UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21977

Invesco Exchange-Traded Fund Trust II

(Exact name of registrant as specified in charter)

3500 Lacey Road

Downers Grove, IL 60515

(Address of principal executive offices) (Zip code)

Daniel E. Draper

President

3500 Lacey Road

Downers Grove, IL 60515

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-983-0903

Date of fiscal year end: October 31

Date of reporting period: October 31, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Invesco Annual Report to Shareholders

October 31, 2018

| | |

| YAO | | Invesco China All-Cap ETF |

| CQQQ | | Invesco China Technology ETF |

| CGW | | Invesco S&P Global Water Index ETF |

Table of Contents

The Market Environment

Domestic Equity

The fiscal year proved to be an increasingly volatile time for US equities. The fiscal year began in the final months of 2017 with several major US stock market indexes repeatedly reaching new highs amid strong corporate profits, the prospect of tax reform legislation and exceedingly low stock market volatility.

Stock market euphoria continued in January 2018 as US equity markets steadily moved higher. Investors remained enthused about the passage of the Tax Cuts and Jobs Act signed into law in late December 2017, which significantly cut corporate tax rates. However, in February 2018, volatility returned to the US stock and bond markets. Worries about how rising interest rates might affect economic growth, concerns about a potential trade war and heightened geopolitical tensions, caused the US stock markets to pull back and volatility to increase.

US equity markets generally recovered in the second quarter of 2018 as strong US retail sales and low unemployment buoyed markets. Throughout the summer, US equities moved higher as corporate profits surged. Several US equity indexes reached new highs despite potential headwinds including trade tensions, tariff announcements and contagion concerns over a Turkish currency crisis. After a relatively quiet summer, market volatility markedly rose in the final month of the fiscal year. US equity markets suffered a sharp sell-off in October 2018 amid rising interest rates and concerns that higher inflation could mean a more restrictive monetary policy. In this environment, there was a flight to safety, as investors fled to defensive areas of the market and U.S. treasuries.

Given signs of a strong economy, the US Federal Reserve raised interest rates four times during the fiscal year: in December 2017 and in March, June and September 2018.1 In contrast, the European Central Bank and central banks in several other countries maintained extraordinarily accommodative monetary policies.

| 1 | Source: US Federal Reserve |

Global Equity

The fiscal year proved to be an increasingly volatile time for global equities. The fiscal year began in the final months of 2017 with several US stock market indexes repeatedly reaching new highs amid strong corporate profits, the prospect of tax reform legislation and exceedingly low stock market volatility. Despite a sharp uptick in volatility, particularly in October 2018, US markets, in general, still produced positive returns for the fiscal year. International markets, however, were meaningfully less robust, many experiencing flat to negative results for the fiscal year. This divergence between the US and other markets could be attributed to the strength of the US economy and the widely-held belief that the US could win trade wars with other countries.

At the beginning of 2018, markets saw significant turbulence in late January and early February, when stocks were whipsawed—first by concerns about accelerated US Federal Reserve (the Fed) tightening and then, later in the year, by fears of brewing trade wars and geopolitical tensions. After a relatively quiet summer, market volatility markedly rose again in the final month of the fiscal year. Global equity markets (particularly the US) suffered a sharp sell-off in October 2018 amid rising interest rates and concerns that higher inflation could result in a more restrictive monetary policy.

Global economic growth, in general, was solid despite weakness in emerging markets. During the fiscal year, emerging markets were impacted by both country-specific issues, as well as, more generalized pressure resulting from the Fed’s tightening policy. In this environment, economic growth unsurprisingly slowed in emerging markets. Within the eurozone, economic growth accelerated, although there was divergence among countries. In Japan, economic growth improved over the latter part of the fiscal year. The US experienced strong growth during the fiscal year due to robust consumer and business spending. In addition, unemployment rates remained low, job creation was strong and inflation remained relatively controlled.

At the close of the fiscal year, equity valuations in developed and emerging markets appeared relatively full in absolute terms—but overseas equity markets were trading at a material discount to those of the US. In sum, while valuations were not cheap, recent earnings growth and upward earnings revisions improved in many non-US developed markets.

| | |

| YAO | | Manager’s Analysis |

| | Invesco China All-Cap ETF (YAO) |

As an index fund, the Invesco China All-Cap ETF (the “Fund”) is passively managed and seeks to track the returns of an underlying index. The Fund seeks to track the investment results (before fees and expenses) of the AlphaShares China All Cap Index (the “Index”). The Fund will invest at least 90% of its total assets in common stocks, American depositary receipts (“ADRs”), American depositary shares (“ADSs”), global depositary receipts (“GDRs”) and international depositary receipts (“IDRs”) that comprise the Index and depositary receipts or shares representing common stocks included in the Index (or underlying securities representing ADRs, ADSs, GDRs and IDRs included in the Index).

The Index is designed to measure and monitor the performance of the investable universe of publicly traded companies based in mainland China (as classified by the S&P BMI Country Code classification system). The Index was created by AlphaShares, LLC (the “Index Provider”) and is maintained by Standard & Poor’s. The Index includes equity securities of companies of all categories of market capitalizations, as defined by the Index Provider (subject to a minimum float-adjusted capitalization of U.S. $400 million). The Index may include Hong Kong listed securities, including China H-shares and Red Chip shares. China H-shares are issued by companies incorporated in mainland China and listed on the Hong Kong Stock Exchange. Red Chip shares are issued by companies with controlling Chinese shareholders that are incorporated outside mainland China and listed on the Hong Kong Stock Exchange. The Index may also include N-Shares, which are issued by companies based in mainland China and listed on the NYSE Arca, Inc. or The NASDAQ Stock Market. The Index does not include China A-Shares (which are subject to substantial restrictions on foreign investment) or China B-Shares (which offer a generally smaller market and limited liquidity), each of which trade on the Shanghai Stock Exchange and the Shenzhen Stock Exchange. The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

The Board of Trustees approved a change in fiscal year end for the Fund from August 31 to October 31. For the fiscal period from September 1, 2018 to October 31, 2018, on a market price basis, the Fund returned (10.77)%. On a net asset value (“NAV”) basis, the Fund returned (10.97)%. During the same time period, the Index returned (11.05)%. During the fiscal period, the Fund’s performance, on a NAV basis, outperformed the Index primarily due to underweight allocation to the information technology sector.

During this same time period, the MSCI China Index (Net) (the “Benchmark Index”) returned (12.71)%. The Benchmark Index is an unmanaged index weighted by market capitalization based on the average performance of approximately 460 securities. The Benchmark Index was selected for its recognition in the marketplace, and its performance comparison is a useful measure for investors as a broad representation of the Chinese equity market.

The performance of the Fund differed from the Benchmark Index because the Fund seeks to track an Index that employs a proprietary stock selection and weighting methodology, whereas the Benchmark Index selects and weights stocks based on market capitalization.

Relative to the Benchmark Index, the Fund was most overweight in the financials sector and most underweight in the information technology sector during the fiscal period ended October 31, 2018. The majority of the Fund’s outperformance relative to the Benchmark Index during that period can be attributed to the Fund being underweight in the information technology sector.

For the fiscal period ended October 31, 2018, the information technology sector contributed most significantly to the Fund’s return. The consumer discretionary and real estate sectors were the greatest detracting sectors.

Positions that contributed most significantly to the Fund’s return for the fiscal period ended October 31, 2018, included Bank of Communications Co., Ltd. a financials company (portfolio average weight of 1.37%), and Netease, Inc., a communication services company (portfolio average weight of 1.30%). Positions that detracted most significantly from the Fund’s return during this period included Alibaba Group Holdings Ltd., a consumer discretionary company (portfolio average weight of 5.32%), and Tencent Holdings Ltd., a communication services company (portfolio average weight of 3.94%).

| | | | |

Sector Breakdown

(% of the Fund’s Net Assets)

as of October 31, 2018 | |

| Financials | | | 28.3 | |

| Communication Services | | | 18.0 | |

| Consumer Discretionary | | | 16.2 | |

| Industrials | | | 6.9 | |

| Energy | | | 6.8 | |

| Real Estate | | | 6.8 | |

| Health Care | | | 4.4 | |

| Consumer Staples | | | 3.7 | |

| Information Technology | | | 3.1 | |

| Utilities | | | 3.1 | |

| Materials | | | 2.7 | |

| Money Market Fund Plus Other Assets Less Liabilities | | | 0.0 | |

Invesco China All-Cap ETF (YAO) (continued)

| | | | |

Top Ten Fund Holdings*

(% of the Fund’s Net Assets)

as of October 31, 2018 | |

| Security | | | | |

| China Construction Bank Corp., H-Shares | | | 5.4 | |

| Alibaba Group Holding Ltd. ADR | | | 5.3 | |

| Baidu, Inc. ADR | | | 4.5 | |

| Industrial & Commercial Bank of China Ltd., H-Shares | | | 4.5 | |

| China Mobile Ltd. | | | 4.4 | |

| Ping An Insurance Group Co. of China Ltd., H-Shares | | | 4.1 | |

| Tencent Holdings Ltd. | | | 3.9 | |

| Bank of China Ltd., H-Shares | | | 2.8 | |

| CNOOC Ltd. | | | 2.4 | |

| China Petroleum & Chemical Corp. (Sinopec), H-Shares | | | 1.8 | |

| Total | | | 39.1 | |

| * | Excluding money market fund holdings. |

Growth of a $10,000 Investment Since Inception

Fund Performance History as of October 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Years Average

Annualized | | | 3 Years Cumulative | | | 5 Years Average

Annualized | | | 5 Years Cumulative | | | | | | Fund Inception | |

| Index | | Average

Annualized | | | Cumulative | |

| AlphaShares China All Cap Index | | | (14.20 | )% | | | 6.00 | % | | | 19.11 | % | | | 4.38 | % | | | 23.92 | % | | | | | | | 4.08 | % | | | 43.54 | % |

| MSCI China Index (Net) | | | (16.73 | ) | | | 6.05 | | | | 19.27 | | | | 4.74 | | | | 26.03 | | | | | | | | 3.47 | | | | 36.08 | |

| Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV Return | | | (14.81 | ) | | | 5.17 | | | | 16.32 | | | | 3.98 | | | | 21.53 | | | | | | | | 3.73 | | | | 39.21 | |

| Market Price Return | | | (13.81 | ) | | | 5.19 | | | | 16.38 | | | | 3.98 | | | | 21.57 | | | | | | | | 3.72 | | | | 39.02 | |

Invesco China All-Cap ETF (YAO) (continued)

Guggenheim China All-Cap ETF (the “Predecessor Fund”) Inception: October 19, 2009

Performance quoted above represents past performance. Past performance is not a guarantee of future results and current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate, and shares of the Fund (“Fund Shares”), when redeemed or sold, may be worth more or less than their original cost. Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information. According to the Fund’s current prospectus, the Fund’s expense ratio of 0.70% is expressed as a unitary management fee to cover operating expenses and expenses incurred in connection with managing the portfolio. NAV and Market Price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and Market Price, respectively. The returns shown in the table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund Shares. See invesco.com/ETFs to find the most recent month-end performance numbers.

Index and Benchmark Index performance results are based upon a hypothetical investment in their respective constituent securities. Index and Benchmark Index returns do not represent Fund returns. An investor cannot invest directly in an index. The Index and Benchmark Index do not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the hypothetical performance shown. In addition, the results actual investors might have achieved would have differed from those shown because of differences in the timing, amounts of their investments, and fees and expenses associated with an investment in the Fund.

Notes Regarding Indexes and Fund Performance History:

| - | Average Annualized and Cumulative Inception returns for the Fund, Index and Benchmark Index are based on the inception date of the Predecessor Fund. |

| - | Effective after the close of business on April 6, 2018, the Predecessor Fund was reorganized into the Fund. Fund returns shown are blended returns of the Predecessor Fund and the Fund. |

| - | Net returns reflect reinvested dividends net of withholding taxes. |

| | |

| CQQQ | | Manager’s Analysis |

| | Invesco China Technology ETF (CQQQ) |

As an index fund, the Invesco China Technology ETF (the “Fund”) is passively managed and seeks to track the returns of an underlying index. The Fund seeks to track the investment results (before fees and expenses) of an equity index called the AlphaShares China Technology Index (the “Index”). The Fund will invest at least 90% of its total assets in common stocks, American depositary receipts (“ADRs”), American depositary shares (“ADSs”), global depositary receipts (“GDRs”) and international depositary receipts (“IDRs”) that comprise the Index and depositary receipts or shares representing common stocks included in the Index (or underlying securities representing ADRs, ADSs, GDRs and IDRs included in the Index).

The Index is designed to measure and monitor the performance of the universe of publicly traded companies which are based in mainland China, Hong Kong or Macau (as classified by the S&P BMI Country Code classification system), are in the Information Technology Sector, as defined by S&P Global Industry Classification Standard (“GICS”) and are open to foreign investment. The Index was created by AlphaShares, LLC (the “Index Provider”) and is maintained by Standard & Poor’s. The Index includes equity securities of companies of all categories of market capitalizations, as defined by the Index Provider (subject to a minimum float-adjusted capitalization of U.S. $150 million). The Index may include Hong Kong listed securities, including China H-shares and Red Chip shares. China H-shares are issued by companies incorporated in mainland China and listed on the Hong Kong Stock Exchange. Red Chip shares are issued by companies with controlling Chinese shareholders that are incorporated outside mainland China and listed on the Hong Kong Stock Exchange. The Index may also include N-Shares, which are issued by companies based in mainland China and listed on the NYSE Arca, Inc. or The NASDAQ Stock Market. The Index does not include China A-Shares (which are subject to substantial restrictions on foreign investment) or China B-Shares (which offer a generally smaller market and limited liquidity), each of which trade on the Shanghai Stock Exchange and the Shenzhen Stock Exchange. The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

The Board of Trustees approved a change in fiscal year end for the Fund from August 31 to October 31. For the fiscal period from September 1, 2018 to October 31, 2018, on a market price basis, the Fund returned (17.32)%. On a net asset value (“NAV”) basis, the Fund returned (17.78)%. During the same time period, the Index returned (17.68)%. During the fiscal period, the Fund’s performance, on a NAV basis, differed from the return of the Index primarily due to fees and operating expenses that the Fund incurred partially offset by income received from the securities lending program in which the Fund participates.

During this same time period, the MSCI China Index (Net) (the “Benchmark Index”) returned (12.71)%. The Benchmark Index is an unmanaged index weighted by market capitalization based on the average performance of approximately 460 securities. The

Benchmark Index was selected for its recognition in the marketplace, and its performance comparison is a useful measure for investors as a broad representation of the Chinese equity market.

The performance of the Fund differed from the Benchmark Index because the Fund seeks to track an Index that employs a proprietary stock selection and weighting methodology, whereas the Benchmark Index selects and weights stocks based on market capitalization.

Relative to the Benchmark Index, the Fund was most overweight in the internet software & services sub-industry and most underweight in the diversified banks sub-industry during the fiscal period ended October 31, 2018. The majority of the Fund’s underperformance relative to the Benchmark Index during that period can be attributed to the Fund being overweight in the internet software & services and electronic components sub-industries.

For the fiscal period ended October 31, 2018, the internet software & services sub-industry detracted most significantly from the Fund’s return, followed by the electronic components sub-industry. There were no contributing sub-industries during the period.

Positions that contributed most significantly to the Fund’s return for the fiscal period ended October 31, 2018, included NetEase, Inc. ADR, an entertainment company (portfolio average weight of 7.71%), and 21Vianet Group, Inc. ADR Class A, an IT services company (portfolio average weight of 0.54%). Positions that detracted most significantly from the Fund’s return during this period included Tencent Holdings Ltd., an interactive media & services company (portfolio average weight of 9.89%), and Alibaba Group Holding Ltd. ADR, an internet & direct marketing retail company (portfolio average weight of 9.77%).

| | | | |

Industry Breakdown

(% of the Fund’s Net Assets)

as of October 31, 2018 | |

| Interactive Media & Services | | | 41.6 | |

| Electronic Equipment, Instruments & Components | | | 12.9 | |

| Internet & Direct Marketing Retail | | | 11.1 | |

| Entertainment | | | 9.3 | |

| Semiconductors & Semiconductor Equipment | | | 6.8 | |

| IT Services | | | 6.2 | |

| Technology Hardware, Storage & Peripherals | | | 5.5 | |

| Software | | | 3.1 | |

| Industry Types Each Less Than 3% | | | 3.4 | |

| Money Market Funds Plus Other Assets Less Liabilities | | | 0.1 | |

Invesco China Technology ETF (CQQQ) (continued)

| | | | |

Top Ten Fund Holdings*

(% of the Fund’s Net Assets)

as of October 31, 2018 | |

| Security | | | | |

| Alibaba Group Holding Ltd. ADR | | | 10.1 | |

| Tencent Holdings Ltd. | | | 9.5 | |

| Baidu, Inc. ADR | | | 8.4 | |

| NetEase, Inc. ADR | | | 8.3 | |

| 58.com, Inc., Class A ADR | | | 4.7 | |

| Momo, Inc., Class A ADR | | | 4.2 | |

| Autohome, Inc., Class A ADR | | | 3.5 | |

| SINA Corp. | | | 3.5 | |

| Lenovo Group Ltd. | | | 3.5 | |

| Sunny Optical Technology Group Co. Ltd. | | | 3.4 | |

| Total | | | 59.1 | |

| * | Excluding money market fund holdings. |

Growth of a $10,000 Investment Since Inception

Fund Performance History as of October 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Years Average

Annualized | | | 3 Years Cumulative | | | 5 Years Average

Annualized | | | 5 Years Cumulative | | | | | | Fund Inception | |

| Index | | | | | Average

Annualized | | | Cumulative | |

| AlphaShares China Technology Index | | | (30.06 | )% | | | 6.73 | % | | | 21.59 | % | | | 5.09 | % | | | 28.15 | % | | | | | | | 7.04 | % | | | 83.11 | % |

| MSCI China Index (Net) | | | (16.73 | ) | | | 6.05 | | | | 19.27 | | | | 4.74 | | | | 26.03 | | | | | | | | 3.25 | | | | 32.92 | |

| Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV Return | | | (30.46 | ) | | | 6.22 | | | | 19.85 | | | | 5.31 | | | | 29.52 | | | | | | | | 6.96 | | | | 81.90 | |

| Market Price Return | | | (30.03 | ) | | | 6.57 | | | | 21.02 | | | | 5.59 | | | | 31.23 | | | | | | | | 7.03 | | | | 83.06 | |

Invesco China Technology ETF (CQQQ) (continued)

Guggenheim China Technology ETF (the “Predecessor Fund”) Inception: December 08, 2009

Performance quoted above represents past performance. Past performance is not a guarantee of future results and current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate, and shares of the Fund (“Fund Shares”), when redeemed or sold, may be worth more or less than their original cost. Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information. According to the Fund’s current prospectus, the Fund’s expense ratio of 0.70% is expressed as a unitary management fee to cover operating expenses and expenses incurred in connection with managing the portfolio. NAV and Market Price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and Market Price, respectively. The returns shown in the table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund Shares. See invesco.com/ETFs to find the most recent month-end performance numbers.

Index and Benchmark Index performance results are based upon a hypothetical investment in their respective constituent securities. Index and Benchmark Index returns do not represent Fund returns. An investor cannot invest directly in an index. The Index and Benchmark Index do not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the hypothetical performance shown. In addition, the results actual investors might have achieved would have differed from those shown because of differences in the timing, amounts of their investments, and fees and expenses associated with an investment in the Fund.

Notes Regarding Indexes and Fund Performance History:

| - | Effective after the close of business on May 18, 2018, the Predecessor Fund was reorganized into the Fund. Fund returns shown are blended returns of the Predecessor Fund and the Fund. |

| - | Average Annualized and Cumulative Inception returns for the Fund, Index and Benchmark Index are based on the inception date of the Predecessor Fund. |

| - | Net returns reflect reinvested dividends net of withholding taxes. |

| | |

| CGW | | Manager’s Analysis |

| | Invesco S&P Global Water Index ETF (CGW) |

As an index fund, the Invesco S&P Global Water Index ETF (the “Fund”) is passively managed and seeks to track the returns of an underlying index. The Fund seeks to track the investment results (before fees and expenses) of the S&P Global Water Index (the “Index”). The Fund will invest at least 90% of its total assets in common stock and American depositary receipts (“ADRs”) that comprise the Index and depositary receipts representing common stocks included in the Index (or underlying securities representing ADRs included in the Index). The depositary receipts included in the Index may be sponsored or unsponsored.

The Index is comprised of 50 equity securities selected, based on investment and other criteria, from a universe of companies listed on global developed market exchanges. Standard & Poor’s Financial Services LLC, a subsidiary of The McGraw-Hill Companies (“S&P”), generally defines “developed markets” as the capital markets of those countries with high levels of per capita income and strict market regulation resulting in greater transparency. Specifically, all or any subset of the following countries/regions are currently considered to be developed markets—Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Luxembourg, the Netherlands, New Zealand, Norway, Portugal, Singapore, South Korea, Spain, Sweden, Switzerland, the United Kingdom and the United States. The universe of companies includes all companies classified by Standard & Poor’s Global Industry Classifications as being associated (in a manner representing a major component of such companies’ business) with the global demand for water, including water utilities, infrastructure, equipment, instruments and materials. Total market capitalization and float-adjusted market capitalization of securities in the Index must be at least $250 million and $100 million, respectively, at the time of each reconstitution, which includes small-, mid-, and large-capitalization securities as defined by S&P. The companies in the universe are selected using criteria as identified by S&P. The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

The Board of Trustees approved a change in fiscal year end for the Fund from August 31 to October 31. For the fiscal period from September 1, 2018 to October 31, 2018, on a market price basis, the Fund returned (8.40)%. On a net asset value (“NAV”) basis, the Fund returned (8.39)%. During the same time period, the Index returned (8.34)%. During the fiscal period, the Fund’s performance, on a NAV basis, differed from the return of the Index primarily due to fees and operating expenses that the Fund incurred during the period.

During this same time period, the MSCI EAFE® Index (Net) (the “Benchmark Index”) returned (7.16)%. The Benchmark Index is an unmanaged index weighted by market capitalization based on the average performance of approximately 920 securities. The Benchmark Index was selected for its recognition in the marketplace, and its performance comparison is a useful measure

for investors as a broad representation of the equities market in developed countries outside the U.S.

The performance of the Fund differed from the Benchmark Index because the Fund seeks to track an Index that employs a proprietary stock selection and weighting methodology, whereas the Benchmark Index selects and weights stocks based on market capitalization.

Relative to the Benchmark Index, the Fund was most overweight in the water utilities sub-industry and most underweight in the diversified banks sub-industry during the fiscal period ended October 31, 2018. The majority of the Fund’s underperformance relative to the Benchmark Index during that period can be attributed to the Fund being overweight in the industrial machinery sub-industry.

For the fiscal period ended October 31, 2018, the construction materials sub-industry detracted most significantly from the Fund’s return, followed by the commodity chemicals and oil & gas equipment & services sub-industries, respectively. There were no contributing sub-industries during the period.

Positions that contributed most significantly to the Fund’s return for the fiscal period ended October 31, 2018, included Companhia de Saneamento Basico do Estado de Sao Paulo SABESP ADR, a water utilities company (portfolio average weight of 1.35%), and American Water Works Company, a water utilities company (portfolio average weight of 9.49%). Positions that detracted most significantly from the Fund’s return during this period included IDEX Corp., an industrial machinery company (portfolio average weight of 5.11%), and Xylem Inc., an industrial machinery company (portfolio average weight of 6.37%).

| | | | |

Industry Breakdown

(% of the Fund’s Net Assets)

as of October 31, 2018 | |

| Water Utilities | | | 34.4 | |

| Machinery | | | 29.5 | |

| Multi-Utilities | | | 12.2 | |

| Building Products | | | 6.6 | |

| Health Care Equipment & Supplies | | | 5.0 | |

| Electronic Equipment, Instruments & Components | | | 4.2 | |

| Industry Types Each Less Than 3% | | | 7.9 | |

| Money Market Fund Plus Other Assets Less Liabilities | | | 0.2 | |

Invesco S&P Global Water Index ETF (CGW) (continued)

| | | | |

Top Ten Fund Holdings*

(% of the Fund’s Net Assets)

as of October 31, 2018 | |

| Security | | | | |

| American Water Works Co., Inc. | | | 9.7 | |

| Xylem, Inc. | | | 6.3 | |

| Veolia Environnement SA | | | 5.2 | |

| Danaher Corp. | | | 5.0 | |

| IDEX Corp. | | | 4.7 | |

| Geberit AG | | | 4.7 | |

| Alfa Laval AB | | | 4.1 | |

| United Utilities Group PLC | | | 3.9 | |

| Suez | | | 3.7 | |

| Aqua America, Inc. | | | 3.5 | |

| Total | | | 50.8 | |

| * | Excluding money market fund holdings. |

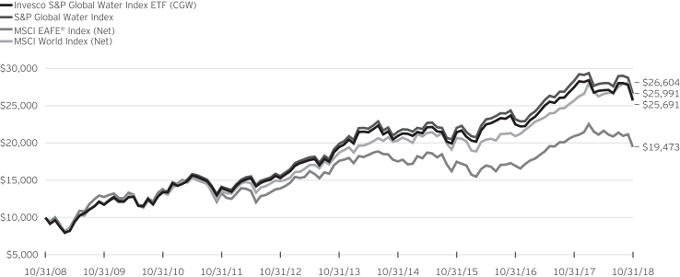

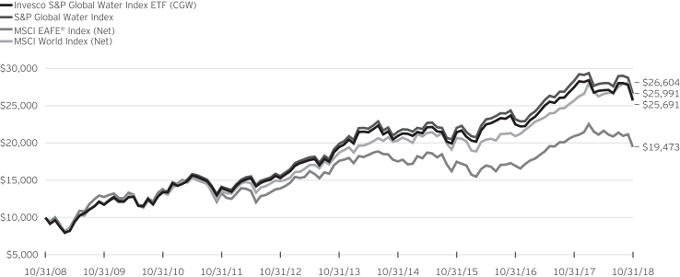

Growth of a $10,000 Investment

Fund Performance History as of October 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Years Average

Annualized | | | 3 Years Cumulative | | | 5 Years Average

Annualized | | | 5 Years Cumulative | | | 10 Years Average

Annualized | | | 10 Years Cumulative | | | | | | Fund Inception | |

| Index | | | | | Average

Annualized | | | Cumulative | |

| S&P Global Water Index | | | (6.20 | )% | | | 6.47 | % | | | 20.68 | % | | | 5.98 | % | | | 33.67 | % | | | 10.28 | % | | | 166.04 | % | | | | | | | 5.00 | % | | | 74.98 | % |

| MSCI EAFE® Index (Net) | | | (6.85 | ) | | | 3.62 | | | | 11.27 | | | | 2.02 | | | | 10.52 | | | | 6.89 | | | | 94.73 | | | | | | | | 0.98 | | | | 11.82 | |

| MSCI World Index (Net) | | | 1.16 | | | | 7.91 | | | | 25.67 | | | | 6.81 | | | | 38.98 | | | | 10.02 | | | | 159.91 | | | | | | | | 4.23 | | | | 60.84 | |

| Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV Return | | | (6.50 | ) | | | 6.22 | | | | 19.84 | | | | 5.70 | | | | 31.93 | | | | 9.90 | | | | 156.91 | | | | | | | | 4.54 | | | | 66.38 | |

| Market Price Return | | | (6.57 | ) | | | 6.20 | | | | 19.79 | | | | 5.66 | | | | 31.72 | | | | 10.05 | | | | 160.56 | | | | | | | | 4.53 | | | | 66.09 | |

Invesco S&P Global Water Index ETF (CGW) (continued)

Guggenheim S&P Global Water Index ETF (the “Predecessor Fund”) Inception: May 14, 2007

Performance quoted above represents past performance. Past performance is not a guarantee of future results and current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate, and shares of the Fund (“Fund Shares”), when redeemed or sold, may be worth more or less than their original cost. Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information. According to the Fund’s current prospectus, the total annual operating expense ratio was indicated as 0.61%. The Financial Highlights section of the Shareholder Report presents the expense ratios based on expenses incurred during the period covered by this report. NAV and Market Price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and Market Price, respectively. The returns shown in the table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund Shares. See invesco.com/ETFs to find the most recent month-end performance numbers.

Index and Benchmark Indexes performance results are based upon a hypothetical investment in their respective constituent securities. Index

and Benchmark Indexes returns do not represent Fund returns. An investor cannot invest directly in an index. The Index and Benchmark Indexes do not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the hypothetical performance shown. In addition, the results actual investors might have achieved would have differed from those shown because of differences in the timing, amounts of their investments, and fees and expenses associated with an investment in the Fund.

Notes Regarding Indexes and Fund Performance History:

| - | Average Annualized and Cumulative Inception returns for the Fund, Index and Benchmark Indexes are based on the inception date of the Predecessor Fund. |

| - | Effective after the close of business on April 6, 2018, the Predecessor Fund was reorganized into the Fund. Fund returns shown are blended returns of the Predecessor Fund and the Fund. |

| - | The Fund has elected to use the MSCI EAFE® Index to represent its broad-based index rather than the MSCI World Index because the MSCI EAFE® Index more closely reflects the performance of the types of securities in which the Fund invests. |

| - | Net returns reflect reinvested dividends net of withholding taxes. |

Schedule of Investments(a)

Invesco China All-Cap ETF (YAO)

October 31, 2018

| | | | | | | | |

Number

of Shares | | | | | Value | |

| | | | Common Stocks & Other Equity Interests—100.0% | |

| | | | Communication Services—18.0% | |

| | 1,553 | | | 58.com, Inc., Class A ADR (China)(b) | | $ | 101,861 | |

| | 220,000 | | | Alibaba Pictures Group Ltd. (Hong Kong)(b) | | | 30,308 | |

| | 966 | | | Autohome, Inc., Class A ADR (China)(c) | | | 69,919 | |

| | 4,827 | | | Baidu, Inc. ADR (China)(b) | | | 917,420 | |

| | 642 | | | Bitauto Holdings Ltd. ADR (China)(b)(c) | | | 12,262 | |

| | 273 | | | Changyou.com Ltd., Class A ADR (China) | | | 3,653 | |

| | 41,993 | | | China Communications Services Corp. Ltd., H-Shares (China) | | | 33,961 | |

| | 95,951 | | | China Mobile Ltd. (China) | | | 897,162 | |

| | 239,981 | | | China Telecom Corp. Ltd., H-Shares (China) | | | 113,265 | |

| | 101,995 | | | China Unicom Hong Kong Ltd. (China) | | | 105,906 | |

| | 3,131 | | | Fang Holdings Ltd. ADR (China)(b) | | | 6,356 | |

| | 2,450 | | | Momo, Inc., Class A ADR (China)(b) | | | 82,246 | |

| | 4,500 | | | NetDragon Websoft Holdings Ltd. (Hong Kong) | | | 7,956 | |

| | 1,273 | | | NetEase, Inc. ADR (China) | | | 264,593 | |

| | 1,088 | | | SINA Corp. (China)(b) | | | 68,881 | |

| | 536 | | | Sohu.com Ltd. ADR (China)(b) | | | 9,686 | |

| | 23,442 | | | Tencent Holdings Ltd. (China) | | | 798,405 | |

| | 1,092 | | | Weibo Corp., Class A ADR (China)(b) | | | 64,439 | |

| | 836 | | | YY, Inc., Class A ADR (China)(b) | | | 53,420 | |

| | | | | | | | |

| | | | | | | 3,641,699 | |

| | | | | | | | |

| | | | Consumer Discretionary—16.2% | |

| | 7,582 | | | Alibaba Group Holding Ltd. ADR (China)(b) | | | 1,078,767 | |

| | 15,000 | | | ANTA Sports Products Ltd. (China) | | | 61,612 | |

| | 27,453 | | | BAIC Motor Corp. Ltd., H-Shares (China)(d) | | | 15,408 | |

| | 508 | | | Baozun, Inc. ADR (China)(b)(c) | | | 20,223 | |

| | 49,996 | | | Brilliance China Automotive Holdings Ltd. (China) | | | 43,622 | |

| | 10,500 | | | BYD Co. Ltd., H-Shares (China)(c) | | | 68,041 | |

| | 58,000 | | | China Dongxiang Group Co. Ltd. (China) | | | 8,952 | |

| | 54,000 | | | China First Capital Group Ltd.

(Hong Kong)(b) | | | 21,767 | |

| | 24,000 | | | China Maple Leaf Educational Systems Ltd. (China) | | | 10,348 | |

| | 35,999 | | | China Travel International Investment Hong Kong Ltd. (China) | | | 9,643 | |

| | 21,000 | | | China Yongda Automobiles Services Holdings Ltd. (China) | | | 11,224 | |

| | 19,500 | | | China ZhengTong Auto Services Holdings Ltd. (China) | | | 9,303 | |

| | 6,604 | | | Ctrip.com International Ltd. ADR (China)(b) | | | 219,781 | |

| | 46,000 | | | Dongfeng Motor Group Co. Ltd., H-Shares (China) | | | 45,299 | |

| | 18,000 | | | Fu Shou Yuan International Group Ltd. (China) | | | 13,800 | |

| | 8,863 | | | Fuyao Glass Industry Group Co. Ltd., H-Shares (China)(d) | | | 26,173 | |

| | 96,993 | | | Geely Automobile Holdings Ltd. (China) | | | 185,588 | |

| | 8,000 | | | Golden Eagle Retail Group Ltd. (China) | | | 8,286 | |

| | 198,991 | | | GOME Retail Holdings Ltd. (China)(b) | | | 19,799 | |

| | 54,000 | | | Great Wall Motor Co. Ltd., H-Shares (China) | | | 31,962 | |

| | 48,398 | | | Guangzhou Automobile Group Co. Ltd., H-Shares (China) | | | 48,957 | |

| | 22,000 | | | Haier Electronics Group Co. Ltd. (Hong Kong)(b) | | | 45,968 | |

| | 1,815 | | | Huazhu Group Ltd. ADR (China) | | | 47,480 | |

| | 860,000 | | | Imperial Pacific International Holdings Ltd. (Hong Kong)(b) | | | 6,692 | |

| | 14,238 | | | JD.com, Inc., Class A ADR (China)(b) | | | 334,878 | |

| | 29,500 | | | Li Ning Co. Ltd. (China)(b) | | | 27,621 | |

| | | | | | | | |

Number

of Shares | | | | | Value | |

| | | | Common Stocks & Other Equity Interests

(continued) | |

| | | | Consumer Discretionary (continued) | |

| | 12,000 | | | Minth Group Ltd. (China) | | $ | 38,881 | |

| | 2,025 | | | New Oriental Education & Technology Group, Inc. ADR (China)(b) | | | 118,483 | |

| | 8,000 | | | Q Technology Group Co. Ltd. (China) | | | 3,786 | |

| | 12,999 | | | Shenzhou International Group Holdings Ltd. (China) | | | 143,597 | |

| | 33,999 | | | Skyworth Digital Holdings Ltd. (Hong Kong) | | | 7,850 | |

| | 6,146 | | | TAL Education Group ADR (China)(b) | | | 178,111 | |

| | 12,000 | | | Tianneng Power International Ltd. (China) | | | 9,598 | |

| | 1,393 | | | Tuniu Corp., Class A ADR (China)(b) | | | 8,859 | |

| | 7,182 | | | Vipshop Holdings Ltd., Class A ADR (China)(b) | | | 34,905 | |

| | 28,000 | | | Virscend Education Co. Ltd. (China)(d) | | | 15,966 | |

| | 43,999 | | | Xinyi Glass Holdings Ltd. (Hong Kong) | | | 43,553 | |

| | 6,631 | | | Yum China Holdings, Inc. (China) | | | 239,246 | |

| | 8,500 | | | Zhongsheng Group Holdings Ltd. (China) | | | 15,505 | |

| | | | | | | | |

| | | | | | | 3,279,534 | |

| | | | | | | | |

| | | | Consumer Staples—3.7% | |

| | 105,993 | | | C.P. Pokphand Co. Ltd. (Hong Kong) | | | 9,194 | |

| | 37,999 | | | China Agri-Industries Holdings Ltd. (China) | | | 12,700 | |

| | 59,000 | | | China Huishan Dairy Holdings Co. Ltd. (China)(b)(e) | | | 0 | |

| | 46,998 | | | China Mengniu Dairy Co. Ltd. (China)(b) | | | 138,487 | |

| | 45,989 | | | China Modern Dairy Holdings Ltd.

(China)(b) | | | 5,749 | |

| | 24,000 | | | China Resources Beer Holdings Co. Ltd. (China) | | | 83,425 | |

| | 68,000 | | | China Shengmu Organic Milk Ltd.

(China)(b)(d) | | | 2,732 | |

| | 35,500 | | | Dali Foods Group Co. Ltd. (China)(d) | | | 25,359 | |

| | 3,500 | | | Health and Happiness H&H International Holdings Ltd. (China)(b) | | | 19,912 | |

| | 13,001 | | | Hengan International Group Co. Ltd. (China) | | | 102,988 | |

| | 37,999 | | | Sun Art Retail Group Ltd. (Hong Kong) | | | 41,540 | |

| | 30,000 | | | Tibet Water Resources Ltd. (Hong Kong)(b) | | | 8,457 | |

| | 31,999 | | | Tingyi Cayman Islands Holding Corp. (China) | | | 47,349 | |

| | 5,928 | | | Tsingtao Brewery Co. Ltd., H-Shares (China) | | | 23,404 | |

| | 23,000 | | | Uni-President China Holdings Ltd. (China) | | | 22,327 | |

| | 5,000 | | | Vinda International Holdings Ltd. (Hong Kong) | | | 7,131 | |

| | 109,993 | | | Want Want China Holdings Ltd. (China) | | | 78,572 | |

| | 162,500 | | | WH Group Ltd. (Hong Kong)(d) | | | 113,800 | |

| | 10,500 | | | Zhou Hei Ya International Holdings Co. Ltd. (China)(b)(d) | | | 5,398 | |

| | | | | | | | |

| | | | | | | 748,524 | |

| | | | | | | | |

| | | | Energy—6.8% | |

| | 35,993 | | | China Coal Energy Co. Ltd., H-Shares (China) | | | 16,115 | |

| | 31,999 | | | China Oilfield Services Ltd., H-Shares (China) | | | 30,001 | |

| | 443,183 | | | China Petroleum & Chemical Corp. (Sinopec), H-Shares (China) | | | 359,548 | |

| | 58,996 | | | China Shenhua Energy Co. Ltd., H-Shares (China) | | | 133,654 | |

| | 278,990 | | | CNOOC Ltd. (China) | | | 479,017 | |

| | 59,994 | | | Kunlun Energy Co. Ltd. (China) | | | 68,111 | |

| | 365,986 | | | PetroChina Co. Ltd., H-Shares (China) | | | 267,975 | |

| | 18,000 | | | Sinopec Kantons Holdings Ltd. (China) | | | 7,325 | |

| | 29,999 | | | Yanzhou Coal Mining Co. Ltd., H-Shares (China) | | | 28,356 | |

| | | | | | | | |

| | | | | | | 1,390,102 | |

| | | | | | | | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

Invesco China All-Cap ETF (YAO) (continued)

October 31, 2018

| | | | | | | | |

Number

of Shares | | | | | Value | |

| | | | Common Stocks & Other Equity Interests

(continued) | |

| | | | Financials—28.3% | |

| | 488,982 | | | Agricultural Bank of China Ltd., H-Shares (China) | | $ | 214,570 | |

| | 1,322,466 | | | Bank of China Ltd., H-Shares (China) | | | 563,441 | |

| | 369,993 | | | Bank of Communications Co. Ltd., H-Shares (China) | | | 277,516 | |

| | 20,000 | | | Central China Securities Co. Ltd.,

H-Shares (China)(d) | | | 4,796 | |

| | 153,000 | | | China Cinda Asset Management Co. Ltd., H-Shares (China) | | | 37,472 | |

| | 200,993 | | | China CITIC Bank Corp. Ltd., H-Shares (China) | | | 124,348 | |

| | 1,384,219 | | | China Construction Bank Corp., H-Shares (China) | | | 1,098,278 | |

| | 14,000 | | | China Everbright Ltd. (China) | | | 24,752 | |

| | 61,000 | | | China Galaxy Securities Co. Ltd., H-Shares (China) | | | 30,658 | |

| | 156,000 | | | China Huarong Asset Management Co. Ltd., H-Shares (China)(d) | | | 28,257 | |

| | 17,200 | | | China International Capital Corp. Ltd., H-Shares (China)(d) | | | 28,259 | |

| | 128,995 | | | China Life Insurance Co. Ltd., H-Shares (China) | | | 257,022 | |

| | 65,493 | | | China Merchants Bank Co. Ltd., H-Shares (China) | | | 252,301 | |

| | 14,800 | | | China Merchants Securities Co. Ltd., H-Shares (China)(d) | | | 16,783 | |

| | 117,888 | | | China Minsheng Banking Corp. Ltd., H-Shares (China) | | | 86,919 | |

| | 170,000 | | | China Minsheng Financial Holding Corp. Ltd. (Hong Kong)(b) | | | 5,183 | |

| | 44,600 | | | China Pacific Insurance (Group) Co. Ltd., H-Shares (China) | | | 166,125 | |

| | 105,000 | | | China Reinsurance Group Corp., H-Shares (China) | | | 20,091 | |

| | 24,800 | | | China Taiping Insurance Holdings Co. Ltd. (China) | | | 82,884 | |

| | 238,515 | | | Chong Sing Holdings Fintech GR

(China)(b) | | | 10,801 | |

| | 43,994 | | | Chongqing Rural Commercial Bank Co. Ltd., H-Shares (China) | | | 24,243 | |

| | 40,001 | | | CITIC Securities Co. Ltd., H-Shares (China) | | | 70,415 | |

| | 13,500 | | | CSC Financial Co. Ltd., H-Shares

(China)(d) | | | 7,646 | |

| | 4,800 | | | Everbright Securities Co. Ltd., H-Shares (China)(d) | | | 4,206 | |

| | 716 | | | Fanhua, Inc. ADR (China) | | | 19,174 | |

| | 38,000 | | | Far East Horizon Ltd. (China) | | | 36,840 | |

| | 23,272 | | | GF Securities Co. Ltd., H-Shares (China) | | | 30,102 | |

| | 55,000 | | | Guotai Junan International Holdings Ltd. (China) | | | 9,963 | |

| | 9,400 | | | Guotai Junan Securities Co. Ltd., H-Shares, Class H (China)(d) | | | 19,809 | |

| | 55,200 | | | Haitong Securities Co. Ltd., H-Shares (China) | | | 55,556 | |

| | 27,927 | | | Huatai Securities Co. Ltd., H-Shares (China)(d) | | | 44,886 | |

| | 14,700 | | | Huishang Bank Corp. Ltd., H-Shares (China) | | | 6,338 | |

| | 1,356,126 | | | Industrial & Commercial Bank of China Ltd., H-Shares (China) | | | 916,839 | |

| | 13,800 | | | New China Life Insurance Co. Ltd., H-Shares (China) | | | 64,516 | |

| | 105 | | | Noah Holdings Ltd. ADR (China)(b) | | | 3,960 | |

| | 14,000 | | | Orient Securities Co. Ltd., H-Shares (China)(d) | | | 9,197 | |

| | 121,000 | | | People’s Insurance Co. Group of China Ltd. (The), H-Shares (China) | | | 49,392 | |

| | | | | | | | |

Number

of Shares | | | | | Value | |

| | | | Common Stocks & Other Equity Interests

(continued) | |

| | | | Financials (continued) | |

| | 119,992 | | | PICC Property & Casualty Co. Ltd., H-Shares (China) | | $ | 116,328 | |

| | 87,652 | | | Ping An Insurance Group Co. of China Ltd., H-Shares (China) | | | 825,714 | |

| | 141,000 | | | Postal Savings Bank of China Co. Ltd., H-Shares (China)(d) | | | 84,175 | |

| | 10,318 | | | Shengjing Bank Co. Ltd., H-Shares

(China)(d) | | | 4,541 | |

| | | | | | | | |

| | | | | | | 5,734,296 | |

| | | | | | | | |

| | | | Health Care—4.4% | |

| | 11,454 | | | 3SBio, Inc. (China)(d) | | | 16,627 | |

| | 860 | | | BeiGene Ltd. ADR (China)(b) | | | 108,308 | |

| | 36,000 | | | China Animal Healthcare Ltd. (China)(b)(e) | | | 0 | |

| | 501 | | | China Biologic Products Holdings, Inc. (China)(b) | | | 33,287 | |

| | 23,495 | | | China Medical System Holdings Ltd. (China) | | | 27,962 | |

| | 11,000 | | | China Resources Medical Holdings Co. Ltd. (China) | | | 7,563 | |

| | 28,000 | | | China Resources Pharmaceutical Group Ltd. (China)(d) | | | 41,075 | |

| | 82,000 | | | CSPC Pharmaceutical Group Ltd. (China) | | | 173,008 | |

| | 15,636 | | | Genertec Universal Medical Group Co. Ltd. (China)(d) | | | 12,147 | |

| | 16,000 | | | Genscript Biotech Corp. (China)(b) | | | 24,410 | |

| | 3,827 | | | Guangzhou Baiyunshan Pharmaceutical Holdings Co. Ltd., H-Shares (China) | | | 13,937 | |

| | 91,200 | | | Hua Han Health Industry Holdings Ltd. (Hong Kong)(b)(e) | | | 0 | |

| | 2,080 | | | Livzon Pharmaceutical Group, Inc., H-Shares (China) | | | 6,036 | |

| | 27,000 | | | Luye Pharma Group Ltd. (China)(d) | | | 20,837 | |

| | 8,000 | | | Microport Scientific Corp. (China) | | | 9,552 | |

| | 40,001 | | | Shandong Weigao Group Medical Polymer Co. Ltd., H-Shares (China) | | | 35,769 | |

| | 8,000 | | | Shanghai Fosun Pharmaceutical Group Co. Ltd., H-Shares (China) | | | 23,981 | |

| | 14,500 | | | Shanghai Pharmaceuticals Holding Co. Ltd., H-Shares (China) | | | 32,036 | |

| | 82,000 | | | Sihuan Pharmaceutical Holdings Group Ltd. (China) | | | 16,631 | |

| | 111,988 | | | Sino Biopharmaceutical Ltd. (China) | | | 100,426 | |

| | 20,801 | | | Sinopharm Group Co. Ltd., H-Shares (China) | | | 100,298 | |

| | 30,000 | | | SSY Group Ltd. (Hong Kong) | | | 25,219 | |

| | 10,000 | | | Tong Ren Tang Technologies Co. Ltd., H-Shares (China) | | | 14,312 | |

| | 7,500 | | | Wuxi Biologics Cayman, Inc. (China)(b)(d) | | | 53,432 | |

| | | | | | | | |

| | | | | | | 896,853 | |

| | | | | | | | |

| | | | Industrials—6.9% | |

| | 395 | | | 51job, Inc. ADR (China)(b) | | | 24,257 | |

| | 33,999 | | | Air China Ltd., H-Shares (China) | | | 27,366 | |

| | 46,999 | | | AviChina Industry & Technology Co. Ltd., H-Shares (China) | | | 31,295 | |

| | 24,000 | | | Beijing Capital International Airport Co. Ltd., H-Shares (China) | | | 25,992 | |

| | 6,818 | | | CAR, Inc. (China)(b) | | | 5,410 | |

| | 76,993 | | | China Communications Construction Co. Ltd., H-Shares (China) | | | 70,419 | |

| | 31,500 | | | China Conch Venture Holdings Ltd. (China) | | | 88,400 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

Invesco China All-Cap ETF (YAO) (continued)

October 31, 2018

| | | | | | | | |

Number

of Shares | | | | | Value | |

| | | | Common Stocks & Other Equity Interests

(continued) | |

| | | | Industrials (continued) | |

| | 28,000 | | | China Eastern Airlines Corp. Ltd., H-Shares (China) | | $ | 15,465 | |

| | 108,000 | | | China Energy Engineering Corp. Ltd., H-Shares (China) | | | 10,470 | |

| | 63,999 | | | China Everbright International Ltd. (China) | | | 51,023 | |

| | 7,000 | | | China High Speed Transmission Equipment Group Co. Ltd. (Hong Kong) | | | 6,527 | |

| | 8,900 | | | China International Marine Containers Group Co. Ltd., H-Shares (China) | | | 7,856 | |

| | 17,000 | | | China Lesso Group Holdings Ltd. (China) | | | 8,956 | |

| | 13,000 | | | China Machinery Engineering Corp., H-Shares (China) | | | 5,920 | |

| | 21,320 | | | China Merchants Port Holdings Co. Ltd. (China) | | | 36,279 | |

| | 32,499 | | | China Railway Construction Corp. Ltd., H-Shares (China) | | | 41,124 | |

| | 66,993 | | | China Railway Group Ltd., H-Shares (China) | | | 59,820 | |

| | 34,000 | | | China Southern Airlines Co. Ltd., H-Shares (China) | | | 18,389 | |

| | 29,999 | | | China State Construction International Holdings Ltd. (China) | | | 21,391 | |

| | 111,000 | | | CITIC Ltd. (China) | | | 166,513 | |

| | 65,990 | | | COSCO SHIPPING Development Co. Ltd., H-Shares (China)(b) | | | 6,734 | |

| | 22,000 | | | COSCO SHIPPING Energy Transportation Co. Ltd., H-Shares (China) | | | 12,039 | |

| | 45,000 | | | COSCO SHIPPING Holdings Co. Ltd., H-Shares (China)(b) | | | 16,073 | |

| | 30,000 | | | COSCO SHIPPING Ports Ltd. (China) | | | 30,615 | |

| | 71,000 | | | CRRC Corp. Ltd., H-Shares (China) | | | 62,311 | |

| | 126,884 | | | Fullshare Holdings Ltd. (Hong Kong)(b)(c) | | | 49,366 | |

| | 20,000 | | | Greentown Service Group Co. Ltd. (China) | | | 13,215 | |

| | 24,000 | | | Guangshen Railway Co. Ltd., H-Shares (China) | | | 8,970 | |

| | 11,000 | | | Haitian International Holdings Ltd. (China) | | | 21,468 | |

| | 22,000 | | | Jiangsu Expressway Co. Ltd., H-Shares (China) | | | 29,523 | |

| | 28,000 | | | Lonking Holdings Ltd. (China) | | | 6,286 | |

| | 49,000 | | | Metallurgical Corp. of China Ltd., H-Shares (China) | | | 11,876 | |

| | 19,000 | | | Qingdao Port International Co. Ltd., H-Shares (China)(b)(d) | | | 11,149 | |

| | 41,998 | | | Shanghai Electric Group Co. Ltd., H-Shares (China) | | | 13,661 | |

| | 8,000 | | | Shanghai Industrial Holdings Ltd. (China) | | | 16,818 | |

| | 12,000 | | | Shenzhen Expressway Co. Ltd., H-Shares (China) | | | 11,037 | |

| | 17,407 | | | Shenzhen International Holdings Ltd. (China) | | | 33,307 | |

| | 20,500 | | | Sinopec Engineering Group Co. Ltd., H-Shares (China) | | | 19,063 | |

| | 37,000 | | | Sinotrans Ltd., H-Shares (China) | | | 12,885 | |

| | 11,500 | | | Sinotruk Hong Kong Ltd. (China) | | | 16,518 | |

| | 22,000 | | | SITC International Holdings Co. Ltd. (China) | | | 16,164 | |

| | 33,600 | | | Weichai Power Co. Ltd., H-Shares (China) | | | 33,217 | |

| | 11,280 | | | Xinjiang Goldwind Science & Technology Co. Ltd., H-Shares (China) | | | 8,403 | |

| | 38,700 | | | Yangzijiang Shipbuilding Holdings Ltd. (China) | | | 34,653 | |

| | 23,999 | | | Zhejiang Expressway Co. Ltd. H-Shares (China) | | | 20,113 | |

| | | | | | | | |

Number

of Shares | | | | | Value | |

| | | | Common Stocks & Other Equity Interests

(continued) | |

| | | | Industrials (continued) | |

| | 9,500 | | | Zhuzhou CRRC Times Electric Co. Ltd., H-Shares (China) | | $ | 50,776 | |

| | 22,599 | | | Zoomlion Heavy Industry Science and Technology Co. Ltd., H-Shares (China) | | | 7,236 | |

| | 6,503 | | | ZTO Express Cayman, Inc. ADR (China) | | | 105,479 | |

| | | | | | | | |

| | | | | | | 1,401,827 | |

| | | | | | | | |

| | | | Information Technology—3.1% | |

| | 12,482 | | | AAC Technologies Holdings, Inc. (China) | | | 94,976 | |

| | 48,000 | | | AGTech Holdings Ltd. (Hong Kong)(b) | | | 2,480 | |

| | 11,000 | | | BYD Electronic International Co. Ltd. (China) | | | 12,895 | |

| | 25,077 | | | China Railway Signal & Communication Corp. Ltd., H-Shares (China)(d) | | | 16,826 | |

| | 36,000 | | | Chinasoft International Ltd. (China)(b) | | | 21,124 | |

| | 18,000 | | | Digital China Holdings Ltd. (Hong Kong)(b) | | | 8,633 | |

| | 26,000 | | | FIT Hon Teng Ltd. (Taiwan)(d) | | | 10,746 | |

| | 214,995 | | | GCL-Poly Energy Holdings Ltd. (China)(b) | | | 12,753 | |

| | 950 | | | Hollysys Automation Technologies Ltd. (China) | | | 18,259 | |

| | 6,000 | | | Hua Hong Semiconductor Ltd. (China)(d) | | | 10,440 | |

| | 385 | | | JinkoSolar Holding Co. Ltd. ADR

(China)(b)(c) | | | 3,103 | |

| | 11,300 | | | Kingboard Holdings Ltd. (China) | | | 30,270 | |

| | 13,500 | | | Kingboard Laminates Holdings Ltd. (Hong Kong) | | | 10,332 | |

| | 32,000 | | | Kingdee International Software Group Co. Ltd. (China) | | | 26,124 | |

| | 17,000 | | | Kingsoft Corp. Ltd. (China) | | | 24,071 | |

| | 9,550 | | | Legend Holdings Corp., H-Shares (China)(d) | | | 25,948 | |

| | 107,995 | | | Lenovo Group Ltd. (China) | | | 68,742 | |

| | 27,500 | | | Meitu, Inc. (China)(b)(d) | | | 14,347 | |

| | 53,692 | | | Semiconductor Manufacturing International Corp. (China)(b) | | | 44,313 | |

| | 11,570 | | | Sunny Optical Technology Group Co. Ltd. (China) | | | 100,360 | |

| | 16,000 | | | TravelSky Technology Ltd., H-Shares (China) | | | 38,778 | |

| | 48,000 | | | Xinyi Solar Holdings Ltd. (China) | | | 15,001 | |

| | 3,000 | | | Yangtze Optical Fibre and Cable Joint Stock Ltd. Co., H-Shares (China)(d) | | | 7,309 | |

| | 13,248 | | | ZTE Corp. H-Shares (China)(b) | | | 20,212 | |

| | | | | | | | |

| | | | | | | 638,042 | |

| | | | | | | | |

| | | | Materials—2.7% | |

| | 67,994 | | | Aluminum Corp. of China Ltd., H-Shares (China)(b) | | | 24,632 | |

| | 18,000 | | | Angang Steel Co. Ltd., H-Shares (China) | | | 15,315 | |

| | 20,500 | | | Anhui Conch Cement Co. Ltd., H-Shares (China) | | | 105,907 | |

| | 41,000 | | | BBMG Corp., H-Shares (China) | | | 11,297 | |

| | 579,031 | | | Beijing Enterprises Clean Energy Group Ltd. (China)(b) | | | 7,312 | |

| | 27,999 | | | China BlueChemical Ltd., H-Shares (China) | | | 9,572 | |

| | 63,000 | | | China Molybdenum Co. Ltd., H-Shares (China) | | | 23,386 | |

| | 67,998 | | | China National Building Material Co. Ltd., H-Shares (China) | | | 48,574 | |

| | 38,000 | | | China Resources Cement Holdings Ltd. (China) | | | 33,495 | |

| | 105,999 | | | China Shanshui Cement Group Ltd. (China)(b) | | | 44,485 | |

| | 24,799 | | | China Zhongwang Holdings Ltd. (China) | | | 11,009 | |

| | 22,000 | | | Fufeng Group Ltd. (China) | | | 9,317 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

Invesco China All-Cap ETF (YAO) (continued)

October 31, 2018

| | | | | | | | |

Number

of Shares | | | | | Value | |

| | | | Common Stocks & Other Equity Interests

(continued) | |

| | | | Materials (continued) | |

| | 13,000 | | | Greatview Aseptic Packaging Co. Ltd. (China) | | $ | 8,623 | |

| | 14,999 | | | Huabao International Holdings Ltd. (Hong Kong) | | | 6,983 | |

| | 20,999 | | | Jiangxi Copper Co. Ltd., H-Shares (China) | | | 23,143 | |

| | 23,999 | | | Lee & Man Paper Manufacturing Ltd. (China) | | | 20,541 | |

| | 30,000 | | | Maanshan Iron & Steel Co. Ltd., H-Shares (China) | | | 16,073 | |

| | 36,000 | | | MMG Ltd. (China)(b) | | | 13,501 | |

| | 28,999 | | | Nine Dragons Paper Holdings Ltd. (Hong Kong) | | | 27,670 | |

| | 58,000 | | | Shougang Fushan Resources Group Ltd. (China) | | | 11,690 | |

| | 53,998 | | | Sinopec Shanghai Petrochemical Co. Ltd., H-Shares (China) | | | 23,695 | |

| | 17,500 | | | Zhaojin Mining Industry Co. Ltd., H-Shares (China) | | | 15,448 | |

| | 99,992 | | | Zijin Mining Group Co. Ltd., H-Shares (China) | | | 37,117 | |

| | | | | | | | |

| | | | | | | 548,785 | |

| | | | | | | | |

| | | | Real Estate—6.8% | |

| | 26,000 | | | Agile Group Holdings Ltd. (China) | | | 29,650 | |

| | 140,000 | | | Carnival Group International Holdings Ltd. (Hong Kong)(b) | | | 2,536 | |

| | 22,000 | | | China Aoyuan Property Group Ltd. (China) | | | 12,853 | |

| | 51,994 | | | China Evergrande Group (China) | | | 124,026 | |

| | 71,998 | | | China Jinmao Holdings Group Ltd. (China) | | | 30,216 | |

| | 28,000 | | | China Logistics Property Holdings Co. Ltd. (China)(b)(d) | | | 9,286 | |

| | 63,995 | | | China Overseas Land & Investment Ltd. (China) | | | 200,408 | |

| | 45,999 | | | China Resources Land Ltd. (China) | | | 156,080 | |

| | 32,000 | | | China SCE Group Holdings Ltd. (China) | | | 10,899 | |

| | 74,000 | | | China South City Holdings Ltd. (China) | | | 10,855 | |

| | 22,796 | | | China Vanke Co. Ltd., H-Shares (China) | | | 70,225 | |

| | 62,000 | | | CIFI Holdings Group Co. Ltd. (China) | | | 25,941 | |

| | 123,873 | | | Country Garden Holdings Co. Ltd. (China) | | | 132,573 | |

| | 30,000 | | | Future Land Development Holdings Ltd. (China) | | | 17,221 | |

| | 11,000 | | | Greentown China Holdings Ltd. (China) | | | 7,633 | |

| | 17,600 | | | Guangzhou R&F Properties Co. Ltd., H-Shares (China) | | | 27,614 | |

| | 12,000 | | | Hopson Development Holdings Ltd. (China) | | | 9,200 | |

| | 18,000 | | | Jiayuan International Group Ltd. (China) | | | 31,594 | |

| | 66,000 | | | Joy City Property Ltd. (China) | | | 6,988 | |

| | 41,000 | | | Kaisa Group Holdings Ltd. (China) | | | 9,989 | |

| | 20,815 | | | KWG Group Holdings Ltd. (China) | | | 15,905 | |

| | 22,000 | | | Logan Property Holdings Co. Ltd. (China) | | | 20,318 | |

| | 25,499 | | | Longfor Group Holdings Ltd. (China) | | | 61,931 | |

| | 31,999 | | | Poly Property Group Co. Ltd. (China) | | | 9,551 | |

| | 29,000 | | | Powerlong Real Estate Holdings Ltd. (China) | | | 9,914 | |

| | 11,837 | | | Red Star Macalline Group Corp. Ltd., H-Shares (China)(d) | | | 10,449 | |

| | 371,930 | | | Renhe Commercial Holdings Co. Ltd. (China)(b) | | | 12,573 | |

| | 10,000 | | | Ronshine China Holdings Ltd. (China)(b) | | | 11,264 | |

| | 53,999 | | | Shenzhen Investment Ltd. (China) | | | 15,498 | |

| | 18,499 | | | Shimao Property Holdings Ltd. (China) | | | 36,199 | |

| | 58,493 | | | Shui On Land Ltd. (China) | | | 11,789 | |

| | 52,493 | | | Sino-Ocean Group Holding Ltd. (China) | | | 20,557 | |

| | 32,499 | | | SOHO China Ltd. (China) | | | 11,027 | |

| | | | | | | | |

Number

of Shares | | | | | Value | |

| | | | Common Stocks & Other Equity Interests

(continued) | |

| | | | Real Estate (continued) | |

| | 40,000 | | | Sunac China Holdings Ltd. (China) | | $ | 108,682 | |

| | 10,000 | | | Times China Holdings Ltd. (China) | | | 8,712 | |

| | 11,500 | | | Yanlord Land Group Ltd. (China) | | | 10,464 | |

| | 105,992 | | | Yuexiu Property Co. Ltd. (China) | | | 16,765 | |

| | 32,000 | | | Yuzhou Properties Co. Ltd. (China) | | | 11,429 | |

| | 71,000 | | | Zall Smart Commerce Group Ltd. (China)(b) | | | 50,718 | |

| | | | | | | | |

| | | | | | | 1,379,532 | |

| | | | | | | | |

| | | | Utilities—3.1% | |

| | 8,500 | | | Beijing Enterprises Holdings Ltd. (China) | | | 45,973 | |

| | 95,986 | | | Beijing Enterprises Water Group Ltd. (China) | | | 48,854 | |

| | 34,000 | | | Beijing Jingneng Clean Energy Co. Ltd., H-Shares (China) | | | 6,375 | |

| | 178,271 | | | CGN Power Co. Ltd., H-Shares (China)(d) | | | 40,933 | |

| | 38,599 | | | China Gas Holdings Ltd. (Hong Kong) | | | 122,108 | |

| | 53,998 | | | China Longyuan Power Group Corp., H-Shares (China) | | | 41,053 | |

| | 74,999 | | | China Power International Development Ltd. (China) | | | 14,829 | |

| | 14,000 | | | China Resources Gas Group Ltd. (China) | | | 53,575 | |

| | 29,999 | | | China Resources Power Holdings Co. Ltd. (China) | | | 52,732 | |

| | 14,000 | | | China Water Affairs Group Ltd. (Hong Kong) | | | 12,626 | |

| | 50,000 | | | CT Environmental Group Ltd. (China) | | | 2,264 | |

| | 47,996 | | | Datang International Power Generation Co. Ltd., H-Shares (China) | | | 10,714 | |

| | 49,998 | | | Guangdong Investment Ltd. (China) | | | 89,289 | |

| | 36,000 | | | Huadian Fuxin Energy Corp. Ltd., H-Shares (China) | | | 6,475 | |

| | 28,000 | | | Huadian Power International Corp. Ltd., H-Shares (China) | | | 10,608 | |

| | 73,994 | | | Huaneng Power International, Inc., H-Shares (China) | | | 41,247 | |

| | 83,456 | | | Huaneng Renewables Corp. Ltd., H-Shares (China) | | | 21,398 | |

| | | | | | | | |

| | | | | | | 621,053 | |

| | | | | | | | |

| | | | Total Investments in Securities

(excluding investments purchased with cash collateral from securities on loan)

(Cost $20,818,282)—100.0% | | | 20,280,247 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | | | Investments Purchased with Cash Collateral from

Securities on Loan | |

| | |

| | | | | | | | |

| | | | Money Market Fund—0.7% | | | |

| | 151,462 | | | Invesco Government & Agency Portfolio—Institutional Class, 2.08%(f)(g)

(Cost $151,462) | | | 151,462 | |

| | | | | | | | |

| | | | Total Investments in Securities

(Cost $20,969,744)—100.7% | | | 20,431,709 | |

| | | | Other assets less liabilities—(0.7)% | | | (150,008 | ) |

| | | | | | | | |

| | | | Net Assets—100.0% | | $ | 20,281,701 | |

| | | | | | | | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

Invesco China All-Cap ETF (YAO) (continued)

October 31, 2018

Investment Abbreviations:

ADR—American Depositary Receipt

Notes to Schedule of Investments:

| (a) | Industry and/or sector classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

| (b) | Non-income producing security. |

| (c) | All or a portion of this security was out on loan at October 31, 2018. |

| (d) | Security purchased or received in a transaction exempt from registration under the Securities Act of 1933, as amended (the “1933 Act”). The security may be resold pursuant to an exemption from registration under the 1933 Act, typically to qualified institutional buyers. The aggregate value of these securities at October 31, 2018 was $758,942, which represented 3.74% of the Fund’s Net Assets. |

| (e) | Security valued using significant unobservable inputs (Level 3). See Note 4. |

| (f) | The security and the Fund are advised by wholly-owned subsidiaries of Invesco Ltd. and are therefore considered to be affiliated. The rate shown is the 7-day SEC standardized yield as of October 31, 2018. |

| (g) | The security has been segregated to satisfy the commitment to return the cash collateral received in securities lending transactions upon the borrower’s return of the securities loaned. See Note 2J. |

This Fund has holdings greater than 10% of net assets in the following country:

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

Schedule of Investments(a)

Invesco China Technology ETF (CQQQ)

October 31, 2018

| | | | | | | | |

Number

of Shares | | | | | Value | |

| | | | Common Stocks & Other Equity Interests—99.9% | |

| | | | Communications Equipment—2.5% | | | |

| | 2,252,500 | | | BYD Electronic International Co. Ltd. (China) | | $ | 2,640,569 | |

| | 3,948,424 | | | China All Access Holdings Ltd. (Hong Kong) | | | 183,838 | |

| | 4,923,737 | | | Comba Telecom Systems Holdings Ltd. (Hong Kong)(b) | | | 690,883 | |

| | 1,429,666 | | | O-Net Technologies Group Ltd. (China)(b) | | | 618,232 | |

| | 1,107,097 | | | Xi’an Haitiantian Holdings Co. Ltd. (China)(b) | | | 283,857 | |

| | 615,306 | | | Yangtze Optical Fibre and Cable Joint Stock Ltd. Co., H-Shares (China)(c) | | | 1,499,138 | |

| | 2,697,480 | | | ZTE Corp. H-Shares (China)(b) | | | 4,115,348 | |

| | | | | | | | |

| | | | | | | 10,031,865 | |

| | | | | | | | |

| | | | Consumer Finance—0.2% | |

| | 39,008 | | | Yirendai Ltd. ADR (China)(d) | | | 606,964 | |

| | | | | | | | |

| | | | Electronic Equipment, Instruments & Components—12.9% | |

| | 1,456,871 | | | AAC Technologies Holdings, Inc. (China) | | | 11,085,332 | |

| | 2,144,054 | | | Anxin-China Holdings Ltd. (China)(b)(e) | | | 0 | |

| | 1,423,052 | | | Camsing International Holding Ltd. (Hong Kong)(b)(d) | | | 1,118,198 | |

| | 6,829,399 | | | China Aerospace International Holdings Ltd. (China) | | | 461,717 | |

| | 5,061,520 | | | China Railway Signal & Communication Corp. Ltd., H-Shares (China)(c) | | | 3,396,127 | |

| | 29,918,307 | | | China Youzan Ltd. (Hong Kong)(b)(d) | | | 2,099,021 | |

| | 5,537,560 | | | FIT Hon Teng Ltd. (Taiwan)(c) | | | 2,288,657 | |

| | 196,065 | | | Hollysys Automation Technologies Ltd. (China) | | | 3,768,369 | |

| | 3,031,369 | | | Ju Teng International Holdings Ltd. (Hong Kong) | | | 765,634 | |

| | 2,360,954 | | | Kingboard Holdings Ltd. (China) | | | 6,324,468 | |

| | 2,750,305 | | | Kingboard Laminates Holdings Ltd. (Hong Kong) | | | 2,104,986 | |

| | 2,632,048 | | | PAX Global Technology Ltd. (Hong Kong) | | | 1,295,980 | |

| | 1,602,653 | | | Sunny Optical Technology Group Co. Ltd. (China) | | | 13,901,626 | |

| | 14,834,361 | | | Tongda Group Holdings Ltd. (Hong Kong) | | | 1,911,206 | |

| | 6,350,997 | | | Truly International Holdings Ltd. (Hong Kong)(b) | | | 923,557 | |

| | 1,686,342 | | | Wasion Holdings Ltd. (China) | | | 828,178 | |

| | | | | | | | |

| | | | | | | 52,273,056 | |

| | | | | | | | |

| | | | Entertainment—9.3% | |

| | 1,719,074 | | | Boyaa Interactive International Ltd. (China)(b) | | | 401,294 | |

| | 57,217 | | | Changyou.com Ltd., Class A ADR (China) | | | 765,564 | |

| | 4,602,754 | | | Leyou Technologies Holdings Ltd. (China)(b) | | | 1,050,964 | |

| | 929,060 | | | NetDragon Websoft Holdings Ltd. (Hong Kong) | | | 1,642,571 | |

| | 162,742 | | | NetEase, Inc. ADR (China) | | | 33,825,925 | |

| | | | | | | | |

| | | | | | | 37,686,318 | |

| | | | | | | | |

| | | | Interactive Media & Services—41.6% | |

| | 292,601 | | | 58.com, Inc., Class A ADR (China)(b) | | | 19,191,699 | |

| | 197,044 | | | Autohome, Inc., Class A ADR

(China)(d) | | | 14,262,045 | |

| | 179,936 | | | Baidu, Inc. ADR (China)(b) | | | 34,198,636 | |

| | 132,468 | | | Bitauto Holdings Ltd. ADR (China)(b)(d) | | | 2,530,139 | |

| | 607,911 | | | Fang Holdings Ltd. ADR (China)(b) | | | 1,234,059 | |

| | 505,517 | | | Momo, Inc., Class A ADR (China)(b) | | | 16,970,206 | |

| | 106,161 | | | Phoenix New Media Ltd. ADR

(China)(b) | | | 341,838 | |

| | 224,580 | | | SINA Corp. (China)(b) | | | 14,218,160 | |

| | | | | | | | |

Number

of Shares | | | | | Value | |

| | | | Common Stocks & Other Equity Interests

(continued) | |

| | | | Interactive Media & Services (continued) | |

| | 109,766 | | | Sohu.com Ltd. ADR (China)(b) | | $ | 1,983,472 | |

| | 1,127,442 | | | Tencent Holdings Ltd. (China) | | | 38,399,241 | |

| | 2,043,973 | | | Tian Ge Interactive Holdings Ltd. (China)(c) | | | 1,076,818 | |

| | 225,372 | | | Weibo Corp., Class A ADR (China)(b) | | | 13,299,202 | |

| | 172,451 | | | YY, Inc., Class A ADR (China)(b) | | | 11,019,619 | |

| | | | | | | | |

| | | | | | | 168,725,134 | |

| | | | | | | | |

| | | | Internet & Direct Marketing Retail—11.1% | |

| | 288,810 | | | Alibaba Group Holding Ltd. ADR (China)(b) | | | 41,091,887 | |

| | 100,805 | | | Baozun, Inc. ADR (China)(b)(d) | | | 4,013,047 | |

| | | | | | | | |

| | | | | | | 45,104,934 | |

| | | | | | | | |

| | | | IT Services—6.2% | |

| | 279,635 | | | 21Vianet Group, Inc., Class A ADR (China)(b) | | | 3,041,031 | |

| | 11,289,090 | | | AGTech Holdings Ltd. (Hong Kong)(b) | | | 583,218 | |

| | 7,633,978 | | | Chinasoft International Ltd. (China)(b) | | | 4,479,463 | |

| | 3,653,396 | | | Digital China Holdings Ltd. (Hong Kong)(b) | | | 1,752,273 | |

| | 205,462 | | | GDS Holdings Ltd. ADR (China)(b)(d) | | | 4,822,193 | |

| | 17,231,265 | | | Green Leader Holdings Group Ltd. (Hong Kong)(b) | | | 147,268 | |

| | 6,545,276 | | | Hi Sun Technology China Ltd. (Hong Kong)(b) | | | 759,778 | |

| | 2,158,514 | | | SUNeVision Holdings Ltd. (Hong Kong) | | | 1,161,942 | |

| | 3,330,081 | | | TravelSky Technology Ltd., H-Shares (China) | | | 8,070,967 | |

| | 9,525,182 | | | Vision Values Holdings Ltd. (Hong Kong)(b) | | | 370,587 | |

| | | | | | | | |

| | | | | | | 25,188,720 | |

| | | | | | | | |

| | | | Real Estate Management & Development—0.3% | |

| | 5,239,972 | | | Landing International Development Ltd. (Hong Kong)(b) | | | 1,089,516 | |

| | | | | | | | |

| | | | Semiconductors & Semiconductor Equipment—6.8% | |

| | 909,787 | | | ASM Pacific Technology Ltd. (Hong Kong) | | | 7,856,798 | |

| | 2,972,387 | | | China Electronics Huada Technology Co. Ltd. (China) | | | 261,620 | |

| | 33,412 | | | Daqo New Energy Corp.

ADR (China)(b) | | | 713,346 | |

| | 43,267,118 | | | GCL-Poly Energy Holdings Ltd.

(China)(b) | | | 2,566,422 | |

| | 1,300,972 | | | Hua Hong Semiconductor Ltd.

(China)(c) | | | 2,263,599 | |

| | 96,380 | | | JinkoSolar Holding Co. Ltd. ADR

(China)(b)(d) | | | 776,823 | |

| | 11,055,497 | | | Semiconductor Manufacturing International Corp. (China)(b)(d) | | | 9,124,304 | |

| | 954,307 | | | Shanghai Fudan Microelectronics Group Co. Ltd., H-Shares (China)(b) | | | 1,044,462 | |

| | 9,812,373 | | | Xinyi Solar Holdings Ltd. (China) | | | 3,066,601 | |

| | | | | | | | |

| | | | | | | 27,673,975 | |

| | | | | | | | |

| | | | Software—3.1% | |

| | 139,002 | | | Cheetah Mobile, Inc., Class A ADR (China)(b) | | | 1,324,689 | |

| | 6,465,770 | | | Kingdee International Software Group Co. Ltd. (China) | | | 5,278,584 | |

| | 3,531,129 | | | Kingsoft Corp. Ltd. (China) | | | 4,999,813 | |

| | 313,924 | | | Link Motion, Inc. ADR (China)(b) | | | 168,263 | |

| | 534,446 | | | National Agricultural Holdings Ltd. (China)(b)(e) | | | 0 | |

| | 10,752,957 | | | Rentian Technology Holdings Ltd. (Hong Kong)(b) | | | 197,518 | |

| | 114,945 | | | Xunlei Ltd. ADR (China)(b) | | | 695,417 | |

| | | | | | | | |

| | | | | | | 12,664,284 | |

| | | | | | | | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

Invesco China Technology ETF (CQQQ) (continued)

October 31, 2018

| | | | | | | | |

Number

of Shares | | | | | Value | |

| | | | Common Stocks & Other Equity Interests

(continued) | |

| | | | Specialty Retail—0.1% | |

| | 95,516 | | | Renren, Inc., Class A ADR (China)(d) | | $ | 136,588 | |

| | | | | | | | |

| | | | Technology Hardware, Storage & Peripherals—5.5% | |

| | 1,977,868 | | | Coolpad Group Ltd. (China)(b)(e) | | | 0 | |

| | 1,952,734 | | | Legend Holdings Corp., H-Shares (China)(c) | | | 5,305,666 | |

| | 22,308,498 | | | Lenovo Group Ltd. (China) | | | 14,199,990 | |

| | 5,545,032 | | | Meitu, Inc. (China)(b)(c) | | | 2,892,974 | |

| | | | | | | | |

| | | | | | | 22,398,630 | |

| | | | | | | | |

| | | | Trading Companies & Distributors—0.3% | |

| | 1,961,620 | | | HC Group, Inc. (China)(b) | | | 1,273,649 | |

| | | | | | | | |

| | | | Total Common Stocks & Other Equity Interests

(Cost $535,540,191) | | | 404,853,633 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | | | Money Market Fund—0.1% | |

| | 590,245 | | | Invesco Premier U.S. Government Money Portfolio—Institutional Class, 2.08%(f)

(Cost $590,245) | | | 590,245 | |

| | | | | | | | |

| | | | Total Investments in Securities

(excluding investments purchased with cash collateral from securities on loan)

(Cost $536,130,436)—100.0% | | | 405,443,878 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | | | Investments Purchased with Cash Collateral from

Securities on Loan | |

| | |

| | | | | | | | |

| | | | Money Market Fund—5.0% | |

| | 20,265,911 | | | Invesco Government & Agency Portfolio—Institutional Class,

2.08%(f)(g)

(Cost $20,265,911) | | | 20,265,911 | |

| | | | | | | | |

| | | | Total Investments in Securities

(Cost $556,396,347)—105.0% | | | 425,709,789 | |

| | | | Other assets less liabilities—(5.0)% | | | (20,168,672 | ) |

| | | | | | | | |

| | | | Net Assets—100.0% | | $ | 405,541,117 | |

| | | | | | | | |

Investment Abbreviations:

ADR—American Depositary Receipt

Notes to Schedule of Investments:

| (a) | Industry and/or sector classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

| (b) | Non-income producing security. |

| (c) | Security purchased or received in a transaction exempt from registration under the Securities Act of 1933, as amended (the “1933 Act”). The security may be resold pursuant to an exemption from registration under the 1933 Act, typically to qualified institutional buyers. The aggregate value of these securities at October 31, 2018 was $18,722,979, which represented 4.62% of the Fund’s Net Assets. |

| (d) | All or a portion of this security was out on loan at October 31, 2018. |

| (e) | Security valued using significant unobservable inputs (Level 3). See Note 4. |

| (f) | The security and the Fund are advised by wholly-owned subsidiaries of Invesco Ltd. and are therefore considered to be affiliated. The rate shown is the 7-day SEC standardized yield as of October 31, 2018. |

| (g) | The security has been segregated to satisfy the commitment to return the cash collateral received in securities lending transactions upon the borrower’s return of the securities loaned. See Note 2J. |

This Fund has holdings greater than 10% of net assets in the following country: