united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-21872 |

| Mutual Fund Series Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450, Cincinnati, OH | 45246 |

| (Address of principal executive offices) | (Zip code) |

| CT CORPORATION SYSTEM |

| 1300 EAST NINTH STREET, CLEVELAND, OH 44114 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | 631-470-2600 |

| Date of fiscal year end: | 6/30 |

| | |

| Date of reporting period: | 6/30/2024 |

Item 1. Reports to Stockholders.

(a)

0001355064mfst:C000128969Membermfst:FinancialsSectorMember2024-06-30

Catalyst Enhanced Income Strategy Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Catalyst Enhanced Income Strategy Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://catalystmf.com/literature-and-forms/. You can also request this information by contacting us at 1-866-447-4228.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $178 | 1.78% |

How did the Fund perform during the reporting period?

This past year has been challenging for most subsectors within fixed income as persistent inflation and thus elevated interest rates have caused most fixed income assets to go sideways. Fortunately, due to the credit strength of our investments and our tactful investment thesis, we have fared considerably better than our benchmark historically. During the last year, duration rallied considerably; however, the Fund has much less exposure to interest rate duration and thus underperformed its benchmark.

Due to macro uncertainty and higher rates, investments in the Fund now yield more than they have in years and are less volatile than they were in the past. For example, before the 2022 bond rout, generic Non-agency RMBS senior bonds yielded 3-5% and now yield 7-12%. They are generally less volatile now than they were then due to amortization and continued strength in the housing market.

We have added and continue to optimistically add agency inverse interest only securities (IIO). These bonds benefit from the front end of the rate curve going lower, which would drive the coupon higher, hence the term inverse. This small position serves as a bit of a macro hedge in the event of large market disruption or recession. We anticipate the interest rate curve steepening towards the end of this year and into 2025, which would be beneficial for this position. This small position can have an outsized impact on total return for the fund.

Over the past year, we have maintained an allocation to select commercial mortgage-backed securities. While these securities provided positive performance in the past, they came under significant pressure late in 2022 and 2023. We did sell some bonds at the end of 2023/early 2024 as this subsector rallied. We find this sector to be one of the best opportunities in fixed income, albeit with specific asset selection.

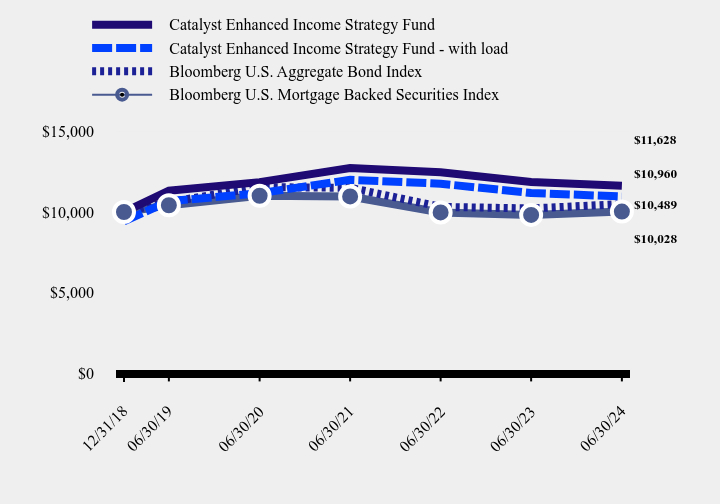

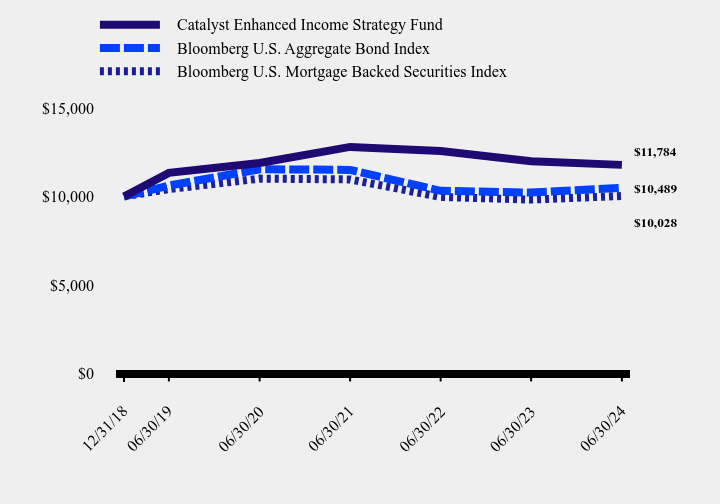

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Catalyst Enhanced Income Strategy Fund | Catalyst Enhanced Income Strategy Fund - with load | Bloomberg U.S. Aggregate Bond Index | Bloomberg U.S. Mortgage Backed Securities Index |

|---|

| 12/31/18 | $10,000 | $9,425 | $10,000 | $10,000 |

| 06/30/19 | $11,318 | $10,668 | $10,611 | $10,417 |

| 06/30/20 | $11,850 | $11,168 | $11,539 | $11,008 |

| 06/30/21 | $12,726 | $11,994 | $11,500 | $10,962 |

| 06/30/22 | $12,467 | $11,750 | $10,317 | $9,972 |

| 06/30/23 | $11,862 | $11,180 | $10,220 | $9,821 |

| 06/30/24 | $11,628 | $10,960 | $10,489 | $10,028 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (12/31/2018) |

|---|

| Catalyst Enhanced Income Strategy Fund | | | |

| Without Load | | 0.54% | 2.78% |

| With Load | | | 1.68% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | | 0.87% |

| Bloomberg U.S. Mortgage Backed Securities Index | 2.12% | | 0.05% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$219,641,002

- Number of Portfolio Holdings312

- Advisory Fee (net of waivers)$3,359,700

- Portfolio Turnover13%

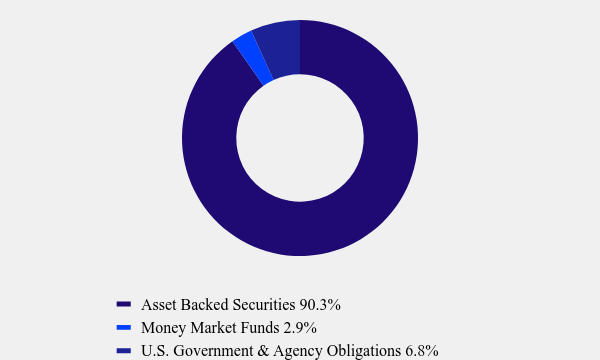

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 90.3% |

| Money Market Funds | 2.9% |

| U.S. Government & Agency Obligations | 6.8% |

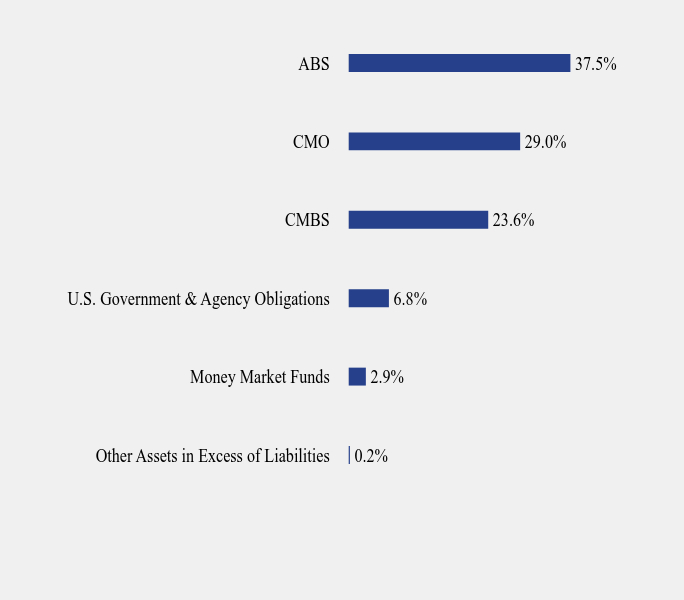

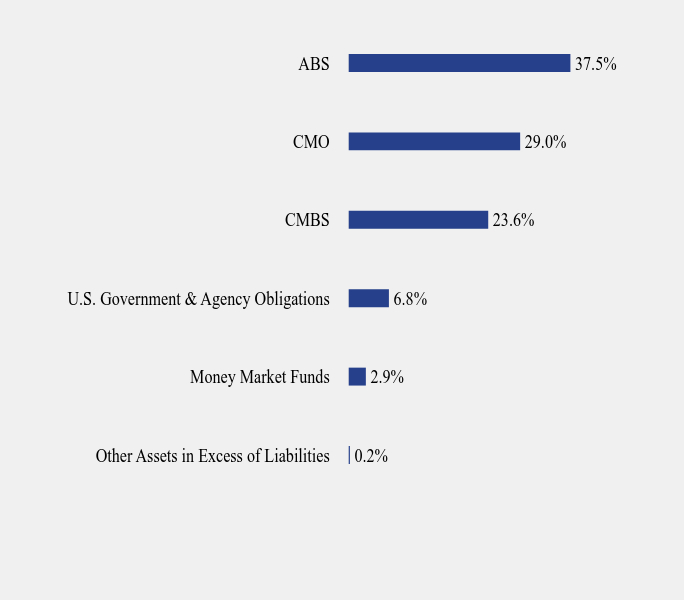

What did the Fund invest in?

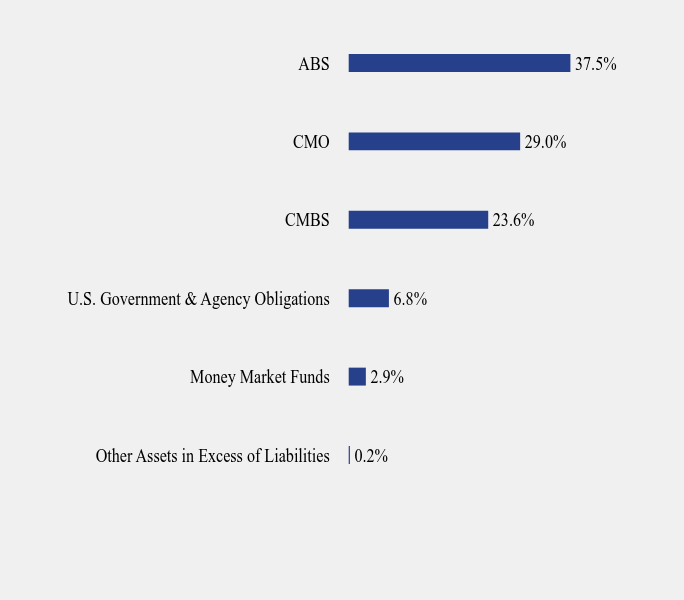

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.2% |

| Money Market Funds | 2.9% |

| U.S. Government & Agency Obligations | 6.8% |

| CMBS | 23.6% |

| CMO | 29.0% |

| ABS | 37.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Starwood Retail Property Trust, 2014-STAR A, 8.500%, 11/15/27 | 4.4% |

| Terwin Mortgage Trust, 2006-3 2A3, 1.566%, 04/25/37 | 3.4% |

| Carrington Mortgage Loan Trust, 2006-FRE2 A2, 2.789%, 10/25/36 | 3.3% |

| JP Morgan Chase Commercial Mortgage Securities Trust, 2011-C3, 5.360%, 02/15/46 | 2.8% |

| Citigroup Commercial Mortgage Trust, 2014-GC21 E, 3.588%, 05/10/47 | 2.1% |

| Credit Suisse Seasoned Loan Trust, 2006-1 M1, 3.268%, 10/25/34 | 2.0% |

| Carrington Mortgage Loan Trust, 2006-FRE2 A5, 2.789%, 03/25/35 | 1.9% |

| Morgan Stanley Capital I Trust, 2006-T21 C, 5.187%, 10/12/52 | 1.8% |

| EMC Mortgage Loan Trust, 2004-B M2, 4.898%, 01/25/41 | 1.8% |

| Citicorp Mortgage Securities Trust, 2008-1 1A1, 6.250%, 02/25/38 | 1.8% |

No material changes occurred during the year ended June 30, 2024.

Catalyst Enhanced Income Strategy Fund - Class A (EIXAX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://catalystmf.com/literature-and-forms/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Catalyst Enhanced Income Strategy Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Catalyst Enhanced Income Strategy Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://catalystmf.com/literature-and-forms/. You can also request this information by contacting us at 1-866-447-4228.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $253 | 2.53% |

How did the Fund perform during the reporting period?

This past year has been challenging for most subsectors within fixed income as persistent inflation and thus elevated interest rates have caused most fixed income assets to go sideways. Fortunately, due to the credit strength of our investments and our tactful investment thesis, we have fared considerably better than our benchmark historically. During the last year, duration rallied considerably; however, the Fund has much less exposure to interest rate duration and thus underperformed its benchmark.

Due to macro uncertainty and higher rates, investments in the Fund now yield more than they have in years and are less volatile than they were in the past. For example, before the 2022 bond rout, generic Non-agency RMBS senior bonds yielded 3-5% and now yield 7-12%. They are generally less volatile now than they were then due to amortization and continued strength in the housing market.

We have added and continue to optimistically add agency inverse interest only securities (IIO). These bonds benefit from the front end of the rate curve going lower, which would drive the coupon higher, hence the term inverse. This small position serves as a bit of a macro hedge in the event of large market disruption or recession. We anticipate the interest rate curve steepening towards the end of this year and into 2025, which would be beneficial for this position. This small position can have an outsized impact on total return for the fund.

Over the past year, we have maintained an allocation to select commercial mortgage-backed securities. While these securities provided positive performance in the past, they came under significant pressure late in 2022 and 2023. We did sell some bonds at the end of 2023/early 2024 as this subsector rallied. We find this sector to be one of the best opportunities in fixed income, albeit with specific asset selection.

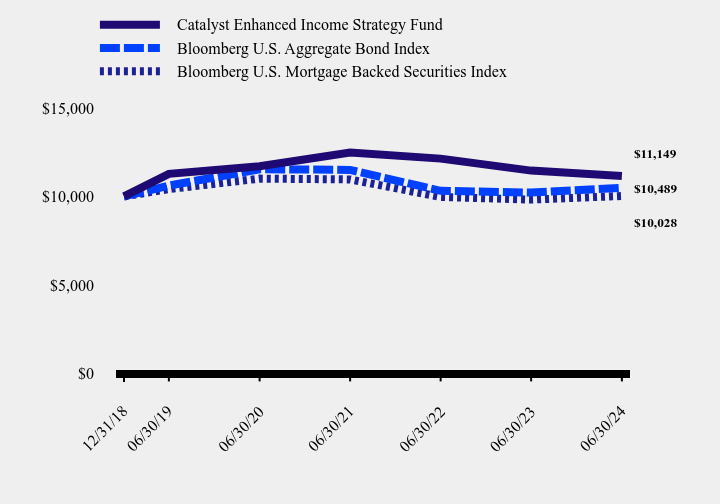

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Catalyst Enhanced Income Strategy Fund | Bloomberg U.S. Aggregate Bond Index | Bloomberg U.S. Mortgage Backed Securities Index |

|---|

| 12/31/18 | $10,000 | $10,000 | $10,000 |

| 06/30/19 | $11,275 | $10,611 | $10,417 |

| 06/30/20 | $11,706 | $11,539 | $11,008 |

| 06/30/21 | $12,480 | $11,500 | $10,962 |

| 06/30/22 | $12,138 | $10,317 | $9,972 |

| 06/30/23 | $11,460 | $10,220 | $9,821 |

| 06/30/24 | $11,149 | $10,489 | $10,028 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (December 31, 2018) |

|---|

| Catalyst Enhanced Income Strategy Fund | | | 2.00% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | | 0.87% |

| Bloomberg U.S. Mortgage Backed Securities Index | 2.12% | | 0.05% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$219,641,002

- Number of Portfolio Holdings312

- Advisory Fee (net of waivers)$3,359,700

- Portfolio Turnover13%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 90.3% |

| Money Market Funds | 2.9% |

| U.S. Government & Agency Obligations | 6.8% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.2% |

| Money Market Funds | 2.9% |

| U.S. Government & Agency Obligations | 6.8% |

| CMBS | 23.6% |

| CMO | 29.0% |

| ABS | 37.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Starwood Retail Property Trust, 2014-STAR A, 8.500%, 11/15/27 | 4.4% |

| Terwin Mortgage Trust, 2006-3 2A3, 1.566%, 04/25/37 | 3.4% |

| Carrington Mortgage Loan Trust, 2006-FRE2 A2, 2.789%, 10/25/36 | 3.3% |

| JP Morgan Chase Commercial Mortgage Securities Trust, 2011-C3, 5.360%, 02/15/46 | 2.8% |

| Citigroup Commercial Mortgage Trust, 2014-GC21 E, 3.588%, 05/10/47 | 2.1% |

| Credit Suisse Seasoned Loan Trust, 2006-1 M1, 3.268%, 10/25/34 | 2.0% |

| Carrington Mortgage Loan Trust, 2006-FRE2 A5, 2.789%, 03/25/35 | 1.9% |

| Morgan Stanley Capital I Trust, 2006-T21 C, 5.187%, 10/12/52 | 1.8% |

| EMC Mortgage Loan Trust, 2004-B M2, 4.898%, 01/25/41 | 1.8% |

| Citicorp Mortgage Securities Trust, 2008-1 1A1, 6.250%, 02/25/38 | 1.8% |

No material changes occurred during the year ended June 30, 2024.

Catalyst Enhanced Income Strategy Fund - Class C (EIXCX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://catalystmf.com/literature-and-forms/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Catalyst Enhanced Income Strategy Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Catalyst Enhanced Income Strategy Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://catalystmf.com/literature-and-forms/. You can also request this information by contacting us at 1-866-447-4228.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $153 | 1.53% |

How did the Fund perform during the reporting period?

This past year has been challenging for most subsectors within fixed income as persistent inflation and thus elevated interest rates have caused most fixed income assets to go sideways. Fortunately, due to the credit strength of our investments and our tactful investment thesis, we have fared considerably better than our benchmark historically. During the last year, duration rallied considerably; however, the Fund has much less exposure to interest rate duration and thus underperformed its benchmark.

Due to macro uncertainty and higher rates, investments in the Fund now yield more than they have in years and are less volatile than they were in the past. For example, before the 2022 bond rout, generic Non-agency RMBS senior bonds yielded 3-5% and now yield 7-12%. They are generally less volatile now than they were then due to amortization and continued strength in the housing market.

We have added and continue to optimistically add agency inverse interest only securities (IIO). These bonds benefit from the front end of the rate curve going lower, which would drive the coupon higher, hence the term inverse. This small position serves as a bit of a macro hedge in the event of large market disruption or recession. We anticipate the interest rate curve steepening towards the end of this year and into 2025, which would be beneficial for this position. This small position can have an outsized impact on total return for the fund.

Over the past year, we have maintained an allocation to select commercial mortgage-backed securities. While these securities provided positive performance in the past, they came under significant pressure late in 2022 and 2023. We did sell some bonds at the end of 2023/early 2024 as this subsector rallied. We find this sector to be one of the best opportunities in fixed income, albeit with specific asset selection.

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Catalyst Enhanced Income Strategy Fund | Bloomberg U.S. Aggregate Bond Index | Bloomberg U.S. Mortgage Backed Securities Index |

|---|

| 12/31/18 | $10,000 | $10,000 | $10,000 |

| 06/30/19 | $11,332 | $10,611 | $10,417 |

| 06/30/20 | $11,891 | $11,539 | $11,008 |

| 06/30/21 | $12,800 | $11,500 | $10,962 |

| 06/30/22 | $12,571 | $10,317 | $9,972 |

| 06/30/23 | $11,991 | $10,220 | $9,821 |

| 06/30/24 | $11,784 | $10,489 | $10,028 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (December 31, 2018) |

|---|

| Catalyst Enhanced Income Strategy Fund | | 0.79% | 3.03% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | | 0.87% |

| Bloomberg U.S. Mortgage Backed Securities Index | 2.12% | | 0.05% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$219,641,002

- Number of Portfolio Holdings312

- Advisory Fee (net of waivers)$3,359,700

- Portfolio Turnover13%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 90.3% |

| Money Market Funds | 2.9% |

| U.S. Government & Agency Obligations | 6.8% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.2% |

| Money Market Funds | 2.9% |

| U.S. Government & Agency Obligations | 6.8% |

| CMBS | 23.6% |

| CMO | 29.0% |

| ABS | 37.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Starwood Retail Property Trust, 2014-STAR A, 8.500%, 11/15/27 | 4.4% |

| Terwin Mortgage Trust, 2006-3 2A3, 1.566%, 04/25/37 | 3.4% |

| Carrington Mortgage Loan Trust, 2006-FRE2 A2, 2.789%, 10/25/36 | 3.3% |

| JP Morgan Chase Commercial Mortgage Securities Trust, 2011-C3, 5.360%, 02/15/46 | 2.8% |

| Citigroup Commercial Mortgage Trust, 2014-GC21 E, 3.588%, 05/10/47 | 2.1% |

| Credit Suisse Seasoned Loan Trust, 2006-1 M1, 3.268%, 10/25/34 | 2.0% |

| Carrington Mortgage Loan Trust, 2006-FRE2 A5, 2.789%, 03/25/35 | 1.9% |

| Morgan Stanley Capital I Trust, 2006-T21 C, 5.187%, 10/12/52 | 1.8% |

| EMC Mortgage Loan Trust, 2004-B M2, 4.898%, 01/25/41 | 1.8% |

| Citicorp Mortgage Securities Trust, 2008-1 1A1, 6.250%, 02/25/38 | 1.8% |

No material changes occurred during the year ended June 30, 2024.

Catalyst Enhanced Income Strategy Fund - Class I (EIXIX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://catalystmf.com/literature-and-forms/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Catalyst Insider Income Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Catalyst Insider Income Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://catalystmf.com/literature-and-forms/. You can also request this information by contacting us at 1-866-447-4228.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $100 | 1.00% |

How did the Fund perform during the reporting period?

The Catalyst Insider Income Fund holds a portfolio of short-term bonds issued by corporations whose executives are purchasing shares of the company’s common stock. Our historical research indicates that companies where insiders are buying the company’s common stock experience substantially lower default rates and bankruptcy rates. The intuition is that corporate insiders would not take an equity stake if the company were in jeopardy of bankruptcy. We believe this provides us with opportunities to identify undervalued bonds of companies with very high-quality credit fundamentals before the market does.

During the reporting period the fund outperformed the Bloomberg U.S. Aggregate Bond Index by over 548 basis points. By using the insider buying signal as the first step in our credit evaluation process, we identified a number of bonds that we believe have been overlooked by the market and possess superior yields to bonds of comparable credit fundamentals. Throughout the year, the portfolio’s average maturity was under 2 years, which worked to the Fund's benefit as yields were highest in the front end of the yield curve. Additionally, the Fund remained default-free during the year and remains default-free since inception. The Fund significantly outperformed the benchmark in part because we identified bonds that had superior yields, did not default, and were short dated (which limited the portfolio’s interest rate risk).

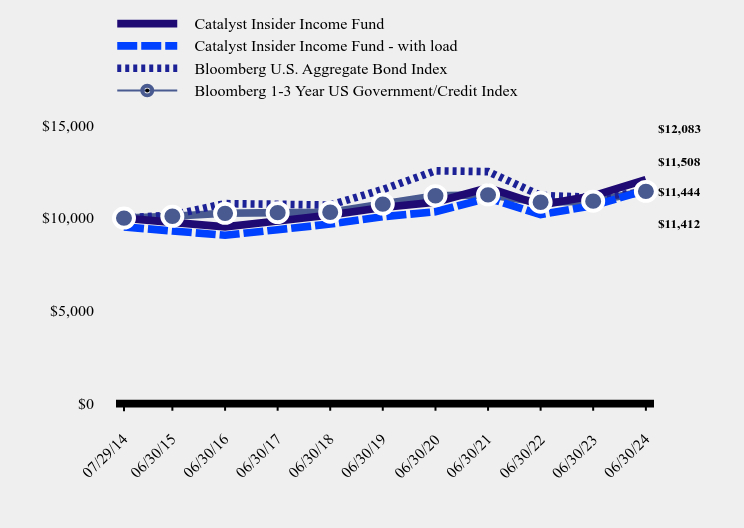

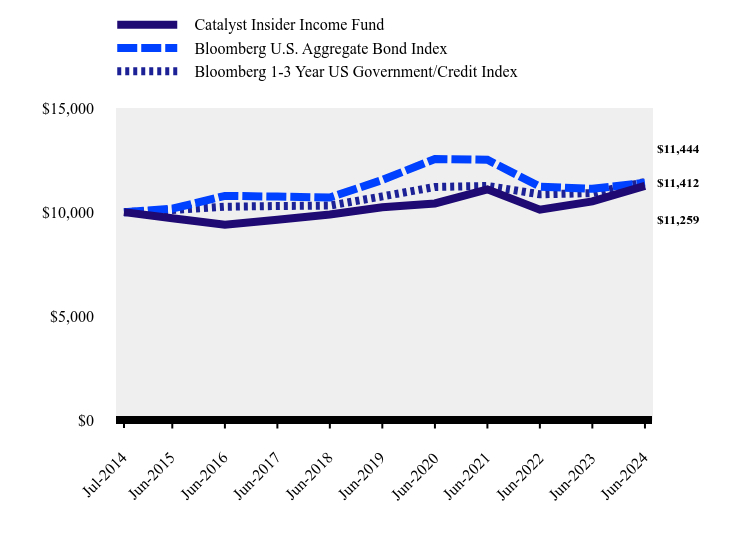

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Catalyst Insider Income Fund | Catalyst Insider Income Fund - with load | Bloomberg U.S. Aggregate Bond Index | Bloomberg 1-3 Year US Government/Credit Index |

|---|

| 07/29/14 | $10,000 | $9,524 | $10,000 | $10,000 |

| 06/30/15 | $9,768 | $9,303 | $10,169 | $10,098 |

| 06/30/16 | $9,528 | $9,074 | $10,780 | $10,259 |

| 06/30/17 | $9,841 | $9,372 | $10,746 | $10,294 |

| 06/30/18 | $10,163 | $9,680 | $10,703 | $10,316 |

| 06/30/19 | $10,576 | $10,072 | $11,545 | $10,756 |

| 06/30/20 | $10,862 | $10,345 | $12,554 | $11,208 |

| 06/30/21 | $11,639 | $11,085 | $12,512 | $11,257 |

| 06/30/22 | $10,701 | $10,192 | $11,225 | $10,856 |

| 06/30/23 | $11,205 | $10,672 | $11,119 | $10,913 |

| 06/30/24 | $12,083 | $11,508 | $11,412 | $11,444 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (7/29/2014) |

|---|

| Catalyst Insider Income Fund | | | |

| Without Load | 7.84% | 2.70% | 1.93% |

| With Load | 2.71% | 1.70% | 1.43% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | | 1.34% |

| Bloomberg 1-3 Year US Government/Credit Index | 4.87% | 1.25% | 1.37% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$55,632,643

- Number of Portfolio Holdings20

- Advisory Fee (net of waivers)$213,631

- Portfolio Turnover17%

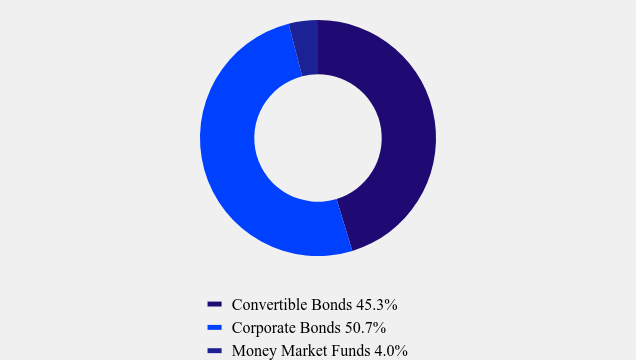

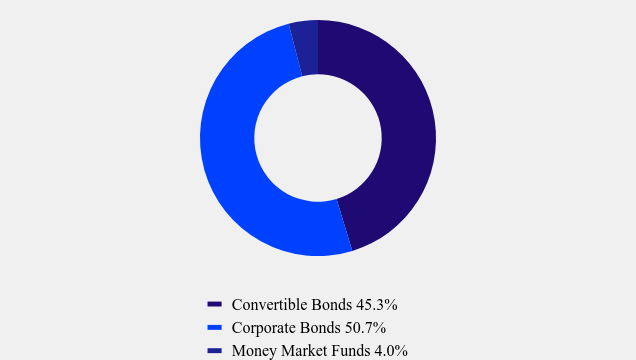

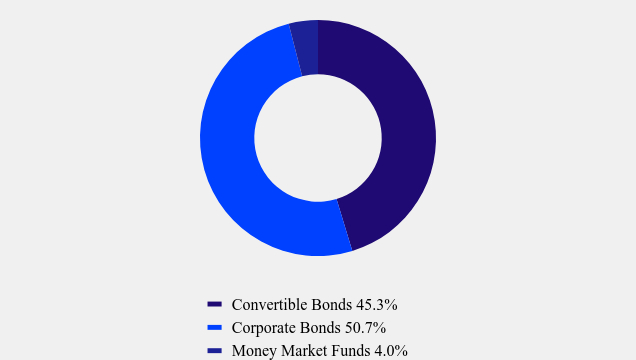

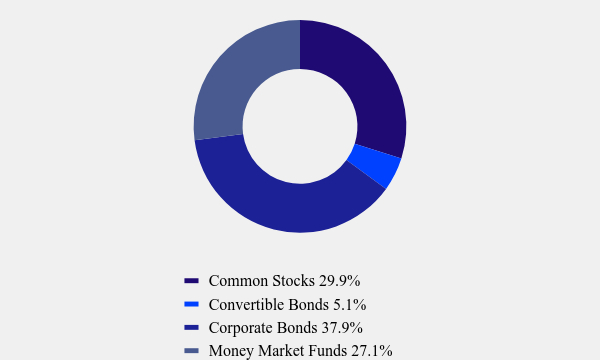

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Convertible Bonds | 45.3% |

| Corporate Bonds | 50.7% |

| Money Market Funds | 4.0% |

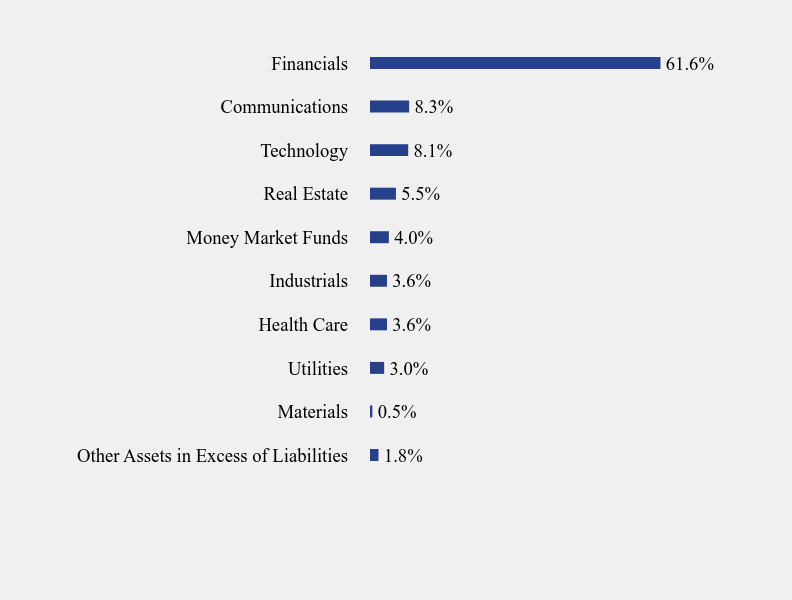

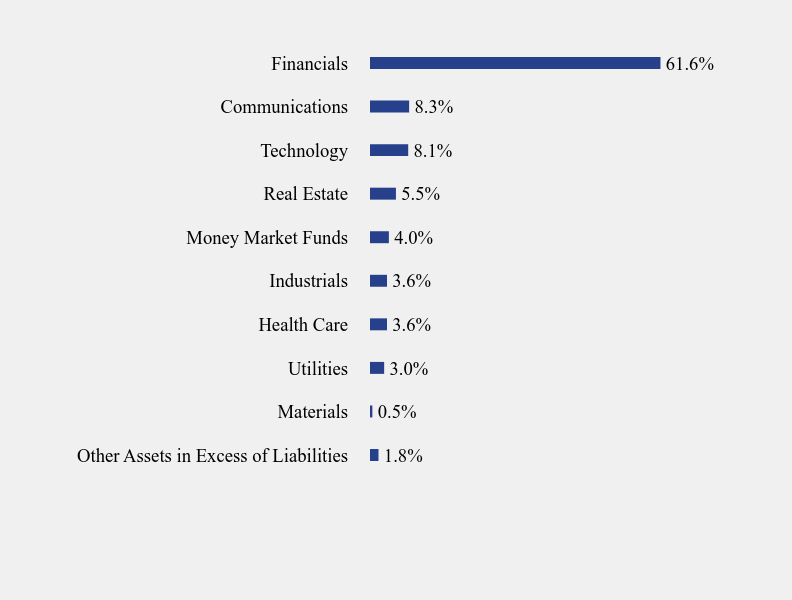

What did the Fund invest in?

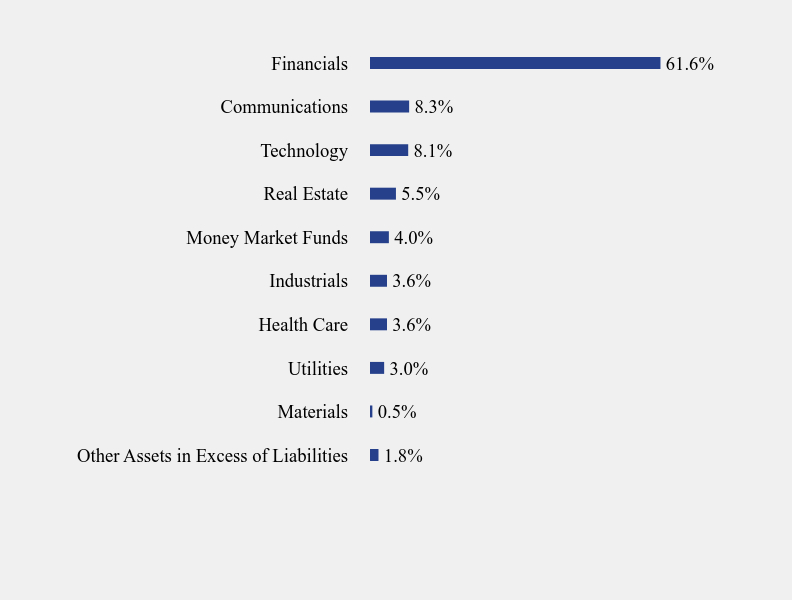

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.8% |

| Materials | 0.5% |

| Utilities | 3.0% |

| Health Care | 3.6% |

| Industrials | 3.6% |

| Money Market Funds | 4.0% |

| Real Estate | 5.5% |

| Technology | 8.1% |

| Communications | 8.3% |

| Financials | 61.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Two Harbors Investment Corporation, 6.250%, due 01/15/26 | 12.1% |

| Redwood Trust, Inc., 5.625%, due 07/15/24 | 8.3% |

| SoFi Technologies, Inc., 10.320%, due 10/15/26 | 7.8% |

| Ambac Assurance Corporation, 5.100%, due 06/7/69 | 7.5% |

| Prospect Capital Corporation, 6.375%, due 03/1/25 | 7.4% |

| Prospect Capital Corporation, 3.706%, due 01/22/26 | 4.9% |

| Ares Capital Corporation, 4.250%, due 03/1/25 | 4.8% |

| New Mountain Finance Corporation, 7.500%, due 10/15/25 | 4.7% |

| VeriSign, Inc., 5.250%, due 04/1/25 | 4.7% |

| Broadcom, Inc., 3.625%, due 10/15/24 | 4.5% |

No material changes occurred during the year ended June 30, 2024.

Catalyst Insider Income Fund - Class A (IIXAX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://catalystmf.com/literature-and-forms/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Catalyst Insider Income Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Catalyst Insider Income Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://catalystmf.com/literature-and-forms/. You can also request this information by contacting us at 1-866-447-4228.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $175 | 1.75% |

How did the Fund perform during the reporting period?

The Catalyst Insider Income Fund holds a portfolio of short-term bonds issued by corporations whose executives are purchasing shares of the company’s common stock. Our historical research indicates that companies where insiders are buying the company’s common stock experience substantially lower default rates and bankruptcy rates. The intuition is that corporate insiders would not take an equity stake if the company were in jeopardy of bankruptcy. We believe this provides us with opportunities to identify undervalued bonds of companies with very high-quality credit fundamentals before the market does.

During the reporting period the fund outperformed the Bloomberg U.S. Aggregate Bond Index by over 548 basis points. By using the insider buying signal as the first step in our credit evaluation process, we identified a number of bonds that we believe have been overlooked by the market and possess superior yields to bonds of comparable credit fundamentals. Throughout the year, the portfolio’s average maturity was under 2 years, which worked to the Fund's benefit as yields were highest in the front end of the yield curve. Additionally, the Fund remained default-free during the year and remains default-free since inception. The Fund significantly outperformed the benchmark in part because we identified bonds that had superior yields, did not default, and were short dated (which limited the portfolio’s interest rate risk).

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Catalyst Insider Income Fund | Bloomberg U.S. Aggregate Bond Index | Bloomberg 1-3 Year US Government/Credit Index |

|---|

| Jul-2014 | $10,000 | $10,000 | $10,000 |

| Jun-2015 | $9,706 | $10,169 | $10,098 |

| Jun-2016 | $9,399 | $10,780 | $10,259 |

| Jun-2017 | $9,630 | $10,746 | $10,294 |

| Jun-2018 | $9,883 | $10,703 | $10,316 |

| Jun-2019 | $10,230 | $11,545 | $10,756 |

| Jun-2020 | $10,418 | $12,554 | $11,208 |

| Jun-2021 | $11,093 | $12,512 | $11,257 |

| Jun-2022 | $10,120 | $11,225 | $10,856 |

| Jun-2023 | $10,519 | $11,119 | $10,913 |

| Jun-2024 | $11,259 | $11,412 | $11,444 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Catalyst Insider Income Fund | 7.04% | 1.94% | 1.20% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | | 1.34% |

| Bloomberg 1-3 Year US Government/Credit Index | 4.87% | 1.25% | 1.37% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$55,632,643

- Number of Portfolio Holdings20

- Advisory Fee (net of waivers)$213,631

- Portfolio Turnover17%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Convertible Bonds | 45.3% |

| Corporate Bonds | 50.7% |

| Money Market Funds | 4.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.8% |

| Materials | 0.5% |

| Utilities | 3.0% |

| Health Care | 3.6% |

| Industrials | 3.6% |

| Money Market Funds | 4.0% |

| Real Estate | 5.5% |

| Technology | 8.1% |

| Communications | 8.3% |

| Financials | 61.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Two Harbors Investment Corporation, 6.250%, due 01/15/26 | 12.1% |

| Redwood Trust, Inc., 5.625%, due 07/15/24 | 8.3% |

| SoFi Technologies, Inc., 10.320%, due 10/15/26 | 7.8% |

| Ambac Assurance Corporation, 5.100%, due 06/7/69 | 7.5% |

| Prospect Capital Corporation, 6.375%, due 03/1/25 | 7.4% |

| Prospect Capital Corporation, 3.706%, due 01/22/26 | 4.9% |

| Ares Capital Corporation, 4.250%, due 03/1/25 | 4.8% |

| New Mountain Finance Corporation, 7.500%, due 10/15/25 | 4.7% |

| VeriSign, Inc., 5.250%, due 04/1/25 | 4.7% |

| Broadcom, Inc., 3.625%, due 10/15/24 | 4.5% |

No material changes occurred during the year ended June 30, 2024.

Catalyst Insider Income Fund - Class C (IIXCX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://catalystmf.com/literature-and-forms/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Catalyst Insider Income Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Catalyst Insider Income Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://catalystmf.com/literature-and-forms/. You can also request this information by contacting us at 1-866-447-4228.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $75 | 0.75% |

How did the Fund perform during the reporting period?

The Catalyst Insider Income Fund holds a portfolio of short-term bonds issued by corporations whose executives are purchasing shares of the company’s common stock. Our historical research indicates that companies where insiders are buying the company’s common stock experience substantially lower default rates and bankruptcy rates. The intuition is that corporate insiders would not take an equity stake if the company were in jeopardy of bankruptcy. We believe this provides us with opportunities to identify undervalued bonds of companies with very high-quality credit fundamentals before the market does.

During the reporting period the fund outperformed the Bloomberg U.S. Aggregate Bond Index by over 548 basis points. By using the insider buying signal as the first step in our credit evaluation process, we identified a number of bonds that we believe have been overlooked by the market and possess superior yields to bonds of comparable credit fundamentals. Throughout the year, the portfolio’s average maturity was under 2 years, which worked to the Fund's benefit as yields were highest in the front end of the yield curve. Additionally, the Fund remained default-free during the year and remains default-free since inception. The Fund significantly outperformed the benchmark in part because we identified bonds that had superior yields, did not default, and were short dated (which limited the portfolio’s interest rate risk).

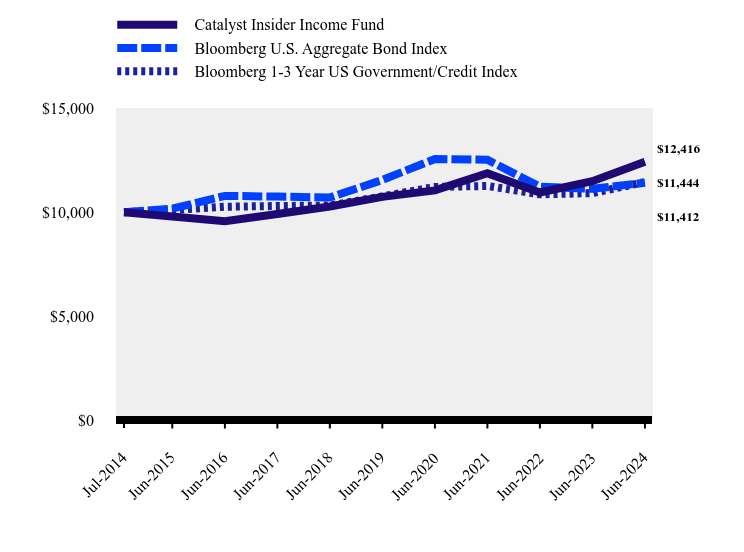

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Catalyst Insider Income Fund | Bloomberg U.S. Aggregate Bond Index | Bloomberg 1-3 Year US Government/Credit Index |

|---|

| Jul-2014 | $10,000 | $10,000 | $10,000 |

| Jun-2015 | $9,791 | $10,169 | $10,098 |

| Jun-2016 | $9,563 | $10,780 | $10,259 |

| Jun-2017 | $9,910 | $10,746 | $10,294 |

| Jun-2018 | $10,272 | $10,703 | $10,316 |

| Jun-2019 | $10,733 | $11,545 | $10,756 |

| Jun-2020 | $11,044 | $12,554 | $11,208 |

| Jun-2021 | $11,866 | $12,512 | $11,257 |

| Jun-2022 | $10,941 | $11,225 | $10,856 |

| Jun-2023 | $11,485 | $11,119 | $10,913 |

| Jun-2024 | $12,416 | $11,412 | $11,444 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Catalyst Insider Income Fund | 8.11% | 2.96% | 2.21% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | | 1.34% |

| Bloomberg 1-3 Year US Government/Credit Index | 4.87% | 1.25% | 1.37% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$55,632,643

- Number of Portfolio Holdings20

- Advisory Fee (net of waivers)$213,631

- Portfolio Turnover17%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Convertible Bonds | 45.3% |

| Corporate Bonds | 50.7% |

| Money Market Funds | 4.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.8% |

| Materials | 0.5% |

| Utilities | 3.0% |

| Health Care | 3.6% |

| Industrials | 3.6% |

| Money Market Funds | 4.0% |

| Real Estate | 5.5% |

| Technology | 8.1% |

| Communications | 8.3% |

| Financials | 61.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Two Harbors Investment Corporation, 6.250%, due 01/15/26 | 12.1% |

| Redwood Trust, Inc., 5.625%, due 07/15/24 | 8.3% |

| SoFi Technologies, Inc., 10.320%, due 10/15/26 | 7.8% |

| Ambac Assurance Corporation, 5.100%, due 06/7/69 | 7.5% |

| Prospect Capital Corporation, 6.375%, due 03/1/25 | 7.4% |

| Prospect Capital Corporation, 3.706%, due 01/22/26 | 4.9% |

| Ares Capital Corporation, 4.250%, due 03/1/25 | 4.8% |

| New Mountain Finance Corporation, 7.500%, due 10/15/25 | 4.7% |

| VeriSign, Inc., 5.250%, due 04/1/25 | 4.7% |

| Broadcom, Inc., 3.625%, due 10/15/24 | 4.5% |

No material changes occurred during the year ended June 30, 2024.

Catalyst Insider Income Fund - Class I (IIXIX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://catalystmf.com/literature-and-forms/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Catalyst/CIFC Senior Secured Income Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Catalyst/CIFC Senior Secured Income Fund for the period of July 1, 2023 to June 30, 2024.You can find additional information about the Fund at https://catalystmf.com/literature-and-forms/. You can also request this information by contacting us at 1-866-447-4228. This report describes change to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $115 | 1.15% |

How did the Fund perform during the reporting period?

Overall, 2023 was a blockbuster year for the loan market, which performed exceptionally well despite various macroeconomic challenges, including pervasive expectations of a recession that ultimately never materialized. The positive momentum carried over into 2024 as loans continued to benefit from higher base rates and a resilient economic growth and labor market environment, which drove the Fund’s strong positive returns.

During the fiscal year ended June 30, 2024, the Fund maintained its higher quality and diversification bias, positioning our portfolio toward what we perceive as stable revenue, EBITDA, and cash flow corporate profiles. The Fund also maintained a structural underweight to lower-quality names and significantly reduced downgrade vulnerable risks, particularly in the B- segment of the market.

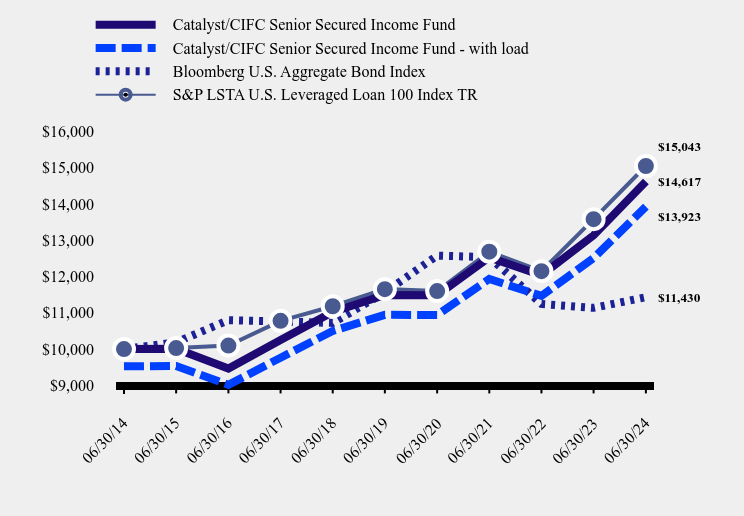

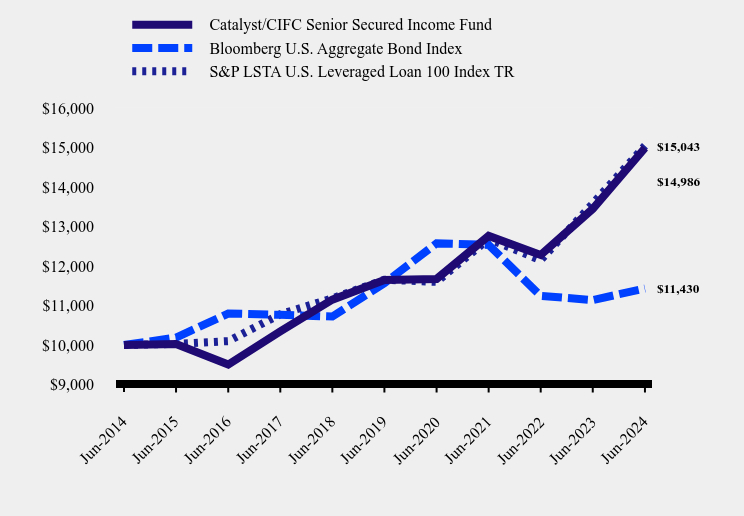

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Catalyst/CIFC Senior Secured Income Fund | Catalyst/CIFC Senior Secured Income Fund - with load | Bloomberg U.S. Aggregate Bond Index | S&P LSTA U.S. Leveraged Loan 100 Index TR |

|---|

| 06/30/14 | $10,000 | $9,525 | $10,000 | $10,000 |

| 06/30/15 | $10,011 | $9,536 | $10,186 | $10,028 |

| 06/30/16 | $9,465 | $9,015 | $10,797 | $10,098 |

| 06/30/17 | $10,251 | $9,764 | $10,763 | $10,778 |

| 06/30/18 | $11,023 | $10,500 | $10,720 | $11,180 |

| 06/30/19 | $11,490 | $10,944 | $11,564 | $11,652 |

| 06/30/20 | $11,483 | $10,938 | $12,575 | $11,598 |

| 06/30/21 | $12,527 | $11,932 | $12,533 | $12,684 |

| 06/30/22 | $12,036 | $11,465 | $11,243 | $12,148 |

| 06/30/23 | $13,134 | $12,511 | $11,137 | $13,580 |

| 06/30/24 | $14,617 | $13,923 | $11,430 | $15,043 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Catalyst/CIFC Senior Secured Income Fund | | | |

| Without Load | 11.29% | 4.93% | 3.87% |

| With Load | 6.02% | 3.91% | 3.36% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | | 1.35% |

| S&P LSTA U.S. Leveraged Loan 100 Index TR | 10.78% | 5.24% | 4.17% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$467,457,691

- Number of Portfolio Holdings352

- Advisory Fee (net of waivers)$2,359,996

- Portfolio Turnover103%

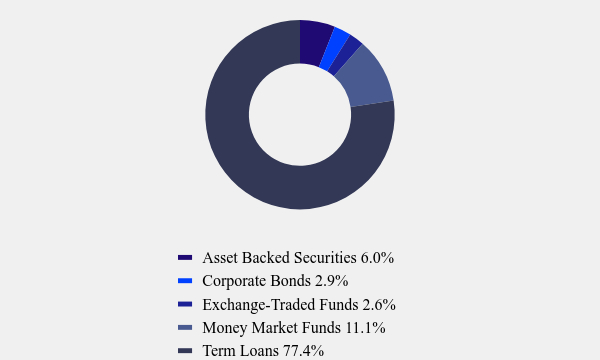

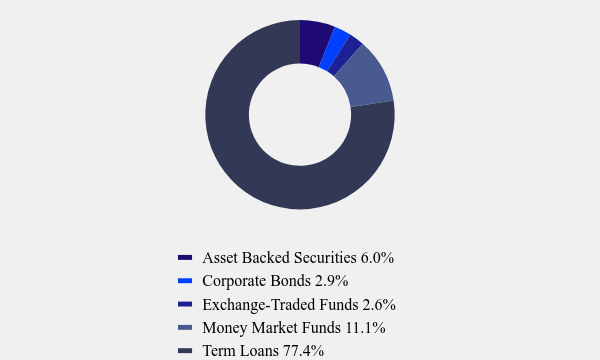

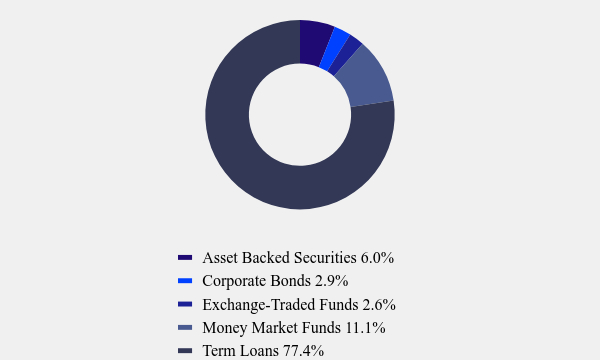

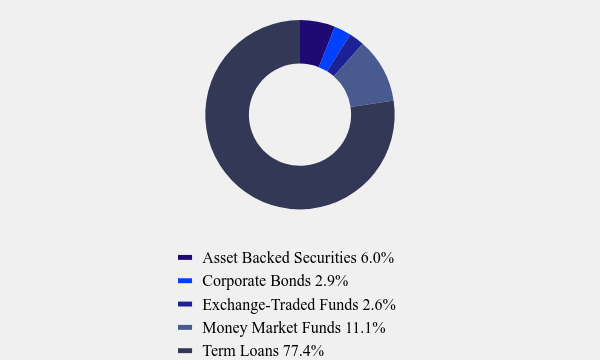

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 6.0% |

| Corporate Bonds | 2.9% |

| Exchange-Traded Funds | 2.6% |

| Money Market Funds | 11.1% |

| Term Loans | 77.4% |

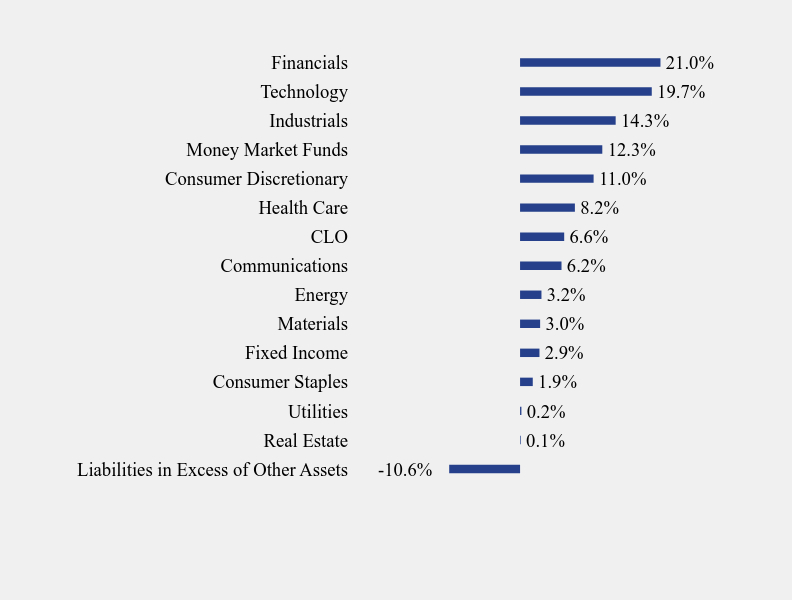

What did the Fund invest in?

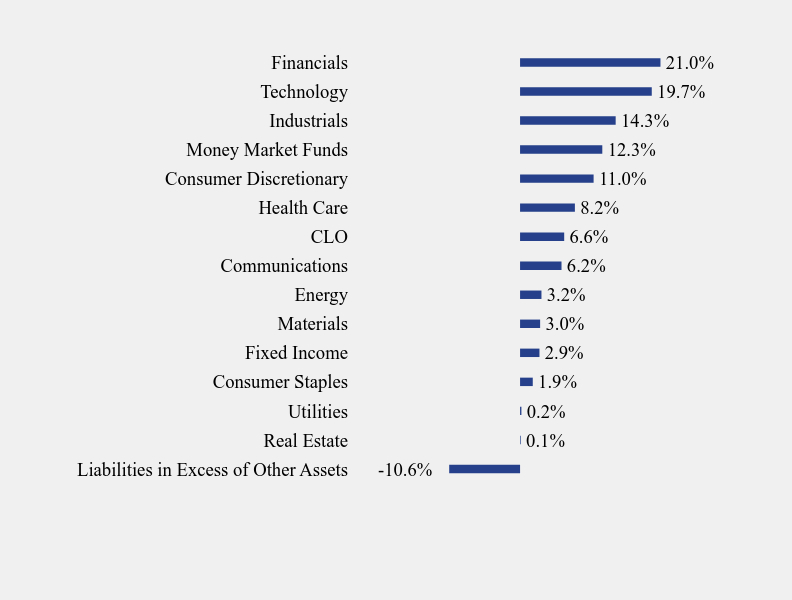

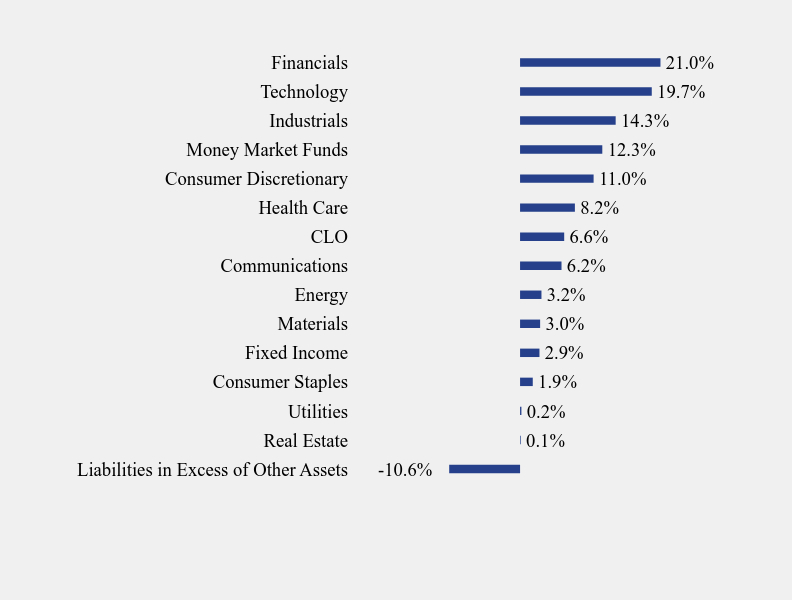

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -10.6% |

| Real Estate | 0.1% |

| Utilities | 0.2% |

| Consumer Staples | 1.9% |

| Fixed Income | 2.9% |

| Materials | 3.0% |

| Energy | 3.2% |

| Communications | 6.2% |

| CLO | 6.6% |

| Health Care | 8.2% |

| Consumer Discretionary | 11.0% |

| Money Market Funds | 12.3% |

| Industrials | 14.3% |

| Technology | 19.7% |

| Financials | 21.0% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Invesco Senior Loan ETF | 1.9% |

| Aretec Group, Inc., 9.320%, 08/09/30 | 1.4% |

| BroadStreet Partners, Inc., 8.571%, 05/12/31 | 1.4% |

| Pug, LLC, 10.079%, 03/12/30 | 1.2% |

| Genesys Cloud Services Holdings II, LLC, 8.829%, 12/01/27 | 1.2% |

| Osaic Holdings, Inc., 9.321%, 08/16/28 | 1.2% |

| Cloud Software Group, Inc., 9.331%, 03/29/29 | 1.2% |

| GTCR W Merger Sub, LLC, 8.309%, 09/20/30 | 1.2% |

| Cotiviti, Inc., 8.579%, 02/24/31 | 1.1% |

| UKG, Inc., 8.576%, 01/31/31 | 1.1% |

During the reporting period, Rick Lam was added as a portfolio manager of the Fund.

Effective April 26, 2024, the Fund’s name changed from “Catalyst/CIFC Floating Rate Income Fund” to “Catalyst/CIFC Senior Secured Income Fund. The Fund further adopted a policy to invest at least 80% of its net assets (plus borrowing for investment purposes) in senior secured debt instruments.

Catalyst/CIFC Senior Secured Income Fund - Class A (CFRAX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://catalystmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Catalyst/CIFC Senior Secured Income Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Catalyst/CIFC Senior Secured Income Fund for the period of July 1, 2023 to June 30, 2024.You can find additional information about the Fund at https://catalystmf.com/literature-and-forms/. You can also request this information by contacting us at 1-866-447-4228. This report describes change to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $190 | 1.90% |

How did the Fund perform during the reporting period?

Overall, 2023 was a blockbuster year for the loan market, which performed exceptionally well despite various macroeconomic challenges, including pervasive expectations of a recession that ultimately never materialized. The positive momentum carried over into 2024 as loans continued to benefit from higher base rates and a resilient economic growth and labor market environment, which drove the Fund’s strong positive returns.

During the fiscal year ended June 30, 2024, the Fund maintained its higher quality and diversification bias, positioning our portfolio toward what we perceive as stable revenue, EBITDA, and cash flow corporate profiles. The Fund also maintained a structural underweight to lower-quality names and significantly reduced downgrade vulnerable risks, particularly in the B- segment of the market.

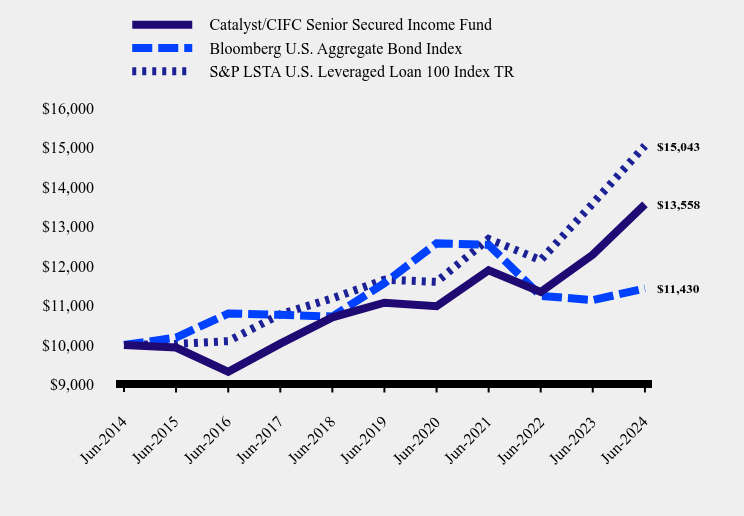

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Catalyst/CIFC Senior Secured Income Fund | Bloomberg U.S. Aggregate Bond Index | S&P LSTA U.S. Leveraged Loan 100 Index TR |

|---|

| Jun-2014 | $10,000 | $10,000 | $10,000 |

| Jun-2015 | $9,936 | $10,186 | $10,028 |

| Jun-2016 | $9,320 | $10,797 | $10,098 |

| Jun-2017 | $10,034 | $10,763 | $10,778 |

| Jun-2018 | $10,700 | $10,720 | $11,180 |

| Jun-2019 | $11,071 | $11,564 | $11,652 |

| Jun-2020 | $10,981 | $12,575 | $11,598 |

| Jun-2021 | $11,893 | $12,533 | $12,684 |

| Jun-2022 | $11,342 | $11,243 | $12,148 |

| Jun-2023 | $12,285 | $11,137 | $13,580 |

| Jun-2024 | $13,558 | $11,430 | $15,043 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Catalyst/CIFC Senior Secured Income Fund | 10.36% | 4.14% | 3.09% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | | 1.35% |

| S&P LSTA U.S. Leveraged Loan 100 Index TR | 10.78% | 5.24% | 4.17% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$467,457,691

- Number of Portfolio Holdings352

- Advisory Fee (net of waivers)$2,359,996

- Portfolio Turnover103%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 6.0% |

| Corporate Bonds | 2.9% |

| Exchange-Traded Funds | 2.6% |

| Money Market Funds | 11.1% |

| Term Loans | 77.4% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -10.6% |

| Real Estate | 0.1% |

| Utilities | 0.2% |

| Consumer Staples | 1.9% |

| Fixed Income | 2.9% |

| Materials | 3.0% |

| Energy | 3.2% |

| Communications | 6.2% |

| CLO | 6.6% |

| Health Care | 8.2% |

| Consumer Discretionary | 11.0% |

| Money Market Funds | 12.3% |

| Industrials | 14.3% |

| Technology | 19.7% |

| Financials | 21.0% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Invesco Senior Loan ETF | 1.9% |

| Aretec Group, Inc., 9.320%, 08/09/30 | 1.4% |

| BroadStreet Partners, Inc., 8.571%, 05/12/31 | 1.4% |

| Pug, LLC, 10.079%, 03/12/30 | 1.2% |

| Genesys Cloud Services Holdings II, LLC, 8.829%, 12/01/27 | 1.2% |

| Osaic Holdings, Inc., 9.321%, 08/16/28 | 1.2% |

| Cloud Software Group, Inc., 9.331%, 03/29/29 | 1.2% |

| GTCR W Merger Sub, LLC, 8.309%, 09/20/30 | 1.2% |

| Cotiviti, Inc., 8.579%, 02/24/31 | 1.1% |

| UKG, Inc., 8.576%, 01/31/31 | 1.1% |

During the reporting period, Rick Lam was added as a portfolio manager of the Fund.

Effective April 26, 2024, the Fund’s name changed from “Catalyst/CIFC Floating Rate Income Fund” to “Catalyst/CIFC Senior Secured Income Fund. The Fund further adopted a policy to invest at least 80% of its net assets (plus borrowing for investment purposes) in senior secured debt instruments.

Catalyst/CIFC Senior Secured Income Fund - Class C (CFRCX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://catalystmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Catalyst/CIFC Senior Secured Income Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Catalyst/CIFC Senior Secured Income Fund for the period of July 1, 2023 to June 30, 2024.You can find additional information about the Fund at https://catalystmf.com/literature-and-forms/. You can also request this information by contacting us at 1-866-447-4228. This report describes change to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C1 | $190 | 1.90% |

How did the Fund perform during the reporting period?

Overall, 2023 was a blockbuster year for the loan market, which performed exceptionally well despite various macroeconomic challenges, including pervasive expectations of a recession that ultimately never materialized. The positive momentum carried over into 2024 as loans continued to benefit from higher base rates and a resilient economic growth and labor market environment, which drove the Fund’s strong positive returns.

During the fiscal year ended June 30, 2024, the Fund maintained its higher quality and diversification bias, positioning our portfolio toward what we perceive as stable revenue, EBITDA, and cash flow corporate profiles. The Fund also maintained a structural underweight to lower-quality names and significantly reduced downgrade vulnerable risks, particularly in the B- segment of the market.

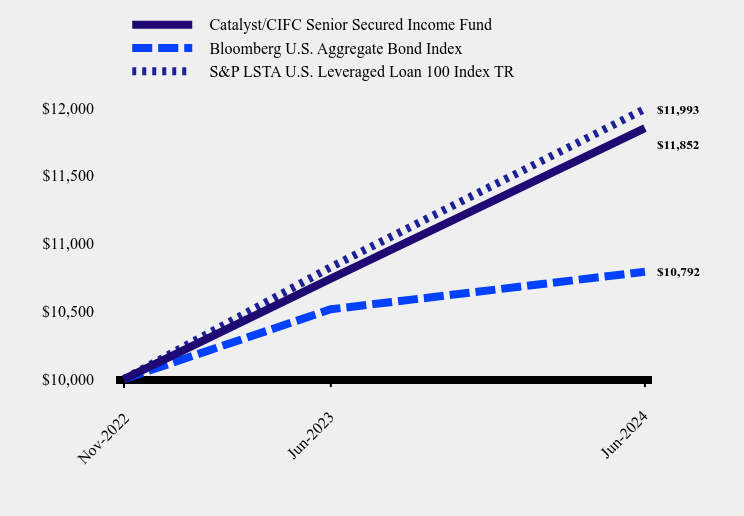

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Catalyst/CIFC Senior Secured Income Fund | Bloomberg U.S. Aggregate Bond Index | S&P LSTA U.S. Leveraged Loan 100 Index TR |

|---|

| Nov-2022 | $10,000 | $10,000 | $10,000 |

| Jun-2023 | $10,741 | $10,515 | $10,826 |

| Jun-2024 | $11,852 | $10,792 | $11,993 |

Average Annual Total Returns

| 1 Year | Since Inception (November 1, 2022) |

|---|

| Catalyst/CIFC Senior Secured Income Fund | 10.34% | 10.77% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | 4.70% |

| S&P LSTA U.S. Leveraged Loan 100 Index TR | 10.78% | 11.57% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$467,457,691

- Number of Portfolio Holdings352

- Advisory Fee (net of waivers)$2,359,996

- Portfolio Turnover103%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 6.0% |

| Corporate Bonds | 2.9% |

| Exchange-Traded Funds | 2.6% |

| Money Market Funds | 11.1% |

| Term Loans | 77.4% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -10.6% |

| Real Estate | 0.1% |

| Utilities | 0.2% |

| Consumer Staples | 1.9% |

| Fixed Income | 2.9% |

| Materials | 3.0% |

| Energy | 3.2% |

| Communications | 6.2% |

| CLO | 6.6% |

| Health Care | 8.2% |

| Consumer Discretionary | 11.0% |

| Money Market Funds | 12.3% |

| Industrials | 14.3% |

| Technology | 19.7% |

| Financials | 21.0% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Invesco Senior Loan ETF | 1.9% |

| Aretec Group, Inc., 9.320%, 08/09/30 | 1.4% |

| BroadStreet Partners, Inc., 8.571%, 05/12/31 | 1.4% |

| Pug, LLC, 10.079%, 03/12/30 | 1.2% |

| Genesys Cloud Services Holdings II, LLC, 8.829%, 12/01/27 | 1.2% |

| Osaic Holdings, Inc., 9.321%, 08/16/28 | 1.2% |

| Cloud Software Group, Inc., 9.331%, 03/29/29 | 1.2% |

| GTCR W Merger Sub, LLC, 8.309%, 09/20/30 | 1.2% |

| Cotiviti, Inc., 8.579%, 02/24/31 | 1.1% |

| UKG, Inc., 8.576%, 01/31/31 | 1.1% |

During the reporting period, Rick Lam was added as a portfolio manager of the Fund.

Effective April 26, 2024, the Fund’s name changed from “Catalyst/CIFC Floating Rate Income Fund” to “Catalyst/CIFC Senior Secured Income Fund. The Fund further adopted a policy to invest at least 80% of its net assets (plus borrowing for investment purposes) in senior secured debt instruments.

Catalyst/CIFC Senior Secured Income Fund - Class C1 (CFRFX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://catalystmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Catalyst/CIFC Senior Secured Income Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Catalyst/CIFC Senior Secured Income Fund for the period of July 1, 2023 to June 30, 2024.You can find additional information about the Fund at https://catalystmf.com/literature-and-forms/. You can also request this information by contacting us at 1-866-447-4228. This report describes change to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $90 | 0.90% |

How did the Fund perform during the reporting period?

Overall, 2023 was a blockbuster year for the loan market, which performed exceptionally well despite various macroeconomic challenges, including pervasive expectations of a recession that ultimately never materialized. The positive momentum carried over into 2024 as loans continued to benefit from higher base rates and a resilient economic growth and labor market environment, which drove the Fund’s strong positive returns.

During the fiscal year ended June 30, 2024, the Fund maintained its higher quality and diversification bias, positioning our portfolio toward what we perceive as stable revenue, EBITDA, and cash flow corporate profiles. The Fund also maintained a structural underweight to lower-quality names and significantly reduced downgrade vulnerable risks, particularly in the B- segment of the market.

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Catalyst/CIFC Senior Secured Income Fund | Bloomberg U.S. Aggregate Bond Index | S&P LSTA U.S. Leveraged Loan 100 Index TR |

|---|

| Jun-2014 | $10,000 | $10,000 | $10,000 |

| Jun-2015 | $10,027 | $10,186 | $10,028 |

| Jun-2016 | $9,504 | $10,797 | $10,098 |

| Jun-2017 | $10,342 | $10,763 | $10,778 |

| Jun-2018 | $11,147 | $10,720 | $11,180 |

| Jun-2019 | $11,648 | $11,564 | $11,652 |

| Jun-2020 | $11,672 | $12,575 | $11,598 |

| Jun-2021 | $12,762 | $12,533 | $12,684 |

| Jun-2022 | $12,279 | $11,243 | $12,148 |

| Jun-2023 | $13,447 | $11,137 | $13,580 |

| Jun-2024 | $14,986 | $11,430 | $15,043 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Catalyst/CIFC Senior Secured Income Fund | 11.44% | 5.17% | 4.13% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | | 1.35% |

| S&P LSTA U.S. Leveraged Loan 100 Index TR | 10.78% | 5.24% | 4.17% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$467,457,691

- Number of Portfolio Holdings352

- Advisory Fee (net of waivers)$2,359,996

- Portfolio Turnover103%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 6.0% |

| Corporate Bonds | 2.9% |

| Exchange-Traded Funds | 2.6% |

| Money Market Funds | 11.1% |

| Term Loans | 77.4% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -10.6% |

| Real Estate | 0.1% |

| Utilities | 0.2% |

| Consumer Staples | 1.9% |

| Fixed Income | 2.9% |

| Materials | 3.0% |

| Energy | 3.2% |

| Communications | 6.2% |

| CLO | 6.6% |

| Health Care | 8.2% |

| Consumer Discretionary | 11.0% |

| Money Market Funds | 12.3% |

| Industrials | 14.3% |

| Technology | 19.7% |

| Financials | 21.0% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Invesco Senior Loan ETF | 1.9% |

| Aretec Group, Inc., 9.320%, 08/09/30 | 1.4% |

| BroadStreet Partners, Inc., 8.571%, 05/12/31 | 1.4% |

| Pug, LLC, 10.079%, 03/12/30 | 1.2% |

| Genesys Cloud Services Holdings II, LLC, 8.829%, 12/01/27 | 1.2% |

| Osaic Holdings, Inc., 9.321%, 08/16/28 | 1.2% |

| Cloud Software Group, Inc., 9.331%, 03/29/29 | 1.2% |

| GTCR W Merger Sub, LLC, 8.309%, 09/20/30 | 1.2% |

| Cotiviti, Inc., 8.579%, 02/24/31 | 1.1% |

| UKG, Inc., 8.576%, 01/31/31 | 1.1% |

During the reporting period, Rick Lam was added as a portfolio manager of the Fund.

Effective April 26, 2024, the Fund’s name changed from “Catalyst/CIFC Floating Rate Income Fund” to “Catalyst/CIFC Senior Secured Income Fund. The Fund further adopted a policy to invest at least 80% of its net assets (plus borrowing for investment purposes) in senior secured debt instruments.

Catalyst/CIFC Senior Secured Income Fund - Class I (CFRIX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://catalystmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Catalyst/MAP Global Balanced Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Catalyst/MAP Global Balanced Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://catalystmf.com/literature-and-forms/. You can also request this information by contacting us at 1-866-447-4228.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $122 | 1.22% |

How did the Fund perform during the reporting period?

At the start of 2023 we did not believe that high interest rates would tip the economy into a recession; however, we did expect the economy to continue to slow. But to our surprise, economic growth grew robustly in 2023. During the fall of 2023, the Federal Reserve (the Fed) declared the rate hike cycle over and that they had conquered inflation. Bond prices rose, causing rates to fall, leading to a strong risk-on feedback loop, rewarding investors who added beta and momentum to their portfolios. With stock valuations today near where they were before the Fed began their aggressive hikes, equity risk premiums are historically low. As a value manager requiring a margin of safety, we find that difficult to achieve in this environment. Relative fund performance for the reporting period was impacted by the outsized performance of momentum stocks, particularly those involved with Artificial Intelligence (AI). Furthermore, our cautious economic stance led to underperformance relative to stronger than expected economic growth.

We believe that the historic rally over the past six months and investors' singular focus on AI and its future potential has caused many to shift their focus away from the numerous structural issues prevalent in the economy. Accordingly, the Fund remains positioned with a defensive bias. The Fund is currently overweight Consumer Staples and Health Care. The Fund has some equity exposure to copper and agricultural commodities, as well as to areas of the market that we believe will benefit from structural technology growth, along with utilities and infrastructure companies. We believe this blueprint will successfully navigate a market where growth is likely to slow, and inflation is expected to remain volatile and above the Fed’s 2% target, and over the long term we believe yields will remain higher for longer.

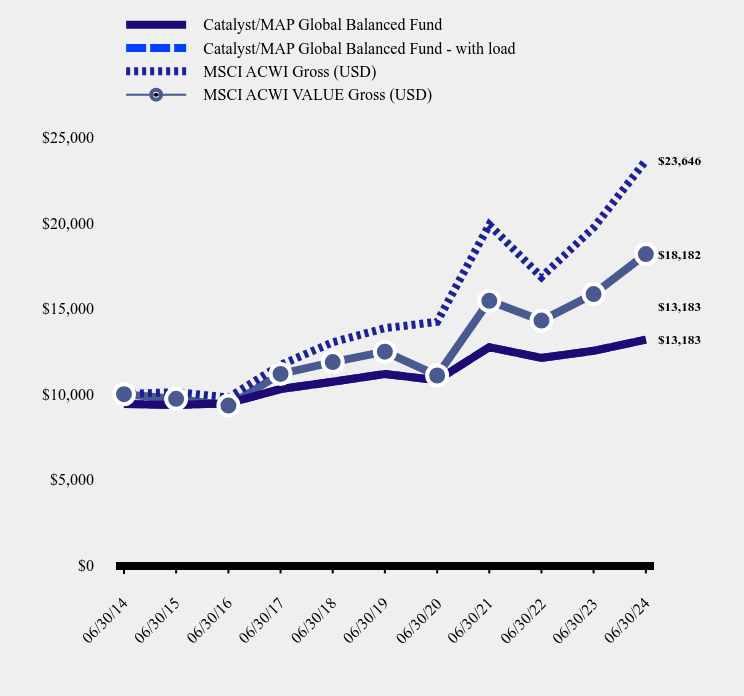

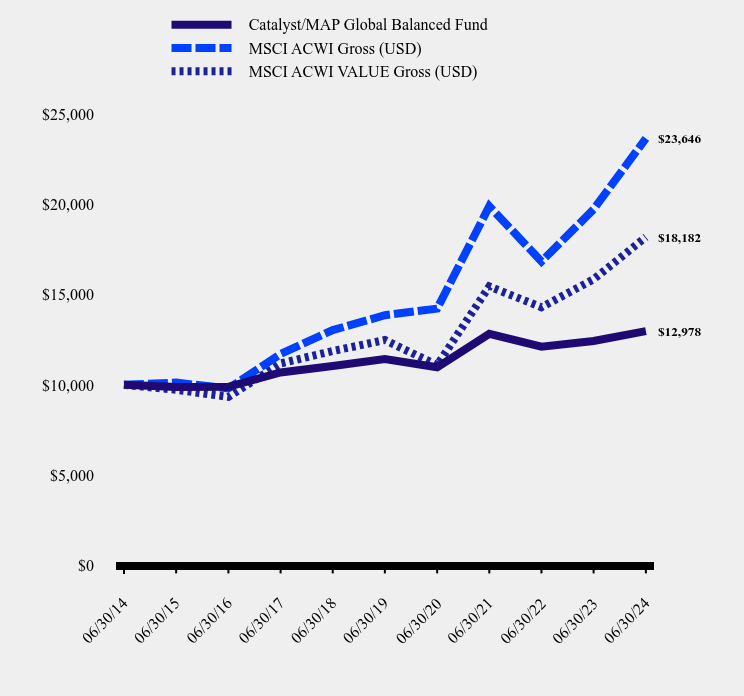

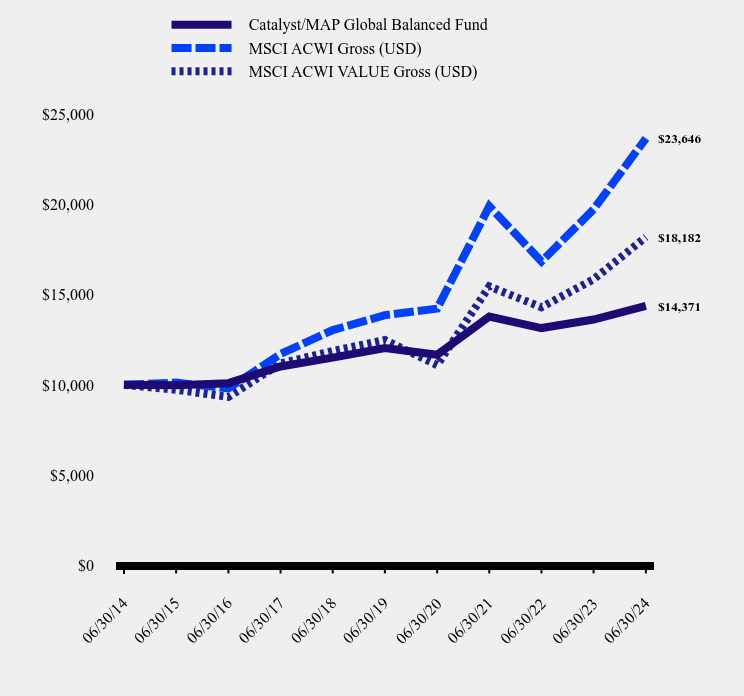

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Catalyst/MAP Global Balanced Fund | Catalyst/MAP Global Balanced Fund - with load | MSCI ACWI Gross (USD) | MSCI ACWI VALUE Gross (USD) |

|---|

| 06/30/14 | $9,425 | $9,425 | $10,000 | $10,000 |

| 06/30/15 | $9,371 | $9,371 | $10,123 | $9,725 |

| 06/30/16 | $9,465 | $9,465 | $9,802 | $9,333 |

| 06/30/17 | $10,299 | $10,299 | $11,706 | $11,184 |

| 06/30/18 | $10,722 | $10,722 | $13,030 | $11,872 |

| 06/30/19 | $11,181 | $11,181 | $13,854 | $12,482 |

| 06/30/20 | $10,815 | $10,815 | $14,220 | $11,090 |

| 06/30/21 | $12,744 | $12,744 | $19,890 | $15,450 |

| 06/30/22 | $12,119 | $12,119 | $16,833 | $14,296 |

| 06/30/23 | $12,531 | $12,531 | $19,717 | $15,844 |

| 06/30/24 | $13,183 | $13,183 | $23,646 | $18,182 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Catalyst/MAP Global Balanced Fund | 5.20% | 3.35% | 3.41% |

| With Load | (0.85)% | 2.13% | 2.80% |

| MSCI ACWI Gross (USD) | 19.92% | 11.28% | 8.99% |

| MSCI ACWI VALUE Gross (USD) | 14.76% | 7.81% | 6.16% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$14,587,043

- Number of Portfolio Holdings61

- Advisory Fee (net of waivers)$0

- Portfolio Turnover30%

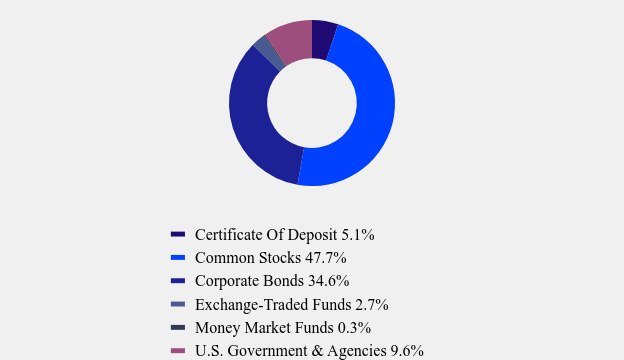

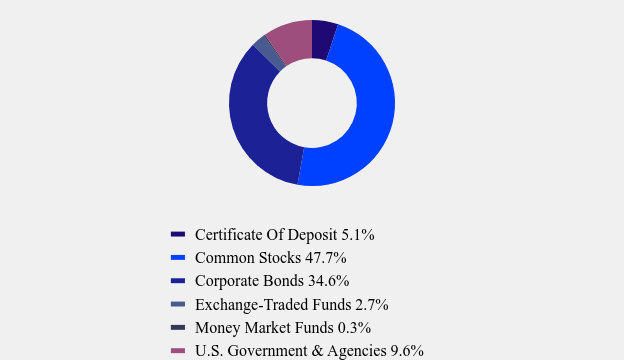

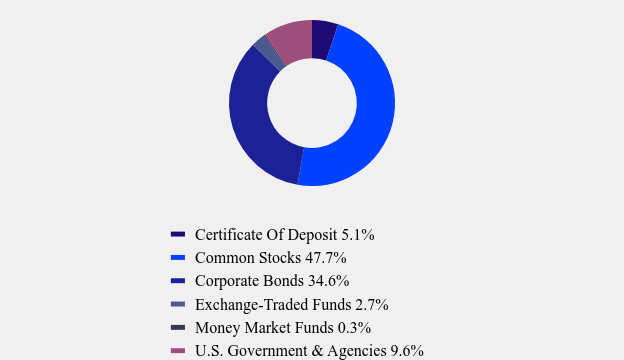

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Certificate Of Deposit | 5.1% |

| Common Stocks | 47.7% |

| Corporate Bonds | 34.6% |

| Exchange-Traded Funds | 2.7% |

| Money Market Funds | 0.3% |

| U.S. Government & Agencies | 9.6% |

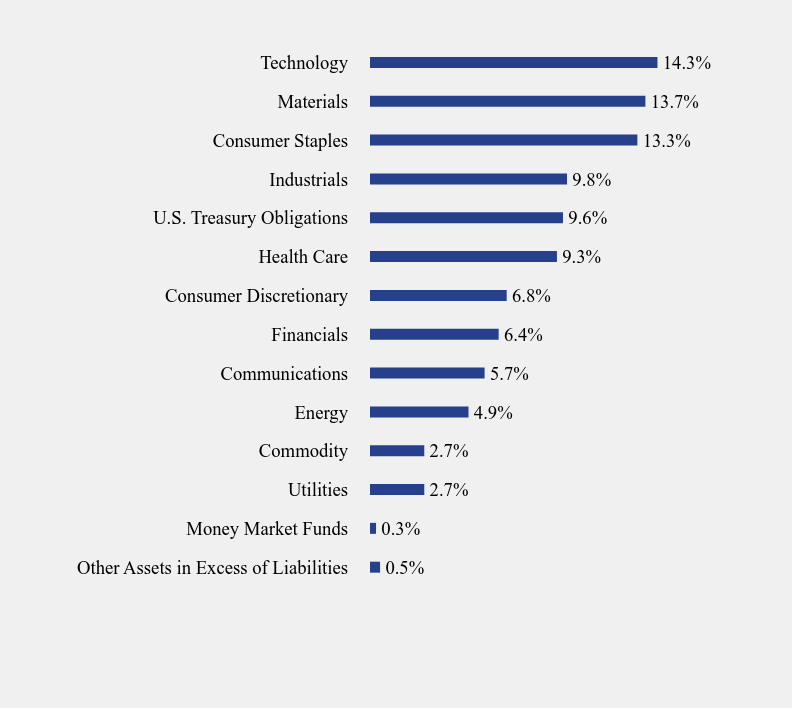

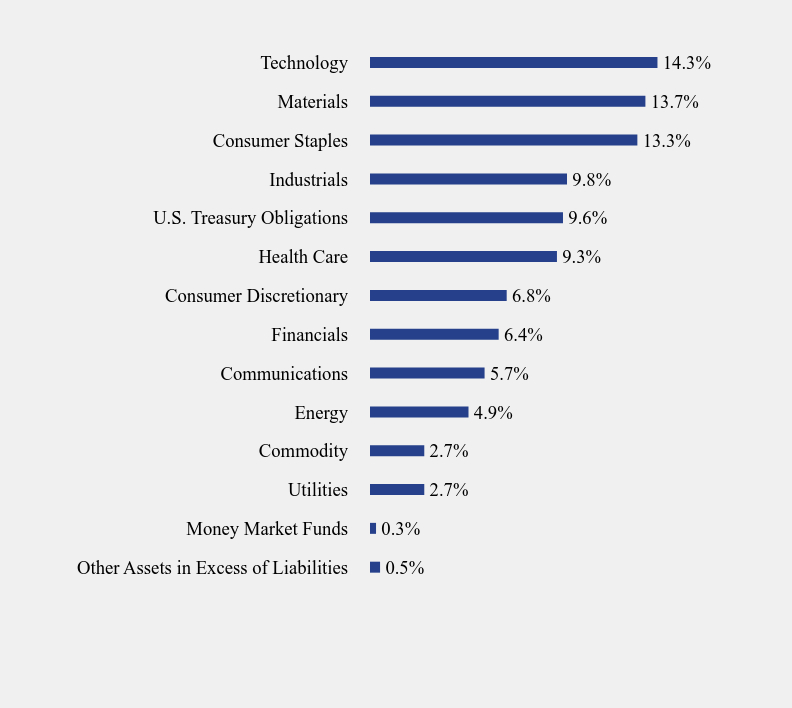

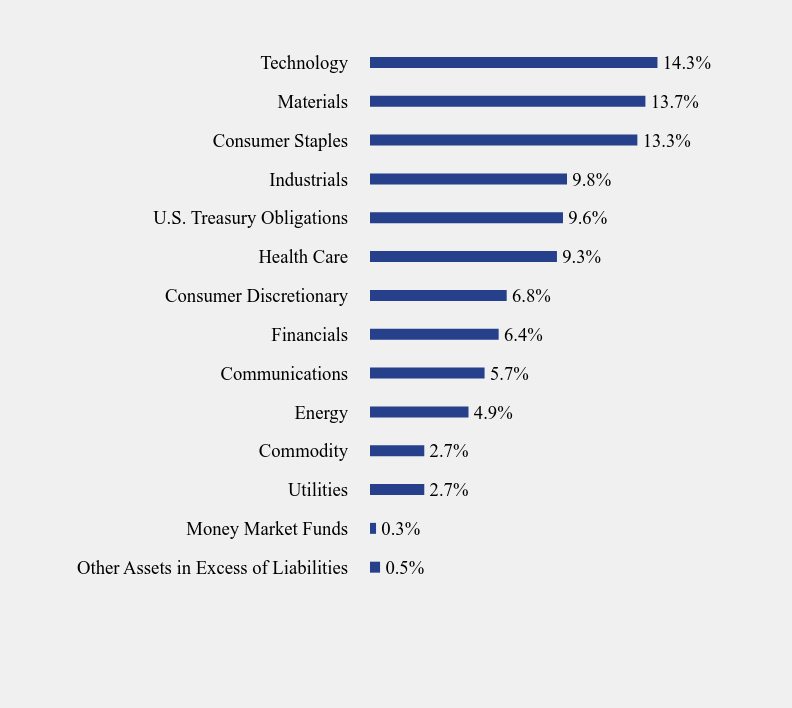

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.5% |

| Money Market Funds | 0.3% |

| Utilities | 2.7% |

| Commodity | 2.7% |

| Energy | 4.9% |

| Communications | 5.7% |

| Financials | 6.4% |

| Consumer Discretionary | 6.8% |

| Health Care | 9.3% |

| U.S. Treasury Obligations | 9.6% |

| Industrials | 9.8% |

| Consumer Staples | 13.3% |

| Materials | 13.7% |

| Technology | 14.3% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| United States Treasury Note, 0.375%, 07/15/24 | 6.8% |

| Microsoft Corporation | 3.6% |

| United States Treasury Note, 2.500%, 01/31/25 | 2.7% |

| Vivendi S.E. | 2.7% |

| SPDR Gold MiniShares Trust | 2.7% |

| Imperial Brands PLC | 2.6% |

| Bunge Global S.A. | 2.6% |

| Sanofi S.A. | 2.5% |

| Nestle S.A. | 2.5% |

| Holcim A.G. | 2.4% |

No material changes occurred during the year ended June 30, 2024.

Catalyst/MAP Global Balanced Fund - Class A (TRXAX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://catalystmf.com/literature-and-forms/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Catalyst/MAP Global Balanced Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Catalyst/MAP Global Balanced Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://catalystmf.com/literature-and-forms/. You can also request this information by contacting us at 1-866-447-4228.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $197 | 1.97% |

How did the Fund perform during the reporting period?

At the start of 2023 we did not believe that high interest rates would tip the economy into a recession; however, we did expect the economy to continue to slow. But to our surprise, economic growth grew robustly in 2023. During the fall of 2023, the Federal Reserve (the Fed) declared the rate hike cycle over and that they had conquered inflation. Bond prices rose, causing rates to fall, leading to a strong risk-on feedback loop, rewarding investors who added beta and momentum to their portfolios. With stock valuations today near where they were before the Fed began their aggressive hikes, equity risk premiums are historically low. As a value manager requiring a margin of safety, we find that difficult to achieve in this environment. Relative fund performance for the reporting period was impacted by the outsized performance of momentum stocks, particularly those involved with Artificial Intelligence (AI). Furthermore, our cautious economic stance led to underperformance relative to stronger than expected economic growth.

We believe that the historic rally over the past six months and investors' singular focus on AI and its future potential has caused many to shift their focus away from the numerous structural issues prevalent in the economy. Accordingly, the Fund remains positioned with a defensive bias. The Fund is currently overweight Consumer Staples and Health Care. The Fund has some equity exposure to copper and agricultural commodities, as well as to areas of the market that we believe will benefit from structural technology growth, along with utilities and infrastructure companies. We believe this blueprint will successfully navigate a market where growth is likely to slow, and inflation is expected to remain volatile and above the Fed’s 2% target, and over the long term we believe yields will remain higher for longer.

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Catalyst/MAP Global Balanced Fund | MSCI ACWI Gross (USD) | MSCI ACWI VALUE Gross (USD) |

|---|

| 06/30/14 | $10,000 | $10,000 | $10,000 |

| 06/30/15 | $9,876 | $10,123 | $9,725 |

| 06/30/16 | $9,892 | $9,802 | $9,333 |

| 06/30/17 | $10,686 | $11,706 | $11,184 |

| 06/30/18 | $11,043 | $13,030 | $11,872 |

| 06/30/19 | $11,424 | $13,854 | $12,482 |

| 06/30/20 | $10,974 | $14,220 | $11,090 |

| 06/30/21 | $12,826 | $19,890 | $15,450 |

| 06/30/22 | $12,112 | $16,833 | $14,296 |

| 06/30/23 | $12,428 | $19,717 | $15,844 |

| 06/30/24 | $12,978 | $23,646 | $18,182 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Catalyst/MAP Global Balanced Fund | 4.43% | 2.58% | 2.64% |

| MSCI ACWI Gross (USD) | 19.92% | 11.28% | 8.99% |

| MSCI ACWI VALUE Gross (USD) | 14.76% | 7.81% | 6.16% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$14,587,043

- Number of Portfolio Holdings61

- Advisory Fee (net of waivers)$0

- Portfolio Turnover30%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Certificate Of Deposit | 5.1% |

| Common Stocks | 47.7% |

| Corporate Bonds | 34.6% |

| Exchange-Traded Funds | 2.7% |

| Money Market Funds | 0.3% |

| U.S. Government & Agencies | 9.6% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.5% |

| Money Market Funds | 0.3% |

| Utilities | 2.7% |

| Commodity | 2.7% |

| Energy | 4.9% |

| Communications | 5.7% |

| Financials | 6.4% |

| Consumer Discretionary | 6.8% |

| Health Care | 9.3% |

| U.S. Treasury Obligations | 9.6% |

| Industrials | 9.8% |

| Consumer Staples | 13.3% |

| Materials | 13.7% |

| Technology | 14.3% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| United States Treasury Note, 0.375%, 07/15/24 | 6.8% |

| Microsoft Corporation | 3.6% |

| United States Treasury Note, 2.500%, 01/31/25 | 2.7% |

| Vivendi S.E. | 2.7% |

| SPDR Gold MiniShares Trust | 2.7% |

| Imperial Brands PLC | 2.6% |

| Bunge Global S.A. | 2.6% |

| Sanofi S.A. | 2.5% |

| Nestle S.A. | 2.5% |

| Holcim A.G. | 2.4% |

No material changes occurred during the year ended June 30, 2024.

Catalyst/MAP Global Balanced Fund - Class C (TRXCX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://catalystmf.com/literature-and-forms/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Catalyst/MAP Global Balanced Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Catalyst/MAP Global Balanced Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://catalystmf.com/literature-and-forms/. You can also request this information by contacting us at 1-866-447-4228.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $97 | 0.97% |

How did the Fund perform during the reporting period?

At the start of 2023 we did not believe that high interest rates would tip the economy into a recession; however, we did expect the economy to continue to slow. But to our surprise, economic growth grew robustly in 2023. During the fall of 2023, the Federal Reserve (the Fed) declared the rate hike cycle over and that they had conquered inflation. Bond prices rose, causing rates to fall, leading to a strong risk-on feedback loop, rewarding investors who added beta and momentum to their portfolios. With stock valuations today near where they were before the Fed began their aggressive hikes, equity risk premiums are historically low. As a value manager requiring a margin of safety, we find that difficult to achieve in this environment. Relative fund performance for the reporting period was impacted by the outsized performance of momentum stocks, particularly those involved with Artificial Intelligence (AI). Furthermore, our cautious economic stance led to underperformance relative to stronger than expected economic growth.

We believe that the historic rally over the past six months and investors' singular focus on AI and its future potential has caused many to shift their focus away from the numerous structural issues prevalent in the economy. Accordingly, the Fund remains positioned with a defensive bias. The Fund is currently overweight Consumer Staples and Health Care. The Fund has some equity exposure to copper and agricultural commodities, as well as to areas of the market that we believe will benefit from structural technology growth, along with utilities and infrastructure companies. We believe this blueprint will successfully navigate a market where growth is likely to slow, and inflation is expected to remain volatile and above the Fed’s 2% target, and over the long term we believe yields will remain higher for longer.

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Catalyst/MAP Global Balanced Fund | MSCI ACWI Gross (USD) | MSCI ACWI VALUE Gross (USD) |

|---|

| 06/30/14 | $10,000 | $10,000 | $10,000 |

| 06/30/15 | $9,976 | $10,123 | $9,725 |

| 06/30/16 | $10,092 | $9,802 | $9,333 |

| 06/30/17 | $11,015 | $11,706 | $11,184 |

| 06/30/18 | $11,509 | $13,030 | $11,872 |

| 06/30/19 | $12,032 | $13,854 | $12,482 |

| 06/30/20 | $11,666 | $14,220 | $11,090 |

| 06/30/21 | $13,780 | $19,890 | $15,450 |

| 06/30/22 | $13,144 | $16,833 | $14,296 |

| 06/30/23 | $13,616 | $19,717 | $15,844 |

| 06/30/24 | $14,371 | $23,646 | $18,182 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Catalyst/MAP Global Balanced Fund | 5.55% | 3.62% | 3.69% |

| MSCI ACWI Gross (USD) | 19.92% | 11.28% | 8.99% |

| MSCI ACWI VALUE Gross (USD) | 14.76% | 7.81% | 6.16% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$14,587,043

- Number of Portfolio Holdings61

- Advisory Fee (net of waivers)$0

- Portfolio Turnover30%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Certificate Of Deposit | 5.1% |

| Common Stocks | 47.7% |

| Corporate Bonds | 34.6% |

| Exchange-Traded Funds | 2.7% |

| Money Market Funds | 0.3% |

| U.S. Government & Agencies | 9.6% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.5% |

| Money Market Funds | 0.3% |

| Utilities | 2.7% |

| Commodity | 2.7% |

| Energy | 4.9% |

| Communications | 5.7% |

| Financials | 6.4% |

| Consumer Discretionary | 6.8% |

| Health Care | 9.3% |

| U.S. Treasury Obligations | 9.6% |

| Industrials | 9.8% |

| Consumer Staples | 13.3% |

| Materials | 13.7% |

| Technology | 14.3% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| United States Treasury Note, 0.375%, 07/15/24 | 6.8% |

| Microsoft Corporation | 3.6% |

| United States Treasury Note, 2.500%, 01/31/25 | 2.7% |

| Vivendi S.E. | 2.7% |

| SPDR Gold MiniShares Trust | 2.7% |

| Imperial Brands PLC | 2.6% |

| Bunge Global S.A. | 2.6% |

| Sanofi S.A. | 2.5% |

| Nestle S.A. | 2.5% |

| Holcim A.G. | 2.4% |

No material changes occurred during the year ended June 30, 2024.

Catalyst/MAP Global Balanced Fund - Class I (TRXIX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://catalystmf.com/literature-and-forms/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Catalyst/SMH High Income Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Catalyst/SMH High Income Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://catalystmf.com/literature-and-forms/. You can also request this information by contacting us at 1-866-447-4228.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $148 | 1.48% |

How did the Fund perform during the reporting period?

Performance of the Fund was primarily driven by the stoppage of increasing interest rates and a general move into more risk-based assets. The Fund outperformed the Ice BofA Cash Pay High Yield Index during the reporting period. The Fund’s returns were higher than our return expectations for the period. We do see a high likelihood of an economic slowdown and uncertainty and expect the overall markets to be volatile moving forward. The high yield class in general should be one of the better performing asset classes in credit on a go forward basis. We are looking at current yields of 6.4% and hope to add a couple more percent in returns above that.

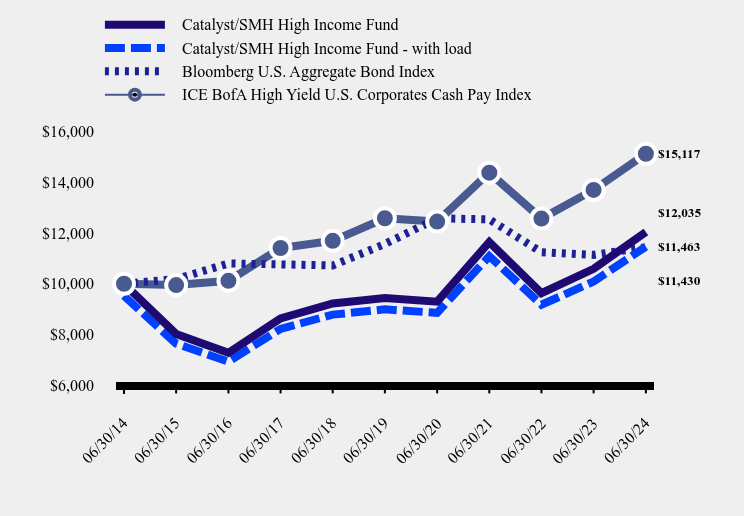

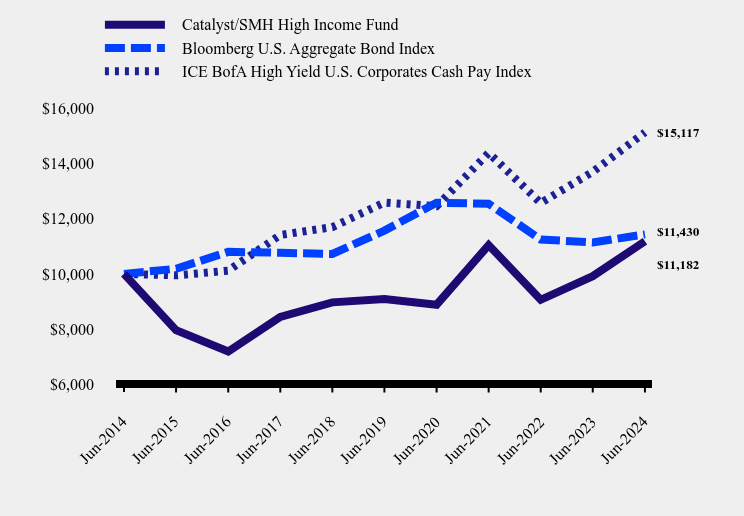

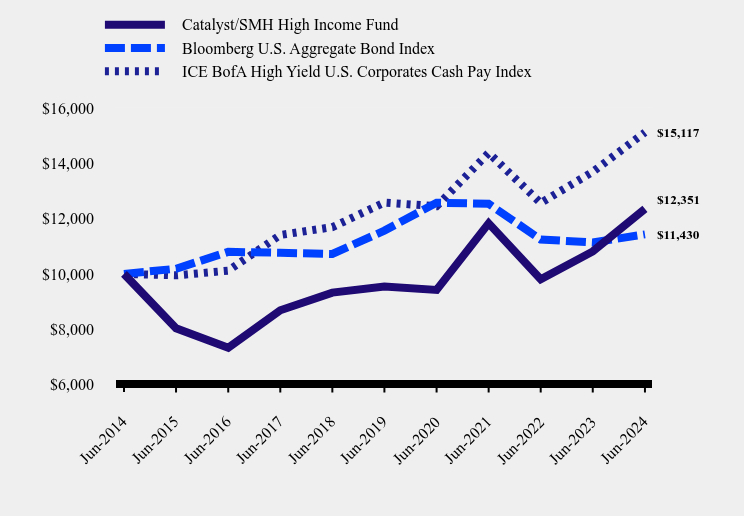

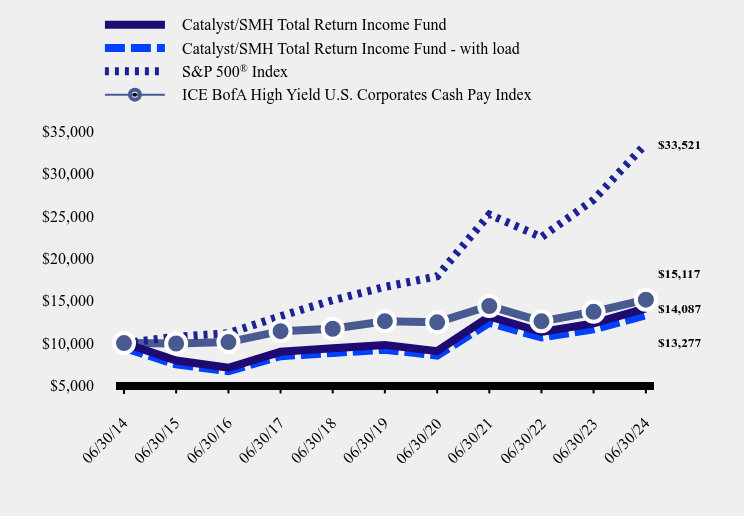

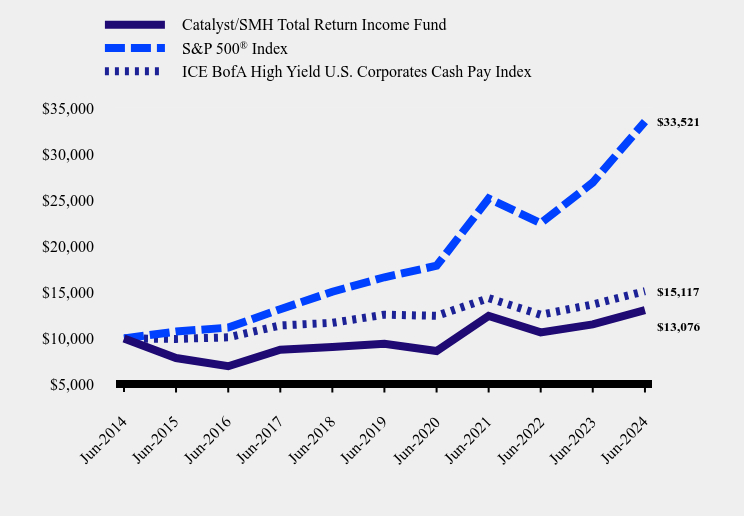

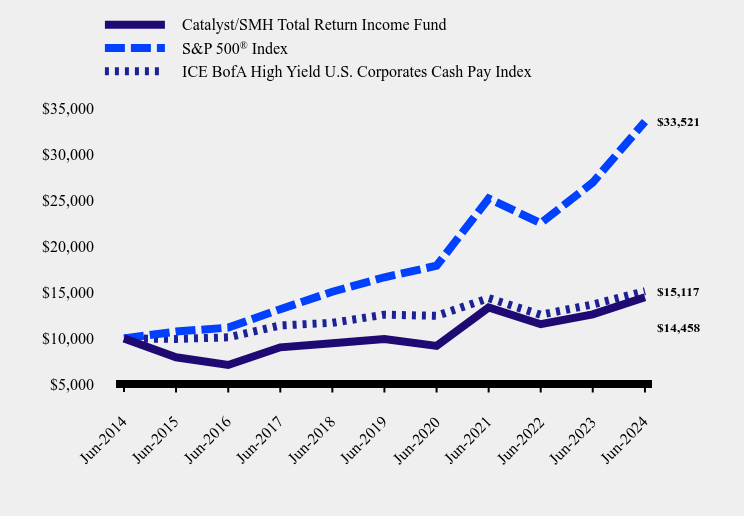

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Catalyst/SMH High Income Fund | Catalyst/SMH High Income Fund - with load | Bloomberg U.S. Aggregate Bond Index | ICE BofA High Yield U.S. Corporates Cash Pay Index |

|---|

| 06/30/14 | $10,000 | $9,525 | $10,000 | $10,000 |

| 06/30/15 | $8,024 | $7,643 | $10,186 | $9,947 |

| 06/30/16 | $7,281 | $6,935 | $10,797 | $10,116 |

| 06/30/17 | $8,636 | $8,225 | $10,763 | $11,406 |

| 06/30/18 | $9,223 | $8,785 | $10,720 | $11,690 |

| 06/30/19 | $9,440 | $8,992 | $11,564 | $12,579 |

| 06/30/20 | $9,297 | $8,856 | $12,575 | $12,446 |

| 06/30/21 | $11,642 | $11,089 | $12,533 | $14,372 |

| 06/30/22 | $9,632 | $9,174 | $11,243 | $12,564 |

| 06/30/23 | $10,589 | $10,086 | $11,137 | $13,691 |

| 06/30/24 | $12,035 | $11,463 | $11,430 | $15,117 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Catalyst/SMH High Income Fund | | | |

| Without Load | 13.65% | 4.98% | 1.87% |

| With Load | 8.25% | 3.96% | 1.37% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | | 1.35% |

| ICE BofA High Yield U.S. Corporates Cash Pay Index | 10.41% | 3.74% | 4.22% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$15,131,607

- Number of Portfolio Holdings34

- Advisory Fee (net of waivers)$15,158

- Portfolio Turnover33%

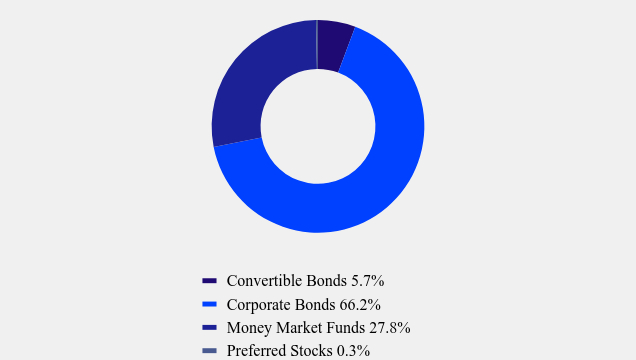

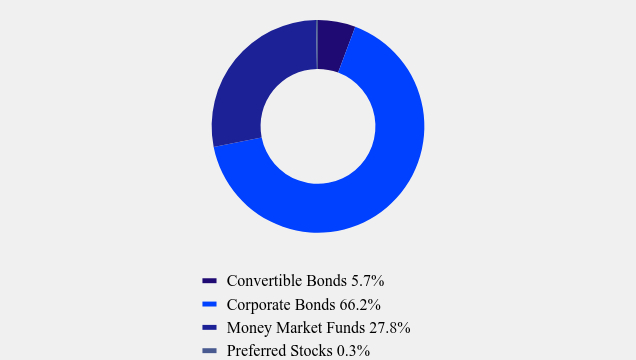

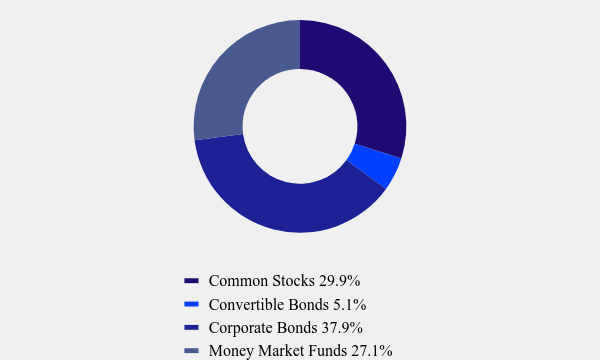

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Convertible Bonds | 5.7% |

| Corporate Bonds | 66.2% |

| Money Market Funds | 27.8% |

| Preferred Stocks | 0.3% |

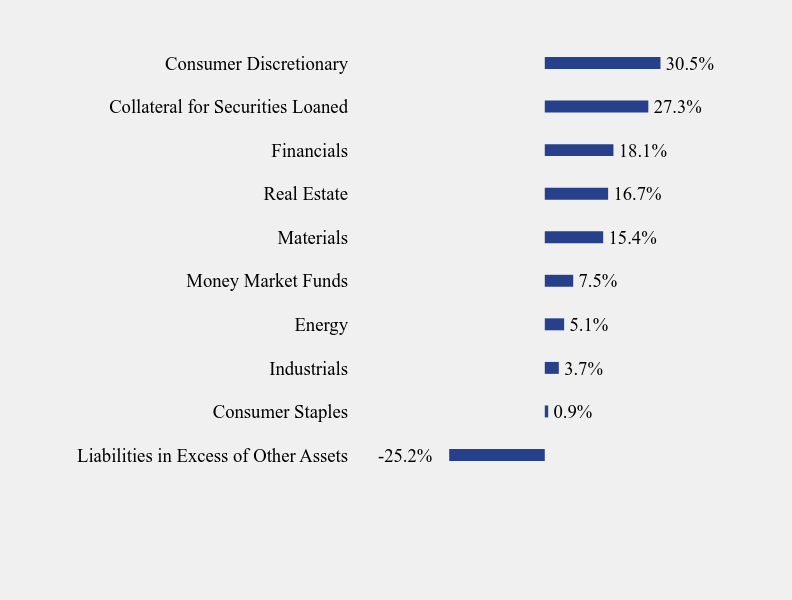

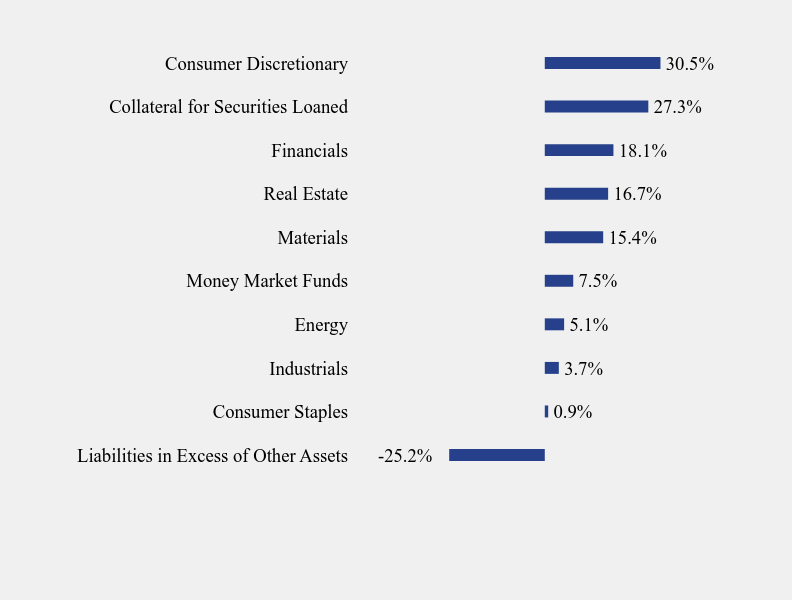

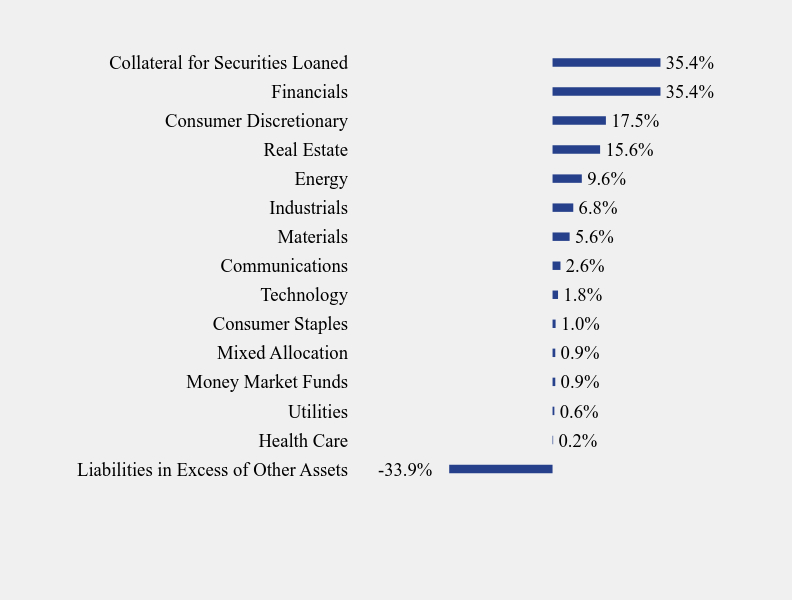

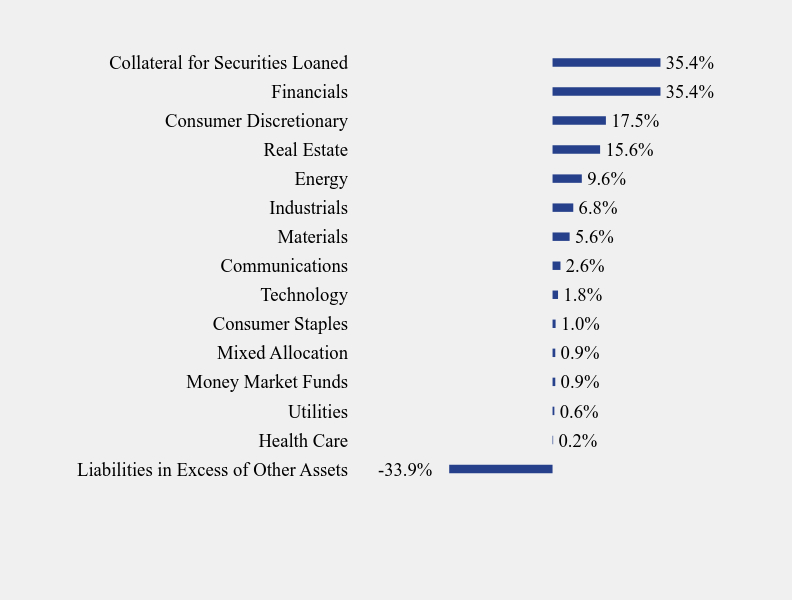

What did the Fund invest in?

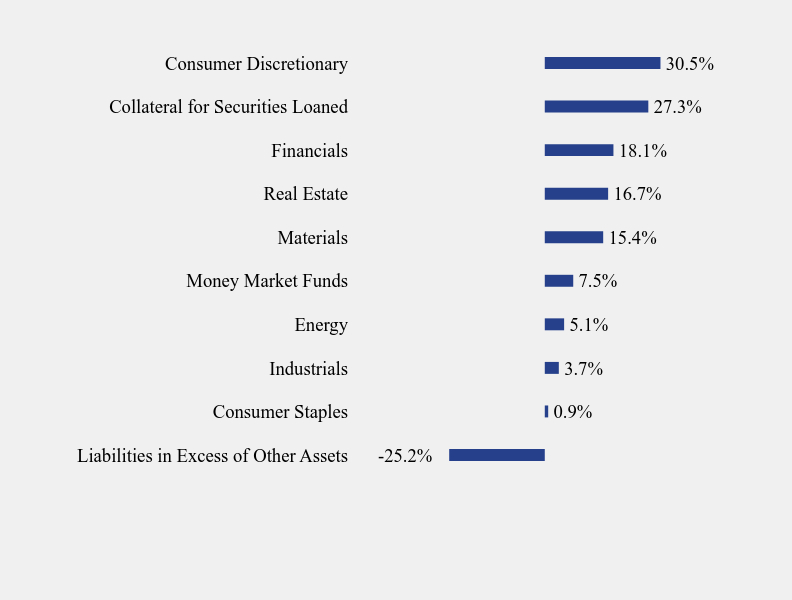

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -25.2% |

| Consumer Staples | 0.9% |

| Industrials | 3.7% |

| Energy | 5.1% |

| Money Market Funds | 7.5% |

| Materials | 15.4% |

| Real Estate | 16.7% |

| Financials | 18.1% |

| Collateral for Securities Loaned | 27.3% |

| Consumer Discretionary | 30.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Coeur Mining, Inc., 5.125%, 02/15/29 | 5.4% |

| Howard Hughes Corporation (The), 4.375%, 02/01/31 | 4.8% |

| American Axle & Manufacturing, Inc., 5.000%, 10/01/29 | 4.5% |

| Nordstrom, Inc., 5.000%, 01/15/44 | 4.4% |

| United States Steel Corporation, 6.650%, 06/01/37 | 4.3% |

| WisdomTree, Inc., 5.750%, 08/15/28 | 4.1% |

| Odeon Finco PLC, 12.750%, 11/01/27 | 3.8% |

| Beazer Homes USA, Inc., 5.875%, 10/15/27 | 3.8% |

| Rayonier AM Products, Inc., 7.625%, 01/15/26 | 3.8% |

| Enova International, Inc., 8.500%, 09/15/25 | 3.7% |

No material changes occurred during the year ended June 30, 2024.

Catalyst/SMH High Income Fund - Class A (HIIFX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://catalystmf.com/literature-and-forms/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Catalyst/SMH High Income Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Catalyst/SMH High Income Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://catalystmf.com/literature-and-forms/. You can also request this information by contacting us at 1-866-447-4228.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $223 | 2.23% |

How did the Fund perform during the reporting period?