UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21910

Claymore Exchange-Traded Fund Trust 2

(Exact name of registrant as specified in charter)

227 West Monroe Street, Chicago, 60606

(Address of principal executive offices) (Zip code)

Amy J. Lee

227 West Monroe Street, Chicago, 60606

(Name and address of agent for service)

Registrant's telephone number, including area code: (312) 827-0100

Date of fiscal year end: May 31

Date of reporting period: June 1, 2014 - May 31, 2015

Item 1. Reports to Stockholders.

The registrant's annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

GUGGENHEIMINVESTMENTS.COM

. . . YOUR ROAD TO THE LATEST, MOST UP-TO-DATE INFORMATION

The shareholder report you are reading right now is just the beginning of the story. Online at guggenheiminvestments.com, you will find:

| • | Daily and historical fund pricing, fund returns, portfolio holdings and characteristics, and distribution history. |

| | |

| • | Investor guides and fund fact sheets. |

| | |

| • | Regulatory documents including a prospectus and copies of shareholder reports. |

Guggenheim Funds Distributors, LLC is constantly updating and expanding shareholder information services on each Fund’s website, in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed, and the results of our efforts. It is just one more small way we are working to keep you better informed about your investment.

| Contents | |

| | |

| Dear Shareholder | 3 |

| | |

| Economic and Market Overview | 4 |

| | |

| Management Discussion of Fund Performance | 6 |

| | |

| Risks and Other Considerations | 13 |

| | |

| Performance Report and Fund Profile | 14 |

| | |

| About Shareholders’ Fund Expenses | 27 |

| | |

| Schedule of Investments | 29 |

| | |

| Statement of Assets and Liabilities | 45 |

| | |

| Statement of Operations | 47 |

| | |

| Statements of Changes in Net Assets | 49 |

| | |

| Financial Highlights | 53 |

| | |

| Notes to Financial Statements | 60 |

| | |

| Report of Independent Registered Public | |

| | |

| Accounting Firm | 67 |

| | |

| Supplemental Information | 68 |

| | |

| Approval of Advisory Agreements – Claymore | |

| | |

| Exchange-Traded Fund Trust 2 | 72 |

| | |

| Trust Information | 79 |

| | |

| About the Trust Adviser | Back Cover |

DEAR SHAREHOLDER

Guggenheim Funds Investment Advisors, LLC (the “Investment Adviser”) is pleased to present the annual shareholder report for seven of our exchange-traded funds (“ETFs” or “Funds”). This report covers performance for the 12 months ended May 31, 2015.

The Investment Adviser is part of Guggenheim Investments, which represents the investment management businesses of Guggenheim Partners, LLC (“Guggenheim”), a global diversified financial services firm.

Guggenheim Funds Distributors, LLC, the distributor of the Funds, is committed to providing investors with innovative investment solutions; as of the date of this report we offer ETFs with a wide range of domestic and global themes, as well as closed-end funds and unit investment trusts. We have built on the investment management strengths of Guggenheim Investments and worked with a diverse group of index providers to create some of the most distinctive ETFs available.

To learn more about economic and market conditions over the last year and the objective and performance of each ETF, we encourage you to read the Economic and Market Overview section of the report, which follows this letter, and the Management Discussion of Fund Performance for each ETF, which begins on page 6.

Sincerely,

Donald Cacciapaglia

President and Chief Executive Officer

Claymore Exchange-Traded Fund Trust 2

June 30, 2015

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 3 |

| ECONOMIC AND MARKET OVERVIEW | May 31, 2015 |

As of the 12 months ended May 31, 2015, the U.S. economic expansion is beginning to approach its late stages, but remains strong. Harsh winter weather caused U.S. growth to slow dramatically in the first quarter of 2015. However, the underlying fundamentals of the economy are positive and there is likely to be a bounce-back over the summer, reminiscent of the 2014 experience.

An improving labor market, rising family household formation numbers, and tight housing inventory all point to a rebound in the domestic housing market, which is key to the ongoing recovery. Lower energy prices are acting as a tax cut for the U.S. consumer. Ideally this would free up discretionary spending in other areas, of which we have seen some evidence.

Liquidity from foreign central banks and comparatively attractive U.S. yields are encouraging foreign investors to buy risk assets in the U.S., but the flip side to these global flows is more volatility both in the U.S. and overseas. The U.S. Federal Reserve (Fed) continues to be concerned about creating asset price bubbles, and appears eager to raise rates, although it will likely wait for further signs of a rebound in growth, and rising inflation. The Fed is focused on wage growth, an indicator of inflationary pressure. With recent minimum wage increases and a falling unemployment rate, wages could begin to accelerate this year. The likely timeframe for a rate hike appears to be drawing nearer, perhaps as early as September 2015. However, we expect the Fed to be cautious and to raise rates slowly, with ample time to assess the market reaction.

Oil remains a key factor in the global outlook. Despite the recent rally in prices, U.S. production continues to increase and inventory levels are extremely high. The global market is likely to remain oversupplied through the end of 2015, limiting how far prices can rise.

The economy in Europe has been strengthening on the back of European Central Bank quantitative easing and depreciation of the euro. In Japan, the impact of ongoing monetary accommodation on the economy is more muted, but the “Abenomics” is likely to continue to be supportive of the equities markets. The Chinese economy is slowing down and policymakers appear likely to continue to ease monetary policy and do whatever is necessary to maintain growth at an acceptable level in the near term.

Liquidity coming out of Europe and other parts of the world is maintaining the positive environment for U.S. risk assets. Given the subdued performance in the first quarter due to concerns over strength of the dollar and the impact on earnings, investors may be reconsidering the adage of “selling in May and going away.” The period leading up to Fed tightening historically has been good for equities and room still exists for multiples to expand, even though valuations overseas are more attractive than for U.S. stocks. Historically, credit spreads don’t widen significantly until defaults rise, and that usually does not take place until one to two years after the Fed begins to tighten monetary policy.

For the 12-month period ended May 31, 2015, the Standard & Poor’s 500 Index (the “S&P 500”) returned 11.81% (this and all other returns cited in this section are total return). Morgan Stanley Capital International (“MSCI”) Europe-Australasia-Far East (“EAFE”) Index returned -0.48% and the MSCI Emerging markets Index returned -0.01%.

In the bond market, the Barclays U.S. Aggregate Bond Index returned 3.03% for the period, while the Barclays U.S. Corporate High Yield Index returned 1.95%. The return of the Barclays 1-3 Month U.S. Treasury Bill Index was 0.02%.

| 4 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT |

Index Definitions

All indices described below are unmanaged and reflect no expenses. It is not possible to invest directly in any index.

The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities or “MBS” (agency fixed-rate and hybrid adjustable-rate mortgage, or “ARM,” pass-throughs), asset-backed securities (“ABS”), and commercial mortgage-backed securities (“CMBS”).

The Barclays U.S. Corporate High Yield Index measures the market of U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bonds.

The Barclays 1-3 Month U.S. Treasury Bill Index tracks the performance of U.S. Treasury Bills with a remaining maturity of one to three months. U.S. Treasury Bills, which are short-term loans to the U.S. government, are full-faith-and-credit obligations of the U.S. Treasury and are generally regarded as being free of any risk of default.

The MSCI China Index is a capitalization-weighted index that monitors the performance of stocks from the country of China.

The MSCI EAFE Index is a capitalization weighted measure of stock markets in Europe, Australasia and the Far East.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance of developed markets. The MSCI World Index (Net) is calculated with net dividends reinvested.

The Standard & Poor’s (“S&P 500”) Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad economy, representing all major industries and is considered a representation of U.S. stock market.

The S&P/TSX Composite Index is a capitalization-weighted index. The index is designed to measure performance of the broad Canadian economy through changes in the aggregate market value of stocks representing all major industries.

The S&P Global Timber & Forestry Index is comprised of 25 of the largest publicly traded companies engaged in the ownership, management, or the upstream supply chain of forests and timberlands. These may be forest products companies, timber REITs, paper products companies, paper packaging companies, or agricultural product companies that are engaged in the ownership, management, or the upstream supply chain of forests and timberlands.

Industry Sectors

Comments about industry sectors in these fund commentaries are based on Bloomberg industry classifications.

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 5 |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited) | May 31, 2015 |

ENY Guggenheim Canadian Energy Income ETF

Fund Overview

The Guggenheim Canadian Energy Income ETF, NYSE Arca ticker: ENY (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the S&P/TSX High Income Energy Index (the “Index”). The Index includes the constituent stocks of the S&P/TSX Composite Index that are classified as energy companies, according to the Global Industry Classification Standard (GICS), and that also meet specific yield requirements.

The Fund will invest at least 80% of its total assets in securities that comprise the Index. The Fund generally will invest in all of the stocks comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited–whether based on net asset value (“NAV”) or market price –assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2015.

On a market price basis, the Fund generated a total return of -32.40%, which included an decrease in market price over the period to $10.79 on May 31, 2015, from $16.44 on May 31, 2014. On an NAV basis, the Fund generated a total return of -32.39%, which included an decrease in NAV over the period to $10.74 on May 31, 2015, from $16.36 on May 31, 2014. At the end of the period the Fund’s shares were trading at a market price premium to NAV, which is to be expected from time to time. NAV performance data reflect fees and expenses of the Fund.

For underlying index and broad Canadian equity market comparison purposes, the Index returned -31.57% and the S&P/TSX Composite Index returned -7.76% for the 12-month period ended May 31, 2015.

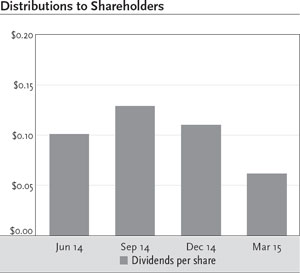

The Fund made quarterly distributions per share of $0.1010 on June 30, 2014; $0.1290 on September 30, 2014; $0.1110 on December 31, 2014; and $0.0617 on March 31, 2015, for a total distribution over the 12 months of $0.4027.

Performance Attribution

Since more than 80% of the Fund’s portfolio is invested in the energy sector, the return of this sector was the main determinant of the Fund’s return, and it was the major source of the Fund’s negative return for the 12-month period ended May 31, 2015. The Fund also has positions in the utilities sector and basic materials sectors, and those also detracted from the Fund’s return.

Positions that contributed the most to return included Encana Corp., which produces, transports, and markets natural gas, oil, and natural gas liquids(5.7% of the Fund’s long-term investments at period end); Talisman Energy, Inc., a Canadian multinational oil and gas exploration and production company (not held in the Fund’s portfolio at period end); and Enbridge, Inc., an energy delivery company that focuses on the transportation, distribution, and generation of energy, primarily in North America (5.1% of the Fund’s long-term investments at period end).

Positions that detracted the most included Canadian Oil Sands Ltd., which generates income from its 37% stake in the Syncrude Joint Venture, the largest producer of light, sweet synthetic oil from Canada’s oil sands; Cenovus Energy, Inc., an integrated oil company; and Pacific Rubiales Energy Corp., an explorer and producer of natural gas and crude oil, with operations focused in Latin America (2.8%, 4.8%, and 0.8%, respectively, of the Fund’s long-term investments at period end).

| 6 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited) continued | May 31, 2015 |

TAO Guggenheim China Real Estate ETF

Fund Overview

The Guggenheim China Real Estate ETF, NYSE Arca ticker: TAO (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the AlphaShares China Real Estate Index (the “Index”).

The Index is designed to measure and monitor the performance of the investable universe of publicly-traded companies and real estate investment trusts (“REITs”) which are open to foreign ownership and derive a majority of their revenues from real estate development, management, and/or ownership of property in China or the Special Administrative Regions of China, such as Hong Kong, and Macau. The Index was created by AlphaShares, LLC and is maintained by Standard & Poor’s.

The Fund will invest at least 90% of its total assets in common stock, American Depositary Receipts (“ADRs”), American Depositary Shares (“ADSs”), Global Depositary Receipts (“GDRs”), and International Depositary Receipts (“IDRs”) that comprise the Index and depositary receipts representing common stocks included in the Index (or underlying securities representing the ADRs, ADSs, GDRs, and IDRs included in the Index). The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2015.

On a market price basis, the Fund generated a total return of 23.28%, which included an increase in market price over the period to $24.55 on May 31, 2015, from $20.43 on May 31, 2014. On an NAV basis, the Fund generated a total return of 22.50%, which included an increase in NAV over the period to $24.50 on May 31, 2015, from $20.52 on May 31, 2014. At the end of the period the Fund’s shares were trading at a market price premium to NAV, which is to be expected from time to time. NAV performance data reflect fees and expenses of the Fund.

For underlying index and market comparison purposes, the Index returned 22.47% and the MSCI China Index, which measures performance of the Chinese equity market, returned 36.22% for the 12-month period ended May 31, 2015.

The Fund made a distribution of $0.544 on December 31, 2014, which was characterized as ordinary income.

Performance Attribution

Nearly all of the Fund’s investments are in the real estate holding and development businesses and are classified in the financial and diversified sectors. For the 12-month period ended May 31, 2015, both sectors contributed to the Fund’s return.

Positions that contributed the most to the Fund’s return included China Resources Land Ltd., which, through its subsidiaries, develops and invests in properties; China Overseas Land & Investment Ltd., a real estate investor and developer that is owned by the China State Construction Engineering Corp.; and Goldin Properties Holdings Ltd., which through its subsidiaries provides property development and investment services (4.5%, 5.4%, and 2.4%, respectively, of the Fund’s long-term investments at period end).

Positions that detracted the most from the Fund’s return included New World China Land Ltd., which, through its subsidiaries, develops and invests in properties in China; Hang Lung Group Ltd., a Hong Kong property developer and property manager; and Kaisa Group Holdings Ltd., an integrated real estate company (1.0%, 2.7%, and 0.0%, respectively, of the Fund’s long-term investments at period end).

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 7 |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited) continued | May 31, 2015 |

HAO Guggenheim China Small Cap ETF

Fund Overview

The Guggenheim China Small Cap ETF, NYSE Arca ticker: HAO (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the AlphaShares China Small Cap Index (the “Index”).

The Index is designed to measure and monitor the performance of publicly traded mainland China-based small-capitalization companies. The Index was created by AlphaShares, LLC (“AlphaShares”) and is maintained by Standard & Poor’s. For inclusion in the Index, AlphaShares defines small-capitalization companies as those companies with a maximum $1.5 billion float-adjusted market capitalization.

The Fund will invest at least 90% of its total assets in common stock, American Depositary Receipts (“ADRs”), American Depositary Shares (“ADSs”), Global Depositary Receipts (“GDRs”), and International Depositary receipts (“IDRs”) that comprise the Index and depositary receipts representing common stocks included in the Index (or underlying securities representing the ADRs, ADSs, GDRs, and IDRs included in the Index). The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2015.

On a market price basis, the Fund generated a total return of 43.07%, which included an increase in market price over the period to $34.56 on May 31, 2015, from $24.70 on May 31, 2014. On an NAV basis, the Fund generated a total return of 43.88%, which included an increase in NAV over the period to $34.78 on May 31, 2015, from $24.72 on May 31, 2014. At the end of the period the Fund’s shares were trading at a market price discount to NAV, which is to be expected from time to time. NAV performance data reflect fees and expenses of the Fund.

For underlying index and broad market comparison purposes, the Index returned 38.51% and the MSCI China Index, which measures performance of the broad Chinese equity market, returned 36.22% for the 12-month period ended May 31, 2015.

The Fund made a distribution of $0.586 on December 31, 2014, which was characterized as ordinary income.

Performance Attribution

For the 12-month period ended May 31, 2015, the industrial sector contributed the most to return, followed by the financial sector. The energy sector detracted the most from return, followed by the retail sector.

Positions that contributed the most to the Fund’s return included Hanergy Thin Film Power Group Ltd., which is engaged in the design and assembly of equipment and turnkey production lines for the production of thin-film solar photovoltaic (PV) modules (not held in the Fund’s portfolio at period end); China Everbright Ltd., which, through its subsidiaries, provides investment banking, commercial banking, corporate finance, and investment advisory services (1.4% of the Fund’s long-term investments at period end); and Shanghai Electric Group Co. Ltd. Class H, which, through its subsidiaries, designs, manufactures, sells, and services a wide range of products and services in the power equipment, electromechanical equipment, transportation equipment, and environmental system industries (1.2% of the Fund’s long-term investments at period end).

Positions that detracted the most from the Fund’s return included SouFun Holdings Ltd. ADR, which operates a real estate Internet portal in China; Anton Oilfield Services Group, which provides onshore oilfield services and products; and Shunfeng International Clean Energy Ltd., which develops, operates, and maintains solar power plants (0.6%, 0.1%, and 0.3%, respectively, of the Fund’s long-term investments at period end).

| 8 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited) continued | May 31, 2015 |

FRN Guggenheim Frontier Markets ETF

Fund Overview

The Guggenheim Frontier Markets ETF, NYSE Arca ticker: FRN (the “Fund”), prior to April 17, 2015, sought investment results that corresponded generally to the performance, before the Fund’s fees and expenses, of an equity index called the BNY Mellon New Frontier DR Index. Effective April 17, 2015, the Fund seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of the BNY Mellon New Frontier Index (the “Index”).

The Index’s methodology was changed as part of an ongoing review of partner indexes to optimize a way to access frontier markets today and going forward. The current Index provider, BNY Mellon, developed a revised version of the previous index that more accurately represents an investment in frontier markets while maintaining a focus on diversification and liquidity. The revised Index also reduces the potential for certain regions in the previous index to be over-concentrated and allows the Fund to take advantage of the greater development of local exchanges and locally traded stocks.

The Index is composed of all liquid (as defined by the criteria set forth below) American depositary receipts (“ADRs”), global depositary receipts (“GDRs”), and local securities of certain countries that are represented in the Index. As of April 17, 2015, the Index was comprised of 71 constituents. The Index tracks the performance of ADRs listed on a U.S. exchange, GDRs traded on the London Stock Exchange (“LSE”), and ordinary share classes of equity securities listed on exchanges in Frontier Market countries.

The Bank of New York Mellon, the Fund’s Index provider (“BNY Mellon” or the “Index Provider”), categorizes countries as “Frontier Market” based upon an evaluation of gross domestic product growth, per capita income growth, experienced and expected inflation rates, privatization of infrastructure, and social inequalities. These countries currently are: Argentina, Bahrain, Bangladesh, Bulgaria, Croatia, Cyprus, Jordan, Kazakhstan, Kenya, Kuwait, Latvia, Lithuania, Nigeria, Oman, Pakistan, Panama, Romania, Sri Lanka, Tunisia, Ukraine, Vietnam, and Zambia.

The universe of potential Index constituents includes all liquid ADRs, GDRs, and ordinary shares which meet certain criteria with respect to trading volume and market capitalization. As of April 17, 2015, potential Index constituents include securities with free-float market capitalizations greater than $250 million, which may include securities of all categories of market capitalizations, as defined by the Index Provider. Effective April 17, 2015, the Fund also may invest directly in other exchange-traded funds (“ETFs”) that provide exposure to securities similar to those securities in which the Fund may directly invest.

Fund Performance

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2015.

On a market price basis, the Fund generated a total return of -18.48%, which included a decrease in market price over the period to $13.33 on May 31, 2015, from $16.86 on May 31, 2014. On an NAV basis, the Fund generated a total return of -18.75%, which included a decrease in NAV over the period to $13.23 on May 31, 2015, from $16.79 on May 31, 2014. At the end of the period the Fund’s shares were trading at a market price premium to NAV, which is to be expected from time to time. NAV performance data reflect fees and expenses of the Fund.

The Index returned -16.62% and the Morgan Stanley Capital International (“MSCI”) Emerging Markets Index returned -0.01% for the 12-month period ended May 31, 2015.

The Fund made a distribution per share of $0.431 on December 31, 2014, that was characterized as ordinary income.

Performance Attribution

For the 12-month period ended May 31, 2015, the utilities sector contributed the most to the Fund’s return, followed by the industrial sector. The energy sector detracted the most from the Fund’s return, followed by the consumer, cyclical sector.

Positions that contributed the most to the Fund’s return included Commercial International Bank Egypt SAE, GDR, which offers financial services to institutions, households, and high net worth individuals (not held in the Fund’s portfolio at period end); Grupo Financiero Galicia SA, ADR, a financial services holding company in Argentina (1.8% of the Fund’s long-term investments at period end); and Banco Macro SA ADR, which attracts deposits and offers retail and commercial banking services primarily in Argentina (1.6% of the Fund’s long-term investments at period end).

Positions that detracted the most from the Fund’s return included Ecopetrol SA, ADR, a Colombian petroleum company; LATAM Airlines Group SA, ADR, an air carrier of passengers and cargo based in Chile; and Bancolombia SA, ADR Preferred, which attracts deposits and offers retail and commercial banking services in Colombia and other Latin American countries (none held in the Fund’s portfolio at period end).

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 9 |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited) continued | May 31, 2015 |

HGI Guggenheim International Multi-Asset Income ETF

Fund Overview

The Guggenheim International Multi-Asset Income ETF, NYSE Arca ticker: HGI (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an index called the Zacks International Multi-Asset Income Index (the “Index”).

The Index is comprised of approximately 150 securities selected, based on investment and other criteria, from a universe of international companies, global real estate investment trusts (“REITs”), master limited partnerships (“MLPs”), Canadian royalty trusts, and American Depositary Receipts (“ADRs”) of emerging market companies and U.S. listed closed-end funds that invest in international companies, and at all times is comprised of at least 40% non-U.S. securities. The companies in the universe are selected using a proprietary strategy developed by Zacks Investment Research, Inc.

The Fund will invest at least 90% of its total assets in securities that comprise the Index and underlying securities representing the ADRs included in the Index. The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2015.

On a market price basis, the Fund generated a total return of -7.53%, which included a decrease in market price over the period to $17.60 on May 31, 2015, from $19.74 on May 31, 2014. On an NAV basis, the Fund generated a total return of -6.64%, which included a decrease in NAV over the period to $17.65 on May 31, 2015, from $19.61 on May 31, 2014. At the end of the period the Fund’s shares were trading at a market price discount to NAV, which is to be expected from time to time. NAV performance data reflect fees and expenses of the Fund.

For underlying index and broad market comparison purposes, the Index returned -6.76% and the Morgan Stanley Capital International Europe, Australasia, and Far East (MSCI EAFE) Index, an index designed to reflect the movements of stock markets in developed countries of Europe and the Pacific Basin, returned -0.48% for the 12-month period ended May 31, 2015.

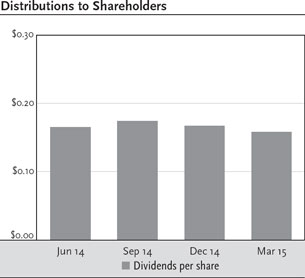

The Fund made quarterly distributions per share of $0.1650 on June 30, 2014; $0.1740 on September 30, 2014; $0.1670 on December 31, 2014; and $0.1579 on March 31, 2015, for a total distribution over the 12 months of $0.6639.

Performance Attribution

For the 12-month period ended May 31, 2015, the industrial sector contributed the most to the Fund’s return, followed by the communications sector. The energy sector detracted the most from the Fund’s return, followed by the financial sector.

Positions that contributed the most to the Fund’s return included NICE-Systems Ltd., a provider of solutions that manage and analyze multimedia content and transactional data (0.3% of the Fund’s long-term investments at period end); Casio Computer Co., Ltd., a multinational electronics manufacturing company (not held in the Fund’s portfolio at period end); and Henderson Land Development Co. Ltd., which, through its subsidiaries, develops, invests in, and manages properties (1.0% of the Fund’s long-term investments at period end).

Positions that detracted the most from the Fund’s return included Comstock Resources, Inc., an independent exploration and production company; Pacific Coast Oil Trust, which owns net profit interests in producing and non-producing oil properties onshore in the Santa Maria Basin and Los Angeles Basin in California; and Baytex Energy Corp., which explores for and produces oil and natural gas (none held in the Fund’s portfolio at period end).

| 10 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited) continued | May 31, 2015 |

SEA Guggenheim Shipping ETF

Fund Overview

The Guggenheim Shipping ETF, NYSE Arca ticker: SEA (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the Dow Jones Global Shipping IndexSM (the “Index”).

The Index is designed to measure the performance of high-dividend paying companies in the global shipping industry. CME Group Index Services, LLC (the “Index Provider”) uses a rules-based methodology to rank companies by yield that are involved in the shipping industry globally that primarily transport goods and materials. The Index Provider considers a company to be in the shipping industry if its revenues are derived primarily from shipping activities (excluding companies solely involved in transporting passengers). The Index Provider determines whether a company is “high-dividend paying” by ranking it relative to other companies in the shipping industry based upon indicated annual yield (most recent distribution annualized and divided by the current share price). The companies in the Index may be located in any country, including those classified as emerging markets.

The Fund will at all times invest at least 90% of its total assets in common stock, American Depositary Receipts (“ADRs”), Global Depositary Receipts (“GDRs”), and master limited partnerships (“MLPs”) that comprise the Index and the underlying stocks of the ADRs and GDRs in the Index. The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2015.

On a market price basis, the Fund generated a total return of -10.78%, which included a decrease in market price over the period to $19.55 on May 31, 2015, from $22.69 on May 31, 2014. On an NAV basis, the Fund generated a total return of -10.52%, which included a decrease in NAV over the period to $19.60 on May 31, 2015, from $22.68 on May 31, 2014. At the end of the period the Fund’s shares were trading at a market price discount to NAV, which is to be expected from time to time. NAV performance data reflect fees and expenses of the Fund.

For underlying index and broad market comparison purposes, the Index returned -10.87% and the MSCI World Index, an index designed to measure the equity market performance of developed markets, returned 5.70% for the 12-month period ended May 31, 2015.

The Fund made quarterly distributions per share of $0.258 on June 30, 2014; $0.154 on September 30, 2014; $0.185 on December 31, 2014; and $0.1199 on March 31, 2015, for a total distribution over the 12 months of $0.7169.

Performance Attribution

Most of the Fund’s portfolio is invested in the industrial sector, and it was the largest detractor from return. The financial sector was a contributor to return.

Positions that contributed most to the Fund’s return included Matson, Inc., which provides shipping services Pacific-wide, mainly to and from the Hawaiian islands; Nordic American Tankers Ltd., a shipping company that owns and charters Suezmax tankers for oil transportation; and Teekay Tankers Ltd. Class A, which provides transportation services through a fleet of crude oil tankers (3.8%, 3.6%, and 2.9%, respectively, of the Fund’s long-term investments at period end).

Positions that detracted the most from the Fund’s return included AP Moller-Maersk A/S Class B, a conglomerate with diversified holdings, including a shipping fleet, industrial and supermarket businesses, and oil and gas exploration and distribution businesses; Golden Ocean Group Ltd., which operates as an international dry bulk shipping company based in Bermuda; and Navios Maritime Holdings, Inc., which offers maritime freight transportation services (16.7%, 4.3%, and 1.9%, respectively, of the Fund’s long-term investments at period end).

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 11 |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited) continued | May 31, 2015 |

CUT Guggenheim Timber ETF

Fund Overview

The Guggenheim Timber ETF, NYSE Arca ticker: CUT (the “Fund”) seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the Beacon Global Timber Index (the “Index”).

All securities in the Index are selected from the universe of global timber companies. Beacon Indexes, LLC (“Beacon” or the “Index Provider”) defines global timber companies as firms which own or lease forested land and harvest the timber from such forested land for commercial use and sale of wood-based products, including lumber, pulp, or other processed or finished goods such as paper and packaging.

The Fund will invest at least 90% of its total assets in common stock, American Depositary Receipts (“ADRs”), and Global Depositary Receipts (“GDRs”) that comprise the Index and depositary receipts representing common stocks included in the Index (or underlying securities representing the ADRs and GDRs included in the Index). The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2015.

On a market price basis, the Fund generated a total return of 6.60%, which included an increase in market price over the period to $26.26 on May 31, 2015, from $25.33 on May 31, 2014. On an NAV basis, the Fund generated a total return of 6.50%, which included an increase in NAV over the period to $26.28 on May 31, 2015, from $25.37 on May 31, 2014. At the end of the period the Fund’s shares were trading at a market price discount to NAV, which is to be expected from time to time. NAV performance data reflect fees and expenses of the Fund.

For underlying index and broad world market comparison purposes, the Index returned 7.40%; the S&P Global Timber and Forestry Index returned 6.62%; and the MSCI World Index, an index designed to measure the equity market performance of developed markets, returned 5.70% for the 12-month period ended May 31, 2015.

The Fund made a distribution per share of $0.685 on December 31, 2014, that was characterized as ordinary income.

Performance Attribution

Approximately 69% of the Fund’s portfolio is invested in the basic materials sector, and it was the major contributor to the Fund’s positive return for the 12-month period ended May 31, 2015. The Fund also has positions in the financial and industrial sectors, but they detracted from return for the period.

Positions that contributed the most to the Fund’s return included Fibria Celulose SA, ADR, which, through its subsidiaries, engages in the production, sale, and export of short fiber pulp; Suzano Papel e Celulose SA Preferred A, which produces and sells bleached eucalyptus kraft pulp and printing and writing paper; and MeadWestvaco Corp., a packaging company that provides packaging solutions to a variety of industries (5.0%, 5.3%, and 4.8%, respectively, of the Fund’s long-term investments at period end).

Positions detracting the most from the Fund’s return included Duratex SA, a publicly listed private Brazilian company involved in manufacturing wood products; Greif Class A, a manufacturer of industrial packaging systems and industrial bulk containers; and Rayonier, Inc., global forest-products company (1.8%, 2.0%, and 3.6%, respectively, of the Fund’s long-term investments at period end).

| 12 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT |

Risks and Other Considerations

The views expressed in this report reflect those of the portfolio managers and Guggenheim Investments only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also contain forward-looking statements that involve risk and uncertainty, and there is no guarantee they will come to pass.

This information does not represent an offer to sell securities of the Funds and it is not soliciting an offer to buy securities of the Funds. An investment in the various Guggenheim Investments ETFs is subject to certain risks and other considerations. Below are some general risks and considerations associated with investing in the Funds, which may cause you to lose money, including the entire principal that you invest. Please refer to the individual ETF prospectus for a more detailed discussion of the Fund-specific risks and considerations.

Equity Risk: The value of the equity securities held by the Funds may fall due to general market and economic conditions, perceptions regarding the industries in which the issuers of securities held by the Funds participate, or factors relating to specific companies in which the Funds invest.

Foreign Investment Risk: Investing in non-U.S. issuers may involve unique risks such as currency, political, and economic risk, as well as less market liquidity, generally greater market volatility and less complete financial information than for U.S. issuers.

Small- and Medium-Sized Company Risk: Investing in securities of these companies involves greater risk as their stocks may be more volatile and less liquid than investing in more established companies. These stocks may have returns that vary, sometimes significantly, from the overall stock market.

Non-Correlation Risk: The Funds’ return may not match the return of the Index including, but not limited to, operating expenses and costs in buying and selling securities to reflect changes in the Index. The Funds may not be fully invested at times. If the Funds utilize a sampling approach or futures or other derivative positions, their return may not correlate with the Index return, as would be the case if they purchased all of the stocks with the same weightings as the Index.

Passive Management Risk: The Funds are not “actively” managed. Therefore, they would not necessarily sell a stock because the stock’s issuer was in financial trouble unless that stock is removed from the Index.

Issuer-Specific Changes: The value of an individual security or particular type of security can be more volatile than the market as a whole and can perform differently from the value of the market as a whole. The value of securities of smaller issuers can be more volatile than that of larger issuers.

Industry Risk: If its Index is comprised of issuers in a particular industry or sector, a Fund would therefore be focused in that industry or sector. Accordingly, that Fund may be subject to more risks than if it were broadly diversified over numerous industries and sectors of the economy.

Non-Diversified Fund Risk: Certain Funds are considered non-diversified and can invest a greater portion of assets in securities of individual issuers than a diversified fund. As a result, changes in the market value of a single investment could cause greater fluctuations in share price than would occur in a diversified fund.

Emerging Markets Risk (CUT, FRN, HGI, TAO, HAO and SEA): Investment in securities of issuers based in developing or “emerging markets” countries entails all of the risks of investing in securities of non-U.S. issuers, as previously described, but to a heightened degree.

Canadian Risk (ENY and HGI): Investing in Canadian royalty trusts and stocks listed on the TSX are subject to: Commodity Exposure Risk, Reliance on Exports Risk, U.S. Economic Risk and Structural Risk (Political Risk).

Master Limited Partnership (MLP) Risk (FRN, SEA and HGI): Investments in securities of MLPs involve risks that differ from an investment in common stock. Holders of the units of MLPs have more limited control and limited rights to vote on matters affecting the partnership. There are also certain tax risks associated with an investment in units of MLPs.

China Investment Risk (HAO and TAO): Investing in securities of Chinese companies involves additional risks, including, but not limited to: the economy of China differs, often unfavorably, from the U.S. economy in such respects as structure, general development, government involvement, wealth distribution, rate of inflation, growth rate, allocation of resources and capital reinvestment, among others; the central government has historically exercised substantial control over virtually every sector of the Chinese economy through administrative regulation and/or state ownership; and actions of the Chinese central and local government authorities continue to have a substantial effect on economic conditions in China.

REIT Risk (HGI and TAO): Investments in securities of real estate companies involve risks. These risks include, among others, adverse changes in national, state or local real estate conditions; obsolescence of properties; changes in the availability, cost and terms of mortgage funds; and the impact of changes in environmental laws.

Risks of Investing In Other Investment Companies (HGI): Investments in securities of other investment companies involve risks, including, among others, the fact that shares of other investment companies are subject to the management fees and other expenses of those companies, and the purchase of shares of some investment companies (in the case of closed-end investment companies) may sometimes require the payment of substantial premiums above the value of such companies’ portfolio securities or net asset values.

Risks of Investing in Frontier Securities (FRN): Investment in securities in emerging markets countries involves risks not associated with investments in securities in developed countries, including risks associated with expropriation and/or nationalization, political or social instability, armed conflict, the impact on the economy as a result of civil war, religious or ethnic unrest and the withdrawal or non-renewal of any license enabling the Fund to trade in securities of a particular country, confiscatory taxation, restrictions on transfers of assets, lack of uniform accounting, auditing and financial reporting standards, less publicly available financial and other information, diplomatic development which could affect U.S. investments in those countries and potential difficulties in enforcing contractual obligations. Frontier countries generally have smaller economies or less developed capital markets than traditional emerging markets, and, as a result, the risk of investing in emerging markets countries are magnified in frontier countries. As of the date of this report, a significant percentage of the BNY Mellon New Frontier Index is comprised of securities of companies from Chile, Columbia and Argentina. To the extent that the Index is focused on securities of any one country, including Chile, Columbia or Argentina, the value of the Index will be especially affected by adverse developments in such country, including the risks described above.

Securities Lending Risk: Although each Fund will receive collateral in connection with all loans of its securities holdings, the Funds would be exposed to a risk of loss should a borrower default on its obligation to return the borrowed securities (e.g., the loaned securities may have appreciated beyond the value of the collateral held by the Fund). In addition, the Funds will bear the risk of loss of any cash collateral that they invest.

In addition to the risks described, there are certain other risks related to investing in the Funds. These risks are described further in each Fund’s Prospectus and Statement of Additional Information and at guggenheiminvestments.com/etf.

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 13 |

| PERFORMANCE REPORT AND FUND PROFILE (Unaudited) | May 31, 2015 |

ENY Guggenheim Canadian Energy Income ETF

| Fund Statistics | | | |

| Share Price | | $ | 10.79 |

| Net Asset Value | | $ | 10.74 |

| Premium to NAV | | | 0.47% |

| Net Assets ($000) | | $ | 42,082 |

| AVERAGE ANNUAL TOTAL RETURNS FOR THE |

| YEAR ENDED MAY 31, 2015 |

| | | | | | | | | | | | | Since |

| | | | One | | Three | | Five | | Inception |

| | | | Year | | Year | | Year | | (07/03/07) |

| Guggenheim Canadian | | | | | | | | | | | | | |

| Energy Income ETF | | | | | | | | | | | | | |

| NAV | | | -32.39 | % | | -7.51 | % | | -5.46 | % | | -6.79 | % |

| Market | | | -32.40 | % | | -7.16 | % | | -5.35 | % | | -6.74 | % |

| Sustainable Canadian | | | | | | | | | | | | | |

| Energy Income | | | | | | | | | | | | | |

| Index S&P/TSX/ | | | | | | | | | | | | | |

| Canadian High | | | | | | | | | | | | | |

| Income Energy | | | | | | | | | | | | | |

Index1 | | | -31.57 | % | | -7.32 | % | | -5.11 | % | | -5.69 | % |

| S&P/TSX Composite | | | | | | | | | | | | | |

| Index | | | -7.76 | % | | 5.81 | % | | 4.35 | % | | 1.71 | % |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. NAV performance data reflects fees and expenses of the Fund. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit guggenheiminvestments.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $25.05 per share for share price returns or initial net asset value (NAV) of $25.05 per share for NAV returns. Returns for periods of less than one year are not annualized.

The S&P/TSX Composite is the headline index for the Canadian equity market. It is the broadest in the S&P/TSX family and is the basis for multiple sub-indices. The referenced indicies are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees or expenses.

Per the most recent prospectus, the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.80%. In the Financial Highlights section of this Annual Report, the Fund’s annualized net operating expense ratio was 0.70% while the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.79%. There is a contractual fee waiver currently in place for this Fund through December 31, 2017 to the extent necessary in keeping the Fund’s operating expense ratio from exceeding 0.65% of average net assets per year. Some expenses fall outside of this expense cap and actual expenses may be higher than 0.65%. Without this expense cap, actual returns would be lower.

| Holdings Diversification | |

| (Market Exposure as % of Net Assets) | |

| Investments | % of Net Assets |

| Energy | 92.0% |

| Basic Materials | 4.0% |

| Utilities | 3.7% |

| Total Common Stocks | 99.7% |

| Investments of Collateral for Securities Loaned | 38.4% |

| Total Investments | 138.1% |

| Other Assets & Liabilities, net | -38.1% |

| Net Assets | 100.0% |

| | |

| Ten Largest Holdings | |

| (% of Total Net Assets) | |

| Encana Corp. | 5.7% |

| Canadian Natural Resources Ltd. | 5.3% |

| Suncor Energy, Inc. | 5.1% |

| Inter Pipeline Ltd. | 5.1% |

| TransCanada Corp. | 5.1% |

| Enbridge, Inc. | 5.1% |

| Crescent Point Energy Corp. | 5.0% |

| Pembina Pipeline Corp. | 5.0% |

| Cenovus Energy, Inc. | 4.8% |

| ARC Resources Ltd. | 4.1% |

| Top Ten Total | 50.3% |

“Ten Largest Holdings” exclude any temporary cash investments.

| 1 | Benchmark returns reflect the blended return of the Sustainable Canadian Energy Income Index from 7/3/07-7/31/13 and the return of the S&P/TSX Canadian High Income Energy Index, net of foreign withholding taxes, from 8/1/13-5/31/15. |

| 14 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT |

| PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued | May 31, 2015 |

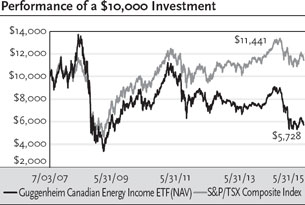

ENY Guggenheim Canadian Energy Income ETF

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the Standard and Poor’s Toronto Stock Exchange Composite Index (S&P/TSX Composite Index). Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The S&P/TSX Composite Index is a capitalization-weighted index. The index is designed to measure performance of the broad Canadian economy through changes in the aggregate market value of stocks representing all major industries. It is not possible to invest directly in the S&P/TSX Composite Index. Investment return and principal value will fluctuate with changes in market conditions and other factors and Fund shares, when redeemed, may be worth more or less than their original investment.

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 15 |

| PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued | May 31, 2015 |

TAO Guggenheim China Real Estate ETF

| Fund Statistics | | | |

| Share Price | | $ | 24.55 |

| Net Asset Value | | $ | 24.50 |

| Premium to NAV | | | 0.20% |

| Net Assets ($000) | | $ | 34,548 |

| AVERAGE ANNUAL TOTAL RETURNS FOR THE | |

| PERIOD ENDED MAY 31, 2015 | |

| | | | | | | | | | | | | Since |

| | | | One | | Three | | Five | | Inception |

| | | | Year | | Year | | Year | | (12/18/07) |

| Guggenheim China | | | | | | | | | | | | | |

| Real Estate ETF | | | | | | | | | | | | | |

| NAV | | | 22.50 | % | | 16.45 | % | | 10.97 | % | | 2.77 | % |

| Market | | | 23.28 | % | | 16.47 | % | | 11.19 | % | | 2.78 | % |

| AlphaShares China | | | | | | | | | | | | | |

| Real Estate | | | | | | | | | | | | | |

| Index | | | 22.47 | % | | 16.92 | % | | 11.50 | % | | 3.49 | % |

| MSCI China | | | | | | | | | | | | | |

| Index | | | 36.22 | % | | 17.90 | % | | 8.96 | % | | 2.51 | % |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. NAV performance data reflects fees and expenses of the Fund. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit guggenheiminvestments.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $23.50 per share for share price returns or initial net asset value (NAV) of $23.50 per share for NAV returns. Returns for periods of less than one year are not annualized.

The MSCI China Index is a capitalization-weighted index that measures the performance of large- and mid-cap securities in the Chinese equity markets and includes representation across China H shares, B shares, Red chips and P chips. The referenced index is unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees or expenses.

Per the most recent prospectus, the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.95%. In the Financial Highlights section of the Annual Report, the Fund’s annualized net operating expense ratio was 0.70%, while the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.88%. There is a contractual fee waiver currently in place for this Fund through December 31, 2017 to the extent necessary in keeping the Fund’s operating expense ratio from exceeding 0.65% of average net assets per year. Some expenses fall outside of this expense cap and actual expenses will be higher than 0.65%. Without this expense cap, actual returns would be lower.

| Holdings Diversification | |

| (Market Exposure as % of Net Assets) | |

| Investments | % of Net Assets |

| Financial | 86.4% |

| Diversified | 13.0% |

| Total Common Stocks | 99.4% |

| Investments of Collateral for Securities Loaned | 1.3% |

| Total Investments | 100.7% |

| Other Assets & Liabilities, net | -0.7% |

| Net Assets | 100.0% |

| | |

| Ten Largest Holdings | |

| (% of Total Net Assets) | |

| China Overseas Land & Investment Ltd. | 5.3% |

| Hongkong Land Holdings Ltd. | 5.2% |

| Henderson Land Development Company Ltd. | 5.1% |

| Sun Hung Kai Properties Ltd. | 4.9% |

| Sino Land Company Ltd. | 4.5% |

| China Resources Land Ltd. | 4.5% |

| Swire Pacific Ltd. | 4.3% |

| Hang Lung Properties Ltd. | 4.2% |

| Wharf Holdings Ltd. | 4.0% |

| New World Development Company Ltd. | 4.0% |

| Top Ten Total | 46.0% |

“Ten Largest Holdings” exclude any temporary cash investments.

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the MSCI China Index. Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The MSCI China Index, a representative sample for the entire Chinese investment universe, combining A, B, H, Red Chip and P Chip share classes as well as US and Singapore-listed Chinese securities. The referenced index is unmanaged. It is not possible to invest directly in the MSCI China Index. Investment return and principal value will fluctuate with changes in market conditions and other factors and Fund shares, when redeemed, may be worth more or less than their original investment.

| 16 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT |

| PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued | May 31, 2015 |

HAO Guggenheim China Small Cap ETF

| Fund Statistics | | | |

| Share Price | | $ | 34.56 |

| Net Asset Value | | $ | 34.78 |

| Discount to NAV | | | -0.63% |

| Net Assets ($000) | | $ | 299,087 |

| AVERAGE ANNUAL TOTAL RETURNS FOR THE | |

| YEAR ENDED MAY 31, 2015 |

| | | | | | | | | | | | | Since |

| | | | One | | Three | | Five | | Inception |

| | | | Year | | Year | | Year | | (01/30/08) |

| Guggenheim China | | | | | | | | | | | | | |

| Small Cap ETF | | | | | | | | | | | | | |

| NAV | | | 43.88 | % | | 22.59 | % | | 9.53 | % | | 6.58 | % |

| Market | | | 43.07 | % | | 22.23 | % | | 9.51 | % | | 6.48 | % |

| AlphaShares China | | | | | | | | | | | | | |

| Small Cap | | | | | | | | | | | | | |

| Index | | | 38.51 | % | | 21.40 | % | | 9.32 | % | | 6.93 | % |

| MSCI China | | | | | | | | | | | | | |

| Index | | | 36.22 | % | | 17.90 | % | | 8.96 | % | | 4.49 | % |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. NAV performance data reflects fees and expenses of the Fund. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit guggenheiminvestments.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $24.34 per share for share price returns or initial net asset value (NAV) of $24.34 per share for NAV returns. Returns for periods of less than one year are not annualized.

The MSCI China Index, a representative sample for the entire Chinese investment universe, combining A, B, H Red Chip and P Chip share classes as well as U.S. and Singapore-listed Chinese securities. The referenced indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees or expenses.

Per the most recent prospectus, the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.84%. In the Financial Highlights section of this Annual Report, the Fund’s annualized net operating expense ratio was 0.75% while the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.83%. There is a contractual fee waiver currently in place for this Fund through December 31, 2017 to the extent necessary in keeping the Fund’s operating expense ratio from exceeding 0.70% of average net assets per year. Some expenses fall outside of this expense cap and actual expenses may be higher than 0.70%. Without this expense cap, actual returns would be lower.

| Holdings Diversification | |

| (Market Exposure as % of Net Assets) | |

| Investments | % of Net Assets |

| Industrial | 19.8% |

| Consumer, Cyclical | 17.2% |

| Financial | 17.2% |

| Consumer, Non-cyclical | 15.5% |

| Basic Materials | 8.9% |

| Communications | 6.3% |

| Technology | 4.8% |

| Other | 10.0% |

| Total Long-Term Investments | 99.7% |

| Investments of Collateral for Securities Loaned | 11.5% |

| Total Investments | 111.2% |

| Other Assets & Liabilities, net | -11.2% |

| Net Assets | 100.0% |

| Ten Largest Holdings | |

| (% of Total Net Assets) | |

| China Everbright Ltd. | 1.4% |

| Shanghai Electric Group Company Ltd. — Class H | 1.2% |

| GOME Electrical Appliances Holding Ltd. | 1.2% |

| AviChina Industry & Technology Company Ltd. — Class H | 1.2% |

| Shenzhou International Group Holdings Ltd. | 1.1% |

| Zijin Mining Group Company Ltd. — Class H | 1.0% |

| Air China Ltd. — Class H | 1.0% |

| Kingsoft Corporation Ltd. | 1.0% |

| Aluminum Corporation of China Ltd. — Class H | 0.9% |

| Zhejiang Expressway Company Ltd. — Class H | 0.9% |

| Top Ten Total | 10.9% |

“Ten Largest Holdings” exclude any temporary cash investments.

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 17 |

| PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued | May 31, 2015 |

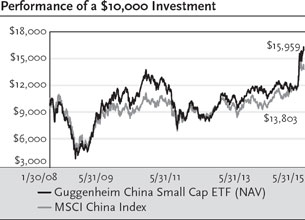

HAO Guggenheim China Small Cap ETF

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the MSCI China Index. Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The MSCI China Index is a capitalization-weighted index that monitors the performance of stocks from the country of China. The index is unmanaged. It is not possible to invest directly in the MSCI China Index. Investment return and principal value will fluctuate with changes in market conditions and other factors and Fund shares, when redeemed, may be worth more or less than their original investment.

| 18 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT |

| PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued | May 31, 2015 |

FRN Guggenheim Frontier Markets ETF

| Fund Statistics | | | |

| Share Price | | $ | 13.33 |

| Net Asset Value | | $ | 13.23 |

| Premium to NAV | | | 0.76% |

| Net Assets ($000) | | $ | 62,058 |

| AVERAGE ANNUAL TOTAL RETURNS FOR THE | |

| PERIOD ENDED MAY 31, 2015 |

| | | | | | | | | | | | | Since |

| | | | One | | Three | | Five | | Inception |

| | | | Year | | Year | | Year | | (06/12/08) |

| Guggenheim Frontier | | | | | | | | | | | | | |

| Markets ETF | | | | | | | | | | | | | |

| NAV | | | -18.75 | % | | -8.50 | % | | -3.25 | % | | -6.02 | % |

| Market | | | -18.48 | % | | -8.55 | % | | -3.68 | % | | -5.91 | % |

| BNY Mellon | | | | | | | | | | | | | |

| New Frontier | | | | | | | | | | | | | |

| Index | | | -16.62 | % | | -7.45 | % | | -2.41 | % | | -5.07 | % |

| MSCI Emerging | | | | | | | | | | | | | |

| Markets | | | | | | | | | | | | | |

| Index | | | -0.01 | % | | 5.96 | % | | 4.08 | % | | 0.68 | % |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. NAV performance data reflects fees and expenses of the Fund. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit guggenheiminvestments.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $24.34 per share for share price returns or initial net asset value (NAV) of $24.34 per share for NAV returns. Returns for periods of less than one year are not annualized.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The referenced indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees or expenses.

Per the most recent prospectus, the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.81%. In the Financial Highlights section of this Annual Report, the Fund’s annualized net operating expense ratio was 0.70% while the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.77%. There is a contractual fee waiver currently in place for this Fund through December 31, 2017 to the extent necessary in keeping the Fund’s operating expense ratio from exceeding 0.65% of average net assets per year. Some expenses fall outside of this expense cap and actual expenses may be higher than 0.65%. Without this expense cap, actual returns would be lower.

| Holdings Diversification | |

| (Market Exposure as % of Net Assets) | |

| Investments | % of Net Assets |

| Financial | 39.1% |

| Energy | 14.8% |

| Communications | 14.5% |

| Consumer, Non-cyclical | 7.9% |

| Consumer, Cyclical | 6.7% |

| Basic Materials | 4.0% |

| Other | 5.2% |

| Total Common Stocks | 92.2% |

| Exchange Traded Funds | 9.0% |

| Investments of Collateral for Securities Loaned | 11.7% |

| Total Investments | 112.9% |

| Other Assets & Liabilities, net | -12.9% |

| Net Assets | 100.0% |

| Ten Largest Holdings | |

| (% of Total Net Assets) | |

| Market Vectors Vietnam ETF | 9.0% |

| Copa Holdings S.A. — Class A | 4.8% |

| YPF S.A. ADR | 4.7% |

| Guaranty Trust Bank plc | 4.1% |

| MercadoLibre, Inc. | 4.1% |

| National Bank of Kuwait SAKP | 3.7% |

| KazMunaiGas Exploration Production JSCGDR | 3.2% |

| Oman Telecommunications Company SAOG | 3.0% |

| Safaricom Ltd. | 2.9% |

| Kuwait Finance House KSCP | 2.9% |

| Top Ten Total | 42.4% |

“Ten Largest Holdings” exclude any temporary cash investments.

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 19 |

| PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued | May 31, 2015 |

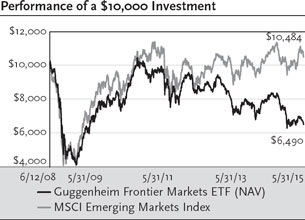

FRN Guggenheim Frontier Markets ETF

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the MSCI Emerging Markets Index. Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. It is not possible to invest directly in the MSCI Emerging Market Index. Investment return and principal value will fluctuate with changes in market conditions and other factors and Fund shares, when redeemed, may be worth more or less than their original investment.

| 20 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT |

| PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued | May 31, 2015 |

HGI Guggenheim International Multi-Asset Income ETF

| Fund Statistics | | | |

| Share Price | | $ | 17.60 |

| Net Asset Value | | $ | 17.65 |

| Discount to NAV | | | -0.28% |

| Net Assets ($000) | | $ | 26,480 |

| AVERAGE ANNUAL TOTAL RETURNS FOR THE | |

| PERIOD ENDED MAY 31, 2015 |

| | | | | | | | | | | | | Since |

| | | | One | | Three | | Five | | Inception |

| | | | Year | | Year | | Year | | (07/11/07) |

| Guggenheim | | | | | | | | | | | | | |

| International | | | | | | | | | | | | | |

| Multi-Asset | | | | | | | | | | | | | |

| Income ETF | | | | | | | | | | | | | |

| NAV | | | -6.64 | % | | 9.83 | % | | 6.34 | % | | -0.02 | % |

| Market | | | -7.53 | % | | 9.62 | % | | 6.28 | % | | -0.06 | % |

| Zacks International | | | | | | | | | | | | | |

| Multi-Asset | | | | | | | | | | | | | |

| Income Index | | | -6.76 | % | | 9.88 | % | | 6.59 | % | | 0.39 | % |

| MSCI EAFE | | | | | | | | | | | | | |

| Index | | | -0.48 | % | | 15.63 | % | | 9.95 | % | | 0.43 | % |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. NAV performance data reflects fees and expenses of the Fund. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit guggenheiminvestments.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $24.98 per share for share price returns or initial net asset value (NAV) of $24.98 per share for NAV returns. Returns for periods of less than one year are not annualized.

The Morgan Stanley Capital International (MSCI) EAFE Index measures the performance for a diverse range of global stock markets within Europe, Australasia and the Far East. The referenced indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees or expenses.

Per the most recent prospectus, the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.84%. In the Financial Highlights section of this Annual Report, the Fund’s annualized net operating expense ratio was 0.70%, while the Fund’s annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.97%. There is a contractual fee waiver currently in place for this Fund through December 31, 2017 to the extent necessary in keeping the Fund’s operating expense ratio from exceeding 0.65% of average net assets per year. Some expenses fall outside of this expense cap and actual expenses will be higher than 0.65%. Without this expense cap, actual returns would be lower.

| Holdings Diversification | |

| (Market Exposure as % of Net Assets) | |

| Investments | |

| Financial | 17.3% |

| Energy | 16.2% |

| Industrial | 11.4% |

| Consumer, Cyclical | 10.3% |

| Consumer, Non-cyclical | 9.8% |

| Communications | 8.8% |

| Basic Materials | 7.7% |

| Technology | 4.6% |

| Utilities | 3.1% |

| Diversified | 0.5% |

| Closed-End Funds | 9.9% |

| Total Long-Term Investments | 99.6% |

| Investments of Collateral for Securities Loaned | 15.7% |

| Total Investments | 115.3% |

| Other Assets & Liabilities, net | -15.3% |

| Total Net Assets | 100.0% |

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments.

| Ten Largest Holdings | |

| (% of Total Net Assets) | |

| Mobile Telesystems OJSC | 2.1% |

| Banco de Chile | 1.8% |

| Formula Systems 1985 Ltd. | 1.5% |

| Grupo Aeroportuario del Pacifico SAB de CV | 1.4% |

| Mitsui & Company Ltd. | 1.3% |

| AXA S.A. | 1.3% |

| Varitronix International Ltd. | 1.2% |

| Mitsubishi Corp. | 1.2% |

| Devon Energy Corp. | 1.2% |

| Canadian Natural Resources Ltd. | 1.2% |

| Top Ten Total | 14.2% |

“Ten Largest Holdings” exclude any temporary cash investments.

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 21 |

| PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued | May 31, 2015 |

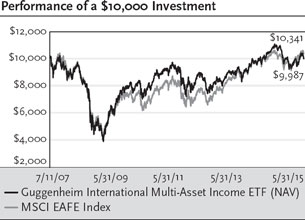

HGI Guggenheim International Multi-Asset Income ETF (continued)

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the MSCI EAFE Index. Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The Morgan Stanley Capital International EAFE Index (“MSCI EAFE Index”) measures the performance for a diverse range of global stock markets within Europe, Australasia and the Far East. The referenced indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees, or expenses.

| 22 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT |

| PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued | May 31, 2015 |

SEA Guggenheim Shipping ETF

| Fund Statistics | | | |

| Share Price | | $ | 19.55 |

| Net Asset Value | | $ | 19.60 |

| Discount to NAV | | | -0.26% |

| Net Assets ($000) | | $ | 70,577 |

| AVERAGE ANNUAL TOTAL RETURNS FOR THE | |

| PERIOD ENDED MAY 31, 2015 |

| | | | | | | | | | Since |

| | | | One | | Three | | Inception |

| | | | Year | | Year | | (06/11/10) |

| Guggenheim Shipping ETF | | | | | | | | | | |

| NAV | | | -10.52 | % | | 10.08 | % | | -2.58 | % |

| Market | | | -10.78 | % | | 10.08 | % | | -2.63 | % |

| Dow Jones Global Shipping | | | | | | | | | | |

IndexSM | | | -10.87 | % | | 9.88 | % | | N/A | |

| Delta Global Shipping Index/ | | | | | | | | | | |

| Dow Jones Global | | | | | | | | | | |

Shipping IndexSM | | | -10.87 | % | | 9.88 | % | | -2.55 | %1 |

| MSCI World Index | | | 5.70 | % | | 17.09 | % | | 12.99 | % |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. NAV performance data reflects fees and expenses of the Fund. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit guggenheiminvestments.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $25.96 per share for share price returns or initial net asset value (NAV) of $25.96 per share for NAV returns. Returns for periods of less than one year are not annualized.

The Morgan Stanley Capital International World Index (MSCI) measures performance from a diverse range of global stock markets, including the U.S., Canada, Europe, Australia, New Zealand, and the Far East. The referenced indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees or expenses.

The Fund’s annual operating ratio of 0.65% is expressed as a unitary fee and covers all expenses of the Fund, except distributions fees, if any, brokerage expenses, taxes, interest, litigation expenses and other extraordinary expenses.

| Holdings Diversification | |

| (Market Exposure as % of Net Assets) | |

| Investments | |

| Industrial | 87.4% |

| Marine Transportation | 7.1% |

| Consumer, Non-cyclical | 4.6% |

| Total Long-Term Investments | 99.1% |

| Investments of Collateral for Securities Loaned | 22.0% |

| Total Investments | 121.1% |

| Other Assets & Liabilities, net | -21.1% |

| Total Net Assets | 100.0% |

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments.

| Ten Largest Holdings | |

| (% of Total Net Assets) | |

| AP Moeller – Maersk,A/S — Class B | 16.6% |

| Nippon Yusen K.K. | 7.6% |

| COSCO Pacific Ltd. | 4.6% |

| Kawasaki Kisen Kaisha Ltd. | 4.3% |

| Teekay Corp. | 4.3% |

| Golden Ocean Group Ltd. | 4.3% |

| Sembcorp Marine Ltd. | 3.9% |

| Matson, Inc. | 3.8% |

| Teekay LNG Partners, LP | 3.8% |

| Teekay Offshore Partners, LP | 3.7% |

| Top Ten Total | 56.9% |

“Ten Largest Holdings” exclude any temporary cash investments.

| 1 | The benchmark return reflects the blended return of the Delta Global Shipping Index from 6/11/10 - 7/26/11 and the return of the Dow Jones Global Shipping IndexSM from 7/27/11 - 5/31/15. |

| CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 23 |

| PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued | May 31, 2015 |

SEA Guggenheim Shipping ETF (continued)