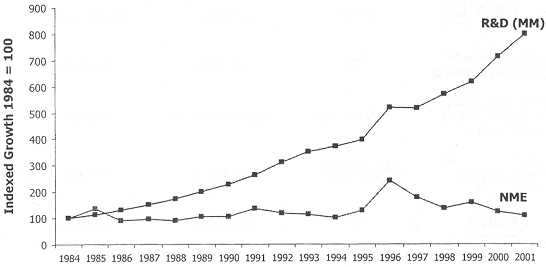

In the last 15-20 years, the pharmaceutical industry has embraced newer drug discovery technologies and focused on shortening discovery timelines in order to meet the intended goal of generating several more NCEs per year. As such, many pharmaceutical companies have discontinued their time- and resource-consuming traditional natural product programs. Instead, they have concentrated on the more high-throughput-friendly area of synthetic chemistry and combinatorial synthesis, and, in a sense, have given up on the unrivalled structural diversity available from nature.

This last drawback can be a major problem when the active compound is too complex to be easily synthesized, as often the case with natural products. With the current emphasis on developing highly efficient discovery processes and on significantly reducing discovery timelines, it is understandable, if somewhat shortsighted, to see why many pharmaceutical companies are discontinuing their in-house natural product programs. Some pharmaceutical companies, however, still maintain efforts in this area, mostly using compounds of microbial origin.

Yet despite this seeming trend away from natural products, there were, in 2001, 143 compounds of natural origin in clinical trials or that had been recently launched. Of these, natural products from plants were by far the dominant source of bioactive compounds (In table below).

Table:. Source of natural product-derived drugs recently launched or in clinical development

MH-B, being one of the only companies that can provide the widest access to natural and novel phytochemodiversity as well as guaranteed, secured and reproducible supply at all scale of bio-active phytochemicals. This is being recognized by the fact that several large pharmaceutical companies have solicited MH-B.

infections, nail deformities, and other problems. Prolonged exposure can lead to eye, skin and lung irritation, abnormal liver or kidney function, nervous system damage or reproductive problems.

With increasing awareness of harmful synthetic chemicals in cosmetics, consumers are demanding products containing safer natural ingredients. In fact, 35% of cosmetic products are plant-based, and this market segment is growing at a rate of 10% per year. For example, most products from Yves Rocher (annual sales: €2B), Pierre Fabre (cosmetics approximately €0.8B) and Clarins (€0.2B), are of plant origin. On the other hand, as one of the pioneers of chemical-based cosmetics, L’Oreal’s market position (€15B) could be considerably affected by this trend.

2- Increasing product regulation

Regulatory agencies are pressing all suppliers to better characterize biologically and chemically the active ingredients, whether of synthetic or natural origin, contained in consumer products and to ensure high levels of reproducibility. These issues remain highly problematic for plant-based products that can only be resolved with great difficulties using traditional production technologies.

3- Increasing marketing demand for new products

The average life cycle of a cosmetic product is 3-5 years, which means that the demand for new products is enormous, with development times, from discovery to commercialization, reduced to less than 12-18 months. For example, L’Oréal markets 5,000 products and, consequently, its R&D team needs to discover and develop 1,000 to 3,000 new products per year.

4- Speeding up the rate of product discovery and development

In an effort to better meet market demand and speed up the rate of product discovery, large cosmetic companies (L’Oréal, Estée Lauder, Shiseido etc.) have adopted, in recent years, modern and faster approaches to speed-up their R&D activities similar to those used in the pharmaceutical industry, for the discovery of new cosmetic ingredients. These involve molecular targets and cellular assays and HTS systems to screen natural product extracts and for extensive toxicity testing prior to human trials. Apparently, this undertaking has not meet with expected success (L’Oréal, personal communications) for the same reasons discussed in section 3.1.1 that led the pharmaceutical industry to shy away from natural product drug discovery using traditional extracts during the last 15-20 years. Therefore, there is an urgent need for companies that have adopted modern discovery technologies to access expertise and plant compound libraries that are compatible with HTS systems such as MH-B’s Phytomics bioprocesses, phytochemical library and Plant Product Discovery Platform (L’Oréal, personal communication).

5- High demand for innovation

An aging population with high levels of disposable income is an important business opportunity for the cosmetic industry. Its is always eagerly seeking novel ingredients both for current product lines and for important unmet market needs such as new anti-aging, natural coloring, skin whitening and natural conservative agents. These innovative ingredients can be crude extracts, partly purified natural products or pure compounds obtained from natural sources.

These trends underline the dynamics of discovery and commercialization in the cosmetic industry. Although the market for individual products may be limited, their large number, high turnover and the insatiable appetite for novelty as well as the demand by regulatory authorities to develop and market safer and better-characterized products represent a tremendous business opportunity. The continuous, reproducible, secured and scalable supply of natural and novel phytochemodiversity compatible with today’s product discovery technologies is a strategic issue for the cosmetic industry. In this context, MH-B is uniquely positioned and has significant competitive advantages to meet this significant and strategic demand of the cosmetic industry.

The Case of the Nutraceutical Industry

The Dietary Supplement Health & Education Act adopted in 1994 in the US has created a regulatory environment that remains difficult to enforce, especially with regards to claims of specific health benefits and prevention. Nutraceuticals and functional foods of natural origin are in great demand, especially from plants. However, discovery, development and production of new products involve mostly conventional approaches in the context of the conservative food market. For example, the flavour industry screens only limited number of compounds annually and focuses mainly on combinations and modifications of known ingredients.

Few companies, however, are developing more systematic and efficient approaches in this area. For example, Senomyx (San Diego, CA) has identified and patented (72 issued patents and 212 pending patent applications) many of the chemokine (GPCR) receptors and ion channels present on the human tongue that detect yumami (savory), sweet, bitter, salt, fat and sour tastes as well as cold and olfactory sensing. This company is a world leader in the exploitation of molecular targets, cellular assays and HTS systems, similar to those used in the pharmaceutical industry, for the discovery and development of novel nutraceuticals. Furthermore, Senomyx has developed a cost effective and efficient process for acceptance of its products by regulatory agencies that yields full approval within 12-24 months from discovery. Senomyx is currently collaborating with Cadbury-Schweppes, Campbell’s Soup Co., Coca-Cola, Kraft and Nestlé.

29

To date, Senomyx has screened 200,000 compounds, mostly synthetic chemicals, using its HTS systems. Following market trends and requests by its collaborators, Senomyx has undertaken limited natural product screening with little success mostly because of reproducibility and supply issues similar to those experienced by the pharmaceutical and cosmetic industries (sections 3.1.1 and 3.1.4).

MARKET SUPPLY FROM THE PHYTOCHEMICAL LIBRARIES

Four types of phytochemical library are commercialized for the discovery and development of new products:

| | |

| 1. | Traditional plant extracts containing 1000’s of phytochemicals (and undesirable impurities) of different polarities, from water soluble to highly lipophilic compounds, present at different concentrations; |

| | |

| 2. | Purified natural phytochemical fractions, obtained from natural extracts, of different polarities, each containing usually 2 to 50 compounds at different concentrations; |

| | |

| 3. | Purified natural phytochemicals (and semi-synthetic derivatives) obtained from separation and purification of higher yield compounds of natural extracts; and |

| | |

| 4. | MH-B’s highly purified natural and novel phytochemical fractions, obtained from cleaner cell culture extracts, of different but more focused polarities, each containing usually 2 to 30 compounds at different concentrations. |

Obviously, all plant compound libraries obtained from natural sources suffer from serious drawbacks, including lack of reproducibility and problematic access of active compounds, especially those of lowest yields. The Phytomics bioprocesses offer MH-B a significant competitive advantage in this area by successfully solving all these technological challenges.

Historically, libraries of crude plant extracts have had limited success, for obvious reasons, in drug discovery environments. Consequently, the value of traditional plant extract libraries has been relatively low. Since purified plant products are not readily available in large numbers, it is difficult to gauge the value that such a library would command, especially when coupled to the breakthrough technologies developed by MH-B. Recently, however, Amgen entered into a three-year, non-exclusive collaboration with Infinity Pharmaceuticals for access to the latter’s “natural product-like” synthetic libraries. The groundbreaking synthetic chemistry-based technologies developed by Infinity Pharmaceuticals mirrors MH-B’s pioneering technological contributions in developing actual plant product biosynthetic libraries for drug discovery. Although most of the deal’s terms were not disclosed, Amgen did make a $25 million equity investment in Infinity.

PATENTS AND INTELLECTUAL PROPERTY

The Company holds one granted US patent ( 6,069,009) with foreign counterpart (Europe, Japan, Australia, Canada and Mexico) on Phytomics Technologies. The process has since been fully integrated into the Phytomics Technologies, to accelerate the growth phase of plant cell cultures and significantly improve the yield of secondary metabolites as well as the economics and reproducibility of the overall production process.

In order to better serve its interest, the Company’s IP strategy will primarily involve aggressively pursuing the filing of patent applications resulting from its product discovery activities including

| | | |

| | • | Proper patent coverage for new plant-based products, that represent the key valuation basis of the Phytomics Technologies and of the Company, and |

| | | |

| | • | Proper process patent coverage for Phytomics bioprocesses used for the production of specific patented plant-based products. |

COMPETITION IN PLANT-BASED PRODUCT DISCOVERY

MH-B’s competitors in plant product discovery include the following.

30

1- Chemistry companies

Companies producing specialty chemicals and those specializing in combinatorial chemistry generally provide large synthetic chemical libraries for discovery programs, that are not as complex as most plant secondary metabolites. Consequently, chemistry companies are not direct competitors of MH-B. On the other hand, MH-B may sub-contract to chemistry companies industrial scale synthesis of promising simple compounds and/or semi-synthesis of promising complex phytochemicals identified through its discovery activities. Consequently, chemistry companies may become valuable partners of MH-B in optimization chemistry and/or bulk synthesis of promising compounds.

2- Companies supplying phytochemical libraries

Currently, few organizations are commercializing phytochemical libraries (In table below). These libraries are composed of crude plant extracts, purified fractions, or pure phytochemicals, with the former being incompatible with modern HTS technologies, are obtained from natural biomass. Therefore, these suppliers cannot guarantee reproducibility, fast supply and large-scale production of active complex compounds. These production issues remain key unresolved difficulties in exploiting plant compound in product discovery projects.

Table: Organizations supplying phytochemical libraries for discovery programs

| | |

Organization | | Characteristics of Phytochemical Library |

| |

|

AnalytiCon Discovery | | 10,000 pure compounds, 25% from plants |

| | |

Albany Molecular | | 170,000 purified fractions, under 10% from plants |

| | |

BioSPECS | | Approximately 2,000 purified compounds, mostly from plants |

| | |

Drug Discovery Ltd. | | Extracts prepared from ~ 9,000 plant species |

| | |

German Natural Product Pool

(Hans-Knöll-Institut) | | Approximately 4,000 purified natural products and derivatives obtained from various sources |

| | |

MerLion | | 500,000 extracts, ~ 25% of from plants |

| | |

Molecular Nature | | 4,000 purified fractions and 1,000 pure compounds obtained from plants |

| | |

National Cancer Institute | | Over 100,000 extracts from plant and marine organisms |

| | |

Sequoia | | 36,000 purified fractions from plants |

COMPETITION IN PLANT COMPOUND PRODUCTION

The competitive landscape in the area of reproducible industrial scale production of specialized complex plant products include the following players.

1- Contract manufacturing organizations (CMO)

Except for DFB Pharmaceuticals/Phytonbiotech (discussed below), all CMO are specializing in either microbial fermentation or mammalian/insect cell cultures, the latter for recombinant protein production. None of them have expertise in plant cell culture bioengineering

31

2- Plant pharming organizations

The number of players in plant pharming is impressive and competition is fierce. Asian, African and South American suppliers offer low cost raw material to American and European extraction companies, which then supply the pharmaceutical, cosmetic and nutraceutical industries with purified plant products. This traditional supply route (i.e., agriculture, harvesting & extraction) has numerous major limitations that can be overcome by industrial scale plant cell culture technologies, which include

| | |

| 1. | Secure and reproducible supply of natural biomass in sufficient quantity on a long term basis; |

| | |

| 2. | Increasing cost of the raw material; |

| | |

| 3. | Proper handling at harvesting of the natural biomass for retained yield, reproducibility and efficient processing; |

| | |

| 4. | Low product yield at processing; |

| | |

| 5. | Efficiency and cost of downstream processing operations to obtain the targeted compound at the desired purity level and in sufficient quantity to meet market demand in a timely fashion. |

This situation is further complicated if the biomass is harvested in the wild and/or when the desired compounds are extracted from plant species that are threatened, grow slowly, are only available in politically unstable areas, are not compatible with greenhouse or large scale culturing, or if harvesting results in the destruction of the plant species.

For cosmetic and nutraceutical products, purification requirements range from partly purified fractions to purified compounds, whilst for pharmaceuticals and specialty chemicals, pure compounds are required. Regulatory agencies, however, are pressuring the nutraceutical and cosmetic industries to increase the level of purification and characterization of commercial plant-based products.

3- Companies involved in industrial scale plant cell culture bioprocessing

Four companies are known to use (or to have used) industrial scale plant cell culture bioprocesses: PhytonBiotech, Inc., Mitsui Chemical, Inc., Samyang Corporation and Protalix Pharmaceuticals Ltd.

PhytonBiotech is the most advanced company in industrial plant cell culture bioprocesses. This company was founded in 1990 to produce Paclitaxel for Brystol-Myers-Squibb, its strategic partner. It succeeded in this undertaking in the late 90’s and its German subsidiary, Phyton GmbH, currently operates the world’s largest commercialcGMP manufacturing facility for the production of extracts containing Paclitaxel and other valuabletaxanes. In 2003, Phyton was acquired by DFB Pharmaceuticals, a CMO, but most of its expert personnel have left the organization.

In the mid 80’s, the Japanese giant Mitsui invested in the development of a first industrial scale plant cell-based bioprocess for the production of shikonin, an anti-inflammatory and coloring agent. This process was successfully scaled up in a 750 L bioreactor and shikonin was produced at high yields. This project, however, was discontinued for marketing reasons. In the late 80’s, Mitsui developed a second plant cell-based bioprocess for the production of ginseng extracts. The production plant was inaugurated in the early 90’s and 1995 sales of the ginseng extract reached US$ 3M. Ginseng extracts were subsequently removed from the market due to severe toxic side effects. Mitsui appears not to have pursued this business.

In the mid 90’s, the Korean company Samyang bought a taxane production technology based on cultured plant cells developed by the American company EsCagenetics. Samyang completed the development of this technology and scaled it up to industrial level for the production of Genexol™, a Paclitaxel-based product currently on the market. This company seems not to have expanded its efforts in this area.

Finally, the Israel start-up company Protalix Biopharmaceutics Ltd (formerly Metabogal, founded in 1994) is now positioning itself as a CMO for the production of recombinant proteins using plant cells cultured in a rudimentary disposable bioreactor system made of 10 L chambers with minimal monitoring and process control.

It appears from our review of the patents published by these companies as well as from personal communications with some of their key executives, that all of them use traditional approaches to plant cell cultures and bioengineering for the production of secondary metabolites. In this context, MH-B is in a good market position and significant competitive advantages in exploiting its highly efficient Phytomics bioprocesses for these business opportunities.

32

BUSINESS MODEL AND STRATEGY

MH-B’s primary business activities will focus on business development (BD). Consequently, the Company will put in place the tools and means to reach out to targeted market stakeholders. Our single most important goal is to identify profitable plant-based product opportunities to develop, as well as to connect with the best companies to partner with, for development.

To carry out its extensive BD activities, MH-B will hire an experienced BD/industrial marketing Vice-President and will develop a network of international BD consultant specialists in the three industries targeted and strategically located, mostly in US and Europe, to complement its business opportunity scouting activities. The latter will actively participate in the identification of clients/partners likely to be interested by the Company’s technologies, expertise, products and services. These consultants work on a back-loaded fee to be paid upon completion of successful transactions.

To support BD activities and identify market opportunities, the Company will create an efficient Data Mining Unit (DMU), under the direction of the VP-BD, that will identify business opportunities and provide the information to drive the Company rationale in elaborating the best-suited and most rewarding strategy for the development of our business activities. Practically, it will be based on a collection of software and procedures to monitor and mine public databases, so as to connect the Company’s technological strengths with stakeholders’ needs.

Market intelligence and public communications will generate a list of prospective partners and clients for the Company. We will adopt a pro-active approach with the market to meet as soon as possible with prospective clients/partners. Recent experience has shown this method to be very productive. Our objective is to establish profitable and value generating commercial partnerships with selected high profile companies in targeted industries.

MH-B istargeting the markets of cosmetic, nutraceutical and pharmaceutical industrial products. More specifically, companies in these markets are either searching for innovative new products of plant origin using modern product discovery technologies and/or struggling to produce efficiently complex plant products. However, they are experiencing serious problems in accessing and producing plant compounds, and currently facing important market gaps and significant unmet needs that MH-B can satisfy efficiently using its unique technologies.

MH-B’s business development activities will be driven by

| | |

| 1. | Needs and requests of prospective customers for plant-based discovery projects and/or production projects targeting promising complex plant products in development and/or already commercialized; and; |

| | |

| 2. | Innovative product concepts identified through market intelligence and DMU research to be developed internally and/or in partnerships |

COMMERCIAL ACTIVITIES

MH-B will focus on two commercial activities.

1- Discovery and development of new plant-based products

The Company exploits the natural and novel chemodiversity, that it can generate using its Phytomics Technologies. This offers the cosmetic, nutraceutical and pharmaceutical industries a new paradigm for the discovery and development of novel products of plant origin, based on its current library of > 160,000 purified phytochemical fractions fully compatible with HTS technologies, and unique expertise and Plant Product Discovery Platform. The strength of this library was shown by partial screening using 11 molecular targets and cellular assays to yield 173 biologically active molecules, of which 59 were new chemical entities. MH-B has the expertise and technologies to expand its purified phytochemical library, including for plant species of interest to partners. Chemical characterization of bioactive compounds can also be conducted in house.

Typicalpartnered product discovery and development projects will usually involve

| | |

| 1. | Selection by the partner of generic or proprietary molecular targets, cellular assays and/or of fraction library to be screened; the latter may be MH-B’s current library or specialized libraries developed by MH-B according to the partner’s requirements; |

| | |

| 2. | Screening by MH-B or the partner fractions using selected targets and assays; |

33

| | |

| 3. | Identification and short term supply of active compounds by MH-B; and |

| | |

| 4. | If the promising plant products are complex, production of pilot (for product development) and commercial quantities of products for the partner and/or final commercializing company. |

These projects will be structured as follows.

| | | |

| 1. | The partner pays |

| | | |

| | • | Licensing fees to access MH-B’s technologies and phytochemical library, |

| | | |

| | • | R&D costs based on a full FTE (Full Time Equivalent) basis that includes profits, or reduced FTE cost (with profits) in exchange for increased milestone and royalty payments to be negotiated, and |

| | | |

| | • | Pre-negotiated milestones (when attained) and royalty (at commercialization) payments. |

| | | |

| 2. | The partner obtains |

| | |

| | • | Co-ownership of product IP, and |

| | | |

| | • | Full commercialization rights with performance clauses. |

| | | |

| 3. | MH-B’s retains |

| | |

| | • | Co-ownership of product IP, and |

| | | |

| | • | Full ownership of production technologies and IP and exclusive industrial scale production rights for complex plant products (2nd commercial activity). |

for which it will retain full product and production IP ownership. Thereafter, MH-B Additionally, MH-B intends to pursue its owninternal product discovery projects will out-license to high profile partners these products for co-development and co-commercialization, which will include license fees, development revenues, milestone and royalty payments as well as exclusive production rights for complex plant products (2nd commercial activity).

In the Pharmaceutical domain, MH-B will actively seek partnered drug discovery projects. In addition, the company has unique expertise in infectious disease and has internally developed promising programs that it will pursue to appropriate levels for subsequent high value partnering with major pharmaceutical companies.

In the cosmetic and nutraceutical domains, the company has already identified a certain number of potential product discovery partnerships (section 4.4.1), one of which has already been signed, that it will pursue actively. MH-B will actively seek new opportunities in these areas. Furthermore, MH-B has identified significant new product opportunities in the cosmetic industry that it intends to pursue internally and/or in partnership.

2- Industrial-scale production of complex plant products of commercial relevance using Phytomics-based bioprocesses

The second commercial activity targets partners that are either selling, intend to conduct or are already conducting product development activities (also with MH-B), including clinical trials on complex plant products that can be obtained using traditional approaches only with great difficulties and at high costs. These products include

| | |

| A. | Partly purified extracts or highly purified phytochemical fractions poorly characterized chemically, whose compounds, or composition cannot be reproduced synthetically, whose supply, using traditional approaches, is problematic, or which contain undesirable components (color, odor, nuisance impurities etc.) difficult to remove at reasonable costs (for example the J&J project discussed in section 4.4.2); and |

| | |

| B. | Purified complex phytochemicals, that cannot be synthesized at industrial scale or produced in sufficient quantities through natural biomass extraction and purification processes, at reasonable costs (Ex.: Taxol™ & Taxotere™). |

Generally, secured, consistent and reproducible supply, in sufficient quantities, of these complex plant products, using traditional approaches, is highly problematic. Uncontrollable uncertainties of supply include political and social issues, poor agricultural and harvesting practices, rare, exotic, endangered, protected and/or slow growing plant species etc. These represent critical issues in conducting reliable product development activities and for subsequent commercialization that remain very difficult to resolve for non-specialist companies.

In the Pharmaceutical domain, MH-B will actively seek production projects. The company has finalized a contact with Pierre Fabre, a French pharmaceutical company, on April 11th 2006.

34

In the cosmetic and nutraceutical domains, the company has already identified a certain number of potential production projects, one of which is being discussed with a cosmetic and consumer multinational. MH-B will actively seek new opportunities in these areas.

A key issue in any cell-based industrial scale production remains the economics of the bioprocess. Traditional approaches to plant cell culture bioengineering have yielded limited industrial success, as underlined in Appendix A (section A.1), in focusing on single products. Still, PhytonBiotech is successful in producing taxane derivatives at industrial scale using a plant-cell based bioprocess. The Phytomics Technologies, which represent significant advances in this field, are solving the limitations previously encountered in plant-cell based bioprocessing. MH-B’s strategy in this area focuses on producing multiple plant products for various customers in the three industries targetedall using the same basic production technologies, including downstream processing operations. This offers important economies of scale in R&D and production and the opportunity for full utilization of planned production facilities that will translate into higher profit margins as well as significant risk reduction. Furthermore, MH-B’s offering of pilot and industrial scale facilities for secured and reproducible production of complex plant products represents an important marketing tool in attracting partners for high value plant product discovery projects.

Typicalproduction projects will usually three phases.Phase I. Feasibility Study involves the development of productive plant cell lines and appropriate culture and downstream processing (extraction, separation & purification) protocols for the production, at high yield and at the target quality level, of the desired product(s). A technico-economical model of this process is also developed to assess the economics of the industrial scale bioprocess. At the end of this work, the partner decides if he wants to undertake further bioprocess development depending on the expected market and production costs of the desired product(s).

DuringPhase II. Pilot Scale Production, the optimized production bioprocess, including downstream processing operations, is developed at pilot level (50 L to 300 L bioreactors; 100 g to kg of product(s)) to validate experimental results obtained at small scale, confirm bioprocess economics and define main scale up parameters. This work also involves production, by MH-B, of pilot quantities (100 g to kg) of desired product(s) at target quality level for partner’s product development activities.

Finally,Phase III. Industrial Scale Production involves the development, by MH-B, of the industrial scale bioprocess for commercial production of desired product(s) and Industrial scale production by MH-B (or subsidiary) of desired product(s) for commercialization.

These projects will be carried out in partnerships and internally, for prospective high potential products. Partnered projects and will be structured as follows.

| | | |

| 1. | The partner pays |

| | |

| | • | Licensing fees to access MH-B’s Phytomics Technologies, |

| | | |

| | • | R&D costs on areduced FTE basis (over US$190,000/FTE) that includes profits, |

| | | |

| | • | Pre-negotiated milestone payments depending on production levels attained and forecasted production costs at Phase I and II of the project, and |

| | | |

| | • | Pilot scale quantities of desired product(s) for development purposes. |

| | | |

| 2. | MH-B’s retains |

| | |

| | • | Full ownership of production technologies and IP and exclusive industrial scale production rights, |

| | | |

| | • | Co-ownership of IP generated from new products discovered during MH-B’s bioprocess development work in the partner’s specific application field, and |

| | | |

| | • | Full ownership of IP generatde from new products discovered during MH-B’s bioprocess development work in application fields other that of the partner’s. |

| | | |

| 3. | MH-B obtains |

| | |

| | • | Royalty payment on final sales of original product(s), |

| | | |

| | • | Exclusive, long term commercial production contract for original product(s) at minimum annual production level and specified and indexed selling price, |

| | | |

| | • | Milestone and royalty payments for new products discovered from MH-B’s bioprocess development work in the partner’s specific application field, |

| | | |

| | • | Exclusive, long term commercial production contract for new products, discovered from MH-B’s bioprocess development work in the partner’s specific application field, at minimum annual production level and specified and indexed selling price, and |

| | | |

| | • | New products discovered from MH-B’s bioprocess development work in application fields other that of the partner’s. |

35

PURSUING THE DEVELOPMENT OF THE PHYTOMICS AND OTHER TECHNOLOGIES

In order to maintain its state-of-the art expertise and increase its competitive advantages in industrial plant biotechnology and phytochemistry, MH-B will pursue the development of its Phytomics Technologies. Within the next 3 years and as illustrated in section 4.6, Phytomics R&D activities will be focused on

| | |

| 1. | Maintaining MH-B’s extensive collection of over 2,200 plant species in culture, which represent an immense source of natural and novel phytochemodiversity immediately available for discovery and production projects as well as a powerful tool in marketing MH-B Phytomics bioprocesses to prospective partners; |

| | |

| 2. | Developing and implementing suitable cryo-preservation protocols and systems for long term, secured conservation of MH-B’s extensive collection of plant species in culture, especially with respect to patent requirements and industrial scale production of high value plant products; |

| | |

| 3. | Pursuing the development of the basic plant cell culture bioprocess, using novel bioengineering and genetic engineering approaches applied to model and commercial biosystems in development, in order to maximize yields and productivity of targeted products; |

| | |

| 4. | Developing and optimizing downstream operations at pilot scale (10-100 g), including those directly interfacing the cell culture process, in order to improve net production yields of purified targeted products; |

| | |

| 5. | Scaling up the Phytomics Technologies from the current 50 L bioreactor to industrial size bioreactors of much larger quantities, including associated downstream processing operations, for the production of purified plant products; this investment project will be undertaken with respect to current and anticipated market demand for discovery and production projects. |

| | |

| 6. | Replenishing and expanding the company’s purified phytochemical library with respect to current and anticipated demand for discovery projects since this expensive undertaking involves long lead times. |

MH-B will also develop a generic technico-economic model that can be applied to a variety of production projects to evaluate their main economic parameters and financial viability.

Co-currently, MH-B also intends to develop cGMP extraction, formulation, encapsulation and packaging facilities that will initially be used for natural source MMH™ products being commercialized by its parent company, Millenia Hope Inc.

These activities will be financed internally and through contribution from product discovery and production projects. In due course, MH-B intends to develop its own industrial scale production facilities to meet market increasing demands.

MARKETS FOR MH-B’S TECHNOLOGIES AND PRODUCT OFFERINGS

For the Pharmaceutical Industry

Pharmaceutical products represent the largest segment of the chemical market with annual sales of US$492B in 2003. The market of plant-based drugs is estimated at more than US$40B per year. The major markets in the pharmaceutical industry are the USA, Japan, Germany, France, UK, Italy and Canada. The R&D budget of the pharmaceutical industry in the US is estimated at US$58B, representing 11.8% of sales of which 60% is spent on clinical trials.

MH-B intends to undertake drug discovery and complex phytochemical production projects for the pharmaceutical industry. The sizes of these market segments are estimated at

| | | |

| | • | Approximately US$4.6B/y for drug discovery excluding preclinical studies (assuming 8% of R&D being spent on drug discovery projects according to (5)), |

| | | |

| | • | Approximately US$47M/y for phytochemical production R&D projects (assuming 1% of R&D spending on plant-based pharmaceuticals ($4.7B) being spent for such projects), and |

| | | |

| | • | Approximately US$0.7B/y for compound sales to pharmaceutical companies (assuming that plant-derived active principles represent 7% of final plant product sales and that 25% of desired phytochemicals cannot be industrially synthesized at industrial scale). |

36

Within the next 3-5 years, MH-B’s objectives are to capture 0.2% of the drug discovery segment ($9M/y), 2% of R&D production projects ($0.9M/y) and 2% of phytochemical-based active principles ($14M/y).

For the Cosmetic Industry

The world market for cosmetics was estimated at US$211B in 2003, of which approximately 35% (US$74B) is plant-based. The R&D spending of this industry is estimated at 3% of total sales or US$6B per year. MH-B intends to undertake product discovery and complex plant-derived product production projects with the cosmetic industry. The sizes of these market segments are estimated at

| | | |

| | • | Approximately US$0.6B/y for product discovery excluding development studies (assuming 10% of R&D spending on product discovery projects), |

| | | |

| | • | Approximately US$22M/y for R&D production projects (assuming 1% of R&D spending on plant-based cosmetic products ($2.2B) being spent on such projects), and |

| | | |

| | • | Approximately US$5.9B/y for plant-based ingredient sales to cosmetic companies (assuming that plant-derived active ingredients represent 8% of final plant-based product sales (the natural origin of products is critical in this market)). |

Within the next 3-5 years, MH-B’s objectives are to capture 1% of the product discovery segment ($6M/y), 5% of R&D production projects ($1M/y) and 0.5% of plant-derived active ingredients ($29M).

Nutraceuticals and functional foods represent the fastest growing segment of the chemical industry with annual growth rates of 20% in some European countries. Global sales in this market were US$138B in 2000 and are expected to increase to US$ 500B by 2010. The largest markets are Japan followed by the US and Europe (mainly the UK, Germany and France). Plant-based products sold for US$ 18.5B in 2000, or 13.5% of this market. The World demand for nutraceutical natural and synthetic chemicals was US$8B in 2005, growing at an annual rate of 6%. The R&D spending of this industry is varies from 3% to 12% of total sales or over US$4B per year.

MH-B intends to undertake product discovery and complex plant-derived product production projects with the nutraceutical industry. The sizes of these market segments are estimated at

| | | |

| | • | Approximately US$24M/y for product discovery excluding development studies (assuming 10% of R&D spending on product discovery projects), |

| | | |

| | • | Approximately US$12M/y for R&D production projects (assuming 5% of R&D spending on plant-based nutraceutical products ($0.5B) being spent on such projects), and |

Within the next 3-5 years, MH-B’s objectives are to capture 6% of the product discovery segment ($1.5M/y), 6% of R&D production projects ($0.7M/y) and 0.2% of ingredient sales ($16M).

In summary, MH-B’s objectives are to generate US$16.5M/y and US$2.6M/y of profitable product discovery and R&D production projects, respectively, in the targeted markets with the next three years excluding milestone and royalty payments. In addition, MH-B expects that the latter projects will translate into US$59M/y profitable production contracts within the next 3-5 years depending on the availability of suitable production facilities.

37

| | | | | | |

Market

(US$/yr) | | Overall

Market Size | | Estimated R&D Spending | | MH-B Target

Market Share |

| |

| |

| |

|

Pharmaceuticals | | $492 Billion

Plant-based products:

$40 Billion (2003) | | $58 Billion (11.8%) | | |

|

1- Drug Discovery | | | | $4.6Billion

(8% of R&D) | | $9 Million (0.2%) |

|

2- R&D production projects | | | | $47Million

(1% of plant-based R&D) | | $0.9Million (2%) |

|

3- Supply of plant-derived | | | | $0.7B (7% *25% of plant-based) | | $14Million (2%) |

|

Active principle | | | | | | |

|

Cosmetics | | $211 Billion

Plant-bases:

$74Billion (2003) | | $6 Billion (3%) | | |

|

1- Product Discovery | | | | $0.6 Billion

(10% of R&D) | | $6Million (1%) |

|

2- R&D production projects | | | | $22 Million

(1% of plant-based R&D) | | $1Million (5%) |

|

3- Sales of plant-derived

ingredients | | | | $5.9 Billion

(8% of plant based) | | $29Million (0.5%) |

|

Nutraceuticals | | $8 Billion (2005) | | $240 Million (3%) | | |

|

1- Product Discovery | | | | $24Million

(10% of R&D) | | $1.5Million (6%) |

|

2- R&D production projects | | | | $12Million

(5% of R&D) | | $0.7Million (6%) |

|

3- Sales of ingredients | | | | $8Billion | | $16Million (0.2%) |

38

EMPLOYEES

As of September 5, 2006, all of our 12 employees are full time employees. The responsibilities of our employees are briefly summarized as follows:

Leonard Stella - - Chief Executive Officer and Director: reviews summarie of its day to day operations, long term strategic planning and operational coordination; head of the sales and marketing teams; handles overall coordination of all scientific testing, etc.

Jean Archambault - President & Chief Operating Officer-Director: Responsible for all day to day operations of MH-B, with support of the CDO and CTO; involved in business development activities with respect to external partners and project coordination, assists in sales and marketing effect;

Bahige Baroudy – Chief Scientific Officer - assists the COO with day to day functions, reviews all scientific data of MH-B heads up all new drug discovery efforts of both MH-B and the parent company

Robert Williams - Chief Development Officer-Director: responsible for supervision of the fulfillment of all contracts; directly involved in management of all scientific teams and projects; assists Plant Biology Group’s scientific endeavors as needed.

Dany Aubry - Chief Technical Officer-Director: responsible for direct operation and management of the application of all contracts; directly involved in management of all functional groups and projects; responsible for plant maintenance and facility expansion;

Martin Gaudette - head of the Biosynthesis and Bioprocess Engineering group; project leader for the L’Oreal Phase 1 project; assists in building maintenance..

Steve Fiset - heads the Bioprocess Scale-up group; responsible for all IT applications at MH-B; assists the Biosynthesis and Bioprocess Engineering group.

Luc Lavoie - head of the Purification group; involved in operation and maintenance of all analytical equipment.

Yvan Chapdelaine – head of the plant biology group; Project Leader for the Pierre Fabre Phase1 project; responsible for all Genetic applications at MH-B.

Chantal Paquin – controller; responsible for all Human Resources; directly involve in financial management at MH-B.

Sophie Roy – works in the Plant Biology group; responsible for maintenance of bank of cell lines.

Francois Harrison – Chemist - works in the Purification group; responsible for the extraction, separation and purification of active compounds assists in the drug discovery efforts;

In addition, we have access to additional clerical services. None of our employees belongs to a union and we believe that our relations with our employees are good. We know of no conflicts of interest between any of our officers and us. We have entered into a work contract with each employee to the exception of Mr. Leonard Stella, our CEO.

DESCRIPTION OF PROPERTY

We lease our corporate offices at 500, Cartier boulevard West, 4th floor, Laval, Quebec at a monthly rate of $50,000 per month rental, excluding office expenses, pursuant to the terms of a month-to-month lease commencing Ferbruary 9, 2006.

39

LEGAL PROCEEDINGS

We are not currently party to any material legal proceedings.

MATERIAL AGREEMENTS

On March 2, 2006, we entered into a consulting agreement with 9111-9081 Quebec Inc. for it to find suitable partners for the financing, licensing or selling of MH-B’s technologies and/or MH-B’s research programs.

We have entered into a number of employment agreements with our employees We have attached the key employment agreements of our 4 officers to the SB-2 Registration Statement as exhibits.

40

MANAGEMENT

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth information about our executive officers and directors.

| | | | | |

Name | | Age | | Position | |

| |

| |

| |

| | | | | |

Leonard Stella | | 44 | | Chief Executive Officer and Director

(Principal Financial Officer) | |

| | | | | |

Jean Archambault | | 53 | | President, Chief Operating Officer and Director | |

Bahige Baroudy | | 54 | | Chief Science Officer and Director | |

Dany Aubry | | 35 | | Chief Technical Officer and Director | |

Robert Williams | | 43 | | Senior Science Officer and Director | |

Set forth below is certain biographical information regarding our executive officers and directors:

The above listed officers and directors will serve until the next annual meeting of the shareholders or disqualification, or until their successors have been duly elected and qualified. Vacancies in the existing Board of Directors are filled by majority vote of the remaining Directors. Officers of the Company serve at the will of the Board of Directors. To our knowledge, there are no agreements or understandings for any officer or director to resign at the request of another person nor is any officer or director acting on behalf of or is to act at the direction of any other person other than in his fiduciary capacity of and for the benefit of us and at our direction.

Mr. Leonard Stella, CEO and Director

Mr. Stella has a Bachelor of Arts from McGill University, and received his Graduate Diploma in Administration from Concordia University in 1986. In 1987 Mr. Stella founded and operated a residential and commercial property developer, Dominion City Development and in 1991, he founded Trans-Immobilia, a residential property company. In 1997 he became the principal founding partner and is now the Chief Executive Officer of Millenia Hope Inc., the parent company of MH-B. Mr. Stella’s strategic vision, which guides Millenia Hope Inc., led to the acquisition of MH-B by Millenia in February 2006.

Jean Archambault, Ph.D., MBA- President and COO

Dr. Archambault was the founder, and served as President and CEO, of Avance Pharma (formally also know as Phytobiotech Inc.) from 1997 to 2005, having also served during that period as a Director after the company’s inception in 1997. Dr. Archambault directed the development of Avance’s Phytomics Technologies. Prior to Avance, Dr. Archambault was a professor and head of the Chemical Engineering Department at theUniversité du Québec à Trois-Rivières (1991-1999) and an associate professor at theÉcole Polytechnique de Montréal (1993-1999). From 1987 to 1991, Dr. Archambault was Head of the Cell Culture Group at the National Research Council of Canada’s Biotechnology Research Institute in Montreal, where he developed and directed all mammalian, insect and plant cell culture bioengineering R&D activities. From 1973 to 1983, Dr. Archambault held various engineering and management positions in industry. He received his Ph.D. (1988) from McGill University in Biochemical Engineering. His MBA was also obtained from McGill University in 1981.

Dr. Bahige Baroudy – Chief Science Officer and Director

Dr. Baroudy joined Avance Pharma in early 2004 (of which the equipment and intellectual property were recently acquired by our subsidiary, Millenia Hope Biopharma) and was responsible for leading the company’s drug discovery efforts. He has 25 years of industry/academic experience in basic research, infectious disease drug discovery and virology. Prior to joining Avance, Dr. Baroudy was Group Director, Antiviral and Antimicrobial Therapy at the Schering-Plough Research Institute (Kenilworth, New Jersey). While at the Schering Plough Research Institute, Dr. Baroudy spearheaded the successful development of CCR5 antagonists that are currently in human clinical trials as HIV entry inhibitors. Dr. Baroudy earned a place on “The Scientific American 50” list as the top Research Leader of 2003 in the Medical Treatment category for this contribution. Prior to joining Schering-Plough, Dr. Baroudy was Director, Division of Molecular Virology at the James N. Gamble Institute of Medical Research from 1989 to 1995, where he established research programs in viral hepatitis and liver diseases, HIV/AIDS and vaccinia virus expression and pathogenesis. From 1985 to 1989, Dr. Baroudy was Research Associate Professor in the Division of Molecular Virology and Immunology at Georgetown University. From 1979 to 1985, Dr. Baroudy worked at the NIH in the Laboratory of

41

Infectious Diseases, the Laboratory of Molecular Oncology and the Laboratory of Biology of Viruses. Dr Baroudy received his Ph.D. in Biochemistry from Georgetown University.

Dany Aubry, Chief Technical Officer and Director.

Mr. Aubry received his M.Sc. in bioengineering fromÉcole Polytechnique de Montréal in 1995 and his B.Sc. in Chemical Engineering from theUniversité du Québec à Trois-Rivières (UQTR) in 1993. Mr. Aubry was the Director of Operations at Avance Pharma from 2002 to 2005, overseeing all operational aspects of its Phytomics Technologies including the R&D programs, cell line generation, biosynthesis and purification of phytochemicals, scale-up of bioprocesses, setting up of laboratory facilities, as well as control of the supply chain for drug discovery activities. In total, Mr. Aubry has 13 years of direct experience in developing plant cell culture bioprocesses, having acted as the leader of the biosynthesis group from 2000 to 2002 at Avance, following his tenure as a bioprocess engineer from 1995 to 2000. His expertise in plant cell cultures covers production of secondary metabolites, somatic embryo andEndomycorrhiza production, as well bioreactor design and bioprocess control.

Robert D. Williams, Ph.D.- Chief Development Officer and Director

Dr. Williams received his B.Sc. Honours in Chemistry from Acadia University in 1984 investigating “Inhibitors of ß-galactosidase”. He then went on to obtain his Ph.D. in Biochemistry in 1990 from the University of Guelph, under the direction of Dr. Brian Ellis for his investigations on “Alkaloids from normal and Ri transformed tissues ofPapaver somniferum”. From there he then spent two years at the Biotechnology Research Institute in Montreal working with Dr. Jean Archambault on plant cell culture technology. He subsequently moved toÉcole Polytechnique de Montréal and worked on a variety of projects in the area of plant cell culture on which he has published numerous papers. As one of the cofounders of Avance Pharma, he had been instrumental since 1997 in the development of its cell culture facility and in all aspects of the generation of its proprietary library of purified fractions. Dr. Williams has extensive cell culture expertise for the generation of cell lines from selected plant species.

Committees

We have no standing audit, nominating and compensating committees of the Board of Directors or committees performing similar functions. Under the Sarbanes-Oxley Act of 2002, each public company is required to have an audit committee consisting solely of independent directors and to explain whether or not any independent director is a financial expert. In the event the public company does not have an audit committee, the Board of Directors becomes charged with the duties of the audit committee. We intend to adopt such a committee upon the acceptance of the present Registration by the Securities Exchange Commission. In the event we are successful in the future in obtaining independent directors to serve on the Board of Directors and on a newly formed audit committee, of which there can be no assurances given, the Board of Directors would first adopt a written charter. Such charter would be expected to include, among other things:

- annually reviewing and reassessing the adequacy of the committees formal charter;

- reviewing the annual audited financial statements with the adequacy of its internal accounting controls;

- reviewing analyses prepared by our management and independent auditors concerning significant financial reporting issues and judgments made in connection with the preparation of its financial statements;

- being directly responsible for the appointment, compensation and oversight of the independent auditor, which shall report directly to the Audit Committee, including resolution of disagreements between management and the auditors regarding financial reporting for the purpose of preparing or issuing an audit report or related work;

- reviewing the independence of the independent auditors;

- reviewing our auditing and accounting principles and practices with the independent auditors and reviewing major changes to our auditing and accounting principles and practices as suggested by the independent auditor or its management;

- reviewing all related party transactions on an ongoing basis for potential conflict of interest situations; and

- all responsibilities given to the Audit Committee by virtue of the Sarbanes-Oxley Act of 2002.

42

Code of Ethics

Effective March 3, 2003, the Securities and Exchange Commission requires registrants like us to either adopt a code of ethics that applies to our Chief Executive Officer and Chief Financial Officer or explain why we have not adopted such a code of ethics. For purposes of item 406 of Regulations S-K, the term “code of ethics” means written standards that are reasonably designed to deter wrong doing and to promote:

- Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships:

- Full, flair, accurate, timely and understandable disclosure in reports and documents that the company files with, or submits to, the Securities & Exchange Commission and in other public communications made by us;

- Compliance with applicable governmental law, rules and regulations;

- The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and

- Accountability for adherence to the code.

Upon acceptance of the present Registration, we will adopt the aforementioned Code of Ethics.

43

EXECUTIVE COMPENSATION

Compensation of Executive Officers

Summary Compensation Table. The following information relates to compensation received by our officers in fiscal years ending November 30, 2005, 2004, 2003 whose salary and compensation exceeded $100,000.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | |

| | Annual Compensation | | Long-Term Compensation | |

| |

| |

| |

Name and Principal Position | | Fiscal Year | | Salary | | Bonus | | Other Annual

Compensation | | Restricted

Stock

Award(s) | | Securities

Underlying

Options | |

Leonard Stella (1) | | | 2005 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

Chief Executive Officer | | | 2004 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | 2003 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | | | | | | | | | | | | | | | | | |

Jean Archambault (2) | | | 2005 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

President | | | 2004 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | 2003 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | | | | | | | | | | | | | | | | | |

Bahige Baroudy (3) | | | 2005 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

Chief Science Officer | | | 2004 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | 2003 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | | | | | | | | | | | | | | | | | |

Dany Aubry (4) | | | 2005 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

Chief Technical Officerr | | | 2004 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | 2003 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | | | | | | | | | | | | | | | | | |

Robert Williams (5) | | | 2005 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

Chief Development Officer | | | 2004 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | 2003 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

44

For the fiscal year ended November 30, 2006 (December 1, 2005 – May 31, 2006)

| |

(1) | Mr. Stella received $0 in compensation |

| |

(2) | Dr. Archambault received $26,250 in compensation |

| |

(3) | Dr. Baroudy received $35,000 in compensation |

| |

(4) | Mr. Aubry received $19,395 in compensation |

| |

(5) | Dr. Williams received $19,395 in compensation |

Option Grants Table. The following table sets forth information concerning individual grants of stock options to purchase our common stock made to the executive officer named in the Summary Compensation Table during fiscal year ended November 30, 2005.

OPTIONS GRANTS IN PRESENT FISCAL YEAR (Individual Grants)

| | | | | | | | |

Name | | Number of securities

underlying options

granted (#) | | Percent of total

options granted to

employees in last

fiscal year | | Exercise or base

Price ($/Share) | | Expiration Date |

None

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR-END OPTION VALUES

Aggregated Option Exercises and Fiscal Year-End Option Value Table. The following table sets forth certain information regarding stock options exercised during fiscal year ending November 30, 2005, by the executive officer named in the Summary Compensation Table.

| | | | | | | | |

Name | | Shares acquired on

exercise (#) | | Value realized ($) | | Number of Securities

Underlying Unexercised

Options at Fiscal

Year-End(#) | | Value of Unexercised

In-the-Money Options at

Fiscal Year-

End($)(1) |

| | | | | |

| |

|

| | | | | | Exercisable/ Unexercisable | | Exercisable/

Unexercisable |

None

Employment Contracts

We have entered into employment contracts with our employees and key personnel, with the exception of Mr. Leonard Stella our Chief Executive Officer.

Compensation of Directors

No director receives any compensation for serving on our Board of Directors.

45

PRINCIPAL STOCKHOLDERS

The following table sets forth certain information derived from the named person, or from the transfer agent, concerning the ownership of common stock as of September 5, 2006, of (i) each person who is known to us to be the beneficial owner of more than 5 percent of the common stock; (ii) all directors and executive officers; and (iii) directors and executive officers as a group:

| | | | |

Name and Address of

Beneficial Owner | | Amount and Nature of

Beneficial Ownership | | Percent of

Class (1) |

| | | | |

Millenia Hope Inc. (2)

1250 Rene Levesque W, suite 2200

Montreal, Quebec, CANADA | | 30,008,000 | | 75% |

| | | | |

2632-3345 Quebec Inc.(3)

3400 Souvenir, suite 320

Laval, Quebec Canada | | 7,592,000 | | 19% |

| |

(1) | Based on 40,000,000 issued and outstanding shares as of September 5, 2006. |

| |

(2) | Millenia Hope, Inc. is a 1934 Exchange Act company. For information on its shareholdings, specifically its principal shareholders, please refer to its 1934 Exchange Act filings listed on the SEC’s website atwww.sec.gov. |

| |

(3) | Paolo Mori, President of 2632-3345 Quebec Inc. |

SELLING STOCKHOLDERS

| | | | | | |

Name of Selling

Stockholder | | Shares Beneficially owned

Before offering | | Offering | | After offering |

| | | | | | |

2632-3345 Quebec Inc. | | 7,592,000 | | 7,592,000 | | 0 |

| | | | | | |

Cede& Co. (1) | | 599,910 | | 599,910 | | 0 |

|

(1) Reflects shares held by Cede & Co. in “street name” | | | | | | |

|

GEORGES ADAM | | 439 | | 439 | | 0 |

GEORGES ADAMS | | 3 003 | | 3 003 | | 0 |

CHARLES ALBANO | | 176 | | 176 | | 0 |

FRANCESCA ALBANO | | 9 871 | | 9 871 | | 0 |

AFTAB AL HASSAN | | 5 272 | | 5 272 | | 0 |

46

| | | | | | |

ANNA ALLAN | | 141 | | 141 | | 0 |

|

ALL SAFE LLC | | 4 394 | | 4 394 | | 0 |

|

ISABEL ALVES | | 26 | | 26 | | 0 |

|

AMBROSIA CORP | | 83 740 | | 83 740 | | 0 |

RAYMOND ANDERSON | | 18 | | 18 | | 0 |

|

ARTURO ANIEVAS | | 1 582 | | 1 582 | | 0 |

ARTURO ANIEVAS CUST -ALEXANDER ANIEVAS UNDER | | 176 | | 176 | | 0 |

ANTHONY ARCURI | | 439 | | 439 | | 0 |

|

DOMENIC ARCURI | | 879 | | 879 | | 0 |

ARIKEA INSULUM SOCIEDAD ANONIMA | | 1 757 | | 1 757 | | 0 |

ISABELLE ARNOLD | | 88 | | 88 | | 0 |

ANNE-MARGOT ARSENAULT | | 18 | | 18 | | 0 |

FRANCINE ARSENAULT | | 30 | | 30 | | 0 |

GEORGES ALEXANDRE ARSENAULT | | 18 | | 18 | | 0 |

GILLES ARSENAULT | | 301 | | 301 | | 0 |

LEONARD ARSENAULT | | 282 | | 282 | | 0 |

RAYMOND ARSENAULT | | 60 | | 60 | | 0 |

ROLANDE ARSENAULT | | 36 | | 36 | | 0 |

|

ASPAC BIOMARK | | 68 539 | | 68 539 | | 0 |

|

SALEHI ASSAD | | 264 | | 264 | | 0 |

BARINDER ATHWAL | | 837 | | 837 | | 0 |

|

JACQUES AUBRY | | 35 | | 35 | | 0 |

|

JOHN AXMIT | | 4 | | 4 | | 0 |

ANIL BADABOUDINE | | 60 | | 60 | | 0 |

|

ABDOULAYE BAH | | 2 636 | | 2 636 | | 0 |

BRUNO BALLARANO | | 123 | | 123 | | 0 |

|

RENE BANDET | | 457 | | 457 | | 0 |

47

| | | | | | |

NGUYEN MINH NGOC BAO | | 527 | | 527 | | 0 |

|

LYNE BARRY | | 12 | | 12 | | 0 |

|

JEAN BASTIEN | | 376 | | 376 | | 0 |

JEAN FRANCOIS BASTIEN | | 397 | | 397 | | 0 |

|

JULIE BASTIEN | | 12 | | 12 | | 0 |

MARTINE BASTIEN | | 18 | | 18 | | 0 |

SERGE BEAUDOIN | | 420 | | 420 | | 0 |

ALAIN BEAUREGARD | | 4 | | 4 | | 0 |

MARCEL BEAUDRY | | 53 | | 53 | | 0 |

MARC BEAUREGARD | | 35 | | 35 | | 0 |

STEPHANE BEAUREGARD | | 4 | | 4 | | 0 |

|

ANDRE BEAULIEU | | 289 | | 289 | | 0 |

MARC BEAUSEJOUR | | 313 | | 313 | | 0 |

|

PATRICK BEDARD | | 5 859 | | 5 859 | | 0 |

ALICE BEDROSSIAN | | 88 | | 88 | | 0 |

MICHEL BEDROSSIAN | | 53 | | 53 | | 0 |

JEAN PHILIPPE BEGIN | | 35 | | 35 | | 0 |

FLORIAN BELHUMEUR | | 1 757 | | 1 757 | | 0 |

|

ENZO BELLANCA | | 70 | | 70 | | 0 |

MESSOD BENDAYAN | | 18 | | 18 | | 0 |

DANIEL BENJAFIELD | | 18 | | 18 | | 0 |

|

CLEMENT BENOIT | | 301 | | 301 | | 0 |

GILLES BENOIT | | 120 | | 120 | | 0 |

|

VIOLETTA BENOIT | | 241 | | 241 | | 0 |

CHRISTIAN BERGERON | | 879 | | 879 | | 0 |

NELSON GERGERON | | 241 | | 241 | | 0 |

|

GILLES BERNARD | | 145 | | 145 | | 0 |

|

JOEL BERNIER | | 169 | | 169 | | 0 |

THERESE BERNIER | | 24 | | 24 | | 0 |

48

| | | | | | |

FREDERIC BERTOLDI | | 351 | | 351 | | 0 |

AMIR ALI BHOJANI | | 30 | | 30 | | 0 |

|

GEORGE BINET | | 4 921 | | 4 921 | | 0 |

|

BIOMED PHARMA | | 5 805 | | 5 805 | | 0 |

BIO-T CONSULTANTS INC | | 93 028 | | 93 028 | | 0 |

ANDRE BISSONNETTE | | 281 | | 281 | | 0 |

|

JOHANNE BLAIS | | 67 | | 67 | | 0 |

|

RICHARD BLAIS | | 296 | | 296 | | 0 |

DAVID WAYNE BLANCHETTE | | 20 | | 20 | | 0 |

DENIS BLAQUIERE | | 1 648 | | 1 648 | | 0 |

|

FRANCE BONIN | | 96 | | 96 | | 0 |

LAURETTE BORDUAS | | 36 | | 36 | | 0 |

|

LOUISE BORYS | | 95 | | 95 | | 0 |

|

WALTER BORYS | | 60 | | 60 | | 0 |

|

CLAUDE BOSSE | | 5 272 | | 5 272 | | 0 |

|

GINO BOSSIO | | 203 | | 203 | | 0 |

JOCELYNE BOUCHER | | 120 | | 120 | | 0 |

STEPHANE BOUCHER | | 12 | | 12 | | 0 |

BEVERLY BOUDREAULT | | 88 | | 88 | | 0 |

BOB BOUDREAULT | | 88 | | 88 | | 0 |

|

DENIS BOUDRIAS | | 24 | | 24 | | 0 |

|

SERGE BOULAIS | | 234 | | 234 | | 0 |

FRANCINE BOULERICE | | 24 | | 24 | | 0 |

JACQUES BOURBONNAIS | | 1 054 | | 1 054 | | 0 |

GERALD BOURDON | | 398 | | 398 | | 0 |

ROLANDE BOURDON-CARBONNEAU | | 24 | | 24 | | 0 |

ROLLANDECARBONEAU-BOURDON | | 24 | | 24 | | 0 |

DAVID BOURNE | | 18 | | 18 | | 0 |

49

| | | | | | |

PATRICIA BOURNE | | 18 | | 18 | | 0 |

FRANCOIS BOURRET | | 602 | | 602 | | 0 |

MICHEL BOUTIN &CHRISTIANE NOLET JT TEN | | 123 | | 123 | | 0 |

|

RAOUL BOUVIN | | 125 | | 125 | | 0 |

|

ALAIN BOYER | | 12 | | 12 | | 0 |

JOCELYNE BRASSARD | | 5 | | 5 | | 0 |

|

LUCIE BRASSARD | | 30 | | 30 | | 0 |

|

BRIGITTE BRIE | | 60 | | 60 | | 0 |

|

BENOIT BRIERE | | 481 | | 481 | | 0 |

|

SYLVAIN BRIERE | | 823 | | 823 | | 0 |

RICHARD BRODMAN | | 1 098 | | 1 098 | | 0 |

|

LORNE BROTMAN | | 176 | | 176 | | 0 |

MAXWELL BROTMAN | | 619 | | 619 | | 0 |

STACEY BROTMAN | | 176 | | 176 | | 0 |

PIERRE BRUNELLE | | 60 | | 60 | | 0 |

JOCELYNE BRUNET | | 74 | | 74 | | 0 |

RINO BUFFONE & ANTONIO DI VINCENZO JTTEN | | 239 | | 239 | | 0 |

|

JOE T BUSBY | | 35 | | 35 | | 0 |

|

DORIS BUSQUE | | 181 | | 181 | | 0 |

JACINTHE BUSQUE | | 60 | | 60 | | 0 |

MARGARET BYWATERS | | 2 636 | | 2 636 | | 0 |

M JOSE CABELLOS | | 70 | | 70 | | 0 |

CLAUDE CADORETTE | | 12 | | 12 | | 0 |

|

RICHARD CAHILL | | 18 927 | | 18 927 | | 0 |

|

PIETRO CALCARA | | 49 | | 49 | | 0 |

128413 CANADA LTD | | 176 | | 176 | | 0 |

4049870 CANADA INC | | 2 636 | | 2 636 | | 0 |

50

| | | | | | |

4170059 CANADA INC | | 17 802 | | 17 802 | | 0 |

4220-1116 CANADA INC | | 3 515 | | 3 515 | | 0 |

4291034 CANADA INC | | 29 876 | | 29 876 | | 0 |

ANGELA CAPURSO | | 3 368 | | 3 368 | | 0 |

CHRISTIAN CARDINAL | | 12 | | 12 | | 0 |

ANTONIO CARNEVALE | | 1 757 | | 1 757 | | 0 |

MARCEL CARPENTIER | | 176 | | 176 | | 0 |

|

PETER CARR | | 18 | | 18 | | 0 |

|

JOE CARUSO | | 62 | | 62 | | 0 |

|

GAIL CASEY | | 4 | | 4 | | 0 |

LEONARDO CASTIELLO | | 1 494 | | 1 494 | | 0 |

ANTONIO CASTILIANO | | 365 | | 365 | | 0 |

GIUSEPPE CASTIGLIONE | | 19 106 | | 19 106 | | 0 |

|

SOFIA CATALINI | | 165 | | 165 | | 0 |

ROSS CATION | | 4 | | 4 | | 0 |

|

GEORGE CATTAN | | 120 | | 120 | | 0 |

DARREN CAVANAGH | | 176 | | 176 | | 0 |

|

FRANK CAVANAGH | | 176 | | 176 | | 0 |

JACQUES CAYER | | 53 | | 53 | | 0 |

GEORGES CHALMERS | | 2 | | 2 | | 0 |

FREDERICK CHAMPAGNE | | 808 | | 808 | | 0 |

NICOLAS CHAMPAGNE | | 808 | | 808 | | 0 |

ALEXANDRE CHAPDELAINE | | 72 | | 72 | | 0 |

CARINE CHAPDELAINE | | 72 | | 72 | | 0 |

JULES CHAPDELAINE | | 120 | | 120 | | 0 |

SUZANNE CHAPDELAINE | | 241 | | 241 | | 0 |

|

ANDRE CHAREST | | 72 | | 72 | | 0 |

MARCH CHARRETTE | | 86 | | 86 | | 0 |

LANGIS CHARRON | | 241 | | 241 | | 0 |

51

| | | | | | |

ROBERT CHELHOT | | 120 | | 120 | | 0 |

|

JOHN CHESNUTT | | 4 | | 4 | | 0 |

STEVEN CHESNUTT | | 4 | | 4 | | 0 |

JACQUES CHIASSON | | 181 | | 181 | | 0 |

|

DENIS CHICOINE | | 202 | | 202 | | 0 |

JEAN PIERRE CHICOINE | | 120 | | 120 | | 0 |

|

JULES CHICOINE | | 602 | | 602 | | 0 |

|

DAVID CHITYAL | | 2 197 | | 2 197 | | 0 |

PERRY CHOINIERE | | 13 181 | | 13 181 | | 0 |

NBCN CLEARING INC FBO -PERRY CHOINIERE 1AVFGYA | | 703 | | 703 | | 0 |

SYLVAIN CHOINIERE | | 293 | | 293 | | 0 |

JUSTINE CHOLETTE | | 313 | | 313 | | 0 |

MICHEL CHOLETTE | | 1 493 | | 1 493 | | 0 |

PHILIPPE CHOLETTE | | 60 | | 60 | | 0 |

MICHEL CHOQUETTE | | 11 | | 11 | | 0 |

CHRISTOS CHRISTOU | | 780 | | 780 | | 0 |

STEPHANE CHRETIEN | | 176 | | 176 | | 0 |

|

SORIBA CISSE | | 6 063 | | 6 063 | | 0 |

|

CLOMAX INC | | 59 | | 59 | | 0 |

|

LINDA COALLIER | | 18 | | 18 | | 0 |

RAFFAEL COBUZZI | | 36 | | 36 | | 0 |

|

THOMAS COFFEY | | 98 | | 98 | | 0 |

|

RONIN COHEN | | 26 | | 26 | | 0 |

|

RENE COMPTOIS | | 120 | | 120 | | 0 |

|

DENISE COMTOIS | | 60 | | 60 | | 0 |

ROBERT COMTOIS | | 84 | | 84 | | 0 |

RODNEY COOMER | | 2 | | 2 | | 0 |

CHANTAL CORBEIL | | 18 | | 18 | | 0 |

52

| | | | | | |

MYLENE CORBEIL | | 18 | | 18 | | 0 |

SUZANNE CORMIER | | 32 | | 32 | | 0 |

ANDRE CORRIVEAU | | 96 | | 96 | | 0 |

ADRIEN CORRIVEAU | | 602 | | 602 | | 0 |

GISELLE CORRIVEAU | | 87 | | 87 | | 0 |

|

BRIAN COSTELLO | | 1 757 | | 1 757 | | 0 |

BRIAN COSTELLO JR | | 1 757 | | 1 757 | | 0 |

BERTHE BLANCHETTE COTE | | 61 | | 61 | | 0 |

|

CLAIRE COTE | | 60 | | 60 | | 0 |

|

JEAN MARC COTE | | 189 | | 189 | | 0 |

|

DAVID COULL | | 148 | | 148 | | 0 |

|

JOAN COULL | | 148 | | 148 | | 0 |

CELINE COULOMBE | | 181 | | 181 | | 0 |

SOLANGE COULOMBE | | 60 | | 60 | | 0 |

ALAIN COUSINEAU | | 527 | | 527 | | 0 |

|

LYNE COUTURE | | 176 | | 176 | | 0 |

CREATION PUBLICITAIRES INC | | 120 | | 120 | | 0 |

SYLVANO CRIVELLO | | 89 | | 89 | | 0 |

|

DIANE CULLEN | | 293 | | 293 | | 0 |

|

FRANK CURTI | | 26 | | 26 | | 0 |

|

EDWARD CUTLER | | 967 | | 967 | | 0 |

|

YVES CYR | | 120 | | 120 | | 0 |

PIERRE DAGENAIS | | 264 | | 264 | | 0 |

BERNARD DALLAIRE | | 18 | | 18 | | 0 |

FILOMENA D’ANDREA | | 239 | | 239 | | 0 |

|

JOSEPH DANIELE | | 12 571 | | 12 571 | | 0 |

GIUSEPPE DANIELLE | | 17 574 | | 17 574 | | 0 |

CHANTAL DANSEREAU | | 60 | | 60 | | 0 |

53

| | | | | | |

NGUYEN THI DAO | | 8 787 | | 8 787 | | 0 |

|

BENOIT DAOUST | | 24 | | 24 | | 0 |

|

DIANE DAOUST | | 60 | | 60 | | 0 |

CHRISTIAN DAVIAU | | 1 757 | | 1 757 | | 0 |

|

LAILA DEBS | | 60 | | 60 | | 0 |

ANNA MARIA DEL BELLO | | 527 | | 527 | | 0 |

FRANK DEL BELLO | | 4 394 | | 4 394 | | 0 |

|

NINO DEL BELLO | | 4 394 | | 4 394 | | 0 |

|

PASCAL DELCY | | 264 | | 264 | | 0 |

|

MANON DELISLE | | 12 | | 12 | | 0 |

|

BRUNO DELORME | | 24 | | 24 | | 0 |

JACQUES DELORME | | 351 | | 351 | | 0 |

FILOMENA DELUCA | | 105 | | 105 | | 0 |

ANGELO DE LUCIA | | 105 | | 105 | | 0 |

JACQUES DENONCOURT | | 18 | | 18 | | 0 |

|

JOHANNE DEPOT | | 60 | | 60 | | 0 |

JEAN GERALD DESIRE | | 2 724 | | 2 724 | | 0 |

MARIO DESJARDINS | | 62 | | 62 | | 0 |

MANON DESROSIERS | | 120 | | 120 | | 0 |

|

FRANK DIACO | | 207 | | 207 | | 0 |

|

J DIAVATIS | | 70 | | 70 | | 0 |

KENNETH DI BREWIN | | 228 | | 228 | | 0 |

LUCIANO DI MARCO | | 615 | | 615 | | 0 |

ROBERTO DI MARCO | | 615 | | 615 | | 0 |

|

BICH VAN DINH | | 5 272 | | 5 272 | | 0 |

|

LOISEL DIOGENE | | 12 | | 12 | | 0 |

CHRISTIAN DIONNE | | 24 | | 24 | | 0 |

AURORA DI PAOLA | | 18 | | 18 | | 0 |

ANTONIO DI VINCENZO | | 214 | | 214 | | 0 |

54

| | | | | | |

DM INVESTMENTS | | 35 148 | | 35 148 | | 0 |

MOHAMMED DOCRAT | | 45 | | 45 | | 0 |

DIETER DOEDERLINE | | 4 | | 4 | | 0 |

CHRISTIAN DONATO | | 15 | | 15 | | 0 |

|

DANIEL DONAVAN | | 351 | | 351 | | 0 |

|

TOM DOUGLAS | | 72 | | 72 | | 0 |

|

SID DRAPKIN | | 88 | | 88 | | 0 |

|

ERIC DROUIN | | 181 | | 181 | | 0 |

|

FANNY DUBUC | | 12 | | 12 | | 0 |

|

ROBERT DUCA | | 176 | | 176 | | 0 |

GREGORY DUCOS | | 28 | | 28 | | 0 |

|

SYLVIE DUFAUX | | 24 | | 24 | | 0 |

JEREMIE DUFOUR | | 3 515 | | 3 515 | | 0 |

|

REAL DUFOUR | | 879 | | 879 | | 0 |

JACQUELINE DUHAMEL | | 24 | | 24 | | 0 |

|

MARIO DUMAIS | | 1 054 | | 1 054 | | 0 |

JEAN-MARIE DUMESNIL | | 248 | | 248 | | 0 |

|

GIZELLE DUMONT | | 120 | | 120 | | 0 |

|

JESSICA DUMONT | | 88 | | 88 | | 0 |

JOSIANE DUMONT | | 88 | | 88 | | 0 |

|

LOUISE DUMONT | | 12 | | 12 | | 0 |

MARC ANDRE DUMONT | | 30 | | 30 | | 0 |

TRUONG VAN DUNG | | 176 | | 176 | | 0 |

|

ANDRE EMOND | | 60 | | 60 | | 0 |

|

DENIS EMOND | | 5 861 | | 5 861 | | 0 |

|

GIULIANO ERCOLI | | 25 | | 25 | | 0 |

|

SYLVAIN ETHIER | | 241 | | 241 | | 0 |

GUY FAFARD &MICHEL FAFARD JT TEN | | 72 | | 72 | | 0 |

55

| | | | | | |

FENCO | | 1 757 | | 1 757 | | 0 |

FENCO ASSOCIATES | | 2 074 | | 2 074 | | 0 |

JEAN-PIERRE FERLAND | | 1 318 | | 1 318 | | 0 |

ROBERT FERRARO | | 176 | | 176 | | 0 |

|

FIDUCIE S.A.M. | | 14 059 | | 14 059 | | 0 |

|

COLLETTE FILION | | 53 | | 53 | | 0 |

|

COLETTE FILLION | | 16 | | 16 | | 0 |

ROBERT FITZGERALD | | 2 | | 2 | | 0 |

LEDO. RAFAEL COLON FLORES | | 88 | | 88 | | 0 |

FONDATION JEUNESSE IN’AFU | | 249 | | 249 | | 0 |

|

LES FORD | | 2 | | 2 | | 0 |

ALEXANDRE FORTIER | | 60 | | 60 | | 0 |

|

DANY FORTIER | | 30 | | 30 | | 0 |

GUY FORTIN | | 989 | | 989 | | 0 |

|

MARIO FORTIER | | 241 | | 241 | | 0 |

|

CHANTAL FORTIN | | 60 | | 60 | | 0 |

|

FRANCE FORTIN | | 12 | | 12 | | 0 |

|

GUY FORTIN | | 717 | | 717 | | 0 |

DONALD FRANCES | | 2 | | 2 | | 0 |

MARCO FRAPPIER | | 5 887 | | 5 887 | | 0 |

BRIGITTE FREGAULT | | 1 172 | | 1 172 | | 0 |

NBCN CLEARING INC FBO- DOMINIQUE FREGAULT | | 908 | | 908 | | 0 |

FRANCOIS FREGAULT | | 60 | | 60 | | 0 |

GINETTE FREGAULT | | 908 | | 908 | | 0 |

MARC-ANDRE FREGAULT | | 908 | | 908 | | 0 |

PATRICIA FRONTEIRA | | 70 | | 70 | | 0 |

|

JOHN FUOCO | | 204 | | 204 | | 0 |

|

MICHEL GAGNE | | 24 | | 24 | | 0 |

56

| | | | | | |

ANDRE GAGNON | | 176 | | 176 | | 0 |

GEORGES GAGNON | | 60 | | 60 | | 0 |

|

RICHER GAGNON | | 60 | | 60 | | 0 |

FRANCES H GAJANO | | 124 | | 124 | | 0 |

PATRICK GALLAME | | 84 | | 84 | | 0 |

GARDERIE LA BASCULE INC | | 301 | | 301 | | 0 |

|

DAVID GAUDETTE | | 1 054 | | 1 054 | | 0 |

GILLES GAUDETTE | | 785 | | 785 | | 0 |

STEPHANIE GAUDETTE | | 12 | | 12 | | 0 |

FRANCE GAUTHIER | | 4 394 | | 4 394 | | 0 |

MAURICE GAUTHIER | | 589 | | 589 | | 0 |

GDCI CAPITAL INC | | 7 820 | | 7 820 | | 0 |

CLAIRE GEOFFRION | | 70 | | 70 | | 0 |

GESTION & CONULTATION MP BEAUDOIN | | 24 | | 24 | | 0 |

GESTION LA SOLUTION LTD | | 9 666 | | 9 666 | | 0 |

GESTION SERBEAU INC | | 96 | | 96 | | 0 |

GESTION SYLVAIN TREMBLAY (1998) INC | | 289 | | 289 | | 0 |

|

CRISTINE GHAKIS | | 1 757 | | 1 757 | | 0 |

|

MIKE GHAKIS | | 5 272 | | 5 272 | | 0 |

|

PATRICK GHAKIS | | 1 757 | | 1 757 | | 0 |

|

CLAIRE GIARD | | 72 | | 72 | | 0 |

SELONKOUE FEIBONAZOUI GILBERT | | 879 | | 879 | | 0 |

MARTINE GINGRAS | | 14 | | 14 | | 0 |

|

DANIEL GINGUES | | 351 | | 351 | | 0 |

|

GABRIELE GIOBI | | 35 | | 35 | | 0 |

|

MAURIZIO GIOBI | | 118 | | 118 | | 0 |

|

HENRI GIRARD | | 35 | | 35 | | 0 |

57

| | | | | | |

CONSULTANT JEAN PIERRE GIRARD | | 35 | | 35 | | 0 |

|

PIERRE GIROUX | | 72 | | 72 | | 0 |

|

SYLVIE GIROUX | | 120 | | 120 | | 0 |

|

CECILE GODIN | | 18 | | 18 | | 0 |

MARY GOLDSMITH | | 9 | | 9 | | 0 |

MARIO GONCALVES | | 60 | | 60 | | 0 |

|

JACQUES GOYET | | 120 | | 120 | | 0 |

|

K C GRAINGER | | 4 077 | | 4 077 | | 0 |

KENNETH C GRAINGER | | 70 | | 70 | | 0 |

MARION GRAINGER | | 381 | | 381 | | 0 |

|

CLAUDE GRAVEL | | 351 | | 351 | | 0 |

|

LOUIS GRECO | | 6 151 | | 6 151 | | 0 |

GREEN PERFORMANCE S.A. | | 8 787 | | 8 787 | | 0 |

|

GIANNI GRIMALDI | | 167 | | 167 | | 0 |

VINCENZA GRIVAS | | 18 | | 18 | | 0 |

|

SABINE GROULX | | 12 | | 12 | | 0 |

|

VANESSA GUAY | | 439 | | 439 | | 0 |

|

MELISSA GUAY | | 1 318 | | 1 318 | | 0 |

CLEMENT GUERARD | | 120 | | 120 | | 0 |

ANGELE GUILBERT | | 24 | | 24 | | 0 |

LOUISE GUILBERT | | 12 | | 12 | | 0 |

RAYMOND GUITARD | | 12 | | 12 | | 0 |

GUYLAINE GRAVEL | | 60 | | 60 | | 0 |

|

J HAMMEL | | 879 | | 879 | | 0 |

|

JOHN K HAMMEL | | 351 | | 351 | | 0 |

MARIE FRANCE HARBEC | | 18 | | 18 | | 0 |

|

SERGE HARBEC | | 290 | | 290 | | 0 |

CHRISTINE HARVEY | | 602 | | 602 | | 0 |

58

| | | | | | |

COULOMBE HAYES | | 28 | | 28 | | 0 |

|

PHILIPPE HAYES | | 60 | | 60 | | 0 |

HERAN CAPITAL INC | | 439 | | 439 | | 0 |

|

TODD HESKELL | | 30 | | 30 | | 0 |

|

ANDRE HETU | | 30 | | 30 | | 0 |

JOHN HIGBINSON SR | | 2 | | 2 | | 0 |

|

LE LE HOANG | | 8 787 | | 8 787 | | 0 |

|

MEIKEN HOHMAN | | 4 | | 4 | | 0 |

|

RORY HOPE | | 2 | | 2 | | 0 |

|

TA NGOC HO | | 1 406 | | 1 406 | | 0 |

|

DENIS HOULD | | 7 | | 7 | | 0 |

|

WILLIAM HUM | | 60 | | 60 | | 0 |

HELEN HURTUBISE | | 53 | | 53 | | 0 |

THE HONG HUYNH | | 1 054 | | 1 054 | | 0 |

|

THE LANG HUYNH | | 1 054 | | 1 054 | | 0 |

|

THE LAY HUYNH | | 492 | | 492 | | 0 |

|

THE IEM HUYNH | | 12 302 | | 12 302 | | 0 |

THE NGHIEM HUYNH | | 4 657 | | 4 657 | | 0 |

|

TRI MINH HUYNH | | 8 523 | | 8 523 | | 0 |

|