UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21902 |

|

Cohen & Steers Institutional Global Realty Shares, Inc. |

(Exact name of registrant as specified in charter) |

|

280 Park Avenue, New York, NY | | 10017 |

(Address of principal executive offices) | | (Zip code) |

|

Tina M. Payne Cohen & Steers Capital Management, Inc. 280 Park Avenue New York, New York 10017 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 832-3232 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2015 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

To Our Shareholders:

We would like to share with you our report for the six months ended June 30, 2015. The net asset value (NAV) at that date was $24.56 per share.

The total returns, including income and change in NAV, for the Fund and its comparative benchmarks were:

| | Six Months Ended

June 30, 2015 | |

| Cohen & Steers Institutional Global Realty Shares | | | –1.00 | % | |

| FTSE EPRA/NAREIT Developed Real Estate Index—neta | | | –3.20 | % | |

| S&P 500 Indexa | | | 1.23 | % | |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Current total returns of the Fund can be obtained by visiting our website at cohenandsteers.com. The Fund's returns assume the reinvestment of all dividends and distributions at NAV. Fund performance reflects fee waivers and/or expense reimbursements, without which the performance would have been lower. Index performance does not reflect the deduction of any fees, taxes or expenses. An investor cannot invest directly in an index. Performance figures for periods shorter than one year are not annualized.

Please note that distributions paid by the Fund to shareholders are subject to recharacterization for tax purposes and are taxable up to the amount of the Fund's investment company taxable income and net realized gains. Distributions in excess of the Fund's investment company taxable income and net realized gains are a return of capital distributed from the Fund's assets.

The Fund implements fair value pricing when the daily change in a specific U.S. market index exceeds a predetermined percentage. Fair value pricing adjusts the valuation of certain non-U.S. equity holdings to account for such index change following the close of foreign markets. This standard practice has been adopted by a majority of the fund industry. In the event fair value pricing is implemented on the first and/or last day of a performance measurement period, the Fund's return may diverge from the relative performance of its benchmark, which does not use fair value pricing.

a The FTSE EPRA/NAREIT Developed Real Estate Index—net is an unmanaged market-capitalization-weighted total return index which consists of publicly traded equity REITs and listed property companies from developed markets whose floats are larger than $100 million and which derive more than half of their revenue from property-related activities and is net of dividend withholding taxes. The S&P 500 Index is an unmanaged index of 500 large-capitalization stocks that is frequently used as a general measure of U.S. stock market performance.

1

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

Market Review

Global real estate securities declined in the period, reflecting a pullback in the U.S., which accounts for about half of the FTSE EPRA/NAREIT Developed Real Estate Index. Real estate stocks were lifted early on by improving economic data in Europe and Japan and the European Central Bank's (ECB) decision to launch quantitative easing. Other central banks, within Europe and elsewhere, announced new easing measures of their own.

However, during the second half of the period real estate stocks were hindered by a rapid rise in sovereign bond yields, as the better economic data helped lift yields off record lows reached earlier in the year. While rates generally peaked in mid-June, risk factors related to China's economy and stock market and Greece's financial crisis weighed heavily on equities in the final days of the period.

In the U.S. (total return of –6.1%b), returns were negative for most property types, despite continued strong fundamentals for U.S. commercial real estate, as reflected in earnings that generally met high expectations. Health care property REITs (–11.7% total return) were among the poorest performers in the quarter. The sector underperformed due to its perceived bond-like characteristics in a period of rising yields, even as health care REITs have been transitioning to more economically sensitive business models over the years.

The shopping center and regional mall sectors (–8.1% and –6.2%, respectively) underperformed, even as tenants continued to exhibit strong interest in proven assets. Self storage companies (3.7%) were top performers, drawing support from strong earnings, with year-over-year rental growth running as high as 10%. Apartment landlords (0.8%) also outperformed with a gain, amid sustained job growth and household formation that has kept demand ahead of supply.

European Markets Advanced Despite Late-Period Volatility

The U.K. (8.0%) performed well in local currency terms, and significantly outperformed as measured in U.S. dollars due to the U.K. currency's relative stability against the dollar during the period. Property fundamentals in the U.K. remained solid as evidenced by good results from the leading London-focused real estate companies.

The U.K. was also supported by market-friendly political news, as the Conservative party did better than expected in the national general elections held in May, winning an outright majority for the first time in 19 years. Investors feared that a hung Parliament would bring new uncertainties, or that a new government would look to change prevailing policies, possibly upsetting positive economic and market trends seen in recent years.

France (9.5%) and the Netherlands (7.0%) both surged in the year's first quarter. With weak economies, these countries' real estate companies stand to benefit from slow but gradual increases in occupancies and rents from relatively low bases as the recovery takes hold. However, they both turned sharply lower amid the spike in interest rates and the mounting Greek crisis late in the period.

b Country returns are in local currencies.

2

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

In Germany (3.8%), Alstria Office was a strong performer, aided in part by a well-timed capital raise, with the funds to be used to finance further growth and make acquisitions. The company later announced an offer to acquire Deutsche Office, a merger that would create Germany's largest listed office real estate company.

Asia Pacific Markets Also Made Gains

Japan (0.3%) saw first-quarter GDP surprise on the upside, rising 3.9% (compared with an initial consensus expectation of 1.5%), buoyed by capital spending. J-REITs declined as high bond-yield volatility led to some regional bank selling; a number of equity issuance announcements from J-REITs also presented technical challenges.

In Hong Kong (5.8%), office fundamentals stayed strong, with the Central Hong Kong vacancy rate falling to a new low of 2.3%. Office demand has been spurred in part by lower capital barriers between Hong Kong and mainland China, which has led financial companies to start to expand their presence in the market. In news, New World Development sold 50% of its stake in three Hong Kong hotels to the Abu Dhabi Investment Authority for HK$13 billion (US$1.7 billion).

In Singapore (2.6%), the office and hospitality sectors had softening fundamentals due to new supply entering the market. The country's economic news remained mixed. First-quarter GDP was a little stronger than forecasted, growing 2.6% year over year, underpinned by service sector growth and a smaller-than-expected contraction in manufacturing. However, employment growth was somewhat disappointing.

In Australia (6.7%), the country's central bank reduced short-term interest rates by 50 basis points to 2.25%, in two increments. While the central bank then left rates unchanged in June, associated commentary suggested it retained a soft easing bias. Consumer confidence surveys improved in the period, with sentiment aided by both the rate cuts and the release of the federal budget, which did not include further fiscal tightening.

Fund Performance

The Fund had a negative total return for the period, although it outperformed its benchmark. Our underweight and stock selection in the U.S. aided relative performance, in part due to our underweight in health care property companies and favorable stock selection in the apartment and hotel sectors. Stock selection in Hong Kong and France also helped performance, as did our overweights in France and Germany and our out-of-index allocation to a China company that had a positive absolute return. Stock selection in the Netherlands and Singapore detracted from relative performance.

Impact of Foreign Currency on Fund Performance

The currency impact of the Fund's investments in foreign securities significantly detracted from absolute performance during the six-month period ended June 30, 2015. Although the Fund reports its NAV and pays dividends in U.S. dollars, the Fund's investments denominated in foreign currencies are subject to foreign currency risk. The U.S. dollar remained strong, reaching an 11-year high during the period, while most other currencies, particularly the euro, tended to soften. Consequently, this was a headwind for absolute returns as a result of the changes in the exchange rates between foreign currencies and the U.S. dollar.

3

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

Investment Outlook

We expect U.S. economic activity to accelerate after a slow start to the year, with GDP expanding nearly 2.5% in 2015. Continued employment and wage growth should support further strength in consumer confidence, in our view, and we expect to see a more-pronounced benefit from lower gasoline prices in the coming months. These potentially favorable demand trends should be met with continued low levels of new supply in most sectors.

Based on our view of a resumed expansion in the U.S. economy, we believe commercial real estate fundamentals will continue to strengthen, driving further increases in cash flows, net asset values and dividend distributions. This macro perspective has led us to prefer cyclically sensitive short-lease sectors. However, our bottom-up analysis has also identified companies offering compelling relative value in traditionally noncyclical sectors. We believe that one area of potential opportunity at present is health care, where certain stocks are trading at discounts to underlying property values for the first time in years, albeit in a context of gradually rising interest rates and a diminishing ability to grow earnings through acquisitions.

Our Views On Europe Remain Intact

We are closely monitoring developments in Greece, and we are cognizant that generous bailout concessions could encourage anti-austerity parties in other peripheral European markets. However, our views on the region's economies and real estate fundamentals remain intact (aside from Greece, where the Fund is not invested), and we have used recent market volatility to purchase stocks we deemed to be oversold.

We believe the U.K. continues to offer attractive upside potential, with room for the current expansion cycle to move forward. While tenant demand has been strengthening, new supply remains tight in most property sectors, driving rents and property values higher. We also believe that conditions for retail landlords should improve amid lower energy costs and higher real wages. These trends could drive continued growth in cash flows, helping to offset the effects of a potential rise in interest rates in 2015.

Looking to continental Europe, we believe the ECB remains in the early stages of its easing cycle, given the lagging European economy and the bank's aim to protect the region from external shocks. We maintain a more-favorable view of Europe's economy than the market consensus, and believe the recovery should particularly benefit owners of European retail properties.

We favor select companies in France and the Netherlands that offer attractive valuations and the potential to benefit from a recovery in fundamentals. We like Germany's residential market given its stable rent growth, but we are mindful of valuations following strong absolute and relative performance over the past year. We also have opportunistic investments in Spain that we believe are well positioned to benefit from a rebound in asset values as the country's unemployment rate declines and demand recovers.

Hong Kong Offices Seeing a Fundamental Recovery

Office fundamentals in Hong Kong are exhibiting clear signs of positive momentum in terms of rents and occupancies, especially within the core central business district. However, severe capital market volatility in China recently has caused us to reassess the rate of expected growth. We think the non-discretionary retail market should be relatively less sensitive to any policy changes in the tourism

4

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

industry. We are positive on office and retail companies with good-quality assets and the pricing power to extract positive rental reversions. We also favor developers in Hong Kong and China trading at attractive valuations and with strong momentum in contract sales.

In Japan, the Tokyo office market is experiencing strong growth in occupancy rates and is in the early stages of recovery in rent growth. Japan developers focused on these assets continue to trade at discounts to their underlying assets. We have lowered our J-REIT weighting on expectations that continued equity issuances will weigh on the supply/demand balance.

In Singapore, we believe valuations for developers with meaningful operations outside Singapore (mostly in China) remain attractive, as supply and demand conditions are more favorable. We have become increasingly cautious toward office REITs, as the significant pipeline of new supply is likely to pressure market rents over the next two years.

In our view, Australia's current monetary easing cycle should drive further cap-rate compression and yield support for the domestic commercial property owners. Within discretionary retail, we believe domestic mall valuations are attractive, based on a general bottoming of fundamentals and malls' potential to benefit from consumer spending related to lower interest rates and steady economic growth. Office fundamentals remain challenging given ongoing supply and weak demand.

Sincerely,

| | | | |

| |

| |

| | | | | ROBERT H. STEERS | | JOSEPH M. HARVEY | |

| | | | | Chairman | | Portfolio Manager | |

| | | | |

| |

| |

| | | | | JON CHEIGH | | CHARLES J. MCKINLEY | |

| | | | | Portfolio Manager | | Portfolio Manager | |

| | | | |

| |

| |

| | | | | LUKE SULLIVAN | | ROGIER QUIRIJNS | |

| | | | | Portfolio Manager | | Portfolio Manager | |

WILLIAM LEUNG

Portfolio Manager

5

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

The views and opinions in the preceding commentary are subject to change without notice and are as of the date of the report. There is no guarantee that any market forecast set forth in the commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice and is not intended to predict or depict performance of any investment.

Visit Cohen & Steers online at cohenandsteers.com

For more information about the Cohen & Steers family of mutual funds, visit cohenandsteers.com. Here you will find fund net asset values, fund fact sheets and portfolio highlights, as well as educational resources and timely market updates.

Our website also provides comprehensive information about Cohen & Steers, including our most recent press releases, profiles of our senior investment professionals and their investment approach to each asset class. The Cohen & Steers family of mutual funds invests in major real asset categories including real estate, infrastructure, commodities and natural resource equities, as well as preferred securities and other income solutions.

6

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

Performance Review (Unaudited)

Average Annual Total Returns—For the Periods Ended June 30, 2015

| | | 1 Year | | 5 Years | | Since Inceptiona | |

Fund | | | 1.65 | % | | | 11.02 | % | | | 3.22 | % | |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate and shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance information current to the most recent month end can be obtained by visiting our website at cohenandsteers.com. Total return assumes the reinvestment of all dividends and distributions at NAV. The performance table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During the periods presented above, the investment manager waived fees and/or reimbursed expenses. Without this arrangement, performance would have been lower.

The annualized gross and net expense ratios were 1.01% and 1.00%, respectively, as disclosed in the May 1, 2015 prospectus. The investment manager has contractually agreed to waive its fee and/or reimburse the Fund so that the Fund's total annual operating expenses (excluding brokerage fees and commissions, taxes, and, upon approval of the Board, extraordinary expenses) do not exceed 1.00% of average daily net assets. This commitment will remain in place for the life of the Fund.

a Inception date of August 10, 2006.

7

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

Expense Example (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs including investment management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period January 1, 2015—June 30, 2015.

Actual Expenses

The first line of the following table provides information about actual account values and expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account Value

January 1, 2015 | | Ending

Account Value

June 30, 2015 | | Expenses Paid

During Perioda

January 1, 2015–

June 30, 2015 | |

Actual (–1.00% return) | | $ | 1,000.00 | | | $ | 990.00 | | | $ | 4.93 | | |

Hypothetical (5% annual return before

expenses) | | $ | 1,000.00 | | | $ | 1,019.84 | | | $ | 5.01 | | |

a Expenses are equal to the Fund's annualized net expense ratio of 1.00% multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

8

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

June 30, 2015

Top Ten Holdings

(Unaudited)

Security | | Value | | % of

Net

Assets | |

Klepierre | | $ | 23,153,688 | | | | 4.5 | | |

Equity Residential | | | 21,964,403 | | | | 4.3 | | |

Land Securities Group PLC | | | 15,915,946 | | | | 3.1 | | |

Simon Property Group | | | 15,904,344 | | | | 3.1 | | |

Mitsui Fudosan Co., Ltd. | | | 15,676,330 | | | | 3.1 | | |

Wereldhave NV | | | 15,505,004 | | | | 3.0 | | |

Vornado Realty Trust | | | 14,222,223 | | | | 2.8 | | |

Mitsubishi Estate Co., Ltd. | | | 13,916,567 | | | | 2.7 | | |

Hongkong Land Holdings Ltd. (USD) | | | 13,575,682 | | | | 2.7 | | |

Public Storage | | | 13,132,675 | | | | 2.6 | | |

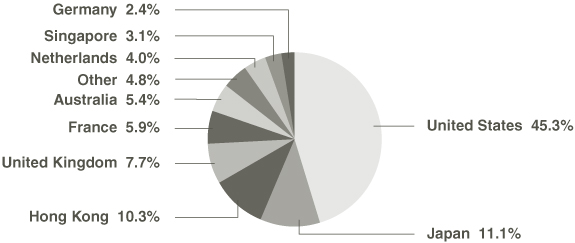

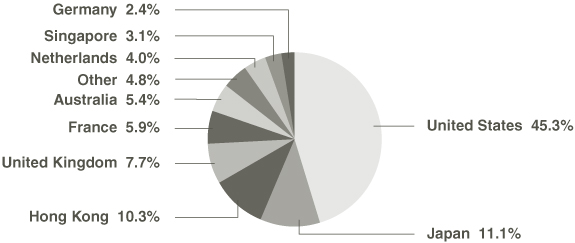

Country Breakdown

(Based on Net Assets)

(Unaudited)

9

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

SCHEDULE OF INVESTMENTS

June 30, 2015 (Unaudited)

| | | | | Number

of Shares | | Value | |

COMMON STOCK | | 99.7% | | | | | | | |

AUSTRALIA | | 5.4% | | | | | | | | | |

REAL ESTATE | |

DIVERSIFIED | | 0.0% | | | | | | | | | |

BGP Holdings PLC (EUR)a,b,c | | | | | 7,741,744 | | | $ | 0 | | |

RETAIL | | 5.4% | | | | | | | | | |

Federation Centres | | | | | 3,915,166 | | | | 8,820,581 | | |

Scentre Group | | | | | 3,274,844 | | | | 9,475,149 | | |

Westfield Corp. | | | | | 1,329,937 | | | | 9,358,152 | | |

| | | | | | | | 27,653,882 | | |

TOTAL AUSTRALIA | | | | | | | 27,653,882 | | |

BERMUDA | | 1.0% | | | | | | | | | |

REAL ESTATE—HOTEL | |

Belmond Ltd., Class A (USD)b | | | | | 408,367 | | | | 5,100,504 | | |

CANADA | | 0.2% | | | | | | | | | |

REAL ESTATE—INDUSTRIAL | |

Pure Industrial Real Estate Trust | | | | | 207,643 | | | | 783,025 | | |

CHINA | | 1.3% | | | | | | | | | |

REAL ESTATE—RESIDENTIAL | |

China Vanke Co. Ltd., Class H (HKD) | | | | | 2,747,300 | | | | 6,762,323 | | |

FRANCE | | 5.9% | | | | | | | | | |

REAL ESTATE | |

DIVERSIFIED | | 1.4% | | | | | | | | | |

Fonciere des Regions | | | | | 61,233 | | | | 5,203,203 | | |

Gecina SA | | | | | 16,590 | | | | 2,044,661 | | |

| | | | | | | | 7,247,864 | | |

RETAIL | | 4.5% | | | | | | | | | |

Klepierre | | | | | 526,383 | | | | 23,153,688 | | |

TOTAL FRANCE | | | | | | | 30,401,552 | | |

GERMANY | | 2.4% | | | | | | | | | |

REAL ESTATE—RESIDENTIAL | |

Deutsche Wohnen AG | | | | | 544,528 | | | | 12,478,258 | | |

See accompanying notes to financial statements.

10

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2015 (Unaudited)

| | | | | Number

of Shares | | Value | |

HONG KONG | | 10.3% | | | | | | | | | |

REAL ESTATE | |

DIVERSIFIED | | 5.8% | | | | | | | | | |

New World Development Co., Ltd. | | | | | 8,787,936 | | | $ | 11,541,071 | | |

Sun Hung Kai Properties Ltd. | | | | | 699,245 | | | | 11,357,076 | | |

Wharf Holdings Ltd. | | | | | 1,049,051 | | | | 6,983,253 | | |

| | | | | | | | 29,881,400 | | |

OFFICE | | 2.7% | | | | | | | | | |

Hongkong Land Holdings Ltd. (USD) | | | | | 1,655,571 | | | | 13,575,682 | | |

RETAIL | | 1.8% | | | | | | | | | |

Link REIT | | | | | 1,581,500 | | | | 9,272,878 | | |

TOTAL HONG KONG | | | | | | | 52,729,960 | | |

ITALY | | 1.0% | | | | | | | | | |

REAL ESTATE—DIVERSIFIED | |

Beni Stabili S.p.A. (USD) | | | | | 7,071,170 | | | | 5,250,272 | | |

JAPAN | | 11.1% | | | | | | | | | |

REAL ESTATE | |

DIVERSIFIED | | 6.7% | | | | | | | | | |

Hulic Co., Ltd. | | | | | 30,482 | | | | 270,486 | | |

Mitsubishi Estate Co., Ltd. | | | | | 646,000 | | | | 13,916,567 | | |

Mitsui Fudosan Co., Ltd. | | | | | 559,833 | | | | 15,676,330 | | |

Nomura Real Estate Master Fund | | | | | 3,505 | | | | 4,456,249 | | |

| | | | | | | | 34,319,632 | | |

OFFICE | | 2.2% | | | | | | | | | |

Hulic REIT | | | | | 3,888 | | | | 5,540,444 | | |

Nippon Building Fund | | | | | 349 | | | | 1,528,488 | | |

Nomura Real Estate Office Fund | | | | | 957 | | | | 4,339,870 | | |

| | | | | | | | 11,408,802 | | |

RETAIL | | 2.2% | | | | | | | | | |

AEON Mall Co., Ltd. | | | | | 285,200 | | | | 5,345,825 | | |

Japan Retail Fund Investment Corp. | | | | | 2,802 | | | | 5,606,976 | | |

| | | | | | | | 10,952,801 | | |

TOTAL JAPAN | | | | | | | 56,681,235 | | |

See accompanying notes to financial statements.

11

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2015 (Unaudited)

| | | | | Number

of Shares | | Value | |

NETHERLANDS | | 4.0% | | | | | | | | | |

REAL ESTATE | |

DIVERSIFIED | | 1.0% | | | | | | | | | |

Nieuwe Steen Investments NV | | | | | 1,268,221 | | | $ | 4,990,981 | | |

RETAIL | | 3.0% | | | | | | | | | |

Wereldhave NV | | | | | 273,075 | | | | 15,505,004 | | |

TOTAL NETHERLANDS | | | | | | | 20,495,985 | | |

SINGAPORE | | 3.1% | | | | | | | | | |

REAL ESTATE | |

DIVERSIFIED | | 1.1% | | | | | | | | | |

Capitaland Ltd. | | | | | 2,152,600 | | | | 5,593,867 | | |

INDUSTRIALS | | 2.0% | | | | | | | | | |

Ascendas REIT | | | | | 1,504,600 | | | | 2,748,128 | | |

Global Logistic Properties Ltd. | | | | | 3,890,000 | | | | 7,307,198 | | |

| | | | | | | | 10,055,326 | | |

TOTAL SINGAPORE | | | | | | | 15,649,193 | | |

SPAIN | | 1.0% | | | | | | | | | |

REAL ESTATE—DIVERSIFIED | |

Hispania Activos Inmobiliarios SAb | | | | | 265,505 | | | | 3,895,336 | | |

Lar Espana Real Estate Socimi SA | | | | | 132,677 | | | | 1,464,949 | | |

TOTAL SPAIN | | | | | | | 5,360,285 | | |

UNITED KINGDOM | | 7.7% | | | | | | | | | |

REAL ESTATE | |

DIVERSIFIED | | 3.1% | | | | | | | | | |

Land Securities Group PLC | | | | | 841,319 | | | | 15,915,946 | | |

OFFICE | | 1.0% | | | | | | | | | |

Derwent London PLC | | | | | 97,126 | | | | 5,191,765 | | |

RETAIL | | 2.4% | | | | | | | | | |

Hammerson PLC | | | | | 1,259,707 | | | | 12,182,681 | | |

SELF STORAGE | | 1.2% | | | | | | | | | |

Big Yellow Group PLC | | | | | 598,561 | | | | 5,995,617 | | |

TOTAL UNITED KINGDOM | | | | | | | 39,286,009 | | |

See accompanying notes to financial statements.

12

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2015 (Unaudited)

| | | | | Number

of Shares | | Value | |

UNITED STATES | | 45.3% | | | | | | | | | |

REAL ESTATE | |

DIVERSIFIED | | 3.5% | | | | | | | | | |

Gramercy Property Trust | | | | | 152,056 | | | $ | 3,553,548 | | |

Vornado Realty Trust | | | | | 149,818 | | | | 14,222,223 | | |

| | | | | | | | 17,775,771 | | |

HEALTH CARE | | 4.0% | | | | | | | | | |

Health Care REIT | | | | | 197,850 | | | | 12,984,896 | | |

Omega Healthcare Investors | | | | | 225,243 | | | | 7,732,592 | | |

| | | | | | | | 20,717,488 | | |

HOTEL | | 3.3% | | | | | | | | | |

Extended Stay America | | | | | 231,545 | | | | 4,346,100 | | |

Host Hotels & Resorts | | | | | 392,424 | | | | 7,781,768 | | |

La Quinta Holdingsb | | | | | 216,945 | | | | 4,957,193 | | |

| | | | | | | | 17,085,061 | | |

OFFICE | | 7.0% | | | | | | | | | |

BioMed Realty Trust | | | | | 358,473 | | | | 6,932,868 | | |

Douglas Emmett | | | | | 187,780 | | | | 5,058,793 | | |

Empire State Realty Trust, Class A | | | | | 248,486 | | | | 4,239,171 | | |

Kilroy Realty Corp. | | | | | 96,115 | | | | 6,454,122 | | |

SL Green Realty Corp. | | | | | 118,585 | | | | 13,031,306 | | |

| | | | | | | | 35,716,260 | | |

RESIDENTIAL | | 12.4% | | | | | | | | | |

APARTMENT | | 10.8% | | | | | | | | | |

American Homes 4 Rent, Class A | | | | | 128,484 | | | | 2,060,883 | | |

Apartment Investment & Management Co. | | | | | 228,341 | | | | 8,432,633 | | |

Education Realty Trust | | | | | 117,315 | | | | 3,678,998 | | |

Equity Residential | | | | | 313,017 | | | | 21,964,403 | | |

Monogram Residential Trust | | | | | 283,440 | | | | 2,556,629 | | |

Starwood Waypoint Residential Trust | | | | | 254,761 | | | | 6,053,121 | | |

UDR | | | | | 331,014 | | | | 10,602,379 | | |

| | | | | | | | 55,349,046 | | |

See accompanying notes to financial statements.

13

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2015 (Unaudited)

| | | | | Number

of Shares | | Value | |

MANUFACTURED HOME | | 1.6% | | | | | | | | | |

Sun Communities | | | | | 131,980 | | | $ | 8,160,324 | | |

TOTAL RESIDENTIAL | | | | | | | 63,509,370 | | |

SELF STORAGE | | 5.0% | | | | | | | | | |

Extra Space Storage | | | | | 187,161 | | | | 12,206,640 | | |

Public Storage | | | | | 71,230 | | | | 13,132,675 | | |

| | | | | | | | 25,339,315 | | |

SHOPPING CENTERS | | 8.6% | | | | | | | | | |

COMMUNITY CENTER | | 3.6% | | | | | | | | | |

DDR Corp. | | | | | 686,680 | | | | 10,616,073 | | |

Regency Centers Corp. | | | | | 127,256 | | | | 7,505,559 | | |

| | | | | | | | 18,121,632 | | |

FREE STANDING | | 1.0% | | | | | | | | | |

Spirit Realty Capital | | | | | 547,612 | | | | 5,295,408 | | |

REGIONAL MALL | | 4.0% | | | | | | | | | |

Macerich Co. (The) | | | | | 62,210 | | | | 4,640,866 | | |

Simon Property Group | | | | | 91,922 | | | | 15,904,344 | | |

| | | | | | | | 20,545,210 | | |

TOTAL SHOPPING CENTERS | | | | | | | 43,962,250 | | |

SPECIALTY | | 1.5% | | | | | | | | | |

CyrusOne | | | | | 134,431 | | | | 3,958,993 | | |

QTS Realty Trust, Class A | | | | | 99,164 | | | | 3,614,528 | | |

| | | | | | | 7,573,521 | | |

TOTAL UNITED STATES | | | | | | | 231,679,036 | | |

TOTAL COMMON STOCK

(Identified cost—$474,965,486) | | | | | | | 510,311,519 | | |

See accompanying notes to financial statements.

14

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2015 (Unaudited)

| | | | | Number

of Shares | | Value | |

SHORT-TERM INVESTMENTS | | | 0.2% | | | | | | | | | | |

MONEY MARKET FUNDS | |

State Street Institutional Treasury Money

Market Fund, 0.00%d | | | | | 1,200,000 | | | $ | 1,200,000 | | |

TOTAL SHORT-TERM INVESTMENTS

(Identified cost—$1,200,000) | | | | | | | 1,200,000 | | |

TOTAL INVESTMENTS (Identified cost—$476,165,486) | | | 99.9 | % | | | | | | | 511,511,519 | | |

OTHER ASSETS IN EXCESS OF LIABILITIES | | | 0.1 | | | | | | | | 351,298 | | |

NET ASSETS (Equivalent to $24.56 per share

based on 20,844,594 shares of common

stock outstanding) | | | 100.0 | % | | | | | | $ | 511,862,817 | | |

Glossary of Portfolio Abbreviations

EUR Euro Currency

HKD Hong Kong Dollar

REIT Real Estate Investment Trust

USD United States Dollar

Note: Percentages indicated are based on the net assets of the Fund.

a Illiquid security. Aggregate holdings equal 0.0% of the net assets of the Fund.

b Non-income producing security.

c Fair valued security. This security has been valued at its fair value as determined in good faith under procedures established by and under the general supervision of the Fund's Board of Directors. Aggregate fair valued securities represent 0.0% of the net assets of the Fund.

d Rate quoted represents the annualized seven-day yield of the Fund.

See accompanying notes to financial statements.

15

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2015 (Unaudited)

Sector Summary | | % of

Net Assets | |

Diversified | | | 24.6 | | |

Retail | | | 19.3 | | |

Residential | | | 16.1 | | |

Office | | | 12.9 | | |

Shopping Centers | | | 8.6 | | |

Self Storage | | | 6.2 | | |

Hotel | | | 4.3 | | |

Health Care | | | 4.0 | | |

Industrials | | | 2.2 | | |

| Specialty | | | 1.5 | | |

Other | | | 0.3 | | |

| | | | 100.0 | | |

See accompanying notes to financial statements.

16

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2015 (Unaudited)

ASSETS: | |

Investments in securities, at value (Identified cost—$476,165,486) | | $ | 511,511,519 | | |

Cash | | | 1,271,610 | | |

Foreign currency, at value (Identified cost—$91,245) | | | 90,997 | | |

Receivable for: | |

Investment securities sold | | | 2,921,071 | | |

Dividends | | | 1,806,310 | | |

Fund shares sold | | | 930,810 | | |

Other assets | | | 3,014 | | |

Total Assets | | | 518,535,331 | | |

LIABILITIES: | |

Payable for: | |

Fund shares redeemed | | | 3,115,509 | | |

Investment securities purchased | | | 2,569,491 | | |

Dividends declared | | | 556,367 | | |

Investment management fees | | | 427,488 | | |

Directors' fees | | | 396 | | |

Other liabilities | | | 3,263 | | |

Total Liabilities | | | 6,672,514 | | |

NET ASSETS applicable to 20,844,594 shares of $0.001 par value of common stock

outstanding | | $ | 511,862,817 | | |

NET ASSET VALUE PER SHARE: | |

($511,862,817 ÷ 20,844,594 shares outstanding) | | $ | 24.56 | | |

NET ASSETS consist of: | |

Paid-in capital | | $ | 490,919,863 | | |

Dividends in excess of net investment income | | | (4,682,691 | ) | |

Accumulated net realized loss | | | (9,715,509 | ) | |

Net unrealized appreciation | | | 35,341,154 | | |

| | | $ | 511,862,817 | | |

See accompanying notes to financial statements.

17

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2015 (Unaudited)

Investment Income: | |

Dividend income (net of $471,029 of foreign withholding tax) | | $ | 6,998,770 | | |

Expenses: | |

Investment management fees | | | 2,703,820 | | |

Registration and filing fees | | | 18,346 | | |

Directors' fees and expenses | | | 16,325 | | |

Line of credit fees | | | 1,450 | | |

Miscellaneous | | | 2,967 | | |

Total Expenses | | | 2,742,908 | | |

Reduction of Expenses (See Note 2) | | | (39,088 | ) | |

Net Expenses | | | 2,703,820 | | |

Net Investment Income | | | 4,294,950 | | |

Net Realized and Unrealized Gain (Loss): | |

Net realized gain (loss) on: | | | | | |

Investments | | | 24,113,288 | | |

Foreign currency transactions | | | 47,798 | | |

Net realized gain | | | 24,161,086 | | |

Net change in unrealized appreciation (depreciation) on: | | | | | |

Investments | | | (33,350,293 | ) | |

Foreign currency translations | | | 8,251 | | |

Net change in unrealized appreciation (depreciation) | | | (33,342,042 | ) | |

Net realized and unrealized loss | | | (9,180,956 | ) | |

Net Decrease in Net Assets Resulting from Operations | | $ | (4,886,006 | ) | |

See accompanying notes to financial statements.

18

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

STATEMENT OF CHANGES IN NET ASSETS (Unaudited)

| | | For the

Six Months Ended

June 30, 2015 | | For the

Year Ended

December 31, 2014 | |

Change in Net Assets: | |

From Operations: | |

Net investment income | | $ | 4,294,950 | | | $ | 11,594,934 | | |

Net realized gain | | | 24,161,086 | | | | 59,039,121 | | |

Net change in unrealized appreciation

(depreciation) | | | (33,342,042 | ) | | | (226,032 | ) | |

Net increase (decrease) in net assets

resulting from operations | | | (4,886,006 | ) | | | 70,408,023 | | |

Dividends to Shareholders from Net

Investment Income | | | (8,946,611 | ) | | | (11,110,088 | ) | |

Capital Stock Transactions: | |

Decrease in net assets from Fund share

transactions | | | (1,617,465 | ) | | | (43,069,870 | ) | |

Total increase (decrease) in net assets | | | (15,450,082 | ) | | | 16,228,065 | | |

Net Assets: | |

Beginning of period | | | 527,312,899 | | | | 511,084,834 | | |

End of perioda | | $ | 511,862,817 | | | $ | 527,312,899 | | |

a Includes dividends in excess of net investment income of $4,682,691 and $31,030, respectively.

See accompanying notes to financial statements.

19

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

FINANCIAL HIGHLIGHTS (Unaudited)

The following table includes selected data for a share outstanding throughout each period and other performance information derived from the financial statements. It should be read in conjunction with the financial statements and notes thereto.

| | | For the Six | | For the Year Ended December 31, | |

| | | Months Ended | | | |

Per Share Operating Performance: | | June 30, 2015 | | 2014 | | 2013 | | 2012 | | 2011 | | 2010 | |

Net asset value, beginning of period | | $ | 25.24 | | | $ | 22.58 | | | $ | 22.28 | | | $ | 18.52 | | | $ | 20.72 | | | $ | 18.51 | | |

Income (loss) from investment

operations: | |

Net investment income | | | 0.21 | a | | | 0.53 | a,b | | | 0.36 | a | | | 0.35 | a | | | 0.56 | | | | 0.84 | c | |

Net realized and unrealized

gain (loss) | | | (0.46 | ) | | | 2.65 | | | | 0.53 | | | | 4.40 | | | | (2.43 | ) | | | 2.33 | | |

Total from investment

operations | | | (0.25 | ) | | | 3.18 | | | | 0.89 | | | | 4.75 | | | | (1.87 | ) | | | 3.17 | | |

Less dividends and distributions

to shareholders from: | |

Net investment income | | | (0.43 | ) | | | (0.52 | ) | | | (0.59 | ) | | | (0.99 | ) | | | (0.26 | ) | | | (0.96 | ) | |

Return of capital | | | — | | | | — | | | | — | | | | — | | | | (0.07 | ) | | | — | | |

Total dividends and

distributions to

shareholders | | | (0.43 | ) | | | (0.52 | ) | | | (0.59 | ) | | | (0.99 | ) | | | (0.33 | ) | | | (0.96 | ) | |

Net increase (decrease) in net

asset value | | | (0.68 | ) | | | 2.66 | | | | 0.30 | | | | 3.76 | | | | (2.20 | ) | | | 2.21 | | |

Net asset value, end of period | | $ | 24.56 | | | $ | 25.24 | | | $ | 22.58 | | | $ | 22.28 | | | $ | 18.52 | | | $ | 20.72 | | |

Total investment returnd | | | –1.00 | %e | | | 14.12 | % | | | 4.07 | % | | | 25.91 | % | | | –9.15 | % | | | 17.56 | % | |

See accompanying notes to financial statements.

20

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

FINANCIAL HIGHLIGHTS (Unaudited)—(Continued)

| | | For the Six | | For the Year Ended December 31, | |

| | | Months Ended | | | |

Ratios/Supplemental Data: | | June 30, 2015 | | 2014 | | 2013 | | 2012 | | 2011 | | 2010 | |

Net assets, end of period (in millions) | | $ | 511.9 | | | $ | 527.3 | | | $ | 511.1 | | | $ | 505.4 | | | $ | 503.5 | | | $ | 525.8 | | |

Ratio of expenses to average daily

net assets (before expense

reduction) | | | 1.01 | %f | | | 1.01 | % | | | 1.01 | % | | | 1.02 | % | | | 1.03 | % | | | 1.03 | % | |

Ratio of expenses to average daily

net assets (net of expense

reduction) | | | 1.00 | %f | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | |

Ratio of net investment income to

average daily net assets

(before expense reduction) | | | 1.58 | %f | | | 2.19 | % | | | 1.54 | % | | | 1.69 | % | | | 1.68 | % | | | 2.07 | % | |

Ratio of net investment income

to average daily net assets

(net of expense reduction) | | | 1.59 | %f | | | 2.20 | % | | | 1.55 | % | | | 1.71 | % | | | 1.71 | % | | | 2.10 | % | |

Portfolio turnover rate | | | 45 | %e | | | 111 | % | | | 126 | % | | | 100 | % | | | 101 | % | | | 111 | % | |

a Calculation based on average shares outstanding.

b 24.4% of gross income was attributable to dividends paid by Westfield Corp.

c 20.6% of gross income was attributable to dividends paid by Unibail-Rodamco.

d Return assumes the reinvestment of all dividends and distributions at NAV.

e Not annualized.

f Annualized.

See accompanying notes to financial statements.

21

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)

Note 1. Organization and Significant Accounting Policies

Cohen & Steers Institutional Global Realty Shares, Inc. (the Fund) was incorporated under the laws of the State of Maryland on May 11, 2006 and is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The Fund's investment objective is total return.

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946—Investment Companies. The accounting policies of the Fund are in conformity with accounting principles generally accepted in the United States of America (GAAP). The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Portfolio Valuation: Investments in securities that are listed on the New York Stock Exchange (NYSE) are valued, except as indicated below, at the last sale price reflected at the close of the NYSE on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and ask prices on such day or, if no ask price is available, at the bid price.

Securities not listed on the NYSE but listed on other domestic or foreign securities exchanges are valued in a similar manner. Securities traded on more than one securities exchange are valued at the last sale price reflected at the close of the exchange representing the principal market for such securities on the business day as of which such value is being determined. If after the close of a foreign market, but prior to the close of business on the day the securities are being valued, market conditions change significantly, certain non-U.S. equity holdings may be fair valued pursuant to procedures established by the Board of Directors.

Readily marketable securities traded in the over-the-counter market, including listed securities whose primary market is believed by Cohen & Steers Capital Management, Inc. (the investment manager) to be over-the-counter, are valued at the last sale price on the valuation date as reported by sources deemed appropriate by the Board of Directors to reflect their fair market value. If there has been no sale on such day, the securities are valued at the mean of the closing bid and ask prices on such day or, if no ask price is available, at the bid price.

Short-term debt securities with a maturity date of 60 days or less are valued at amortized cost, which approximates fair value. Investments in open-end mutual funds are valued at their closing net asset value.

The policies and procedures approved by the Fund's Board of Directors delegate authority to make fair value determinations to the investment manager, subject to the oversight of the Board of Directors. The investment manager has established a valuation committee (Valuation Committee) to administer, implement and oversee the fair valuation process according to the policies and procedures

22

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

approved annually by the Board of Directors. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

Securities for which market prices are unavailable, or securities for which the investment manager determines that the bid and/or ask price or a counterparty valuation does not reflect market value, will be valued at fair value, as determined in good faith by the Valuation Committee, pursuant to procedures approved by the Fund's Board of Directors. Circumstances in which market prices may be unavailable include, but are not limited to, when trading in a security is suspended, the exchange on which the security is traded is subject to an unscheduled close or disruption or material events occur after the close of the exchange on which the security is principally traded. In these circumstances, the Fund determines fair value in a manner that fairly reflects the market value of the security on the valuation date based on consideration of any information or factors it deems appropriate. These may include, but are not limited to, recent transactions in comparable securities, information relating to the specific security and developments in the markets.

Foreign equity fair value pricing procedures utilized by the Fund may cause certain non-U.S. equity holdings to be fair valued on the basis of fair value factors provided by a pricing service to reflect any significant market movements between the time the Fund values such securities and the earlier closing of foreign markets.

The Fund's use of fair value pricing may cause the net asset value of Fund shares to differ from the net asset value that would be calculated using market quotations. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security may be materially different than the value that could be realized upon the sale of that security.

Fair value is defined as the price that the Fund would expect to receive upon the sale of an investment or expect to pay to transfer a liability in an orderly transaction with an independent buyer in the principal market or, in the absence of a principal market, the most advantageous market for the investment or liability. The hierarchy of inputs that are used in determining the fair value of the Fund's investments is summarized below.

• Level 1—quoted prices in active markets for identical investments

• Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, credit risk, etc.)

• Level 3—significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfer at the end of the period in which the underlying event causing the movement occurred. Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. As of June 30, 2015, there were $229,119,895 of securities transferred between

23

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

Level 1 and Level 2, which resulted from the Fund not utilizing foreign equity fair value pricing procedures as of June 30, 2015.

The following is a summary of the inputs used as of June 30, 2015 in valuing the Fund's investments carried at value:

| | Total | | Quoted Prices

in Active

Markets for

Identical

Investments

(Level 1) | | Other

Significant

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | |

Common Stock:

Australia | | $ | 27,653,882 | | | $ | 27,653,882 | | | $ | — | | | $ | — | a | |

Other Countries | | | 482,657,637 | | | | 482,657,637 | | | | — | | | | — | | |

| Short-Term Investments | | | 1,200,000 | | | | — | | | | 1,200,000 | | | | — | | |

Total Investmentsb | | $ | 511,511,519 | | | $ | 510,311,519 | | | $ | 1,200,000 | | | $ | — | | |

a BGP Holdings PLC was acquired via a spinoff and has been fair valued, by the Valuation Committee, at zero pursuant to the Fund's fair value procedures and classified as a Level 3 security.

b Portfolio holdings are disclosed individually on the Schedule of Investments.

Security Transactions and Investment Income: Security transactions are recorded on trade date. Realized gains and losses on investments sold are recorded on the basis of identified cost. Interest income is recorded on the accrual basis. Discounts are accreted and premiums are amortized over the life of the respective securities. Dividend income is recorded on the ex-dividend date, except for certain dividends on foreign securities, which are recorded as soon as the Fund is informed after the ex-dividend date. Distributions from U.S. Real Estate Investment Trusts (REITs) are recorded as ordinary income, net realized capital gain or return of capital based on information reported by the REITs and management's estimates of such amounts based on historical information. These estimates are adjusted when the actual source of distributions is disclosed by the REITs and actual amounts may differ from the estimated amounts.

Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based upon prevailing exchange rates on the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollars based upon prevailing exchange rates on the respective dates of such transactions. The Fund does not isolate that portion of the results of operations resulting from fluctuations in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, including gains and losses on forward foreign currency exchange contracts, currency gains or losses realized

24

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund's books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the values of assets and liabilities, other than investments in securities, on the date of valuation, resulting from changes in exchange rates. Pursuant to U.S. federal income tax regulations, certain foreign currency gains/losses included in realized and unrealized gains/losses are included in or are a reduction of ordinary income for federal income tax purposes.

Foreign Securities: The Fund directly purchases securities of foreign issuers. Investing in securities of foreign issuers involves special risks not typically associated with investing in securities of U.S. issuers. The risks include possible revaluation of currencies, the ability to repatriate funds, less complete financial information about companies and possible future adverse political and economic developments. Moreover, securities of many foreign issuers and their markets may be less liquid and their prices more volatile than securities of comparable U.S. issuers.

Dividends and Distributions to Shareholders: Dividends from net investment income and capital gain distributions are determined in accordance with U.S. federal income tax regulations, which may differ from GAAP. Dividends from net investment income, if any, are declared and paid semi-annually. Net realized capital gains, unless offset by any available capital loss carryforward, are typically distributed to shareholders at least annually. Dividends and distributions to shareholders are recorded on the ex-dividend date and are automatically reinvested in full and fractional shares of the Fund based on the net asset value per share at the close of business on the payable date unless the shareholder has elected to have them paid in cash. Dividends from net investment income are subject to recharacterization for tax purposes.

Income Taxes: It is the policy of the Fund to continue to qualify as a regulated investment company, if such qualification is in the best interest of the shareholders, by complying with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies, and by distributing substantially all of its taxable earnings to its shareholders. Also, in order to avoid the payment of any federal excise taxes, the Fund will distribute substantially all of its net investment income and net realized gains on a calendar year basis. Accordingly, no provision for federal income or excise tax is necessary. Dividend and interest income from holdings in non-U.S. securities is recorded net of non-U.S. taxes paid. Security and foreign currency transactions and any gains realized by the Fund on the sale of securities in certain non-U.S. markets are subject to non-U.S. taxes. The Fund records a liability based on any unrealized gains on securities held in these markets in order to estimate the potential non-U.S. taxes due upon the sale of these securities. Management has analyzed the Fund's tax positions taken on federal and applicable state income tax returns as well as its tax positions in non-U.S. jurisdictions in which it trades for all open tax years and has concluded that as of June 30, 2015, no additional provisions for income tax are required in the Fund's financial statements. The Fund's tax positions for the tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service, state departments of revenue and by foreign tax authorities.

25

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

Note 2. Investment Management Fees and Other Transactions with Affiliates

Investment Management Fees: The investment manager serves as the Fund's investment manager pursuant to an investment management agreement (the investment management agreement). Under the terms of the investment management agreement, the investment manager provides the Fund with day-to-day investment decisions and generally manages the Fund's investments in accordance with the stated policies of the Fund, subject to the supervision of the Board of Directors.

For the services provided to the Fund, the investment manager receives a fee, accrued daily and paid monthly, at the annual rate of 1.00% of the average daily net assets of the Fund.

The investment manager is also responsible, under the investment management agreement, for the performance of certain administrative functions for the Fund. Additionally, the investment manager pays certain expenses of the Fund, including administrative and custody fees, transfer agent fees, professional fees, and reports to shareholders.

The investment manager has contractually agreed to waive its fees and/or reimburse the Fund so that the Fund's total annual operating expenses (excluding brokerage fees and commissions, taxes, and, upon approval of the Board, extraordinary expenses) do not exceed 1.00% of the average daily net assets of the Fund. This commitment will remain in place for the life of the Fund. For the six months ended June 30, 2015, fees waived and/or expenses reimbursed totaled $39,088.

Under subadvisory agreements between the investment manager and each of Cohen & Steers Asia Limited and Cohen & Steers UK Limited (collectively, the subadvisors), affiliates of the investment manager, the subadvisors are responsible for managing the Fund's investments in certain non-U.S. real estate securities. For their services provided under the subadvisory agreements, the investment manager (not the Fund) pays the subadvisors. The investment manager allocates 50% of the investment management fee received from the Fund among itself and each subadvisor based on the portion of the Fund's average daily assets managed by the investment manager and each subadvisor.

Directors' and Officers' Fees: Certain directors and officers of the Fund are also directors, officers, and/or employees of the investment manager. The Fund does not pay compensation to directors and officers affiliated with the investment manager.

Note 3. Purchases and Sales of Securities

Purchases and sales of securities, excluding short-term investments, for the six months ended June 30, 2015, totaled $239,563,603 and $240,364,184, respectively.

26

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

Note 4. Income Tax Information

As of June 30, 2015 the federal tax cost and net unrealized appreciation and depreciation in value of securities were as follows:

Cost for federal income tax purposes | | $ | 476,165,486 | | |

Gross unrealized appreciation | | $ | 56,329,421 | | |

| Gross unrealized depreciation | | | (20,983,388 | ) | |

Net unrealized appreciation | | $ | 35,346,033 | | |

As of December 31, 2014, the Fund had a net capital loss carryforward of $25,657,974, which may be used to offset future capital gains. This loss is a short-term capital loss carryover which will expire on December 31, 2017. In addition, the Fund incurred net ordinary losses of $243,114 after October 31, 2014, that it has elected to treat as arising in the following fiscal year.

Note 5. Capital Stock

The Fund is authorized to issue 100 million shares of capital stock, at a par value of $0.001 per share. The Board of Directors of the Fund may increase or decrease the aggregate number of shares of common stock that the Fund has authority to issue. Transactions in Fund shares were as follows:

| | For the

Six Months Ended

June 30, 2015 | | For the

Year Ended

December 31, 2014 | |

| | Shares | | Amount | | Shares | | Amount | |

Sold | | | 1,123,471 | | | $ | 29,496,010 | | | | 3,926,288 | | | $ | 95,144,064 | | |

Issued as reinvestment

of dividends | | | 326,305 | | | | 8,100,295 | | | | 418,207 | | | | 10,424,302 | | |

Redeemed | | | (1,500,609 | ) | | | (39,213,770 | ) | | | (4,621,749 | ) | | | (111,771,433 | ) | |

Redemption in-kinda | | | — | | | | — | | | | (1,459,530 | ) | | | (36,866,803 | ) | |

Net decrease | | | (50,833 | ) | | $ | (1,617,465 | ) | | | (1,736,784 | ) | | $ | (43,069,870 | ) | |

a Certain shareholders of the Fund were permitted to redeem shares in-kind. As a result, the Fund realized a net gain of $2,947,319 for financial reporting purposes.

Note 6. Borrowings

The Fund, in conjunction with other Cohen & Steers open-end funds, was a party to a $200,000,000 syndicated credit agreement (the credit agreement) with State Street Bank and Trust Company, as administrative agent and operations agent, and the lenders identified in the credit agreement (as applicable), which expired January 23, 2015. The Fund paid a commitment fee of 0.10% per annum on

27

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

its proportionate share of the unused portion of the credit agreement. On January 23, 2015, the credit agreement was renewed and expires January 22, 2016. Under the renewed credit agreement, the total commitment amount has been reduced to $50,000,000 and the Fund pays a commitment fee of 0.15% per annum on its proportionate share of the unused portion of the credit agreement.

During the six months ended June 30, 2015, the Fund did not borrow under the credit agreement.

Note 7. Other

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is dependent on claims that may be made against the Fund in the future and, therefore, cannot be estimated; however, based on experience, the risk of material loss from such claims is considered remote.

Note 8. Subsequent Events

Management has evaluated events and transactions occurring after June 30, 2015 through the date that the financial statements were issued, and has determined that no additional disclosure in the financial statements is required.

28

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

OTHER INFORMATION

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling 800-330-7348, (ii) on our website at cohenandsteers.com or (iii) on the Securities and Exchange Commission's (the SEC) website at http://www.sec.gov. In addition, the Fund's proxy voting record for the most recent 12-month period ended June 30 is available by August 31 of each year (i) without charge, upon request, by calling 800-330-7348 or (ii) on the SEC's website at http://www.sec.gov.

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund's Forms N-Q are available (i) without charge, upon request, by calling 800-330-7348 or (ii) on the SEC's website at http://www.sec.gov. In addition, the Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

Please note that distributions paid by the Fund to shareholders are subject to recharacterization for tax purposes. The Fund may also pay distributions in excess of the Fund's net investment company taxable income and net realized gains and this excess would be a tax free return of capital distributed from the Fund's assets. The final tax treatment of all distributions is reported to shareholders on their 1099-DIV forms, which are mailed after the close of each calendar year.

APPROVAL OF INVESTMENT MANAGEMENT AND SUBADVISORY AGREEMENTS

The Board of Directors of the Fund, including a majority of the directors who are not parties to the Fund's investment management and subadvisory agreements (the Management Agreements), or interested persons of any such party (Independent Directors), has the responsibility under the 1940 Act to approve the Fund's Management Agreements for their initial two year term and their continuation annually thereafter at a meeting of the Board of Directors called for the purpose of voting on the approval or continuation. At a telephonic meeting of the Board of Directors held on June 9, 2015 and at a meeting held in person on June 16, 2015, the Management Agreements were discussed and were unanimously continued for a term ending June 30, 2016 by the Fund's Board of Directors, including the Independent Directors. The Independent Directors were represented by independent counsel who assisted them in their deliberations during the meeting and executive session.

In considering whether to continue the Management Agreements, the Board of Directors reviewed materials provided by the Fund's investment manager (the Investment Manager) and Fund counsel which included, among other things, fee, expense and performance information compared to peer funds (Peer Funds) and performance comparisons to a larger category universe, prepared by an independent data provider; summary information prepared by the Investment Manager; and a memorandum outlining the legal duties of the Board of Directors. The Board of Directors also spoke directly with representatives of the independent data provider and met with investment advisory personnel. In addition, the Board of Directors considered information provided from time to time by the Investment Manager throughout the year at meetings of the Board of Directors, including presentations by portfolio managers relating to the investment performance of the Fund and the investment strategies used in pursuing the Fund's objective. In particular, the Board of Directors considered the following:

(i) The nature, extent and quality of services to be provided by the Investment Manager and the Subadvisors: The Board of Directors reviewed the services that the Investment Manager and the sub-investment advisors (the Subadvisors) provide to the Fund, including, but not limited to, making the

29

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

day-to-day investment decisions for the Fund, and, for the Investment Manager, generally managing the Fund's investments in accordance with the stated policies of the Fund. The Board of Directors also discussed with officers and portfolio managers of the Fund the types of transactions that were being done on behalf of the Fund. Additionally, the Board of Directors took into account the services provided by the Investment Manager and the Subadvisors to other funds, including those that have investment objectives and strategies similar to the Fund. The Board of Directors next considered the education, background and experience of the Investment Manager's and Subadvisors' personnel, noting particularly that the favorable history and reputation of the portfolio managers for the Fund has had, and would likely continue to have, a favorable impact on the Fund. The Board of Directors further noted the Investment Manager's and Subadvisors' ability to attract qualified and experienced personnel. The Board of Directors also considered the administrative services provided by the Investment Manager, including compliance and accounting services. After consideration of the above factors, among others, the Board of Directors concluded that the nature, extent and quality of services provided by the Investment Manager and the Subadvisors are adequate and appropriate.

(ii) Investment performance of the Fund and the Investment Manager and Subadvisors: The Board of Directors considered the investment performance of the Fund versus Peer Funds and compared to a relevant benchmark. The Board of Directors noted that the Fund underperformed the median of the Peer Funds for the one-, three- and five-year periods ended March 31, 2015, ranking in the fourth, fourth and fifth quintiles, respectively. The Board of Directors also noted that the Fund had underperformed its benchmark for the five-year period and performed in line with its benchmark for the one- and three-year periods. The Board of Directors also noted that the Fund has outperformed its benchmark since the reorganization of the global real estate investment team in May 2012, through March 31, 2015. The Board of Directors engaged in discussions with the Investment Manager regarding the contributors to and detractors from the Fund's performance during the periods. The Board of Directors also considered supplemental information provided by the Investment Manager, including a narrative summary of various factors affecting performance and the Investment Manager's performance in managing other real estate funds. The Board of Directors then determined that Fund performance, in light of all considerations noted above, was satisfactory.

(iii) Cost of the services to be provided and profits to be realized by the Investment Manager from the relationship with the Fund: Next, the Board of Directors considered the advisory fees payable by the Fund, as well as total expense ratios. As part of its analysis, the Board of Directors gave consideration to the fee and expense analyses provided by the independent data provider. The Board of Directors noted that the Fund's actual and contractual management fees were higher than the medians of the Peer Funds, ranking in the fifth quintile for each. The Board of Directors noted that the Fund's net expense ratio was less than 0.01% higher than the median of the Peer Funds, ranking in the third quintile. The Board of Directors also considered the effect the unitary fee charged by the Investment Manager, which limits total expenses of the Fund, has on the Fund's contractual and actual management fee rankings. The Board of Directors concluded that the Fund's expense structure was satisfactory.

The Board of Directors also reviewed information regarding the profitability to the Investment Manager of its relationship with the Fund. The Board of Directors considered the level of the Investment Manager's profits and whether the profits were reasonable for the Investment Manager. The Board of Directors noted that the Investment Manager is currently waiving its fee and/or reimbursing expenses

30

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

of the Fund. Since the Subadvisors are paid by the Investment Manager and not by the Fund and are affiliates of the Investment Manager, and the Board of Directors considered the profitability of the Investment Manager as a whole, the Board of Directors did not consider the Subadvisors' separate profitability to be relevant to their considerations. The Board of Directors took into consideration other benefits to be derived by the Investment Manager in connection with the Management Agreements, noting particularly the research and related services, within the meaning of Section 28(e) of the Securities Exchange Act of 1934, as amended, that the Investment Manager receives by allocating the Fund's brokerage transactions. The Board of Directors concluded that the profits realized by the Investment Manager from its relationship with the Fund were reasonable and consistent with the Investment Manager's fiduciary duties.

(iv) The extent to which economies of scale would be realized as the Fund grows and whether fee levels would reflect such economies of scale: The Board of Directors noted that the Investment Manager pays most of the regular operating costs of the Fund and reimburses the Fund to the extent that total expenses exceed the advisory fee rate. The Board of Directors determined that there were not at this time significant economies of scale that were not being shared with shareholders.

(v) Comparison of services to be rendered and fees to be paid to those under other investment advisory contracts, such as contracts of the same and other investment advisers or other clients: As discussed above in (iii), the Board of Directors compared the fees paid under the Management Agreements to those under other investment advisory contracts of other investment advisers managing Peer Funds. The Board of Directors also compared the services rendered, fees paid and profitability under the Management Agreements to those under the Investment Manager's other advisory agreements and advisory contracts with institutional and other clients with similar investment mandates. The Board of Directors also considered the entrepreneurial risk and financial exposure assumed by the Investment Manager in developing and managing the Fund that the Investment Manager does not have with institutional and other clients and other differences in the management of registered investment companies and institutional accounts. The Board of Directors determined that on a comparative basis the fees under the Management Agreements were reasonable in relation to the services provided.

No single factor was cited as determinative to the decision of the Board of Directors. Rather, after weighing all of the considerations and conclusions discussed above, the Board of Directors, including the Independent Directors, unanimously approved the continuation of the Management Agreements.

31

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

Cohen & Steers Privacy Policy

Facts | | What Does Cohen & Steers Do With Your Personal Information? | |

Why? | | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. | |

What? | | The types of personal information we collect and share depend on the product or service you have with us. This information can include:

• Social Security number and account balances

• Transaction history and account transactions

• Purchase history and wire transfer instructions | |

How? | | All financial companies need to share customers' personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers' personal information; the reasons Cohen & Steers chooses to share; and whether you can limit this sharing. | |

Reasons we can share your personal information | | Does Cohen & Steers

share? | | Can you limit this

sharing? | |

For our everyday business purposes—

such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or reports to credit bureaus | | Yes | | No | |

For our marketing purposes—

to offer our products and services to you | | Yes | | No | |

For joint marketing with other financial companies— | | No | | We don't share | |

For our affiliates' everyday business purposes—

information about your transactions and experiences | | No | | We don't share | |

For our affiliates' everyday business purposes—

information about your creditworthiness | | No | | We don't share | |

For our affiliates to market to you— | | No | | We don't share | |

For non-affiliates to market to you— | | No | | We don't share | |

Questions? Call 800-330-7348

32

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

Cohen & Steers Privacy Policy—(Continued)

Who we are | | | |

Who is providing this notice? | | Cohen & Steers Capital Management, Inc., Cohen & Steers Asia Limited, Cohen & Steers UK Limited, Cohen & Steers Securities, LLC, Cohen & Steers Private Funds and Cohen & Steers Open- and Closed-End Funds (collectively, Cohen & Steers). | |

What we do | | | |

How does Cohen & Steers protect my personal information? | | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. We restrict access to your information to those employees who need it to perform their jobs, and also require companies that provide services on our behalf to protect your information. | |

How does Cohen & Steers collect my personal information? | | We collect your personal information, for example, when you:

• Open an account or buy securities from us

• Provide account information or give us your contact information

• Make deposits or withdrawals from your account

We also collect your personal information from other companies. | |

Why can't I limit all sharing? | | Federal law gives you the right to limit only:

• sharing for affiliates' everyday business purposes—information about your creditworthiness

• affiliates from using your information to market to you

• sharing for non-affiliates to market to you

State law and individual companies may give you additional rights to limit sharing. | |

Definitions | | | |

Affiliates | | Companies related by common ownership or control. They can be financial and nonfinancial companies.

• Cohen & Steers does not share with affiliates. | |

Non-affiliates | | Companies not related by common ownership or control. They can be financial and nonfinancial companies.

• Cohen & Steers does not share with non-affiliates. | |

Joint marketing | | A formal agreement between non-affiliated financial companies that together market financial products or services to you.

• Cohen & Steers does not jointly market. | |

33

COHEN & STEERS INSTITUTIONAL GLOBAL REALTY SHARES, INC.

Cohen & Steers Investment Solutions

COHEN & STEERS GLOBAL REALTY SHARES

• Designed for investors seeking total return, investing primarily in global real estate equity securities