Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21864

WisdomTree Trust

(Exact name of registrant as specified in charter)

245 Park Avenue, 35th Floor

New York, NY 10167

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (866) 909-9473

Date of fiscal year end: August 31

Date of reporting period: August 31, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

Table of Contents

WisdomTree Trust

Currency Strategy, Fixed Income and Alternative Funds

Annual Report

August 31, 2017

Currency Strategy Funds:

WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU)

WisdomTree Brazilian Real Strategy Fund (BZF)

WisdomTree Chinese Yuan Strategy Fund (CYB)

WisdomTree Emerging Currency Strategy Fund (CEW)

Fixed Income Funds:

WisdomTree Asia Local Debt Fund (ALD)

WisdomTree Barclays Interest Rate Hedged U.S. Aggregate Bond Fund (AGZD)

(formerly, WisdomTree Barclays U.S. Aggregate Bond Zero Duration Fund)

WisdomTree Barclays Negative Duration U.S. Aggregate Bond Fund (AGND)

(formerly, WisdomTree Barclays U.S. Aggregate Bond Negative Duration Fund)

WisdomTree Barclays Yield Enhanced U.S. Aggregate Bond Fund (AGGY)

(formerly, WisdomTree Barclays U.S. Aggregate Bond Enhanced Yield Fund)

WisdomTree Barclays Yield Enhanced U.S. Short-Term Aggregate Bond Fund (SHAG)

WisdomTree Bloomberg Floating Rate Treasury Fund (USFR)

WisdomTree Emerging Markets Corporate Bond Fund (EMCB)

WisdomTree Emerging Markets Local Debt Fund (ELD)

WisdomTree Interest Rate Hedged High Yield Bond Fund (HYZD)

(formerly, WisdomTree BofA Merrill Lynch High Yield Bond Zero Duration Fund)

WisdomTree Negative Duration High Yield Bond Fund (HYND)

(formerly, WisdomTree BofA Merrill Lynch High Yield Bond Negative Duration Fund)

Alternative Funds:

WisdomTree CBOE S&P 500 PutWrite Strategy Fund (PUTW)

WisdomTree Managed Futures Strategy Fund (WDTI)

Table of Contents

| 1 | ||||

| 6 | ||||

| 22 | ||||

| 27 | ||||

| Schedules of Investments | ||||

| 30 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

WisdomTree Barclays Interest Rate Hedged U.S. Aggregate Bond Fund | 39 | |||

WisdomTree Barclays Negative Duration U.S. Aggregate Bond Fund | 42 | |||

| 46 | ||||

WisdomTree Barclays Yield Enhanced U.S. Short-Term Aggregate Bond Fund | 58 | |||

| 60 | ||||

| 61 | ||||

| 64 | ||||

| 67 | ||||

| 73 | ||||

| 78 | ||||

| 79 | ||||

| 80 | ||||

| 84 | ||||

| 88 | ||||

| 94 | ||||

| 102 | ||||

| 123 | ||||

Approval of Investment Advisory and Sub-Advisory Agreements (unaudited) | 124 | |||

| 127 | ||||

| 129 | ||||

| 130 |

“WisdomTree” is a registered mark of WisdomTree Investments, Inc. and is licensed for use by the WisdomTree Trust.

Table of Contents

Management’s Discussion of Funds’ Performance

(unaudited)

Economic Environment

Over the fiscal year ended August 31, 2017, the global economy continued to slowly expand, with some areas of note showing improvements, while others were showing signs of slight sluggishness.

After raising the fed funds rate from a 0% – 0.50% target to a 0.50% – 0.75% target in December of 2016, the U.S. Federal Reserve (Fed) continued its path of raising rates in March and June of 2017, to targets of 0.75% – 1.00% and 1.00% – 1.25%, respectively. In doing so, the Fed continued their intent to “gradually” normalize short term interest rates. Since August 31, 2017, the Fed has announced their intent to begin normalizing their $4.5 trillion balance sheet, with runoffs scheduled to start in October of 2017 and for subsequent quarters. In addition, they indicated one more potential rate hike in 2017 occurring, with the possibility of three rate hikes in 2018.

Calendar year 2017 began with the continuation of the “inflation trade” post-President Trump’s election into office in November of 2016. U.S. equity markets have continued their historical bull run, with a near 18.5% return in the S&P 500 Index since the election and 16.23% for the fiscal year ending August 31, 2017. A combination of global reflation, positive corporate earnings and financials, as well as hopes for deregulation, repatriation, and tax reform have continued to drive markets to all-time highs. Despite a myriad of headlines surrounding economic fears of a recession, geopolitical fears surrounding President Trump, North Korea, and natural disasters, these “Teflon” markets have shrugged off any short-term volatility in stride and have continued to settle at newer highs.

However, as commodity markets began to stabilize running into the end of 2016, crude oil prices have since been largely range-bound between $54 and $42 a barrel through the end of August 2017. The first 7 months of 2017 showed continued downward pressure on prices, with only the last few months showing regained strength.

The U.S. dollar continued its multi-year rally from August 31, 2016 through the end of calendar year 2016, seeing a 6.4% increase. However, what followed for 2017 would be the biggest weakening period for the U.S. dollar in nearly a decade. The Dollar Spot Index ended the fiscal year at 92.7 as of August 31, 2017. This is a nearly 9.3% drop since the beginning of the year (102.2), and as a result, emerging market (EM) assets broadly have seen a sharp and steady rebound throughout most of the year. Much of the EM rally has also not been driven by commodity prices like in years past, but rather improving sectors such as Financials and Technology.

After the June Brexit vote in 2016, global bond yields and stock markets fell as they priced in expectations for slower economic growth in the U.K. and Europe at large. Since then, U.K. and European GDP forecasts and markets have rallied sharply, erasing most of the losses that occurred after the vote. In some cases, these rebounds have surpassed pre-vote levels. While some of this fueled by the weakening U.S. dollar, the European recovery has a handful of catalysts that could help drive markets farther; the unraveling of the “Trump Trade” as we have seen in recent weeks, the market-friendly results in most of the European elections that occurred this year, as well as improved corporate earnings and economic growth.

To conclude, the global outlook largely remains policy and interest rates dependent. Barring any geopolitical crisis, much of the concepts that have driven movements for the first 8 months of 2017 should continue through the end of the year and into next year, hinged on the ideas of improved financials, low and steady U.S. interest rate increases, and the enactment of market-friendly policies.

Foreign Exchange and Fixed Income Markets

In the developed world, Japanese policy makers continue to target policy rates below zero like their European Central Bank (ECB) counterparts. European government bond yields continued to grind lower, with some countries experiencing negative bond yields out

| WisdomTree Currency Strategy, Fixed Income and Alternative Funds | 1 |

Table of Contents

Management’s Discussion of Funds’ Performance (unaudited) (continued)

through 10 years. ECB President Mario Draghi has not said when or if he will begin to taper off of their Quantitative Easing (QE) program, or if he intends on raising rates in the future, but has indicated his willingness to do what is necessary when the time is right, perhaps learning from his premature announcements and policies of years past. As of August 31, 2017, U.K. 10-year bonds are up fiscal year from 0.64% to 1.03%, German 10-year bonds are up from -0.07% to 0.36%, while Japan 10-year bond yields have been relatively near their 0% pegged yield.

In the U.S., the 10-year treasury yield has experienced some volatility during the fiscal year. The 10-year yield started at 1.58% on August 31, 2016 and ended at 2.44% on December 31, 2016. 10-year treasury yields rose as high as 2.63% following the first rate-hike of 2017, but have been largely in a downward trend since then. The 10-year yield fell to 2.12% by the end of August 2017. U.S. 10-Year – 2 Year spreads have come full circle after starting the fiscal year at 0.77%, widening to as high as 1.36%, and then tightening back to 0.79% at the end of August 2017. With the Fed signaling for a “low and slow” rate hiking cycle, corporate investment grade and high yield spreads tightened. For high yield spreads, they tightened by about 1.12% over the fiscal year (4.90% vs. 3.78%), and were as low as 3.44% in early March 2017. For investment grade spreads, they tightened by about 0.25% (1.35% to 1.10%), which also saw lows of 1.02% in late July and early August of 2017. Similar to last year, yields in emerging market bonds (both sovereign and corporates) fell, resulting in positive performance. Also, locally-denominated EM sovereign debt provided positive returns resulting from declining local bond yields, a weakening U.S. dollar, and EM currency appreciation.

On the currency front, the U.S. dollar has seen sharp declines from its highs in the beginning of 2017, helping to strengthen the Japanese yen and Euro considerably. Japanese yen strengthening can also be contributed by those seeking a safer haven asset from the growing geopolitical risk of the United States, while impactful European elections yielded market favorable outcomes and signs of improving economic outlooks have helped strengthen the Euro. Several risk-off trading sessions propelled the Japanese yen even higher as the currency was viewed as a safe haven asset. Additionally, currencies of heavy commodity exporters such as the Norwegian krone and Canadian dollar have ended the fiscal year positive as China concerns subsided and commodity prices roared back. Along the same previously mentioned ideas, EM and European currencies were among the best performing currencies during the fiscal year. For the fiscal year ended August 31, 2017, the South African rand appreciated 13.29%, the Russian ruble 12.63%, the Polish zloty 9.57% and Czech koruna appreciated 10.50%. After the Trump campaign rhetoric failed to materialize substantive policies, many investors took back increased exposure into the Mexican Peso, as it appreciated 15.9% from the beginning of 2017 to August 31, 2017, and 5.02% during the fiscal year.

Fixed Income and Currency Strategy Funds’ Performance

For the fiscal year ending August 31, 2017, 12 of 13 fixed income and currency strategy funds (excluding funds with less than six months of operating history) had positive performance based on net asset value (NAV).

Currency Strategy Funds

Currency appreciation and income returns were strong drivers of fund performance over the fiscal year, while the currency strategy funds continued to achieve exposure to the applicable currency markets by investing primarily in short-term U.S. money market securities and forward currency contracts.

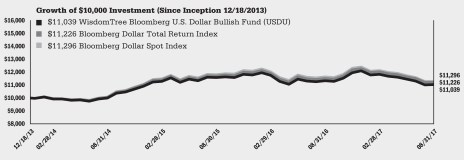

The WisdomTree Bloomberg U.S. Dollar Bullish Fund returned -2.66% over the fiscal year based on NAV, underperforming its industry reference benchmark, the Bloomberg U.S. Dollar Total Return Index, by 0.11%. Geopolitical concerns contributed to a weakening of the U.S. dollar in 2017, and therefore was a detractor from Fund performance for the fiscal year. The slight underperformance to its industry reference benchmark was primarily due to changes in the value of forward currency contracts and deductions for Fund expenses.

| 2 | WisdomTree Currency Strategy, Fixed Income and Alternative Funds |

Table of Contents

Management’s Discussion of Funds’ Performance (unaudited) (continued)

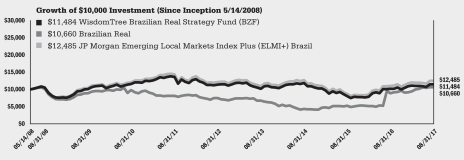

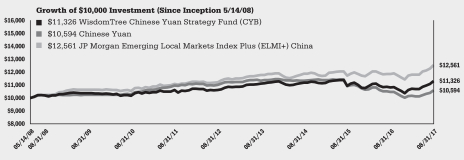

For the two single currency funds for the fiscal year, both funds produced total returns based on NAV which exceeded the change in value of the underlying currency (see pages 7 and 8 herein for standardized performance tables for each single currency fund). Of the strongest performing single currency funds, the WisdomTree Brazilian Real Strategy Fund (the “Brazilian Real Strategy Fund”) generated total returns for the fiscal year that were significantly greater than the underlying change in the spot return of the currency. Spot currency returns represent the change in foreign exchange rates versus the U.S. dollar available for immediate delivery. The Brazilian Real Strategy Fund increased 13.01% for the fiscal year based on NAV, outperforming the 2.78% appreciation in the Brazilian real versus the U.S. dollar. The WisdomTree Chinese Yuan Strategy Fund, which returned 4.59% for the fiscal year based on NAV, boosted relative performance versus the Chinese yuan through investments made in both onshore and offshore Chinese yuan forwards, outperforming the spot return of 1.19%

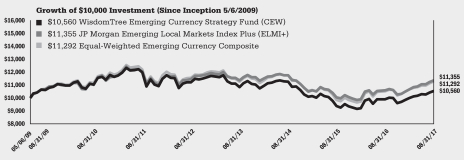

The WisdomTree Emerging Currency Strategy Fund posted a 6.51% return over the fiscal year based on NAV, underperforming its industry reference benchmark, the JP Morgan Emerging Local Markets Index Plus, which returned 7.05%. The Fund’s overweights to the Philippines, Colombia, and Indonesia were the largest contributors to the underperformance as these currencies were among the worst performers over the past year. Overweights to Poland and Chile contributed positively to Fund performance as both were among some of the stronger performing EM currencies over the same period.

Fixed Income Funds

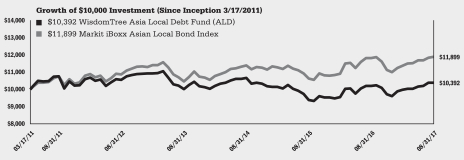

Local Asian bonds performed well relative to local debt of other emerging market countries. The WisdomTree Asia Local Debt Fund returned 1.81% based on NAV for the fiscal year ending August 31, 2017, outperforming its industry reference benchmark, the Markit iBoxx Asian Local Bond Index, by 1.11%. The Fund’s positive returns were most notably attributed to exposure to the Thailand baht, South Korean won, and Singapore dollar. The Fund’s strategic exposure to Australia and New Zealand versus the benchmark were significant. Australia’s currency appreciated 5.72% during the fiscal year, providing an additional positive contributor for the Fund’s return.

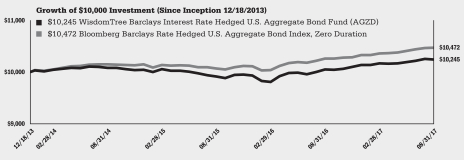

The WisdomTree Barclays Interest Rate Hedged U.S. Aggregate Bond Fund (formerly the WisdomTree Barclays U.S. Aggregate Bond Zero Duration Fund) seeks to track the price and yield performance, before fees and expenses, of the Bloomberg Barclays Rate Hedged U.S. Aggregate Bond Index, Zero Duration. For the fiscal year ended August 31, 2017, the Index returned 2.04% versus the Fund’s return of 1.93% based on NAV. The difference between the Index and Fund returns are primarily due to representative sampling, deductions for Fund expenses and transaction costs. During the fiscal year, the Fund invested in derivatives, specifically short futures contracts on U.S. Treasury bonds, to hedge against a rise in interest rates. At August 31, 2017, yields on 5-year, 10-year, and 30-year U.S. Treasury bonds all ended the period higher than where they began a year ago, but off their highs from the beginning of calendar year 2017. As a result of the overall increase in U.S. Treasury yields, the Fund’s use of derivatives contributed positively to Fund performance during the fiscal year.

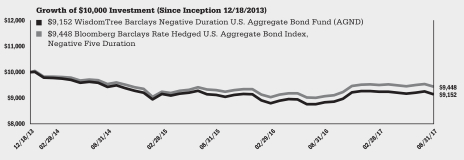

The WisdomTree Barclays Negative Duration U.S. Aggregate Bond Fund (formerly the WisdomTree Barclays U.S. Aggregate Bond Negative Duration Fund) seeks to track the price and yield performance, before fees and expenses, of the Bloomberg Barclays Rate Hedged U.S. Aggregate Bond Index, Negative Five Duration. For the fiscal year ended August 31, 2017, the Index returned 4.06% versus the Fund’s return of 3.55% based on NAV. The difference between the Index and Fund returns are primarily due to representative sampling, deductions for Fund expenses and transaction costs. During the fiscal year, the Fund invested in derivatives, specifically short futures contracts on U.S. Treasury bonds, to hedge against a rise in interest rates. At August 31, 2017, yields on 5-year, 10-year, and 30-year U.S. Treasury bonds all ended the period higher than where they began a year ago, but off their highs from the beginning of calendar year 2017. As a result of the overall increase in U.S. Treasury yields, the Fund’s use of derivatives contributed positively to the Fund’s performance during the fiscal period.

| WisdomTree Currency Strategy, Fixed Income and Alternative Funds | 3 |

Table of Contents

Management’s Discussion of Funds’ Performance (unaudited) (continued)

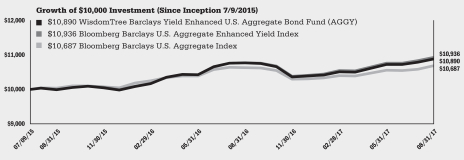

The WisdomTree Barclays Yield Enhanced U.S. Aggregate Bond Fund (formerly the WisdomTree Barclays U.S. Aggregate Bond Enhanced Yield Fund) seeks to achieve the returns of the Bloomberg Barclays U.S. Aggregate Enhanced Yield Index (the “Index”). The Index uses a rules-based approach to re-weight subcomponents of the Bloomberg Barclays U.S. Aggregate Index (the “U.S. Aggregate Index”) with the aim of earning a higher yield while broadly retaining the risk characteristics of the U.S. Aggregate Index. For the fiscal year ended August 31, 2017, the Fund returned 1.05% based on NAV while the Index returned 1.49%. During the same period, the Fund outperformed the U.S. Aggregate Index (0.49%) by 0.56%. As a result of its overweight to corporate bonds relative to the U.S. Aggregate Index, the Fund benefitted from tightening corporate spreads during the fiscal year. The Fund’s longer duration profile will typically benefit the Fund in falling rate periods, and detract from it in rising rate periods.

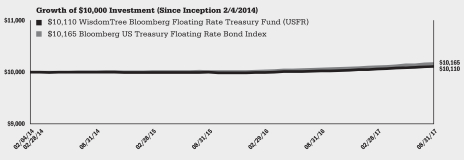

The WisdomTree Bloomberg Floating Rate Treasury Fund seeks to track the price and yield performance, before fees and expenses, of the Bloomberg U.S. Treasury Floating Rate Bond Index. For the fiscal year ended August 31, 2017, the Index returned 1.04% versus the Fund’s return of 0.85% based on NAV. The difference between the Index and Fund returns are primarily due to deductions for Fund expenses and transaction costs.

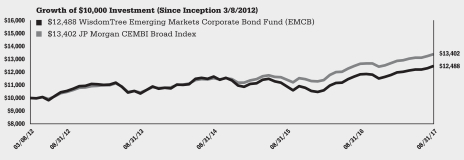

The WisdomTree Emerging Markets Corporate Bond Fund invests in the dollar-denominated debt of emerging market corporate issuers and utilizes the JP Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad as its industry reference benchmark. During the fiscal year, the Fund generated a total return of 5.51% based on NAV, underperforming its industry reference benchmark by about 0.30% which returned 5.81% during the period. Every country exposure within the Fund and the industry reference benchmark had positive total returns for the fiscal year. However, some countries far outperformed others. The Fund’s largest overweight was to Argentina, which was one of the top 5 performers for the fiscal year. The Fund’s underweight to Israel and significant underweight to China were positive contributors to the Fund’s performance. Some of the top detractors to the Fund’s performance relative to the industry reference benchmark were the Fund’s overweights to Russia and Colombia.

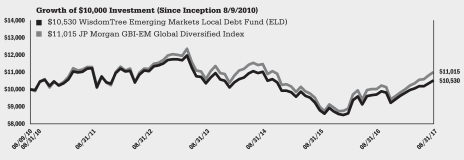

The WisdomTree Emerging Markets Local Debt Fund’s return of 8.46% based on NAV for the fiscal year were primarily driven by strong local bond returns, both contributed income and principal returns. Most EM currencies have appreciated, along with a weak U.S. dollar, on the backs of stronger outlooks and improving financials. Despite posting positive returns, the Emerging Market Local Debt Fund underperformed its industry reference benchmark, JP Morgan GBI-EM Global Diversified Index (9.86%) by 1.40%. This relative underperformance was due in large part because of the Fund’s Poland and Mexico underweights relative to the benchmark.

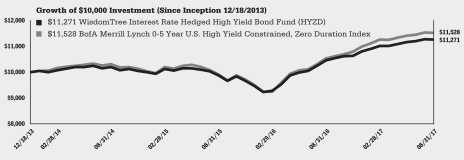

The WisdomTree Interest Rate Hedged High Yield Bond Fund (formerly the WisdomTree BofA Merrill Lynch High Yield Bond Zero Duration Fund) seeks to track the price and yield performance, before fees and expenses, of the BofA Merrill Lynch 0-5 Year U.S. High Yield Constrained, Zero Duration Index. For the fiscal year ending August 31, 2017, the Index returned 9.37% versus the Fund’s return of 7.73% based on NAV. The difference between the Fund and Index returns are primarily due to representative sampling, deductions for Fund expenses and transaction costs. During the fiscal year, the Fund invested in derivatives, specifically short futures contracts on U.S. Treasury bonds, to hedge against a rise in interest rates. At August 31, 2017, yields on 5-year, 10-year, and 30-year U.S. Treasury bonds all ended the period higher than where they began a year ago, but off their highs from the beginning of the calendar year. As a result of net positive capital share transactions in the Fund since the beginning of calendar year 2017 and the overall decline in U.S. Treasury yields during that period, the Fund’s use of derivatives detracted from overall Fund performance during the fiscal year ended August 31, 2017. In addition, high yield securities have outperformed their investment grade counterparts during the fiscal year, thus contributing more to the positive performance.

| 4 | WisdomTree Currency Strategy, Fixed Income and Alternative Funds |

Table of Contents

Management’s Discussion of Funds’ Performance (unaudited) (concluded)

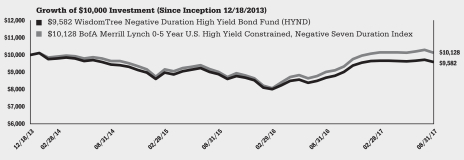

The WisdomTree Negative Duration High Yield Bond Fund (formerly the WisdomTree BofA Merrill Lynch High Yield Bond Negative Duration Fund) seeks to track the price and yield performance, before fees and expenses, of the BofA Merrill Lynch 0-5 Year U.S. High Yield Constrained, Negative Seven Duration Index. For the fiscal year ended August 31, 2017, the Index returned 12.51% versus the Fund’s return of 10.44% based on NAV. The underperformance is primarily due to representative sampling, deductions for Fund expenses and transaction costs. During the fiscal year, the Fund invested in derivatives, specifically short futures contracts on U.S. Treasury bonds, to hedge against a rise in interest rates. At August 31, 2017, yields on 5-year, 10-year, and 30-year U.S. Treasury bonds all ended the period higher than where they began a year ago, but off their highs from the beginning of the year. As a result of net positive capital share transactions in the Fund since the beginning of calendar year 2017 and the overall decline in U.S. Treasury yields during that period, the Fund’s use of derivatives detracted from overall Fund performance during the fiscal year ended August 31, 2017. In addition, high yield securities have outperformed their investment grade counterparts during this period, thus contributing more to the positive performance.

Alternative Funds

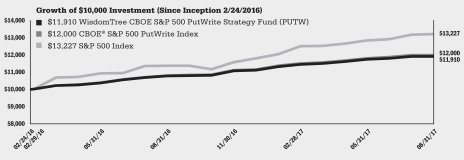

The WisdomTree CBOE S&P 500 PutWrite Strategy Fund posted a 10.52% return based on NAV for the fiscal year ended August 31, 2017, underperforming its industry reference benchmark, the CBOE S&P 500 PutWrite Index (the “Index”), which returned 11.12%. The difference between the Index and Fund returns are primarily due to deductions for Fund expenses and transaction costs.

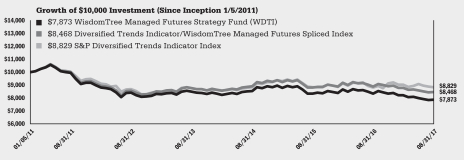

The WisdomTree Managed Futures Strategy Fund seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Managed Futures Index. For the fiscal year ended August 31, 2017, the Index returned -4.62% versus the Fund’s return of -5.54% based on NAV. The difference between the Index and Fund returns are primarily due to deductions for Fund expenses and transaction costs. Some of the top contributors to the Fund’s performance were its short exposure to copper positions throughout the fiscal year, the Fund’s long exposure to the Euro in the last quarter of the fiscal year, and the Fund’s short exposure to lean hogs futures in the first month of the fiscal year. Some of the top detractors to the Fund’s performance during the fiscal year were various positions in high grade copper and silver, and the Fund’s long exposure to natural gas futures in the first five months of 2017.

Despite the Fed raising interest rates away from zero bound, longer term treasury yields generally fell over the fiscal year ending August 31, 2017. The market continued to grapple with the pace and timing of interest rate hikes in the U.S. At the beginning of 2016, there were expectations of up to 4 rate hikes, and yet the Fed rates rose once in 2016. Since then, the Fed has had 2 rate hikes in 2017, with the expectation of a third later in 2017. Consequently, the U.S. dollar weakened significantly through August 31, 2017. The Euro and British strengthened against the U.S. dollar on the back of overblown fears of Brexit as well as an economic recovery underway in Europe The Japanese yen also had strengthened over the year in large part from a weakening U.S. dollar. Energy markets were significantly negative through the year ended August 31, 2017. As a result, energy investments were a detractor to Fund performance this year. Sugar ended the fiscal year down nearly 25%. Live cattle and lean hog futures were among the worst performing investments. Precious metals like gold and silver have been largely flat during the fiscal year. In the recent months leading up to August 31, 2017, Wheat futures contracts saw a spike up in price, only to come back down into negative performance territory.

| WisdomTree Currency Strategy, Fixed Income and Alternative Funds | 5 |

Table of Contents

Performance Summary (unaudited)

WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU)

Investment Breakdown† as of 8/31/17

| Investment Type | % of Net Assets | |||

U.S. Government Obligations | 99.4% | |||

Other Assets less Liabilities‡ | 0.6% | |||

Total | 100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Holdings* as of 8/31/17

| Description | % of Net Assets | |||

U.S. Treasury Bill, | 51.1% | |||

U.S. Treasury Bill, | 48.3% | |||

| * | The holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree Bloomberg U.S. Dollar Bullish Fund (the ‘‘Fund’’) seeks to provide total returns, before fees and expenses, that exceed the performance of the Bloomberg Dollar Total Return Index (the ‘‘Index’’).

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2017, the Fund’s annual expense ratio was 0.50%.

Performance as of 8/31/17

| Average Annual Total Return | ||||||||||||

| 1 Year | 3 Year | Since Inception1 | ||||||||||

Fund NAV Returns | -2.66 | % | 3.36 | % | 2.71 | % | ||||||

Fund Market Price Returns | -2.73 | % | 3.33 | % | 2.69 | % | ||||||

Bloomberg Dollar Total Return Index | -2.55 | % | 3.76 | % | 3.17 | % | ||||||

Bloomberg Dollar Spot Index | -2.94 | % | 3.85 | % | 3.34 | % | ||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on December 18, 2013. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| 6 | WisdomTree Currency Strategy, Fixed Income and Alternative Funds |

Table of Contents

Performance Summary (unaudited)

WisdomTree Brazilian Real Strategy Fund (BZF)

Investment Breakdown† as of 8/31/17

| Investment Type | % of Net Assets | |||

U.S. Government Obligations | 87.9% | |||

Other Assets less Liabilities‡ | 12.1% | |||

Total | 100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Holdings* as of 8/31/17

| Description | % of Net Assets | |||

U.S. Treasury Bill, | 44.0% | |||

U.S. Treasury Bill, | 43.9% | |||

| * | The holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree Brazilian Real Strategy Fund (the ‘‘Fund’’) seeks to achieve total returns reflective of both money market rates in Brazil available to foreign investors and changes in value of the Brazilian real relative to the U.S. dollar. The Brazilian real is a developing market currency, which can experience periods of significant volatility. Although the Fund invests in very short-term, investment grade instruments, the Fund is not a ‘‘money market’’ fund and it is not the objective of the Fund to maintain a constant share price.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2017, as amended August 29, 2017, the Fund’s annual expense ratio was 0.45%.

Performance as of 8/31/17

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | Since Inception1 | |||||||||||||

Fund NAV Returns | 13.01 | % | -0.95 | % | 0.13 | % | 1.50 | % | ||||||||

Fund Market Price Returns | 12.34 | % | -0.95 | % | 0.17 | % | 1.37 | % | ||||||||

JP Morgan Emerging Local Markets Index Plus (ELMI+) Brazil | 13.15 | % | -0.53 | % | 0.58 | % | 2.41 | % | ||||||||

Brazilian real | 2.78 | % | -10.74 | % | -8.40 | % | -6.65 | % | ||||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on May 14, 2008. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| WisdomTree Currency Strategy, Fixed Income and Alternative Funds | 7 |

Table of Contents

Performance Summary (unaudited)

WisdomTree Chinese Yuan Strategy Fund (CYB)

Investment Breakdown† as of 8/31/17

| Investment Type | % of Net Assets | |||

U.S. Government Obligations | 63.2% | |||

Repurchase Agreement | 32.0% | |||

Other Assets less Liabilities‡ | 4.8% | |||

Total | 100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Holdings* as of 8/31/17

| Description | % of Net Assets | |||

U.S. Treasury Bill, | 42.3% | |||

Citigroup, Inc., tri-party repurchase agreement, | 32.0% | |||

U.S. Treasury Bill, | 20.9% | |||

| * | The holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

| †† | Fully collateralized by U.S. Government and U.S. Government agency securities. |

The WisdomTree Chinese Yuan Strategy Fund (the ‘‘Fund”) seeks to achieve total returns reflective of both money market rates in China available to foreign investors and changes in value of the Chinese yuan relative to the U.S. dollar. The Chinese yuan is a developing market currency, which can experience periods of significant volatility. Although the Fund invests in very short-term, investment grade instruments, the Fund is not a “money market” fund and it is not the objective of the Fund to maintain a constant share price.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2017, the Fund’s annual expense ratio was 0.45%.

Performance as of 8/31/17

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | Since Inception1 | |||||||||||||

Fund NAV Returns | 4.59 | % | 0.38 | % | 1.29 | % | 1.35 | % | ||||||||

Fund Market Price Returns | 4.84 | % | 0.47 | % | 1.32 | % | 1.25 | % | ||||||||

JP Morgan Emerging Local Markets Index Plus (ELMI+) China | 5.92 | % | 1.86 | % | 2.26 | % | 2.48 | % | ||||||||

Chinese yuan | 1.19 | % | -2.27 | % | -0.79 | % | 0.62 | % | ||||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on May 14, 2008. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| 8 | WisdomTree Currency Strategy, Fixed Income and Alternative Funds |

Table of Contents

Performance Summary (unaudited)

WisdomTree Emerging Currency Strategy Fund (CEW)

Investment Breakdown† as of 8/31/17

| Investment Type | % of Net Assets | |||

U.S. Government Obligations | 66.9% | |||

Repurchase Agreement | 31.6% | |||

Other Assets less Liabilities‡ | 1.5% | |||

Total | 100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Holdings* as of 8/31/17

| Description | % of Net Assets | |||

U.S. Treasury Bill, | 34.6% | |||

U.S. Treasury Bill, | 32.3% | |||

Citigroup, Inc., tri-party repurchase agreement, | 31.6% | |||

| * | The holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

| †† | Fully collateralized by U.S. Government and U.S. Government agency securities. |

The WisdomTree Emerging Currency Strategy Fund (the ‘‘Fund’’) seeks to achieve total returns reflective of both money market rates in selected emerging market countries available to foreign investors and changes to the value of these currencies relative to the U.S. dollar. Emerging market currencies can experience periods of significant volatility. Although the Fund invests in short-term, investment grade instruments, the Fund is not a ‘’money market’’ fund and it is not the objective of the Fund to maintain a constant share price.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2017, the Fund’s annual expense ratio was 0.55%.

Performance as of 8/31/17

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | Since Inception1 | |||||||||||||

Fund NAV Returns | 6.51 | % | -2.15 | % | -1.20 | % | 0.66 | % | ||||||||

Fund Market Price Returns | 6.51 | % | -2.17 | % | -1.22 | % | 0.55 | % | ||||||||

JP Morgan Emerging Local Markets Index Plus (ELMI+) | 7.05 | % | -1.15 | % | -0.20 | % | 1.54 | % | ||||||||

Equal-Weighted Emerging Currency Composite | 7.31 | % | -1.33 | % | -0.46 | % | 1.47 | % | ||||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on May 6, 2009. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| WisdomTree Currency Strategy, Fixed Income and Alternative Funds | 9 |

Table of Contents

Performance Summary (unaudited)

WisdomTree Asia Local Debt Fund (ALD)

Country Breakdown† as of 8/31/17

| Country | % of Net Assets | |||

Thailand | 12.7% | |||

Australia | 12.7% | |||

United States | 11.0% | |||

Supranational Bonds | 10.4% | |||

Indonesia | 10.3% | |||

Singapore | 6.2% | |||

Hong Kong | 6.1% | |||

Malaysia | 6.0% | |||

Philippines | 5.8% | |||

South Korea | 4.4% | |||

China | 3.8% | |||

New Zealand | 3.2% | |||

India | 1.9% | |||

Other Assets less Liabilities‡ | 5.5% | |||

Total | 100.0% | |||

| † | The Fund’s country breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings* as of 8/31/17

| Description | % of Net Assets | |||

Citigroup, Inc., tri-party repurchase agreement, | 11.0% | |||

Queensland Treasury Corp., | 4.3% | |||

South Australian Government Financing Authority, | 3.7% | |||

Indonesia Treasury Bond, | 3.3% | |||

Thailand Government Bond, | 3.2% | |||

International Finance Corp., | 3.1% | |||

Western Australian Treasury Corp., | 3.1% | |||

Nordic Investment Bank, | 3.0% | |||

Indonesia Treasury Bond, | 2.9% | |||

Thailand Government Bond, | 2.8% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

| †† | Fully collateralized by U.S. Government and U.S. Government agency securities. |

The WisdomTree Asia Local Debt Fund (the ‘‘Fund’’) seeks a high level of total return consisting of both income and capital appreciation. The Fund attempts to achieve its objective through investments in fixed income instruments denominated in the currencies of a broad range of Asian countries.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2017, the Fund’s annual expense ratio was 0.55%.

Performance as of 8/31/17

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | Since Inception1 | |||||||||||||

Fund NAV Returns | 1.81 | % | -0.90 | % | -0.30 | % | 0.60 | % | ||||||||

Fund Market Price Returns | 1.81 | % | -0.78 | % | -0.30 | % | 0.58 | % | ||||||||

Markit iBoxx Asian Local Bond Index | 0.70 | % | 1.44 | % | 1.81 | % | 2.73 | % | ||||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on March 17, 2011. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| 10 | WisdomTree Currency Strategy, Fixed Income and Alternative Funds |

Table of Contents

Performance Summary (unaudited)

WisdomTree Barclays Interest Rate Hedged U.S. Aggregate Bond Fund (AGZD)

(Formerly, WisdomTree Barclays U.S. Aggregate Bond Zero Duration Fund)

Investment Breakdown† as of 8/31/17

| Investment Type | % of Net Assets | |||

U.S. Government Obligations | 33.6% | |||

U.S. Government Agencies | 29.9% | |||

Corporate Bonds | 25.3% | |||

Foreign Corporate Bonds | 4.3% | |||

Commercial Mortgage-Backed Securities | 4.0% | |||

Foreign Government Obligations | 1.4% | |||

Municipal Bond | 0.8% | |||

U.S. Government Agencies Sold Short | -0.8% | |||

Other Assets less Liabilities‡ | 1.5% | |||

Total | 100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings* as of 8/31/17

| Description | % of Net Assets | |||

U.S. Treasury Note, | 11.1% | |||

U.S. Treasury Note, | 4.8% | |||

U.S. Treasury Bond, | 4.3% | |||

U.S. Treasury Note, | 3.2% | |||

U.S. Treasury Note, | 2.3% | |||

U.S. Treasury Bond, | 2.3% | |||

U.S. Treasury Note, | 1.3% | |||

U.S. Treasury Note, | 1.3% | |||

Government National Mortgage Association, | 1.3% | |||

Government National Mortgage Association, | 1.3% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree Barclays Interest Rate Hedged U.S. Aggregate Bond Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the Bloomberg Barclays Rate Hedged U.S. Aggregate Bond Index, Zero Duration (the ‘‘Index’’).

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2017, the Fund’s annual expense ratio was 0.23%.

Performance as of 8/31/17

| Average Annual Total Return | ||||||||||||

| 1 Year | 3 Year | Since Inception1 | ||||||||||

Fund NAV Returns | 1.93 | % | 0.53 | % | 0.66 | % | ||||||

Fund Market Price Returns | 2.14 | % | 0.53 | % | 0.72 | % | ||||||

Bloomberg Barclays Rate Hedged U.S. Aggregate Bond Index, Zero Duration | 2.04 | % | 1.04 | % | 1.25 | % | ||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NASDAQ on December 18, 2013. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| WisdomTree Currency Strategy, Fixed Income and Alternative Funds | 11 |

Table of Contents

Performance Summary (unaudited)

WisdomTree Barclays Negative Duration U.S. Aggregate Bond Fund (AGND)

(Formerly, WisdomTree Barclays U.S. Aggregate Bond Negative Duration Fund)

Investment Breakdown† as of 8/31/17

| Investment Type | % of Net Assets | |||

U.S. Government Obligations | 36.3% | |||

U.S. Government Agencies | 29.4% | |||

Corporate Bonds | 23.7% | |||

Foreign Corporate Bonds | 2.7% | |||

Commercial Mortgage-Backed Securities | 2.2% | |||

Foreign Government Agencies | 1.2% | |||

Foreign Government Obligations | 1.1% | |||

Asset-Backed Securities | 0.6% | |||

Municipal Bonds | 0.6% | |||

Other Assets less Liabilities‡ | 2.2% | |||

Total | 100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings* as of 8/31/17

| Description | % of Net Assets | |||

U.S. Treasury Note, | 4.7% | |||

U.S. Treasury Note, | 4.1% | |||

U.S. Treasury Note, | 4.1% | |||

U.S. Treasury Note, | 3.2% | |||

U.S. Treasury Note, | 2.9% | |||

U.S. Treasury Bond, | 2.8% | |||

U.S. Treasury Bond, | 2.7% | |||

U.S. Treasury Note, | 1.8% | |||

U.S. Treasury Note, | 1.7% | |||

U.S. Treasury Note, | 1.7% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree Barclays Negative Duration U.S. Aggregate Bond Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the Bloomberg Barclays Rate Hedged U.S. Aggregate Bond Index, Negative Five Duration (the ‘‘Index’’).

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2017, the Fund’s annual expense ratio was 0.28%.

Performance as of 8/31/17

| Average Annual Total Return | ||||||||||||

| 1 Year | 3 Year | Since Inception1 | ||||||||||

Fund NAV Returns | 3.55 | % | -1.02 | % | -2.36 | % | ||||||

Fund Market Price Returns | 3.80 | % | -0.98 | % | -2.24 | % | ||||||

Bloomberg Barclays Rate Hedged U.S. Aggregate Bond Index, Negative Five Duration | 4.06 | % | -0.36 | % | -1.52 | % | ||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NASDAQ on December 18, 2013. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| 12 | WisdomTree Currency Strategy, Fixed Income and Alternative Funds |

Table of Contents

Performance Summary (unaudited)

WisdomTree Barclays Yield Enhanced U.S. Aggregate Bond Fund (AGGY)

(Formerly, WisdomTree Barclays U.S. Aggregate Bond Enhanced Yield Fund)

Investment Breakdown† as of 8/31/17

| Investment Type | % of Net Assets | |||

Corporate Bonds | 41.0% | |||

U.S. Government Agencies | 24.9% | |||

U.S. Government Obligations | 14.7% | |||

Foreign Corporate Bonds | 8.3% | |||

Commercial Mortgage-Backed Securities | 6.9% | |||

Foreign Government Obligations | 2.6% | |||

Municipal Bonds | 0.7% | |||

Foreign Government Agencies | 0.1% | |||

Other Assets less Liabilities‡ | 0.8% | |||

Total | 100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings* as of 8/31/17

| Description | % of Net Assets | |||

U.S. Treasury Note, | 3.0 | % | ||

U.S. Treasury Note, | 2.4 | % | ||

U.S. Treasury Note, | 1.0 | % | ||

U.S. Treasury Bond, | 0.9 | % | ||

U.S. Treasury Note, | 0.9 | % | ||

Federal National Mortgage Association, | 0.8 | % | ||

U.S. Treasury Note, | 0.7 | % | ||

Federal National Mortgage Association, | 0.7 | % | ||

Federal National Mortgage Association, | 0.7 | % | ||

U.S. Treasury Note, | 0.6 | % | ||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree Barclays Yield Enhanced U.S. Aggregate Bond Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the Bloomberg Barclays U.S. Aggregate Enhanced Yield Index.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2017, the Fund’s net and gross annual expense ratios were 0.12% and 0.20%, respectively. WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.12% through December 31, 2017, unless earlier terminated by the Board of Trustees of the Trust for any reason at any time.

Performance as of 8/31/17

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 1.05 | % | 4.05 | % | ||||

Fund Market Price Returns | 1.03 | % | 4.13 | % | ||||

Bloomberg Barclays U.S. Aggregate Enhanced Yield Index | 1.49 | % | 4.26 | % | ||||

Bloomberg Barclays U.S. Aggregate Index | 0.49 | % | 3.14 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on July 9, 2015. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| WisdomTree Currency Strategy, Fixed Income and Alternative Funds | 13 |

Table of Contents

Performance Summary (unaudited)

WisdomTree Barclays Yield Enhanced U.S. Short-Term Aggregate Bond Fund (SHAG)

Investment Breakdown† as of 8/31/17

| Investment Type | % of Net Assets | |||

Corporate Bonds | 63.1% | |||

U.S. Government Obligations | 17.9% | |||

Commercial Mortgage-Backed Securities | 6.1% | |||

U.S. Government Agencies | 5.4% | |||

Foreign Corporate Bonds | 3.8% | |||

Foreign Government Obligations | 1.4% | |||

Other Assets less Liabilities‡ | 2.3% | |||

Total | 100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings* as of 8/31/17

| Description | % of Net Assets | |||

U.S. Treasury Note, | 9.9% | |||

U.S. Treasury Note, | 8.0% | |||

Federal National Mortgage Association, | 5.4% | |||

Bank of New York Mellon Corp. (The), | 2.0% | |||

American International Group, Inc., | 2.0% | |||

CVS Health Corp., | 2.0% | |||

AbbVie, Inc., | 2.0% | |||

Sysco Corp., | 2.0% | |||

Dow Chemical Co. (The), | 2.0% | |||

Time Warner, Inc., | 2.0% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree Barclays Yield Enhanced U.S. Short-Term Aggregate Bond Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the Bloomberg Barclays U.S. Short Aggregate Enhanced Yield Index.

The Fund had less than six months of operating history at the end of the reporting period and therefore no comparative performance information is shown in this shareholder report. Comparative performance information for the most recent month-end is available at www.wisdomtree.com.

| 14 | WisdomTree Currency Strategy, Fixed Income and Alternative Funds |

Table of Contents

Performance Summary (unaudited)

WisdomTree Bloomberg Floating Rate Treasury Fund (USFR)

Investment Breakdown†

as of 8/31/17

| Investment Type | % of Net Assets | |||

U.S. Government Obligations | 99.8% | |||

Other Assets less Liabilities‡ | 0.2% | |||

Total | 100.0% | |||

| † | The Fund’s investment breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Holdings* as of 8/31/17

| Description | % of Net Assets | |||

U.S. Treasury Floating Rate Note, | 27.0% | |||

U.S. Treasury Floating Rate Note, | 27.0% | |||

U.S. Treasury Floating Rate Note, | 27.0% | |||

U.S. Treasury Floating Rate Note, | 18.8% | |||

| * | The holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular security. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree Bloomberg Floating Rate Treasury Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of an index that measures the performance of the market for floating rate public obligations of the U.S. Treasury.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2017, the Fund’s net and gross annual expense ratios were 0.15% and 0.20%, respectively. WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.15% through December 31, 2017, unless earlier terminated by the Board of Trustees of the Trust for any reason at any time.

Performance as of 8/31/17

| Average Annual Total Return | ||||||||||||

| 1 Year | 3 Year | Since Inception1 | ||||||||||

Fund NAV Returns | 0.85 | % | 0.38 | % | 0.31 | % | ||||||

Fund Market Price Returns | 0.93 | % | 0.34 | % | 0.22 | % | ||||||

Bloomberg U.S. Treasury Floating Rate Bond Index | 1.04 | % | 0.52 | % | 0.46 | % | ||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on February 4, 2014. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| WisdomTree Currency Strategy, Fixed Income and Alternative Funds | 15 |

Table of Contents

Performance Summary (unaudited)

WisdomTree Emerging Markets Corporate Bond Fund (EMCB)

Country Breakdown† as of 8/31/17

| Country | % of Net Assets | |||

Brazil | 14.8% | |||

Russia | 10.8% | |||

Hong Kong | 10.4% | |||

China | 5.8% | |||

Mexico | 5.5% | |||

Argentina | 5.4% | |||

South Korea | 5.0% | |||

Indonesia | 4.1% | |||

Turkey | 3.7% | |||

Singapore | 3.5% | |||

Colombia | 3.5% | |||

India | 2.8% | |||

Peru | 2.7% | |||

United Arab Emirates | 2.4% | |||

Kazakhstan | 2.3% | |||

Chile | 2.3% | |||

Morocco | 2.1% | |||

Qatar | 1.3% | |||

Malaysia | 1.2% | |||

Luxembourg | 0.7% | |||

Guatemala | 0.7% | |||

South Africa | 0.6% | |||

Poland | 0.6% | |||

Kuwait | 0.6% | |||

Ecuador | 0.5% | |||

Ghana | 0.5% | |||

Senegal | 0.5% | |||

Honduras | 0.5% | |||

Other Assets less Liabilities‡ | 5.2% | |||

Total | 100.0% | |||

| † | The Fund’s country breakdown may change over time. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings* as of 8/31/17

| Description | % of Net Assets | |||

Hutchison Whampoa International 12 II Ltd., | 2.9% | |||

Shinhan Bank Co., Ltd., | 2.8% | |||

Braskem America Finance Co., | 2.6% | |||

Petrobras Global Finance B.V., | 2.5% | |||

Southern Copper Corp., | 2.5% | |||

Petrobras Global Finance B.V., | 2.4% | |||

Lukoil International Finance B.V., | 2.4% | |||

KazMunayGas National Co. JSC, | 2.3% | |||

Oversea-Chinese Banking Corp. Ltd., | 2.2% | |||

OCP S.A., | 2.1% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree Emerging Markets Corporate Bond Fund (the ‘‘Fund’’) seeks a high level of total return consisting of both income and capital appreciation. The Fund attempts to achieve its objective through investments in debt securities issued by corporate entities that are domiciled in, or economically tied to, emerging market countries.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated January 1, 2017, as amended August 23, 2017, the Fund’s annual expense ratio was 0.60%.

Performance as of 8/31/17

| Average Annual Total Return | ||||||||||||||||

| 1 Year | 3 Year | 5 Year | Since Inception1 | |||||||||||||

Fund NAV Returns | 5.51 | % | 2.28 | % | 3.40 | % | 4.13 | % | ||||||||

Fund Market Price Returns | 5.98 | % | 2.02 | % | 3.24 | % | 4.05 | % | ||||||||

JP Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad | 5.81 | % | 5.08 | % | 5.02 | % | 5.48 | % | ||||||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the NASDAQ on March 8, 2012. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.