Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21864

WisdomTree Trust

(Exact name of registrant as specified in charter)

245 Park Avenue, 35th Floor

New York, NY 10167

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (866) 909-9473

Date of fiscal year end: June 30

Date of reporting period: June 30, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached hereto.

Table of Contents

WisdomTree Trust

Annual Report

June 30, 2018

International Equity ETFs:

WisdomTree Dynamic Currency Hedged Europe Equity Fund (DDEZ)

WisdomTree Dynamic Currency Hedged International Equity Fund (DDWM)

WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Fund (DHDG)

WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund (DDLS)

WisdomTree Dynamic Currency Hedged Japan Equity Fund (DDJP)

WisdomTree Emerging Markets Dividend Fund (DVEM)

WisdomTree Europe Domestic Economy Fund (EDOM)

WisdomTree Global ex-Mexico Equity Fund (XMX)

WisdomTree Global Hedged SmallCap Dividend Fund (HGSD)

WisdomTree Global SmallCap Dividend Fund (GSD)

WisdomTree ICBCCS S&P China 500 Fund (WCHN)

Fixed Income ETFs:

WisdomTree Fundamental U.S. Corporate Bond Fund (WFIG)

WisdomTree Fundamental U.S. High Yield Corporate Bond Fund (WFHY)

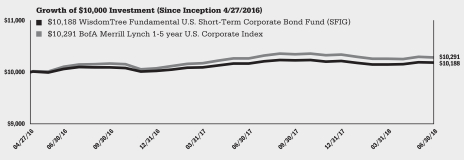

WisdomTree Fundamental U.S. Short-Term Corporate Bond Fund (SFIG)

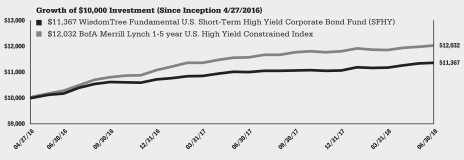

WisdomTree Fundamental U.S. Short-Term High Yield Corporate Bond Fund (SFHY)

Alternative ETFs:

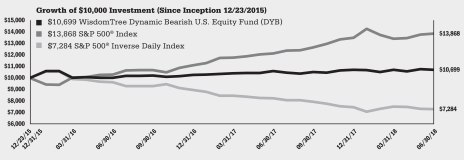

WisdomTree Dynamic Bearish U.S. Equity Fund (DYB)

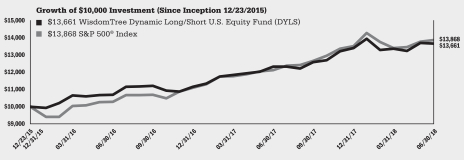

WisdomTree Dynamic Long/Short U.S. Equity Fund (DYLS)

Asset Allocation ETFs:

WisdomTree Balanced Income Fund (WBAL)

Table of Contents

| 1 | ||||

Information about Performance and Shareholder Expense Examples (unaudited) | 3 | |||

| 4 | ||||

| 22 | ||||

| Schedules of Investments | ||||

| 26 | ||||

WisdomTree Dynamic Currency Hedged International Equity Fund | 31 | |||

WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Fund | 44 | |||

WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund | 49 | |||

| 62 | ||||

| 68 | ||||

| 78 | ||||

| 82 | ||||

| 89 | ||||

| 97 | ||||

| 104 | ||||

| 111 | ||||

| 113 | ||||

| 115 | ||||

WisdomTree Fundamental U.S. Short-Term High Yield Corporate Bond Fund | 117 | |||

| 119 | ||||

| 122 | ||||

| 124 | ||||

| 125 | ||||

| 129 | ||||

| 133 | ||||

| 139 | ||||

| 148 | ||||

| 169 | ||||

| 171 | ||||

| 173 | ||||

| 175 | ||||

“WisdomTree” is a registered mark of WisdomTree Investments, Inc. and is licensed for use by the WisdomTree Trust.

Table of Contents

(unaudited)

The U.S. equity market, as measured by the S&P 500® Index, returned 14.37% for the 12-month fiscal period that ended June 30, 2018 (the “period”). The main drivers of positive returns included positive market sentiment following strong corporate earnings, tailwinds due to tax cuts and deregulation, gradual monetary policy normalization, as well as positive consumer and business survey data. However, this period saw its first 10% market correction in nearly three years as volatility returned to U.S. equities after a multi-year stretch of low-to-decreasing volatility. February 2018 is when the first bout of significant market volatility occurred, as the CBOE Volatility Index reached an intraday-high of 50.30, a level not seen since 2015. However, in the months to follow, the markets would see both sharp rebounds and pullbacks before ultimately settling back to a path of normalcy. From the end of March 2018 through the end of the fiscal period, volatility decreased to more subdued levels.

The run-up during the second half of 2017 was characterized by its absence of significant market volatility in favor of generally steady gains, powered primarily by positive economic sentiment as shown by consumer and business survey data as well as corporate profit growth. However, much of the attention that was put on the pro-growth fiscal stimulus softened substantially over the first six-months of 2018, as the market grappled with geopolitical risk. Overall, large-cap companies lagged when compared to their mid-cap and small-cap counterparts. There continues to be risks that weigh heavily on the markets, particularly when it comes to potential trade-wars that could break out between the U.S. and its major trading partner countries.

Additionally, the U.S. Federal Reserve (the “Fed”) has raised their target interest rate three times in this fiscal period, once in 2017 and twice so far in 2018. Additionally, the Fed called for two additional rate hikes for the remainder of 2018, a slightly more hawkish approach than their previously documented stance calling for only one more additional hike. The 10-year U.S. Treasury yield has increased from 2.30% at the beginning of the period, to 2.86% at the end of the period; reaching a high of 3.11% in mid-May of 2018. In fixed income, the yield curve has continued to flatten as short-term rates have increased more than long-term rates. The spread between 2-year and 10-year U.S. Treasury yields has decreased from 0.918% to 0.328% at the end of the period.

U.S. short-term and long-term interest rates, as measured by the Fed funds rate, the 2-Year U.S. Treasury Note rate and the 10-Year U.S. Treasury Note rate, rose 0.75%, 1.14%, and 0.56% respectively over the period. Short-term rates were driven by the Fed raising rates three times in 0.25% increments as they viewed measures of financial conditions positing the economy’s ability to withstand monetary tightening. Longer-term interest rates rose nearly at half the rate of the shorter end rates, signaling a flattening yield curve. With geopolitical concerns and continued rate normalization policies, interest rate volatility picked up in the first six months of 2018. This volatility was somewhat exacerbated by hawkish sentiment when the Fed signaled for an additional rate hike for the remainder of 2018; equaling four hikes total by the end of the 2018 calendar year.

During the last six months of 2017, investment grade and high yield spreads, as measured by the ICE BofA Merrill Lynch U.S. Corporate Master Option-Adjusted Spread and the ICE BofA Merrill Lynch U.S. High Yield Option-Adjusted Spread, both tightened 0.16% and 0.14%, respectively, to finish near multi-year lows. However, spreads in both have expanded through the first six-months of 2018, with high-yields spreads experiencing newfound volatility alongside equity markets.

Developed international equity markets, as measured by the MSCI EAFE Index, returned 6.12% in local currency terms and 6.84% in U.S. dollar terms for the period. Like the U.S. equity markets, developed international equity markets began the period with a bullish run through the end of January 2018. However, when the U.S. markets saw sharp declines in February 2018, developed international equity markets followed suit. However, developed international equity markets have not rebounded in the same fashion as the U.S. markets. Much of this is due to the combination of a recently

| WisdomTree Trust | 1 |

Table of Contents

Market Environment Overview

(unaudited) (concluded)

strengthening U.S. dollar, weakening European economic data, European geopolitical risk, and fears over potential U.S./EU trade tensions. Still, the strong performance of developed international equity markets in the second half of 2017 has helped buffer volatility in 2018, helping to explain the positive performance for the fiscal period. Looking at MSCI’s country-level developed European stock indexes over the course of the fiscal year, the top three performers were Norway (23.68%), United Kingdom (8.24%), and Finland (7.81%); the bottom three performers were Spain (-5.78%), Denmark (-1.26%), and Belgium (-0.69%).

In late October of 2017, Japanese Prime Minister Shinzo Abe won a snap election that extended his term an additional four years, allowing for him to continue to implement his economic policies. The Bank of Japan (“BoJ”) has continued its monetary policy of keeping short-term interest rates below 0%. The BoJ’s commitment to targeting a zero-yield on the 10-year Japanese Government Bond was a significant tailwind for the Tokyo Stock Price Index which returned 9.31%, in local currency terms, over the fiscal year. Positive corporate profit growth and economic growth in the first quarter of 2017 continued in Japan through the remainder of 2017, where it saw continued gains in Japanese equities. However, starting in early 2018, weaker economic data emerged from Japan, which, coupled with volatile U.S. equity markets, resulted in equally volatile returns and softened optimism for Japanese equities. Many look to see how de-escalation of the Korean peninsula and how potential trade wars between the U.S. and neighboring Asian countries may potentially affect Japan’s outlook.

Emerging market (“EM”) equities, as measured by the MSCI Emerging Markets Index, returned 10.50% in local currency terms and 8.20% in U.S. dollar terms over the period. For much of the period, broad weakness in the U.S. dollar helped boost foreign EM currencies. However, a handful of countries (South Africa, Argentina, Brazil, and Turkey) experienced negative performance due to political and/or economic shocks. EM equities performed well from the beginning of the fiscal period to their peak in January 2018, alongside their U.S. equity counterparts. However, as volatility and uncertainty sprouted from the U.S. market, riskier assets like those in EMs were sold off. After the initial sell-off in February 2018, broad EM stock values remained relatively flat through May 2018. In June 2018, both U.S. dollar appreciation and global trade fears have negatively impacted EM assets. Fundamentally speaking, the EM remains attractive from a valuation perspective, with an average price-to-earnings ratio ranging from 11-14 over the course of the period. Many EM countries have economies heavily reliant on the performance of the energy market, making the stabilization of oil prices a major tailwind. One of the biggest drivers for the positive performance has been the price movement in oil, as the price of crude oil futures have risen from $46 per barrel at the start of the fiscal period to $74 per barrel at the end of the fiscal period. Additionally, in the EM, there continues to be easing from many EM central banks, a growing consumer class, robust earnings growth, and improving economic data.

| 2 | WisdomTree Trust |

Table of Contents

Information about Performance and Shareholder Expense Examples (unaudited)

Performance

The performance tables on the following pages are provided for comparative purposes and represent the period noted. Each Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the midpoint of the bid and ask price for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities.

Fund shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Fund NAV returns are calculated using a Fund’s daily 4:00 p.m. eastern time NAV. Market price returns reflect the midpoint of the bid and ask price as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and an index is not available for direct investment. In comparison, the Funds’ performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or taxes that a shareholder would pay on Fund distributions. Past performance is no guarantee of future results. For the most recent month-end performance information visit www.wisdomtree.com.

Shareholder Expense Examples

Each Fund’s performance table is accompanied by a shareholder expense example. As a shareholder of a WisdomTree Fund, you incur two types of cost: (1) transaction costs, including brokerage commissions on purchases and sales of your Fund shares and (2) ongoing costs, including management fees and other Fund expenses. The examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2018 to June 30, 2018. Except where noted, expenses are calculated using each Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 181/365 (to reflect the one-half year period). The annualized expense ratio does not include acquired fund fees and expenses (“AFFEs”), which are fees and expenses incurred indirectly by a Fund through its investments in certain underlying investment companies.

Actual expenses

The first line in the shareholder expense example table shown on the following pages provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Fund under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the period.

Hypothetical example for comparison purposes

The second line in the shareholder expense example table shown on the following pages provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line in the table is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| WisdomTree Trust | 3 |

Table of Contents

Management’s Discussion of Funds’ Performance as of June 30, 2018 (unaudited)

WisdomTree Dynamic Currency Hedged Europe Equity Fund (DDEZ)

Sector Breakdown†

| Sector | % of Net Assets | |||

Financials | 23.7% | |||

Industrials | 13.1% | |||

Consumer Discretionary | 13.0% | |||

Consumer Staples | 10.8% | |||

Utilities | 9.5% | |||

Energy | 7.4% | |||

Materials | 6.9% | |||

Telecommunication Services | 5.6% | |||

Health Care | 5.1% | |||

Information Technology | 3.2% | |||

Real Estate | 1.6% | |||

Other Assets less Liabilities‡ | 0.1% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

Description | % of Net Assets | |||

Anheuser-Busch InBev | 4.0% | |||

TOTAL S.A. | 2.9% | |||

Daimler AG, Registered Shares | 2.0% | |||

Banco Santander S.A. | 2.0% | |||

Eni SpA | 1.9% | |||

Intesa Sanpaolo SpA | 1.9% | |||

Allianz SE, Registered Shares | 1.8% | |||

Deutsche Telekom AG, Registered Shares | 1.8% | |||

Sanofi | 1.8% | |||

Siemens AG, Registered Shares | 1.8% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

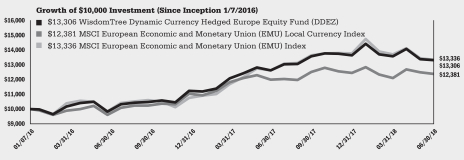

The WisdomTree Dynamic Currency Hedged Europe Equity Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Dynamic Currency Hedged Europe Equity Index (the “Index”). In seeking to track the Index, the Fund invests in European dividend-paying companies while at the same time dynamically hedging exposure to fluctuations of the value of the euro relative to the U.S. dollar. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 5.41% at net asset value (“NAV”) for the fiscal year ending June 30, 2018 (for more complete performance information please see the performance table below). The Fund’s position in France contributed positively to performance while its position in Spain contributed negatively to performance. The Fund uses a rules-based process, combining momentum, value, and interest rate factors, to help determine a currency hedge ratio on the underlying euro exposure. Over the course of the fiscal year, in a period that saw a lot of currency volatility, the various hedge ratios collectively provided outperformance to an unhedged benchmark of European stocks. During the fiscal year, the Fund’s use of forward foreign currency contracts contributed positively to the Fund performance as a result of the Fund’s dynamic use of currency hedging during periods in which the U.S. dollar strengthened (more currency hedged) or weakened (less currency hedged) against the euro.

Shareholder Expense Example

| Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period | |||||||||||||

Actual | $ | 1,000.00 | $ | 975.50 | 0.43 | %1 | $ | 2.11 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,022.66 | 0.43 | %1 | $ | 2.16 | ||||||||

| 1 | WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.43% through October 31, 2018, unless earlier terminated by the Board of Trustees of the WisdomTree Trust for any reason. |

Performance

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 5.41 | % | 12.19 | % | ||||

Fund Market Price Returns | 4.25 | % | 12.42 | % | ||||

WisdomTree Dynamic Currency Hedged Europe Equity Index | 5.14 | % | 12.12 | % | ||||

MSCI European Economic and Monetary Union (EMU) Local Currency Index | 3.33 | % | 8.99 | % | ||||

MSCI European Economic and Monetary Union (EMU) Index | 5.74 | % | 12.31 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on January 7, 2016. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| 4 | WisdomTree Trust |

Table of Contents

Management’s Discussion of Funds’ Performance as of June 30, 2018 (unaudited)

WisdomTree Dynamic Currency Hedged International Equity Fund (DDWM)

Sector Breakdown†

| Sector | % of Net Assets | |||

Financials | 22.2% | |||

Industrials | 12.4% | |||

Consumer Discretionary | 11.5% | |||

Consumer Staples | 10.4% | |||

Energy | 8.3% | |||

Health Care | 8.1% | |||

Telecommunication Services | 7.4% | |||

Materials | 7.4% | |||

Utilities | 5.4% | |||

Information Technology | 3.6% | |||

Real Estate | 2.8% | |||

Other Assets less Liabilities‡ | 0.5% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

BP PLC | 1.5% | |||

HSBC Holdings PLC | 1.4% | |||

Royal Dutch Shell PLC, Class A | 1.3% | |||

China Mobile Ltd. | 1.3% | |||

Royal Dutch Shell PLC, Class B | 1.3% | |||

Nestle S.A., Registered Shares | 1.2% | |||

Anheuser-Busch InBev S.A./N.V. | 1.2% | |||

Novartis AG, Registered Shares | 1.2% | |||

TOTAL S.A. | 1.2% | |||

Toyota Motor Corp. | 1.1% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

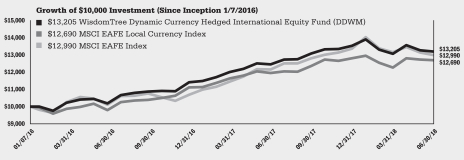

The WisdomTree Dynamic Currency Hedged International Equity Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Dynamic Currency Hedged International Equity Index (the “Index”). In seeking to track the Index, the Fund invests in dividend-paying companies in the industrialized world outside of the U.S. and Canada while at the same time dynamically hedging exposure to fluctuations of the value of the applicable foreign currencies relative to the U.S. dollar. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 6.04% at net asset value (“NAV”) for the fiscal year ending June 30, 2018 (for more complete performance information please see the performance table below). The Fund’s position in Netherlands contributed positively to performance while its position in Switzerland contributed negatively to performance. The Fund uses a rules-based process, combining momentum, value, and interest rate factors, to help determine a currency hedge ratio on the foreign currency exposure. Over the course of the fiscal year, in a period that saw significant currency volatility globally, the various hedge ratios collectively provided in-line performance to an unhedged benchmark of Europe, Australasia and Far East (EAFE) stocks. Much of the outperformance in the first six months of the fiscal period was offset by similar levels of underperformance in the following six months of the fiscal period. During the fiscal year, the Fund’s use of forward foreign currency contracts detracted from performance as a result of the Fund’s use of dynamic currency hedging during periods in which the U.S. dollar strengthened (more currency hedged) or weakened (less currency hedged) against applicable international currencies.

Shareholder Expense Example

| Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period | |||||||||||||

Actual | $ | 1,000.00 | $ | 975.40 | 0.35 | %1 | $ | 1.71 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,023.06 | 0.35 | %1 | $ | 1.76 | ||||||||

| 1 | WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.35% through October 31, 2018, unless earlier terminated by the Board of Trustees of the WisdomTree Trust for any reason. |

Performance

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 6.04 | % | 11.83 | % | ||||

Fund Market Price Returns | 5.32 | % | 11.84 | % | ||||

WisdomTree Dynamic Currency Hedged International Equity Index | 6.26 | % | 11.93 | % | ||||

MSCI EAFE Local Currency Index | 6.12 | % | 10.08 | % | ||||

MSCI EAFE Index | 6.84 | % | 11.13 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on January 7, 2016. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| WisdomTree Trust | 5 |

Table of Contents

Management’s Discussion of Funds’ Performance as of June 30, 2018 (unaudited)

WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Fund (DHDG)

Sector Breakdown†

| Sector | % of Net Assets | |||

Industrials | 20.0% | |||

Consumer Discretionary | 19.6% | |||

Health Care | 16.6% | |||

Consumer Staples | 13.9% | |||

Information Technology | 13.7% | |||

Materials | 4.6% | |||

Financials | 3.8% | |||

Real Estate | 3.6% | |||

Telecommunication Services | 2.2% | |||

Energy | 1.7% | |||

Other Assets less Liabilities‡ | 0.3% | |||

Total | 100.0% | |||

| † | The sector information shown is that of the Underlying Fund. The Underlying Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets of the Underlying Fund includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

Novo Nordisk A/S, Class B | 6.3% | |||

British American Tobacco PLC | 5.7% | |||

Diageo PLC | 5.3% | |||

Industria de Diseno Textil S.A. | 4.0% | |||

Airbus SE | 2.7% | |||

China Overseas Land & Investment Ltd. | 2.6% | |||

Tokyo Electron Ltd. | 2.4% | |||

CSL Ltd. | 1.9% | |||

ASML Holding N.V. | 1.7% | |||

Astellas Pharma, Inc. | 1.6% | |||

| * | The ten largest holdings shown is that of the Underlying Fund and are subject to change, and there are no guarantees the Underlying Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). For a full list of current holdings information for the Underlying Fund please visit www.wisdomtree.com. |

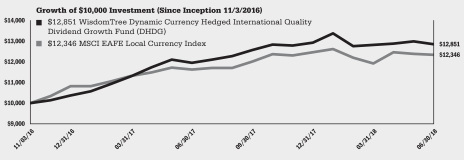

The WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Index (the ‘‘Index’’). In seeking to track the Index, the Fund invests in companies from developed market countries, excluding the U.S. and Canada, with growth and quality characteristics while at the same time dynamically hedging exposure to fluctuations between the value of foreign currencies relative to the U.S. dollar. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index (including indirect investments through the WisdomTree International Quality Dividend Growth Fund (IQDG) (the ‘‘Underlying Fund’’)) whose risk, return and other characteristics resemble the risk, return, and other characteristics of the Index as a whole.

The Fund returned 7.44% at net asset value (“NAV”) for the fiscal year ending June 30, 2018 (for more complete performance information please see the performance table below). The Fund’s exposure to the Netherlands from its investment in the Underlying Fund contributed positively to performance while its exposure to Israel from its investment in the Underlying Fund contributed negatively to performance. The Fund’s underperformance versus the Index for the fiscal year ending June 30, 2018 was primarily due to the fund-of-fund structure where the Underlying Fund held is valued at its market price rather than its NAV. The Fund uses a rules-based process, combining momentum, value, and interest rate factors, to help determine a currency hedge ratio on the foreign currency exposure. Over the course of the fiscal year, in a period that saw heavy currency volatility, the Fund’s various hedge ratios combined with an inherent quality tilt toward dividend growing stocks, collectively provided outperformance to an unhedged benchmark of Europe, Australasia and Far East (EAFE) stocks. This outperformance was seen throughout the fiscal year, including the “risk-off” environments seen during the various market corrections in broad developed markets in 2018. During the fiscal year, the Fund’s use of forward foreign currency contracts contributed positively to performance as a result of the Fund’s use of dynamic currency hedging during periods in which the U.S. dollar strengthened (more currency hedged) or weakened (less currency hedged) against applicable international currencies.

Shareholder Expense Example

Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the | |||||||||||||

Actual | $ | 1,000.00 | $ | 993.20 | 0.10 | %1 | $ | 0.49 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,024.30 | 0.10 | %1 | $ | 0.50 | ||||||||

| 1 | WisdomTree Asset Management, Inc. has contractually agreed to waive a portion of its management fee in an amount equal to the acquired fund fees and expenses (“AFFEs”) attributable to the Fund’s investments in the Underlying Fund, as well as an additional 0.10%, through October 31, 2018, unless earlier terminated by the Board of Trustees of the WisdomTree Trust for any reason. The impact of AFFEs will cause the “Annualized Expense Ratio” to be higher per the stated net expense ratio in the Fund’s prospectus. |

Performance

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 7.44 | % | 16.34 | % | ||||

Fund Market Price Returns | 7.65 | % | 16.43 | % | ||||

WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Index | 9.05 | % | 17.21 | % | ||||

MSCI EAFE Local Currency Index | 6.12 | % | 13.58 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on November 3, 2016. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| 6 | WisdomTree Trust |

Table of Contents

Management’s Discussion of Funds’ Performance as of June 30, 2018 (unaudited)

WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund (DDLS)

Sector Breakdown†

| Sector | % of Net Assets | |||

Industrials | 23.0% | |||

Consumer Discretionary | 20.0% | |||

Financials | 15.2% | |||

Materials | 8.5% | |||

Information Technology | 7.5% | |||

Consumer Staples | 7.1% | |||

Real Estate | 6.9% | |||

Health Care | 3.8% | |||

Energy | 3.1% | |||

Utilities | 2.6% | |||

Telecommunication Services | 2.1% | |||

Other Assets less Liabilities‡ | 0.2% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

Hutchison Port Holdings Trust | 0.5% | |||

StarHub Ltd. | 0.5% | |||

Delek Group Ltd. | 0.5% | |||

NOS, SGPS, S.A. | 0.4% | |||

Jupiter Fund Management PLC | 0.4% | |||

Banca Generali SpA | 0.4% | |||

Lenzing AG | 0.4% | |||

Vedanta Resources PLC | 0.4% | |||

Air New Zealand Ltd. | 0.4% | |||

Azimut Holding SpA | 0.4% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

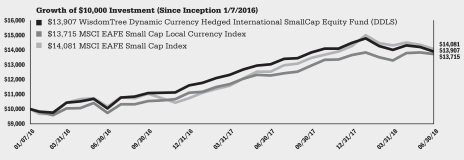

The WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Dynamic Currency Hedged International SmallCap Equity Index (the “Index”). In seeking to track the Index, the Fund invests in the small-capitalization segment of dividend-paying companies in the industrialized world outside of the U.S. and Canada while at the same time dynamically hedging exposure to fluctuations of the value of the applicable foreign currencies relative to the U.S. dollar. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 6.73% at net asset value (“NAV”) for the fiscal year ending June 30, 2018 (for more complete performance information please see the performance table below). The Fund’s position in Japan contributed positively to performance while its position in Israel contributed negatively to performance. The Fund uses a rules-based process, combining momentum, value, and interest rate factors, to help determine a currency hedge ratio on the foreign currency exposure. Over the course of the fiscal year from July 2017 through March 2018, the various hedge ratios collectively provided relatively in-line performance to an unhedged benchmark of Europe, Australasia and Far East (EAFE) small cap stocks. However, from March 2018 to the end of the fiscal year, the hedge ratios collective provided underperformance, in a period where the U.S. dollar rallied broadly. During the fiscal year, the Fund’s use of forward foreign currency contracts contributed positively to performance as a result of the Fund’s use of dynamic currency hedging during periods in which the U.S. dollar strengthened (more currency hedged) or weakened (less currency hedged) against applicable international currencies.

Shareholder Expense Example

| Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period | |||||||||||||

Actual | $ | 1,000.00 | $ | 959.40 | 0.43 | %1 | $ | 2.09 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,022.66 | 0.43 | %1 | $ | 2.16 | ||||||||

| 1 | WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.43% through October 31, 2018, unless earlier terminated by the Board of Trustees of the WisdomTree Trust for any reason. |

Performance

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 6.73 | % | 14.20 | % | ||||

Fund Market Price Returns | 6.24 | % | 14.62 | % | ||||

WisdomTree Dynamic Currency Hedged International SmallCap Equity Index | 7.29 | % | 14.73 | % | ||||

MSCI EAFE Small Cap Local Currency Index | 11.82 | % | 13.59 | % | ||||

MSCI EAFE Small Cap Index | 12.45 | % | 14.80 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on January 7, 2016. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| WisdomTree Trust | 7 |

Table of Contents

Management’s Discussion of Funds’ Performance as of June 30, 2018 (unaudited)

WisdomTree Dynamic Currency Hedged Japan Equity Fund (DDJP)

Sector Breakdown†

| Sector | % of Net Assets | |||

Consumer Discretionary | 21.3% | |||

Industrials | 18.4% | |||

Financials | 15.4% | |||

Information Technology | 10.2% | |||

Telecommunication Services | 8.2% | |||

Consumer Staples | 7.5% | |||

Materials | 6.9% | |||

Health Care | 6.4% | |||

Real Estate | 2.4% | |||

Utilities | 1.5% | |||

Energy | 1.1% | |||

Other Assets less Liabilities‡ | 0.7% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

Toyota Motor Corp. | 5.1% | |||

NTT DOCOMO, Inc. | 3.3% | |||

Nippon Telegraph & Telephone Corp. | 2.6% | |||

Japan Tobacco, Inc. | 2.4% | |||

Mitsubishi UFJ Financial Group, Inc. | 2.1% | |||

Nissan Motor Co., Ltd. | 1.8% | |||

Japan Post Holdings Co., Ltd. | 1.8% | |||

KDDI Corp. | 1.7% | |||

Sumitomo Mitsui Financial Group, Inc. | 1.7% | |||

Canon, Inc. | 1.6% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

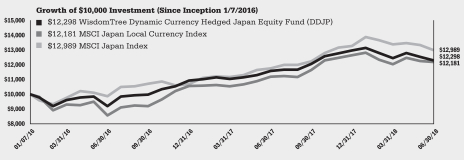

The WisdomTree Dynamic Currency Hedged Japan Equity Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Dynamic Currency Hedged Japan Equity Index (the “Index”). In seeking to track the Index, the Fund invests in Japanese dividend-paying companies while at the same time dynamically hedging exposure to fluctuations of the value of the Japanese yen relative to the U.S. dollar. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 6.34% at net asset value (“NAV”) for the fiscal year ending June 30, 2018 (for more complete performance information please see the performance table below). The Fund’s position in Industrials contributed positively to performance while its position in Financials contributed negatively to performance. The Fund uses a rules-based process, combining momentum, value, and interest rate factors, to help determine a currency hedge ratio on the underlying Japanese yen exposure. Over the course of the fiscal year, in a period that saw little currency volatility and only modest yen appreciation, the various hedge ratios collectively provided underperformance to an unhedged benchmark of Japanese stocks. During the fiscal year, the Fund’s use of forward foreign currency contracts detracted from performance as a result of the Fund’s use of dynamic currency hedging during periods in which the U.S. dollar strengthened (more currency hedged) or weakened (less currency hedged) against the Japanese yen.

Shareholder Expense Example

| Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period | |||||||||||||

Actual | $ | 1,000.00 | $ | 949.70 | 0.43 | %1 | $ | 2.08 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,022.66 | 0.43 | %1 | $ | 2.16 | ||||||||

| 1 | WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.43% through October 31, 2018, unless earlier terminated by the Board of Trustees of the WisdomTree Trust for any reason. |

Performance

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 6.34 | % | 8.69 | % | ||||

Fund Market Price Returns | 5.71 | % | 8.62 | % | ||||

WisdomTree Dynamic Currency Hedged Japan Equity Index | 6.98 | % | 9.47 | % | ||||

MSCI Japan Local Currency Index | 8.94 | % | 8.28 | % | ||||

MSCI Japan Index | 10.51 | % | 11.12 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on January 7, 2016. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| 8 | WisdomTree Trust |

Table of Contents

Management’s Discussion of Funds’ Performance as of June 30, 2018 (unaudited)

WisdomTree Emerging Markets Dividend Fund (DVEM)

Sector Breakdown†

| Sector | % of Net Assets | |||

Financials | 22.3% | |||

Information Technology | 18.4% | |||

Energy | 12.7% | |||

Materials | 11.5% | |||

Telecommunication Services | 6.9% | |||

Consumer Discretionary | 6.7% | |||

Consumer Staples | 6.5% | |||

Industrials | 5.6% | |||

Utilities | 4.4% | |||

Real Estate | 2.7% | |||

Health Care | 1.7% | |||

Other Assets less Liabilities‡ | 0.6% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

Taiwan Semiconductor Manufacturing Co., Ltd. | 3.7% | |||

China Construction Bank Corp., Class H | 3.3% | |||

Samsung Electronics Co., Ltd. | 3.2% | |||

Lukoil PJSC, ADR | 2.0% | |||

Gazprom PJSC, ADR | 1.7% | |||

Hon Hai Precision Industry Co., Ltd. | 1.7% | |||

China Mobile Ltd. | 1.7% | |||

Industrial & Commercial Bank of China Ltd., Class H | 1.6% | |||

Bank of China Ltd., Class H | 1.2% | |||

China Petroleum & Chemical Corp., Class H | 1.2% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

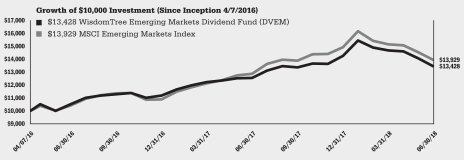

The WisdomTree Emerging Markets Dividend Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Emerging Markets Dividend Index (the “Index”). In seeking to track the Index, the Fund invests in dividend-paying companies in the emerging markets. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 7.05% at net asset value (“NAV”) for the fiscal year ending June 30, 2018 (for more complete performance information please see the performance table below). The Fund’s position in China contributed positively to performance while its position in Indonesia contributed negatively to performance. Additionally, the Fund’s positions in Energy, due to a sizeable oil rally, contributed the most to performance, while its positions in Telecommunication Services contributed the least. During the first six months of the fiscal year, emerging market (“EM”) companies saw significant positive gains along with many of the developed stock markets, which would later prove to serve as a performance cushion for the remaining months of the fiscal year. In February 2018, a U.S. market correction and resurgence in U.S. equity volatility brought down many EM equity markets, as riskier assets were being taken off the table by investors. In addition to the broad market sell-off, the U.S. dollar also appreciated towards the end of the fiscal year, having a negative impact on the performance of EM companies. Potentially the biggest factor to cause EM underperformance in 2018 can be attributed to the growing concerns over potential U.S. and foreign nation trade wars and how they may impact global trade; particularly as it relates to the U.S. and China trade tariffs, as China was the largest weight in the Fund.

Shareholder Expense Example

| Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period | |||||||||||||

Actual | $ | 1,000.00 | $ | 942.90 | 0.32 | % | $ | 1.54 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,023.21 | 0.32 | % | $ | 1.61 | ||||||||

Performance

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 7.05 | % | 14.11 | % | ||||

Fund Market Price Returns | 6.51 | % | 14.33 | % | ||||

WisdomTree Emerging Markets Dividend Index | 7.21 | % | 14.16 | % | ||||

MSCI Emerging Markets Index | 8.20 | % | 16.02 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on April 7, 2016. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| WisdomTree Trust | 9 |

Table of Contents

Management’s Discussion of Funds’ Performance as of June 30, 2018 (unaudited)

WisdomTree Europe Domestic Economy Fund (EDOM)

Sector Breakdown†

| Sector | % of Net Assets | |||

Financials | 30.0% | |||

Industrials | 27.0% | |||

Consumer Discretionary | 19.4% | |||

Information Technology | 7.3% | |||

Materials | 6.7% | |||

Energy | 5.6% | |||

Real Estate | 3.6% | |||

Other Assets less Liabilities‡ | 0.4% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

TOTAL S.A. | 2.3% | |||

Siemens AG, Registered Shares | 1.7% | |||

Allianz SE, Registered Shares | 1.3% | |||

BNP Paribas S.A. | 1.1% | |||

AXA S.A. | 1.1% | |||

Vinci S.A. | 1.0% | |||

Eni SpA | 1.0% | |||

Deutsche Post AG, Registered Shares | 0.9% | |||

ING Groep N.V. | 0.9% | |||

Amadeus IT Group S.A. | 0.9% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

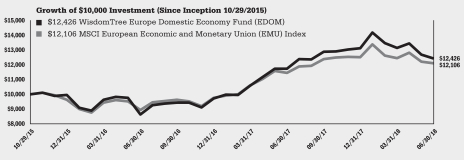

The WisdomTree Europe Domestic Economy Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Europe Domestic Economy Index (the “Index”). In seeking to track the Index, the Fund invests in European companies that are sensitive to economic growth prospects in the eurozone and that derive more than 50% of their revenue from Europe. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 5.90% at net asset value (“NAV”) for the fiscal year ending June 30, 2018 (for more complete performance information please see the performance table below). The Fund’s position in Germany contributed most positively to performance, while its position in Netherlands contributed least positively to performance. Additionally, the Fund’s positions in Information Technology sector contributed the most to performance, while its positions in Consumer Discretionary sector contributed the least. Like many of the developed markets, the latter half of 2017 saw significant positive returns. This proved to be a buffer to overall fiscal year returns, as in February 2018, a market correction and resurgence in U.S. equity volatility brought down many of its developed market and European counterparts. In 2018, there are a few explanations for the European equity market’s negative performance: weaker economic data surprising on the downside, fears over the long-term stability of the European Union (“EU”), concerns over details of a potential BREXIT deal between the EU and the United Kingdom, and overarching concerns of potential tariffs and trade wars between the EU and the U.S. Additionally, while the euro has appreciated against the U.S. dollar by 2.26% over the entire fiscal year, it has depreciated 2.67% in 2018 alone.

Shareholder Expense Example

| Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period | |||||||||||||

Actual | $ | 1,000.00 | $ | 948.20 | 0.48 | %1 | $ | 2.32 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,022.41 | 0.48 | %1 | $ | 2.41 | ||||||||

| 1 | WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.48% through October 31, 2018, unless earlier terminated by the Board of Trustees of the WisdomTree Trust for any reason. |

Performance

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 5.90 | % | 8.46 | % | ||||

Fund Market Price Returns | 4.53 | % | 8.17 | % | ||||

WisdomTree Europe Domestic Economy Index | 5.48 | % | 8.32 | % | ||||

MSCI European Economic and Monetary Union (EMU) Index | 5.74 | % | 7.42 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on October 29, 2015. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| 10 | WisdomTree Trust |

Table of Contents

Management’s Discussion of Funds’ Performance as of June 30, 2018 (unaudited)

WisdomTree Global ex-Mexico Equity Fund (XMX)

Sector Breakdown†

| Sector | % of Net Assets | |||

Information Technology | 19.0% | |||

Financials | 17.7% | |||

Consumer Discretionary | 12.1% | |||

Health Care | 11.4% | |||

Industrials | 11.3% | |||

Consumer Staples | 8.0% | |||

Energy | 6.7% | |||

Materials | 4.9% | |||

Utilities | 3.0% | |||

Real Estate | 2.9% | |||

Telecommunication Services | 2.8% | |||

Other Assets less Liabilities‡ | 0.2% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

Apple, Inc. | 2.2% | |||

Microsoft Corp. | 1.7% | |||

Amazon.com, Inc. | 1.6% | |||

Facebook, Inc., Class A | 1.0% | |||

Alphabet, Inc., Class A | 0.9% | |||

JPMorgan Chase & Co. | 0.8% | |||

Exxon Mobil Corp. | 0.8% | |||

Johnson & Johnson | 0.7% | |||

Tencent Holdings Ltd. | 0.7% | |||

Berkshire Hathaway, Inc., Class B | 0.7% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

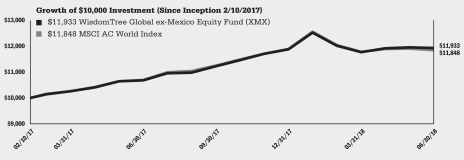

The WisdomTree Global ex-Mexico Equity Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Global ex-Mexico Equity Index (the “Index”). In seeking to track the Index, the Fund invests in large-capitalization companies operating across diversified sectors in developed and emerging markets throughout the world, excluding Mexico. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 11.74% at net asset value (“NAV”) for the fiscal year ending June 30, 2018 (for more complete performance information please see the performance table below). The Fund’s position in the United States contributed positively to performance while its position in Israel contributed negatively to performance. Collectively, global equity markets saw strong performance for the first six months of the fiscal period. In early 2018, the U.S. equity market experienced its first correction in nearly three years and started a new period of market volatility. These events caused a ripple effect throughout most of the global equity markets. However, performance has rebounded from its March 2018 lows. This strategy has benefited from having no exposure to Mexican stocks, as the Mexico equity market has underperformed significantly in the fiscal year in the wake of political uncertainty, trade fears, and a weakening Mexican peso.

Shareholder Expense Example

Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the | |||||||||||||

Actual | $ | 1,000.00 | $ | 1,004.50 | 0.23 | %1 | $ | 1.14 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,023.65 | 0.23 | %1 | $ | 1.15 | ||||||||

| 1 | Effective April 1, 2018, the Fund’s management fee was permanently reduced to 0.20%. Prior to April 1, 2018, WisdomTree Asset Management, Inc. had contractually agreed to limit the management fee to 0.30%. |

Performance

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 11.74 | % | 13.60 | % | ||||

Fund Market Price Returns | 11.14 | % | 13.29 | % | ||||

WisdomTree Global ex-Mexico Equity Index | 11.33 | % | 13.41 | % | ||||

MSCI AC World Index | 10.73 | % | 13.04 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on February 10, 2017. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| WisdomTree Trust | 11 |

Table of Contents

Management’s Discussion of Funds’ Performance as of June 30, 2018 (unaudited)

WisdomTree Global Hedged SmallCap Dividend Fund (HGSD)

Sector Breakdown†

| Sector | % of Net Assets | |||

Industrials | 20.4% | |||

Consumer Discretionary | 19.2% | |||

Financials | 13.8% | |||

Real Estate | 10.8% | |||

Information Technology | 8.2% | |||

Materials | 7.8% | |||

Consumer Staples | 6.5% | |||

Utilities | 5.1% | |||

Health Care | 2.9% | |||

Energy | 2.5% | |||

Telecommunication Services | 1.9% | |||

Investment Company | 0.5% | |||

Other Assets less Liabilities‡ | 0.4% | |||

Total | 100.0% | |||

| † | The sector information shown is that of the Underlying Fund. The Underlying Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets of the Underlying Fund includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

Covanta Holding Corp. | 1.5% | |||

Brinker International, Inc. | 1.2% | |||

Guess?, Inc. | 1.1% | |||

Washington Prime Group, Inc. | 1.0% | |||

DSW, Inc., Class A | 0.8% | |||

Waddell & Reed Financial, Inc., Class A | 0.8% | |||

Cheesecake Factory, Inc. (The) | 0.8% | |||

Chesapeake Lodging Trust | 0.7% | |||

CBL & Associates Properties, Inc. | 0.7% | |||

Artisan Partners Asset Management, Inc., Class A | 0.6% | |||

| * | The ten largest holdings shown is that of the Underlying Fund and are subject to change, and there are no guarantees the Underlying Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). For a full list of holdings information for the Underlying Fund, please see pages 97 - 103 of this report. |

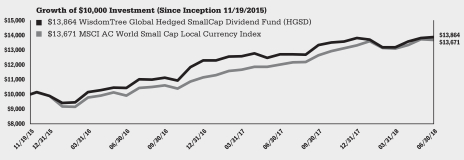

The WisdomTree Global Hedged SmallCap Dividend Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Global Hedged SmallCap Dividend Index (the ‘‘Index’’). In seeking to track the Index, the Fund invests globally in small capitalization companies while hedging exposure to fluctuations between the U.S. dollar and applicable foreign currencies. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index (including indirect investments through the WisdomTree Global SmallCap Dividend Fund (GSD) (the ‘‘Underlying Fund’’)) whose risk, return and other characteristics resemble the risk, return, and other characteristics of the Index as a whole.

The Fund returned 9.16% at net asset value (“NAV”) for the fiscal year ending June 30, 2018 (for more complete performance information please see the performance table below). The Fund’s exposure to the United States from its investment in the Underlying Fund contributed most positively to performance, while its exposures to Italy and Brazil from its investment in the Underlying Fund contributed most negatively to performance. Additionally, the Fund’s exposure to the Industrials sector from its investment in the Underlying Fund contributed the most to performance, while its exposure to the Telecommunications Services sector from its investment in the Underlying Fund contributed the least. From the beginning of the fiscal period through January 2018, small cap equities globally were continuing to show strong positive performance much like the rest of the market. However, in February 2018, a market correction and resurgence in U.S. equity volatility brought down many of the global equity markets, particularly in small caps. Despite this, the global small cap companies have rebounded to their pre-correction levels by the end of the fiscal period. The Fund’s overall positive performance during the fiscal year, was in large part due to the U.S. being the largest weight in the Underlying Fund, as the U.S. itself has rebounded relatively stronger than many of its developed market counterparts. In the first half of the fiscal year, many foreign currencies appreciated relative to the U.S. dollar, but in the second half of the fiscal year, a near reversal of broad U.S. dollar strengthening occurred against most major currencies. Overall, it was more beneficial to be hedged than unhedged foreign currencies for the entire fiscal year. The Fund’s use of forward foreign currency contracts contributed positively to performance as a result of the overall appreciation in the U.S. dollar against applicable international currencies during the fiscal year.

Shareholder Expense Example

| Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid Period | |||||||||||||

Actual | $ | 1,000.00 | $ | 1,004.70 | 0.00 | %1 | $ | 0.00 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,024.79 | 0.00 | %1 | $ | 0.00 | ||||||||

| 1 | WisdomTree Asset Management, Inc. has contractually agreed to waive a portion of its management fee in an amount equal to the acquired fund fees and expenses (“AFFEs”) attributable to the Fund’s investments in the Underlying Fund through October 31, 2018, unless earlier terminated by the Board of Trustees of the WisdomTree Trust for any reason. The impact of AFFEs will cause the “Annualized Expense Ratio” to be higher per the stated net expense ratio in the Fund’s prospectus. |

Performance

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 9.16 | % | 13.30 | % | ||||

Fund Market Price Returns | 9.34 | % | 13.19 | % | ||||

WisdomTree Global Hedged SmallCap Dividend Index | 9.80 | % | 13.64 | % | ||||

MSCI AC World Small Cap Local Currency Index | 13.90 | % | 12.71 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on November 19, 2015. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| 12 | WisdomTree Trust |

Table of Contents

Management’s Discussion of Funds’ Performance as of June 30, 2018 (unaudited)

WisdomTree Global SmallCap Dividend Fund (GSD)

Sector Breakdown†

| Sector | % of Net Assets | |||

Industrials | 20.4% | |||

Consumer Discretionary | 19.2% | |||

Financials | 13.8% | |||

Real Estate | 10.8% | |||

Information Technology | 8.2% | |||

Materials | 7.8% | |||

Consumer Staples | 6.5% | |||

Utilities | 5.1% | |||

Health Care | 2.9% | |||

Energy | 2.5% | |||

Telecommunication Services | 1.9% | |||

Investment Company | 0.5% | |||

Other Assets less Liabilities‡ | 0.4% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

Covanta Holding Corp. | 1.5% | |||

Brinker International, Inc. | 1.2% | |||

Guess?, Inc. | 1.1% | |||

Washington Prime Group, Inc. | 1.0% | |||

DSW, Inc., Class A | 0.8% | |||

Waddell & Reed Financial, Inc., Class A | 0.8% | |||

Cheesecake Factory, Inc. (The) | 0.8% | |||

Chesapeake Lodging Trust | 0.7% | |||

CBL & Associates Properties, Inc. | 0.7% | |||

Artisan Partners Asset Management, Inc., Class A | 0.6% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

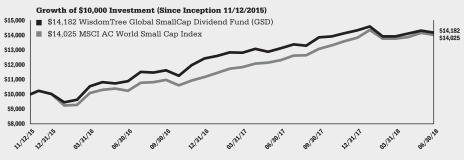

The WisdomTree Global SmallCap Dividend Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Global SmallCap Dividend Index (the “Index”). In seeking to track the Index, the Fund invests globally in dividend-paying small capitalization companies. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 8.21% at net asset value (“NAV”) for the fiscal year ending June 30, 2018 (for more complete performance information please see the performance table below). The Fund’s position in the United States contributed most positively to performance, while its positions in Italy and Brazil contributed most negatively to performance. Additionally, the Fund’s positions in Industrials contributed the most to performance, while its positions in Telecommunication Services contributed the least. From the beginning of the fiscal period through January 2018, small cap equities globally were continuing to show strong positive performance much like the rest of the market. However, in February 2018, a market correction and resurgence in U.S. equity volatility brought down many of the global equity markets, particularly in small caps. Despite this, the global small cap companies have rebounded to their pre-correction levels by the end of the fiscal period. The Fund’s overall positive performance during the fiscal year, was in large part due to the U.S. being the largest weight in the Fund, as the U.S. itself has rebounded relatively stronger than many of its developed market counterparts. In the first half of the fiscal year, many foreign currencies appreciated relative to the U.S. dollar, but in the second half of the fiscal year, a near reversal of broad U.S. dollar strengthening occurred against most major currencies.

Shareholder Expense Example

| Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid | |||||||||||||

Actual | $ | 1,000.00 | $ | 989.20 | 0.43 | % | $ | 2.12 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,022.66 | 0.43 | % | $ | 2.16 | ||||||||

Performance

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 8.21 | % | 14.18 | % | ||||

Fund Market Price Returns | 8.26 | % | 14.26 | % | ||||

WisdomTree Global SmallCap Dividend Index | 8.97 | % | 14.39 | % | ||||

MSCI AC World Small Cap Index | 13.83 | % | 13.71 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on November 12, 2015. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| WisdomTree Trust | 13 |

Table of Contents

Management’s Discussion of Funds’ Performance as of June 30, 2018 (unaudited)

WisdomTree ICBCCS S&P China 500 Fund (WCHN)

Sector Breakdown†

| Sector | % of Net Assets | |||

Financials | 23.3% | |||

Information Technology | 22.0% | |||

Consumer Discretionary | 11.7% | |||

Industrials | 9.9% | |||

Materials | 6.9% | |||

Health Care | 6.2% | |||

Consumer Staples | 6.2% | |||

Real Estate | 5.3% | |||

Energy | 3.3% | |||

Utilities | 2.8% | |||

Telecommunication Services | 1.7% | |||

Other Assets less Liabilities‡ | 0.7% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

Tencent Holdings Ltd. | 9.3% | |||

Alibaba Group Holding Ltd., ADR | 7.1% | |||

China Construction Bank Corp., Class H | 3.3% | |||

Ping An Insurance Group Co. of China Ltd., Class A | 2.9% | |||

Baidu, Inc., ADR | 2.3% | |||

China Merchants Bank Co., Ltd., Class A | 2.2% | |||

Industrial & Commercial Bank of China Ltd., Class H | 2.0% | |||

China Mobile Ltd. | 1.7% | |||

Ping An Insurance Group Co. of China Ltd., Class H | 1.6% | |||

Kweichow Moutai Co., Ltd., Class A | 1.5% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

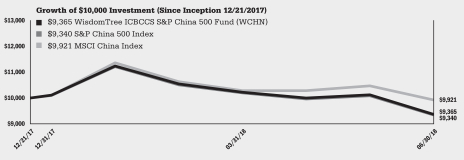

The WisdomTree ICBCCS S&P China 500 Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the S&P China 500 Index (the “Index”). In seeking to track the Index, the Fund invests in a broad universe of Chinese equities (500 companies). The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned -6.35% at net asset value (“NAV”) from inception date on December 21, 2017 through June 30, 2018 (for more complete performance information please see the performance table below). The performance difference between the Fund and the Index, was mainly due to security selection and positive cash drag, leading to outperformance of 0.25%. The Fund saw positive total returns from inception to the end of January 2018. In February 2018, U.S. equity markets experienced a sizable correction, the first in nearly three years, beginning a new period of market volatility. These events caused a paralleled ripple effect throughout most global equity markets, particularly in China. What had continued to drag on Chinese equities during the fiscal period was the ever-growing fears of an all-out trade war between China and the U.S. As of the fiscal period-end, sizable tariffs have been announced by both countries, but a trade deal to be struck in the future remains a possibility, as is the goal of both countries. Aside from geopolitical risks, the fundamentals of China remain strong and point to continued growth in both economic data and corporate earnings.

Shareholder Expense Example

| Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period | |||||||||||||

Actual | $ | 1,000.00 | $ | 926.20 | 0.55 | % | $ | 2.63 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,022.07 | 0.55 | % | $ | 2.76 | ||||||||

Performance

| Cumulative Total Return | ||||

Since Inception1 | ||||

Fund NAV Returns | -6.35 | % | ||

Fund Market Price Returns | -7.44 | % | ||

S&P China 500 Index | -6.60 | % | ||

MSCI China Index | -0.79 | % | ||

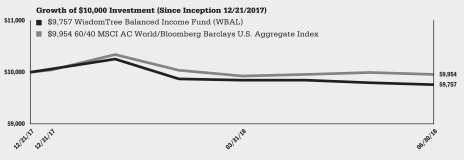

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on December 21, 2017. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| 14 | WisdomTree Trust |

Table of Contents

Management’s Discussion of Funds’ Performance as of June 30, 2018 (unaudited)

WisdomTree Fundamental U.S. Corporate Bond Fund (WFIG)

Sector Breakdown†

| Sector | % of Net Assets | |||

Financials | 29.8% | |||

Health Care | 15.9% | |||

Consumer Discretionary | 12.4% | |||

Industrials | 8.6% | |||

Consumer Staples | 8.3% | |||

Telecommunication Services | 6.2% | |||

Information Technology | 6.1% | |||

Utilities | 5.5% | |||

Energy | 2.6% | |||

Materials | 2.0% | |||

Real Estate | 1.2% | |||

U.S. Government Obligations | 0.2% | |||

Other Assets less Liabilities‡ | 1.2% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

Morgan Stanley, | 3.2% | |||

Dow Chemical Co. (The), | 3.1% | |||

Verizon Communications, Inc., | 3.1% | |||

Citigroup, Inc., | 3.0% | |||

Pfizer, Inc., | 2.6% | |||

Warner Media LLC, | 2.5% | |||

McKesson Corp., | 2.3% | |||

Synchrony Financial, | 2.3% | |||

HSBC USA, Inc., | 2.2% | |||

AT&T, Inc., | 2.1% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

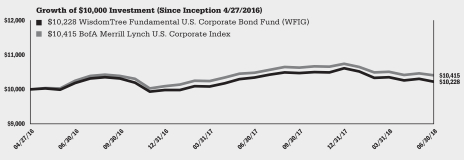

The WisdomTree Fundamental U.S. Corporate Bond Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Fundamental U.S. Corporate Bond Index (the “Index”). In seeking to track the Index, the Fund invests in issuers in the U.S. investment grade corporate bond market that are deemed to exhibit favorable fundamentals and opportunities for income. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned -1.11% at net asset value (“NAV”) for the fiscal year ending June 30, 2018 (for more complete performance information please see the performance table below). Relative to the benchmark, security selection was the primary detractor driven primarily by Utilities (Pacific Gas & Electric Co.) and Communications (AT&T, Inc.). During the fiscal year, credit curves steepened and thus long-end positions generally underperformed. Conversely, the Fund benefited from a positive security selection in Financials and Consumer Staples sectors, which were primarily positioned in the intermediate part of the curve. During the first six months of the fiscal year, the Fund had consistent positive total returns. However, for the following six months, the Fund was negatively impacted by both continued rising interest rates, and from equity market volatility, as credit bonds were sold off during a “risk-off” environment. The Fund underperformance as compared to the Index can mainly be attributed to representative sampling.

Shareholder Expense Example

| Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period | |||||||||||||

Actual | $ | 1,000.00 | $ | 963.70 | 0.18 | %1 | $ | 0.88 | ||||||||

Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,023.90 | 0.18 | %1 | $ | 0.90 | ||||||||

| 1 | WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.18% through October 31, 2018, unless earlier terminated by the Board of Trustees of the WisdomTree Trust for any reason. |

Performance

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | -1.11 | % | 1.04 | % | ||||

Fund Market Price Returns | -1.25 | % | 0.62 | % | ||||

WisdomTree Fundamental U.S. Corporate Bond Index | -0.56 | % | 1.68 | % | ||||

BofA Merrill Lynch U.S. Corporate Index | -0.70 | % | 1.89 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on April 27, 2016. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| WisdomTree Trust | 15 |

Table of Contents

Management’s Discussion of Funds’ Performance as of June 30, 2018 (unaudited)

WisdomTree Fundamental U.S. High Yield Corporate Bond Fund (WFHY)

Sector Breakdown†

| Sector | % of Net Assets | |||

Consumer Discretionary | 21.1% | |||

Health Care | 17.6% | |||

Materials | 10.4% | |||

Energy | 9.0% | |||

Consumer Staples | 7.6% | |||

Financials | 7.6% | |||

Information Technology | 7.5% | |||

Industrials | 7.4% | |||

Telecommunication Services | 4.6% | |||

Utilities | 2.2% | |||

Real Estate | 1.0% | |||

Other Assets less Liabilities‡ | 4.0% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings*

| Description | % of Net Assets | |||

First Data Corp., | 3.1% | |||

HCA, Inc., | 3.0% | |||

Navient Corp., | 2.4% | |||

CCO Holdings LLC, | 2.4% | |||

Scientific Games International, Inc., | 2.3% | |||

DPL, Inc., | 2.2% | |||

Valeant Pharmaceuticals International, Inc., | 2.1% | |||

DaVita, Inc., | 2.0% | |||

Berry Global, Inc., | 2.0% | |||