UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21991

Fidelity Rutland Square Trust II

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Christina H. Lee, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | May 31 |

|

|

Date of reporting period: | May 31, 2024 |

Item 1.

Reports to Stockholders

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF MAY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Strategic Advisers® Alternatives Fund Strategic Advisers® Alternatives Fund : FSLTX |

| | | |

This annual shareholder report contains information about Strategic Advisers® Alternatives Fund for the period June 1, 2023 to May 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/

prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Strategic Advisers® Alternatives Fund | $ 11 | 0.11% | |

What affected the Fund's performance this period?

- •Within the alternative investment market, diversified macro and multi-strategy strategies performed well for the 12 months ending May 31, 2024. Conversely, the environment has been challenging for certain arbitrage strategies.

- •The Fund's investments are organized into three categories: Return-seeking, Diversifying and Defensive.

- •Eaton Vance Global Macro Absolute Return Advantage Fund and BlackRock Systematic Multi-Strategy Fund - both in the Return-seeking group - each gained about 10% and were the top contributors to performance versus the benchmark. Eaton Vance seeks niche investment opportunities in markets around the world. BlackRock's strategy utilizes a multisector fixed-income sleeve combined with a market-neutral equity component and a global macro sleeve. Both funds benefited from positions that were leveraged to global economic growth trends. Emerging-markets exposure provided a further boost to Eaton Vance. Meanwhile, for BlackRock, a defensive long/short equity strategy, coupled with allocations to interest rates and corporate credit, aided its result.

- •John Hancock Diversified Macro Fund (+11%) also added considerable value the past 12 months. This fund employs a rules-based process across asset classes to provide exposure to diversified sources of return. Favorable positioning in stocks, currencies, energy and interest rates fueled its strong performance.

- •On the downside, T. Rowe Price Dynamic Global Bond Fund (-8%) was the primary relative detractor this period. Hedging strategies designed to protect against downturns in corporate credit and global equity markets weighed on its performance.

- •Within the Defensive category, the sub-advised Equity Market Protective Put mandate from Fidelity® Diversifying Solutions performed as expected, generating negative performance amid rising equity markets.

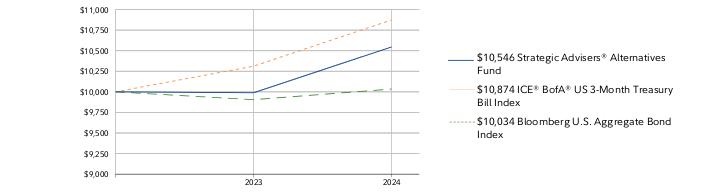

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

July 12, 2022 through May 31, 2024.

Initial investment of $10,000.

Strategic Advisers® Alternatives Fund | $10,000 | $9,989 | $10,546 |

ICE® BofA® US 3-Month Treasury Bill Index | $10,000 | $10,311 | $10,874 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $9,905 | $10,034 |

| | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund A |

| Strategic Advisers® Alternatives Fund | 5.58% | 2.85% |

| ICE® BofA® US 3-Month Treasury Bill Index | 5.45% | 4.54% |

| Bloomberg U.S. Aggregate Bond Index | 1.31% | 0.18% |

A From July 12, 2022

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of May 31, 2024)

KEY FACTS | | |

| Fund Size | $2,420,680,473 | |

| Number of Holdings | 903 | |

| Total Advisory Fee | $1,920,378 | |

| Portfolio Turnover | 106% | |

What did the Fund invest in?

(as of May 31, 2024)

DERIVATIVE EXPOSURE (% of Fund's net assets) | | |

| Futures Contracts | 9.4 | |

| Swaps | 48.5 | |

| Options | 0.0 | |

| Forward Foreign Currency Contracts | 24.7 | |

| |

| Alternative Funds | 44.2 |

| Fixed-Income Funds | 5.5 |

| Corporate Bonds | 3.5 |

| U.S. Treasury Obligations | 0.4 |

| Asset-Backed Securities | 0.4 |

| U.S. Government Agency - Mortgage Securities | 0.1 |

| U.S. Government Agency Obligations | 0.1 |

| CMOs and Other Mortgage Related Securities | 0.0 |

| Foreign Government and Government Agency Obligations | 0.0 |

| Futures Contracts | 5.1 |

| Swaps | 26.6 |

| Forward Foreign Currency Contracts | 13.5 |

| Options | 0.0 |

ASSET ALLOCATION (% of Fund's Total Exposure) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - 0.6% |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| BlackRock Systematic Multi-Strategy Fund Investor A Shares | 10.6 | |

| Eaton Vance Global Macro Absolute Return Advantage Fund Class A | 10.0 | |

| Fidelity SAI Convertible Arbitrage Fund | 9.6 | |

| The Merger Fund Class A | 7.6 | |

| First Trust Merger Arbitrage Fund Class I | 7.4 | |

| Absolute Convertible Arbitrage Fund Investor Shares | 6.4 | |

| Stone Ridge Diversified Alternatives Fund Class I | 6.1 | |

| JHancock Diversified Macro Fund Class A | 5.9 | |

| BlackRock Global Equity Market Neutral Fund A Shares | 5.3 | |

| Victory Market Neutral Income Fund Class I | 5.2 | |

| | 74.1 | |

| |

How has the Fund changed?

This is a summary of certain changes to the Fund since June 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by July 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: - •Management fee

- •Operating expenses

| Strategic Advisers entered into new sub-advisory agreements on behalf of the fund. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

1.9913342.100 6570-TSRA-0724 | | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF MAY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Strategic Advisers® Municipal Bond Fund Strategic Advisers® Municipal Bond Fund : FSMUX |

| | | |

This annual shareholder report contains information about Strategic Advisers® Municipal Bond Fund for the period June 1, 2023 to May 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/

prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Strategic Advisers® Municipal Bond Fund | $ 8 | 0.08% | |

What affected the Fund's performance this period?

- •U.S. tax-exempt municipal bonds achieved a modest gain for the 12 months ending May 31, 2024. The full-year advance was largely the result of a strong bond market rally in the final two months of 2023, but was marked by high levels of volatility as investors anxiously awaited the arrival of interest-rate reductions by the U.S. Federal Reserve.

- •Against this backdrop, all of our sub-advisers contributed versus the benchmark this period. Leading the way were both mandates from T. Rowe Price - High Yield Bond (+6%) and Long-Term Bond (+4%) - in addition to MFS (+5%), FIAM® (+4%) and Western Asset Management (+4%). All these managers benefited from allocations to lower-quality investment-grade securities, high-yield municipal debt and comparatively light exposure to lower-coupon bonds.

- •The High-Yield mandate from sub-adviser MacKay Shields (+7%) also notably contributed, aided by holdings of lower-quality and longer-maturity debt, along with municipal holdings in Puerto Rico.

- •There were no relative detractors of note the past 12 months.

- •We continue to maintain our allocations to managers with sizable holdings in higher-yielding bonds. As of period end, about two-thirds of the portfolio was allocated to sub-advisers and one-third to institutional mutual funds.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

June 17, 2021 through May 31, 2024.

Initial investment of $10,000.

Strategic Advisers® Municipal Bond Fund | $10,000 | $9,208 | $9,202 | $9,570 |

Bloomberg Municipal Bond Index | $10,000 | $9,288 | $9,334 | $9,583 |

| | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | Life of Fund A |

| Strategic Advisers® Municipal Bond Fund | 4.00% | -1.48% |

| Bloomberg Municipal Bond Index | 2.67% | -1.43% |

A From June 17, 2021

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of May 31, 2024)

KEY FACTS | | |

| Fund Size | $12,255,783,317 | |

| Number of Holdings | 7,542 | |

| Total Advisory Fee | $9,555,626 | |

| Portfolio Turnover | 48% | |

What did the Fund invest in?

(as of May 31, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| Municipal Bond Funds | 29.5 | |

| Transportation | 16.8 | |

| General Obligations | 11.2 | |

| Special Tax | 9.1 | |

| Health Care | 8.6 | |

| State G.O. | 5.9 | |

| Others(Individually Less Than 5%) | 18.9 | |

| 100.0 | |

| |

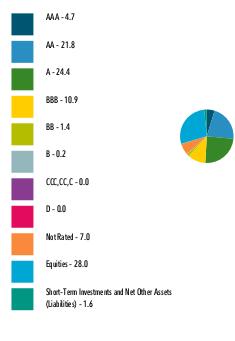

| AAA | 4.7 |

| AA | 21.8 |

| A | 24.4 |

| BBB | 10.9 |

| BB | 1.4 |

| B | 0.2 |

| CCC,CC,C | 0.0 |

| D | 0.0 |

| Not Rated | 7.0 |

| Equities | 28.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.6 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| New York | 7.7 |

| Illinois | 6.7 |

| California | 6.2 |

| Texas | 4.9 |

| New Jersey | 3.5 |

| | |

How has the Fund changed?

This is a summary of certain changes to the Fund since June 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by July 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: - •Management fee

- •Operating expenses

| |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

1.9913326.100 6352-TSRA-0724 | | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF MAY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Strategic Advisers® Short Duration Fund Strategic Advisers® Short Duration Fund : FAUDX |

| | | |

This annual shareholder report contains information about Strategic Advisers® Short Duration Fund for the period June 1, 2023 to May 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/

prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Strategic Advisers® Short Duration Fund | $ 4 | 0.04% | |

What affected the Fund's performance this period?

- •U.S. taxable investment-grade bonds achieved a modest gain for the 12 months ending May 31, 2024. The full-year advance was largely the result of a strong bond market rally in the final two months of 2023, but was marked by high levels of volatility as investors anxiously awaited the arrival of interest-rate reductions by the U.S. Federal Reserve.

- •We organize the Fund's investments into three categories: money market/low volatility; low duration (averaging less than one year); and short-term (an average duration of one to two years).

- •During the period, the inversion of the yield curve helped the portfolio's low duration managers outperform their short-term counterparts, as the former offered higher yields with less interest rate sensitivity.

- •This environment benefited sub-adviser FIAM® (+6%) because its exposure to high-quality, short-duration corporate credit had minimal rate sensitivity amid a rising-rate backdrop. Moreover, it is the largest investment in the portfolio, so its performance typically has a sizable impact on the Fund's overall return.

- •Similar dynamics boosted the return of PIMCO Short-Term Fund (+7%). Additionally, early in the period, a short hedging strategy focused on the 10-year portion of the yield curve aided PIMCO's performance. This strategy worked well as bond prices fell and 10-year yields rose, spurred by declining concerns about the 2023 regional banking crisis.

- •On the downside, the iShares® 1-3 Year Treasury Bond exchange-traded fund (+3%) was the foremost relative detractor in an environment of rising short-term bond yields.

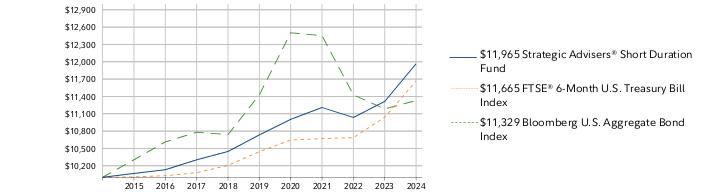

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

May 31, 2014 through May 31, 2024.

Initial investment of $10,000.

Strategic Advisers® Short Duration Fund | $10,000 | $10,066 | $10,131 | $10,303 | $10,447 | $10,734 | $11,003 | $11,208 | $11,036 | $11,313 | $11,965 |

FTSE® 6-Month U.S. Treasury Bill Index | $10,000 | $10,006 | $10,028 | $10,079 | $10,206 | $10,443 | $10,646 | $10,669 | $10,686 | $11,040 | $11,665 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $10,303 | $10,612 | $10,780 | $10,739 | $11,426 | $12,502 | $12,452 | $11,428 | $11,183 | $11,329 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | 5 Year | 10 Year |

| Strategic Advisers® Short Duration Fund | 5.76% | 2.20% | 1.81% |

| FTSE® 6-Month U.S. Treasury Bill Index | 5.66% | 2.24% | 1.55% |

| Bloomberg U.S. Aggregate Bond Index | 1.31% | -0.17% | 1.26% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of May 31, 2024)

KEY FACTS | | |

| Fund Size | $4,592,922,635 | |

| Number of Holdings | 1,122 | |

| Total Advisory Fee | $1,537,134 | |

| Portfolio Turnover | 59% | |

What did the Fund invest in?

(as of May 31, 2024)

| Fixed-Income Funds | 60.7 |

| Corporate Bonds | 16.0 |

| U.S. Treasury Obligations | 9.8 |

| Asset-Backed Securities | 8.2 |

| CMOs and Other Mortgage Related Securities | 2.3 |

| U.S. Government Agency - Mortgage Securities | 0.7 |

| Other Investments | 0.1 |

| Municipal Securities | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| PIMCO Short-Term Fund Institutional Class | 10.7 | |

| JPMorgan Ultra-Short Income ETF | 9.7 | |

| Baird Ultra Short Bond Fund Institutional Class | 9.0 | |

| US Treasury Notes | 8.2 | |

| T. Rowe Price Ultra Short-Term Bond Fund | 6.7 | |

| BlackRock Ultra Short-Term Bond ETF | 5.6 | |

| iShares 1-3 Year Treasury Bond ETF | 5.2 | |

| Morgan Stanley Institutional Fund Trust Ultra-Short Income Portfolio Class IR | 4.7 | |

| Baird Short-Term Bond Fund Institutional Class | 3.3 | |

| Fidelity SAI Short-Term Bond Fund | 2.6 | |

| | 65.7 | |

| |

How has the Fund changed?

This is a summary of certain changes to the Fund since June 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by July 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

1.9913318.100 2387-TSRA-0724 | | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF MAY 31, 2024 | |

| | Strategic Advisers® Fidelity® U.S. Total Stock Fund Strategic Advisers® Fidelity® U.S. Total Stock Fund : FCTDX |

| | | |

This annual shareholder report contains information about Strategic Advisers® Fidelity® U.S. Total Stock Fund for the period June 1, 2023 to May 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/

prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Strategic Advisers® Fidelity® U.S. Total Stock Fund | $ 15 | 0.13% | |

What affected the Fund's performance this period?

- •U.S. equities gained considerably for the 12 months ending May 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year. Amid this favorable backdrop for higher-risk assets, U.S. stocks continued their late-2023 momentum and ended May just shy of a record close, powered by signs of continued U.S. economic strength.

- •Against this backdrop, Fidelity® Growth Company Fund (+38%) was the top contributor versus the benchmark. Overweight stakes in chipmaker Nvidia and pharmaceutical giant Eli Lilly helped fuel this fund's strong result, along with a generally supportive market environment for its high-growth approach.

- •Fidelity® Contrafund (+42%) also added considerable value, as this fund's momentum bias served it well during the second half of the period. More specifically, a sizable overweight in Meta Platforms, the parent of Facebook, helped considerably, along with stock picks among information technology, consumer discretionary and health care companies.

- •Fidelity® Magellan Fund (+37%) was another leading relative contributor this period. Here, a meaningful investment in General Electric helped this fund's quality-growth strategy outperform, as did comparatively light exposure to electric-vehicle maker Tesla, whose stock substantially underperformed the past 12 months.

- •On the downside, the Value Discovery mandate from sub-adviser FIAM® (+15%) was the foremost relative detractor this period. Its value-focused approach emphasizing high-quality companies lagged the performance of the large-cap growth stocks largely responsible for fueling the market's rally. Additionally, it was hurt by adverse positioning among technology stocks, picks in health care and an overweight in the consumer staples sector.

- •Fidelity® SAI U.S. Low Volatility Index Fund (+20%) was a more moderate headwind to performance, as its defensive positioning could not keep pace with the momentum of the Dow Jones U.S. Total Stock Market Index.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

March 20, 2018 through May 31, 2024.

Initial investment of $10,000.

Strategic Advisers® Fidelity® U.S. Total Stock Fund | $10,000 | $9,960 | $9,956 | $11,136 | $16,328 | $15,536 | $16,072 |

Dow Jones U.S. Total Stock Market Index℠ | $10,000 | $10,039 | $10,283 | $11,445 | $16,478 | $15,820 | $16,123 |

| | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | 5 Year | Life of Fund A |

| Strategic Advisers® Fidelity® U.S. Total Stock Fund | 29.93% | 15.97% | 12.60% |

| Dow Jones U.S. Total Stock Market Index℠ | 27.68% | 14.89% | 12.35% |

A From March 20, 2018

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of May 31, 2024)

KEY FACTS | | |

| Fund Size | $118,698,908,859 | |

| Number of Holdings | 1,775 | |

| Total Advisory Fee | $110,694,223 | |

| Portfolio Turnover | 30% | |

What did the Fund invest in?

(as of May 31, 2024)

| Domestic Equity Funds | 50.3 |

| Common Stocks | 47.8 |

| Bonds | 1.1 |

| Preferred Stocks | 0.1 |

| Other Investments | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity Growth Company Fund | 10.6 | |

| Fidelity SAI U.S. Quality Index Fund | 10.0 | |

| Fidelity Magellan Fund | 6.2 | |

| Fidelity SAI U.S. Low Volatility Index Fund | 5.9 | |

| Fidelity Contrafund | 4.8 | |

| Fidelity Extended Market Index Fund | 2.5 | |

| Fidelity Blue Chip Growth Fund | 2.4 | |

| Microsoft Corp | 2.4 | |

| Fidelity SAI U.S. Large Cap Index Fund | 2.3 | |

| Fidelity SAI U.S. Value Index Fund | 2.3 | |

| | 49.4 | |

| |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

1.9913320.100 3080-TSRA-0724 | | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF MAY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Strategic Advisers® Fidelity® Emerging Markets Fund Strategic Advisers® Fidelity® Emerging Markets Fund : FGOMX |

| | | |

This annual shareholder report contains information about Strategic Advisers® Fidelity® Emerging Markets Fund for the period June 1, 2023 to May 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/

prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Strategic Advisers® Fidelity® Emerging Markets Fund | $ 22 | 0.20% | |

What affected the Fund's performance this period?

- •Emerging-markets equities saw strong performance for the 12 months ending May 31, 2024, driven by global disinflation, improved earnings, expanding economies and a frenzy over generative artificial intelligence. Despite this, global equities also experienced elevated volatility for much of the period due to uncertainty about China's economy, the ongoing war in Ukraine, growing tension in the Middle East and changes in global transit following commercial ship attacks in the Red Sea.

- •Against this backdrop, Fidelity® SAI Emerging Markets Value Index Fund (+22%) was the top contributor versus the benchmark. This fund benefited from strong stock selection in India and South Korea, along with favorable overall positioning in China. Overall, value stocks performed well within emerging markets this period, providing a stylistic tailwind for the fund.

- •Two mandates from sub-adviser FIAM® - Concentrated EM (+19%) and Select EM Equity (+16%) - also added considerable value compared with the benchmark. The former was propelled most by investment choices in India, Brazil and South Korea. Meanwhile, the latter employs a growth-at-a-reasonable-price approach that combines bottom-up stock selection with a quantitative portfolio-construction process. Here, picks among information technology and consumer discretionary stocks in China notably helped, as did favorable exposure to equity markets in Brazil and picks in South Korea.

- •There were no meaningful relative detractors the past 12 months. That said, Fidelity® SAI Emerging Markets Low Volatility Index Fund (+11%) slightly pressured the broader Fund's relative return. In particular, an underweight among semiconductor stocks in Taiwan caused this fund to lag the benchmark.

- •Notable positioning changes this period included adding a small stake in Fidelity® China Region Fund to help diversify the portfolio's exposure to this market.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

October 30, 2018 through May 31, 2024.

Initial investment of $10,000.

Strategic Advisers® Fidelity® Emerging Markets Fund | $10,000 | $10,863 | $10,691 | $16,384 | $12,878 | $12,070 | $13,986 |

MSCI Emerging Markets Index | $10,000 | $10,775 | $10,305 | $15,562 | $12,478 | $11,422 | $12,841 |

| | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | 5 Year | Life of Fund A |

| Strategic Advisers® Fidelity® Emerging Markets Fund | 15.88% | 5.18% | 6.19% |

| MSCI Emerging Markets Index | 12.42% | 3.57% | 4.58% |

A From October 30, 2018

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of May 31, 2024)

KEY FACTS | | |

| Fund Size | $15,065,219,526 | |

| Number of Holdings | 257 | |

| Total Advisory Fee | $19,993,590 | |

| Portfolio Turnover | 33% | |

What did the Fund invest in?

(as of May 31, 2024)

| International Equity Funds | 48.6 |

| Common Stocks | 44.7 |

| Preferred Stocks | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 6.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity SAI Emerging Markets Value Index Fund | 20.4 | |

| Fidelity SAI Emerging Markets Index Fund | 11.0 | |

| Fidelity Advisor Emerging Markets Fund - Class Z | 10.7 | |

| Fidelity SAI Emerging Markets Low Volatility Index Fund | 5.7 | |

| Taiwan Semiconductor Manufacturing Co Ltd | 4.8 | |

| Tencent Holdings Ltd | 2.7 | |

| Samsung Electronics Co Ltd | 2.3 | |

| Alibaba Group Holding Ltd | 1.0 | |

| PDD Holdings Inc Class A ADR | 0.9 | |

| Fidelity Advisor China Region Fund - Class Z | 0.8 | |

| | 60.3 | |

| |

How has the Fund changed?

This is a summary of certain changes to the Fund since June 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by July 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes: | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

1.9913322.100 3310-TSRA-0724 | | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF MAY 31, 2024 | |

| | Strategic Advisers® Tax-Sensitive Short Duration Fund Strategic Advisers® Tax-Sensitive Short Duration Fund : FGNSX |

| | | |

This annual shareholder report contains information about Strategic Advisers® Tax-Sensitive Short Duration Fund for the period June 1, 2023 to May 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/

prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Strategic Advisers® Tax-Sensitive Short Duration Fund | $ 7 | 0.07% | |

What affected the Fund's performance this period?

- •U.S. tax-exempt municipal bonds achieved a modest gain for the 12 months ending May 31, 2024. The full-year advance was largely the result of a strong bond market rally in the final two months of 2023, but was marked by high levels of volatility as investors anxiously awaited the arrival of interest-rate reductions by the U.S. Federal Reserve.

- •Against this backdrop, three of four sub-advised mandates aided performance versus the benchmark the past 12 months. These include strategies from FIAM®, T. Rowe Price and Allspring Global Investments, with each advancing about 4%. The common theme with all three was that their portfolios had longer average maturities and therefore greater interest rate sensitivity than the broader Fund's benchmark during a period when rates fell. This positioning was a tailwind, particularly when rates dropped sharply in the fourth quarter of 2023 amid a rapid cooling of inflation that prompted the U.S. Federal Reserve to signal it was likely finished hiking rates and could even potentially implement cuts in the coming year.

- •Even T. Rowe Price, which is a shorter-term, enhanced cash strategy, was propelled in Q4 by an allocation to tax-exempt investments at the longer end of the short-term maturity spectrum.

- •The Fund's cash allocation, which averaged about 5% the past 12 months, rose about 5% and was another notable relative contributor.

- •There were no significant relative detractors this period. That said, the Limited Term (1-4 Year) Municipal Income mandate from FIAM® (+3%) modestly underperformed and slightly weighed on performance due to having greater interest-rate sensitivity in periods when rates rose.

- •We continue to maintain our allocations to managers with sizable holdings in higher-yielding bonds.

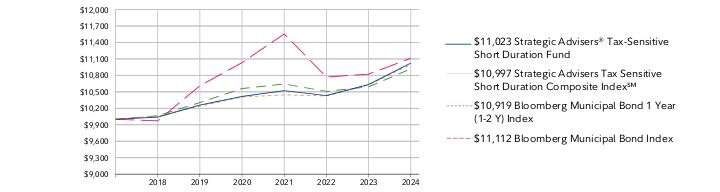

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

December 28, 2017 through May 31, 2024.

Initial investment of $10,000.

Strategic Advisers® Tax-Sensitive Short Duration Fund | $10,000 | $10,039 | $10,258 | $10,416 | $10,521 | $10,432 | $10,634 | $11,023 |

Strategic Advisers Tax Sensitive Short Duration Composite Index℠ | $10,000 | $10,059 | $10,239 | $10,406 | $10,444 | $10,425 | $10,626 | $10,997 |

Bloomberg Municipal Bond 1 Year (1-2 Y) Index | $10,000 | $10,064 | $10,305 | $10,560 | $10,643 | $10,508 | $10,591 | $10,919 |

Bloomberg Municipal Bond Index | $10,000 | $9,972 | $10,610 | $11,032 | $11,555 | $10,770 | $10,823 | $11,112 |

| | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | 5 Year | Life of Fund A |

| Strategic Advisers® Tax-Sensitive Short Duration Fund | 3.67% | 1.45% | 1.53% |

| Strategic Advisers Tax Sensitive Short Duration Composite Index℠ | 3.49% | 1.44% | 1.49% |

| Bloomberg Municipal Bond 1 Year (1-2 Y) Index | 3.10% | 1.17% | 1.38% |

| Bloomberg Municipal Bond Index | 2.67% | 0.93% | 1.65% |

A From December 28, 2017

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of May 31, 2024)

KEY FACTS | | |

| Fund Size | $3,904,665,804 | |

| Number of Holdings | 1,555 | |

| Total Advisory Fee | $2,570,931 | |

| Portfolio Turnover | 68% | |

What did the Fund invest in?

(as of May 31, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| General Obligations | 15.4 | |

| Municipal Funds | 15.1 | |

| Health Care | 12.2 | |

| Transportation | 9.2 | |

| Electric Utilities | 5.7 | |

| Resource Recovery | 5.4 | |

| Industrial Development | 5.2 | |

| Others(Individually Less Than 5%) | 31.8 | |

| 100.0 | |

| |

| AAA | 10.1 |

| AA | 20.5 |

| A | 30.6 |

| BBB | 8.3 |

| BB | 0.2 |

| Not Rated | 9.4 |

| Equities | 12.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 8.1 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Texas | 11.4 |

| Illinois | 6.3 |

| New York | 5.5 |

| Pennsylvania | 4.7 |

| Florida | 3.8 |

| | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

1.9913319.100 3058-TSRA-0724 | | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF MAY 31, 2024 | |

| | Strategic Advisers® Fidelity® Core Income Fund Strategic Advisers® Fidelity® Core Income Fund : FIWGX |

| | | |

This annual shareholder report contains information about Strategic Advisers® Fidelity® Core Income Fund for the period June 1, 2023 to May 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/

prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Strategic Advisers® Fidelity® Core Income Fund | $ 5 | 0.05% | |

What affected the Fund's performance this period?

- •U.S. taxable investment-grade bonds achieved a modest gain for the 12 months ending May 31, 2024. The full-year advance was largely the result of a strong bond market rally in the final two months of 2023, but was marked by high levels of volatility as investors anxiously awaited the arrival of interest-rate reductions by the U.S. Federal Reserve.

- •Against this backdrop, Fidelity® SAI Total Bond Fund (+3.5%) was the top contributor versus the benchmark. An underweight allocation to government-agency mortgage-backed securities (MBS) aided its performance, as did holdings in high-yield corporate credit and bank loans. The fund's positioning in emerging-markets debt was another plus, as was having less interest rate sensitivity than the broader benchmark.

- •The Core Investment Grade mandate from sub-adviser FIAM® (+3%) also added considerable value compared with the benchmark. Here, favorable yield-curve positioning, comparatively light exposure to agency MBS and an allocation to investment-grade corporate credit notably helped.

- •Fidelity® New Markets Income Fund (+17%) was another key relative contributor, fueled by the strong performance of emerging-markets debt.

- •On the downside, the Fund's exposure to intermediate- and long-maturity U.S. Treasury securities were the foremost relative detractors. These included Fidelity® SAI Long-Term Treasury Bond Index Fund (-8.5%) and Fidelity® SAI U.S. Treasury Bond Fund (0%). The portfolio's holdings in U.S. Treasury securities are primarily for liquidity and hedging purposes. This period, however, they posted flat to negative returns amid rising bond yields. Intermediate-term U.S. Treasuries held up better than long-term bonds due to their lower comparative rate sensitivity.

- •As of May 31, the Fund continued to maintain larger allocations to U.S. Treasuries and MBS.

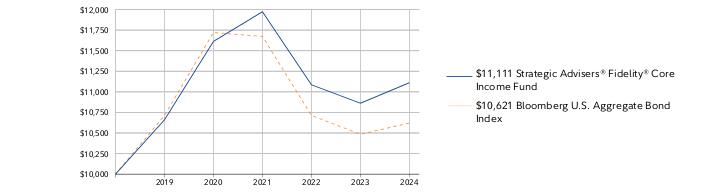

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

October 16, 2018 through May 31, 2024.

Initial investment of $10,000.

Strategic Advisers® Fidelity® Core Income Fund | $10,000 | $10,660 | $11,613 | $11,973 | $11,085 | $10,861 | $11,111 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $10,712 | $11,721 | $11,674 | $10,714 | $10,484 | $10,621 |

| | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | 5 Year | Life of Fund A |

| Strategic Advisers® Fidelity® Core Income Fund | 2.30% | 0.83% | 1.89% |

| Bloomberg U.S. Aggregate Bond Index | 1.31% | -0.17% | 1.08% |

A From October 16, 2018

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of May 31, 2024)

KEY FACTS | | |

| Fund Size | $66,499,440,851 | |

| Number of Holdings | 6,145 | |

| Total Advisory Fee | $28,674,452 | |

| Portfolio Turnover | 207% | |

What did the Fund invest in?

(as of May 31, 2024)

| Fixed-Income Funds | 48.1 |

| U.S. Government Agency - Mortgage Securities | 21.1 |

| Corporate Bonds | 14.5 |

| U.S. Treasury Obligations | 12.5 |

| CMOs and Other Mortgage Related Securities | 5.2 |

| Asset-Backed Securities | 3.8 |

| Preferred Securities | 0.1 |

| Foreign Government and Government Agency Obligations | 0.1 |

| Other Investments | 0.0 |

| Municipal Securities | 0.0 |

| Bank Loan Obligations | 0.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (5.4)% |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Fidelity SAI Total Bond Fund | 23.6 | |

| US Treasury Notes | 9.6 | |

| Fidelity SAI U.S. Treasury Bond Index Fund | 9.2 | |

| Uniform Mortgage Backed Securities | 7.7 | |

| Ginnie Mae II Pool | 5.9 | |

| Fannie Mae Mortgage pass-thru certificates | 4.6 | |

| Fidelity SAI Long-Term Treasury Bond Index Fund | 3.8 | |

| Fidelity Intermediate Treasury Bond Index Fund | 3.7 | |

| US Treasury Bonds | 2.9 | |

| Freddie Mac Gold Pool | 2.2 | |

| | 73.2 | |

| |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

1.9913321.100 3306-TSRA-0724 | | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF MAY 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Strategic Advisers® Large Cap Fund Strategic Advisers® Large Cap Fund : FALCX |

| | | |

This annual shareholder report contains information about Strategic Advisers® Large Cap Fund for the period June 1, 2023 to May 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/

prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Strategic Advisers® Large Cap Fund | $ 20 | 0.18% | |

What affected the Fund's performance this period?

- •U.S. equities gained considerably for the 12 months ending May 31, 2024, driven by resilient corporate profits, a frenzy over generative artificial intelligence and the Federal Reserve's likely pivot to cutting interest rates later this year. Amid this favorable backdrop for higher-risk assets, U.S. stocks continued their late-2023 momentum and ended May just shy of a record close, powered by signs of continued U.S. economic strength.

- •Against this backdrop, sub-adviser T. Rowe Price (+31%) was the top contributor versus the benchmark. This manager - the Fund's largest investment - runs a sector-neutral core strategy and benefited from broadly positive stock selection, led by picks in the information technology, health care and financials sectors.

- •Sub-adviser JPMorgan Investment Management (+32%) also added considerable relative value this period. Similar to T. Rowe Price, JPMorgan employs a core-type approach and did a nice job with investment choices among consumer discretionary, technology and financials companies. Both T. Rowe Price and JPMorgan received a sizable boost from outsized exposure to chipmaker Nvidia, which had a meteoric rise this period.

- •Fidelity® Growth Company Fund (+38%) provided a further lift to the broader Fund's relative result, aided by overweight stakes in Nvidia and pharmaceutical giant Eli Lilly, along with a generally supportive market environment for its high-growth approach.

- •In contrast, Fidelity® SAI U.S. Low Volatility Index Fund (+20%) was the foremost relative detractor. This fund's defensive positioning could not keep pace with the S&P 500® Index the past 12 months.

- •During the period we reduced our investment in JPMorgan's Value mandate and reallocated those assets into JPMorgan's Large Cap Core strategy.

- •As of May 31, most of the Fund's assets were allocated to managers pursuing core strategies.

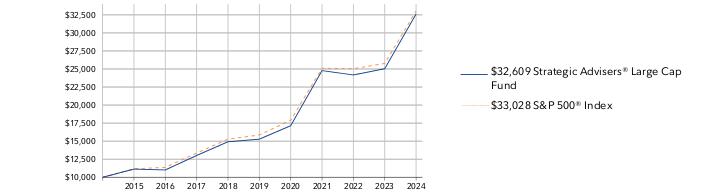

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

May 31, 2014 through May 31, 2024.

Initial investment of $10,000.

Strategic Advisers® Large Cap Fund | $10,000 | $11,137 | $11,014 | $13,021 | $14,921 | $15,280 | $17,140 | $24,775 | $24,174 | $25,038 | $32,609 |

S&P 500® Index | $10,000 | $11,181 | $11,372 | $13,359 | $15,281 | $15,859 | $17,895 | $25,109 | $25,034 | $25,766 | $33,028 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS: | | 1 Year | 5 Year | 10 Year |

| Strategic Advisers® Large Cap Fund | 30.24% | 16.37% | 12.55% |

| S&P 500® Index | 28.19% | 15.80% | 12.69% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics (as of May 31, 2024)

KEY FACTS | | |

| Fund Size | $63,322,205,968 | |

| Number of Holdings | 1,376 | |

| Total Advisory Fee | $96,677,347 | |

| Portfolio Turnover | 61% | |

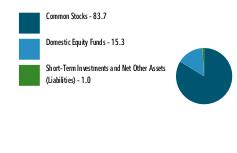

What did the Fund invest in?

(as of May 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 23.2 | |

| Financials | 12.8 | |

| Health Care | 10.6 | |

| Consumer Discretionary | 8.7 | |

| Communication Services | 7.8 | |

| Industrials | 7.3 | |

| Consumer Staples | 4.3 | |

| Energy | 3.9 | |

| Utilities | 2.0 | |

| Materials | 1.7 | |

| Real Estate | 1.4 | |

| |

| Common Stocks | 83.7 |

| Domestic Equity Funds | 15.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 98.7 |

| China | 0.4 |

| Canada | 0.4 |

| Taiwan | 0.3 |

| Denmark | 0.1 |

| United Kingdom | 0.1 |

| Bermuda | 0.0 |

| Switzerland | 0.0 |

| Netherlands | 0.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Microsoft Corp | 5.7 | |

| Fidelity Growth Company Fund | 5.5 | |

| NVIDIA Corp | 4.9 | |

| Apple Inc | 4.6 | |

| Amazon.com Inc | 3.3 | |

| Fidelity SAI U.S. Large Cap Index Fund | 3.0 | |

| Fidelity SAI U.S. Low Volatility Index Fund | 2.9 | |

| Meta Platforms Inc Class A | 2.0 | |

| Alphabet Inc Class C | 1.7 | |

| Alphabet Inc Class A | 1.6 | |

| | 35.2 | |

| |

How has the Fund changed?

This is a summary of certain changes to the Fund since June 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by July 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

Strategic Advisers entered into new sub-advisory agreements on behalf of the fund. Strategic Advisers terminated certain sub-advisory agreements on behalf of the fund. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

1.9913325.100 6209-TSRA-0724 | | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec |

Item 2.

Code of Ethics

As of the end of the period, May 31, 2024, Fidelity Rutland Square Trust II (the trust) has adopted a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its President and Treasurer and its Chief Financial Officer. A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

Item 3.

Audit Committee Financial Expert

The Board of Trustees of the trust has determined that Heidi L. Steiger is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Ms. Steiger is independent for purposes of Item 3 of Form N-CSR.

Item 4.

Principal Accountant Fees and Services

Fees and Services

The following table presents fees billed by PricewaterhouseCoopers LLP (“PwC”) in each of the last two fiscal years for services rendered to Strategic Advisers Alternatives Fund, Strategic Advisers Fidelity Core Income Fund, Strategic Advisers Fidelity Emerging Markets Fund, Strategic Advisers Fidelity U.S. Total Stock Fund, Strategic Advisers Large Cap Fund, Strategic Advisers Municipal Bond Fund, Strategic Advisers Short Duration Fund and Strategic Advisers Tax-Sensitive Short Duration Fund (the “Funds”):

Services Billed by PwC

May 31, 2024 FeesA

| | | | |

| Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

Strategic Advisers Alternatives Fund | $60,000 | $5,000 | $16,600 | $10,600 |

Strategic Advisers Fidelity Core Income Fund | $53,700 | $4,000 | $9,700 | $8,500 |

Strategic Advisers Fidelity Emerging Markets Fund | $26,700 | $2,500 | $6,700 | $5,200 |

Strategic Advisers Fidelity U.S. Total Stock Fund | $40,800 | $3,500 | $8,700 | $7,400 |

Strategic Advisers Large Cap Fund | $42,700 | $3,800 | $9,600 | $8,000 |

Strategic Advisers Municipal Bond Fund | $63,300 | $4,300 | $5,500 | $9,100 |

Strategic Advisers Short Duration Fund | $38,700 | $3,400 | $7,900 | $7,300 |

Strategic Advisers Tax-Sensitive Short Duration Fund | $39,300 | $3,400 | $6,700 | $7,200 |

|

|

|

|

|

| | | | |

| Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

Strategic Advisers Alternatives Fund | $52,400 | $3,600 | $13,400 | $8,400 |

Strategic Advisers Fidelity Core Income Fund | $50,300 | $3,500 | $10,700 | $8,400 |

Strategic Advisers Fidelity Emerging Markets Fund | $26,700 | $2,200 | $6,700 | $5,200 |

Strategic Advisers Fidelity U.S. Total Stock Fund | $39,800 | $3,100 | $14,600 | $7,400 |

Strategic Advisers Large Cap Fund | $42,200 | $3,300 | $14,700 | $7,900 |

Strategic Advisers Municipal Bond Fund | $73,000 | $3,500 | $6,600 | $8,500 |

Strategic Advisers Short Duration Fund | $38,800 | $3,000 | $7,900 | $7,300 |

Strategic Advisers Tax-Sensitive Short Duration Fund | $39,400 | $3,000 | $6,700 | $7,200 |

|

|

|

|

|

A Amounts may reflect rounding.

B Strategic Advisers Alternatives Fund commenced operations on July 12, 2022.

The following table(s) present(s) fees billed by PwC that were required to be approved by the Audit Committee for services that relate directly to the operations and financial reporting of the Fund(s) and that are rendered on behalf of Strategic Advisers, LLC (“Strategic Advisers”) and entities controlling, controlled by, or under common control with Strategic Advisers (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) that provide ongoing services to the Fund(s) (“Fund Service Providers”):

Services Billed by PwC

| | |

| May 31, 2024A | May 31, 2023A,B |

Audit-Related Fees | $9,367,800 | $8,604,200 |

Tax Fees | $61,000 | $1,000 |

All Other Fees | $- | $- |

A Amounts may reflect rounding

B May include amounts billed prior to the Strategic Advisers Alternatives Fund’s commencement of operations.

“Audit-Related Fees” represent fees billed for assurance and related services that are reasonably related to the performance of the fund audit or the review of the fund's financial statements and that are not reported under Audit Fees.

“Tax Fees” represent fees billed for tax compliance, tax advice or tax planning that relate directly to the operations and financial reporting of the fund.

“All Other Fees” represent fees billed for services provided to the fund or Fund Service Provider, a significant portion of which are assurance related, that relate directly to the operations and financial reporting of the fund, excluding those services that are reported under Audit Fees, Audit-Related Fees or Tax Fees.

Assurance services must be performed by an independent public accountant.

* * *

The aggregate non-audit fees billed by PwC for services rendered to the Fund(s), Strategic Advisers (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any Fund Service Provider for each of the last two fiscal years of the Fund(s) are as follows:

| | |

Billed By | May 31, 2024A | May 31, 2023A,B |

PwC | $15,028,000 | $14,224,800 |

|

|

|

A Amounts may reflect rounding

B May include amounts billed prior to the Strategic Advisers Alternatives Fund’s commencement of operations.

The trust's Audit Committee has considered non-audit services that were not pre-approved that were provided by PwC to Fund Service Providers to be compatible with maintaining the independence of PwC in its(their) audit of the Fund(s), taking into account representations from PwC, in accordance with Public Company Accounting Oversight Board rules, regarding its independence from the Fund(s) and its(their) related entities and Strategic Advisers’ review of the appropriateness and permissibility under

applicable law of such non-audit services prior to their provision to the Fund(s) Service Providers.

Audit Committee Pre-Approval Policies and Procedures

The trust’s Audit Committee must pre-approve all audit and non-audit services provided by a fund’s independent registered public accounting firm relating to the operations or financial reporting of the fund. Prior to the commencement of any audit or non-audit services to a fund, the Audit Committee reviews the services to determine whether they are appropriate and permissible under applicable law.

The Audit Committee has adopted policies and procedures to, among other purposes, provide a framework for the Committee’s consideration of non-audit services by the audit firms that audit the Fidelity funds. The policies and procedures require that any non-audit service provided by a fund audit firm to a Fidelity fund and any non-audit service provided by a fund auditor to a Fund Service Provider that relates directly to the operations and financial reporting of a Fidelity fund (“Covered Service”) are subject to approval by the Audit Committee before such service is provided.

All Covered Services must be approved in advance of provision of the service either: (i) by formal resolution of the Audit Committee, or (ii) by oral or written approval of the service by the Chair of the Audit Committee (or if the Chair is unavailable, such other member of the Audit Committee as may be designated by the Chair to act in the Chair’s absence). The approval contemplated by (ii) above is permitted where the Treasurer determines that action on such an engagement is necessary before the next meeting of the Audit Committee.

Non-audit services provided by a fund audit firm to a Fund Service Provider that do not relate directly to the operations and financial reporting of a Fidelity fund are reported to the Audit Committee periodically.

Non-Audit Services Approved Pursuant to Rule 2-01(c)(7)(i)(C) and (ii) of Regulation S-X (“De Minimis Exception”)

There were no non-audit services approved or required to be approved by the Audit Committee pursuant to the De Minimis Exception during the Fund’s(s’) last two fiscal years relating to services provided to (i) the Fund(s) or (ii) any Fund Service Provider that relate directly to the operations and financial reporting of the Fund(s).

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable.

Item 7.

Financial Statements and Financial Highlights for Open-End Management Investment Companies

Strategic Advisers® Tax-Sensitive Short Duration Fund

Offered exclusively to certain managed account clients of Strategic Advisers LLC or its affiliates - not available for sale to the general public

Annual Report

May 31, 2024

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-3455 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2024 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Item 7: Financial Statements and Financial Highlights for Open-End Management Investment Companies (Annual Report)

Strategic Advisers® Tax-Sensitive Short Duration Fund

Schedule of Investments May 31, 2024

Showing Percentage of Net Assets

| Municipal Bonds - 61.6% |

| | | Principal Amount (a) | Value ($) |

| Alabama - 2.1% | | | |

| Birmingham Arpt. Auth. Series 2020: | | | |

| 5% 7/1/24 (Build America Mutual Assurance Insured) | | 325,000 | 325,243 |

| 5% 7/1/25 (Build America Mutual Assurance Insured) | | 325,000 | 329,851 |

| Black Belt Energy Gas District: | | | |

| (Proj. No. 6) Series 2021 B, 4% 12/1/24 | | 1,250,000 | 1,248,419 |

| (Proj. No.7) Series 2021 C1: | | | |

4% 12/1/24 | | 3,000,000 | 2,996,207 |

4% 12/1/25 | | 4,000,000 | 3,993,440 |

| Bonds: | | | |

(Proj. No.7): | | | |

Series 2021 C1, 4%, tender 12/1/26 (b) | | 11,350,000 | 11,326,862 |

Series 2021 C2, SIFMA Municipal Swap Index + 0.350% 3.71%, tender 12/1/26 (b)(c) | | 2,350,000 | 2,296,624 |

Series 2019 A, 4%, tender 12/1/25 (b) | | 3,050,000 | 3,047,083 |

Series 2022 D2, U.S. Secured Overnight Fin. Rate (SOFR) Index + 1.400% 4.971%, tender 6/1/27 (b)(c) | | 5,000,000 | 5,024,401 |

Series 2022 E, 5%, tender 6/1/28 (b) | | 2,370,000 | 2,460,688 |

Series 2023 D1, 5.5%, tender 2/1/29 (b) | | 1,000,000 | 1,055,283 |

| Series 2022 C, 5.25% 6/1/24 | | 735,000 | 735,009 |

| Series 2022 C1: | | | |

5.25% 12/1/24 | | 2,025,000 | 2,032,528 |

5.25% 6/1/25 | | 695,000 | 700,750 |

5.25% 12/1/25 | | 1,125,000 | 1,139,427 |

5.25% 6/1/26 | | 575,000 | 584,038 |

| Series 2022 E: | | | |

5% 6/1/24 | | 1,790,000 | 1,790,024 |

5% 6/1/25 | | 825,000 | 830,319 |

5% 6/1/26 | | 1,140,000 | 1,153,619 |

| Series 2023 A: | | | |

5% 10/1/24 | | 2,075,000 | 2,079,002 |

5% 10/1/25 | | 2,125,000 | 2,148,906 |

| Series 2023 C, 5.5% 6/1/27 | | 685,000 | 706,307 |

| Health Care Auth. for Baptist Health Series 2023 A: | | | |

| 5% 11/15/24 | | 1,385,000 | 1,389,480 |

| 5% 11/15/25 | | 1,290,000 | 1,306,551 |

| Infirmary Health Systems Spl. Care Facilities Fing. Auth. Rev. Series 2016 A, 5% 2/1/26 | | 500,000 | 505,358 |

| Jefferson County Swr. Rev. Series 2024: | | | |

| 5% 10/1/24 | | 165,000 | 165,487 |

| 5% 10/1/25 | | 740,000 | 751,037 |

| 5% 10/1/26 | | 445,000 | 457,212 |

| 5% 10/1/27 | | 410,000 | 426,757 |

| Mobile County Board of School Commissioners Series 2016 A, 5% 3/1/25 | | 100,000 | 100,877 |

| Mobile Indl. Dev. Board Poll. Cont. Rev. Bonds: | | | |

| (Alabama Pwr. Co. Barry Plant Proj.): | | | |

Series 2007 C, 3.78%, tender 6/16/26 (b) | | 740,000 | 737,685 |

Series 2008, 3.65%, tender 1/10/25 (b) | | 12,050,000 | 12,003,824 |

| Series 2009 E, 1%, tender 6/26/25 (b) | | 600,000 | 579,608 |

| Southeast Alabama Gas Supply District: | | | |

| (Proj. No. 1) Series 2024 A: | | | |

5% 4/1/25 | | 3,070,000 | 3,081,643 |

5% 4/1/26 | | 1,500,000 | 1,510,047 |

| Bonds (Proj. No. 2) Series 2018 A, 4%, tender 6/1/24 (b) | | 6,130,000 | 6,130,000 |

| Southeast Energy Auth. Rev.: | | | |

| (Proj. No. 2) Series 2021 B1: | | | |

4% 6/1/24 | | 1,090,000 | 1,089,973 |

4% 6/1/25 | | 300,000 | 298,670 |

| (Proj. NO. 5) Series 2023 A: | | | |

5% 7/1/24 | | 350,000 | 350,145 |

5% 7/1/25 | | 650,000 | 654,895 |

5% 7/1/27 | | 1,185,000 | 1,205,337 |

5.25% 7/1/28 | | 1,945,000 | 2,003,834 |

| Univ. of South Alabama Univ. Rev. Series 2021, 4% 4/1/26 | | 500,000 | 501,301 |

TOTAL ALABAMA | | | 83,253,751 |

| Alaska - 0.3% | | | |

| Alaska Gen. Oblig. Series 2015 B, 5% 8/1/24 | | 1,090,000 | 1,091,801 |

| Alaska Hsg. Fin. Corp. Series 2021 A, 3% 6/1/24 | | 400,000 | 399,981 |

| Alaska Hsg. Fin. Corp. Mtg. Rev. Series 2022 A, 3% 6/1/51 | | 455,000 | 434,137 |

| Alaska Int'l. Arpts. Revs. Series 2021 C: | | | |

| 5% 10/1/25 (d) | | 1,980,000 | 2,006,401 |

| 5% 10/1/28 (d) | | 1,000,000 | 1,043,807 |

| Alaska Muni. Bond Bank Series 2023 TWO: | | | |

| 5% 12/1/24 (d) | | 460,000 | 461,122 |

| 5% 12/1/25 (d) | | 485,000 | 489,733 |

| 5% 12/1/26 (d) | | 510,000 | 519,518 |

| Northern Tobacco Securitization Corp. Tobacco Settlement Rev. Series 2021 A: | | | |

| 5% 6/1/24 | | 1,500,000 | 1,500,018 |

| 5% 6/1/25 | | 2,415,000 | 2,436,901 |

| 5% 6/1/26 | | 1,000,000 | 1,019,947 |

TOTAL ALASKA | | | 11,403,366 |

| Arizona - 3.2% | | | |

| Arizona Health Facilities Auth. Rev.: | | | |

| (Scottsdale Lincoln Hospitals Proj.) Series 2014 A: | | | |

5% 12/1/24 | | 45,000 | 45,216 |

5% 12/1/26 | | 110,000 | 110,609 |

| Bonds Series 2015 B: | | | |

0.250% x SIFMA Municipal Swap Index 3.61%, tender 11/4/26 (b)(c) | | 2,105,000 | 2,079,723 |

0.250% x SIFMA Municipal Swap Index 3.61%, tender 1/1/46 (b)(c) | | 395,000 | 395,262 |

| Arizona Indl. Dev. Auth. Hosp. Rev. Series 2020 A, 5% 2/1/26 | | 750,000 | 766,616 |

| Arizona Indl. Dev. Auth. Single F Bonds Series 2024 B, 3.75%, tender 4/1/25 (b)(e) | | 4,875,000 | 4,867,825 |

| Bullhead City Excise Taxes Series 2021 2, 0.75% 7/1/25 | | 325,000 | 309,854 |

| Chandler Indl. Dev. Auth. Indl. Dev. Rev. Bonds (Intel Corp. Proj.): | | | |

| Series 2007, 4.1%, tender 6/15/28 (b)(d) | | 570,000 | 565,280 |

| Series 2019: | | | |

4%, tender 6/1/29 (b)(d)(e) | | 4,000,000 | 3,963,967 |

5%, tender 6/3/24 (b)(d) | | 41,475,000 | 41,475,000 |

| Series 2022 2, 5%, tender 9/1/27 (b)(d) | | 11,300,000 | 11,535,466 |

| Coconino County Poll. Cont. Corp. Rev. Bonds (Navada Pwr. Co. Projs.) Series 2017 A, 4.125%, tender 3/31/26 (b)(d) | | 1,055,000 | 1,043,587 |

| Glendale Union School District 205 Series A: | | | |

| 5% 7/1/24 (Assured Guaranty Muni. Corp. Insured) | | 225,000 | 225,165 |

| 5% 7/1/25 (Assured Guaranty Muni. Corp. Insured) | | 225,000 | 228,030 |

| Maricopa County Rev. Bonds: | | | |

| Series 2019 D, 5%, tender 5/15/26 (b) | | 9,600,000 | 9,803,881 |

| Series 2023 A1, 5%, tender 5/15/26 (b) | | 6,040,000 | 6,168,275 |

| Series 2023 A2, 5%, tender 5/15/28 (b) | | 2,120,000 | 2,205,340 |

| Series C, 5%, tender 10/18/24 (b) | | 1,140,000 | 1,144,138 |

| Northern Arizona Univ. Ctfs. of Prtn. (Northern Arizona Univeristy Projs.) Series 2024: | | | |

| 5% 9/1/25 (Assured Guaranty Muni. Corp. Insured) (e) | | 860,000 | 873,641 |

| 5% 9/1/26 (Assured Guaranty Muni. Corp. Insured) (e) | | 1,540,000 | 1,582,860 |

| Phoenix Civic Impt. Board Arpt. Rev.: | | | |

| Series 2017 A, 5% 7/1/24 (d) | | 1,020,000 | 1,020,585 |

| Series 2018, 5% 7/1/24 (d) | | 400,000 | 400,230 |

| Series 2023, 5% 7/1/25 (d) | | 1,100,000 | 1,113,857 |

| Phoenix Civic Impt. Corp. Wtr. Sys. Rev. Series 2014 B, 5% 7/1/27 | | 400,000 | 400,310 |

| Phoenix Indl. Solid Waste Disp. Rev. Bonds (Republic Svc., Inc. Proj.) Series 2013, 4.05%, tender 8/1/24 (b)(d) | | 33,475,000 | 33,473,460 |

| Yuma Pledged Rev. Series 2021: | | | |

| 4% 7/1/24 | | 300,000 | 299,981 |

| 4% 7/1/25 | | 505,000 | 507,046 |

TOTAL ARIZONA | | | 126,605,204 |

| Arkansas - 0.0% | | | |

| Arkansas Dev. Fin. Auth. Pub. Safety Charges (Arkansas Division of Emergency Mgmt. Proj.) Series 2020, 5% 6/1/24 | | 565,000 | 565,014 |

| California - 2.6% | | | |

| Bay Area Toll Auth. San Francisco Bay Toll Bridge Rev. Bonds: | | | |

| Series 2018 A, 2.625%, tender 4/1/26 (b) | | 290,000 | 281,754 |

| Series A, 2.95%, tender 4/1/26 (b) | | 105,000 | 102,446 |

| Series B, 2.85%, tender 4/1/25 (b) | | 90,000 | 88,985 |

| California Cmnty. Choice Fing. Auth. Clean Energy Proj. Rev. Series 2023 C, 5% 10/1/26 | | 625,000 | 626,472 |

| California Gen. Oblig.: | | | |

| Series 2017, 5% 11/1/24 | | 2,500,000 | 2,513,197 |

| Series 2018, 5% 8/1/24 | | 2,575,000 | 2,578,817 |

| California Health Facilities Fing. Auth. Rev. Bonds: | | | |

| (Providence St. Jospeh Health) Series 2016 B3, 2%, tender 10/1/25 (b) | | 1,250,000 | 1,214,454 |

| Series 2016 B2, 4%, tender 10/1/24 (b) | | 7,000,000 | 6,991,804 |

| Series 2021 A, 3%, tender 8/15/25 (b) | | 2,665,000 | 2,636,987 |

| California Hsg. Fin. Agcy. Ltd. Obl Bonds Series 2023 V, 5%, tender 11/1/26 (b) | | 5,000,000 | 5,099,493 |

| California Infrastructure and Econ. Dev. Bank Rev. Bonds: | | | |

| (Brightline West Passenger Rail Proj.) Series 2020 A, 3.95%, tender 1/30/25 (b)(d)(f) | | 3,000,000 | 2,999,990 |

| (Los Angeles County Museum of Art Proj.) Series 2021 A, 1.2%, tender 6/1/28 (b) | | 395,000 | 344,305 |

| California Muni. Fin. Auth. Solid Waste Disp. Rev. Bonds: | | | |

| (Republic Svcs., Inc. Proj.): | | | |

Series 2021 A, 4%, tender 10/1/24 (b)(d) | | 4,300,000 | 4,297,342 |

Series 2021 B, 4%, tender 7/15/24 (b)(d) | | 7,900,000 | 7,892,192 |

| (Waste Mgmt., Inc. Proj.): | | | |

Series 2017 A, 4.25%, tender 12/2/24 (b)(d) | | 8,750,000 | 8,747,422 |

Series 2020 B, 4.8%, tender 6/2/25 (b)(d) | | 5,250,000 | 5,252,769 |

Series 2020, 4.1%, tender 6/3/24 (b)(d) | | 3,890,000 | 3,890,000 |

| California Poll. Cont. Fing. Auth. Solid Waste Disp. Rev. Bonds: | | | |

| (Republic Svcs. INC. Proj.) Series 2023, 4.125%, tender 8/15/24 (b)(d)(f) | | 5,400,000 | 5,392,513 |

| (Republic Svcs., Inc. Proj.) Series 2017 A1, 4.05%, tender 7/15/24 (b)(d)(f) | | 1,000,000 | 999,943 |

| California Pub. Fin. Auth. Rev. Series 2021 A, 4% 10/15/24 | | 380,000 | 378,589 |

| California Pub. Works Board Lease Rev. Series 2014 B, 5% 10/1/25 | | 350,000 | 351,638 |

| California Statewide Cmntys. Dev. Auth. Rev. Series 2007: | | | |

| 4%, tender 7/1/40 (Assured Guaranty Muni. Corp. Insured) (b) | | 8,275,000 | 8,275,000 |

| 4%, tender 7/1/41 (Assured Guaranty Muni. Corp. Insured) (b) | | 5,525,000 | 5,525,000 |

| 5.2%, tender 7/1/40 (Assured Guaranty Muni. Corp. Insured) (b) | | 2,175,000 | 2,175,000 |

| Castaic Lake Wtr. Agcy. Ctfs. of Prtn. Series 1999, 0% 8/1/28 (AMBAC Insured) | | 225,000 | 194,582 |

| Fresno Arpt. Rev. Series 2023 A: | | | |

| 5% 7/1/24 (Build America Mutual Assurance Insured) (d) | | 250,000 | 250,078 |

| 5% 7/1/25 (Build America Mutual Assurance Insured) (d) | | 500,000 | 504,559 |

| Los Angeles County Dev. Authorities Bonds Series 2023 C, 3.75%, tender 12/1/26 (b) | | 3,000,000 | 2,962,754 |

| Los Angeles Dept. Arpt. Rev.: | | | |

| Series 2015 D, 5% 5/15/25 (d) | | 1,705,000 | 1,722,423 |

| Series 2016 B, 5% 5/15/26 (d) | | 135,000 | 137,633 |

| Series 2016, 5% 5/15/26 (d) | | 550,000 | 560,727 |

| Series 2021 A, 5% 5/15/27 (d) | | 1,300,000 | 1,337,329 |

| Series 2022 C: | | | |

5% 5/15/25 (d) | | 455,000 | 459,650 |

5% 5/15/26 (d) | | 1,205,000 | 1,228,502 |

| Series 2022 G, 5% 5/15/25 (d) | | 550,000 | 555,620 |

| Series 2023 A: | | | |

5% 5/15/25 (d) | | 255,000 | 257,606 |

5% 5/15/26 (d) | | 440,000 | 448,582 |

| Los Angeles Unified School District Ctfs. of Prtn. Series 2023 A, 5% 10/1/26 | | 3,910,000 | 4,049,024 |

| Northern California Energy Auth. Series 2024: | | | |

| 5% 8/1/25 | | 600,000 | 604,820 |

| 5% 8/1/26 | | 450,000 | 456,193 |

| Port of Oakland Rev. Series 2017, 5% 11/1/24 (d) | | 100,000 | 100,308 |

| San Diego County Reg'l. Arpt. Auth. Arpt. Rev. Series 2019 B, 5% 7/1/25 (d) | | 1,000,000 | 1,010,171 |

| San Francisco City & County Arpts. Commission Int'l. Arpt. Rev.: | | | |

| Series 2019 H, 5% 5/1/25 (d) | | 680,000 | 686,528 |

| Series 2022 A, 5% 5/1/26 (d) | | 2,000,000 | 2,042,929 |

| Series 2023 A, 5% 5/1/25 (d) | | 400,000 | 403,840 |

| Southern California Pub. Pwr. Auth. Series 2024 A, 5% 9/1/29 | | 650,000 | 674,990 |

| Southern California Pub. Pwr. Auth. Rev. Bonds Series 2020 C, 0.65%, tender 7/1/25 (b) | | 250,000 | 241,451 |

| West Contra Costa Unified School District Series 2004 C, 0% 8/1/25 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 260,000 | 248,931 |

TOTAL CALIFORNIA | | | 99,795,342 |

| Colorado - 1.5% | | | |

| Colorado Bridge Enterprise Rev. Series 2017, 4% 6/30/24 (d) | | 1,330,000 | 1,329,081 |

| Colorado Health Facilities Auth. Rev. Bonds: | | | |

| Bonds: | | | |

Series 2018 B, 5%, tender 11/20/25 (b) | | 8,060,000 | 8,176,473 |

Series 2019 B: | | | |

5%, tender 8/1/25 (b) | | 300,000 | 302,898 |

5%, tender 8/1/26 (b) | | 340,000 | 345,748 |

5%, tender 11/19/26 (b) | | 905,000 | 928,774 |

Series 2022 B, 5%, tender 8/17/26 (b) | | 2,155,000 | 2,208,980 |

Series 2023 A1, 5%, tender 11/15/28 (b) | | 3,060,000 | 3,202,542 |

| Series 2019 A, 5% 1/1/25 | | 1,205,000 | 1,213,847 |

| Series 2022 A, 5% 11/1/26 | | 400,000 | 411,243 |

| Colorado Hsg. & Fin. Auth.: | | | |

| Series 2019 F, 4.25% 11/1/49 | | 95,000 | 94,440 |

| Series 2019 H, 4.25% 11/1/49 | | 45,000 | 44,733 |

| Colorado Hsg. & Fin. Auth. Multi-family Hsg. Rev. Bonds (The Reserves at Eagle Point Proj.) Series 2024, 3.5%, tender 11/1/26 (b) | | 9,090,000 | 8,957,930 |

| Colorado Reg'l. Trans. District (Denver Transit Partners Eagle P3 Proj.) Series 2020, 5% 1/15/25 | | 650,000 | 653,048 |

| Colorado Univ. Co. Hosp. Auth. Rev. Bonds Series 2019 C, 5%, tender 11/15/24 (b) | | 300,000 | 300,083 |

| Denver City & County Arpt. Rev.: | | | |

| Series 2018 A: | | | |

5% 12/1/27 (d) | | 2,315,000 | 2,394,961 |

5% 12/1/29 (d) | | 185,000 | 192,198 |

| Series 2020 B1, 5% 11/15/24 (d) | | 6,775,000 | 6,805,114 |

| Series 2022 A: | | | |

5% 11/15/24 (d) | | 1,000,000 | 1,004,445 |

5% 11/15/25 (d) | | 1,485,000 | 1,510,805 |

| Series 2022 C, 5% 11/15/26 | | 800,000 | 829,984 |

| Series 2022 D: | | | |

5% 11/15/24 (d) | | 4,000,000 | 4,017,779 |

5.25% 11/15/26 (d) | | 775,000 | 801,550 |

| Series 2023 B, 5% 11/15/25 (d) | | 3,275,000 | 3,326,353 |

| E-470 Pub. Hwy. Auth. Rev.: | | | |

| Bonds Series 2021 B, U.S. Secured Overnight Fin. Rate (SOFR) Index + 0.350% 3.914%, tender 6/3/24 (b)(c) | | 3,250,000 | 3,246,245 |

| Series 2020 A: | | | |

5% 9/1/24 | | 450,000 | 451,188 |

5% 9/1/25 | | 300,000 | 305,237 |

| Maiker Hsg. Partners Colo Multi Bonds Series 2023, 4.5%, tender 5/1/26 (b) | | 1,175,000 | 1,175,281 |

| Univ. of Colorado Enterprise Sys. Rev. Bonds: | | | |

| Series 2019 C, 2%, tender 10/15/24 (b) | | 2,500,000 | 2,481,585 |

| Series 2021 C3A, 2%, tender 10/15/25 (b) | | 1,360,000 | 1,319,756 |

TOTAL COLORADO | | | 58,032,301 |

| Connecticut - 1.1% | | | |

| Connecticut Gen. Oblig.: | | | |

| Series 2013 A, 4.35% 3/1/25 (b) | | 510,000 | 511,659 |

| Series 2015 B, 3.375% 6/15/29 | | 150,000 | 146,925 |

| Series 2018 C, 5% 6/15/26 | | 3,125,000 | 3,218,136 |

| Series A, 4% 1/15/25 | | 3,500,000 | 3,508,195 |

| Series C, 4% 6/1/24 | | 525,000 | 525,001 |

| Connecticut Health & Edl. Facilities Auth. Rev.: | | | |

| Bonds: | | | |

Series 2010 A3, 2.95%, tender 7/1/27 (b) | | 3,140,000 | 3,065,487 |

Series 2010 A4, 1.1%, tender 2/11/25 (b) | | 5,440,000 | 5,317,268 |

Series 2014 B, 1.8%, tender 7/1/24 (b) | | 545,000 | 543,624 |

Series 2015 A, 0.375%, tender 7/12/24 (b) | | 1,525,000 | 1,516,779 |

Series 2017 B2, 3.2%, tender 7/1/26 (b) | | 2,575,000 | 2,550,070 |

Series 2017 C2, 2.8%, tender 2/3/26 (b) | | 10,400,000 | 10,179,379 |

| Series 2013 N, 5% 7/1/24 | | 100,000 | 100,103 |

| Series 2014 A, 5% 7/1/27 | | 390,000 | 390,177 |

| Series 2019 A, 5% 7/1/26 | | 260,000 | 260,009 |

| Series 2022 M, 5% 7/1/26 | | 200,000 | 203,160 |

| Series L1, 4% 7/1/25 | | 600,000 | 595,599 |

| Series N, 5% 7/1/24 | | 375,000 | 374,732 |

| Connecticut Hsg. Fin. Auth. Series 2021, 0.45% 11/15/25 | | 700,000 | 660,406 |

| Connecticut Spl. Tax Oblig. Trans. Infrastructure Rev.: | | | |

| Series 2018 B, 5% 10/1/31 | | 500,000 | 529,016 |

| Series 2022 B, 5% 7/1/24 | | 5,835,000 | 5,840,404 |

| Hartford Gen. Oblig. Series 2015 C, 5% 7/15/25 (Assured Guaranty Muni. Corp. Insured) | | 640,000 | 650,985 |

| New Haven Gen. Oblig. Series 2016 A, 5% 8/15/25 (Assured Guaranty Muni. Corp. Insured) | | 20,000 | 20,252 |

| Univ. of Connecticut Gen. Oblig. Series 2019 A, 5% 11/1/25 | | 225,000 | 229,822 |

| West Haven Gen. Oblig. Series 2021: | | | |

| 4% 9/15/24 | | 260,000 | 259,945 |

| 4% 9/15/25 | | 255,000 | 255,543 |

| 4% 9/15/26 | | 255,000 | 255,258 |

TOTAL CONNECTICUT | | | 41,707,934 |

| Delaware - 0.0% | | | |

| Delaware Econ. Dev. Auth. Rev. Bonds (Delmarva Pwr. & Lt. Co. Proj.) Series A, 1.05%, tender 7/1/25 (b) | | 565,000 | 545,564 |

| Delaware, New Jersey - 0.0% | | | |

| Delaware River & Bay Auth. Rev. Series 2022, 5% 1/1/25 | | 1,000,000 | 1,007,538 |

| District Of Columbia - 0.6% | | | |

| District of Columbia Hsg. Fin. Agcy. Multi-family Hsg. Rev. Bonds (The Clara Apts. Proj.) Series 2021, 3.75%, tender 10/1/24 (b) | | 1,500,000 | 1,498,880 |

| Metropolitan Washington DC Arpts. Auth. Sys. Rev.: | | | |

| Series 2014 A, 5% 10/1/26 (d) | | 160,000 | 160,070 |

| Series 2017 A: | | | |

5% 10/1/24 (d) | | 115,000 | 115,312 |

5% 10/1/26 (d) | | 145,000 | 148,889 |

| Series 2018 A: | | | |

5% 10/1/24 (d) | | 3,100,000 | 3,108,422 |

5% 10/1/26 (d) | | 325,000 | 333,717 |

| Series 2019 A, 5% 10/1/25 (d) | | 155,000 | 157,268 |

| Series 2020 A: | | | |

5% 10/1/24 (d) | | 6,355,000 | 6,372,265 |

5% 10/1/25 (d) | | 530,000 | 537,754 |

| Series 2021 A: | | | |

5% 10/1/24 (d) | | 8,000,000 | 8,021,734 |