UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21825

AARP FUNDS

(Exact name of registrant as specified in charter)

650 F. Street, N.W.

Washington, DC 20004

(Address of principal executive offices) (Zip code)

| | |

| (Name and Address of Agent for Service) | | Copy to: |

| |

Richard Hisey AARP Financial Incorporated Two Highwood Drive, Suite 202 Tewksbury, MA 01876 | | Gary O. Cohen, Esq. Jorden Burt LLP 1025 Thomas Jefferson Street, NW Suite 400 East Washington, DC 20007-5208 |

Registrant’s telephone number, including area code: (202) 434-3650

Date of fiscal year end: June 30

Date of reporting period: June 30, 2008

| Item 1. | Report to Shareholders |

Letter to Shareholders

Market Commentary

Annual Report

June 30, 2008

AARP Aggressive Fund

AARP Moderate Fund

AARP Conservative Fund

AARP Income Fund

AARP Money Market Fund

A LETTER TO SHAREHOLDERS

| | |

Richard M. Hisey President, AARP Funds | | Dear Fellow Shareholder, Over the past year, an impressive array of macroeconomic difficulties has challenged economies – both developed and emerging – and depressed financial markets. Rising oil and commodity prices, falling home values and a weakening job market have pressured stock prices, while credit and inflation concerns have limited bond market returns. Smart strategies for volatile times While it is never easy to watch an account decline in value, remember that any new funds added during market downturns have |

greater purchasing power – your money simply buys more shares at lower prices. This is the same strategy that savvy shoppers employ when items go on sale prompting them to stock up. However, sales do not go on forever and some shoppers, who wait for even lower prices, may miss out on good bargains. Similarly, if you are unnerved by the current downturn or are sitting on the sidelines, rather than continuing to make regular investments according to an overall plan1, you may forfeit the opportunity to “buy low” – to invest in funds when they may be bargain priced.

One way of judging how cheap or expensive stocks are is to examine their price-to-earnings ratio or P/E ratio. The P/E ratio is a measurement tool that compares a companies’ stock price to its earnings. A lower P/E ratio is generally better. Without getting overly complicated, the price to earnings ratio of the Standard and Poor’s 500 Index was 17.64 as of June 30, 2008. This ratio is below the 5-, 10-, and 20-year historical averages, which range between 20 and 26. Put simply, on a relative basis, stock prices are cheaper than they have been in the recent past.

Can prices get even cheaper? Possibly. The truth is not even knowledgeable, experienced professionals know what will happen next. However, history shows that downturns are natural, normal and – yes, even healthy, because they can help bring exuberant markets back into balance. Investors who understand this often find it easier to stay focused on their goals and to continue to invest regardless of the environment – a rewarding strategy because the long-term direction of both stocks and bonds has been upward, despite recessions and bear markets. To sell a losing investment is to ensure a loss. In addition, you risk missing out on any substantial gains when markets recover and they have often done so in the past, with big moves over a short period of time.

So if you’re tempted to get out of the investment markets during volatile times, consider what you may miss. One of the basic principles of investing is to invest for the long term. Over time, riding out the high and lows of the market has proven to be a more effective financial strategy.

NOT PART OF THE ANNUAL REPORT

The benefits of diversification

While the bond market has delivered gains over the past year, stocks have experienced a bear-market decline of approximately 20%. As a result, investors with diversified portfolios, such as those represented by AARP lifestyle funds, have had a built-in cushion against stock market volatility. These funds have held up better than funds that invest in the stock market only.

Diversification2 is just one of the benefits of investing in AARP Funds. In addition, they offer low fees, the benefits of indexing, automatic rebalancing3 and simple choices. If you have questions about your funds, call a Financial Advisor at AARP Financial. Our advisors are salaried professionals who are focused on your needs – they do not work on commission. They can provide guidance, answer your questions and help you make informed decisions about your investments especially in this challenging environment. You can discuss your financial needs with one of these capable and experienced professionals by calling 1-800-958-6457 any time between 8:00 a.m. and 6:00 p.m. Eastern Time, Monday through Friday.

Thank you for investing in AARP Funds. We will continue to work hard to earn your confidence and to help you keep your long-term financial goals on target.

Sincerely,

Richard M. Hisey

President, AARP Funds

This Shareholder Report must be preceded or accompanied by the AARP Funds prospectus for individuals who are not current AARP Funds shareholders. An investor should consider the investment objectives, risks, charges and expenses of AARP Funds carefully before investing. To get an additional prospectus containing this and other information, please call 1-800-958-6457. Read the prospectus carefully before you invest.

While AARP has licensed the use of its name to AARP Funds and endorses the services provided by AARP Financial Inc., AARP does not offer financial products or services itself, and it cannot recommend that you or any specific individual should purchase any particular product or service. AARP Financial Inc. is a registered investment adviser and a subsidiary of AARP.

Financial Advisors are registered as representatives of ALPS Distributors, Inc., a registered broker-dealer, and as investment adviser representatives of AARP Financial Inc, a registered investment adviser. AARP Financial Inc. offers investment advisory services and is not affiliated with ALPS Distributors, Inc

AARP Funds are advised by AARP Financial Inc. and distributed by ALPS Distributors, Inc.

1 | An Automatic Investment Plan does not assure a profit and does not protect against a loss in a declining market. |

2 | Diversification can help you reduce overall risk although it does not eliminate the risk of investment loss. |

3 | The sale of an investment for the purpose of rebalancing may be subject to taxes. |

NOT PART OF THE ANNUAL REPORT

Market Commentary June 30, 2008

Equity markets extended their losses in the second quarter of 2008, as fresh worries about the banking sector – precipitated by problems at government-sponsored residential mortgage enterprises, Freddie Mac and Fannie Mae – as well as rising food and energy prices, weighed heavily on investor sentiment. Despite a rebound in the months of April and May, hopes for a recovery were dashed as June proved to be a challenging month for global equity markets. It was the third consecutive quarter of negative performance for the S&P 500 Index, which has lost 11.96% for the year through June 30. The Morgan Stanley Capital International (“MSCI”) U.S. Investable Market 2500 Index recorded a 1.52% loss for the quarter, bringing its six month return to -10.82%.

Other than energy and materials, all major sectors lost value during the first half of the year, with the financial sector down almost 30%. International equities, as measured by the MSCI EAFE (Europe, Australasia, and Far East) Index, recorded a 2.25% loss for the quarter, bringing the six month total to -10.96%. With the exception of Canada – which is enjoying the fruits of the recent energy boom – all major developed market indices lost value in first half of 2008, as the run up in energy prices exacts a heavy toll in virtually all economies. However, despite the problems at Fannie and Freddie and the substantial write-offs undertaken in the banking and finance sectors in general, bonds, as measured by the Lehman Brothers Aggregate Bond Index, have fared well. While the index is only marginally positive – up 1.13% year-to-date – bonds generally provided welcome relief to investors who have experienced double-digit losses in equities during this time.

While many indices have fallen into what is considered bear market territory, not all the news on the economy is bad. First, corporate balance sheets remain strong, with large cash positions and low inventory levels. Second, the overall trade balance has recovered in response to a weaker dollar. In fact, U.S. exports, aided by sustained weakness in the U.S. dollar, have helped many American multinationals withstand a slowing U.S. economy better than smaller companies with primarily domestic markets. In the second quarter, Coca Cola noted that, while domestic beverage sales have softened, international revenue received a boost from the weak dollar. And, surprisingly, a weak dollar, coupled with high

NOT PART OF THE ANNUAL REPORT

energy prices, have been a boon for a few U.S. firms. Honeywell, which derives a signification portion of its revenue overseas, has said that higher energy prices have actually helped with sales of temperature control equipment as customers seek energy savings. Although non-farm payrolls have fallen during 2008, the decline is substantially below that of 2001-2002. Finally, while some economists predicted that the U.S. economy would shrink in the first quarter, the final GDP results showed the economy growing by a percentage point.

While debates continue as to whether or not the U.S. economy is in, or will head into, recession; whether the recent run-up in oil and other commodity prices is a boom or a bubble; and whether or not there will be additional fallout from the credit crunch, there is no question that world economy faces an uphill battle. The recent convergence of events serves as a reminder of why it is important to focus on long term performance. Maintaining a well-diversified mix of investments with a long term viewpoint is one of the best ways to ride out unnerving and, sometimes extreme, short-term market trends.

The views, forecasts and supporting information contained in this Market Commentary are as of June 30, 2008 and are subject to change.

Sources: SSgA Funds Management, Inc., MSCI Barra, Lehman Brothers, Inc., IMF

NOT PART OF THE ANNUAL REPORT

AARP FUNDS

…

Annual Report

June 30, 2008

…

KEEPING YOU INFORMED

This shareholder report for the AARP Funds represents our commitment to providing communications that are clear, concise and informative. One of our highest priorities at AARP Funds is to help you make sense of investment information that is often complex. We hope you find it helpful in evaluating your investment with us.

EXPERTISE AND GUIDANCE WHEN YOU NEED IT

AARP Financial’s Financial Advisors are ready to help you determine if you are on track financially for retirement and to answer specific questions about AARP Funds. They work on salary, not commission, and are there to help you focus on your goals, take decisive action and feel comfortable with your decisions. Financial Advisors are FINRA registered representatives through ALPS Distributors, Inc., and are employed by AARP Financial.

| | | | |

| | AARP FUNDS 2008 ANNUAL REPORT | | 1 |

Table of Contents

This Shareholder Report must be preceded or accompanied by the AARP Funds prospectus for individuals who are not current AARP Funds shareholders. An investor should consider the investment objectives, risks, charges and expenses of AARP Funds carefully before investing. To get an additional prospectus containing this and other information, please call 1-800-958-6457. Read the prospectus carefully before you invest.

While AARP has licensed the use of its name to AARP Funds and endorses the services provided by AARP Financial Inc., AARP cannot recommend that you or any specific individual should purchase shares of a particular fund. AARP is not a registered investment adviser or broker/dealer.

AARP Funds are distributed by ALPS Distributors, Inc.

AARP Financial Inc. is not affiliated with ALPS Distributors, Inc.

| | | | |

| 2 | | AARP FUNDS 2008 ANNUAL REPORT | | AARP Funds Overview |

AARP Funds Overview

The AARP Funds (excluding the AARP Money Market Fund) are “funds of funds” because they invest substantially all of their assets in the underlying AARP Portfolios (the “AARP Portfolios”), each of which is a separately registered investment company.

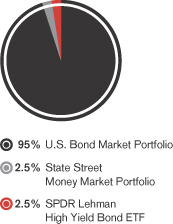

The AARP Funds (excluding the AARP Money Market Fund) invest in one or more of the AARP Portfolios, but in different amounts. In addition to its investment in the U.S. Bond Market Portfolio, the AARP Income Fund also invests a portion of its assets in the SPDR Lehman High Yield Bond ETF and the State Street Money Market Portfolio (the “State Street Portfolio”), a series of a separately registered investment company called the State Street Master Funds.

The AARP Money Market Fund is a feeder fund, buying shares of the master fund, the State Street Portfolio. This is called a “master-feeder” structure because it allows different feeder funds to pool their assets in an underlying master fund to seek economies of scale.

| | | | | | | | | | |

| | | | | | |

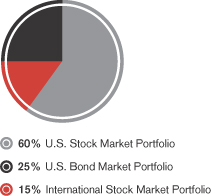

| | | AARP

Aggressive Fund | | AARP

Moderate Fund | | AARP

Conservative Fund | | AARP

Income Fund | | AARP Money

Market Fund |

| Investment Objective | | Seeks growth of capital and some current income | | Seeks a balance of growth of capital and current income | | Seeks primarily current income, with some growth of capital | | Seeks current income and long- term preservation of capital | | Seeks current income, liquidity, preservation of capital, and a stable $1.00 per

share price |

U.S. Stock

Market Portfolio | | 60% | | 40% | | 20% | | – | | – |

U.S. Bond

Market Portfolio | | 25% | | 50% | | 75% | | 95% | | – |

International Stock

Market Portfolio | | 15% | | 10% | | 5% | | – | | – |

State Street

Portfolio | | – | | – | | – | | 2.5% | | 100% |

| SPDR Lehman High Yield Bond ETF | | – | | – | | – | | 2.5% | | – |

Source: AARP Funds

AARP Portfolios Top 10 Holdings as a percentage of net assets at June 30, 2008

| | | | | | | | | | | | | | | | | | |

| U.S. Stock Market Portfolio | | | | | | U.S. Bond Market Portfolio | | | | | | International Stock Market Portfolio |

| | | | | | | | | |

Exxon Mobil Corp. | | 3.3% | | | | | | FHLMC, 5.500%, 3/1/36 | | 1.8% | | | | | | BP PLC | | 1.7% |

General Electric Co. | | 1.9% | | | | | | U.S. Treasury Notes,

4.625%, 2/15/17 | | 1.5% | | | | | | Total SA | | 1.4% |

Microsoft Corp. | | 1.6% | | | | | | U.S. Treasury Notes,

3.125%, 5/15/18 | | 1.4% | | | | | | HSBC Holdings PLC | | 1.4% |

Chevron Corp. | | 1.4% | | | | | | U.S. Treasury Notes,

2.625%, 5/31/10 | | 1.3% | | | | | | Nestle SA | | 1.4% |

AT&T, Inc. | | 1.4% | | | | | | U.S. Treasury Notes,

4.250%, 11/1/15 | | 1.1% | | | | | | Vodafone Group PLC | | 1.2% |

Procter & Gamble Co. | | 1.3% | | | | | | FHLMC, 5.000%, 3/1/36 | | 1.0% | | | | | | Royal Dutch Shell PLC | | 1.1% |

Johnson & Johnson | | 1.3% | | | | | | FNMA, 5.500%, 4/1/35 | | 1.0% | | | | | | BHP Billiton Ltd. | | 1.1% |

International Business Machines Corp. | | 1.1% | | | | | | FNMA, 7.000%, 8/1/37 | | 0.9% | | | | | | Toyota Motor Corp. | | 1.0% |

Apple Computer, Inc. | | 1.0% | | | | | | FNMA, 4.750%, 12/15/10 | | 0.9% | | | | | | Novartis AG | | 1.0% |

ConocoPhillips | | 1.0% | | | | | | U.S. Treasury Notes,

4.000%, 4/15/10 | | 0.9% | | | | | | E.ON AG | | 1.0% |

Total | | 15.3% | | | | | | Total | | 11.8% | | | | | | Total | | 12.3% |

| | | | |

| How the Funds Performed | | AARP FUNDS 2008 ANNUAL REPORT | | 3 |

How the Funds Performed as of June 30, 2008

| | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | 1 year | | | | Average annual since

inception | | | |

| | | | | AARP Aggressive Fund | | | | -7.49% | | | | 4.43% | 1 | | |

| | | | | Aggressive Composite Index | | | | -7.28% | | | | 4.94% | 1 | | |

| | | | | MSCI U.S. Investable Market 2500 Index®2 | | | | -12.30% | | | | 3.58% | 1 | | |

| | | | | AARP Moderate Fund | | | | -2.79% | | | | 4.53% | 1 | | |

| | | | | Moderate Composite Index | | | | -2.56% | | | | 5.04% | 1 | | |

| | | | | MSCI U.S. Investable Market 2500 Index®2 | | | | -12.30% | | | | 3.58% | 1 | | |

| | | | | Lehman Brothers Aggregate Bond Index®2 | | | | 7.12% | | | | 4.96% | 1 | | |

| | | | | AARP Conservative Fund | | | | 2.04% | | | | 4.60% | 1 | | |

| | | | | Conservative Composite Index | | | | 2.24% | | | | 5.04% | 1 | | |

| | | | | Lehman Brothers Aggregate Bond Index®2 | | | | 7.12% | | | | 4.96% | 1 | | |

| | | | | AARP Income Fund | | | | 6.83% | | | | 4.89% | 3 | | |

| | | | | Income Composite Index | | | | 6.93% | | | | 5.25% | 3 | | |

| | | | | Lehman Brothers Aggregate Bond Index®2 | | | | 7.12% | | | | 5.30% | 3 | | |

| | | | | Citigroup 3-Month Treasury Bill Index | | | | 3.33% | | | | 4.07% | 3 | | |

| | | | | AARP Money Market Fund | | | | 4.09% | | | | 4.59% | 4 | | |

| | | | | Citigroup 3-Month Treasury Bill Index | | | | 3.33% | | | | 4.19% | 4 | | |

| | | | | AARP Money Market Fund 7-Day Annualized Yield | | | | 2.30% | | | | | | | |

| | |

| | | 1 For the period from January 1, 2006 (commencement of operations) to June 30, 2008. 2 The MSCI U.S. Investable Market 2500 Index and the Lehman Brothers Aggregate Bond Index serve as broad measures of the U.S equity and taxable bond markets, respectively. Since the Funds invest in differing combinations of these and other markets, Composite Indexes have been constucted utilizing the proportionate weightings of the indexes for each market. These Composite Indexes provide a particularly useful benchmark to measure the performance of the Funds. For more detailed information regarding the Composite Indexes, please see A Word about Benchmarks that follows. 3 For the period from September 29, 2006 (commencement of operations) to June 30, 2008. 4 For the period from July 1, 2006 (commencement of operations) to June 30, 2008. Sources: MSCI Barra, Lehman Brothers Inc., Citigroup, AARP Financial Inc. Total returns for periods less than one year are not annualized. |

Total annual fund operating fees and expense are 1.33% for the Aggressive Fund, 0.92% for the Moderate Fund, 1.59% for the Conservative Fund, 4.64% for the Income Fund and 0.83% for the Money Market Fund. Net annual fund operating fees and expenses for the funds (after contractual waivers and/or reimbursements) are 0.30% for the Money Market Fund and 0.50% for the others through November 1, 2008 and November 1, 2009, respectively.

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. The performance of the Funds assumes the reinvestment of all dividends and distributions. The indexes above have been adjusted to reflect reinvestment of dividends on securities in the indexes. The adviser is waiving a portion of its advisory fee and other operating expenses. Had the fees not been waived or reimbursed, returns would have been lower. It is not possible to invest directly in an Index.

For the most recent month-end performance and after-tax returns, visit www.aarpfunds.com or call 1-800-958-6457.

An investment in the AARP Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

| | | | |

| 4 | | AARP FUNDS 2008 ANNUAL REPORT | | A Word about Benchmarks |

A Word about Benchmarks

A useful tool to measure the performance of AARP Funds.

When evaluating how your investment performed, it’s helpful to compare it to an appropriate benchmark. You can think of the benchmark as a handy yardstick for measuring how well the fund did in meeting its investment objectives. For example, the AARP Income Fund tries to produce comparable returns of the Lehman Brothers Aggregate Bond Index.

The AARP Aggressive Fund, AARP Moderate Fund and AARP Conservative Fund are indexed and try to produce the returns of a mixture of three indexes. For these Funds, a particularly useful benchmark is one that combines the three indexes in similar amounts to the target investments of the Funds. When you combine different indexes into one benchmark, it’s called a “composite index”.

We also believe it is useful for you to consider the returns of the overall bond and stock markets when you assess the performance of the AARP Funds. This allows you to see how diversification works in practice. Sometimes the bond and stock markets move in opposite directions, or when the stock market goes down, the bond market doesn’t go quite as far down.

There is one caveat though. Please remember that a benchmark of indexes has a built-in performance advantage over an actual mutual fund. An index is merely a list of securities in a stock or bond market so the returns of indexes do not reflect the real world costs of managing a mutual fund. It is difficult to match the returns of an index because of this difference.

Indexes vs. index funds

Indexes, as opposed to index funds, are a group or list of securities representing a market or part of a market. The returns of the index do not reflect the costs of actually investing in the index and do not include fees, brokerage commissions or other expenses of investing. While you can invest in an index fund – it’s a real investment, you cannot invest directly in an index – it’s just a list.

| | | | |

| A Word about Benchmarks | | AARP FUNDS 2008 ANNUAL REPORT | | 5 |

Following is a table that shows the make up of the index weightings for each AARP Fund:

| | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | AARP

Aggressive Fund | | AARP

Moderate Fund | | AARP

Conservative

Fund | | AARP

Income Fund | | AARP Money

Market Fund | | |

| | | | | Aggressive

Composite

Index | | Moderate

Composite

Index | | Conservative

Composite

Index | | Income

Composite

Index | | | | |

| | | MSCI U.S. Investable

Market 2500 Index® | | 60% | | 40% | | 20% | | – | | – | | |

| | | Lehman Brothers

Aggregate Bond Index® | | 25% | | 50% | | 75% | | 95% | | – | | |

| | | MSCI EAFE Index® | | 15% | | 10% | | 5% | | – | | – | | |

| | | Citigroup 3-Month

Treasury Bill Index | | – | | – | | – | | 5% | | 100% | | |

Source: AARP Funds

A description of each index

• | | MSCI U.S. Investable Market 2500 Index®* – The index includes about 2,500 securities listed on the New York and American Stock Exchanges and the Nasdaq over-the-counter market. The stocks include companies of all types and sizes, which represent the investable universe of companies in the U.S. Equity market. |

• | | Lehman Brothers Aggregate Bond Index® – The index includes a large variety of U.S. and foreign bonds traded in U.S. markets that are investment grade and taxable, covering three major types of bonds: government and corporate bonds, mortgage-backed securities and asset-backed securities. |

• | | MSCI EAFE Index®* – The index includes about 1,000 securities that are listed on the stock exchanges of 21 developed countries, excluding the United States and Canada. |

| • | | Citigroup 3-Month Treasury Bill Index – The index is comprised of equal dollar amounts of 3-Month Treasury Bills purchased at the beginning of each of the prior three consecutive months. As each bill matures, all proceeds are reinvested in a new 3-month bill. |

| * | Please note that although the AARP Funds seek to track these MSCI indexes, MSCI does not sponsor, endorse, or promote the AARP Funds. For a more detailed description of our relationship with MSCI please see the statement of additional information for the AARP Funds. |

| | | | |

| 6 | | AARP FUNDS 2008 ANNUAL REPORT | | AARP Aggressive Fund Overview |

AARP Aggressive Fund Overview

| | | | | | |

| | | |

Portfolio of investments June 30, 2008 | | | | | | |

Mutual funds: 100.4% | | | | | | |

| | | Shares | | Value | |

| | | | | | | |

| U.S. Stock Market Portfolio1 – 60.2% | | 1,485,869 | | $ | 15,081,568 | |

| | |

| U.S. Bond Market Portfolio1 – 25.1% | | 629,658 | | | 6,283,987 | |

| | |

| International Stock Market Portfolio1 – 15.1% | | 340,288 | | | 3,770,392 | |

| | |

| Total investments: 100.4% (Identified cost $26,623,002) | | | | | 25,135,947 | |

| | | | | | | |

| Other assets and liabilities, net: (0.4)% | | | | | (91,453 | ) |

| | | | | | | |

| Total net assets: 100.0% | | | | $ | 25,044,494 | |

1 Affiliated issuer. See Notes to Financial Statements. | | | | | | |

| | |

| |

Performance as of June 30, 2008 |

| | |

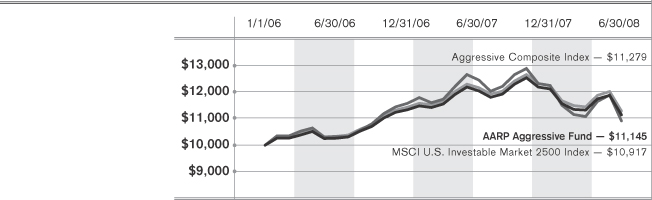

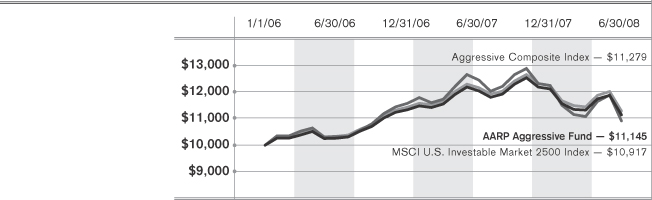

Growth of $10,000 This graph illustrates the

hypothetical investment of

$10,000 in the AARP

Aggressive Fund from

January 1, 2006

(commencement of

operations) through June 30,

2008, compared to the

Aggressive Composite Index

and the MSCI U.S. Investable

Market 2500 Index.2 | |  |

| | |

| | | This hypothetical example does not represent the returns of any particular investment. |

| | | | | | | | |

| | | | | |

| Performance summary | | Average Annual Returns as of June 30, 2008 | | 1-Year | | Since

inception | | |

| | | AARP Aggressive Fund | | (7.49)% | | 4.43%1 | | |

| | | Aggressive Composite Index2 | | (7.28)% | | 4.94%1 | | |

| | | MSCI U.S. Investable Market 2500 Index®2 | | (12.30)% | | 3.58%1 | | |

| | | | | |

| | |

| |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will

fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes

over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a

shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank

and are not federally insured. The performance of the Funds assumes the reinvestment of all dividends and distributions. The indexes above

have been adjusted to reflect reinvestment of dividends on securities in the indexes. The adviser is waiving a portion of its advisory fee and

other operating expenses. Had the fees not been waived or reimbursed, returns would have been lower. It is not possible to invest directly in

an Index. For the most recent month-end performance and after-tax returns, visit www.aarpfunds.com or call 1-800-958-6457. 1 For the period from January 1, 2006 (commencement of operations) to June 30, 2008.

2 The MSCI U.S. Investable Market 2500 Index serves as a broad measure of the U.S. equity market. Since the Fund invests in differing

combinations of this and other markets, the Aggressive Composite Index has been constructed utilizing the proportionate weightings of the

indexes for each market. This Composite Index provides a particularly useful benchmark to measure the performance of the Fund. For more

detailed information regarding the Composite Indexes and the Underlying Indexes, please see “A Word about Benchmarks” on page 4. |

| | | | |

| AARP Aggressive Fund Overview | | AARP FUNDS 2008 ANNUAL REPORT | | 7 |

Portfolio construction

AARP Aggressive Fund

Performance commentary

The AARP Aggressive Fund seeks growth of capital and some current income. To achieve this objective, the Fund targets an asset allocation of 60% in U.S. equity, 15% in international equity, and 25% in bonds. For the year ended June 30, 2008, the AARP Aggressive Fund returned -7.49%, as compared to the Aggressive Composite Index return of -7.28% and the MSCI U.S. Investable Market 2500 Index return of -12.30%. The Fund’s performance includes the operating expenses, whereas index returns are unmanaged and do not include expenses of any kind. The Fund tracked its benchmark closely during the period and continues to benefit from its diversification to its underlying asset classes.

During the twelve month period ended June 30, 2008, stock returns have been negative; however, bond returns have been positive. In fact, strong bond returns enhanced the Fund’s performance during the period as the U.S. Bond Market Portfolio returned 7.20%. In contrast, weak equity performance, both in the U.S. and internationally, detracted from performance as the U.S. Stock Market Portfolio returned -12.35% and the International Stock Market Portfolio returned -10.62%, for the year ending June 30, 2008.

The twelve month period ended June 30, 2008 proved to be a volatile period for global financial markets and investors. The period did not start that way, as July 2007 recorded all-time highs in many major indices including the S&P 500 Index. However, a perfect storm of macroeconomic challenges, led off by problems in the U.S. sub-prime mortgage sector, erased those gains and subsequently produced double digit market losses in the months to come. Problems in the sub-prime mortgage market quickly spread to other credit sectors including the high yield corporate bond sector and resulted in massive asset write downs at several large financial institutions. In 2007, several mortgage-related hedge funds had collapsed; by February of 2008, a prominent investment bank had collapsed. During this time, the Federal Reserve Bank (“the Fed”) reduced key rates a number of times and took additional steps to mitigate the credit crunch and jump start economic growth. In addition, the U.S. Government launched a $160 billion fiscal stimulus package in the first half of 2008. While the package could very well have helped the U.S. economy avoid negative Gross Domestic Product growth in the 2nd Quarter of 2008, its long-term impact for the economy is questionable since the package consists of one-time tax rebates.

We believe that high market volatility is likely to persist and the risks to global growth are skewed to the downside, reflecting uncertainty about the effects of financial market turbulence, increasing inflation, and the resilience of the U.S. labor market. On the positive side, a persistently weak U.S. dollar has increased the competitiveness of U.S. produced goods sold overseas and has cushioned a slowdown in domestic consumer spending. At the same time, fear of a recession in the U.S. will continue to be a challenge for investors in the second half of 2008.

Sources: SSgA FM, Bloomberg, Factset

| | | | |

| 8 | | AARP FUNDS 2008 ANNUAL REPORT | | AARP Moderate Fund Overview |

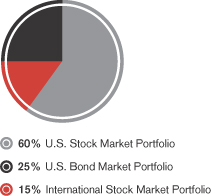

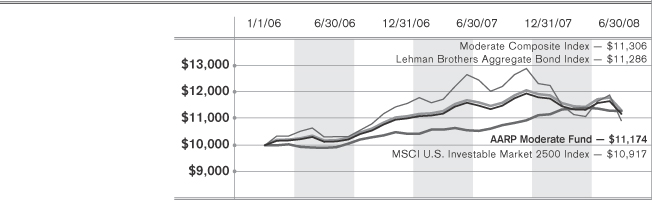

AARP Moderate Fund Overview

| | | | | | |

| | | |

Portfolio of investments June 30, 2008 | | | | | | |

Mutual funds: 100.2% | | | | | | |

| | | Shares | | Value | |

| | | | | | | |

| U.S. Bond Market Portfolio1 – 50.1% | | 2,125,572 | | $ | 21,213,208 | |

| | |

| U.S. Stock Market Portfolio1 – 40.1% | | 1,671,977 | | | 16,970,566 | |

| | |

| International Stock Market Portfolio1 – 10.0% | | 382,910 | | | 4,242,641 | |

| | |

| Total investments: 100.2% (Identified cost $43,955,106) | | | | | 42,426,415 | |

| | | | | | | |

| Other assets and liabilities, net: (0.2)% | | | | | (102,859 | ) |

| | | | | | | |

| Total net assets: 100.0% | | | | $ | 42,323,556 | |

1 Affiliated issuer. See Notes to Financial Statements. | | | | | | |

| | |

| |

Performance as of June 30, 2008 |

| | |

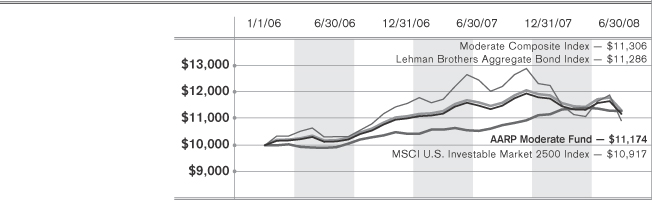

Growth of $10,000 This graph illustrates the

hypothetical investment of

$10,000 in the AARP

Moderate Fund from

January 1, 2006

(commencement of

operations) through June 30,

2008, compared to the

Moderate Composite Index,

the MSCI U.S. Investable

Market 2500 Index, and the

Lehman Brothers Aggregate

Bond Index.2 | |  |

| | |

| | | This hypothetical example does not represent the returns of any particular investment. |

| | | | | | | | | | |

| | | | | | | |

| Performance summary | | Average Annual Returns as of June 30, 2008 | | 1-Year | | Since

inception | | | | |

| | | AARP Moderate Fund | | (2.79)% | | 4.53%1 | | | | |

| | | Moderate Composite Index2 | | (2.56)% | | 5.04%1 | | | | |

| | | MSCI U.S. Investable Market 2500 Index®2 | | (12.30)% | | 3.58%1 | | | | |

| | | Lehman Brothers Aggregate Bond Index®2 | | 7.12% | | 4.96%1 | | | | |

| | | | | | | |

| | | | |

| |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will

fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes

over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a

shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank

and are not federally insured. The performance of the Funds assumes the reinvestment of all dividends and distributions. The indexes above

have been adjusted to reflect reinvestment of dividends on securities in the indexes. The adviser is waiving a portion of its advisory fee and other

operating expenses. Had the fees not been waived or reimbursed, returns would have been lower. It is not possible to invest directly in an Index. For the most recent month-end performance and after-tax returns, visit www.aarpfunds.com or call 1-800-958-6457. 1 For the period from January 1, 2006 (commencement of operations) to June 30, 2008.

2 The MSCI U.S. Investable Market 2500 Index and the Lehman Brothers Aggregate Bond Index serve as broad measures of the U.S.

equity and taxable bond market. Since the Fund invests in differing combinations of this and other markets, the Moderate Composite Index

has been constructed utilizing the proportionate weightings of the indexes for each market. This Composite Index provides a particularly

useful benchmark to measure the performance of the Fund. For more detailed information regarding the Composite Indexes and the

Underlying Indexes, please see “A Word about Benchmarks” on page 4. |

| | | | |

| AARP Moderate Fund Overview | | AARP FUNDS 2008 ANNUAL REPORT | | 9 |

Portfolio construction

Tracking difference

The difference between the performance of the Fund and its comparative index.

AARP Moderate Fund

Performance commentary

The AARP Moderate Fund seeks a balance of growth of capital and current income. To achieve this objective, the Fund targets an asset allocation of 50% in bonds, 40% in U.S. equity and 10% in international equity. For the year ended June 30, 2008, the AARP Moderate Fund returned -2.79%, as compared to the Moderate Composite Index return of -2.56%, 7.12% for the Lehman Brothers Aggregate Bond Index and -12.30% for the MSCI U.S. Investable Market 2500 Index. The Fund’s performance includes the operating expenses, whereas index returns are unmanaged and do not include expenses of any kind. The Fund tracked its benchmark closely during the period and continues to benefit from its diversification to its underlying asset classes.

During the twelve month period ended June 30, 2008, stock and bond performance was mixed. The Fund’s performance during the period was helped by its investment in the U.S. Bond Market Portfolio, which returned 7.20%. However, global equity investments declined in value and hurt performance as the U.S. Stock Market Portfolio returned -12.35% and the International Stock Market Portfolio returned -10.62%, for the year ending June 30, 2008.

The twelve month period ended June 30, 2008 was marked by increased volatility in global financial markets, precipitated in part by problems in the U.S. sub-prime credit market. Despite achieving a record closing high on July 19, 2007, the S&P 500 Index, and equity markets in general, experienced a sharp reversal in August as credit problems worsened and forced many institutions to sell equities to cover losses in certain bond sectors. The Federal Reserve Bank (“the Fed”) took swift and creative action to provide liquidity to the market. Not only did the Fed reduce key rates several times, but it also encouraged investment banks to borrow from it at its discount window.

A combination of rising oil and commodity prices, falling home prices and a weakening labor market resulted in a sharp decline in global equity prices in early 2008. Equity market investors grew increasingly concerned—with good reason—that the consumer and consumer related spending would be hurt by these factors. Consumer spending drives almost two-thirds of U.S. Gross Domestic Product. Once again, taking note of the situation and the potential negative implications, the Fed continued to ease monetary policy. As an additional measure, the U.S. Government launched a substantial fiscal stimulus package in the form of one-time tax rebates.

We believe that increased volatility in the markets is likely to persist and the risks to global economic growth remain high, reflecting uncertainty about the effects of financial market turmoil, increasing inflation and the resilience of the U.S. labor market. Accordingly, investors’ fear of a recession in the U.S. will continue to be a headwind in the second half of 2008.

Sources: SSgA FM, Bloomberg, Factset

| | | | |

| 10 | | AARP FUNDS 2008 ANNUAL REPORT | | AARP Conservative Fund Overview |

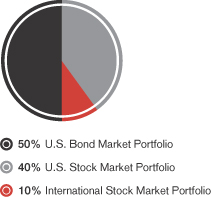

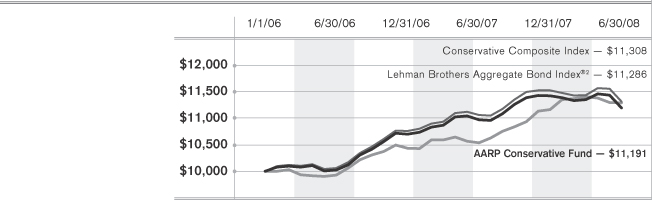

AARP Conservative Fund Overview

| | | | | | |

| | | |

Portfolio of investments June 30, 2008 | | | | | | |

Mutual funds: 100.4% | | | | | | |

| | | Shares | | Value | |

| | | | | | | |

| U.S. Bond Market Portfolio1 – 75.3% | | 1,363,005 | | $ | 13,602,788 | |

| | |

| U.S. Stock Market Portfolio1 – 20.1% | | 357,380 | | | 3,627,410 | |

| | |

| International Stock Market Portfolio1 – 5.0% | | 81,846 | | | 906,852 | |

| | |

| Total investments: 100.4% (Identified cost $18,414,765) | | | | | 18,137,050 | |

| | | | | | | |

| Other assets and liabilities, net: (0.4)% | | | | | (72,291 | ) |

| | | | | | | |

| Total net assets: 100.0% | | | | $ | 18,064,759 | |

1 Affiliated issuer. See Notes to Financial Statements. | | | | | | |

| | |

| |

Performance as of June 30, 2008 |

| | |

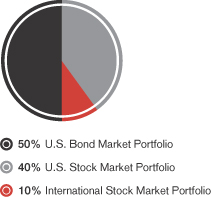

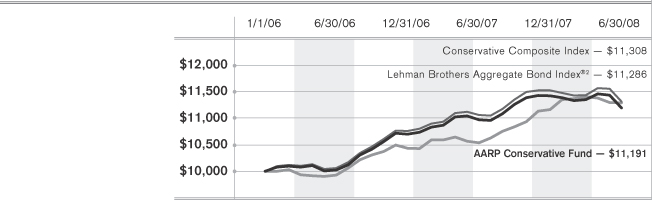

Growth of $10,000 This graph illustrates the

hypothetical investment of

$10,000 in the AARP

Conservative Fund from

January 1, 2006

(commencement of

operations) through June 30,

2008, compared to the

Conservative Composite

Index and the Lehman

Brothers Aggregate Bond

Index.2 | |  |

| | |

| | | This hypothetical example does not represent the returns of any particular investment. |

| | | | | | | | |

| | | | | |

| Performance summary | | Average Annual Returns as of June 30, 2008 | | 1-Year | | Since

inception | | |

| | | AARP Conservative Fund | | 2.04% | | 4.60%1 | | |

| | | Conservative Composite Index2 | | 2.24% | | 5.04%1 | | |

| | | Lehman Brothers Aggregate Bond Index®2 | | 7.12% | | 4.96%1 | | |

| | | | | |

| | |

| |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will

fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes

over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a

shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank and

are not federally insured. The performance of the Funds assumes the reinvestment of all dividends and distributions. The indexes above have

been adjusted to reflect reinvestment of dividends on securities in the indexes. The adviser is waiving a portion of its advisory fee and other

operating expenses. Had the fees not been waived or reimbursed, returns would have been lower. It is not possible to invest directly in an Index. For the most recent month-end performance and after-tax returns, visit www.aarpfunds.com or call 1-800-958-6457. 1 For the period from January 1, 2006 (commencement of operations) to June 30, 2008.

2 The Lehman Brothers Aggregate Bond Index serves as a broad measure of the U.S. taxable bond market. Since the Fund invests in

differing combinations of this and other markets, the Conservative Composite Index has been constructed utilizing the proportionate

weightings of the indexes for each market. This Composite Index provides a particularly useful benchmark to measure the performance of

the Fund. For more detailed information regarding the Composite Indexes and the Underlying Indexes, please see “A Word about

Benchmarks” on page 4. Sources: Lehman Brothers, Inc., AARP Financial Inc. |

| | | | |

| AARP Conservative Fund Overview | | AARP FUNDS 2008 ANNUAL REPORT | | 11 |

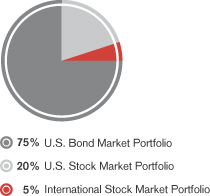

Portfolio construction

AARP Conservative Fund

Performance commentary

The AARP Conservative Fund seeks primarily current income, with some growth of capital. To achieve this objective, the Fund targets an asset allocation of 75% in bonds, 20% in U.S. equity and 5% in international equity. For the year ended June 30, 2008, the AARP Conservative Fund returned 2.04%, as compared to the Conservative Composite Index return of 2.24%, and 7.12% for the Lehman Brothers Aggregate Bond Index. The Fund’s performance includes the operating expenses, whereas index returns are unmanaged and do not include expenses of any kind. The Fund tracked its benchmark closely during the period and continues to benefit from its diversification to its underlying asset classes.

During the twelve month period ended June 30, 2008, bonds performed considerably better than stocks. The Fund’s substantial allocation to U.S. investment-grade bonds helped to protect it from the downturn in the equity markets and problems that occurred in other sectors of the credit markets—most notably the sub-prime mortgage sector. The Fund’s performance was boosted by its investment in the U.S. Bond Market Portfolio which returned 7.20%. In contrast, the Fund’s 25% allocation to equities—both U.S. and developed international equities—detracted from performance as the U.S. Stock Market Portfolio returned -12.35% and the International Stock Market Portfolio returned -10.62%, for the year ending June 30, 2008.

Despite closing at record highs during July 2007, the S&P 500 Index, the Dow Jones Industrial Average and many other global indices lost ground during the twelve month period ended June 30, 2008. A slowdown and subsequent downturn in real estate markets throughout the U.S. translated into problems for the sub-prime mortgage market. These problems spread rapidly to other credit markets including the asset-backed commercial paper sector and the high-yield bond sector. This prompted investors to seek less risky alternatives such as U.S. Treasuries; the result of that demand pushed Treasury prices up and their yields down. Rising oil and commodity prices and their inflationary effects on consumer goods caused Treasury Inflation-Protected Securities (“TIPS”) to perform particularly well during this time.

During the previous twelve months, the Federal Reserve Bank (“the Fed”) took a number of steps to address the credit crunch and rejuvenate economic growth. In early 2008, and for the first time since the Great Depression, the Fed opened its discount window to help troubled investment banks. At the same time, the U.S. Government weighed in with a $160 billion fiscal stimulus package to help U.S. households cope with a depressed housing market, tightened lending standards and increased costs for food and fuel. As the second quarter of 2008 was coming to a close, both the U.S. Treasury and the Fed worked on plans to support mortgage giants Freddie Mac and Fannie Mae in order to prevent further problems and a potentially systemic collapse in the global financial markets.

We believe that volatility in the markets is likely to continue, at least in the near term. Although the Fed has worked diligently to contain the problems in the credit markets, it is unclear whether or not there will be additional flare-ups in the credit markets and subsequent asset write downs in the months to come. Much of the uncertainty centers on the U.S. consumer—already tapped from rising energy prices, falling home values and a weakening job market—and consumer spending. A weaker consumer could cause a further slowdown in the economy which could increase the likelihood of mortgage defaults and losses, and tempers expectations for global growth.

Sources: SSgA FM, Bloomberg, Factset

| | | | |

| 12 | | AARP FUNDS 2008 ANNUAL REPORT | | AARP Income Fund Overview |

AARP Income Fund Overview

| | | | | | |

| | | |

Portfolio of investments June 30, 2008 | | | | | | |

Mutual funds: 100.8% | | | | | | |

| | | Shares | | Value | |

| | | | | | | |

| U.S. Bond Market Portfolio1 – 95.7% | | 618,644 | | $ | 6,174,069 | |

| | |

| State Street Money Market Portfolio2 – 2.7% | | 173,789 | | | 173,789 | |

| | |

| SPDR Lehman High Yield Bond ETF2 – 2.4% | | 3,575 | | | 157,229 | |

| | |

| Total investments: 100.8% (Identified cost $6,576,981) | | | | | 6,505,087 | |

| | | | | | | |

| Other assets and liabilities, net: (0.8)% | | | | | (54,720 | ) |

| | | | | | | |

| Total net assets: 100.0% | | | | $ | 6,450,367 | |

1 Affiliated issuer. 2 Investment in non-controlled affiliate. See Notes to Financial Statements. | | | | | | |

| | |

| |

Performance as of June 30, 2008 |

| | |

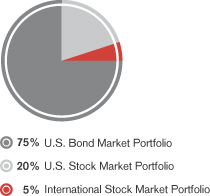

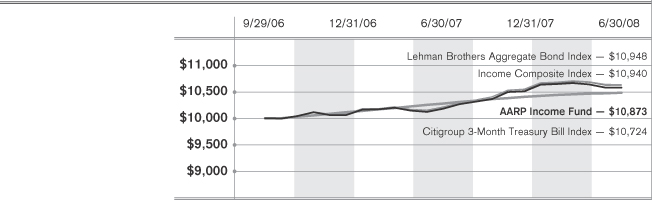

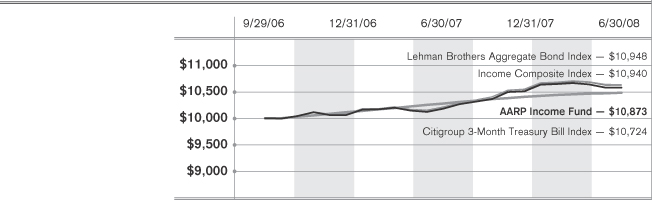

Growth of $10,000 This graph illustrates the

hypothetical investment of

$10,000 in the AARP Income

Fund from September 29,

2006 (commencement of

operations) through June 30,

2008, compared to the

Income Composite Index, the

Lehman Brothers Aggregate

Bond Index, and the

Citigroup 3-Month Treasury

Bill Index.2 | |  |

| | |

| | | This hypothetical example does not represent the returns of any particular investment. |

| | | | | | | | |

| | | | | |

| Performance summary | | Average Annual Returns as of June 30, 2008 | | 1-Year | | Since

inception | | |

| | | AARP Income Fund | | 6.83% | | 4.89%1 | | |

| | | Income Composite Index2 | | 6.93% | | 5.25%1 | | |

| | | Lehman Brothers Aggregate Bond Index®2 | | 7.12% | | 5.30%1 | | |

| | | Citigroup 3-Month Treasury Bill Index | | 3.33% | | 4.07%1 | | |

| | | | | |

| | | | | | |

| |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will

fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes

over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a

shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank

and are not federally insured. The performance of the Funds assumes the reinvestment of all dividends and distributions. The indexes above

have been adjusted to reflect reinvestment of dividends on securities in the indexes. The adviser is waiving a portion of its advisory fee and other

operating expenses. Had the fees not been waived or reimbursed, returns would have been lower. It is not possible to invest directly in an Index. For the most recent month-end performance and after-tax returns, visit www.aarpfunds.com or call 1-800-958-6457. 1 For the period from September 29, 2006 (commencement of operations) to June 30, 2008.

2 The Lehman Brothers Aggregate Bond Index serves as a broad measure of the U.S. taxable bond market. Since the Fund invests in differing

combinations of this and other markets, the Income Composite Index has been constructed utilizing the proportionate weightings of the indexes

for each market. This Composite Index provides a particularly useful benchmark to measure the performance of the Fund. For more detailed

information regarding the Composite Indexes and the Underlying Indexes, please see “A Word about Benchmarks” on page 4. |

| | | | |

| AARP Income Fund Overview | | AARP FUNDS 2008 ANNUAL REPORT | | 13 |

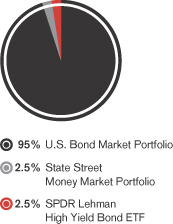

Portfolio construction

AARP Income Fund

Performance commentary

The AARP Income Fund seeks current income and long-term preservation of capital. To achieve this objective, the Fund targeted an asset allocation of 95% in long-term bonds and 5% in short-term securities for most of the reporting period. However, this asset allocation was slightly changed in late May 2008 by investing 2.5% of assets in high yield bonds and reducing investments in short-term securities to 2.5%. For the year ended June 30, 2008, the AARP Income Fund returned 6.83%, as compared to the Income Composite Index return of 6.93%, 3.33% for the Citigroup 3-Month Treasury Bill Index, and 7.12% for the Lehman Brothers Aggregate Bond Index. The Fund’s performance includes the operating expenses, whereas index returns are unmanaged and do not include expenses of any kind. The Fund tracked its benchmark closely during the period and benefits from its allocations to fixed income and short-term securities.

The Fund’s investments in bonds and short-term securities helped to protect investors from the downturn in the equity markets. Its investment in the U.S. Bond Market Portfolio returned 7.20%, while the State Street Money Market Portfolio returned 3.94% in the period.

The economy’s prospects took a distinct turn for the worse in the summer of 2007. Inventories of new and existing homes for sale rose to their highest levels since the housing market correction of the early 1990s, pushing new home construction to its lowest level in more than a decade. Crude oil prices continued to move higher, flirting with the $100 a barrel mark in late November 2007 and eventually breaching the $140 a barrel mark by the end of June 2008.

Holding U.S. government bonds was generally profitable as steady deterioration in mortgage bonds and leveraged loans convinced the Federal Reserve Bank of the economic risks associated with the credit market turmoil. The Federal Reserve Bank acted with discount-rate cuts in both August and September and a half percentage cut in the Fed funds target at the September 18, 2007 meeting of the Federal Open Market Committee. In the third quarter of 2007, two-year and three year maturities saw yield declines upward of 0.85%, while ten-year yields retreated by roughly half as much.

During the twelve month period ending June 30, 2008 monetary easing and fiscal stimulus were brought to bear on the U.S. economy to address a multitude of economic challenges. The Fed funds target was lowered from 5.25% to 2% and the U.S. Government introduced a $160 billion stimulus package in the form of tax credit to consumers. Increased capital markets volatilities especially in equities forced many investors to seek the safety of U.S. Government bonds.

However, by the end of June, the dual pressure on food and fuel expenses exacerbated inflations concerns and drove headline Consumer Price Index (“CPI”) to 5% from a year ago. The Federal Reserve Bank, understandably, is worried that an increase in the CPI could lead to further inflationary pressures, leading to changes in wage bargaining and business pricing behavior that will eventually push up actual inflation. The Federal Reserve Bank, however, is currently restricted to using hawkish rhetoric to contain such expectations, because of the fragility of financial markets and the economy preclude tightening at this time.

Sources: Bloomberg, SSgA FM, FactSet

| | | | |

| 14 | | AARP FUNDS 2008 ANNUAL REPORT | | AARP Money Market Fund Overview |

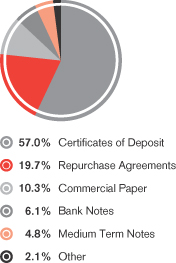

AARP Money Market Fund Overview

| | | |

| | |

Portfolio of investments June 30, 2008 | | | |

Mutual funds: 99.2% | | | |

| | | Value |

| | | | |

| Investment in State Street Money Market Portfolio1 – 99.2% | | $ | 76,451,920 |

| |

| Total investments: 99.2% (Identified cost $76,451,920) | | | 76,451,920 |

| | | | |

| Other assets and liabilities, net: 0.8% | | | 623,693 |

| | | | |

| Total net assets: 100.0% | | $ | 77,075,613 |

1 The financial statements of the State Street Money Market Portfolio, including its investment portfolio, are included elsewhere within this report and should be read in conjunction with the AARP Money Market Fund’s financial statements. AARP Money Market Fund invests only in State Street Money Market Portfolio. At June 30, 2008, AARP Money Market Fund owned 0.89% of the State Street Money Market Portfolio. See Notes to Financial Statements. |

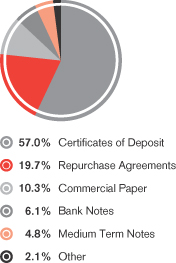

Portfolio construction*

| | |

| Maturities ladder as of June 30, 2008 | | |

| |

| 0-3 Days | | 26.0% |

| |

| |

| 4-90 Days | | 65.3% |

| |

| |

| 90+ Days | | 8.7% |

| |

| |

| Total | | 100.0% |

| |

| |

| Average Maturity | | 40 Days |

| | | | |

| |

| Performance summary | | |

| Average Annual Returns as of June 30, 2008 |

| |

| | | 1-Year | | Since

inception |

| |

| | |

| AARP Money Market Fund | | 4.09% | | 4.59%1 |

| |

| | |

| Citigroup 3-Month Treasury Bill Index | | 3.33% | | 4.19%1 |

| |

| | |

| AARP Money Market Fund 7-Day Yield | | 2.30% | | |

| |

*Portfolio construction represents the composition of the underlying holdings in the State Street Money Market Portfolio, whose financial statements are included elsewhere in this report.

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. The performance of the Funds assumes the reinvestment of all dividends and distributions. The indexes above have been adjusted to reflect reinvestment of dividends on securities in the indexes. The adviser is waiving a portion of its advisory fee and other operating expenses. Had the fees not been waived or reimbursed, returns would have been lower. It is not possible to invest directly in an Index.

For the most recent month-end performance and after-tax returns, visit www.aarpfunds.com or call 1-800-958-6457.

An investment in the AARP Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

1 | For the period from July 1, 2006 (commencement of operations) to June 30, 2008. |

Sources: Citigroup, AARP Financial Inc.

| | | | |

| Understanding Your Expenses | | AARP FUNDS 2008 ANNUAL REPORT | | 15 |

Understanding Your Expenses (unaudited)

As a shareholder of a Fund, you incur ongoing costs, including investment advisory fees, distribution (12b-1) fees, shareholder services fees, and other expenses of running a fund. It’s important to understand exactly how much you pay to purchase and own a fund and to compare the costs of owning different funds because these costs reduce your returns.

The example in the table on the next page is intended to help you to understand your ongoing costs in dollars of investing in an AARP Fund and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2008 to June 30, 2008.

Actual expenses

The first line for each Fund in the table on the next page, labeled “Actual”, provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the line labeled “Actual” under the heading entitled “Expenses paid during period” to estimate the expenses attributable to your investment during this period.

Hypothetical example for comparison purposes

The second line for each fund in the table, labeled “Hypothetical”, helps you compare the costs of an AARP Fund to other funds using a 5% return as required by the Securities and Exchange Commission for all mutual funds. It provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not a Fund’s actual return. You should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures help you to compare the ongoing costs of investing in an AARP Fund with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as redemption fees which are charged by some mutual funds. Therefore, the line labeled “Hypothetical” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transaction costs were included, your costs would have been higher.

| | | | |

| 16 | | AARP FUNDS 2008 ANNUAL REPORT | | Understanding Your Expenses |

In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of the underlying portfolios in which the Fund invests. Because the underlying portfolios have varied expenses and fee levels and the Fund may own different proportions of the underlying funds at different times, the amount of fees and expenses incurred indirectly by the Fund may vary in the future. However, AARP Financial has agreed contractually to waive fees and reimburse expenses to keep the net total operating expenses of the AARP Funds, including the indirect fees and expenses of the underlying portfolios, at 0.50% of average daily net assets through at least November 1, 2008. In addition, effective March 1, 2007, AARP Financial has agreed contractually to waive fees and reimburse expenses to keep the net total operating expenses of the AARP Money Market Fund, including its pro-rata allocation of expenses from the State Street Portfolio, at 0.30% of average daily net assets through at least November 1, 2009.

| | | | | | | | | | | | | | | | |

| | | | | | | |

| | | Beginning

account value

1/1/08 | | Ending

account value

6/30/08 | | Expenses paid

during period2 | | Annualized

expense ratio2 | | Effective

expenses paid during

period3 | | Effective

annualized

expense

ratio3 |

| |

| |

| AARP Aggressive Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 920.40 | | $ | 1.15 | | 0.24% | | $ | 2.39 | | 0.50% |

Hypothetical1 | | $ | 1,000 | | $ | 1,023.67 | | $ | 1.21 | | | | $ | 2.51 | | |

| |

| |

| AARP Moderate Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 951.00 | | $ | 1.16 | | 0.24% | | $ | 2.43 | | 0.50% |

Hypothetical1 | | $ | 1,000 | | $ | 1,023.67 | | $ | 1.21 | | | | $ | 2.51 | | |

| |

| |

| AARP Conservative Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 980.00 | | $ | 1.23 | | 0.25% | | $ | 2.46 | | 0.50% |

Hypothetical1 | | $ | 1,000 | | $ | 1,023.62 | | $ | 1.26 | | | | $ | 2.51 | | |

| |

| |

| AARP Income Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,010.00 | | $ | 1.30 | | 0.26% | | $ | 2.50 | | 0.50% |

Hypothetical1 | | $ | 1,000 | | $ | 1,023.57 | | $ | 1.31 | | | | $ | 2.51 | | |

| |

| |

| AARP Money Market Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,015.60 | | $ | 1.50 | | 0.30% | | $ | 1.50 | | 0.30% |

Hypothetical1 | | $ | 1,000 | | $ | 1,023.37 | | $ | 1.51 | | | | $ | 1.51 | | |

| |

| |

| |

1 The Hypothetical example assumes a 5% return before expenses. 2 Expenses reflect the Fund’s annualized net expense ratios multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). The fees and expenses of the underlying portfolios are not included in these amounts. 3 Effective expenses reflect the sum of the expenses borne directly by the Fund plus the Fund’s pro-rata share of the weighted average expense ratio of the underlying portfolios in which it invests. The effective annualized expense ratio combines the Fund’s annualized net expense ratio and the annualized weighted average expense ratios of the underlying portfolios. The annualized weighted average expense ratio includes the annualized expense ratio for each underlying portfolio weighted for the Fund’s relative average investment during the same period. |

| | | | |

| How to Read Financial Statements | | AARP FUNDS 2008 ANNUAL REPORT | | 17 |

How to Read Financial Statements

Mutual funds are companies that pool money from many investors and invest that money in stocks, bonds and other securities and assets. Mutual fund financial statements show investors where a fund’s money came from, where it went, where it is and what it is worth as of the close of the fund’s most recent fiscal period. The portfolio of investments shows where the money is as of the close of the fund’s most recent fiscal period. The holdings of each AARP Fund as of June 30, 2008 are shown in the individual Fund Overview sections of this annual report. In addition, this section of the annual report contains four additional financial statements:

1. Statements of assets and liabilities.

These statements are the Funds’ balance sheets as of the close of the period (June 30, 2008). They show the value and the cost of what each Fund owned, how much it owed to others and the resulting difference or “net assets”.

| • | | Assets are the stocks, bonds, cash, and other financial instruments that a fund owns and has purchased with monies investors pay when they purchase shares. |

| • | | Liabilities are the amounts of money that a fund owes. Liabilities include payments due for the purchase of financial investments as well as bills that a fund incurs for services that are needed to run a fund, such as legal services and printing. |

| • | | Net assets = total assets – total liabilities. Net assets represent what is left of assets after liabilities are subtracted. This leftover amount belongs to the investors, or shareholders, of the fund. |

2. Statements of operations

These statements provide a summary of the investment income, such as dividends, that a fund has earned as well as gains and losses from its investment activities for the period ended June 30, 2008. Realized gains or losses reflect the difference between purchase price and selling price for transactions that took place during the period. Unrealized gains and losses reflect the difference between purchase price and the value of positions that are still held as of the end of the period. The statements also include specific details of fund expenses.

3. Statements of changes in net assets

These statements describe the changes in net assets during the current and prior period, which result from operations, any distributions of earnings to investors, and any shareholder transactions.

4. Financial highlights

The financial highlights table is intended to help you understand a fund’s financial performance for a share outstanding for the current period and each of the applicable prior periods.

The Notes to Financial Statements provide additional information to help you better understand the financial statements. They include a description of the most important accounting policies used in portraying the company’s financial condition and results, including how a fund records and values its investments, tax information, as well as additional detail on shareholder and investment transactions.

| | | | |

| 18 | | AARP FUNDS 2008 ANNUAL REPORT | | Financial Statements |

Financial Statements

| | | | | | | | | | | | | | | | | | | |

|

Statements of assets and liabilities June 30, 2008 |

| | | AARP

Aggressive

Fund | | | AARP

Moderate

Fund | | | AARP

Conservative

Fund | | | AARP

Income

Fund | | | AARP

Money Market

Fund |

| | | | | | | | | | | | | | | | | | | |

| Assets: | | | | | | | | | | | | | | | | | | | |

| Investments in affiliated issuers, at value (identified cost of $26,623,002, $43,955,106, $18,414,765 and $6,403,192, respectively) | | $ | 25,135,947 | | | $ | 42,426,415 | | | $ | 18,137,050 | | | $ | 6,331,298 | | | $ | – |

| Investments in State Street Money Market Portfolio, at value (identified cost of $173,789 and $76,451,920, respectively) | | | – | | | | – | | | | – | | | | 173,789 | | | | 76,451,920 |

| Receivable from adviser | | | 2,406 | | | | 3,809 | | | | – | | | | 2,103 | | | | 20,817 |

| Receivable for investments sold | | | 393,353 | | | | 1,258,146 | | | | 164,754 | | | | 17,784 | | | | – |

| Receivable for fund shares sold | | | 32,841 | | | | 80,975 | | | | 99,783 | | | | 6,268 | | | | 822,004 |

| Total assets | | $ | 25,564,547 | | | $ | 43,769,345 | | | $ | 18,401,587 | | | $ | 6,531,242 | | | $ | 77,294,741 |

| | | | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | | | | |

| Payable for investments purchased | | | 285,401 | | | | 586,736 | | | | 257,592 | | | | – | | | | – |

| Payable for fund shares redeemed | | | 140,793 | | | | 752,385 | | | | 6,945 | | | | 26,273 | | | | 131,670 |

| Income distribution payable | | | 18,825 | | | | 33,998 | | | | 14,940 | | | | 3,282 | | | | 3,030 |

| Payable to adviser | | | – | | | | – | | | | 589 | | | | – | | | | – |

| Accrued portfolio acct. fees (Note 6) | | | 1,604 | | | | 1,607 | | | | 1,602 | | | | 1,588 | | | | 1,485 |

| Accrued administration fees (Note 6) | | | 785 | | | | 1,260 | | | | 513 | | | | 178 | | | | 2,202 |

| Accrued transfer agent fees (Note 6) | | | 22,747 | | | | 17,410 | | | | 6,168 | | | | 2,928 | | | | 22,104 |

| Accrued distribution services fee | | | 4,476 | | | | 7,187 | | | | 2,928 | | | | 1,017 | | | | 12,564 |

| Accrued audit fees | | | 15,345 | | | | 15,345 | | | | 15,345 | | | | 15,345 | | | | 15,345 |

| Accrued registration fees | | | 963 | | | | 747 | | | | 1,092 | | | | 150 | | | | 538 |

| Accrued printing and postage expenses | | | 10,253 | | | | 10,253 | | | | 10,253 | | | | 11,253 | | | | 11,329 |

| Accrued legal fees | | | 10,557 | | | | 10,557 | | | | 10,557 | | | | 10,557 | | | | 10,557 |

| Accrued miscellaneous expense | | | 8,304 | | | | 8,304 | | | | 8,304 | | | | 8,304 | | | | 8,304 |

| Total liabilities | | $ | 520,053 | | | $ | 1,445,789 | | | $ | 336,828 | | | $ | 80,875 | | | $ | 219,128 |

| | | | | | | | | | | | | | | | | | | |

| Net assets | | $ | 25,044,494 | | | $ | 42,323,556 | | | $ | 18,064,759 | | | $ | 6,450,367 | | | $ | 77,075,613 |

| Net assets consist of: | | | | | | | | | | | | | | | | | | | |

| Paid-in capital | | $ | 26,586,972 | | | $ | 43,805,867 | | | $ | 18,321,184 | | | $ | 6,514,540 | | | $ | 77,073,714 |

| Net unrealized appreciation (depreciation) of investments | | | (1,487,055 | ) | | | (1,528,691 | ) | | | (277,715 | ) | | | (71,894 | ) | | | – |

| Accumulated net realized gain (loss) on investments | | | (55,460 | ) | | | 46,337 | | | | 21,283 | | | | 7,718 | | | | 1,899 |

| Undistributed net investment income | | | 37 | | | | 43 | | | | 7 | | | | 3 | | | | – |

| Net assets | | $ | 25,044,494 | | | $ | 42,323,556 | | | $ | 18,064,759 | | | $ | 6,450,367 | | | $ | 77,075,613 |

| | | | | | | | | | | | | | | | | | | |

| Shares of beneficial interest outstanding | | | 2,395,250 | | | | 4,101,189 | | | | 1,784,257 | | | | 644,013 | | | | 77,073,714 |

| Net asset value per share | | $ | 10.46 | | | $ | 10.32 | | | $ | 10.12 | | | $ | 10.02 | | | $ | 1.00 |

|

| See Notes to Financial Statements. |

| | | | |

| Financial Statements | | AARP FUNDS 2008 ANNUAL REPORT | | 19 |

Financial Statements (continued)

| | | | | | | | | | | | | | | | | | | | |

|

Statements of operations Year ended June 30, 2008 | |

| | | AARP

Aggressive

Fund | | | AARP

Moderate

Fund | | | AARP

Conservative

Fund | | | AARP

Income

Fund | | | AARP

Money Market

Fund | |

| | | | | | | | | | | | | | | | | | | | |

| Investment income: | | | | | | | | | | | | | | | | | | | | |

| Dividends from affiliated issuers | | $ | 691,340 | | | $ | 1,360,035 | | | $ | 604,298 | | | $ | 183,006 | | | $ | – | |

| Interest allocated from State Street Money Market Portfolio | | | – | | | | – | | | | – | | | | 7,429 | | | | 2,584,003 | |

| Total investment income | | $ | 691,340 | | | $ | 1,360,035 | | | $ | 604,298 | | | $ | 190,435 | | | $ | 2,584,003 | |

| | | | | | | | | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | | | | | | | | |

| Expenses allocated from State Street Money Market Portfolio | | | – | | | | – | | | | – | | | | 185 | | | | 63,703 | |

| Investment adviser fee (Note 6) | | | 2,550 | | | | 3,942 | | | | 1,442 | | | | 383 | | | | – | |

| Administration fees (Note 6) | | | 8,926 | | | | 13,796 | | | | 5,046 | | | | 1,340 | | | | 22,260 | |

| Registration fees | | | 18,868 | | | | 22,233 | | | | 19,551 | | | | 23,004 | | | | 26,671 | |

| Transfer and dividend disbursing agent fees and expenses (Note 6) | | | 118,617 | | | | 103,895 | | | | 37,599 | | | | 12,834 | | | | 138,540 | |

| Trustees’ fees | | | 20,000 | | | | 20,000 | | | | 20,000 | | | | 20,000 | | | | 20,000 | |

| Audit fees | | | 18,786 | | | | 18,786 | | | | 18,786 | | | | 18,035 | | | | 18,035 | |

| Legal fees | | | 49,655 | | | | 49,655 | | | | 49,655 | | | | 49,655 | | | | 49,655 | |

| Portfolio accounting fees (Note 6) | | | 18,929 | | | | 19,067 | | | | 18,874 | | | | 17,390 | | | | 17,132 | |

| Distribution service fees | | | 51,007 | | | | 78,833 | | | | 28,835 | | | | 7,659 | | | | 127,200 | |

| Printing and postage expenses | | | 17,174 | | | | 17,174 | | | | 17,174 | | | | 17,174 | | | | 17,174 | |

| Insurance expense | | | 5,344 | | | | 8,508 | | | | 3,218 | | | | 974 | | | | 18,305 | |

| Miscellaneous | | | 9,094 | | | | 9,094 | | | | 9,094 | | | | 9,094 | | | | 9,094 | |

| Total expenses | | $ | 338,950 | | | $ | 364,983 | | | $ | 229,274 | | | $ | 177,727 | | | $ | 527,769 | |

| | | | | | | | | | | | | | | | | | | | |

| Waivers and reimbursements (Note 6): | | | | | | | | | | | | | | | | | | | | |

| Reduction of expenses by investment adviser | | | (277,206 | ) | | | (268,545 | ) | | | (193,699 | ) | | | (167,727 | ) | | | (336,980 | ) |

| Net expenses | | | 61,744 | | | | 96,438 | | | | 35,575 | | | | 10,000 | | | | 190,789 | |

| Net investment income | | | 629,596 | | | | 1,263,597 | | | | 568,723 | | | | 180,435 | | | | 2,393,214 | |

| | | | | | | | | | | | | | | | | | | | |

| Realized and unrealized gain (loss) on investments: | | | | | | | | | | | | | | | | | |

| Net realized gain (loss) on affiliated investments | | | (116,239 | ) | | | 81,734 | | | | 57,346 | | | | 11,408 | | | | – | |

| Net realized gain allocated from State Street Money Market Portfolio | | | – | | | | – | | | | – | | | | – | | | | 1,903 | |

| Capital gain distributions from affiliated investments | | | 239,142 | | | | 239,992 | | | | 41,459 | | | | – | | | | – | |

| Net change in unrealized appreciation (depreciation) of investments | | | (2,861,553 | ) | | | (2,907,787 | ) | | | (505,064 | ) | | | (35,643 | ) | | | – | |

| Net realized and unrealized gain (loss) on investments | | | (2,738,650 | ) | | | (2,586,061 | ) | | | (406,259 | ) | | | (24,235 | ) | | | 1,903 | |

| Change in net assets resulting from operations | | $ | (2,109,054 | ) | | $ | (1,322,464 | ) | | $ | 162,464 | | | $ | 156,200 | | | $ | 2,395,117 | |

|

| See Notes to Financial Statements. | |

| | | | |

| 20 | | AARP FUNDS 2008 ANNUAL REPORT | | Financial Statements |

Financial Statements (continued)

| | | | | | | | | | | | | | | | | | |

| | | |

Statements of changes in net assets | | | | | | | | | | | |

| | | AARP Aggressive Fund | | | AARP Moderate Fund | | | |

| | | | | |

| | | Year

ended

6/30/08 | | | Year

ended

6/30/07 | | | Year

ended

6/30/08 | | | Year

ended

6/30/07 | | | |

| Increase (decrease) in net assets | | | | | | | | | | | | | | | | | | |

| Operations: | | | | | | | | | | | | | | | | | | |

| Net investment income | | $ | 629,596 | | | $ | 311,276 | | | $ | 1,263,597 | | | $ | 706,669 | | | |

| Net realized gain (loss) on investments | | | 122,903 | | | | 64,523 | | | | 321,726 | | | | 174,252 | | | |

| Net change in unrealized appreciation (depreciation) of investments | | | (2,861,553 | ) | | | 1,463,167 | | | | (2,907,787 | ) | | | 1,590,280 | | | |

| Change in net assets resulting from operations | | | (2,109,054 | ) | | | 1,838,966 | | | | (1,322,464 | ) | | | 2,471,201 | | | |

| | | | | | | | | | | | | | | | | | |

| Distributions to shareholders: | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (687,591 | ) | | | (326,680 | ) | | | (1,322,333 | ) | | | (726,251 | ) | | |

| From net realized gains on investments | | | (161,853 | ) | | | (485 | ) | | | (362,860 | ) | | | (448 | ) | | |

| Change in net assets resulting from distributions to shareholders | | | (849,444 | ) | | | (327,165 | ) | | | (1,685,193 | ) | | | (726,699 | ) | | |

| | | | | | | | | | | | | | | | | | |

| Share transactions: | | | | | | | | | | | | | | | | | | |

| Proceeds from sales of shares | | | 14,172,454 | | | | 14,326,319 | | | | 21,178,734 | | | | 20,156,884 | | | |

| Net asset value of shares issued on reinvestment of dividends | | | 800,783 | | | | 306,759 | | | | 1,603,205 | | | | 690,077 | | | |

| Cost of shares redeemed | | | (7,192,023 | ) | | | (2,376,776 | ) | | | (9,376,196 | ) | | | (3,798,646 | ) | | |

| Change in net assets resulting from share transactions | | | 7,781,214 | | | | 12,256,302 | | | | 13,405,743 | | | | 17,048,315 | | | |

| Change in net assets | | | 4,822,716 | | | | 13,768,103 | | | | 10,398,086 | | | | 18,792,817 | | | |

| | | | | | | | | | | | | | | | | | |

| Net assets: | | | | | | | | | | | | | | | | | | |

| Beginning of year | | $ | 20,221,778 | | | $ | 6,453,675 | | | $ | 31,925,470 | | | $ | 13,132,653 | | | |

| End of year | | $ | 25,044,494 | | | $ | 20,221,778 | | | $ | 42,323,556 | | | $ | 31,925,470 | | | |

| Undistributed net investment income included in net assets at end of period | | $ | 37 | | | $ | 60 | | | $ | 43 | | | $ | 586 | | | |

1 | For the period from September 29, 2006 (commencement of operations) through June 30, 2007. |

See Notes to Financial Statements.

| | | | |

| Financial Statements | | AARP FUNDS 2008 ANNUAL REPORT | | 21 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | AARP Conservative Fund | | | AARP Income Fund | | | AARP Money Market Fund | |

| | | | | | |

| | | Year

ended

6/30/08 | | | Year

ended

6/30/07 | | | Year

ended

6/30/08 | | | Period

ended