UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number | | 811-21903 |

Nuveen Global Equity Income Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: December 31

Date of reporting period: June 30, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| | |

| | |  |

| Closed-End Funds | |

| | | | | | |

| | | | | | | Semi-Annual Report June 30, 2016 |

| | | |

| | | | | | |

| | | | | | | |

| JGV | | | | | | |

| Nuveen Global Equity Income Fund | | |

| | | | | | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | |

| | | | | | | | |

| | | |

| | Life is Complex | | | | |

| |

| | Nuveen makes things e-simple. It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready—no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish. |

| | |

| | Free e-Reports right to your e-mail! |

| |

| | www.investordelivery.com If you receive your Nuveen Fund dividends and statements from your financial advisor or brokerage account. |

| |

| or | | www.nuveen.com/accountaccess If you receive your Nuveen Fund dividends and statements directly from Nuveen. |

Table

of Contents

Chairman’s Letter

to Shareholders

Dear Shareholders,

The U.S. economy is now seven years into the recovery, but its pace remains stubbornly subpar compared to past recoveries. Economic data continues to be a mixed bag, as it has been throughout this expansion period. While the unemployment rate fell below its pre-recession level and wages have grown slightly, a surprisingly weak jobs growth report in May cast doubt over the future strength of the labor market. The June employment report was much stronger, however, easing fears that a significant downtrend was emerging. The housing market has improved markedly but its contribution to the recovery has been lackluster. Deflationary pressures, including the dramatic slide in commodity prices, have kept inflation much lower for longer than many expected.

U.S. growth remains modest, while economic conditions elsewhere continue to appear vulnerable. On June 23, 2016, the U.K. voted to leave the European Union, known as “Brexit.” The outcome surprised the global markets, leading to high levels of volatility across equities, fixed income and currencies in the days following the vote. Although the turbulence subsided not long after and many asset classes have largely recovered, uncertainties remain about the Brexit separation process and the economic and political impacts on the U.K., Europe and the rest of the world.

In the meantime, global central banks remain accommodative in efforts to bolster growth. The European Central Bank and Bank of Japan have been providing aggressive monetary stimulus, including adopting negative interest rates in both Europe and Japan, as their economies continue to lag the U.S.’s recovery. China’s policy makers have also continued to manage its slowdown, but investors are still worried about where the world’s second-largest economy might ultimately land.

Many of these ambiguities – both domestic and international – have kept the U.S. Federal Reserve (Fed) from raising short-term interest rates any further since December’s first and only increase thus far. While markets rallied earlier in the year on the widely held expectation that the Fed would defer any increases until June, the unusually weak May jobs report and the Brexit concerns compelled the Fed to hold rates steady at its June meeting. Although labor market conditions improved in June, Britain’s “leave” vote is expected to keep the Fed on hold until later in 2016.

With global economic growth still looking fairly fragile, during certain periods financial markets were volatile over the past year. Although sentiment has improved and conditions have generally recovered from the intense volatility seen in early 2016 and following the Brexit vote in June, we expect that turbulence remains on the horizon for the time being. In this environment, Nuveen remains committed to both managing downside risks and seeking upside potential. If you’re concerned about how resilient your investment portfolio might be, we encourage you to talk to your financial advisor.

On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

William J. Schneider

Chairman of the Board

August 23, 2016

Portfolio Manager’s

Comments

Nuveen Global Equity Income Fund (JGV)

The Fund’s investment portfolio is managed by Tradewinds Global Investors, LLC, (Tradewinds), an affiliate of Nuveen Investments, Inc. Rod Parsley was the portfolio manager for the Fund.

During May 2016, the Board of the Nuveen Global Equity Income Fund (JGV) approved a plan to reorganize the Fund into the open-end Nuveen NWQ Global Equity Income Fund. The Board also approved the termination of the sub-advisory agreement between Nuveen Fund Advisors, LLC (NFAL) and Tradewinds for JGV, effective August 1, 2016, subsequent to the close of this reporting period.

Additionally, as of August 1, 2016, JGV is no longer managed by Rod Parsley. The Fund is currently managed by James T. Stephenson, CFA, a Managing Director, Portfolio Manager and Equity Analyst at NWQ and Thomas J. Ray, CFA, a Managing Director, Head of Fixed Income and Portfolio Manager at NWQ.

Here Rod Parsley reviews key management strategies and the Fund’s performance for the six-month reporting period ended June 30, 2016.

What key strategies were used to manage the Fund during this six-month reporting period ended June 30, 2016?

The Fund seeks total return and dividend income by investing primarily in a diversified global portfolio of value equity securities and by opportunistically writing covered-call options. Our basic investment philosophy continues to be searching for good business franchises around the globe whose securities are selling below their intrinsic value. All else being equal, the Fund favors stocks which pay dividends over those that do not.

The Fund’s portfolio manager and the Tradewinds research team found what they perceive to be significant value across many sectors globally, particularly in the generally volatile environment of 2016 thus far. We believe this has resulted in a differentiated and high conviction portfolio.

Covered-call options are primarily used to enhance yield. The Fund continued its use of covered-call options during the reporting period, and the portfolio manager will continue to opportunistically sell calls on a security-by-security basis.

The Fund also utilizes a currency hedging program, whereby the Fund systematically hedges the currency risk from its investments in non-U.S. dollar denominated foreign equity securities. These positions had a positive impact on performance during the reporting period.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio manager as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Portfolio Manager’s Comments (continued)

How did the Fund perform during this six-month reporting period ended June 30, 2016?

The table in the Performance Overview and Holding Summaries section of this report provides total returns for the six-month, one-year, five-year and since inception periods ended June 30, 2016. The Fund’s total return at net asset value (NAV) is compared with the performance of a corresponding market index. For the six-month reporting period ending June 30, 2016, the Fund’s common shares at NAV outperformed both its comparative Blended Benchmark and the MSCI All Country World Index.

While there were many market developments during the reporting period, Britain’s vote to leave the European Union, or “Brexit,” near the end of the reporting period attracted the bulk of investor attention. The heightened uncertainty generated by the widely unanticipated referendum results led to severe market declines in the days following, though some of those specific losses were recovered before the month closed. Some fairly immediate effects of Brexit included ratings agencies downgrading the U.K.’s credit rating, the Bank of England laying rhetorical groundwork for an interest rate cut and businesses considering moving operations out of the U.K.

Early in the reporting period, global equity markets had experienced elevated volatility due to investor concerns regarding prospective Federal Reserve tightening, continued weakness in oil prices, uncertainty regarding global growth (particularly in China) and the unexpected announcement of a negative interest rate policy from the Bank of Japan. Flight-to-safety effects could be seen in multiple areas, with defensive equity sectors and gold rising in value. In February, investors began finding solace in select countervailing factors, such as oil prices seeming to hit at least a short-term bottom, and a rally took place that lasted until the aforementioned British referendum results.

While the world post-Brexit may be likely to exhibit lower growth than previously expected, we see some cyclical companies representing attractive opportunities for patient investors who hold them through to a more stable period. As always, where political or economic disorder causes market disruptions we believe great values can be found, and many companies are trading at close to all-time-low valuations. Prudence during times of intensified uncertainty is also key, however. Accordingly, we’re selectively adding to some current positions.

The Fund’s relative sector allocation effects were positive over the reporting period, but favorable stock selections were a slightly stronger factor behind outperformance. Stock selections within the utilities, energy and health care sectors led contribution to relative performance. Performance was limited by unfavorable stock selections in the financials, industrials and consumer staples sectors.

Brazilian water and waste utility Companhia de Saneamento Basico do Estado de Sao Paulo (Sabesp) was the top contributor to performance during the reporting period. The company continues to benefit from reduced water rationing incentives and increased water consumption as higher rainfall during the year has helped to alleviate drought strain. Additionally, we believe Sabesp is poised to increase revenue through the resumption of local water payments and the reactivation of unpursued claims that had been suspended due to legal issues around rationing, the Brazilian elections, rising inflation and drought. Although the company is still challenged by devalued local currency and foreign debt issues, we believe operational enhancements position Sabesp to benefit when the effects of foreign currency improve.

Communications services company CenturyLink Inc. was another contributor to performance. Following slightly negative growth last year, the company released a strong earnings report during the first quarter of 2016 and beat earnings expectations by a significant margin. We find the company has generated strong free cash flow, allowing for share repurchases and what we view as an attractive dividend. We believe CenturyLink is still undervalued and possible improvements in its high-speed internet, Prism TV and data center businesses should provide opportunity for continued growth in the coming years.

Multi-national integrated oil/gas company Royal Dutch Shell PLC also contributed to performance. The company has benefited from oil prices improving significantly over much of the reporting period. Refining market margins grew as well, which also acted as a tailwind for the company. Shell has pivoted its business to place greater focus on less capital intensive, higher cash flow assets, and we believe investors have recognized this.

Swiss bank UBS Group AG was the top detractor from performance during the reporting period. The financials sector was notably weak during the early part of the reporting period, a generalized sell-off that certainly affected UBS. Additionally, the company announced poor financial results during the first quarter that set investors on edge. UBS also suffered from Brexit concerns and continued to receive pressure to make further cost structure improvements. We believe UBS has made reasonable headway in its restructuring, especially in light of the departure of three senior executives in an effort to streamline global operations. UBS will certainly be challenged as the full aftermath of Brexit is determined, but we believe the bank is making intelligent decisions that will position it to better meet these challenges over the long-term.

Scottish financial holding company Royal Bank of Scotland Group PLC was another detractor from performance. While we still believe the company is effectively transitioning away from high-capital-intensity, higher risk investment banking toward higher return, lower risk retail/commercial banking, the transition is taking an extended period, as we initially expected. Other investors have proven less patient with this transition, especially in an environment of extreme weakness for European banks and the repercussions of Brexit. However, we believe that the company has suffered from an undue amount of investor pessimism and we find Royal Bank of Scotland to be an increasingly attractive investment as it focuses on higher return operations.

Multi-national insurance company Ageas SA also detracted from performance, after having contributed during much of 2015. During the reporting period the company agreed to pay €1.2 billion to settle legacy Fortis claims. While this represents a substantial sum, we believe the company wisely removed a significant overhang that could now make it a more broadly attractive investment going forward.

As mentioned previously, the Fund continued to write call options on individual stocks held in its portfolio as part of its overall management strategy. The covered call writing strategy contributed negatively to the Fund’s performance during the period.

We also use foreign currency exchange forward contracts to manage foreign currency exposure. For example, the Fund may hedge positions in select currencies. These positions had a positive impact on performance during the reporting period.

Share

Information

DISTRIBUTION INFORMATION

The following information regarding the Fund’s distributions is current as of May 31, 2016, the date of the distribution data included within the Fund’s most recent distribution notice at the time this report was prepared. The Fund’s distribution levels may vary over time based on the Fund’s investment activities and portfolio investment value changes.

The Fund has adopted a managed distribution program. The goal of the Fund’s managed distribution program is to provide shareholders relatively consistent and predictable cash flow by systematically converting its expected long-term return potential into regular distributions. As a result, regular distributions throughout the year will likely include a portion of expected long-term and/or short-term gains (both realized and unrealized), along with net investment income.

Important points to understand about Nuveen fund managed distributions are:

| • | | The Fund seeks to establish a relatively stable common share distribution rate that roughly corresponds to the projected total return from its investment strategy over an extended period of time. However, you should not draw any conclusions about the Fund’s past or future investment performance from its current distribution rate. |

| • | | Actual common share returns will differ from projected long-term returns (and therefore the Fund’s distribution rate), at least over shorter time periods. Over a specific timeframe, the difference between actual returns and total distributions will be reflected in an increasing (returns exceed distributions) or a decreasing (distributions exceed returns) Fund net asset value. |

| • | | Each period’s distributions are expected to be paid from some or all of the following sources: |

| | • | | net investment income consisting of regular interest and dividends, |

| | • | | net realized gains from portfolio investments, and |

| | • | | unrealized gains, or, in certain cases, a return of principal (non-taxable distributions). |

| • | | A non-taxable distribution is a payment of a portion of the Fund’s capital. When the Fund’s returns exceed distributions, it may represent portfolio gains generated, but not realized as a taxable capital gain. In periods when the Fund’s returns fall short of distributions, it will represent a portion of your original principal unless the shortfall is offset during other time periods over the life of your investment (previous or subsequent) when the Fund’s total return exceeds distributions. |

| • | | Because distribution source estimates are updated throughout the current fiscal year based on the Fund’s performance, these estimates may differ from both the tax information reported to you in the Fund’s 1099 statement, as well as the ultimate economic sources of distributions over the life of your investment. |

The following table provides information regarding the Fund’s distributions and total return performance over various time periods. This information is intended to help you better understand whether the Fund’s returns for the specified time periods were sufficient to meet its distributions.

Data as of May 31, 2016

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Per Share Distribution | | | | | | | | | | | | | | | Annualized Total

Return on NAV | | | | |

Inception Date | | Quarterly | | | Monthly Equivalent | | | Monthly Net

Investment

Income1 | | | YTD Net Realized Gain/Loss2 | | | Inception Unrealized Gain/Loss2 | | | Current Distribution Rate on NAV3 | | | 1-Year | | | 5-Year | | | YTD | | | YTD Distribution Rate on NAV4 | |

7/2006 | | $ | 0.2340 | | | $ | 0.0780 | | | $ | 0.0307 | | | $ | 0.0616 | | | $ | (1.1113 | ) | | | 7.55 | % | | | (11.43 | )% | | | (2.42 | )% | | | 2.89 | % | | | 3.77 | % |

| 1 | Net investment income is expressed as a monthly amount using a six-month average. |

| 2 | These are approximations. Actual amounts may be more or less than amounts listed above. |

| 3 | Current distribution, annualized, expressed over the most recent month-end NAV. |

| 4 | Sum of year-to-date distributions expressed over the most recent month-end NAV. |

The following table provides estimates of the Fund’s distribution sources, reflecting year-to-date cumulative experience through the latest month-end. These estimates are for informational purposes only. The Fund attributes these estimates equally to each regular distribution throughout the year. Consequently, the estimated information shown below is for the current distribution, and also represents an updated estimate for all prior months in the year.

The amounts and sources of distributions reported in this notice are only estimates and are not being provided for tax reporting purposes. The actual amounts and character of the distributions for tax reporting purposes will be reported to shareholders on Form 1099-DIV which will be sent to shareholders shortly after calendar year-end. More details about the Fund’s distributions and the basis for these estimates are available on www.nuveen.com/cef.

Data as of May 31, 2016

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Current Quarter | | | Calendar YTD | |

| | | | Estimated Source of Distribution | | | Estimated Per Share Amounts | |

Per Share

Distribution | | | Net

Investment

Income1 | | | Realized Gains | | | Return of Capital2 | | | Distributions3 | | | Net

Investment

Income1 | | | Realized Gains | | | Return of Capital2 | |

| | $0.2340 | | | | 42.3% | | | | 13.2% | | | | 44.5% | | | | $0.4680 | | | | $0.1982 | | | | $0.0616 | | | | $0.2082 | |

| 1 | Net investment income is a projection through the end of the current calendar quarter based on most recent month-end data. |

| 2 | Return of capital may represent unrealized gains, return of shareholder’s principal, or both. In certain circumstances, all or a portion of the return of capital may be characterized as ordinary income under federal tax law. The acutal tax characterization will be provided to shareholders on Form 1099-DIV shortly after claendar year-end. |

| 3 | Includes the most recent quarterly distribution declaration. |

SHARE REPURCHASES

During August 2016 (subsequent to the close of this reporting period), the Fund’s Board of Trustees reauthorized an open-market share repurchase program, allowing the Fund to repurchase an aggregate of up to approximately 10% of its outstanding shares.

As of June 30, 2016, and since the inception of the Fund’s repurchase program, the Fund has cumulatively repurchased and retired its outstanding shares as shown in the accompanying table.

| | | | |

| | | JGV | |

Shares cumulatively repurchased and retired | | | 625,700 | |

Shares authorized for repurchase | | | 1,905,000 | |

During the current reporting period, the Fund did not repurchase any of its outstanding shares.

Share Information (Unaudited) (continued)

OTHER SHARE INFORMATION

As of June 30, 2016, and during the current reporting period, the Fund’s share price was trading at a premium/(discount) to its NAV as shown in the accompanying table.

| | | | |

| | | JGV | |

NAV | | | $12.11 | |

Share price | | | $11.67 | |

Premium/(Discount) to NAV | | | (3.63 | )% |

6-month average premium/(discount) to NAV | | | (8.16 | )% |

Risk

Considerations

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation.

Nuveen Global Equity Income Fund (JGV)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Common stock returns often have experienced significant volatility. Foreign investments involve additional risks, including currency fluctuation if not hedged, political and economic instability, lack of liquidity and differing legal and accounting standards. The risks of foreign investments are magnified in emerging markets. The fund’s currency hedging strategy may not completely eliminate the fund’s currency exposure. For these and other risks, including counterparty risk and call option risk, please see the Fund’s web page at www.nuveen.com/JGV.

JGV

Nuveen Global Equity Income Fund

Performance Overview and Holding Summaries as of June 30, 2016

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of June 30, 2016

| | | | | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | |

| | | 6-Month | | | 1-Year | | | 5-Year | | | Since

Inception | |

| JGV at NAV | | | 2.43% | | | | (7.24)% | | | | (2.02)% | | | | 3.25% | |

| JGV at Share Price | | | 11.34% | | | | 1.89% | | | | (2.08)% | | | | 3.08% | |

| Blended Benchmark | | | 2.33% | | | | (1.85)% | | | | 5.34% | | | | 5.01% | |

| MSCI All Country World Index | | | 1.23% | | | | (3.73)% | | | | 5.38% | | | | 4.48% | |

Average Annual Total Returns as of June 30, 20161

(including retained gain tax credit/refund)

| | | | | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | |

| | | 6-Month | | | 1-Year | | | 5-Year | | | Since

Inception | |

| JGV at NAV | | | 2.43% | | | | (7.24)% | | | | (2.02)% | | | | 3.33% | |

| JGV at Share Price | | | 11.34% | | | | 1.89% | | | | (2.08)% | | | | 3.16% | |

Since inception returns are from 7/24/06. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

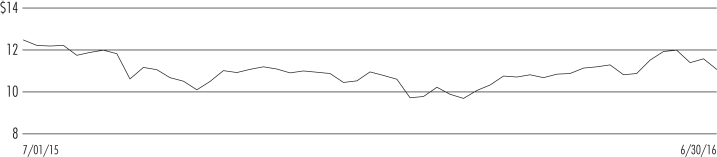

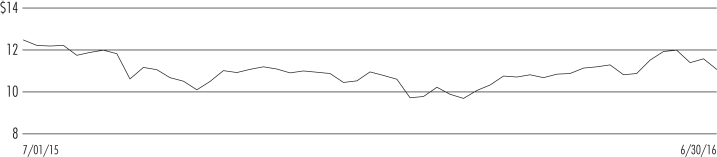

Share Price Performance — Weekly Closing Price

| 1 | The Fund elected to retain a portion of its realized long-term capital gains for the tax year ended December 31, 2007, and pay required federal corporate income taxes on these amounts. These standardized total returns include the economic benefit to shareholders of record of this tax credit/refund. The Fund had no retained capital gains for the tax years ended December 31, 2008 through December 31, 2015 or for the tax year ended December 31, 2006. |

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Fund Allocation

(% of net assets)

| | | | |

| Common Stocks | | | 91.5% | |

| Mortgage-Backed Securities | | | 0.0% | |

| Repurchase Agreements | | | 11.3% | |

| Other Assets Less Liabilities | | | (2.8)% | |

Net Assets | | | 100% | |

Portfolio Composition

(% of total investments)1

| | | | |

| Oil, Gas & Consumable Fuels | | | 10.8% | |

| Diversified Telecommunication Services | | | 8.0% | |

| Insurance | | | 8.0% | |

| Pharmaceuticals | | | 7.5% | |

| Food Products | | | 7.4% | |

| Independent Power & Renewable Electricity Producers | | | 6.0% | |

| Banks | | | 5.5% | |

| Real Estate Investment Trust | | | 5.3% | |

| Automobiles | | | 5.2% | |

| Chemicals | | | 3.8% | |

| Semiconductors & Semiconductor Equipment | | | 2.7% | |

| Other | | | 18.8% | |

| Repurchase Agreements | | | 11.0% | |

Total | | | 100% | |

Top Five Issuers

(% of total long-term investments)1

| | | | |

| BP PLC | | | 4.8% | |

| Bunge Limited | | | 4.4% | |

| CenturyLink Inc. | | | 4.3% | |

| Royal Dutch Shell PLC, Class B Shares | | | 4.0% | |

| Agrium Inc. | | | 3.8% | |

Country Allocation

(% of total investments)1

| | | | |

United States | | | 58.1% | |

United Kingdom | | | 9.8% | |

Norway | | | 5.3% | |

Switzerland | | | 5.1% | |

Belgium | | | 3.8% | |

Denmark | | | 3.1% | |

Other | | | 14.8% | |

Total | | | 100% | |

| 1 | Excluding investments in derivatives. |

JGV

| | |

Nuveen Global Equity Income Fund | | |

Portfolio of Investments | | June 30, 2016 (Unaudited) |

| | | | | | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | | | | Value | |

| | | | | |

| | | | LONG-TERM INVESTMENTS – 91.5% | | | | | | | | | | | | | | | | |

| | | | | |

| | | | COMMON STOCKS – 91.5% | | | | | | | | | | | | | | | | |

| | | | | |

| | | | Automobiles – 5.3% | | | | | | | | | | | | |

| | | | | |

| | 273,000 | | | General Motors Company | | | | | | | | | | | | | | $ | 7,725,900 | |

| | 43,800 | | | Toyota Motor Corporation, Sponsored ADR | | | | | | | | | | | | | | | 4,379,562 | |

| | | | Total Automobiles | | | | | | | | | | | | | | | 12,105,462 | |

| | | | | |

| | | | Banks – 5.6% | | | | | | | | | | | | |

| | | | | |

| | 184,771 | | | ABN AMRO Group NV, (2) | | | | | | | | | | | | | | | 3,037,754 | |

| | 380,000 | | | Banco Bilbao Vizcaya Argentaria S.A Sponsored ADR | | | | | | | | | | | | | | | 2,181,200 | |

| | 935,000 | | | HSBC Holdings PLC, (2) | | | | | | | | | | | | | | | 5,792,838 | |

| | 800,000 | | | Royal Bank of Scotland Group PLC, (2), (3) | | | | | | | | | | | | | | | 1,812,922 | |

| | | | Total Banks | | | | | | | | | | | | | | | 12,824,714 | |

| | | | | |

| | | | Beverages – 2.0% | | | | | | | | | | | | |

| | | | | |

| | 47,700 | | | Carlsberg AS, B Shares, (2) | | | | | | | | | | | | | | | 4,550,959 | |

| | | | | |

| | | | Capital Markets – 2.7% | | | | | | | | | | | | |

| | | | | |

| | 468,000 | | | UBS Group AG | | | | | | | | | | | | | | | 6,065,280 | |

| | | | | |

| | | | Chemicals – 3.9% | | | | | | | | | | | | |

| | | | | |

| | 97,400 | | | Agrium Inc. | | | | | | | | | | | | | | | 8,806,908 | |

| | | | | |

| | | | Commercial Services & Supplies – 1.8% | | | | | | | | | | | | |

| | | | | |

| | 1,591,590 | | | Cape PLC, (2) | | | | | | | | | | | | | | | 4,083,449 | |

| | | | | |

| | | | Diversified Telecommunication Services – 8.3% | | | | | | | | | | | | |

| | | | | |

| | 343,500 | | | CenturyLink Inc., (4) | | | | | | | | | | | | | | | 9,964,935 | |

| | 168,501 | | | Telefonica S.A, (2), (3) | | | | | | | | | | | | | | | 1,599,717 | |

| | 436,000 | | | Telenor ASA, (2) | | | | | | | | | | | | | | | 7,217,111 | |

| | | | Total Diversified Telecommunication Services | | | | | | | | | | | | | | | 18,781,763 | |

| | | | | |

| | | | Electric Utilities – 1.3% | | | | | | | | | | | | |

| | | | | |

| | 78,500 | | | Exelon Corporation | | | | | | | | | | | | | | | 2,854,260 | |

| | | | | |

| | | | Food & Staples Retailing – 2.5% | | | | | | | | | | | | |

| | | | | |

| | 161,900 | | | Andersons, Inc. | | | | | | | | | | | | | | | 5,753,926 | |

| | | | | |

| | | | Food Products – 7.6% | | | | | | | | | | | | |

| | | | | |

| | 285,000 | | | Adecoagro SA, (3) | | | | | | | | | | | | | | | 3,126,450 | |

| | 52,500 | | | Archer-Daniels-Midland Company | | | | | | | | | | | | | | | 2,251,725 | |

| | 175,500 | | | Bunge Limited | | | | | | | | | | | | | | | 10,380,825 | |

| | 170,000 | | | MHP SA, 144A, GDR, (2) | | | | | | | | | | | | | | | 1,564,000 | |

| | | | Total Food Products | | | | | | | | | | | | | | | 17,323,000 | |

| | | | | |

| | | | Independent Power & Renewable Electricity Producers – 6.2% | | | | | | | | | | | | |

| | | | | |

| | 450,000 | | | AES Corporation | | | | | | | | | | | | | | | 5,616,000 | |

| | 325,000 | | | NRG Energy Inc. | | | | | | | | | | | | | | | 4,871,750 | |

| | 154,000 | | | Pattern Energy Group Inc. | | | | | | | | | | | | | | | 3,537,380 | |

| | | | Total Independent Power & Renewable Electricity Producers | | | | | | | | | | | | | | | 14,025,130 | |

| | | | | |

| | | | Insurance – 8.2% | | | | | | | | | | | | |

| | | | | |

| | 150,500 | | | Ageas SA, (2) | | | | | | | | | | | | | | | 5,231,269 | |

| | 102,500 | | | Axis Capital Holdings Limited | | | | | | | | | | | | | | | 5,637,500 | |

| | | | | | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | | | | Value | |

| | | | | |

| | | | Insurance (continued) | | | | | | | | | | | | |

| | | | | |

| | 249,832 | | | CNA Financial Corporation | | | | | | | | | | | | | | $ | 7,849,721 | |

| | | | Total Insurance | | | | | | | | | | | | | | | 18,718,490 | |

| | | | | |

| | | | Life Sciences Tools & Services – 1.1% | | | | | | | | | | | | |

| | | | | |

| | 55,000 | | | Agilent Technologies, Inc. | | | | | | | | | | | | | | | 2,439,800 | |

| | | | | |

| | | | Media – 1.7% | | | | | | | | | | | | |

| | | | | |

| | 166,000 | | | Interpublic Group of Companies, Inc. | | | | | | | | | | | | | | | 3,834,600 | |

| | | | | |

| | | | Oil, Gas & Consumable Fuels – 11.1% | | | | | | | | | | | | |

| | | | | |

| | 86,725 | | | Apache Corporation | | | | | | | | | | | | | | | 4,827,981 | |

| | 313,500 | | | BP PLC, Sponsored ADR | | | | | | | | | | | | | | | 11,132,385 | |

| | 335,000 | | | Royal Dutch Shell PLC, Class B Shares, (2) | | | | | | | | | | | | | | | 9,255,571 | |

| | | | Total Oil, Gas & Consumable Fuels | | | | | | | | | | | | | | | 25,215,937 | |

| | | | | |

| | | | Pharmaceuticals – 7.7% | | | | | | | | | | | | |

| | | | | |

| | 181,000 | | | Pfizer Inc. | | | | | | | | | | | | | | | 6,373,010 | |

| | 22,200 | | | Roche Holdings AG, (2) | | | | | | | | | | | | | | | 5,858,131 | |

| | 127,000 | | | Sanofi-Aventis, Sponsored ADR | | | | | | | | | | | | | | | 5,314,950 | |

| | | | Total Pharmaceuticals | | | | | | | | | | | | | | | 17,546,091 | |

| | | | | |

| | | | Real Estate Investment Trust – 5.4% | | | | | | | | | | | | |

| | | | | |

| | 386,000 | | | Colony Capital, Inc., Class A | | | | | | | | | | | | | | | 5,925,100 | |

| | 630,000 | | | Lexington Realty Trust | | | | | | | | | | | | | | | 6,369,300 | |

| | | | Total Real Estate Investment Trust | | | | | | | | | | | | | | | 12,294,400 | |

| | | | | |

| | | | Real Estate Management & Development – 1.2% | | | | | | | | | | | | |

| | | | | |

| | 460,000 | | | City Developments Limited, (2) | | | | | | | | | | | | | | | 2,795,350 | |

| | | | | |

| | | | Semiconductors & Semiconductor Equipment – 2.8% | | | | | | | | | | | | |

| | | | | |

| | 462,000 | | | Micron Technology, Inc., (3) | | | | | | | | | | | | | | | 6,357,120 | |

| | | | | |

| | | | Software – 2.0% | | | | | | | | | | | | |

| | | | | |

| | 236,000 | | | Infoblox, Incorporated, (3) | | | | | | | | | | | | | | | 4,427,360 | |

| | | | | |

| | | | Specialty Retail – 1.3% | | | | | | | | | | | | |

| | | | | |

| | 141,000 | | | DSW Inc., Class A | | | | | | | | | | | | | | | 2,986,380 | |

| | | | | |

| | | | Textiles, Apparel & Luxury Goods – 0.0% | | | | | | | | | | | | |

| | | | | |

| | 2,506,000 | | | China Hongxing Sports Limited, (5) | | | | | | | | | | | | | | | 2 | |

| | | | | |

| | | | Water Utilities – 1.8% | | | | | | | | | | | | |

| | | | |

| | 374,000 | | | Companhia de Saneamento Basico do Estado de Sao Paulo, Sponsored ADR, (3) | | | | | | | | | | | | 3,351,040 | |

| | 3,975,000 | | | Sound Global Ltd., (3), (5) | | | | | | | | | | | | | | | 763,428 | |

| | | | Total Water Utilities | | | | | | | | | | | | | | | 4,114,468 | |

| | | | Total Common Stocks (cost $232,515,078) | | | | | | | | | | | | | | | 207,904,849 | |

| | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | | Maturity | | | Ratings (6) | | | Value | |

| | | | | |

| | | | MORTGAGE-BACKED SECURITIES – 0.0% | | | | | | | | | | | | |

| | | | | |

| $ | 25 | | | Fannie Mae Mortgage Pool 100195 | | | 2.610% | | | | 8/20/22 | | | | Aaa | | | $ | 24,564 | |

| $ | 25 | | | Total Mortgage-Backed Securities (cost $24,449) | | | | | | | | | | | | | | | 24,564 | |

| | | | Total Long-Term Investments (cost $232,539,527) | | | | | | | | | | | | | | | 207,929,413 | |

| | | | |

| JGV | | Nuveen Global Equity Income Fund | | |

| | Portfolio of Investments (continued) | | June 30, 2016 (Unaudited) |

| | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | | Maturity | | | | | | Value | |

| | | | | |

| | | | SHORT-TERM INVESTMENTS – 11.3% | | | | | | | | | | | | |

| | | | | |

| | | | REPURCHASE AGREEMENTS – 11.3% | | | | | | | | | | | | |

| | | | | |

| $ | 25,751 | | | Repurchase Agreement with Fixed Income Clearing Corporation, dated 6/30/16, repurchase price $25,751,025, collateralized by $23,775,000 U.S. Treasury Notes, 2.750%, due 11/15/23, value $26,271,375 | | | 0.030% | | | | 7/01/16 | | | | | | | $ | 25,751,004 | |

| | | | Total Short-Term Investments (cost $25,751,004) | | | | | | | | | | | | | | | 25,751,004 | |

| | | | Total Investments (cost $258,290,531) – 102.8% | | | | | | | | | | | | | | | 233,680,417 | |

| | | | Other Assets Less Liabilities – (2.8)% (7) | | | | | | | | | | | | | | | (6,268,989 | ) |

| | | | Net Assets – 100% | | | | | | | | | | | | | | $ | 227,411,428 | |

Investments in Derivatives as of June 30, 2016

Options Written

| | | | | | | | | | | | | | | | | | | | |

Number of

Contracts | | | Description | | Notional

Amount (8) | | | Expiration

Date | | | Strike

Price | | | Value | |

| | (250 | ) | | Agrium Inc. | | $ | (2,250,000 | ) | | | 7/15/16 | | | $ | 90 | | | $ | (56,250 | ) |

| | (640 | ) | | Exelon Corporation | | | (2,240,000 | ) | | | 7/15/16 | | | | 35 | | | | (92,800 | ) |

| | (890 | ) | | Total Options Written (premiums received $161,070) | | $ | (4,490,000 | ) | | | | | | | | | | $ | (149,050 | ) |

Forward Foreign Currency Exchange Contracts

| | | | | | | | | | | | | | | | | | | | | | | | |

Counterparty | | Currency Contracts to Deliver | | | Notional Amount (Local Currency) | | | In Exchange For Currency | | | Notional Amount (Local Currency) | | | Settlement Date | | | Unrealized Appreciation (Depreciation) (U.S. Dollars) | |

Morgan Stanley Capital Services LLC | | | Australian Dollar | | | | 4,900,589 | | | | U.S. Dollar | | | | 3,596,366 | | | | 7/29/2016 | | | $ | (55,256 | ) |

Morgan Stanley Capital Services LLC | | | Danish Krone | | | | 30,626,509 | | | | U.S. Dollar | | | | 4,524,752 | | | | 7/29/2016 | | | | (48,954 | ) |

Morgan Stanley Capital Services LLC | | | Euro | | | | 16,539,740 | | | | U.S. Dollar | | | | 18,175,487 | | | | 7/29/2016 | | | | (195,499 | ) |

Morgan Stanley Capital Services LLC | | | Hong Kong Dollar | | | | 6,099,973 | | | | U.S. Dollar | | | | 786,180 | | | | 7/29/2016 | | | | (332 | ) |

Morgan Stanley Capital Services LLC | | | Japanese Yen | | | | 490,463,156 | | | | U.S. Dollar | | | | 4,829,604 | | | | 7/29/2016 | | | | 76,596 | |

Morgan Stanley Capital Services LLC | | | Norwegian Krone | | | | 56,934,054 | | | | U.S. Dollar | | | | 6,618,284 | | | | 7/29/2016 | | | | (184,704 | ) |

Morgan Stanley Capital Services LLC | | | Pound Sterling | | | | 22,854,155 | | | | U.S. Dollar | | | | 30,061,441 | | | | 7/29/2016 | | | | (369,235 | ) |

Morgan Stanley Capital Services LLC | | | Singapore Dollar | | | | 4,145,670 | | | | U.S. Dollar | | | | 3,040,016 | | | | 7/29/2016 | | | | (36,868 | ) |

Morgan Stanley Capital Services LLC | | | Swiss Franc | | | | 5,568,964 | | | | U.S. Dollar | | | | 5,688,130 | | | | 7/29/2016 | | | | (23,708 | ) |

Morgan Stanley Capital Services LLC | | | U.S. Dollar | | | | 12,000 | | | | Australian Dollar | | | | 16,351 | | | | 7/29/2016 | | | | 183 | |

Morgan Stanley Capital Services LLC | | | U.S. Dollar | | | | 22,816 | | | | Hong Kong Dollar | | | | 176,994 | | | | 7/29/2016 | | | | 5 | |

Morgan Stanley Capital Services LLC | | | U.S. Dollar | | | | 248,547 | | | | Japanese Yen | | | | 25,237,391 | | | | 7/29/2016 | | | | (3,975 | ) |

Morgan Stanley Capital Services LLC | | | U.S. Dollar | | | | 250,292 | | | | Norwegian Krone | | | | 2,152,902 | | | | 7/29/2016 | | | | 6,956 | |

Morgan Stanley Capital Services LLC | | | U.S. Dollar | | | | 252,278 | | | | Singapore Dollar | | | | 343,896 | | | | 7/29/2016 | | | | 2,959 | |

Morgan Stanley Capital Services LLC | | | U.S. Dollar | | | | 303,103 | | | | Danish Krone | | | | 2,050,662 | | | | 7/29/2016 | | | | 3,139 | |

Morgan Stanley Capital Services LLC | | | U.S. Dollar | | | | 333,106 | | | | Swiss Franc | | | | 325,926 | | | | 7/29/2016 | | | | 1,182 | |

Morgan Stanley Capital Services LLC | | | U.S. Dollar | | | | 555,564 | | | | Pound Sterling | | | | 422,259 | | | | 7/29/2016 | | | | 6,680 | |

Morgan Stanley Capital Services LLC | | | U.S. Dollar | | | | 1,241,733 | | | | Euro | | | | 1,129,814 | | | | 7/29/2016 | | | | 13,171 | |

| | | | | | | | | | | | | | | | | | | | | | | $ | (807,660 | ) |

For Fund portfolio compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications into sectors for reporting ease.

| (1) | All percentages shown in the Portfolio of Investments are based on net assets. |

| (2) | For fair value measurement disclosure purposes, investment classified as Level 2. See Notes to Financial Statements, Note 2 – Investment Valuation and Fair Value Measurements for more information. |

| (3) | Non-income producing; issuer has not declared a dividend within the past twelve months. |

| (4) | Investment, or portion of investment, has been pledged as collateralize the net payment obligations for investments in derivatives. |

| (5) | Investment valued at fair value using methods determined in good faith by, or at the discretion of the Board. For fair value measurement disclosure purposes, investment classified as Level 3. See Notes to Financial Statements, Note 2 – Investment Valuation and Fair Value Measurements for more information. |

| (6) | For financial reporting purposes, the ratings disclosed are the highest of Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) or Fitch, Inc. (“Fitch”) rating. Ratings below BBB by Standard & Poor’s, Baa by Moody’s or BBB by Fitch are considered to be below investment grade. Holdings designated N/R are not rated by any of these national rating agencies. |

| (7) | Other assets less liabilities includes the unrealized appreciation (depreciation) of certain over-the-counter (“OTC”) derivatives as presented on the Statement of Assets and Liabilities, when applicable. The unrealized appreciation (depreciation) of OTC-cleared and exchanged-traded derivatives is recognized as part of the cash collateral at brokers and/or the receivable or payable for variation margin as presented on the Statement of Assets and Liabilities, when applicable. Other assets less liabilities also includes the value of options as presented on the Statement of Assets and Liabilities. |

| (8) | For disclosure purposes, Notional Amount is calculated by multiplying the Number of Contracts by the Strike Price by 100. |

| 144A | Investment is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These investments may only be resold in transactions exempt from registration, which are normally those transactions with qualified institutional buyers. |

| ADR | American Depositary Receipt |

| GDR | Global Depositary Receipt |

See accompanying notes to financial statements.

| | | | | | |

Statement of Assets and Liabilities | | June 30, 2016 (Unaudited) |

| | | | |

Assets | | | | |

Long-term investments, at value (cost $232,539,527) | | $ | 207,929,413 | |

Short-term investments, at value (cost approximates value) | | | 25,751,004 | |

Receivable for: | | | | |

Dividends | | | 585,014 | |

Interest | | | 75 | |

Investments sold | | | 605,704 | |

Reclaims | | | 160,197 | |

Other assets | | | 33,778 | |

Total assets | | | 235,065,185 | |

Liabilities | | | | |

Options written, at value (premiums received $161,070) | | | 149,050 | |

Unrealized depreciation on forward foreign currency exchange contracts, net | | | 807,660 | |

Payable for: | | | | |

Dividends | | | 4,262,852 | |

Investments purchased | | | 2,089,494 | |

Accrued expenses: | | | | |

Management fees | | | 179,579 | |

Trustees fees | | | 29,998 | |

Other | | | 135,124 | |

Total liabilities | | | 7,653,757 | |

Net assets | | $ | 227,411,428 | |

Shares outstanding | | | 18,776,509 | |

Net asset value (“NAV”) per share outstanding | | $ | 12.11 | |

Net assets consist of: | | | | |

Shares, $0.01 par value per share | | $ | 187,765 | |

Paid-in surplus | | | 300,942,650 | |

Undistributed (Over-distribution of) net investment income | | | (5,257,748 | ) |

Accumulated net realized gain (loss) | | | (43,036,432 | ) |

Net unrealized appreciation (depreciation) | | | (25,424,807 | ) |

Net assets | | $ | 227,411,428 | |

Authorized shares | | | Unlimited | |

See accompanying notes to financial statements.

| | | | | | |

Statement of Operations | | Six Months Ended June 30, 2016 (Unaudited) |

| | | | |

Investment Income (net of foreign tax withheld of $230,459) | | $ | 4,800,113 | |

Expenses | | | | |

Management fees | | | 1,058,357 | |

Custodian fees | | | 60,104 | |

Trustees fees | | | 3,029 | |

Professional fees | | | 56,444 | |

Shareholder reporting expenses | | | 25,306 | |

Shareholder servicing agent fees | | | 214 | |

Stock exchange listing fees | | | 3,895 | |

Investor relations expenses | | | 27,957 | |

Other | | | 5,721 | |

Total expenses | | | 1,241,027 | |

Net investment income (loss) | | | 3,559,086 | |

Realized and Unrealized Gain (Loss) | | | | |

Net realized gain (loss) from: | | | | |

Investments and foreign currency | | | 3,608,162 | |

Forward foreign currency exchange contracts | | | (169,576 | ) |

Options written | | | 785,211 | |

Change in net unrealized appreciation (depreciation) of: | | | | |

Investments and foreign currency | | | (1,595,464 | ) |

Forward foreign currency exchange contracts | | | (807,660 | ) |

Options written | | | (12,087 | ) |

Net realized and unrealized gain (loss) | | | 1,808,586 | |

Net increase (decrease) in net assets from operations | | $ | 5,367,672 | |

See accompanying notes to financial statements.

| | | | | | |

Statement of Changes in Net Assets | | (Unaudited) |

| | | | | | | | |

| | | Six Months

Ended

6/30/2016 | | | Year

Ended

12/31/15 | |

Operations | | | | | | | | |

Net investment income (loss) | | $ | 3,559,086 | | | $ | 2,616,209 | |

Net realized gain (loss) from: | | | | | | | | |

Investments and foreign currency | | | 3,608,162 | | | | (9,120,883 | ) |

Forward foreign currency exchange contracts | | | (169,576 | ) | | | — | |

Options written | | | 785,211 | | | | 1,598,341 | |

Change in net unrealized appreciation (depreciation) of: | | | | | | | | |

Investments and foreign currency | | | (1,595,464 | ) | | | (20,586,377 | ) |

Forward foreign currency exchange contracts | | | (807,660 | ) | | | — | |

Options written | | | (12,087 | ) | | | 260,649 | |

Net increase (decrease) in net assets from operations | | | 5,367,672 | | | | (25,232,061 | ) |

Distributions to Shareholders | | | | | | | | |

From and in excess of net investment income | | | (8,787,406 | ) | | | — | |

From net investment income | | | — | | | | (2,634,017 | ) |

Return of capital | | | — | | | | (16,137,900 | ) |

Decrease in net assets from distributions to shareholders | | | (8,787,406 | ) | | | (18,771,917 | ) |

Capital Share Transactions | | | | | | | | |

Cost of shares repurchased or retired | | | — | | | | (2,901,378 | ) |

Net increase (decrease) in net assets from capital share transactions | | | — | | | | (2,901,378 | ) |

Net increase (decrease) in net assets | | | (3,419,734 | ) | | | (46,905,356 | ) |

Net assets at the beginning of period | | | 230,831,162 | | | | 277,736,518 | |

Net assets at the end of period | | $ | 227,411,428 | | | $ | 230,831,162 | |

Undistributed (Over-distribution of) net investment income at the end of period | | $ | (5,257,748 | ) | | $ | (29,428 | ) |

See accompanying notes to financial statements.

THIS PAGE INTENTIONALLY LEFT BLANK

Financial

Highlights (Unaudited)

Selected data for a share outstanding throughout each period:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Investment Operations | | | Less Distributions | | | | | | | | | | |

| | | Beginning

NAV | | | Net

Investment

Income

(Loss)(a) | | | Net

Realized/

Unrealized

Gain (Loss) | | | Total | | | From

Net

Investment

Income | | | From

Accumulated

Net

Realized

Gains | | | Return of

Capital | | | Total | | | Discount

from

Shares

Repurchased

and Retired | | | Ending

NAV | | | Ending

Share

Price | |

Year Ended 12/31: | |

2016(f) | | $ | 12.29 | | | $ | 0.19 | | | $ | 0.10 | | | $ | 0.29 | | | $ | (0.47 | )** | | $ | — | | | $ | — | | | $ | (0.47 | ) | | $ | — | | | $ | 12.11 | | | $ | 11.67 | |

2015 | | | 14.59 | | | | 0.14 | | | | (1.48 | ) | | | (1.34 | ) | | | (0.14 | ) | | | — | | | | (0.85 | ) | | | (0.99 | ) | | | 0.03 | | | | 12.29 | | | | 10.92 | |

2014 | | | 15.22 | | | | 0.23 | | | | 0.18 | | | | 0.41 | | | | (0.23 | ) | | | — | | | | (0.83 | ) | | | (1.06 | ) | | | 0.02 | | | | 14.59 | | | | 13.01 | |

2013 | | | 15.96 | | | | 0.35 | | | | — | * | | | 0.35 | | | | (0.37 | ) | | | — | | | | (0.72 | ) | | | (1.09 | ) | | | — | * | | | 15.22 | | | | 13.17 | |

2012 | | | 16.91 | | | | 0.42 | | | | (0.10 | ) | | | 0.32 | | | | (0.49 | ) | | | (0.33 | ) | | | (0.45 | ) | | | (1.27 | ) | | | — | * | | | 15.96 | | | | 14.91 | |

2011 | | | 20.30 | | | | 0.46 | | | | (2.48 | ) | | | (2.02 | ) | | | (0.83 | ) | | | (0.46 | ) | | | (0.08 | ) | | | (1.37 | ) | | | — | | | | 16.91 | | | | 16.76 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Ratios/Supplemental Data | |

| Total Returns | | | | | | Ratios to Average Net Assets(c) | | | | |

Based

on

NAV(b) | | | Based

on

Share

Price(b) | | | Ending

Net Assets

(000) | | | Expenses | | | Net

Investment

Income (Loss) | | | Portfolio

Turnover

Rate(d) | |

| | | | | | | | | | | | | | | | | | | | | | |

| | 2.43 | % | | | 11.34 | % | | $ | 227,411 | | | | 1.13 | %*** | | | 3.24 | %*** | | | 22 | % |

| | (9.26 | ) | | | (8.61 | ) | | | 230,831 | | | | 1.09 | | | | 0.99 | | | | 99 | |

| | 2.75 | | | | 6.73 | | | | 277,737 | | | | 1.11 | | | | 1.54 | | | | 128 | |

| | 2.50 | | | | (4.24 | ) | | | 292,334 | | | | 1.16 | | | | 2.30 | | | | 143 | |

| | 2.03 | | | | (3.29 | ) | | | 306,591 | | | | 1.20 | | | | 2.61 | | | | 51 | |

| | (10.28 | ) | | | (11.00 | ) | | | 324,957 | | | | 1.16 | | | | 2.41 | | | | 92 | |

| (a) | Per share Net Investment Income (Loss) is calculated using the average daily shares method. |

| (b) | Total Return Based on NAV is the combination of changes in NAV, reinvested dividend income at NAV and reinvested capital gains distributions at NAV, if any. The last dividend declared in the period, which is typically paid on the first business day of the following month, is assumed to be reinvested at the ending NAV. The actual reinvest price for the last dividend declared in the period may often be based on the Fund’s market price (and not its NAV), and therefore may be different from the price used in the calculation. Total returns are not annualized. |

Total Return Based on Share Price is the combination of changes in the market price per share and the effect of reinvested dividend income and reinvested capital gains distributions, if any, at the average price paid per share at the time of reinvestment. The last dividend declared in the period, which is typically paid on the first business day of the following month, is assumed to be reinvested at the ending market price. The actual reinvestment for the last dividend declared in the period may take place over several days, and in some instances may not be based on the market price, so the actual reinvestment price may be different from the price used in the calculation. Total returns are not annualized.

| (c) | Each ratio includes the effect of dividends expense on securities sold short as follows: |

| | | | |

Ratios of Dividends Expense on

Securities Sold Short

to Average Net Assets(e) | |

Year Ended 12/31: | |

2013 | | | 0.01 | % |

2012 | | | 0.02 | |

2011 | | | 0.03 | |

| (d) | Portfolio Turnover Rate is calculated based on the lesser of long-term purchases or sales (as disclosed in Note 5 – Investment Transactions) divided by the average long-term market value during the period. |

| (e) | Effective for periods beginning after December 31, 2013, the Fund no longer makes short sales of securities. |

| (f) | For the six months ended June 30, 2016. |

| * | Rounds to less than $0.01 per share. |

| ** | Represents distributions paid “From and in excess of net investment income” for the six months ended June 30, 2016 (as described in Note 1 – General Information and Significant Accounting Policies, Dividends and Distributions to Shareholders). |

See accompanying notes to financial statements.

Notes to

Financial Statements (Unaudited)

1. General Information and Significant Accounting Policies

General Information

Fund Information

Nuveen Global Equity Income Fund, (the “Fund”) is registered under the Investment Company Act of 1940, as amended, as a diversified, closed-end management investment company. The Fund’s shares are listed on the New York Stock Exchange (“NYSE”) and trade under the ticker symbol “JGV.” The Fund was organized as a Massachusetts business trust on May 17, 2006.

The end of the reporting period for the Fund is June 30, 2016, and the period covered by these Notes to Financial Statements is the six months ended June 30, 2016 (the “current fiscal period”).

Investment Adviser

The Fund’s investment adviser is Nuveen Fund Advisors, LLC (the “Adviser”), a wholly-owned subsidiary of Nuveen Investments, Inc. (“Nuveen”). Nuveen is an operating division of TIAA Global Asset Management. The Adviser is responsible for the Fund’s overall investment strategy and asset allocation decisions. The Adviser has entered into a sub-advisory agreement with Tradewinds Global Investors, LLC (the “Sub-Adviser”), an affiliate of Nuveen, under which the Sub-Adviser manages the investment portfolio of the Fund, including its options strategy. Effective August 1, 2016 (subsequent to the close of this reporting period), the Adviser entered into a sub-advisory agreement with NWQ Investment Management Company, LLC (“NWQ”), an affiliate of Nuveen, under which NWQ will manage the investment portfolio of the Fund and the sub-advisory agreement with the Sub-Adviser was terminated.

Investment Objectives and Principal Investment Strategies

The Fund’s investment objective is to provide a high level of total return by investing primarily in a diversified global portfolio of value equity securities. The Fund invests at least 80% of its managed assets (as defined in Note 7 – Management Fees and Other Transactions with Affiliates) in equity securities of which at least 40% will be of non-U.S. companies. The Fund may also opportunistically write covered calls on up to 35% of the equity portfolio and may invest up to 10% of its managed assets in debt securities.

Fund Reorganization

In May 2016, the Nuveen funds’ Board of Trustees approved the reorganization of the Fund, into NWQ Global Equity Income Fund (the “Acquiring Fund”), an open-end fund organized as a series of Nuveen Investment Trust. Both the Acquiring Fund and the Fund are advised by the Adviser and NWQ and have similar investment mandates. In order for the reorganization to occur, it must be approved by the shareholders of the Fund.

If the Fund’s shareholders approve the reorganization, the Fund’s shareholders will receive shares of the Acquiring Fund of equal value immediately prior to the closing of the reorganization. After this reorganization, then-existing Fund shareholders will no longer own shares of the Fund, but instead will become shareholders of the Acquiring Fund. Consequently, those shareholders will no longer own shares of a closed-end fund trading on the New York Stock Exchange, but rather will own shares of an open-end fund. Investors can liquidate those shares by redeeming them with the Acquiring Fund, and can purchase additional shares from that fund.

A special meeting of the shareholders of the Fund for the purpose of voting on the proposed reorganization is scheduled for September 16, 2016. It is currently anticipated that reorganizing the Fund into the Acquiring Fund (if approved by shareholders) would occur shortly after the Fund’s shareholder meeting. Further information regarding the proposed reorganization is contained in proxy materials sent to Fund shareholders in late August 2016.

Also in May 2016, the Board of Trustees of the Acquiring Fund approved the reorganization of that fund with two open-end funds, Nuveen Tradewinds Value Opportunities Fund and Nuveen Tradewinds Global All-Cap Fund. If the shareholders of those funds approve their respective reorganizations, it is expected that those reorganizations would occur after the reorganization of the Fund into the Acquiring Fund.

Significant Accounting Policies

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standard Board (FASB) Accounting Standards Codification (ASC) Topic 946 “Financial Services – Investment Companies.” The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Investment Transactions

Investment transactions are recorded on a trade date basis. Realized gains and losses from investment transactions are determined on the specific identification method, which is the same basis used for federal income tax purposes. Investments purchased on a when-issued/delayed delivery basis may have extended settlement periods. Any investments so purchased are subject to market fluctuation during this period. The Fund has earmarked securities in its portfolio with a current value at least equal to the amount of the when-issued/delayed delivery purchase commitments.

As of the end of the reporting period, the Fund did not have any outstanding when-issued/delayed purchase commitments.

Investment Income

Dividend income is recorded on the ex-dividend date or, for foreign securities, when information is available. Interest income, which reflects the amortization of premiums and includes accretion of discounts for financial reporting purposes, is recorded on an accrual basis. Interest income also reflects paydown gains and losses, if any.

Professional Fees

Professional fees presented on the Statement of Operations consist of legal fees incurred in the normal course of operations, audit fees, tax consulting fees and, in some cases, workout expenditures. Workout expenditures are incurred in an attempt to protect or enhance an investment or to pursue other claims or legal actions on behalf of Fund shareholders. If a refund is received for workout expenditures paid in a prior reporting period, such amounts will be recognized as “Legal fee refund” on the Statement of Operations.

Dividends and Distributions to Common Shareholders

Distributions to common shareholders are recorded on the ex-dividend date. The amount and timing of distributions are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP.

The Fund makes quarterly cash distributions to common shareholders of a stated dollar amount per share. Subject to approval and oversight by the Fund’s Board of Trustees (the “Board”), the Fund seeks to maintain a stable distribution level designed to deliver the long-term return potential of the Fund’s investment strategy through regular quarterly distributions (a “Managed Distribution Program”). Total distributions during a calendar year generally will be made from the Fund’s net investment income, net realized capital gains and net unrealized capital gains in the Fund’s portfolio, if any. The portion of distributions paid attributed to net unrealized gains, if any, is distributed from the Fund’s assets and is treated by shareholders as a nontaxable distribution (“return of capital”) for tax purposes. In the event that total distributions during a calendar year exceed the Fund’s total return on net asset value (“NAV”), the difference will reduce NAV per share. If the Fund’s total return on NAV exceeds total distributions during a calendar year, the excess will be reflected as an increase in NAV per share. The final determination of the source and character of all distributions paid by the Fund during the fiscal year is made after the end of the fiscal year and is reflected in the financial statements contained in the annual report as of December 31 each year.

The distributions made by the Fund during the current fiscal period are provisionally classified as being “From and in excess of net investment income,” and those distributions will be classified as being from net investment income, net realized capital gains and/or a return of capital for tax purposes after the fiscal year end. For purposes of calculating “Undistributed (Overdistribution of) net investment income” as of the end of the reporting period, the distribution amounts provisionally classified as “From and in excess of net investment income” were treated as being entirely from net investment income. Consequently, the financial statements as of the end of the reporting period, reflect an over-distribution of net investment income.

Indemnifications

Under the Fund’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts that provide general indemnifications to other parties. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

Netting Agreements

In the ordinary course of business, the Fund may enter into transactions subject to enforceable master repurchase agreements, International Swaps and Derivative Association, Inc. (“ISDA”) master agreements or other similar arrangements (“netting agreements”). Generally, the right to offset in netting agreements allows the Fund to offset certain securities and derivatives with a specific counterparty, when applicable, as well as any collateral received or delivered to that counterparty based on the terms of the agreements. Generally, the Fund manages its cash collateral and securities collateral on a counterparty basis.

The Fund’s investments subject to netting agreements as of the end of the reporting period, if any, are further described in Note 3 – Portfolio Securities and Investments in Derivatives.

Notes to Financial Statements (Unaudited) (continued)

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results may differ from those estimates.

2. Investment Valuation and Fair Value Measurements

The fair valuation input levels as described below are for fair value measurement purposes.

Fair value is defined as the price that would be received upon selling an investment or transferring a liability in an orderly transaction to an independent buyer in the principal or most advantageous market for the investment. A three-tier hierarchy is used to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability. Observable inputs are based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. Unobservable inputs are based on the best information available in the circumstances. The following is a summary of the three-tiered hierarchy of valuation input levels.

| | |

| Level 1 – | | Inputs are unadjusted and prices are determined using quoted prices in active markets for identical securities. |

| Level 2 – | | Prices are determined using other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| Level 3 – | | Prices are determined using significant unobservable inputs (including management’s assumptions in determining the fair value of investments). |

Common stocks and other equity-type securities are valued at the last sales price on the securities exchange on which such securities are primarily traded and are generally classified as Level 1. Securities primarily traded on the NASDAQ National Market (“NASDAQ”) are valued at the NASDAQ Official Closing Price and are generally classified as Level 1. However, securities traded on a securities exchange or NASDAQ for which there were no transactions on a given day or securities not listed on a securities exchange or NASDAQ are valued at the quoted bid price and are generally classified as Level 2. Prices of certain American Depository Receipts (“ADR”) held by the Fund that trade in the United States are valued based on the last traded price, official closing price or the most recent bid price of the underlying non-U.S. traded stock, adjusted as appropriate for the underlying to ADR conversion ratio and foreign exchange rate, and from time-to-time may also be adjusted further to take into account material events that may take place after the close of the local non-U.S. market but before the close of the NYSE, which may represent a transfer from a Level 1 to a Level 2 security.

Prices of fixed-income securities are provided by an independent pricing service (“pricing service”) approved by the Board. The pricing service establishes a security’s fair value using methods that may include consideration of the following: yields or prices of investments of comparable quality, type of issue, coupon, maturity and rating, market quotes or indications of value from security dealers, evaluations of anticipated cash flows or collateral, general market conditions and other information and analysis, including the obligor’s credit characteristics considered relevant. These securities are generally classified as Level 2. In pricing certain securities, particularly less liquid and lower quality securities, the pricing service may consider information about a security, its issuer or market activity provided by the Adviser. These securities are generally classified as Level 2 or Level 3 depending on the observability of the significant inputs.

Prices of forward foreign currency exchange contracts are also provided by an independent pricing service approved by the Board using the same methods as described above, and are generally classified as Level 2.

Repurchase agreements are valued at contract amount plus accrued interest, which approximates market value. These securities are generally classified as Level 2.

The value of exchange-traded options are based on the mean of the closing bid and ask prices and are generally classified as Level 1. Options traded in the over-the-counter (“OTC”) market are valued using an evaluated mean price and are generally classified as Level 2.

Investments initially valued in currencies other than the U.S. dollar are converted to the U.S. dollar using exchange rates obtained from pricing services. As a result, the NAV of the Fund’s shares may be affected by changes in the value of currencies in relation to the U.S. dollar. The value of securities traded in markets outside the United States or denominated in currencies other than the U.S. dollar may be affected significantly on a day that the NYSE is closed and an investor is not able to purchase, redeem or exchange shares. If significant market events occur between the time of determination of the closing price of a foreign security on an exchange and the time that the Fund’s NAV is determined, or if under the Fund’s procedures, the closing price of a foreign security is not deemed to be reliable, the security would be valued at fair value as determined in accordance with procedures established in good faith by the Board. These securities are generally classified as Level 2 or Level 3 depending on the observability of the significant inputs.

Certain securities may not be able to be priced by the pre-established pricing methods as described above. Such securities may be valued by the Board and/or its appointee at fair value. These securities generally include, but are not limited to, restricted securities (securities which may not be publicly sold without registration under the Securities Act of 1933, as amended) for which a pricing service is unable to provide a market price; securities whose trading

has been formally suspended; debt securities that have gone into default and for which there is no current market quotation; a security whose market price is not available from a pre-established pricing source; a security with respect to which an event has occurred that is likely to materially affect the value of the security after the market has closed but before the calculation of the Fund’s NAV (as may be the case in non-U.S. markets on which the security is primarily traded) or make it difficult or impossible to obtain a reliable market quotation; and a security whose price, as provided by the pricing service, is not deemed to reflect the security’s fair value. As a general principle, the fair value of a security would appear to be the amount that the owner might reasonably expect to receive for it in a current sale. A variety of factors may be considered in determining the fair value of such securities, which may include consideration of the following: yields or prices of investments of comparable quality, type of issue, coupon, maturity and rating, market quotes or indications of value from security dealers, evaluations of anticipated cash flows or collateral, general market conditions and other information and analysis, including the obligor’s credit characteristics considered relevant. These securities are generally classified as Level 2 or Level 3 depending on the observability of the significant inputs. Regardless of the method employed to value a particular security, all valuations are subject to review by the Board and/or its appointee.

The inputs or methodologies used for valuing securities are not an indication of the risks associated with investing in those securities. The following is a summary of the Fund’s fair value measurements as of the end of the reporting period:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Long-Term Investments: | | | | | | | | | | | | | | | | |

Common Stocks* | | $ | 154,342,348 | | | $ | 52,799,071 | ** | | $ | 763,430 | ** | | $ | 207,904,849 | |

Mortgage-Backed Securities | | | — | | | | 24,564 | | | | — | | | | 24,564 | |

Short-Term Investments: | | | | | | | | | | | | | | | | |

Repurchase Agreements | | | — | | | | 25,751,004 | | | | — | | | | 25,751,004 | |

Investments in Derivatives: | | | | | | | | | | | | | | | | |

Options Written | | | (149,050 | ) | | | — | | | | — | | | | (149,050 | ) |

Forward Foreign Currency Exchange Contracts*** | | | — | | | | (807,660 | ) | | | — | | | | (807,660 | ) |

Total | | $ | 154,193,298 | | | $ | 77,766,979 | | | $ | 763,430 | | | $ | 232,723,707 | |

| * | Refer to the Fund’s Portfolio of Investments for industry classifications. |

| ** | Refer to the Fund’s Portfolio of Investments for securities classified as Level 2 and Level 3. |

| *** | Represents net unrealized appreciation (depreciation) as reported in the Fund’s Portfolio of Investments. |

The Board is responsible for the valuation process and has appointed the oversight of the daily valuation process to the Adviser’s Valuation Committee. The Valuation Committee, pursuant to the valuation policies and procedures adopted by the Board, is responsible for making fair value determinations, evaluating the effectiveness of the Fund’s pricing policies and reporting to the Board. The Valuation Committee is aided in its efforts by the Adviser’s dedicated Securities Valuation Team, which is responsible for administering the daily valuation process and applying fair value methodologies as approved by the Valuation Committee. When determining the reliability of independent pricing services for investments owned by the Fund, the Valuation Committee, among other things, conducts due diligence reviews of the pricing services and monitors the quality of security prices received through various testing reports conducted by the Securities Valuation Team.

The Valuation Committee will consider pricing methodologies it deems relevant and appropriate when making a fair value determination, based on the facts and circumstances specific to the portfolio instrument. Fair value determinations generally will be derived as follows, using public or private market information:

| | (i) | If available, fair value determinations shall be derived by extrapolating from recent transactions or quoted prices for identical or comparable securities. |

| | (ii) | If such information is not available, an analytical valuation methodology may be used based on other available information including, but not limited to: analyst appraisals, research reports, corporate action information, issuer financial statements and shelf registration statements. Such analytical valuation methodologies may include, but are not limited to: multiple of earnings, discount from market value of a similar freely-traded security, discounted cash flow analysis, book value or a multiple thereof, risk premium/yield analysis, yield to maturity and/or fundamental investment analysis. |

The purchase price of a portfolio instrument will be used to fair value the instrument only if no other valuation methodology is available or deemed appropriate, and it is determined that the purchase price fairly reflects the instrument’s current value.

For each portfolio security that has been fair valued pursuant to the policies adopted by the Board, the fair value price is compared against the last available and next available market quotations. The Valuation Committee reviews the results of such testing and fair valuation occurrences are reported to the Board.

Notes to Financial Statements (Unaudited) (continued)

3. Portfolio Securities and Investments in Derivatives

Portfolio Securities

Foreign Currency Transactions