | $246,727,093 | | $214,389,891 |

| Shares outstanding | | 6,929,009 | | 31,538,411 | | 38,867,163 | | 18,120,582 | | 16,808,561 |

| Net asset value, offering price and redemption price per share | | $16.68 | | $16.19 | | $15.21 | | $13.62 | | $12.75 |

| Class I | | | | | | | | | | |

| Net assets | | $11,466,217 | | $36,723,318 | | $45,823,330 | | $12,386,558 | | $14,388,527 |

| Shares outstanding | | 688,118 | | 2,273,367 | | 3,030,675 | | 913,556 | | 1,130,238 |

| Net asset value, offering price and redemption price per share | | $16.66 | | $16.15 | | $15.12 | | $13.56 | | $12.73 |

| Class R1 | | | | | | | | | | |

| Net assets | | $6,603,561 | | $17,179,077 | | $16,184,522 | | $5,878,891 | | $6,878,097 |

| Shares outstanding | | 395,764 | | 1,056,261 | | 1,069,154 | | 432,572 | | 539,796 |

| Net asset value, offering price and redemption price per share | | $16.69 | | $16.26 | | $15.14 | | $13.59 | | $12.74 |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK MULTIMANAGER LIFESTYLE PORTFOLIOS 25 |

STATEMENTS OF ASSETS AND LIABILITIES 6-30-18 (unaudited) |

Continued |

| | Multimanager | | Multimanager | | Multimanager | | Multimanager | | Multimanager |

| | Lifestyle | | Lifestyle | | Lifestyle | | Lifestyle | | Lifestyle |

| | Aggressive | | Growth | | Balanced | | Moderate | | Conservative |

| | Portfolio | | Portfolio | | Portfolio | | Portfolio | | Portfolio |

| Class R2 | | | | | | | | | | |

| Net assets | | $7,145,802 | | $15,109,370 | | $15,398,519 | | $4,769,962 | | $3,284,971 |

| Shares outstanding | | 431,013 | | 938,324 | | 1,018,200 | | 351,760 | | 257,920 |

| Net asset value, offering price and redemption price per share | | $16.58 | | $16.10 | | $15.12 | | $13.56 | | $12.74 |

| Class R3 | | | | | | | | | | |

| Net assets | | $8,759,379 | | $13,211,551 | | $17,572,854 | | $5,690,676 | | $3,938,079 |

| Shares outstanding | | 526,952 | | 816,867 | | 1,158,375 | | 418,899 | | 309,564 |

| Net asset value, offering price and redemption price per share | | $16.62 | | $16.17 | | $15.17 | | $13.58 | | $12.72 |

| Class R4 | | | | | | | | | | |

| Net assets | | $6,579,252 | | $8,908,739 | | $11,709,565 | | $4,803,794 | | $2,785,826 |

| Shares outstanding | | 395,650 | | 549,643 | | 771,517 | | 354,349 | | 218,938 |

| Net asset value, offering price and redemption price per share | | $16.63 | | $16.21 | | $15.18 | | $13.56 | | $12.72 |

| Class R5 | | | | | | | | | | |

| Net assets | | $6,015,547 | | $16,340,107 | | $16,988,986 | | $8,420,191 | | $4,698,392 |

| Shares outstanding | | 360,774 | | 1,005,485 | | 1,117,669 | | 620,442 | | 369,049 |

| Net asset value, offering price and redemption price per share | | $16.67 | | $16.25 | | $15.20 | | $13.57 | | $12.73 |

| Class R6 | | | | | | | | | | |

| Net assets | | $30,576,047 | | $86,962,545 | | $78,197,709 | | $26,376,368 | | $15,035,633 |

| Shares outstanding | | 1,834,455 | | 5,377,996 | | 5,173,767 | | 1,946,708 | | 1,181,962 |

| Net asset value, offering price and redemption price per share | | $16.67 | | $16.17 | | $15.11 | | $13.55 | | $12.72 |

| Class 1 | | | | | | | | | | |

| Net assets | | $3,392,246,088 | | $9,376,634,345 | | $9,128,655,120 | | $2,467,500,974 | | $1,740,952,823 |

| Shares outstanding | | 203,855,124 | | 579,873,409 | | 604,139,510 | | 181,838,445 | | 136,824,577 |

| Net asset value, offering price and redemption price per share | | $16.64 | | $16.17 | | $15.11 | | $13.57 | | $12.72 |

| Class 5 | | | | | | | | | | |

| Net assets | | — | | $320,023,398 | | $163,381,679 | | $59,047,157 | | — |

| Shares outstanding | | — | | 19,814,422 | | 10,807,472 | | 4,356,497 | | — |

| | — | | $16.15 | | $15.12 | | $13.55 | | — |

| Maximum offering price per share | | | | | | | | | | |

| Class A (net asset value per share ÷ 95%)2 | | $17.57 | | $17.07 | | $16.01 | | $14.33 | | $13.42 |

| 1 | Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| 2 | On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced. |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK MULTIMANAGER LIFESTYLE PORTFOLIOS 26 |

STATEMENTS OF OPERATIONS For the six months ended 6-30-18 (unaudited) |

| |

| | Multimanager | | Multimanager | | Multimanager | | Multimanager | | Multimanager |

| | Lifestyle | | Lifestyle | | Lifestyle | | Lifestyle | | Lifestyle |

| | Aggressive | | Growth | | Balanced | | Moderate | | Conservative |

| | Portfolio | | Portfolio | | Portfolio | | Portfolio | | Portfolio |

| Investment income | | | | | | | | | | |

| Interest | | $10 | | $58,603 | | $195,664 | | $67,337 | | $53,605 |

| Income distributions received from affiliated funds | | 2,781,174 | | 42,524,683 | | 78,980,213 | | 31,805,685 | | 28,388,764 |

| Total investment income | | 2,781,184 | | 42,583,286 | | 79,175,877 | | 31,873,022 | | 28,442,369 |

| Expenses | | | | | | | | | | |

| Investment management fees | | 2,575,881 | | 7,098,832 | | 7,272,232 | | 2,169,176 | | 1,634,406 |

| Distribution and service fees | | 2,450,479 | | 8,294,420 | | 8,810,233 | | 3,182,260 | | 2,649,027 |

| Accounting and legal services fees | | 323,703 | | 955,336 | | 936,113 | | 276,232 | | 203,770 |

| Transfer agent fees | | 359,486 | | 1,280,251 | | 1,386,850 | | 528,182 | | 459,077 |

| Trustees’ fees | | 35,335 | | 105,395 | | 104,111 | | 31,236 | | 23,503 |

| Custodian fees | | 20,309 | | 20,320 | | 20,309 | | 20,301 | | 20,301 |

| State registration fees | | 78,649 | | 94,495 | | 95,153 | | 82,188 | | 78,812 |

| Printing and postage | | 31,217 | | 81,660 | | 74,808 | | 33,858 | | 29,308 |

| Professional fees | | 53,175 | | 112,384 | | 113,392 | | 52,176 | | 45,584 |

| Other | | 18,846 | | 45,653 | | 45,789 | | 18,218 | | 15,179 |

| Total expenses | | 5,947,080 | | 18,088,746 | | 18,858,990 | | 6,393,827 | | 5,158,967 |

| Less expense reductions | | (1,779,314) | | (4,285,778) | | (4,016,916) | | (1,100,044) | | (752,053) |

| Net expenses | | 4,167,766 | | 13,802,968 | | 14,842,074 | | 5,293,783 | | 4,406,914 |

| Net investment income (loss) | | (1,386,582) | | 28,780,318 | | 64,333,803 | | 26,579,239 | | 24,035,455 |

| Realized and unrealized gain (loss) | | | | | | | | | | |

| Net realized gain (loss) on | | | | | | | | | | |

| Affiliated funds | | 16,062,567 | | 79,917,229 | | 72,470,135 | | 28,912,991 | | 13,686,993 |

| Capital gain distributions received from affiliated funds | | 7,037,639 | | 13,578,861 | | 10,727,079 | | 2,192,945 | | — |

| | 23,100,206 | | 93,496,090 | | 83,197,214 | | 31,105,936 | | 13,686,993 |

| Change in net unrealized appreciation (depreciation) of | | | | | | | | | | |

| Unaffiliated investments and translation assets and liabilities in | | | | | | | | | | |

| foreign currencies | | — | | 6,712 | | 18,121 | | 6,446 | | 5,214 |

| Affiliated funds | | 29,088,042 | | (51,570,650) | | (143,094,944) | | (88,953,917) | | (78,259,402) |

| | 29,088,042 | | (51,563,938) | | (143,076,823) | | (88,947,471) | | (78,254,188) |

| Net realized and unrealized gain (loss) | | 52,188,248 | | 41,932,152 | | (59,879,609) | | (57,841,535) | | (64,567,195) |

| Increase (decrease) in net assets from operations | | $50,801,666 | | $70,712,470 | | $4,454,194 | | $(31,262,296) | | $(40,531,740) |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK MULTIMANAGER LIFESTYLE PORTFOLIOS 27 |

STATEMENTS OF CHANGES IN NET ASSETS |

| |

| | Multimanager Lifestyle | | Multimanager Lifestyle | | Multimanager Lifestyle |

| | Aggressive Portfolio | | Growth Portfolio | | Balanced Portfolio |

| | Six months | | | | Six months | | | | Six months | | |

| | ended | | | | ended | | | | ended | | |

| | 6-30-18 | | Year ended | | 6-30-18 | | Year ended | | 6-30-18 | | Year ended |

| | (unaudited) | | 12-31-17 | | (unaudited) | | 12-31-17 | | (unaudited) | | 12-31-17 |

| Increase (decrease) in net assets | | | | | | | | | | | | |

| From operations | | | | | | | | | | | | |

| Net investment income (loss) | | $(1,386,582) | | $42,319,602 | | $28,780,318 | | $180,472,305 | | $64,333,803 | | $232,927,423 |

| Net realized gain (loss) | | 23,100,206 | | 433,174,281 | | 93,496,090 | | 1,105,943,599 | | 83,197,214 | | 890,230,751 |

| Change in net unrealized appreciation (depreciation) | | 29,088,042 | | 396,816,221 | | (51,563,938) | | 969,575,201 | | (143,076,823) | | 700,180,954 |

| Increase (decrease) in net assets resulting from | | | | | | | | | | | | |

| operations | | 50,801,666 | | 872,310,104 | | 70,712,470 | | 2,255,991,105 | | 4,454,194 | | 1,823,339,128 |

| Distributions to shareholders | | | | | | | | | | | | |

| From net investment income | | | | | | | | | | | | |

| Class A | | — | | (3,646,118) | | — | | (19,802,476) | | (7,132,489) | | (28,483,192) |

| Class B | | — | | (9,936) | | — | | (234,447) | | (25,759) | | (410,994) |

| Class C | | — | | (146,045) | | — | | (3,242,022) | | (414,217) | | (6,299,154) |

| Class I | | — | | (98,275) | | — | | (550,048) | | (247,612) | | (747,213) |

| Class R1 | | — | | (26,086) | | — | | (154,438) | | (35,020) | | (204,760) |

| Class R2 | | — | | (37,134) | | — | | (143,411) | | (53,400) | | (214,087) |

| Class R3 | | — | | (50,744) | | — | | (132,784) | | (47,532) | | (226,587) |

| Class R4 | | — | | (70,310) | | — | | (148,281) | | (54,735) | | (253,066) |

| Class R5 | | — | | (68,461) | | — | | (317,544) | | (95,336) | | (361,493) |

| Class R6 | | — | | (314,535) | | — | | (1,179,126) | | (455,440) | | (1,212,237) |

| Class 1 | | — | | (37,942,285) | | — | | (150,224,009) | | (53,267,095) | | (192,067,901) |

| Class 5 | | — | | — | | — | | (4,800,561) | | (980,606) | | (3,191,062) |

| From net realized gain | | | | | | | | | | | | |

| Class A | | — | | (39,385,250) | | — | | (116,759,804) | | — | | (100,770,250) |

| Class B | | — | | (800,649) | | — | | (3,118,726) | | — | | (2,562,018) |

| Class C | | — | | (11,769,057) | | — | | (43,127,064) | | — | | (39,489,874) |

| Class I | | — | | (774,499) | | — | | (2,616,580) | | — | | (2,531,067) |

| Class R1 | | — | | (500,804) | | — | | (1,251,950) | | — | | (924,611) |

| Class R2 | | — | | (454,536) | | — | | (916,237) | | — | | (792,379) |

| Class R3 | | — | | (793,934) | | — | | (964,788) | | — | | (970,223) |

| Class R4 | | — | | (639,842) | | — | | (777,551) | | — | | (729,505) |

| Class R5 | | — | | (515,988) | | — | | (1,461,106) | | — | | (1,037,691) |

| Class R6 | | — | | (2,275,330) | | — | | (5,273,023) | | — | | (3,980,157) |

| Class 1 | | — | | (283,356,257) | | — | | (687,474,222) | | — | | (544,063,698) |

| Class 5 | | — | | — | | — | | (21,309,492) | | — | | (9,039,027) |

| Total distributions | | — | | (383,676,075) | | — | | (1,065,979,690) | | (62,809,241) | | (940,562,246) |

| From portfolio share transactions | | | | | | | | | | | | |

| Portfolio share transactions | | (226,796,800) | | (208,805,463) | | (818,616,614) | | (856,881,292) | | (771,153,009) | | (1,093,819,887) |

| Total from portfolio share transactions | | (226,796,800) | | (208,805,463) | | (818,616,614) | | (856,881,292) | | (771,153,009) | | (1,093,819,887) |

| Total increase (decrease) | | (175,995,134) | | 279,828,566 | | (747,904,144) | | 333,130,123 | | (829,508,056) | | (211,043,005) |

| Net assets | | | | | | | | | | | | |

| Beginning of period | | 4,280,604,278 | | 4,000,775,712 | | 12,899,679,912 | | 12,566,549,789 | | 12,765,979,950 | | 12,977,022,955 |

| End of period | | $4,104,609,144 | | $4,280,604,278 | | $12,151,775,768 | | $12,899,679,912 | | $11,936,471,894 | | $12,765,979,950 |

| Undistributed net investment income (loss) | | $(1,386,582) | | — | | $28,780,318 | | — | | $1,524,562 | | — |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK MULTIMANAGER LIFESTYLE PORTFOLIOS 28 |

STATEMENTS OF CHANGES IN NET ASSETS |

Continued |

| | Multimanager Lifestyle | | Multimanager Lifestyle |

| | Moderate Portfolio | | Conservative Portfolio |

| | Six months | | | | Six months | | |

| | ended | | | | ended | | |

| | 6-30-18 | | Year ended | | 6-30-18 | | Year ended |

| | (unaudited) | | 12-31-17 | | (unaudited) | | 12-31-17 |

| Increase (decrease) in net assets | | | | | | | | |

| From operations | | | | | | | | |

| Net investment income (loss) | | $26,579,239 | | $81,787,949 | | $24,035,455 | | $66,559,789 |

| Net realized gain (loss) | | 31,105,936 | | 160,963,712 | | 13,686,993 | | 57,944,633 |

| Change in net unrealized appreciation (depreciation) | | (88,947,471) | | 167,895,212 | | (78,254,188) | | 89,546,885 |

| Increase (decrease) in net assets resulting from operations | | (31,262,296) | | 410,646,873 | | (40,531,740) | | 214,051,307 |

| Distributions to shareholders | | | | | | | | |

| From net investment income | | | | | | | | |

| Class A | | (4,176,345) | | (13,122,758) | | (4,630,936) | | (12,586,671) |

| Class B | | (43,640) | | (247,892) | | (59,952) | | (247,626) |

| Class C | | (687,904) | | (3,715,222) | | (983,275) | | (3,713,003) |

| Class I | | (95,770) | | (256,162) | | (134,694) | | (329,156) |

| Class R1 | | (26,477) | | (97,985) | | (42,890) | | (114,893) |

| Class R2 | | (27,270) | | (100,716) | | (24,343) | | (52,539) |

| Class R3 | | (29,322) | | (102,218) | | (28,766) | | (87,356) |

| Class R4 | | (33,492) | | (128,939) | | (24,271) | | (95,853) |

| Class R5 | | (71,257) | | (213,977) | | (44,671) | | (142,590) |

| Class R6 | | (210,058) | | (613,121) | | (150,263) | | (357,695) |

| Class 1 | | (20,097,132) | | (62,035,952) | | (17,393,033) | | (49,052,835) |

| Class 5 | | (491,243) | | (1,408,409) | | — | | — |

| From net realized gain | | | | | | | | |

| Class A | | — | | (28,906,924) | | — | | (7,289,747) |

| Class B | | — | | (825,491) | | — | | (201,255) |

| Class C | | — | | (12,558,582) | | — | | (3,130,221) |

| Class I | | — | | (586,806) | | — | | (176,714) |

| Class R1 | | — | | (258,345) | | — | | (76,649) |

| Class R2 | | — | | (186,763) | | — | | (24,432) |

| Class R3 | | — | | (273,150) | | — | | (53,976) |

| Class R4 | | — | | (209,322) | | — | | (50,582) |

| Class R5 | | — | | (397,368) | | — | | (56,772) |

| Class R6 | | — | | (1,036,595) | | — | | (188,692) |

| Class 1 | | — | | (112,572,656) | | — | | (23,369,847) |

| Class 5 | | — | | (2,594,852) | | — | | — |

| Total distributions | | (25,989,910) | | (242,450,205) | | (23,517,094) | | (101,399,104) |

| From portfolio share transactions | | | | | | | | |

| Portfolio share transactions | | (217,317,842) | | (376,449,368) | | (212,756,900) | | (386,543,256) |

| Total from portfolio share transactions | | (217,317,842) | | (376,449,368) | | (212,756,900) | | (386,543,256) |

| Total increase (decrease) | | (274,570,048) | | (208,252,700) | | (276,805,734) | | (273,891,053) |

| Net assets | | | | | | | | |

| Beginning of period | | 3,801,595,893 | | 4,009,848,593 | | 2,872,645,717 | | 3,146,536,770 |

| End of period | | $3,527,025,845 | | $3,801,595,893 | | $2,595,839,983 | | $2,872,645,717 |

| Undistributed net investment income (loss) | | $589,329 | | — | | $518,361 | | — |

| SEE NOTES TO FINANCIAL STATEMENTS | SEMIANNUAL REPORT | JOHN HANCOCK MULTIMANAGER LIFESTYLE PORTFOLIOS 29 |

| Multimanager Lifestyle Aggressive Portfolio | | | | | | | | | | |

| | | | | | | | | | | |

| Per share operating performance for a share outstanding throughout each period | | | Ratios and supplemental data |

| | Income (loss) from | | | | | | | | | | | |

| | investment operations | | Less distributions | | | Ratios to average net assets | | |

| | | Net real- | | | | | | | | | | | |

| Net asset | | ized and | | | | | | | | | | Net | |

| value, | Net | unrealized | Total from | | | | Net asset | | Expenses | Expenses | Net | assets, | |

| beginning | investment | gain (loss) | investment | From net | From net | Total | value, | Total | before | including | investment | end of | Portfolio |

| of period | income | on invest- | operations | investment | realized | distribu- | end of | return | reductions | reductions | income | period | turnover |

| Period ended | ($) | (loss) ($)1, 2 | ments ($) | ($) | income ($) | gain ($)3 | tions ($) | period ($) | (%)4, 5 | (%)6 | (%)6 | (loss) (%)2 | (in millions) | (%) |

| Multimanager Lifestyle Aggressive Portfolio | | | | | | | | | | | | |

| Class A | | | | | | | | | | | | | | |

| 6-30-20187 | 16.52 | (0.03) | 0.20 | 0.17 | — | — | — | 16.69 | 1.038 | 0.569 | 0.479 | (0.34)9 | 512 | 5 |

| 12-31-2017 | 14.72 | 0.13 | 3.23 | 3.36 | (0.13) | (1.43) | (1.56) | 16.52 | 22.79 | 0.55 | 0.48 | 0.79 | 499 | 23 |

| 12-31-2016 | 14.87 | 0.12 | 0.91 | 1.03 | (0.12) | (1.06) | (1.18) | 14.72 | 6.92 | 0.53 | 0.47 | 0.78 | 419 | 31 |

| 12-31-2015 | 16.29 | 0.11 | (0.34) | (0.23) | (0.10) | (1.09) | (1.19) | 14.87 | (1.54) | 0.52 | 0.47 | 0.64 | 411 | 15 |

| 12-31-2014 | 15.94 | 0.10 | 0.60 | 0.70 | (0.09) | (0.26) | (0.35) | 16.29 | 4.39 | 0.53 | 0.47 | 0.59 | 393 | 18 |

| 12-31-2013 | 12.95 | 0.09 | 3.24 | 3.33 | (0.09) | (0.25) | (0.34) | 15.94 | 25.70 | 0.54 | 0.52 | 0.58 | 337 | 21 |

| Class B | | | | | | | | | | | | | | |

| 6-30-20187 | 16.55 | (0.09) | 0.20 | 0.11 | — | — | — | 16.66 | 0.668 | 1.269 | 1.179 | (1.05)9 | 8 | 5 |

| 12-31-2017 | 14.75 | (0.02) | 3.26 | 3.24 | (0.01) | (1.43) | (1.44) | 16.55 | 21.97 | 1.25 | 1.18 | (0.10) | 10 | 23 |

| 12-31-2016 | 14.90 | (0.01) | 0.93 | 0.92 | (0.01) | (1.06) | (1.07) | 14.75 | 6.15 | 1.23 | 1.19 | (0.08) | 12 | 31 |

| 12-31-2015 | 16.33 | (0.04) | (0.32) | (0.36) | — | (1.07) | (1.07) | 14.90 | (2.31) | 1.24 | 1.21 | (0.26) | 16 | 15 |

| 12-31-2014 | 15.98 | (0.06) | 0.63 | 0.57 | — | (0.22) | (0.22) | 16.33 | 3.58 | 1.28 | 1.26 | (0.36) | 22 | 18 |

| 12-31-2013 | 12.98 | (0.05) | 3.26 | 3.21 | — | (0.21) | (0.21) | 15.98 | 24.73 | 1.3210 | 1.32 | (0.33) | 27 | 21 |

| Class C | | | | | | | | | | | | | | |

| 6-30-20187 | 16.57 | (0.09) | 0.20 | 0.11 | — | — | — | 16.68 | 0.668 | 1.269 | 1.179 | (1.05)9 | 116 | 5 |

| 12-31-2017 | 14.76 | —11 | 3.25 | 3.25 | (0.01) | (1.43) | (1.44) | 16.57 | 22.03 | 1.25 | 1.18 | (0.03) | 148 | 23 |

| 12-31-2016 | 14.92 | —11 | 0.91 | 0.91 | (0.01) | (1.06) | (1.07) | 14.76 | 6.07 | 1.23 | 1.19 | 0.01 | 155 | 31 |