MARCH 31, 2013 Semiannual Report to Stockholders |

| |

DWS High Income Opportunities Fund, Inc. Ticker Symbol: DHG |

|

Contents

26 Statement of Assets and Liabilities 28 Statement of Operations 29 Statement of Cash Flows 30 Statement of Changes in Net Assets 33 Notes to Financial Statements 43 Dividend Reinvestment and Cash Purchase Plan 46 Additional Information |

The fund seeks high current income with a secondary objective of total return.

Closed-end funds, unlike open-end funds, are not continuously offered. There is a one time public offering and once issued, shares of closed-end funds are sold in the open market through a stock exchange. Shares of closed-end funds frequently trade at a discount to net asset value. The price of the fund's shares is determined by a number of factors, several of which are beyond the control of the fund. Therefore, the fund cannot predict whether its shares will trade at, below or above net asset value.

Any fund that concentrates in a particular segment of the market will generally be more volatile than a fund that invests more broadly. Bond investments are subject to interest-rate and credit risks. When interest rates rise, bond prices generally fall. Credit risk refers to the ability of an issuer to make timely payments of principal and interest. Investments in lower-quality ("junk bonds") and non-rated securities present greater risk of loss than investments in higher-quality securities. There are special risks associated with an investment in real estate, including REITS. These risks include credit risk, interest rate fluctuations and the impact of varied economic conditions. Stocks may decline in value. Investing in foreign securities, particularly those of emerging markets, presents certain risks, such as currency fluctuations, political and economic changes, and market risks. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. Leverage results in additional risks and can magnify the effect of any gains or losses.

DWS Investments is part of the Deutsche Asset & Wealth Management division of Deutsche Bank AG.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Performance Summary March 31, 2013 (Unaudited)

Performance is historical, assumes reinvestment of all dividend and capital gain distributions, and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when sold, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please visit www.dws-investments.com for the Fund's most recent month-end performance.

Fund specific data and performance are provided for information purposes only and are not intended for trading purposes.

Average Annual Total Returns as of 3/31/13 | |

| DWS High Income Opportunities Fund, Inc. | | 6-Month‡ | | | 1-Year | | | 5-Year | | | Life of Fund* | |

Based on Net Asset Value(a) | | | 6.38 | % | | | 13.67 | % | | | -1.26 | % | | | -3.06 | % |

Based on Market Price(a) | | | 1.05 | % | | | 4.82 | % | | | 0.56 | % | | | -4.60 | % |

Credit Suisse High Yield Index(b) | | | 6.17 | % | | | 12.43 | % | | | 10.81 | % | | | 8.60 | % |

Morningstar Closed-End High Yield Bond Funds Category(c) | | | 7.67 | % | | | 16.35 | % | | | 9.04 | % | | | 8.14 | % |

‡ Total returns shown for periods less than one year are not annualized.

* The Fund commenced operations on November 22, 2006. The performance shown for the index and the Morningstar Category is for the time period of November 30, 2006 through March 31, 2013, which is based on the performance period of the life of the Fund.

On November 5, 2010, the Fund adopted its current name and investment policies. Prior to that date the Fund was known as DWS Dreman Value Income Edge Fund, Inc. and its investment objective was to seek to achieve a high level of total return. Performance prior to November 5, 2010 should not be considered representative of the present Fund.

| Net Asset Value and Market Price | |

| | | As of 3/31/13 | | | As of 9/30/12 | |

| Net Asset Value | | $ | 16.39 | | | $ | 16.03 | |

| Market Price | | $ | 15.51 | | | $ | 15.97 | |

Prices and net asset value fluctuate and are not guaranteed.

| Distribution Information | |

Six Months as of 3/31/13: Income Dividends | | $ | .62 | |

| March Income Dividend | | $ | .10 | |

Current Annualized Distribution Rate (Based on Net Asset Value) as of 3/31/13† | | | 7.32 | % |

Current Annualized Distribution Rate (Based on Market Price) as of 3/31/13† | | | 7.74 | % |

† Current annualized distribution rate is the latest monthly dividend shown as an annualized percentage of net asset value/market price on March 31, 2013. Distribution rate simply measures the level of dividends and is not a complete measure of performance. Distribution rates are historical, not guaranteed, and will fluctuate.

(a) Total return based on net asset value reflects changes in the Fund's net asset value during the period. Total return based on market value reflects changes in market value. Each figure assumes that dividend and capital gain distributions, if any, were reinvested. These figures will differ depending upon the level of any discount from or premium to net asset value at which the Fund's shares traded during the period.

(b) Credit Suisse High Yield Index is an unmanaged, unleveraged trader-priced portfolio constructed to mirror the global high-yield debt market.

(c) Morningstar's Closed-End High Yield Bond Funds category represents portfolios that concentrate on lower-quality bonds, which are riskier than those of higher-quality companies. These portfolios generally offer higher yields than other types of portfolios, but they are also more vulnerable to economic and credit risk. These portfolios primarily invest in U.S. high-income debt securities, where at least 65% or more of bond assets are not rated or are rated by a major agency such as Standard & Poor's or Moody's at the level of BB (considered speculative for taxable bonds) and below. Category returns assume reinvestment of dividends. It is not possible to invest directly in a Morningstar category.

Gary Russell, CFA, Managing Director

Portfolio Manager of the fund. Joined the fund in 2010.

• Joined Deutsche Asset & Wealth Management in 1996. Served as the head of the High Yield group in Europe and as an Emerging Markets portfolio manager.

• Prior to that, four years at Citicorp as a research analyst and structurer of collateralized mortgage obligations. Prior to Citicorp, served as an officer in the U.S. Army from 1988 to 1991.

• Head of U.S. High Yield Bonds: New York.

• BS, United States Military Academy (West Point); MBA, New York University, Stern School of Business.

Portfolio Summary (Unaudited)

Investment Portfolio as of March 31, 2013 (Unaudited) | | | Principal Amount ($)(a) | | | Value ($) | |

| | | | |

| Corporate Bonds 118.7% | |

| Consumer Discretionary 26.2% | |

| 313 Group, Inc., 144A, 6.375%, 12/1/2019 | | | | 375,000 | | | | 372,188 | |

| AMC Networks, Inc., 7.75%, 7/15/2021 | | | | 165,000 | | | | 186,863 | |

| Avis Budget Car Rental LLC: | |

| 144A, 5.5%, 4/1/2023 (b) | | | 365,000 | | | | 364,088 | |

| 8.25%, 1/15/2019 | | | 700,000 | | | | 776,125 | |

| BC Mountain LLC, 144A, 7.0%, 2/1/2021 | | | | 360,000 | | | | 381,600 | |

| Block Communications, Inc., 144A, 7.25%, 2/1/2020 | | | | 715,000 | | | | 777,562 | |

| Boyd Gaming Corp., 144A, 9.0%, 7/1/2020 | | | | 275,000 | | | | 286,000 | |

| Caesar's Entertainment Operating Co., Inc.: | |

| 8.5%, 2/15/2020 | | | 695,000 | | | | 686,312 | |

| 10.0%, 12/15/2018 | | | 970,000 | | | | 660,812 | |

| 11.25%, 6/1/2017 | | | 3,900,000 | | | | 4,148,625 | |

| Carlson Wagonlit BV, 144A, 6.875%, 6/15/2019 | | | | 400,000 | | | | 417,000 | |

| CCO Holdings LLC: | |

| 5.25%, 9/30/2022 | | | 2,645,000 | | | | 2,598,712 | |

| 6.625%, 1/31/2022 | | | 840,000 | | | | 900,900 | |

| 7.0%, 1/15/2019 | | | 235,000 | | | | 253,213 | |

| 7.25%, 10/30/2017 | | | 1,110,000 | | | | 1,197,412 | |

| 7.375%, 6/1/2020 | | | 100,000 | | | | 110,875 | |

| 7.875%, 4/30/2018 | | | 6,300,000 | | | | 6,701,625 | |

| CDR DB Sub, Inc., 144A, 7.75%, 10/15/2020 | | | | 210,000 | | | | 215,775 | |

| Cequel Communications Holdings I LLC: | |

| 144A, 6.375%, 9/15/2020 | | | 2,070,000 | | | | 2,147,625 | |

| 144A, 8.625%, 11/15/2017 | | | 3,385,000 | | | | 3,617,719 | |

| Chester Downs & Marina LLC, 144A, 9.25%, 2/1/2020 | | | | 130,000 | | | | 124,150 | |

| Clear Channel Communications, Inc., 144A, 11.25%, 3/1/2021 | | | | 495,000 | | | | 507,375 | |

| Clear Channel Worldwide Holdings, Inc.: | |

| Series A, 144A, 6.5%, 11/15/2022 | | | 445,000 | | | | 463,913 | |

| Series B, 144A, 6.5%, 11/15/2022 | | | 665,000 | | | | 701,575 | |

| Series A, 7.625%, 3/15/2020 | | | 105,000 | | | | 108,544 | |

| Series B, 7.625%, 3/15/2020 | | | 1,065,000 | | | | 1,111,594 | |

| Crown Media Holdings, Inc., 10.5%, 7/15/2019 | | | | 275,000 | | | | 310,063 | |

| Cumulus Media Holdings, Inc., 7.75%, 5/1/2019 | | | | 350,000 | | | | 359,625 | |

| Delphi Corp., 5.0%, 2/15/2023 | | | | 490,000 | | | | 518,175 | |

| DISH DBS Corp.: | |

| 6.75%, 6/1/2021 | | | 145,000 | | | | 160,950 | |

| 7.125%, 2/1/2016 | | | 2,500,000 | | | | 2,778,125 | |

| Griffey Intermediate, Inc., 144A, 7.0%, 10/15/2020 | | | | 370,000 | | | | 377,400 | |

| Harron Communications LP, 144A, 9.125%, 4/1/2020 | | | | 520,000 | | | | 577,200 | |

| Hertz Corp.: | |

| 144A, 4.25%, 4/1/2018 | | | 575,000 | | | | 585,781 | |

| 6.75%, 4/15/2019 | | | 450,000 | | | | 491,062 | |

| 7.5%, 10/15/2018 | | | 6,000,000 | | | | 6,622,500 | |

| Jo-Ann Stores Holdings, Inc., 144A, 9.75%, 10/15/2019 (PIK) | | | | 210,000 | | | | 220,500 | |

| Libbey Glass, Inc., 6.875%, 5/15/2020 | | | | 216,000 | | | | 233,010 | |

| Lions Gate Entertainment, Inc., 144A, 10.25%, 11/1/2016 | | | | 505,000 | | | | 551,081 | |

| MDC Partners, Inc., 144A, 6.75%, 4/1/2020 | | | | 275,000 | | | | 277,750 | |

| Mediacom Broadband LLC, 144A, 6.375%, 4/1/2023 | | | | 800,000 | | | | 830,000 | |

| Mediacom LLC, 7.25%, 2/15/2022 | | | | 200,000 | | | | 220,000 | |

| MGM Resorts International: | |

| 6.625%, 12/15/2021 | | | 1,100,000 | | | | 1,153,625 | |

| 144A, 6.75%, 10/1/2020 | | | 160,000 | | | | 169,600 | |

| 7.5%, 6/1/2016 | | | 550,000 | | | | 609,125 | |

| 7.625%, 1/15/2017 | | | 385,000 | | | | 427,350 | |

| 144A, 8.625%, 2/1/2019 | | | 1,585,000 | | | | 1,846,525 | |

| 10.0%, 11/1/2016 | | | 445,000 | | | | 530,662 | |

| National CineMedia LLC: | |

| 6.0%, 4/15/2022 | | | 400,000 | | | | 429,000 | |

| 7.875%, 7/15/2021 | | | 465,000 | | | | 517,894 | |

| Palace Entertainment Holdings LLC, 144A, 8.875%, 4/15/2017 | | | | 390,000 | | | | 413,400 | |

| PETCO Animal Supplies, Inc., 144A, 9.25%, 12/1/2018 | | | | 670,000 | | | | 738,675 | |

| Petco Holdings, Inc., 144A, 8.5%, 10/15/2017 (PIK) | | | | 105,000 | | | | 108,281 | |

| Quebecor Media, Inc., 144A, 5.75%, 1/15/2023 | | | | 375,000 | | | | 382,500 | |

| Regal Entertainment Group: | |

| 5.75%, 2/1/2025 | | | 90,000 | | | | 88,425 | |

| 9.125%, 8/15/2018 | | | 350,000 | | | | 392,875 | |

| Sinclair Television Group, Inc., 144A, 5.375%, 4/1/2021 (b) | | | | 185,000 | | | | 183,613 | |

| Sirius XM Radio, Inc., 144A, 8.75%, 4/1/2015 | | | | 1,015,000 | | | | 1,129,187 | |

| Sotheby's, 144A, 5.25%, 10/1/2022 | | | | 370,000 | | | | 373,700 | |

| Starz LLC, 144A, 5.0%, 9/15/2019 | | | | 295,000 | | | | 303,850 | |

| Stoneridge, Inc., 144A, 9.5%, 10/15/2017 | | | | 5,100,000 | | | | 5,482,500 | |

| UCI International, Inc., 8.625%, 2/15/2019 | | | | 235,000 | | | | 243,225 | |

| Unitymedia Hessen GmbH & Co., KG: | |

| 144A, 5.5%, 1/15/2023 | | | 1,630,000 | | | | 1,674,825 | |

| 144A, 7.5%, 3/15/2019 | | | 825,000 | | | | 902,344 | |

| Unitymedia KabelBW GmbH, 144A, 9.625%, 12/1/2019 | EUR | | | 1,595,000 | | | | 2,274,769 | |

| Univision Communications, Inc.: | |

| 144A, 6.875%, 5/15/2019 | | | 110,000 | | | | 117,700 | |

| 144A, 8.5%, 5/15/2021 | | | 135,000 | | | | 145,800 | |

| UPC Holding BV, 144A, 8.375%, 8/15/2020 | EUR | | | 580,000 | | | | 813,806 | |

| Viking Cruises Ltd., 144A, 8.5%, 10/15/2022 | | | | 375,000 | | | | 412,500 | |

| Visant Corp., 10.0%, 10/1/2017 | | | | 1,220,000 | | | | 1,113,250 | |

| Visteon Corp., 6.75%, 4/15/2019 | | | | 738,000 | | | | 789,660 | |

| XM Satellite Radio, Inc., 144A, 7.625%, 11/1/2018 | | | | 3,000,000 | | | | 3,311,250 | |

| Yonkers Racing Corp., 144A, 11.375%, 7/15/2016 | | | | 320,000 | | | | 343,200 | |

| | | | | 72,354,520 | |

| Consumer Staples 2.3% | |

| Alliance One International, Inc., 10.0%, 7/15/2016 | | | | 500,000 | | | | 528,125 | |

| Chiquita Brands International, Inc., 144A, 7.875%, 2/1/2021 | | | | 335,000 | | | | 351,331 | |

| Constellation Brands, Inc., 6.0%, 5/1/2022 | | | | 180,000 | | | | 196,650 | |

| Del Monte Corp., 7.625%, 2/15/2019 | | | | 810,000 | | | | 840,375 | |

| FAGE Dairy Industry SA, 144A, 9.875%, 2/1/2020 | | | | 215,000 | | | | 235,963 | |

| JBS U.S.A. LLC, 144A, 8.25%, 2/1/2020 | | | | 295,000 | | | | 322,288 | |

| NBTY, Inc., 9.0%, 10/1/2018 | | | | 1,540,000 | | | | 1,720,950 | |

| Pilgrim's Pride Corp., 7.875%, 12/15/2018 | | | | 265,000 | | | | 286,531 | |

| Smithfield Foods, Inc., 6.625%, 8/15/2022 | | | | 475,000 | | | | 517,750 | |

| Sun Products Corp., 144A, 7.75%, 3/15/2021 | | | | 635,000 | | | | 639,762 | |

| Tops Holding Corp., 144A, 8.875%, 12/15/2017 | | | | 180,000 | | | | 197,550 | |

| U.S. Foods, Inc., 144A, 8.5%, 6/30/2019 | | | | 385,000 | | | | 408,581 | |

| | | | | 6,245,856 | |

| Energy 12.6% | |

| Access Midstream Partners LP: | |

| 4.875%, 5/15/2023 | | | 455,000 | | | | 449,313 | |

| 6.125%, 7/15/2022 | | | 615,000 | | | | 659,587 | |

| Arch Coal, Inc., 7.0%, 6/15/2019 | | | | 220,000 | | | | 198,550 | |

| Berry Petroleum Co.: | |

| 6.375%, 9/15/2022 | | | 360,000 | | | | 382,500 | |

| 6.75%, 11/1/2020 | | | 360,000 | | | | 388,800 | |

| BreitBurn Energy Partners LP, 7.875%, 4/15/2022 | | | | 370,000 | | | | 395,900 | |

| Chaparral Energy, Inc.: | |

| 7.625%, 11/15/2022 | | | 235,000 | | | | 256,738 | |

| 144A, 7.625%, 11/15/2022 | | | 215,000 | | | | 232,738 | |

| 9.875%, 10/1/2020 | | | 1,750,000 | | | | 2,021,250 | |

| Chesapeake Energy Corp., 3.25%, 3/15/2016 (b) | | | | 905,000 | | | | 915,181 | |

| Chesapeake Oilfield Operating LLC, 144A, 6.625%, 11/15/2019 | | | | 400,000 | | | | 412,000 | |

| Continental Resources, Inc., 5.0%, 9/15/2022 | | | | 330,000 | | | | 350,625 | |

| Crestwood Midstream Partners LP, 7.75%, 4/1/2019 | | | | 1,155,000 | | | | 1,204,087 | |

| Crosstex Energy LP, 144A, 7.125%, 6/1/2022 | | | | 195,000 | | | | 206,700 | |

| Denbury Resources, Inc., 4.625%, 7/15/2023 | | | | 890,000 | | | | 858,850 | |

| Dresser-Rand Group, Inc., 6.5%, 5/1/2021 | | | | 780,000 | | | | 832,650 | |

| Eagle Rock Energy Partners LP, 8.375%, 6/1/2019 | | | | 610,000 | | | | 643,550 | |

| EP Energy LLC: | |

| 6.875%, 5/1/2019 | | | 635,000 | | | | 695,325 | |

| 7.75%, 9/1/2022 | | | 165,000 | | | | 182,325 | |

| 9.375%, 5/1/2020 | | | 145,000 | | | | 167,475 | |

| EPE Holdings LLC, 144A, 8.125%, 12/15/2017 (PIK) | | | | 790,000 | | | | 829,500 | |

| EV Energy Partners LP, 8.0%, 4/15/2019 | | | | 1,595,000 | | | | 1,682,725 | |

| Frontier Oil Corp., 6.875%, 11/15/2018 | | | | 630,000 | | | | 681,975 | |

| Halcon Resources Corp.: | |

| 144A, 8.875%, 5/15/2021 | | | 990,000 | | | | 1,066,725 | |

| 144A, 9.75%, 7/15/2020 | | | 295,000 | | | | 325,975 | |

| Holly Energy Partners LP, 144A, 6.5%, 3/1/2020 | | | | 205,000 | | | | 217,813 | |

| Kodiak Oil & Gas Corp., 144A, 5.5%, 1/15/2021 | | | | 445,000 | | | | 466,138 | |

| Linn Energy LLC: | |

| 144A, 6.25%, 11/1/2019 | | | 815,000 | | | | 833,337 | |

| 6.5%, 5/15/2019 | | | 240,000 | | | | 251,100 | |

| MarkWest Energy Partners LP, 5.5%, 2/15/2023 | | | | 210,000 | | | | 219,975 | |

| MEG Energy Corp.: | |

| 144A, 6.375%, 1/30/2023 | | | 990,000 | | | | 1,029,600 | |

| 144A, 6.5%, 3/15/2021 | | | 435,000 | | | | 463,275 | |

| Midstates Petroleum Co., Inc., 144A, 10.75%, 10/1/2020 | | | | 210,000 | | | | 233,100 | |

| Newfield Exploration Co., 5.75%, 1/30/2022 | | | | 390,000 | | | | 417,300 | |

| Northern Oil & Gas, Inc., 8.0%, 6/1/2020 | | | | 1,010,000 | | | | 1,052,925 | |

| Oasis Petroleum, Inc.: | |

| 6.5%, 11/1/2021 | | | 300,000 | | | | 327,000 | |

| 6.875%, 1/15/2023 | | | 225,000 | | | | 247,500 | |

| 7.25%, 2/1/2019 | | | 715,000 | | | | 775,775 | |

| Offshore Group Investment Ltd.: | |

| 144A, 7.125%, 4/1/2023 | | | 730,000 | | | | 746,425 | |

| 144A, 7.5%, 11/1/2019 | | | 530,000 | | | | 561,800 | |

| OGX Austria GmbH, 144A, 8.375%, 4/1/2022 | | | | 320,000 | | | | 241,600 | |

| Plains Exploration & Production Co.: | |

| 6.125%, 6/15/2019 | | | 430,000 | | | | 470,850 | |

| 6.75%, 2/1/2022 | | | 975,000 | | | | 1,085,906 | |

| 6.875%, 2/15/2023 | | | 940,000 | | | | 1,064,550 | |

| Range Resources Corp., 144A, 5.0%, 3/15/2023 | | | | 180,000 | | | | 184,050 | |

| Sabine Pass Liquefaction LLC, 144A, 5.625%, 2/1/2021 | | | | 455,000 | | | | 472,062 | |

| Sabine Pass LNG LP, 7.5%, 11/30/2016 | | | | 565,000 | | | | 624,325 | |

| SandRidge Energy, Inc., 7.5%, 3/15/2021 | | | | 915,000 | | | | 951,600 | |

| SESI LLC: | |

| 6.375%, 5/1/2019 | | | 440,000 | | | | 473,000 | |

| 7.125%, 12/15/2021 | | | 1,280,000 | | | | 1,432,000 | |

| Shelf Drilling Holdings Ltd., 144A, 8.625%, 11/1/2018 | | | | 265,000 | | | | 280,900 | |

| Swift Energy Co.: | |

| 7.875%, 3/1/2022 | | | 785,000 | | | | 820,325 | |

| 144A, 7.875%, 3/1/2022 | | | 465,000 | | | | 485,925 | |

| Talos Production LLC, 144A, 9.75%, 2/15/2018 | | | | 695,000 | | | | 688,050 | |

| Tesoro Corp.: | |

| 4.25%, 10/1/2017 | | | 400,000 | | | | 418,000 | |

| 5.375%, 10/1/2022 | | | 280,000 | | | | 291,900 | |

| Venoco, Inc., 8.875%, 2/15/2019 | | | | 560,000 | | | | 543,200 | |

| WPX Energy, Inc., 5.25%, 1/15/2017 | | | | 450,000 | | | | 471,375 | |

| | | | | 34,883,725 | |

| Financials 17.0% | |

| AerCap Aviation Solutions BV, 6.375%, 5/30/2017 | | | | 1,300,000 | | | | 1,395,875 | |

| Ally Financial, Inc.: | |

| 5.5%, 2/15/2017 | | | 700,000 | | | | 757,220 | |

| 6.25%, 12/1/2017 | | | 7,000,000 | | | | 7,828,121 | |

| Alphabet Holding Co., Inc., 144A, 7.75%, 11/1/2017 (PIK) | | | | 185,000 | | | | 192,863 | |

| Altice Financing SA, 144A, 7.875%, 12/15/2019 | | | | 420,000 | | | | 457,968 | |

| AmeriGas Finance LLC: | |

| 6.75%, 5/20/2020 | | | 200,000 | | | | 217,500 | |

| 7.0%, 5/20/2022 | | | 200,000 | | | | 217,500 | |

| Antero Resources Finance Corp.: | |

| 7.25%, 8/1/2019 | | | 540,000 | | | | 585,225 | |

| 9.375%, 12/1/2017 | | | 225,000 | | | | 244,125 | |

| Ardagh Packaging Finance PLC, 144A, 4.875%, 11/15/2022 | | | | 285,000 | | | | 281,438 | |

| Ashtead Capital, Inc., 144A, 6.5%, 7/15/2022 | | | | 560,000 | | | | 608,300 | |

| Ashton Woods U.S.A. LLC, 144A, 6.875%, 2/15/2021 | | | | 595,000 | | | | 603,925 | |

| AWAS Aviation Capital Ltd., 144A, 7.0%, 10/17/2016 | | | | 868,600 | | | | 916,373 | |

| Banco Bradesco SA, 144A, 5.75%, 3/1/2022 | | | | 1,355,000 | | | | 1,446,462 | |

| BOE Merger Corp., 144A, 9.5%, 11/1/2017 (PIK) | | | | 375,000 | | | | 403,594 | |

| Caesar's Operating Escrow LLC, 144A, 9.0%, 2/15/2020 | | | | 460,000 | | | | 462,875 | |

| CIT Group, Inc., 5.25%, 3/15/2018 | | | | 1,045,000 | | | | 1,128,600 | |

| DuPont Fabros Technology LP, (REIT), 8.5%, 12/15/2017 | | | | 750,000 | | | | 806,250 | |

| E*TRADE Financial Corp.: | |

| 6.375%, 11/15/2019 | | | 535,000 | | | | 565,762 | |

| 6.75%, 6/1/2016 | | | 680,000 | | | | 732,700 | |

| Fibria Overseas Finance Ltd., 144A, 6.75%, 3/3/2021 | | | | 220,000 | | | | 242,990 | |

| Ford Motor Credit Co., LLC: | |

| 5.0%, 5/15/2018 | | | 780,000 | | | | 859,100 | |

| 5.875%, 8/2/2021 | | | 560,000 | | | | 640,601 | |

| 6.625%, 8/15/2017 | | | 1,000,000 | | | | 1,166,219 | |

| Fresenius Medical Care U.S. Finance II, Inc.: | |

| 144A, 5.625%, 7/31/2019 | | | 405,000 | | | | 444,487 | |

| 144A, 5.875%, 1/31/2022 | | | 355,000 | | | | 396,269 | |

| Fresenius Medical Care U.S. Finance, Inc.: | |

| 144A, 5.75%, 2/15/2021 | | | 235,000 | | | | 259,088 | |

| 144A, 6.5%, 9/15/2018 | | | 210,000 | | | | 239,400 | |

| Hexion U.S. Finance Corp.: | |

| 6.625%, 4/15/2020 | | | 175,000 | | | | 175,438 | |

| 8.875%, 2/1/2018 | | | 1,240,000 | | | | 1,283,400 | |

| International Lease Finance Corp.: | |

| 3.875%, 4/15/2018 | | | 1,370,000 | | | | 1,366,575 | |

| 4.625%, 4/15/2021 | | | 640,000 | | | | 638,400 | |

| 5.75%, 5/15/2016 | | | 205,000 | | | | 221,400 | |

| 6.25%, 5/15/2019 | | | 605,000 | | | | 662,475 | |

| 8.625%, 1/15/2022 | | | 565,000 | | | | 718,962 | |

| 8.75%, 3/15/2017 | | | 1,220,000 | | | | 1,435,025 | |

| Level 3 Financing, Inc.: | |

| 144A, 7.0%, 6/1/2020 | | | 710,000 | | | | 743,725 | |

| 8.125%, 7/1/2019 | | | 375,000 | | | | 412,500 | |

| 8.625%, 7/15/2020 | | | 295,000 | | | | 328,925 | |

| MPT Operating Partnership LP: | |

| (REIT), 6.375%, 2/15/2022 | | | 335,000 | | | | 360,125 | |

| (REIT), 6.875%, 5/1/2021 | | | 550,000 | | | | 596,750 | |

| Neuberger Berman Group LLC: | |

| 144A, 5.625%, 3/15/2020 | | | 305,000 | | | | 319,488 | |

| 144A, 5.875%, 3/15/2022 | | | 505,000 | | | | 534,037 | |

| Nielsen Finance LLC, 144A, 4.5%, 10/1/2020 | | | | 280,000 | | | | 279,650 | |

| NII Capital Corp., 7.625%, 4/1/2021 | | | | 290,000 | | | | 208,800 | |

| Odebrecht Finance Ltd., 144A, 6.0%, 4/5/2023 | | | | 672,000 | | | | 752,640 | |

| Pinnacle Foods Finance LLC, 9.25%, 4/1/2015 | | | | 730,000 | | | | 732,737 | |

| Reynolds Group Issuer, Inc.: | |

| 5.75%, 10/15/2020 | | | 745,000 | | | | 758,969 | |

| 8.5%, 5/15/2018 | | | 3,715,000 | | | | 3,905,394 | |

| 9.875%, 8/15/2019 | | | 115,000 | | | | 126,069 | |

| Sable International Finance Ltd., 144A, 8.75%, 2/1/2020 | | | | 200,000 | | | | 226,000 | |

| Schaeffler Finance BV, 144A, 7.75%, 2/15/2017 | | | | 755,000 | | | | 850,319 | |

| Serta Simmons Holdings LLC, 144A, 8.125%, 10/1/2020 | | | | 210,000 | | | | 218,138 | |

| Sky Growth Acquisition Corp., 144A, 7.375%, 10/15/2020 | | | | 325,000 | | | | 343,687 | |

| Tronox Finance LLC, 144A, 6.375%, 8/15/2020 | | | | 470,000 | | | | 455,900 | |

| U.S. Coatings Acquisition, Inc., 144A, 7.375%, 5/1/2021 | | | | 230,000 | | | | 242,075 | |

| UPCB Finance III Ltd., 144A, 6.625%, 7/1/2020 | | | | 2,090,000 | | | | 2,246,750 | |

| UPCB Finance V Ltd., 144A, 7.25%, 11/15/2021 | | | | 405,000 | | | | 447,525 | |

| UPCB Finance VI Ltd., 144A, 6.875%, 1/15/2022 | | | | 405,000 | | | | 440,437 | |

| Wind Acquisition Finance SA, 144A, 7.25%, 2/15/2018 | | | | 685,000 | | | | 713,256 | |

| WMG Acquisition Corp., 144A, 6.0%, 1/15/2021 | | | | 190,000 | | | | 199,025 | |

| | | | | 47,045,426 | |

| Health Care 6.1% | |

| Aviv Healthcare Properties LP, 7.75%, 2/15/2019 | | | | 955,000 | | | | 1,026,625 | |

| Biomet, Inc.: | |

| 144A, 6.5%, 8/1/2020 | | | 655,000 | | | | 695,119 | |

| 144A, 6.5%, 10/1/2020 | | | 185,000 | | | | 190,203 | |

| Community Health Systems, Inc.: | |

| 5.125%, 8/15/2018 | | | 2,160,000 | | | | 2,262,600 | |

| 7.125%, 7/15/2020 | | | 1,230,000 | | | | 1,334,550 | |

| HCA Holdings, Inc., 7.75%, 5/15/2021 | | | | 1,275,000 | | | | 1,420,828 | |

| HCA, Inc.: | |

| 5.875%, 3/15/2022 | | | 500,000 | | | | 538,750 | |

| 6.5%, 2/15/2020 | | | 2,155,000 | | | | 2,431,109 | |

| 7.5%, 2/15/2022 | | | 1,615,000 | | | | 1,857,250 | |

| 7.875%, 2/15/2020 | | | 2,110,000 | | | | 2,331,550 | |

| Hologic, Inc., 6.25%, 8/1/2020 | | | | 385,000 | | | | 409,544 | |

| IMS Health, Inc., 144A, 6.0%, 11/1/2020 | | | | 465,000 | | | | 484,762 | |

| Physio-Control International, Inc., 144A, 9.875%, 1/15/2019 | | | | 295,000 | | | | 332,613 | |

| STHI Holding Corp., 144A, 8.0%, 3/15/2018 | | | | 325,000 | | | | 355,063 | |

| Tenet Healthcare Corp.: | |

| 144A, 4.5%, 4/1/2021 | | | 90,000 | | | | 88,200 | |

| 6.25%, 11/1/2018 | | | 975,000 | | | | 1,082,250 | |

| | | | | 16,841,016 | |

| Industrials 12.5% | |

| Accuride Corp., 9.5%, 8/1/2018 | | | | 1,520,000 | | | | 1,554,200 | |

| Aguila 3 SA, 144A, 7.875%, 1/31/2018 | | | | 920,000 | | | | 986,700 | |

| Air Lease Corp.: | |

| 4.75%, 3/1/2020 | | | 535,000 | | | | 548,375 | |

| 6.125%, 4/1/2017 | | | 850,000 | | | | 920,125 | |

| BE Aerospace, Inc., 6.875%, 10/1/2020 | | | | 6,910,000 | | | | 7,644,187 | |

| Belden, Inc., 144A, 5.5%, 9/1/2022 | | | | 660,000 | | | | 676,500 | |

| Bombardier, Inc.: | |

| 144A, 5.75%, 3/15/2022 | | | 815,000 | | | | 836,394 | |

| 144A, 6.125%, 1/15/2023 | | | 530,000 | | | | 549,875 | |

| Building Materials Corp. of America, 144A, 7.5%, 3/15/2020 | | | | 6,000,000 | | | | 6,555,000 | |

| Casella Waste Systems, Inc., 7.75%, 2/15/2019 | | | | 820,000 | | | | 781,050 | |

| Clean Harbors, Inc., 144A, 5.125%, 6/1/2021 | | | | 475,000 | | | | 486,281 | |

| DigitalGlobe, Inc., 144A, 5.25%, 2/1/2021 | | | | 270,000 | | | | 268,313 | |

| Ducommun, Inc., 9.75%, 7/15/2018 | | | | 320,000 | | | | 352,000 | |

| DynCorp International, Inc., 10.375%, 7/1/2017 | | | | 1,500,000 | | | | 1,477,500 | |

| Florida East Coast Railway Corp., 8.125%, 2/1/2017 | | | | 435,000 | | | | 466,538 | |

| FTI Consulting, Inc., 144A, 6.0%, 11/15/2022 | | | | 375,000 | | | | 396,563 | |

| GenCorp, Inc., 144A, 7.125%, 3/15/2021 | | | | 1,340,000 | | | | 1,413,700 | |

| Huntington Ingalls Industries, Inc.: | |

| 6.875%, 3/15/2018 | | | 535,000 | | | | 581,813 | |

| 7.125%, 3/15/2021 | | | 110,000 | | | | 119,625 | |

| Interline Brands, Inc., 7.5%, 11/15/2018 | | | | 200,000 | | | | 217,000 | |

| Iron Mountain, Inc., 5.75%, 8/15/2024 | | | | 460,000 | | | | 459,425 | |

| Kenan Advantage Group, Inc., 144A, 8.375%, 12/15/2018 | | | | 725,000 | | | | 761,250 | |

| Navios Maritime Holdings, Inc.: | |

| 8.125%, 2/15/2019 | | | 770,000 | | | | 696,850 | |

| 8.875%, 11/1/2017 | | | 1,035,000 | | | | 1,056,994 | |

| Navios South American Logistics, Inc., 144A, 9.25%, 4/15/2019 | | | | 100,000 | | | | 107,500 | |

| Ply Gem Industries, Inc., 9.375%, 4/15/2017 | | | | 160,000 | | | | 176,000 | |

| Rexel SA, 144A, 5.25%, 6/15/2020 (b) | | | | 490,000 | | | | 496,125 | |

| Spirit AeroSystems, Inc., 6.75%, 12/15/2020 | | | | 955,000 | | | | 1,019,462 | |

| Titan International, Inc., 144A, 7.875%, 10/1/2017 | | | | 240,000 | | | | 258,300 | |

| United Rentals North America, Inc.: | |

| 5.75%, 7/15/2018 | | | 690,000 | | | | 747,787 | |

| 6.125%, 6/15/2023 | | | 45,000 | | | | 48,150 | |

| 7.375%, 5/15/2020 | | | 565,000 | | | | 627,150 | |

| 7.625%, 4/15/2022 | | | 565,000 | | | | 631,387 | |

| Watco Companies LLC, 144A, 6.375%, 4/1/2023 | | | | 275,000 | | | | 282,906 | |

| Welltec AS, 144A, 8.0%, 2/1/2019 | | | | 200,000 | | | | 218,500 | |

| | | | | 34,419,525 | |

| Information Technology 6.9% | |

| Alliance Data Systems Corp., 144A, 5.25%, 12/1/2017 | | | | 470,000 | | | | 487,625 | |

| Avaya, Inc., 144A, 7.0%, 4/1/2019 | | | | 1,605,000 | | | | 1,568,887 | |

| CDW LLC, 8.5%, 4/1/2019 | | | | 3,210,000 | | | | 3,583,162 | |

| CyrusOne LP, 144A, 6.375%, 11/15/2022 | | | | 185,000 | | | | 193,788 | |

| eAccess Ltd., 144A, 8.25%, 4/1/2018 | | | | 315,000 | | | | 348,863 | |

| Equinix, Inc.: | |

| 4.875%, 4/1/2020 | | | 480,000 | | | | 483,600 | |

| 5.375%, 4/1/2023 | | | 1,275,000 | | | | 1,290,938 | |

| 7.0%, 7/15/2021 | | | 440,000 | | | | 488,400 | |

| 8.125%, 3/1/2018 | | | 230,000 | | | | 254,150 | |

| First Data Corp.: | |

| 144A, 6.75%, 11/1/2020 | | | 1,305,000 | | | | 1,360,463 | |

| 144A, 7.375%, 6/15/2019 | | | 475,000 | | | | 505,281 | |

| 144A, 10.625%, 6/15/2021 (b) | | | 740,000 | | | | 748,325 | |

| 144A, 11.25%, 1/15/2021 | | | 480,000 | | | | 499,200 | |

| Freescale Semiconductor, Inc., 144A, 9.25%, 4/15/2018 | | | | 1,275,000 | | | | 1,399,312 | |

| Hughes Satellite Systems Corp.: | |

| 6.5%, 6/15/2019 | | | 850,000 | | | | 932,875 | |

| 7.625%, 6/15/2021 | | | 435,000 | | | | 497,531 | |

| IAC/InterActiveCorp., 144A, 4.75%, 12/15/2022 | | | | 355,000 | | | | 347,013 | |

| Jabil Circuit, Inc., 5.625%, 12/15/2020 | | | | 3,750,000 | | | | 3,975,000 | |

| | | | | 18,964,413 | |

| Materials 8.0% | |

| APERAM: | |

| 144A, 7.375%, 4/1/2016 | | | 155,000 | | | | 156,163 | |

| 144A, 7.75%, 4/1/2018 | | | 210,000 | | | | 208,950 | |

| Ashland, Inc., 144A, 3.875%, 4/15/2018 | | | | 270,000 | | | | 273,375 | |

| Axiall Corp., 144A, 4.875%, 5/15/2023 | | | | 110,000 | | | | 111,925 | |

| Berry Plastics Corp., 9.75%, 1/15/2021 | | | | 1,290,000 | | | | 1,507,687 | |

| Continental Rubber of America Corp., 144A, 4.5%, 9/15/2019 | | | | 295,000 | | | | 301,638 | |

| Crown Americas LLC, 6.25%, 2/1/2021 | | | | 105,000 | | | | 114,713 | |

| Eagle Spinco, Inc., 144A, 4.625%, 2/15/2021 | | | | 225,000 | | | | 228,938 | |

| Essar Steel Algoma, Inc.: | |

| 144A, 9.375%, 3/15/2015 | | | 3,055,000 | | | | 2,932,800 | |

| 144A, 9.875%, 6/15/2015 | | | 195,000 | | | | 158,438 | |

| Exopack Holding Corp., 10.0%, 6/1/2018 | | | | 435,000 | | | | 432,825 | |

| FMG Resources August 2006 Pty Ltd.: | |

| 144A, 6.0%, 4/1/2017 | | | 605,000 | | | | 621,637 | |

| 144A, 6.875%, 4/1/2022 | | | 435,000 | | | | 455,663 | |

| 144A, 7.0%, 11/1/2015 | | | 635,000 | | | | 665,162 | |

| 144A, 8.25%, 11/1/2019 | | | 520,000 | | | | 560,950 | |

| Huntsman International LLC: | |

| 4.875%, 11/15/2020 | | | 420,000 | | | | 423,150 | |

| 8.625%, 3/15/2020 | | | 585,000 | | | | 653,737 | |

| IAMGOLD Corp., 144A, 6.75%, 10/1/2020 | | | | 555,000 | | | | 534,187 | |

| Ineos Finance PLC, 144A, 9.0%, 5/15/2015 | | | | 700,000 | | | | 736,750 | |

| Inmet Mining Corp.: | |

| 144A, 7.5%, 6/1/2021 | | | 1,035,000 | | | | 1,120,387 | |

| 144A, 8.75%, 6/1/2020 | | | 610,000 | | | | 677,100 | |

| JMC Steel Group, Inc., 144A, 8.25%, 3/15/2018 | | | | 325,000 | | | | 344,500 | |

| Kaiser Aluminum Corp., 8.25%, 6/1/2020 | | | | 490,000 | | | | 548,800 | |

| KGHM International Ltd., 144A, 7.75%, 6/15/2019 | | | | 1,180,000 | | | | 1,239,000 | |

| LyondellBasell Industries NV, 6.0%, 11/15/2021 | | | | 200,000 | | | | 237,000 | |

| Molycorp, Inc., 10.0%, 6/1/2020 | | | | 165,000 | | | | 162,525 | |

| Novelis, Inc.: | |

| 8.375%, 12/15/2017 | | | 1,595,000 | | | | 1,746,525 | |

| 8.75%, 12/15/2020 | | | 1,550,000 | | | | 1,747,625 | |

| Packaging Dynamics Corp., 144A, 8.75%, 2/1/2016 | | | | 610,000 | | | | 638,212 | |

| Perstorp Holding AB, 144A, 8.75%, 5/15/2017 | | | | 400,000 | | | | 423,000 | |

| Polymer Group, Inc., 7.75%, 2/1/2019 | | | | 590,000 | | | | 643,100 | |

| PolyOne Corp., 144A, 5.25%, 3/15/2023 | | | | 1,010,000 | | | | 1,017,575 | |

| Rain CII Carbon LLC, 144A, 8.25%, 1/15/2021 | | | | 285,000 | | | | 307,800 | |

| Sealed Air Corp., 144A, 5.25%, 4/1/2023 | | | | 90,000 | | | | 90,338 | |

| | | | | 22,022,175 | |

| Telecommunication Services 21.9% | |

| Altice Finco SA, 144A, 9.875%, 12/15/2020 | | | | 420,000 | | | | 470,400 | |

| CenturyLink, Inc., Series V, 5.625%, 4/1/2020 | | | | 180,000 | | | | 184,050 | |

| Cincinnati Bell, Inc., 8.25%, 10/15/2017 | | | | 5,575,000 | | | | 5,909,500 | |

| CPI International, Inc., 8.0%, 2/15/2018 | | | | 500,000 | | | | 520,000 | |

| Cricket Communications, Inc., 7.75%, 10/15/2020 | | | | 4,005,000 | | | | 3,994,987 | |

| Digicel Group Ltd.: | |

| 144A, 8.25%, 9/30/2020 | | | 755,000 | | | | 800,300 | |

| 144A, 10.5%, 4/15/2018 | | | 1,170,000 | | | | 1,301,625 | |

| Digicel Ltd.: | |

| 144A, 7.0%, 2/15/2020 | | | 200,000 | | | | 209,000 | |

| 144A, 8.25%, 9/1/2017 | | | 835,000 | | | | 883,012 | |

| Frontier Communications Corp.: | |

| 7.125%, 1/15/2023 | | | 2,450,000 | | | | 2,480,625 | |

| 7.625%, 4/15/2024 (b) | | | 195,000 | | | | 200,606 | |

| 8.5%, 4/15/2020 | | | 1,900,000 | | | | 2,151,750 | |

| Intelsat Jackson Holdings SA: | |

| 7.25%, 10/15/2020 | | | 5,905,000 | | | | 6,488,119 | |

| 7.5%, 4/1/2021 | | | 2,135,000 | | | | 2,375,187 | |

| 8.5%, 11/1/2019 | | | 1,100,000 | | | | 1,233,375 | |

| Intelsat Luxembourg SA: | |

| 144A, 7.75%, 6/1/2021 (b) | | | 1,185,000 | | | | 1,205,737 | |

| 144A, 8.125%, 6/1/2023 (b) | | | 185,000 | | | | 188,006 | |

| 11.5%, 2/4/2017 (PIK) | | | 2,146,718 | | | | 2,279,815 | |

| Level 3 Communications, Inc., 144A, 8.875%, 6/1/2019 | | | | 55,000 | | | | 60,088 | |

| Lynx I Corp., 144A, 5.375%, 4/15/2021 | | | | 200,000 | | | | 208,000 | |

| MetroPCS Wireless, Inc.: | |

| 6.625%, 11/15/2020 | | | 2,200,000 | | | | 2,299,000 | |

| 7.875%, 9/1/2018 | | | 835,000 | | | | 912,237 | |

| SBA Communications Corp., 144A, 5.625%, 10/1/2019 | | | | 370,000 | | | | 380,638 | |

| Sprint Nextel Corp.: | |

| 6.0%, 12/1/2016 | | | 3,710,000 | | | | 4,025,350 | |

| 6.0%, 11/15/2022 | | | 630,000 | | | | 647,325 | |

| 9.125%, 3/1/2017 | | | 295,000 | | | | 348,838 | |

| Syniverse Holdings, Inc., 9.125%, 1/15/2019 | | | | 255,000 | | | | 279,863 | |

| Telesat Canada, 144A, 6.0%, 5/15/2017 | | | | 4,185,000 | | | | 4,373,325 | |

| tw telecom holdings, Inc., 5.375%, 10/1/2022 | | | | 520,000 | | | | 542,100 | |

| Windstream Corp.: | |

| 144A, 6.375%, 8/1/2023 | | | 450,000 | | | | 446,625 | |

| 7.5%, 6/1/2022 | | | 315,000 | | | | 337,050 | |

| 7.5%, 4/1/2023 | | | 160,000 | | | | 169,600 | |

| 7.75%, 10/15/2020 | | | 355,000 | | | | 385,175 | |

| 7.75%, 10/1/2021 | | | 625,000 | | | | 681,250 | |

| 8.125%, 9/1/2018 | | | 10,500,000 | | | | 11,497,500 | |

| | | | | 60,470,058 | |

| Utilities 5.2% | |

| AES Corp.: | |

| 7.75%, 10/15/2015 | | | 1,930,000 | | | | 2,168,837 | |

| 8.0%, 10/15/2017 | | | 2,200,000 | | | | 2,587,750 | |

| Calpine Corp., 144A, 7.875%, 7/31/2020 | | | | 3,350,000 | | | | 3,668,250 | |

| DPL, Inc., 6.5%, 10/15/2016 | | | | 2,395,000 | | | | 2,526,725 | |

| Electricite de France SA, 144A, 5.25%, 1/29/2049 | | | | 430,000 | | | | 427,179 | |

| Energy Future Holdings Corp., Series Q, 6.5%, 11/15/2024 | | | | 525,000 | | | | 355,031 | |

| Energy Future Intermediate Holding Co., LLC, 10.0%, 12/1/2020 | | | | 130,000 | | | | 147,388 | |

| IPALCO Enterprises, Inc., 5.0%, 5/1/2018 | | | | 1,290,000 | | | | 1,393,200 | |

| NRG Energy, Inc.: | |

| 7.625%, 1/15/2018 | | | 380,000 | | | | 432,250 | |

| 8.25%, 9/1/2020 | | | 580,000 | | | | 654,675 | |

| | | | | 14,361,285 | |

Total Corporate Bonds (Cost $310,415,228) | | | | 327,607,999 | |

| | |

| Government & Agency Obligation 0.4% | |

| Sovereign Bonds | |

| Republic of Croatia, 144A, 6.25%, 4/27/2017 (Cost $1,114,087) | | | | 1,120,000 | | | | 1,199,688 | |

| | |

| Loan Participations and Assignments 21.1% | |

| Senior Loans* | |

| Consumer Discretionary 6.9% | |

| Burger King Corp., Term Loan B, 3.75%, 9/27/2019 | | | | 796,000 | | | | 807,228 | |

| Caesars Entertainment Operating Co., Term Loan B6, 5.454%, 1/26/2018 | | | | 476,638 | | | | 442,878 | |

| Clear Channel Communications, Inc., Term Loan B, 3.854%, 1/29/2016 | | | | 477,436 | | | | 424,500 | |

| Cumulus Media Holdings, Inc., Second Lien Term Loan, 7.5%, 9/16/2019 | | | | 605,000 | | | | 626,680 | |

| Goodyear Tire & Rubber Co., Second Lien Term Loan, 4.75%, 4/30/2019 | | | | 4,770,000 | | | | 4,821,659 | |

| Lord & Taylor Holdings LLC, Term Loan B, 5.75%, 1/11/2019 | | | | 826,286 | | | | 835,842 | |

| Petco Animal Supplies, Inc., Term Loan, 4.0%, 11/24/2017 | | | | 719,172 | | | | 730,097 | |

| Pilot Travel Centers LLC: | |

| Term Loan B, 3.75%, 3/30/2018 | | | | 1,106,251 | | | | 1,120,632 | |

| Term Loan B2, 4.25%, 8/7/2019 | | | | 2,940,225 | | | | 2,980,197 | |

| Tomkins LLC: | |

| Term Loan B2, 3.75%, 9/29/2016 | | | | 4,127,511 | | | | 4,179,126 | |

| First Lien Term Loan, 5.0%, 11/9/2018 | | | | 693,263 | | | | 704,528 | |

| Univision Communications, Inc., Term Loan, 4.75%, 3/2/2020 | | | | 747,489 | | | | 752,509 | |

| WMG Acquisition Corp., Term Loan, 5.25%, 11/1/2018 | | | | 548,063 | | | | 557,569 | |

| | | | | 18,983,445 | |

| Consumer Staples 2.2% | |

| Albertson's LLC, Term Loan, 5.75%, 3/21/2016 | | | | 1,445,000 | | | | 1,471,704 | |

| Del Monte Foods Co., Term Loan, 4.0%, 3/8/2018 | | | | 1,941,416 | | | | 1,962,198 | |

| HJ Heinz Co., Term Loan B2, 2.5%, 3/27/2020 | | | | 1,620,000 | | | | 1,635,860 | |

| Pinnacle Foods Finance LLC, Term Loan F, 4.75%, 10/17/2018 | | | | 1,101,675 | | | | 1,115,997 | |

| | | | | 6,185,759 | |

| Energy 2.6% | |

| Chesapeake Energy Corp., Term Loan, 5.75%, 12/1/2017 | | | | 1,440,000 | | | | 1,486,627 | |

| Plains Exploration & Production, 7 year Term Loan, 4.0%, 11/30/2019 | | | | 1,290,000 | | | | 1,294,837 | |

| Samson Investment Co., Second Lien Term Loan, 6.0%, 9/25/2018 | | | | 2,215,000 | | | | 2,244,770 | |

| Tallgrass Operations LLC, Term Loan, 5.25%, 11/13/2018 | | | | 2,204,475 | | | | 2,251,331 | |

| | | | | 7,277,565 | |

| Health Care 1.2% | |

| Par Pharmaceutical Companies, Inc., Term Loan B, 4.25%, 9/30/2019 | | | | 1,283,558 | | | | 1,298,929 | |

| Warner Chilcott Co., LLC, Term Loan B2, 4.25%, 3/15/2018 | | | | 187,028 | | | | 190,360 | |

| Warner Chilcott Corp., Term Loan B1, 4.25%, 3/15/2018 | | | | 757,566 | | | | 771,062 | |

| WC Luxco S.a.r.l., Term Loan B3, 4.25%, 3/15/2018 | | | | 415,919 | | | | 423,328 | |

| WP Prism, Inc., Term Loan, 6.25%, 5/31/2018 (PIK) | | | | 500,000 | | | | 496,250 | |

| | | | | 3,179,929 | |

| Industrials 1.0% | |

| Buffalo Gulf Coast Terminals LLC, Term Loan, 5.25%, 10/31/2017 | | | | 825,850 | | | | 844,432 | |

| WP CPP Holdings, Inc., First Lien Term Loan, 4.75%, 12/27/2019 | | | | 1,960,000 | | | | 1,970,613 | |

| | | | | 2,815,045 | |

| Information Technology 2.7% | |

| First Data Corp.: | |

| Term Loan B, 4.204%, 3/23/2018 | | | | 3,987,082 | | | | 3,980,363 | |

| Term Loan, 5.204%, 3/24/2017 | | | | 3,320,000 | | | | 3,353,615 | |

| | | | | 7,333,978 | |

| Telecommunication Services 4.1% | |

| Crown Castle International Corp., Term Loan B, 4.0%, 1/31/2019 | | | | 4,873,387 | | | | 4,936,083 | |

| DigitalGlobe, Inc., Term Loan B, 3.75%, 1/24/2020 | | | | 75,000 | | | | 76,137 | |

| Kabel Deutschland GmbH, Term Loan F1, 3.25%, 2/1/2019 | | | | 4,967,730 | | | | 5,031,889 | |

| MetroPCS Wireless, Inc., Term Loan B3, 4.0%, 3/16/2018 | | | | 1,374,472 | | | | 1,381,832 | |

| | | | | 11,425,941 | |

| Utilities 0.4% | |

| NRG Energy, Inc., Term Loan B, 3.25%, 7/2/2018 | | | | 1,121,439 | | | | 1,138,205 | |

Total Loan Participations and Assignments (Cost $57,302,720) | | | | 58,339,867 | |

| | | Shares | | | Value ($) | |

| | | | |

| Preferred Stock 0.3% | |

| Financials | |

| Ally Financial, Inc. 144A, 7.0% (Cost $722,594) | | | 770 | | | | 761,530 | |

| | |

| Cash Equivalents 5.1% | |

| Central Cash Management Fund, 0.12% (c) (Cost $14,179,497) | | | 14,179,497 | | | | 14,179,497 | |

| | | % of Net Assets | | | Value ($) | |

| | | | |

Total Investment Portfolio (Cost $383,734,126)† | | | 145.6 | | | | 402,088,581 | |

| Notes Payable | | | (44.9 | ) | | | (124,000,000 | ) |

| Other Assets and Liabilities, Net | | | (0.7 | ) | | | (1,940,186 | ) |

| Net Assets | | | 100.0 | | | | 276,148,395 | |

* Floating rate securities' yields vary with a designated market index or market rate, such as the coupon-equivalent of the U.S. Treasury Bill rate. These securities are shown at their current rate as of March 31, 2013.

† The cost for federal income tax purposes was $383,734,126. At March 31, 2013, net unrealized appreciation for all securities based on tax cost was $18,354,455. This consisted of aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost of $19,700,554 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $1,346,099.

(a) Principal amount stated in U.S. dollars unless otherwise noted.

(b) When-issued security.

(c) Affiliated fund managed by Deutsche Investment Management Americas Inc. The rate shown is the annualized seven-day yield at period end.

144A: Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

PIK: Denotes that all or a portion of the income is paid in-kind in the form of additional principal.

REIT: Real Estate Investment Trust

The Fund can invest in certain Senior Loan agreements that include the obligation to make additional loans in certain circumstances. The Fund reserves against such contingent obligations by segregating cash, liquid securities and liquid Senior Loans. At March 31, 2013, the Fund had an unfunded loan commitment of $549,808, which could be extended at the option of the borrower, pursuant to the following loan agreement:

| Borrower | | Unfunded Loan Commitment ($) | | | Value ($) | | | Unrealized Appreciation ($) | |

| Tallgrass Operations LLC, Term Delay Draw, 11/13/2017 | | | 549,808 | | | | 555,000 | | | | 5,192 | |

At March 31, 2013, open credit default swap contracts sold were as follows:

Effective/ Expiration Date | | Notional Amount ($) (d) | | | Fixed Cash Flows Received | | Underlying Debt Obligations/ Quality Rating (e) | | Value ($) | | | Upfront Payments Paid ($) | | | Unrealized Appreciation ($) | |

12/20/2011 3/20/2017 | | | 705,000 | 1 | | | 5.0 | % | CIT Group, Inc., 5.5%, 2/15/2019, BB- | | | 95,050 | | | | 23,594 | | | | 71,456 | |

9/20/2012 12/20/2017 | | | 910,000 | 2 | | | 5.0 | % | General Motors Co., 3.3%, 12/20/2017, BB+ | | | 112,514 | | | | 63,874 | | | | 48,640 | |

| Total unrealized appreciation | | | | 120,096 | |

(d) The maximum potential amount of future undiscounted payments that the Fund could be required to make under a credit default swap contract would be the notional amount of the contract. These potential amounts would be partially offset by any recovery values of the referenced debt obligation or net amounts received from the settlement of buy protection credit default swap contracts entered into by the Fund for the same referenced debt obligation, if any.

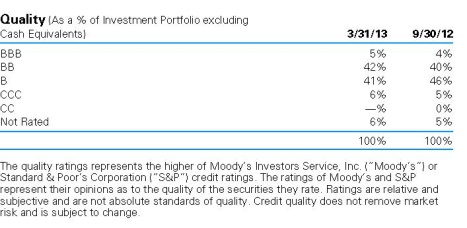

(e) The quality ratings represent the higher of Moody's Investors Service, Inc. ("Moody's") or Standard & Poor's Corporation ("S&P") credit ratings and are unaudited.

Counterparty:

1 Credit Suisse

2 UBS AG

As of March 31, 2013, the Fund had the following open forward foreign currency exchange contracts:

| Contracts to Deliver | | In Exchange For | | Settlement Date | | Unrealized Appreciation ($) | | Counterparty |

| EUR | | | 2,409,500 | | USD | | | 3,122,857 | | 4/15/2013 | | | 33,996 | | Citigroup, Inc. |

| Currency Abbreviations |

EUR Euro USD United States Dollar |

For information on the Fund's policy and additional disclosure regarding credit default swaps and forward foreign currency exchange contracts, please refer to Note B in the accompanying Notes to Financial Statements.

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of March 31, 2013 in valuing the Fund's investments. For information on the Fund's policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | |

| Fixed Income Investments (f) | |

| Corporate Bonds | | $ | — | | | $ | 327,607,999 | | | $ | — | | | $ | 327,607,999 | |

| Government & Agency Obligations | | | — | | | | 1,199,688 | | | | — | | | | 1,199,688 | |

| Loan Participations and Assignments | | | — | | | | 58,339,867 | | | | — | | | | 58,339,867 | |

| Preferred Stock | | | — | | | | 761,530 | | | | — | | | | 761,530 | |

| Short-Term Investments | | | 14,179,497 | | | | — | | | | — | | | | 14,179,497 | |

| Unfunded Loan Commitment | | | — | | | | 5,192 | | | | — | | | | 5,192 | |

Derivatives (g) Credit Default Swaps Contracts | | | — | | | | 120,096 | | | | — | | | | 120,096 | |

| Forward Foreign Currency Contracts | | | — | | | | 33,996 | | | | — | | | | 33,996 | |

| Total | | $ | 14,179,497 | | | $ | 388,068,368 | | | $ | — | | | $ | 402,247,865 | |

There have been no transfers between fair value measurement levels during the period ended March 31, 2013.

(f) See Investment Portfolio for additional detailed categorizations.

(g) Derivatives include unrealized appreciation (depreciation) on credit default swap contracts and forward foreign currency exchange contracts.

The accompanying notes are an integral part of the financial statements.

Statement of Assets and Liabilities | as of March 31, 2013 (Unaudited) | |

| Assets | |

Investments: Investments in non-affiliated securities, at value (cost $369,554,629) | | $ | 387,909,084 | |

| Investment in Central Cash Management Fund (cost $14,179,497) | | | 14,179,497 | |

| Total investments in securities, at value (cost $383,734,126) | | | 402,088,581 | |

| Foreign currency, at value (cost $107) | | | 105 | |

| Receivable for investments sold | | | 1,417,036 | |

| Receivable for investments sold — when-issued securities | | | 453,600 | |

| Interest receivable | | | 7,079,095 | |

| Unrealized appreciation on unfunded loan commitment | | | 5,192 | |

| Unrealized appreciation on swap contracts | | | 120,096 | |

| Unrealized appreciation on forward foreign currency exchange contracts | | | 33,996 | |

| Upfront payments paid on swap contracts | | | 87,468 | |

| Other assets | | | 3,833 | |

| Total assets | | | 411,289,002 | |

| Liabilities | |

| Cash overdraft | | | 196,816 | |

| Payable for investments purchased | | | 5,565,104 | |

| Payable for investments purchased — when-issued securities | | | 4,699,907 | |

| Notes payable | | | 124,000,000 | |

| Interest on notes payable | | | 189,775 | |

| Accrued management fee | | | 288,456 | |

| Accrued Directors' fees | | | 1,825 | |

| Other accrued expenses and payables | | | 198,724 | |

| Total liabilities | | | 135,140,607 | |

| Net assets, at value | | $ | 276,148,395 | |

The accompanying notes are an integral part of the financial statements.

Statement of Assets and Liabilities as of March 31, 2013 (Unaudited) (continued) | |

| Net Assets Consist of | |

| Undistributed net investment income | | | 455,776 | |

Net unrealized appreciation (depreciation) on: Investments | | | 18,354,455 | |

| Unfunded loan commitment | | | 5,192 | |

| Swap contracts | | | 120,096 | |

| Foreign currency | | | 32,043 | |

| Accumulated net realized gain (loss) | | | (603,533,232 | ) |

| Paid-in capital | | | 860,714,065 | |

| Net assets, at value | | $ | 276,148,395 | |

| Net Asset Value | |

Class A Net Asset Value per share ($276,148,395 ÷ 16,850,701 shares of common stock issued and outstanding, $.01 par value, 100,000,000 shares authorized) | | $ | 16.39 | |

The accompanying notes are an integral part of the financial statements.

| for the six months ended March 31, 2013 (Unaudited) | |

| Investment Income | |

| Interest | | $ | 12,732,872 | |

| Dividends | | | 20,475 | |

| Income distributions — Central Cash Management Fund | | | 7,197 | |

| Total income | | | 12,760,544 | |

Expenses: Management fee | | | 1,659,808 | |

| Administration fee | | | 195,271 | |

| Services to shareholders | | | 810 | |

| Custodian fee | | | 19,162 | |

| Professional fees | | | 56,495 | |

| Reports to shareholders | | | 57,469 | |

| Directors' fees and expenses | | | 7,590 | |

| Interest expense | | | 810,770 | |

| Stock exchange listing fees | | | 11,836 | |

| Other | | | 29,594 | |

| Total expenses | | | 2,848,805 | |

| Net investment income | | | 9,911,739 | |

| Realized and Unrealized Gain (Loss) | |

Net realized gain (loss) from: Investments | | | 3,338,593 | |

| Swap contracts | | | 30,741 | |

| Foreign currency | | | (186,523 | ) |

| | | | 3,182,811 | |

Change in net unrealized appreciation (depreciation) on: Investments | | | 3,152,036 | |

| Unfunded loan commitment | | | 5,192 | |

| Swap contracts | | | 66,911 | |

| Foreign currency | | | 194,850 | |

| | | | 3,418,989 | |

| Net gain (loss) | | | 6,601,800 | |

| Net increase (decrease) in net assets resulting from operations | | $ | 16,513,539 | |

The accompanying notes are an integral part of the financial statements.

| for the six months ended March 31, 2013 (Unaudited) | |

Increase (Decrease) in Cash: Cash Flows from Operating Activities | | | |

| Net increase (decrease) in net assets resulting from operations | | $ | 16,513,539 | |

Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided (used) by operating activities: Purchases of long-term investments | | | (118,321,535 | ) |

| Net purchases, sales and maturities of short-term investments | | | (11,693,308 | ) |

| Net amortization/accretion of premium (discount) | | | 414,193 | |

| Proceeds from sales and maturities of long-term investments | | | 124,419,885 | |

| (Increase) decrease in receivable for investments and when-issued securities sold | | | 697,777 | |

| (Increase) decrease in interest receivable | | | 470,634 | |

| (Increase) decrease in upfront payments paid on swap contracts | | | (60,910 | ) |

| (Increase) decrease in other assets | | | 13,507 | |

| Increase (decrease) in interest on notes payable | | | 155,185 | |

| Increase (decrease) in payable for investments and when-issued securities purchased | | | (5,664,465 | ) |

| Increase (decrease) in other accrued expenses and payables | | | (19,581 | ) |

| Change in unrealized (appreciation) depreciation on investments | | | (3,152,036 | ) |

| Change in unrealized (appreciation) depreciation on swaps | | | (66,911 | ) |

| Change in net unrealized (appreciation) depreciation on forward foreign currency exchange contracts | | | (200,995 | ) |

| Change in unrealized (appreciation) depreciation in unfunded loan commitment | | | (5,192 | ) |

| Net realized (gain) loss from investments | | | (3,338,593 | ) |

| Cash provided (used) by operating activities | | $ | 161,194 | |

| Cash Flows from Financing Activities | | | | |

| Net increase (decrease) in cash overdraft (including foreign currency) | | | 196,711 | |

| Net increase (decrease) in notes payable | | | 10,000,000 | |

| Distributions paid (net of reinvestment of distributions) | | | (10,430,584 | ) |

| Cash provided (used) for financing activities | | | (233,873 | ) |

| Increase (decrease) in cash | | | (72,679 | ) |

| Cash at beginning of period (including foreign currency) | | | 72,679 | |

| Cash at end of period | | $ | — | |

| Supplemental Disclosure | | | | |

| Interest paid on notes | | | (655,585 | ) |

The accompanying notes are an integral part of the financial statements.

Statement of Changes in Net Assets | Increase (Decrease) in Net Assets | | Six Months Ended March 31, 2013 (Unaudited) | | | Year Ended September 30, 2012 | |

Operations: Net investment income | | $ | 9,911,739 | | | $ | 20,998,230 | |

| Net realized gain (loss) | | | 3,182,811 | | | | (1,902,230 | ) |

| Change in net unrealized appreciation (depreciation) | | | 3,418,989 | | | | 38,905,696 | |

| Net increase (decrease) in net assets resulting from operations | | | 16,513,539 | | | | 58,001,696 | |

Distributions to shareholders from: Net investment income | | | (10,430,584 | ) | | | (22,473,098 | ) |

| Total distributions | | | (10,430,584 | ) | | | (22,473,098 | ) |

Fund share transactions: Reinvestment of distributions | | | — | | | | 151,320 | |

| Net increase (decrease) in net assets from Fund share transactions | | | — | | | | 151,320 | |

| Increase (decrease) in net assets | | | 6,082,955 | | | | 35,679,918 | |

| Net assets at beginning of period | | | 270,065,440 | | | | 234,385,522 | |

| Net assets at end of period (including undistributed net investment income of $455,776 and $974,621, respectively) | | $ | 276,148,395 | | | $ | 270,065,440 | |

| Other Information | |

| Shares outstanding at beginning of period | | | 16,850,701 | | | | 16,841,021 | |

| Shares reinvested | | | — | | | | 9,680 | |

| Shares outstanding at end of period | | | 16,850,701 | | | | 16,850,701 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | Years Ended September 30, | |

| | | Six Months Ended 3/31/13 (Unaudited) | | | 2012 | | | 2011 | | | 2010 | | | | 2009 | e | | | 2008 | e |

| Selected Per Share Data | |

| Net asset value, beginning of period | | $ | 16.03 | | | $ | 13.92 | | | $ | 15.03 | | | $ | 13.58 | | | $ | 20.67 | | | $ | 35.83 | |

Income (loss) from investment operations: Net investment incomea | | | .59 | | | | 1.25 | | | | 1.25 | | | | 1.03 | | | | 1.16 | | | | 2.86 | |

| Net realized and unrealized gain (loss) | | | .39 | | | | 2.19 | | | | (1.09 | ) | | | 1.19 | | | | (6.79 | ) | | | (14.86 | ) |

| Total from investment operations | | | .98 | | | | 3.44 | | | | .16 | | | | 2.22 | | | | (5.63 | ) | | | (12.00 | ) |

Less distributions from: Net investment income | | | (.62 | ) | | | (1.33 | ) | | | (1.42 | ) | | | (.88 | ) | | | (1.42 | ) | | | (3.18 | ) |

| Return of capital | | | — | | | | — | | | | — | | | | — | | | | (.06 | ) | | | — | |

| Total distributions | | | (.62 | ) | | | (1.33 | ) | | | (1.42 | ) | | | (.88 | ) | | | (1.48 | ) | | | (3.18 | ) |

NAV accretion resulting from repurchases of shares and shares tendered at a discount to NAVa | | | — | | | | — | | | | .15 | | | | .11 | | | | .02 | | | | .02 | |

| Net asset value, end of period | | $ | 16.39 | | | $ | 16.03 | | | $ | 13.92 | | | $ | 15.03 | | | $ | 13.58 | | | $ | 20.67 | |

| Market value, end of period | | $ | 15.51 | | | $ | 15.97 | | | $ | 13.07 | | | $ | 13.40 | | | $ | 11.18 | | | $ | 16.60 | |

| Total Return | |

Based on net asset value (%)b | | | 6.38 | ** | | | 25.73 | c | | | 2.16 | c | | | 18.67 | c | | | (22.28 | ) | | | (34.70 | ) |

Based on market value (%)b | | | 1.05 | ** | | | 33.41 | | | | 7.66 | | | | 28.42 | | | | (20.29 | ) | | | (37.47 | ) |

| Ratios to Average Net Assets and Supplemental Data | |

| Net assets, end of period ($ millions) | | | 276 | | | | 270 | | | | 234 | | | | 365 | | | | 350 | | | | 539 | |

Ratio of expenses before fee reductions (including interest expense and dividend expense for securities sold short) (%)f | | | 2.09 | * | | | 2.30 | | | | 2.52 | | | | 1.64 | | | | 2.42 | | | | 2.63 | |

Ratio of expenses after fee reductions (including interest expense and dividend expense for securities sold short) (%)f | | | 2.09 | * | | | 2.08 | | | | 2.31 | | | | 1.50 | | | | 2.42 | | | | 2.63 | |

Ratio of expenses after fee reductions (excluding interest expense and dividend expense for securities sold short) (%)f | | | 1.50 | * | | | 1.44 | | | | 1.68 | | | | 1.24 | | | | 1.54 | | | | 1.47 | |

Financial Highlights (continued) | |

| | | | | | Years Ended September 30, | |

| | Six Months Ended 3/31/13 (Unaudited) | | | 2012 | | | 2011 | | | 2010 | | | | 2009 | e | | | 2008 | e |

| Ratio of net investment income (%) | | | 7.27 | * | | | 8.12 | | | | 8.08 | | | | 7.18 | | | | 10.40 | | | | 9.23 | |

| Portfolio turnover rate (%) | | | 31 | ** | | | 36 | | | | 134 | | | | 154 | | | | 27 | | | | 75 | |

| Total debt outstanding, end of period ($ thousands) | | | 124,000 | | | | 114,000 | | | | 98,000 | | | | 50,000 | | | | 15,000 | | | | 266,000 | |

Asset coverage per $1,000 of debtd | | | 3,227 | | | | 3,369 | | | | 3,392 | | | | 8,303 | | | | 24,362 | | | | 3,026 | |

a Based on average shares outstanding during the period. b Total return based on net asset value reflects changes in the Fund's net asset value during the period. Total return based on market value reflects changes in market value. Each figure assumes that dividend and capital gain distributions, if any, were reinvested. These figures will differ depending upon the level of any discount from or premium to net asset value at which the Fund's shares traded during the period. c Total return would have been lower had certain fees not been reduced. d Asset coverage equals the total net assets plus borrowings of the Fund divided by the borrowings outstanding at period end. e Per share data, including the proportionate impact to market price, have been restated to reflect the effects of a 1 for 2 reverse stock split effective prior to the opening of trading on the NYSE on August 10, 2009. f Prior to November 5, 2010, the Fund utilized short sales as part of the hedge strategy that sought to provide returns that were uncorrelated with the market. * Annualized ** Not annualized |

Notes to Financial Statements (Unaudited)

A. Organization and Significant Accounting Policies

DWS High Income Opportunities Fund, Inc. (the "Fund") is registered under the Investment Company Act of 1940, as amended (the "1940 Act''), as a closed-end management investment company organized as a Maryland corporation. Effective as of November 11, 2012, pursuant to applicable provisions of the 1940 Act and rules thereunder, the Fund's diversification sub-classification changed from non-diversified to diversified.

The Fund's financial statements are prepared in accordance with accounting principles generally accepted in the United States of America which require the use of management estimates. Actual results could differ from those estimates. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Debt securities and senior loans are valued at prices supplied by independent pricing services approved by the Fund's Board. If the pricing services are unable to provide valuations, securities are valued at the most recent bid quotation or evaluated price, as applicable, obtained from one or more broker-dealers. Such services may use various pricing techniques which take into account appropriate factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics and other data, as well as broker quotes. These securities are generally categorized as Level 2.

Investments in open-end investment companies are valued at their net asset value each business day and are categorized as Level 1.

Forward currency contracts are valued at the prevailing forward exchange rate of the underlying currencies and are categorized as Level 2.

Swap contracts are valued daily based upon prices supplied by a Board-approved pricing vendor, if available, and otherwise are valued at the price provided by the broker-dealer. Swap contracts are generally categorized as Level 2.

Securities and other assets for which market quotations are not readily available or for which the above valuation procedures are deemed not to reflect fair value are valued in a manner that is intended to reflect their fair value as determined in accordance with procedures approved by the Board and are generally categorized as Level 3. In accordance with the Fund's valuation procedures, factors used in determining value may include, but are not limited to, the type of the security; the size of the holding; the initial cost of the security; the existence of any contractual restrictions on the security's disposition; the price and extent of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices from broker-dealers and/or pricing services; information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities); an analysis of the company's or issuer's financial statements; an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold and with respect to debt securities; the maturity, coupon, creditworthiness, currency denomination, and the movement of the market in which the security is normally traded. The value determined under these procedures may differ from published values for the same securities.

Disclosure about the classification of fair value measurements is included in a table following the Fund's Investment Portfolio.

New Accounting Pronouncement. In January 2013, Accounting Standard Update 2013-01 (ASU 2013-01), Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities, replaced Accounting Standards Update 2011-11 (ASU 2011-11), Disclosures about Offsetting Assets and Liabilities. ASU 2013-01 is effective for fiscal years beginning on or after January 1, 2013, and interim periods within those annual periods. ASU 2011-11 was intended to enhance disclosure requirements on the offsetting of financial assets and liabilities. The ASU 2013-01 limits the scope of the new balance sheet offsetting disclosures to derivatives, repurchase agreements, and securities lending transactions to the extent that they are (1) offset in the financial statements or (2) subject to an enforceable master netting arrangement or similar agreement. Management is currently evaluating the application of ASU 2013-01 and its impact, if any, on the Fund's financial statements.

Foreign Currency Translations. The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing exchange rates at period end. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of the transactions.

Net realized and unrealized gains and losses on foreign currency transactions represent net gains and losses between trade and settlement dates on securities transactions, the acquisition and disposition of foreign currencies, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed but is included with net realized and unrealized gain/appreciation and loss/depreciation on investments.

When-Issued/Delayed Delivery Securities. The Fund may purchase or sell securities with delivery or payment to occur at a later date beyond the normal settlement period. At the time the Fund enters into a commitment to purchase or sell a security, the transaction is recorded and the value of the transaction is reflected in the net asset value. The price of such security and the date when the security will be delivered and paid for are fixed at the time the transaction is negotiated. The value of the security may vary with market fluctuations. At the time the Fund enters into a purchase transaction it is required to segregate cash or other liquid assets at least equal to the amount of the commitment.

Certain risks may arise upon entering into when-issued or delayed delivery transactions from the potential inability of counterparties to meet the terms of their contracts or if the issuer does not issue the securities due to political, economic, or other factors. Additionally, losses may arise due to changes in the value of the underlying securities.

Loan Participations and Assignments. Senior loans are portions of loans originated by banks and sold in pieces to investors. These U.S. dollar-denominated fixed and floating rate loans ("Loans") in which the Fund invests, are arranged through private negotiations between the borrower and one or more financial institutions ("Lenders"). The Fund invests in such Loans in the form of participations in Loans ("Participations") or assignments of all or a portion of loans from third parties ("Assignments"). Participations typically result in the Fund having a contractual relationship only with the Lender, not with the borrower. The Fund has the right to receive payments of principal, interest and any fees to which it is entitled from the Lender selling the Participation and only upon receipt by the Lender of the payments from the borrower. In connection with purchasing Participations, the Fund generally has no right to enforce compliance by the borrower with the terms of the loan agreement relating to the Loan, nor any rights of set-off against the borrower, and the Fund will not benefit directly from any collateral supporting the Loan in which it has purchased the Participation. As a result, the Fund assumes the credit risk of both the borrower and the Lender that is selling the Participation. Assignments typically result in the Fund having a direct contractual relationship with the borrower, and the Fund may enforce compliance by the borrower with the terms of the loan agreement. Senior Loans held by the Fund are generally in the form of Assignments but the Fund may also invest in Participations. All Senior Loans involve interest rate risk, liquidity risk and credit risk, including the potential default or insolvency of the borrower.

Federal Income Taxes. The Fund's policy is to comply with the requirements of the Internal Revenue Code, as amended, which are applicable to regulated investment companies, and to distribute all of its taxable income to its shareholders.

Under the Regulated Investment Company Modernization Act of 2010, net capital losses incurred post-enactment may be carried forward indefinitely, and their character is retained as short-term and/or long-term. Previously, net capital losses were carried forward for eight years and treated as short-term losses. As a transition rule, the Act requires that post-enactment net capital losses be used before pre-enactment net capital losses.

At September 30, 2012, the Fund had a net tax basis capital loss carryforward of approximately $511,896,000 of pre-enactment losses, which may be applied against any realized net taxable capital gains of each succeeding year until fully utilized or until September 30, 2016 ($58,426,000), September 30, 2017 ($198,233,000), September 30, 2018 ($243,689,000) and September 30, 2019 ($11,548,000), the respective expiration dates, whichever occurs first; and approximately $94,820,000 of post-enactment long-term losses, which may be applied against realized net taxable capital gains indefinitely.

The Fund has reviewed the tax positions for the open tax years as of September 30, 2012 and has determined that no provision for income tax is required in the Fund's financial statements. The Fund's federal tax returns for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Distribution of Income and Gains. Net investment income of the Fund is declared and distributed to shareholders monthly. Net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed, and, therefore, will be distributed to shareholders at least annually.

The timing and characterization of certain income and capital gain distributions are determined annually in accordance with federal tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences primarily relate to certain securities sold at a loss and forward foreign currency commitments. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting the net asset value of the Fund.

The tax character of current year distributions will be determined at the end of the current fiscal year.

Statement of Cash Flows. Information on financial transactions which have been settled through the receipt and disbursement of cash is presented in the Statement of Cash Flows. The cash amount shown in the Statement of Cash Flows represents the cash overdraft and foreign currency position at the Fund's custodian bank at March 31, 2013.

Contingencies. In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience, the Fund expects the risk of loss to be remote.

Other. Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date, net of foreign withholding taxes. Realized gains and losses from investment transactions are recorded on an identified cost basis and may include proceeds from litigation. All premiums and discounts are amortized/accreted for financial reporting purposes, with the exception of securities in default of principal.

B. Derivative Instruments

Credit Default Swap Contracts. A credit default swap is a contract between a buyer and a seller of protection against pre-defined credit events for the reference entity. For the six months ended March 31, 2013, the Fund sold credit default swap contracts to gain exposure to an underlying issuer's credit quality characteristics. As a seller in the credit default swap contract, the Fund is required to pay the par (or other agreed-upon) value of the referenced entity to the counterparty with the occurrence of a credit event by a third party, such as a U.S. or foreign corporate issuer, on the reference entity, which would likely result in a loss to the Fund. In return, the Fund receives from the counterparty a periodic stream of payments over the term of the contract provided that no credit event has occurred. If no credit event occurs, the Fund keeps the stream of payments with no payment obligations. As a buyer in the credit default swap contract, the Fund functions as the counterparty referenced above. This involves the risk that the contract may expire worthless. It also involves counterparty risk that the seller may fail to satisfy its payment obligations to the Fund with the occurrence of a credit event. When the Fund sells a credit default swap contract it will cover its commitment. This is achieved by, among other methods, maintaining cash or liquid assets equal to the aggregate notional value of the reference entities for all outstanding credit default swap contracts sold by the Fund.

The value of the credit default swap is adjusted daily and the change in value, if any, is recorded daily as unrealized appreciation or depreciation in the Statement of Assets and Liabilities. An upfront payment, if any, made by the Fund is recorded as an asset in the Statement of Assets and Liabilities. An upfront payment, if any, received by the Fund is recorded as a liability in the Statement of Assets and Liabilities. Under the terms of the credit default swap contracts, the Fund receives or makes quarterly payments based on a specified interest rate on a fixed notional amount. These payments are recorded as a realized gain or loss in the Statement of Operations. Payments received or made as a result of a credit event or termination of the contract are recognized, net of a proportional amount of the upfront payment, as realized gains or losses in the Statement of Operations.

A summary of the open credit default swap contracts as of March 31, 2013 is included in a table following the Fund's Investment Portfolio. For the six months ended March 31, 2013, the investment in credit default swap contracts sold had a total notional value generally indicative of a range from $705,000 to $1,615,000.

Forward Foreign Currency Exchange Contracts. A forward foreign currency exchange contract ("forward currency contract") is a commitment to purchase or sell a foreign currency at the settlement date at a negotiated rate. For the six months ended March 31, 2013, the Fund entered into forward currency contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign currency denominated portfolio holdings and to facilitate transactions in foreign currency denominated securities.

Forward currency contracts are valued at the prevailing forward exchange rate of the underlying currencies and unrealized gain (loss) is recorded daily. On the settlement date of the forward currency contract, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value of the contract at the time it was closed. Certain risks may arise upon entering into forward currency contracts from the potential inability of counterparties to meet the terms of their contracts. The maximum counterparty credit risk to the Fund is measured by the unrealized gain on appreciated contracts. Additionally, when utilizing forward currency contracts to hedge, the Fund gives up the opportunity to profit from favorable exchange rate movements during the term of the contract.

A summary of the open forward currency contracts as of March 31, 2013 is included in a table following the Fund's Investment Portfolio. For the six months ended March 31, 2013, the investment in forward currency contracts short vs. U.S. dollars had a total contract value generally indicative of a range from approximately $3,123,000 to $7,374,000, and the investment in forward currency contracts long vs. U.S. dollars had a total contract value generally indicative of a range from $0 to approximately $100,000.

The following tables summarize the value of the Fund's derivative instruments held as of March 31, 2013 and the related location in the accompanying Statement of Assets and Liabilities, presented by primary underlying risk exposure:

| Asset Derivatives | | Forward Contracts | | | Swap Contracts | | | Total | |

| Credit Contracts (a) | | $ | — | | | $ | 120,096 | | | $ | 120,096 | |

| Foreign Exchange Contracts (b) | | | 33,996 | | | | — | | | | 33,996 | |

| | | $ | 33,996 | | | $ | 120,096 | | | $ | 154,092 | |

Each of the above derivatives is located in the following Statement of Assets and Liabilities accounts: