UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21825

AARP FUNDS

(Exact name of registrant as specified in charter)

601 E. Street, N.W.

Washington, DC 20004

(Address of principal executive offices)(Zip code)

| | |

| (Name and Address of Agent for Service) | | Copy to: |

| |

Larry C. Renfro AARP Funds 650 F Street, N.W. Washington, DC 20004 | | Jane A. Kanter, Esq. Dechert LLP 1775 I Street, N.W. Washington, DC 20006-2401 |

Registrant’s telephone number, including area code: (202) 434-3546

Date of fiscal year end: June 30

Date of reporting period: June 30, 2006

Item 1: Report to Shareholders.

AARP FUNDS

. . .

Annual Report

June 30, 2006

A new vision for the American investor

. . .

AARP Conservative Fund

AARP Moderate Fund

AARP Aggressive Fund

. . .

KEEPING YOU INFORMED

This first annual report for the AARP Funds represents our commitment to providing communications that are clear, concise and informative. One of our highest priorities at AARP Funds is to help you make sense of investment information that is often complex. We hope you find it helpful in evaluating your investment with us.

EXPERTISE AND GUIDANCE WHEN YOU NEED IT

AARP Financial’s investment counselors are ready to help you determine if you are on track financially for retirement and to answer specific questions about AARP Funds. They work on salary, not commission, and are there to help you focus on your goals, take decisive action and feel comfortable with your decisions. Investment counselors are NASD registered representatives through ALPS Distributors, Inc., and are employed by AARP Financial.

Table of Contents

While AARP has licensed the use of its name to AARP Funds and endorses the services provided by AARP Financial Incorporated, AARP cannot recommend that you or any specific individual should purchase shares of a particular fund. AARP is not a registered investment adviser or broker/dealer. Investment counselors are NASD registered representatives through ALPS Distributors, Inc., a registered broker/dealer, and are employed by AARP Financial, a registered investment adviser.

This Annual Report must be preceded or accompanied by the applicable AARP Fund’s prospectus for individuals who are not current AARP Funds shareholders. An investor should consider the investment objectives, risks, charges and expenses of AARP Funds carefully before investing. To get a prospectus containing this and other information, please call (800) 958-6457. Read the prospectus carefully before you invest.

AARP Funds are distributed by ALPS Distributors, Inc.

AARP FUNDS 2006 ANNUAL REPORT 1

A LETTER TO SHAREHOLDERS

Larry C. Renfro

President

AARP Funds

Fellow Shareholder,

In our first annual report, I want to share with you the story of AARP Funds, and why they were created.

It’s actually a story about you. It begins with a simple observation: Many of us aren’t saving enough for retirement. And when we do manage to save, often times we’re not making smart investment choices.

Over the past several years, AARP has gone to great lengths to figure out how investors got into this situation, and what AARP should do to help.

The first thing was to talk with well-known experts. The process included poring over industry and academic studies, looking at key statistics, and talking directly with AARP members.

The findings were telling — many financial products often fall far short of meeting investors’ needs. Many carry large minimum initial investment requirements and impose high fees that eat away returns. Others capitalize on investment fads and clutter the market with a confusing array of choices. And so many products demand too much time and effort, and financial expertise beyond the reach of many investors.

Investing has gotten far more difficult than it needs to be for many of us. And when anything gets difficult, people often stumble and make mistakes that can reduce their returns.

AARP’s conclusion: Americans need a better, more affordable way to invest. And AARP would have to make it happen.

As a nonprofit, nonpartisan membership organization for people age 50 and over, AARP felt uniquely positioned to help Americans achieve retirement readiness.

And so AARP Financial was born. Five fundamental principles drive its investment philosophy: low cost, simple choices, indexing, diversification, and rebalancing. AARP Financial believes these are core investment principles that should stand as the foundation of any prudent retirement investing program, and are the foundation of AARP Funds.

2 A Letter to Shareholders

Low fees

Research indicates that many investors overlook costs when choosing a mutual fund — despite the fact that fees can have a tremendous impact on reducing returns. For example, consider the average U.S. stock fund, which charges 1.13% of an investor’s account balance every year.1 If you invested $100,000 in such a fund and earned 5% a year, those fees would cost you a stunning $53,944 after 20 years. Pick a fund that charges just 0.50% instead, and you would have an extra $28,634 for your retirement, all other things being equal.2

AARP Financial’s solution? Build a low-cost strategy into a new fund family, so that investors could enjoy these potential savings.

Simple choices

American consumers often think the more choices, the better. But that isn’t necessarily true — at least, not when it comes to investing. How can anyone possibly pick from thousands of U.S. mutual funds? Research suggests that too much choice may confuse investors, rather than help them.3 For example, research indicates that the more funds a 401(k) plan offers, the fewer employees participate.4 Faced with a daunting array of options, many investors seem to give up, feel paralyzed or simply take a guess.

AARP Financial concluded that a simpler approach was in order. That’s why the AARP Conservative, Moderate and Aggressive Funds combine both stocks and bonds to provide a complete, diversified portfolio in one purchase.

| 1 | Investment Company Institute, Research Fundamentals, Fees and Expenses of Mutual Funds, 2005, Vol. 15/No. 4, June 2006. |

| 2 | These calculations came from the U.S. Securities and Exchange Commission’s online tool for comparing the costs of owning mutual funds, The SEC Mutual Fund Cost Calculator. You can find the tool by going to the SEC’s Web site at www.sec.gov. (Please keep in mind that AARP Funds do not operate, maintain, or have any connections to The SEC Mutual Fund Cost Calculator.) |

| 3 | Benartzi, Shlomo, and Richard H. Thaler, How Much Is Investor Autonomy Worth?, 2001; Iyengar, Sheena S., Wei Jiang, Gur Huberman, How Much Choice Is Too Much?: Determinants of Individual Contributions in 401(k) Retirement Plans, Draft, March 2003; Thaler, Richard H., and Shlomo Benartzi, Save More Tomorrow: Using Behavioral Economics to Increase Employee Saving, Journal of Political Economy, 2004. |

A Letter to Shareholders 3

Indexing

When you think of a mutual fund, you may picture portfolio managers who spend long hours looking at company research and actively trading stocks and bonds. That style of fund management is very popular. The problem is, it may not always work very well. Studies over the years indicate that active managers have rarely beaten the returns of major market indexes over long periods of time.5

That’s why the AARP Funds use index investing. Index investments are designed to reflect a broader market — such as the stock or bond market — rather than trying to outguess the market and pick individual winners and losers. Index funds may achieve a performance advantage by maintaining low management fees and low turnover (the buying and selling of securities by the fund). Please note that past performance doesn’t guarantee future results.

Diversification

By now, most investors have heard the mantra of diversification: Avoid putting all your eggs in one basket, and spread your investments across different kinds of assets, such as stocks and bonds. None of us can tell which investments will rise in price, but if your investments are diversified enough, you may own investments that rise in value. Just as important, if you are adequately diversified, the impact of investments that lose value will be lessened. Please keep in mind that diversification doesn’t eliminate the risk of experiencing investment losses.

From the start, the AARP Conservative, Moderate and Aggressive Funds were designed to provide diversification by investing in a mix of stocks and bonds that seek to track the returns of major market indexes.

Automatic rebalancing

Prudent portfolio management suggests that investors should regularly monitor their investments, and adjust them as needed. That’s because, over time, some investments may rise and others fall, leaving more or less risk than originally intended. To stay on track, investors may need to periodically sell off investments that have risen in value, and buy more of others that have fallen — a process called “rebalancing.” Selling an investment for rebalancing purposes may be subject to taxes.

Many investors may have trouble rebalancing on their own. If so many of us find it difficult to make a single investment decision, how many will commit to making such decisions every month or every year? That is why every AARP Fund is automatically rebalanced by professionals, so that investors don’t have to do it themselves.

| 5 | Malkiel, Burton G., The Random Walk Guide to Investing, 2003. |

4 A Letter to Shareholders

How it all fits together, especially in today’s markets

The beauty of these five principles is the way they all work together. Whatever the short-term economic and market environment, the AARP Funds are designed for the mid- to long-term investor. By offering a complete, diversified investment program that is closely monitored, our goal is to help you stay on track, as you prepare for and enjoy retirement.

This approach to investing is designed to help investors weather stormy markets. Given the level of uncertainty in the market today, the urge to try to “time the market” — that is, the urge to avoid a market drop or catch an upswing — is a natural one. But market movements are virtually impossible to predict, even if you’re an expert investor. And the penalties for guessing wrong can be very costly. History suggests that market bumps tend to smooth out over time. Staying invested in a well-diversified investment like an AARP Fund may help you keep on course through the inevitable ups and downs in the market.

I am pleased that so many AARP Fund investors like you seem to agree with our no-nonsense approach. We appreciate the trust you have placed in us by investing in our funds, and pledge to continue striving to live up to our mission — giving you an easier, more cost-effective way to invest for retirement. If at any time you should have any questions, please feel free to contact us at (800) 958-6457.

Sincerely,

Larry C. Renfro

President

An investor should consider the investment objective, risks, charges and expenses of AARP Funds carefully before investing. To get a Prospectus containing this and other information, call (800) 958-6457. Read the Prospectus carefully before you invest.

AARP Funds are distributed by ALPS Distributors, Inc.

A Letter to Shareholders 5

Market Commentary

After a strong first quarter, which saw stocks rise across the board, volatility returned to the markets in the second quarter of 2006 with increasing uncertainty about inflation and interest rates. During the first quarter, economic growth was strong and many investors believed the Federal Reserve would end its cycle of interest rate hikes, limiting inflation without stalling economic growth. U.S. stocks, as measured by the MSCI U.S. Investable Market 2500 index, returned 5.3% in the quarter ended March 31, 2006, while international stocks, as measured by the MSCI EAFE index, posted a 9.4% gain for the same period. Bonds did not fare as well; the Lehman Brothers Aggregate Bond Index recorded a small first-quarter loss of -0.65%.

During the second quarter ended June 30, 2006, the economy continued to grow, but so did inflation and, with it, investor concerns. The inflection point occurred in mid-May when the U.S. Federal Reserve Bank raised the Fed Funds target rate to 5% and stated that additional increases may be necessary to address inflationary concerns. Higher interest rates, higher energy costs and higher housing prices all contributed to concerns that consumer spending and sentiment in the U.S. would be adversely affected, with corresponding implications for economic growth. Indeed, economic growth did begin to slow in the second quarter. Market volatility often accompanies such turning points and this instance proved to be no different. During the second quarter, the Dow Jones Industrial Average experienced numerous days with 100+ point changes. For the second quarter, U.S. stocks recorded a loss of

-1.88%; U.S. bonds posted a marginal loss of -0.08%; and only international stocks managed to eke out a small gain of 0.70% for the quarter.

Nevertheless, for the six months, both U.S. and international stocks remained in positive territory, which is a good example of why it’s important to focus on long-term performance, rather than short term ups and downs. Maintaining a well-diversified mix of stocks and bonds with a long-term perspective is one of the best ways to weather short-term market trends, including the increase in volatility that began in the quarter ended June 30, 2006.

Notification of Change in Portfolio Manager

On July 5, 2006, AARP Financial announced the appointment of Richard M. Hisey as its Chief Investment Officer responsible for investment strategy, portfolio management and performance analysis of the AARP Funds.

Prior to joining AARP Financial, Mr. Hisey served as Executive Vice President and Chief Investment Officer of Cole Management Incorporated. He also spent 15 years at Lexington Global Asset Managers, Inc. (now ING/Reliastar), where he served as the portfolio manager and investment strategist for a Russian equity mutual fund.

6 AARP FUNDS 2006 ANNUAL REPORT Market Commentary

AARP Funds Overview

The AARP Funds are “funds of funds” because they invest substantially all of their assets in the underlying “Portfolios” of AARP Portfolios, a separately registered investment company. Each AARP Fund invests in all three of the Portfolios, but in different amounts.

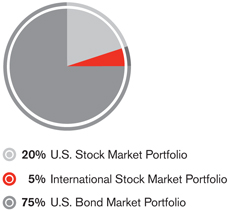

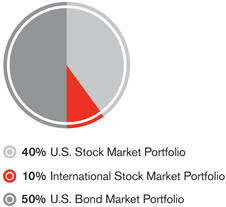

| | | | | | | | | |

| | | AARP Conservative Fund | | | AARP Moderate Fund | | | AARP Aggressive Fund | |

Investment Objective | | Seeks primarily current

income, with some growth

of capital | | | Seeks a balance of

growth of capital and

current income | | | Seeks growth of capital and some

current income | |

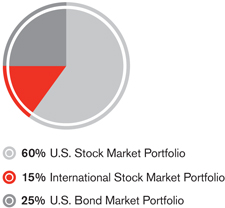

Investment Allocation | | | | | | | | | |

U.S. Bond Market Portfolio | | 75 | % | | 50 | % | | 25 | % |

U.S. Stock Market Portfolio | | 20 | % | | 40 | % | | 60 | % |

International Stock Market Portfolio | | 5 | % | | 10 | % | | 15 | % |

How the Funds Performed

Period ended June 30, 2006 (since commencement of operations on January 1, 2006)

| | | | | | | | | | | | | |

| AARP Conservative Fund | | 0.24 | % | | AARP Moderate Fund | | 1.44 | % | | AARP Aggressive Fund | | 2.60 | % |

Conservative Composite Index | | 0.63 | % | | Moderate Composite Index | | 1.98 | % | | Aggressive Composite Index | | 3.32 | % |

Lehman Brothers Aggregate Bond Index® | | –0.72 | % | | MSCI U.S. Investable Market 2500 Index® | | 3.29 | % | | MSCI U.S. Investable Market 2500 Index® | | 3.29 | % |

| | | | | Lehman Brothers Aggregate Bond Index® | | –0.72 | % | | | | | |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For the most recent month-end performance and after-tax returns, visit www.aarpfunds.com or call (800) 958-6457. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

A Word about Benchmarks

A useful tool to measure the performance of AARP Funds

When evaluating how your investment performed, it’s helpful to compare it to an appropriate benchmark. You can think of the benchmark as a handy yardstick for measuring how well the fund did in meeting its investment objectives. In our case, because the AARP Funds are indexed and trying to produce the returns of a mixture of three indexes,

AARP Funds Overview 7

A Word about Benchmarks (continued)

Indexes vs. index funds

Indexes, as opposed to index funds, are a group or list of securities representing a market or part of a market. The returns of the index do not reflect the costs of actually investing in the index and do not include fees, brokerage commissions or other expenses of investing. While you can invest in an index fund - it’s a real investment, you cannot invest directly in an index - it’s just a list.

we believe that the most useful benchmark is one that combines the three indexes in similar amounts to the AARP Funds. When you combine different indexes into one benchmark, it’s called a “composite index.”

We also believe it is useful for you to consider the returns of the overall bond and stock markets when you assess the performance of the AARP Funds. This allows you to see how diversification works in practice. Sometimes the bond and stock markets move in opposite directions, or when the stock market goes down, the bond market doesn’t go quite as far down.

There is one caveat though. Please remember that a benchmark of indexes has a built-in performance advantage over an actual mutual fund. An index is merely a list of securities in a stock or bond market so the returns of indexes do not reflect the real world costs of managing a mutual fund. It is difficult to match the returns of an index because of this difference.

Following is a table that shows the make up of the composite indexes for each AARP Fund:

| | | | | | | | | |

| | | AARP Conservative Fund

Conservative Composite Index | | | AARP Moderate Fund

Moderate Composite Index | | | AARP Aggressive Fund Aggressive Composite

Index | |

Lehman Brothers Aggregate Bond Index | | 75 | % | | 50 | % | | 25 | % |

MSCI U.S. Investable Market 2500® Index | | 20 | % | | 40 | % | | 60 | % |

MSCI EAFE® Index | | 5 | % | | 10 | % | | 15 | % |

A description of each index

| • | | Lehman Brothers Aggregate Bond Index — The index includes a large variety of U.S. bonds that are investment grade and taxable, covering three major types of bonds: government and corporate bonds, mortgage-backed securities and asset-backed securities. |

| • | | MSCI U.S. Investable Market 2500 Index* — The index includes about 2,500 securities listed on the New York and American Stock Exchanges and the Nasdaq over-the-counter market. The stocks represent companies of all types and sizes. |

| • | | MSCI EAFE Index* — The index includes about 1,000 securities that are listed on the stock exchanges of 21 developed countries, excluding the United States and Canada. |

| * | Please note that although the AARP Funds seek to track these MSCI indexes, MSCI does not sponsor, endorse, or promote the AARP Funds. For a more detailed description of our relationship with MSCI please see the prospectus and statement of additional information for the AARP Funds. |

8 AARP FUNDS 2006 ANNUAL REPORT Benchmark

AARP Conservative Fund Overview

Portfolio of investments

June��30, 2006

Mutual funds: 100.2%

| | | | | | |

| | | Shares | | Value | |

U.S. Bond Market Portfolio1 | | 509,527 | | $ | 4,942,414 | |

U.S. Stock Market Portfolio1 | | 130,866 | | | 1,319,133 | |

International Stock Market Portfolio1 | | 31,248 | | | 329,039 | |

| | | | | | |

Total investments: 100.2% (Identified cost $6,696,059) | | | | | 6,590,586 | |

| | | | | | |

Other assets and liabilities, net: (0.2)% | | | | | (10,050 | ) |

| | | | | | |

Total net assets: 100.0% | | | | $ | 6,580,536 | |

See Notes to Financial Statements.

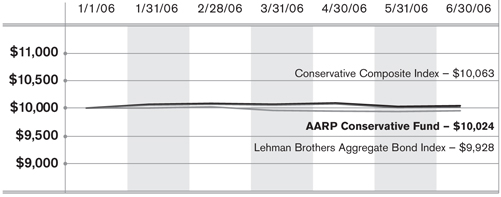

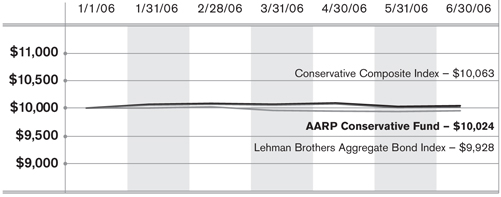

Growth of $10,000 as of June 30, 2006

Cumulative total return for the six months ended June 30, 2006

|

| This graph illustrates the hypothetical investment of $10,000 in the AARP Conservative Fund from January 1, 2006 (commencement of operations) through June 30, 2006, compared to the Conservative Composite Index* and the Lehman Brothers Aggregate Bond Index.* |

This hypothetical example does not represent the returns of any particular investment.

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For the most recent month-end performance and after-tax returns, visit www.aarpfunds.com or call (800) 958-6457. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

| * | The fund’s performance assumes the reinvestment of all dividends and distributions. The Conservative Composite Index and the Lehman Brothers Aggregate Bond Index have been adjusted to reflect reinvestment of dividends on securities in the indexes. For more information on the Conservative Composite Index and the Lehman Brothers Aggregate Bond Index, please see “A Word about Benchmarks” on page 7. |

AARP Conservative Fund Overview AARP FUNDS 2006 ANNUAL REPORT 9

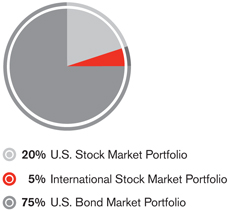

AARP Conservative Fund

Portfolio construction

Performance commentary

The Conservative Fund seeks primarily current income, with some growth of capital. Its portfolio targets an asset allocation of 20% U.S. stocks, 5% international stocks and 75% bonds.

For the six months ending June 30, 2006, the AARP Conservative Fund returned 0.24%, as compared to the Conservative Composite Index of 0.63% and as compared to the Lehman Brothers Aggregate Bond Index, which recorded a loss of -0.72% for the six months. The Fund tracked its composite benchmark index closely, after a brief startup period. Of course, an index fund very rarely matches the performance of its benchmark index exactly, since a fund has operating expenses and an index does not.

While the bond markets declined during this period, the Fund delivered a small positive return, thanks to a diversified portfolio balanced with U.S. and international stocks. Given its large weighting in bonds, the key factor in the fund’s performance during the first six months was the dynamic interest rate environment in the U.S. During this time, the U.S. Federal Reserve Bank continued its policy of raising short term interest rates to address inflationary concerns in the U.S. As interest rates rise, the value of existing bonds tend to decline and for the first six months of 2006, U.S. bonds (as measured by the Lehman Brothers Aggregate Bond Index) declined by -0.72%. Compared to its composite index, the primary detractors from performance were: 1) fund expenses — indexes do not have expenses; and, 2) tracking differences (the difference between the performance of the Fund and its comparative index) as the Fund began operations. Compared to the Lehman Brothers Aggregate Bond Index, the key contributors to the Fund’s performance were its investments in the U.S. Stock Market Portfolio (which recorded a total return of 1.52% for the period) and the International Stock Market Portfolio (which recorded a total return of 7.10% for the period).

10 AARP FUNDS 2006 ANNUAL REPORT AARP Conservative Fund

AARP Moderate Fund Overview

Portfolio of investments

June 30, 2006

Mutual funds: 100.0%

| | | | | |

| | | Shares | | Value |

U.S. Bond Market Portfolio1 | | 676,693 | | $ | 6,563,921 |

U.S. Stock Market Portfolio1 | | 520,907 | | | 5,250,747 |

International Stock Market Portfolio1 | | 124,614 | | | 1,312,186 |

| | | | | |

Total investments: 100.0% (Identified cost $13,338,038) | | | | | 13,126,854 |

| | | | | |

Other assets and liabilities, net: 0.0% | | | | | 5,799 |

| | | | | |

Total net assets: 100.0% | | | | $ | 13,132,653 |

See Notes to Financial Statements.

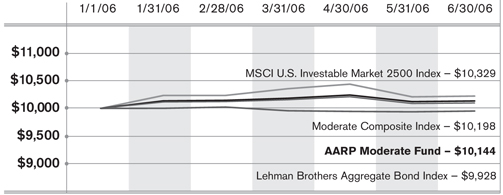

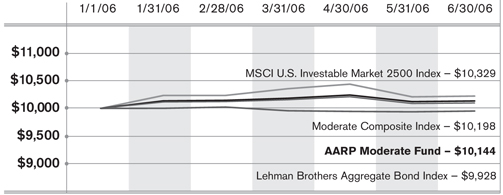

Growth of $10,000 as of June 30, 2006

Cumulative total return for the six months ended June 30, 2006

|

| This graph illustrates the hypothetical investment of $10,000 in the AARP Moderate Fund from January 1, 2006 (commencement of operations) through June 30, 2006, compared to the Moderate Composite Index, the MSCI U.S. Investable Market 2500 Index*, and the Lehman Brothers Aggregate Bond Index.* |

This hypothetical example does not represent the returns of any particular investment.

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For the most recent month-end performance and after-tax returns, visit www.aarpfunds.com or or call (800) 958-6457. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

| * | The fund’s performance assumes the reinvestment of all dividends and distributions. The Moderate Composite Index, the MSCI U.S. Investable Market 2500 Index and the Lehman Brothers Aggregate Bond Index have been adjusted to reflect reinvestment of dividends on securities in the indexes. For more information on the Moderate Composite Index, the MSCI U.S. Investable Market 2500 Index and the Lehman Brothers Aggregate Bond Index, please see “A Word about Benchmarks” on page 7. |

AARP Moderate Fund Overview AARP FUNDS 2006 ANNUAL REPORT 11

AARP Moderate Fund

Portfolio construction

Tracking difference

The difference between the performance of the Fund and its comparative index.

Performance commentary

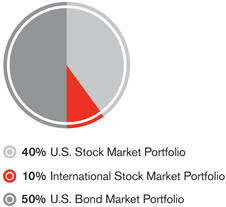

The AARP Moderate Fund seeks a balance of growth of capital and current income. To pursue this objective, the fund targets an investment of 40% of its portfolio in U.S. stocks, 10% in international stocks and 50% in bonds.

For the six months ending June 30, 2006, the AARP Moderate Fund returned 1.44%, as compared to the Moderate Composite Index of 1.98%, -0.72% for the Lehman Brothers Aggregate Bond Index and 3.29% for the MSCI U.S. Investable 2500 Index. The Fund tracked its composite benchmark index closely, after a brief startup period. Of course, an index fund very rarely matches the performance of its benchmark index exactly, since a fund has operating expenses and an index does not.

For the six months, the key factors in the Fund’s performance were the returns generated by the U.S. Bond Market Portfolio and the U.S. Stock Market Portfolio, given their weightings in the Fund. The dynamic interest rate environment in the U.S. was a key detractor for the six months. During this time, the U.S. Federal Reserve Bank continued its policy of raising short-term interest rates to address inflationary concerns in the U.S. As interest rates rise, the value of existing bonds tend to decline and for the first six months of 2006, U.S. bonds (as measured by the Lehman Brothers Aggregate Bond Index) declined by -0.72%, negatively impacting the Fund’s performance. The Fund’s position in U.S. stocks was a net contributor to performance during the period. Within the U.S. stock market (as measured by the MSCI U.S. Investable Market 2500 Index), the energy, financial and industrials sectors all contributed to performance. Conversely, the information technology (-6%) and healthcare sectors (-4%) were down for the period. Against the indexes, the Fund’s performance was negatively impacted by Fund expenses (the indexes do not have expenses) and tracking differences as the Fund began operations.

12 AARP FUNDS 2006 ANNUAL REPORT AARP Moderate Fund

AARP Aggressive Fund Overview

Portfolio of investments

June 30, 2006

Mutual funds: 99.9%

| | | | | |

| | | Shares | | Value |

U.S. Bond Market Portfolio1 | | 166,686 | | $ | 1,616,858 |

U.S. Stock Market Portfolio1 | | 383,551 | | | 3,866,199 |

International Stock Market Portfolio1 | | 91,625 | | | 964,812 |

| | | | | |

Total investments: 99.9% (Identified cost $6,536,538) | | | | | 6,447,869 |

| | | | | |

Other assets and liabilities, net: 0.1% | | | | | 5,806 |

| | | | | |

Total net assets: 100.0% | | | | $ | 6,453,675 |

See Notes to Financial Statements.

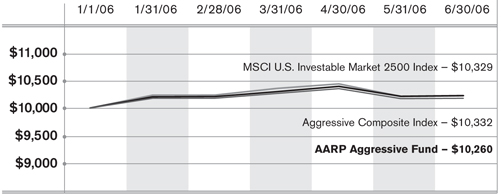

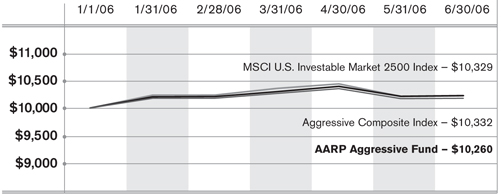

Growth of $10,000 as of June 30, 2006

Cumulative total return for the six months ended June 30, 2006

|

| This graph illustrates the hypothetical investment of $10,000 in the AARP Aggressive Fund from January 1, 2006 (commencement of operations) through June 30, 2006, compared to the Aggressive Composite Index* and the MSCI Investable Market 2500 Index.* |

This hypothetical example does not represent the returns of any particular investment.

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For the most recent month-end performance and after-tax returns, visit www.aarpfunds.com or call (800) 958-6457. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

| * | The fund’s performance assumes the reinvestment of all dividends and distributions. The Aggressive Composite Index and the MSCI U.S. Investable Market 2500 Index have been adjusted to reflect reinvestment of dividends on securities in the indexes. For more information on the Aggressive Composite Index and the MSCI U.S. Investable Market 2500 Index, please see “A Word about Benchmarks” on page 7. |

AARP Aggressive Fund Overview AARP FUNDS 2006 ANNUAL REPORT 13

AARP Aggressive Fund

Portfolio construction

Performance commentary

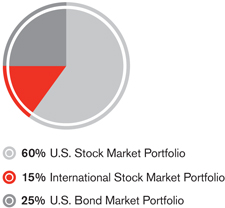

The AARP Aggressive Fund seeks growth of capital and some current income. It targets an asset allocation of 60% U.S. stocks, 15% international stocks and 25% bonds.

For the six months ending June 30, 2006, the AARP Aggressive Fund returned 2.60%, as compared to the Aggressive Composite Index of 3.32% and as compared to the MSCI U.S. Investable Market 2500 Index return of 3.29%. The Fund tracked its benchmark index closely, after a brief startup period. Of course, an index fund very rarely matches the performance of its benchmark index exactly, since a fund has operating expenses and an index does not.

For the six month period, the key contributor to the Fund’s performance was its investment in the U.S. Stock Market Portfolio. Within the U.S. stock market (as measured by the MSCI U.S. Investable Market 2500 Index), the energy, financial and industrials sectors all contributed to performance. In particular, ExxonMobil, the largest stock in the index, added 0.15% to the performance of the benchmark, returning 6.0%, driven by the global demand for oil. Conversely, the information technology (-6%) and healthcare sectors (-4%) were down for the period. Although a lesser weighting, the Fund’s investment in the International Stock Market Portfolio was a net contributor to performance during the period. International stocks, as measured by the MSCI EAFE Index, generated a positive return of 10.16% for the period, with every sector in the index producing a positive return. The major contributors from a sector standpoint were financials, materials and healthcare. Against the indexes, the Fund’s performance was negatively impacted by fund expenses (the indexes do not have expenses) and tracking differences as the Fund began operations.

14 AARP FUNDS 2006 ANNUAL REPORT AARP Aggressive Fund

Understanding Your Expenses

As a shareholder of a Fund, you incur ongoing costs, including investment advisory fees, distribution (12b-1) fees, shareholder services fees, and other expenses of running a fund. In addition, if you sell shares within 60 days of purchase you may have to pay a redemption fee. As discussed earlier, it’s important to understand exactly how much you pay to purchase and own a fund and to compare the costs of owning different funds because these costs reduce your returns.

The example in the table on the next page is intended to help you understand your ongoing costs in dollars of investing in an AARP Fund and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2006 to June 30, 2006.

Actual expenses

The first line for each Fund in the table on the next page, labeled “Actual,” provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the line labeled “Actual” under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

Hypothetical example for comparison purposes

The second line for each fund in the table, labeled “Hypothetical,” helps you compare the costs of an AARP Fund to other funds. It provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not a Fund’s actual return. You should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures help you to compare the ongoing costs of investing in an AARP Fund with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as redemption fees. Therefore, the line labeled “Hypothetical” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transaction costs were included, your costs would have been higher.

In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of the underlying portfolios in which the Fund invests. Because the underlying funds have varied expenses and fee levels and the Fund may own different proportions of the underlying funds at different times, the amount of fees and expenses incurred indirectly by the Fund may vary in the future. However, AARP Financial has agreed contractually to waive fees and reimburse expenses to keep the net total operating expenses of the AARP Funds, including the indirect fees and expenses of the underlying portfolios, at 0.50% of average daily net assets through November 1, 2007.

Understanding Your Expenses AARP FUNDS 2006 ANNUAL REPORT 15

| | | | | | | | | |

| | | Beginning account value

1/1/06 | | Ending account value

6/30/06 | | Expenses paid during period1 |

AARP Conservative Fund | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,002.40 | | $ | 1.19 |

Hypothetical | | $ | 1,000 | | $ | 1,023.60 | | $ | 1.20 |

(assuming a 5% return before expenses) | | | | | | | | | |

AARP Moderate Fund | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,014.40 | | $ | 1.20 |

Hypothetical | | $ | 1,000 | | $ | 1,023.60 | | $ | 1.20 |

(assuming a 5% return before expenses) | | | | | | | | | |

AARP Aggressive Fund | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,026.00 | | $ | 1.21 |

Hypothetical | | $ | 1,000 | | $ | 1,023.60 | | $ | 1.20 |

(assuming a 5% return before expenses) | | | | | | | | | |

| 1 | Expenses reflect the fund’s annualized net expense ratios multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The annualized net expense ratios are as follows: AARP Conservative Fund 0.24%, AARP Moderate Fund 0.24%, AARP Aggressive Fund 0.24%. |

The example above is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2006 to June 30, 2006.

16 AARP FUNDS 2006 ANNUAL REPORT Understanding Your Expenses

How to Read Financial Statements

Mutual funds are companies that pool money from many investors and invest that money in stocks, bonds and other securities and assets. Mutual fund financial statements show investors where a fund’s money came from, where it went, where it is and what it is worth as of the close of the fund’s most recent fiscal period. The portfolio of investments shows where the money is as of the close of the fund’s most recent fiscal period. The combined holdings of each AARP Fund as of June 30, 2006 are shown in the individual Fund Overview sections of this annual report. In addition, this section of the annual report contains four additional financial statements:

1. Statements of assets and liabilities.

These statements are the Funds’ balance sheets as of the close of the period (June 30, 2006). They show the value and the cost of what each Fund owned, how much it owed to others and the resulting difference or “net assets”.

| • | | Assets are the stocks, bonds, cash, and other financial instruments that a fund owns and has purchased with monies investors pay when they purchase shares. |

| • | | Liabilities are the amounts of money that a fund owes. Liabilities include payments due for the purchase of financial investments as well as bills that a fund incurs for services that are needed to run a fund, such as legal services and printing. |

| • | | Net assets = total assets – total liabilities. Net assets represent what is left of assets after liabilities are subtracted. This leftover amount belongs to the investors, or shareholders, of the fund. |

2. Statements of operations

These statements provide a summary of the investment income, such as dividends, that a fund has earned as well as gains and losses from its investment activities for the period ended June 30, 2006. Realized gains or losses reflect the difference between purchase price and selling price for transactions that took place during the period. Unrealized gains and losses reflect the difference between purchase price and the value of positions that are still held as of the end of the period. The statements also include specific details of fund expenses.

3. Statements of changes in net assets

These statements describe the increases or decreases in net assets during the period, which result from operations, any distributions of earnings to investors, and any shareholder transactions.

4. Financial highlights

The financial highlights table is intended to help you understand a fund’s financial performance for a share outstanding for the entire period ended June 30, 2006.

The Notes to Financial Statements provide additional information to help you better understand the financial statements. They include a description of the most important accounting policies used in portraying the company’s financial condition and results, including how a fund records and values it investments, tax information, as well as additional detail on shareholder and investment transactions.

How to Read Financial Statements AARP FUNDS 2006 ANNUAL REPORT 17

Financial Statements

Statements of assets and liabilities

June 30, 2006

| | | | | | | | | | | | |

| | | AARP

Conservative

Fund | | | AARP

Moderate

Fund | | | AARP

Aggressive

Fund | |

Assets: | | | | | | | | | | | | |

Investments in affiliated issuers, at value (identified cost of $6,696,059, 13,338,038 and 6,536,538, respectively) | | $ | 6,590,586 | | | $ | 13,126,854 | | | $ | 6,447,869 | |

Dividends receivable | | | 65,067 | | | | 108,878 | | | | 43,701 | |

Receivable from advisor | | | 75,112 | | | | 103,245 | | | | 92,408 | |

Receivable for investments sold | | | — | | | | 1,497 | | | | — | |

Receivable for fund shares sold | | | 825 | | | | 8,274 | | | | 1,325 | |

| | | | | | | | | | | | |

Total assets | | $ | 6,731,590 | | | $ | 13,348,748 | | | $ | 6,585,303 | |

| | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | |

Payable for investments purchased | | | 65,612 | | | | 117,153 | | | | 45,026 | |

Payable for fund shares redeemed | | | 280 | | | | 1,497 | | | | — | |

Payable for Trustees’ fees | | | 2,483 | | | | 2,483 | | | | 2,483 | |

Payable for portfolio accounting fees (Note 6) | | | 2,865 | | | | 2,899 | | | | 2,975 | |

Payable for administrative services (Note 6) | | | 180 | | | | 356 | | | | 179 | |

Payable for transfer and dividend disbursing agent fees and expenses (Note 6) | | | 9,915 | | | | 18,875 | | | | 11,201 | |

Payable for distribution service fees | | | 2,622 | | | | 5,008 | | | | 2,688 | |

Payable for audit fee | | | 12,333 | | | | 12,333 | | | | 12,333 | |

Payable for legal fees | | | 34,035 | | | | 34,035 | | | | 34,035 | |

Payable for printing fees | | | 17,500 | | | | 17,500 | | | | 17,500 | |

Other accrued expenses and liabilities | | | 3,229 | | | | 3,956 | | | | 3,208 | |

| | | | | | | | | | | | |

Total liabilities | | $ | 151,054 | | | $ | 216,095 | | | $ | 131,628 | |

| | | | | | | | | | | | |

Net assets | | $ | 6,580,536 | | | $ | 13,132,653 | | | $ | 6,453,675 | |

| | | | | | | | | | | | |

Net assets consist of: | | | | | | | | | | | | |

Paid-in capital | | $ | 6,688,926 | | | $ | 13,352,374 | | | $ | 6,549,512 | |

Net unrealized depreciation on investments | | | (105,473 | ) | | | (211,184 | ) | | | (88,669 | ) |

Accumulated net realized loss on investments | | | (2,922 | ) | | | (8,541 | ) | | | (7,172 | ) |

Undistributed net investment income | | | 5 | | | | 4 | | | | 4 | |

| | | | | | | | | | | | |

Net assets | | $ | 6,580,536 | | | $ | 13,132,653 | | | $ | 6,453,675 | |

| | | | | | | | | | | | |

Shares of beneficial interest outstanding | | | 667,367 | | | | 1,308,498 | | | | 634,546 | |

| | | | | | | | | | | | |

Net asset value per share | | $ | 9.86 | | | $ | 10.04 | | | $ | 10.17 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

18 AARP FUNDS 2006 ANNUAL REPORT Financial Statements

Financial Statements (continued)

Statements of operations

Period ended June 30, 20061

| | | | | | | | | | | | |

| | | AARP

Conservative

Fund | | | AARP

Moderate

Fund | | | AARP

Aggressive

Fund | |

Investment income: | | | | | | | | | | | | |

Dividends from affiliated issuers | | $ | 84,547 | | | $ | 138,741 | | | $ | 59,303 | |

| | | |

Expenses: | | | | | | | | | | | | |

Investment adviser fee (Note 6) | | | 148 | | | | 280 | | | | 161 | |

Administrative services (Note 6) | | | 518 | | | | 979 | | | | 562 | |

Registration fees | | | 27,782 | | | | 30,265 | | | | 28,396 | |

Transfer and dividend disbursing agent fees and expenses (Note 6) | | | 30,530 | | | | 56,958 | | | | 47,207 | |

Trustees’ fees | | | 20,233 | | | | 20,233 | | | | 20,233 | |

Auditing fees | | | 16,500 | | | | 16,500 | | | | 16,500 | |

Legal fees | | | 34,035 | | | | 34,035 | | | | 34,035 | |

Portfolio accounting fees (Note 6) | | | 7,872 | | | | 7,899 | | | | 7,975 | |

Distribution service fees | | | 2,958 | | | | 5,594 | | | | 3,210 | |

Printing and postage | | | 17,500 | | | | 17,500 | | | | 17,500 | |

Insurance expense | | | 10,476 | | | | 10,476 | | | | 10,476 | |

Miscellaneous | | | 2,500 | | | | 2,500 | | | | 2,500 | |

| | | | | | | | | | | | |

Total expenses | | $ | 171,052 | | | $ | 203,219 | | | $ | 188,755 | |

| | | | | | | | | | | | |

Waivers and reimbursements (Note 6): | | | | | | | | | | | | |

Reduction of expenses by investment adviser | | | (167,401 | ) | | | (196,371 | ) | | | (184,865 | ) |

| | | | | | | | | | | | |

Net expenses | | | 3,651 | | | | 6,848 | | | | 3,890 | |

| | | | | | | | | | | | |

Net investment income | | | 80,896 | | | | 131,893 | | | | 55,413 | |

| | | | | | | | | | | | |

Realized and unrealized gain (loss) on investments: | | | | | | | | | | | | |

Net realized loss on affiliated investments | | | (3,063 | ) | | | (8,776 | ) | | | (7,511 | ) |

Net realized gain on nonaffiliated investments | | | 141 | | | | 235 | | | | 339 | |

Net change in unrealized depreciation on investments | | | (105,473 | ) | | | (211,184 | ) | | | (88,669 | ) |

| | | | | | | | | | | | |

Net realized and unrealized loss on investments | | | (108,395 | ) | | | (219,725 | ) | | | (95,841 | ) |

| | | | | | | | | | | | |

Change in net assets resulting from operations | | $ | (27,499 | ) | | $ | (87,832 | ) | | $ | (40,428 | ) |

| | | | | | | | | | | | |

| 1 | For the period from December 22, 2005 (inception date) through June 30, 2006. |

See Notes to Financial Statements.

Financial Statements AARP FUNDS 2006 ANNUAL REPORT 19

Statements of changes in net assets

Period ended June 30, 20061

| | | | | | | | | | | | |

| | | AARP

Conservative

Fund | | | AARP

Moderate

Fund | | | AARP

Aggressive

Fund | |

Increase (decrease) in net assets | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | |

Net investment income | | $ | 80,896 | | | $ | 131,893 | | | $ | 55,413 | |

Net realized loss on investments | | | (2,922 | ) | | | (8,541 | ) | | | (7,172 | ) |

Net change in unrealized depreciation of investments | | | (105,473 | ) | | | (211,184 | ) | | | (88,669 | ) |

| | | | | | | | | | | | |

Change in net assets resulting from operations | | | (27,499 | ) | | | (87,832 | ) | | | (40,428 | ) |

| | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | |

From net investment income | | | (80,891 | ) | | | (131,889 | ) | | | (55,409 | ) |

| | | | | | | | | | | | |

Share transactions: | | | | | | | | | | | | |

Proceeds from sale of shares | | | 6,690,868 | | | | 13,442,261 | | | | 6,547,117 | |

Net asset value of shares issued on reinvestment of dividends | | | 72,536 | | | | 124,549 | | | | 51,294 | |

Cost of shares redeemed | | | (107,478 | ) | | | (247,436 | ) | | | (82,899 | ) |

| | | | | | | | | | | | |

Change in net assets resulting from share transactions | | | 6,655,926 | | | | 13,319,374 | | | | 6,515,512 | |

| | | | | | | | | | | | |

Change in net assets | | | 6,547,536 | | | | 13,099,653 | | | | 6,419,675 | |

| | | | | | | | | | | | |

Net assets: | | | | | | | | | | | | |

Beginning of period | | $ | 33,000 | | | $ | 33,000 | | | $ | 34,000 | |

| | | | | | | | | | | | |

End of period | | $ | 6,580,536 | | | $ | 13,132,653 | | | $ | 6,453,675 | |

| | | | | | | | | | | | |

Undistributed net investment income included in net assets at end of period | | $ | 5 | | | $ | 4 | | | $ | 4 | |

| | | | | | | | | | | | |

| 1 | For the period from December 22, 2005 (fund inception date) through June 30, 2006. |

See Notes to Financial Statements.

20 AARP FUNDS 2006 ANNUAL REPORT Financial Statements

Financial Statements (continued)

Financial highlights

Six months ended June 30, 20061 (For a share outstanding throughout the period)

| | | | | | | | | | | | |

| | | AARP

Conservative

Fund | | | AARP Moderate Fund | | | AARP Aggressive Fund | |

Net asset value, beginning of period2 | | $ | 10.00 | | | $ | 10.00 | | | $ | 10.00 | |

| | | |

Income from investment operations: | | | | | | | | | | | | |

Net investment income (loss) | | | 0.16 | | | | 0.10 | | | | 0.09 | |

Net realized and unrealized gain (loss) on investments | | | (0.14 | ) | | | 0.04 | | | | 0.17 | |

| | | | | | | | | | | | |

Total from investment operations | | | 0.02 | | | | 0.14 | | | | 0.26 | |

| | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | |

Distributions from net investment income | | | (0.16 | ) | | | (0.10 | ) | | | (0.09 | ) |

| | | | | | | | | | | | |

Net asset value, end of period | | $ | 9.86 | | | $ | 10.04 | | | $ | 10.17 | |

| | | | | | | | | | | | |

Total return3 | | | 0.24 | % | | | 1.44 | % | | | 2.60 | % |

| | | | | | | | | | | | |

Ratios to average net assets: | | | | | | | | | | | | |

Net expenses4 | | | 0.24 | %5 | | | 0.24 | %5 | | | 0.24 | %5 |

| | | | | | | | | | | | |

Net investment income (loss) | | | 5.31 | %5 | | | 4.58 | %5 | | | 3.36 | %5 |

| | | | | | | | | | | | |

Expense waiver/reimbursement6 | | | (11.00 | )%5 | | | (6.82 | )%5 | | | (11.22 | )%5 |

| | | | | | | | | | | | |

Supplemental data: | | | | | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 6,581 | | | $ | 13,133 | | | $ | 6,454 | |

| | | | | | | | | | | | |

Portfolio Turnover | | | 7 | % | | | 5 | % | | | 7 | % |

| | | | | | | | | | | | |

| 1 | For the period from January 1, 2006 (commencement of operations) to June 30, 2006. |

| 2 | As of the Funds’ inception date, December 22, 2005. |

| 3 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. Total returns for periods less than one year are not annualized. |

| 4 | In addition to the fees and expenses which the funds bear directly, the funds indirectly bear a pro-rata share of the fees and expenses of the underlying portfolios in which the funds invest. The net expense ratio shown does not include these indirect expenses. If included, the net expense ratio for each fund would be 0.50%. |

| 5 | Computed on an annualized basis. |

| 6 | This expense decrease is reflected in both the net expense and the net investment income (loss) ratios shown above. |

See Notes to Financial Statements.

Financial Statements AARP FUNDS 2006 ANNUAL REPORT 21

Notes to Financial Statements

1. Business and Organization

AARP Conservative Fund, AARP Moderate Fund and AARP Aggressive Fund (the “Funds”) are each a series of AARP Funds (the “Trust”). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. The inception date of the Funds was December 22, 2005; the Funds began operations, including recording income and expenses, on January 1, 2006 (“commencement of operations”). The Funds are “funds of funds” because they invest substantially all of their assets in the underlying series (the “Underlying Portfolios”) of AARP Portfolios, a separately registered investment company. Each Fund invests in all three of the AARP Portfolios, but in different amounts. The investment objective of the AARP Conservative Fund is to seek primarily current income with some growth of capital. The investment objective of the AARP Moderate Fund is to seek a balance of growth of capital and current income. The investment objective of the AARP Aggressive Fund is to seek growth of capital and some current income.

2. Significant accounting policies

The financial statements have been prepared in accordance with United States generally accepted accounting principles (“GAAP”). The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of their financial statements.

INVESTMENT VALUATION

Because the Funds invest in the three Underlying Portfolios, they value their investments in the Underlying Portfolios daily at the closing net asset value of each Underlying Portfolio.

Securities of the Underlying Portfolios are valued as of the close of trading on the New York Stock Exchange (generally 4:00 p.m. Eastern time) on the valuation date. An independent pricing service generally provides these prices. Stock holdings are valued at the latest quoted sales price or official closing price taken from the primary market in which the stock trades. If a security does not trade during the day, it is valued at the average of the latest quotes for buying and selling the security, the bid and asked prices. Bond holdings are generally valued as reported by an independent pricing service at what is called an “evaluated average price,” which considers such factors as comparable bond prices, yields, maturities and ratings. Short-term investments with a maturity at issuance of 365 days or less are generally valued at amortized cost, which approximates market value. Foreign securities quoted in foreign currencies are translated into U.S. dollars based upon exchange rates prevailing at the close of trading and as provided by an independent source.

22 AARP FUNDS 2006 ANNUAL REPORT Notes to Financial Statements

Notes to Financial Statements (continued)

Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the Fund’s pricing time but after the close of the securities’ primary markets (e.g. foreign securities), are valued by methods deemed by the board of trustees of AARP Portfolios to represent fair value.

FEDERAL TAXES

The Funds intend to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. The Funds plan to distribute substantially all of their investment company taxable income, including any net realized gain on investments not offset by capital loss carryforwards, if any, to shareholders. For these reasons, no federal income or excise tax provision is required.

SECURITIES TRANSACTIONS, DIVIDEND AND INTEREST INCOME AND EXPENSES

Securities transactions are recorded on a trade date basis, the date the Fund agrees to purchase or sell a security. Interest income, if any, is recorded daily on an accrual basis. Dividend income is recorded on the ex-dividend date. Realized gains and losses from securities transactions are recorded on the basis of identified cost. Expenses are accrued daily. Many expenses are directly attributable to one Fund and therefore are charged accordingly. Expenses that are not directly attributable to one or more Funds are allocated among applicable Funds on an equitable and consistent basis considering such things as the nature and type of expenses and the relative net assets of the Funds.

USE OF MANAGEMENT ESTIMATES

The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported changes in net assets during the reporting period. Actual results could differ from those estimates.

INDEMNIFICATIONS

The Funds’ organizational documents provide current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Funds. In the normal course of business, the Funds may also enter into contracts that provide general indemnifications. The Funds’ maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Funds. The risk of material loss from such claims is considered remote.

Notes to Financial Statements AARP FUNDS 2006 ANNUAL REPORT 23

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS

Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. Capital gain distributions, if any, are generally declared and paid annually. Income distributions, if any, are generally declared and paid quarterly for the AARP Conservative Fund and semi-annually for the AARP Moderate Fund and the AARP Aggressive Fund.

INVESTMENTS IN UNDERLYING PORTFOLIOS

In addition to the fees and expenses which the Funds bear directly, the Funds indirectly bear a pro-rata share of the fees and expenses of the Underlying Portfolios in which the Funds invest.

3. Capital share transactions

The Funds have authorized an unlimited number of $0.001 par value shares. Transactions in shares were as follows:

| | | |

AARP Conservative Fund | | | |

Period ended June 30, 20061 | | | |

Shares sold | | 667,421 | |

Dividends and/or distributions reinvested | | 7,395 | |

Shares Redeemed | | (10,749 | ) |

| | | |

Net increase (decrease) | | 664,067 | |

| | | |

AARP Moderate Fund | | | |

Period ended June 30, 20061 | | | |

Shares sold | | 1,317,120 | |

Dividends and/or distributions reinvested | | 12,619 | |

Shares Redeemed | | (24,541 | ) |

| | | |

Net increase (decrease) | | 1,305,198 | |

| | | |

AARP Aggressive Fund | | | |

Period ended June 30, 20061 | | | |

Shares sold | | 634,167 | |

Dividends and/or distributions reinvested | | 5,155 | |

Shares Redeemed | | (8,176 | ) |

| | | |

Net increase (decrease) | | 631,146 | |

| | | |

| 1 | For the period from December 22, 2005 (Fund inception date) through June 30, 2006. |

4. Purchases and sales of securities

The aggregate cost of purchases and proceeds from sales of securities, other than short-term obligations, for the six months ended June 30, 2006 were as follows:

| | | | | | |

Fund name | | Purchases | | Sales |

AARP Conservative Fund | | $ | 6,956,033 | | $ | 257,052 |

AARP Moderate Fund | | | 13,700,936 | | | 354,357 |

AARP Aggressive Fund | | | 6,813,666 | | | 269,957 |

24 AARP FUNDS 2006 ANNUAL REPORT Notes to Financial Statements

Notes to Financial Statements (continued)

5. Federal income tax information

Net investment income (loss) and net realized gain (loss) may differ for financial statement and tax purposes. The character of dividends and distributions made during the fiscal year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences are attributable to the differing treatments for the deferral of losses on wash sales. Also, due to timing of dividends and distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or net realized gain was recorded by a Fund. Additionally, short-term capital gains are considered ordinary income for income tax purposes.

The tax character of distributions paid during the fiscal year ended June 30, 2006, was as follows:

| | | | | | | | | |

| | | Distributions paid from: |

Fund name | | Ordinary income | | Long-term

capital gains | | Total |

AARP Conservative Fund | | $ | 80,891 | | $ | — | | $ | 80,891 |

AARP Moderate Fund | | | 131,889 | | | — | | | 131,889 |

AARP Aggressive Fund | | | 55,409 | | | — | | | 55,409 |

The table below shows distribution requirements the Funds must satisfy under the income tax regulations. In addition the table shows losses the Funds may be able to offset against income and gains realized in future years as well as unrealized appreciation or depreciation of securities and other investments for federal income tax purposes. Under current tax law, certain capital and net foreign currency losses realized after October 31 within the taxable year may be deferred and treated as occurring on the first day of the following year.

| | | | | | | | | | |

Fund name | | Undistributed net investment income | | Post October

Losses Deferred | | Net unrealized appreciation

(depreciation) based on cost

of securities and other investments for

federal income tax purposes | |

AARP Conservative Fund | | $ | 211 | | $ | — | | $ | (108,601 | ) |

AARP Moderate Fund | | | 98 | | | — | | | (219,819 | ) |

AARP Aggressive Fund | | | 4 | | | 79 | | | (95,762 | ) |

Notes to Financial Statements AARP FUNDS 2006 ANNUAL REPORT 25

The aggregate cost of securities and other investments and the composition of unrealized appreciation and depreciation of securities and other investments for federal income tax purposes as of June 30, 2006 are noted below. The primary difference between appreciation or depreciation of securities and other investments as recorded in compliance with tax rules and those same items recorded in accordance with generally accepted accounting principles, if applicable, is attributable to the tax deferral of losses or the tax realization of financial statement unrealized gain or loss.

| | | | | | | | | | | | | | |

Fund name | | Federal tax

cost of securities | | Gross unrealized

Appreciation | | Gross unrealized

Depreciation | | | Net unrealized

appreciation

(depreciation) | |

AARP Conservative Fund | | $ | 6,699,187 | | $ | 0 | | $ | (108,601 | ) | | $ | (108,601 | ) |

AARP Moderate Fund | | | 13,346,673 | | | 0 | | | (219,819 | ) | | | (219,819 | ) |

AARP Aggressive Fund | | | 6,543,631 | | | 3,702 | | | (99,464 | ) | | | (95,762 | ) |

6. Fees and other transactions with affiliates

ADVISER AND SUB-ADVISER FEES

The Trust has an investment advisory agreement with AARP Financial Incorporated, “AARP Financial,” which delegates to AARP Financial the responsibility to manage the investment activities of the Funds, including the overall investment program of the Funds. AARP Financial is also responsible for overseeing the Funds’ sub-adviser, SSgA Funds Management, Inc. (“SSgA FM”), which rebalances the Funds under the direction of AARP Financial and manages the day-to-day investments of the Underlying Portfolios’ assets. Each Fund pays to AARP Financial an annual fee of 0.01% of its average daily net assets. AARP Financial pays SSgA FM for its sub-advisory services out of these fees. Through at least November 30, 2007, AARP Financial has contractually agreed to waive its fees and/or reimburse expenses to keep the total annual operating expenses of the Funds and the Underlying Portfolios at 0.50% of average daily net assets. The expense reimbursement amount payable by AARP Financial will be dependent on the actual expenses of the Funds and the Portfolios.

26 AARP FUNDS 2006 ANNUAL REPORT Notes to Financial Statements

Notes to Financial Statements (continued)

For the six months ended June 30, 2006, AARP Financial contractually waived/reimbursed the following fees:

| | | | | | |

Fund name | | Adviser

fee waiver | | Reimbursement of other

operating expenses |

AARP Conservative Fund | | $ | 148 | | $ | 167,253 |

AARP Moderate Fund | | | 280 | | | 196,091 |

AARP Aggressive Fund | | | 161 | | | 184,704 |

ADMINISTRATION FEES

As the Funds’ administrator, AARP Financial provides the Funds with general administrative services associated with the day-to-day operations of the Funds and monitors and coordinates the activities of the other service providers to the Funds. For its administrative services, AARP Financial receives an annual fee of .035% of each Fund’s average daily net assets.

SUB-ADMINISTRATION, TRANSFER AGENCY AND CUSTODIAN FEES

State Street Bank and Trust Company (“State Street”) acts as the sub-administrator, transfer agent, custodian and fund accounting agent for the Funds. State Street is a subsidiary of State Street Corporation and an affiliate of SSgA FM. Under the terms of the sub-administration agreement, AARP Financial pays to State Street an annual fee at the rate of 0.0175% of the first $6 billion of the Funds’ average daily net assets and then a decreasing rate for average daily net assets above that level. Under the terms of the transfer agency agreement, each Fund pays to State Street an annual fee at the rate of 0.135% of the first $5 billion of the Funds’ average daily net assets and then a decreasing rate for average daily net assets above that level, plus out-of-pocket expenses. State Street has in turn delegated the provision of transfer agency services to its affili-ate, Boston Financial Data Services, Inc. Under the terms of the custody agreement, each Fund pays to State Street an annual fee of $15,000, plus out-of-pocket expenses.

REDEMPTION FEES

The Funds impose a 2.00% redemption fee to shareholders who redeem shares held for 60 days or less. All redemption fees are recorded by the Funds as additions to paid-in-capital. For the period ended June 30, 2006, the redemption fees for the AARP Conservative Fund, AARP Moderate Fund and AARP Aggressive Fund shares amounted to $1,580, $539 and $31, respectively.

SUBSEQUENT EVENT

The AARP Money Market Fund was introduced on June 30, 2006 and commenced operations on July 1, 2006.

Notes to Financial Statements AARP FUNDS 2006 ANNUAL REPORT 27

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders of AARP Funds:

We have audited the accompanying statements of assets and liabilities of AARP Conservative Fund, AARP Moderate Fund and AARP Aggressive Fund, each a series of the AARP Funds (collectively the “Funds”), including the portfolios of investments, as of June 30, 2006, and the related statements of operations and the statements of changes in net assets for the period from December 22, 2005 (inception date) to June 30, 2006, and the financial highlights for the period from January 1, 2006 (commencement of operations) to June 30, 3006. These financial statements and financial highlights are the responsibility of management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2006 by correspondence with the transfer agent of the underlying portfolios, or by other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of AARP Conservative Fund, AARP Moderate Fund and AARP Aggressive Fund, as of June 30, 2006, the results of their operations, and the changes in their net assets for the period from December 22, 2005 to June 30, 2006, and the financial highlights for the period from January 1, 2006 to June 30, 2006, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

August 23, 2006

28 AARP FUNDS 2006 ANNUAL REPORT Report of Independent Registered Public Accounting Firm

AARP Funds—Supplemental Information (unaudited)

2006 U.S. Tax Distribution Information to Shareholders

Corporate Dividends Received Deduction. For the fiscal year ended June 30, 2006, a percentage of dividends distributed by the Funds listed below qualify for the dividends received deduction for corporate shareholders. These percentages are as follows:

| | | |

Fund | | Qualifying Percentages | |

AARP Conservative Fund | | 7.15 | % |

AARP Moderate Fund | | 16.88 | |

AARP Aggressive Fund | | 33.20 | |

Qualified Dividend Income. The amount of dividends distributed by the Funds during the fiscal year ended June 30, 2006 are considered qualified dividend income, and are eligible for reduced tax rates. These lower rates range from 5% to 15% depending on an individual’s tax bracket. These amounts and corresponding percentage of dividends paid are as follows:

| | | | | | |

Fund | | Percentage of

Dividends Paid | | | Amounts |

AARP Conservative Fund | | 13 | % | | $ | 10,488 |

AARP Moderate Fund | | 31 | % | | | 41,115 |

AARP Aggressive Fund | | 58 | % | | | 32,161 |

Proxy voting policies, procedures and record

Both a description of the policies and procedures that AARP Financial uses to determine how to vote proxies on behalf of the Funds and the Underlying Portfolios relating to portfolios securities and information regarding how AARP Financial voted proxies related to portfolio securities during the most recent fiscal year ended June 30 is available on our web site at www.aarpfunds.com and, without charge, upon request, by calling us at (800) 958-6457. Such information for the AARP Funds is also available on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov.

Shareholder statements and reports

When we send financial reports, prospectuses and other regulatory materials to shareholders, we attempt to reduce the volume of mail you receive by sending one copy of these documents to two or more account holders who share the same address. However, if you wish to receive individual copies of materials, please contact us at (800) 958-6457. Once we have received your instructions, we will begin sending individual copies for each account within 30 days.

Statement regarding availability of quarterly fund schedule

The Funds and Underlying Portfolios file complete schedules of investments with the SEC for the quarters ended September 30 and March 31 of each fiscal year (commencing with the quarter ended March 31, 2006) on Form N-Q which will be available on the SEC’s

AARP Funds–Supplemental Information AARP FUNDS 2006 ANNUAL REPORT 29

website at www.sec.gov. Additionally, the Funds’ and Underlying Portfolios’ Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington DC. For information on the Public Reference Room, call (800) SEC-0330.

Board deliberations regarding the approval of the AARP Funds’ Investment Advisory Agreement and Investment Sub-Advisory Agreement

AARP Funds (“Trust”) has entered into an Investment Advisory Agreement (“Advisory Agreement”) with AARP Financial Incorporated (“AARP Financial”). The Trust and AARP Financial have entered into an Investment Sub-Advisory Agreement (“Sub-Advisory Agreement” and, together with the Advisory Agreement, “Agreements”) with SSgA Funds Management Inc. (“SSgA FM”).

The Board of Trustees of the Trust, including the Trustees of the Trust who are not “interested persons” of the Trust within the meaning of that term as defined in the Investment Company Act of 1940, as amended (“Independent Trustees”), unanimously approved each of the Agreements for an initial term of two years for each of the Funds at an “in person” meeting held on October 14, 2005.

In determining to approve the Agreements, the Trustees reviewed and evaluated all information and factors they believed, in light of legal advice furnished to them by independent legal counsel and through the exercise of their own business judgment, to be relevant and appropriate. Among other information, the Board reviewed: (i) the responses of each of AARP Financial and SSgA FM to requests for information made by counsel to the Independent Trustees and (ii) information regarding the proposed investment advisory and other fees and estimated total expenses of each of the Funds as compared to generally similar funds. The Board’s decision to approve the Agreements was based on a comprehensive consideration of all of the information provided to the Board in connection with the contract approval process and otherwise, and was not based on any single factor. Each member of the Board may have weighed certain factors differently. Some of the more significant considerations of the Board are summarized below.

The nature, extent and quality of the services proposed to be provided by AARP Financial and SSgA FM

In evaluating the nature, extent and quality of AARP Financial’s and SSgA FM’s proposed services, the Trustees considered the types of services to be provided under the Agreements and the capabilities, personnel and other resources of AARP Financial and SSgA FM. They noted that AARP Financial would be responsible for managing the investment activities of the Funds, including providing the overall investment program and asset allocation of the Funds, overseeing SSgA FM, and for assessing whether

30 AARP FUNDS 2006 ANNUAL REPORT AARP Funds – Supplemental Information

AARP Funds—Supplemental Information (unaudited)

(continued)

the Funds, as designed, meet the needs of shareholders and potential investors. They noted that SSgA FM would be responsible for rebalancing the Funds’ portfolios to meet the target allocations set by AARP Financial. In considering the services to be rendered, the Trustees reviewed the organizational structure and the responsibilities of AARP Financial and SSgA FM, as well as the qualifications of key personnel. The Board considered that AARP Financial was newly created and had no prior investment advisory experience. With respect to SSgA FM, the Trustees reviewed, among other things, information regarding SSgA FM’s approach to making investment decisions, organization and management, and the experience of SSgA FM’s personnel who would be providing advisory services to the Funds. The Board noted, in particular, the team created by AARP Financial to provide investment management services to the Funds and the scale and depth of SSgA FM’s capabilities in managing asset allocation strategies.

In addition to investment management and advisory services, the Board considered the quality of the administrative and other non-advisory services proposed to be provided by AARP Financial, SSgA FM or their affiliates, including administration and shareholder support services proposed to be provided by AARP Financial, the proposed license by AARP of its name and use of its member list to ALPS Distributors, Inc. (which, as the proposed distributor of the Trust’s shares, would use the member list in connection with the distribution of the Funds’ shares and the license to sub-license the use of the AARP name to the Trust), and the custody, transfer agency, sub-administration and accounting services proposed to be provided to the Trust by State Street Bank and Trust Company (“State Street”), an affiliate of SSgA FM.

In evaluating the services, the Trustees also considered AARP Financial’s and SSgA FM’s compliance programs and AARP Financial’s anticipated capability to monitor and assess SSgA FM’s performance and compliance program. Based on their review, the Trustees concluded that, overall, the nature, extent and quality of proposed investment management and sub-advisory services to be provided to the Trust and to each of the Funds under the Agreements supported approval of the Agreements.

Investment performance

The Board noted that the Funds have not commenced operations and so had no investment or performance history. The Board also noted that AARP Financial was a newly created investment adviser with no clients and, therefore, no investment performance with respect to other investment advisory clients. Finally, the Board considered representations by AARP Financial and SSgA FM as to SSgA FM’s prior experience with asset allocation investment strategies. The Board concluded that the lack of any prior investment performance directly apposite of the proposed investment strategy did not preclude approval of the Agreements, given the other factors and considerations.

AARP Funds – Supplemental Information AARP FUNDS 2006 ANNUAL REPORT 31

The costs of services to be provided and profits to be realized by AARP Financial and SSgA FM from their relationship with the Funds.