UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21991

Fidelity Rutland Square Trust II

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Christina H. Lee, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | February 29 |

|

|

Date of reporting period: | February 29, 2024 |

Item 1.

Reports to Stockholders

Strategic Advisers® Income Opportunities Fund

Offered exclusively to certain managed account clients of Strategic Advisers LLC or its affiliates - not available for sale to the general public

Annual Report

February 29, 2024

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-3455 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2024 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns |

| | | | |

Periods ended February 29, 2024 | Past 1 year | Past 5 years | Past 10 years |

| Strategic Advisers® Income Opportunities Fund | 10.29% | 3.91% | 3.82% |

| $10,000 Over 10 Years |

| |

Let's say hypothetically that $10,000 was invested in Strategic Advisers® Income Opportunities Fund on February 28, 2014. The chart shows how the value of your investment would have changed, and also shows how the ICE® BofA® US High Yield Constrained Index performed over the same period. |

|

|

Market Recap:

High-yield bonds gained 10.97% for the 12 months ending February 29, 2024, according to the ICE BofA® US High Yield Constrained Index, as robust earnings, a slowing in the pace of inflation and resilient late-cycle expansion of the U.S. economy aided risk assets. The index advanced fairly steadily for most the period, rising alongside U.S. stocks, which were driven by a narrow set of firms in the information technology and communication services sectors. A likely shift in monetary policy also provided a boost for high yield. Aggressive rate hikes by the U.S. Federal Reserve continued until late July, when the Fed decided to pause a series of increases that began in March 2022 at a 22-year high while it observed the effect on inflation and the economy. After the Federal Reserve's November 1 meeting, when the central bank hinted it might be done raising rates, the high-yield index reversed a two-month decline that was due to soaring yields on longer-term government bonds and mixed earnings from some big and influential firms. The index rose 8.40% through year-end and gained only modestly in the first two months of 2024. For the full 12 months, all but one of 19 industries in the index advanced, with retail (+15%) leading, followed by financial services (+13%), which benefited from high interest rates. Energy, the largest segment in the index this period, gained 12%. Conversely, the banking (-9%) group lagged most, while media (+8%) finished much closer to the broader market.

Comments from Portfolio Manager Charles Sterling:

For the fiscal year ending February 29, 2024, the Fund gained 10.29%, trailing the 10.97% advance of the benchmark ICE BofASM U.S. High Yield Constrained Index. Among the Fund's active underlying managers, sub-advisers PGIM (+9%) and FIAM® (+9%) were the primary detractors versus the benchmark. A sharp decline in bonds issued by Jamaica-based telecommunications company Digicel weighed on PGIM's result, as did security selection in other areas. PGIM is one of the largest investments in the portfolio, so its performance typically has a sizable impact on the Fund's overall return. For FIAM, a restructuring-related markdown in the price of an energy holding against a backdrop of declining energy prices hurt, as did overweight exposure to the telecom industry. MainStay MacKay High Yield Corporate Bond Fund (+9.5%) and Eaton Vance Income Fund of Boston (+10%) were more moderate relative detractors. There is a substantial defensive emphasis in these managers' strategies, which caused them to lag in a market environment led by lower-quality securities. On the plus side, Artisan High Income Fund (+12%) and Fidelity® Capital & Income Fund (+12%) were the top relative contributors. Artisan benefited from a sizable allocation to lower-rated bonds, along with holdings of leveraged bank loans. Fidelity Capital & Income had a substantial allocation to leveraged equities, and that fueled its outperformance. Investments in lower-rated credits and an allocation to bank loans also boosted sub-adviser T. Rowe Price (+11%), as did an overweight in the energy sector. During the period, amid a benign outlook for defaults within the high-yield market, I made modest adjustments to the portfolio to reduce its defensive positioning. I did this by increasing allocations to opportunistic managers that are willing to assume slightly more risk by selectively investing in lower-rated debt.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

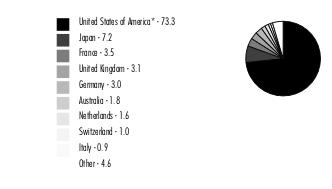

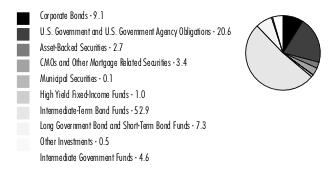

The information in the following tables is based on the direct Investments of the Fund.

Top Holdings (% of Fund's net assets) |

| (excluding cash equivalents) |

| Artisan High Income Fund Investor Shares | 14.4 | |

| Fidelity Capital & Income Fund | 10.1 | |

| BlackRock High Yield Bond Portfolio Class K | 7.7 | |

| Eaton Vance Income Fund of Boston Class A | 7.3 | |

| MainStay High Yield Corporate Bond Fund Class A | 6.7 | |

| Vanguard High-Yield Corporate Fund Admiral Shares | 2.7 | |

| U.S. Treasury Obligations | 1.1 | |

| CCO Holdings LLC/CCO Holdings Capital Corp. | 0.9 | |

| Tenet Healthcare Corp. | 0.8 | |

| TransDigm, Inc. | 0.8 | |

Quality Diversification (% of Fund's net assets) |

|

Percentages shown as 0.0% may reflect amounts less than 0.05%. |

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

Asset Allocation (% of Fund's net assets) |

|

|

Asset Allocation of funds in the pie chart reflect the categorizations of the asset as defined by Morningstar as of the reporting date.

Showing Percentage of Net Assets

| Corporate Bonds - 44.1% |

| | | Principal Amount (a) | Value ($) |

| Convertible Bonds - 0.3% | | | |

| COMMUNICATION SERVICES - 0.2% | | | |

| Media - 0.2% | | | |

| DISH Network Corp.: | | | |

| 0% 12/15/25 | | 198,000 | 143,451 |

| 2.375% 3/15/24 | | 950,000 | 934,610 |

| 3.375% 8/15/26 | | 1,568,000 | 927,080 |

| | | | 2,005,141 |

| CONSUMER DISCRETIONARY - 0.0% | | | |

| Automobiles - 0.0% | | | |

| Rivian Automotive, Inc. 4.625% 3/15/29 (b) | | 410,000 | 330,460 |

| | | | |

| INFORMATION TECHNOLOGY - 0.1% | | | |

| Semiconductors & Semiconductor Equipment - 0.1% | | | |

| ON Semiconductor Corp. 0% 5/1/27 | | 104,000 | 162,448 |

| Wolfspeed, Inc. 1.875% 12/1/29 | | 645,000 | 336,045 |

| | | | 498,493 |

| Technology Hardware, Storage & Peripherals - 0.0% | | | |

| Seagate HDD Cayman 3.5% 6/1/28 (b) | | 170,000 | 212,987 |

| Western Digital Corp. 3% 11/15/28 (b) | | 150,000 | 198,000 |

| | | | 410,987 |

TOTAL INFORMATION TECHNOLOGY | | | 909,480 |

| | | | |

| REAL ESTATE - 0.0% | | | |

| Real Estate Management & Development - 0.0% | | | |

| Redfin Corp. 0.5% 4/1/27 | | 456,000 | 260,360 |

| | | | |

| UTILITIES - 0.0% | | | |

| Electric Utilities - 0.0% | | | |

| PG&E Corp. 4.25% 12/1/27 (b) | | 158,000 | 157,842 |

| | | | |

| Independent Power and Renewable Electricity Producers - 0.0% | | | |

| NextEra Energy Partners LP 2.5% 6/15/26 (b) | | 128,000 | 115,200 |

| Sunnova Energy International, Inc. 0.25% 12/1/26 | | 39,000 | 19,507 |

| | | | 134,707 |

TOTAL UTILITIES | | | 292,549 |

| | | | |

| TOTAL CONVERTIBLE BONDS | | | 3,797,990 |

| Nonconvertible Bonds - 43.8% | | | |

| COMMUNICATION SERVICES - 5.1% | | | |

| Diversified Telecommunication Services - 0.9% | | | |

| Altice France SA: | | | |

| 5.125% 1/15/29(b) | | 867,000 | 655,041 |

| 5.125% 7/15/29(b) | | 755,000 | 570,134 |

| 8.125% 2/1/27(b) | | 850,000 | 781,210 |

| C&W Senior Financing Designated Activity Co. 6.875% 9/15/27 (b) | | 1,470,000 | 1,385,475 |

| Cablevision Lightpath LLC: | | | |

| 3.875% 9/15/27(b) | | 825,000 | 747,812 |

| 5.625% 9/15/28(b) | | 300,000 | 249,663 |

| Connect Finco SARL / Connect U.S. Finco LLC 6.75% 10/1/26 (b) | | 1,990,000 | 1,952,525 |

| Consolidated Communications, Inc. 5% 10/1/28 (b) | | 190,000 | 156,942 |

| Frontier Communications Holdings LLC: | | | |

| 5% 5/1/28(b) | | 640,000 | 592,291 |

| 5.875% 10/15/27(b) | | 274,000 | 264,821 |

| 5.875% 11/1/29 | | 235,000 | 201,280 |

| Iliad Holding SAS 6.5% 10/15/26 (b) | | 1,215,000 | 1,201,241 |

| Level 3 Financing, Inc.: | | | |

| 3.4% 3/1/27(b) | | 700,000 | 563,521 |

| 3.625% 1/15/29(b) | | 557,000 | 325,845 |

| 3.75% 7/15/29(b) | | 795,000 | 465,075 |

| 4.25% 7/1/28(b) | | 390,000 | 239,850 |

| 4.625% 9/15/27(b) | | 350,000 | 233,580 |

| 10.5% 5/15/30(b) | | 479,000 | 490,975 |

| Sitios Latinoamerica S.A.B. de CV 5.375% 4/4/32 (b) | | 180,000 | 165,708 |

| Telecom Italia Capital SA: | | | |

| 6% 9/30/34 | | 242,000 | 224,532 |

| 7.2% 7/18/36 | | 98,000 | 97,408 |

| 7.721% 6/4/38 | | 200,000 | 204,846 |

| Telenet Finance Luxembourg Notes SARL 5.5% 3/1/28 (b) | | 200,000 | 187,500 |

| Windstream Escrow LLC 7.75% 8/15/28 (b) | | 300,000 | 280,087 |

| Zayo Group Holdings, Inc. 4% 3/1/27 (b) | | 420,000 | 349,650 |

| | | | 12,587,012 |

| Entertainment - 0.2% | | | |

| Cinemark U.S.A., Inc. 5.25% 7/15/28 (b) | | 660,000 | 616,506 |

| Live Nation Entertainment, Inc. 4.75% 10/15/27 (b) | | 665,000 | 636,681 |

| Playtika Holding Corp. 4.25% 3/15/29 (b) | | 605,000 | 516,210 |

| Roblox Corp. 3.875% 5/1/30 (b) | | 1,055,000 | 924,001 |

| | | | 2,693,398 |

| Media - 3.7% | | | |

| Advantage Sales & Marketing, Inc. 6.5% 11/15/28 (b) | | 764,000 | 711,093 |

| Altice Financing SA: | | | |

| 5% 1/15/28(b) | | 1,585,000 | 1,402,315 |

| 5.75% 8/15/29(b) | | 2,885,000 | 2,484,766 |

| Altice France Holding SA: | | | |

| 6% 2/15/28(b) | | 3,070,000 | 1,549,571 |

| 10.5% 5/15/27(b) | | 1,935,000 | 1,264,067 |

| CCO Holdings LLC/CCO Holdings Capital Corp.: | | | |

| 4.25% 2/1/31(b) | | 1,435,000 | 1,154,224 |

| 4.25% 1/15/34(b) | | 375,000 | 280,372 |

| 4.5% 8/15/30(b) | | 1,488,000 | 1,234,326 |

| 4.5% 5/1/32 | | 3,150,000 | 2,488,514 |

| 4.5% 6/1/33(b) | | 1,725,000 | 1,326,951 |

| 4.75% 2/1/32(b) | | 240,000 | 193,626 |

| 5% 2/1/28(b) | | 1,500,000 | 1,384,120 |

| 5.5% 5/1/26(b) | | 40,000 | 39,301 |

| 6.375% 9/1/29(b) | | 2,967,000 | 2,787,546 |

| 7.375% 3/1/31(b) | | 1,530,000 | 1,482,461 |

| Clear Channel Outdoor Holdings, Inc.: | | | |

| 5.125% 8/15/27(b) | | 200,000 | 187,008 |

| 7.5% 6/1/29(b) | | 680,000 | 562,700 |

| 7.75% 4/15/28(b) | | 995,000 | 860,132 |

| 9% 9/15/28(b) | | 1,180,000 | 1,230,740 |

| CSC Holdings LLC: | | | |

| 3.375% 2/15/31(b) | | 127,000 | 89,653 |

| 4.125% 12/1/30(b) | | 1,152,000 | 857,756 |

| 4.625% 12/1/30(b) | | 2,175,000 | 1,209,594 |

| 5.375% 2/1/28(b) | | 211,000 | 183,914 |

| 5.75% 1/15/30(b) | | 1,945,000 | 1,143,806 |

| 6.5% 2/1/29(b) | | 510,000 | 444,552 |

| 7.5% 4/1/28(b) | | 1,245,000 | 885,052 |

| 11.75% 1/31/29(b) | | 1,585,000 | 1,656,835 |

| Diamond Sports Group LLC/Diamond Sports Finance Co.: | | | |

| 5.375%(b)(c) | | 6,605,000 | 379,788 |

| 6.625%(b)(c) | | 13,785,000 | 792,638 |

| DIRECTV Financing LLC / DIRECTV Financing Co-Obligor, Inc. 5.875% 8/15/27 (b) | | 735,000 | 693,744 |

| DISH DBS Corp.: | | | |

| 5.125% 6/1/29 | | 1,570,000 | 669,566 |

| 5.25% 12/1/26(b) | | 825,000 | 658,969 |

| 5.75% 12/1/28(b) | | 632,000 | 437,660 |

| 7.375% 7/1/28 | | 1,420,000 | 692,633 |

| 7.75% 7/1/26 | | 2,034,000 | 1,296,675 |

| DISH Network Corp. 11.75% 11/15/27 (b) | | 1,189,000 | 1,239,626 |

| Gray Television, Inc.: | | | |

| 5.375% 11/15/31(b) | | 895,000 | 578,980 |

| 5.875% 7/15/26(b) | | 875,000 | 830,358 |

| iHeartCommunications, Inc. 8.375% 5/1/27 | | 539,567 | 323,740 |

| Lamar Media Corp. 4.875% 1/15/29 | | 897,000 | 849,908 |

| LCPR Senior Secured Financing DAC: | | | |

| 5.125% 7/15/29(b) | | 185,000 | 155,459 |

| 6.75% 10/15/27(b) | | 310,000 | 292,950 |

| Midas Opco Holdings LLC 5.625% 8/15/29 (b) | | 1,645,000 | 1,468,656 |

| Midcontinent Communications & Midcontinent Finance Corp. 5.375% 8/15/27 (b) | | 394,000 | 373,315 |

| News Corp. 3.875% 5/15/29 (b) | | 125,000 | 112,977 |

| Nexstar Media, Inc. 5.625% 7/15/27 (b) | | 250,000 | 236,920 |

| Outfront Media Capital LLC / Corp. 7.375% 2/15/31 (b) | | 230,000 | 240,044 |

| Radiate Holdco LLC/Radiate Financial Service Ltd.: | | | |

| 4.5% 9/15/26(b) | | 300,000 | 236,239 |

| 6.5% 9/15/28(b) | | 2,260,000 | 1,087,625 |

| Scripps Escrow, Inc. 5.875% 7/15/27 (b) | | 338,000 | 274,365 |

| Sinclair Television Group, Inc. 5.125% 2/15/27 (b) | | 515,000 | 473,576 |

| Sirius XM Radio, Inc.: | | | |

| 4% 7/15/28(b) | | 2,120,000 | 1,909,941 |

| 4.125% 7/1/30(b) | | 1,315,000 | 1,131,370 |

| 5% 8/1/27(b) | | 1,074,000 | 1,023,122 |

| 5.5% 7/1/29(b) | | 605,000 | 572,121 |

| TEGNA, Inc. 5% 9/15/29 | | 80,000 | 70,400 |

| Townsquare Media, Inc. 6.875% 2/1/26 (b) | | 466,000 | 449,555 |

| Univision Communications, Inc.: | | | |

| 6.625% 6/1/27(b) | | 1,866,000 | 1,808,896 |

| 7.375% 6/30/30(b) | | 790,000 | 763,038 |

| 8% 8/15/28(b) | | 1,400,000 | 1,407,476 |

| Virgin Media Secured Finance PLC 4.5% 8/15/30 (b) | | 150,000 | 131,102 |

| VZ Secured Financing BV 5% 1/15/32 (b) | | 665,000 | 567,622 |

| Ziggo Bond Co. BV 6% 1/15/27 (b) | | 20,000 | 19,551 |

| Ziggo BV 4.875% 1/15/30 (b) | | 170,000 | 151,438 |

| | | | 53,497,038 |

| Wireless Telecommunication Services - 0.3% | | | |

| Digicel Group Holdings Ltd.: | | | |

| 0% 12/31/30(b)(d) | | 545 | 1,247 |

| 0% 12/31/30(b)(d) | | 24,712 | 2 |

| 0% 12/31/30(b)(d) | | 12,739 | 14,310 |

| 0% 12/31/30(b)(d) | | 39,741 | 4 |

| Digicel Intermediate Holdings 12% 5/25/27 pay-in-kind (e) | | 204,326 | 200,342 |

| Digicel MidCo Ltd. / DIFL U.S. II LLC PIK 10.5% 11/25/28 pay-in-kind (e) | | 22,064 | 17,651 |

| Intelsat Jackson Holdings SA: | | | |

| 6.5% 3/15/30(b) | | 2,185,000 | 2,032,885 |

| 9.75%(b)(c)(d) | | 50,000 | 0 |

| Millicom International Cellular SA: | | | |

| 4.5% 4/27/31(b) | | 235,000 | 202,970 |

| 5.125% 1/15/28(b) | | 171,000 | 162,840 |

| Telesat Canada/Telesat LLC 6.5% 10/15/27 (b) | | 865,000 | 380,600 |

| U.S. Cellular Corp. 6.7% 12/15/33 | | 315,000 | 309,932 |

| VMED O2 UK Financing I PLC: | | | |

| 4.25% 1/31/31(b) | | 127,000 | 107,711 |

| 4.75% 7/15/31(b) | | 1,850,000 | 1,599,531 |

| | | | 5,030,025 |

TOTAL COMMUNICATION SERVICES | | | 73,807,473 |

| | | | |

| CONSUMER DISCRETIONARY - 8.8% | | | |

| Automobile Components - 1.0% | | | |

| Adient Global Holdings Ltd.: | | | |

| 4.875% 8/15/26(b) | | 575,000 | 557,325 |

| 7% 4/15/28(b) | | 255,000 | 259,972 |

| 8.25% 4/15/31(b) | | 860,000 | 905,507 |

| Albion Financing 2 SARL 8.75% 4/15/27 (b) | | 370,000 | 369,969 |

| American Axle & Manufacturing, Inc.: | | | |

| 6.25% 3/15/26 | | 162,000 | 160,099 |

| 6.5% 4/1/27 | | 300,000 | 296,318 |

| Clarios Global LP / Clarios U.S. Finance Co. 8.5% 5/15/27 (b) | | 1,450,000 | 1,457,514 |

| Dana Financing Luxembourg SARL 8.5% 7/15/31 (b) | EUR | 601,000 | 711,839 |

| Dana, Inc.: | | | |

| 4.25% 9/1/30 | | 780,000 | 672,682 |

| 5.375% 11/15/27 | | 50,000 | 48,264 |

| 5.625% 6/15/28 | | 1,565,000 | 1,514,963 |

| Hertz Corp.: | | | |

| 4.625% 12/1/26(b) | | 125,000 | 110,651 |

| 5% 12/1/29(b) | | 390,000 | 298,783 |

| IHO Verwaltungs GmbH 4.75% 9/15/26 pay-in-kind (b)(e) | | 40,000 | 38,469 |

| J.B. Poindexter & Co., Inc. 8.75% 12/15/31 (b) | | 235,000 | 240,744 |

| Macquarie AirFinance Holdings: | | | |

| 8.125% 3/30/29(b) | | 575,000 | 597,856 |

| 8.375% 5/1/28(b) | | 320,000 | 335,194 |

| Nesco Holdings II, Inc. 5.5% 4/15/29 (b) | | 346,000 | 322,832 |

| Patrick Industries, Inc.: | | | |

| 4.75% 5/1/29(b) | | 200,000 | 183,028 |

| 7.5% 10/15/27(b) | | 125,000 | 125,469 |

| PECF USS Intermediate Holding III Corp. 8% 11/15/29 (b) | | 289,000 | 126,127 |

| Tenneco, Inc. 8% 11/17/28 (b) | | 1,330,000 | 1,211,963 |

| The Goodyear Tire & Rubber Co.: | | | |

| 5% 7/15/29 | | 15,000 | 13,807 |

| 5.25% 4/30/31 | | 1,150,000 | 1,041,469 |

| 5.25% 7/15/31 | | 1,620,000 | 1,462,018 |

| 5.625% 4/30/33 | | 270,000 | 241,421 |

| ZF North America Capital, Inc.: | | | |

| 4.75% 4/29/25(b) | | 235,000 | 231,428 |

| 6.875% 4/14/28(b) | | 335,000 | 342,039 |

| 7.125% 4/14/30(b) | | 390,000 | 406,352 |

| | | | 14,284,102 |

| Automobiles - 0.5% | | | |

| Ford Motor Co.: | | | |

| 3.25% 2/12/32 | | 195,000 | 159,911 |

| 4.75% 1/15/43 | | 323,000 | 261,312 |

| 5.291% 12/8/46 | | 35,000 | 30,267 |

| 6.1% 8/19/32 | | 980,000 | 978,283 |

| 7.4% 11/1/46 | | 75,000 | 80,458 |

| 9.625% 4/22/30 | | 700,000 | 817,754 |

| PM General Purchaser LLC 9.5% 10/1/28 (b) | | 755,000 | 762,664 |

| Rivian Holdco & Rivian LLC & Rivian Automotive LLC 6 month U.S. LIBOR + 5.620% 11.4932% 10/15/26 (b)(e)(f) | | 4,340,000 | 4,129,903 |

| | | | 7,220,552 |

| Broadline Retail - 0.3% | | | |

| CMG Media Corp. 8.875% 12/15/27 (b) | | 2,205,000 | 1,473,540 |

| Kohl's Corp. 4.25% 7/17/25 | | 20,000 | 19,433 |

| Match Group Holdings II LLC: | | | |

| 3.625% 10/1/31(b) | | 435,000 | 366,488 |

| 4.125% 8/1/30(b) | | 1,544,000 | 1,364,016 |

| 4.625% 6/1/28(b) | | 500,000 | 470,085 |

| 5% 12/15/27(b) | | 175,000 | 166,919 |

| 5.625% 2/15/29(b) | | 490,000 | 470,400 |

| Nordstrom, Inc.: | | | |

| 4.25% 8/1/31 | | 70,000 | 58,906 |

| 4.375% 4/1/30 | | 45,000 | 39,758 |

| | | | 4,429,545 |

| Distributors - 0.2% | | | |

| Ritchie Bros. Holdings, Inc.: | | | |

| 6.75% 3/15/28(b) | | 385,000 | 394,028 |

| 7.75% 3/15/31(b) | | 570,000 | 599,213 |

| Windsor Holdings III, LLC 8.5% 6/15/30 (b) | | 1,590,000 | 1,645,127 |

| | | | 2,638,368 |

| Diversified Consumer Services - 0.2% | | | |

| Adtalem Global Education, Inc. 5.5% 3/1/28 (b) | | 802,000 | 763,368 |

| GEMS MENASA Cayman Ltd./GEMS Education Delaware LLC 7.125% 7/31/26 (b) | | 675,000 | 668,810 |

| Service Corp. International: | | | |

| 3.375% 8/15/30 | | 400,000 | 343,408 |

| 4% 5/15/31 | | 460,000 | 404,185 |

| 5.125% 6/1/29 | | 105,000 | 102,459 |

| Sotheby's 7.375% 10/15/27 (b) | | 230,000 | 220,921 |

| TKC Holdings, Inc.: | | | |

| 6.875% 5/15/28(b) | | 280,000 | 262,150 |

| 10.5% 5/15/29(b) | | 295,000 | 267,784 |

| WASH Multifamily Acquisition, Inc. 5.75% 4/15/26 (b) | | 430,000 | 417,100 |

| | | | 3,450,185 |

| Hotels, Restaurants & Leisure - 4.6% | | | |

| 1011778 BC Unlimited Liability Co./New Red Finance, Inc.: | | | |

| 3.875% 1/15/28(b) | | 160,000 | 149,245 |

| 4% 10/15/30(b) | | 1,334,000 | 1,171,791 |

| Affinity Interactive 6.875% 12/15/27 (b) | | 645,000 | 594,954 |

| Boyd Gaming Corp. 4.75% 6/15/31 (b) | | 175,000 | 158,964 |

| Brinker International, Inc. 8.25% 7/15/30 (b) | | 600,000 | 628,806 |

| Caesars Entertainment, Inc.: | | | |

| 4.625% 10/15/29(b) | | 1,375,000 | 1,255,369 |

| 6.5% 2/15/32(b) | | 1,250,000 | 1,259,354 |

| 7% 2/15/30(b) | | 1,455,000 | 1,490,588 |

| 8.125% 7/1/27(b) | | 2,505,000 | 2,572,099 |

| Carnival Corp.: | | | |

| 4% 8/1/28(b) | | 225,000 | 207,531 |

| 5.75% 3/1/27(b) | | 1,980,000 | 1,955,235 |

| 6% 5/1/29(b) | | 1,345,000 | 1,312,190 |

| 6.65% 1/15/28 | | 110,000 | 108,394 |

| 7% 8/15/29(b) | | 490,000 | 508,274 |

| 7.625% 3/1/26(b) | | 2,680,000 | 2,714,867 |

| 10.5% 6/1/30(b) | | 1,750,000 | 1,909,306 |

| Carrols Restaurant Group, Inc. 5.875% 7/1/29 (b) | | 225,000 | 229,633 |

| CCM Merger, Inc. 6.375% 5/1/26 (b) | | 250,000 | 246,619 |

| Cedar Fair LP 5.25% 7/15/29 | | 792,000 | 748,108 |

| Churchill Downs, Inc.: | | | |

| 5.75% 4/1/30(b) | | 1,410,000 | 1,354,807 |

| 6.75% 5/1/31(b) | | 630,000 | 630,375 |

| Cirsa Finance International SARL: | | | |

| 4.5% 3/15/27(b) | EUR | 515,000 | 542,697 |

| 6.5% 3/15/29(b) | EUR | 100,000 | 109,385 |

| 10.375% 11/30/27(b) | EUR | 90,000 | 104,811 |

| ClubCorp Holdings, Inc. 8.5% 9/15/25 (b) | | 74,000 | 66,600 |

| Everi Holdings, Inc. 5% 7/15/29 (b) | | 149,000 | 147,696 |

| Fertitta Entertainment LLC / Fertitta Entertainment Finance Co., Inc. 6.75% 1/15/30 (b) | | 1,810,000 | 1,598,681 |

| Garden SpinCo Corp. 8.625% 7/20/30 (b) | | 115,000 | 121,912 |

| Golden Entertainment, Inc. 7.625% 4/15/26 (b) | | 536,000 | 533,628 |

| Hilton Domestic Operating Co., Inc.: | | | |

| 3.625% 2/15/32(b) | | 1,325,000 | 1,131,895 |

| 4% 5/1/31(b) | | 190,000 | 168,812 |

| Hilton Grand Vacations Borrower Escrow LLC 6.625% 1/15/32 (b) | | 330,000 | 329,999 |

| International Game Technology PLC: | | | |

| 5.25% 1/15/29(b) | | 985,000 | 952,119 |

| 6.25% 1/15/27(b) | | 1,610,000 | 1,616,796 |

| Jacobs Entertainment, Inc.: | | | |

| 6.75% 2/15/29(b) | | 890,000 | 848,588 |

| 6.75% 2/15/29(b) | | 325,000 | 308,035 |

| Life Time, Inc.: | | | |

| 5.75% 1/15/26(b) | | 882,000 | 874,598 |

| 8% 4/15/26(b) | | 1,123,000 | 1,133,275 |

| Light & Wonder International, Inc.: | | | |

| 7.25% 11/15/29(b) | | 2,200,000 | 2,251,295 |

| 7.5% 9/1/31(b) | | 485,000 | 505,294 |

| Lindblad Expeditions Holdings 9% 5/15/28 (b) | | 500,000 | 527,500 |

| Lindblad Expeditions LLC 6.75% 2/15/27 (b) | | 40,000 | 40,165 |

| Lottomatica SpA 7.125% 6/1/28 (b) | EUR | 130,000 | 148,567 |

| MajorDrive Holdings IV LLC 6.375% 6/1/29 (b) | | 295,000 | 254,438 |

| Merlin Entertainments Group 7.375% 2/15/31 (b) | | 500,000 | 500,258 |

| MGM Resorts International: | | | |

| 4.75% 10/15/28 | | 1,376,000 | 1,291,563 |

| 5.5% 4/15/27 | | 337,000 | 330,056 |

| Midwest Gaming Borrower LLC / Midwest Gaming Financial Corp. 4.875% 5/1/29 (b) | | 1,090,000 | 999,527 |

| Motion Finco SARL 7.375% 6/15/30 (b) | EUR | 405,000 | 454,756 |

| NCL Corp. Ltd.: | | | |

| 3.625% 12/15/24(b) | | 224,000 | 220,600 |

| 5.875% 3/15/26(b) | | 1,610,000 | 1,572,568 |

| 5.875% 2/15/27(b) | | 1,155,000 | 1,141,511 |

| 7.75% 2/15/29(b) | | 1,725,000 | 1,768,173 |

| 8.125% 1/15/29(b) | | 398,000 | 418,729 |

| 8.375% 2/1/28(b) | | 275,000 | 288,685 |

| NCL Finance Ltd. 6.125% 3/15/28 (b) | | 895,000 | 872,991 |

| Ontario Gaming GTA LP 8% 8/1/30 (b) | | 310,000 | 316,172 |

| Penn Entertainment, Inc. 5.625% 1/15/27 (b) | | 1,350,000 | 1,290,485 |

| Premier Entertainment Sub LLC 5.875% 9/1/31 (b) | | 425,000 | 301,053 |

| Royal Caribbean Cruises Ltd.: | | | |

| 4.25% 7/1/26(b) | | 640,000 | 616,392 |

| 5.375% 7/15/27(b) | | 770,000 | 755,211 |

| 5.5% 8/31/26(b) | | 750,000 | 741,419 |

| 5.5% 4/1/28(b) | | 1,880,000 | 1,845,632 |

| 6.25% 3/15/32(b)(g) | | 770,000 | 772,204 |

| 8.25% 1/15/29(b) | | 700,000 | 742,475 |

| 9.25% 1/15/29(b) | | 1,225,000 | 1,317,723 |

| 11.625% 8/15/27(b) | | 300,000 | 324,495 |

| SeaWorld Parks & Entertainment, Inc. 5.25% 8/15/29 (b) | | 1,175,000 | 1,095,693 |

| Six Flags Entertainment Corp.: | | | |

| 5.5% 4/15/27(b) | | 770,000 | 753,638 |

| 7.25% 5/15/31(b) | | 1,205,000 | 1,212,531 |

| Sugarhouse HSP Gaming Prop Mezz LP/Sugarhouse HSP Gaming Finance Corp. 5.875% 5/15/25 (b) | | 280,000 | 277,176 |

| Viking Cruises Ltd.: | | | |

| 5.875% 9/15/27(b) | | 880,000 | 860,200 |

| 7% 2/15/29(b) | | 125,000 | 124,945 |

| 9.125% 7/15/31(b) | | 480,000 | 519,638 |

| Viking Ocean Cruises Ship VII Ltd. 5.625% 2/15/29 (b) | | 600,000 | 579,000 |

| Wynn Macau Ltd.: | | | |

| 5.125% 12/15/29(b) | | 650,000 | 585,813 |

| 5.5% 10/1/27(b) | | 2,265,000 | 2,146,088 |

| 5.625% 8/26/28(b) | | 500,000 | 468,415 |

| Wynn Resorts Finance LLC / Wynn Resorts Capital Corp.: | | | |

| 5.125% 10/1/29(b) | | 550,000 | 518,817 |

| 7.125% 2/15/31(b) | | 305,000 | 314,968 |

| Yum! Brands, Inc.: | | | |

| 3.625% 3/15/31 | | 95,000 | 83,545 |

| 4.625% 1/31/32 | | 430,000 | 394,744 |

| 5.35% 11/1/43 | | 845,000 | 810,038 |

| 5.375% 4/1/32 | | 80,000 | 76,817 |

| 6.875% 11/15/37 | | 1,170,000 | 1,270,525 |

| | | | 66,498,564 |

| Household Durables - 0.6% | | | |

| Ashton Woods U.S.A. LLC/Ashton Woods Finance Co.: | | | |

| 4.625% 8/1/29(b) | | 75,000 | 68,100 |

| 4.625% 4/1/30(b) | | 690,000 | 620,284 |

| 6.625% 1/15/28(b) | | 25,000 | 24,847 |

| Beazer Homes U.S.A., Inc.: | | | |

| 5.875% 10/15/27 | | 225,000 | 218,705 |

| 7.25% 10/15/29 | | 1,475,000 | 1,479,192 |

| Brookfield Residential Properties, Inc./Brookfield Residential U.S. Corp.: | | | |

| 4.875% 2/15/30(b) | | 679,000 | 603,044 |

| 5% 6/15/29(b) | | 175,000 | 156,583 |

| 6.25% 9/15/27(b) | | 563,000 | 545,461 |

| Castle UK Finco PLC 7% 5/15/29 (b) | GBP | 295,000 | 344,450 |

| Empire Communities Corp. 7% 12/15/25 (b) | | 175,000 | 173,012 |

| KB Home 4.8% 11/15/29 | | 875,000 | 820,313 |

| LGI Homes, Inc.: | | | |

| 4% 7/15/29(b) | | 95,000 | 81,465 |

| 8.75% 12/15/28(b) | | 30,000 | 31,444 |

| M/I Homes, Inc. 4.95% 2/1/28 | | 485,000 | 461,701 |

| Newell Brands, Inc.: | | | |

| 5.2% 4/1/26(h) | | 100,000 | 97,106 |

| 6.375% 9/15/27 | | 100,000 | 96,871 |

| 6.5% 4/1/46(h) | | 80,000 | 63,825 |

| 6.625% 9/15/29 | | 100,000 | 95,722 |

| STL Holding Co. LLC 8.75% 2/15/29 (b) | | 225,000 | 230,189 |

| SWF Escrow Issuer Corp. 6.5% 10/1/29 (b) | | 1,025,000 | 720,921 |

| Tempur Sealy International, Inc. 4% 4/15/29 (b) | | 50,000 | 44,817 |

| TopBuild Corp. 4.125% 2/15/32 (b) | | 235,000 | 205,820 |

| TRI Pointe Group, Inc./TRI Pointe Holdings, Inc. 5.875% 6/15/24 | | 5,000 | 4,997 |

| TRI Pointe Homes, Inc. 5.7% 6/15/28 | | 620,000 | 609,652 |

| | | | 7,798,521 |

| Leisure Products - 0.1% | | | |

| Amer Sports Co. 6.75% 2/16/31 (b) | | 405,000 | 403,060 |

| Mattel, Inc. 5.45% 11/1/41 | | 80,000 | 72,251 |

| Vista Outdoor, Inc. 4.5% 3/15/29 (b) | | 145,000 | 143,188 |

| | | | 618,499 |

| Specialty Retail - 1.1% | | | |

| Arko Corp. 5.125% 11/15/29 (b) | | 480,000 | 416,160 |

| At Home Group, Inc.: | | | |

| 4.875% 7/15/28(b) | | 255,000 | 107,100 |

| 7.125% 5/12/28 pay-in-kind(b)(e) | | 317,998 | 136,739 |

| Bath & Body Works, Inc.: | | | |

| 6.625% 10/1/30(b) | | 1,550,000 | 1,558,511 |

| 6.95% 3/1/33 | | 440,000 | 428,348 |

| 7.5% 6/15/29 | | 230,000 | 236,810 |

| Carvana Co.: | | | |

| 4.875% 9/1/29(b) | | 242,000 | 162,140 |

| 5.5% 4/15/27(b) | | 220,000 | 170,806 |

| 5.875% 10/1/28(b) | | 160,000 | 106,793 |

| 12% 12/1/28 pay-in-kind(b)(e) | | 113,903 | 109,479 |

| 13% 6/1/30 pay-in-kind(b)(e) | | 171,593 | 160,425 |

| 14% 6/1/31 pay-in-kind(b)(e) | | 205,309 | 199,762 |

| Champions Financing, Inc. 8.75% 2/15/29 (b) | | 395,000 | 403,481 |

| Foot Locker, Inc. 4% 10/1/29 (b) | | 60,000 | 50,774 |

| Gap, Inc. 3.875% 10/1/31 (b) | | 750,000 | 604,986 |

| Global Auto Holdings Ltd./AAG FH UK Ltd.: | | | |

| 8.375% 1/15/29(b) | | 235,000 | 224,054 |

| 8.75% 1/15/32(b) | | 255,000 | 242,129 |

| Jaguar Land Rover Automotive PLC: | | | |

| 5.875% 1/15/28(b) | | 845,000 | 831,889 |

| 7.75% 10/15/25(b) | | 350,000 | 353,036 |

| LBM Acquisition LLC 6.25% 1/15/29 (b) | | 750,000 | 675,659 |

| LCM Investments Holdings: | | | |

| 4.875% 5/1/29(b) | | 900,000 | 808,244 |

| 8.25% 8/1/31(b) | | 455,000 | 464,371 |

| Mavis Tire Express Services TopCo LP 6.5% 5/15/29 (b) | | 2,610,000 | 2,448,029 |

| Michaels Companies, Inc. 7.875% 5/1/29 (b) | | 220,000 | 142,055 |

| Park River Holdings, Inc.: | | | |

| 5.625% 2/1/29(b) | | 775,000 | 651,969 |

| 6.75% 8/1/29(b) | | 150,000 | 128,440 |

| PetSmart, Inc. / PetSmart Finance Corp. 7.75% 2/15/29 (b) | | 455,000 | 449,616 |

| Sally Holdings LLC: | | | |

| 5.625% 12/1/25 | | 925,000 | 924,397 |

| 6.75% 3/1/32 | | 530,000 | 528,476 |

| Specialty Building Products Holdings LLC 6.375% 9/30/26 (b) | | 665,000 | 650,397 |

| Staples, Inc.: | | | |

| 7.5% 4/15/26(b) | | 80,000 | 76,913 |

| 10.75% 4/15/27(b) | | 80,000 | 73,200 |

| Victoria's Secret & Co. 4.625% 7/15/29 (b) | | 130,000 | 109,658 |

| Wand NewCo 3, Inc. 7.625% 1/30/32 (b) | | 1,190,000 | 1,222,725 |

| | | | 15,857,571 |

| Textiles, Apparel & Luxury Goods - 0.2% | | | |

| Crocs, Inc. 4.125% 8/15/31 (b) | | 130,000 | 110,604 |

| Hanesbrands, Inc. 4.875% 5/15/26 (b) | | 75,000 | 72,377 |

| Kontoor Brands, Inc. 4.125% 11/15/29 (b) | | 770,000 | 688,593 |

| Levi Strauss & Co. 3.5% 3/1/31 (b) | | 130,000 | 112,654 |

| Wolverine World Wide, Inc. 4% 8/15/29 (b) | | 2,330,000 | 1,866,913 |

| | | | 2,851,141 |

TOTAL CONSUMER DISCRETIONARY | | | 125,647,048 |

| | | | |

| CONSUMER STAPLES - 0.8% | | | |

| Beverages - 0.1% | | | |

| Primo Water Holdings, Inc. 4.375% 4/30/29 (b) | | 180,000 | 163,305 |

| Triton Water Holdings, Inc. 6.25% 4/1/29 (b) | | 1,080,000 | 942,819 |

| | | | 1,106,124 |

| Consumer Staples Distribution & Retail - 0.1% | | | |

| Albertsons Companies LLC/Safeway, Inc./New Albertson's, Inc./Albertson's LLC: | | | |

| 3.5% 3/15/29(b) | | 590,000 | 525,665 |

| 4.875% 2/15/30(b) | | 225,000 | 211,208 |

| C&S Group Enterprises LLC 5% 12/15/28 (b) | | 320,000 | 253,512 |

| Iceland Bondco PLC: | | | |

| 3 month EURIBOR EURO INTER + 5.500% 9.401% 12/15/27(b)(e)(f) | EUR | 100,000 | 108,891 |

| 4.625% 3/15/25 (Reg. S) | GBP | 100,000 | 125,157 |

| 10.875% 12/15/27(b) | GBP | 100,000 | 133,465 |

| KeHE Distributor / Nextwave 9% 2/15/29 (b) | | 290,000 | 290,851 |

| Performance Food Group, Inc. 5.5% 10/15/27 (b) | | 124,000 | 121,437 |

| U.S. Foods, Inc. 6.875% 9/15/28 (b) | | 100,000 | 101,750 |

| United Natural Foods, Inc. 6.75% 10/15/28 (b) | | 40,000 | 33,309 |

| | | | 1,905,245 |

| Food Products - 0.4% | | | |

| B&G Foods, Inc.: | | | |

| 5.25% 9/15/27 | | 1,315,000 | 1,222,643 |

| 8% 9/15/28(b) | | 575,000 | 598,608 |

| Chobani LLC/Finance Corp., Inc.: | | | |

| 4.625% 11/15/28(b) | | 80,000 | 73,999 |

| 7.625% 7/1/29(b) | | 635,000 | 638,295 |

| Darling Ingredients, Inc. 6% 6/15/30 (b) | | 950,000 | 936,172 |

| Fiesta Purchaser, Inc. 7.875% 3/1/31 (b) | | 150,000 | 154,674 |

| Lamb Weston Holdings, Inc.: | | | |

| 4.125% 1/31/30(b) | | 565,000 | 511,932 |

| 4.375% 1/31/32(b) | | 95,000 | 84,876 |

| Pilgrim's Pride Corp.: | | | |

| 3.5% 3/1/32 | | 100,000 | 83,554 |

| 4.25% 4/15/31 | | 115,000 | 102,791 |

| Post Holdings, Inc.: | | | |

| 4.5% 9/15/31(b) | | 700,000 | 623,210 |

| 4.625% 4/15/30(b) | | 624,000 | 567,762 |

| 6.25% 2/15/32(b) | | 705,000 | 708,644 |

| | | | 6,307,160 |

| Household Products - 0.0% | | | |

| Energizer Holdings, Inc. 4.75% 6/15/28 (b) | | 409,000 | 373,968 |

| | | | |

| Personal Care Products - 0.1% | | | |

| BellRing Brands, Inc. 7% 3/15/30 (b) | | 860,000 | 877,561 |

| | | | |

| Tobacco - 0.1% | | | |

| Vector Group Ltd. 5.75% 2/1/29 (b) | | 781,000 | 715,492 |

| | | | |

TOTAL CONSUMER STAPLES | | | 11,285,550 |

| | | | |

| ENERGY - 6.4% | | | |

| Energy Equipment & Services - 0.8% | | | |

| Archrock Partners LP / Archrock Partners Finance Corp. 6.875% 4/1/27 (b) | | 295,000 | 293,515 |

| CGG SA 8.75% 4/1/27 (b) | | 330,000 | 294,353 |

| Diamond Foreign Asset Co. / Diamond Finance, LLC 8.5% 10/1/30 (b) | | 750,000 | 768,017 |

| Jonah Energy Parent LLC 12% 11/5/25 (d)(i) | | 645,029 | 682,118 |

| Nabors Industries Ltd.: | | | |

| 7.25% 1/15/26(b) | | 493,000 | 485,605 |

| 7.5% 1/15/28(b) | | 330,000 | 303,600 |

| Nabors Industries, Inc.: | | | |

| 7.375% 5/15/27(b) | | 75,000 | 74,724 |

| 9.125% 1/31/30(b) | | 680,000 | 697,000 |

| Noble Finance II LLC 8% 4/15/30 (b) | | 150,000 | 154,222 |

| NuStar Logistics LP 5.625% 4/28/27 | | 665,000 | 658,157 |

| Precision Drilling Corp.: | | | |

| 6.875% 1/15/29(b) | | 25,000 | 24,694 |

| 7.125% 1/15/26(b) | | 297,000 | 296,618 |

| Seadrill Finance Ltd. 8.375% 8/1/30 (b) | | 1,255,000 | 1,289,722 |

| Transocean Aquila Ltd. 8% 9/30/28 (b) | | 380,000 | 387,125 |

| Transocean, Inc.: | | | |

| 6.8% 3/15/38 | | 825,000 | 647,118 |

| 7.25% 11/1/25(b) | | 219,000 | 215,792 |

| 7.5% 1/15/26(b) | | 321,000 | 317,392 |

| 8% 2/1/27(b) | | 515,000 | 502,733 |

| 8.75% 2/15/30(b) | | 1,134,000 | 1,164,418 |

| 11.5% 1/30/27(b) | | 884,000 | 919,360 |

| U.S.A. Compression Partners LP/U.S.A. Compression Finance Corp. 6.875% 4/1/26 | | 160,000 | 159,782 |

| Valaris Ltd. 8.375% 4/30/30 (b) | | 920,000 | 943,357 |

| | | | 11,279,422 |

| Oil, Gas & Consumable Fuels - 5.6% | | | |

| Aethon United BR LP / Aethon United Finance Corp. 8.25% 2/15/26 (b) | | 1,845,000 | 1,852,635 |

| Altus Midstream LP: | | | |

| 5.875% 6/15/30(b) | | 1,740,000 | 1,695,480 |

| 6.625% 12/15/28(b) | | 1,620,000 | 1,639,932 |

| Antero Midstream Partners LP/Antero Midstream Finance Corp.: | | | |

| 5.375% 6/15/29(b) | | 746,000 | 709,526 |

| 5.75% 3/1/27(b) | | 100,000 | 97,844 |

| 5.75% 1/15/28(b) | | 775,000 | 759,759 |

| 6.625% 2/1/32(b) | | 125,000 | 124,489 |

| 7.875% 5/15/26(b) | | 100,000 | 102,146 |

| Antero Resources Corp.: | | | |

| 5.375% 3/1/30(b) | | 800,000 | 762,402 |

| 7.625% 2/1/29(b) | | 140,000 | 144,191 |

| Ascent Resources - Utica LLC/ARU Finance Corp.: | | | |

| 7% 11/1/26(b) | | 386,000 | 385,739 |

| 8.25% 12/31/28(b) | | 450,000 | 456,919 |

| 9% 11/1/27(b) | | 450,000 | 569,842 |

| Athabasca Oil Corp. 9.75% 11/1/26 (b) | | 767,000 | 808,518 |

| California Resources Corp. 7.125% 2/1/26 (b) | | 140,000 | 140,738 |

| Calumet Specialty Products Partners LP/Calumet Finance Corp. 9.75% 7/15/28 (b) | | 120,000 | 118,871 |

| Chesapeake Energy Corp.: | | | |

| 5.875% 2/1/29(b) | | 325,000 | 321,490 |

| 6.75% 4/15/29(b) | | 1,935,000 | 1,942,236 |

| Citgo Petroleum Corp.: | | | |

| 6.375% 6/15/26(b) | | 646,000 | 650,026 |

| 7% 6/15/25(b) | | 575,000 | 573,644 |

| 8.375% 1/15/29(b) | | 100,000 | 105,017 |

| Civitas Resources, Inc.: | | | |

| 8.375% 7/1/28(b) | | 670,000 | 701,104 |

| 8.625% 11/1/30(b) | | 495,000 | 529,690 |

| 8.75% 7/1/31(b) | | 445,000 | 473,245 |

| CNX Midstream Partners LP 4.75% 4/15/30 (b) | | 170,000 | 148,725 |

| CNX Resources Corp.: | | | |

| 7.25% 3/1/32(b) | | 395,000 | 393,628 |

| 7.375% 1/15/31(b) | | 115,000 | 115,935 |

| Comstock Resources, Inc.: | | | |

| 5.875% 1/15/30(b) | | 795,000 | 695,156 |

| 6.75% 3/1/29(b) | | 1,646,000 | 1,518,335 |

| Conuma Resources Ltd. 13.125% 5/1/28 (b) | | 294,000 | 291,060 |

| Coronado Finance Pty Ltd. 10.75% 5/15/26 (b) | | 245,000 | 253,772 |

| CQP Holdco LP / BIP-V Chinook Holdco LLC 7.5% 12/15/33 (b) | | 250,000 | 254,891 |

| CrownRock LP/CrownRock Finance, Inc.: | | | |

| 5% 5/1/29(b) | | 259,000 | 254,791 |

| 5.625% 10/15/25(b) | | 60,000 | 59,703 |

| CVR Energy, Inc.: | | | |

| 5.75% 2/15/28(b) | | 537,000 | 498,449 |

| 8.5% 1/15/29(b) | | 320,000 | 322,000 |

| DCP Midstream Operating LP: | | | |

| 5.625% 7/15/27 | | 10,000 | 10,034 |

| 6.75% 9/15/37(b) | | 590,000 | 628,041 |

| 8.125% 8/16/30 | | 570,000 | 649,510 |

| Delek Logistics Partners LP/Delek Logistics Finance Corp.: | | | |

| 6.75% 5/15/25 | | 60,000 | 60,005 |

| 7.125% 6/1/28(b) | | 540,000 | 517,050 |

| 8.625% 3/15/29(b)(g) | | 165,000 | 165,176 |

| DT Midstream, Inc.: | | | |

| 4.125% 6/15/29(b) | | 40,000 | 36,550 |

| 4.375% 6/15/31(b) | | 20,000 | 18,006 |

| EG Global Finance PLC 12% 11/30/28 (b) | | 1,510,000 | 1,594,183 |

| Endeavor Energy Resources LP/EER Finance, Inc. 5.75% 1/30/28 (b) | | 615,000 | 619,982 |

| Energean PLC 6.5% 4/30/27 (b) | | 140,000 | 127,706 |

| Energy Transfer LP: | | | |

| 5.625% 5/1/27(b) | | 979,000 | 970,209 |

| 5.75% 4/1/25 | | 73,000 | 72,880 |

| 6% 2/1/29(b) | | 600,000 | 601,656 |

| 7.375% 2/1/31(b) | | 755,000 | 789,994 |

| EnLink Midstream LLC: | | | |

| 5.625% 1/15/28(b) | | 335,000 | 330,079 |

| 6.5% 9/1/30(b) | | 330,000 | 338,272 |

| EnLink Midstream Partners LP 4.85% 7/15/26 | | 180,000 | 175,502 |

| EQM Midstream Partners LP: | | | |

| 6% 7/1/25(b) | | 25,000 | 24,966 |

| 6.5% 7/1/27(b) | | 325,000 | 328,250 |

| 7.5% 6/1/27(b) | | 250,000 | 255,776 |

| 7.5% 6/1/30(b) | | 200,000 | 212,571 |

| Global Partners LP/GLP Finance Corp.: | | | |

| 6.875% 1/15/29 | | 253,000 | 249,359 |

| 7% 8/1/27 | | 437,000 | 437,140 |

| 8.25% 1/15/32(b) | | 225,000 | 230,783 |

| Golar LNG Ltd. 7% 10/20/25 (b) | | 335,000 | 330,953 |

| Gulfport Energy Corp. 8% 5/17/26 (b) | | 405,000 | 412,153 |

| Harbour Energy PLC 5.5% 10/15/26 (b) | | 20,000 | 19,493 |

| Harvest Midstream I LP 7.5% 9/1/28 (b) | | 425,000 | 428,433 |

| Hess Midstream Operations LP: | | | |

| 5.125% 6/15/28(b) | | 620,000 | 595,659 |

| 5.5% 10/15/30(b) | | 100,000 | 96,101 |

| HF Sinclair Corp. 5% 2/1/28 (b) | | 335,000 | 322,592 |

| Hilcorp Energy I LP/Hilcorp Finance Co.: | | | |

| 5.75% 2/1/29(b) | | 200,000 | 193,416 |

| 6% 4/15/30(b) | | 275,000 | 266,981 |

| 6% 2/1/31(b) | | 1,235,000 | 1,190,942 |

| 6.25% 11/1/28(b) | | 1,125,000 | 1,116,763 |

| 6.25% 4/15/32(b) | | 525,000 | 507,938 |

| 8.375% 11/1/33(b) | | 1,255,000 | 1,348,184 |

| Howard Midstream Energy Partners LLC 8.875% 7/15/28 (b) | | 448,000 | 472,080 |

| Independence Energy Finance LLC: | | | |

| 7.25% 5/1/26(b) | | 1,265,000 | 1,260,383 |

| 9.25% 2/15/28(b) | | 1,385,000 | 1,449,392 |

| Magnolia Oil & Gas Operating LLC/Magnolia Oil & Gas Finance Corp. 6% 8/1/26 (b) | | 1,845,000 | 1,808,626 |

| Matador Resources Co. 5.875% 9/15/26 | | 333,000 | 329,749 |

| MEG Energy Corp. 5.875% 2/1/29 (b) | | 236,000 | 230,091 |

| Mesquite Energy, Inc. 7.25% (b)(c)(d) | | 3,242,000 | 0 |

| Murphy Oil U.S.A., Inc. 3.75% 2/15/31 (b) | | 290,000 | 247,456 |

| New Fortress Energy, Inc.: | | | |

| 6.5% 9/30/26(b) | | 1,650,000 | 1,593,138 |

| 6.75% 9/15/25(b) | | 874,000 | 869,490 |

| NGL Energy Operating LLC/NGL Energy Finance Corp.: | | | |

| 8.125% 2/15/29(b) | | 435,000 | 439,101 |

| 8.375% 2/15/32(b) | | 1,125,000 | 1,142,755 |

| Northern Oil & Gas, Inc.: | | | |

| 8.125% 3/1/28(b) | | 290,000 | 293,663 |

| 8.75% 6/15/31(b) | | 90,000 | 94,050 |

| Occidental Petroleum Corp.: | | | |

| 4.2% 3/15/48 | | 95,000 | 72,598 |

| 4.4% 4/15/46 | | 295,000 | 235,708 |

| 4.4% 8/15/49 | | 130,000 | 96,135 |

| 4.5% 7/15/44 | | 240,000 | 184,975 |

| 6.125% 1/1/31 | | 320,000 | 328,237 |

| 6.2% 3/15/40 | | 1,225,000 | 1,244,183 |

| 6.45% 9/15/36 | | 235,000 | 247,422 |

| 6.625% 9/1/30 | | 400,000 | 420,960 |

| 7.5% 5/1/31 | | 555,000 | 612,910 |

| 7.95% 6/15/39 | | 1,275,000 | 1,475,771 |

| 8.875% 7/15/30 | | 470,000 | 542,070 |

| Parkland Corp.: | | | |

| 4.5% 10/1/29(b) | | 375,000 | 342,656 |

| 4.625% 5/1/30(b) | | 1,130,000 | 1,032,210 |

| PBF Holding Co. LLC/PBF Finance Corp. 7.875% 9/15/30 (b) | | 530,000 | 543,080 |

| Permian Resources Operating LLC: | | | |

| 5.875% 7/1/29(b) | | 285,000 | 277,875 |

| 7% 1/15/32(b) | | 1,020,000 | 1,047,314 |

| 7.75% 2/15/26(b) | | 25,000 | 25,299 |

| 8% 4/15/27(b) | | 125,000 | 128,908 |

| 9.875% 7/15/31(b) | | 575,000 | 636,813 |

| Prairie Acquiror LP 9% 8/1/29 (b)(g) | | 445,000 | 448,386 |

| Range Resources Corp.: | | | |

| 4.75% 2/15/30(b) | | 610,000 | 566,693 |

| 8.25% 1/15/29 | | 260,000 | 271,250 |

| Rockcliff Energy II LLC 5.5% 10/15/29 (b) | | 640,000 | 589,407 |

| Rockies Express Pipeline LLC: | | | |

| 3.6% 5/15/25(b) | | 275,000 | 266,632 |

| 6.875% 4/15/40(b) | | 135,000 | 132,933 |

| 7.5% 7/15/38(b) | | 775,000 | 786,660 |

| SilverBow Resources, Inc. CME Term SOFR 3 Month Index + 7.750% 13.1346% 12/15/28 (e)(f)(i) | | 755,000 | 745,647 |

| Sitio Royalties OP / Sitio Finance Corp. 7.875% 11/1/28 (b) | | 100,000 | 102,210 |

| Southwestern Energy Co.: | | | |

| 4.75% 2/1/32 | | 2,590,000 | 2,352,672 |

| 5.375% 3/15/30 | | 900,000 | 860,202 |

| Sunoco LP/Sunoco Finance Corp.: | | | |

| 4.5% 5/15/29 | | 635,000 | 586,580 |

| 4.5% 4/30/30 | | 475,000 | 432,194 |

| 5.875% 3/15/28 | | 140,000 | 138,496 |

| Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp.: | | | |

| 5.5% 1/15/28(b) | | 603,000 | 572,850 |

| 6% 3/1/27(b) | | 985,000 | 972,195 |

| 6% 12/31/30(b) | | 1,740,000 | 1,618,072 |

| 6% 9/1/31(b) | | 2,035,000 | 1,864,129 |

| 7.375% 2/15/29(b) | | 810,000 | 808,186 |

| Talos Production, Inc.: | | | |

| 9% 2/1/29(b) | | 70,000 | 71,544 |

| 9.375% 2/1/31(b) | | 100,000 | 103,291 |

| Teine Energy Ltd. 6.875% 4/15/29 (b) | | 35,000 | 33,216 |

| Venture Global Calcasieu Pass LLC: | | | |

| 4.125% 8/15/31(b) | | 500,000 | 438,830 |

| 6.25% 1/15/30(b) | | 1,620,000 | 1,617,437 |

| Venture Global LNG, Inc.: | | | |

| 8.125% 6/1/28(b) | | 725,000 | 736,532 |

| 8.375% 6/1/31(b) | | 2,960,000 | 2,993,925 |

| 9.5% 2/1/29(b) | | 1,510,000 | 1,609,982 |

| 9.875% 2/1/32(b) | | 1,250,000 | 1,316,101 |

| Vermilion Energy, Inc. 6.875% 5/1/30 (b) | | 785,000 | 756,544 |

| Viper Energy, Inc. 7.375% 11/1/31 (b) | | 55,000 | 56,631 |

| Vital Energy, Inc.: | | | |

| 9.75% 10/15/30 | | 125,000 | 133,890 |

| 10.125% 1/15/28 | | 100,000 | 104,663 |

| Western Gas Partners LP: | | | |

| 5.25% 2/1/50 | | 185,000 | 163,661 |

| 5.3% 3/1/48 | | 95,000 | 81,870 |

| 5.5% 8/15/48 | | 55,000 | 48,327 |

| | | | 80,852,152 |

TOTAL ENERGY | | | 92,131,574 |

| | | | |

| FINANCIALS - 4.5% | | | |

| Banks - 0.1% | | | |

| HAT Holdings I LLC/HAT Holdings II LLC: | | | |

| 3.375% 6/15/26(b) | | 125,000 | 116,885 |

| 6% 4/15/25(b) | | 64,000 | 63,350 |

| 8% 6/15/27(b) | | 688,000 | 714,360 |

| Intesa Sanpaolo SpA: | | | |

| 4.198% 6/1/32(b)(e) | | 200,000 | 164,051 |

| 4.95% 6/1/42(b)(e) | | 200,000 | 144,268 |

| 5.71% 1/15/26(b) | | 350,000 | 346,804 |

| UniCredit SpA: | | | |

| 5.459% 6/30/35(b)(e) | | 254,000 | 234,701 |

| 5.861% 6/19/32(b)(e) | | 95,000 | 92,075 |

| Western Alliance Bancorp. 3% 6/15/31 (e) | | 341,000 | 299,057 |

| | | | 2,175,551 |

| Capital Markets - 0.4% | | | |

| AssuredPartners, Inc.: | | | |

| 5.625% 1/15/29(b) | | 175,000 | 160,969 |

| 7.5% 2/15/32(b) | | 1,024,000 | 1,006,316 |

| Broadstreet Partners, Inc. 5.875% 4/15/29 (b) | | 425,000 | 394,212 |

| Coinbase Global, Inc. 3.625% 10/1/31 (b) | | 375,000 | 293,603 |

| Hightower Holding LLC 6.75% 4/15/29 (b) | | 300,000 | 281,543 |

| Jane Street Group LLC/JSG Finance, Inc. 4.5% 11/15/29 (b) | | 700,000 | 644,133 |

| Jefferies Finance LLC/JFIN Co-Issuer Corp. 5% 8/15/28 (b) | | 695,000 | 625,088 |

| LPL Holdings, Inc.: | | | |

| 4% 3/15/29(b) | | 530,000 | 486,257 |

| 4.375% 5/15/31(b) | | 340,000 | 307,549 |

| StoneX Group, Inc. 7.875% 3/1/31 (b)(g) | | 115,000 | 116,466 |

| VistaJet Malta Finance PLC / XO Management Holding, Inc.: | | | |

| 6.375% 2/1/30(b) | | 980,000 | 715,400 |

| 7.875% 5/1/27(b) | | 625,000 | 529,069 |

| 9.5% 6/1/28(b) | | 354,000 | 298,245 |

| | | | 5,858,850 |

| Consumer Finance - 1.4% | | | |

| Ally Financial, Inc.: | | | |

| 5.75% 11/20/25 | | 164,000 | 163,183 |

| 6.7% 2/14/33 | | 463,000 | 456,190 |

| Bread Financial Holdings, Inc. 9.75% 3/15/29 (b) | | 660,000 | 675,015 |

| Capstone Borrower, Inc. 8% 6/15/30 (b) | | 885,000 | 914,692 |

| Cobra AcquisitionCo LLC 6.375% 11/1/29 (b) | | 630,000 | 516,944 |

| Ford Motor Credit Co. LLC: | | | |

| 2.9% 2/10/29 | | 670,000 | 583,721 |

| 3.375% 11/13/25 | | 300,000 | 287,827 |

| 3.625% 6/17/31 | | 280,000 | 238,698 |

| 3.815% 11/2/27 | | 330,000 | 307,742 |

| 4% 11/13/30 | | 95,000 | 83,995 |

| 4.389% 1/8/26 | | 195,000 | 189,614 |

| 5.125% 6/16/25 | | 95,000 | 94,038 |

| 7.35% 3/6/30 | | 700,000 | 742,002 |

| goeasy Ltd.: | | | |

| 4.375% 5/1/26(b) | | 175,000 | 167,409 |

| 9.25% 12/1/28(b) | | 110,000 | 116,718 |

| LFS Topco LLC 5.875% 10/15/26 (b) | | 375,000 | 346,655 |

| Navient Corp.: | | | |

| 4.875% 3/15/28 | | 630,000 | 575,083 |

| 5% 3/15/27 | | 315,000 | 298,615 |

| 5.5% 3/15/29 | | 1,895,000 | 1,714,791 |

| 5.625% 8/1/33 | | 265,000 | 215,906 |

| 6.75% 6/15/26 | | 766,000 | 769,233 |

| 9.375% 7/25/30 | | 980,000 | 1,024,147 |

| 11.5% 3/15/31 | | 735,000 | 804,008 |

| OneMain Finance Corp.: | | | |

| 3.5% 1/15/27 | | 830,000 | 763,993 |

| 3.875% 9/15/28 | | 900,000 | 786,324 |

| 5.375% 11/15/29 | | 655,000 | 607,799 |

| 6.625% 1/15/28 | | 1,076,000 | 1,069,890 |

| 6.875% 3/15/25 | | 40,000 | 40,400 |

| 7.125% 3/15/26 | | 535,000 | 543,689 |

| 7.875% 3/15/30 | | 1,375,000 | 1,398,422 |

| 9% 1/15/29 | | 1,795,000 | 1,885,181 |

| PROG Holdings, Inc. 6% 11/15/29 (b) | | 1,000,000 | 919,125 |

| SLM Corp. 4.2% 10/29/25 | | 352,000 | 341,331 |

| | | | 19,642,380 |

| Financial Services - 1.5% | | | |

| At Home Cayman 11.5% 5/12/28 (b) | | 147,691 | 101,538 |

| Block, Inc.: | | | |

| 2.75% 6/1/26 | | 100,000 | 93,284 |

| 3.5% 6/1/31 | | 495,000 | 422,271 |

| Enact Holdings, Inc. 6.5% 8/15/25 (b) | | 1,540,000 | 1,540,062 |

| Freedom Mortgage Corp.: | | | |

| 6.625% 1/15/27(b) | | 300,000 | 286,052 |

| 7.625% 5/1/26(b) | | 225,000 | 223,341 |

| 12% 10/1/28(b) | | 50,000 | 54,167 |

| 12.25% 10/1/30(b) | | 200,000 | 220,046 |

| Freedom Mortgage Hold 9.25% 2/1/29 (b) | | 60,000 | 60,912 |

| GGAM Finance Ltd.: | | | |

| 7.75% 5/15/26(b) | | 175,000 | 177,844 |

| 8% 2/15/27(b) | | 558,000 | 571,934 |

| 8% 6/15/28(b) | | 395,000 | 408,660 |

| Gn Bondco LLC 9.5% 10/15/31 (b) | | 760,000 | 752,400 |

| GTCR W-2 Merger Sub LLC 7.5% 1/15/31 (b) | | 2,195,000 | 2,289,385 |

| Icahn Enterprises LP/Icahn Enterprises Finance Corp.: | | | |

| 4.375% 2/1/29 | | 1,045,000 | 881,708 |

| 5.25% 5/15/27 | | 441,000 | 405,169 |

| 6.25% 5/15/26 | | 1,465,000 | 1,427,556 |

| LD Holdings Group LLC 6.125% 4/1/28 (b) | | 275,000 | 224,469 |

| MidCap Financial Issuer Trust: | | | |

| 5.625% 1/15/30(b) | | 465,000 | 393,301 |

| 6.5% 5/1/28(b) | | 1,020,000 | 934,575 |

| MPH Acquisition Holdings LLC 5.5% 9/1/28 (b) | | 900,000 | 785,250 |

| Nationstar Mortgage Holdings, Inc.: | | | |

| 5.125% 12/15/30(b) | | 665,000 | 593,583 |

| 5.5% 8/15/28(b) | | 543,000 | 512,613 |

| 5.75% 11/15/31(b) | | 320,000 | 293,187 |

| NCR Atleos Corp. 9.5% 4/1/29 (b) | | 757,000 | 800,751 |

| P&L Development LLC/PLD Finance Corp. 7.75% 11/15/25 (b) | | 365,000 | 293,745 |

| PennyMac Financial Services, Inc.: | | | |

| 4.25% 2/15/29(b) | | 1,165,000 | 1,050,329 |

| 5.375% 10/15/25(b) | | 525,000 | 516,662 |

| 5.75% 9/15/31(b) | | 50,000 | 45,975 |

| 7.875% 12/15/29(b) | | 817,000 | 836,289 |

| Quicken Loans LLC/Quicken Loans Co-Issuer, Inc. 3.625% 3/1/29 (b) | | 150,000 | 133,056 |

| Quicken Loans LLC/Quicken Loans Co.-Issuer, Inc. 4% 10/15/33 (b) | | 580,000 | 481,539 |

| Scientific Games Holdings LP/Scientific Games U.S. Finco, Inc. 6.625% 3/1/30 (b) | | 1,210,000 | 1,134,375 |

| United Shore Financial Services LLC: | | | |

| 5.5% 4/15/29(b) | | 525,000 | 490,043 |

| 5.75% 6/15/27(b) | | 740,000 | 717,855 |

| Verscend Escrow Corp. 9.75% 8/15/26 (b) | | 1,340,000 | 1,342,586 |

| | | | 21,496,512 |

| Insurance - 1.0% | | | |

| Acrisure LLC / Acrisure Finance, Inc.: | | | |

| 4.25% 2/15/29(b) | | 80,000 | 70,958 |

| 8.25% 2/1/29(b) | | 1,040,000 | 1,027,555 |

| 10.125% 8/1/26(b) | | 860,000 | 894,403 |

| Alliant Holdings Intermediate LLC/Alliant Holdings Co.-Issuer: | | | |

| 5.875% 11/1/29(b) | | 960,000 | 878,774 |

| 6.75% 10/15/27(b) | | 1,761,000 | 1,710,856 |

| 6.75% 4/15/28(b) | | 100,000 | 99,333 |

| 7% 1/15/31(b) | | 1,315,000 | 1,309,858 |

| AmWINS Group, Inc.: | | | |

| 4.875% 6/30/29(b) | | 235,000 | 216,741 |

| 6.375% 2/15/29(b) | | 485,000 | 485,316 |

| GTCR AP Finance, Inc. 8% 5/15/27 (b) | | 1,430,000 | 1,432,414 |

| HUB International Ltd.: | | | |

| 5.625% 12/1/29(b) | | 695,000 | 645,058 |

| 7.25% 6/15/30(b) | | 1,940,000 | 1,979,010 |

| 7.375% 1/31/32(b) | | 2,590,000 | 2,598,205 |

| Jones DesLauriers Insurance Management, Inc. 8.5% 3/15/30 (b) | | 845,000 | 878,800 |

| National Financial Partners Corp. 8.5% 10/1/31 (b) | | 100,000 | 110,382 |

| Ryan Specialty Group LLC 4.375% 2/1/30 (b) | | 390,000 | 362,228 |

| USI, Inc. 7.5% 1/15/32 (b) | | 95,000 | 94,644 |

| | | | 14,794,535 |

| Mortgage Real Estate Investment Trusts - 0.1% | | | |

| Rithm Capital Corp. 6.25% 10/15/25 (b) | | 85,000 | 83,902 |

| Starwood Property Trust, Inc.: | | | |

| 3.75% 12/31/24(b) | | 123,000 | 120,538 |

| 4.375% 1/15/27(b) | | 765,000 | 717,188 |

| | | | 921,628 |

TOTAL FINANCIALS | | | 64,889,456 |

| | | | |

| HEALTH CARE - 3.4% | | | |

| Biotechnology - 0.0% | | | |

| Emergent BioSolutions, Inc. 3.875% 8/15/28 (b) | | 587,000 | 237,730 |

| Grifols SA 4.75% 10/15/28 (b) | | 220,000 | 183,216 |

| | | | 420,946 |

| Health Care Equipment & Supplies - 0.6% | | | |

| AdaptHealth LLC: | | | |

| 4.625% 8/1/29(b) | | 1,388,000 | 1,155,510 |

| 5.125% 3/1/30(b) | | 330,000 | 275,963 |

| Avantor Funding, Inc.: | | | |

| 3.875% 11/1/29(b) | | 235,000 | 210,631 |

| 4.625% 7/15/28(b) | | 1,475,000 | 1,392,228 |

| Bausch + Lomb Corp. 8.375% 10/1/28 (b) | | 600,000 | 627,000 |

| Embecta Corp.: | | | |

| 5% 2/15/30(b) | | 540,000 | 430,380 |

| 6.75% 2/15/30(b) | | 75,000 | 65,063 |

| Hologic, Inc. 3.25% 2/15/29 (b) | | 120,000 | 106,993 |

| Medline Borrower LP: | | | |

| 3.875% 4/1/29(b) | | 1,800,000 | 1,613,940 |

| 5.25% 10/1/29(b) | | 2,475,000 | 2,289,340 |

| Teleflex, Inc. 4.25% 6/1/28 (b) | | 20,000 | 18,672 |

| | | | 8,185,720 |

| Health Care Providers & Services - 1.9% | | | |

| 180 Medical, Inc. 3.875% 10/15/29 (b) | | 180,000 | 161,100 |

| AMN Healthcare: | | | |

| 4% 4/15/29(b) | | 617,000 | 541,418 |

| 4.625% 10/1/27(b) | | 200,000 | 188,190 |

| Cano Health, Inc. 6.25% (b)(c) | | 140,000 | 1,400 |

| Community Health Systems, Inc.: | | | |

| 4.75% 2/15/31(b) | | 710,000 | 540,282 |

| 5.25% 5/15/30(b) | | 1,730,000 | 1,380,243 |

| 5.625% 3/15/27(b) | | 515,000 | 471,187 |

| 6% 1/15/29(b) | | 990,000 | 851,400 |

| 6.125% 4/1/30(b) | | 950,000 | 594,301 |

| 6.875% 4/15/29(b) | | 566,000 | 361,161 |

| 8% 3/15/26(b) | | 20,000 | 19,801 |

| 8% 12/15/27(b) | | 1,355,000 | 1,295,854 |

| 10.875% 1/15/32(b) | | 5,000 | 5,092 |

| DaVita, Inc.: | | | |

| 3.75% 2/15/31(b) | | 3,050,000 | 2,502,762 |

| 4.625% 6/1/30(b) | | 535,000 | 470,611 |

| LifePoint Health, Inc. 4.375% 2/15/27 (b) | | 525,000 | 486,998 |

| ModivCare Escrow Issuer, Inc. 5% 10/1/29 (b) | | 60,000 | 44,250 |

| Modivcare, Inc. 5.875% 11/15/25 (b) | | 326,000 | 318,308 |

| Molina Healthcare, Inc.: | | | |

| 3.875% 5/15/32(b) | | 105,000 | 90,315 |

| 4.375% 6/15/28(b) | | 590,000 | 549,562 |

| Pediatrix Medical Group, Inc. 5.375% 2/15/30 (b) | | 270,000 | 242,669 |

| Prime Healthcare Services 7.25% 11/1/25 (b) | | 625,000 | 623,438 |

| Radiology Partners, Inc. 8.5% 1/31/29 pay-in-kind (b)(e) | | 321,000 | 308,561 |

| Regionalcare Hospital Partners 9.75% 12/1/26 (b) | | 1,738,000 | 1,737,503 |

| RegionalCare Hospital Partners Holdings, Inc.: | | | |

| 5.375% 1/15/29(b) | | 790,000 | 629,851 |

| 9.875% 8/15/30(b) | | 285,000 | 295,684 |

| 11% 10/15/30(b) | | 1,012,000 | 1,070,497 |

| Select Medical Corp. 6.25% 8/15/26 (b) | | 855,000 | 852,845 |

| Star Parent, Inc. 9% 10/1/30 (b) | | 568,000 | 599,450 |

| Tenet Healthcare Corp.: | | | |

| 4.25% 6/1/29 | | 2,425,000 | 2,230,243 |

| 4.375% 1/15/30 | | 2,600,000 | 2,381,325 |

| 6.125% 10/1/28 | | 2,330,000 | 2,303,788 |

| 6.125% 6/15/30 | | 2,025,000 | 2,005,462 |

| 6.75% 5/15/31(b) | | 505,000 | 509,419 |

| 6.875% 11/15/31 | | 840,000 | 859,950 |

| | | | 27,524,920 |

| Health Care Technology - 0.1% | | | |

| Athenahealth Group, Inc. 6.5% 2/15/30 (b) | | 1,330,000 | 1,190,718 |

| IQVIA, Inc.: | | | |

| 5% 10/15/26(b) | | 30,000 | 29,323 |

| 6.5% 5/15/30(b) | | 500,000 | 506,930 |

| | | | 1,726,971 |

| Life Sciences Tools & Services - 0.1% | | | |

| Charles River Laboratories International, Inc.: | | | |

| 3.75% 3/15/29(b) | | 225,000 | 202,979 |

| 4% 3/15/31(b) | | 180,000 | 158,762 |

| 4.25% 5/1/28(b) | | 70,000 | 65,653 |

| | | | 427,394 |

| Pharmaceuticals - 0.7% | | | |

| 1375209 BC Ltd. 9% 1/30/28 (b) | | 250,000 | 244,390 |

| Bausch Health Companies, Inc.: | | | |

| 5% 1/30/28(b) | | 2,400,000 | 1,091,614 |

| 5.25% 1/30/30(b) | | 1,822,000 | 785,959 |

| 5.5% 11/1/25(b) | | 485,000 | 451,346 |

| 6.25% 2/15/29(b) | | 1,860,000 | 850,931 |

| 9% 12/15/25(b) | | 140,000 | 133,160 |

| Jazz Securities DAC 4.375% 1/15/29 (b) | | 350,000 | 322,449 |

| Organon & Co. / Organon Foreign Debt Co-Issuer BV: | | | |

| 4.125% 4/30/28(b) | | 590,000 | 539,768 |

| 5.125% 4/30/31(b) | | 2,390,000 | 2,048,517 |

| Teva Pharmaceutical Finance Netherlands III BV: | | | |

| 5.125% 5/9/29 | | 1,585,000 | 1,496,747 |

| 6.75% 3/1/28 | | 1,145,000 | 1,158,522 |

| 7.875% 9/15/29 | | 435,000 | 462,742 |

| 8.125% 9/15/31 | | 555,000 | 599,599 |

| Valeant Pharmaceuticals International, Inc. 8.5% 1/31/27 (b) | | 24,000 | 13,657 |

| | | | 10,199,401 |

TOTAL HEALTH CARE | | | 48,485,352 |

| | | | |

| INDUSTRIALS - 5.2% | | | |

| Aerospace & Defense - 1.1% | | | |

| AAR Escrow Issuer LLC 6.75% 3/15/29 (b)(g)(j) | | 65,000 | 65,614 |

| Bombardier, Inc.: | | | |

| 7.5% 2/1/29(b) | | 2,175,000 | 2,206,091 |

| 7.875% 4/15/27(b) | | 605,000 | 605,772 |

| 8.75% 11/15/30(b) | | 475,000 | 497,567 |

| Howmet Aerospace, Inc.: | | | |

| 5.9% 2/1/27 | | 100,000 | 100,956 |

| 5.95% 2/1/37 | | 40,000 | 40,616 |

| 6.875% 5/1/25 | | 100,000 | 101,048 |

| Moog, Inc. 4.25% 12/15/27 (b) | | 30,000 | 28,076 |

| Spirit Aerosystems, Inc. 9.75% 11/15/30 (b) | | 565,000 | 605,317 |

| The Boeing Co.: | | | |

| 5.805% 5/1/50 | | 800,000 | 771,104 |

| 5.93% 5/1/60 | | 625,000 | 598,368 |

| TransDigm, Inc.: | | | |

| 4.625% 1/15/29 | | 950,000 | 871,160 |

| 5.5% 11/15/27 | | 1,399,000 | 1,350,035 |

| 6.375% 3/1/29(b) | | 1,150,000 | 1,155,198 |

| 6.625% 3/1/32(b) | | 1,490,000 | 1,499,310 |

| 6.75% 8/15/28(b) | | 795,000 | 802,950 |

| 6.875% 12/15/30(b) | | 2,086,000 | 2,110,844 |

| 7.125% 12/1/31(b) | | 1,215,000 | 1,246,371 |

| 7.5% 3/15/27 | | 425,000 | 424,655 |

| | | | 15,081,052 |

| Air Freight & Logistics - 0.1% | | | |

| Aercap Global Aviation Trust 6.5% 6/15/45 (b)(e) | | 155,000 | 153,714 |

| Rand Parent LLC 8.5% 2/15/30 (b) | | 910,000 | 883,762 |

| | | | 1,037,476 |

| Building Products - 0.5% | | | |

| Advanced Drain Systems, Inc.: | | | |

| 5% 9/30/27(b) | | 40,000 | 38,644 |

| 6.375% 6/15/30(b) | | 435,000 | 434,986 |

| AmeriTex Holdco Intermediate LLC 10.25% 10/15/28 (b) | | 40,000 | 41,900 |

| BCPE Ulysses Intermediate, Inc. 7.75% 4/1/27 pay-in-kind (b)(e) | | 225,000 | 215,588 |

| Builders FirstSource, Inc.: | | | |

| 4.25% 2/1/32(b) | | 275,000 | 241,622 |

| 6.375% 6/15/32(b) | | 294,000 | 293,954 |

| 6.375% 3/1/34(b) | | 605,000 | 603,588 |

| Cornerstone Building Brands, Inc. 6.125% 1/15/29 (b) | | 600,000 | 540,750 |

| EMRLD Borrower LP / Emerald Co. 6.625% 12/15/30 (b) | | 565,000 | 566,978 |

| Griffon Corp. 5.75% 3/1/28 | | 150,000 | 145,125 |

| Jeld-Wen, Inc. 4.625% 12/15/25 (b) | | 225,000 | 219,349 |

| Masonite International Corp.: | | | |

| 3.5% 2/15/30(b) | | 250,000 | 220,652 |

| 5.375% 2/1/28(b) | | 48,000 | 47,820 |

| MIWD Holdco II LLC / MIWD Finance Corp. 5.5% 2/1/30 (b) | | 330,000 | 301,106 |

| New Enterprise Stone & Lime Co., Inc. 5.25% 7/15/28 (b) | | 840,000 | 800,429 |

| Oscar Acquisition Co. LLC / Oscar Finance, Inc. 9.5% 4/15/30 (b) | | 180,000 | 175,056 |

| Shea Homes Ltd. Partnership/Corp.: | | | |

| 4.75% 2/15/28 | | 600,000 | 572,290 |

| 4.75% 4/1/29 | | 75,000 | 70,439 |

| Standard Industries, Inc./New Jersey 4.375% 7/15/30 (b) | | 1,370,000 | 1,221,472 |

| | | | 6,751,748 |

| Commercial Services & Supplies - 1.4% | | | |

| ACCO Brands Corp. 4.25% 3/15/29 (b) | | 560,000 | 496,456 |

| Allied Universal Holdco LLC 7.875% 2/15/31 (b) | | 1,084,000 | 1,076,498 |

| Allied Universal Holdco LLC / Allied Universal Finance Corp.: | | | |

| 6% 6/1/29(b) | | 1,765,000 | 1,461,385 |

| 6.625% 7/15/26(b) | | 530,000 | 528,395 |

| 9.75% 7/15/27(b) | | 2,305,000 | 2,296,983 |

| APX Group, Inc. 5.75% 7/15/29 (b) | | 375,000 | 356,599 |

| Artera Services LLC 8.5% 2/15/31 (b) | | 770,000 | 786,596 |

| Atlas Luxco 4 SARL / Allied Universal Holdco LLC / Allied Universal Finance Corp.: | | | |

| 4.625% 6/1/28(b) | | 785,000 | 697,944 |

| 4.625% 6/1/28(b) | | 915,000 | 810,551 |

| Brand Industrial Services, Inc. 10.375% 8/1/30 (b) | | 855,000 | 909,230 |

| Cimpress PLC 7% 6/15/26 | | 65,000 | 64,718 |

| Clean Harbors, Inc. 6.375% 2/1/31 (b) | | 95,000 | 94,442 |

| CoreCivic, Inc.: | | | |

| 4.75% 10/15/27 | | 90,000 | 84,833 |

| 8.25% 4/15/26 | | 790,000 | 807,317 |

| Covanta Holding Corp.: | | | |

| 4.875% 12/1/29(b) | | 805,000 | 703,485 |

| 5% 9/1/30 | | 175,000 | 151,813 |

| GFL Environmental, Inc.: | | | |

| 3.75% 8/1/25(b) | | 195,000 | 189,325 |

| 4% 8/1/28(b) | | 100,000 | 91,687 |

| 4.375% 8/15/29(b) | | 600,000 | 546,642 |

| 4.75% 6/15/29(b) | | 50,000 | 46,817 |

| 5.125% 12/15/26(b) | | 195,000 | 190,740 |

| 6.75% 1/15/31(b) | | 680,000 | 695,545 |

| Legends Hospitality Holding Co. LLC/Legends Hospitality Co-Issuer, Inc. 5% 2/1/26 (b) | | 346,000 | 343,939 |

| Madison IAQ LLC: | | | |

| 4.125% 6/30/28(b) | | 1,200,000 | 1,093,150 |

| 5.875% 6/30/29(b) | | 835,000 | 745,523 |

| Neptune BidCo U.S., Inc. 9.29% 4/15/29 (b) | | 1,015,000 | 951,563 |

| NorthRiver Midstream Finance LP 5.625% 2/15/26 (b) | | 470,000 | 460,757 |

| Prime Securities Services Borrower LLC/Prime Finance, Inc. 6.25% 1/15/28 (b) | | 900,000 | 888,015 |

| Stericycle, Inc.: | | | |

| 3.875% 1/15/29(b) | | 480,000 | 431,961 |

| 5.375% 7/15/24(b) | | 155,000 | 154,923 |

| The GEO Group, Inc.: | | | |

| 6% 4/15/26 | | 50,000 | 48,039 |

| 9.5% 12/31/28(b) | | 650,000 | 648,315 |

| VT Topco, Inc. 8.5% 8/15/30 (b) | | 175,000 | 182,516 |

| Williams Scotsman, Inc. 7.375% 10/1/31 (b) | | 403,000 | 418,052 |

| | | | 19,454,754 |

| Construction & Engineering - 0.3% | | | |

| AECOM 5.125% 3/15/27 | | 1,030,000 | 1,008,943 |

| Amsted Industries, Inc. 4.625% 5/15/30 (b) | | 540,000 | 491,656 |

| ATP Tower Holdings LLC/Andean Tower Partners 4.05% 4/27/26 (b) | | 215,000 | 199,413 |

| Cloud Crane LLC 11.5% 9/1/28 (b) | | 375,000 | 389,841 |

| Pike Corp.: | | | |

| 5.5% 9/1/28(b) | | 74,000 | 70,194 |

| 8.625% 1/31/31(b) | | 475,000 | 501,625 |

| Railworks Holdings LP 8.25% 11/15/28 (b) | | 410,000 | 407,236 |

| SRS Distribution, Inc. 6% 12/1/29 (b) | | 1,305,000 | 1,214,962 |

| | | | 4,283,870 |

| Electrical Equipment - 0.3% | | | |

| Albion Financing 1 SARL 6.125% 10/15/26 (b) | | 605,000 | 598,285 |

| EnerSys 6.625% 1/15/32 (b) | | 65,000 | 65,269 |

| GrafTech Global Enterprises, Inc. 9.875% 12/15/28 (b) | | 595,000 | 472,430 |

| Regal Rexnord Corp.: | | | |

| 6.05% 2/15/26(b) | | 300,000 | 301,242 |

| 6.05% 4/15/28(b) | | 195,000 | 196,225 |

| 6.3% 2/15/30(b) | | 195,000 | 198,553 |

| Sensata Technologies BV: | | | |

| 4% 4/15/29(b) | | 760,000 | 689,265 |

| 5% 10/1/25(b) | | 40,000 | 39,627 |

| 5.875% 9/1/30(b) | | 785,000 | 764,544 |

| Wesco Distribution, Inc.: | | | |

| 6.375% 3/15/29(b) | | 170,000 | 170,016 |

| 6.625% 3/15/32(b) | | 140,000 | 140,046 |

| 7.125% 6/15/25(b) | | 150,000 | 150,896 |

| 7.25% 6/15/28(b) | | 540,000 | 551,846 |

| | | | 4,338,244 |

| Ground Transportation - 0.2% | | | |

| Avis Budget Car Rental LLC/Avis Budget Finance, Inc.: | | | |

| 4.75% 4/1/28(b) | | 650,000 | 588,816 |

| 5.375% 3/1/29(b) | | 150,000 | 136,563 |

| 5.75% 7/15/27(b) | | 20,000 | 19,057 |

| RXO, Inc. 7.5% 11/15/27 (b) | | 175,000 | 180,687 |

| Uber Technologies, Inc. 8% 11/1/26 (b) | | 765,000 | 778,461 |

| Watco Companies LLC / Watco Finance Corp. 6.5% 6/15/27 (b) | | 940,000 | 913,865 |

| XPO, Inc.: | | | |

| 6.25% 6/1/28(b) | | 305,000 | 305,686 |

| 7.125% 6/1/31(b) | | 90,000 | 91,916 |

| 7.125% 2/1/32(b) | | 315,000 | 320,246 |

| | | | 3,335,297 |

| Industrial Conglomerates - 0.0% | | | |

| Benteler International AG 10.5% 5/15/28 (b) | | 295,000 | 316,756 |

| Ladder Capital Finance Holdings LLLP/Ladder Capital Finance Corp. 4.75% 6/15/29 (b) | | 360,000 | 323,080 |

| | | | 639,836 |

| Machinery - 0.5% | | | |

| Chart Industries, Inc.: | | | |

| 7.5% 1/1/30(b) | | 325,000 | 335,241 |

| 9.5% 1/1/31(b) | | 220,000 | 236,361 |

| Hillenbrand, Inc. 3.75% 3/1/31 | | 590,000 | 502,975 |

| Loxam SAS 6.375% 5/31/29 (b) | EUR | 190,000 | 212,283 |

| Mueller Water Products, Inc. 4% 6/15/29 (b) | | 1,305,000 | 1,186,760 |

| Stevens Holding Co., Inc. 6.125% 10/1/26 (b) | | 335,000 | 332,488 |

| Terex Corp. 5% 5/15/29 (b) | | 435,000 | 406,204 |

| Titan International, Inc. 7% 4/30/28 | | 425,000 | 421,998 |

| TK Elevator U.S. Newco, Inc. 5.25% 7/15/27 (b) | | 1,435,000 | 1,378,384 |

| Trinity Industries, Inc. 7.75% 7/15/28 (b) | | 275,000 | 283,375 |

| Vertical Holdco GmbH: | | | |

| 6.625% 7/15/28 (Reg. S) | EUR | 1,125,000 | 1,167,361 |

| 7.625% 7/15/28(b) | | 581,000 | 568,485 |

| | | | 7,031,915 |

| Marine Transportation - 0.0% | | | |

| Navios South American Logistics, Inc./Navios Logistics Finance U.S., Inc. 10.75% 7/1/25 (b) | | 85,000 | 85,213 |

| Seaspan Corp. 5.5% 8/1/29 (b) | | 380,000 | 323,961 |

| | | | 409,174 |

| Passenger Airlines - 0.3% | | | |

| Air Canada 3.875% 8/15/26 (b) | | 145,000 | 137,323 |

| American Airlines, Inc.: | | | |

| 7.25% 2/15/28(b) | | 300,000 | 302,497 |

| 8.5% 5/15/29(b) | | 115,000 | 120,895 |

| American Airlines, Inc. / AAdvantage Loyalty IP Ltd.: | | | |

| 5.5% 4/20/26(b) | | 772,500 | 765,419 |

| 5.75% 4/20/29(b) | | 1,520,000 | 1,486,482 |

| Hawaiian Brand Intellectual Property Ltd. / HawaiianMiles Loyalty Ltd. 5.75% 1/20/26 (b) | | 325,000 | 306,719 |

| Mileage Plus Holdings LLC 6.5% 6/20/27 (b) | | 70,000 | 70,017 |

| Spirit Loyalty Cayman Ltd. / Spirit IP Cayman Ltd. 8% 9/20/25 (b) | | 171,000 | 123,677 |

| United Airlines, Inc.: | | | |

| 4.375% 4/15/26(b) | | 625,000 | 601,540 |

| 4.625% 4/15/29(b) | | 1,205,000 | 1,111,498 |

| | | | 5,026,067 |

| Professional Services - 0.1% | | | |

| ASGN, Inc. 4.625% 5/15/28 (b) | | 175,000 | 163,206 |

| CoreLogic, Inc. 4.5% 5/1/28 (b) | | 265,000 | 234,692 |

| Korn Ferry 4.625% 12/15/27 (b) | | 75,000 | 70,877 |

| TriNet Group, Inc.: | | | |

| 3.5% 3/1/29(b) | | 250,000 | 221,360 |

| 7.125% 8/15/31(b) | | 90,000 | 91,677 |

| | | | 781,812 |

| Trading Companies & Distributors - 0.4% | | | |

| Alta Equipment Group, Inc. 5.625% 4/15/26 (b) | | 200,000 | 193,406 |

| Beacon Roofing Supply, Inc. 6.5% 8/1/30 (b) | | 430,000 | 432,328 |

| FLY Leasing Ltd. 7% 10/15/24 (b) | | 55,000 | 53,901 |

| Fortress Transportation & Infrastructure Investors LLC 7.875% 12/1/30 (b) | | 190,000 | 199,215 |

| Foundation Building Materials, Inc. 6% 3/1/29 (b) | | 650,000 | 567,178 |

| H&E Equipment Services, Inc. 3.875% 12/15/28 (b) | | 2,280,000 | 2,057,330 |

| United Rentals North America, Inc.: | | | |

| 3.75% 1/15/32 | | 150,000 | 129,812 |

| 3.875% 2/15/31 | | 945,000 | 835,144 |

| 4% 7/15/30 | | 877,000 | 793,930 |

| 4.875% 1/15/28 | | 525,000 | 506,780 |

| 5.25% 1/15/30 | | 100,000 | 96,824 |

| | | | 5,865,848 |

TOTAL INDUSTRIALS | | | 74,037,093 |

| | | | |

| INFORMATION TECHNOLOGY - 2.5% | | | |

| Communications Equipment - 0.2% | | | |

| CommScope, Inc. 4.75% 9/1/29 (b) | | 345,000 | 236,325 |

| HTA Group Ltd. 7% 12/18/25 (b) | | 725,000 | 718,388 |

| Hughes Satellite Systems Corp. 6.625% 8/1/26 | | 303,000 | 199,683 |

| IHS Netherlands Holdco BV 8% 9/18/27 (b) | | 95,000 | 85,182 |

| ViaSat, Inc.: | | | |

| 5.625% 9/15/25(b) | | 1,325,000 | 1,286,005 |

| 5.625% 4/15/27(b) | | 775,000 | 727,531 |

| 7.5% 5/30/31(b) | | 450,000 | 316,125 |

| | | | 3,569,239 |

| Electronic Equipment, Instruments & Components - 0.1% | | | |

| Coherent Corp. 5% 12/15/29 (b) | | 500,000 | 466,250 |

| Likewize Corp. 9.75% 10/15/25 (b) | | 585,000 | 595,281 |

| Sensata Technologies, Inc. 3.75% 2/15/31 (b) | | 95,000 | 81,239 |

| TTM Technologies, Inc. 4% 3/1/29 (b) | | 885,000 | 787,736 |

| | | | 1,930,506 |

| IT Services - 0.4% | | | |

| Acuris Finance U.S. 5% 5/1/28 (b) | | 580,000 | 519,292 |

| Gartner, Inc.: | | | |

| 3.625% 6/15/29(b) | | 434,000 | 388,862 |

| 4.5% 7/1/28(b) | | 255,000 | 241,379 |

| GCI LLC 4.75% 10/15/28 (b) | | 720,000 | 646,034 |

| Go Daddy Operating Co. LLC / GD Finance Co., Inc.: | | | |

| 3.5% 3/1/29(b) | | 610,000 | 543,130 |

| 5.25% 12/1/27(b) | | 440,000 | 425,700 |

| Presidio Holdings, Inc. 8.25% 2/1/28 (b) | | 845,000 | 833,246 |

| Rackspace Hosting, Inc. 3.5% 2/15/28 (b) | | 475,000 | 191,247 |

| Sabre GLBL, Inc. 11.25% 12/15/27 (b) | | 330,000 | 310,200 |

| Tempo Acquisition LLC 5.75% 6/1/25 (b) | | 260,000 | 257,440 |

| Twilio, Inc.: | | | |

| 3.625% 3/15/29 | | 350,000 | 311,157 |

| 3.875% 3/15/31 | | 540,000 | 469,904 |

| Virtusa Corp. 7.125% 12/15/28 (b) | | 80,000 | 70,950 |

| | | | 5,208,541 |

| Semiconductors & Semiconductor Equipment - 0.2% | | | |

| Entegris, Inc.: | | | |

| 3.625% 5/1/29(b) | | 175,000 | 154,875 |

| 4.75% 4/15/29(b) | | 35,000 | 33,002 |

| 5.95% 6/15/30(b) | | 2,670,000 | 2,618,080 |

| | | | 2,805,957 |

| Software - 1.5% | | | |

| Black Knight InfoServ LLC 3.625% 9/1/28 (b) | | 795,000 | 747,300 |

| Boxer Parent Co., Inc.: | | | |

| 7.125% 10/2/25(b) | | 970,000 | 970,960 |

| 9.125% 3/1/26(b) | | 605,000 | 602,529 |

| Central Parent, Inc./Central Merger Sub, Inc. 7.25% 6/15/29 (b) | | 1,920,000 | 1,932,720 |

| Clarivate Science Holdings Corp. 4.875% 7/1/29 (b) | | 425,000 | 385,437 |

| Cloud Software Group, Inc.: | | | |

| 6.5% 3/31/29(b) | | 1,175,000 | 1,094,228 |

| 9% 9/30/29(b) | | 3,520,000 | 3,285,247 |

| CNT PRNT/CDK GLO II/FIN 8% 6/15/29 (b) | | 1,075,000 | 1,101,812 |

| Elastic NV 4.125% 7/15/29 (b) | | 170,000 | 152,699 |

| Fair Isaac Corp.: | | | |

| 4% 6/15/28(b) | | 1,070,000 | 993,939 |

| 5.25% 5/15/26(b) | | 575,000 | 568,902 |

| Gen Digital, Inc.: | | | |

| 5% 4/15/25(b) | | 815,000 | 806,850 |

| 6.75% 9/30/27(b) | | 765,000 | 768,931 |

| 7.125% 9/30/30(b) | | 995,000 | 1,016,517 |

| ION Trading Technologies Ltd. 5.75% 5/15/28 (b) | | 405,000 | 363,488 |

| McAfee Corp. 7.375% 2/15/30 (b) | | 1,785,000 | 1,575,402 |

| MicroStrategy, Inc. 6.125% 6/15/28 (b) | | 545,000 | 525,489 |

| NCR Voyix Corp.: | | | |

| 5.125% 4/15/29(b) | | 625,000 | 579,485 |

| 5.25% 10/1/30(b) | | 155,000 | 140,013 |

| Open Text Corp. 3.875% 2/15/28 (b) | | 225,000 | 206,748 |

| Open Text Holdings, Inc.: | | | |

| 4.125% 2/15/30(b) | | 345,000 | 304,591 |

| 4.125% 12/1/31(b) | | 385,000 | 329,529 |

| UKG, Inc. 6.875% 2/1/31 (b) | | 3,625,000 | 3,662,700 |

| Veritas U.S., Inc./Veritas Bermuda Ltd. 7.5% 9/1/25 (b) | | 120,000 | 110,033 |

| | | | 22,225,549 |

| Technology Hardware, Storage & Peripherals - 0.1% | | | |

| Seagate HDD Cayman: | | | |

| 5.75% 12/1/34 | | 245,000 | 235,494 |

| 8.25% 12/15/29(b) | | 85,000 | 91,078 |

| 8.5% 7/15/31(b) | | 105,000 | 113,528 |

| Western Digital Corp.: | | | |

| 2.85% 2/1/29 | | 331,000 | 278,767 |

| 3.1% 2/1/32 | | 140,000 | 109,578 |

| | | | 828,445 |

TOTAL INFORMATION TECHNOLOGY | | | 36,568,237 |

| | | | |

| MATERIALS - 3.8% | | | |

| Chemicals - 1.4% | | | |

| Ashland, Inc.: | | | |

| 3.375% 9/1/31(b) | | 250,000 | 209,447 |

| 6.875% 5/15/43 | | 275,000 | 283,940 |

| ASP Unifrax Holdings, Inc. 5.25% 9/30/28 (b) | | 300,000 | 190,232 |

| Avient Corp. 7.125% 8/1/30 (b) | | 1,027,000 | 1,049,502 |

| Axalta Coating Systems Dutch Holding B BV 7.25% 2/15/31 (b) | | 500,000 | 518,725 |

| Celanese U.S. Holdings LLC: | | | |

| 6.55% 11/15/30 | | 290,000 | 301,508 |

| 6.7% 11/15/33 | | 1,065,000 | 1,118,767 |

| Consolidated Energy Finance SA 12% 2/15/31 (b) | | 645,000 | 659,242 |

| CVR Partners LP/CVR Nitrogen Finance Corp. 6.125% 6/15/28 (b) | | 1,005,000 | 950,308 |

| Element Solutions, Inc. 3.875% 9/1/28 (b) | | 182,000 | 164,951 |

| Gpd Companies, Inc. 10.125% 4/1/26 (b) | | 545,000 | 501,226 |

| GrafTech Finance, Inc. 4.625% 12/15/28 (b) | | 887,000 | 583,037 |

| INEOS Quattro Finance 2 PLC 9.625% 3/15/29 (b) | | 200,000 | 210,351 |

| Invictus U.S. Newco LLC 5% 10/30/29 (b) | | 550,000 | 467,374 |

| Iris Holding, Inc. 10% 12/15/28 (b) | | 475,000 | 411,695 |

| Itelyum Regeneration SpA 4.625% 10/1/26 (b) | EUR | 215,000 | 226,061 |

| Kobe U.S. Midco 2, Inc. 9.25% 11/1/26 pay-in-kind (b)(e) | | 214,500 | 180,045 |

| Kronos Acquisition Holdings, Inc. / KIK Custom Products, Inc. 7% 12/31/27 (b) | | 475,000 | 458,375 |

| LSB Industries, Inc. 6.25% 10/15/28 (b) | | 160,000 | 151,723 |

| Methanex Corp.: | | | |

| 5.125% 10/15/27 | | 1,041,000 | 1,000,172 |

| 5.25% 12/15/29 | | 565,000 | 537,215 |

| 5.65% 12/1/44 | | 602,000 | 510,217 |

| NOVA Chemicals Corp.: | | | |

| 4.25% 5/15/29(b) | | 435,000 | 359,807 |

| 5% 5/1/25(b) | | 200,000 | 195,313 |

| 5.25% 6/1/27(b) | | 122,000 | 112,998 |

| 8.5% 11/15/28(b) | | 110,000 | 116,144 |

| 9% 2/15/30(b) | | 100,000 | 100,320 |

| Nufarm Australia Ltd. 5% 1/27/30 (b) | | 510,000 | 467,706 |

| Olin Corp. 5% 2/1/30 | | 375,000 | 350,486 |

| Olympus Water U.S. Holding Corp.: | | | |

| 4.25% 10/1/28(b) | | 380,000 | 340,290 |

| 6.25% 10/1/29(b) | | 405,000 | 359,238 |

| 9.75% 11/15/28(b) | | 985,000 | 1,046,609 |

| Rain Carbon, Inc. 12.25% 9/1/29 (b) | | 225,000 | 225,029 |

| Rain CII Carbon LLC/CII Carbon Corp. 7.25% 4/1/25 (b) | | 17,000 | 16,554 |

| SCIH Salt Holdings, Inc.: | | | |

| 4.875% 5/1/28(b) | | 80,000 | 73,100 |

| 6.625% 5/1/29(b) | | 225,000 | 204,583 |

| The Chemours Co. LLC: | | | |

| 4.625% 11/15/29(b) | | 520,000 | 427,584 |

| 5.375% 5/15/27 | | 215,000 | 196,400 |

| 5.75% 11/15/28(b) | | 450,000 | 394,671 |

| The Scotts Miracle-Gro Co.: | | | |

| 4% 4/1/31 | | 1,090,000 | 924,560 |

| 4.375% 2/1/32 | | 60,000 | 50,173 |