united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-21872 |

| Mutual Fund Series Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450, Cincinnati, OH | 45246 |

| (Address of principal executive offices) | (Zip code) |

| CT CORPORATION SYSTEM |

| 1300 EAST NINTH STREET, CLEVELAND, OH 44114 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | 631-470-2600 |

| Date of fiscal year end: | 6/30 |

| Date of reporting period: | 6/30/2024 |

Item 1. Reports to Stockholders.

(a)

0001355064mfst:C000080457Membermfst:A592688105MettlerMinusToledoInternationalIncCTIMember2024-06-30

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Eventide Balanced Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.eventidefunds.com. You can also request this information by contacting us at 1-877-771-3836. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $107 | 1.07% |

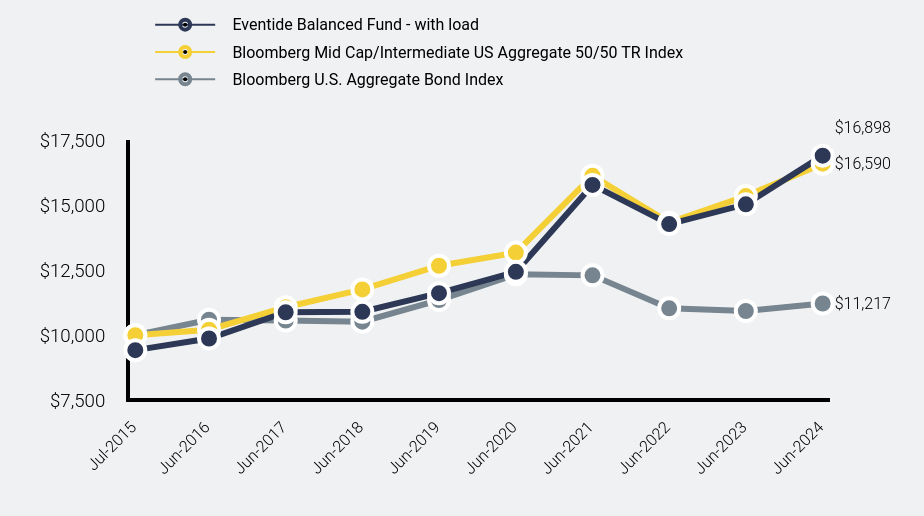

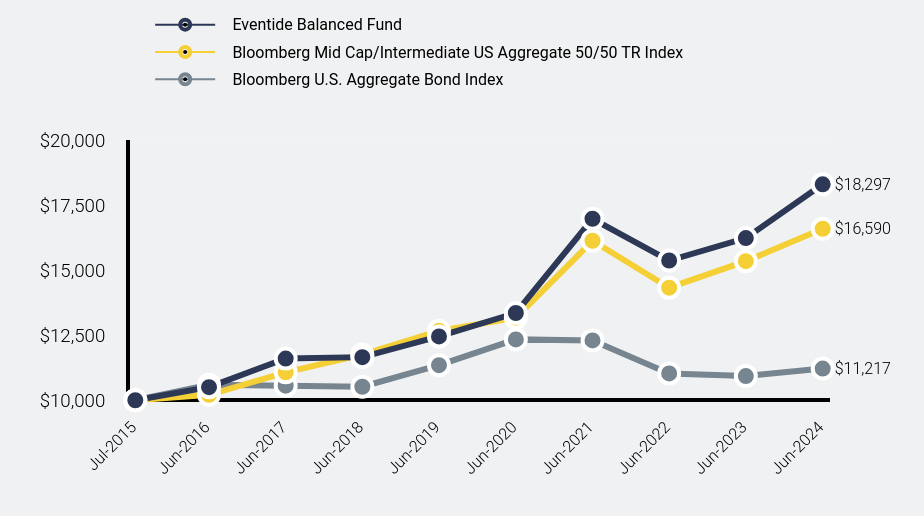

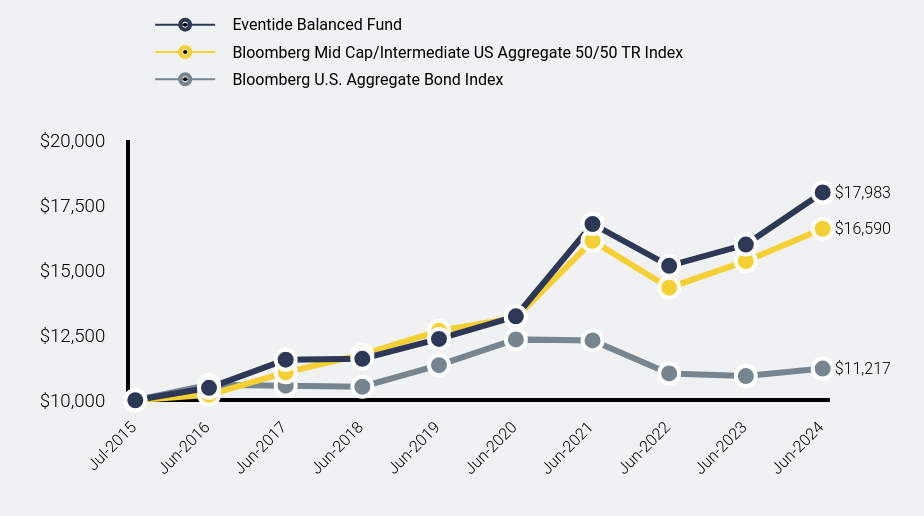

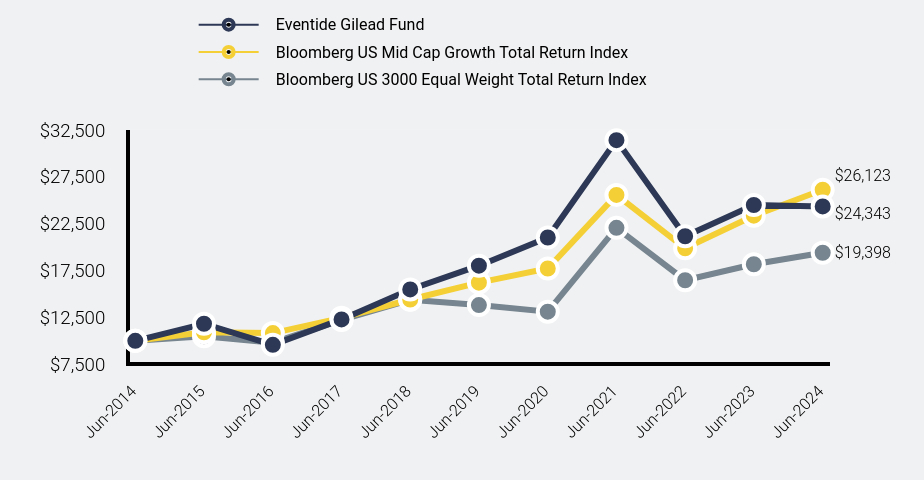

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Eventide Balanced Fund - with load | Bloomberg Mid Cap/Intermediate US Aggregate 50/50 TR Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| Jul-2015 | $9,425 | $10,000 | $10,000 |

| Jun-2016 | $9,872 | $10,210 | $10,595 |

| Jun-2017 | $10,882 | $11,074 | $10,562 |

| Jun-2018 | $10,899 | $11,757 | $10,520 |

| Jun-2019 | $11,614 | $12,668 | $11,348 |

| Jun-2020 | $12,435 | $13,172 | $12,339 |

| Jun-2021 | $15,773 | $16,127 | $12,298 |

| Jun-2022 | $14,268 | $14,324 | $11,032 |

| Jun-2023 | $15,027 | $15,344 | $10,929 |

| Jun-2024 | $16,898 | $16,590 | $11,217 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. In connection with new SEC Rules on shareholder reporting, the Fund's performance information above is compared with a broad-based benchmark, Bloomberg US Aggregate Index, which represents the overall domestic bond market. In addition, the strategy benchmark, Bloomberg Mid Cap/Intermediate US Aggregate 50/50 TR Index, is included as the adviser believes it is more representative of the fund's investment universe.

How did the Fund perform during the reporting period?

For the year ended 6/30/2024, the Fund outperformed its primary benchmark. The Fund’s equity positions outperformed its benchmark for the year across many sectors (IT, Industrials, Energy, and Utilities), while underperforming in Consumer Discretionary and Financials. The Fund’s fixed income positions outperformed its benchmark due to the strength of corporate bonds versus treasuries. We believe the Fund is well-positioned in key growth themes (technology, AI, electrification, energy efficiency, and infrastructure). We remain focused on resilient companies led by excellent management teams and positioned for long-term growth. With lower interest rates, balanced strategies providing exposure to high-quality, dividend-growing equities, along with downside protection, may regain favor. We remain committed to resilient growth, strong financials, stakeholder value creation, and the overarching theme of human flourishing.

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (July 15, 2015) |

|---|

| Eventide Balanced Fund - Class A |

| Without Load | 12.45% | 7.79% | 6.73% |

| With Load | 5.98% | 6.53% | 6.03% |

| Bloomberg Mid Cap/Intermediate US Aggregate 50/50 TR Index | 8.12% | 5.54% | 5.81% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | | 1.29% |

| Net Assets | $379,519,782 |

| Number of Portfolio Holdings | 155 |

| Advisory Fee (net of waivers) | $1,839,950 |

| Portfolio Turnover | 43% |

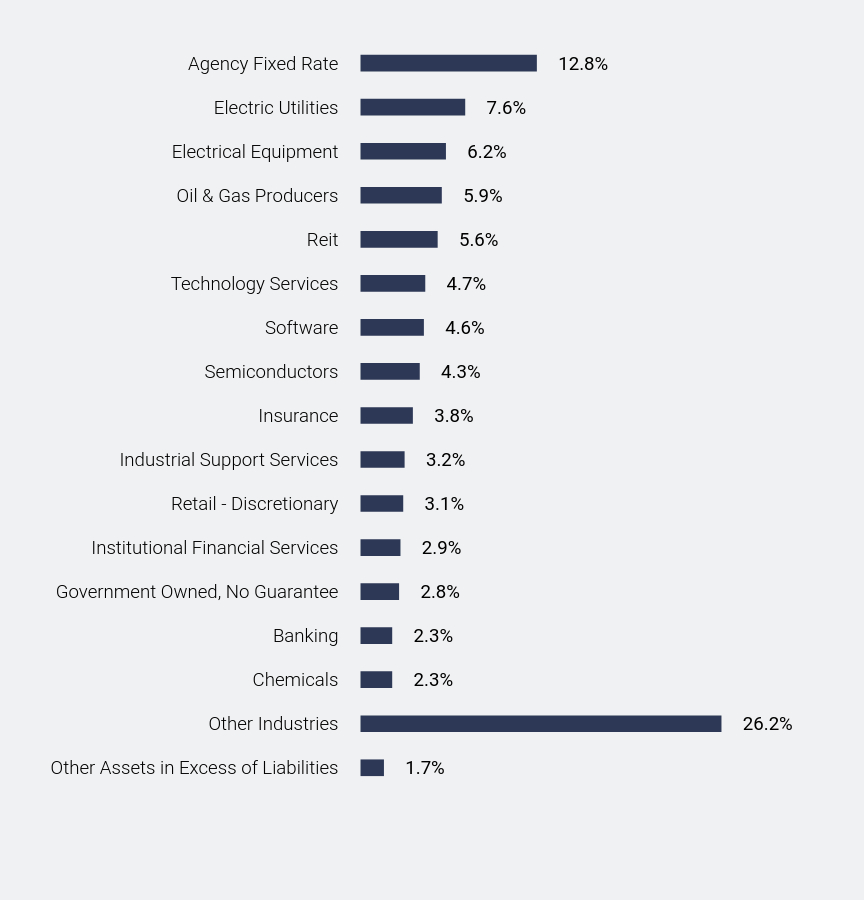

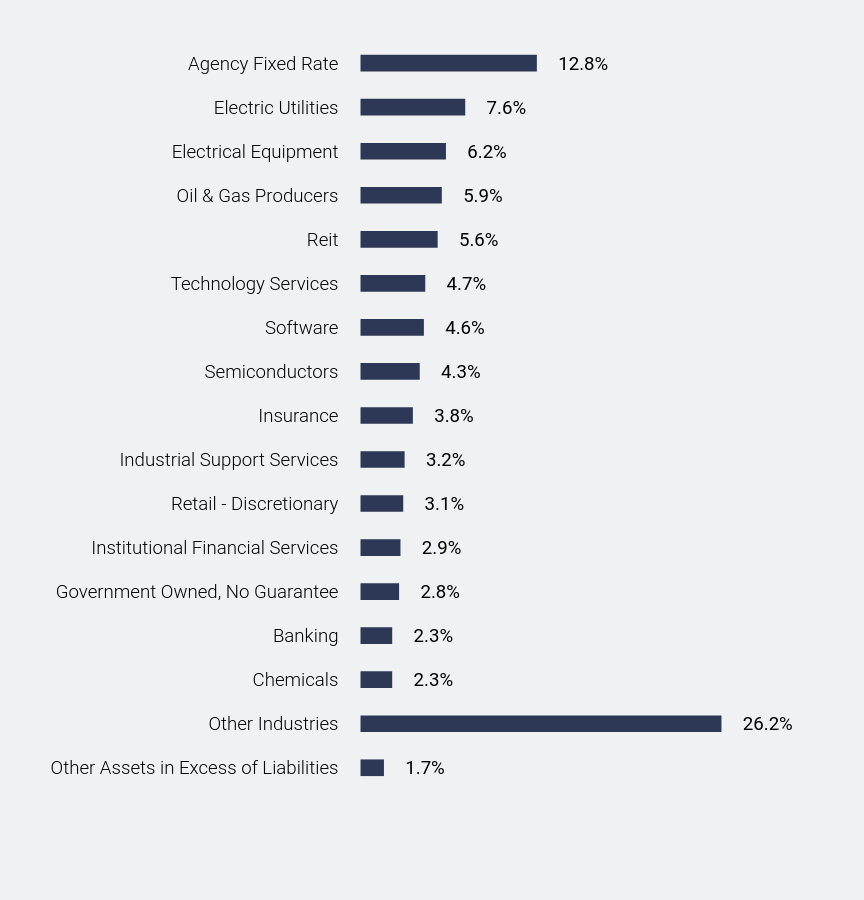

What did the Fund invest in?

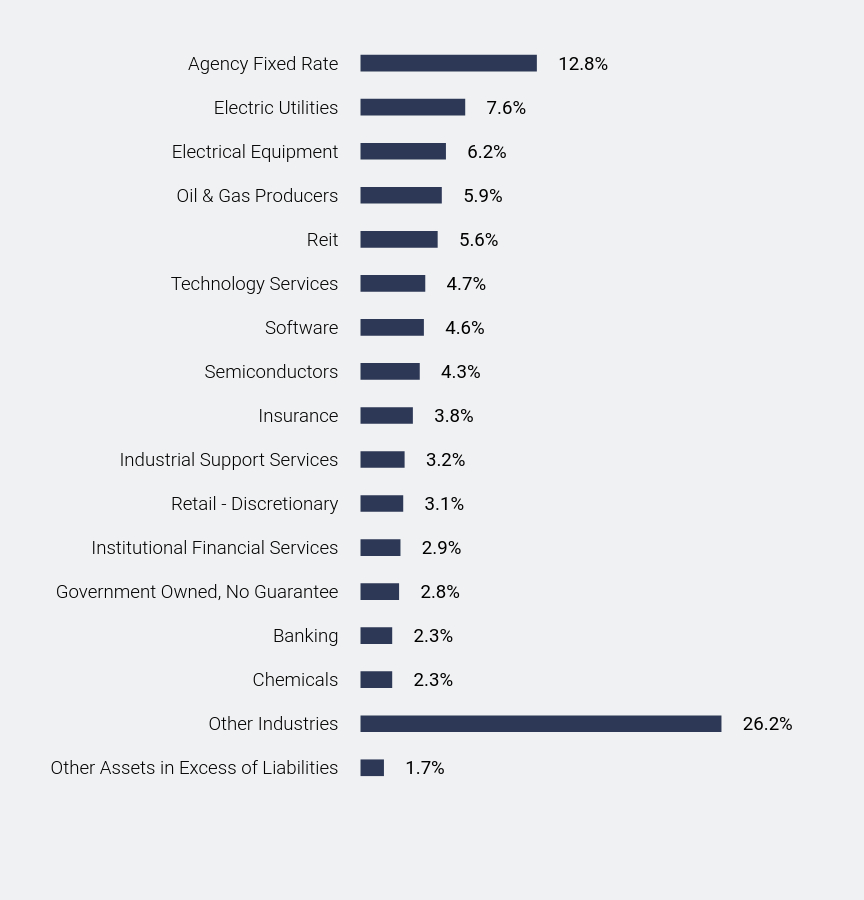

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.7% |

| Other Industries | 26.2% |

| Chemicals | 2.3% |

| Banking | 2.3% |

| Government Owned, No Guarantee | 2.8% |

| Institutional Financial Services | 2.9% |

| Retail - Discretionary | 3.1% |

| Industrial Support Services | 3.2% |

| Insurance | 3.8% |

| Semiconductors | 4.3% |

| Software | 4.6% |

| Technology Services | 4.7% |

| Reit | 5.6% |

| Oil & Gas Producers | 5.9% |

| Electrical Equipment | 6.2% |

| Electric Utilities | 7.6% |

| Agency Fixed Rate | 12.8% |

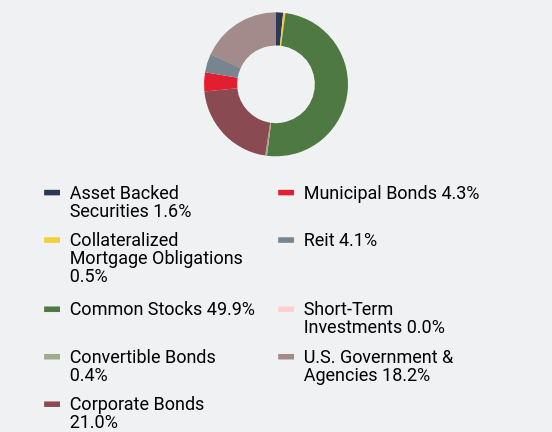

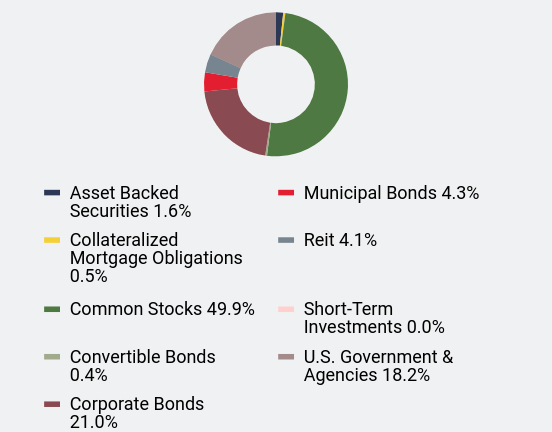

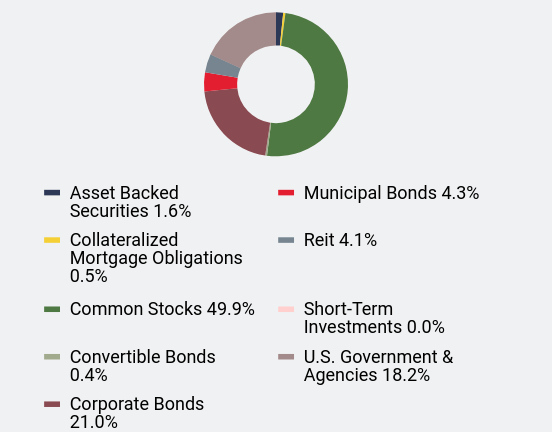

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 1.6% |

| Collateralized Mortgage Obligations | 0.5% |

| Common Stocks | 49.9% |

| Convertible Bonds | 0.4% |

| Corporate Bonds | 21.0% |

| Municipal Bonds | 4.3% |

| Reit | 4.1% |

| Short-Term Investments | 0.0% |

| U.S. Government & Agencies | 18.2% |

Top 10 Holdings* (% of net assets)

| Holding Name | % of Net Assets |

| Trane Technologies PLC | 3.2% |

| nVent Electric PLC | 3.0% |

| Arthur J Gallagher & Company | 2.6% |

| Roper Technologies, Inc. | 2.6% |

| CDW Corporation | 2.3% |

| KLA Corporation | 2.3% |

| Targa Resources Corporation | 2.0% |

| Ferguson PLC | 2.0% |

| Williams Companies, Inc. (The) | 1.8% |

| Houlihan Lokey, Inc. | 1.6% |

* Does not include cash/money market funds/equivalents. Based on percentage of net assets. Holdings can change at any time, are subject to risks discussed in the Fund’s prospectus, and should not be considered investment advice.

This is a summary of certain changes to the Fund since July 1, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by November 1, 2024 at https://www.eventidefunds.com/prospectus or upon request at 1-877-771-EVEN (3836). The Fund’s name changed from “Eventide Multi-Asset Income Fund” to “Eventide Balanced Fund” on November 1, 2023. That same day, the Fund adopted a policy to invest at least 25% of its assets in equity securities and at least 25% of its assets in fixed income securities.

Eventide Balanced Fund - Class A (ETAMX )

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://www.eventidefunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Eventide Balanced Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.eventidefunds.com. You can also request this information by contacting us at 1-877-771-3836. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $182 | 1.82% |

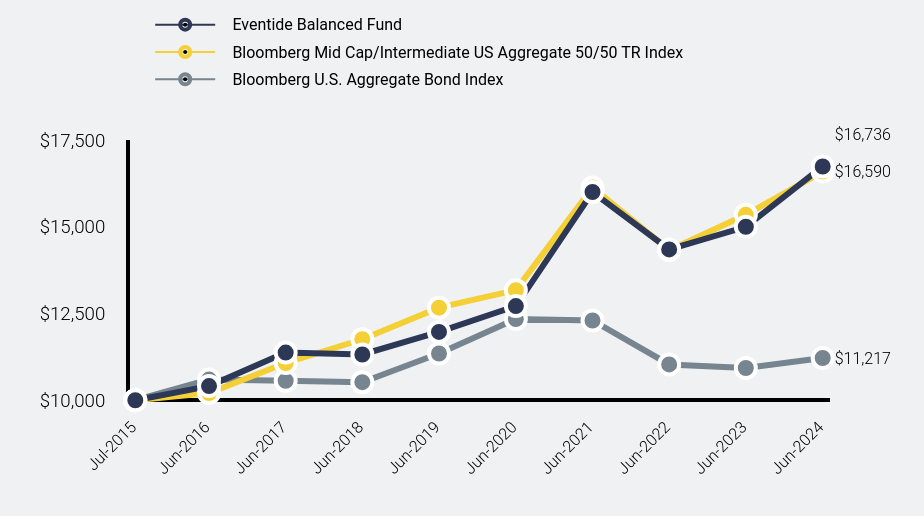

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Eventide Balanced Fund | Bloomberg Mid Cap/Intermediate US Aggregate 50/50 TR Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| Jul-2015 | $10,000 | $10,000 | $10,000 |

| Jun-2016 | $10,408 | $10,210 | $10,595 |

| Jun-2017 | $11,375 | $11,074 | $10,562 |

| Jun-2018 | $11,319 | $11,757 | $10,520 |

| Jun-2019 | $11,968 | $12,668 | $11,348 |

| Jun-2020 | $12,714 | $13,172 | $12,339 |

| Jun-2021 | $16,000 | $16,127 | $12,298 |

| Jun-2022 | $14,346 | $14,324 | $11,032 |

| Jun-2023 | $14,999 | $15,344 | $10,929 |

| Jun-2024 | $16,736 | $16,590 | $11,217 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. In connection with new SEC Rules on shareholder reporting, the Fund's performance information above is compared with a broad-based benchmark, Bloomberg US Aggregate Index, which represents the overall domestic bond market. In addition, the strategy benchmark, Bloomberg Mid Cap/Intermediate US Aggregate 50/50 TR Index, is included as the adviser believes it is more representative of the fund's investment universe.

How did the Fund perform during the reporting period?

For the year ended 6/30/2024, the Fund outperformed its primary benchmark. The Fund’s equity positions outperformed its benchmark for the year across many sectors (IT, Industrials, Energy, and Utilities), while underperforming in Consumer Discretionary and Financials. The Fund’s fixed income positions outperformed its benchmark due to the strength of corporate bonds versus treasuries. We believe the Fund is well-positioned in key growth themes (technology, AI, electrification, energy efficiency, and infrastructure). We remain focused on resilient companies led by excellent management teams and positioned for long-term growth. With lower interest rates, balanced strategies providing exposure to high-quality, dividend-growing equities, along with downside protection, may regain favor. We remain committed to resilient growth, strong financials, stakeholder value creation, and the overarching theme of human flourishing.

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (July 15, 2015) |

|---|

| Eventide Balanced Fund - Class C | 11.58% | 6.94% | 5.91% |

| Bloomberg Mid Cap/Intermediate US Aggregate 50/50 TR Index | 8.12% | 5.54% | 5.81% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | | 1.29% |

| Net Assets | $379,519,782 |

| Number of Portfolio Holdings | 155 |

| Advisory Fee (net of waivers) | $1,839,950 |

| Portfolio Turnover | 43% |

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.7% |

| Other Industries | 26.2% |

| Chemicals | 2.3% |

| Banking | 2.3% |

| Government Owned, No Guarantee | 2.8% |

| Institutional Financial Services | 2.9% |

| Retail - Discretionary | 3.1% |

| Industrial Support Services | 3.2% |

| Insurance | 3.8% |

| Semiconductors | 4.3% |

| Software | 4.6% |

| Technology Services | 4.7% |

| Reit | 5.6% |

| Oil & Gas Producers | 5.9% |

| Electrical Equipment | 6.2% |

| Electric Utilities | 7.6% |

| Agency Fixed Rate | 12.8% |

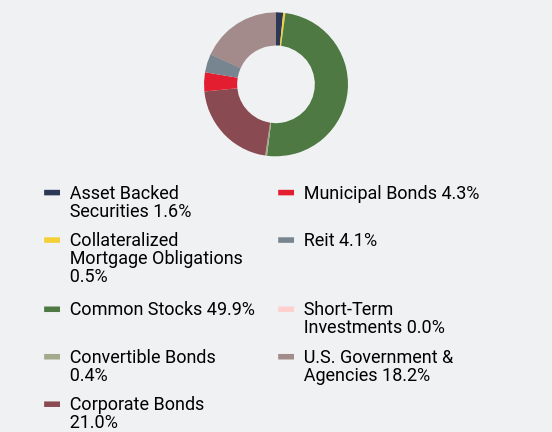

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 1.6% |

| Collateralized Mortgage Obligations | 0.5% |

| Common Stocks | 49.9% |

| Convertible Bonds | 0.4% |

| Corporate Bonds | 21.0% |

| Municipal Bonds | 4.3% |

| Reit | 4.1% |

| Short-Term Investments | 0.0% |

| U.S. Government & Agencies | 18.2% |

Top 10 Holdings* (% of net assets)

| Holding Name | % of Net Assets |

| Trane Technologies PLC | 3.2% |

| nVent Electric PLC | 3.0% |

| Arthur J Gallagher & Company | 2.6% |

| Roper Technologies, Inc. | 2.6% |

| CDW Corporation | 2.3% |

| KLA Corporation | 2.3% |

| Targa Resources Corporation | 2.0% |

| Ferguson PLC | 2.0% |

| Williams Companies, Inc. (The) | 1.8% |

| Houlihan Lokey, Inc. | 1.6% |

* Does not include cash/money market funds/equivalents. Based on percentage of net assets. Holdings can change at any time, are subject to risks discussed in the Fund’s prospectus, and should not be considered investment advice.

This is a summary of certain changes to the Fund since July 1, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by November 1, 2024 at https://www.eventidefunds.com/prospectus or upon request at 1-877-771-EVEN (3836). The Fund’s name changed from “Eventide Multi-Asset Income Fund” to “Eventide Balanced Fund” on November 1, 2023. That same day, the Fund adopted a policy to invest at least 25% of its assets in equity securities and at least 25% of its assets in fixed income securities.

Eventide Balanced Fund - Class C (ETCMX )

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://www.eventidefunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Eventide Balanced Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.eventidefunds.com. You can also request this information by contacting us at 1-877-771-3836. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $82 | 0.82% |

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Eventide Balanced Fund | Bloomberg Mid Cap/Intermediate US Aggregate 50/50 TR Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| Jul-2015 | $10,000 | $10,000 | $10,000 |

| Jun-2016 | $10,503 | $10,210 | $10,595 |

| Jun-2017 | $11,603 | $11,074 | $10,562 |

| Jun-2018 | $11,657 | $11,757 | $10,520 |

| Jun-2019 | $12,451 | $12,668 | $11,348 |

| Jun-2020 | $13,352 | $13,172 | $12,339 |

| Jun-2021 | $16,973 | $16,127 | $12,298 |

| Jun-2022 | $15,368 | $14,324 | $11,032 |

| Jun-2023 | $16,229 | $15,344 | $10,929 |

| Jun-2024 | $18,297 | $16,590 | $11,217 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. In connection with new SEC Rules on shareholder reporting, the Fund's performance information above is compared with a broad-based benchmark, Bloomberg US Aggregate Index, which represents the overall domestic bond market. In addition, the strategy benchmark, Bloomberg Mid Cap/Intermediate US Aggregate 50/50 TR Index, is included as the adviser believes it is more representative of the fund's investment universe.

How did the Fund perform during the reporting period?

For the year ended 6/30/2024, the Fund outperformed its primary benchmark. The Fund’s equity positions outperformed its benchmark for the year across many sectors (IT, Industrials, Energy, and Utilities), while underperforming in Consumer Discretionary and Financials. The Fund’s fixed income positions outperformed its benchmark due to the strength of corporate bonds versus treasuries. We believe the Fund is well-positioned in key growth themes (technology, AI, electrification, energy efficiency, and infrastructure). We remain focused on resilient companies led by excellent management teams and positioned for long-term growth. With lower interest rates, balanced strategies providing exposure to high-quality, dividend-growing equities, along with downside protection, may regain favor. We remain committed to resilient growth, strong financials, stakeholder value creation, and the overarching theme of human flourishing.

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (July 15, 2015) |

|---|

| Eventide Balanced Fund - Class I | 12.75% | 8.00% | 6.97% |

| Bloomberg Mid Cap/Intermediate US Aggregate 50/50 TR Index | 8.12% | 5.54% | 5.81% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | | 1.29% |

| Net Assets | $379,519,782 |

| Number of Portfolio Holdings | 155 |

| Advisory Fee (net of waivers) | $1,839,950 |

| Portfolio Turnover | 43% |

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.7% |

| Other Industries | 26.2% |

| Chemicals | 2.3% |

| Banking | 2.3% |

| Government Owned, No Guarantee | 2.8% |

| Institutional Financial Services | 2.9% |

| Retail - Discretionary | 3.1% |

| Industrial Support Services | 3.2% |

| Insurance | 3.8% |

| Semiconductors | 4.3% |

| Software | 4.6% |

| Technology Services | 4.7% |

| Reit | 5.6% |

| Oil & Gas Producers | 5.9% |

| Electrical Equipment | 6.2% |

| Electric Utilities | 7.6% |

| Agency Fixed Rate | 12.8% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 1.6% |

| Collateralized Mortgage Obligations | 0.5% |

| Common Stocks | 49.9% |

| Convertible Bonds | 0.4% |

| Corporate Bonds | 21.0% |

| Municipal Bonds | 4.3% |

| Reit | 4.1% |

| Short-Term Investments | 0.0% |

| U.S. Government & Agencies | 18.2% |

Top 10 Holdings* (% of net assets)

| Holding Name | % of Net Assets |

| Trane Technologies PLC | 3.2% |

| nVent Electric PLC | 3.0% |

| Arthur J Gallagher & Company | 2.6% |

| Roper Technologies, Inc. | 2.6% |

| CDW Corporation | 2.3% |

| KLA Corporation | 2.3% |

| Targa Resources Corporation | 2.0% |

| Ferguson PLC | 2.0% |

| Williams Companies, Inc. (The) | 1.8% |

| Houlihan Lokey, Inc. | 1.6% |

* Does not include cash/money market funds/equivalents. Based on percentage of net assets. Holdings can change at any time, are subject to risks discussed in the Fund’s prospectus, and should not be considered investment advice.

This is a summary of certain changes to the Fund since July 1, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by November 1, 2024 at https://www.eventidefunds.com/prospectus or upon request at 1-877-771-EVEN (3836). The Fund’s name changed from “Eventide Multi-Asset Income Fund” to “Eventide Balanced Fund” on November 1, 2023. That same day, the Fund adopted a policy to invest at least 25% of its assets in equity securities and at least 25% of its assets in fixed income securities.

Eventide Balanced Fund - Class I (ETIMX )

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://www.eventidefunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Eventide Balanced Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.eventidefunds.com. You can also request this information by contacting us at 1-877-771-3836. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class N | $102 | 1.02% |

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Eventide Balanced Fund | Bloomberg Mid Cap/Intermediate US Aggregate 50/50 TR Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| Jul-2015 | $10,000 | $10,000 | $10,000 |

| Jun-2016 | $10,479 | $10,210 | $10,595 |

| Jun-2017 | $11,558 | $11,074 | $10,562 |

| Jun-2018 | $11,591 | $11,757 | $10,520 |

| Jun-2019 | $12,358 | $12,668 | $11,348 |

| Jun-2020 | $13,226 | $13,172 | $12,339 |

| Jun-2021 | $16,772 | $16,127 | $12,298 |

| Jun-2022 | $15,166 | $14,324 | $11,032 |

| Jun-2023 | $15,982 | $15,344 | $10,929 |

| Jun-2024 | $17,983 | $16,590 | $11,217 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. In connection with new SEC Rules on shareholder reporting, the Fund's performance information above is compared with a broad-based benchmark, Bloomberg US Aggregate Index, which represents the overall domestic bond market. In addition, the strategy benchmark, Bloomberg Mid Cap/Intermediate US Aggregate 50/50 TR Index, is included as the adviser believes it is more representative of the fund's investment universe.

How did the Fund perform during the reporting period?

For the year ended 6/30/2024, the Fund outperformed its primary benchmark. The Fund’s equity positions outperformed its benchmark for the year across many sectors (IT, Industrials, Energy, and Utilities), while underperforming in Consumer Discretionary and Financials. The Fund’s fixed income positions outperformed its benchmark due to the strength of corporate bonds versus treasuries. We believe the Fund is well-positioned in key growth themes (technology, AI, electrification, energy efficiency, and infrastructure). We remain focused on resilient companies led by excellent management teams and positioned for long-term growth. With lower interest rates, balanced strategies providing exposure to high-quality, dividend-growing equities, along with downside protection, may regain favor. We remain committed to resilient growth, strong financials, stakeholder value creation, and the overarching theme of human flourishing.

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (July 15, 2015) |

|---|

| Eventide Balanced Fund - Class N | 12.52% | 7.79% | 6.77% |

| Bloomberg Mid Cap/Intermediate US Aggregate 50/50 TR Index | 8.12% | 5.54% | 5.81% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | | 1.29% |

| Net Assets | $379,519,782 |

| Number of Portfolio Holdings | 155 |

| Advisory Fee (net of waivers) | $1,839,950 |

| Portfolio Turnover | 43% |

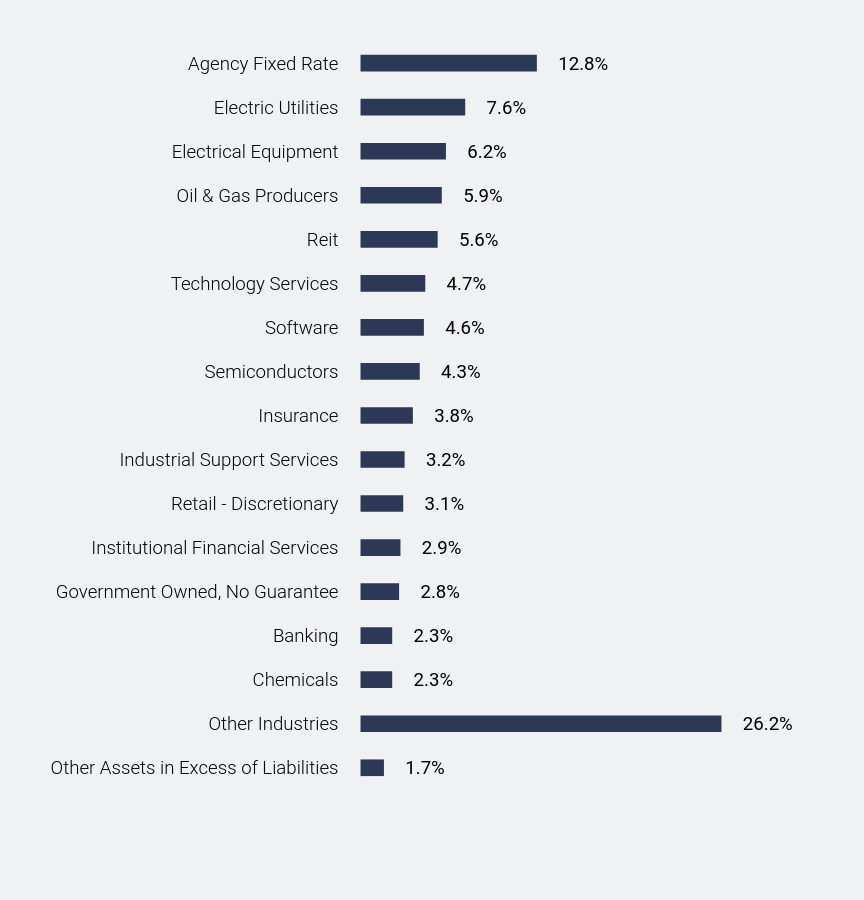

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.7% |

| Other Industries | 26.2% |

| Chemicals | 2.3% |

| Banking | 2.3% |

| Government Owned, No Guarantee | 2.8% |

| Institutional Financial Services | 2.9% |

| Retail - Discretionary | 3.1% |

| Industrial Support Services | 3.2% |

| Insurance | 3.8% |

| Semiconductors | 4.3% |

| Software | 4.6% |

| Technology Services | 4.7% |

| Reit | 5.6% |

| Oil & Gas Producers | 5.9% |

| Electrical Equipment | 6.2% |

| Electric Utilities | 7.6% |

| Agency Fixed Rate | 12.8% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 1.6% |

| Collateralized Mortgage Obligations | 0.5% |

| Common Stocks | 49.9% |

| Convertible Bonds | 0.4% |

| Corporate Bonds | 21.0% |

| Municipal Bonds | 4.3% |

| Reit | 4.1% |

| Short-Term Investments | 0.0% |

| U.S. Government & Agencies | 18.2% |

Top 10 Holdings* (% of net assets)

| Holding Name | % of Net Assets |

| Trane Technologies PLC | 3.2% |

| nVent Electric PLC | 3.0% |

| Arthur J Gallagher & Company | 2.6% |

| Roper Technologies, Inc. | 2.6% |

| CDW Corporation | 2.3% |

| KLA Corporation | 2.3% |

| Targa Resources Corporation | 2.0% |

| Ferguson PLC | 2.0% |

| Williams Companies, Inc. (The) | 1.8% |

| Houlihan Lokey, Inc. | 1.6% |

* Does not include cash/money market funds/equivalents. Based on percentage of net assets. Holdings can change at any time, are subject to risks discussed in the Fund’s prospectus, and should not be considered investment advice.

This is a summary of certain changes to the Fund since July 1, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by November 1, 2024 at https://www.eventidefunds.com/prospectus or upon request at 1-877-771-EVEN (3836). The Fund’s name changed from “Eventide Multi-Asset Income Fund” to “Eventide Balanced Fund” on November 1, 2023. That same day, the Fund adopted a policy to invest at least 25% of its assets in equity securities and at least 25% of its assets in fixed income securities.

Eventide Balanced Fund - Class N (ETNMX )

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://www.eventidefunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Eventide Core Bond Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.eventidefunds.com. You can also request this information by contacting us at 1-877-771-3836.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $83 | 0.83% |

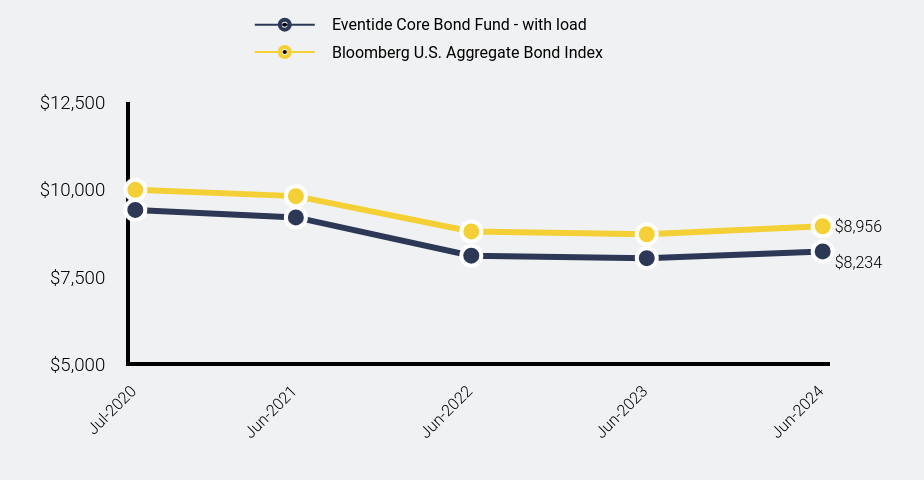

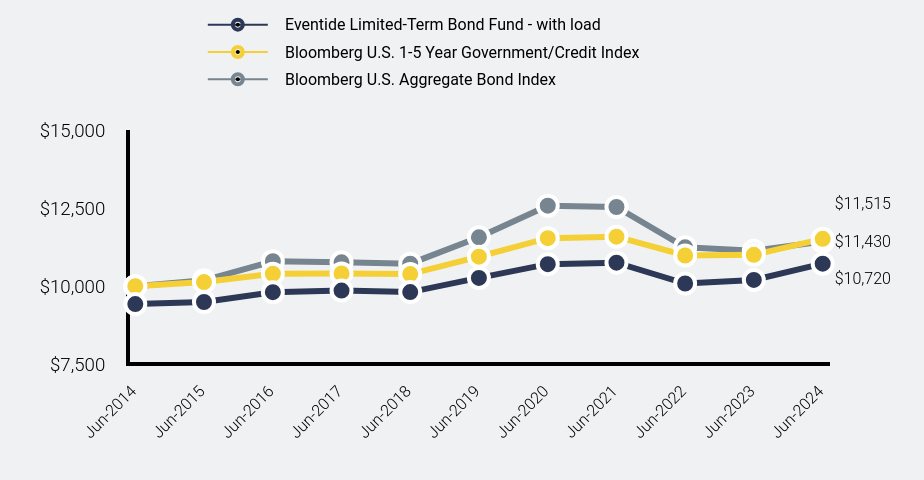

How did the Fund perform during the reporting period?

Performance of the Fund for the year was materially impacted by fluctuations of the yield curve and the performance of corporate bonds relative to treasuries. Corporate bonds outperformed treasuries for the year ended 6/30/24, which had a positive impact on the Fund's returns on an absolute and relative basis. However, this positive effect was offset by higher long-term rates as the yield curve flattened, resulting in slight underperformance of the Fund relative to the benchmark.

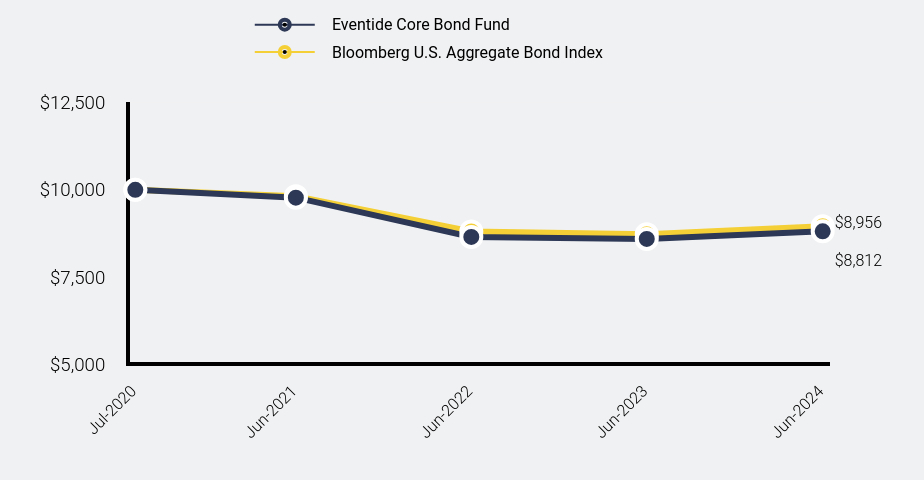

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Eventide Core Bond Fund - with load | Bloomberg U.S. Aggregate Bond Index |

|---|

| Jul-2020 | $9,425 | $10,000 |

| Jun-2021 | $9,210 | $9,820 |

| Jun-2022 | $8,113 | $8,809 |

| Jun-2023 | $8,040 | $8,727 |

| Jun-2024 | $8,234 | $8,956 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. In connection with new SEC Rules on shareholder reporting, the Fund's performance information above is compared with a broad-based benchmark, Bloomberg US Aggregate Index, which represents the overall domestic bond market.

| Net Assets | $137,304,892 |

| Number of Portfolio Holdings | 95 |

| Advisory Fee (net of waivers) | $225,991 |

| Portfolio Turnover | 33% |

Average Annual Total Returns

| 1 Year | Since Inception (July 31, 2020) |

|---|

| Eventide Core Bond Fund - Class A |

| Without Load | 2.42% | |

| With Load | | |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | |

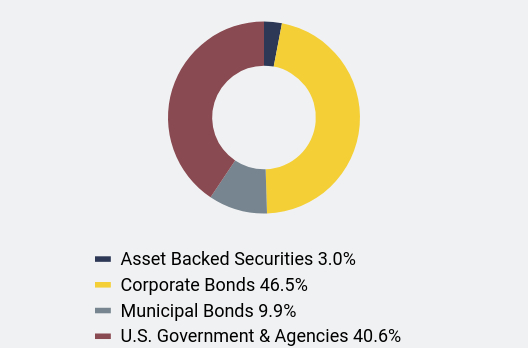

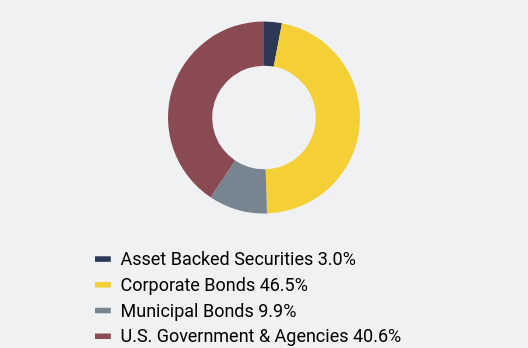

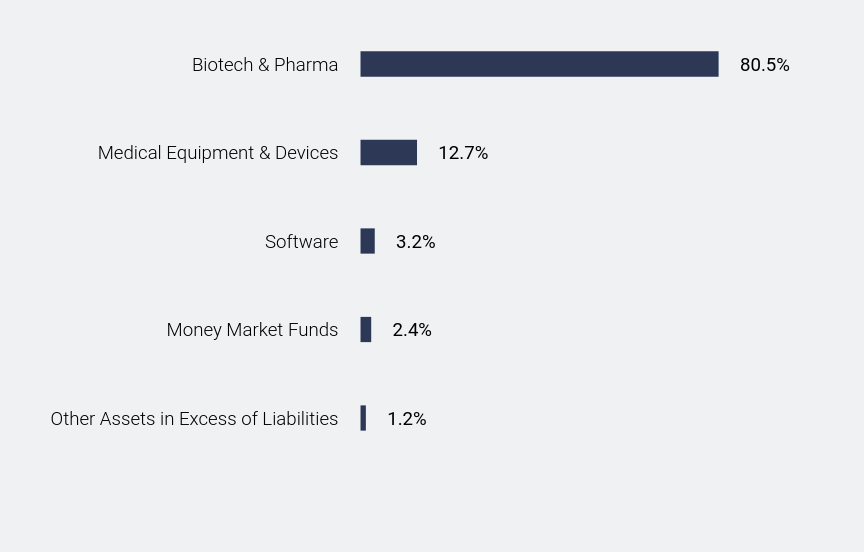

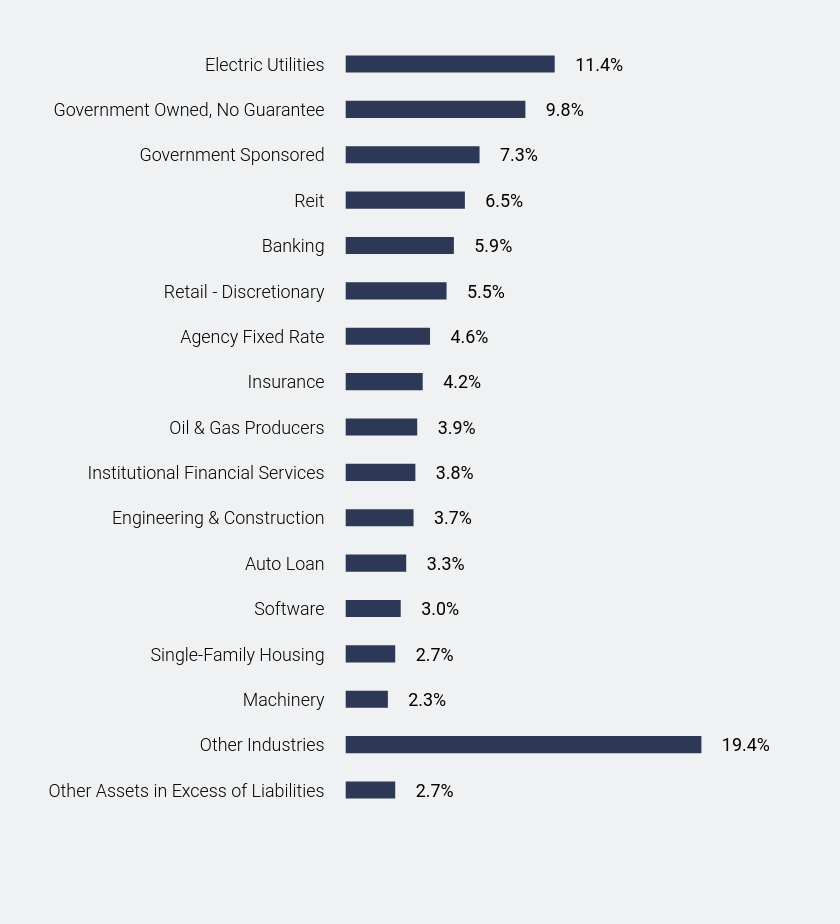

What did the Fund invest in?

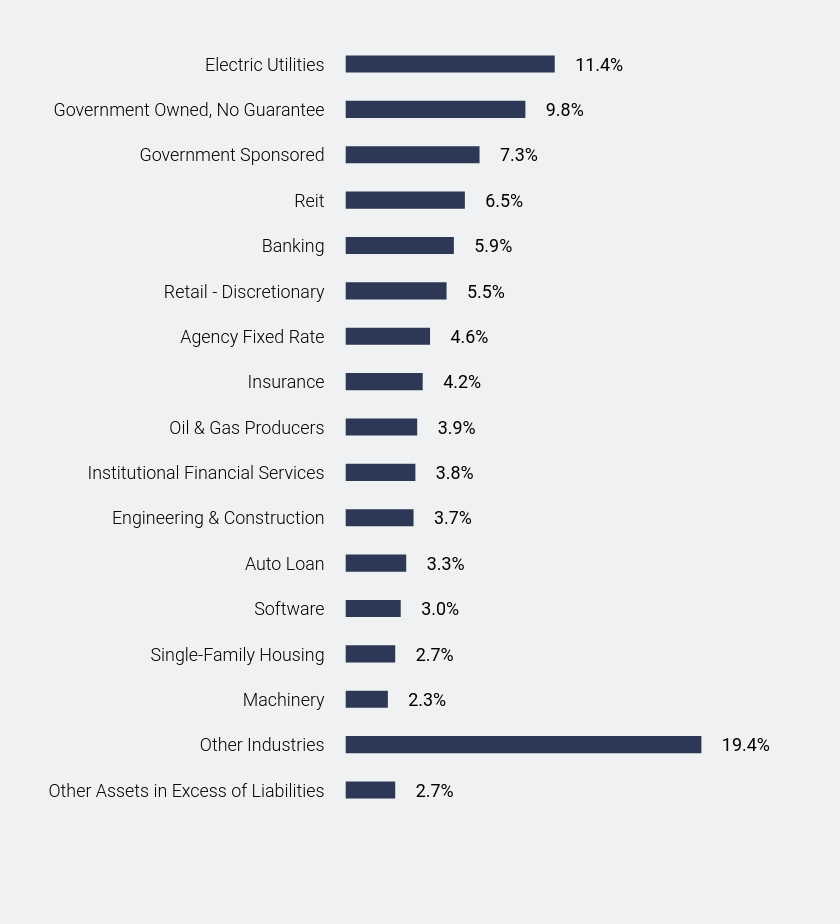

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 2.7% |

| Other Industries | 14.5% |

| Technology Services | 1.5% |

| Retail - Discretionary | 1.7% |

| Auto Loan | 1.7% |

| Software | 2.3% |

| Semiconductors | 2.5% |

| Engineering & Construction | 2.7% |

| Banking | 3.0% |

| Institutional Financial Services | 3.0% |

| Oil & Gas Producers | 3.8% |

| Reit | 4.3% |

| Single-Family Housing | 5.2% |

| Government Owned, No Guarantee | 5.5% |

| Government Sponsored | 7.3% |

| Electric Utilities | 11.7% |

| Agency Fixed Rate | 26.6% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 3.0% |

| Corporate Bonds | 46.5% |

| Municipal Bonds | 9.9% |

| U.S. Government & Agencies | 40.6% |

Top 10 Holdings* (% of net assets)

| Holding Name | % of Net Assets |

| JPMorgan Chase & Company, 6.070%, due 10/22/27 | 1.9% |

| Federal Home Loan Mortgage Corporation, 6.250%, due 07/15/32 | 1.8% |

| Federal National Mortgage Association, 6.250%, due 05/15/29 | 1.8% |

| Freddie Mac Pool, 4.500%, due 08/1/52 | 1.8% |

| Fannie Mae Pool, 2.000%, due 06/1/51 | 1.8% |

| Fannie Mae Pool, 5.500%, due 01/1/53 | 1.6% |

| Fannie Mae Pool, 4.500%, due 11/1/52 | 1.6% |

| Freddie Mac Pool, 5.000%, due 01/1/53 | 1.6% |

| Morgan Stanley, 0.864%, due 10/21/25 | 1.6% |

| Freddie Mac Pool, 3.500%, due 06/1/52 | 1.5% |

* Does not include cash/money market funds/equivalents. Based on percentage of net assets. Holdings can change at any time, are subject to risks discussed in the Fund’s prospectus, and should not be considered investment advice.

No material changes occurred during the year ended June 30, 2024.

Eventide Core Bond Fund - Class A (ETARX )

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://www.eventidefunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Eventide Core Bond Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.eventidefunds.com. You can also request this information by contacting us at 1-877-771-3836.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $158 | 1.58% |

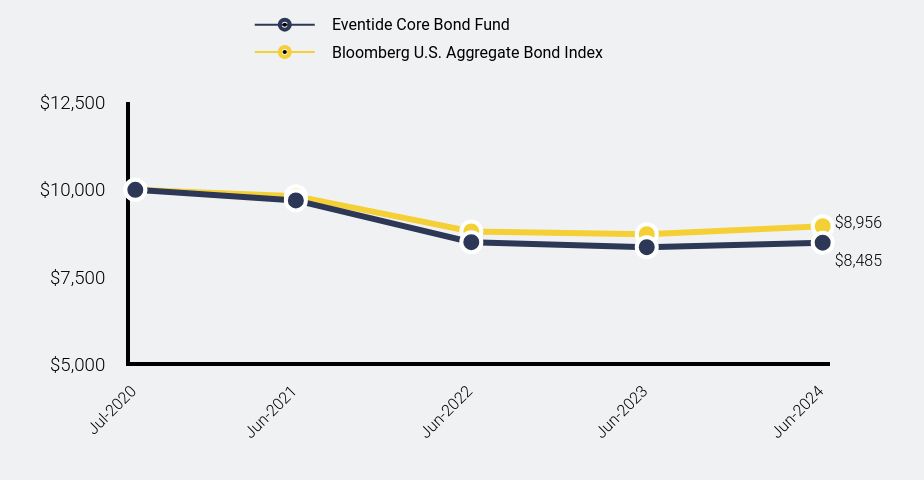

How did the Fund perform during the reporting period?

Performance of the Fund for the year was materially impacted by fluctuations of the yield curve and the performance of corporate bonds relative to treasuries. Corporate bonds outperformed treasuries for the year ended 6/30/24, which had a positive impact on the Fund's returns on an absolute and relative basis. However, this positive effect was offset by higher long-term rates as the yield curve flattened, resulting in slight underperformance of the Fund relative to the benchmark.

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Eventide Core Bond Fund | Bloomberg U.S. Aggregate Bond Index |

|---|

| Jul-2020 | $10,000 | $10,000 |

| Jun-2021 | $9,698 | $9,820 |

| Jun-2022 | $8,499 | $8,809 |

| Jun-2023 | $8,357 | $8,727 |

| Jun-2024 | $8,485 | $8,956 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. In connection with new SEC Rules on shareholder reporting, the Fund's performance information above is compared with a broad-based benchmark, Bloomberg US Aggregate Index, which represents the overall domestic bond market.

| Net Assets | $137,304,892 |

| Number of Portfolio Holdings | 95 |

| Advisory Fee (net of waivers) | $225,991 |

| Portfolio Turnover | 33% |

Average Annual Total Returns

| 1 Year | Since Inception (July 31, 2020) |

|---|

| Eventide Core Bond Fund - Class C | 1.53% | |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | |

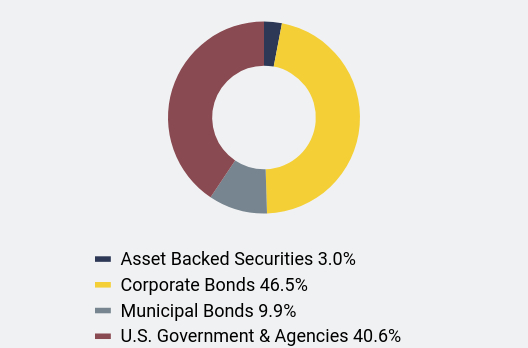

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 2.7% |

| Other Industries | 14.5% |

| Technology Services | 1.5% |

| Retail - Discretionary | 1.7% |

| Auto Loan | 1.7% |

| Software | 2.3% |

| Semiconductors | 2.5% |

| Engineering & Construction | 2.7% |

| Banking | 3.0% |

| Institutional Financial Services | 3.0% |

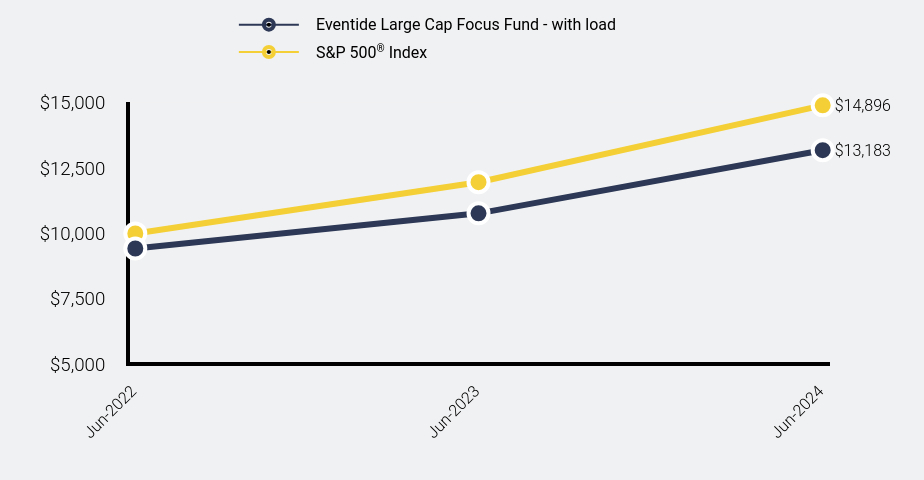

| Oil & Gas Producers | 3.8% |

| Reit | 4.3% |

| Single-Family Housing | 5.2% |

| Government Owned, No Guarantee | 5.5% |

| Government Sponsored | 7.3% |

| Electric Utilities | 11.7% |

| Agency Fixed Rate | 26.6% |

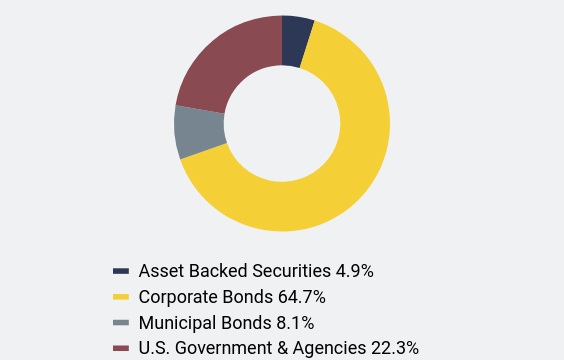

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 3.0% |

| Corporate Bonds | 46.5% |

| Municipal Bonds | 9.9% |

| U.S. Government & Agencies | 40.6% |

Top 10 Holdings* (% of net assets)

| Holding Name | % of Net Assets |

| JPMorgan Chase & Company, 6.070%, due 10/22/27 | 1.9% |

| Federal Home Loan Mortgage Corporation, 6.250%, due 07/15/32 | 1.8% |

| Federal National Mortgage Association, 6.250%, due 05/15/29 | 1.8% |

| Freddie Mac Pool, 4.500%, due 08/1/52 | 1.8% |

| Fannie Mae Pool, 2.000%, due 06/1/51 | 1.8% |

| Fannie Mae Pool, 5.500%, due 01/1/53 | 1.6% |

| Fannie Mae Pool, 4.500%, due 11/1/52 | 1.6% |

| Freddie Mac Pool, 5.000%, due 01/1/53 | 1.6% |

| Morgan Stanley, 0.864%, due 10/21/25 | 1.6% |

| Freddie Mac Pool, 3.500%, due 06/1/52 | 1.5% |

* Does not include cash/money market funds/equivalents. Based on percentage of net assets. Holdings can change at any time, are subject to risks discussed in the Fund’s prospectus, and should not be considered investment advice.

No material changes occurred during the year ended June 30, 2024.

Eventide Core Bond Fund - Class C (ETCRX )

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://www.eventidefunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Eventide Core Bond Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.eventidefunds.com. You can also request this information by contacting us at 1-877-771-3836.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $58 | 0.58% |

How did the Fund perform during the reporting period?

Performance of the Fund for the year was materially impacted by fluctuations of the yield curve and the performance of corporate bonds relative to treasuries. Corporate bonds outperformed treasuries for the year ended 6/30/24, which had a positive impact on the Fund's returns on an absolute and relative basis. However, this positive effect was offset by higher long-term rates as the yield curve flattened, resulting in slight underperformance of the Fund relative to the benchmark.

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Eventide Core Bond Fund | Bloomberg U.S. Aggregate Bond Index |

|---|

| Jul-2020 | $10,000 | $10,000 |

| Jun-2021 | $9,776 | $9,820 |

| Jun-2022 | $8,651 | $8,809 |

| Jun-2023 | $8,593 | $8,727 |

| Jun-2024 | $8,812 | $8,956 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. In connection with new SEC Rules on shareholder reporting, the Fund's performance information above is compared with a broad-based benchmark, Bloomberg US Aggregate Index, which represents the overall domestic bond market.

| Net Assets | $137,304,892 |

| Number of Portfolio Holdings | 95 |

| Advisory Fee (net of waivers) | $225,991 |

| Portfolio Turnover | 33% |

Average Annual Total Returns

| 1 Year | Since Inception (July 31, 2020) |

|---|

| Eventide Core Bond Fund - Class I | 2.54% | |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | |

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 2.7% |

| Other Industries | 14.5% |

| Technology Services | 1.5% |

| Retail - Discretionary | 1.7% |

| Auto Loan | 1.7% |

| Software | 2.3% |

| Semiconductors | 2.5% |

| Engineering & Construction | 2.7% |

| Banking | 3.0% |

| Institutional Financial Services | 3.0% |

| Oil & Gas Producers | 3.8% |

| Reit | 4.3% |

| Single-Family Housing | 5.2% |

| Government Owned, No Guarantee | 5.5% |

| Government Sponsored | 7.3% |

| Electric Utilities | 11.7% |

| Agency Fixed Rate | 26.6% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 3.0% |

| Corporate Bonds | 46.5% |

| Municipal Bonds | 9.9% |

| U.S. Government & Agencies | 40.6% |

Top 10 Holdings* (% of net assets)

| Holding Name | % of Net Assets |

| JPMorgan Chase & Company, 6.070%, due 10/22/27 | 1.9% |

| Federal Home Loan Mortgage Corporation, 6.250%, due 07/15/32 | 1.8% |

| Federal National Mortgage Association, 6.250%, due 05/15/29 | 1.8% |

| Freddie Mac Pool, 4.500%, due 08/1/52 | 1.8% |

| Fannie Mae Pool, 2.000%, due 06/1/51 | 1.8% |

| Fannie Mae Pool, 5.500%, due 01/1/53 | 1.6% |

| Fannie Mae Pool, 4.500%, due 11/1/52 | 1.6% |

| Freddie Mac Pool, 5.000%, due 01/1/53 | 1.6% |

| Morgan Stanley, 0.864%, due 10/21/25 | 1.6% |

| Freddie Mac Pool, 3.500%, due 06/1/52 | 1.5% |

* Does not include cash/money market funds/equivalents. Based on percentage of net assets. Holdings can change at any time, are subject to risks discussed in the Fund’s prospectus, and should not be considered investment advice.

No material changes occurred during the year ended June 30, 2024.

Eventide Core Bond Fund - Class I (ETIRX )

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://www.eventidefunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Eventide Core Bond Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.eventidefunds.com. You can also request this information by contacting us at 1-877-771-3836.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class N | $78 | 0.78% |

How did the Fund perform during the reporting period?

Performance of the Fund for the year was materially impacted by fluctuations of the yield curve and the performance of corporate bonds relative to treasuries. Corporate bonds outperformed treasuries for the year ended 6/30/24, which had a positive impact on the Fund's returns on an absolute and relative basis. However, this positive effect was offset by higher long-term rates as the yield curve flattened, resulting in slight underperformance of the Fund relative to the benchmark.

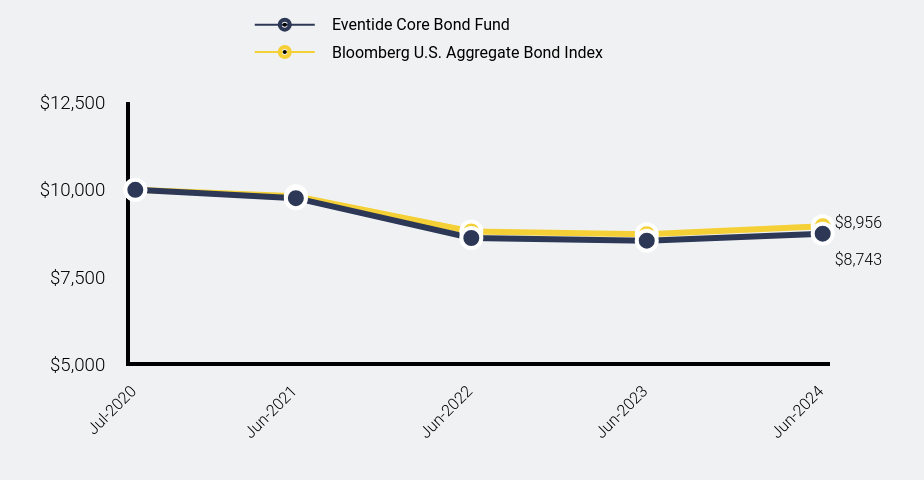

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Eventide Core Bond Fund | Bloomberg U.S. Aggregate Bond Index |

|---|

| Jul-2020 | $10,000 | $10,000 |

| Jun-2021 | $9,761 | $9,820 |

| Jun-2022 | $8,620 | $8,809 |

| Jun-2023 | $8,543 | $8,727 |

| Jun-2024 | $8,743 | $8,956 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. In connection with new SEC Rules on shareholder reporting, the Fund's performance information above is compared with a broad-based benchmark, Bloomberg US Aggregate Index, which represents the overall domestic bond market.

| Net Assets | $137,304,892 |

| Number of Portfolio Holdings | 95 |

| Advisory Fee (net of waivers) | $225,991 |

| Portfolio Turnover | 33% |

Average Annual Total Returns

| 1 Year | Since Inception (July 31, 2020) |

|---|

| Eventide Core Bond Fund - Class N | 2.34% | |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | |

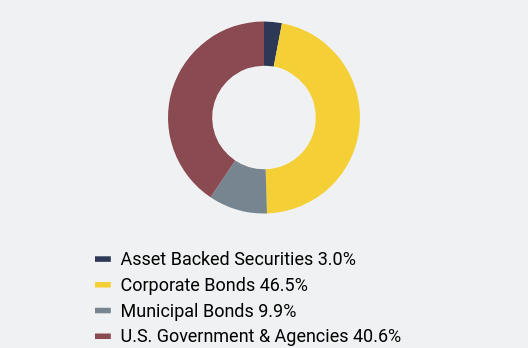

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 2.7% |

| Other Industries | 14.5% |

| Technology Services | 1.5% |

| Retail - Discretionary | 1.7% |

| Auto Loan | 1.7% |

| Software | 2.3% |

| Semiconductors | 2.5% |

| Engineering & Construction | 2.7% |

| Banking | 3.0% |

| Institutional Financial Services | 3.0% |

| Oil & Gas Producers | 3.8% |

| Reit | 4.3% |

| Single-Family Housing | 5.2% |

| Government Owned, No Guarantee | 5.5% |

| Government Sponsored | 7.3% |

| Electric Utilities | 11.7% |

| Agency Fixed Rate | 26.6% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 3.0% |

| Corporate Bonds | 46.5% |

| Municipal Bonds | 9.9% |

| U.S. Government & Agencies | 40.6% |

Top 10 Holdings* (% of net assets)

| Holding Name | % of Net Assets |

| JPMorgan Chase & Company, 6.070%, due 10/22/27 | 1.9% |

| Federal Home Loan Mortgage Corporation, 6.250%, due 07/15/32 | 1.8% |

| Federal National Mortgage Association, 6.250%, due 05/15/29 | 1.8% |

| Freddie Mac Pool, 4.500%, due 08/1/52 | 1.8% |

| Fannie Mae Pool, 2.000%, due 06/1/51 | 1.8% |

| Fannie Mae Pool, 5.500%, due 01/1/53 | 1.6% |

| Fannie Mae Pool, 4.500%, due 11/1/52 | 1.6% |

| Freddie Mac Pool, 5.000%, due 01/1/53 | 1.6% |

| Morgan Stanley, 0.864%, due 10/21/25 | 1.6% |

| Freddie Mac Pool, 3.500%, due 06/1/52 | 1.5% |

* Does not include cash/money market funds/equivalents. Based on percentage of net assets. Holdings can change at any time, are subject to risks discussed in the Fund’s prospectus, and should not be considered investment advice.

No material changes occurred during the year ended June 30, 2024.

Eventide Core Bond Fund - Class N (ETNRX )

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://www.eventidefunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Eventide Dividend Opportunities Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Eventide Dividend Opportunities Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.eventidefunds.com. You can also request this information by contacting us at 1-877-771-3836.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $120 | 1.20% |

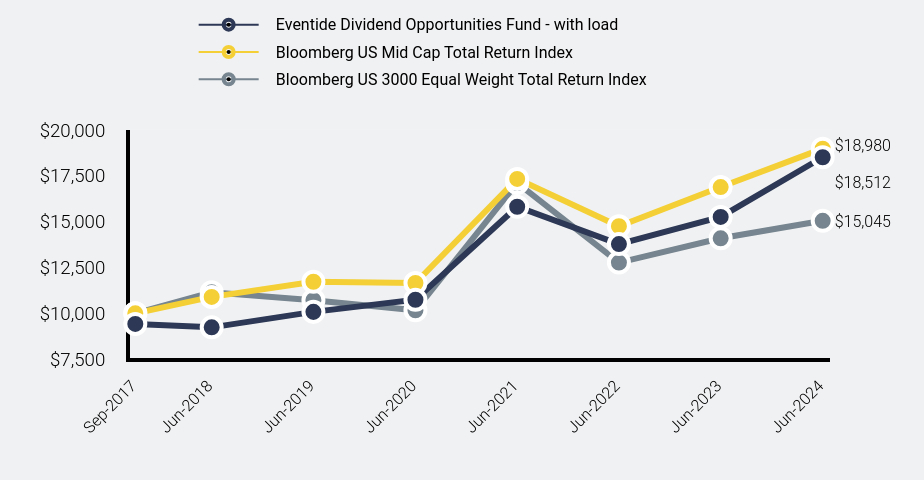

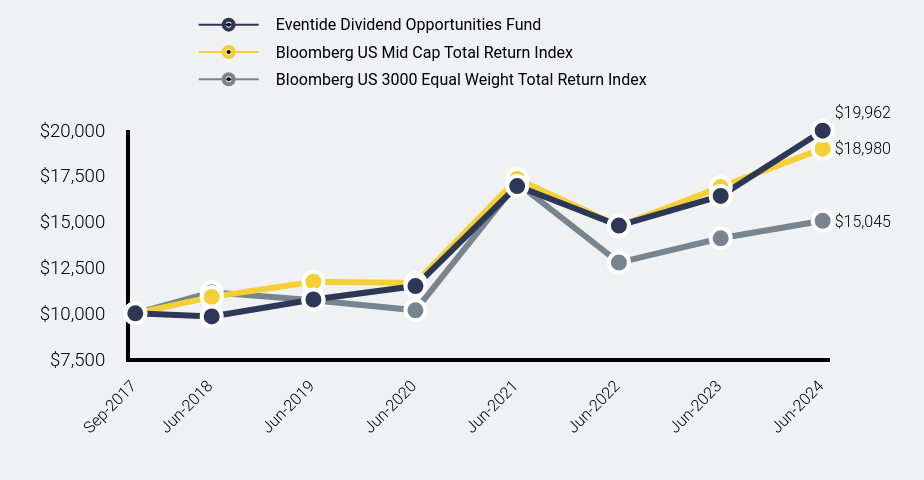

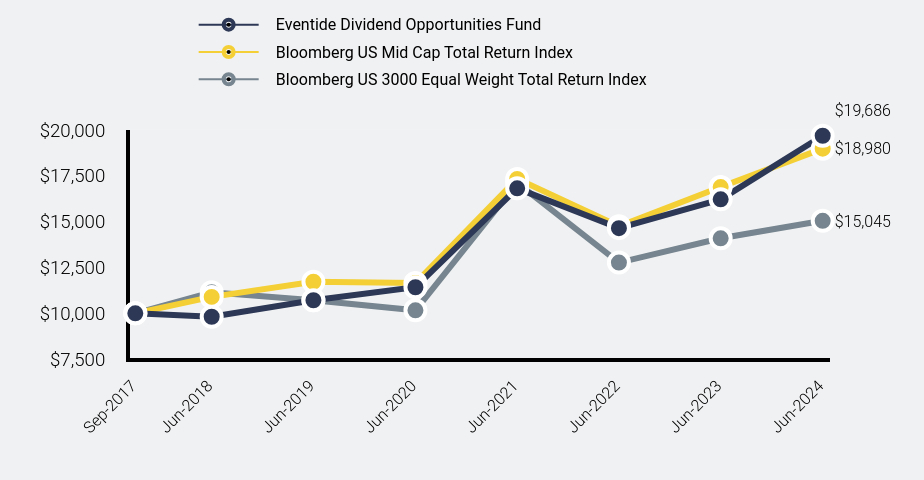

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Eventide Dividend Opportunities Fund - with load | Bloomberg US Mid Cap Total Return Index | Bloomberg US 3000 Equal Weight Total Return Index |

|---|

| Sep-2017 | $9,425 | $10,000 | $10,000 |

| Jun-2018 | $9,236 | $10,897 | $11,146 |

| Jun-2019 | $10,081 | $11,723 | $10,713 |

| Jun-2020 | $10,742 | $11,654 | $10,166 |

| Jun-2021 | $15,814 | $17,332 | $17,109 |

| Jun-2022 | $13,778 | $14,753 | $12,770 |

| Jun-2023 | $15,256 | $16,886 | $14,093 |

| Jun-2024 | $18,512 | $18,980 | $15,045 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. In connection with new SEC Rules on shareholder reporting, the Fund's performance information above is compared with a broad-based benchmark, Bloomberg US 3000 Equal Weight Total Return Index, which represents the overall domestic equity market. In addition, the strategy benchmark, Bloomberg US Mid Cap Total Return Index, is included as the adviser believes it is more representative of the fund's investment universe.

How did the Fund perform during the reporting period?

The Fund outperformed its benchmark for the year ended 6/30/2024. The Fund outperformed in many sectors (IT, Industrials, Energy, Utilities) and underperformed in Consumer Discretionary and Financials. We continue to add high-quality companies in growth areas (technology, AI, electrification, infrastructure). Emphasizing attractive valuations, dividend growth, and strong business fundamentals, we believe we are well-positioned for volatility or a pivot to lower interest rates, as investors seek dividends. The Fund may lag during rallies led by lower-quality or cyclical sectors. Our experience bolsters our confidence that high-quality, dividend-growth companies serving customers and stakeholders well also serve shareholders well. We are committed to resilient growth, strong financials, value creation, and human flourishing.

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (September 29, 2017) |

|---|

| Eventide Dividend Opportunities Fund - Class A |

| Without Load | 21.35% | 12.92% | 10.52% |

| With Load | 14.40% | 11.60% | 9.55% |

| Bloomberg US Mid Cap Total Return Index | 12.40% | 10.12% | 9.96% |

| Bloomberg US 3000 Equal Weight Total Return Index | 6.75% | 7.03% | 6.24% |

- Net Assets$863,913,670

- Number of Portfolio Holdings49

- Advisory Fee (net of waivers)$4,876,704

- Portfolio Turnover38%

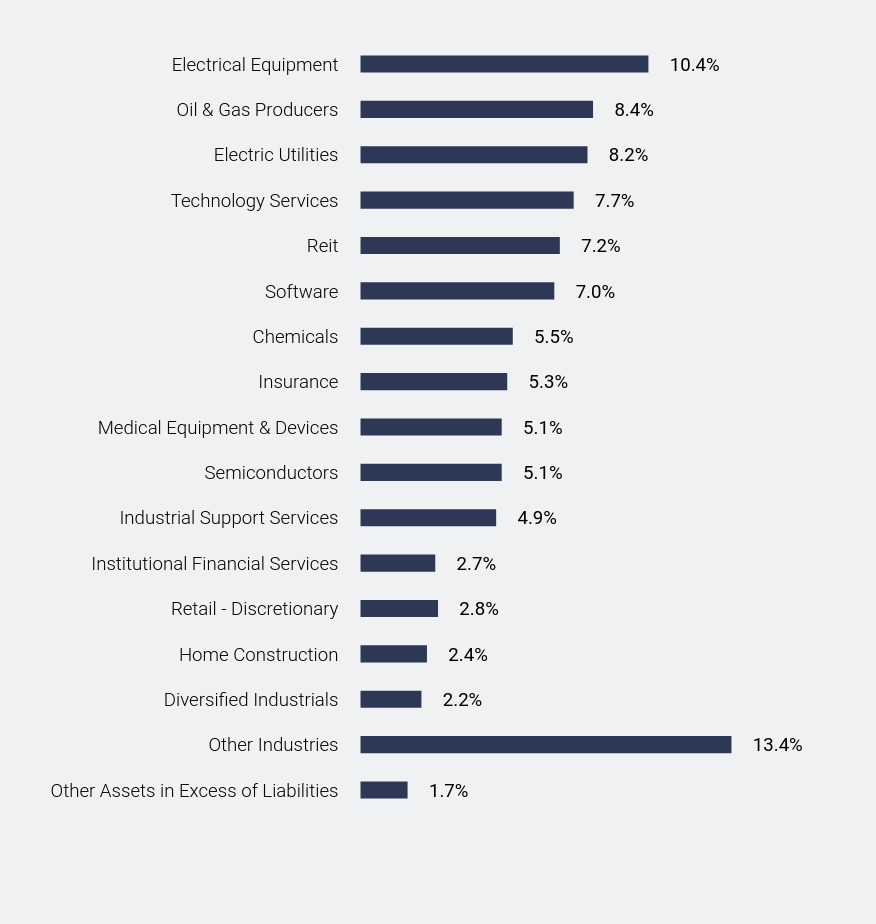

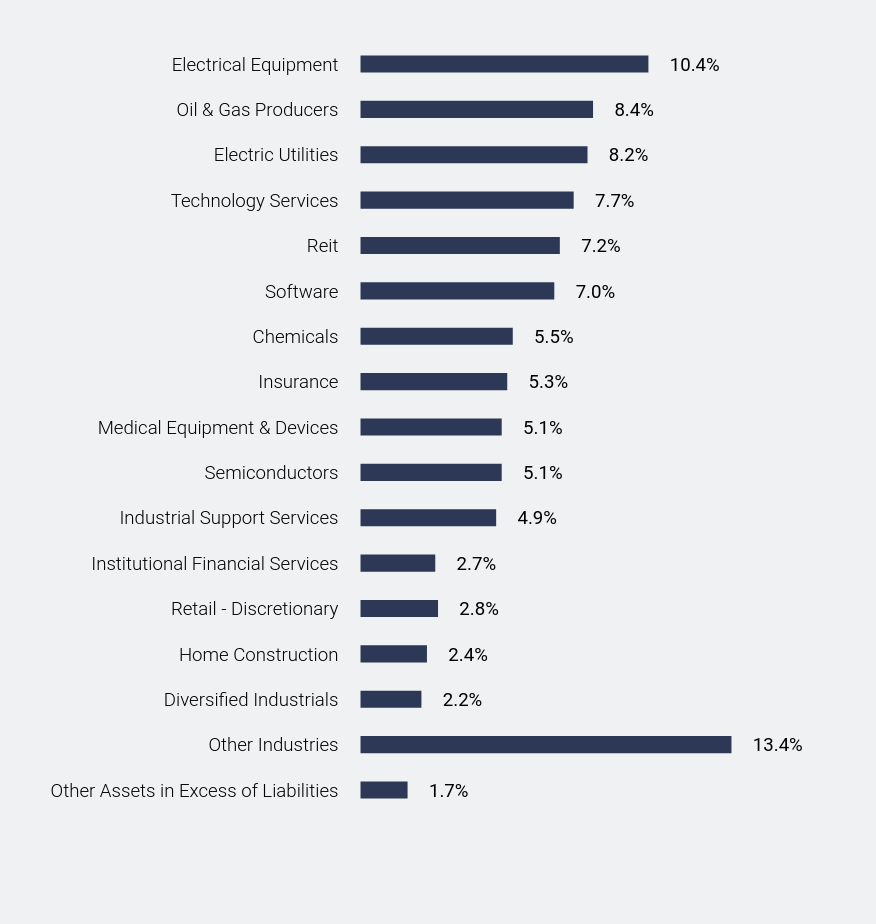

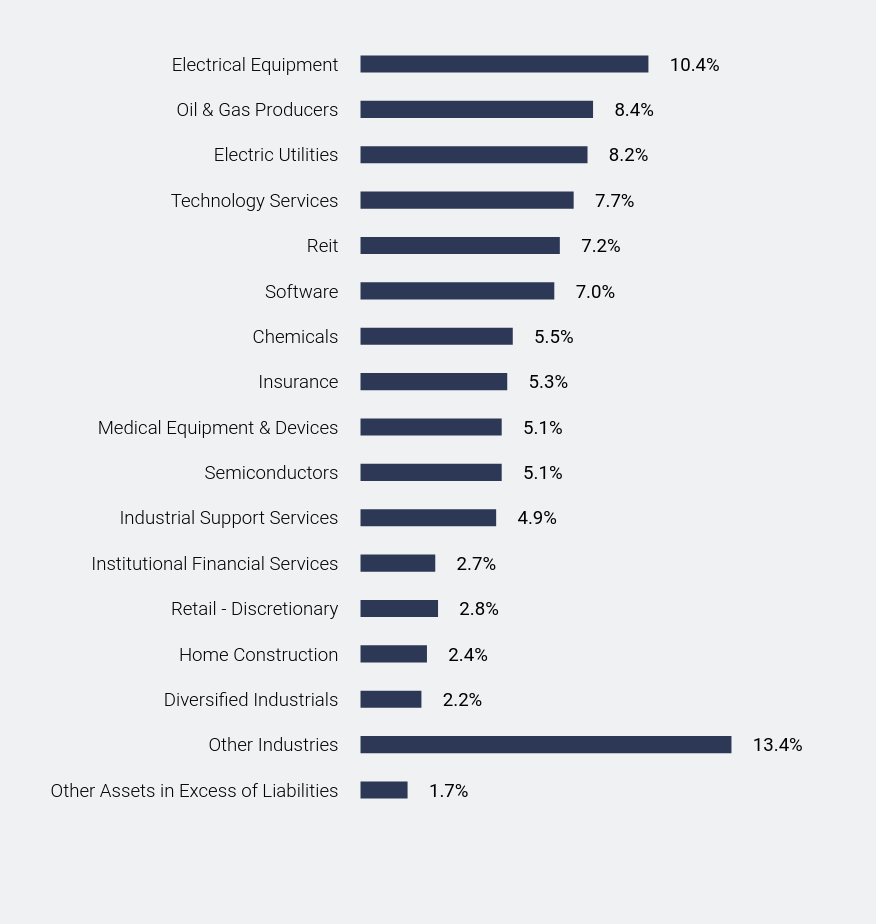

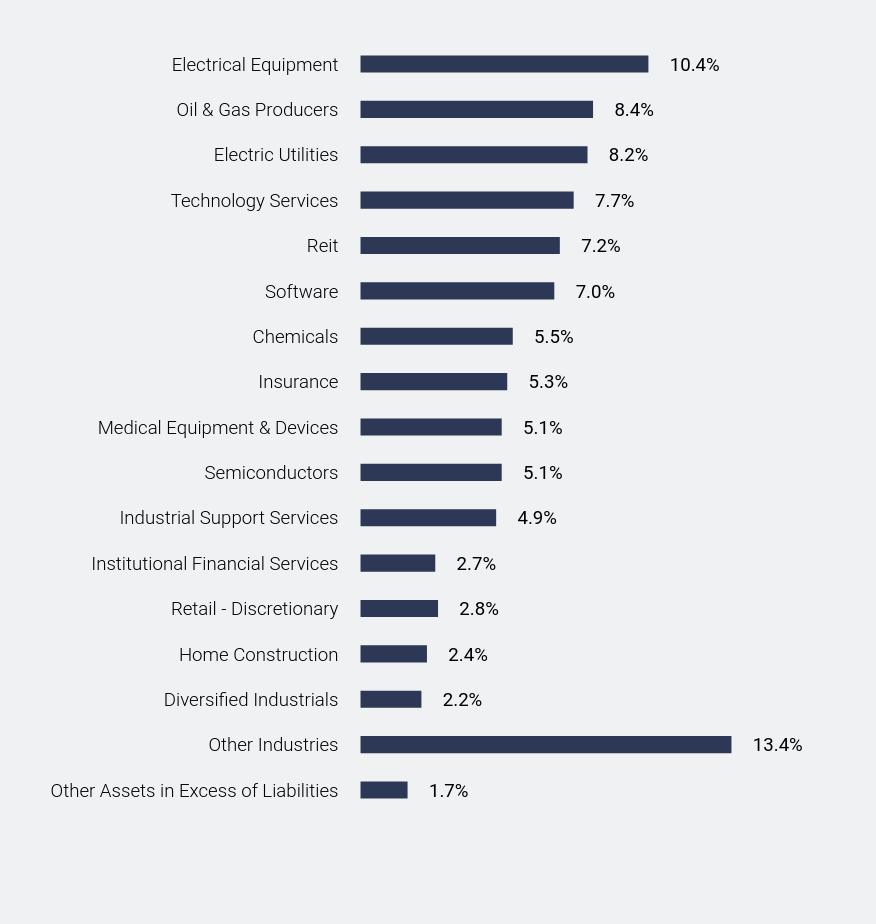

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.7% |

| Other Industries | 13.4% |

| Diversified Industrials | 2.2% |

| Home Construction | 2.4% |

| Retail - Discretionary | 2.8% |

| Institutional Financial Services | 2.7% |

| Industrial Support Services | 4.9% |

| Semiconductors | 5.1% |

| Medical Equipment & Devices | 5.1% |

| Insurance | 5.3% |

| Chemicals | 5.5% |

| Software | 7.0% |

| Reit | 7.2% |

| Technology Services | 7.7% |

| Electric Utilities | 8.2% |

| Oil & Gas Producers | 8.4% |

| Electrical Equipment | 10.4% |

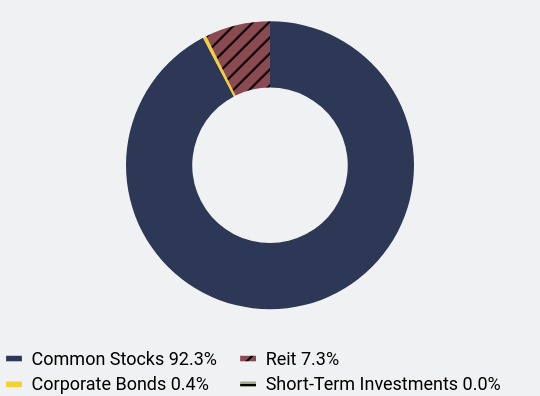

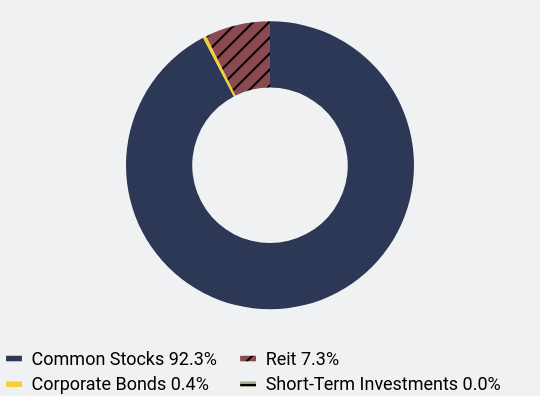

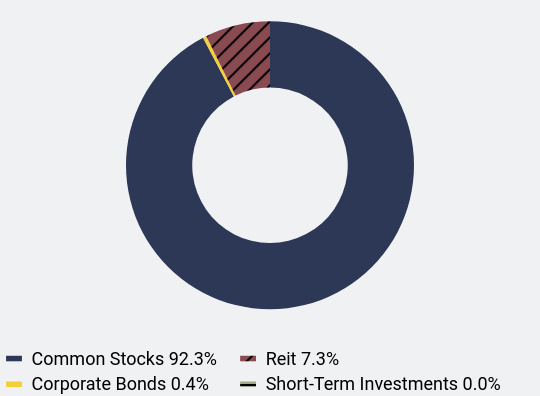

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 92.3% |

| Corporate Bonds | 0.4% |

| Reit | 7.3% |

| Short-Term Investments | 0.0% |

Top 10 Holdings* (% of net assets)

| Holding Name | % of Net Assets |

| Trane Technologies PLC | 5.4% |

| nVent Electric PLC | 5.1% |

| Arthur J Gallagher & Company | 4.5% |

| Roper Technologies, Inc. | 4.4% |

| CDW Corporation | 4.1% |

| KLA Corporation | 4.0% |

| Targa Resources Corporation | 3.5% |

| Ferguson PLC | 3.4% |

| Williams Companies, Inc. (The) | 3.2% |

| STERIS plc | 2.8% |

* Does not include cash/money market funds/equivalents. Based on percentage of net assets. Holdings can change at any time, are subject to risks discussed in the Fund’s prospectus, and should not be considered investment advice.

No material changes occurred during the year ended June 30, 2024.

Eventide Dividend Opportunities Fund - Class A (ETADX )

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://www.eventidefunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Eventide Dividend Opportunities Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Eventide Dividend Opportunities Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.eventidefunds.com. You can also request this information by contacting us at 1-877-771-3836.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $195 | 1.95% |

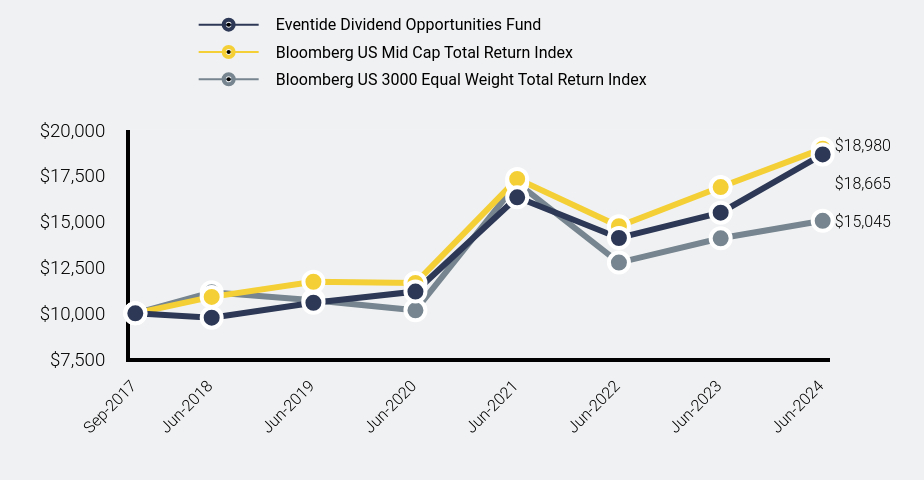

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Eventide Dividend Opportunities Fund | Bloomberg US Mid Cap Total Return Index | Bloomberg US 3000 Equal Weight Total Return Index |

|---|

| Sep-2017 | $10,000 | $10,000 | $10,000 |

| Jun-2018 | $9,763 | $10,897 | $11,146 |

| Jun-2019 | $10,577 | $11,723 | $10,713 |

| Jun-2020 | $11,188 | $11,654 | $10,166 |

| Jun-2021 | $16,326 | $17,332 | $17,109 |

| Jun-2022 | $14,110 | $14,753 | $12,770 |

| Jun-2023 | $15,490 | $16,886 | $14,093 |

| Jun-2024 | $18,665 | $18,980 | $15,045 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. In connection with new SEC Rules on shareholder reporting, the Fund's performance information above is compared with a broad-based benchmark, Bloomberg US 3000 Equal Weight Total Return Index, which represents the overall domestic equity market. In addition, the strategy benchmark, Bloomberg US Mid Cap Total Return Index, is included as the adviser believes it is more representative of the fund's investment universe.

How did the Fund perform during the reporting period?

The Fund outperformed its benchmark for the year ended 6/30/2024. The Fund outperformed in many sectors (IT, Industrials, Energy, Utilities) and underperformed in Consumer Discretionary and Financials. We continue to add high-quality companies in growth areas (technology, AI, electrification, infrastructure). Emphasizing attractive valuations, dividend growth, and strong business fundamentals, we believe we are well-positioned for volatility or a pivot to lower interest rates, as investors seek dividends. The Fund may lag during rallies led by lower-quality or cyclical sectors. Our experience bolsters our confidence that high-quality, dividend-growth companies serving customers and stakeholders well also serve shareholders well. We are committed to resilient growth, strong financials, value creation, and human flourishing.

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (September 29, 2017) |

|---|

| Eventide Dividend Opportunities Fund - Class C | 20.50% | 12.03% | 9.69% |

| Bloomberg US Mid Cap Total Return Index | 12.40% | 10.12% | 9.96% |

| Bloomberg US 3000 Equal Weight Total Return Index | 6.75% | 7.03% | 6.24% |

- Net Assets$863,913,670

- Number of Portfolio Holdings49

- Advisory Fee (net of waivers)$4,876,704

- Portfolio Turnover38%

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.7% |

| Other Industries | 13.4% |

| Diversified Industrials | 2.2% |

| Home Construction | 2.4% |

| Retail - Discretionary | 2.8% |

| Institutional Financial Services | 2.7% |

| Industrial Support Services | 4.9% |

| Semiconductors | 5.1% |

| Medical Equipment & Devices | 5.1% |

| Insurance | 5.3% |

| Chemicals | 5.5% |

| Software | 7.0% |

| Reit | 7.2% |

| Technology Services | 7.7% |

| Electric Utilities | 8.2% |

| Oil & Gas Producers | 8.4% |

| Electrical Equipment | 10.4% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 92.3% |

| Corporate Bonds | 0.4% |

| Reit | 7.3% |

| Short-Term Investments | 0.0% |

Top 10 Holdings* (% of net assets)

| Holding Name | % of Net Assets |

| Trane Technologies PLC | 5.4% |

| nVent Electric PLC | 5.1% |

| Arthur J Gallagher & Company | 4.5% |

| Roper Technologies, Inc. | 4.4% |

| CDW Corporation | 4.1% |

| KLA Corporation | 4.0% |

| Targa Resources Corporation | 3.5% |

| Ferguson PLC | 3.4% |

| Williams Companies, Inc. (The) | 3.2% |

| STERIS plc | 2.8% |

* Does not include cash/money market funds/equivalents. Based on percentage of net assets. Holdings can change at any time, are subject to risks discussed in the Fund’s prospectus, and should not be considered investment advice.

No material changes occurred during the year ended June 30, 2024.

Eventide Dividend Opportunities Fund - Class C (ETCDX )

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://www.eventidefunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Eventide Dividend Opportunities Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Eventide Dividend Opportunities Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.eventidefunds.com. You can also request this information by contacting us at 1-877-771-3836.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $95 | 0.95% |

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Eventide Dividend Opportunities Fund | Bloomberg US Mid Cap Total Return Index | Bloomberg US 3000 Equal Weight Total Return Index |

|---|

| Sep-2017 | $10,000 | $10,000 | $10,000 |

| Jun-2018 | $9,832 | $10,897 | $11,146 |

| Jun-2019 | $10,756 | $11,723 | $10,713 |

| Jun-2020 | $11,487 | $11,654 | $10,166 |

| Jun-2021 | $16,942 | $17,332 | $17,109 |

| Jun-2022 | $14,787 | $14,753 | $12,770 |

| Jun-2023 | $16,404 | $16,886 | $14,093 |

| Jun-2024 | $19,962 | $18,980 | $15,045 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. In connection with new SEC Rules on shareholder reporting, the Fund's performance information above is compared with a broad-based benchmark, Bloomberg US 3000 Equal Weight Total Return Index, which represents the overall domestic equity market. In addition, the strategy benchmark, Bloomberg US Mid Cap Total Return Index, is included as the adviser believes it is more representative of the fund's investment universe.

How did the Fund perform during the reporting period?

The Fund outperformed its benchmark for the year ended 6/30/2024. The Fund outperformed in many sectors (IT, Industrials, Energy, Utilities) and underperformed in Consumer Discretionary and Financials. We continue to add high-quality companies in growth areas (technology, AI, electrification, infrastructure). Emphasizing attractive valuations, dividend growth, and strong business fundamentals, we believe we are well-positioned for volatility or a pivot to lower interest rates, as investors seek dividends. The Fund may lag during rallies led by lower-quality or cyclical sectors. Our experience bolsters our confidence that high-quality, dividend-growth companies serving customers and stakeholders well also serve shareholders well. We are committed to resilient growth, strong financials, value creation, and human flourishing.

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (September 29, 2017) |

|---|

| Eventide Dividend Opportunities Fund - Class I | 21.70% | 13.16% | 10.78% |

| Bloomberg US Mid Cap Total Return Index | 12.40% | 10.12% | 9.96% |

| Bloomberg US 3000 Equal Weight Total Return Index | 6.75% | 7.03% | 6.24% |

- Net Assets$863,913,670

- Number of Portfolio Holdings49

- Advisory Fee (net of waivers)$4,876,704

- Portfolio Turnover38%

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.7% |

| Other Industries | 13.4% |

| Diversified Industrials | 2.2% |

| Home Construction | 2.4% |

| Retail - Discretionary | 2.8% |

| Institutional Financial Services | 2.7% |

| Industrial Support Services | 4.9% |

| Semiconductors | 5.1% |

| Medical Equipment & Devices | 5.1% |

| Insurance | 5.3% |

| Chemicals | 5.5% |

| Software | 7.0% |

| Reit | 7.2% |

| Technology Services | 7.7% |

| Electric Utilities | 8.2% |

| Oil & Gas Producers | 8.4% |

| Electrical Equipment | 10.4% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 92.3% |

| Corporate Bonds | 0.4% |

| Reit | 7.3% |

| Short-Term Investments | 0.0% |

Top 10 Holdings* (% of net assets)

| Holding Name | % of Net Assets |

| Trane Technologies PLC | 5.4% |

| nVent Electric PLC | 5.1% |

| Arthur J Gallagher & Company | 4.5% |

| Roper Technologies, Inc. | 4.4% |

| CDW Corporation | 4.1% |

| KLA Corporation | 4.0% |

| Targa Resources Corporation | 3.5% |

| Ferguson PLC | 3.4% |

| Williams Companies, Inc. (The) | 3.2% |

| STERIS plc | 2.8% |

* Does not include cash/money market funds/equivalents. Based on percentage of net assets. Holdings can change at any time, are subject to risks discussed in the Fund’s prospectus, and should not be considered investment advice.

No material changes occurred during the year ended June 30, 2024.

Eventide Dividend Opportunities Fund - Class I (ETIDX )

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://www.eventidefunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Eventide Dividend Opportunities Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Eventide Dividend Opportunities Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.eventidefunds.com. You can also request this information by contacting us at 1-877-771-3836.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class N | $115 | 1.15% |

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Eventide Dividend Opportunities Fund | Bloomberg US Mid Cap Total Return Index | Bloomberg US 3000 Equal Weight Total Return Index |

|---|

| Sep-2017 | $10,000 | $10,000 | $10,000 |

| Jun-2018 | $9,813 | $10,897 | $11,146 |

| Jun-2019 | $10,716 | $11,723 | $10,713 |

| Jun-2020 | $11,424 | $11,654 | $10,166 |

| Jun-2021 | $16,817 | $17,332 | $17,109 |

| Jun-2022 | $14,647 | $14,753 | $12,770 |

| Jun-2023 | $16,216 | $16,886 | $14,093 |

| Jun-2024 | $19,686 | $18,980 | $15,045 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. In connection with new SEC Rules on shareholder reporting, the Fund's performance information above is compared with a broad-based benchmark, Bloomberg US 3000 Equal Weight Total Return Index, which represents the overall domestic equity market. In addition, the strategy benchmark, Bloomberg US Mid Cap Total Return Index, is included as the adviser believes it is more representative of the fund's investment universe.

How did the Fund perform during the reporting period?

The Fund outperformed its benchmark for the year ended 6/30/2024. The Fund outperformed in many sectors (IT, Industrials, Energy, Utilities) and underperformed in Consumer Discretionary and Financials. We continue to add high-quality companies in growth areas (technology, AI, electrification, infrastructure). Emphasizing attractive valuations, dividend growth, and strong business fundamentals, we believe we are well-positioned for volatility or a pivot to lower interest rates, as investors seek dividends. The Fund may lag during rallies led by lower-quality or cyclical sectors. Our experience bolsters our confidence that high-quality, dividend-growth companies serving customers and stakeholders well also serve shareholders well. We are committed to resilient growth, strong financials, value creation, and human flourishing.

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (September 29, 2017) |

|---|

| Eventide Dividend Opportunities Fund - Class N | 21.40% | 12.93% | 10.55% |

| Bloomberg US Mid Cap Total Return Index | 12.40% | 10.12% | 9.96% |

| Bloomberg US 3000 Equal Weight Total Return Index | 6.75% | 7.03% | 6.24% |

- Net Assets$863,913,670

- Number of Portfolio Holdings49

- Advisory Fee (net of waivers)$4,876,704

- Portfolio Turnover38%

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.7% |

| Other Industries | 13.4% |

| Diversified Industrials | 2.2% |

| Home Construction | 2.4% |

| Retail - Discretionary | 2.8% |

| Institutional Financial Services | 2.7% |

| Industrial Support Services | 4.9% |

| Semiconductors | 5.1% |

| Medical Equipment & Devices | 5.1% |

| Insurance | 5.3% |

| Chemicals | 5.5% |

| Software | 7.0% |

| Reit | 7.2% |

| Technology Services | 7.7% |

| Electric Utilities | 8.2% |

| Oil & Gas Producers | 8.4% |

| Electrical Equipment | 10.4% |

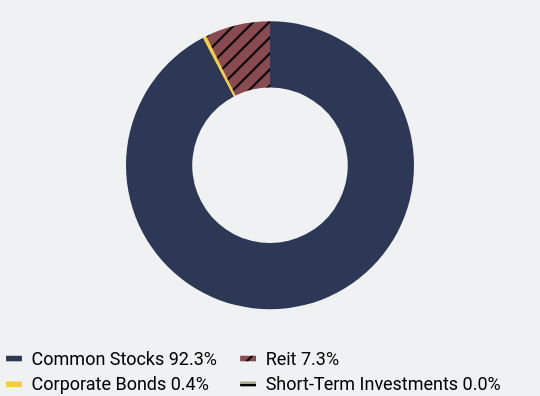

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 92.3% |

| Corporate Bonds | 0.4% |

| Reit | 7.3% |

| Short-Term Investments | 0.0% |

Top 10 Holdings* (% of net assets)

| Holding Name | % of Net Assets |

| Trane Technologies PLC | 5.4% |

| nVent Electric PLC | 5.1% |

| Arthur J Gallagher & Company | 4.5% |

| Roper Technologies, Inc. | 4.4% |

| CDW Corporation | 4.1% |

| KLA Corporation | 4.0% |

| Targa Resources Corporation | 3.5% |

| Ferguson PLC | 3.4% |

| Williams Companies, Inc. (The) | 3.2% |

| STERIS plc | 2.8% |

* Does not include cash/money market funds/equivalents. Based on percentage of net assets. Holdings can change at any time, are subject to risks discussed in the Fund’s prospectus, and should not be considered investment advice.

No material changes occurred during the year ended June 30, 2024.

Eventide Dividend Opportunities Fund - Class N (ETNDX )

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://www.eventidefunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Eventide Exponential Technologies Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Eventide Exponential Technologies Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.eventidefunds.com. You can also request this information by contacting us at 1-877-771-3836.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $168 | 1.68% |

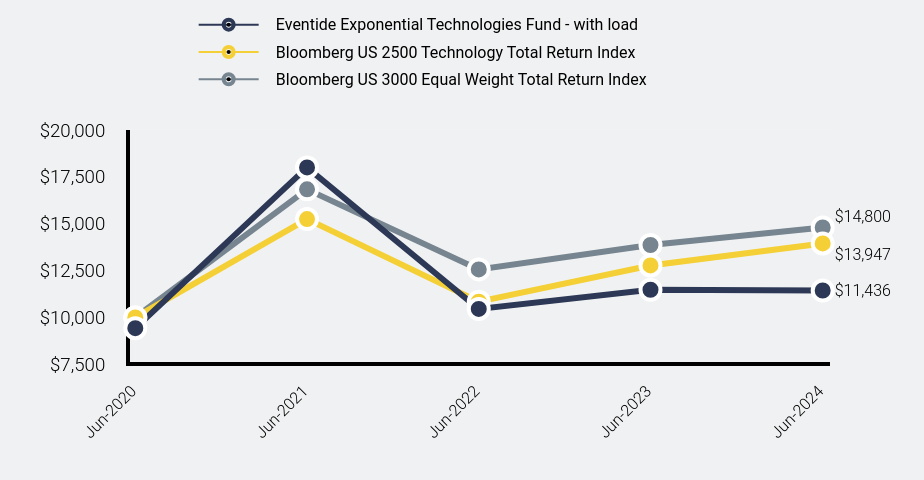

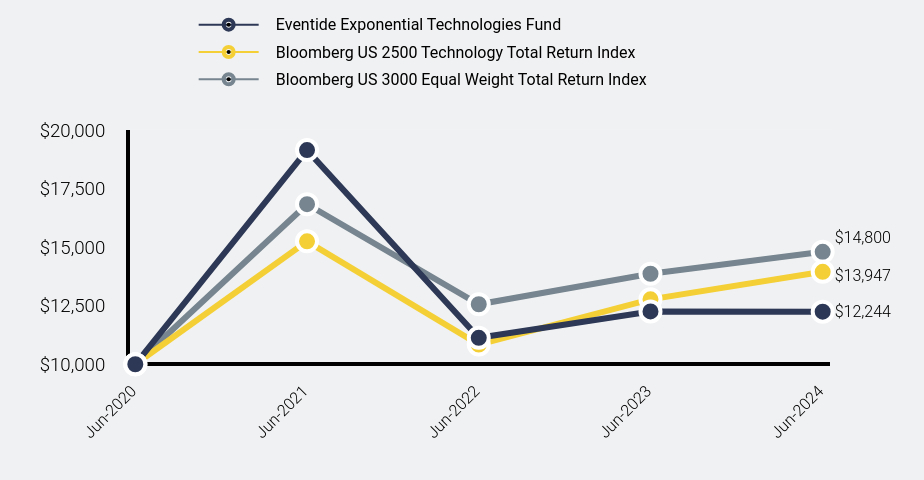

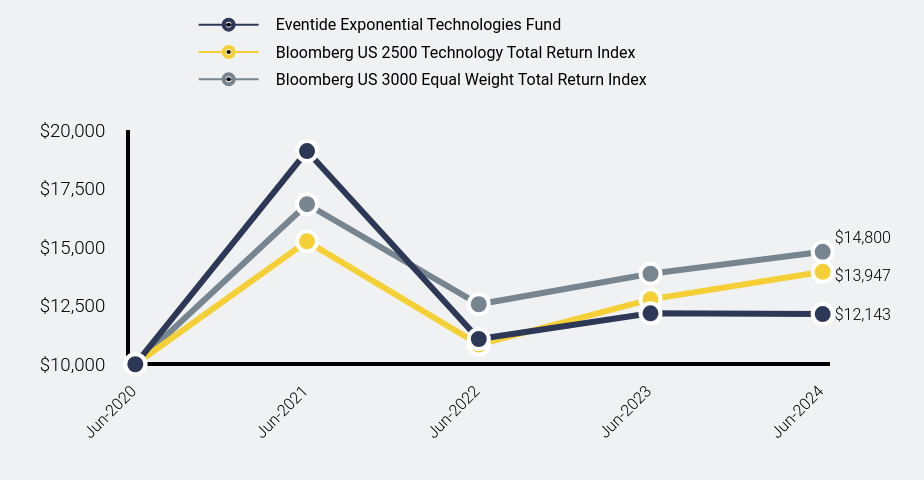

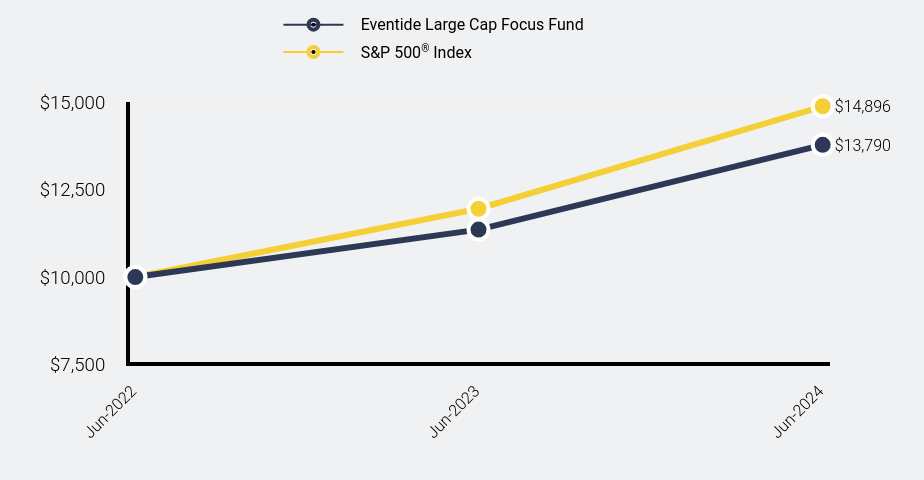

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Eventide Exponential Technologies Fund - with load | Bloomberg US 2500 Technology Total Return Index | Bloomberg US 3000 Equal Weight Total Return Index |

|---|

| Jun-2020 | $9,425 | $10,000 | $10,000 |

| Jun-2021 | $18,002 | $15,247 | $16,831 |

| Jun-2022 | $10,451 | $10,839 | $12,562 |

| Jun-2023 | $11,474 | $12,771 | $13,864 |

| Jun-2024 | $11,436 | $13,947 | $14,800 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. In connection with new SEC Rules on shareholder reporting, the Fund's performance information above is compared with a broad-based benchmark, Bloomberg US 3000 Equal Weight Total Return Index, which represents the overall domestic equity market. In addition, the strategy benchmark, Bloomberg US 2500 Technology Total Return Index, is included as the adviser believes it is more representative of the fund's investment universe.

How did the Fund perform during the reporting period?

The fiscal year began with the widest market dispersion between large and small companies in 20 years. This fissure provided opportunities to assert a contrarian position aligned with our vision for long-term success. At year’s end, the Fund – focusing on the long-term growth potential of small and mid-cap companies driven by innovative, high-performing cultures and strategic, high-integrity leadership – struggled against the overperforming large and mega-caps. We remain convinced the laggards harbor substantial potential, though they have in the short term negatively affected performance. Our fundamental analysis reveals companies we believe are unfairly overlooked, a dynamic that can present investment opportunities at attractive prices. We are confident in the Fund’s portfolio companies and look forward to the market realizing their potential.

Average Annual Total Returns

| 1 Year | Since Inception (June 30, 2020) |

|---|

| Eventide Exponential Technologies Fund - Class A |

| Without Load | | 4.95% |

| With Load | | 3.41% |

| Bloomberg US 2500 Technology Total Return Index | 9.21% | 8.67% |

| Bloomberg US 3000 Equal Weight Total Return Index | 6.75% | 10.30% |

| Net Assets | $115,486,506 |

| Number of Portfolio Holdings | 34 |

| Advisory Fee (net of waivers) | $1,245,618 |

| Portfolio Turnover | 70% |

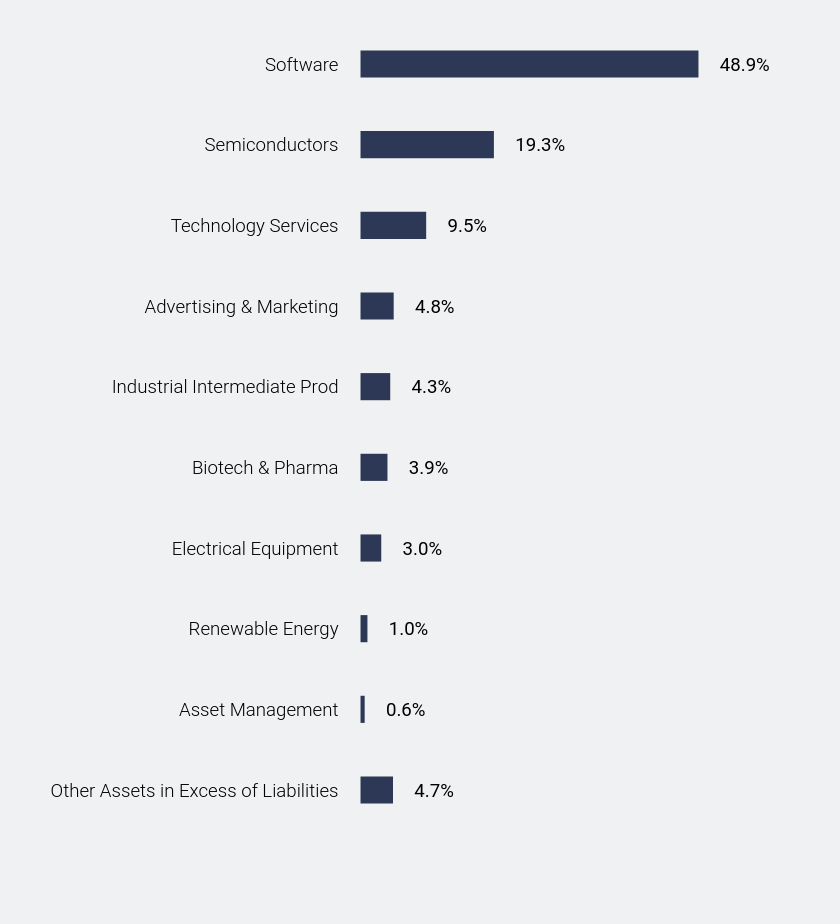

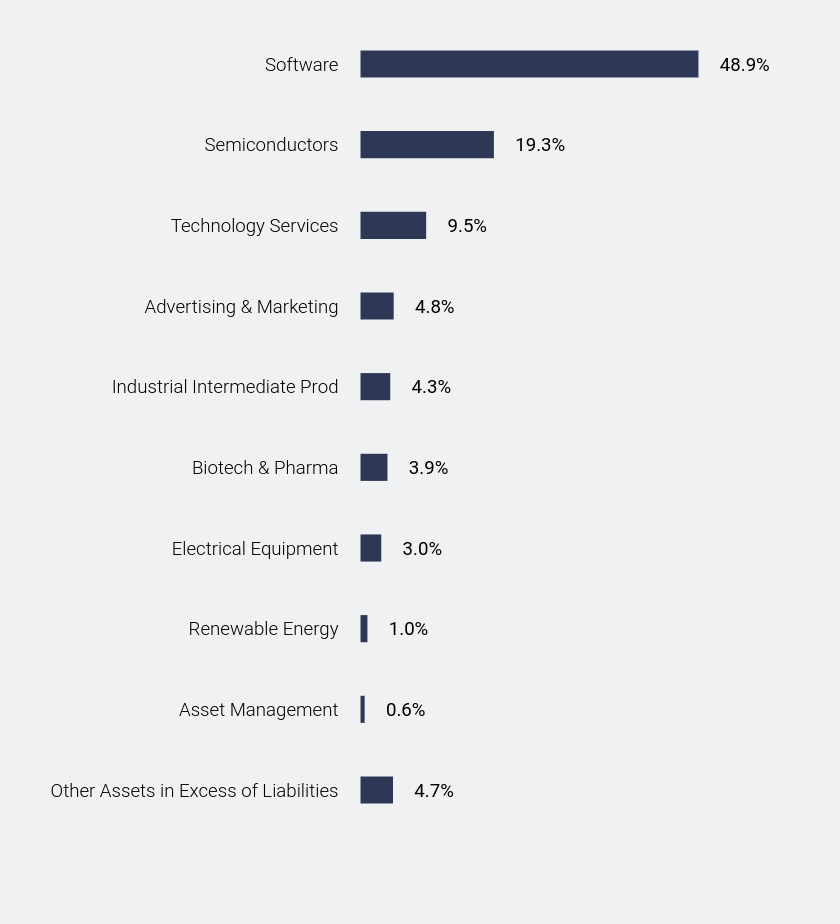

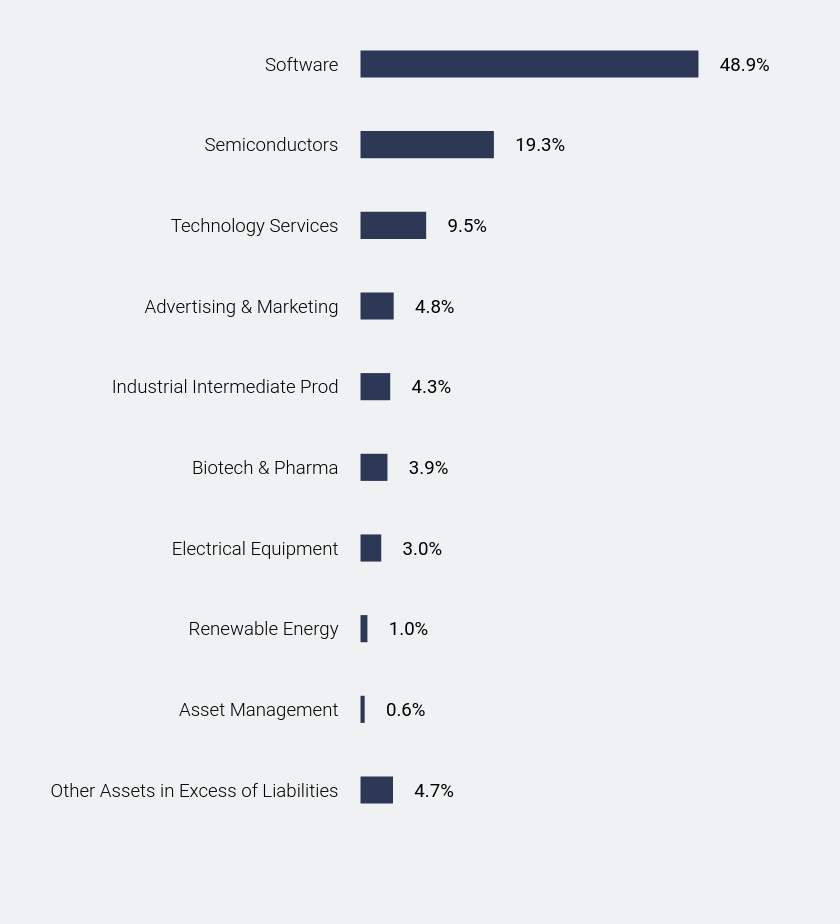

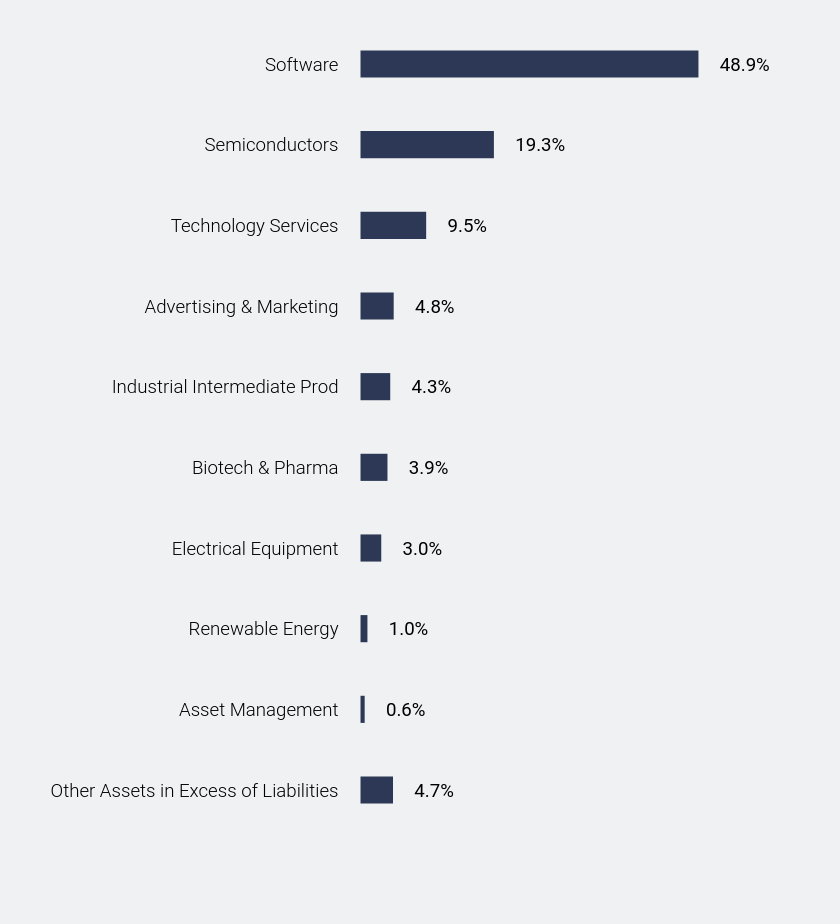

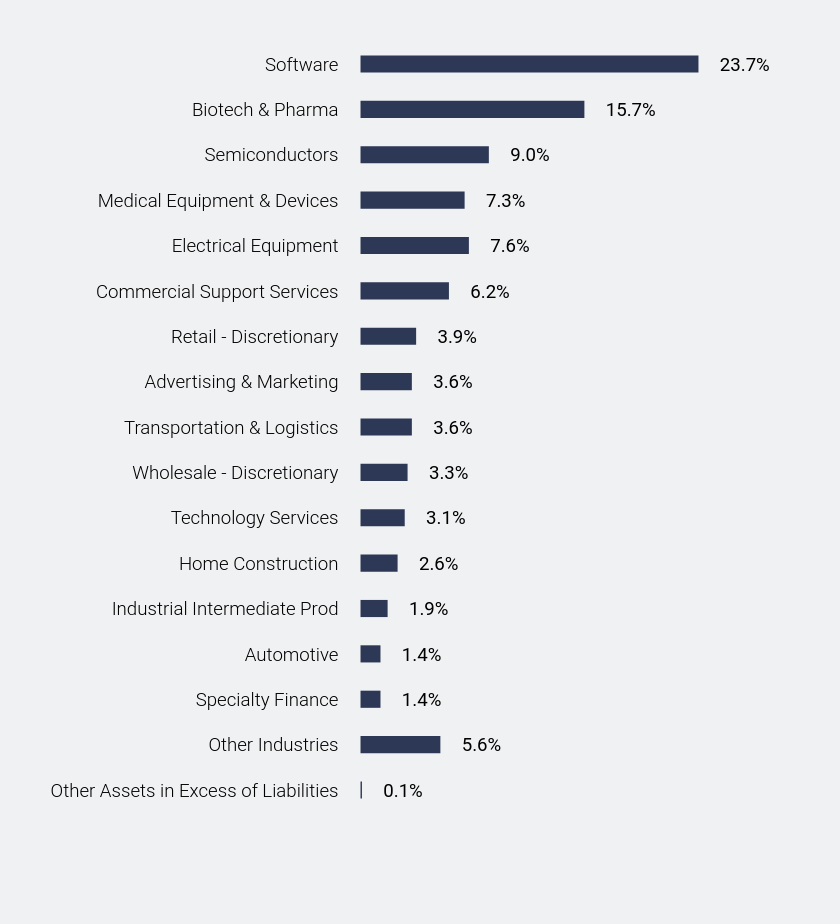

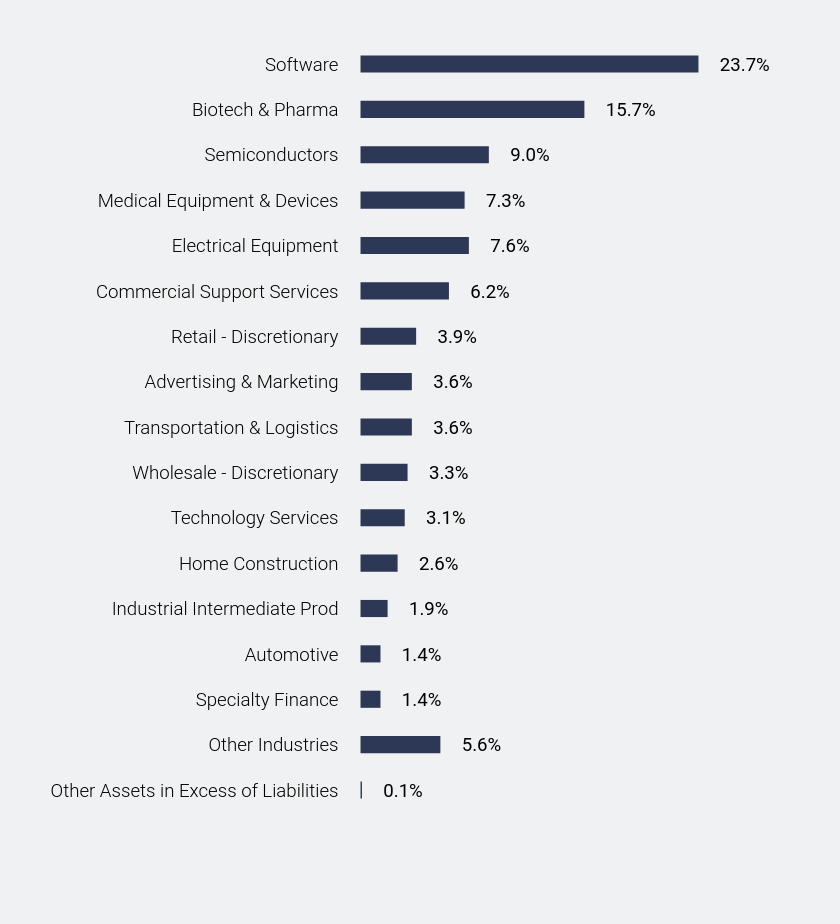

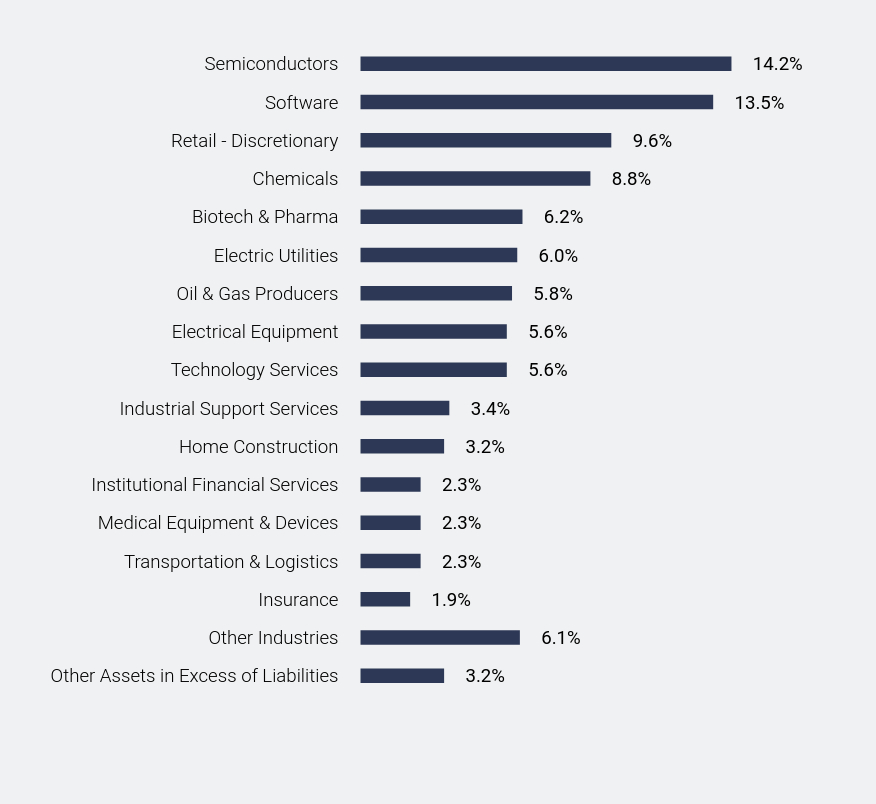

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 4.7% |

| Asset Management | 0.6% |

| Renewable Energy | 1.0% |

| Electrical Equipment | 3.0% |

| Biotech & Pharma | 3.9% |

| Industrial Intermediate Prod | 4.3% |

| Advertising & Marketing | 4.8% |

| Technology Services | 9.5% |

| Semiconductors | 19.3% |

| Software | 48.9% |

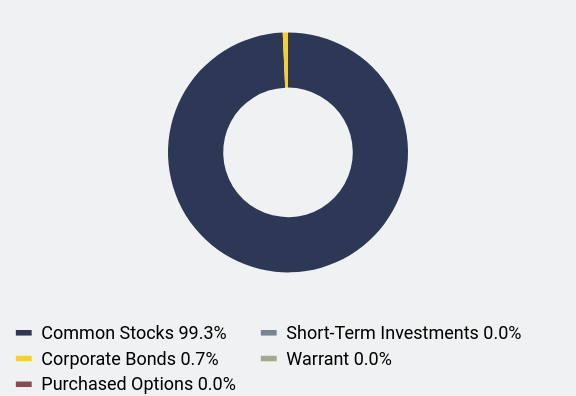

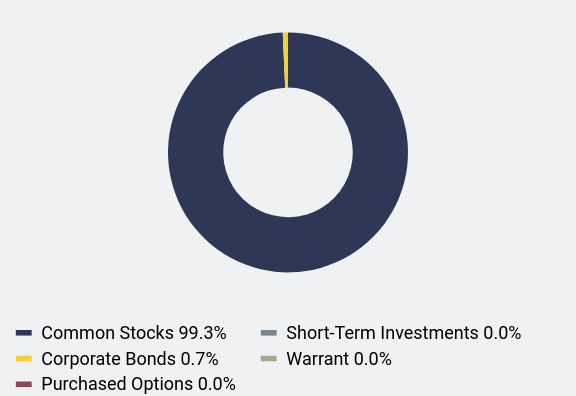

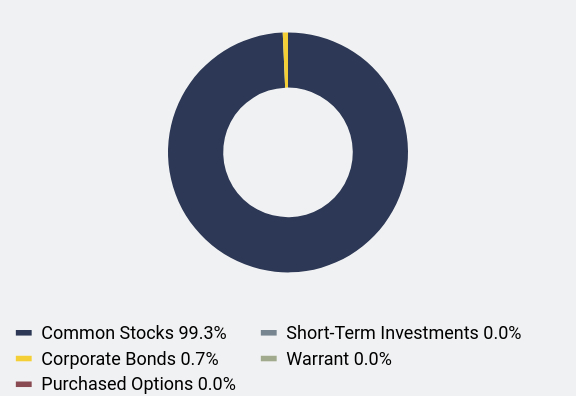

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 99.3% |

| Corporate Bonds | 0.7% |

| Purchased Options | 0.0% |

| Short-Term Investments | 0.0% |

| Warrant | 0.0% |

Top 10 Holdings* (% of net assets)

| Holding Name | % of Net Assets |

| Monday.com Ltd. | 5.6% |

| Datadog, Inc. - Class A | 5.4% |

| Monolithic Power Systems, Inc. | 5.3% |

| Synopsys, Inc. | 5.1% |

| Constellation Software, Inc. | 4.8% |

| Trade Desk, Inc. (The) - Class A | 4.8% |

| Lam Research Corporation | 4.7% |

| Xometry, Inc. | 4.3% |

| KLA Corporation | 4.0% |

| TransMedics Group, Inc. | 3.9% |

* Does not include cash/money market funds/equivalents. Based on percentage of net assets. Holdings can change at any time, are subject to risks discussed in the Fund’s prospectus, and should not be considered investment advice.

No material changes occurred during the year ended June 30, 2024.

Eventide Exponential Technologies Fund - Class A (ETAEX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://www.eventidefunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Eventide Exponential Technologies Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Eventide Exponential Technologies Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.eventidefunds.com. You can also request this information by contacting us at 1-877-771-3836.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $243 | 2.43% |

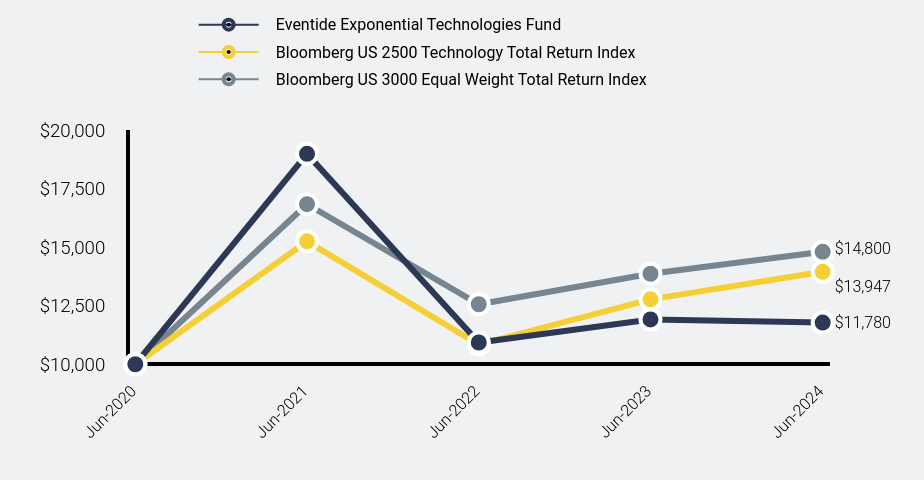

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Eventide Exponential Technologies Fund | Bloomberg US 2500 Technology Total Return Index | Bloomberg US 3000 Equal Weight Total Return Index |

|---|

| Jun-2020 | $10,000 | $10,000 | $10,000 |

| Jun-2021 | $18,980 | $15,247 | $16,831 |

| Jun-2022 | $10,928 | $10,839 | $12,562 |

| Jun-2023 | $11,912 | $12,771 | $13,864 |

| Jun-2024 | $11,780 | $13,947 | $14,800 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. In connection with new SEC Rules on shareholder reporting, the Fund's performance information above is compared with a broad-based benchmark, Bloomberg US 3000 Equal Weight Total Return Index, which represents the overall domestic equity market. In addition, the strategy benchmark, Bloomberg US 2500 Technology Total Return Index, is included as the adviser believes it is more representative of the fund's investment universe.

How did the Fund perform during the reporting period?

The fiscal year began with the widest market dispersion between large and small companies in 20 years. This fissure provided opportunities to assert a contrarian position aligned with our vision for long-term success. At year’s end, the Fund – focusing on the long-term growth potential of small and mid-cap companies driven by innovative, high-performing cultures and strategic, high-integrity leadership – struggled against the overperforming large and mega-caps. We remain convinced the laggards harbor substantial potential, though they have in the short term negatively affected performance. Our fundamental analysis reveals companies we believe are unfairly overlooked, a dynamic that can present investment opportunities at attractive prices. We are confident in the Fund’s portfolio companies and look forward to the market realizing their potential.

Average Annual Total Returns

| 1 Year | Since Inception (June 30, 2020) |

|---|

| Eventide Exponential Technologies Fund - Class C | | 4.18% |

| Bloomberg US 2500 Technology Total Return Index | 9.21% | 8.67% |

| Bloomberg US 3000 Equal Weight Total Return Index | 6.75% | 10.30% |

| Net Assets | $115,486,506 |

| Number of Portfolio Holdings | 34 |

| Advisory Fee (net of waivers) | $1,245,618 |

| Portfolio Turnover | 70% |

What did the Fund invest in?

Industry Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 4.7% |

| Asset Management | 0.6% |

| Renewable Energy | 1.0% |

| Electrical Equipment | 3.0% |

| Biotech & Pharma | 3.9% |

| Industrial Intermediate Prod | 4.3% |

| Advertising & Marketing | 4.8% |

| Technology Services | 9.5% |

| Semiconductors | 19.3% |

| Software | 48.9% |

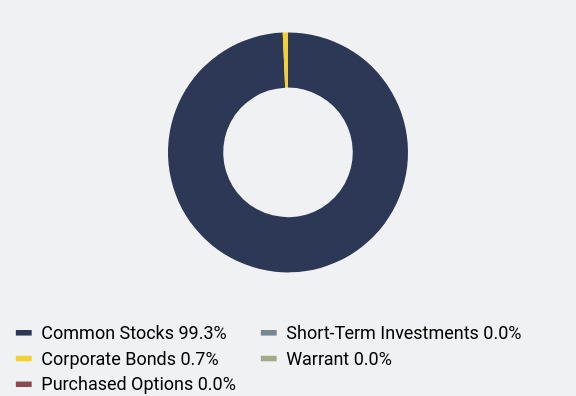

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 99.3% |

| Corporate Bonds | 0.7% |

| Purchased Options | 0.0% |

| Short-Term Investments | 0.0% |

| Warrant | 0.0% |

Top 10 Holdings* (% of net assets)

| Holding Name | % of Net Assets |

| Monday.com Ltd. | 5.6% |

| Datadog, Inc. - Class A | 5.4% |

| Monolithic Power Systems, Inc. | 5.3% |

| Synopsys, Inc. | 5.1% |

| Constellation Software, Inc. | 4.8% |

| Trade Desk, Inc. (The) - Class A | 4.8% |

| Lam Research Corporation | 4.7% |

| Xometry, Inc. | 4.3% |

| KLA Corporation | 4.0% |

| TransMedics Group, Inc. | 3.9% |

* Does not include cash/money market funds/equivalents. Based on percentage of net assets. Holdings can change at any time, are subject to risks discussed in the Fund’s prospectus, and should not be considered investment advice.

No material changes occurred during the year ended June 30, 2024.

Eventide Exponential Technologies Fund - Class C (ETCEX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://www.eventidefunds.com ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Eventide Exponential Technologies Fund

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Eventide Exponential Technologies Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.eventidefunds.com. You can also request this information by contacting us at 1-877-771-3836.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $143 | 1.43% |

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Eventide Exponential Technologies Fund | Bloomberg US 2500 Technology Total Return Index | Bloomberg US 3000 Equal Weight Total Return Index |

|---|

| Jun-2020 | $10,000 | $10,000 | $10,000 |

| Jun-2021 | $19,140 | $15,247 | $16,831 |

| Jun-2022 | $11,128 | $10,839 | $12,562 |

| Jun-2023 | $12,254 | $12,771 | $13,864 |

| Jun-2024 | $12,244 | $13,947 | $14,800 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. In connection with new SEC Rules on shareholder reporting, the Fund's performance information above is compared with a broad-based benchmark, Bloomberg US 3000 Equal Weight Total Return Index, which represents the overall domestic equity market. In addition, the strategy benchmark, Bloomberg US 2500 Technology Total Return Index, is included as the adviser believes it is more representative of the fund's investment universe.

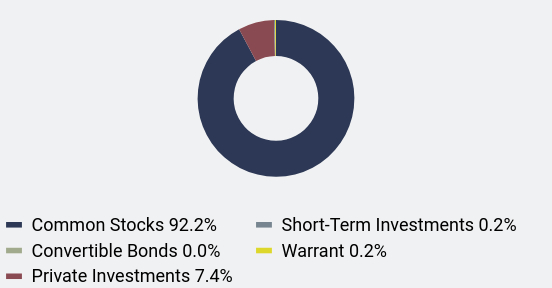

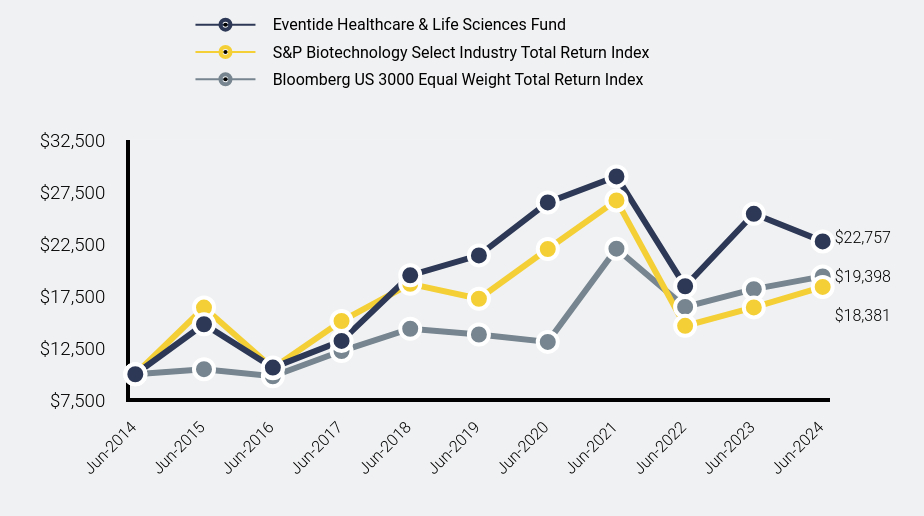

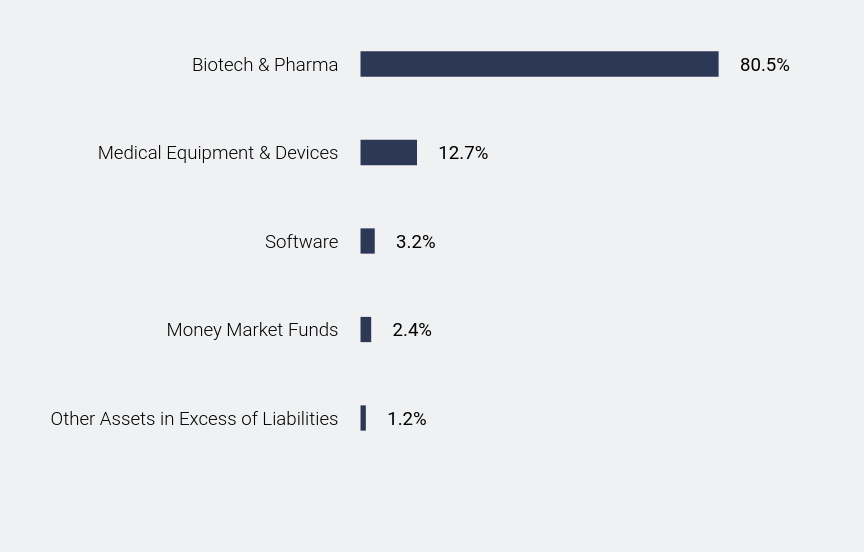

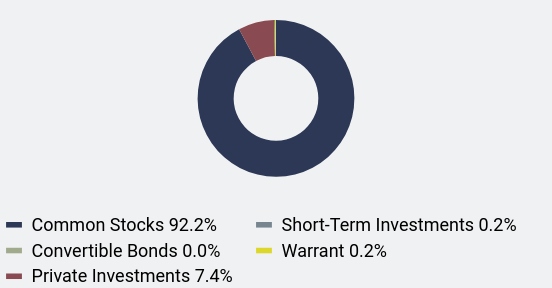

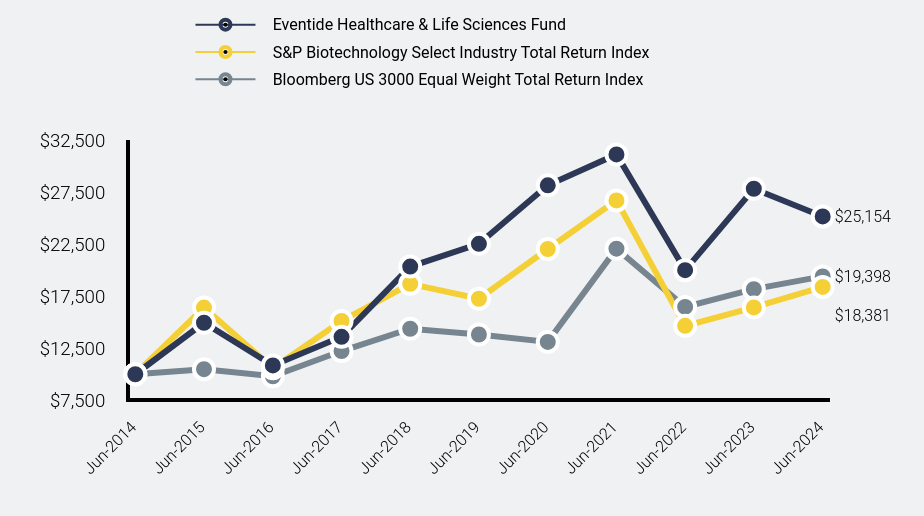

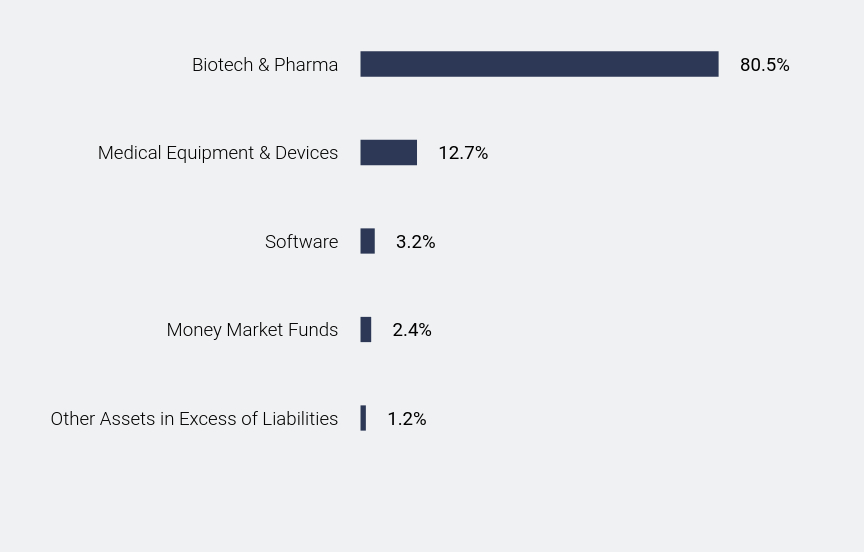

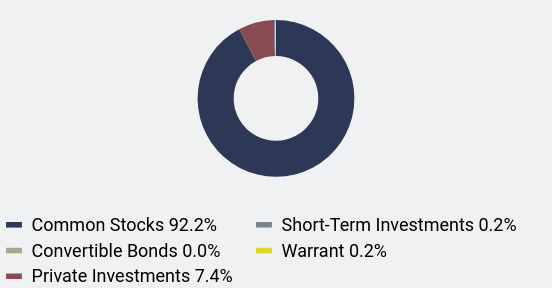

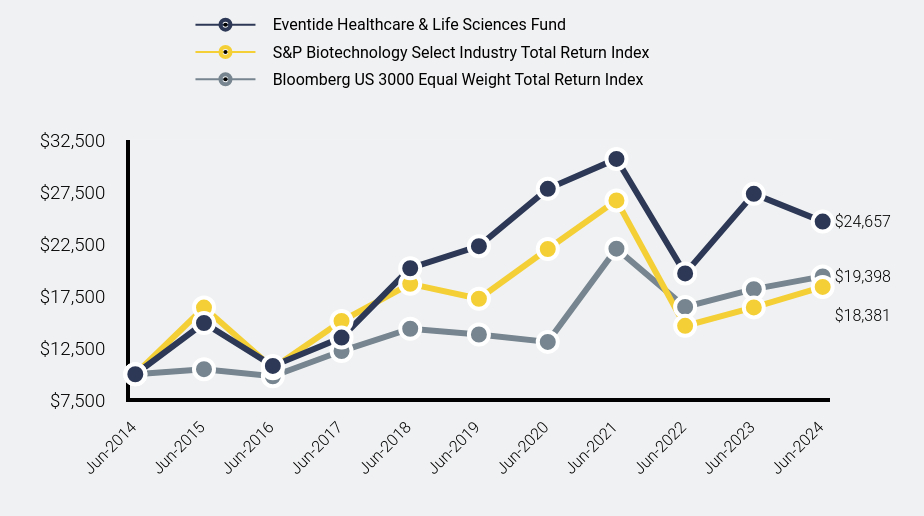

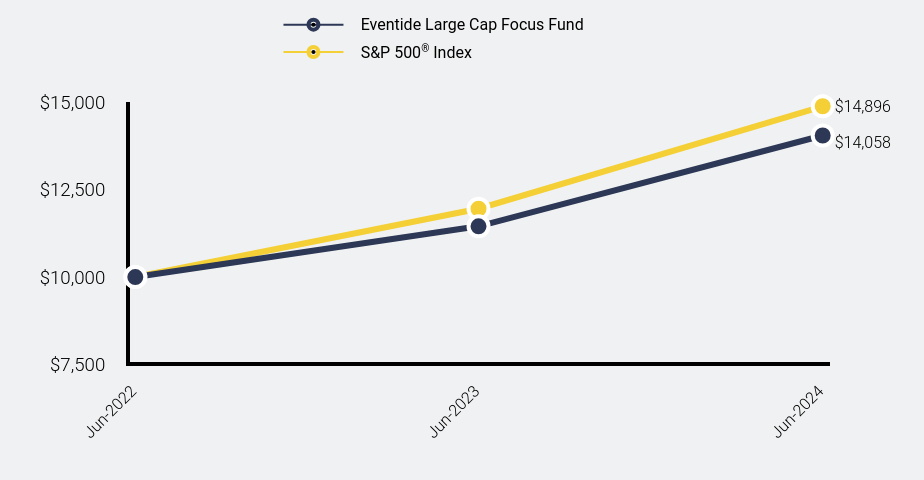

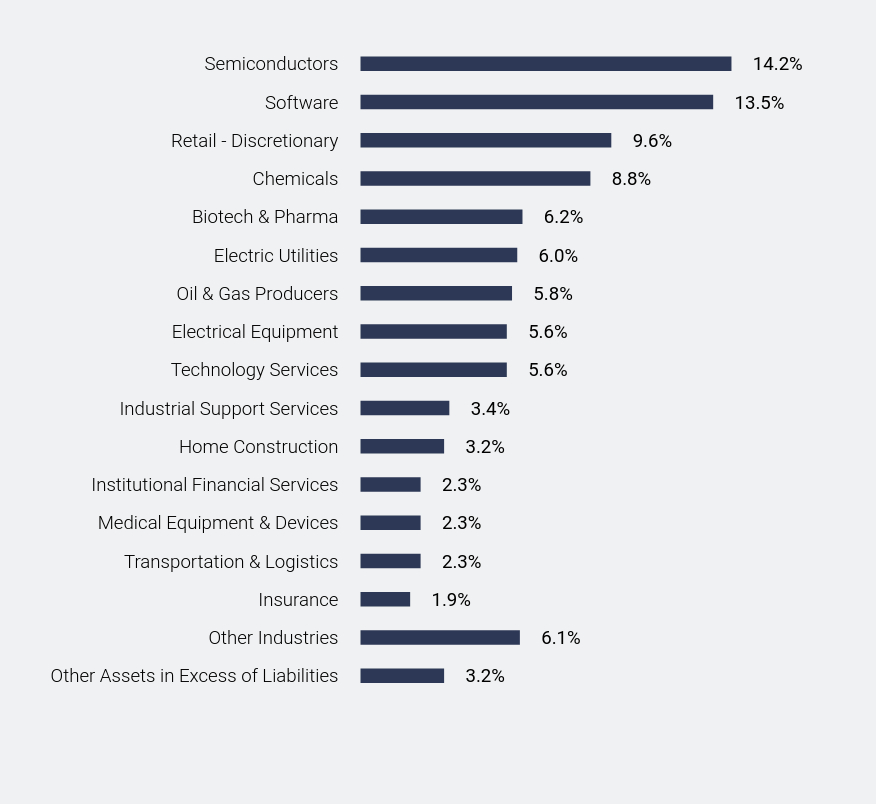

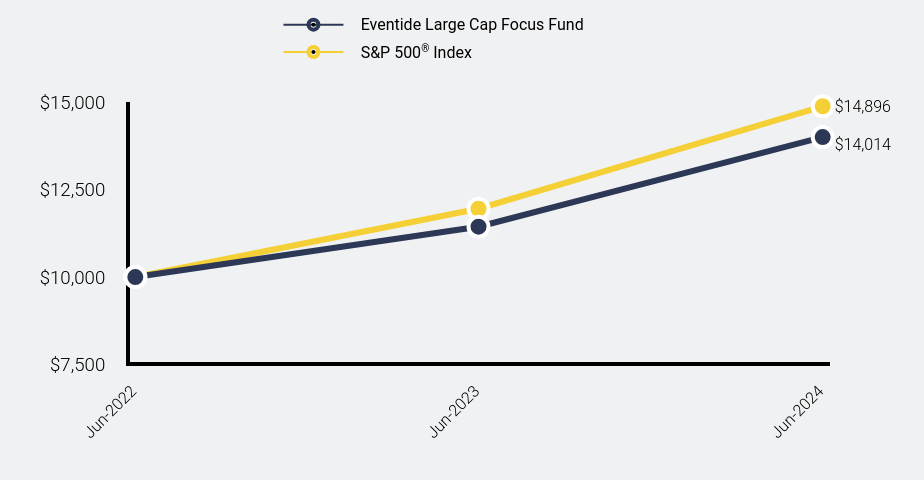

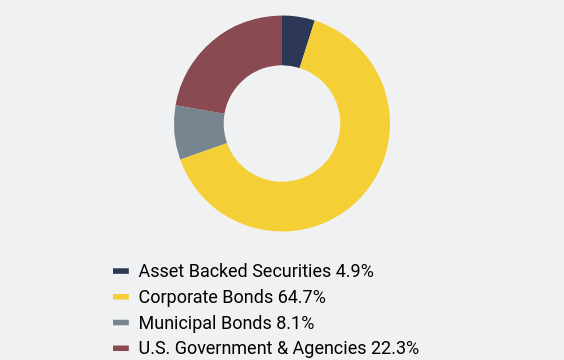

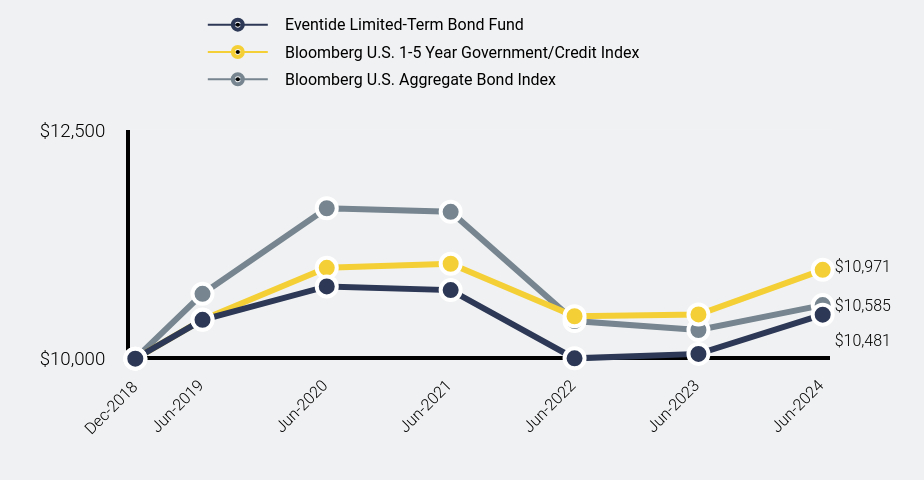

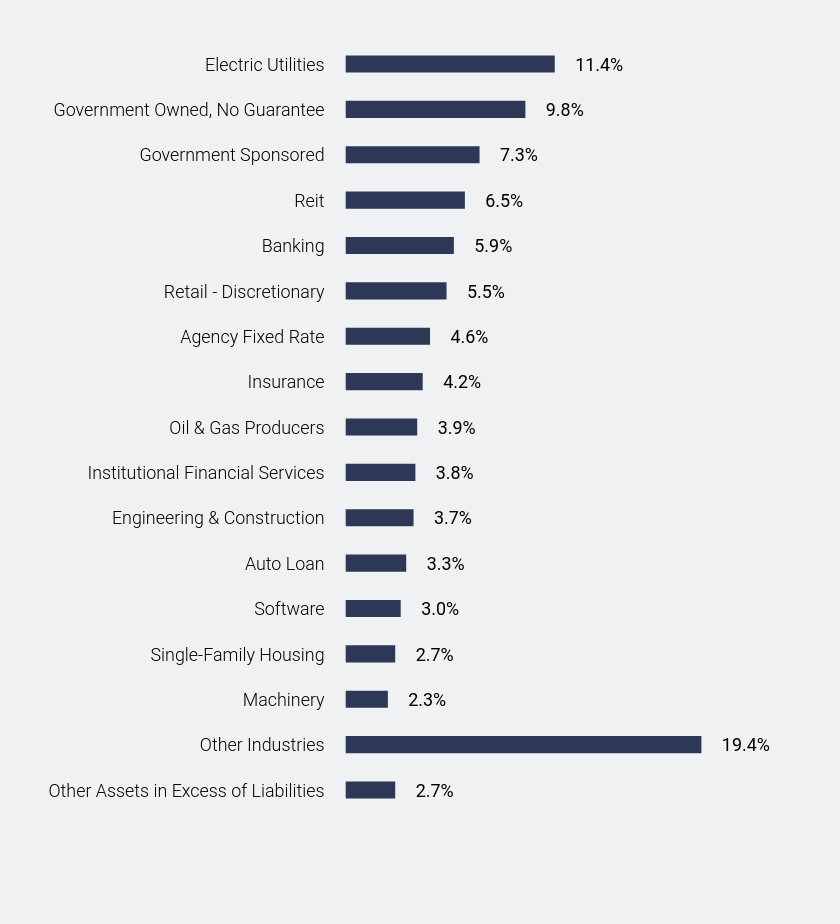

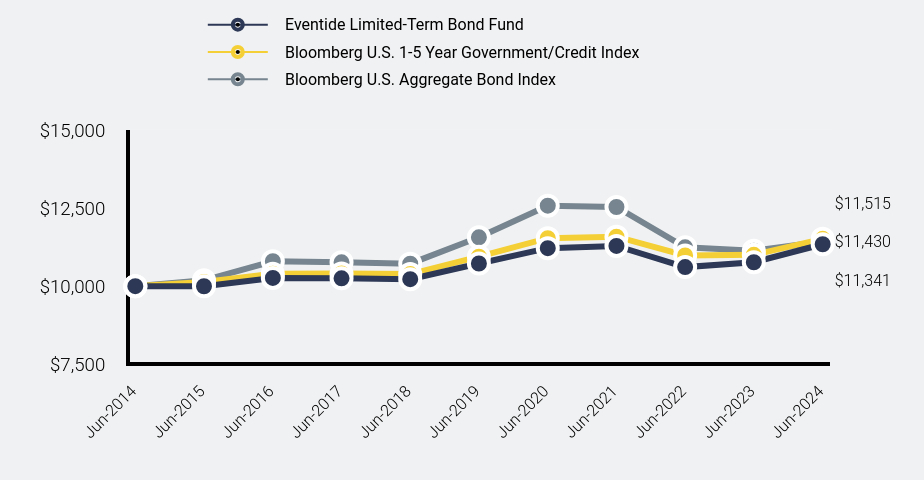

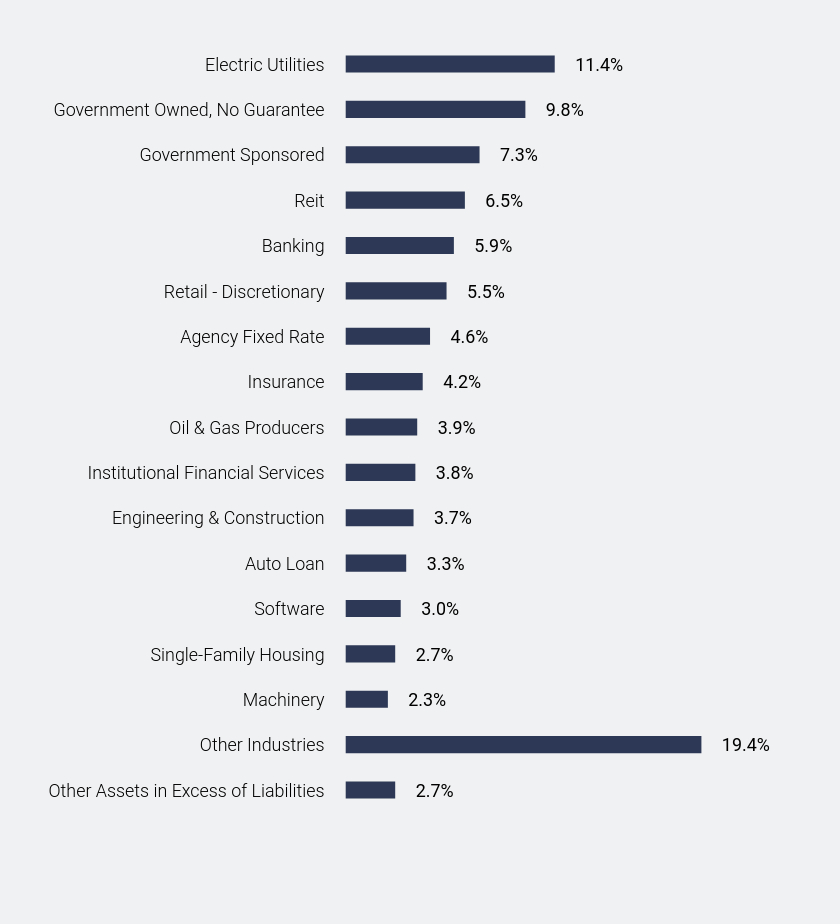

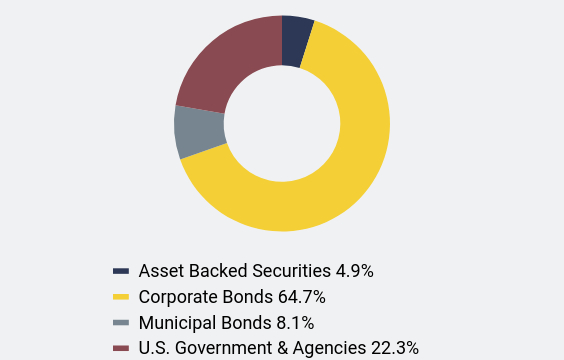

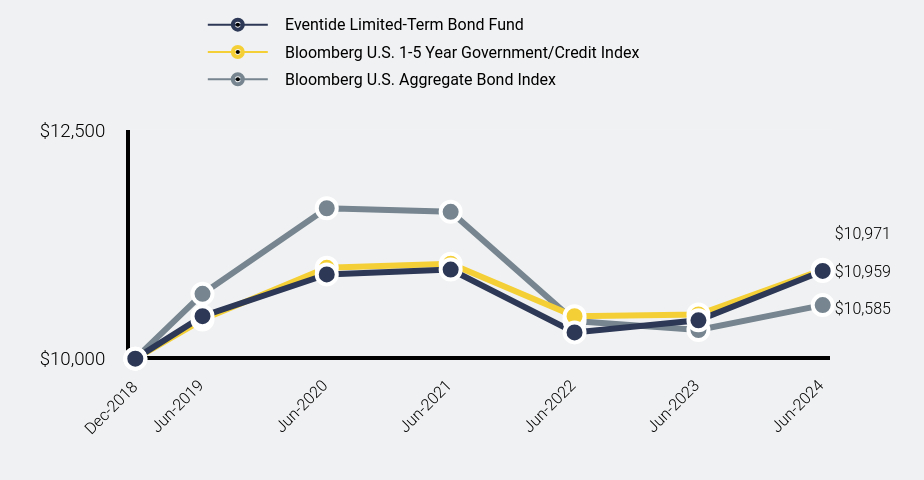

How did the Fund perform during the reporting period?