gross APR of %, an original term to maturity equal to the [statistical] pool original term to maturity of months and months of seasoning;]

(ii) all prepayments on the automobile loan contracts each month are made in full at the specified constant percentage of ABS and there are no defaults, losses or repurchases;

(iii) each scheduled monthly payment on the automobile loan contracts is made on the last day of each month and each month has 30 days;

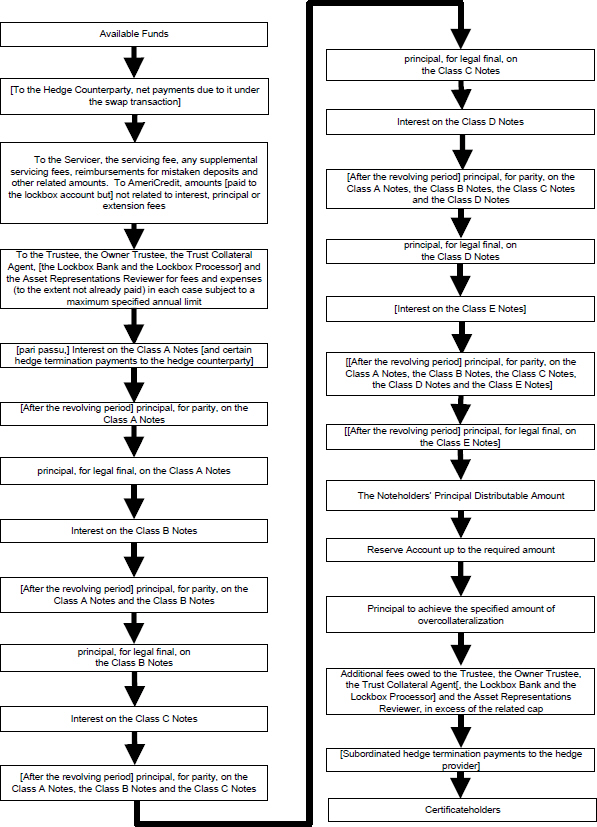

(iv) [the initial principal amount of the Class A-1 Notes is $ , the Class A-2[-A] Notes is $ , [the Class A-2-B Notes is $ ,] the Class A-3 Notes is $ , the Class B Notes is $ , the Class C Notes is $ , the Class D Notes is $ , and the Class E Notes is $ ;]

(v) [the Class A-2-A Notes and the Class A-2-B Notes, collectively, are the Class A-2 Notes, and constitute a single class having equal rights to payments of principal and interest, which will be made on a pro rata basis based on the principal amount of the Class A-2 Notes;]

(vi) [interest accrues on the Class A-1 Notes at % per annum [and the Class A-2-B Notes at a fixed rate of % per annum,] on an [“actual/360” basis];]

(vii) [interest accrues on the Class A-2-A Notes at % per annum, the Class A-3 Notes at % per annum, the Class B Notes at % per annum, the Class C Notes at % per annum, and the Class D Notes at % per annum. [Prior to the [twenty-fourth] distribution date, interest on the Class E Notes will accrue at 0.00%. From and after the [twenty-fourth] distribution date, interest on the Class E Notes will accrue at % the Class E Notes at % per annum, on a [“30/360” basis]];]

(viii) payments on the notes are made on the day of each month commencing in , 20 ;

(ix) the notes are purchased on , 20 ;

(x) the scheduled monthly payment for each automobile loan contract was calculated on the basis of the characteristics described in the following table and in such a way that each automobile loan contract would amortize in a manner that will be sufficient to repay the principal balance of that automobile loan contract by its indicated remaining term to maturity;

(xi) the first due date for each automobile loan contract is the last day of the month of the assumed cutoff date for that automobile loan contract as set forth in the [following]/[applicable] table below;

(xii) the servicer or the depositor exercises its redemption option to purchase the automobile loan contracts at the earliest opportunity;

(xiii) [during the revolving period, the revolving account money is used to purchase the subsequent automobile loan contracts at their respective initial Principal Balances on each distribution date to build and maintain a target level of overcollateralization and there are no funds in the revolving account at the end of any distribution date;]

(xiv) [all of the pre-funding account money is used to purchase the subsequent automobile loan contracts;]

(xv) principal will be paid on each class of the notes on each distribution date as necessary to build and maintain the required overcollateralization;

(xvi) a servicing fee is paid to the servicer monthly that equals 2.25% per annum times the aggregate principal balance of the automobile loan contracts as of the first day of the related collection period [plus the aggregate Principal Balance of all subsequent automobile loan contracts sold to the issuing entity];

(xvii) the trustee, the trust collateral agent, the owner trustee and the asset representations reviewer receive monthly fees equal to $[ ] in the aggregate; [and]

96