| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| | |

| Investment Company Act file number | 811-21861 |

| |

| AMERICAN CENTURY GROWTH FUNDS, INC. |

| (Exact name of registrant as specified in charter) |

| |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| |

| CHARLES A. ETHERINGTON |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| | |

| Date of fiscal year end: | 07-31 |

| | |

| Date of reporting period: | 07-31-2010 |

| |

| |

| | |

| |

| ITEM 1. REPORTS TO STOCKHOLDERS. |

|

| Annual Report | |

| July 31, 2010 | |

|

| American Century Investments® |

Legacy Large Cap Fund

| |

| President’s Letter | 2 |

| Independent Chairman’s Letter | 3 |

| Market Perspective | 4 |

| Market Index Total Returns | 4 |

| |

| Legacy Large Cap | |

| |

| Performance | 5 |

| Portfolio Commentary | 7 |

| Top Ten Holdings | 9 |

| Top Five Industries | 9 |

| Types of Investments in Portfolio | 9 |

| |

| Shareholder Fee Example | 10 |

| |

| Financial Statements | |

| |

| Schedule of Investments | 12 |

| Statement of Assets and Liabilities | 14 |

| Statement of Operations | 15 |

| Statement of Changes in Net Assets | 16 |

| Notes to Financial Statements | 17 |

| Financial Highlights | 23 |

| Report of Independent Registered Public Accounting Firm | 27 |

| |

| Other Information | |

| |

| Proxy Voting Results | 28 |

| Management | 29 |

| Board Approval of Management Agreements | 33 |

| Additional Information | 39 |

| Index Definitions | 40 |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Dear Investor:

To learn more about the capital markets, your investment, and the portfolio management strategies American Century Investments provides, we encourage you to review this shareholder report for the financial reporting period ended July 31, 2010.

On the following pages, you will find investment performance and portfolio information, presented with the expert perspective and commentary of our portfolio management team. This report remains one of our most important vehicles for conveying the information you need about your investment performance, and about the market factors and strategies that affect fund returns. For additional information on the markets, we encourage you to visit the “Insights & News” tab at our Web site, americancentury.com, for updates and further expert commentary.

The top of our Web site’s home page also provides a link to “Our Story,” which, first and foremost, outlines our commitment—since 1958—to helping clients reach their financial goals. We believe strongly that we will only be successful when our clients are successful. That’s who we are.

Another important, unique facet of our story and who we are is “Profits with a Purpose,” which describes our bond with the Stowers Institute for Medical Research (SIMR). SIMR is a world-class biomedical organization—founded by our company founder James E. Stowers, Jr. and his wife Virginia—that is dedicated to researching the causes, treatment, and prevention of gene-based diseases, including cancer. Through American Century Investments’ private ownership structure, more than 40% of our profits support SIMR.

Mr. Stowers’ example of achieving financial success and using that platform to help humanity motivates our entire American Century Investments team. His story inspires us to help each of our clients achieve success. Thank you for sharing your financial journey with us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

2

|

| Independent Chairman’s Letter |

Fellow Shareholders,

The principal event at a recent board meeting was the retirement of Jim Stowers, Jr. from the American Century Mutual Funds Kansas City board. This was one of those times when you felt like you were living a historical moment. Jim—who celebrated his 86th birthday in January—founded what was known as Twentieth Century Mutual Funds over 50 years ago. Through the years, his number one priority has been to “Put Investors First!” The board presented Jim with a resolution acknowledging that, by building a successful investment company, he has impacted the lives of many by helping them on the path to financial success.

We respect Jim’s decision to focus his energy on the Stowers Institute for Medical Research and American Century Companies, Inc. (ACC), the parent company of the funds’ investment advisor. The pioneering medical research that Jim and his wife Virginia have made possible through the Institute should enrich the lives of millions in the future.

Shortly after his retirement from the board, we received word that ACC’s co-chairman Richard W. Brown had succeeded Jim as trustee of a trust that holds a significant interest in ACC stock as a part of Jim’s long-standing estate and business succession plan. While holding less than a majority interest, the trust is presumed to control the funds’ investment advisors under the Investment Company Act of 1940. This change triggered the need for a shareholder proxy to approve new management and subadvisory agreements for the funds. I am happy to report that all of the proposals contained in the proxy received the necessary votes and were approved.

On behalf of the board, I want to once again thank Jim for his mutual fund board service. More than three years ago, Jim and Richard Brown installed a strong and effective leadership team at American Century Investments and I look forward to continuing to work with them on behalf of fund shareholders. And while Jim no longer sits on the fund board, the inherent optimism captured by his favorite catch phrase—“The best is yet to be”—still resonates with all of us who have the privilege of serving you. I invite you to send your comments, questions or concerns to me at dhpratt@fundboardchair.com.

Best regards,

Don Pratt

3

By David Hollond, Chief Investment Officer, U.S. Growth Equity — Mid & Small Cap

Stocks Gained as Economy Improved

The U.S. stock market advanced for the 12-month period ended July 31, 2010, amid signs of a stabilizing economy and improving corporate earnings. Following four consecutive quarters of declining output, gross domestic product (GDP) levels reversed course during the reporting period. Driven by improving conditions in manufacturing, housing, and consumer spending, the economy delivered positive growth in the third and fourth quarters of 2009, as well as the first two quarters of 2010.

Corporate earnings reports also provided cause for optimism. As many companies enacted stringent cost-cutting measures, profit margins improved and earnings levels consistently exceeded analysts’ expectations. In this environment, stocks gained ground for much of the reporting period.

Late Decline Trimmed Gains

During May and June, concerns grew that the sovereign debt problems in Europe might have a ripple effect on the U.S. and other parts of the world. Data released in June raised worries about the sustainability of economic recovery in the U.S. New home sales fell 33% in June to a record low level. The duration of unemployment climbed to 34.4 weeks, the longest wait on record for U.S. workers to find jobs, as the unemployment rate neared a 26-year high. Reacting to the fears, markets retraced earlier gains amid high levels of volatility. In July, though, investor sentiment improved. Although second quarter GDP figures released in July revealed a growth rate of only 2.4%, healthy corporate earnings levels appeared to buoy investors’ moods. Markets rallied in response to favorable earnings reports, with the Dow Jones Industrial Average registering its largest monthly gain in a year.

Despite the market’s stumble in May and June, broad market indices returned approximately 15% for the 12-month reporting period. Mid-cap stocks outperformed small- and large-capitalization issues (see the table below). Value shares outpaced their growth-oriented counterparts across all market capitalizations.

| |

| Market Index Total Returns | |

| For the 12 months ended July 31, 2010 | |

| U.S. Stocks | |

| Russell 1000 Index (Large-Cap) | 14.51% |

| Russell Midcap Index | 23.21% |

| Russell 2000 Index (Small-Cap) | 18.43% |

| Foreign Stocks | |

| MSCI EAFE (Europe, Australasia, Far East) Index | 6.26% |

| MSCI EM (Emerging Markets) Index | 19.92% |

4

| | | | |

| Legacy Large Cap | | | | |

| |

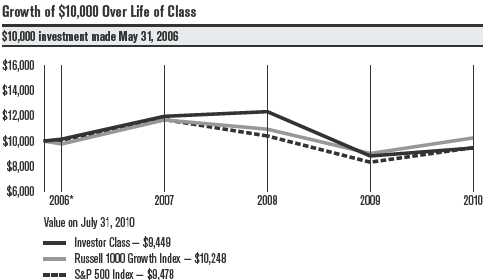

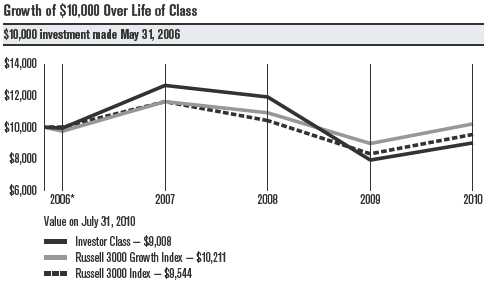

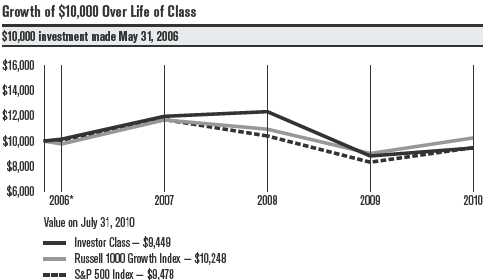

| Total Returns as of July 31, 2010 | | | |

| | | | Average | |

| | | | Annual Returns | |

| | Ticker Symbol | 1 year | Since Inception | Inception Date |

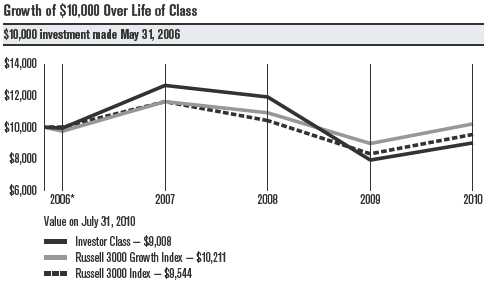

| Investor Class | ACGOX | 7.13% | -1.35% | 5/31/06 |

| S&P 500 Index | — | 13.84% | -1.28% | — |

| Russell 1000 Growth Index | — | 13.65% | 0.59% | — |

| Institutional Class | ACGHX | 7.45% | -1.15% | 5/31/06 |

| Advisor Class | ACGDX | 7.01% | -1.58% | 5/31/06 |

| R Class | ACGEX | 6.64% | -1.84% | 5/31/06 |

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The fund’s investment process may also result in high portfolio turnover, which could mean high transaction costs, affecting both performance and capital gains tax liabilities to investors. International investing involves special risks, such as political instability and currency fluctuations.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

5

Legacy Large Cap

| | | |

| *From 5/31/06, the Investor Class’s inception date. Not annualized. | | |

| |

| Total Annual Fund Operating Expenses | | |

| Investor Class | Institutional Class | Advisor Class | R Class |

| 1.10% | 0.90% | 1.35% | 1.60% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The fund’s investment process may also result in high portfolio turnover, which could mean high transaction costs, affecting both performance and capital gains tax liabilities to investors. International investing involves special risks, such as political instability and currency fluctuations.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

6

Legacy Large Cap

Portfolio Managers: John T. Small Jr. and Stephen Pool

Performance Summary

Legacy Large Cap returned 7.13%* for the 12 months ended July 31, 2010, underperforming the 13.84% return of the portfolio’s benchmark, the S&P 500 Index and the 13.65% return of the Russell 1000 Growth Index.

As discussed in the Market Perspective on page 4, U.S. stock indices generally gained during the reporting period amid signs of improving economic conditions and investor sentiment. In an environment of changing and volatile market conditions, Legacy Large Cap’s management team remained focused on the fundamental business prospects of its portfolio investments.

Although Legacy Large Cap delivered positive returns for the reporting period, its performance lagged that of its benchmark. The majority of the relative underperformance was attributable to stock decisions in the industrials, information technology, and consumer discretionary sectors. Holdings in the consumer staples and materials sectors partially offset those relative losses.

Industrials, Information Technology Led Underperformance, But Some Holdings Helped

The industrials and information technology sectors were the largest sources of relative underperformance for Legacy Large Cap, although the portfolio derived positive absolute results from both sectors. In the industrials sector, an allocation to the construction and engineering industry reflected a focus on Fluor Corp. Although the company is a likely beneficiary of infrastructure build-out initiatives under the Obama administration, its stock price has been hindered by uncertainty about the timing and magnitude of demand for its services.

Within the information technology sector, holdings in the communications equipment industry group detracted from relative performance. Research in Motion, which is not a benchmark constituent, experienced a decline in its share price amid concerns that the maker of the Blackberry handheld device might not be able to maintain momentum in the face of a fragile economic environment and increased competition. Software company Microsoft also weighed on portfolio performance. The company experienced gains for the reporting period, but declined while it was held in the portfolio.

A number of holdings in the information technology sector significantly benefited absolute and relative performance. Within the sector, the portfolio held an overweight stake in personal computer maker Apple, Inc. The company announced higher-than-expected earnings due to solid sales growth in its iPhone and iPad devices during the period.

|

| *All fund returns referenced in this commentary are for Investor Class shares. |

7

Legacy Large Cap

Elsewhere in the information technology sector, IT consulting and services company Cognizant Technology Solutions Corp. also contributed meaningfully to absolute and relative returns. The company, whose largest segment is financial services, delivered strong earnings levels and raised guidance for future earnings as demand increased. A significant overweight position in virtualization software maker VMware also contributed to absolute and relative performance. The company announced earnings that exceeded analysts’ expectations, amid escalating demand.

Consumer Discretionary Hindered Returns, But Select Positions Contributed

In the consumer discretionary sector, Legacy Large Cap’s stock choices in the specialty retail industry collectively detracted from relative performance, although some holdings in the group contributed. Detractors included big box electronics chain Best Buy, which delivered earnings that fell below analysts’ expectations. A substantial overweight stake in TJX Cos., an off-price retailer, however, benefited absolute and relative returns.

Within the multiline retail industry group, the portfolio held a detrimental stake in Kohl’s Corp. The company’s share price slid as concerns about consumer spending grew during the period.

Consumer Staples, Materials Contributed

Within the consumer staples sector, stock selection in the beverages group helped absolute and relative returns. The portfolio’s strongest individual contributor to relative gains was Brazil-based Cia de Bebidas das Americas (Ambev), the world’s fourth largest beverage company. The company, which distributes Pepsi in Latin America, saw solid revenue growth as it benefited from growing Latin American economies. A position in non-benchmark holding Reynolds American also contributed meaningfully to relative returns. As sales increased, the company reported first quarter 2010 earnings that exceeded analysts’ forecasts, and raised guidance for future earnings.

The materials sector was also a source of relative outperformance. Economically sensitive metals and mining companies, including India-based Sterlite Industries Ltd. and Freeport-McMoRan Copper & Gold, Inc. benefited from continued reports of global economic improvement and positive earnings releases.

Outlook

We remain cautiously optimistic in our market outlook. Despite volatile conditions, markets have performed positively in the past year. Nonetheless, we continue to look for more meaningful improvements in economic conditions. Regardless of conditions, Legacy Large Cap employs financial acceleration and price momentum screens to identify investment opportunities in any given economic environment. As always, it will employ a quantitative model to exploit large-cap investment opportunities across the growth and value spectrums.

8

| | |

| Legacy Large Cap | |

| |

| Top Ten Holdings | |

| | | % of net assets |

| | | as of 7/31/10 |

| Apple, Inc. | 5.1% |

| Cognizant Technology Solutions Corp., Class A | 3.4% |

| International Business Machines Corp. | 2.9% |

| Texas Instruments, Inc. | 2.7% |

| VMware, Inc., Class A | 2.7% |

| Reynolds American, Inc. | 2.7% |

| Enterprise Products Partners LP | 2.6% |

| United Technologies Corp. | 2.5% |

| Capital One Financial Corp. | 2.4% |

| Broadcom Corp., Class A | 2.4% |

| |

| Top Five Industries | |

| | | % of net assets |

| | | as of 7/31/10 |

| Semiconductors & Semiconductor Equipment | 7.3% |

| Tobacco | 7.1% |

| Health Care Providers & Services | 6.6% |

| Food Products | 6.4% |

| IT Services | 6.3% |

| |

| Types of Investments in Portfolio | |

| | | % of net assets |

| | | as of 7/31/10 |

| Domestic Common Stocks | 87.8% |

| Foreign Common Stocks(1) | 10.1% |

| Total Common Stocks | 97.9% |

| Temporary Cash Investments | 2.1% |

| Other Assets and Liabilities | —(2) |

| (1) | Includes depositary shares, dual listed securities and foreign ordinary shares. | |

| (2) | Category is less than 0.05% of total net assets. | |

9

|

| Shareholder Fee Example (Unaudited) |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/ exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from February 1, 2010 to July 31, 2010.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. We will not charge the fee as long as you choose to manage your accounts exclusively online. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

10

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | |

| | Beginning | Ending | Expenses Paid | |

| | Account Value | Account Value | During Period* | Annualized |

| | 2/1/10 | 7/31/10 | 2/1/10 – 7/31/10 | Expense Ratio* |

| Actual | | | | |

| Investor Class | $1,000 | $1,012.60 | $5.54 | 1.11% |

| Institutional Class | $1,000 | $1,013.80 | $4.54 | 0.91% |

| Advisor Class | $1,000 | $1,012.70 | $6.79 | 1.36% |

| R Class | $1,000 | $1,010.40 | $8.03 | 1.61% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,019.29 | $5.56 | 1.11% |

| Institutional Class | $1,000 | $1,020.28 | $4.56 | 0.91% |

| Advisor Class | $1,000 | $1,018.05 | $6.80 | 1.36% |

| R Class | $1,000 | $1,016.81 | $8.05 | 1.61% |

| *Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, |

| multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

11

| | | | | | |

| Legacy Large Cap | | | | | |

| |

| JULY 31, 2010 | | | | | | |

| | Shares | Value | | | Shares | Value |

| Common Stocks — 97.9% | | | | INDUSTRIAL CONGLOMERATES — 4.5% | |

| AEROSPACE & DEFENSE — 2.5% | | | | 3M Co. | 1,971 | $ 168,599 |

| United Technologies Corp. | 2,462 | $ 175,048 | | Tyco International Ltd. | 3,889 | 148,871 |

| BEVERAGES — 2.1% | | | | | | 317,470 |

| PepsiCo, Inc. | 2,290 | 148,644 | | INSURANCE — 1.3% | | |

| CHEMICALS — 4.7% | | | | Travelers Cos., Inc. (The) | 1,788 | 90,205 |

| E.I. du Pont de Nemours & Co. | 4,137 | 168,252 | | IT SERVICES — 6.3% | | |

| PPG Industries, Inc. | 2,317 | 160,962 | | Cognizant Technology Solutions | | |

| | | | | Corp., Class A(1) | 4,360 | 237,882 |

| | | 329,214 | | International Business | | |

| COMMERCIAL BANKS — 2.1% | | | | Machines Corp. | 1,621 | 208,136 |

| Fifth Third Bancorp. | 11,406 | 144,970 | | | | 446,018 |

| COMPUTERS & PERIPHERALS — 5.1% | | | MACHINERY — 2.3% | | |

| Apple, Inc.(1) | 1,411 | 362,980 | | Dover Corp. | 3,391 | 162,666 |

| CONSUMER FINANCE — 4.1% | | | | MEDIA — 4.5% | | |

| American Express Co. | 2,717 | 121,287 | | Viacom, Inc., Class B | 4,924 | 162,689 |

| Capital One Financial Corp. | 4,051 | 171,479 | | Walt Disney Co. (The) | 4,609 | 155,277 |

| | | 292,766 | | | | 317,966 |

| DIVERSIFIED TELECOMMUNICATION | | | OIL, GAS & CONSUMABLE FUELS — 2.6% | |

| SERVICES — 6.0% | | | | Enterprise Products Partners LP | 4,772 | 180,334 |

| China Unicom | | | | PHARMACEUTICALS — 4.0% | | |

| (Hong Kong) Ltd. ADR | 10,132 | 138,201 | | | | |

| Chunghwa Telecom | | | | AstraZeneca plc ADR | 2,633 | 132,808 |

| Co Ltd. ADR(1) | 6,753 | 142,826 | | Eli Lilly & Co. | 4,228 | 150,517 |

| Qwest Communications | | | | | | 283,325 |

| International, Inc. | 24,855 | 140,679 | | ROAD & RAIL — 2.2% | | |

| | | 421,706 | | Union Pacific Corp. | 2,051 | 153,148 |

| ELECTRIC UTILITIES — 1.4% | | | | SEMICONDUCTORS & SEMICONDUCTOR | |

| Southern Co. | 2,795 | 98,747 | | EQUIPMENT — 7.3% | | |

| ELECTRONIC EQUIPMENT, | | | | Broadcom Corp., Class A | 4,698 | 169,269 |

| INSTRUMENTS & COMPONENTS — 1.4% | | | Intel Corp. | 7,263 | 149,618 |

| Corning, Inc. | 5,582 | 101,146 | | Texas Instruments, Inc. | 7,837 | 193,495 |

| FOOD PRODUCTS — 6.4% | | | | | | 512,382 |

| Hershey Co. (The) | 3,494 | 164,218 | | SOFTWARE — 4.9% | | |

| Sara Lee Corp. | 9,746 | 144,143 | | Intuit, Inc.(1) | 4,002 | 159,079 |

| Unilever plc ADR | 5,098 | 145,956 | | VMware, Inc., Class A(1) | 2,437 | 188,941 |

| | | 454,317 | | | | 348,020 |

| HEALTH CARE PROVIDERS & SERVICES — 6.6% | | SPECIALTY RETAIL — 4.1% | | |

| Cardinal Health, Inc. | 4,764 | 153,734 | | AutoZone, Inc.(1) | 713 | 150,849 |

| McKesson Corp. | 2,518 | 158,181 | | TJX Cos., Inc. (The) | 3,332 | 138,345 |

| UnitedHealth Group, Inc. | 5,145 | 156,665 | | | | 289,194 |

| | | 468,580 | | TOBACCO — 7.1% | | |

| HOTELS, RESTAURANTS & LEISURE — 2.1% | | | Altria Group, Inc. | 6,714 | 148,782 |

| McDonald’s Corp. | 2,089 | 145,666 | | Lorillard, Inc. | 2,122 | 161,781 |

| HOUSEHOLD PRODUCTS — 2.3% | | | | Reynolds American, Inc. | 3,252 | 188,031 |

| Kimberly-Clark Corp. | 2,553 | 163,699 | | | | 498,594 |

| | | | | TOTAL COMMON STOCKS | | |

| | | | | (Cost $6,066,739) | | 6,906,805 |

12

| | | | | | |

| Legacy Large Cap | | | | | |

| | Principal | | | Geographic Diversification | |

| | Amount/ | | | (as a % of net assets) | |

| | Shares | Value | | United States | 87.8% |

| Temporary Cash Investments — 2.1% | | United Kingdom | 4.0% |

| FHLB Discount Notes, 0.06%, | | | | Switzerland | 2.1% |

| 8/2/10(2) | $ 100,000 | $ 100,000 | | Taiwan (Republic of China) | 2.0% |

| JPMorgan U.S. Treasury | | | | People’s Republic of China | 2.0% |

| Plus Money Market Fund | | | | | | |

| Agency Shares | 47,702 | 47,702 | | Cash and Equivalents* | 2.1% |

| TOTAL TEMPORARY | | | | *Includes temporary cash investments and other assets and liabilities. |

| CASH INVESTMENTS | | | | | | |

| (Cost $147,702) | | 147,702 | | Notes to Schedule of Investments | |

| TOTAL INVESTMENT | | | | ADR = American Depositary Receipt | |

| SECURITIES — 100.0% | | | | FHLB = Federal Home Loan Bank | |

| (Cost $6,214,441) | | 7,054,507 | | (1) | Non-income producing. | |

| OTHER ASSETS AND LIABILITIES(3) | 1,400 | | | | |

| | | | | (2) | The rate indicated is the yield to maturity at purchase. | |

| TOTAL NET ASSETS — 100.0% | | $7,055,907 | | (3) | Category is less than 0.05% of total net assets. | |

| |

| |

| | | | | See Notes to Financial Statements. | |

13

|

| Statement of Assets and Liabilities |

| |

| JULY 31, 2010 | |

| Assets | |

| Investment securities, at value (cost of $6,214,441) | $7,054,507 |

| Receivable for capital shares sold | 1,067 |

| Dividends and interest receivable | 7,038 |

| | 7,062,612 |

| | |

| Liabilities | |

| Accrued management fees | 6,459 |

| Distribution and service fees payable | 246 |

| | 6,705 |

| | |

| Net Assets | $7,055,907 |

| | |

| Net Assets Consist of: | |

| Capital (par value and paid-in surplus) | $11,005,972 |

| Undistributed net investment income | 64,463 |

| Accumulated net realized loss on investment transactions | (4,854,594) |

| Net unrealized appreciation on investments | 840,066 |

| | $ 7,055,907 |

| | | |

| | Net assets | Shares outstanding | Net asset value per share |

| Investor Class, $0.01 Par Value | $5,901,018 | 669,545 | $8.81 |

| Institutional Class, $0.01 Par Value | $400,640 | 45,313 | $8.84 |

| Advisor Class, $0.01 Par Value | $323,359 | 36,843 | $8.78 |

| R Class, $0.01 Par Value | $430,890 | 49,303 | $8.74 |

See Notes to Financial Statements.

14

| |

| YEAR ENDED JULY 31, 2010 | |

| Investment Income (Loss) | |

| Income: | |

| Dividends (net of foreign taxes withheld of $443) | $ 168,840 |

| Interest | 271 |

| | 169,111 |

| | |

| Expenses: | |

| Management fees | 93,419 |

| Distribution and service fees: | |

| Advisor Class | 762 |

| R Class | 2,594 |

| Directors’ fees and expenses | 335 |

| Other expenses | 360 |

| | 97,470 |

| | |

| Net investment income (loss) | 71,641 |

| | |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on investment transactions | 1,118,669 |

| Change in net unrealized appreciation (depreciation) on investments | (476,093) |

| | |

| Net realized and unrealized gain (loss) | 642,576 |

| | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ 714,217 |

| |

| |

| See Notes to Financial Statements. | |

15

|

| Statement of Changes in Net Assets |

| | |

| YEARS ENDED JULY 31, 2010 AND JULY 31, 2009 | | |

| Increase (Decrease) in Net Assets | 2010 | 2009 |

| Operations | | |

| Net investment income (loss) | $ 71,641 | $ 79,098 |

| Net realized gain (loss) | 1,118,669 | (5,623,945) |

| Change in net unrealized appreciation (depreciation) | (476,093) | 830,639 |

| Net increase (decrease) in net assets resulting from operations | 714,217 | (4,714,208) |

| | | |

| Distributions to Shareholders | | |

| From net investment income: | | |

| Investor Class | (70,574) | — |

| Institutional Class | (4,710) | — |

| Advisor Class | (1,987) | — |

| R Class | (1,880) | — |

| Decrease in net assets from distributions | (79,151) | — |

| | | |

| Capital Share Transactions | | |

| Net increase (decrease) in net assets from capital share transactions | (2,921,474) | (2,595,719) |

| | | |

| | | |

| Net increase (decrease) in net assets | (2,286,408) | (7,309,927) |

| | | |

| Net Assets | | |

| Beginning of period | 9,342,315 | 16,652,242 |

| End of period | $ 7,055,907 | $ 9,342,315 |

| | | |

| Undistributed net investment income | $64,463 | $79,098 |

| |

| |

| See Notes to Financial Statements. | | |

16

|

| Notes to Financial Statements |

JULY 31, 2010

1. Organization and Summary of Significant Accounting Policies

Organization — American Century Growth Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act) as an open-end management investment company. Legacy Large Cap Fund (the fund) is one fund in a series issued by the corporation. The fund is diversified under the 1940 Act. The fund’s investment objective is to seek long-term capital growth by investing primarily in stocks of large-sized market capitalization companies. The following is a summary of the fund’s significant accounting policies.

Multiple Class — The fund is authorized to issue the Investor Class, the Institutional Class, the Advisor Class and the R Class. The share classes differ principally in their respective distribution and shareholder servicing expenses and arrangements. All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Security Valuations — Securities traded primarily on a principal securities exchange are valued at the last reported sales price, or at the mean of the latest bid and asked prices where no last sales price is available. Depending on local convention or regulation, securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official close price. Investments in open-end management investment companies are valued at the reported net asset value. Discount notes may be valued through a commercial pricing service or at amortized cost, which approximates fair value. Securities traded on foreign securities exchanges and over-the-counter markets are normally completed before the close of business on days that the New York Stock Exchange (the Exchange) is open and may also take place on days when the Exchange is not open. If an event occurs after the value of a security was established but before the net asset value per share was determined that was likely to materially change the net asset value, that security would be valued as determined in accordance with procedures adopted by the Board of Directors. If the fund determines that the market price of a portfolio security is not readily available, or that the valuation methods mentioned above do not reflect the security’s fair value, such security is valued as determined by the Board of Directors or its designee, in accordance with procedures adopted by the Board of Directors, if such determination would materially impact a fund’s net asset value. Certain other circumstances may cause the fund to use alternative procedures to value a security such as: a security has been declared in default; trading in a security has been halted during the trading day; or there is a foreign market holiday and no trading will commence .

Security Transactions — For financial reporting purposes, security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that American Century Investment Management, Inc. (ACIM) (the investment advisor) has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

17

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. The fund is no longer subject to examination by tax authorities for years prior to 2007. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. Accordingly, no provision has been made for federal or state income taxes.

Distributions to Shareholders — Distributions to shareholders are recorded on the ex-dividend date. Distributions from net investment income and net realized gains, if any, are generally declared and paid annually.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

Use of Estimates — The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America, which may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates.

2. Fees and Transactions with Related Parties

Management Fees — The corporation has entered into a Management Agreement (the Agreement) with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The Agreement provides that all expenses of managing and operating the fund, except brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on the daily net assets of the specific class of shares of the fund and paid monthly in arrears. For funds with a stepped fee schedule, the rate of the fee is determined by applying a fee rate calculation formula. This formula takes into account the fund’s assets as well as cert ain assets, if any, of other clients of the investment advisor outside the American Century Investments family of funds (such as subadvised funds and separate accounts) that have very similar investment teams and investment strategies (strategy assets). The annual management fee schedule for Large Cap ranges from 0.80% to 1.10% for the Investor Class, Advisor Class and R Class. The Institutional Class is 0.20% less at each point within the range. The effective annual management fee for each class for the year ended July 31, 2010 was 1.10% for the Investor Class, Advisor Class and R Class and 0.90% for the Institutional Class.

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for each of the Advisor Class and R Class (collectively the plans), pursuant to Rule 12b-1 of the 1940 Act. The plans provide that the Advisor Class will pay American Century Investment Services, Inc. (ACIS) an annual distribution and service fee of 0.25%. The plans provide that the R Class will pay ACIS an annual distribution and service fee of 0.50%. The fees are computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plans during the year ended July 31, 2010, are detailed in the Statement of Operations.

18

Related Parties — Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC), the parent of the corporation’s investment advisor, ACIM, the distributor of the corporation, ACIS, and the corporation’s transfer agent, American Century Services, LLC. ACIM owns 11% of the outstanding shares of the fund. ACIM does not invest in the fund for the purpose of exercising management or control.

The fund is eligible to invest in a money market fund for temporary purposes, which is managed by J.P. Morgan Investment Management, Inc. (JPMIM). The fund has a Mutual Funds Services Agreement with J.P. Morgan Investor Services Co. (JPMIS). JPMorgan Chase Bank (JPMCB) is a custodian of the fund. JPMIM, JPMIS and JPMCB are wholly owned subsidiaries of JPMorgan Chase & Co. (JPM). JPM is an equity investor (non-voting shares) in ACC.

3. Investment Transactions

Purchases and sales of investment securities, excluding short-term investments, for the year ended July 31, 2010, were $13,565,924 and $16,403,742, respectively.

4. Capital Share Transactions

The corporation is authorized to issue 3,000,000,000 shares. Transactions in shares of the fund were as follows:

| | | | |

| | Year ended July 31, 2010 | Year ended July 31, 2009 |

| | Shares | Amount | Shares | Amount |

| Investor Class | | | | |

| Sold | 117,375 | $ 1,047,090 | 359,783 | $ 3,049,427 |

| Issued in reinvestment of distributions | 7,267 | 66,276 | — | — |

| Redeemed | (384,933) | (3,431,672) | (592,705) | (5,038,469) |

| | (260,291) | (2,318,306) | (232,922) | (1,989,042) |

| Institutional Class | | | | |

| Sold | 1,638 | 14,965 | 2,519 | 20,430 |

| Issued in reinvestment of distributions | 515 | 4,710 | — | — |

| Redeemed | (40,887) | (377,955) | — | — |

| | (38,734) | (358,280) | 2,519 | 20,430 |

| Advisor Class | | | | |

| Sold | 17,496 | 152,915 | 29,453 | 264,301 |

| Issued in reinvestment of distributions | 218 | 1,987 | — | — |

| Redeemed | (14,584) | (127,009) | (108,364) | (891,032) |

| | 3,130 | 27,893 | (78,911) | (626,731) |

| R Class | | | | |

| Sold | 6 | 50 | 350 | 2,503 |

| Issued in reinvestment of distributions | 207 | 1,880 | — | — |

| Redeemed | (30,024) | (274,711) | (350) | (2,879) |

| | (29,811) | (272,781) | — | (376) |

| Net increase (decrease) | (325,706) | $(2,921,474) | (309,314) | $(2,595,719) |

19

5. Fair Value Measurements

The fund’s securities valuation process is based on several considerations and may use multiple inputs to determine the fair value of the positions held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels as follows:

• Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical securities;

• Level 2 valuation inputs consist of significant direct or indirect observable market data (including quoted prices for similar securities, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.); or

• Level 3 valuation inputs consist of significant unobservable inputs (including a fund’s own assumptions).

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments.

The following is a summary of the valuation inputs used to determine the fair value of the fund’s securities as of July 31, 2010. The Schedule of Investments provides additional details on the fund’s portfolio holdings.

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investment Securities | | | |

| Domestic Common Stocks | $6,198,143 | — | — |

| Foreign Common Stocks | 708,662 | — | — |

| Temporary Cash Investments | 47,702 | $100,000 | — |

| Total Value of Investment Securities | $6,954,507 | $100,000 | — |

6. Interfund Lending

The fund, along with certain other funds in the American Century Investments family of funds, may participate in an interfund lending program, pursuant to an Exemptive Order issued by the Securities and Exchange Commission (SEC). This program provides an alternative credit facility allowing the fund to borrow from or lend to other funds in the American Century Investments family of funds that permit such transactions. Interfund lending transactions are subject to each fund’s investment policies and borrowing and lending limits. The interfund loan rate earned/paid on interfund lending transactions is determined daily based on the average of certain current market rates. Interfund lending transactions normally extend only overnight, but can have a maximum duration of seven days. The program is subject to annual approval by the Board of Directors. During the year ended July 31, 2010, the fund did not utilize the program.

7. Risk Factors

The fund’s investment process may result in high portfolio turnover, which could mean high transaction costs, affecting both performance and capital gains tax liabilities to investors. There are certain risks involved in investing in foreign securities. These risks include those resulting from future adverse political, social, and economic developments, fluctuations in currency exchange rates, the possible imposition of exchange controls, and other foreign laws or restrictions.

20

8. Federal Tax Information

The tax character of distributions paid during the years ended July 31, 2010 and July 31, 2009 were as follows:

| | |

| | 2010 | 2009 |

| Distributions Paid From | | |

| Ordinary income | $79,151 | — |

| Long-term capital gains | — | — |

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of July 31, 2010, the federal tax cost of investments and the components of distributable earnings on a tax-basis were as follows:

| | |

| Federal tax cost of investments | $6,208,989 |

| Gross tax appreciation of investments | $903,211 |

| Gross tax depreciation of investments | (57,693) |

| Net tax appreciation (depreciation) of investments | $845,518 |

| Undistributed ordinary income | $64,463 |

| Accumulated capital losses | $(4,860,046) |

The difference between book-basis and tax-basis cost and unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales.

The accumulated capital losses listed above represent net capital loss carryovers that may be used to offset future realized capital gains for federal income tax purposes. Future capital loss carryover utilization in any given year may be subject to Internal Revenue Code limitations. Capital loss carryovers of $(3,451,519) and $(1,408,527) expire in 2017 and 2018, respectively.

21

9. Corporate Event

As part of a long-standing estate and business succession plan established by ACC Co-Chairman James E. Stowers, Jr., the founder of American Century Investments, ACC Co-Chairman Richard W. Brown succeeded Mr. Stowers as trustee of a trust that holds a greater-than-25% voting interest in ACC, the parent corporation of the fund’s advisor. Under the 1940 Act, this is presumed to represent control of ACC even though it is less than a majority interest. The change of trustee was considered a change of control of ACC and therefore also a change of control of the fund’s advisor even though there has been no change to its management and none is anticipated. The change of control resulted in the assignment of the fund’s investment advisory agreement. Under the 1940 Act, an assignment automatically terminated such agreement, making the approval of a new agreement necessary.

On February 18, 2010, the Board of Directors approved an interim investment advisory agreement under which the fund was managed until a new agreement was approved by fund shareholders. On March 29, 2010, the Board of Directors approved a new investment advisory agreement. The interim agreement and the new agreement are substantially identical to the terminated agreement (with the exception of different effective and termination dates) and did not result in changes in the management of American Century Investments, the fund, its investment objectives, fees or services provided.

The new agreement for the fund was approved by shareholders at a Special Meeting of Shareholders on June 16, 2010. The new agreement went into effect on July 16, 2010.

10. Other Tax Information (Unaudited)

The following information is provided pursuant to provisions of the Internal Revenue Code.

The fund hereby designates up to the maximum amount allowable as qualified dividend income for the fiscal year ended July 31, 2010.

For corporate taxpayers, the fund hereby designates $79,151, or up to the maximum amount allowable, of ordinary income distributions paid during the fiscal year ended July 31, 2010 as qualified for the corporate dividends received deduction.

22

| | | | | | |

| Legacy Large Cap | | | | | |

| |

| Investor Class | | | | | |

| For a Share Outstanding Throughout the Years Ended July 31 (except as noted) | | |

| | | 2010 | 2009 | 2008 | 2007 | 2006(1) |

| Per-Share Data | | | | | |

| Net Asset Value, Beginning of Period | $8.30 | $11.60 | $11.90 | $10.15 | $10.00 |

| Income From Investment Operations | | | | | |

| Net Investment Income (Loss)(2) | 0.08 | 0.07 | 0.01 | 0.08 | 0.01 |

| Net Realized and Unrealized Gain (Loss) | 0.51 | (3.37) | 0.41 | 1.73 | 0.14 |

| Total From Investment Operations | 0.59 | (3.30) | 0.42 | 1.81 | 0.15 |

| Distributions | | | | | |

| From Net Investment Income | (0.08) | — | (0.03) | (0.06) | — |

| From Net Realized Gains | — | — | (0.61) | — | — |

| From Tax Return of Capital | — | — | (0.08) | — | — |

| Total Distributions | (0.08) | — | (0.72) | (0.06) | — |

| Net Asset Value, End of Period | $8.81 | $8.30 | $11.60 | $11.90 | $10.15 |

| |

| Total Return(3) | 7.13% | (28.45)% | 3.07% | 17.83% | 1.50% |

| | | | | | |

| Ratios/Supplemental Data | | | | | |

| Ratio of Operating Expenses | | | | | |

| to Average Net Assets | 1.11% | 1.10% | 1.11% | 1.10% | 1.10%(4) |

| Ratio of Net Investment Income (Loss) | | | | | |

| to Average Net Assets | 0.86% | 0.83% | 0.10% | 0.72% | 0.66%(4) |

| Portfolio Turnover Rate | 163% | 283% | 175% | 246% | 39% |

| Net Assets, End of Period (in thousands) | $5,901 | $7,714 | $13,487 | $5,887 | $2,180 |

| (1) | May 31, 2006 (fund inception) through July 31, 2006. | | | | |

| (2) | Computed using average shares outstanding throughout the period. | | | | |

| (3) | Total return assumes reinvestment of net investment income and capital gains distributions, if any. Total returns for periods less than one year |

| | are not annualized. Total returns are calculated based on the net asset value of the last business day. | | |

| (4) | Annualized. | | | | | |

See Notes to Financial Statements.

23

| | | | | | |

| Legacy Large Cap | | | | | |

| |

| Institutional Class | | | | | |

| For a Share Outstanding Throughout the Years Ended July 31 (except as noted) | | |

| | | 2010 | 2009 | 2008 | 2007 | 2006(1) |

| Per-Share Data | | | | | |

| Net Asset Value, Beginning of Period | $8.32 | $11.61 | $11.92 | $10.15 | $10.00 |

| Income From Investment Operations | | | | | |

| Net Investment Income (Loss)(2) | 0.09 | 0.08 | 0.04 | 0.10 | 0.01 |

| Net Realized and Unrealized Gain (Loss) | 0.53 | (3.37) | 0.40 | 1.74 | 0.14 |

| Total From Investment Operations | 0.62 | (3.29) | 0.44 | 1.84 | 0.15 |

| Distributions | | | | | |

| From Net Investment Income | (0.10) | — | (0.04) | (0.07) | — |

| From Net Realized Gains | — | — | (0.61) | — | — |

| From Tax Return of Capital | — | — | (0.10) | — | — |

| Total Distributions | (0.10) | — | (0.75) | (0.07) | — |

| Net Asset Value, End of Period | $8.84 | $8.32 | $11.61 | $11.92 | $10.15 |

| |

| Total Return(3) | 7.45% | (28.34)% | 3.19% | 18.16% | 1.50% |

| | | | | | |

| Ratios/Supplemental Data | | | | | |

| Ratio of Operating Expenses | | | | | |

| to Average Net Assets | 0.91% | 0.90% | 0.91% | 0.90% | 0.90%(4) |

| Ratio of Net Investment Income (Loss) | | | | | |

| to Average Net Assets | 1.06% | 1.03% | 0.30% | 0.92% | 0.86%(4) |

| Portfolio Turnover Rate | 163% | 283% | 175% | 246% | 39% |

| Net Assets, End of Period (in thousands) | $401 | $699 | $947 | $899 | $761 |

| (1) | May 31, 2006 (fund inception) through July 31, 2006. | | | | |

| (2) | Computed using average shares outstanding throughout the period. | | | | |

| (3) | Total return assumes reinvestment of net investment income and capital gains distributions, if any. Total returns for periods less than one year |

| | are not annualized. Total returns are calculated based on the net asset value of the last business day. | | |

| (4) | Annualized. | | | | | |

See Notes to Financial Statements.

24

| | | | | | |

| Legacy Large Cap | | | | | |

| |

| Advisor Class | | | | | |

| For a Share Outstanding Throughout the Years Ended July 31 (except as noted) | | |

| | | 2010 | 2009 | 2008 | 2007 | 2006(1) |

| Per-Share Data | | | | | |

| Net Asset Value, Beginning of Period | $8.26 | $11.58 | $11.88 | $10.14 | $10.00 |

| Income From Investment Operations | | | | | |

| Net Investment Income (Loss)(2) | 0.05 | 0.04 | (0.02) | 0.05 | 0.01 |

| Net Realized and Unrealized Gain (Loss) | 0.53 | (3.36) | 0.41 | 1.73 | 0.13 |

| Total From Investment Operations | 0.58 | (3.32) | 0.39 | 1.78 | 0.14 |

| Distributions | | | | | |

| From Net Investment Income | (0.06) | — | (0.02) | (0.04) | — |

| From Net Realized Gains | — | — | (0.61) | — | — |

| From Tax Return of Capital | — | — | (0.06) | — | — |

| Total Distributions | (0.06) | — | (0.69) | (0.04) | — |

| Net Asset Value, End of Period | $8.78 | $8.26 | $11.58 | $11.88 | $10.14 |

| |

| Total Return(3) | 7.01% | (28.67)% | 2.81% | 17.59% | 1.40% |

| | | | | | |

| Ratios/Supplemental Data | | | | | |

| Ratio of Operating Expenses | | | | | |

| to Average Net Assets | 1.36% | 1.35% | 1.36% | 1.35% | 1.35%(4) |

| Ratio of Net Investment Income (Loss) | | | | | |

| to Average Net Assets | 0.61% | 0.58% | (0.15)% | 0.47% | 0.41%(4) |

| Portfolio Turnover Rate | 163% | 283% | 175% | 246% | 39% |

| Net Assets, End of Period (in thousands) | $323 | $278 | $1,304 | $895 | $761 |

| (1) | May 31, 2006 (fund inception) through July 31, 2006. | | | | |

| (2) | Computed using average shares outstanding throughout the period. | | | | |

| (3) | Total return assumes reinvestment of net investment income and capital gains distributions, if any. Total returns for periods less than one year |

| | are not annualized. Total returns are calculated based on the net asset value of the last business day. | | |

| (4) | Annualized. | | | | | |

See Notes to Financial Statements.

25

| | | | | | |

| Legacy Large Cap | | | | | |

| |

| R Class | | | | | |

| For a Share Outstanding Throughout the Years Ended July 31 (except as noted) | | |

| | | 2010 | 2009 | 2008 | 2007 | 2006(1) |

| Per-Share Data | | | | | |

| Net Asset Value, Beginning of Period | $8.23 | $11.56 | $11.87 | $10.14 | $10.00 |

| Income From Investment Operations | | | | | |

| Net Investment Income (Loss)(2) | 0.03 | 0.03 | (0.05) | 0.02 | —(3) |

| Net Realized and Unrealized Gain (Loss) | 0.52 | (3.36) | 0.40 | 1.73 | 0.14 |

| Total From Investment Operations | 0.55 | (3.33) | 0.35 | 1.75 | 0.14 |

| Distributions | | | | | |

| From Net Investment Income | (0.04) | — | (0.02) | (0.02) | —(3) |

| From Net Realized Gains | — | — | (0.61) | — | — |

| From Tax Return of Capital | — | — | (0.03) | — | — |

| Total Distributions | (0.04) | — | (0.66) | (0.02) | —(3) |

| Net Asset Value, End of Period | $8.74 | $8.23 | $11.56 | $11.87 | $10.14 |

| |

| Total Return(4) | 6.64% | (28.81)% | 2.47% | 17.33% | 1.40% |

| | | | | | |

| Ratios/Supplemental Data | | | | | |

| Ratio of Operating Expenses | | | | | |

| to Average Net Assets | 1.61% | 1.60% | 1.61% | 1.60% | 1.60%(5) |

| Ratio of Net Investment Income (Loss) | | | | | |

| to Average Net Assets | 0.36% | 0.33% | (0.40)% | 0.22% | 0.16%(5) |

| Portfolio Turnover Rate | 163% | 283% | 175% | 246% | 39% |

| Net Assets, End of Period (in thousands) | $431 | $651 | $915 | $903 | $760 |

| (1) | May 31, 2006 (fund inception) through July 31, 2006. | | | | |

| (2) | Computed using average shares outstanding throughout the period. | | | | |

| (3) | Per-share amount was less than $0.005. | | | | | |

| (4) | Total return assumes reinvestment of net investment income and capital gains distributions, if any. Total returns for periods less than one year |

| | are not annualized. Total returns are calculated based on the net asset value of the last business day. | | |

| (5) | Annualized. | | | | | |

See Notes to Financial Statements.

26

|

| Report of Independent Registered Public Accounting Firm |

The Board of Directors and Shareholders,

American Century Growth Funds, Inc.:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Legacy Large Cap Fund, one of the funds constituting American Century Growth Funds, Inc. (the “Corporation”), as of July 31, 2010, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented. These financial statements and financial highlights are the responsibility of the Corporation’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Corporation is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Corporation’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing t he accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of July 31, 2010, by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Legacy Large Cap Fund of American Century Growth Funds, Inc. as of July 31, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of periods presented, in conformity with accounting principles generally accepted in the United States of America.

Deloitte & Touche LLP

Kansas City, Missouri

September 17, 2010

27

A special meeting of shareholders was held on June 16, 2010, to vote on the following proposals. Each proposal received the required number of votes and was adopted. A summary of voting results is listed below each proposal.

Proposal 1:

To elect one Director to the Board of Directors of American Century Growth Funds, Inc. (the proposal was voted on by all shareholders of funds issued by American Century Growth Funds, Inc.):

| | |

| John R. Whitten | For: | 34,780,129 |

| | Withhold: | 790,090 |

| | Abstain: | 0 |

| | Broker Non-Vote: | 0 |

The other directors whose term of office continued after the meeting include Jonathan S. Thomas, Thomas A. Brown, Andrea C. Hall, James A. Olson, Donald H. Pratt, and M. Jeannine Strandjord.

Proposal 2:

To approve a management agreement between the fund and American Century Investment Management, Inc.:

| | |

| Investor, Advisor, and R Classes | For: | 5,367,072 |

| | Against: | 119,240 |

| | Abstain: | 252,667 |

| | Broker Non-Vote: | 490,698 |

| |

| Institutional Class | For: | 414,588 |

| | Against: | 0 |

| | Abstain: | 0 |

| | Broker Non-Vote: | 15,555 |

28

The Board of Directors

The individuals listed below serve as directors of the fund. Each director will continue to serve in this capacity until death, retirement, resignation or removal from office. The mandatory retirement age for directors who are not “interested persons,” as that term is defined in the Investment Company Act (independent directors), is 72. However, the mandatory retirement age may be extended or changed with the approval of the remaining independent directors.

Mr. Thomas is the only director who is an “interested person” because he currently serves as President and Chief Executive Officer of American Century Companies, Inc. (ACC), the parent company of American Century Investment Management, Inc. (ACIM or the advisor).

The other directors (more than three-fourths of the total number) are independent; that is, they have never been employees, directors or officers of, and have no financial interest in, ACC or any of its wholly owned, direct or indirect, subsidiaries, including ACIM, American Century Investment Services, Inc. (ACIS) and American Century Services, LLC (ACS). The directors serve in this capacity for seven (in the case of Mr. Thomas, 15) registered investment companies in the American Century Investments family of funds.

The following presents additional information about the directors. The mailing address for each director is 4500 Main Street, Kansas City, Missouri 64111.

Independent Directors

Thomas A. Brown

Year of Birth: 1940

Position(s) with the Fund: Director

Length of Time Served: Since 1980

Principal Occupation(s) During the Past Five Years: Managing Member, Associated Investments,

LLC (real estate investment company); Brown Cascade Properties, LLC (real estate

investment company) (2001 to 2009)

Number of Funds in Fund Complex Overseen by Director: 63

Other Directorships Held by Director During the Past Five Years: None

Education/Other Professional Experience: BS in Mechanical Engineering, University of

Kansas; formerly, Chief Executive Officer, Associated Bearings Company; formerly,

Area Vice President, Applied Industrial Technologies (bearings and power

transmission company)

29

Andrea C. Hall

Year of Birth: 1945

Position(s) with the Fund: Director

Length of Time Served: Since 1997

Principal Occupation(s) During the Past Five Years: Retired as advisor to the President, Midwest

Research Institute (not-for-profit research organization) (June 2006)

Number of Funds in Fund Complex Overseen by Director: 63

Other Directorships Held by Director During the Past Five Years: None

Education/Other Professional Experience: BS in Biology, Florida State University; PhD in

Biology, Georgetown University; formerly, Senior Vice President and Director of

Research Operations, Midwest Research Institute

James A. Olson

Year of Birth: 1942

Position(s) with the Fund: Director

Length of Time Served: Since 2007

Principal Occupation(s) During the Past Five Years: Member, Plaza Belmont LLC (private equity

fund manager); Chief Financial Officer, Plaza Belmont LLC (September 1999 to

September 2006)

Number of Funds in Fund Complex Overseen by Director: 63

Other Directorships Held by Director During the Past Five Years: Saia, Inc. and Entertainment

Properties Trust

Education/Other Professional Experience: BS in Business Administration and MBA, St. Louis

University; CPA; 21 years of experience as a partner in the accounting firm of Ernst

& Young LLP

Donald H. Pratt

Year of Birth: 1937

Position(s) with the Fund: Director, Chairman of the Board

Length of Time Served: Since 1995 (Chairman since 2005)

Principal Occupation(s) During the Past Five Years: Chairman and Chief Executive Officer,

Western Investments, Inc. (real estate company)

Number of Funds in Fund Complex Overseen by Director: 63

Other Directorships Held by Director During the Past Five Years: None

Education/Other Professional Experience: BS in Industrial Engineering, Wichita State

University; MBA, Harvard Business School; serves on the Board of Governors of

the Independent Directors Council and Investment Company Institute; formerly,

Chairman of the Board, Butler Manufacturing Company (metal buildings producer)

M. Jeannine Strandjord

Year of Birth: 1945

Position(s) with the Fund: Director

Length of Time Served: Since 1994

Principal Occupation(s) During the Past Five Years: Retired, formerly, Senior Vice President,

Process Excellence, Sprint Corporation (telecommunications company) (January

2005-September 2005)

Number of Funds in Fund Complex Overseen by Director: 63

Other Directorships Held by Director During the Past Five Years: DST Systems Inc., Euronet

Worldwide Inc., Charming Shoppes, Inc.

Education/Other Professional Experience: BS in Business Administration and Accounting,

University of Kansas; CPA; formerly, Senior Vice President of Financial Services and

Treasurer and Chief Financial Officer, Global Markets Group; Sprint Corporation;

formerly, with the accounting firm of Ernst and Whinney

30

John R. Whitten

Year of Birth: 1946

Position(s) with the Fund: Director

Length of Time Served: Since 2008

Principal Occupation(s) During the Past Five Years: Project Consultant, Celanese Corp.

(industrial chemical company)

Number of Funds in Fund Complex Overseen by Director: 63

Other Directorships Held by Director During the Past Five Years: Rudolph Technologies, Inc.

Professional Education/Experience: BS in Business Administration, Cleveland State

University; CPA; formerly, Chief Financial Officer and Treasurer, Applied Industrial

Technologies, Inc.; thirteen years of experience with accounting firm Deloitte &

Touche LLP

Interested Director

Jonathan S. Thomas

Year of Birth: 1963

Position(s) with the Fund: Director and President

Length of Time Served: Since 2007

Principal Occupation(s) During the Past Five Years: President and Chief Executive Officer,

ACC (March 2007 to present); Chief Administrative Officer, ACC (February 2006 to

February 2007); Executive Vice President, ACC (November 2005 to February 2007);

Global Chief Operating Officer and Managing Director, Morgan Stanley (investment

management) (March 2000 to November 2005). Also serves as: Chief Executive

Officer and Manager, ACS; Executive Vice President, ACIM; Director, ACC, ACIM

and other ACC subsidiaries

Number of Funds in Fund Complex Overseen by Director: 104

Other Directorships Held by Director During the Past Five Years: None

Education/Other Professional Experience: BA in Economics, University of Massachusetts;

MBA, Boston College; formerly held senior leadership roles with Fidelity

Investments, Boston Financial Services and Bank of America; serves on the Board of

Governors of the Investment Company Institute

31

Officers

The following table presents certain information about the executive officers of the fund. Each officer serves as an officer for each of the 15 investment companies in the American Century family of funds, unless otherwise noted. No officer is compensated for his or her service as an officer of the fund. The listed officers are interested persons of the fund and are appointed or re-appointed on an annual basis. The mailing address for each of the officers listed below is 4500 Main Street, Kansas City, Missouri 64111.

| | |

| Name | Offices with | |

| (Year of Birth) | the fund | Principal Occupation(s) During the Past Five Years |

| Jonathan S. | Director and | President and Chief Executive Officer, ACC (March 2007 to present); |

| Thomas | President | Chief Administrative Officer, ACC (February 2006 to February 2007); |

| (1963) | since 2007 | Executive Vice President, ACC (November 2005 to February 2007); Global |

| | | Chief Operating Officer and Managing Director, Morgan Stanley (March |

| | | 2000 to November 2005). Also serves as: Chief Executive Officer and |

| | | Manager, ACS; Executive Vice President, ACIM; Director, ACC, ACIM and |

| | | other ACC subsidiaries |

| Barry Fink | Executive | Chief Operating Officer and Executive Vice President, ACC (September 2007 |

| (1955) | Vice President | to present); President, ACS (October 2007 to present); Managing Director, |

| | since 2007 | Morgan Stanley (2000 to 2007); Global General Counsel, Morgan Stanley |

| | | (2000 to 2006). Also serves as: Manager, ACS and Director, ACC and |

| | | certain ACC subsidiaries |

| Maryanne L. | Chief Compliance | Chief Compliance Officer, American Century funds, ACIM and ACS (August |

| Roepke | Officer since 2006 | 2006 to present); Assistant Treasurer, ACC (January 1995 to August 2006); |

| (1956) | and Senior | and Treasurer and Chief Financial Officer, various American Century funds |

| | Vice President | (July 2000 to August 2006). Also serves as: Senior Vice President, ACS |

| | since 2000 | |

| Charles A. | General Counsel | Attorney, ACC (February 1994 to present); Vice President, ACC (November |

| Etherington | since 2007 | 2005 to present), General Counsel, ACC (March 2007 to present); Also |

| (1957) | and Senior | serves as General Counsel, ACIM, ACS, ACIS and other ACC subsidiaries; |

| | Vice President | and Senior Vice President, ACIM and ACS |

| | since 2006 | |

| Robert J. Leach | Vice President, | Vice President, ACS (February 2000 to present); and Controller, various |

| (1966) | Treasurer and | American Century funds (1997 to September 2006) |

| | Chief Financial | |

| | Officer since 2006 | |

| David H. Reinmiller | Vice President | Attorney, ACC (January 1994 to present); Associate General Counsel, ACC |

| (1963) | since 2000 | (January 2001 to present); Chief Compliance Officer, American Century |

| | | funds and ACIM (January 2001 to February 2005). Also serves as Vice |

| | | President, ACIM and ACS |

| Ward D. Stauffer | Secretary | Attorney, ACC (June 2003 – Present) |

| (1960) | since 2005 | |

The Statement of Additional Information has additional information about the fund’s directors and is available without charge, upon request, by calling 1-800-345-2021.

32

|

| Board Approval of Management Agreements |

American Century Investment Management, Inc. (“ACIM” or the “Advisor”) currently serves as investment advisor to the Fund under a management agreement (the “Current Management Agreement”) that took effect on July 16, 2010, following approval by the Fund’s Board of Directors (the “Board”) and shareholders. The Advisor previously served as investment advisor to the Fund pursuant to a management agreement (the “Prior Management Agreement”) and an interim management agreement (the “Interim Management Agreement”). The Interim Management Agreement terminated in accordance with its terms on July 16, 2010, upon the effectiveness of the Current Management Agreement. The Prior Management Agreement terminated on February 16, 2010, as a result of a change of control of the Advisor’s parent company, American Century Companies, Inc. (“ACC”). The cha nge in control occurred as the result of a change in the trustee of a trust created by James E. Stowers, Jr., the founder of American Century Investments, which holds shares representing a significant interest in ACC stock. Mr. Stowers previously served as the trustee of the trust. On February 16, 2010, Richard W. Brown, Co-Chairman of ACC with Mr. Stowers, became the trustee in accordance with the terms of the trust and Mr. Stowers’ long-standing estate and succession plan.

On February 18, 2010, the Board approved the Interim Agreement in accordance with Rule 15a-4 under the Investment Company Act to ensure continued management of the Fund by the Advisor after the termination of the Prior Agreement and until shareholder approval of the Current Management Agreement as required under the Act. The Board approved the Current Agreement and recommended its approval to shareholders. Fund shareholders approved the Current Agreement at a meeting held on June 16, 2010.

The Interim Agreement and the Current Agreement are substantially identical to the Prior Agreement except for their effective dates and the termination provisions of the Interim Agreement. Under the Current Agreement, the Advisor will provide the same services as provided by the Advisor, be subject to the same duties, and receive the same compensation rate as under the Prior Agreement.

Basis for Board Approval of Interim Agreement

In considering the approval of the Interim Agreement, Rule 15a-4 requires the Board to approve the contract within ten business days of the termination of the prior agreement and to determine that the compensation to be received under the interim agreement is no greater than would have been received under the corresponding prior agreement. In connection with the approval, the Board noted that it oversees on a continuous basis and evaluates at its quarterly meetings, directly and through the committees of the Board, the nature and quality of significant services provided by the Advisor, the investment performance of the Fund, shareholder services, audit and compliance functions and a variety of other matters relating to the Fund’s operations.

33