Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21864

WisdomTree Trust

(Exact name of registrant as specified in charter)

245 Park Avenue, 35th Floor

New York, NY 10167

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (866) 909-9473

Date of fiscal year end: August 31

Date of reporting period: August 31, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

Table of Contents

WisdomTree Trust

Currency Strategy, Fixed Income and Alternative Funds

Annual Report

August 31, 2016

Currency Strategy Funds:

WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU)

WisdomTree Brazilian Real Strategy Fund (BZF)

WisdomTree Chinese Yuan Strategy Fund (CYB)

WisdomTree Commodity Currency Strategy Fund (CCX)

WisdomTree Emerging Currency Strategy Fund (CEW)

WisdomTree Indian Rupee Strategy Fund (ICN)

Fixed Income Funds:

WisdomTree Asia Local Debt Fund (ALD)

WisdomTree Australia & New Zealand Debt Fund (AUNZ)

WisdomTree Barclays U.S. Aggregate Bond Enhanced Yield Fund (AGGY)

WisdomTree Barclays U.S. Aggregate Bond Negative Duration Fund (AGND)

WisdomTree Barclays U.S. Aggregate Bond Zero Duration Fund (AGZD)

WisdomTree Bloomberg Floating Rate Treasury Fund (USFR)

WisdomTree BofA Merrill Lynch High Yield Bond Negative Duration Fund (HYND)

WisdomTree BofA Merrill Lynch High Yield Bond Zero Duration Fund (HYZD)

WisdomTree Emerging Markets Corporate Bond Fund (EMCB)

WisdomTree Emerging Markets Local Debt Fund (ELD)

WisdomTree Japan Interest Rate Strategy Fund (JGBB)

WisdomTree Strategic Corporate Bond Fund (CRDT)

WisdomTree Western Asset Unconstrained Bond Fund (UBND)

Alternative Funds:

WisdomTree CBOE S&P 500 PutWrite Strategy Fund (PUTW)

WisdomTree Global Real Return Fund (RRF)

WisdomTree Managed Futures Strategy Fund (WDTI)

Table of Contents

| 1 | ||||

| 7 | ||||

| 29 | ||||

| 36 | ||||

| Schedules of Investments | ||||

| 39 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 49 | ||||

| 51 | ||||

WisdomTree Barclays U.S. Aggregate Bond Negative Duration Fund | 60 | |||

| 63 | ||||

| 66 | ||||

WisdomTree BofA Merrill Lynch High Yield Bond Negative Duration Fund | 67 | |||

WisdomTree BofA Merrill Lynch High Yield Bond Zero Duration Fund | 71 | |||

| 74 | ||||

| 77 | ||||

| 80 | ||||

| 81 | ||||

| 83 | ||||

| 86 | ||||

| 87 | ||||

| 89 | ||||

| 90 | ||||

| 95 | ||||

| 100 | ||||

| 108 | ||||

| 119 | ||||

| 145 | ||||

| 146 | ||||

| 147 | ||||

| 149 | ||||

| 151 |

“WisdomTree” is a registered mark of WisdomTree Investments, Inc. and is licensed for use by the WisdomTree Trust.

Table of Contents

Management’s Discussion of Funds’ Performance (unaudited)

Economic Environment

Over the fiscal year ended August 31, 2016, the global economy continued to expand, but at a slower pace. Despite keeping markets on edge for much of 2015, the U.S. Federal Reserve (Fed) decided to begin the path to raising rates in December 2015. In its announcement, the Fed increased the band of the Federal Funds Rate target from 0 to 25 basis points to 25 to 50 basis points. In doing so, it sought to emphasize that it intended to “gradually” normalize short term interest rates.

2016 began with selloffs in global markets as investors questioned the ability of central banks to revive growth; and fears and headlines about a potential U.S. recession began to surface. However, as commodity markets began to stabilize and the assumed pace of Fed tightening was pushed back, risk assets rebounded to end the quarter unchanged. Since falling as low as $26 a barrel in February, crude oil prices have since rallied to $45 a barrel by the end of August. The rebound in oil was seen as a barometer for the broader commodity complex as well as global growth expectations. Many emerging market (EM) countries are net commodity exporters and have been net beneficiaries. On the contrary, after a four-year rally, the U.S. dollar has generally been experiencing a period of consolidation. On the back of a weaker U.S. dollar and a stronger commodity outlook, EM currencies broadly rebounded throughout most of the fiscal year.

In June 2016, British voters surprised markets by voting to leave the European Union (EU). After the vote, global bond yields fell, pricing in expectations of slower economic growth across the United Kingdom and Europe at large. Global markets sold off and yields on the 10-Year U.S. Treasury note declined to 1.47% by the end of June as investors flocked toward safe haven assets. Curiously, in the weeks following the “Brexit” vote, global equity markets rebounded erasing earlier losses. This was primarily due to the likely delay in the triggering of Article 50 of the Lisbon treaty which sets out how an EU country might voluntarily leave the union. The global economy continues to muddle along despite heightened concerns about valuations.

To conclude, the global outlook largely remains policy dependent. Despite much speculation for potentially multiple rate hikes in 2016, the Fed has continued to revise down the number of hikes. Going back to last August, economists and portfolio managers alike were mixed in their opinions about if and when the Fed would even begin to raise the Fed Funds Rate.

Foreign Exchange and Fixed Income Markets

In the developed world, Japanese policy makers have joined the European Central Bank in moving their target policy rates below zero. European government bond yields continued to grind lower, with some countries experiencing negative bond yields out through 10 years. Last year, European Central Bank President Mario Draghi told investors around the world to brace for an uptick in bond market volatility. Despite nascent sparks of volatility in August 2016, volatility in the bond market is significantly lower than in August 2015.

In the U.S., 10-year treasury yields experienced approximately a 100 basis point range, but ended the fiscal year about 64 basis points lower than where they started in August 2015 (2.22% vs. 1.58%). With the Fed signaling for a “low and slow” rate hiking cycle, both corporate and high yield spreads tightened. High yield spreads tightened by about 54 basis points over the fiscal year (5.44% vs. 4.90%), and about 349 basis points since its 1-year high in February (8.39% vs. 4.90%). Crude oil strength benefitted high yield issuers with significant exposure to commodities after a difficult 2015. Similarly, yields in EM bonds (both sovereign and corporates) fell, resulting in positive performance. For the first time in over three years, locally-denominated EM sovereign debt provided positive returns, in the form of declining local bond yields and EM currency appreciation.

On the currency front, contrary to performance last year, the U.S. dollar has since given back some its previous gains. A lack of continued divergent monetary policies from the Fed against that of European and Japanese foreign central banks supported a stronger

| WisdomTree Currency Strategy, Fixed Income and Alternative Funds | 1 |

Table of Contents

Management’s Discussion of Funds’ Performance (unaudited) (continued)

European euro and Japanese yen over the fiscal year. Several risk-off trading sessions propelled the Japanese yen even higher as the currency was viewed as a haven asset. Additionally, currencies of heavy commodity exporters such as the Norwegian krone, Canadian dollar, Australian dollar, and the New Zealand dollar have all ended the fiscal year positive as China concerns subsided and commodity prices roared back. Resounding crude oil strength and easing geopolitical concerns contributed to two of the best performing currencies, the Brazilian real and the Russian ruble, each appreciating around 23% and 13%, respectively, year to date.

Fixed Income and Currency Strategy Funds’ Performance

Currency Strategy Funds

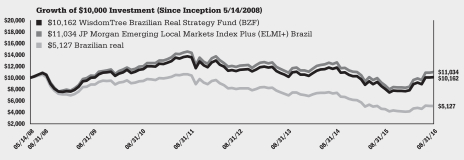

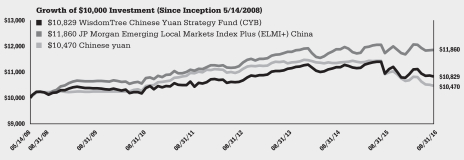

Income return was a strong driver of fund performance over the last fiscal year, while the currency strategy funds continued to achieve exposure to the applicable currency markets by investing primarily in short-term U.S. money market securities and/or forward currency contracts. Among the single currency funds for the fiscal year, all 3 funds produced total returns based on NAV which exceeded the change in value of the underlying currency. Of the strongest performing single currency funds, the WisdomTree Brazilian Real Strategy Fund and the WisdomTree Indian Rupee Strategy Fund, generated total returns for the fiscal year that were significantly greater than the underlying change in the spot return of the currency. Spot currency returns represent the change in foreign exchange rates versus the U.S. dollar available for immediate delivery. The WisdomTree Brazilian Real Strategy Fund increased 25.66% for the fiscal year based on NAV, outperforming the 12.63% appreciation in the Brazilian real versus the U.S. dollar. The WisdomTree Indian Rupee Strategy Fund increased by 4.71% in value for the fiscal year based on NAV, while the Indian rupee spot currency returned -1.04%. The WisdomTree Chinese Yuan Strategy Fund, which returned -1.01% for the fiscal year based on NAV, boosted relative performance versus the Chinese yuan through investments made in both onshore and offshore Chinese yuan forwards, outperforming the spot currency return of -4.14%.

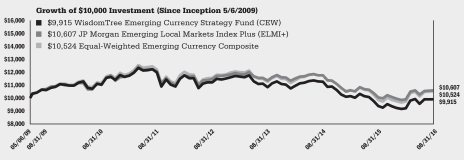

The WisdomTree Emerging Currency Strategy Fund posted a 5.64% return over the fiscal year, outperforming its industry reference benchmark, the JP Morgan Emerging Local Markets Index Plus, which returned 5.62%. The Fund’s overweights to Colombia, Brazil, and Indonesia were the largest contributors to the outperformance as these currencies were among the best performers over the past year. Underweights to Mexico helped as the peso was the worst performing EM currency over the same period. The Fund’s underweight to Russia and overweight to South Africa detracted from overall Fund performance.

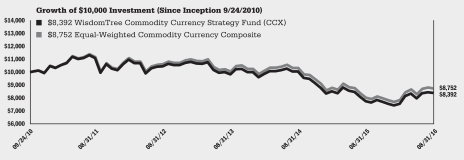

The WisdomTree Commodity Currency Strategy Fund increased by 8.19% over the fiscal year ended August 31, 2016 based on NAV. The Equal-Weighted Commodity Currency Composite returned 9.07% over the same period. Despite a poor start to the fiscal year, commodity currencies largely rebounded along with the broader commodity complex.

The WisdomTree Bloomberg U.S. Dollar Bullish Fund returned -2.05% over the fiscal year, underperforming its reference benchmark, the Bloomberg Dollar Total Return Index, which returned -1.70%. Concerns about the economic outlook of the United Kingdom and Europe contributed to U.S. dollar strength against the British pound and European euro, and therefore contributed positively to Fund performance for the fiscal year. However, a tremendously strong Japanese yen was a major detractor to performance, and more than offset those gains. The underperformance to its reference benchmark was primarily due to changes in the value of forward currency contracts.

Fixed Income Funds

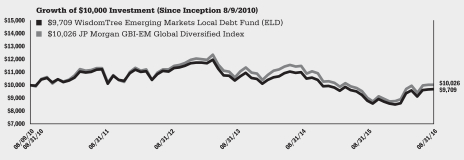

The WisdomTree Emerging Markets Local Debt Fund’s return of 10.34% based on NAV for the fiscal year was primarily driven by strong local bond returns that contributed both income and principal returns. The rebound in commodity prices in 2016 sparked a sharp

| 2 | WisdomTree Currency Strategy, Fixed Income and Alternative Funds |

Table of Contents

Management’s Discussion of Funds’ Performance (unaudited) (continued)

appreciation in EM currencies. Commodity exporters experienced the greatest gains as Brazil, Russia, and Colombia were prominent beneficiaries. As a region, Asian bonds fared better than those of Latin America, Europe, and South Africa sovereigns. Despite posting positive returns, the WisdomTree Emerging Markets Local Debt Fund underperformed its reference benchmark, the JP Morgan GBI-EM Global Diversified Index, by 0.99%.

Local Asian bonds performed well relative to local debt of other EM countries. The WisdomTree Asia Local Debt Fund gained 8.81% of its value based on NAV for the fiscal year ending August 31, 2016, underperforming its industry benchmark, the Markit iBoxx Asian Local Bond Index, by 2.42%. The Fund’s positive returns were most notably attributed to exposure to Indonesia, South Korea, and New Zealand. The Fund’s strategic exposure to Australia and New Zealand versus the Index were significant. Australia and New Zealand yields fell, while their currencies appreciated, both positive contributors for Fund returns.

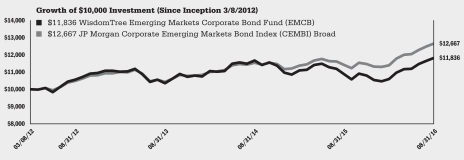

The WisdomTree Emerging Markets Corporate Bond Fund invests in the dollar-denominated debt of emerging market corporate issuers and utilizes the JP Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad as its industry reference benchmark. During the recently ended fiscal year, the Fund generated a total return of 8.71% based on NAV, underperforming its industry reference benchmark by 2.15% which returned 10.86% during the period. An overall bias to energy and commodity-related sectors, and underweights to financials contributed to Fund performance.

The WisdomTree Australia & New Zealand Debt Fund seeks to achieve a high level of total return consisting of both income and capital appreciation through investments in debt securities denominated in Australian or New Zealand dollars. The Fund employs a structured approach in balancing its investments between debt of sovereign and semi-government issuers (local, state, and territory governments of Australia) within the two countries and the debt of supranational and other agencies (for example, developmental organizations such as the World Bank or International Monetary Fund) in these countries. The Fund utilizes the Citigroup Australian Broad Investment-Grade Bond Index as its industry reference benchmark. The Fund outperformed its industry reference benchmark, which returned 12.89% versus the Fund’s return of 13.58% based on NAV for the fiscal year. The Fund benefitted positively from both currency and a local bond returns. Over the fiscal period, the Australian dollar and New Zealand dollar appreciated approximately 6% and 14% respectively. Falling Australian and New Zealand yields added to positive bond returns for the same period.

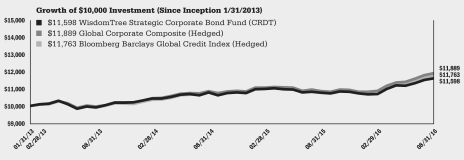

The WisdomTree Strategic Corporate Bond Fund seeks to achieve a high level of total return consisting of both income and capital appreciation through investments in the debt of corporate entities that are organized in or maintain their principal place of business in countries throughout the world, including the U.S. The Fund utilizes the Bloomberg Barclays Global Credit Index (Hedged) as its industry reference benchmark. The Bloomberg Barclays Global Credit Index (Hedged) contains investment-grade and high-yield credit securities from the Bloomberg Barclays Multiverse Index, which is a broad-based measure of the global fixed-income bond market. The Bloomberg Barclays Multiverse Index is the union of the Bloomberg Barclays Global Aggregate Index and the Bloomberg Barclays Global High Yield Index and captures investment grade and high yield securities in all eligible currencies. The Bloomberg Barclays Multiverse Index family includes a wide range of standard and customized subindices by sector, quality, maturity, and country. The Fund underperformed its industry reference benchmark, which returned 8.95% versus the Fund’s return of 7.85% based on NAV for the fiscal year.

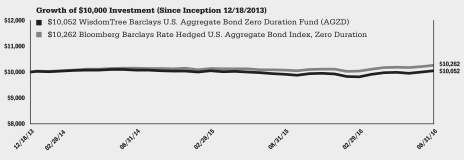

The WisdomTree Barclays U.S. Aggregate Bond Zero Duration Fund seeks to track the price and yield performance, before fees and expenses, of the Bloomberg Barclays Rate Hedged U.S. Aggregate Bond Index, Zero Duration. For the fiscal year ended August 31, 2016, the Index returned 1.86% versus the Fund’s return of 1.35% based on NAV. The difference between the Index and Fund returns are primarily due to representative

| WisdomTree Currency Strategy, Fixed Income and Alternative Funds | 3 |

Table of Contents

Management’s Discussion of Funds’ Performance (unaudited) (continued)

sampling, changes in the futures to cash bond basis, deductions for Fund expenses and transaction costs. During the fiscal year, the Fund invested in derivatives, specifically short futures contracts on U.S. Treasury bonds, to hedge against a rise in interest rates. At August 31, 2016, yields on 5-year, 10-year, and 30-year U.S. Treasury bonds all ended the period lower than where they began a year ago. As a result of the overall decline in U.S. Treasury yields, the Fund’s use of derivatives detracted from Fund performance during the fiscal period.

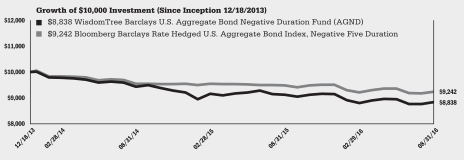

The WisdomTree Barclays U.S. Aggregate Bond Negative Duration Fund seeks to track the price and yield performance, before fees and expenses, of the Bloomberg Barclays Rate Hedged U.S. Aggregate Bond Index, Negative Five Duration. For the fiscal year ended August 31, 2016, the Index returned -2.50% versus the Fund’s return of -3.11% based on NAV. The difference between the Index and Fund returns are primarily due to representative sampling, deductions for Fund expenses and transaction costs. During the fiscal year, the Fund invested in derivatives, specifically short futures contracts on U.S. Treasury bonds, to hedge against a rise in interest rates. At August 31, 2016, yields on 5-year, 10-year, and 30-year U.S. Treasury bonds all ended the period lower than where they began a year ago. As a result of the overall decline in U.S. Treasury yields, the Fund’s use of derivatives detracted from Fund performance during the fiscal period.

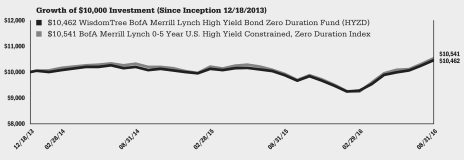

The WisdomTree BofA Merrill Lynch High Yield Bond Zero Duration Fund seeks to track the price and yield performance, before fees and expenses, of the BofA Merrill Lynch 0-5 Year U.S. High Yield Constrained, Zero Duration Index. For the fiscal year ended August 31, 2016, the Index returned 6.23% versus the Fund’s return of 5.92% based on NAV. The underperformance between the Fund and Index returns is primarily due to representative sampling and Fund expenses. During the fiscal year, the Fund invested in derivatives, specifically short futures contracts on U.S. Treasury bonds, to hedge against a rise in interest rates. At August 31, 2016, yields on 5-year, 10-year, and 30-year U.S. Treasury bonds all ended the period lower than where they began a year ago. As a result of the overall decline in U.S. Treasury yields, the Fund’s use of derivatives detracted from Fund performance during the fiscal period.

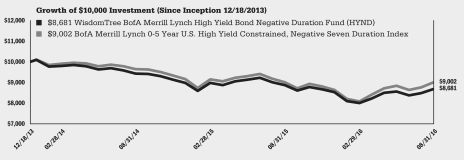

The WisdomTree BofA Merrill Lynch High Yield Bond Negative Duration Fund seeks to track the price and yield performance, before fees and expenses, of the BofA Merrill Lynch 0-5 Year U.S. High Yield Constrained, Negative Seven Duration Index. For the fiscal year ended August 31, 2016, the Index returned -0.12% versus the Fund’s return of -2.22% based on NAV. The underperformance is primarily due to representative sampling and Fund expenses. During the fiscal year, the Fund invested in derivatives, specifically short futures contracts on U.S. Treasury bonds, to hedge against a rise in interest rates. At August 31, 2016, yields on 5-year, 10-year, and 30-year U.S. Treasury bonds all ended the period lower than where they began a year ago. As a result of the overall decline in U.S. Treasury yields, the Fund’s use of derivatives detracted from Fund performance during the fiscal period.

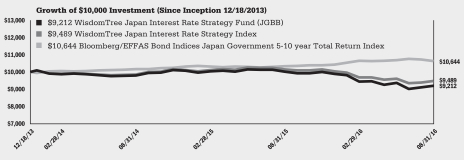

The WisdomTree Japan Interest Rate Strategy Fund seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Japan Interest Rate Strategy Index. For the fiscal year ended August 31, 2016, the Index returned -6.67% versus the Fund’s return of -8.10% based on NAV. The difference between the Index and Fund returns are primarily due to deductions for Fund expenses and transaction costs. During the period, the Fund utilized short forward currency contracts and short Japan Government Bond futures contracts in a strategy designed to rise in value when the Japanese yen depreciates against the U.S. dollar and/or Japanese interest rates rise. For the fiscal year ended August 31, 2016, the Fund’s use of short forward currency contracts detracted from Fund performance as the Japanese yen strengthened against the U.S. dollar by approximately 17% during the period. For the fiscal year ended August 31, 2016, the Fund’s use of short Japan Government Bond futures contracts detracted from Fund performance as the yields on 10-year Japan Government Bonds decreased overall by approximately 44 basis points year-over-year.

| 4 | WisdomTree Currency Strategy, Fixed Income and Alternative Funds |

Table of Contents

Management’s Discussion of Funds’ Performance (unaudited) (continued)

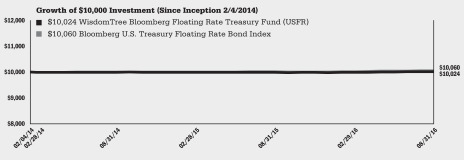

The WisdomTree Bloomberg Floating Rate Treasury Fund seeks to track the price and yield performance, before fees and expenses, of the Bloomberg U.S. Treasury Floating Rate Bond Index. For the fiscal year ended August 31, 2016, the Index returned 0.46% versus the Fund’s return of 0.28% based on NAV. The difference between the Index and Fund returns are primarily due to deductions for Fund expenses and transaction costs.

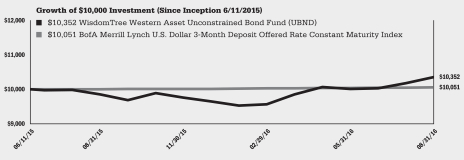

The WisdomTree Western Asset Unconstrained Bond Fund seeks to achieve a high level of return within the parameters of a focused risk-based target through investments across the global fixed income markets. The Fund is not managed to a benchmark. For the fiscal year ended August 31, 2016, the Fund has returned 5.09% based on NAV, with the main contributor to positive performance being a tightening in credit spreads of U.S. corporate and emerging market bonds. In comparison, the BofA Merrill Lynch U.S. Dollar 3-Month Deposit Offered Rate Constant Maturity Index has returned 0.46% in the same period. During the fiscal period ended August 31, 2016, the Fund utilized short futures contracts on U.S. Treasury bonds to hedge interest rate risk. At August 31, 2016, yields on 10-year and 30-year U.S. Treasury bonds ended the period 64 and 73 basis points lower, respectively, than at the start of the period. As a result of the overall decline in U.S. Treasury yields, the Fund’s use of short futures contracts to hedge against a rise in interest rates detracted from Fund performance during the fiscal period.

The WisdomTree Barclays U.S. Aggregate Bond Enhanced Yield Fund seeks to achieve the returns of the Bloomberg Barclays U.S. Aggregate Enhanced Yield Index. The Bloomberg Barclays U.S. Aggregate Enhanced Yield Index uses a rules-based approach to re-weight subcomponents of the Bloomberg Barclays U.S. Aggregate Index with the aim of earning a higher yield while broadly retaining the risk characteristics of the U.S. Aggregate. For the fiscal year ended August 31, 2016, the Fund has returned 7.81% based on NAV while the Index has returned 7.75%. During the same period, the Fund outperformed the Bloomberg Barclays U.S. Aggregate Index (5.97%) by 184 basis points. As a result of its longer duration profile and overweight to corporate bonds relative to the Bloomberg Barclays U.S. Aggregate Index, the Fund benefitted from falling yields and tightening corporate spreads.

Alternative Funds

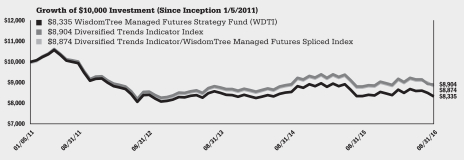

The WisdomTree Managed Futures Strategy Fund posted a -0.12% return based on NAV for the fiscal year ended August 31, 2016. The Fund underperformed its industry benchmark, the Diversified Trends Indicator Index by 1.25% based on NAV for the fiscal year. This was primarily due to deductions for Fund expenses and transaction costs.

Despite the Fed raising interest rates away from zero bound, longer term treasury yields generally fell over the fiscal year ended August 31, 2016. The market continues to grapple with the pace and timing of interest rate hikes in the U.S. At the beginning of 2016, there were expectations of up to 4 rate hikes. Since then, the Fed has yet to act on their second. Consequently, the U.S. dollar weakened and ended the fiscal year ending August 31, 2016 in negative territory. Although the European euro and British pound depreciated against the U.S. dollar on the back of concerns on Europe and United Kingdom growth, the Japanese yen sharply appreciated over the fiscal year. Gains from investments in Japanese yen more than offset losses from investments in the European euro and the British pound. Energy markets were significantly negative towards the end of 2015 before reversing course around the end first quarter of 2016. As a result, energy investments were a detractor to performance this year. Sugar ended the fiscal year nearly up 92%. Since peaking in 2014, livestock as a group continues to underperform. Live cattle and lean hog were among the bottom performing investments. Since hitting multiyear lows in December of 2015, both silver and gold picked up steam in the beginning of 2016, and never took the foot off the gas pedal. Led by 27% and 16% returns from silver and gold, the precious metals sector were strong contributors to Fund performance. In summary, investment positions in the sugar, the Japanese yen, and silver were the most significant contributors to performance. Conversely, positions in wheat, live cattle and corn were the largest detractors. Overall, the Fund’s use of derivatives contributed positively to performance for the fiscal year.

| WisdomTree Currency Strategy, Fixed Income and Alternative Funds | 5 |

Table of Contents

Management’s Discussion of Funds’ Performance (unaudited) (concluded)

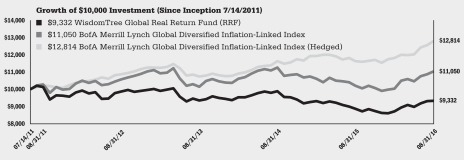

The WisdomTree Global Real Return Fund posted a 5.29% return over the fiscal year ended August 31, 2016, underperforming its industry reference benchmark, the BofA Merrill Lynch Global Diversified Inflation-Linked Index, which returned 8.24%. Over the course of the fiscal year, expectations for global inflation broadly improved as the Fed began its path to normalizing rates. Global inflation-linked investments contributed positively to performance. During the same period, the Fund utilized foreign currency contracts as hedges to offset currency risk from positions in international inflation linked bonds and international equities. The Fund’s use of forward foreign currency contracts broadly contributed positively to performance. These currency gains were primarily attributed to deprecation in the European euro and Mexican peso against the U.S. dollar.

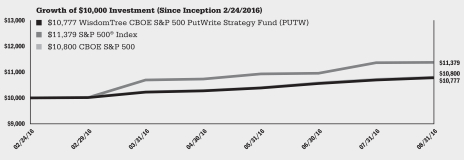

The WisdomTree CBOE S&P 500 PutWrite Strategy Fund posted a 7.77% return since its inception on February 24, 2016 through the fiscal period ended August 31, 2016, underperforming its industry reference benchmark, the CBOE S&P 500 PutWrite Index, which returned 8.00%. The difference between the Index and Fund returns are primarily due to deductions for Fund expenses and transaction costs. During the fiscal period, to implement its investment strategy, the Fund employed the use of derivatives, specifically by writing put options on the S&P 500 Index (SPX) in return for a premium from the option buyer. By selling SPX Put options, the Fund receives a premium from the option buyer, which increases the Fund’s return if the option is not exercised and expires worthless (i.e. “out-of-the-money”). If, however, the value of the SPX increases beyond the amount of premiums received, the Fund’s returns would not be expected to increase accordingly. Further, if the value of the SPX falls below the SPX Put option’s strike price, the option finishes “in-the-money” and the Fund pays the option buyer the difference between the SPX Put option strike price and the value of the SPX which would result in a loss to the Fund and detract from Fund performance. During the fiscal period, the S&P 500 Index returned 13.79% which translated overall into positive performance for the Fund as the written SPX put options were generally out-of-the-money.

| 6 | WisdomTree Currency Strategy, Fixed Income and Alternative Funds |

Table of Contents

Performance Summary (unaudited)

WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU)

Investment Breakdown† as of 8/31/16

| Investment Type | % of Net Assets | |||

U.S. Government Obligations | 98.4% | |||

Other Assets less Liabilities‡ | 1.6% | |||

Total | 100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Holdings* as of 8/31/16

| Description | % of Net Assets | |||

U.S. Treasury Bill, | 63.2% | |||

U.S. Treasury Bill, | 35.2% | |||

| * | The holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree Bloomberg U.S. Dollar Bullish Fund (the “Fund”) seeks to provide total returns, before fees and expenses, that exceed the performance of the Bloomberg Dollar Total Return Index (the “Index”).

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2016, the Fund’s annual expense ratio was 0.50%.

Performance as of 8/31/16

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | -2.05 | % | 4.76 | % | ||||

Fund Market Price Returns | -2.02 | % | 4.77 | % | ||||

Bloomberg Dollar Total Return Index | -1.70 | % | 5.37 | % | ||||

Bloomberg Dollar Spot Index | -1.57 | % | 5.77 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on December 18, 2013. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| WisdomTree Currency Strategy, Fixed Income and Alternative Funds | 7 |

Table of Contents

Performance Summary (unaudited)

WisdomTree Brazilian Real Strategy Fund (BZF)

Investment Breakdown† as of 8/31/16

| Investment Type | % of Net Assets | |||

U.S. Government Obligations | 81.0% | |||

Repurchase Agreement | 16.1% | |||

Other Assets less Liabilities‡ | 2.9% | |||

Total | 100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Holdings* as of 8/31/16

| Description | % of Net Assets | |||

U.S. Treasury Bill, | 64.0% | |||

U.S. Treasury Bill, | 17.0% | |||

Deutsche Bank, tri-party repurchase agreement, | 16.1% | |||

| * | The holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

| †† | Fully collateralized by U.S. Government securities. |

The WisdomTree Brazilian Real Strategy Fund (the “Fund”) seeks to achieve total returns reflective of both money market rates in Brazil available to foreign investors and changes in value of the Brazilian real relative to the U.S. dollar. The Brazilian real is a developing market currency, which can experience periods of significant volatility. Although the Fund invests in very short-term, investment grade instruments, the Fund is not a “money market” fund and it is not the objective of the Fund to maintain a constant share price.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2016, the Fund’s annual expense ratio was 0.45%.

Performance as of 8/31/16

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | Since Inception1 | |||||||||||||

Fund NAV Returns | 25.66 | % | -0.16 | % | -5.67 | % | 0.19 | % | ||||||||

Fund Market Price Returns | 25.84 | % | 0.16 | % | -5.49 | % | 0.12 | % | ||||||||

JP Morgan Emerging Local Markets Index Plus (ELMI+) Brazil | 26.83 | % | 0.42 | % | -5.15 | % | 1.19 | % | ||||||||

Brazilian real | 12.63 | % | -9.75 | % | -13.26 | % | -7.73 | % | ||||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on May 14, 2008. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| 8 | WisdomTree Currency Strategy, Fixed Income and Alternative Funds |

Table of Contents

Performance Summary (unaudited)

WisdomTree Chinese Yuan Strategy Fund (CYB)

Investment Breakdown† as of 8/31/16

| Investment Type | % of Net Assets | |||

U.S. Government Obligations | 68.7% | |||

Repurchase Agreement | 31.1% | |||

Other Assets less Liabilities‡ | 0.2% | |||

Total | 100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Holdings* as of 8/31/16

| Description | % of Net Assets | |||

U.S. Treasury Bill, | 52.3% | |||

Citigroup, Inc., tri-party repurchase agreement, | 31.1% | |||

U.S. Treasury Bill, | 16.4% | |||

| * | The holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

| †† | Fully collateralized by U.S. Government and U.S. Government agency securities. |

The WisdomTree Chinese Yuan Strategy Fund (the “Fund”) seeks to achieve total returns reflective of both money market rates in China available to foreign investors and changes in value of the Chinese yuan relative to the U.S. dollar. The Chinese yuan is a developing market currency, which can experience periods of significant volatility. Although the Fund invests in very short-term, investment grade instruments, the Fund is not a “money market” fund and it is not the objective of the Fund to maintain a constant share price.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2016, the Fund’s annual expense ratio was 0.45%.

Performance as of 8/31/16

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | Since Inception1 | |||||||||||||

Fund NAV Returns | -1.01 | % | -0.90 | % | 0.36 | % | 0.96 | % | ||||||||

Fund Market Price Returns | -0.89 | % | -0.88 | % | 0.33 | % | 0.83 | % | ||||||||

JP Morgan Emerging Local Markets Index Plus (ELMI+) China | 0.98 | % | 0.19 | % | 1.34 | % | 2.08 | % | ||||||||

Chinese yuan | -4.14 | % | -2.63 | % | -0.93 | % | 0.55 | % | ||||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on May 14, 2008. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| WisdomTree Currency Strategy, Fixed Income and Alternative Funds | 9 |

Table of Contents

Performance Summary (unaudited)

WisdomTree Commodity Currency Strategy Fund (CCX)

Investment Breakdown† as of 8/31/16

| Investment Type | % of Net Assets | |||

U.S. Government Obligations | 62.6% | |||

Repurchase Agreement | 31.5% | |||

Other Assets less Liabilities‡ | 5.9% | |||

Total | 100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Holdings* as of 8/31/16

| Description | % of Net Assets | |||

U.S. Treasury Bill, | 62.6% | |||

Citigroup, Inc., tri-party repurchase agreement, | 31.5% | |||

| * | The holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

| †† | Fully collateralized by U.S. Government and U.S. Government agency securities. |

The WisdomTree Commodity Currency Strategy Fund (the “Fund”) seeks to achieve total returns reflective of money market rates in selected commodity-producing countries and changes in value of such countries’ currencies relative to the U.S. dollar. The term “commodity currency” generally is used to describe the currency of a country whose economic success is commonly identified with the production and export of commodities (such as precious metals, oil, agricultural products or other raw materials) and whose value is closely linked to the value of such commodities. The Fund invests in commodity-producing countries, such as Australia, Brazil, Canada, Chile, Colombia, Indonesia, Malaysia, New Zealand, Norway, Peru, Russia and South Africa. This list may change based on market developments. Although this Fund invests in very short-term, investment grade instruments, the Fund is not a “money market” fund and it is not the objective of the Fund to maintain a constant share price.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2016, the Fund’s annual expense ratio was 0.55%.

Performance as of 8/31/16

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | Since Inception1 | |||||||||||||

Fund NAV Returns | 8.19 | % | -5.18 | % | -5.45 | % | -2.91 | % | ||||||||

Fund Market Price Returns | 7.63 | % | -5.04 | % | -5.46 | % | -2.89 | % | ||||||||

Barclays Commodity Producers Currency Index2 | 3.33 | % | -7.07 | % | -7.23 | % | -4.60 | % | ||||||||

Equal-Weighted Commodity Currency Composite | 9.07 | % | -4.54 | % | -4.78 | % | -2.22 | % | ||||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on September 24, 2010. |

| 2 | Total returns for the Index are only through June 6, 2016 as the Index has been discontinued by Barclays and, therefore, Index values are no longer available after this date. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| 10 | WisdomTree Currency Strategy, Fixed Income and Alternative Funds |

Table of Contents

Performance Summary (unaudited)

WisdomTree Emerging Currency Strategy Fund (CEW)

Investment Breakdown† as of 8/31/16

| Investment Type | % of Net Assets | |||

U.S. Government Obligations | 63.7% | |||

Repurchase Agreement | 32.0% | |||

Other Assets less Liabilities‡ | 4.3% | |||

Total | 100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Holdings* as of 8/31/16

| Description | % of Net Assets | |||

U.S. Treasury Bill, | 33.1% | |||

Citigroup, Inc., tri-party repurchase agreement, | 32.0% | |||

U.S. Treasury Bill, | 30.6% | |||

| * | The holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

| †† | Fully collateralized by U.S. Government and U.S. Government agency securities. |

The WisdomTree Emerging Currency Strategy Fund (the “Fund”) seeks to achieve total returns reflective of both money market rates in selected emerging market countries available to foreign investors and changes to the value of these currencies relative to the U.S. dollar. Emerging market currencies can experience periods of significant volatility. Although the Fund invests in short-term, investment grade instruments, the Fund is not a “money market” fund and it is not the objective of the Fund to maintain a constant share price.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2016, the Fund’s annual expense ratio was 0.55%.

Performance as of 8/31/16

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | Since Inception1 | |||||||||||||

Fund NAV Returns | 5.64 | % | -2.95 | % | -3.71 | % | -0.12 | % | ||||||||

Fund Market Price Returns | 5.45 | % | -2.87 | % | -3.71 | % | -0.24 | % | ||||||||

JP Morgan Emerging Local Markets Index Plus (ELMI+) | 5.62 | % | -2.30 | % | -2.52 | % | 0.81 | % | ||||||||

Equal-Weighted Emerging Currency Composite | 6.73 | % | -2.24 | % | -2.92 | % | 0.70 | % | ||||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on May 6, 2009. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| WisdomTree Currency Strategy, Fixed Income and Alternative Funds | 11 |

Table of Contents

Performance Summary (unaudited)

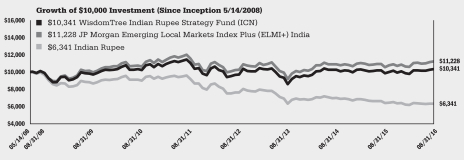

WisdomTree Indian Rupee Strategy Fund (ICN)

Investment Breakdown† as of 8/31/16

| Investment Type | % of Net Assets | |||

U.S. Government Obligations | 67.3% | |||

Repurchase Agreement | 31.3% | |||

Other Assets less Liabilities‡ | 1.4% | |||

Total | 100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Holdings* as of 8/31/16

| Description | % of Net Assets | |||

U.S. Treasury Bill, | 67.3% | |||

Citigroup, Inc., tri-party repurchase agreement, | 31.3% | |||

| * | The holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

| †† | Fully collateralized by U.S. Government and U.S. Government agency securities. |

The WisdomTree Indian Rupee Strategy Fund (the “Fund”) seeks to achieve total returns reflective of both money market rates in India available to foreign investors and changes in value of the Indian rupee relative to the U.S. dollar. The Indian rupee is a developing market currency, which can experience periods of significant volatility. Although the Fund invests in very short-term, investment grade instruments, the Fund is not a “money market” fund and it is not the objective of the Fund to maintain a constant share price.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2016, the Fund’s annual expense ratio was 0.45%.

Performance as of 8/31/16

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | Since Inception1 | |||||||||||||

Fund NAV Returns | 4.71 | % | 6.38 | % | -1.33 | % | 0.41 | % | ||||||||

Fund Market Price Returns | 4.82 | % | 6.02 | % | -1.39 | % | 0.31 | % | ||||||||

JP Morgan Emerging Local Markets Index Plus (ELMI+) India | 6.03 | % | 6.86 | % | -0.61 | % | 1.41 | % | ||||||||

Indian rupee | -1.04 | % | -0.07 | % | -7.20 | % | -5.34 | % | ||||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on May 14, 2008. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| 12 | WisdomTree Currency Strategy, Fixed Income and Alternative Funds |

Table of Contents

Performance Summary (unaudited)

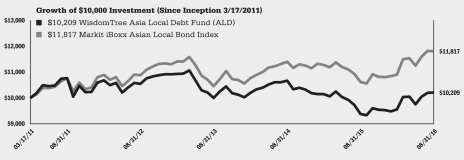

WisdomTree Asia Local Debt Fund (ALD)

Country Breakdown† as of 8/31/16

| Country | % of Net Assets | |||

Australia | 13.1% | |||

Supranational Bonds | 12.9% | |||

Thailand | 12.8% | |||

South Korea | 7.6% | |||

United States | 7.3% | |||

Hong Kong | 6.7% | |||

Philippines | 6.6% | |||

Malaysia | 6.3% | |||

Singapore | 6.2% | |||

Indonesia | 4.1% | |||

China | 4.1% | |||

New Zealand | 2.7% | |||

Other Assets less Liabilities‡ | 9.6% | |||

Total | 100.0% | |||

| † | The Fund’s country breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings* as of 8/31/16

| Description | % of Net Assets | |||

Citigroup, Inc., tri-party repurchase agreement, | 7.3% | |||

Hong Kong Government Bond Programme, | 4.4% | |||

Queensland Treasury Corp., | 4.4% | |||

International Finance Corp., | 4.2% | |||

Malaysia Government Bond, | 4.1% | |||

Nordic Investment Bank, | 4.1% | |||

South Australian Government Financing Authority, | 4.1% | |||

Thailand Government Bond, | 3.8% | |||

Thailand Government Bond, | 3.2% | |||

Western Australian Treasury Corp., | 3.0% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

| †† | Fully collateralized by U.S. Government securities. |

The WisdomTree Asia Local Debt Fund (the “Fund”) seeks a high level of total return consisting of both income and capital appreciation. The Fund attempts to achieve its objective through investments in fixed income instruments denominated in the currencies of a broad range of Asian countries.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2016, the Fund’s annual expense ratio was 0.55%.

Performance as of 8/31/16

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | Since Inception1 | |||||||||||||

Fund NAV Returns | 8.81 | % | 0.66 | % | -1.06 | % | 0.38 | % | ||||||||

Fund Market Price Returns | 9.30 | % | 0.96 | % | -1.10 | % | 0.36 | % | ||||||||

Markit iBoxx Asian Local Bond Index | 11.23 | % | 4.13 | % | 1.88 | % | 3.10 | % | ||||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on March 17, 2011. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| WisdomTree Currency Strategy, Fixed Income and Alternative Funds | 13 |

Table of Contents

Performance Summary (unaudited)

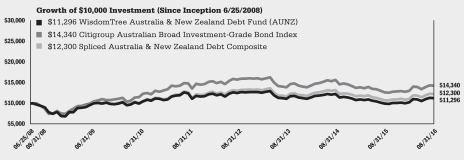

WisdomTree Australia & New Zealand Debt Fund (AUNZ)

Country Breakdown† as of 8/31/16

| Country | % of Net Assets | |||

Australia | 59.9% | |||

Supranational Bonds | 27.1% | |||

New Zealand | 11.8% | |||

Other Assets less Liabilities‡ | 1.2% | |||

Total | 100.0% | |||

| † | The Fund’s country breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings* as of 8/31/16

| Description | % of Net Assets | |||

Australia Government Bond, | 3.5% | |||

Australia Government Bond, | 2.7% | |||

Nordic Investment Bank, | 2.5% | |||

Treasury Corp. of Victoria, | 2.4% | |||

Northern Territory Treasury Corp., | 2.4% | |||

European Bank for Reconstruction & Development, | 2.4% | |||

Western Australian Treasury Corp., | 2.4% | |||

Australia Government Bond, | 2.3% | |||

Australia Government Bond, | 2.3% | |||

Queensland Treasury Corp., | 2.3% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree Australia & New Zealand Debt Fund (the “Fund”) seeks a high level of total return consisting of both income and capital appreciation. The Fund attempts to achieve its investment objective through investments in fixed income instruments denominated in Australian or New Zealand dollars.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2016, the Fund’s annual expense ratio was 0.45%.

Performance as of 8/31/16

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | Since Inception1 | |||||||||||||

Fund NAV Returns2 | 13.58 | % | 0.54 | % | -1.93 | % | 1.50 | % | ||||||||

Fund Market Price Returns2 | 14.14 | % | 0.66 | % | -1.96 | % | 1.40 | % | ||||||||

Citigroup Australian Broad Investment-Grade Bond Index | 12.89 | % | 1.02 | % | -0.75 | % | 4.50 | % | ||||||||

Spliced Australia & New Zealand Debt Composite | 14.33 | % | 1.72 | % | -0.58 | % | 2.56 | % | ||||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on June 25, 2008. |

| 2 | The information reflects the investment objective and strategy of the WisdomTree Dreyfus New Zealand Dollar Fund through October 24, 2011 and the investment objective of the WisdomTree Australia & New Zealand Debt Fund thereafter. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| 14 | WisdomTree Currency Strategy, Fixed Income and Alternative Funds |

Table of Contents

Performance Summary (unaudited)

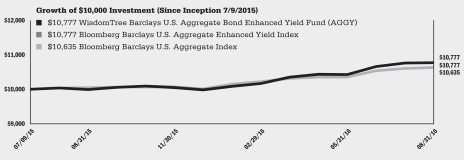

WisdomTree Barclays U.S. Aggregate Bond Enhanced Yield Fund (AGGY)

Investment Breakdown† as of 8/31/16

| Investment Type | % of Net Assets | |||

Corporate Bonds | 41.9% | |||

U.S. Government Agencies | 24.6% | |||

U.S. Government Obligations | 16.3% | |||

Commercial Mortgage-Backed Securities | 6.6% | |||

Foreign Corporate Bonds | 6.3% | |||

Foreign Government Obligations | 2.4% | |||

Municipal Bonds | 1.0% | |||

Asset-Backed Securities | 0.4% | |||

Foreign Government Agencies | 0.2% | |||

U.S. Government Agencies Sold Short | -0.5% | |||

Other Assets less Liabilities‡ | 0.8% | |||

Total | 100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings* as of 8/31/16

| Description | % of Net Assets | |||

U.S. Treasury Note, | 2.7% | |||

U.S. Treasury Note, | 2.2% | |||

U.S. Treasury Note, | 1.8% | |||

U.S. Treasury Bond, | 1.5% | |||

U.S. Treasury Bond, | 1.4% | |||

U.S. Treasury Note, | 1.3% | |||

Tennessee Valley Authority, | 1.1% | |||

U.S. Treasury Note, | 1.0% | |||

U.S. Treasury Note, | 1.0% | |||

Federal National Mortgage Association, | 1.0% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree Barclays U.S. Aggregate Bond Enhanced Yield Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the Bloomberg Barclays U.S. Aggregate Enhanced Yield Index.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2016, the Fund’s net and gross annual expense ratios were 0.12% and 0.20%, respectively. WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.12% through December 31, 2016, unless earlier terminated by the Board of Trustees of the Trust for any reason at any time.

Performance as of 8/31/16

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 7.81 | % | 6.74 | % | ||||

Fund Market Price Returns | 8.06 | % | 6.91 | % | ||||

Bloomberg Barclays U.S. Aggregate Enhanced Yield Index | 7.75 | % | 6.73 | % | ||||

Bloomberg Barclays U.S. Aggregate Index | 5.97 | % | 5.51 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on July 9, 2015. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| WisdomTree Currency Strategy, Fixed Income and Alternative Funds | 15 |

Table of Contents

Performance Summary (unaudited)

WisdomTree Barclays U.S. Aggregate Bond Negative Duration Fund (AGND)

Investment Breakdown† as of 8/31/16

Investment Type | % of Net Assets | |||

U.S. Government Obligations | 29.7% | |||

U.S. Government Agencies | 28.8% | |||

Corporate Bonds | 24.7% | |||

Commercial Mortgage-Backed Securities | 4.6% | |||

Foreign Corporate Bonds | 3.0% | |||

Foreign Government Obligations | 1.6% | |||

Supranational Bond | 1.6% | |||

Municipal Bond | 1.2% | |||

Foreign Government Agencies | 1.1% | |||

Other Assets less Liabilities‡ | 3.7% | |||

Total | 100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings* as of 8/31/16

Description | % of Net Assets | |||

U.S. Treasury Note, | 16.6% | |||

U.S. Treasury Bond, | 3.8% | |||

U.S. Treasury Bond, | 3.4% | |||

U.S. Treasury Bond, | 3.0% | |||

U.S. Treasury Bond, | 2.9% | |||

Federal Home Loan Mortgage Corp., | 2.0% | |||

Federal National Mortgage Association, | 1.8% | |||

Government National Mortgage Association, | 1.8% | |||

Federal Home Loan Mortgage Corp., | 1.7% | |||

European Investment Bank, | 1.6% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree Barclays U.S. Aggregate Bond Negative Duration Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the Bloomberg Barclays Rate Hedged U.S. Aggregate Bond Index, Negative Five Duration (the “Index”).

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2016, the Fund’s annual expense ratio was 0.28%.

Performance as of 8/31/16

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | -3.11 | % | -4.46 | % | ||||

Fund Market Price Returns | -2.78 | % | -4.38 | % | ||||

Bloomberg Barclays Rate Hedged U.S. Aggregate Bond Index, Negative Five Duration | -2.50 | % | -3.51 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NASDAQ on December 18, 2013. |