could result in substantial damages, settlements, fines, penalties, diminished income or reputational harm to the sponsor, and could materially and adversely affect the interests of the noteholders or the servicer’s ability to perform its duties under the transaction documents. The proceedings identified below are those in connection with which the sponsor believes a material loss is reasonably possible or probable.

[Insert disclosure regarding any material legal proceedings pending against the sponsor and servicer, or known to be contemplated by governmental authorities, in accordance with Regulation AB Item 1117.]

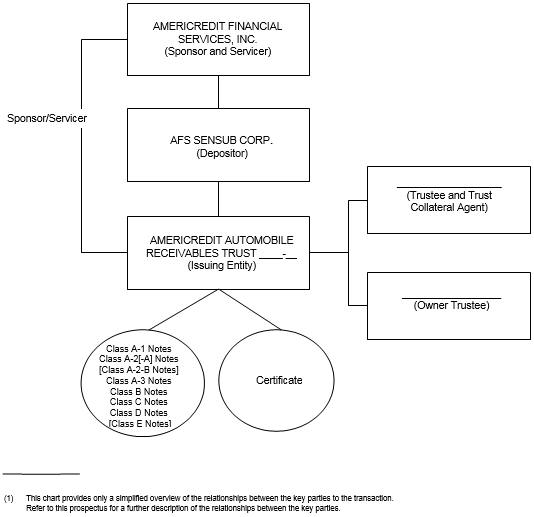

[The Depositor]

[Insert disclosure regarding any material legal proceedings pending against the depositor, or known to be contemplated by governmental authorities, in accordance with Regulation AB Item 1117.]

The Trustee and the Trust Collateral Agent

[Insert disclosure regarding any material legal proceedings pending against the trustee and trust collateral agent, or known to be contemplated by governmental authorities, in accordance with Regulation AB Item 1117.]

The Owner Trustee

[Insert disclosure regarding any material legal proceedings pending against the owner trustee, or know to be contemplated by governmental authorities, in accordance with Regulation AB Item 1117.]

Certain Relationships and Related Transactions

In the ordinary course of business from time to time, the sponsor and its affiliates have business relationships and agreements with affiliates of the owner trustee and the trustee [and the hedge counterparty], including commercial banking, committed credit facilities, underwriting agreements, hedging agreements and financial advisory services, all on arm’s length terms and conditions.

The owner trustee is not an affiliate of any of the depositor, the sponsor, the servicer, the issuing entity or the trustee. However, the owner trustee and one or more of its affiliates may, from time to time, engage in arm’s length transactions with the depositor, the sponsor, the trustee, or affiliates of any of them, that are distinct from its role as owner trustee, including transactions both related and unrelated to the securitization of automobile loan contracts.

The trustee is not an affiliate of any of the depositor, the sponsor, the servicer, the issuing entity, the owner trustee. However, the trustee and one or more of its affiliates may, from time to time, engage in arm’s length transactions with the depositor, the sponsor, the owner trustee, the sponsor or affiliates of any of them, that are distinct from its role as trustee, including transactions both related and unrelated to the securitization of automobile loan contracts.

The sponsor, the depositor and the servicer are affiliates and also engage in other transactions with each other involving securitizations and sales of automobile loan contracts.

[Disclosure regarding additional affiliations provided for each transaction.]

Credit Risk Retention

[The risk retention regulations in Regulation RR of the Exchange Act require the sponsor, either directly or through its majority-owned affiliates, to retain a 5% economic interest in the credit risk of the automobile loan contracts. The depositor is a wholly-owned subsidiary of the sponsor and [intends to]/[will] retain the required economic interest in the credit risk of the automobile loan contracts to satisfy the sponsor’s obligations under Regulation RR.]

133