UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21977

| | | | |

| | Invesco Exchange-Traded Fund Trust II | | |

| | (Exact name of registrant as specified in charter) | | |

| | | | |

| | 3500 Lacey Road Downers Grove, IL 60515 | | |

| | (Address of principal executive offices) (Zip code) | | |

| | Daniel E. Draper President 3500 Lacey Road Downers Grove, IL 60515 | | |

| | (Name and address of agent for service) | | |

Registrant’s telephone number, including area code: 800-983-0903

Date of fiscal year end: August 31

Date of reporting period: August 31, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Invesco Annual Report to Shareholders

August 31, 2018

| | |

| YAO | | Invesco China All-Cap ETF |

| CQQQ | | Invesco China Technology ETF |

| CGW | | Invesco S&P Global Water Index ETF |

| GHII | | Invesco S&P High Income Infrastructure ETF |

| SEA | | Invesco Shipping ETF |

| TAN | | Invesco Solar ETF |

Table of Contents

Effective June 4, 2018, the Funds’ names changed as part of an overall rebranding strategy whereby the PowerShares name was changed to the Invesco brand. This resulted in all references to the PowerShares name being changed to Invesco.

The Market Environment

Domestic Equity

The fiscal period proved to be another strong, albeit increasingly volatile, time for US equities. As the fiscal period unfolded in the later months of 2017, several major US stock market indexes repeatedly reached new highs amid improving economic data, strong corporate profits and the prospect of tax reform legislation. Stock market volatility remained exceedingly low—a hallmark of 2017.

At the outset of 2018, US equity markets continued to steadily move higher in January as investors remained enthused about the passage of the Tax Cuts and Jobs Act signed into law in late December 2017, which significantly cut corporate tax rates. However, in February 2018, volatility returned to the US stock and bond markets. Worries about how rising interest rates might affect economic growth, concerns about a potential trade war and heightened geopolitical tensions, caused the US stock market to pull back and volatility to increase. In addition, in April 2018, the yield on the 10-year US Treasury bond climbed above 3%—a psychologically important level—for the first time since December 2013.1

Despite a disappointing first quarter, US equity markets generally recovered in the second quarter of 2018. Strong US retail sales and low unemployment continued to buoy US equity markets. In the final months of the fiscal period, US equities moved higher, despite several potential headwinds including trade tensions, tariff announcements and contagion concerns over a Turkish currency crisis. Ultimately, the fiscal period ended the same way it began with several US equity indexes reaching new record highs.

Given signs of a strong economy, the US Federal Reserve raised interest rates three times during the fiscal period: in December 2017 and in March and June 2018.2 In contrast, the European Central Bank and central banks in several other countries maintained extraordinarily accommodative monetary policies.

| 2 | Source: US Federal Reserve |

International Equity

Global equity markets delivered positive returns for the fiscal period ended August 31, 2018. That positive performance was despite significant turbulence in late January and early February 2018, when stocks were whipsawed—first by concerns about accelerated US Federal Reserve tightening and then, later in the year, by fears of brewing trade wars. Geopolitical risks and tighter monetary policies overseas were additional headwinds to global equity markets. In spite of these risks, global equities generally rose during the fiscal period.

In Europe, economic growth remained positive amid improving employment, industrial production and consumption trends in many countries. However, European equity markets retrenched in August amid concerns regarding Italy’s budget concerns and contagion fears regarding the Turkish lira. The political environment in Germany improved, with Chancellor Angela Merkel finally securing a coalition government in order to continue her leadership. French President Emmanuel Macron continued his efforts at labor reform, boosting business confidence and business spending. The European Central Bank remained supportive of European equities, maintaining a dovish tone throughout the fiscal period.

Weakness in emerging equity markets during August was broad based. Investors worried about threats to global trade as the US prepared to impose tariffs on an additional $200 billion worth of Chinese imports. While the prospect of a deepening trade dispute pushed Chinese equity markets into negative territory, Latin America was the worst-performing region, with losses in Brazil accentuated by political uncertainties and currency weakness. Economic growth in emerging markets remained relatively strong over the fiscal period. However, volatility increased toward the end of the fiscal period with several markets registering losses.

At the close of the fiscal period, equity valuations in developed and emerging markets appeared relatively full in absolute terms—but overseas equity markets were trading at a material discount to those of the US. In sum, while valuations were not cheap, recent earnings growth and upward earnings revisions improved in many non-US developed markets.

| | |

| YAO | | Manager’s Analysis |

| | Invesco China All-Cap ETF (YAO) |

Welcome to Invesco! Effective after the close of business on April 6, 2018, Guggenheim China All-Cap ETF (the “Predecessor Fund”) was reorganized into Invesco China All-Cap ETF (formerly known as PowerShares China All-Cap Portfolio), a newly created exchange-traded fund in Invesco’s family of ETFs, in a tax-free transaction. The ticker symbol and Index did not change. Performance information set forth below refers to both the performance of the Predecessor Fund and the Fund.

As an index fund, the Invesco China All-Cap ETF (the “Fund”) is passively managed and seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the AlphaShares China All Cap Index (the “Index”). The Index is designed to measure and monitor the performance of the investable universe of publicly traded companies based in mainland China (as classified by the S&P BMI Country Code classification system). The Index was created by AlphaShares, LLC ( the “Index Provider”) and is maintained by Standard & Poor’s. The Index includes equity securities of companies of all categories of market capitalizations, as defined by the Index Provider (subject to a minimum float-adjusted capitalization of U.S. $400 million). The Index may include Hong Kong listed securities, including China H-shares and Red Chip shares. China H-shares are issued by companies incorporated in mainland China and listed on the Hong Kong Stock Exchange. Red Chip shares are issued by companies with controlling Chinese shareholders that are incorporated outside mainland China and listed on the Hong Kong Stock Exchange. The Index may also include N-Shares, which are issued by companies based in mainland China and listed on the NYSE Arca, Inc. or The Nasdaq Stock Market. The Index does not include China A-Shares (which are subject to substantial restrictions on foreign investment) or China B-Shares (which offer a generally smaller market and limited liquidity), each of which trade on the Shanghai Stock Exchange and the Shenzhen Stock Exchange. The Fund will invest at least 90% of its total assets in common stocks, American depositary receipts (“ADRs”), American depositary shares (“ADSs”), global depositary receipts (“GDRs”) and international depositary receipts (“IDRs”) that comprise the Index and depositary receipts or shares representing common stocks included in the Index (or underlying securities representing ADRs, ADSs, GDRs and IDRs included in the Index). The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

For the fiscal year ended August 31, 2018, on a market price basis, the Fund returned (0.44)%. On a net asset value (“NAV”) basis, the Fund returned 0.19%. During the same time period, the Index returned 1.03%. During the fiscal year, the Fund’s performance, on a NAV basis, differed from the return of the Index primarily due to fees and operating expenses that the Fund incurred during the period.

During this same time period, the MSCI China Index (Net) (the “Benchmark Index”) returned 0.22%. The Benchmark Index is an unmanaged index weighted by market capitalization based on the

average performance of approximately 450 securities. The Benchmark Index was selected for its recognition in the marketplace, and its performance comparison is a useful measure for investors as a broad representation of the Chinese equity market.

The performance of the Fund differed from the Benchmark Index because the Fund seeks to track an Index that employs a proprietary stock selection and weighting methodology, whereas the Benchmark Index selects and weights stocks based on market capitalization.

Relative to the Benchmark Index, the Fund was most overweight in the financials sector and most underweight in the information technology sector during the fiscal year ended August 31, 2018. The majority of the Fund’s underperformance relative to the Benchmark Index during that period can be attributed to the Fund being underweight in the information technology sector as well as fees and operating expenses that the Fund incurred.

For the fiscal year ended August 31, 2018, the health care sector contributed most significantly to the Fund’s return, followed by the energy and consumer staples sectors, respectively. The consumer discretionary and telecommunication services sectors were the greatest detracting sectors.

Positions that contributed most significantly to the Fund’s return for the fiscal year ended August 31, 2018, included Ping An Insurance Group Co. of China Ltd., H-Shares (China), a financials company (portfolio average weight of 3.49%), and CNOOC Ltd. (China), an energy company (portfolio average weight of 1.71%). Positions that detracted most significantly from the Fund’s return during this period included JD.com, Inc., Class A ADR (China), a consumer discretionary company (portfolio average weight of 2.23%), and China Life Insurance Co. Ltd., H-Shares (China), a financials company (portfolio average weight of 1.55%).

| | | | |

Sector Breakdown (% of the Fund’s Net Assets)

as of August 31, 2018 | |

| Financials | | | 26.8 | |

| Information Technology | | | 21.8 | |

| Consumer Discretionary | | | 11.7 | |

| Real Estate | | | 7.5 | |

| Energy | | | 6.6 | |

| Industrials | | | 6.4 | |

| Telecommunication Services | | | 5.2 | |

| Health Care | | | 4.7 | |

| Consumer Staples | | | 3.5 | |

| Utilities | | | 3.0 | |

| Materials | | | 2.6 | |

| Money Market Funds Plus Other Assets Less Liabilities | | | 0.2 | |

Invesco China All-Cap ETF (YAO) (continued)

| | | | |

Top Ten Fund Holdings*

(% of the Fund’s Net Assets)

as of August 31, 2018 | |

| Security | | | | |

| China Construction Bank Corp., H-Shares | | | 5.4 | |

| Alibaba Group Holding Ltd. ADR | | | 5.2 | |

| Baidu, Inc. ADR | | | 4.8 | |

| Tencent Holdings Ltd. | | | 4.5 | |

| Industrial & Commercial Bank of China Ltd., H-Shares | | | 4.4 | |

| China Mobile Ltd. | | | 4.0 | |

| Ping An Insurance Group Co. of China Ltd., H-Shares | | | 3.7 | |

| Bank of China Ltd., H-Shares | | | 2.6 | |

| CNOOC Ltd. | | | 2.2 | |

| China Petroleum & Chemical Corp. (Sinopec), H-Shares | | | 2.0 | |

| Total | | | 38.8 | |

| * | Excluding money market fund holdings. |

Growth of a $10,000 Investment Since Inception

Fund Performance History as of August 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Years Average

Annualized | | | 3 Years Cumulative | | | 5 Years Average

Annualized | | | 5 Years Cumulative | | | | | | Fund Inception | |

| Index | | | | | Average

Annualized | | | Cumulative | |

| AlphaShares China All Cap Index | | | 1.03 | % | | | 13.66 | % | | | 46.84 | % | | | 8.69 | % | | | 51.70 | % | | | | | | | 5.55 | % | | | 61.36 | % |

| MSCI China Index (Net) | | | 0.22 | | | | 13.49 | | | | 46.16 | | | | 9.27 | | | | 55.79 | | | | | | | | 5.14 | | | | 55.89 | |

| Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV Return | | | 0.19 | | | | 12.87 | | | | 43.81 | | | | 8.23 | | | | 48.54 | | | | | | | | 5.17 | | | | 56.36 | |

| Market Price Return | | | (0.44 | ) | | | 13.20 | | | | 45.07 | | | | 8.28 | | | | 48.87 | | | | | | | | 5.13 | | | | 55.79 | |

Invesco China All—Cap ETF (YAO) (continued)

Predecessor Fund Inception: October 19, 2009

Performance quoted above represents past performance. Past performance is not a guarantee of future results and current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate, and shares of the Fund (“Fund Shares”), when redeemed or sold, may be worth more or less than their original cost. Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information. According to the Fund’s current prospectus, the Fund’s expense ratio of 0.70% is expressed as a unitary management fee to cover operating expenses and expenses incurred in connection with managing the portfolio. NAV and Market Price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and Market Price, respectively. The returns shown in the table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund Shares. See invesco.com/ETFs to find the most recent month-end performance numbers.

Index and Benchmark Index performance results are based upon a hypothetical investment in their respective constituent securities. Index and Benchmark Index returns do not represent Fund returns. An investor cannot invest directly in an index. The Index and Benchmark Index do not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the hypothetical performance shown. In addition, the results actual investors might have achieved would have differed from those shown because of differences in the timing, amounts of their investments, and fees and expenses associated with an investment in the Fund.

Notes Regarding Indexes and Fund Performance History:

| - | Effective after the close of business on April 6, 2018, the Predecessor Fund was reorganized into the Fund. Fund returns shown are blended returns of the Predecessor Fund and the Fund. |

| - | Average Annualized and Cumulative Inception returns for the Fund, Index and Benchmark Index are based on the inception date of the Predecessor Fund. |

| - | Net returns reflect reinvested dividends net of withholding taxes. |

| | |

| CQQQ | | Manager’s Analysis |

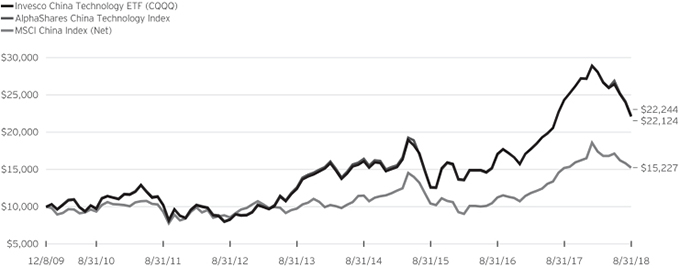

| | Invesco China Technology ETF (CQQQ) |

Welcome to Invesco! Effective after the close of business on May 18, 2018, Guggenheim China Technology ETF (the “Predecessor Fund”) was reorganized into Invesco China Technology ETF (formerly known as PowerShares China Technology Portfolio), a newly created exchange-traded fund in Invesco’s family of ETFs, in a tax-free transaction. The ticker symbol and Index did not change. Performance information set forth below refers to both the performance of the Predecessor Fund and the Fund.

As an index fund, the Invesco China Technology ETF (the “Fund”) is passively managed and seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the AlphaShares China Technology Index (the “Index”). The Index is designed to measure and monitor the performance of the universe of publicly traded companies which are based in mainland China, Hong Kong or Macau (as classified by the S&P BMI Country Code classification system), are in the Information Technology Sector, as defined by S&P Global Industry Classification Standard (“GICS”) and are open to foreign investment. The Index was created by AlphaShares, LLC (“AlphaShares” or the “Index Provider”) and is maintained by Standard & Poor’s. The Index includes equity securities of companies of all categories of market capitalizations, as defined by the Index Provider (subject to a minimum float-adjusted capitalization of U.S. $150 million). The Index may include Hong Kong listed securities, including China H-shares and Red Chip shares. China H-shares are issued by companies incorporated in mainland China and listed on the Hong Kong Stock Exchange. Red Chip shares are issued by companies with controlling Chinese shareholders that are incorporated outside mainland China and listed on the Hong Kong Stock Exchange. The Index may also include N-Shares, which are issued by companies based in mainland China and listed on the NYSE Arca, Inc. or The Nasdaq Stock Market. The Index does not include China A-Shares (which are subject to substantial restrictions on foreign investment) or China B-Shares (which offer a generally smaller market and limited liquidity), each of which trade on the Shanghai Stock Exchange and the Shenzhen Stock Exchange. The Fund will invest at least 90% of its total assets in common stocks, American depositary receipts (“ADRs”), American depositary shares (“ADSs”), global depositary receipts (“GDRs”) and international depositary receipts (“IDRs”) that comprise the Index and depositary receipts or shares representing common stocks included in the Index (or underlying securities representing ADRs, ADSs, GDRs and IDRs included in the Index). The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

For the fiscal year ended August 31, 2018, on a market price basis, the Fund returned (9.33)%. On a net asset value (“NAV”) basis, the Fund returned (9.05)%. During the same time period, the Index returned (8.58)%. During the fiscal year, the Fund’s

performance, on a NAV basis, differed from the return of the Index primarily due to fees and operating expenses that the Fund incurred during the period.

During this same time period, the MSCI China Index (Net) (the “Benchmark Index”) returned 0.22%. The Benchmark Index is an unmanaged index weighted by market capitalization based on the average performance of approximately 450 securities. The Benchmark Index was selected for its recognition in the marketplace, and its performance comparison is a useful measure for investors as a broad representation of the Chinese equity market.

The performance of the Fund differed from the Benchmark Index because the Fund seeks to track an Index that employs a proprietary stock selection and weighting methodology, whereas the Benchmark Index selects and weights stocks based on market capitalization.

Relative to the Benchmark Index, the Fund was most overweight in the internet software & services sub-industry and most underweight in the diversified banks sub-industry during the fiscal year ended August 31, 2018. The majority of the Fund’s underperformance relative to the Benchmark Index during that period can be attributed to the Fund being overweight in the electronic components and electronic manufacturing services sub-industries.

For the fiscal year ended August 31, 2018, the semiconductors sub-industry contributed most significantly to the Fund’s return, followed by the technology distributors sub-industry. The electronic components, electronic manufacturing services and the internet software & services sub-industries were the primary detracting sub-industries.

Positions that contributed most significantly to the Fund’s return for the fiscal year ended August 31, 2018, included 58.com, Inc., Class A ADR (China) ,an internet software & services company (portfolio average weight of 4.27%), and Lenovo Group Ltd. (China), a technology hardware, storage & peripherals company (portfolio average weight of 2.30%). Positions that detracted most significantly from the Fund’s return during this period included NetEase, Inc. ADR (China), an internet software & services company (portfolio average weight of 6.10%), and AAC Technologies Holdings, Inc. (China), an electronic equipment, instruments & components company (portfolio average weight of 4.06%).

Invesco China Technology ETF (CQQQ) (continued)

| | | | |

Industry Breakdown

(% of the Fund’s Net Assets)

as of August 31, 2018 | |

| Internet Software & Services | | | 58.8 | |

| Electronic Equipment, Instruments & Components | | | 14.6 | |

| Semiconductors & Semiconductor Equipment | | | 8.1 | |

| IT Services | | | 5.5 | |

| Technology Hardware, Storage & Peripherals | | | 5.2 | |

| Software | | | 4.6 | |

| Communications Equipment | | | 2.6 | |

| Real Estate Management & Development | | | 0.5 | |

| Consumer Finance | | | 0.1 | |

| Specialty Retail | | | 0.0 | |

| Money Market Funds Plus Other Assets Less Liabilities | | | (0.0) | |

| | | | |

Top Ten Fund Holdings*

(% of the Fund’s Net Assets)

as of August 31, 2018 | |

| Security | | | | |

| Tencent Holdings Ltd. | | | 10.3 | |

| Alibaba Group Holding Ltd. ADR | | | 9.5 | |

| Baidu, Inc. ADR | | | 8.5 | |

| NetEase, Inc. ADR | | | 6.8 | |

| 58.com, Inc., Class A ADR | | | 4.8 | |

| Sunny Optical Technology Group Co. Ltd. | | | 4.4 | |

| AAC Technologies Holdings, Inc. | | | 3.5 | |

| Autohome, Inc., Class A ADR | | | 3.4 | |

| Lenovo Group Ltd. | | | 3.2 | |

| SINA Corp. | | | 3.2 | |

| Total | | | 57.6 | |

| * | Excluding money market fund holdings. |

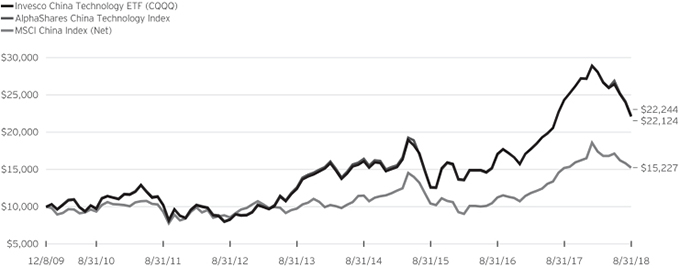

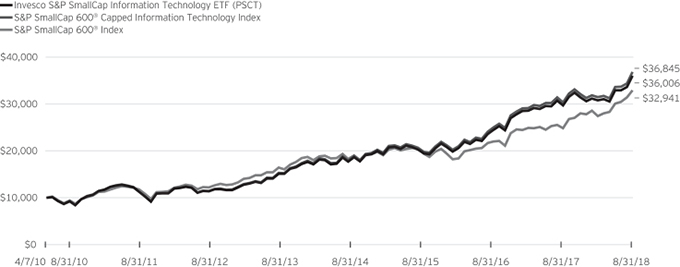

Growth of a $10,000 Investment Since Inception

Fund Performance History as of August 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Years Average

Annualized | | | 3 Years Cumulative | | | 5 Years Average

Annualized | | | 5 Years Cumulative | | | | | | Fund Inception | |

| Index | | | | | Average

Annualized | | | Cumulative | |

| AlphaShares China Technology Index | | | (8.58 | )% | | | 21.05 | % | | | 77.37 | % | | | 12.03 | % | | | 76.46 | % | | | | | | | 9.59 | % | | | 122.44 | % |

| MSCI China Index (Net) | | | 0.22 | | | | 13.49 | | | | 46.16 | | | | 9.27 | | | | 55.79 | | | | | | | | 4.94 | | | | 52.27 | |

| Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV Return | | | (9.05 | ) | | | 20.53 | | | | 75.12 | | | | 12.26 | | | | 78.27 | | | | | | | | 9.52 | | | | 121.24 | |

| Market Price Return | | | (9.33 | ) | | | 20.90 | | | | 76.74 | | | | 12.25 | | | | 78.20 | | | | | | | | 9.53 | | | | 121.41 | |

Invesco China Technology ETF (CQQQ) (continued)

Predecessor Fund Inception: December 08, 2009

Performance quoted above represents past performance. Past performance is not a guarantee of future results and current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate, and shares of the Fund (“Fund Shares”), when redeemed or sold, may be worth more or less than their original cost. Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information. According to the Fund’s current prospectus, the Fund’s expense ratio of 0.70% is expressed as a unitary management fee to cover operating expenses and expenses incurred in connection with managing the portfolio. NAV and Market Price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and Market Price, respectively. The returns shown in the table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund Shares. See invesco.com/ETFs to find the most recent month-end performance numbers.

Index and Benchmark Index performance results are based upon a hypothetical investment in their respective constituent securities. Index and Benchmark Index returns do not represent Fund returns. An investor cannot invest directly in an index. The Index and Benchmark Index do not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the hypothetical performance shown. In addition, the results actual investors might have achieved would have differed from those shown because of differences in the timing, amounts of their investments, and fees and expenses associated with an investment in the Fund.

Notes Regarding Indexes and Fund Performance History:

| - | Effective after the close of business on May 18, 2018, the Predecessor Fund was reorganized into the Fund. Fund returns shown are blended returns of the Predecessor Fund and the Fund. |

| - | Average Annualized and Cumulative Inception returns for the Fund, Index and Benchmark Index are based on the inception date of the Predecessor Fund. |

| - | Net returns reflect reinvested dividends net of withholding taxes. |

| | |

| CGW | | Manager’s Analysis |

| | Invesco S&P Global Water Index ETF (CGW) |

Welcome to Invesco! Effective after the close of business on April 6, 2018, Guggenheim S&P Global Water Index ETF (the “Predecessor Fund”) was reorganized into Invesco S&P Global Water Index ETF (formerly known as PowerShares S&P Global Water Index Portfolio), a newly created exchange-traded fund in Invesco’s family of ETFs, in a tax-free transaction. The ticker symbol and Index did not change. Performance information set forth below refers to both the performance of the Predecessor Fund and the Fund.

As an index fund, the Invesco S&P Global Water Index ETF (the “Fund”) is passively managed and seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the S&P Global Water Index (the “Index”). The Index is comprised of 50 equity securities selected, based on investment and other criteria, from a universe of companies listed on global developed market exchanges. Standard & Poor’s Financial Services LLC, a subsidiary of The McGraw-Hill Companies (“S&P”), generally defines “developed markets” as the capital markets of those countries with high levels of per capita income and strict market regulation resulting in greater transparency. Specifically, all or any subset of the following countries/regions are currently considered to be developed markets—Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Luxembourg, the Netherlands, New Zealand, Norway, Portugal, Singapore, South Korea, Spain, Sweden, Switzerland, the United Kingdom and the United States. The universe of companies includes all companies classified by Standard & Poor’s Global Industry Classifications as being associated (in a manner representing a major component of such companies’ business) with the global demand for water, including water utilities, infrastructure, equipment, instruments and materials. Total market capitalization and float-adjusted market capitalization of securities in the Index must be at least $250 million and $100 million, respectively, at the time of each reconstitution, which includes small-, mid-, and large-capitalization securities as defined by S&P. The companies in the universe are selected using criteria as identified by S&P. The Fund will invest at least 90% of its total assets in common stock and American depositary receipts (“ADRs”) that comprise the Index and depositary receipts representing common stocks included in the Index (or underlying securities representing ADRs included in the Index). The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

For the fiscal year ended August 31, 2018, on a market price basis, the Fund returned 7.09%. On a net asset value (“NAV”) basis, the Fund returned 7.51%. During the same time period, the Index returned 7.89%. During the fiscal year, the Fund’s performance, on a NAV basis, differed from the return of the Index primarily due to fees and operating expenses that the Fund incurred during the period.

During this same time period, the MSCI EAFE® Index (Net) (the “Benchmark Index”) returned 4.39%. The Benchmark Index is an unmanaged index weighted by market capitalization based on the average performance of approximately 925 securities. The Benchmark Index was selected for its recognition in the marketplace, and its performance comparison is a useful measure for investors as a broad representation of the equities market in developed countries outside the U.S.

The performance of the Fund differed from the Benchmark Index because the Fund seeks to track an Index that employs a proprietary stock selection and weighting methodology, whereas the Benchmark Index selects and weights stocks based on market capitalization.

Relative to the Benchmark Index, the Fund was most overweight in the water utilities sub-industry and most underweight in the diversified banks sub-industry during the fiscal year ended August 31, 2018. The majority of the Fund’s outperformance relative to the Benchmark Index during that period can be attributed to the Fund being overweight in the industrial machinery sub-industry.

For the fiscal year ended August 31, 2018, the industrial machinery sub-industry contributed most significantly to the Fund’s return, followed by the health care equipment and environmental & facilities services sub-industries, respectively.

Positions that contributed most significantly to the Fund’s return for the fiscal year ended August 31, 2018, included IDEX Corp., an industrial machinery company (portfolio average weight of 4.69%), and Xylem Inc., an industrial machinery company (portfolio average weight of 5.69%). Positions that detracted most significantly from the Fund’s return during this period included Companhia de Saneamento Basico do Estado de Sao Paulo SABESP Sponsored ADR, a water utilities company (no longer held at fiscal year-end), and Beijing Enterprises Water Group Ltd., a water utilities company (portfolio average weight of 1.89%).

Invesco S&P Global Water Index ETF (CGW) (continued)

| | | | |

Industry Breakdown

(% of the Fund’s Net Assets)

as of August 31, 2018 | |

| Water Utilities | | | 33.4 | |

| Machinery | | | 28.7 | |

| Multi-Utilities | | | 12.3 | |

| Building Products | | | 6.5 | |

| Health Care Equipment & Supplies | | | 5.1 | |

| Electronic Equipment, Instruments & Components | | | 3.8 | |

| Chemicals | | | 2.3 | |

| Commercial Services & Supplies | | | 2.4 | |

| Household Durables | | | 2.0 | |

| Electrical Equipment | | | 2.0 | |

| Construction & Engineering | | | 0.7 | |

| Energy Equipment & Services | | | 0.2 | |

| Construction Materials | | | 0.1 | |

| Money Market Funds Plus Other Assets Less Liabilities | | | 0.5 | |

| | | | |

Top Ten Fund Holdings*

(% of the Fund’s Net Assets)

as of August 31, 2018 | |

| Security | | | | |

| American Water Works Co., Inc. | | | 9.1 | |

| Xylem, Inc. | | | 6.1 | |

| IDEX Corp. | | | 5.2 | |

| Geberit AG | | | 5.1 | |

| Danaher Corp. | | | 5.1 | |

| Veolia Environnement SA | | | 4.4 | |

| Aqua America, Inc. | | | 3.8 | |

| United Utilities Group PLC | | | 3.8 | |

| Severn Trent PLC | | | 3.6 | |

| Alfa Laval AB | | | 3.6 | |

| Total | | | 49.8 | |

| * | Excluding money market fund holdings. |

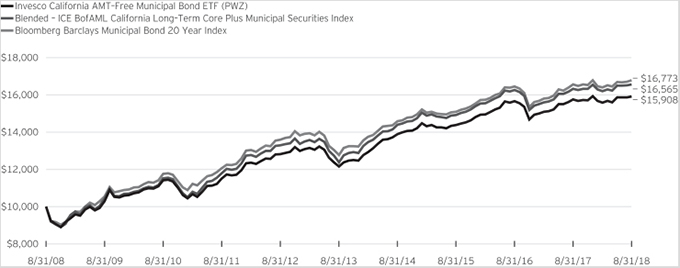

Growth of a $10,000 Investment

Fund Performance History as of August 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | 3 Years Average

Annualized | | | 3 Years Cumulative | | | 5 Years Average

Annualized | | | 5 Years Cumulative | | | 10 Years Average

Annualized | | | 10 Years Cumulative | | | | | | Fund Inception | |

| Index | | 1 Year | | | | | | Average

Annualized | | | Cumulative | |

| S&P Global Water Index (Net) | | | 7.89 | % | | | 11.92 | % | | | 40.19 | % | | | 10.19 | % | | | 62.47 | % | | | 7.22 | % | | | 100.81 | % | | | | | | | 5.89 | % | | | 90.91 | % |

| MSCI EAFE® Index (Net) | | | 4.39 | | | | 7.04 | | | | 22.66 | | | | 5.73 | | | | 32.15 | | | | 3.66 | | | | 43.22 | | | | | | | | 1.66 | | | | 20.45 | |

| MSCI World Index (Net) | | | 13.10 | | | | 11.92 | | | | 40.19 | | | | 10.23 | | | | 62.76 | | | | 7.13 | | | | 99.18 | | | | | | | | 4.95 | | | | 72.63 | |

| Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV Return | | | 7.51 | | | | 11.62 | | | | 39.06 | | | | 9.90 | | | | 60.34 | | | | 6.80 | | | | 93.00 | | | | | | | | 5.42 | | | | 81.62 | |

| Market Price Return | | | 7.09 | | | | 11.61 | | | | 39.02 | | | | 9.89 | | | | 60.24 | | | | 6.68 | | | | 90.97 | | | | | | | | 5.41 | | | | 81.33 | |

Invesco S&P Global Water Index ETF (CGW) (continued)

Predecessor Fund Inception: May 14, 2007

Performance quoted above represents past performance. Past performance is not a guarantee of future results and current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate, and shares of the Fund (“Fund Shares”), when redeemed or sold, may be worth more or less than their original cost. Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information. According to the Fund’s current prospectus, the total annual operating expense ratio was indicated as 0.61%. The Financial Highlights section of the Shareholder Report presents the expense ratios based on expenses incurred during the period covered by this report. NAV and Market Price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and Market Price, respectively. The returns shown in the table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund Shares. See invesco.com/ETFs to find the most recent month-end performance numbers.

Index and Benchmark Indexes performance results are based upon a hypothetical investment in their respective constituent securities. Index

and Benchmark Indexes returns do not represent Fund returns. An investor cannot invest directly in an index. The Index and Benchmark Indexes do not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the hypothetical performance shown. In addition, the results actual investors might have achieved would have differed from those shown because of differences in the timing, amounts of their investments, and fees and expenses associated with an investment in the Fund.

Notes Regarding Indexes and Fund Performance History:

| - | Effective after the close of business on April 6, 2018, the Predecessor Fund was reorganized into the Fund. Fund returns shown are blended returns of the Predecessor Fund and the Fund. |

| - | Average Annualized and Cumulative Inception returns for the Fund, Index and Benchmark Indexes are based on the inception date of the Predecessor Fund. |

| - | Net returns reflect reinvested dividends net of withholding taxes. |

| - | The Fund has elected to use the MSCI EAFE® Index to represent its broad-based index rather than the MSCI World Index because the MSCI EAFE® Index more closely reflects the performance of the types of securities in which the Fund invests. |

| | |

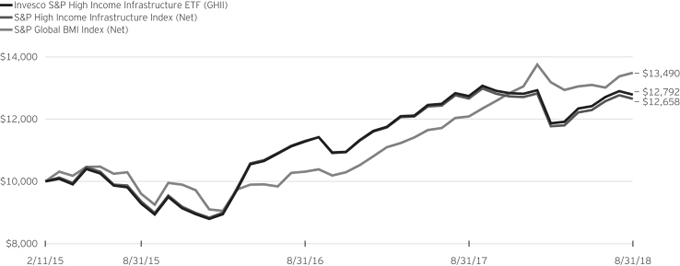

| GHII | | Manager’s Analysis |

| | Invesco S&P High Income Infrastructure ETF (GHII) |

Welcome to Invesco! Effective after the close of business on May 18, 2018, Guggenheim S&P High Income Infrastructure ETF (the “Predecessor Fund”) was reorganized into Invesco S&P High Income Infrastructure ETF (formerly known as PowerShares S&P High Income Infrastructure Portfolio), a newly created exchange-traded fund in Invesco’s family of ETFs, in a tax-free transaction. The ticker symbol and Index did not change. Performance information set forth below refers to both the performance of the Predecessor Fund and the Fund.

As an index fund, the Invesco S&P High Income Infrastructure ETF (the “Fund”) is passively managed and seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the S&P High Income Infrastructure Index (the “Index”). The Index is designed to measure and monitor the performance of 50 high-yielding global equity securities of companies that engage in various infrastructure-related sub-industries. Index constituents must meet size, listing and liquidity requirements and also be part of the S&P Global BMI Index, which is a rules-based index that measures global stock market performance. Index constituents must be equity securities of companies classified in one of the infrastructure clusters (the “Infrastructure Clusters”) determined by the S&P Dow Jones Index Group, based on the Global Industry Classification Standard (“GICS® ”) sub-industry classifications. Securities in the Infrastructure Clusters must have a float-adjusted market capitalization (i.e., a market capitalization that is calculated based on the number of shares that are readily available in the market rather than all shares outstanding) greater than $250 million, a three-month average daily value traded of $1 million or higher and be listed on a developed market stock exchange. The top 50 highest-yielding securities that meet these criteria (ranked by 12-month dividend yield) are selected for inclusion in the Index. The Fund will invest at least 90% of its total assets in common stocks that comprise the Index and depositary receipts representing common stocks included in the Index. The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

For the fiscal year ended August 31, 2018, on a market price basis, the Fund returned 0.37%. On a net asset value (“NAV”) basis, the Fund returned 0.40%. During the same time period, the Index returned (0.03)%. During the fiscal year, the Fund’s performance, on a NAV basis, differed from the return of the Index primarily due to differences in the treatment of dividends between the Fund and the Index.

During this same time period, the S&P Global BMI Index (the “Benchmark Index”) returned 11.63%. The Benchmark Index is an unmanaged index weighted by market capitalization based on the average performance of approximately 11,200 securities. The Benchmark Index was selected for its recognition in the marketplace, and its performance comparison is a useful measure for investors as a broad representation of equity markets in developed countries.

The performance of the Fund differed from the Benchmark Index because the Fund seeks to track an Index that employs a proprietary stock selection and weighting methodology, whereas the Benchmark Index selects and weights stocks based on market capitalization.

Relative to the Benchmark Index, the Fund was most overweight in the utilities sector and most underweight in the industrials sector during the fiscal year ended August 31, 2018. The majority of the Fund’s underperformance relative to the Benchmark Index during that period can be attributed to the Fund being overweight in the utilities sector and underweight in the information technology sector.

For the fiscal year ended August 31, 2018, the energy sector contributed most significantly to the Fund’s return, followed by the utilities sector. The industrials sector was the only detracting sector.

Positions that contributed most significantly to the Fund’s return for the fiscal year ended August 31, 2018, included Targa Resources Corp., an energy company (portfolio average weight of 4.32%), and Electricite de France S.A., an electric utilities company (no longer held at fiscal year-end). Positions that detracted most significantly from the Fund’s return during this period included Macquarie Infrastructure Corp., an industrials company (portfolio average weight of 3.49%), and Hutchison Port Holdings Trust (Hong Kong), an industrials company (portfolio average weight of 2.28%).

| | | | |

Sector Breakdown

(% of the Fund’s Net Assets)

as of August 31, 2018 | |

| Utilities | | | 53.4 | |

| Energy | | | 33.4 | |

| Industrials | | | 12.8 | |

| Other Assets Less Liabilities | | | 0.4 | |

|

Top Ten Fund Holdings

(% of the Fund’s Net Assets)

as of August 31, 2018 | |

| Security | | | | |

| Macquarie Infrastructure Corp. | | | 5.2 | |

| Ship Finance International Ltd. | | | 4.5 | |

| Hutchison Port Holdings Trust | | | 4.5 | |

| Targa Resources Corp. | | | 3.8 | |

| SemGroup Corp., Class A | | | 3.5 | |

| AltaGas Ltd. | | | 3.5 | |

| Enbridge Income Fund Holdings, Inc. | | | 3.4 | |

| Inter Pipeline Ltd. | | | 3.3 | |

| Pattern Energy Group, Inc., Class A | | | 3.0 | |

| Snam SpA | | | 2.8 | |

| Total | | | 37.5 | |

Invesco S&P High Income Infrastructure ETF (GHII) (continued)

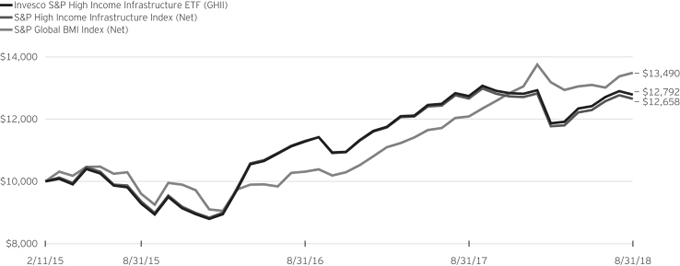

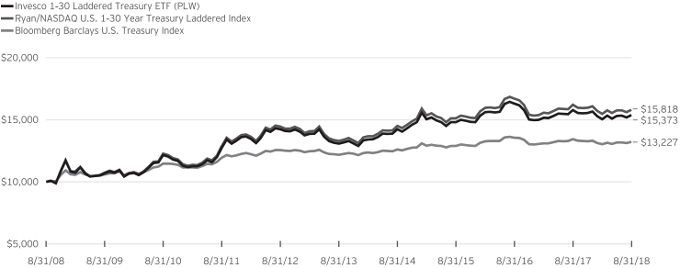

Growth of a $10,000 Investment Since Inception

Fund Performance History as of August 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Years Average

Annualized | | | 3 Years Cumulative | | | | | | Fund Inception | |

| Index | | | | | Average

Annualized | | | Cumulative | |

| S&P High Income Infrastructure Index (Net) | | | (0.03 | )% | | | 10.60 | % | | | 35.31 | % | | | | | | | 6.86 | % | | | 26.58 | % |

| S&P Global BMI Index (Net) | | | 11.63 | | | | 11.98 | | | | 40.41 | | | | | | | | 8.80 | | | | 34.90 | |

| Fund | | | | | | | | | | | | | | | | | | |

| NAV Return | | | 0.40 | | | | 11.24 | | | | 37.64 | | | | | | | | 7.18 | | | | 27.92 | |

| Market Price Return | | | 0.37 | | | | 11.75 | | | | 39.56 | | | | | | | | 7.17 | | | | 27.87 | |

Predecessor Fund Inception: February 11, 2015

Performance quoted above represents past performance. Past performance is not a guarantee of future results and current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate, and shares of the Fund (“Fund Shares”), when redeemed or sold, may be worth more or less than their original cost. Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information. According to the Fund’s current prospectus, the Fund’s expense ratio of 0.45% is expressed as a unitary management fee to cover operating expenses and expenses incurred in connection with managing the portfolio. NAV and Market Price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and Market Price, respectively. The returns shown in the table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund Shares. See invesco.com/ETFs to find the most recent month-end performance numbers.

Index and Benchmark Index performance results are based upon a hypothetical investment in their respective constituent securities. Index and Benchmark Index returns do not represent Fund returns. An investor cannot invest directly in an index. The Index and Benchmark Index do not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the hypothetical performance shown. In addition, the results actual investors might have achieved would have differed from those shown because of differences in the timing, amounts of their investments, and fees and expenses associated with an investment in the Fund.

Notes Regarding Indexes and Fund Performance History:

| - | Effective after the close of business on May 18, 2018, the Predecessor Fund was reorganized into the Fund. Fund returns shown are blended returns of the Predecessor Fund and the Fund. |

| - | Average Annualized and Cumulative Inception returns for the Fund, Index and Benchmark Index are based on the inception date of the Predecessor Fund. |

| - | Net returns reflect reinvested dividends net of withholding taxes. |

| | |

| SEA | | Manager’s Analysis |

| | Invesco Shipping ETF (SEA) |

As an index fund, the Invesco Shipping ETF (the “Fund”) is passively managed and seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the Dow Jones Global Shipping IndexSM (the “Index”). The Index is designed to measure the performance of high dividend-paying companies in the shipping industry. CME Group Index Services LLC (“CME Indexes” or the “Index Provider”) uses a rules-based methodology to rank companies by yield that are involved in the shipping industry globally that primarily transport goods and materials. The Index Provider determines whether a company is “high-dividend paying” by ranking it relative to other companies in the shipping industry based upon indicated annual yield (most recent distribution annualized and divided by the current share price). The Index Provider considers a company to be in the shipping industry if its revenues are derived primarily from shipping activities (excluding companies solely involved in transporting passengers). The Index constituents are weighted based on their float-adjusted market capitalization. The Fund will at all times invest at least 90% of its total assets in common stock, American depositary receipts (“ADRs”), global depositary receipts (“GDRs”) and master limited partnerships (“MLPs”) that comprise the Index and the underlying stocks in respect of the ADRs and GDRs in the Index. The depositary receipts included in the Index may be sponsored or unsponsored. The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

The Board of Trustees approved a change in the fiscal year end for the Fund from May 31 to August 31. For the fiscal period from June 1, 2018 to August 31, 2018, on a market price basis, the Fund returned (5.69)%. On a net asset value (“NAV”) basis, the Fund returned (5.67)%. During the same time period, the Index returned (5.89)%. During the fiscal period, the Fund’s performance, on a NAV basis, differed from the return of the Index primarily due to revenue generated from the securities lending program in which the Fund participates partially offset by the fees and operating expenses that the Fund incurred, as well as trading costs associated with portfolio rebalances during the period.

During this same time period, the MSCI World Index (Net) (the “Benchmark Index”) returned 4.35%. The Benchmark Index is an unmanaged index weighted by market capitalization based on the average performance of approximately 1,640 securities. The Benchmark Index was selected for its recognition in the marketplace, and its performance comparison is a useful measure for investors as a broad representation of equity markets in developed countries.

The performance of the Fund differed from the Benchmark Index because the Fund seeks to track an Index that employs a proprietary stock selection and weighting methodology, whereas the Benchmark Index selects and weights stocks based on market capitalization.

Relative to the Benchmark Index, the Fund was most overweight in the marine sub-industry and most underweight in the banks sub-industry during the fiscal period ended August 31, 2018. The majority of the Fund’s underperformance relative to the Benchmark Index during that period can be attributed to the Fund being underweight in the technology hardware, storage & peripherals sub-industry.

For the fiscal period ended August 31, 2018, the metals & mining sub-industry contributed most significantly to the Fund’s return, followed by the automobiles and semiconductors sub-industries, respectively. The oil, gas & consumable fuels sub-industry was the most significant detracting sub-industry.

Positions that contributed most significantly to the Fund’s return for the fiscal period ended August 31, 2018, included AP Moller – Maersk A/S, Class B, an oil, gas & consumable fuels company (portfolio average weight of 18.30%), and Maston, Inc., an oil, gas & consumable fuels company (portfolio average weight of 4.39%). Positions that detracted most significantly from the Fund’s return during this period included Scorpio Tankers, Inc., (portfolio average weight of 1.98%), and Nippon Yusen KK, an oil, gas & consumable fuels company (portfolio average weight of 6.15%).

| | | | |

Sector Breakdown

(% of the Fund’s Net Assets)

as of August 31, 2018 | |

| Industrials | | | 67.2 | |

| Energy | | | 32.8 | |

| Money Market Fund Plus Other Assets Less Liabilities | | | 0.0 | |

| | | | |

Top Ten Fund Holdings*

(% of the Fund’s Net Assets)

as of August 31, 2018 | |

| Security | | | | |

| AP Moller—Maersk A/S, Class B | | | 20.6 | |

| Mitsui OSK Lines Ltd. | | | 7.4 | |

| Nippon Yusen KK | | | 7.2 | |

| Golar LNG Ltd. | | | 5.8 | |

| Euronav NV | | | 4.3 | |

| Matson, Inc. | | | 4.3 | |

| Ship Finance International Ltd. | | | 4.0 | |

| Kawasaki Kisen Kaisha Ltd. | | | 3.9 | |

| Hapag-Lloyd AG | | | 3.4 | |

| GasLog Partners LP | | | 3.1 | |

| Total | | | 64.0 | |

| * | Excluding money market fund holdings. |

Invesco Shipping ETF (SEA) (continued)

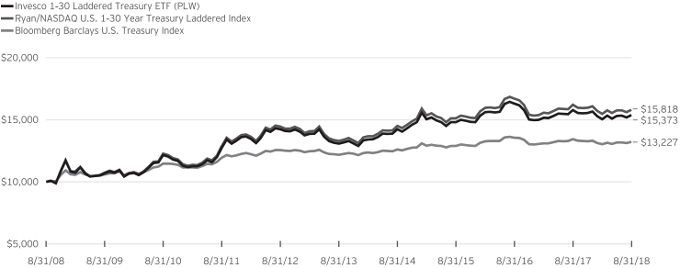

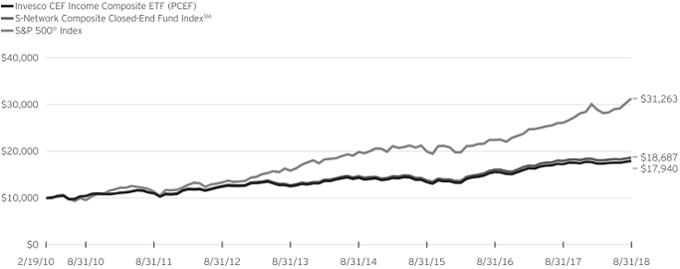

Growth of a $10,000 Investment Since Inception

Fund Performance History as of August 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Years Average

Annualized | | | 3 Years Cumulative | | | 5 Years Average

Annualized | | | 5 Years Cumulative | | | | | | Fund Inception | |

| Index | | | | | Average

Annualized | | | Cumulative | |

| Blended—Dow Jones Global Shipping IndexSM | | | (9.72 | )% | | | (9.95 | )% | | | (26.99 | )% | | | (6.80 | )% | | | (29.69 | )% | | | | | | | (7.24 | )% | | | (46.11 | )% |

| MSCI World Index (Net) | | | 13.10 | | | | 11.92 | | | | 40.19 | | | | 10.23 | | | | 62.76 | | | | | | | | 11.11 | | | | 137.73 | |

| Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV Return | | | (9.09 | ) | | | (8.95 | ) | | | (24.53 | ) | | | (6.07 | ) | | | (26.87 | ) | | | | | | | (6.57 | ) | | | (42.79 | ) |

| Market Price Return | | | (9.35 | ) | | | (8.96 | ) | | | (24.55 | ) | | | (6.16 | ) | | | (27.23 | ) | | | | | | | (6.61 | ) | | | (42.98 | ) |

Predecessor Fund Inception: June 11, 2010

Performance quoted above represents past performance. Past performance is not a guarantee of future results and current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate, and shares of the Fund (“Fund Shares”), when redeemed or sold, may be worth more or less than their original cost. Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information. According to the Fund’s current prospectus, the Fund’s expense ratio of 0.65% is expressed as a unitary management fee to cover operating expenses and expenses incurred in connection with managing the portfolio. NAV and Market Price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and Market Price, respectively. The returns shown in the table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund Shares. See invesco.com/ETFs to find the most recent month-end performance numbers.

Blended-Index and Benchmark Index performance results are based upon a hypothetical investment in their respective constituent securities.

Blended-Index and Benchmark Index returns do not represent Fund returns. An investor cannot invest directly in an index. The Blended-Index and Benchmark Index do not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the hypothetical performance shown. In addition, the results actual investors might have achieved would have differed from those shown because of differences in the timing, amounts of their investments, and fees and expenses associated with an investment in the Fund.

Notes Regarding Indexes and Fund Performance History:

| - | Effective after the close of business on April 6, 2018, the Predecessor Fund was reorganized into the Fund. Fund returns shown are blended returns of the Predecessor Fund and the Fund. |

| - | Average Annualized and Cumulative Inception returns for the Fund, Blended-Index and Benchmark Index are based on the inception date of the Predecessor Fund. |

| - | The Blended-Dow Jones Global Shipping IndexSM performance is comprised of the performance of the Delta Global Shipping Index, the Fund’s previous underlying index, prior to the conversion date, July 27, 2011, followed by the performance of the Index, starting from the conversion date through August 31, 2018. |

| - | Net returns reflect reinvested dividends net of withholding taxes. |

| | |

| TAN | | Manager’s Analysis |

| | Invesco Solar ETF (TAN) |

Welcome to Invesco! Effective after the close of business on May 18, 2018, Guggenheim Solar ETF (the “Predecessor Fund”) was reorganized into Invesco Solar ETF (formerly known as PowerShares Solar Portfolio), a newly created exchange-traded fund in Invesco’s family of ETFs, in a tax-free transaction. The ticker symbol and Index did not change. Performance information set forth below refers to both the performance of the Predecessor Fund and the Fund.

As an index fund, the Invesco Solar ETF (the “Fund”) is passively managed and seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the MAC Global Solar Energy Index (the “Index”). The Index is comprised of securities selected based on the relative importance of solar power within the company’s business model, as determined by MAC Indexing LLC (the “Index Provider”). The Index is designed to track companies within the following business segments of the solar energy industry, including those companies that derive a significant amount of their revenues from the solar industry: companies that produce solar power equipment and products for end-users, companies that produce fabrication products (such as the equipment used by solar cell and module producers to manufacture solar power equipment) or services (such as companies specializing in the solar cell manufacturing or the provision of consulting services to solar cell and module producers) for solar power equipment producers, companies that supply raw materials or components to solar power equipment producers or integrators; companies that derive a significant portion of their business from solar power system sales, distribution, installation, integration or financing; and companies that specialize in selling electricity derived from solar power. The Index is comprised of equity securities, including American depositary receipts (“ADRs”) and global depositary receipts (“GDRs”), traded in developed markets. While the equity securities comprising the Index are traded in developed markets, the issuers of such securities may be located in emerging markets. Emerging market countries are countries that major international financial institutions, such as the World Bank, generally consider to be less economically mature than developed nations. The Fund will invest at least 90% of its total assets in common stock, ADRs and GDRs that comprise the Index and depositary receipts representing common stocks included in the Index (or underlying securities representing ADRs and GDRs included in the Index). The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

For the fiscal year ended August 31, 2018, on a market price basis, the Fund returned 2.33%. On a net asset value (“NAV”) basis, the Fund returned 3.19%. During the same time period, the Index returned 1.97%. During the fiscal year, the Fund’s performance, on a NAV basis, differed from the return of the Index primarily due to revenue generated from the securities

lending program in which the Fund participates, which was offset by the fees and operating expenses that the Fund incurred, as well as trading costs associated with portfolio rebalances during the period.

During this same time period, the MSCI World Index (Net) (the “Benchmark Index”) returned 13.10%. The Benchmark Index is an unmanaged index weighted by market capitalization based on the average performance of approximately 1,640 securities. The Benchmark Index was selected for its recognition in the marketplace, and its performance comparison is a useful measure for investors as a broad representation of equity markets in developed countries.

The performance of the Fund differed from the Benchmark Index because the Fund seeks to track an Index that employs a proprietary stock selection and weighting methodology, whereas the Benchmark Index selects and weights stocks based on market capitalization.

Relative to the Benchmark Index, the Fund was most overweight in the semiconductors & semiconductor equipment industry and most underweight in the banks industry during the fiscal year ended August 31, 2018. The majority of the Fund’s underperformance relative to the Benchmark Index during that period can be attributed to the Fund being underweight in the internet & direct marketing retail industry as well as fees and operating expenses that the Fund incurred.

For the fiscal year ended August 31, 2018, the electrical equipment industry contributed most significantly to the Fund’s return, followed by the independent power and renewable electricity producers and mortgage real estate investment trusts (REITs) industries, respectively. The semiconductors & semiconductor equipment and containers & packaging industries detracted most significantly.

Positions that contributed most significantly to the Fund’s return for the fiscal year ended August 31, 2018, included SolarEdge Technologies, Inc., a semiconductors & semiconductor equipment company (portfolio average weight of 6.78%), and Sunrun, Inc., an electrical equipment company(portfolio average weight of 4.69%). Positions that detracted most significantly from the Fund’s return during this period included Meyer Burger Technology AG (Switzerland), a semiconductors & semiconductor equipment company (portfolio average weight of 4.76%), and JinkoSolar Holding Co. Ltd. ADR (China), a semiconductors & semiconductor equipment company (portfolio average weight of 4.11%).

Invesco Solar ETF (TAN) (continued)

| | | | |

Industry Breakdown

(% of the Fund’s Net Assets)

as of August 31, 2018 | |

| Semiconductors & Semiconductor Equipment | | | 50.7 | |

| Independent Power & Renewable Electricity Producers | | | 25.0 | |

| Electrical Equipment | | | 12.9 | |

| Mortgage REITs | | | 5.5 | |

| Containers & Packaging | | | 3.0 | |

| Construction & Engineering | | | 2.4 | |

| Money Market Funds Plus Other Assets Less Liabilities | | | 0.5 | |

| | | | |

Top Ten Fund Holdings*

(% of the Fund’s Net Assets)

as of August 31, 2018 | |

| Security | | | | |

| First Solar, Inc. | | | 9.1 | |

| SolarEdge Technologies, Inc. | | | 6.7 | |

| Xinyi Solar Holdings Ltd. | | | 6.2 | |

| Sunrun, Inc. | | | 5.7 | |

| Canadian Solar, Inc. | | | 5.5 | |

| Hannon Armstrong Sustainable Infrastructure Capital, Inc. | | | 5.5 | |

| Atlantica Yield PLC | | | 5.1 | |

| Scatec Solar ASA | | | 4.7 | |

| Encavis AG | | | 4.6 | |

| JinkoSolar Holding Co. Ltd. ADR | | | 4.4 | |

| Total | | | 57.5 | |

| * | Excluding money market fund holdings. |

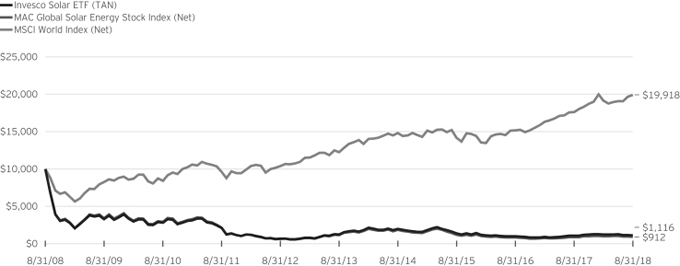

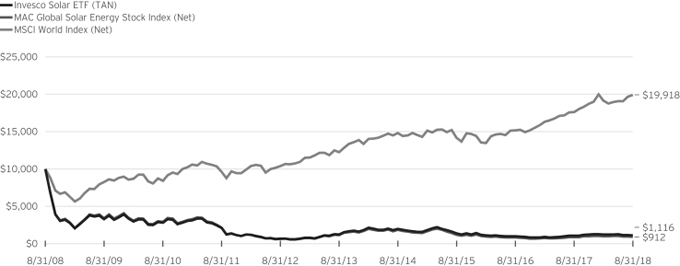

Growth of a $10,000 Investment

Fund Performance History as of August 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | 3 Years Average

Annualized | | | 3 Years Cumulative | | | 5 Years Average

Annualized | | | 5 Years Cumulative | | | 10 Years Average

Annualized | | | 10 Years Cumulative | | | | | | Fund Inception | |

| Index | | 1 Year | | | | | | Average

Annualized | | | Cumulative | |

| MAC Global Solar Energy Index (Net) | | | 1.97 | % | | | (9.23 | )% | | | (25.22 | )% | | | (4.72 | )% | | | (21.49 | )% | | | (21.29 | )% | | | (90.88 | )% | | | | | | | (20.48 | )% | | | (90.73 | )% |

| MSCI World Index (Net) | | | 13.10 | | | | 11.92 | | | | 40.19 | | | | 10.23 | | | | 62.76 | | | | 7.13 | | | | 99.18 | | | | | | | | 6.15 | | | | 85.70 | |

| Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV Return | | | 3.19 | | | | (7.12 | ) | | | (19.89 | ) | | | (2.04 | ) | | | (9.79 | ) | | | (19.69 | ) | | | (88.84 | ) | | | | | | | (18.72 | ) | | | (88.36 | ) |

| Market Price Return | | | 2.33 | | | | (7.11 | ) | | | (19.86 | ) | | | (2.08 | ) | | | (9.97 | ) | | | (19.75 | ) | | | (88.92 | ) | | | | | | | (18.76 | ) | | | (88.42 | ) |

Invesco Solar ETF (TAN) (continued)

Predecessor Fund Inception: April 15, 2008

Performance quoted above represents past performance. Past performance is not a guarantee of future results and current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate, and shares of the Fund (“Fund Shares”), when redeemed or sold, may be worth more or less than their original cost. Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information. According to the Fund’s current prospectus, the Fund’s expense ratio of 0.50% is expressed as a unitary management fee to cover operating expenses and expenses incurred in connection with managing the portfolio. NAV and Market Price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and Market Price, respectively. The returns shown in the table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund Shares. See invesco.com/ETFs to find the most recent month-end performance numbers.

Index and Benchmark Index performance results are based upon a hypothetical investment in their respective constituent securities. Index and Benchmark Index returns do not represent Fund returns. An investor cannot invest directly in an index. The Index and Benchmark Index do not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the hypothetical performance shown. In addition, the results actual investors might have achieved would have differed from those shown because of differences in the timing, amounts of their investments, and fees and expenses associated with an investment in the Fund.

Notes Regarding Indexes and Fund Performance History:

| - | Effective after the close of business on May 18, 2018, the Predecessor Fund was reorganized into the Fund. Fund returns shown are blended returns of the Predecessor Fund and the Fund. |

| - | Average Annualized and Cumulative Inception returns for the Fund, Index and Benchmark Index are based on the inception date of the Predecessor Fund. |

| - | Net returns reflect reinvested dividends net of withholding taxes. |

Schedule of Investments(a)

Invesco China All-Cap ETF (YAO)

August 31, 2018

| | | | | | | | |

Number

of Shares | | | | | Value | |

| | | | Common Stocks & Other Equity Interests—99.8% | |

| | | | Consumer Discretionary—11.7% | |

| | 230,000 | | | Alibaba Pictures Group Ltd. (Hong

Kong)(b) | | $ | 27,838 | |

| | 20,000 | | | ANTA Sports Products Ltd. (China) | | | 108,933 | |

| | 30,453 | | | BAIC Motor Corp. Ltd. (China)(c) | | | 25,607 | |

| | 51,996 | | | Brilliance China Automotive Holdings Ltd. (China) | | | 82,410 | |

| | 12,000 | | | BYD Co. Ltd., H-Shares (China)(d) | | | 71,322 | |

| | 58,000 | | | China Dongxiang Group Co. Ltd. (China) | | | 9,606 | |

| | 54,000 | | | China First Capital Group Ltd. (Hong Kong)(b) | | | 28,896 | |

| | 24,000 | | | China Maple Leaf Educational Systems Ltd. (China) | | | 13,118 | |

| | 35,999 | | | China Travel International Investment Hong Kong Ltd. (China) | | | 11,696 | |

| | 13,000 | | | China Yongda Automobiles Services Holdings Ltd. (China) | | | 11,809 | |

| | 19,500 | | | China ZhengTong Auto Services Holdings Ltd. (China) | | | 11,950 | |

| | 7,357 | | | Ctrip.com International Ltd. ADR

(China)(b) | | | 288,027 | |

| | 50,000 | | | Dongfeng Motor Group Co. Ltd., H-Shares (China) | | | 55,868 | |

| | 18,000 | | | Fu Shou Yuan International Group Ltd. (China) | | | 16,122 | |

| | 8,863 | | | Fuyao Glass Industry Group Co. Ltd., H-Shares (China)(c) | | | 32,690 | |

| | 87,993 | | | Geely Automobile Holdings Ltd. (China) | | | 186,997 | |

| | 8,000 | | | Golden Eagle Retail Group Ltd. (China) | | | 9,061 | |

| | 198,991 | | | GOME Retail Holdings Ltd. (China)(b) | | | 19,268 | |

| | 54,000 | | | Great Wall Motor Co. Ltd., H-Shares (China) | | | 33,230 | |

| | 48,398 | | | Guangzhou Automobile Group Co. Ltd., H-Shares (China) | | | 52,536 | |

| | 22,000 | | | Haier Electronics Group Co. Ltd. (Hong Kong)(b) | | | 57,320 | |

| | 2,029 | | | Huazhu Group Ltd. ADR (China) | | | 69,838 | |

| | 860,000 | | | Imperial Pacific International Holdings Ltd. (Hong Kong)(b) | | | 7,999 | |

| | 13,713 | | | JD.com, Inc., Class A ADR (China)(b) | | | 429,217 | |

| | 27,500 | | | Li Ning Co. Ltd. (China)(b) | | | 29,010 | |

| | 12,000 | | | Minth Group Ltd. (China) | | | 49,153 | |

| | 2,283 | | | New Oriental Education & Technology Group, Inc. ADR (China) | | | 179,444 | |

| | 5,000 | | | Q Technology Group Co. Ltd. (China) | | | 3,230 | |

| | 11,999 | | | Shenzhou International Group Holdings Ltd. (China) | | | 157,461 | |

| | 33,999 | | | Skyworth Digital Holdings Ltd. (Hong Kong) | | | 11,003 | |

| | 4,983 | | | TAL Education Group ADR (China)(b) | | | 147,497 | |

| | 12,000 | | | Tianneng Power International Ltd. (China) | | | 14,907 | |

| | 1,393 | | | Tuniu Corp., Class A ADR (China)(b) | | | 10,434 | |

| | 7,524 | | | Vipshop Holdings Ltd., Class A ADR (China)(b) | | | 52,518 | |

| | 19,000 | | | Virscend Education Co. Ltd. (China)(c) | | | 11,571 | |

| | 43,999 | | | Xinyi Glass Holdings Ltd. (Hong Kong) | | | 54,936 | |

| | 6,766 | | | Yum China Holdings, Inc. (China) | | | 261,709 | |

| | 11,000 | | | Zhongsheng Group Holdings Ltd. (China) | | | 24,133 | |

| | | | | | | | |

| | | | | | | 2,668,364 | |

| | | | | | | | |

| | | | Consumer Staples—3.5% | |

| | 105,993 | | | C.P. Pokphand Co. Ltd. (Hong Kong) | | | 9,723 | |

| | 37,999 | | | China Agri-Industries Holdings Ltd. (China) | | | 15,105 | |

| | 59,000 | | | China Huishan Dairy Holdings Co. Ltd. (China)(b)(e) | | | 0 | |

| | 46,998 | | | China Mengniu Dairy Co. Ltd. (China)(b) | | | 135,625 | |

| | 45,989 | | | China Modern Dairy Holdings Ltd. (China)(b) | | | 7,031 | |

| | | | | | | | |

Number

of Shares | | | | | Value | |

| | | | Common Stocks & Other Equity Interests

(continued) | |

| | | | Consumer Staples (continued) | |

| | 28,000 | | | China Resources Beer Holdings Co. Ltd. (China) | | $ | 119,150 | |

| | 68,000 | | | China Shengmu Organic Milk Ltd.

(China)(b)(c) | | | 3,379 | |

| | 35,500 | | | Dali Foods Group Co. Ltd. (China)(c) | | | 25,781 | |

| | 3,000 | | | Health and Happiness H&H International Holdings Ltd. (China)(b) | | | 19,015 | |

| | 12,501 | | | Hengan International Group Co. Ltd. (China) | | | 112,525 | |

| | 37,999 | | | Sun Art Retail Group Ltd. (Hong Kong) | | | 43,814 | |

| | 24,000 | | | Tibet Water Resources Ltd. (Hong Kong)(b) | | | 7,247 | |

| | 31,999 | | | Tingyi Cayman Islands Holding Corp. (China) | | | 57,158 | |

| | 5,928 | | | Tsingtao Brewery Co. Ltd., H-Shares (China) | | | 28,171 | |

| | 23,000 | | | Uni-President China Holdings Ltd. (China) | | | 22,652 | |

| | 5,000 | | | Vinda International Holdings Ltd. (Hong Kong) | | | 8,371 | |

| | 109,993 | | | Want Want China Holdings Ltd. (China) | | | 89,828 | |

| | 123,000 | | | WH Group Ltd. (Hong Kong)(c) | | | 92,772 | |

| | 10,500 | | | Zhou Hei Ya International Holdings Co. Ltd. (China)(b)(c) | | | 6,287 | |

| | | | | | | | |

| | | | | | | 803,634 | |

| | | | | | | | |

| | | | Energy—6.6% | |

| | 35,993 | | | China Coal Energy Co. Ltd., H-Shares (China) | | | 15,316 | |

| | 31,999 | | | China Oilfield Services Ltd., H-Shares (China) | | | 28,375 | |

| | 447,183 | | | China Petroleum & Chemical Corp. (Sinopec), H-Shares (China) | | | 449,525 | |

| | 58,996 | | | China Shenhua Energy Co. Ltd., H-Shares (China) | | | 131,538 | |

| | 282,990 | | | CNOOC Ltd. (China) | | | 500,440 | |

| | 59,994 | | | Kunlun Energy Co. Ltd. (China) | | | 62,678 | |

| | 371,986 | | | PetroChina Co. Ltd., H-Shares (China) | | | 276,777 | |

| | 18,000 | | | Sinopec Kantons Holdings Ltd. (China) | | | 8,027 | |

| | 31,999 | | | Yanzhou Coal Mining Co. Ltd., H-Shares (China) | | | 36,977 | |

| | | | | | | | |

| | | | | | | 1,509,653 | |

| | | | | | | | |

| | | | Financials—26.8% | |

| | 465,982 | | | Agricultural Bank of China Ltd., H-Shares (China) | | | 225,602 | |

| | 1,332,466 | | | Bank of China Ltd., H-Shares (China) | | | 599,269 | |

| | 373,993 | | | Bank of Communications Co. Ltd., H-Shares (China) | | | 270,170 | |

| | 20,000 | | | Central China Securities Co. Ltd., H-Shares (China) | | | 5,122 | |

| | 153,000 | | | China Cinda Asset Management Co. Ltd., H-Shares (China) | | | 39,571 | |

| | 202,993 | | | China CITIC Bank Corp. Ltd., H-Shares (China) | | | 126,727 | |

| | 1,395,219 | | | China Construction Bank Corp., H-Shares (China) | | | 1,235,431 | |

| | 14,000 | | | China Everbright Ltd. (China) | | | 24,508 | |

| | 61,000 | | | China Galaxy Securities Co. Ltd., H-Shares (China) | | | 29,844 | |

| | 192,000 | | | China Huarong Asset Management Co. Ltd., H-Shares (China)(c) | | | 39,873 | |

| | 16,400 | | | China International Capital Corp. Ltd., H-Shares (China)(c) | | | 30,005 | |

| | 129,995 | | | China Life Insurance Co. Ltd., H-Shares (China) | | | 293,813 | |

| | 66,493 | | | China Merchants Bank Co. Ltd., H-Shares (China) | | | 254,996 | |

| | 14,800 | | | China Merchants Securities Co. Ltd., H-Shares (China)(c) | | | 17,140 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

Invesco China All-Cap ETF (YAO) (continued)

August 31, 2018

| | | | | | | | |

Number

of Shares | | | | | Value | |

| | | | Common Stocks & Other Equity Interests

(continued) | |

| | | | Financials (continued) | |

| | 131,388 | | | China Minsheng Banking Corp. Ltd., H-Shares (China) | | $ | 94,077 | |

| | 170,000 | | | China Minsheng Financial Holding Corp. Ltd. (Hong Kong)(b) | | | 8,664 | |

| | 48,600 | | | China Pacific Insurance (Group) Co. Ltd., H-Shares (China) | | | 181,115 | |

| | 105,000 | | | China Reinsurance Group Corp., H-Shares (China) | | | 20,735 | |

| | 25,200 | | | China Taiping Insurance Holdings Co. Ltd. (China) | | | 79,945 | |

| | 266,515 | | | Chong Sing Holdings Fintech GR (China)(b) | | | 18,676 | |

| | 43,994 | | | Chongqing Rural Commercial Bank Co. Ltd., H-Shares (China) | | | 23,710 | |

| | 40,001 | | | CITIC Securities Co. Ltd., H-Shares (China) | | | 71,655 | |

| | 13,500 | | | CSC Financial Co. Ltd., H-Shares (China)(b)(c) | | | 8,187 | |

| | 12,200 | | | Everbright Securities Co. Ltd., H-Shares (China)(c) | | | 11,891 | |

| | 716 | | | Fanhua, Inc. ADR (China) | | | 16,668 | |

| | 38,000 | | | Far East Horizon Ltd. (China) | | | 35,972 | |

| | 25,272 | | | GF Securities Co. Ltd., H-Shares (China) | | | 31,715 | |

| | 55,000 | | | Guotai Junan International Holdings Ltd. (China) | | | 10,231 | |

| | 10,800 | | | Guotai Junan Securities Co. Ltd., H-Shares (China)(c) | | | 22,291 | |

| | 55,200 | | | Haitong Securities Co. Ltd., H-Shares (China) | | | 48,808 | |

| | 27,927 | | | Huatai Securities Co. Ltd., H-Shares (China)(b)(c) | | | 41,843 | |

| | 18,700 | | | Huishang Bank Corp. Ltd., H-Shares (China) | | | 8,100 | |

| | 1,368,126 | | | Industrial & Commercial Bank of China Ltd., H-Shares (China) | | | 1,007,500 | |

| | 12,600 | | | New China Life Insurance Co. Ltd., H-Shares (China) | | | 57,069 | |

| | 423 | | | Noah Holdings Ltd. ADR (China)(b) | | | 19,898 | |

| | 14,000 | | | Orient Securities Co. Ltd., H-Shares (China)(c) | | | 9,436 | |

| | 121,000 | | | People’s Insurance Co. Group of China Ltd. (The), H-Shares (China) | | | 52,415 | |

| | 119,992 | | | PICC Property & Casualty Co. Ltd., H-Shares (China) | | | 135,144 | |

| | 88,652 | | | Ping An Insurance Group Co. of China Ltd., H-Shares (China) | | | 853,889 | |

| | 69,000 | | | Postal Savings Bank of China Co. Ltd., H-Shares (China)(c) | | | 40,615 | |

| | 10,318 | | | Shengjing Bank Co. Ltd., H-Shares (China)(c) | | | 5,390 | |

| | | | | | | | |

| | | | | | | 6,107,710 | |

| | | | | | | | |

| | | | Health Care—4.7% | |

| | 19,954 | | | 3SBio, Inc. (China)(c) | | | 38,083 | |

| | 860 | | | BeiGene Ltd. ADR (China)(b) | | | 152,676 | |

| | 36,000 | | | China Animal Healthcare Ltd.

(China)(b)(e) | | | 0 | |

| | 387 | | | China Biologic Products Holdings, Inc. (China)(b) | | | 34,699 | |

| | 23,495 | | | China Medical System Holdings Ltd. (China) | | | 38,914 | |

| | 28,000 | | | China Resources Pharmaceutical Group Ltd. (China)(c) | | | 44,806 | |

| | 9,500 | | | China Resources Phoenix Healthcare Holdings Co. Ltd. (China) | | | 8,799 | |

| | 78,000 | | | CSPC Pharmaceutical Group Ltd. (China) | | | 196,767 | |

| | 12,136 | | | Genertec Universal Medical Group Co. Ltd. (China)(c) | | | 9,648 | |

| | | | | | | | |

Number

of Shares | | | | | Value | |

| | | | Common Stocks & Other Equity Interests

(continued) | |

| | | | Health Care (continued) | |

| | 16,000 | | | Genscript Biotech Corp. (China)(b) | | $ | 34,451 | |

| | 3,827 | | | Guangzhou Baiyunshan Pharmaceutical Holdings Co. Ltd., H-Shares (China) | | | 14,091 | |

| | 91,200 | | | Hua Han Health Industry Holdings Ltd. (Hong Kong)(b)(e) | | | 0 | |

| | 2,080 | | | Livzon Pharmaceutical Group, Inc., H-Shares (China) | | | 8,401 | |

| | 30,500 | | | Luye Pharma Group Ltd. (China)(c) | | | 28,717 | |

| | 8,000 | | | Microport Scientific Corp. (China) | | | 10,101 | |

| | 40,001 | | | Shandong Weigao Group Medical Polymer Co. Ltd., H-Shares (China) | | | 37,866 | |

| | 8,000 | | | Shanghai Fosun Pharmaceutical Group Co. Ltd., H-Shares (China) | | | 32,310 | |

| | 14,500 | | | Shanghai Pharmaceuticals Holding Co. Ltd., H-Shares (China) | | | 38,056 | |

| | 82,000 | | | Sihuan Pharmaceutical Holdings Group Ltd. (China) | | | 18,178 | |

| | 111,988 | | | Sino Biopharmaceutical Ltd. (China) | | | 141,824 | |

| | 20,801 | | | Sinopharm Group Co. Ltd., H-Shares (China) | | | 103,490 | |

| | 32,000 | | | SSY Group Ltd. (Hong Kong) | | | 29,762 | |