| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

|

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| | |

| Investment Company Act file number | 811-21861 |

| |

| AMERICAN CENTURY GROWTH FUNDS, INC. |

| (Exact name of registrant as specified in charter) |

| |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | | (Zip Code) |

| |

| CHARLES A. ETHERINGTON |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| Date of fiscal year end: | 07-31 |

| Date of reporting period: | 07-31-2009 |

| | |

| | | |

ITEM 1. REPORTS TO STOCKHOLDERS.

|

| Annual Report |

| July 31, 2009 |

|

| American Century Investments |

Legacy Focused Large Cap Fund

Legacy Large Cap Fund

Legacy Multi Cap Fund

Dear Investor:

Thank you for investing with us during the financial reporting period ended July 31, 2009. We appreciate your trust in American Century Investments® during these challenging times.

The U.S. economy continued to struggle at the close of the reporting period, part of the lingering fallout from the subprime-initiated credit and financial crises and global recession that shook the capital markets during the past two years. The recession has affected everyone—from first-time individual investors to hundred-year-old financial institutions.

However, as we mark the second anniversary of the start of the subprime mortgage meltdown, the worst of the economic and financial market obstacles appear to be behind us. The rate of U.S. economic decline has slowed, as have the drop-offs in housing prices and jobs. Risk appetites returned to the markets in recent months, evidenced by the strong stock rebound since early March.

Risk was a predominant theme during the reporting period, as the investment pendulum swung from risk avoidance to risk acceptance. We believe, however, that caution and risk management are still advisable. We don’t think we’re out of the economic woods yet, not with mortgage and corporate default rates on the rise, housing prices continuing to decline in some regions, and job losses still mounting.

Effective risk management requires a commitment to disciplined investment approaches that balance risk and reward, with the goal of setting and maintaining risk levels that are appropriate for portfolio objectives. At American Century Investments, we’ve stayed true to the principles that have guided us for over 50 years, including our commitment to delivering superior investment performance and helping investors reach their financial goals. Risk management is part of that commitment—we offer portfolios that can help diversify and stabilize investment returns.

The coming months will likely present additional challenges, but I’m certain that we have the investment professionals and processes in place to provide competitive and compelling long-term results for you. Thank you for your continued confidence in us.

Sincerely,

Jonathan S. Thomas

President and Chief Executive Officer

American Century Investments

|

| Independent Chairman’s Letter |

I am Don Pratt, an independent director and chairman of the mutual fund board responsible for the U.S. Growth Equity, U.S. Value Equity, Global and Non-U.S. Equity and Asset Allocation funds managed by American Century Investments. The board consists of seven independent directors and two directors who are affiliated with the investment advisor.

As one of your independent shareholder representatives on the fund board, I plan to write you from time to time with updates on board activities and news about your funds. My co-independent directors and I are committed to putting your interests first. We work closely with American Century Investments on maintaining strong fund performance, providing quality service to shareholders at competitive fees and ensuring ethical business practices and compliance with all applicable fund regulations.

Last year, the board welcomed its newest independent director, John R. Whitten. He is a great addition to an experienced board where, collectively, the independent directors have served the funds for more than 76 years. This continuity served shareholders well as the investment advisor initiated a successful management transition, creating a strong senior leadership team consisting of well-tenured company executives and experienced industry veterans. Under the leadership of President and Chief Executive Officer Jonathan Thomas and Chief Investment Officer Enrique Chang, the firm has made the achievement of superior investment performance its primary focus and the key driver of its success going forward. This focus helped the company generate strong relative performance against the backdrop of 2008’s unprecedented market volatility.

As investors in the American Century funds, my fellow directors and I share your investing experience. We know firsthand how decisions made at the board level affect all shareholders. To further guide our efforts on your behalf, I invite you to send me your comments, questions or suggestions by email to dhpratt@fundboardchair.com. Thank you for allowing me to serve as your advocate on our board.

| |

| Market Perspective | 2 |

| Market Index Total Returns | 2 |

| |

| Legacy Focused Large Cap | |

| |

| Performance | 3 |

| Portfolio Commentary | 5 |

| Top Ten Holdings | 7 |

| Top Five Industries | 7 |

| Types of Investments in Portfolio | 7 |

| |

| Legacy Large Cap | |

| |

| Performance | 8 |

| Portfolio Commentary | 10 |

| Top Ten Holdings | 12 |

| Top Five Industries | 12 |

| Types of Investments in Portfolio | 12 |

| |

| Legacy Multi Cap | |

| |

| Performance | 13 |

| Portfolio Commentary | 15 |

| Top Ten Holdings | 17 |

| Top Five Industries | 17 |

| Types of Investments in Portfolio | 17 |

| |

| Shareholder Fee Examples | 18 |

| |

| Financial Statements | |

| |

| Schedule of Investments | 21 |

| Statement of Assets and Liabilities | 27 |

| Statement of Operations | 28 |

| Statement of Changes in Net Assets | 29 |

| Notes to Financial Statements | 31 |

| Financial Highlights | 39 |

| Report of Independent Registered Public Accounting Firm | 51 |

| |

| Other Information | |

| |

| Management | 52 |

| Approval of Management Agreements | 56 |

| Additional Information | 61 |

| Index Definitions | 62 |

The opinions expressed in the Market Perspective and each of the Portfolio Commentaries reflect those of the portfolio management team as of the date of the report, and do not necessarily represent the opinions of American Century Investments or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for com parative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

By Glenn Fogle, Chief Investment Officer, U.S. Growth Equity — Mid & Small Cap

A Historic Market Decline

The U.S. stock market declined sharply for the 12 months ended July 31, 2009, in an environment marked by severe volatility and dramatic shifts in market sentiment. Major equity indices marched downward amid a debilitating credit crunch, extreme turmoil in the financial sector, and a worsening economic downturn.

A deepening liquidity crisis—sparked by the mortgage market collapse in 2007—led to an increasingly urgent need for capital at many financial companies. Following a series of bankruptcies and takeovers in the financial industry in late 2008, the government moved swiftly to provide financial assistance and other support to prevent a full-scale collapse in the financial system. A series of interest cuts by the Federal Reserve in late 2008 ultimately resulted in an unprecedented federal funds rate of 0.00% –0.25%. The government also passed the Emergency Stabilization Act, which authorized the use of $700 billion to purchase distressed assets and make injections of capital into banks.

The credit crisis exacerbated the weakness in the U.S. economy, which had officially entered a recession in December 2007. The unemployment rate surged to its highest level since 1983, consumer spending shrank, and the housing market continued to deteriorate. The difficult financial and economic conditions drove markets down through late 2008 and into early 2009. From the beginning of the reporting period through March 9, 2009, broad equity indices fell by more than 40%.

Early Signs of Recovery

Market conditions shifted markedly in the final months of the reporting period. After sinking to a multi-year low on March 9, 2009, equity markets staged a powerful rebound amid signs of economic stabilization. Further supporting market strength, investors grew confident about the federal government’s actions to stimulate economic activity and restore liquidity in the credit markets.

Despite the rebound in the second half of the reporting period, broad equity indices declined by approximately 20% for the 12-month period, as shown in the table below. Changing perceptions drove much of the rally, but a truly sustainable long-term advance requires significant improvements in economic and company fundamentals, which have yet to materialize.

| |

| Market Index Total Returns | |

| For the 12 months ended July 31, 2009 | |

| U.S. Stocks | |

| Russell 1000 Index (Large-Cap) | -20.17% |

| Russell Midcap Index | -22.22% |

| Russell 2000 Index (Small-Cap) | -20.72% |

| Foreign Stocks | |

| MSCI EAFE (Europe, Australasia, Far East) Index | -22.60% |

| MSCI EM (Emerging Markets) Index | -16.84% |

2

| | | |

| Legacy Focused Large Cap | | | |

| |

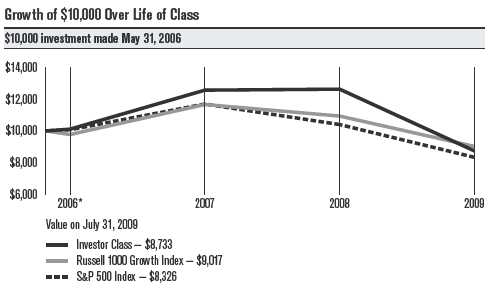

| Total Returns as of July 31, 2009 | | | |

| | | Average | |

| | | Annual Returns | |

| | 1 year | Since Inception | Inception Date |

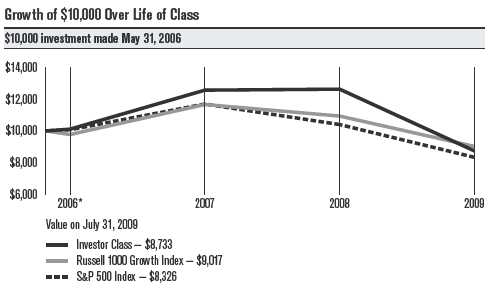

| Investor Class | -30.92% | -4.18% | 5/31/06 |

| S&P 500 Index(1) | -19.96% | -5.62% | — |

| Russell 1000 Growth Index(1) | -17.57% | -3.22% | — |

| Institutional Class | -30.73% | -3.98% | 5/31/06 |

| Advisor Class | -31.06% | -4.41% | 5/31/06 |

| R Class | -31.28% | -4.67% | 5/31/06 |

| (1) Data provided by Lipper Inc. — A Reuters Company. © 2009 Reuters. All rights reserved. Any copying, republication or redistribution of Lipper |

| content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Lipper shall not be |

| liable for any errors or delays in the content, or for any actions taken in reliance thereon. | | |

| The data contained herein has been obtained from company reports, financial reporting services, periodicals and other resources believed to be |

| reliable. Although carefully verified, data on compilations is not guaranteed by Lipper and may be incomplete. No offer or solicitations to buy or |

| sell any of the securities herein is being made by Lipper. | | | |

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The fund is considered nondiversified, which may subject the fund to risk because a price change in any one security may have a greater impact than would be the case if the fund were diversified. The fund’s investment process may also result in high portfolio turnover, which could mean high transaction costs, affecting both performance and capital gains tax liabilities to investors. International investing involves special risks, such as political instability and currency fluctuations.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

3

Legacy Focused Large Cap

| | | | |

| One-Year Returns Over Life of Class | | | |

| Periods ended July 31 | | | | |

| | 2006* | 2007 | 2008 | 2009 |

| Investor Class | 1.10% | 24.44% | 0.49% | -30.92% |

| S&P 500 Index | 0.75% | 16.13% | -11.09% | -19.96% |

| Russell 1000 Growth Index | -2.29% | 19.47% | -6.29% | -17.57% |

| *From 5/31/06, the Investor Class’s inception date. Not annualized. | | | |

| |

| Total Annual Fund Operating Expenses | | | |

| Investor Class | Institutional Class | Advisor Class | R Class |

| 1.11% | 0.91% | 1.36% | 1.61% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The fund is considered nondiversified, which may subject the fund to risk because a price change in any one security may have a greater impact than would be the case if the fund were diversified. The fund’s investment process may also result in high portfolio turnover, which could mean high transaction costs, affecting both performance and capital gains tax liabilities to investors. International investing involves special risks, such as political instability and currency fluctuations.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

4

Legacy Focused Large Cap

Portfolio Managers: John T. Small Jr. and Stephen Pool

Performance Summary

Legacy Focused Large Cap declined -30.92%* for the 12 months ended July 31, 2009, compared with a -19.96% decline for the portfolio’s benchmark, the S&P 500 Index. The Russell 1000 Growth Index fell -17.57%.

As discussed in the Market Perspective on page 2, U.S. stock indices fell during the reporting period amid a volatile market climate, ongoing credit crisis, and economic recession. The last five months of the period featured a rally in lower-quality stocks with weak balance sheets, poor to negative earnings and cash flow, and negative price momentum. This is at odds with our investment approach, which centers on owning companies that exhibit accelerating earnings and revenues and where the market recognizes this by way of share-price momentum.

Within the portfolio, stock selection in the consumer staples, materials and industrials sectors accounted for the bulk of underperformance relative to the benchmark. An overweight allocation to IT stocks partially offset those losses, and an underweight allocation in the financials sector benefited relative performance.

The portfolio also maintained a significant allocation to foreign stocks. These holdings detracted from performance.

Consumer Staples Led Underperformance

The consumer staples sector was Legacy Focused Large Cap’s largest source of underperformance relative to the benchmark. Here, a detrimental allocation to the food products group reflected overweight stakes in Campbell Soup Company, Kellogg Company, and General Mills Inc. All three holdings hurt relative returns as they experienced larger share price declines during the time they were held in the portfolio than for the entire reporting period. Underweight allocations elsewhere in the sector, including food and staples retailers and tobacco companies, also hurt performance.

Materials, Industrials Detracted

The materials sector was home to relative underperformance. Within the chemicals industry, the portfolio focused on fertilizer companies Mosaic Co. and Canada-based Potash Corp. of Saskatchewan Inc., which are not benchmark constituents. The companies have both benefited in past reporting periods from secularly higher demand in the fertilizer market, driven by a higher standard of living in emerging markets, a lower availability of farmland, and a greater global focus on biofuels. During the reporting period, though, declining demand for fertilizer resulted in lower commodity prices, driving the companies’ share prices down.

*All fund returns referenced in this commentary are for Investor Class shares.

5

Legacy Focused Large Cap

Within the industrials sector, Legacy Focused Large Cap maintained overweight positions in railroad companies, including Norfolk Southern. This industry has experienced improving fundamentals as higher fuel prices created an advantage for the more fuel-efficient railroads versus trucking companies, and as coal shipments continued to increase. During the reporting period, however, these positions detracted from absolute and relative returns.

Information Technology Hindered Results

Although the portfolio’s overweight in the information technology sector contributed to relative returns, select holdings detracted. Research In Motion, which is not a benchmark constituent, experienced a drop in its share price amid concerns that the maker of the Blackberry hand-held device might not be able to maintain momentum in the sluggish economic environment.

Financials, Consumer Discretionary Contributed

The portfolio’s underweight in the financials sector reflected relatively smaller allocations to the insurance and diversified financial services group. Legacy Focused Large Cap was rewarded as these industry groups suffered significant declines. Within the diversified financial services group, in particular, the portfolio avoided Citigroup Inc. and Bank of America Corp., whose share prices declined 83% and 53%, respectively, in the benchmark.

An overweight in the capital markets industry included a stake in Germany-based Deutsche Bank AG, which is not represented in the benchmark. The position helped both absolute and relative performance, as the bank’s share price gained 37% for the time it was held in the portfolio, despite suffering double-digit declines for the entire reporting period.

Outlook

We are cautiously optimistic in our market outlook. Although markets have rebounded in the past several months, we continue to look for more meaningful improvements in economic conditions. Regardless of conditions, Legacy Focused Large Cap employs financial acceleration and price momentum screens to identify investment opportunities in any given economic environment. As always, it will employ a quantitative model to exploit large-cap investment opportunities across the growth and value spectrums.

6

| | | |

| Legacy Focused Large Cap | | |

| |

| Top Ten Holdings as of July 31, 2009 | | |

| | | % of net assets | % of net assets |

| | | as of 7/31/09 | as of 1/31/09 |

| Baidu, Inc. ADR | 4.1% | — |

| Goldman Sachs Group, Inc. (The) | 4.0% | — |

| Cia de Bebidas das Americas, Preference Shares ADR | 3.9% | — |

| Amazon.com, Inc. | 3.9% | — |

| Apple, Inc. | 3.9% | — |

| Texas Instruments, Inc. | 3.7% | — |

| Franklin Resources, Inc. | 3.7% | — |

| Deutsche Bank AG | 3.7% | — |

| Freeport-McMoRan Copper & Gold, Inc. | 3.6% | — |

| TJX Cos., Inc. (The) | 3.5% | — |

| |

| Top Five Industries as of July 31, 2009 | | |

| | | % of net assets | % of net assets |

| | | as of 7/31/09 | as of 1/31/09 |

| Capital Markets | 21.0% | — |

| Internet Software & Services | 7.2% | — |

| Beverages | 6.7% | — |

| Semiconductors & Semiconductor Equipment | 6.7% | — |

| Metals & Mining | 6.3% | 6.5% |

| |

| Types of Investments in Portfolio | | |

| | | % of net assets | % of net assets |

| | | as of 7/31/09 | as of 1/31/09 |

| Domestic Common Stocks | 63.2% | 83.7% |

| Foreign Common Stocks(1) | 36.0% | 16.3% |

| Total Common Stocks | 99.2% | 100.0% |

| Other Assets and Liabilities | 0.8% | —(2) |

| (1) | Includes depositary shares, dual listed securities and foreign ordinary shares. | | |

| (2) | Category is less than 0.05% of total net assets. | | |

7

| | | |

| Legacy Large Cap | | | |

| |

| Total Returns as of July 31, 2009 | | | |

| | | Average | |

| | | Annual Returns | |

| | 1 year | Since Inception | Inception Date |

| Investor Class | -28.45% | -3.88% | 5/31/06 |

| S&P 500 Index(1) | -19.96% | -5.62% | — |

| Russell 1000 Growth Index(1) | -17.57% | -3.22% | — |

| Institutional Class | -28.34% | -3.72% | 5/31/06 |

| Advisor Class | -28.67% | -4.15% | 5/31/06 |

| R Class | -28.81% | -4.37% | 5/31/06 |

| (1) | Data provided by Lipper Inc. — A Reuters Company. © 2009 Reuters. All rights reserved. Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon. |

| | The data contained herein has been obtained from company reports, financial reporting services, periodicals and other resources believed to be reliable. Although carefully verified, data on compilations is not guaranteed by Lipper and may be incomplete. No offer or solicitations to buy or sell any of the securities herein is being made by Lipper. |

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The fund’s investment process may also result in high portfolio turnover, which could mean high transaction costs, affecting both performance and capital gains tax liabilities to investors. International investing involves special risks, such as political instability and currency fluctuations.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

8

Legacy Large Cap

| | | | |

| One-Year Returns Over Life of Class | | | |

| Periods ended July 31 | | | | |

| | 2006* | 2007 | 2008 | 2009 |

| Investor Class | 1.50% | 17.83% | 3.07% | -28.45% |

| S&P 500 Index | 0.75% | 16.13% | -11.09% | -19.96% |

| Russell 1000 Growth Index | -2.29% | 19.47% | -6.29% | -17.57% |

| *From 5/31/06, the Investor Class’s inception date. Not annualized. | | | |

| |

| Total Annual Fund Operating Expenses | | | |

| Investor Class | Institutional Class | Advisor Class | R Class |

| 1.11% | 0.91% | 1.36% | 1.61% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 . or visit americancentury.com. The fund’s investment process may also result in high portfolio turnover, which could mean high transaction costs, affecting both performance and capital gains tax liabilities to investors. International investing involves special risks, such as politic al instability and currency fluctuations.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

9

Legacy Large Cap

Portfolio Managers: John T. Small Jr. and Stephen Pool

Performance Summary

Legacy Large Cap declined -28.45%* for the 12 months ended July 31, 2009, underperforming the -19.96% decline of the portfolio’s benchmark, the S&P 500 Index and the -17.57% decline of the Russell 1000 Growth Index.

As discussed in the Market Perspective on page 2, U.S. stock indices fell during the reporting period amid a volatile market climate, ongoing credit crisis, and economic recession. The last five months of the period featured a rally in lower-quality stocks with weak balance sheets, poor to negative earnings and cash flow, and negative price momentum. This is at odds with our investment approach, which centers on owning companies that exhibit accelerating earnings and revenues and where the market recognizes this by way of share-price momentum.

Stock selection in the information technology and materials sectors accounted for the bulk of Legacy Large Cap’s underperformance relative to the benchmark. Holdings in the industrials and financials sectors also weighed on relative returns. An effective mix of energy stocks only partially offset those losses.

The portfolio also maintained a significant allocation to foreign stocks. These holdings detracted from performance.

Information Technology, Materials Led Underperformance

Holdings in the information technology sector weighed on performance, particularly within the software and semiconductor industry groups. The portfolio’s overweight stake in VMware Inc. hurt returns relative to the benchmark as the virtualization software producer’s share price declined modestly during the reporting period. The portfolio also held a detrimental stake in semiconductor company STMicroelectronics, which is not a benchmark constituent.

The materials sector also was a key source of Legacy Large Cap’s relative underperformance. Within the sector, the portfolio maintained a stake in Brazilian steel producer Gerdau SA, which had been a significant contributor to returns in the past amid rising steel prices. During the reporting period, though, Gerdau’s share price fell as demand and prices for steel both weakened.

Also in the materials sector, the portfolio maintained an underweight stake in the chemicals industry which included Canadian fertilizer company Potash Corp. of Saskatchewan Inc. The company is one of several holdings that have formerly benefited from burgeoning demand for fertilizer, driven by a higher standard of living in emerging markets, a lower availability of farmland, and a greater global focus on biofuels. During the past 12 months, however, declining demand for fertilizer resulted in lower commodity prices, driving the company’s share price down.

*All fund returns referenced in this commentary are for Investor Class shares.

10

Legacy Large Cap

Industrials, Financials Detracted

The industrials sector was home to several holdings that weighed on relative performance. Holdings in the aerospace and defense industry focused on defense contractors, including Lockheed Martin.

Elsewhere in the industrials sector, Legacy Large Cap maintained overweight positions in railroad companies, including Union Pacific. This industry has experienced improving fundamentals as higher fuel prices created an advantage for the more fuel efficient railroads versus trucking companies, and as coal shipments continued to increase. More recently, though, these positions detracted from absolute and relative returns.

Stock picks in the financials sector also hurt performance relative to the benchmark. The portfolio held a stake in MetLife, which is not represented in the benchmark. The insurer’s earnings fell amid declining revenue from premiums and lower investment income.

Energy Helped

In the energy sector, a substantial underweighting in companies involved in equipment and services benefited returns. Within the group, the portfolio held an overweight in National Oilwell Varco. Although the company’s share price tumbled more than 50% in the benchmark for the 12-month period, it gained 35% during the time it was held in the portfolio. Avoiding oil services company Schlumberger also contributed meaningfully to relative performance.

Outlook

We are cautiously optimistic in our market outlook. Although markets have rebounded in the past several months, we continue to look for more meaningful improvements in economic conditions. Regardless of conditions, Legacy Large Cap employs financial acceleration and price momentum screens to identify investment opportunities in any given economic environment. As always, it will employ a quantitative model to exploit large-cap investment opportunities across the growth and value spectrums.

11

| | |

| Legacy Large Cap | | |

| |

| Top Ten Holdings as of July 31, 2009 | | |

| | % of net assets | % of net assets |

| | as of 7/31/09 | as of 1/31/09 |

| Research In Motion Ltd. | 3.4% | 2.9% |

| Apple, Inc. | 3.0% | — |

| International Business Machines Corp. | 2.8% | 2.3% |

| Freeport-McMoRan Copper & Gold, Inc. | 2.7% | — |

| MasterCard, Inc., Class A | 2.6% | 2.0% |

| Baidu, Inc. ADR | 2.6% | — |

| Yum! Brands, Inc. | 2.5% | 2.1% |

| Telefonaktiebolaget LM Ericsson ADR | 2.4% | 2.1% |

| Enersis SA ADR | 2.4% | — |

| Texas Instruments, Inc. | 2.4% | — |

| |

| Top Five Industries as of July 31, 2009 | | |

| | % of net assets | % of net assets |

| | as of 7/31/09 | as of 1/31/09 |

| Capital Markets | 10.7% | — |

| Pharmaceuticals | 8.2% | 11.6% |

| Communications Equipment | 7.9% | 6.7% |

| Health Care Providers & Services | 6.3% | — |

| IT Services | 5.4% | 8.7% |

| |

| Types of Investments in Portfolio | | |

| | % of net assets | % of net assets |

| | as of 7/31/09 | as of 1/31/09 |

| Domestic Common Stocks | 61.9% | 80.1% |

| Foreign Common Stocks(1) | 35.5% | 19.5% |

| Total Common Stocks | 97.4% | 99.6% |

| Temporary Cash Investments | 2.5% | 0.4% |

| Other Assets and Liabilities | 0.1% | —(2) |

| (1) | Includes depositary shares, dual listed securities and foreign ordinary shares. |

| (2) | Category is less than 0.05% of total net assets. |

12

| | | |

| Legacy Multi Cap | | | |

| |

| Total Returns as of July 31, 2009 | | | |

| | | Average | |

| | | Annual Returns | |

| | 1 year | Since Inception | Inception Date |

| Investor Class | -33.53% | -7.10% | 5/31/06 |

| Russell 3000 Index(1) | -20.21% | -5.67% | — |

| Russell 3000 Growth Index(1) | -17.82% | -3.39% | — |

| Institutional Class | -33.42% | -6.91% | 5/31/06 |

| Advisor Class | -33.76% | -7.36% | 5/31/06 |

| R Class | -33.94% | -7.63% | 5/31/06 |

| (1) | Data provided by Lipper Inc. — A Reuters Company. © 2009 Reuters. All rights reserved. Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon. |

| | The data contained herein has been obtained from company reports, financial reporting services, periodicals and other resources believed to be reliable. Although carefully verified, data on compilations is not guaranteed by Lipper and may be incomplete. No offer or solicitations to buy or sell any of the securities herein is being made by Lipper. |

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. Historically, small company stocks have been more volatile than the stocks of larger, more established companies. The fund’s investment process may also result in high portfolio turnover, which could mean high transaction costs, affecting both performance and capital gains tax liabilities to investors. International investing involves special risks, such as political instability and currency fluctuations.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

13

Legacy Multi Cap

| | | | |

| One-Year Returns Over Life of Class | | | |

| Periods ended July 31 | | | | |

| | 2006* | 2007 | 2008 | 2009 |

| Investor Class | -0.60% | 27.21% | -5.78% | -33.53% |

| Russell 3000 Index | 0.08% | 16.08% | -10.32% | -20.21% |

| Russell 3000 Growth Index | -2.54% | 19.24% | -6.11% | -17.82% |

| *From 5/31/06, the Investor Class’s inception date. Not annualized. | | | |

| |

| Total Annual Fund Operating Expenses | | | |

| Investor Class | Institutional Class | Advisor Class | R Class |

| 1.16% | 0.96% | 1.41% | 1.66% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. Historically, small company stocks have been more volatile than the stocks of larger, more established companies. The fund’s investment process may also result in high portfolio turnover, which could mean high transaction costs, affecting both performance and capital gains tax liabilities to investors. International invest ing involves special risks, such as political instability and currency fluctuations.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

14

Legacy Multi Cap

Portfolio Managers: John T. Small Jr. and Stephen Pool

Performance Summary

Legacy Multi Cap declined -33.53%* for the 12 months ended July 31, 2009, lagging its benchmark, the Russell 3000 Index, which declined -20.21%.

As discussed in the Market Perspective on page 2, U.S. stock indices fell during the reporting period amid a volatile market climate, ongoing credit crisis, and economic recession. The last five months of the period featured a rally in lower-quality stocks with weak balance sheets, poor to negative earnings and cash flow, and negative price momentum. This is at odds with our investment approach, which centers on owning companies that exhibit accelerating earnings and revenues and where the market recognizes this by way of share-price momentum.

Holdings in the consumer discretionary, information technology, and industrials sectors accounted for the bulk of Legacy Multi Cap’s under-performance relative to its benchmark. An overweight allocation to the materials sector further trimmed relative returns. Effective stock selection in the utilities sector partially offset those losses.

The portfolio also maintained a significant allocation to foreign stocks. These holdings detracted from performance.

Consumer Discretionary, Information Technology Led Underperformance

An overweight stake in the consumer discretionary sector reflected a focus on private education companies. Although these companies as a group had benefited from expanding student enrollments in previous reporting periods as a result of corporate layoffs and fewer job opportunities, their share prices were hurt as investors seemed willing to move toward more aggressive holdings late in the reporting period. Overweight stakes in DeVry Inc. and ITT Educational Services Inc., in particular, were among the portfolio’s largest detractors.

Elsewhere in the consumer discretionary sector, media holdings also hurt performance. China-based VisionChina Media Inc., which operates advertising networks using mobile digital television broadcasts on public transportation systems, curbed absolute and relative returns as its share price sank.

The information technology sector was also a meaningful source of underperformance for Legacy Multi Cap. An underweight allocation to the semiconductor industry and companies involved in computers and peripherals, coupled with ineffective security selection within both industries, trimmed performance relative to the benchmark.

*All fund returns referenced in this commentary are for Investor Class shares.

15

Legacy Multi Cap

Industrials, Materials Detracted

In the industrials sector, Legacy Multi Cap maintained overweight positions in railroad companies, including Norfolk Southern Corp. This industry has experienced improving fundamentals as higher fuel prices created an advantage for the more fuel efficient railroads versus trucking companies, and as coal shipments continued to increase. More recently, however, these positions collectively detracted from absolute and relative returns.

Industrials holding DXP Enterprises also weighed on performance. The provider of pumping solutions to end users in the oil and gas and general manufacturing industries experienced a steep drop in its share price due to soft demand.

Within the materials sector, Legacy Multi Cap focused on the metals and mining industry and chemical companies. In the metals and mining group, steel company Cliffs Natural Resources (formerly Cleveland-Cliffs) detracted from absolute and relative performance. The company, which produces iron ore pellets for steel manufacturers, has contributed to the portfolio’s returns in the past amid rising prices for iron ore. During the reporting period, though, its share price fell significantly as demand and prices for iron ore both declined.

Picks in Utilities Helped

Holdings in the utilities sector benefited portfolio returns relative to the benchmark. Overweight stakes in Florida-based electric utility FPL Group Inc., in particular, boosted relative performance. An underweight position in Exelon Corp., which delivers electricity to customers in Illinois and Pennsylvania, also helped relative performance, as the company’s share price lost ground during the period.

Outlook

We are cautiously optimistic in our market outlook. Although markets have rebounded in the past several months, we continue to look for more meaningful improvements in economic conditions. Regardless of conditions, Legacy Multi Cap employs financial acceleration and price momentum characteristics to identify investment opportunities in any given economic environment. As always, it will employ a quantitative model to exploit investment opportunities across the growth and value spectrum.

16

| | |

| Legacy Multi Cap | | |

| |

| Top Ten Holdings as of July 31, 2009 | | |

| | % of net assets | % of net assets |

| | as of 7/31/09 | as of 1/31/09 |

| Strayer Education, Inc. | 2.1% | 2.4% |

| Walter Energy, Inc. | 1.9% | — |

| DreamWorks Animation SKG, Inc., Class A | 1.9% | 1.5% |

| Teck Resources Ltd., Class B | 1.8% | — |

| DCP Midstream Partners LP | 1.8% | — |

| McAfee, Inc. | 1.7% | 1.3% |

| Tessera Technologies, Inc. | 1.5% | — |

| Aflac, Inc. | 1.5% | — |

| Kirkland’s, Inc. | 1.5% | — |

| Anaren, Inc. | 1.4% | 1.1% |

| |

| Top Five Industries as of July 31, 2009 | | |

| | % of net assets | % of net assets |

| | as of 7/31/09 | as of 1/31/09 |

| Insurance | 15.4% | 6.7% |

| Health Care Providers & Services | 7.3% | 8.6% |

| Pharmaceuticals | 5.5% | 8.0% |

| Software | 4.8% | 1.9% |

| Metals & Mining | 4.7% | 0.8% |

| |

| Types of Investments in Portfolio | | |

| | % of net assets | % of net assets |

| | as of 7/31/09 | as of 1/31/09 |

| Domestic Common Stocks | 78.2% | 90.6% |

| Foreign Common Stocks(1) | 20.4% | 9.1% |

| Total Common Stocks | 98.6% | 99.7% |

| Temporary Cash Investments | 0.7% | 0.3% |

| Other Assets and Liabilities | 0.7% | —(2) |

| (1) | Includes depositary shares, dual listed securities and foreign ordinary shares. |

| (2) | Category is less than 0.05% of total net assets. |

17

|

| Shareholder Fee Examples (Unaudited) |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/ exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from February 1, 2009 to July 31, 2009.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. We will not charge the fee as long as you choose to manage your accounts exclusively online. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

18

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | |

| | Beginning | Ending | Expenses Paid | |

| | Account Value | Account Value | During Period* | Annualized |

| | 2/1/09 | 7/31/09 | 2/1/09 – 7/31/09 | Expense Ratio* |

| Legacy Focused Large Cap | | | |

| Actual | | | | |

| Investor Class | $1,000 | $1,123.00 | $5.79 | 1.10% |

| Institutional Class | $1,000 | $1,124.00 | $4.74 | 0.90% |

| Advisor Class | $1,000 | $1,122.00 | $7.10 | 1.35% |

| R Class | $1,000 | $1,119.60 | $8.41 | 1.60% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,019.34 | $5.51 | 1.10% |

| Institutional Class | $1,000 | $1,020.33 | $4.51 | 0.90% |

| Advisor Class | $1,000 | $1,018.10 | $6.76 | 1.35% |

| R Class | $1,000 | $1,016.86 | $8.00 | 1.60% |

| Legacy Large Cap | | | | |

| Actual | | | | |

| Investor Class | $1,000 | $1,143.30 | $5.85 | 1.10% |

| Institutional Class | $1,000 | $1,142.90 | $4.78 | 0.90% |

| Advisor Class | $1,000 | $1,140.90 | $7.17 | 1.35% |

| R Class | $1,000 | $1,139.90 | $8.49 | 1.60% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,019.34 | $5.51 | 1.10% |

| Institutional Class | $1,000 | $1,020.33 | $4.51 | 0.90% |

| Advisor Class | $1,000 | $1,018.10 | $6.76 | 1.35% |

| R Class | $1,000 | $1,016.86 | $8.00 | 1.60% |

| * | Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

19

| | | | |

| | Beginning | Ending | Expenses Paid | |

| | Account Value | Account Value | During Period* | Annualized |

| | 2/1/09 | 7/31/09 | 2/1/09 – 7/31/09 | Expense Ratio* |

| Legacy Multi Cap | | | | |

| Actual | | | | |

| Investor Class | $1,000 | $1,117.60 | $6.04 | 1.15% |

| Institutional Class | $1,000 | $1,118.60 | $4.99 | 0.95% |

| Advisor Class | $1,000 | $1,115.40 | $7.34 | 1.40% |

| R Class | $1,000 | $1,113.20 | $8.65 | 1.65% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,019.09 | $5.76 | 1.15% |

| Institutional Class | $1,000 | $1,020.08 | $4.76 | 0.95% |

| Advisor Class | $1,000 | $1,017.85 | $7.00 | 1.40% |

| R Class | $1,000 | $1,016.61 | $8.25 | 1.65% |

| * | Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

20

| | | | | | |

| Legacy Focused Large Cap | | | | |

| |

| JULY 31, 2009 | | | | | | |

| |

| | Shares | Value | | | Shares | Value |

| Common Stocks — 99.2% | | | METALS & MINING — 6.3% | | |

| | | | | Freeport-McMoRan | | |

| BEVERAGES — 6.7% | | | | Copper & Gold, Inc. | 8,124 | $ 489,877 |

| Cia de Bebidas das Americas, | | | | Sterlite Industries India Ltd. ADR | 28,650 | 379,613 |

| Preference Shares ADR | 7,667 | $ 539,220 | | | | |

| Coca-Cola Enterprises, Inc. | 20,575 | 386,604 | | | | 869,490 |

| | | 925,824 | | ROAD & RAIL — 3.3% | | |

| CAPITAL MARKETS — 21.0% | | | | CSX Corp. | 11,414 | 457,930 |

| | | | | SEMICONDUCTORS & | | |

| BlackRock, Inc. | 2,351 | 447,959 | | SEMICONDUCTOR EQUIPMENT — 6.7% | |

| Credit Suisse Group AG ADR | 9,276 | 439,404 | | Taiwan Semiconductor | | |

| Deutsche Bank AG | 7,893 | 512,256 | | Manufacturing Co. Ltd. ADR | 38,583 | 403,964 |

| Franklin Resources, Inc. | 5,789 | 513,368 | | Texas Instruments, Inc. | 21,366 | 513,852 |

| Goldman Sachs | | | | | | 917,816 |

| Group, Inc. (The) | 3,339 | 545,259 | | SPECIALTY RETAIL — 3.5% | | |

| T. Rowe Price Group, Inc. | 9,432 | 440,569 | | TJX Cos., Inc. (The) | 13,477 | 488,272 |

| | | 2,898,815 | | TEXTILES, APPAREL & LUXURY GOODS — 3.0% |

| COMMERCIAL BANKS — 3.1% | | | | Coach, Inc. | 14,173 | 419,379 |

| Banco Santander SA ADR | 29,351 | 424,415 | | WIRELESS TELECOMMUNICATION SERVICES — 2.9% |

| COMMUNICATIONS EQUIPMENT — 6.0% | | | Mobile TeleSystems OJSC ADR | 9,642 | 404,867 |

| Research In Motion Ltd.(1) | 5,315 | 403,940 | | | | |

| | | | | TOTAL INVESTMENT | | |

| Telefonaktiebolaget LM | | | | SECURITIES — 99.2% | | |

| Ericsson ADR | 42,901 | 416,998 | | (Cost $11,225,951) | | 13,673,582 |

| | | 820,938 | | OTHER ASSETS | | |

| COMPUTERS & PERIPHERALS — 3.9% | | | AND LIABILITIES — 0.8% | | 114,022 |

| Apple, Inc.(1) | 3,279 | 535,756 | | TOTAL NET ASSETS — 100.0% | | $13,787,604 |

| CONSUMER FINANCE — 6.1% | | | | | | |

| American Express Co. | 13,155 | 372,681 | | Geographic Diversification | |

| Capital One Financial Corp. | 15,054 | 462,158 | | (as a % of net assets) | | |

| | | 834,839 | | United States | | 63.2% |

| ELECTRONIC EQUIPMENT, | | | | Switzerland | | 6.7% |

| INSTRUMENTS & COMPONENTS — 3.5% | | | People’s Republic of China | | 4.1% |

| Tyco Electronics Ltd. | 22,300 | 478,781 | | Brazil | | 3.9% |

| ENERGY EQUIPMENT & SERVICES — 2.6% | | | Germany | | 3.7% |

| Cameron | | | | Spain | | 3.1% |

| International Corp.(1) | 11,670 | 364,454 | | | | |

| | | | | Sweden | | 3.0% |

| HEALTH CARE PROVIDERS & SERVICES — 2.7% | | Russian Federation | | 2.9% |

| Quest Diagnostics, Inc. | 6,771 | 369,832 | | Taiwan (Republic of China) | | 2.9% |

| INDUSTRIAL CONGLOMERATES — 3.4% | | | Canada | | 2.9% |

| 3M Co. | 6,608 | 465,996 | | India | | 2.8% |

| INTERNET & CATALOG RETAIL — 3.9% | | | Other Assets and Liabilities | | 0.8% |

| Amazon.com, Inc.(1) | 6,263 | 537,115 | | | | |

| INTERNET SOFTWARE & SERVICES — 7.2% | | | Notes to Schedule of Investments |

| Baidu, Inc. ADR(1) | 1,605 | 558,765 | | ADR = American Depositary Receipt | | |

| eBay, Inc.(1) | 20,296 | 431,290 | | OJSC = Open Joint Stock Company | | |

| | | 990,055 | | (1) Non-income producing. | | |

| IT SERVICES — 3.4% | | | | | | |

| International Business | | | | Industry classifications and geographic diversification are unaudited. |

| Machines Corp. | 3,977 | 469,008 | | See Notes to Financial Statements. | | |

21

| | | | | | |

| Legacy Large Cap | | | | | |

| |

| JULY 31, 2009 | | | | | | |

| |

| | Shares | Value | | | Shares | Value |

| Common Stocks — 97.4% | | | | INDUSTRIAL CONGLOMERATES — 2.0% | |

| AEROSPACE & DEFENSE — 1.9% | | | | 3M Co. | 2,668 | $ 188,147 |

| Raytheon Co. | 3,713 | $ 174,325 | | INSURANCE — 2.0% | | |

| BEVERAGES — 4.1% | | | | Prudential Financial, Inc. | 4,147 | 183,588 |

| Cia de Bebidas das Americas, | | | | INTERNET & CATALOG RETAIL — 2.3% | |

| Preference Shares ADR | 2,757 | 193,900 | | Amazon.com, Inc.(1) | 2,519 | 216,029 |

| Coca-Cola Enterprises, Inc. | 9,920 | 186,397 | | INTERNET SOFTWARE & SERVICES — 2.6% | |

| | | 380,297 | | Baidu, Inc. ADR(1) | 692 | 240,913 |

| BIOTECHNOLOGY — 2.0% | | | | IT SERVICES — 5.4% | | |

| Gilead Sciences, Inc.(1) | 3,821 | 186,962 | | International Business | | |

| CAPITAL MARKETS — 10.7% | | | | Machines Corp. | 2,178 | 256,852 |

| BlackRock, Inc. | 1,111 | 211,690 | | MasterCard, Inc., Class A | 1,271 | 246,612 |

| Credit Suisse Group AG ADR | 4,301 | 203,738 | | | | 503,464 |

| Deutsche Bank AG | 2,516 | 163,288 | | MEDIA — 1.9% | | |

| Franklin Resources, Inc. | 2,483 | 220,193 | | Walt Disney Co. (The) | 6,995 | 175,714 |

| T. Rowe Price Group, Inc. | 4,363 | 203,796 | | METALS & MINING — 4.6% | | |

| | | 1,002,705 | | Freeport-McMoRan | | |

| | | | | Copper & Gold, Inc. | 4,222 | 254,587 |

| COMMUNICATIONS EQUIPMENT — 7.9% | | | Sterlite Industries India Ltd. ADR | 13,520 | 179,140 |

| QUALCOMM, Inc. | 4,151 | 191,818 | | | | 433,727 |

| Research In Motion Ltd.(1) | 4,194 | 318,744 | | | | |

| | | | | MULTILINE RETAIL — 1.9% | | |

| Telefonaktiebolaget LM | | | | Target Corp. | 4,133 | 180,281 |

| Ericsson ADR | 23,497 | 228,391 | | | | |

| | | 738,953 | | MULTI-UTILITIES — 2.1% | | |

| | | | | Public Service | | |

| COMPUTERS & PERIPHERALS — 5.4% | | | Enterprise Group, Inc. | 6,180 | 200,541 |

| Apple, Inc.(1) | 1,738 | 283,972 | | | | |

| | | | | PHARMACEUTICALS — 8.2% | | |

| Hewlett-Packard Co. | 5,042 | 218,318 | | AstraZeneca plc ADR | 3,994 | 185,481 |

| | | 502,290 | | Merck & Co., Inc. | 6,095 | 182,911 |

| DIVERSIFIED TELECOMMUNICATION | | | Novo Nordisk A/S ADR | 3,622 | 211,489 |

| SERVICES — 4.2% | | | | | | |

| Telecomunicacoes de Sao Paulo | | | | Sanofi-Aventis SA ADR | 5,709 | 186,342 |

| SA, Preference Shares ADR | 7,611 | 176,423 | | | | 766,223 |

| Telefonica SA ADR | 2,868 | 214,068 | | SEMICONDUCTORS & | | |

| | | 390,491 | | SEMICONDUCTOR EQUIPMENT — 4.3% | |

| | | | | Taiwan Semiconductor | | |

| ELECTRIC UTILITIES — 2.4% | | | | Manufacturing Co. Ltd. ADR | 17,294 | 181,068 |

| Enersis SA ADR | 11,795 | 226,346 | | Texas Instruments, Inc. | 9,347 | 224,796 |

| ELECTRONIC EQUIPMENT, | | | | | | 405,864 |

| INSTRUMENTS & COMPONENTS — 2.2% | | | | | |

| LG Display Co., Ltd. ADR | 14,043 | 202,921 | | SPECIALTY RETAIL — 4.0% | | |

| | | | | AutoZone, Inc.(1) | 1,071 | 164,473 |

| HEALTH CARE PROVIDERS & SERVICES — 6.3% | | | | |

| Express Scripts, Inc.(1) | 2,687 | 188,198 | | TJX Cos., Inc. (The) | 5,804 | 210,279 |

| | | | | | | 374,752 |

| Medco Health Solutions, Inc.(1) | 3,870 | 204,568 | | | | |

| | | | | TOBACCO — 4.3% | | |

| WellPoint, Inc.(1) | 3,633 | 191,241 | | | | |

| | | | | Altria Group, Inc. | 11,143 | 195,337 |

| | | 584,007 | | Lorillard, Inc. | 2,834 | 208,922 |

| HOTELS, RESTAURANTS & LEISURE — 2.5% | | | | | 404,259 |

| Yum! Brands, Inc. | 6,479 | 229,745 | | | | |

22

| | | | | |

| Legacy Large Cap | | | | |

| |

| |

| | Shares/ | | | Geographic Diversification | |

| | Principal | | | (as a % of net assets) | |

| | Amount | Value | | United States | 61.9% |

| WIRELESS TELECOMMUNICATION SERVICES — 2.2% | | Brazil | 4.0% |

| America Movil SAB | | | | | |

| de CV, Series L ADR | 4,871 | $ 209,502 | | Canada | 3.4% |

| TOTAL COMMON STOCKS | | | | People’s Republic of China | 2.6% |

| (Cost $7,785,887) | | 9,102,046 | | Sweden | 2.4% |

| Temporary Cash Investments — 2.5% | | Chile | 2.4% |

| | | | | Spain | 2.3% |

| FHLB Discount Notes, | | | | | |

| 0.09%, 8/3/09(2) | $200,000 | 200,000 | | Denmark | 2.3% |

| JPMorgan U.S. Treasury | | | | Mexico | 2.2% |

| Plus Money Market Fund | | | | Switzerland | 2.2% |

| Agency Shares | 34,841 | 34,841 | | South Korea | 2.2% |

| TOTAL TEMPORARY | | | | France | 2.0% |

| CASH INVESTMENTS | | | | United Kingdom | 2.0% |

| (Cost $234,841) | | 234,841 | | | |

| | | | | Taiwan (Republic of China) | 1.9% |

| TOTAL INVESTMENT | | | | | |

| SECURITIES — 99.9% | | | | India | 1.9% |

| (Cost $8,020,728) | | 9,336,887 | | Germany | 1.7% |

| OTHER ASSETS | | | | Cash and Equivalents* | 2.6% |

| AND LIABILITIES — 0.1% | | 5,428 | | * Includes temporary cash investments and other assets and liabilities. |

| TOTAL NET ASSETS — 100.0% | | $9,342,315 | | | |

| |

| Notes to Schedule of Investments |

| ADR = American Depositary Receipt |

| FHLB = Federal Home Loan Bank |

| (1) | Non-income producing. |

| (2) | The rate indicated is the yield to maturity at purchase. |

| |

| Industry classifications and geographic diversification are unaudited. |

| |

| |

| See Notes to Financial Statements. |

23

| | | | | | |

| Legacy Multi Cap | | | | | | |

| |

| JULY 31, 2009 | | | | | | |

| |

| | Shares | Value | | | Shares | Value |

| Common Stocks — 98.6% | | | | ELECTRICAL EQUIPMENT — 1.1% | |

| | | | | GT Solar International, Inc.(1) | 42,725 | $ 264,895 |

| AEROSPACE & DEFENSE — 2.6% | | | | | | |

| Cubic Corp. | 6,077 | $ 237,975 | | ELECTRONIC EQUIPMENT, | | |

| | | | | INSTRUMENTS & COMPONENTS — 3.4% | |

| Lockheed Martin Corp. | 2,208 | 165,070 | | CPI International, Inc.(1) | 23,853 | 227,796 |

| Raytheon Co. | 4,458 | 209,303 | | | | |

| | | | | LG Display Co., Ltd. ADR | 22,711 | 328,174 |

| | | 612,348 | | | | |

| | | | | Spectrum Control, Inc.(1) | 25,624 | 252,909 |

| BEVERAGES — 1.0% | | | | | | |

| Coca-Cola Enterprises, Inc. | 12,097 | 227,303 | | | | 808,879 |

| CAPITAL MARKETS — 2.3% | | | | ENERGY EQUIPMENT & SERVICES — 0.9% | |

| BlackRock, Inc. | 1,353 | 257,801 | | Noble Corp. | 6,460 | 218,736 |

| Franklin Resources, Inc. | 3,164 | 280,583 | | FOOD & STAPLES RETAILING — 0.8% | |

| | | 538,384 | | Delhaize Group ADR | 2,777 | 197,695 |

| CHEMICALS — 1.2% | | | | FOOD PRODUCTS — 3.7% | | |

| FMC Corp. | 6,020 | 292,813 | | ConAgra Foods, Inc. | 11,388 | 223,546 |

| COMMERCIAL BANKS — 1.2% | | | | Del Monte Foods Co. | 23,419 | 226,227 |

| Southside Bancshares, Inc. | 13,190 | 298,622 | | J.M. Smucker Co. (The) | 4,527 | 226,486 |

| COMMUNICATIONS EQUIPMENT — 3.4% | | | Unilever plc ADR | 8,019 | 211,301 |

| | | | | | | 887,560 |

| Anaren, Inc.(1) | 19,036 | 342,267 | | | | |

| | | | | HEALTH CARE EQUIPMENT & SUPPLIES — 2.1% |

| Research In Motion Ltd.(1) | 3,155 | 239,780 | | | | |

| | | | | Covidien plc | 6,129 | 231,737 |

| Telefonaktiebolaget LM | | | | Hospira, Inc.(1) | 7,302 | 280,616 |

| Ericsson ADR | 23,442 | 227,856 | | | | |

| | | 809,903 | | | | 512,353 |

| COMPUTERS & PERIPHERALS — 2.3% | | | HEALTH CARE PROVIDERS & SERVICES — 7.3% |

| Apple, Inc.(1) | 1,624 | 265,345 | | AmerisourceBergen Corp. | 13,750 | 271,150 |

| Seagate Technology | 23,286 | 280,364 | | CIGNA Corp. | 9,795 | 278,178 |

| | | 545,709 | | DaVita, Inc.(1) | 4,624 | 229,813 |

| DIVERSIFIED CONSUMER SERVICES — 4.6% | | | Emergency Medical | | |

| | | | | Services Corp., Class A(1) | 7,553 | 295,625 |

| H&R Block, Inc. | 8,149 | 136,007 | | | | |

| | | | | Laboratory Corp. | | |

| ITT Educational Services, Inc.(1) | 1,390 | 135,316 | | of America Holdings(1) | 3,860 | 259,353 |

| Lincoln Educational | | | | Metropolitan Health | | |

| Services Corp.(1) | 15,930 | 324,335 | | Networks, Inc.(1) | 69,900 | 166,362 |

| Strayer Education, Inc. | 2,314 | 491,447 | | WellPoint, Inc.(1) | 4,808 | 253,093 |

| | | 1,087,105 | | | | 1,753,574 |

| DIVERSIFIED FINANCIAL SERVICES — 2.3% | | | HOUSEHOLD DURABLES — 1.2% | | |

| Bank of America Corp. | 22,738 | 336,295 | | Jarden Corp.(1) | 11,419 | 281,478 |

| Moody’s Corp. | 9,087 | 215,725 | | INDEPENDENT POWER PRODUCERS | |

| | | 552,020 | | & ENERGY TRADERS — 1.8% | | |

| DIVERSIFIED TELECOMMUNICATION | | | Mirant Corp.(1) | 10,049 | 181,485 |

| SERVICES — 2.7% | | | | NRG Energy, Inc.(1) | 8,828 | 240,210 |

| Portugal Telecom SGPS SA ADR | 22,432 | 229,928 | | | | 421,695 |

| Telecomunicacoes de Sao Paulo | | | | | | |

| SA, Preference Shares ADR | 10,224 | 236,992 | | INSURANCE — 15.4% | | |

| Windstream Corp. | 20,361 | 178,566 | | Aflac, Inc. | 9,231 | 349,486 |

| | | 645,486 | | Alleghany Corp.(1) | 697 | 188,539 |

| ELECTRIC UTILITIES — 1.0% | | | | Allianz SE ADR | 20,395 | 202,114 |

| Cia Paranaense de Energia ADR | 15,053 | 233,623 | | Allied World Assurance Co. | | |

| | | | | Holdings Ltd. | 5,215 | 226,644 |

24

| | | | | | |

| Legacy Multi Cap | | | | | |

| |

| | Shares | Value | | | Shares/ | |

| Assured Guaranty Ltd. | 14,564 | $ 203,459 | | | Principal | |

| Cincinnati Financial Corp. | 9,131 | 220,514 | | | Amount | Value |

| | | | | SEMICONDUCTORS & | | |

| Delphi Financial | | | | SEMICONDUCTOR EQUIPMENT — 4.5% | |

| Group, Inc., Class A | 11,917 | 283,982 | | | | |

| Fairfax Financial Holdings Ltd. | 830 | 253,474 | | Himax Technologies, Inc. ADR | 65,014 | $ 248,354 |

| HCC Insurance Holdings, Inc. | 11,855 | 297,560 | | National Semiconductor Corp. | 15,249 | 229,650 |

| | | | | Tessera Technologies, Inc.(1) | 12,680 | 356,181 |

| Loews Corp. | 7,731 | 232,085 | | | | |

| MBIA, Inc.(1) | 30,594 | 128,189 | | Texas Instruments, Inc. | 9,909 | 238,311 |

| Odyssey Re Holdings Corp. | 3,638 | 168,076 | | | | 1,072,496 |

| Progressive Corp. (The)(1) | 15,724 | 244,980 | | SOFTWARE — 4.8% | | |

| | | | | i2 Technologies, Inc.(1) | 17,124 | 230,489 |

| StanCorp Financial Group, Inc. | 7,605 | 261,764 | | | | |

| | | | | McAfee, Inc.(1) | 9,036 | 402,825 |

| Tower Group, Inc. | 7,711 | 192,544 | | | | |

| | | | | MicroStrategy, Inc., Class A(1) | 5,325 | 325,091 |

| Unum Group | 12,342 | 231,659 | | | | |

| | | 3,685,069 | | Tyler Technologies, Inc.(1) | 12,535 | 193,039 |

| IT SERVICES — 1.8% | | | | | | 1,151,444 |

| Affiliated Computer | | | | SPECIALTY RETAIL — 3.9% | | |

| Services, Inc., Class A(1) | 4,121 | 195,377 | | Dress Barn, Inc. (The)(1) | 12,900 | 201,111 |

| iGate Corp. | 33,404 | 242,179 | | GameStop Corp., Class A(1) | 6,263 | 137,097 |

| | | 437,556 | | Kirkland’s, Inc.(1) | 25,275 | 349,048 |

| MACHINERY — 0.9% | | | | TJX Cos., Inc. (The) | 6,882 | 249,335 |

| Chart Industries, Inc.(1) | 10,852 | 209,009 | | | | 936,591 |

| MEDIA — 2.8% | | | | TEXTILES, APPAREL & LUXURY GOODS — 2.0% |

| DISH Network Corp., Class A(1) | 12,026 | 203,841 | | Carter’s, Inc.(1) | 9,075 | 257,185 |

| DreamWorks Animation | | | | Unifirst Corp. | 5,656 | 220,132 |

| SKG, Inc., Class A(1) | 14,586 | 459,605 | | | | 477,317 |

| | | 663,446 | | TOBACCO — 2.0% | | |

| METALS & MINING — 4.7% | | | | Altria Group, Inc. | 13,448 | 235,743 |

| Gold Fields Ltd. ADR | 18,689 | 225,389 | | Lorillard, Inc. | 3,407 | 251,164 |

| Teck Resources Ltd., Class B(1) | 16,355 | 429,973 | | | | 486,907 |

| Walter Energy, Inc. | 9,333 | 460,677 | | TOTAL COMMON STOCKS | | |

| | | 1,116,039 | | (Cost $19,726,967) | | 23,538,392 |

| OIL, GAS & CONSUMABLE FUELS — 1.8% | | | Temporary Cash Investments — 0.7% |

| DCP Midstream Partners LP | 16,809 | 418,880 | | FHLB Discount Notes, | | |

| PERSONAL PRODUCTS — 0.8% | | | | 0.09%, 8/3/09(2) | $100,000 | 100,000 |

| Schiff Nutrition | | | | JPMorgan U.S. Treasury | | |

| International, Inc.(1) | 34,495 | 195,587 | | Plus Money Market Fund | | |

| PHARMACEUTICALS — 5.5% | | | | Agency Shares | 68,970 | 68,970 |

| AstraZeneca plc ADR | 5,960 | 276,783 | | TOTAL TEMPORARY | | |

| Bristol-Myers Squibb Co. | 10,537 | 229,074 | | CASH INVESTMENTS | | |

| Forest Laboratories, Inc.(1) | 7,400 | 191,142 | | (Cost $168,970) | | 168,970 |

| | | | | TOTAL INVESTMENT | | |

| Merck & Co., Inc. | 7,760 | 232,878 | | SECURITIES — 99.3% | | |

| Novo Nordisk A/S ADR | 3,321 | 193,913 | | (Cost $19,895,937) | | 23,707,362 |

| Sanofi-Aventis SA ADR | 5,683 | 185,493 | | OTHER ASSETS | | |

| | | 1,309,283 | | AND LIABILITIES — 0.7% | | 168,585 |

| REAL ESTATE INVESTMENT TRUSTS (REITs) — 0.8% | | TOTAL NET ASSETS — 100.0% | | $23,875,947 |

| Plum Creek Timber Co., Inc. | 6,029 | 188,587 | | | | |

25

| | | | |

| Legacy Multi Cap | | | | |

| |

| Geographic Diversification | | | Notes to Schedule of Investments |

| (as a % of net assets) | | | ADR = American Depositary Receipt |

| United States | 78.2% | | FHLB = Federal Home Loan Bank |

| Canada | 3.9% | | (1) | Non-income producing. |

| United Kingdom | 2.0% | | (2) | The rate indicated is the yield to maturity at purchase. |

| Brazil | 2.0% | | | |

| Bermuda | 1.8% | | Industry classifications and geographic diversification are unaudited. |

| South Korea | 1.4% | | | |

| Cayman Islands | 1.2% | | | |

| Taiwan (Republic of China) | 1.0% | | See Notes to Financial Statements. |

| Ireland | 1.0% | | | |

| Portugal | 1.0% | | | |

| Sweden | 1.0% | | | |

| South Africa | 0.9% | | | |

| Germany | 0.8% | | | |

| Belgium | 0.8% | | | |

| Denmark | 0.8% | | | |

| France | 0.8% | | | |

| Cash and Equivalents* | 1.4% | | | |

| * Includes temporary cash investments and other assets and liabilities. | | | |

26

|

| Statement of Assets and Liabilities |

| | | |

| JULY 31, 2009 | | | |

| | Focused Large Cap | Large Cap | Multi Cap |

| Assets | | | |

| Investment securities, at value (cost of $11,225,951, | | | |

| $8,020,728 and $19,895,937, respectively) | $13,673,582 | $9,336,887 | $23,707,362 |

| Receivable for investments sold | 159,525 | — | 210,007 |

| Receivable for capital shares sold | 4,835 | 565 | 2,978 |

| Dividends and interest receivable | 29,146 | 15,618 | 11,073 |

| | 13,867,088 | 9,353,070 | 23,931,420 |

| | | | |

| Liabilities | | | |

| Disbursements in excess of demand deposit cash | 40,472 | — | — |

| Payable for capital shares redeemed | 26,886 | 2,324 | 33,339 |

| Accrued management fees | 12,088 | 8,112 | 21,926 |

| Distribution and service fees payable | 38 | 319 | 208 |

| | 79,484 | 10,755 | 55,473 |

| | | | |

| Net Assets | $13,787,604 | $9,342,315 | $23,875,947 |

| | | | |

| Net Assets Consist of: | | | |

| Capital (par value and paid-in surplus) | $ 28,636,269 | $13,927,446 | $ 36,211,886 |

| Undistributed net investment income | 4,318 | 79,098 | 300,977 |

| Accumulated net realized loss on investment transactions | (17,300,614) | (5,980,388) | (16,448,341) |

| Net unrealized appreciation on investments | 2,447,631 | 1,316,159 | 3,811,425 |

| | $ 13,787,604 | $ 9,342,315 | $ 23,875,947 |

| | | | |

| Investor Class, $0.01 Par Value | | | |

| Net assets | $13,594,326 | $7,713,566 | $22,725,762 |

| Shares outstanding | 1,635,364 | 929,836 | 2,918,402 |

| Net asset value per share | $8.31 | $8.30 | $7.79 |

| | | | |

| Institutional Class, $0.01 Par Value | | | |

| Net assets | $32,343 | $699,415 | $27,540 |

| Shares outstanding | 3,878 | 84,047 | 3,519 |

| Net asset value per share | $8.34 | $8.32 | $7.83 |

| | | | |

| Advisor Class, $0.01 Par Value | | | |

| Net assets | $146,441 | $278,464 | $1,081,377 |

| Shares outstanding | 17,692 | 33,713 | 139,864 |

| Net asset value per share | $8.28 | $8.26 | $7.73 |

| | | | |

| R Class, $0.01 Par Value | | | |

| Net assets | $14,494 | $650,870 | $41,268 |

| Shares outstanding | 1,759 | 79,114 | 5,377 |

| Net asset value per share | $8.24 | $8.23 | $7.67 |

| |

| |

| See Notes to Financial Statements. | | | |

27

| | | |

| YEAR ENDED JULY 31, 2009 | | | |

| | Focused Large Cap | Large Cap | Multi Cap |

| Investment Income (Loss) | | | |

| Income: | | | |

| Dividends (net of foreign taxes withheld of $6,157, | | | |

| $1,466 and $2,011, respectively) | $ 346,609 | $ 187,736 | $ 589,843 |

| Interest | 982 | 5,058 | 1,879 |

| | 347,591 | 192,794 | 591,722 |

| | | | |

| Expenses: | | | |

| Management fees | 214,068 | 108,814 | 264,491 |

| Distribution and service fees: | | | |

| Advisor Class | 789 | 1,241 | 1,236 |

| R Class | 96 | 3,188 | 204 |

| Directors’ fees and expenses | 802 | 431 | 899 |

| Other expenses | 1,486 | 22 | 52 |

| | 217,241 | 113,696 | 266,882 |

| | | | |

| Net investment income (loss) | 130,350 | 79,098 | 324,840 |

| | | | |

| Realized and Unrealized Gain (Loss) | | | |

| Net realized gain (loss) on investment transactions (net of | | | |

| foreign taxes withheld of $126,032, $– and $-, respectively) | (12,672,591) | (5,623,945) | (11,352,369) |

| Change in net unrealized appreciation (depreciation) | | | |

| on investments | 865,762 | 830,639 | (543,313) |

| | | | |

| Net realized and unrealized gain (loss) | (11,806,829) | (4,793,306) | (11,895,682) |

| | | | |

| Net Increase (Decrease) in Net Assets | | | |

| Resulting from Operations | $(11,676,479) | $(4,714,208) | $(11,570,842) |

| |

| |

| See Notes to Financial Statements. | | | |

28

|

| Statement of Changes in Net Assets |

| | | | |

| YEARS ENDED JULY 31, 2009 AND JULY 31, 2008 | | | |

| | Focused Large Cap | Large Cap |

| Increase (Decrease) in Net Assets | 2009 | 2008 | 2009 | 2008 |

| Operations | | | | |

| Net investment income (loss) | $ 130,350 | $ 49,777 | $ 79,098 | $ 6,911 |

| Net realized gain (loss) | (12,672,591) | (4,616,872) | (5,623,945) | (79,650) |

| Change in net unrealized | | | | |

| appreciation (depreciation) | 865,762 | (263,252) | 830,639 | (406,076) |

| Net increase (decrease) in net assets | | | | |

| resulting from operations | (11,676,479) | (4,830,347) | (4,714,208) | (478,815) |

| | | | | |

| Distributions to Shareholders | | | | |

| From net investment income: | | | | |

| Investor Class | — | (126,337) | — | (19,295) |

| Institutional Class | — | (18,993) | — | (3,251) |

| Advisor Class | — | (4,343) | — | (2,193) |

| R Class | — | (320) | — | (1,119) |

| From net realized gains: | | | | |

| Investor Class | — | (887,994) | — | (335,193) |

| Institutional Class | — | (115,208) | — | (45,918) |

| Advisor Class | — | (38,076) | — | (53,441) |

| R Class | — | (3,734) | — | (45,741) |

| From tax return of capital: | | | | |

| Investor Class | — | (234,140) | — | (43,667) |

| Institutional Class | — | (35,199) | — | (7,359) |

| Advisor Class | — | (8,049) | — | (4,965) |

| R Class | — | (594) | — | (2,534) |

| Decrease in net assets from distributions | — | (1,472,987) | — | (564,676) |

| | | | | |

| Capital Share Transactions | | | | |

| Net increase (decrease) in net assets from | | | | |

| capital share transactions | (14,631,232) | 32,324,361 | (2,595,719) | 9,111,702 |

| | | | | |

| Net increase (decrease) in net assets | (26,307,711) | 26,021,027 | (7,309,927) | 8,068,211 |

| | | | | |

| Net Assets | | | | |

| Beginning of period | 40,095,315 | 14,074,288 | 16,652,242 | 8,584,031 |

| End of period | $ 13,787,604 | $40,095,315 | $ 9,342,315 | $16,652,242 |

| | | | | |

| Undistributed net investment income | $4,318 | — | $79,098 | — |

| |

| |

| See Notes to Financial Statements. | | | | |

29

| | |

| YEARS ENDED JULY 31, 2009 AND JULY 31, 2008 | | |

| | Multi Cap |

| Increase (Decrease) in Net Assets | 2009 | 2008 |

| Operations | | |

| Net investment income (loss) | $ 324,840 | $ (70,406) |

| Net realized gain (loss) | (11,352,369) | (5,119,615) |

| Change in net unrealized appreciation (depreciation) | (543,313) | 2,407,698 |

| Net increase (decrease) in net assets resulting from operations | (11,570,842) | (2,782,323) |

| | | |

| Distributions to Shareholders | | |

| From net realized gains: | | |

| Investor Class | — | (552,672) |

| Institutional Class | — | (257) |

| Advisor Class | — | (12,791) |

| R Class | — | (696) |

| Decrease in net assets from distributions | — | (566,416) |

| | | |

| Capital Share Transactions | | |

| Net increase (decrease) in net assets from capital share transactions | (787,651) | 1,216,738 |

| | | |

| Net increase (decrease) in net assets | (12,358,493) | (2,132,001) |

| | | |

| Net Assets | | |

| Beginning of period | 36,234,440 | 38,366,441 |

| End of period | $ 23,875,947 | $ 36,234,440 |

| | | |

| Undistributed net investment income | $300,977 | — |

| |

| |

| See Notes to Financial Statements. | | |

30

|

| Notes to Financial Statements |

JULY 31, 2009

1. Organization and Summary of Significant Accounting Policies