UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21869

NEXPOINT CREDIT STRATEGIES FUND

(Exact name of registrant as specified in charter)

200 Crescent Court

Suite 700

Dallas, Texas 75201

(Address of principal executive offices)(Zip code)

NexPoint Advisors, L.P.

200 Crescent Court

Suite 700

Dallas, Texas 75201

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (877) 665-1287

Date of fiscal year end: December 31

Date of reporting period: December 31, 2016

Item 1. Reports to Stockholders.

A copy of the Annual Report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”), is attached herewith.

2

NexPoint Credit Strategies Fund

Annual Report

December 31, 2016

NexPoint Credit Strategies Fund

TABLE OF CONTENTS

Economic and market conditions change frequently.

There is no assurance that the trends described in this report will continue or commence.

Privacy Policy

We recognize and respect your privacy expectations, whether you are a visitor to our web site, a potential shareholder, a current shareholder or even a former shareholder.

Collection of Information. We may collect nonpublic personal information about you from the following sources:

| | • | | Account applications and other forms, which may include your name, address and social security number, written and electronic correspondence and telephone contacts; |

| | • | | Web site information, including any information captured through the use of “cookies”; and |

| | • | | Account history, including information about the transactions and balances in your accounts with us or our affiliates. |

Disclosure of Information. We may share the information we collect with our affiliates. We may also disclose this information as otherwise permitted by law. We do not sell your personal information to third parties for their independent use.

Confidentiality and Security of Information. We restrict access to nonpublic personal information about you to our employees and agents who need to know such information to provide products or services to you. We maintain physical, electronic and procedural safeguards that comply with federal standards to guard your nonpublic personal information, although you should be aware that data protection cannot be guaranteed.

PORTFOLIO MANAGER COMMENTARY (unaudited)

| | |

| December 31, 2016 | | NexPoint Credit Strategies Fund |

2016 Performance

In 2016, the net asset value (“NAV”) of the NexPoint Credit Strategies Fund (the “Fund”) was up 22.54% while its market price was up 27.69%, including reinvested dividends, reducing the discount to NAV during the year. The Fund outperformed its benchmark, the Credit Suisse Hedge Fund Index that returned 1.25% as well as other Allocation and Fixed Income closed-end funds. The Fund had a rough start to the year as financial markets tumbled amid slowing global growth concerns and commodity price weakness. However, as commodity prices rebounded, credit and equity markets normalized enabling the Fund’s performance to rebound significantly.

On February 15, 2017, the Fund received the Alt Credit U.S. Performance Award for the Top ‘40 Act Credit Fund over the trailing 5-year period.

| | | | | | | | | | | | | | | | |

| NHF | | 1 Year | | | 3 Year | | | 5 Year | | | Inception

to Date | |

NAV | | | 22.54 | % | | | 5.76 | % | | | 16.79 | % | | | 2.70 | % |

Market Price | | | 27.69 | % | | | 11.05 | % | | | 19.06 | % | | | 4.91 | % |

For the year ended December 31, 2016, the top five performing investments in the portfolio were the Fund’s positions in Vistra Energy (the former TXU), NexPoint Real Estate Opportunities, LLC, Grayson CLO Preferred Equity, Medivation common equity and Stratford CLO Preferred Equity. The top five underperforming investments in the portfolio for the year ended December 31, 2016 were Twitter common equity, Anadarko Petroleum, Salesforce.com, Zillow Group common equity, and Aberdeen Loan Funding Preferred Equity. Overall, the Fund’s equity investments detracted approximately 6.5% from the Fund’s NAV return. The Fund’s leading contributors to performance included its investments in CLOs, Loans, and REITs, which contributed approximately 12%, 11.25%, and 2%, respectively, to the Fund’s NAV return.

Portfolio Highlights

Vistra Energy, one of the largest, high conviction positions in the portfolio that we continued to hold after it significantly underperformed in 2015, was the largest contributor to the Fund’s overall performance in 2016. To provide a little history on the position, Vistra Energy is the largest power generator and retailer in Texas. The company has an integrated business platform that provides stability to cash flow yet opportunity for upside as power prices recover. Texas is a unique marketplace for an electricity provider: it is the second largest state economy and one of the fastest growing; electricity produced in Texas is consumed in Texas, making it subject to favorable supply-demand dynamics; and its power market is unregulated with compensation achieved through supply-demand imbalances. Their former parent company, Energy Future Holdings, was taken private in a 2007 leveraged buyout led by KKR, TPG and Goldman Sachs. Stumbling after being saddled with roughly $40 billion in debt, the company eventually filed for Chapter 11 bankruptcy in April 2014.

The Fund’s initial investment was in the company’s 1st Lien Term Loan following the bankruptcy announcement. Our view was that a combination of technical factors (large position held in many loan funds many of whom became forced sellers) and fundamental factors (severely depressed power prices in the Texas market) created an opportunity to invest in a critical piece of energy infrastructure at an attractive valuation during the bottoming of the cycle. Our position in the fulcrum security gave us an opportunity to participate in equity upside post-bankruptcy while providing downside protection during bankruptcy as the position earned an approximate 15% current yield.

The investment contributed to the Fund’s 2016 performance (Vistra Energy common equity +12.7% since emergence), and we believe the foundation is set for the position to provide positive returns in the future. The company emerged from bankruptcy in October (which converted our 1st lien TL into common equity), hired new senior management, initiated guidance for 2016 and 2017 EBITDA and free cash flow which were above projections provided during the bankruptcy process, and paid a $2.32/share special dividend.

Looking ahead to 2017 and beyond, we view the investment thesis in three parts: 1) standalone valuation convergence to peers post-bankruptcy, 2) cyclical earnings upside, and 3) potential for strategic value creation opportunities. With this in mind, we believe that catalysts from strategic value creation opportunities along with earnings recovery will provide attractive returns for this investment going forward.

The Fund’s allocation to CLOs, both CLO debt and CLO equity, contributed the most to the Fund’s NAV return. Following the selloff in credit towards the end of 2015, beginning of 2016, CLOs recovered markedly as investor interest in risk assets improved and markets normalized throughout the remainder of the year. CLOs can be effected by broad technical issues that hit credit markets, but risk is muted by their long-term financing structure.

Taking into consideration the Feds rate hike plans, we anticipate a strong technical demand for floating rate securities and thus CLOs. This optimism is tempered somewhat given the realization that higher rates may impact levered balance sheets. We also believe that CLOs are still cheap on a fundamental basis. Recently implemented CLO risk retention regulations as well as post-crisis banking reform has reduced CLO demand and kept spreads historically wide (despite current spread narrowing). We

PORTFOLIO MANAGER COMMENTARY (unaudited)

| | |

| December 31, 2016 | | NexPoint Credit Strategies Fund |

don’t expect the administration to eliminate risk retention rules, but we believe small tweaks to banking regulations could allow smaller banks to purchase more CLOs. And with market risk appetite rising with expectations for nominal growth, fiscal spending optimism, oil production cuts, and global growth, we expect CLO demand to pick up and spreads to compress. With a favorable technical picture, attractive yields, and structural protections, we believe CLOs should continue to offer investors attractive risk-adjusted returns.

Lastly, the preferred equity real estate positions in one of the Fund’s internally owned REIT subsidiaries, NexPoint Real Estate Capital, LLC. (“NREC”), made a meaningful contribution to the Fund’s performance. For the full year 2016, NREC received gross distributions of $25.0 million, which included $16.3 million from two investments that were redeemed during the period. The first, a $2.8 million position in an apartment complex in in Galveston, Texas was redeemed in February 2016 after a 22-month investment period. This investment earned an internal rate of return of 17.89%. The second position was redeemed in April 2016 after only a 7-month investment period when the borrower chose to redeem our $13 million position. A Dallas-based apartment complex, this investment earned an internal rate of return of 19.36%. As of December 31, 2016, NREC had 14 preferred equity positions representing $74.0 million of invested capital. For the full year 2016, those investments earned an unlevered yield of 11.87%.

We believe financing shortfalls within the commercial real estate market have become a common occurrence and are likely to persist in the future. Due to new regulations designed to reduce risk at financial institutions, real estate lenders have become more sensitive to what regulators have termed “high-volatility commercial real estate” (HVCRE), leaving developers and investors with large financing shortfalls — our preferred and mezzanine structure is designed to fill this gap. Preferred and mezzanine lenders can provide value to real estate owners and operators by developing structured financial products to capitalize acquisitions, refinance, or enhance the property. Preferred and mezzanine structures usually include downside protection via change of control provisions, foreclosures, forced-sale rights, and put options in the event of default. Our preferred and mezzanine investments are structured in a flexible manner in an attempt to help mitigate risk, such as real estate market cycles, maturing first mortgages, etc. We estimate the term of each of our investments to be roughly 36 months.

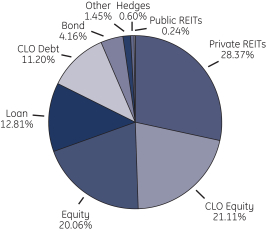

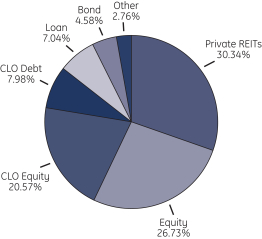

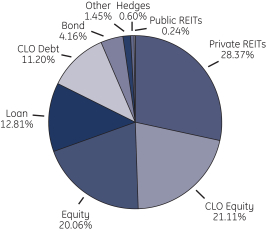

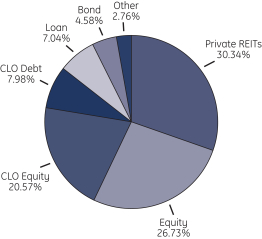

As of December 31, 2015 and December 31, 2016, the Fund’s investments were allocated among the following asset classes.

| | |

| 2015 | | 2016 |

| |

| |  |

The Fund’s Strategy

The Fund’s investment adviser, NexPoint Advisers L.P. (the “Investment Adviser”), manages the Fund pursuant to a multi-strategy investment program that attempts to exceed the return of the Fund’s benchmark in a transparent, registered fund format, with monthly dividends. We will typically allocate the Fund’s investments in the following asset classes: public equities, private equity investments, collateralized loan obligation (CLOs) debt, high yield bonds, syndicated floating rate bank loans, real estate assets, CLO equity, non-traditional yield oriented investments and may hedge exposure where necessary.

Shareholder Loyalty Program

In July 2012, we developed and implemented a unique and creative Shareholder Loyalty Program (the “Program”) that we believe rewards long-term shareholders while aligning the interests of the portfolio manager and other employees of the Investment Adviser and its affiliates with those of the Fund’s shareholders. The primary purpose of the Program is to promote shareholder loyalty. Subject to certain limitations, the Program offers shareholders a 2% gross-up on all new contributions made through accounts held by the Program’s administrator that are held for at least 12-months after initial purchase date. The Program was offered to employees of NexPoint and affiliates beginning in July 2012 and has increased direct employee ownership in the Fund. All costs of the program, including the cost of the gross-up on purchases and dividend reinvestments, are paid by the Investment Adviser, not by the Fund.

FUND PROFILE (unaudited)

| | |

| | NexPoint Credit Strategies Fund |

NexPoint Credit Strategies Fund seeks to provide both current income and capital appreciation.

Net Assets as of December 31, 2016

$414.8 million

Portfolio Data as of December 31, 2016

The information below provides a snapshot of NexPoint Credit Strategies Fund at the end of the reporting period. NexPoint Credit Strategies Fund is actively managed and the composition of its portfolio will change over time. Current and future holdings are subject to risk.

| | | | |

| Quality Breakdown as of 12/31/2016 (%)(1) | |

BB | | | 9.6 | |

B | | | 29.8 | |

CCC or Lower | | | 26.0 | |

Not Rated | | | 34.6 | |

| | | | |

| Top 5 Sectors as of 12/31/2016 (%)(2) | |

Real Estate Investment Trust | | | 39.9 | |

Financial | | | 33.0 | |

Telecommunications | | | 12.4 | |

Asset-Backed Securities | | | 11.2 | |

Information Technology | | | 7.7 | |

| | | | |

| Top 10 Holdings as of 12/31/2016 (%)(2) | |

NexPoint Real Estate Capital, LLC (Common Stocks) | | | 22.5 | |

NexPoint Real Estate Opportunities, LLC (Common Stocks) | | | 17.3 | |

TerreStar Corporation (Common Stocks) | | | 8.4 | |

Metro-Goldwyn-Mayer, Inc. (Common Stocks) | | | 6.7 | |

Vistra Energy Corp. (Common Stocks) | | | 6.1 | |

Twitter, Inc. (Common Stocks) | | | 5.7 | |

Grayson CLO, Ltd. (Preferred Stocks) | | | 5.2 | |

Stratford CLO, Ltd. (Preferred Stocks) | | | 5.0 | |

Greenbriar CLO, Ltd. (Preferred Stocks) | | | 4.4 | |

Specialty Financial Products, Ltd. (Common Stocks) | | | 4.2 | |

| (1) | Quality is calculated as a percentage of total bonds and notes. Sectors and holdings are calculated as a percentage of total assets. The quality ratings reflected were issued by Standard & Poors, a nationally recognized statistical rating organization. Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily. The ratings assigned by credit rating agencies are but one of the considerations that the Fund’s investment adviser incorporates into its credit analysis process, along with such other issuer-specific factors as cash flows, capital structure and leverage ratios, ability to deleverage through free cash flow, quality of management, market positioning and access to capital, as well as such security specific factors as the terms of the security (e.g., interest rate, and time to maturity) and the amount of any collateral. Quality ratings reflect the credit quality of the underlying bonds in the Fund’s portfolio and not the Fund itself. Quality ratings are subject to change. |

| (2) | Top 5 Sectors and Top 10 Holdings tables are calculated as a percentage of total net assets. |

FINANCIAL STATEMENTS

| | |

| December 31, 2016 | | NexPoint Credit Strategies Fund |

A guide to understanding the Fund’s financial statements

| | |

| Investment Portfolio | | The Investment Portfolio details all of the Fund’s holdings and its market value as of the last day of the reporting period. Portfolio holdings are organized by type of asset and industry to demonstrate areas of concentration and diversification. |

| |

| Statement of Assets and Liabilities | | This statement details the Fund’s assets, liabilities, net assets and share price for each share class as of the last day of the reporting period. Net assets are calculated by subtracting all of the Fund’s liabilities (including any unpaid expenses) from the total of the Fund’s investment and noninvestment assets. The net asset value per share for each class is calculated by dividing net assets allocated to that share class by the number of shares outstanding in that class as of the last day of the reporting period. |

| |

| Statement of Operations | | This statement reports income earned by the Fund and the expenses incurred by the Fund during the reporting period. The Statement of Operations also shows any net gain or loss the Fund realized on the sales of its holdings during the period as well as any unrealized gains or losses recognized over the period. The total of these results represents the Fund’s net increase or decrease in net assets from operations. |

| |

| Statement of Changes in Net Assets | | This statement details how the Fund’s net assets were affected by its operating results, distributions to shareholders and shareholder transactions (e.g., subscriptions, redemptions and distribution reinvestments) during the reporting period. The Statement of Changes in Net Assets also details changes in the number of shares outstanding. |

| |

| Statement of Cash Flows | | This statement reports net cash and foreign currency provided or used by operating, investing and financing activities and the net effect of those flows on cash and foreign currency during the period. |

| |

| Financial Highlights | | The Financial Highlights demonstrate how the Fund’s net asset value per share was affected by the Fund’s operating results. The Financial Highlights also disclose the classes’ performance and certain key ratios (e.g., net expenses and net investment income as a percentage of average net assets). |

| |

| Notes to Financial Statements | | These notes disclose the organizational background of the Funds, certain of its significant accounting policies (including those surrounding security valuation, income recognition and distributions to shareholders), federal tax information, fees and compensation paid to affiliates and significant risks and contingencies. |

INVESTMENT PORTFOLIO

| | |

| As of December 31, 2016 | | NexPoint Credit Strategies Fund |

| | | | | | | | |

| |

Principal Amount ($) | | Value ($) | |

|

| | U.S. Senior Loans (a) - 9.8% | |

|

| | CHEMICALS - 0.5% | |

| | 826,662 | | | Vertellus Holdings, LLC

Second Lien Term Loan

13.00%, 10/31/2021 | | | 731,596 | |

| | 1,366,050 | | | Exit Term Loan

10.00%, 04/30/2018 | | | 1,345,559 | |

| | | | | | | | |

| | | | | | | 2,077,155 | |

| | | | | | | | |

|

| | ENERGY - 0.5% | |

| | 439,481 | | | Azure Midstream Energy LLC

Term Loan B

7.50%, 11/15/2018 | | | 408,168 | |

| | 499,831 | | | Fieldwood Energy LLC

First Lien Term Loan

8.00%, 08/31/2020 | | | 476,714 | |

| | 861,558 | | | First Lien Last Out Term Loan

8.38%, 09/30/2020 | | | 756,017 | |

| | 698,516 | | | Second Lien Term Loan

8.38%, 09/30/2020 | | | 499,439 | |

| | | | | | | | |

| | | | | | | 2,140,338 | |

| | | | | | | | |

|

| | GAMING & LEISURE (b) - 2.0% | |

| | 8,322,966 | | | Ginn-LA CS Borrower LLC

First Lien Tranche B Term Loan (c) | | | — | |

| | 3,883,480 | | | Ginn-LA CS Borrower LLC

First Lien Tranche A Credit-Linked

Deposit (c) | | | — | |

| | 9,166,283 | | | LLV Holdco LLC

Exit Revolving Loan

5.00%, 02/28/2017 (d)(e) | | | 8,249,655 | |

| | | | | | | | |

| | | | | | | 8,249,655 | |

| | | | | | | | |

|

| | HOUSING (b)(c) - 0.0% | |

| | 2,221,161 | | | LBREP/L-SunCal Master I LLC

First Lien Term Loan B | | | — | |

| | | | | | | | |

|

| | MEDIA & TELECOMMUNICATIONS (b)(c) - 0.0% | |

| | 2,578,841 | | | Endurance Business Media, Inc.

First Lien Term Loan | | | — | |

| | | | | | | | |

|

| | SERVICE - 2.9% | |

| | 14,527,091 | | | Weight Watchers International, Inc.

Tranche B-2 Initial Term Loan

4.07%, 04/02/2020 | | | 12,114,577 | |

| | | | | | | | |

|

| | TELECOMMUNICATIONS (b)(e) - 3.8% | |

| | 15,570,001 | | | TerreStar Corporation

Term Loan A

5.50%, 02/27/2020 | | | 15,523,291 | |

| | | | | | | | |

|

| | UTILITY (f) - 0.1% | |

| | 92,329,417 | | | Texas Competitive Electric Holdings Co., LLC

Non Extended Escrow Loan

| | | 461,647 | |

| | | | | | | | |

| | | | Total U.S. Senior Loans

(Cost $54,605,407) | | | 40,566,663 | |

| | | | | | | | |

| | | | | | | | |

| |

Principal Amount | | Value ($) | |

|

| | Foreign Denominated or Domiciled | |

| | Senior Loans (a) - 1.0% | |

|

| | MARSHALL ISLANDS (g) - 1.0% | |

| | USD | |

| | 6,221,469 | | | Drillships Financing Holding, Inc.

Tranche Term Loan B-1

6.00%, 03/31/2021 | | | 4,062,619 | |

| | | | | | | | |

|

| | UNITED KINGDOM (b)(c) - 0.0% | |

| | GBP | | | | | | | |

| | 702,703 | | | Henson No. 4, Ltd.

Term Loan Facility B | | | — | |

| | 213,468 | | | Henson No. 4, Ltd.

Term Loan Facility B | | | — | |

| | 710,448 | | | Henson No. 4, Ltd.

Term Loan Facility C | | | — | |

| | 217,359 | | | Henson No. 4, Ltd.

Term Loan Facility C | | | — | |

| | | | | | | | |

| | | | Total Foreign Denominated or Domiciled Senior Loans

(Cost $4,292,132) | | | 4,062,619 | |

| | | | | | | | |

|

| | Asset-Backed Securities - 11.2% | |

| | 14,000,000 | | | Acis CLO, Ltd.

Series 2013-1A, Class SUB

0.00%, 04/18/2024 (h)(i) | | | 5,174,960 | |

| | 7,500,000 | | | Series 2015-6A, Class SUB

0.00%, 05/01/2027 (h)(i) | | | 4,689,847 | |

| | 6,000,000 | | | Series 2014-3A, Class E

5.64%, 02/01/2026 (h)(i)(j) | | | 4,807,200 | |

| | 4,500,000 | | | Series 2013-1A, Class E

6.48%, 04/18/2024 (h)(i)(j) | | | 3,987,000 | |

| | 5,000,000 | | | Series 2014-3A, Class F

6.49%, 02/01/2026 (h)(i)(j) | | | 3,191,500 | |

| | 9,142,000 | | | Series 2013-1A, Class F

7.38%, 04/18/2024 (h)(i)(j) | | | 7,046,654 | |

| | 2,250,000 | | | ALM VII R-2, Ltd.

Series 2013-7R2A, Class SUBR

0.00%, 10/15/2116 (i)(j) | | | 1,620,000 | |

| | 1,000,000 | | | Apidos CLO

Series 2013-12A, Class F

5.78%, 04/15/2025 (i)(j) | | | 796,500 | |

| | 1,925,000 | | | Betony CLO, Ltd.

Series 2015-1A, Class SUB

0.00%, 04/15/2027 (i) | | | 1,038,268 | |

| | 1,000,000 | | | CIFC Funding, Ltd.

Series 2014-4A, Class F

6.48%, 10/17/2026 (i)(j) | | | 815,000 | |

| | 1,000,000 | | | Flagship CLO VIII, Ltd.

Series 2014-8A, Class F

6.73%, 01/16/2026 (i)(j) | | | 655,000 | |

| | 2,915,407 | | | Grayson CLO, Ltd.

Series 2006-1A, Class D

4.49%, 11/01/2021 (h)(i)(j) | | | 2,434,365 | |

| | 850,000 | | | Greywolf CLO, Ltd.

Series 2013-1A, Class E

5.93%, 04/15/2025 (i)(j) | | | 709,325 | |

| | 701,696 | | | Highland Loan Funding V, Ltd.

3.39%, 08/01/2017 (b)(h) | | | 574,900 | |

| | | | | | |

| See accompanying Notes to Financial Statements. | | | | | | 5 |

INVESTMENT PORTFOLIO (continued)

| | |

| As of December 31, 2016 | | NexPoint Credit Strategies Fund |

| | | | | | | | |

| |

Principal Amount ($) | | Value ($) | |

|

| | Asset-Backed Securities (continued) | |

| | 7,377,599 | | | Highland Park CDO, Ltd.

Series 2006-1A, Class A2

1.33%, 11/25/2051 (h)(i)(j) | | | 7,008,719 | |

| | 1,500,000 | | | Valhalla CLO, Ltd.

Series 2004-1A, Class EIN

0.00%, 08/01/2020 (h)(i) | | | 337,500 | |

| | 2,100,000 | | | Vibrant CLO II, Ltd.

Series 2013-2A, Class E

6.38%, 07/24/2024 (i)(j) | | | 1,596,000 | |

| | | | | | | | |

| | | | Total Asset-Backed Securities

(Cost $52,730,746) | | | 46,482,738 | |

| | | | | | | | |

|

| | Corporate Bonds & Notes - 5.9% | |

|

| | ENERGY - 1.7% | |

| | 681 | | | American Energy-Permian Basin LLC

7.38%, 11/01/2021 (i) | | | 581 | |

| | 18,439,000 | | | Ocean Rig UDW, Inc.

7.25%, 04/01/2019 (i)(k)(l) | | | 7,099,015 | |

| | 5,000,000 | | | Venoco, LLC (c) | | | 100,000 | |

| | | | | | | | |

| | | | | | | 7,199,596 | |

| | | | | | | | |

|

| | INFORMATION TECHNOLOGY (l) - 3.7% | |

| | 23,971,250 | | | Avaya, Inc.

10.50%, 03/01/2021 (i) | | | 10,427,494 | |

| | 5,000,000 | | | Scientific Games International, Inc.

10.00%, 12/01/2022 | | | 5,000,000 | |

| | | | | | | | |

| | | | | | | 15,427,494 | |

| | | | | | | | |

|

| | TELECOMMUNICATIONS - 0.2% | |

| | 2,060,602 | | | iHeartCommunications, Inc., PIK

14.00%, 02/01/2021 | | | 795,907 | |

| | | | | | | | |

|

| | TRANSPORTATION (c) - 0.2% | |

| | 3,750,000 | | | DPH Holdings Corp. | | | 150,000 | |

| | 3,933,000 | | | DPH Holdings Corp. | | | 157,320 | |

| | 8,334,000 | | | DPH Holdings Corp. | | | 333,360 | |

| | | | | | | | |

| | | | | | | 640,680 | |

| | | | | | | | |

|

| | UTILITY (f) - 0.1% | |

| | 5,000,000 | | | Texas Competitive Electric Holdings Co., LLC | | | 75,000 | |

| | 24,000,000 | | | Texas Competitive Electric Holdings Co., LLC | | | 204,000 | |

| | | | | | | | |

| | | | | | | 279,000 | |

| | | | | | | | |

| | | | Total Corporate Bonds & Notes

(Cost $54,124,320) | | | 24,342,677 | |

| | | | | | | | |

|

| | Foreign Corporate Bonds & Notes - 0.0% | |

|

| | NETHERLANDS (b)(c) - 0.0% | |

| | USD | | | | | | | |

| | 64,515,064 | | | Celtic Pharma Phinco BV, PIK | | | — | |

| | 28,665,284 | | | Celtic Pharma Phinco BV, PIK | | | — | |

| | | | | | | | |

| | | | | | | — | |

| | | | | | | | |

| | | | Total Foreign Corporate Bonds & Notes

(Cost $62,254,526) | | | — | |

| | | | | | | | |

| | | | | | | | |

| |

Principal Amount ($) | | Value ($) | |

|

| | Sovereign Bonds - 0.4% | |

| | 1,000,000 | | | Argentine Republic Government International Bond

2.50%, 12/31/2038 (m) | | | 617,500 | |

| | 1,000,000 | | | 7.63%, 04/22/2046 (i)(k) | | | 1,002,500 | |

| | | | | | | | |

| | | | Total Sovereign Bonds

(Cost $1,506,376) | | | 1,620,000 | |

| | | | | | | | |

| |

Shares | | | |

|

| | Common Stocks - 77.1% | |

|

| | CHEMICALS - 1.1% | |

| | 456,875 | | | MPM Holdings, Inc. (k)(l)(n) | | | 3,959,507 | |

| | 661,330 | | | Vertellus Specialties, Inc. | | | 843,196 | |

| | | | | | | | |

| | | | | | | 4,802,703 | |

| | | | | | | | |

|

| | CONSUMER DISCRETIONARY (k)(l)(n) - 1.6% | |

| | 392,273 | | | K12, Inc. | | | 6,731,405 | |

| | | | | | | | |

|

| | ENERGY (n) - 1.0% | |

| | 1,890 | | | Arch Coal, Inc., Class A (k) | | | 147,515 | |

| | 336 | | | California Resources Corp. | | | 7,153 | |

| | 2,242,718 | | | Ocean Rig UDW, Inc. (k) | | | 3,902,329 | |

| | | | | | | | |

| | | | | | | 4,056,997 | |

| | | | | | | | |

|

| | FINANCIAL - 5.4% | |

| | 1,000,000 | | | Adelphia Recovery Trust | | | 600 | |

| | 46,601 | | | American Banknote Corp. (b)(n) | | | 100,658 | |

| | 1,005,985 | | | Fortress Investment Group LLC,

Class A (k)(l) | | | 4,889,087 | |

| | 15,267,474 | | | Specialty Financial Products, Ltd. (b)(e)(n) | | | 17,469,044 | |

| | | | | | | | |

| | | | | | | 22,459,389 | |

| | | | | | | | |

|

| | GAMING & LEISURE (b)(e)(n) - 0.0% | |

| | 14 | | | LLV Holdco LLC - Litigation Trust Units | | | — | |

| | 26,712 | | | LLV Holdco LLC - Series A, Membership Interest | | | — | |

| | 144 | | | LLV Holdco LLC - Series B, Membership Interest | | | — | |

| | | | | | | | |

| | | | | | | — | |

| | | | | | | | |

|

| | HEALTHCARE (b)(e)(n) - 0.2% | |

| | 24,000,000 | | | Genesys Ventures IA, LP | | | 751,200 | |

| | | | | | | | |

|

| | HOUSING (b) - 0.2% | |

| | 368,150 | | | CCD Equity Partners LLC | | | 909,331 | |

| | | | | | | | |

|

| | INFORMATION TECHNOLOGY - 5.7% | |

| | 833 | | | CDK Global, Inc. (k) | | | 49,722 | |

| | 1 | | | Magnachip Semiconductor Corp. (n) | | | 6 | |

| | 1,446,400 | | | Twitter, Inc. (k)(l)(n) | | | 23,576,320 | |

| | | | | | | | |

| | | | | | | 23,626,048 | |

| | | | | | | | |

|

| | MEDIA & TELECOMMUNICATIONS - 7.0% | |

| | 9,295 | | | Cumulus Media, Inc., Class A (n) | | | 9,481 | |

| | 18,000 | | | Gray Television, Inc.,

Class A (k)(n) | | | 187,200 | |

| | 24,097 | | | Loral Space & Communications,

Inc. (k)(l)(n) | | | 989,182 | |

| | | | | | |

| 6 | | | | | | See accompanying Notes to Financial Statements. |

INVESTMENT PORTFOLIO (continued)

| | |

| As of December 31, 2016 | | NexPoint Credit Strategies Fund |

| | | | | | | | |

| |

Shares | | Value ($) | |

|

| | Common Stocks (continued) | |

|

| | MEDIA & TELECOMMUNICATIONS (continued) | |

| | 308,875 | | | Metro-Goldwyn-Mayer, Inc.,

Class A (n)(o) | | | 27,772,959 | |

| | 645 | | | Time, Inc. (k) | | | 11,513 | |

| | | | | | | | |

| | | | | | | 28,970,335 | |

| | | | | | | | |

|

| | REAL ESTATE (b)(e)(n) - 0.0% | |

| | 560,390 | | | Allenby | | | 1 | |

| | 5,270,997 | | | Claymore | | | 5 | |

| | | | | | | | |

| | | | | | | 6 | |

| | | | | | | | |

|

| | REAL ESTATE INVESTMENT TRUST (b)(e)(n) - 39.9% | |

| | 8,271,300 | | | NexPoint Real Estate Capital, LLC, REIT | | | 93,428,471 | |

| | 25,255,573 | | | NexPoint Real Estate Opportunities, LLC, REIT | | | 71,937,975 | |

| | | | | | | | |

| | | | | | | 165,366,446 | |

| | | | | | | | |

|

| | TELECOMMUNICATIONS (b)(e)(n)(o) - 8.4% | |

| | 110,872 | | | TerreStar Corporation | | | 34,788,307 | |

| | | | | | | | |

|

| | UTILITY - 6.2% | |

| | 26,220 | | | Entegra TC LLC, Class A (n) | | | 734,161 | |

| | 1,272,973 | | | Entegra TC LLC, Class B (b)(n) | | | — | |

| | 1,618,542 | | | Vistra Energy Corp. (l) | | | 25,087,401 | |

| | | | | | | | |

| | | | | | | 25,821,562 | |

| | | | | | | | |

|

| | WIRELESS COMMUNICATIONS (k)(n) - 0.4% | |

| | 226,052 | | | Pendrell Corp. | | | 1,525,851 | |

| | | | | | | | |

| | | | Total Common Stocks

(Cost $487,755,092) | | | 319,809,580 | |

| | | | | | | | |

|

| | Preferred Stocks - 27.6% | |

|

| | FINANCIAL (h) - 27.6% | |

| | 14,500 | | | Aberdeen Loan Funding, Ltd. | | | 4,422,500 | |

| | 1,200 | | | Brentwood CLO, Ltd. (i) | | | 444,000 | |

| | 13,800 | | | Brentwood CLO, Ltd. | | | 5,106,000 | |

| | 34,500 | | | Eastland CLO, Ltd. | | | 12,192,300 | |

| | 5,000 | | | Eastland Investors Corp. (i) | | | 1,767,000 | |

| | 7,750 | | | Gleneagles CLO, Ltd. (i) | | | 2,964,375 | |

| | 62,600 | | | Grayson CLO, Ltd., Series II (i) | | | 21,571,021 | |

| | 1,500 | | | Grayson Investors Corp. (i) | | | 516,877 | |

| | 3,750 | | | Greenbriar CLO, Ltd. (i) | | | 1,771,875 | |

| | 39,000 | | | Greenbriar CLO, Ltd. | | | 18,427,500 | |

| | 2,500 | | | Liberty CLO, Ltd. (i) | | | 737,750 | |

| | 8,500 | | | Red River CLO, Ltd., Series PS-2 | | | 2,148,377 | |

| | 10,500 | | | Rockwall CDO, Ltd. (i) | | | 7,428,750 | |

| | 6,000 | | | Southfork CLO, Ltd. (i) | | | 1,984,500 | |

| | 41,500 | | | Stratford CLO, Ltd. (i) | | | 20,890,477 | |

| | 29,007 | | | Westchester CLO, Ltd. (i) | | | 11,969,739 | |

| | | | | | | | |

| | | | | | | 114,343,041 | |

| | | | | | | | |

| | | | Total Preferred Stocks

(Cost $169,308,711) | | | 114,343,041 | |

| | | | | | | | |

|

| | Exchange-Traded Funds (k)(n) - 0.0% | |

| | 11,700 | | | Direxion Daily Gold Miners Index Bull 3X Shares ETF | | | 89,388 | |

| | | | | | | | |

| | | | Total Exchange-Traded Funds

(Cost $1,995,037) | | | 89,388 | |

| | | | | | | | |

| | | | | | | | |

| |

Units | | Value ($) | |

|

| | Rights - 0.6% | |

|

| | UTILITY (n) - 0.6% | |

| | 1,618,542 | | | Texas Competitive Electric Holdings Co., LLC | | | 2,670,594 | |

| | | | | | | | |

| | | | Total Rights

(Cost $5,105,621) | | | 2,670,594 | |

| | | | | | | | |

|

| | Warrants - 0.0% | |

|

| | ENERGY (n) - 0.0% | |

| | 4,071 | | | Arch Coal, Inc. expires 10/05/23 | | | 151,645 | |

| | 6,536,535 | | | Kinder Morgan, Inc.,

expires 05/25/2017 | | | 35,951 | |

| | | | | | | | |

| | | | | | | 187,596 | |

| | | | | | | | |

|

| | GAMING & LEISURE (b)(e)(n) - 0.0% | |

| | 602 | | | LLV Holdco LLC - Series C, Membership Interest | | | — | |

| | 828 | | | LLV Holdco LLC - Series D, Membership Interest | | | — | |

| | 925 | | | LLV Holdco LLC - Series E, Membership Interest | | | — | |

| | 1,041 | | | LLV Holdco LLC - Series F, Membership Interest | | | — | |

| | 1,179 | | | LLV Holdco LLC - Series G, Membership Interest | | | — | |

| | | | | | | | |

| | | | Total Warrants

(Cost $4,500,396) | | | 187,596 | |

| | | | | | | | |

| | Total Investments - 133.6% | | | | |

| | | | (Cost $898,178,364) | | | 554,174,896 | |

| | | | | | | | |

| |

Shares | | | |

| |

| | Securities Sold Short - (1.7)% | | | | |

| |

| | Common Stocks - (1.7)% | | | | |

| |

| | ENERGY (p) - 0.0% | | | | |

| | (8,451) | | | Seventy Seven Energy, Inc. | | | (930 | ) |

| | | | | | | | |

|

| | Information Technology (p) - (1.7)% | |

| | (50,400) | | | Zillow Group, Inc., Class A | | | (1,837,080 | ) |

| | (140,400) | | | Zillow Group, Inc., Class C | | | (5,120,388 | ) |

| | | | | | | | |

| | | | | | | (6,957,468 | ) |

| | | | | | | | |

| | | | Total Common Stocks

(Proceeds $7,634,868) | | | (6,958,398 | ) |

| | | | | | | | |

| | | | Total Securities Sold Short

(Proceeds $7,634,868) | | | (6,958,398 | ) |

| | | | | | | | |

| | Other Assets & Liabilities, Net - (31.9)% | | | (132,416,792 | ) |

| | | | | | | | |

| | Net Assets - 100.0% | | | 414,799,706 | |

| | | | | | | | |

| | | | | | |

| See accompanying Notes to Financial Statements. | | | | | | 7 |

INVESTMENT PORTFOLIO (concluded)

| | |

| As of December 31, 2016 | | NexPoint Credit Strategies Fund |

| (a) | Senior loans (also called bank loans, leveraged loans, or floating rate loans) in which the Fund invests generally pay interest at rates which are periodically determined by reference to a base lending rate plus a spread (unless otherwise identified, all senior loans carry a variable rate of interest). These base lending rates are generally (i) the Prime Rate offered by one or more major United States banks, (ii) the lending rate offered by one or more European banks such as the London Interbank Offered Rate (“LIBOR”) or (iii) the Certificate of Deposit rate. Rate shown represents the weighted average rate at December 31, 2016. Senior loans, while exempt from registration under the Securities Act of 1933, as amended (the “1933 Act”), contain certain restrictions on resale and cannot be sold publicly. Senior secured floating rate loans often require prepayments from excess cash flow or permit the borrower to repay at its election. The degree to which borrowers repay, whether as a contractual requirement or at their election, cannot be predicted with accuracy. As a result, the actual remaining maturity may be substantially less than the stated maturity shown. |

| (b) | Represents fair value as determined by the Fund’s Board of Trustees (the “Board”), or its designee in good faith, pursuant to the policies and procedures approved by the Board. The Board considers fair valued securities to be securities for which market quotations are not readily available and these securities may be valued using a combination of observable and unobservable inputs. Securities with a total aggregate value of $243,732,838, or 58.8% of net assets, were fair valued under the Fund’s valuation procedures as of December 31, 2016. |

| (c) | The issuer is, or is in danger of being, in default of its payment obligation. |

| (d) | Fixed rate senior loan. |

| (e) | Affiliated issuer. Assets with a total aggregate market value of $242,147,949, or 58.4% of net assets, were affiliated with the Fund as of December 31, 2016. |

| (f) | Represents value held in escrow pending future events. No interest is being accrued. |

| (g) | All or a portion of this position has not settled. As applicable, full contract rates do not take effect until settlement date. |

| (h) | Securities of collateralized loan obligations where an affiliate of the Investment Adviser serves as collateral manager. |

| (i) | Securities exempt from registration under Rule 144A of the 1933 Act. These securities may only be resold in transaction exempt from registration to qualified institutional buyers. At December 31, 2016, these securities amounted to $136,483,792 or 32.9% of net assets. |

| (j) | Variable or floating rate security. The interest rate shown reflects the rate in effect December 31, 2016. |

| (k) | All or part of this security is pledged as collateral for short sales and written options contracts. The market value of the securities pledged as collateral was $39,617,334. |

| (l) | All or part of the security is pledged as collateral for the Committed Facility Agreement with BNP Paribas Prime Brokerage, Inc. The market value of the securities pledged as collateral was $ 31,761,367. |

| (m) | Step coupon bond. The interest rate shown reflects the rate in effect December 31, 2016 and will reset at a future date. |

| (n) | Non-income producing security. |

| (o) | Restricted Securities. These securities are not registered and may not be sold to the public. There are legal and/or contractual restrictions on resale. The Fund does not have the right to demand that such securities be registered. The values of these securities are determined by valuations provided by pricing services, brokers, dealers, market makers, or in good faith under the procedures established by the Fund’s Board of Trustees. Additional Information regarding such securities follows: |

| | | | | | | | | | | | | | | | | | | | |

Restricted

Security | | Security

Type | | | Acquisition

Date | | | Cost of

Security | | | Market

Value at

Period

End | | | Percent

of Net

Assets | |

Metro-Goldwyn-Mayer, Inc. | |

| Common

Stocks |

| | | 12/20/2010 | | | $ | 13,929,926 | | | $ | 27,772,959 | | | | 6.7 | % |

TerreStar Corporation | |

| Common

Stocks |

| | | 11/14/2014 | | | $ | 31,589,558 | | | $ | 34,788,307 | | | | 8.4 | % |

| (p) | No dividend payable on security sold short. |

| | |

Currency Abbreviations: |

| GBP | | British Pound |

| USD | | United States Dollar |

| | |

| Glossary: | | |

| CDO | | Collateralized Debt Obligation |

| CLO | | Collateralized Loan Obligation |

| ETF | | Exchange-Traded Fund |

| PIK | | Payment-in-Kind |

| REIT | | Real Estate Investment Trust |

| | | | |

Foreign Denominated or Domiciled Senior Loans

and Foreign Corporate Bonds & Notes

Industry Concentration Table:

(% of Net Assets) | |

Energy | | | 1.0 | % |

Healthcare | | | 0.0 | % |

Retail | | | 0.0 | % |

| | | | |

Total | | | 1.0 | % |

| | | | |

| | | | | | |

| 8 | | | | | | See accompanying Notes to Financial Statements. |

STATEMENTS OF ASSETS AND LIABILITIES

| | |

| As of December 31, 2016 | | NexPoint Credit Strategies Fund |

| | | | |

| | | ($) | |

Assets | | | | |

Investments from unaffiliated issuers, at value (cost $581,967,097) | | | 312,026,947 | |

Affiliated issuers, at value (cost $316,211,267) (Note 11) | | | 242,147,949 | |

| | | | |

Total Investments, at value (cost $898,178,364) | | | 554,174,896 | |

Receivable for: | | | | |

Due from broker | | | 1,736,660 | |

Investments sold | | | 42,154 | |

Dividends and interest | | | 6,055,546 | |

Prepaid expenses and other assets | | | 694,528 | |

| | | | |

Total assets | | | 562,703,784 | |

| | | | |

| |

Liabilities | | | | |

Due to custodian | | | 656,200 | |

Due to broker | | | 13,025,757 | |

Notes payable (Note 6) | | | 124,983,081 | |

Securities sold short, at value (proceeds $7,634,868) (Notes 2 and 9) | | | 6,958,398 | |

| |

Payable for: | | | | |

Distributions to shareholders | | | 345 | |

Investments purchased | | | 1,050,220 | |

Investment advisory and administration fees (Note 8) | | | 531,530 | |

Interest expense (Note 6) | | | 259,999 | |

Accrued expenses and other liabilities | | | 438,548 | |

| | | | |

Total liabilities | | | 147,904,078 | |

| | | | |

| |

Commitments and Contingencies (Note 9) | | | | |

| | | | |

Net Assets Applicable to Common Shares | | | 414,799,706 | |

| | | | |

| |

Net Assets Consist of: | | | | |

Par value (Note 1) | | | 16,022 | |

Paid-in capital | | | 861,671,474 | |

Accumulated (distributions in excess of) net investment income | | | 29,688,677 | |

Accumulated net realized loss from investments, securities sold short, written options, futures contracts and foreign currency transactions | | | (133,249,469 | ) |

Net unrealized appreciation (depreciation) on investments and securities sold short | | | (343,326,998 | ) |

| | | | |

Net Assets Applicable to Common Shares | | | 414,799,706 | |

| | | | |

| |

Common Shares | | | | |

Net Assets | | | 414,799,706 | |

Shares outstanding (unlimited authorization) | | | 16,022,326 | |

Net asset value per share (Net assets/shares outstanding) | | | 25.89 | |

| | | | | | |

| See accompanying Notes to Financial Statements. | | | | | | 9 |

STATEMENTS OF OPERATIONS

| | |

| For the Year Ended December 31, 2016 | | NexPoint Credit Strategies Fund |

| | | | |

| | | ($) | |

Investment Income | | | | |

Income: | | | | |

Dividends from unaffiliated issuers | | | 41,053,498 | |

Dividends from affiliated issuers (Note 11) | | | 13,256,016 | |

Securities lending income (Note 4) | | | 8,303 | |

Interest from unaffiliated issuers | | | 20,556,096 | |

Interest from affiliated issuers (Note 11) | | | 2,091,696 | |

Other income | | | 51,812 | |

| | | | |

Total Income | | | 77,017,421 | |

| | | | |

| |

Expenses: | | | | |

Investment advisory (Note 8) | | | 5,419,265 | |

Administration fees (Note 8) | | | 1,083,853 | |

Transfer agent fees | | | 67,779 | |

Trustees fees (Note 8) | | | 77,503 | |

Accounting services fees | | | 137,552 | |

Audit fees | | | 373,693 | |

Legal fees | | | 426,166 | |

Registration fees | | | 21,637 | |

Insurance | | | 63,798 | |

Reports to shareholders | | | 197,054 | |

Interest expense (Note 6) | | | 3,516,046 | |

Dividends and fees on securities sold short (Note 2) | | | 267,915 | |

Other | | | 83,575 | |

| | | | |

Total operating expenses | | | 11,735,836 | |

| | | | |

Net investment income | | | 65,281,585 | |

| | | | |

| |

Net Realized and Unrealized Gain (Loss) on Investments | | | | |

Realized gain (loss) on: | | | | |

Investments from unaffiliated issuers | | | (55,430,901 | ) |

Securities sold short (Note 2) | | | 4,803,104 | |

Written options contracts (Note 3) | | | 302,877 | |

Futures contracts (Note 3) | | | (220 | ) |

Foreign currency related transactions | | | (1,441 | ) |

| |

Change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | 73,643,756 | |

Securities sold short (Note 2) | | | (2,910,160 | ) |

Written options contracts (Note 3) | | | 6,626,614 | |

Foreign currency related translations | | | 81,633 | |

| | | | |

Net realized and unrealized gain (loss) on investments | | | 27,115,262 | |

| | | | |

Total increase in net assets resulting from operations | | | 92,396,847 | |

| | | | |

| | | | | | |

| 10 | | | | | | See accompanying Notes to Financial Statements. |

STATEMENTS OF CHANGES IN NET ASSETS

| | |

| | NexPoint Credit Strategies Fund |

| | | | | | | | |

| | | Year Ended

December 31, 2016

($) | | | Year Ended

December 31, 2015

($) | |

Increase (Decrease) in Net Assets Operations: | | | | | | | | |

Net investment income | | | 65,281,585 | | | | 139,812,878 | |

Net realized gain (loss) on investments, securities sold short and foreign currency transactions | | | (50,326,581 | ) | | | 18,008,984 | |

Net change in unrealized depreciation on investments, securities sold short, written options contracts and translation of assets and liabilities denominated in foreign currency | | | 77,441,843 | | | | (274,559,990 | ) |

| | | | | | | | |

Net increase (decrease) from operations | | | 92,396,847 | | | | (116,738,128 | ) |

| | | | | | | | |

| | |

Distributions Declared to Common Shareholders | | | | | | | | |

From net investment income | | | (44,778,032 | ) | | | (45,994,364 | ) |

Spin-Off (Note 12) | | | — | | | | (332,056,224 | ) |

| | | | | | | | |

Total distributions declared to common shareholders | | | (44,778,032 | ) | | | (378,050,588 | ) |

| | | | | | | | |

Total increase/(decrease) in net assets from common shares | | | 47,618,815 | | | | (494,788,716 | ) |

| | | | | | | | |

| | |

Share transactions: | | | | | | | | |

Value of distributions reinvested | | | 1,102,742 | | | | — | |

Cost of shares redeemed (Note 13) | | | — | | | | (10,532 | ) |

| | | | | | | | |

Net increase (decrease) from shares transactions | | | 1,102,742 | | | | (10,532 | ) |

| | | | | | | | |

Total increase (decrease) in net assets | | | 48,721,557 | | | | (494,799,248 | ) |

| | | | | | | | |

| | |

Net Assets | | | | | | | | |

Beginning of period | | | 366,078,149 | | | | 860,877,397 | |

| | | | | | | | |

End of period (including undistributed net investment income of $29,688,677 and $(1,123,636) respectively) | | | 414,799,706 | | | | 366,078,149 | |

| | | | | | | | |

| | |

Change in Common Shares | | | | | | | | |

Issued for distribution reinvested | | | 52,973 | | | | — | |

Shares redeemed (Note 13) | | | (302 | ) | | | (713 | ) |

| | | | | | | | |

Net increase/(decrease) in common shares | | | 52,671 | | | | (713 | ) |

| | | | | | | | |

| | | | | | |

| See accompanying Notes to Financial Statements. | | | | | | 11 |

STATEMENT OF CASH FLOWS

| | |

| For the Six Months Ended December 31, 2016 | | NexPoint Credit Strategies Fund |

| | | | |

| | | ($) | |

Cash Flows Provided by (Used for) Operating Activities: | | | | |

Net increase in net assets resulting from operations | | | 92,396,847 | |

| |

Adjustments to Reconcile Net Investment Income to Net Cash Provided by Operating Activities | | | | |

Operating Activities: | | | | |

Purchases of investment securities from unaffiliated issuers | | | (319,810,995 | ) |

Proceeds from disposition of investment securities from unaffiliated issuers | | | 367,685,688 | |

Proceeds from disposition of investment securities from affiliated issuers | |

| 6,576,895

|

|

Purchases of investment securities from affiliated issuers | | | (2,515,865 | ) |

Purchases of securities sold short | | | (13,206,822 | ) |

Proceeds of securities sold short | | | 688,732 | |

Paydowns at cost | | | 13,324,997 | |

Net accretion of discount | | | (3,536,755 | ) |

Net realized loss on investments from unaffiliated issuers | | | 55,430,901 | |

Net realized gain on securities sold short, written options contracts and foreign currency transa | | | (5,104,540 | ) |

Net change in unrealized appreciation/(depreciation) on investments, securities sold short, written options contracts and translation on assets and liabilities denominated in foreign currency | | | (77,441,843 | ) |

Decrease in due from broker | | | 18,597,750 | |

Decrease in receivable for investments sold | | | 2,000,476 | |

Increase in receivable for dividends and interest | | | (255,704 | ) |

Increase in prepaid expenses and other assets | | | (631,474 | ) |

Decrease in payable for investments purchased | | | (9,118,530 | ) |

Increase in payable due to broker | | | 13,025,757 | |

Decrease in payables to related parties | | | (83,049 | ) |

Decrease in payable to transfer agent fees | | | (20,699 | ) |

Decrease in payable for interest expense | | | (95,930 | ) |

Decrease in accrued expenses and other liabilities | | | (233,056 | ) |

| | | | |

Net cash flow provided by operating activities | | | 137,672,781 | |

| |

Cash Flows Received from (Used In) Financing Activities: | | | | |

Decrease in notes payable | | | (90,942,234 | ) |

Distributions paid in cash | | | (43,675,290 | ) |

| | | | |

Net cash flow received from (used in) financing activities | | | (134,617,524 | ) |

Effect of exchange rate changes on cash | | | 80,192 | |

| | | | |

Net Increase in Cash | | | 3,135,449 | |

| |

Cash & Foreign Currency/Due to Custodian/Bank Overdraft of Foreign Currency: | | | | |

Beginning of period | | | (3,791,649 | ) |

| | | | |

End of period | | | (656,200 | ) |

| | | | |

| |

Supplemental disclosure of cash flow information: | | | | |

Cash paid during the period for interest | | | 3,611,976 | |

Reinvestment of distributions | | | 1,102,742 | |

| | | | | | |

| 12 | | | | | | See accompanying Notes to Financial Statements. |

FINANCIAL HIGHLIGHTS

| | |

| | NexPoint Credit Strategies Fund, Class A |

Selected data for a share outstanding throughout each period is as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | For the Years Ended December 31, | |

| Common Shares Per Share Operating Performance: | | 2016 | | | 2015* | | | 2014 | | | 2013 | | | 2012 | |

| | | | | |

Net Asset Value, Beginning of Year | | $ | 22.92 | | | $ | 53.92 | | | $ | 11.34 | | | $ | 7.46 | | | $ | 6.94 | |

Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 4.08 | | | | 8.75 | (a) | | | 0.82 | | | | 0.63 | | | | 0.43 | |

Net realized and unrealized gain/(loss) | | | 1.69 | | | | (16.08 | ) | | | 2.02 | | | | 3.80 | | | | 0.52 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 5.77 | | | | (7.33 | ) | | | 2.84 | | | | 4.43 | | | | 0.95 | |

Less Distributions Declared to Common Shareholders: | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (2.80 | ) | | | (2.88 | ) | | | (0.70 | ) | | | (0.55 | ) | | | (0.43 | ) |

From spin-off (Note 12) | | | — | | | | (20.79 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total distributions declared to common shareholders | | | (2.80 | ) | | | (23.67 | ) | | | (0.70 | ) | | | (0.55 | ) | | | (0.43 | ) |

Net Asset Value, End of Period | | $ | 25.89 | | | $ | 22.92 | | | $ | 13.48 | | | $ | 11.34 | | | $ | 7.46 | |

Market Value, End of Period | | $ | 22.77 | | | $ | 20.44 | | | $ | 11.23 | | | $ | 9.42 | | | $ | 6.64 | |

Market Value Total Return(b) | | | 27.69 | % | | | (18.09 | )% | | | 26.77 | % | | | 52.03 | % | | | 14.73 | % |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in 000’s) | | $ | 414,800 | | | $ | 366,078 | | | $ | 860,877 | | | $ | 724,485 | | | $ | 476,263 | |

Common Share Information at End of Period: | | | | | | | | | | | | | | | | | | | | |

Ratios based on average net assets of common shares: | | | | | | | | | | | | | | | | | | | | |

Gross operating expenses(c) | | | 3.12 | % | | | 3.43 | % | | | 2.48 | % | | | 2.82 | % | | | 3.14 | % |

Net investment income/(loss) | | | 17.34 | % | | | 24.23 | %(d) | | | 6.45 | % | | | 7.01 | % | | | 6.00 | % |

Common and Preferred Share Information at End of Period: | | | | | | | | | | | | | | | | | |

Ratios based on average Managed Assets (as defined in Note 8) of common shares: | | | | | | | | | | | | | | | | | | | | |

Gross operating expenses(c) | | | 2.17 | % | | | 2.23 | % | | | 1.68 | % | | | 1.98 | % | | | 2.26 | % |

Net investment income (loss) | | | 12.05 | % | | | 15.79 | %(f) | | | 4.38 | % | | | 4.91 | % | | | 4.32 | % |

Portfolio turnover rate(f) | | | 41 | % | | | 31 | % | | | 59 | % | | | 74 | % | | | 92 | % |

| * | Per share data prior to October 6, 2015 has been adjusted to give effect to a 4 to 1 reverse stock split. (See Note 13) |

| (a) | Includes non-recurring dividend from Freedom REIT. (see Note 12). |

| (b) | Based on market value per share. Distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s Dividend Reinvestment Plan. |

| (c) | Supplemental expense ratios are shown below: |

| | | | | | | | | | | | | | | | | | | | |

| | | For the Years Ended December 31, | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

Ratios based on average net assets of common shares: | | | | | | | | | | | | | | | | | | | | |

Net operating expenses (net of waiver/reimbursement, if applicable, but gross of all other operating expenses) | | | 3.12 | % | | | 3.43 | % | | | 2.48 | % | | | 2.82 | % | | | 3.14 | % |

Interest expense and commitment fees | | | 0.93 | % | | | 0.71 | % | | | 0.50 | % | | | 0.60 | % | | | 0.92 | % |

Dividends and fees on securities sold short | | | 0.07 | % | | | 0.24 | % | | | 0.07 | % | | | 0.05 | % | | | 0.01 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | For the Years Ended December 31, | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

Ratios based on average Managed Assets of common shares: | | | | | | | | | | | | | | | | | | | | |

Net operating expenses (net of waiver/reimbursement, if applicable, but gross of all other operating expenses) | | | 2.17 | % | | | 2.23 | % | | | 1.68 | % | | | 1.98 | % | | | 2.26 | % |

Interest expense and commitment fees | | | 0.65 | % | | | 0.46 | % | | | 0.34 | % | | | 0.42 | % | | | 0.66 | % |

Dividends and fees on securities sold short | | | 0.05 | % | | | 0.15 | % | | | 0.04 | % | | | 0.03 | % | | | 0.01 | % |

| (d) | Net investment income (excluding non-recurring dividend from Freedom REIT) was 9.76% (See Note 12) |

| (e) | Net investment income (excluding non-recurring dividend from Freedom REIT) was 6.36% (See Note 12) |

| (f) | Excludes in-kind activity |

| | | | | | |

| See accompanying Notes to Financial Statements. | | | | | | 13 |

NOTES TO FINANCIAL STATEMENTS

| | |

| December 31, 2016 | | NexPoint Credit Strategies Fund |

Note 1. Organization

NexPoint Credit Strategies Fund (the “Fund”) is a Delaware statutory trust and is registered with the U.S. Securities and Exchange Commission (the “SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. This report includes information for the year ended December 31, 2016. The Fund trades on the New York Stock Exchange (“NYSE”) under the ticker symbol NHF. The Fund may issue an unlimited number of common shares, par value $0.001 per share (“Common Shares”). The Fund commenced operations on June 29, 2006. NexPoint Advisors, L.P. (“NexPoint” or “the Investment Adviser”), an affiliate of Highland Capital Management Fund Advisors, L.P. (“Highland”), is the investment adviser and administrator to the Fund.

Note 2. Significant Accounting Policies

The following summarizes the significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

Use of Estimates

The Fund is an investment company that applies the accounting and reporting guidance of Accounting Standards Codification Topic 946 applicable to investment companies. The Fund’s financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”), which require the Investment Adviser to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ materially.

Fund Valuation

The net asset value (“NAV”) of the Fund’s common shares is calculated daily on each day that the NYSE is open for business as of the close of the regular trading session on the NYSE, usually 4:00 PM, Eastern Time. The NAV is calculated by dividing the value of the Fund’s net assets attributable to common shares by the numbers of common shares outstanding.

Valuation of Investments

In computing the Fund’s net assets attributable to its common shares, securities with readily available market quotations on the NYSE, National Association of Securities Dealers Automated Quotation (“NASDAQ”) or other nationally recognized exchange, use the closing quotations on

the respective exchange for valuation of those securities. Securities for which there are no readily available market quotations will be valued pursuant to policies adopted by the Fund’s Board of Trustees (the “Board”). Typically, such securities will be valued at the mean between the most recently quoted bid and ask prices provided by the principal market makers. If there is more than one such principal market maker, the value shall be the average of such means. Securities without a sale price or quotations from principal market makers on the valuation day may be priced by an independent pricing service. Generally, the Fund’s loan and bond positions are not traded on exchanges and consequently are valued based on a mean of the bid and ask price from the third-party pricing services or broker-dealer sources that the Investment Adviser has determined to have the capability to provide appropriate pricing services and have been approved by the Board.

Securities for which market quotations are not readily available, or for which the Fund has determined that the price received from a pricing service or broker-dealer is “stale” or otherwise does not represent fair value (such as when events materially affecting the value of securities occur between the time when market price is determined and calculation of the Fund’s NAV), will be valued by the Fund at fair value, as determined by the Board or its designee in good faith in accordance with procedures approved by the Board, taking into account factors reasonably determined to be relevant, including, among other things: (i) the fundamental analytical data relating to the investment; (ii) the nature and duration of restrictions on disposition of the securities; and (iii) an evaluation of the forces that influence the market in which these securities are purchased and sold. In these cases, the Fund’s NAV will reflect the affected portfolio securities’ fair value as determined in the judgment of the Board or its designee instead of being determined by the market. Using a fair value pricing methodology to value securities may result in a value that is different from a security’s most recent sale price and from the prices used by other investment companies to calculate their NAVs. Determination of fair value is uncertain because it involves subjective judgments and estimates.

There can be no assurance that the Fund’s valuation of a security will not differ from the amount that it realizes upon the sale of such security. Those differences could have a material impact to the Fund. The NAV shown in the Fund’s financial statements may vary from the NAV published by the Fund as of its period end because portfolio securities transactions are accounted for on the trade date (rather than the day following the trade date) for financial statement purposes.

NOTES TO FINANCIAL STATEMENTS (continued)

| | |

| December 31, 2016 | | NexPoint Credit Strategies Fund |

Fair Value Measurements

The Fund has performed an analysis of all existing investments and derivative instruments to determine the significance and character of inputs to their fair value determination. The levels of fair value inputs used to measure the Fund’s investments are characterized into a fair value hierarchy. Where inputs for an asset or liability fall into more than one level in the fair value hierarchy, the investment is classified in its entirety based on the lowest level input that is significant to that investment’s valuation. The three levels of the fair value hierarchy are described below:

| Level 1 — | Quoted unadjusted prices for identical instruments in active markets to which the Fund has access at the date of measurement; |

| Level 2 — | Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active, but are valued based on executed trades; broker quotations that constitute an executable price; and alternative pricing sources supported by observable inputs are classified within Level 2. Level 2 inputs are either directly or indirectly observable for the asset in connection with market data at the measurement date; and |

| Level 3 — | Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. In certain cases, investments classified within Level 3 may include securities for which the Fund has obtained indicative quotes from broker-dealers that do not necessarily represent prices the broker may be willing to trade on, as such quotes can be subject to material management judgment. Unobservable inputs are those inputs that reflect the Fund’s own assumptions that market participants would use to price the asset or liability based on the best available information. |

The Investment Adviser has established policies and procedures, as described above and approved by the Board, to ensure that valuation methodologies for investments and financial instruments that are categorized within all levels of the fair value hierarchy are fair and consistent. A Pricing Committee has been established to provide oversight of the valuation policies, processes and procedures, and is comprised of personnel from the Investment Adviser and its affiliates. The Pricing Committee meets monthly to review the proposed valuations for investments and financial instruments and is responsible for evaluating the overall fairness and consistent application of established policies.

As of December 31, 2016, the Fund’s investments consisted of senior loans, asset-backed securities, corporate bonds and notes, foreign corporate bonds and notes, sovereign bonds, common stocks, preferred stocks, exchange-traded funds, warrants, and securities sold short. The fair value of the Fund’s loans, bonds and asset-backed securities are generally based on quotes received from brokers or independent pricing services. Loans, bonds, and asset-backed securities with quotes that are based on actual trades with a sufficient level of activity on or near the measurement date are classified as Level 2 assets. Loans, bonds and asset-backed securities that are priced using quotes derived from implied values, indicative bids, or a limited number of actual trades are classified as Level 3 assets because the inputs used by the brokers and pricing services to derive the values are not readily observable.

The fair value of the Fund’s common stocks, preferred stocks, exchange-traded funds, and warrants that are not actively traded on national exchanges are generally priced using quotes derived from implied values, indicative bids, or a limited amount of actual trades and are classified as Level 3 assets because the inputs used by the brokers and pricing services to derive the values are not readily observable. The Fund’s real estate investments include equity interests in limited liability companies and equity issued by Real Estate Investment Trusts (“REITs”) that invest in commercial real estate. The fair value of real estate investments that are not actively traded on national exchanges are based on internal models developed by the Investment Adviser. The significant inputs to the models include cash flow projections for the underlying properties, capitalization rates and appraisals performed by independent valuation firms. These inputs are not readily observable, and the Fund has classified the investments as Level 3 assets. Exchange-traded options are valued based on the last trade price on the primary exchange on which they trade. If an option does not trade, the mid-price, which is the mean of the bid and ask price, is utilized to value the option.

At the end of each calendar quarter, the Investment Adviser evaluates the Level 2 and 3 assets and liabilities for changes in liquidity, including but not limited to: whether a broker is willing to execute at the quoted price, the depth and consistency of prices from third party services, and the existence of contemporaneous, observable trades in the market. Additionally, the Investment Adviser evaluates the Level 1 and 2 assets and liabilities on a quarterly basis for changes in listings or delistings on national exchanges.

Due to the inherent uncertainty of determining the fair value of investments that do not have a readily available market value, the fair value of the Fund’s investments may

NOTES TO FINANCIAL STATEMENTS (continued)

| | |

| December 31, 2016 | | NexPoint Credit Strategies Fund |

fluctuate from period to period. Additionally, the fair value of investments may differ significantly from the values that would have been used had a ready market existed for such investments and may differ materially from the

values the Fund may ultimately realize. Further, such investments may be subject to legal and other restrictions on resale or otherwise less liquid than publicly traded securities.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. A summary of the inputs used to value the Fund’s assets as of December 31, 2016 is as follows:

| | | | | | | | | | | | | | | | |

| | | Total

value at

December 31, 2016 | | | Level 1

Quoted

Price | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | |

Assets | | | | | | | | | | | | | | | | |

U.S. Senior Loans | | | | | | | | | | | | | | | | |

Chemicals | | $ | 2,077,155 | | | $ | — | | | $ | 2,077,155 | | | $ | — | |

Energy | | | 2,140,338 | | | | — | | | | 2,140,338 | | | | — | |

Gaming & Leisure | | | 8,249,655 | | | | — | | | | — | | | | 8,249,655 | |

Housing | | | — | | | | — | | | | — | | | | — | (2) |

Media & Telecommunications | | | — | | | | — | | | | — | | | | — | (2) |

Service | | | 12,114,577 | | | | — | | | | 12,114,577 | | | | — | |

Telecommunications | | | 15,523,291 | | | | — | | | | — | | | | 15,523,291 | |

Utility | | | 461,647 | | | | — | | | | 461,647 | | | | — | |

Foreign Denominated or Domiciled Senior Loans | | | 4,062,619 | | | | — | | | | 4,062,619 | | | | — | (2) |

Asset-Backed Securities | | | 46,482,738 | | | | — | | | | 45,907,838 | | | | 574,900 | |

Corporate Bonds & Notes(1) | | | 24,342,677 | | | | — | | | | 24,342,677 | | | | — | |

Foreign Corporate Bonds & Notes(1) | | | — | | | | — | | | | — | | | | — | (2) |

Sovereign Bonds | | | 1,620,000 | | | | — | | | | 1,620,000 | | | | — | |

Common Stocks | | | | | | | | | | | | | | | | |

Chemicals | | | 4,802,703 | | | | — | | | | 843,196 | | | | 3,959,507 | |

Consumer Discretionary | | | 6,731,405 | | | | 6,731,405 | | | | — | | | | — | |

Energy | | | 4,056,997 | | | | 4,056,997 | | | | — | | | | — | |

Financial | | | 22,459,389 | | | | 4,889,687 | | | | — | | | | 17,569,702 | |

Gaming & Leisure | | | — | | | | — | | | | — | | | | — | (2) |

Healthcare | | | 751,200 | | | | — | | | | — | | | | 751,200 | |

Housing | | | 909,331 | | | | — | | | | — | | | | 909,331 | |

Information Technology | | | 23,626,048 | | | | 23,626,048 | | | | — | | | | — | |

Media & Telecommunications | | | 28,970,335 | | | | 1,197,376 | | | | 27,772,959 | | | | — | |

Real Estate | | | 6 | | | | — | | | | — | | | | 6 | |

Real Estate Investment Trust | | | 165,366,446 | | | | — | | | | — | | | | 165,366,446 | |

Telecommunications | | | 34,788,307 | | | | — | | | | — | | | | 34,788,307 | |

Utilities | | | 25,821,562 | | | | 25,087,401 | | | | 734,161 | | | | — | |

Wireless Communications | | | 1,525,851 | | | | 1,525,851 | | | | — | | | | — | |

Preferred Stocks(1) | | | 114,343,041 | | | | — | | | | 114,343,041 | | | | — | |

Exchange-Traded Funds | | | 89,388 | | | | 89,388 | | | | — | | | | — | |

Rights(1) | | | | | | | | | | | | | | | | |

Utility | | | 2,670,594 | | | | — | | | | 2,670,594 | | | | — | |

Warrants(1) | | | | | | | | | | | | | | | | |

Energy | | | 187,596 | | | | 35,951 | | | | 151,645 | | | | — | |

Gaming & Leisure | | | — | | | | — | | | | — | | | | — | (2) |

| | | | | | | | | | | | | | | | |

Total Assets | | $ | 554,174,896 | | | $ | 67,240,104 | | | $ | 239,242,447 | | | $ | 247,692,345 | |

| | | | | | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | | | | | |

Securities Sold Short(1) | | $ | (6,958,398 | ) | | $ | (6,958,398 | ) | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total Liabilities | | $ | (6,958,398 | ) | | $ | (6,958,398 | ) | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total | | $ | 547,216,498 | | | $ | 60,281,706 | | | $ | 239,242,447 | | | $ | 247,692,345 | |

| | | | | | | | | | | | | | | | |

| (1) | See Investment Portfolio detail for industry breakout. |

| (2) | This category includes securities with a value of zero. |

NOTES TO FINANCIAL STATEMENTS (continued)

| | |

| December 31, 2016 | | NexPoint Credit Strategies Fund |

The table below sets forth a summary of changes in the Fund’s assets measured at fair value using significant unobservable inputs (Level 3) for the year ended December 31, 2016.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Balance

as of

December 31,

2015 | | | Transfers

into

Level 3 | | | Transfers

out

of Level 3 | | | Net

Amortization

(Accretion)

of Premium/

(Discount) | | | Net

Realized

Gain/

(Losses) | | | Net

Unrealized

Gains/

(Losses) | | | Net

Purchases | | | Net

(Sales) | | | Balance

as of

December 31,

2016 | | | Change in

Un

realized

Gain/

(Loss)

on Level 3

securities

still held

at

period

end | |

U.S. Senior Loans | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gaming & Leisure | | $ | 4,476,048 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 3,322,090 | | | $ | 451,517 | (a) | | $ | — | | | $ | 8,249,655 | | | $ | 3,322,090 | |

Telecommunications | | | 13,874,103 | | | | — | | | | — | | | | (2,345 | ) | | | — | | | | 11,354 | | | | 1,640,179 | (a) | | | — | | | | 15,523,291 | | | | 11,354 | |

Foreign Denominated or Domiciled Senior Loans | | | 35,060 | | | | — | | | | — | | | | — | | | | 14,158 | | | | 9,744 | | | | 2,556 | | | | (61,518 | ) | | | — | | | | — | |

Asset-Backed Securities | | | — | | | | 574,900 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 574,900 | | | | — | |

Common Stocks | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Chemicals | | | 4,682,969 | | | | — | | | | — | | | | — | | | | — | | | | (723,462 | ) | | | 1,449,861 | | | | (1,449,861 | ) | | | 3,959,507 | | | | (1,313,307 | ) |

Financial | | | 22,516,499 | | | | — | | | | — | | | | — | | | | 2,096,897 | | | | 791,391 | | | | 1,852,149 | | | | (9,687,234 | ) | | | 17,569,702 | | | | 1,489,762 | |

Healthcare | | | 1,569,600 | | | | — | | | | — | | | | — | | | | — | | | | (818,400 | ) | | | — | | | | — | | | | 751,200 | | | | (818,400 | ) |

Housing | | | 1,141,265 | | | | — | | | | — | | | | — | | | | — | | | | (231,934 | ) | | | — | | | | — | | | | 909,331 | | | | (231,934 | ) |

Real Estate | | | 5 | | | | — | | | | — | | | | — | | | | — | | | | (513,716 | ) | | | 513,717 | | | | — | | | | 6 | | | | (513,716 | ) |

Real Estate Investment Trust | | | 161,905,867 | | | | — | | | | — | | | | — | | | | 69,599 | | | | 3,636,080 | | | | — | | | | (245,100 | ) | | | 165,366,446 | | | | 3,636,080 | |

Telecommunications | | | 33,434,560 | | | | — | | | | — | | | | — | | | | — | | | | 1,353,747 | | | | — | | | | — | | | | 34,788,307 | | | | 1,353,747 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | $ | 243,635,976 | | | $ | 574,900 | | | $ | — | | | $ | (2,345 | ) | | $ | 2,180,654 | | | $ | 6,836,894 | | | $ | 5,909,979 | | | $ | (11,443,713 | ) | | $ | 247,692,345 | | | $ | 6,935,676 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Represents payment in kind interest |

Investments designated as Level 3 may include assets valued using quotes or indications furnished by brokers which are based on models or estimates and may not be executable prices. In light of the developing market conditions, the Investment Adviser continues to search for observable data points and evaluate broker quotes and indications received for portfolio investments. As a result, for the year ended December 31, 2016, $574,900 of the Fund’s portfolio investments was transferred from Level 2 to Level 3. Determination of fair values is uncertain

because it involves subjective judgments and estimates that are unobservable. Transfers from Level 2 to Level 3 are due to a decline in market activity (e.g. frequency of trades), which resulted in a reduction of available market inputs to determine price.

The Fund uses end of period market value in the determination of the amount associated with any transfers between levels.

NOTES TO FINANCIAL STATEMENTS (continued)

| | |

| December 31, 2016 | | NexPoint Credit Strategies Fund |

The following is a summary of significant unobservable inputs used in the fair valuation of assets and liabilities categorized within Level 3 of the fair value hierarchy:

| | | | | | | | | | | | |

| Category | | Market

Value at

12/31/2016 | | | Valuation Technique | | Unobservable Inputs | | Input Value(s) | |

Common Stock | | $ | 223,344,499 | | | Third-Party Pricing Vendor | | N/A | | | N/A | |

| | | | | | Net Asset Value | | N/A | | | N/A | |

| | | | | | Multiples Analysis | | Price/MHz-PoP | | | $0.13 - $0.50 | |

| | | | | | | | Multiple of EBITDA | | | 1.5x - 8.0x | |

| | | | | | | | Capitalization Rates | | | 6.1% | |

| | | | | | | | Liquidity Discount | | | 25% | |

| | | | | | | | Minority Discount | | | 20% | |

| | | | | | Third-Party Valuations | | Capitalization Rates | | | 5.5% - 8.75% | |

| | | | | | Recovery Analysis | | Scenario Probabilities | | | 33% | |

| | | | | | Discounted Cash Flow | | Discount Rate | | | 19% | |

U.S. Senior Loans | | | 23,772,946 | | | Discounted Cash Flow | | Spread Adjustment | | | 0.10% | |

| | | | | | Adjusted Appraisal | | Liquidity Discount | | | 10% | |

Asset-Backed Securities | | | 574,900 | | | Discounted Cash Flow | | Discount Rate | | | 9% | |

| | | | | | | | | | | | |

Total | | $ | 247,692,345 | | | | | | | | | |

Security Transactions

Security transactions are accounted for on the trade date. Realized gains/(losses) on investments sold are recorded on the basis of the specific identification method for both financial statement and U.S. federal income tax purposes taking into account any foreign taxes withheld.

Income Recognition

Corporate actions (including cash dividends) are recorded on the ex-dividend date, net of applicable withholding taxes, except for certain foreign corporate actions, which are recorded as soon after ex-dividend date as such information becomes available. Interest income is recorded on the accrual basis.