Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21864

WisdomTree Trust

(Exact name of registrant as specified in charter)

245 Park Avenue, 35th Floor

New York, NY 10167

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code:(866) 909-9473

Date of fiscal year end: June 30

Date of reporting period: June 30, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

Table of Contents

WisdomTree Trust

Annual Report

June 30, 2017

International Equity ETFs:

WisdomTree Dynamic Currency Hedged Europe Equity Fund (DDEZ)

WisdomTree Dynamic Currency Hedged International Equity Fund (DDWM)

WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Fund (DHDG)

WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund (DDLS)

WisdomTree Dynamic Currency Hedged Japan Equity Fund (DDJP)

WisdomTree Emerging Markets Dividend Fund (DVEM)

WisdomTree Europe Domestic Economy Fund (EDOM)

(formerly, WisdomTree Europe Local Recovery Fund (EZR))

WisdomTree Global ex-Mexico Equity Fund (XMX)

WisdomTree Global Hedged SmallCap Dividend Fund (HGSD)

WisdomTree Global SmallCap Dividend Fund (GSD)

WisdomTree Strong Dollar Emerging Markets Equity Fund (EMSD)

U.S. Equity ETFs:

WisdomTree U.S. Domestic Economy Fund (WUSA)

(formerly, WisdomTree Strong Dollar U.S. Equity Fund (USSD))

WisdomTree U.S. Export and Multinational Fund (WEXP)

(formerly, WisdomTree Weak Dollar U.S. Equity Fund (USWD))

Fixed Income ETFs:

WisdomTree Fundamental U.S. Corporate Bond Fund (WFIG)

WisdomTree Fundamental U.S. High Yield Corporate Bond Fund (WFHY)

WisdomTree Fundamental U.S. Short-Term Corporate Bond Fund (SFIG)

WisdomTree Fundamental U.S. Short-Term High Yield Corporate Bond Fund (SFHY)

Alternative ETFs:

WisdomTree Dynamic Bearish U.S. Equity Fund (DYB)

WisdomTree Dynamic Long/Short U.S. Equity Fund (DYLS)

Table of Contents

| 1 | ||||

| 5 | ||||

| 24 | ||||

| 28 | ||||

| Schedules of Investments | ||||

| 31 | ||||

WisdomTree Dynamic Currency Hedged International Equity Fund | 35 | |||

WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Fund | 46 | |||

WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund | 48 | |||

| 60 | ||||

| 65 | ||||

| 73 | ||||

| 76 | ||||

| 83 | ||||

| 87 | ||||

| 94 | ||||

| 97 | ||||

| 101 | ||||

| 104 | ||||

| 106 | ||||

| 108 | ||||

WisdomTree Fundamental U.S. Short-Term High Yield Corporate Bond Fund | 110 | |||

| 112 | ||||

| 114 | ||||

| 116 | ||||

| 120 | ||||

| 124 | ||||

| 131 | ||||

| 141 | ||||

| 160 | ||||

Approval of Investment Advisory and Sub-Advisory Agreements (unaudited) | 161 | |||

| 163 | ||||

| 165 | ||||

| 167 |

“WisdomTree” is a registered mark of WisdomTree Investments, Inc. and is licensed for use by the WisdomTree Trust.

Table of Contents

Management’s Discussion of Funds’ Performance

(unaudited)

Market Environment Overview

The U.S. equity market, as measured by the S&P 500® Index, returned 17.90% for the 12-month fiscal period that ended June 30, 2017 (the “period”). The main drivers of returns over this period included positive market sentiment following political risk events, corporate profits buoyed in part by an energy sector recovery from low year-over-year comparisons, positive consumer and business survey data and finally market expectations of monetary policy normalization that was consistently more dovish than central bank projections. The first notable political risk event, the British European Union referendum, did not actually occur during the period but was a major factor in the July 2016 gains of 3.69% that were sustained through the summer months. The market sell-off in response to the late June “Brexit” vote was largely reversed as investors digested the ambiguous near-term impact of the result. In fall 2016, U.S. equity markets began showing signs of significant risk-off positioning ahead of the U.S. presidential election before rallying in response to President Donald Trump’s victory. The late 2016 rally was further assisted by an output cut agreement by the Organization of Petroleum Exporting Countries (OPEC) and some key non-OPEC countries. The first half of 2017 was characterized by its absence of significant market volatility in favor of generally steady gains, powered primarily by positive economic sentiment as shown by consumer and business survey data as well as corporate profit growth. Expectations for pro-growth fiscal stimulus softened substantially over the first six-months of 2017, dragging down the performance of small-caps and the U.S. dollar. Even though the Federal Reserve (the “Fed”) raised their target rate twice in 2017, the 10-Year Treasury yield actually ended the period lower than where it started, which also put pressure on the highest yielding stocks within U.S. markets.

The developed international equity markets, as measured by the MSCI EAFE Index, returned 22.10% in local currency terms and 20.27% in U.S. dollar terms for the period. Similar to U.S. equity markets, developed international equity markets began the period with a 4.75% Brexit sell-off recovery, in local currency terms, in July 2016. The developed international equity markets also benefited from two of the same inflection points as the U.S. equity markets by the way of the U.S. Presidential election and the OPEC production agreement. The performance of developed international equity markets was largely subdued in the early part of 2017 following the strong returns of late 2016. Positive corporate profit growth and economic growth in the first quarter in Japan and Europe resulted in modest equity market gains, but risk off sentiment pervaded with investors awaiting the outcome of a series of elections in Europe, and global central bank policy uncertainty tempered equity market returns. With market-friendly outcomes in elections in the Netherlands and France, coupled with the European Central Bank signaling commitment to continued accommodative monetary policy in the face of positive economic data, the market rallied during the latter half of this time-frame. For Japan specifically, commitment to targeting a zero-yield on the 10-year Japanese Government Bond was a significant tailwind for the Tokyo Stock Price Index which returned 7.4%, in local currency terms, in the first half of 2017.

Emerging markets, as measured by the MSCI Emerging Markets Index, returned 21.77% in local currency terms and 23.75% in U.S. dollar terms over the period. The primer for emerging market returns for the second half of 2016 was energy market stability from the lows of the first quarter, culminating with the December OPEC output agreement. Many emerging market countries have economies heavily reliant on the performance of the energy market, making the stabilization of oil prices a major tailwind for emerging markets as a whole. The main themes for the first half of 2017 were the performance in the Technology sector, particularly in South Korea, Taiwan and China, as well as outperformance in Indian equities. While the U.S. dollar staged a rally in the second half of 2016 with a rise in U.S. interest rates, this headwind was largely reversed in the first half of 2017 as emerging market currencies recovered.

U.S. short-term and long-term interest rates, as measured by the Federal Funds rate, the 2-Year Treasury Bill rate and the 10-Year U.S. Treasury Note rate, rose 0.75% to 0.85%

| WisdomTree Trust Annual Report June 30, 2017 | 1 |

Table of Contents

Management’s Discussion of Funds’ Performance

(unaudited) (continued)

over the period. Short-term rates were driven by the Fed raising rates three times in 0.25% increments as they viewed measures of financial conditions positing the economy’s ability to withstand monetary tightening. Longer-term interest rates rose nearly 1.00% in the aftermath of the election as market participants eschewed previous low-growth expectations prior to the election of President Trump. His election signaled looser fiscal policy that would result in higher borrowing costs and greater inflation. With subdued expectations for the administration’s ability to spur the type of pro-growth fiscal policy that had been heralded post-election, interest rate volatility picked up in the first six months of 2017. This volatility was exacerbated by hawkish sentiment out of several major central banks in developed international markets towards the end of the period. The 10-Year Treasury yield finished the first half of 2017 just 0.14% below where it started the year. During the period, investment grade and high-yield spreads, as measured by the BofA Merrill Lynch U.S. Corporate Master Option-Adjusted Spread and BofA Merrill Lynch U.S. High Yield Option-Adjusted Spread, both tightened 0.47% and 2.44%, respectively, to finish near multi-year lows. Credit spreads exhibited few bouts of extreme volatility in a steady grind tighter as equity markets rallied and energy markets stabilized.

WisdomTree Funds’ Performance Overview

The following table reflects the WisdomTree Funds’ performance (excluding those with less than six months of operating history) versus capitalization-weighted benchmark indexes:

| Ticker | WisdomTree Fund | 1-Year NAV Return | Performance Benchmark | 1-Year Return | Difference | |||||||

DDEZ | WisdomTree Dynamic Currency Hedged Europe Equity Fund | 28.55% | MSCI European Economic and Monetary Union (EMU) Local Currency Index | 24.85% | 3.70% | |||||||

| MSCI European Economic and Monetary Union (EMU) Index | 28.15% | 0.40% | ||||||||||

DDWM | WisdomTree Dynamic Currency Hedged International Equity Fund | 22.25% | MSCI EAFE Local Currency Index | 22.10% | 0.15% | |||||||

| MSCI EAFE Index | 20.27% | 1.98% | ||||||||||

DHDG | WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Fund* | 19.61% | MSCI EAFE Local Currency Index | 16.35% | 3.26% | |||||||

DDLS | WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund | 29.80% | MSCI EAFE Small Cap Local Currency Index | 25.93% | 3.87% | |||||||

| MSCI EAFE Small Cap Index | 23.18% | 6.62% | ||||||||||

DDJP | WisdomTree Dynamic Currency Hedged Japan Equity Fund | 25.70% | MSCI Japan Local Currency Index | 30.53% | -4.83% | |||||||

| MSCI Japan Index | 19.18% | 6.52% | ||||||||||

DVEM | WisdomTree Emerging Markets Dividend Fund | 19.46% | MSCI Emerging Markets Index | 23.75% | -4.29% | |||||||

EDOM | WisdomTree Europe Domestic Economy Fund | 36.05% | MSCI European Economic and Monetary Union (EMU) Index | 28.15% | 7.90% | |||||||

HGSD | WisdomTree Global Hedged SmallCap Dividend Fund | 21.89% | MSCI AC World Small Cap Local Currency Index | 21.08% | 0.81% | |||||||

GSD | WisdomTree Global SmallCap Dividend Fund | 20.56% | MSCI AC World Small Cap Index | 20.47% | 0.09% | |||||||

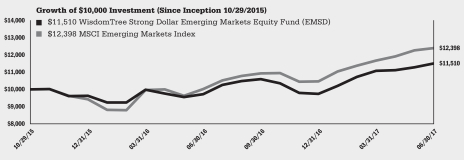

EMSD | WisdomTree Strong Dollar Emerging Markets Equity Fund | 18.52% | MSCI Emerging Markets Index | 23.75% | -5.23% | |||||||

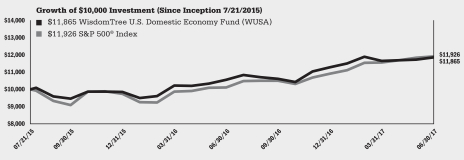

WUSA | WisdomTree U.S. Domestic Economy Fund | 12.34% | S&P 500 Index | 17.90% | -5.56% | |||||||

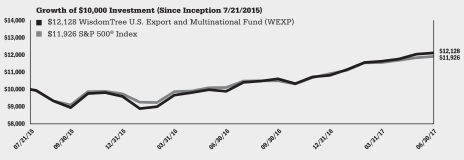

WEXP | WisdomTree U.S. Export and Multinational Fund | 22.55% | S&P 500 Index | 17.90% | 4.65% | |||||||

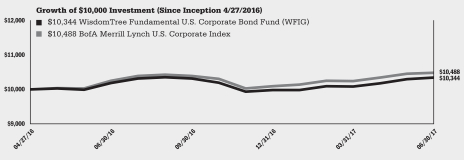

WFIG | WisdomTree Fundamental U.S. Corporate Bond Fund | 1.52% | BofA Merrill Lynch U.S. Corporate Index | 2.33% | -0.81% | |||||||

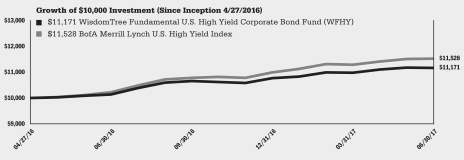

WFHY | WisdomTree Fundamental U.S. High Yield Corporate Bond Fund | 10.23% | BofA Merrill Lynch U.S. High Yield Index | 12.75% | -2.52% | |||||||

| 2 | WisdomTree Trust Annual Report June 30, 2017 |

Table of Contents

Management’s Discussion of Funds’ Performance

(unaudited) (continued)

| Ticker | WisdomTree Fund | 1-Year NAV Return | Performance Benchmark | 1-Year Return | Difference | |||||||

SFIG | WisdomTree Fundamental U.S. Short-Term Corporate Bond Fund | 1.02% | BofA Merrill Lynch 1-5 Year U.S. Corporate Index | 1.59% | -0.57% | |||||||

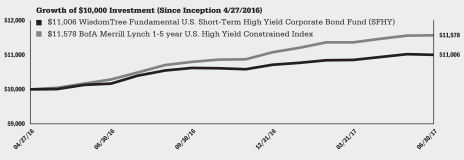

SFHY | WisdomTree Fundamental U.S. Short-Term High Yield Corporate Bond Fund | 8.19% | BofA Merrill Lynch 1-5 Year U.S. High Yield Constrained Index | 12.55% | -4.36% | |||||||

DYB | WisdomTree Dynamic Bearish U.S. Equity Fund | 5.93% | S&P 500 Index | 17.90% | -11.97% | |||||||

| S&P 500 Inverse Daily Index | -14.64% | 20.57% | ||||||||||

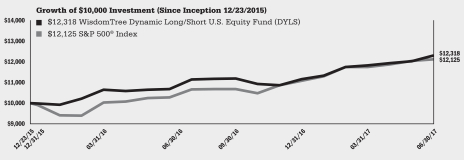

DYLS | WisdomTree Dynamic Long/Short U.S. Equity Fund | 15.25% | S&P 500 Index | 17.90% | -2.65% | |||||||

| * | Since the Fund had less than one year of operating history, the returns shown are cumulative returns since the inception date of the Fund. |

Two strong relative performers versus their MSCI European Economic and Monetary Union (EMU) Index benchmarks were the WisdomTree Europe Domestic Economy Fund (EDOM) and the WisdomTree Dynamic Currency Hedged Europe Equity Fund (DDEZ) which outperformed their respective benchmarks by 7.90% and 3.70%, respectively, during the period. The outperformance of EDOM makes sense with its design to target companies most sensitive to economic growth in the eurozone, ultimately overweighting the Index in Financials, Industrials and Consumer Discretionary sectors that performed well in this timeframe of strengthening economic growth. DDEZ also enjoyed the gains of a strengthening eurozone economy, without the specific design to overweight to cyclicals, as it outperformed both the MSCI EMU Local Currency Index and the MSCI EMU Index.

Strategies with notable outperformance relative to their MSCI EAFE benchmarks include the WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund (DDLS) and the WisdomTree Dynamic Currency Hedged International Equity Fund (DDWM). Both funds exhibited outperformance relative to their local currency benchmarks, and even greater outperformance relative to unhedged benchmarks. Given the volatility of equity markets over the period, it makes sense that a dividend approach would outperform, particularly so in the case of the small-cap fund’s outperformance. DDWM and DDLS benefited from being over 50% hedged for most of this timeframe of significant currency volatility, with the most notable benefit from the hedge to the British pound following the Brexit vote.

The WisdomTree Emerging Markets Dividend Fund (DVEM) and the WisdomTree Strong Dollar Emerging Markets Equity Fund (EMSD) both underperformed their MSCI Emerging Markets Index benchmark. DVEM has underperformed due to its overweight to Energy and underweight Information Technology sectors relative to its benchmark, as well as due to its dividend-weighting approach, a value strategy, in a period where growth outperformed value. The underperformance of EMSD is largely attributed to its lack of exposure to Energy and Materials sectors which rallied in 2016. In the first half of 2017, EMSD has fared well relative to its benchmark due to its overweight to cyclicals, particularly to the Information Technology sector, as well as heavy country overweights to Taiwan, South Korea, and India, three of the best performing countries in emerging markets.

The WisdomTree U.S. Domestic Economy Fund (WUSA) and the WisdomTree U.S. Export and Multinational Fund (WEXP) saw a performance differential of over 10% during the period relative to the S&P 500 Index. Revenue from within and outside the United States is a main determinant of eligibility for both funds, and as a result, they can have very different sector compositions, which can be a driver of short term performance. For example, WUSA requires constituents to have over 80% of their revenue come from within the United States. As a result of this screen, the fund is significantly underweight the information technology sector, which tends to have a more global revenue base, compared to the performance benchmark the S&P 500 Index. This underweight was the primary driver of underperformance over the period for WUSA. On the other hand, WEXP which requires constituents to have over 40% of their revenue come from outside

| WisdomTree Trust Annual Report June 30, 2017 | 3 |

Table of Contents

Management’s Discussion of Funds’ Performance

(unaudited) (concluded)

the United States, was able to outperform the S&P 500 Index over the period. WEXP was slightly overweight the information technology sector relative to the S&P 500, but underweights to telecommunications, real estate and utilities (or sectors mostly with a domestic revenue base) added to relative performance.

The alternative products had a mixed performance during the period. The WisdomTree Dynamic Bearish U.S. Equity Fund (DYB) handily outperformed the S&P 500 Inverse Daily Index, but underperformed the S&P 500 Index. In a bullish equity market period, where the S&P 500 Index hit all-time highs, this was a challenging environment for the bearish DYB. For the WisdomTree Dynamic Long/Short U.S. Equity Fund (DYLS), this was also a challenging environment to beat its S&P 500 Index benchmark that was mostly up throughout the timeframe with strong outperformance for growth stocks. DYLS was hedged in November 2016, a period where U.S. equities markets rallied significantly following President Trump’s victory. Aside from that month, DYLS was mostly unhedged during the 12-month period.

For the fundamental fixed income funds, the WisdomTree Fundamental U.S. High Yield Corporate Bond Fund (WFHY) and the WisdomTree Fundamental U.S. Short-Term High Yield Corporate Bond Fund (SFHY) both underperformed their respective Bank of America Merrill Lynch Indexes. This underperformance of 2.52% and 4.36%, respectively, was largely driven by a significant underweight to the Energy sector as a result of the fundamental screen. The methodologies of these funds both tilt towards higher quality bonds than their respective benchmarks. Oil prices largely stabilized over the 12-month period without a significant move in either direction which was ultimately conducive to a positive backdrop for energy credit. During a period where credit spreads in the high-yield space significantly tightened with minimal volatility, these funds would be expected to underperform.

Fund returns are shown at NAV. Please see Performance Summaries on the subsequent pages for more complete performance information. Please see pages 24 to 27 for the list of index descriptions.

Fund performance assumes reinvestment of dividends and capital gain distributions. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and an index is not available for direct investment. In comparison, the Funds’ performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or taxes that a shareholder would pay on Fund distributions. Past performance is no guarantee of future results. For the most recent month-end performance information visit www.wisdomtree.com.

| 4 | WisdomTree Trust Annual Report June 30, 2017 |

Table of Contents

Performance Summary (unaudited)

WisdomTree Dynamic Currency Hedged Europe Equity Fund (DDEZ)

Sector Breakdown† as of 6/30/17

| Sector | % of Net Assets | |||

Financials | 24.5% | |||

Industrials | 13.8% | |||

Consumer Discretionary | 12.2% | |||

Consumer Staples | 10.1% | |||

Utilities | 10.0% | |||

Energy | 7.2% | |||

Materials | 6.7% | |||

Telecommunication Services | 5.5% | |||

Health Care | 4.7% | |||

Information Technology | 3.6% | |||

Real Estate | 1.6% | |||

Other Assets less Liabilities‡ | 0.1% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings* as of 6/30/17

| Description | % of Net Assets | |||

Anheuser-Busch InBev S.A. | 3.8% | |||

Daimler AG, Registered Shares | 2.6% | |||

TOTAL S.A. | 2.6% | |||

Allianz SE, Registered Shares | 2.4% | |||

Siemens AG, Registered Shares | 2.3% | |||

Banco Santander S.A. | 2.3% | |||

Eni SpA | 2.1% | |||

ING Groep N.V. | 2.0% | |||

Sanofi | 1.8% | |||

BASF SE | 1.8% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree Dynamic Currency Hedged Europe Equity Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Dynamic Currency Hedged Europe Equity Index. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

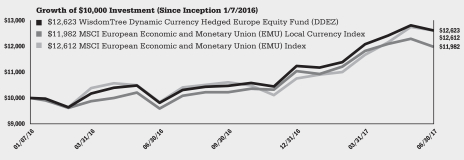

The Fund returned 28.55% at net asset value (“NAV”) for the fiscal year ending June 30, 2017 (for more complete performance information please see the table below). The Fund’s position in France contributed positively to performance while its position in Belgium contributed negatively to performance. During the fiscal year, the Fund utilized forward foreign currency contracts as hedges to offset euro currency exposure from positions in European equities. During the fiscal year, the Fund’s use of forward foreign currency contracts contributed positively to Fund performance as a result of the Fund’s dynamic use of currency hedging during periods in which the U.S. dollar strengthened (more currency hedged) or weakened (less currency hedged) against the euro.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated November 1, 2016, the Fund’s net and gross annual expense ratios were 0.43% and 0.48%, respectively. WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.43% through October 31, 2017, unless earlier terminated by the Board of Trustees of the Trust for any reason at any time.

Performance as of 6/30/17

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 28.55 | % | 17.02 | % | ||||

Fund Market Price Returns | 27.67 | % | 18.29 | % | ||||

WisdomTree Dynamic Currency Hedged Europe Equity Index | 28.65 | % | 17.10 | % | ||||

MSCI European Economic and Monetary Union (EMU) Local Currency Index | 24.85 | % | 13.00 | % | ||||

MSCI European Economic and Monetary Union (EMU) Index | 28.15 | % | 16.98 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the BATS Exchange, Inc. on January 7, 2016. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| WisdomTree Trust Annual Report June 30, 2017 | 5 |

Table of Contents

Performance Summary (unaudited)

WisdomTree Dynamic Currency Hedged International Equity Fund (DDWM)

Sector Breakdown† as of 6/30/17

| Sector | % of Net Assets | |||

Financials | 22.6% | |||

Industrials | 12.8% | |||

Consumer Discretionary | 11.7% | |||

Consumer Staples | 9.9% | |||

Health Care | 8.7% | |||

Energy | 8.1% | |||

Telecommunication Services | 7.7% | |||

Materials | 6.0% | |||

Utilities | 5.8% | |||

Information Technology | 3.6% | |||

Real Estate | 2.9% | |||

Other Assets less Liabilities‡ | 0.2% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings* as of 6/30/17

| Description | % of Net Assets | |||

Royal Dutch Shell PLC, Class B | 1.6% | |||

HSBC Holdings PLC | 1.6% | |||

Nestle S.A., Registered Shares | 1.5% | |||

BP PLC | 1.5% | |||

Novartis AG, Registered Shares | 1.5% | |||

China Mobile Ltd. | 1.4% | |||

Royal Dutch Shell PLC, Class A | 1.3% | |||

Toyota Motor Corp. | 1.2% | |||

Anheuser-Busch InBev S.A. | 1.2% | |||

TOTAL S.A. | 1.1% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree Dynamic Currency Hedged International Equity Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Dynamic Currency Hedged International Equity Index. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

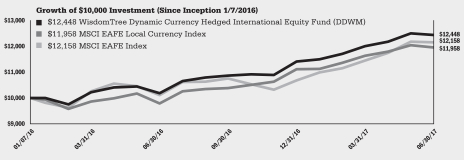

The Fund returned 22.25% at net asset value (“NAV”) for the fiscal year ending June 30, 2017 (for more complete performance information please see the table below). The Fund’s position in Japan contributed positively to performance while its position in Belgium contributed negatively to performance. During the fiscal year, the Fund utilized forward foreign currency contracts as hedges to offset applicable international currency exposure from positions in international equities. During the fiscal year, the Fund’s use of forward foreign currency contracts contributed positively to performance as a result of the Fund’s use of dynamic currency hedging during periods in which the U.S. dollar strengthened (more currency hedged) or weakened (less currency hedged) against applicable international currencies.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated November 1, 2016, the Fund’s net and gross annual expense ratios were 0.35% and 0.40%, respectively. WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.35% through October 31, 2017, unless earlier terminated by the Board of Trustees of the Trust for any reason at any time.

Performance as of 6/30/17

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 22.25 | % | 15.92 | % | ||||

Fund Market Price Returns | 21.58 | % | 16.46 | % | ||||

WisdomTree Dynamic Currency Hedged International Equity Index | 22.29 | % | 15.94 | % | ||||

MSCI EAFE Local Currency Index | 22.10 | % | 12.85 | % | ||||

MSCI EAFE Index | 20.27 | % | 14.12 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the BATS Exchange, Inc. on January 7, 2016. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| 6 | WisdomTree Trust Annual Report June 30, 2017 |

Table of Contents

Performance Summary (unaudited)

WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Fund (DHDG)

Sector Breakdown† as of 6/30/17

| Sector | % of Net Assets | |||

Consumer Staples | 20.0% | |||

Consumer Discretionary | 19.7% | |||

Health Care | 19.5% | |||

Industrials | 16.7% | |||

Information Technology | 10.8% | |||

Materials | 4.8% | |||

Financials | 3.4% | |||

Real Estate | 3.2% | |||

Telecommunication Services | 1.0% | |||

Energy | 0.6% | |||

Other Assets less Liabilities‡ | 0.3% | |||

Total | 100.0% | |||

| † | The sector information shown is that of the Underlying Fund. The Underlying Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets of the Underlying Fund includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings* as of 6/30/17

| Description | % of Net Assets | |||

Roche Holding AG, Genusschein | 6.1% | |||

Novo Nordisk A/S, Class B | 4.8% | |||

Unilever N.V., CVA | 4.3% | |||

British American Tobacco PLC | 3.8% | |||

LVMH Moet Hennessy Louis Vuitton SE | 2.9% | |||

Industria de Diseno Textil S.A. | 2.8% | |||

Diageo PLC | 2.7% | |||

Unilever PLC | 2.6% | |||

Airbus SE | 2.4% | |||

China Overseas Land & Investment Ltd. | 2.1% | |||

| * | The ten largest holdings shown is that of the Underlying Fund and are subject to change, and there are no guarantees the Underlying Fund will remain invested in any particular company. Excludes Underlying Fund’s derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Index (the “Index”). The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index (including indirect investments through the WisdomTree International Quality Dividend Growth Fund (the ‘‘Underlying Fund’’)) whose risk, return and other characteristics resemble the risk, return, and other characteristics of the Index as a whole.

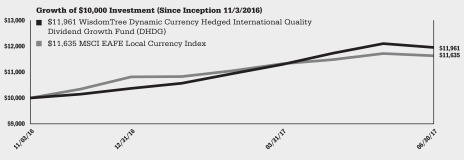

The Fund returned 19.61% at net asset value (“NAV”) from Fund inception date on November 3, 2016 through June 30, 2017 (for more complete performance information please see the table below). The Fund’s exposure to the Netherlands from its investment in the Underlying Fund contributed positively to performance while its exposure to Norway from its investment in the Underlying Fund contributed negatively to performance. During the fiscal year, the Fund utilized forward foreign currency contracts as hedges to offset applicable international currency exposure from positions in international equities. During the fiscal year, the Fund’s use of forward foreign currency contracts detracted from performance as a result of the Fund’s use of dynamic currency hedging during periods in which the U.S. dollar strengthened (more currency hedged) or weakened (less currency hedged) against applicable international currencies.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated October 28, 2016, the Fund’s net and gross annual expense ratios were 0.48% and 0.96%, respectively. The prospectus expense ratio includes 0.38% of acquired fund fees and expenses (‘‘AFFEs’’). The prospectus expense ratio may not correlate to the expense ratio in the Fund’s financial highlights and financial statements because the financial highlights and financial statements reflect only the operating expenses of the Fund and do not include AFFEs, which are fees and expenses incurred indirectly by the Fund through its investments in certain underlying investment companies. WisdomTree Asset Management, Inc. has contractually agreed to waive a portion of its management fee in an amount equal to the AFFEs attributable to the Fund’s investments in the Underlying Fund, as well as an additional 0.10%, through October 31, 2017, unless earlier terminated by the Board of Trustees of WisdomTree Trust for any reason at any time.

Performance as of 6/30/17

| Cumulative Total Return | ||||

| Since Inception1 | ||||

Fund NAV Returns | 19.61 | % | ||

Fund Market Price Returns | 19.53 | % | ||

WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Index | 19.26 | % | ||

MSCI EAFE Local Currency Index | 16.35 | % | ||

| 1 | Total returns are calculated based on the commencement of Fund trading on the BATS Exchange, Inc. on November 3, 2016. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| WisdomTree Trust Annual Report June 30, 2017 | 7 |

Table of Contents

Performance Summary (unaudited)

WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund (DDLS)

Sector Breakdown† as of 6/30/17

| Sector | % of Net Assets | |||

Industrials | 23.2% | |||

Consumer Discretionary | 20.5% | |||

Financials | 13.3% | |||

Materials | 8.6% | |||

Information Technology | 7.5% | |||

Consumer Staples | 7.1% | |||

Real Estate | 7.1% | |||

Health Care | 4.6% | |||

Energy | 2.9% | |||

Utilities | 2.9% | |||

Telecommunication Services | 2.3% | |||

Other Assets less Liabilities‡ | 0.0% | * | ||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

| * | Represents less than 0.1%. |

Top Ten Holdings* as of 6/30/17

| Description | % of Net Assets | |||

TalkTalk Telecom Group PLC | 0.6% | |||

Air New Zealand Ltd. | 0.6% | |||

IOOF Holdings Ltd. | 0.4% | |||

Cofinimmo S.A. | 0.4% | |||

Hanwa Co., Ltd. | 0.4% | |||

Citycon Oyj | 0.4% | |||

Saras SpA | 0.4% | |||

Contact Energy Ltd. | 0.4% | |||

Okasan Securities Group, Inc. | 0.4% | |||

Platinum Asset Management Ltd. | 0.4% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Dynamic Currency Hedged International SmallCap Equity Index. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

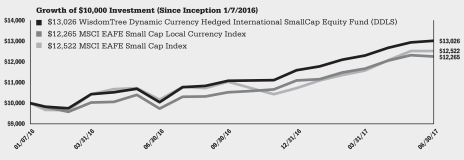

The Fund returned 29.80% at net asset value (“NAV”) for the fiscal year ending June 30, 2017 (for more complete performance information please see the table below). The Fund’s position in Japan contributed positively to performance while its position in Ireland contributed least positively to performance. During the fiscal year, the Fund utilized forward foreign currency contracts as hedges to offset applicable international currency exposure from positions in international equities. During the fiscal year, the Fund’s use of forward foreign currency contracts contributed positively to performance as a result of the Fund’s use of dynamic currency hedging during periods in which the U.S. dollar strengthened (more currency hedged) or weakened (less currency hedged) against applicable international currencies.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated November 1, 2016, the Fund’s net and gross annual expense ratios were 0.43% and 0.48%, respectively. WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.43% through October 31, 2017, unless earlier terminated by the Board of Trustees of the Trust for any reason at any time.

Performance as of 6/30/17

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 29.80 | % | 19.53 | % | ||||

Fund Market Price Returns | 30.43 | % | 20.64 | % | ||||

WisdomTree Dynamic Currency Hedged International SmallCap Equity Index | 30.38 | % | 20.05 | % | ||||

MSCI EAFE Small Cap Local Currency Index | 25.93 | % | 14.80 | % | ||||

MSCI EAFE Small Cap Index | 23.18 | % | 16.42 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the BATS Exchange, Inc. on January 7, 2016. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| 8 | WisdomTree Trust Annual Report June 30, 2017 |

Table of Contents

Performance Summary (unaudited)

WisdomTree Dynamic Currency Hedged Japan Equity Fund (DDJP)

Sector Breakdown† as of 6/30/17

| Sector | % of Net Assets | |||

Consumer Discretionary | 21.5% | |||

Industrials | 18.8% | |||

Financials | 16.5% | |||

Information Technology | 10.1% | |||

Consumer Staples | 7.5% | |||

Telecommunication Services | 7.5% | |||

Health Care | 6.6% | |||

Materials | 6.1% | |||

Real Estate | 2.6% | |||

Utilities | 1.6% | |||

Energy | 0.8% | |||

Other Assets less Liabilities‡ | 0.4% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings* as of 6/30/17

| Description | % of Net Assets | |||

Toyota Motor Corp. | 5.0% | |||

NTT DOCOMO, Inc. | 2.7% | |||

Mitsubishi UFJ Financial Group, Inc. | 2.5% | |||

Japan Tobacco, Inc. | 2.3% | |||

Nippon Telegraph & Telephone Corp. | 2.2% | |||

Nissan Motor Co., Ltd. | 2.0% | |||

Sumitomo Mitsui Financial Group, Inc. | 2.0% | |||

Canon, Inc. | 2.0% | |||

Japan Post Holdings Co., Ltd. | 1.9% | |||

KDDI Corp. | 1.9% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

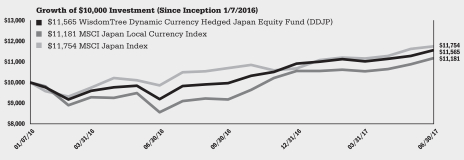

The WisdomTree Dynamic Currency Hedged Japan Equity Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Dynamic Currency Hedged Japan Equity Index. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 25.70% at net asset value (“NAV”) for the fiscal year ending June 30, 2017 (for more complete performance information please see the table below). The Fund’s position in Financials contributed positively to performance while its position in Telecommunication Services contributed negatively to performance. During the fiscal year, the Fund utilized forward foreign currency contracts as hedges to offset Japanese yen currency exposure from positions in Japanese equities. During the fiscal year, the Fund’s use of forward foreign currency contracts contributed positively to Fund performance as a result of the Fund’s dynamic use of currency hedging during periods in which the U.S. dollar strengthened (more currency hedged) or weakened (less currency hedged) against the Japanese yen.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated November 1, 2016, the Fund’s net and gross annual expense ratios were 0.43% and 0.48%, respectively. WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.43% through October 31, 2017, unless earlier terminated by the Board of Trustees of the Trust for any reason at any time.

Performance as of 6/30/17

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 25.70 | % | 10.31 | % | ||||

Fund Market Price Returns | 24.82 | % | 10.64 | % | ||||

WisdomTree Dynamic Currency Hedged Japan Equity Index | 27.01 | % | 11.18 | % | ||||

MSCI Japan Local Currency Index | 30.53 | % | 7.84 | % | ||||

MSCI Japan Index | 19.18 | % | 11.54 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the BATS Exchange, Inc. on January 7, 2016. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| WisdomTree Trust Annual Report June 30, 2017 | 9 |

Table of Contents

Performance Summary (unaudited)

WisdomTree Emerging Markets Dividend Fund (DVEM)

Sector Breakdown† as of 6/30/17

| Sector | % of Net Assets | |||

Financials | 22.0% | |||

Information Technology | 15.0% | |||

Telecommunication Services | 10.8% | |||

Energy | 10.8% | |||

Materials | 9.2% | |||

Consumer Staples | 8.0% | |||

Consumer Discretionary | 6.7% | |||

Industrials | 6.6% | |||

Utilities | 5.6% | |||

Real Estate | 3.5% | |||

Health Care | 0.9% | |||

Other Assets less Liabilities‡ | 0.9% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings* as of 6/30/17

| Description | % of Net Assets | |||

China Construction Bank Corp., Class H | 3.7% | |||

Taiwan Semiconductor Manufacturing Co., Ltd. | 3.2% | |||

China Mobile Ltd. | 3.0% | |||

Samsung Electronics Co., Ltd. | 2.3% | |||

Hon Hai Precision Industry Co., Ltd. | 1.6% | |||

Lukoil PJSC, ADR | 1.5% | |||

Rosneft Oil Co. PJSC, GDR Reg S | 1.2% | |||

Industrial & Commercial Bank of China Ltd., Class H | 1.1% | |||

Gazprom PJSC, ADR | 1.1% | |||

Ambev S.A. | 1.0% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

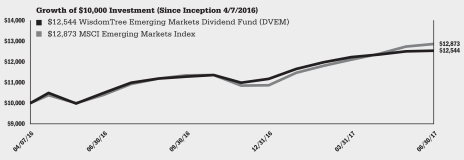

The WisdomTree Emerging Markets Dividend Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Emerging Markets Dividend Index. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 19.46% at net asset value (“NAV”) for the fiscal year ending June 30, 2017 (for more complete performance information please see the table below). The Fund’s position in Taiwan contributed positively to performance while its position in the Philippines contributed negatively to performance.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated November 1, 2016, the Fund’s annual expense ratio was 0.32%.

Performance as of 6/30/17

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 19.46 | % | 20.18 | % | ||||

Fund Market Price Returns | 19.76 | % | 21.09 | % | ||||

WisdomTree Emerging Markets Dividend Index | 19.38 | % | 20.15 | % | ||||

MSCI Emerging Markets Index | 23.75 | % | 22.79 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the BATS Exchange, Inc. on April 7, 2016. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| 10 | WisdomTree Trust Annual Report June 30, 2017 |

Table of Contents

Performance Summary (unaudited)

WisdomTree Europe Domestic Economy Fund (EDOM)

(formerly, WisdomTree Europe Local Recovery Fund)

Sector Breakdown† as of 6/30/17

| Sector | % of Net Assets | |||

Financials | 30.4% | |||

Industrials | 27.4% | |||

Consumer Discretionary | 20.9% | |||

Information Technology | 6.7% | |||

Materials | 6.0% | |||

Energy | 5.2% | |||

Real Estate | 3.2% | |||

Other Assets less Liabilities‡ | 0.2% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings* as of 6/30/17

| Description | % of Net Assets | |||

TOTAL S.A. | 1.7% | |||

Allianz SE, Registered Shares | 1.5% | |||

BNP Paribas S.A. | 1.4% | |||

ING Groep N.V. | 1.4% | |||

Siemens AG, Registered Shares | 1.3% | |||

Vinci S.A. | 1.0% | |||

Intesa Sanpaolo SpA | 1.0% | |||

Deutsche Post AG, Registered Shares | 0.9% | |||

AXA S.A. | 0.9% | |||

Societe Generale S.A. | 0.9% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

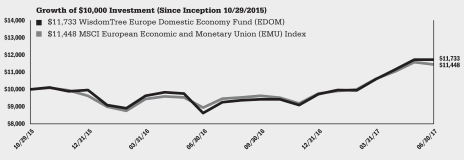

The WisdomTree Europe Domestic Economy Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Europe Domestic Economy Index. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 36.05% at net asset value (“NAV”) for the fiscal year ending June 30, 2017 (for more complete performance information please see the table below). The Fund’s position in France contributed most positively to performance while its position in Portugal contributed least positively to performance.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated November 1, 2016, as supplemented March 17, 2017, the Fund’s net and gross annual expense ratios were 0.48% and 0.58%, respectively. WisdomTree Asset Management, Inc. has contractually agreed to limit the management fee to 0.48% through October 31, 2017, unless earlier terminated by the Board of Trustees of the Trust for any reason at any time.

Performance as of 6/30/17

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 36.05 | % | 10.02 | % | ||||

Fund Market Price Returns | 36.09 | % | 10.40 | % | ||||

WisdomTree Europe Domestic Economy Index2 | 36.28 | % | 10.06 | % | ||||

MSCI European Economic and Monetary Union (EMU) Index | 28.15 | % | 8.43 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the BATS Exchange, Inc. on October 29, 2015. |

| 2 | Prior to March 17, 2017, the WisdomTree Europe Domestic Economy Index was known as the WisdomTree Europe Local Recovery Index. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| WisdomTree Trust Annual Report June 30, 2017 | 11 |

Table of Contents

Performance Summary (unaudited)

WisdomTree Global ex-Mexico Equity Fund (XMX)

Sector Breakdown† as of 6/30/17

| Sector | % of Net Assets | |||

Financials | 17.7% | |||

Information Technology | 16.3% | |||

Health Care | 12.2% | |||

Consumer Discretionary | 11.9% | |||

Industrials | 11.7% | |||

Consumer Staples | 9.5% | |||

Energy | 5.8% | |||

Materials | 4.9% | |||

Utilities | 3.3% | |||

Real Estate | 3.2% | |||

Telecommunication Services | 3.2% | |||

Other Assets less Liabilities‡ | 0.3% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings* as of 6/30/17

| Description | % of Net Assets | |||

Apple, Inc. | 1.9% | |||

Microsoft Corp. | 1.3% | |||

Alphabet, Inc., Class A | 1.0% | |||

Amazon.com, Inc. | 1.0% | |||

Facebook, Inc., Class A | 0.9% | |||

Johnson & Johnson | 0.8% | |||

Exxon Mobil Corp. | 0.8% | |||

JPMorgan Chase & Co. | 0.8% | |||

Berkshire Hathaway, Inc., Class B | 0.7% | |||

Samsung Electronics Co., Ltd. | 0.7% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree Global ex-Mexico Equity Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Global ex-Mexico Equity Index. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund had less than six months of operating history at the end of the reporting period and therefore no comparative performance information is shown in this shareholder report. Comparative performance information for the most recent month-end is available at www.wisdomtree.com.

| 12 | WisdomTree Trust Annual Report June 30, 2017 |

Table of Contents

Performance Summary (unaudited)

WisdomTree Global Hedged SmallCap Dividend Fund (HGSD)

Sector Breakdown† as of 6/30/17

| Sector | % of Net Assets | |||

Industrials | 21.2% | |||

Consumer Discretionary | 16.0% | |||

Financials | 13.1% | |||

Real Estate | 12.8% | |||

Materials | 8.9% | |||

Information Technology | 7.5% | |||

Consumer Staples | 5.8% | |||

Energy | 5.0% | |||

Utilities | 4.9% | |||

Telecommunication Services | 2.4% | |||

Health Care | 2.0% | |||

Investment Company | 0.1% | |||

Other Assets less Liabilities‡ | 0.3% | |||

Total | 100.0% | |||

| † | The sector information shown is that of the Underlying Fund. The Underlying Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets of the Underlying Fund includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings* as of 6/30/17

| Description | % of Net Assets | |||

CoreCivic, Inc. | 1.8% | |||

GEO Group, Inc. (The) | 1.7% | |||

CVR Energy, Inc. | 1.6% | |||

Kronos Worldwide, Inc. | 1.2% | |||

Waddell & Reed Financial, Inc., Class A | 0.8% | |||

GATX Corp. | 0.7% | |||

RR Donnelley & Sons Co. | 0.7% | |||

Xenia Hotels & Resorts, Inc. | 0.7% | |||

Diebold Nixdorf, Inc. | 0.7% | |||

Time, Inc. | 0.7% | |||

| * | The ten largest holdings shown is that of the Underlying Fund and are subject to change, and there are no guarantees the Underlying Fund will remain invested in any particular company. Excludes Underlying Fund’s derivatives and investment of cash collateral for securities on loan (if any). |

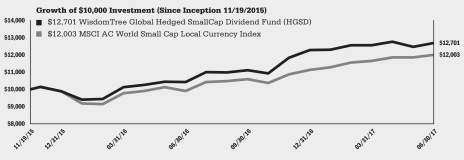

The WisdomTree Global Hedged SmallCap Dividend Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Global Hedged SmallCap Dividend Index (the “Index”). The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index (including indirect investments through the WisdomTree Global SmallCap Dividend Fund (the ‘‘Underlying Fund’’)) whose risk, return and other characteristics resemble the risk, return, and other characteristics of the Index as a whole.

The Fund returned 21.89% at net asset value (“NAV”) for the fiscal year ending June 30, 2017 (for more complete performance information please see the table below). The Fund’s exposure to the United States from its investment in the Underlying Fund contributed positively to performance while its exposure to Spain from its investment in the Underlying Fund contributed negatively to performance. During the fiscal year, the Fund utilized forward foreign currency contracts as hedges to offset applicable international currency exposure from positions in international equities. The Fund’s use of forward foreign currency contracts contributed positively to performance as a result of the overall appreciation in the U.S. dollar against applicable international currencies during the fiscal year.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes a shareholder would pay on the sale of Fund shares or on Fund distributions. As of the Fund’s current prospectus dated November 1, 2016, the Fund’s net and gross annual expense ratios were 0.43% and 0.86%, respectively. The prospectus expense ratio includes 0.43% of acquired fund fees and expenses (‘‘AFFEs’’). The prospectus expense ratio may not correlate to the expense ratio in the Fund’s financial highlights and financial statements because the financial highlights and financial statements reflect only the operating expenses of the Fund and do not include AFFEs, which are fees and expenses incurred indirectly by the Fund through its investments in certain underlying investment companies. WisdomTree Asset Management, Inc. has contractually agreed to waive a portion of its management fee in an amount equal to the AFFEs attributable to the Fund’s investments in the Underlying Fund through July 31, 2018, unless earlier terminated by the Board of Trustees of WisdomTree Trust for any reason at any time.

Performance as of 6/30/17

| Average Annual Total Return | ||||||||

| 1 Year | Since Inception1 | |||||||

Fund NAV Returns | 21.89 | % | 15.94 | % | ||||

Fund Market Price Returns | 20.57 | % | 15.65 | % | ||||

WisdomTree Global Hedged SmallCap Dividend Index | 21.05 | % | 16.08 | % | ||||

MSCI AC World Small Cap Local Currency Index | 21.08 | % | 11.98 | % | ||||

| 1 | Total returns are calculated based on the commencement of Fund trading on the BATS Exchange, Inc. on November 19, 2015. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

| WisdomTree Trust Annual Report June 30, 2017 | 13 |

Table of Contents

Performance Summary (unaudited)

WisdomTree Global SmallCap Dividend Fund (GSD)

Sector Breakdown† as of 6/30/17

| Sector | % of Net Assets | |||

Industrials | 21.2% | |||

Consumer Discretionary | 16.0% | |||

Financials | 13.1% | |||

Real Estate | 12.8% | |||

Materials | 8.9% | |||

Information Technology | 7.5% | |||

Consumer Staples | 5.8% | |||

Energy | 5.0% | |||

Utilities | 4.9% | |||

Telecommunication Services | 2.4% | |||

Health Care | 2.0% | |||

Investment Company | 0.1% | |||

Other Assets less Liabilities‡ | 0.3% | |||

Total | 100.0% | |||

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. It does not include derivatives (if any). |

| ‡ | Other assets includes investment of cash collateral for securities on loan (if any). |

Top Ten Holdings* as of 6/30/17

| Description | % of Net Assets | |||

CoreCivic, Inc. | 1.8% | |||

GEO Group, Inc. (The) | 1.7% | |||

CVR Energy, Inc. | 1.6% | |||

Kronos Worldwide, Inc. | 1.2% | |||

Waddell & Reed Financial, Inc., Class A | 0.8% | |||

GATX Corp. | 0.7% | |||

RR Donnelley & Sons Co. | 0.7% | |||

Xenia Hotels & Resorts, Inc. | 0.7% | |||

Diebold Nixdorf, Inc. | 0.7% | |||

Time, Inc. | 0.7% | |||

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

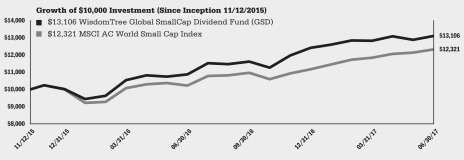

The WisdomTree Global SmallCap Dividend Fund (the ‘‘Fund’’) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Global SmallCap Dividend Index. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 20.56% at net asset value (“NAV”) for the fiscal year ending June 30, 2017 (for more complete performance information please see the table below). The Fund’s position in the United States contributed positively to performance while its position in Spain contributed negatively to performance. During the fiscal year, the Fund utilized equity futures contracts on a temporary basis to obtain market exposure consistent with the Fund’s investment objective as part of the Fund’s annual portfolio rebalance. The Fund’s use of equity futures contracts detracted from performance during the fiscal year.

The following performance table is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of the Fund’s portfolio securities.