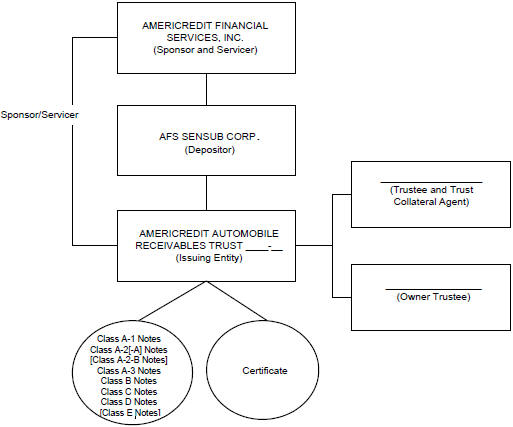

$ [or $ ] Automobile Receivables Backed Notes

AmeriCredit Automobile Receivables Trust 20 -

Issuing Entity (CIK No. )

AFS SenSub Corp.

Depositor (CIK No. 0001347185)

Sponsor and Servicer (CIK No. 0001002761)

| | | | |

| | | | The issuing entity will issue - |

| | |

| | | | ● [seven] classes of notes that are offered by this prospectus; and |

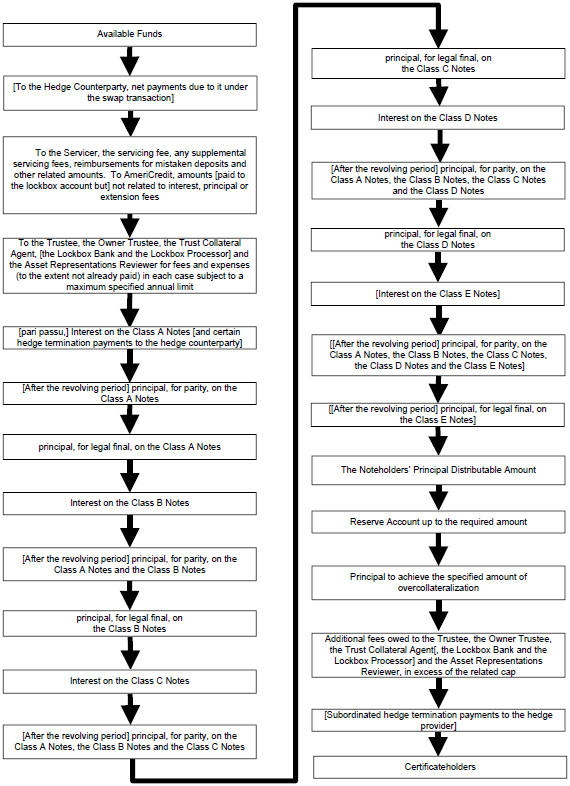

We suggest that you read the section entitled “Risk Factors” on page 25 of this prospectus and consider the factors in that section before making a decision to invest in the notes. The notes are automobile loan asset-backed securities which represent obligations of the issuing entity and are not interests in or obligations of any other person or entity. Neither the notes nor the automobile loan contracts will be insured or guaranteed by any governmental agency or instrumentality. You should retain this prospectus for future reference. | | | | ● [[one] class of subordinated notes that is not offered by this prospectus. [These][This] class of subordinated notes [are anticipated to be privately placed primarily with institutional investors]/[will initially be retained by the depositor or an affiliate of the depositor].]; and ● all or a portion of one or more of the [other] classes of notes may be retained by the depositor or its affiliates. The notes - ● are backed by a pledge of assets of the issuing entity. The assets of the issuing entity securing the notes will include a pool of sub-prime automobile loan contracts secured by new and used automobiles, light duty trucks and vans. Sub-prime automobile loan contracts are contracts made to borrowers who have experienced prior credit difficulties and generally have credit bureau scores ranging from 500 to 700; ● receive monthly distributions [of interest and, after the revolving period, of principal] on the day of each month, or, if not a business day, then on the next business day, beginning on , 20 ; and ● currently have no trading market. Credit enhancement for the notes offered by this prospectus will consist of - ● excess cashflow collected on the pool of automobile loan contracts; ● overcollateralization resulting from the excess of the principal balance of the automobile loan contracts over the aggregate principal amount of the notes; ● the subordination of each class of notes to those classes senior to it[, including the subordination of the class of notes which is not being offered by this prospectus to each class of notes being offered by this prospectus]; and ● a reserve account that can be used to cover payments of timely interest, parity principal payments and ultimate principal on the notes. |

| | |

| | |

| | |

| | |

[AmeriCredit Automobile Receivables Trust 20 - will offer asset-backed notes with an aggregate initial principal amount of $ or an aggregate initial principal amount of $ . If the aggregate initial principal amount of the notes is $ , the following notes will be offered:]

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Principal

Amount[(1)][(7)] | | | Interest

Rate | | Final Scheduled

Distribution Date | | Price

to Public[(2)] | | Underwriting

Discounts | | Proceeds

to Seller[(3)] |

| | | | | | |

Class A-1 Notes | | | $ | | | | % | | | | , 20 | | | | % | | | | % | | | | % | |

| | | | | | |

Class A-2[-A] Notes[(4)] | | | $ | | | | % | | | | , 20 | | | | % | | | | % | | | | % | |

| | | | | | |

[Class A-2-B Notes[(4)]] | | | $ | | |

| [30-day average SOFR] +

%[(5)][(6)] |

| | | , 20 | | | | % | | | | % | | | | %] | |

| | | | | | |

Class A-3 Notes | | | $ | | | | % | | | | , 20 | | | | % | | | | % | | | | % | |

| | | | | | |

Class B Notes | | | $ | | | | % | | | | , 20 | | | | % | | | | % | | | | % | |

| | | | | | |

Class C Notes | | | $ | | | | % | | | | , 20 | | | | % | | | | % | | | | % | |

| | | | | | |

Class D Notes | | | $ | | | | % | | | | , 20 | | | | % | | | | % | | | | % | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | $ | | | | | | | | | | | | $ | | | | $ | | | | $ | |

[(1) If the aggregate initial principal amount of the notes is $ , the following notes will be offered: $ of Class A-1 Notes, $ of Class A-2 Notes, $ of Class A-3 Notes, $ of Class B Notes, $ of Class C Notes and $ of Class D Notes. The sponsor will make the determination regarding the aggregate initial principal amount of the notes based on, among other considerations, market conditions and investor demand at the time of pricing. See “Risk Factors—Risks Related to the Characteristics of the Notes—Risks associated with unknown aggregate initial principal amount of the notes.”]

[(2)] Plus accrued interest, if any, from , 20 .

[(3)] Before deducting expenses, estimated to be $ .

[[(4)] The allocation of the principal amount between the Class A-2-A Notes and the Class A-2-B Notes will be determined on or before the date of pricing.][The issuing entity expects that the principal amount of the Class A-2-B Notes will not exceed $ .]

[[(5)] The Class A-2-B Notes will accrue interest at a floating rate based on [30-day average SOFR]. For more information on how [30-day average SOFR] is determined, see “Description of the Notes—Determination of SOFR”.] [Note: For illustrative purposes, the prospectus contemplates that the Class A-2-B notes will accrue interest at a floating rate based on 30-day average secured overnight financing rate (SOFR). In a particular transaction, none or different classes of notes may accrue interest at a floating rate and that floating rate of interest may be based on an index different than [30-day average SOFR].]

[[(6)] If the sum of [30-day average SOFR] + % is less than 0.00% for any interest period, then the interest rate for the Class A-2-B Notes for such interest period will be deemed to be 0.00%.]

[[(7)] At least 5% of the initial principal amount of each class of notes will be retained by the depositor or another majority-owned affiliate of the sponsor to satisfy the risk retention obligations of the sponsor described under “Credit Risk Retention”.][Note: For vertical risk retention only]

[The issuing entity will not pay principal during the revolving period, which is scheduled to terminate on , 20 . However, if the revolving period terminated early as a result of an early amortization event, principal payments may commence prior to that date.] [The issuing entity will enter into a hedge agreement with [hedge counterparty] for the purpose of providing an additional source of funds for payments on the notes.]

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | |

| | Joint Bookrunners | | |

| [ ] | | | | [ ] |

| | Co-Managers for the Class A Notes | | |

| [ ] | | | | [ ] |

Prospectus dated , 20 .

[The registrant intends to utilize pay-as-you-go takedowns from the registration statement on Form SF-3 to which this form of prospectus relates

(Registration No. 333-[ ]) and in connection with any corresponding issuance of securities the registrant will pay the related registration fee and

include the following table in the related prospectus. The registration fees will be calculated in accordance with Rule 457(s) of the Securities Act of 1933, as amended]

CALCULATION OF REGISTRATION FEE

| | | | | | | | | | |

Title of Each Class of Securities to be Registered | | Amount to be Registered | | Proposed Maximum Offering Price per Unit(1) | | Proposed Maximum Aggregate Offering Price(1) | | Amount of Registration Fee | | |

Auto Loan Asset Backed Securities | | $ [(2)] | | % | | $ | | $ [(2)] | | |

(1) Estimated solely for the purpose of calculating the registration fee.

(2) [Pursuant to Rule 457(p) of the General Rules and Regulations of the Securities Act of 1933, as amended, $ of the filing fees that were paid on , 20 in connection with a prior offering under Registration Statement No. 333-[ ] (originally filed on , 20 and under which the depositor and the issuing entity are registrants) are being offset against the filing fees related to the securities offered hereby. Pursuant to Rule 456(c) of the General Rules and Regulations under the Securities Act of 1933, as amended, the remaining $ of the filing fees related to securities offered hereby is paid herewith.]