UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-21972

Name of Fund: BlackRock Credit Allocation Income Trust (BTZ)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Credit Allocation Income Trust, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 10/31/2017

Date of reporting period: 04/30/2017

Item 1 – Report to Stockholders

APRIL 30, 2017

| | | | |

SEMI-ANNUAL REPORT (UNAUDITED) | | | |  |

BlackRock Credit Allocation Income Trust (BTZ)

BlackRock Floating Rate Income Trust (BGT)

BlackRock Multi-Sector Income Trust (BIT)

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

Dear Shareholder,

In the 12 months ended April 30, 2017, risk assets, such as stocks and high-yield bonds, delivered strong performance. These markets showed great resilience during a period with big surprises, including the United Kingdom’s vote to leave the European Union and the outcome of the U.S. presidential election, which brought only brief spikes in equity market volatility. However, high-quality assets with more interest rate sensitivity struggled. U.S. Treasuries posted negative returns as rising energy prices, modest wage increases and steady job growth led to expectations of higher inflation and anticipation of interest rate increases by the U.S. Federal Reserve (the “Fed”).

The global reflationary theme — rising nominal growth, wages and inflation — was the dominant driver of asset returns during the period, outweighing significant political upheavals and uncertainty. Reflationary expectations accelerated after the U.S. election and continued into the beginning of 2017, stoked by expectations that the new presidential administration’s policies would provide an extra boost to U.S. growth. More recently, however, growing skepticism about the likelihood of significant near-term U.S. tax reform and infrastructure spending has tempered enthusiasm around the reflation trade. Nonetheless, markets have remained generally positive thus far in 2017 and continue to exhibit low levels of volatility by historical standards. Although political uncertainty persisted, benign credit conditions and expectations for economic growth have kept markets fairly tranquil. The period ended with a global risk asset rally following centrist Emmanuel Macron’s win in the first round of the French presidential election and better-than-expected U.S. and European corporate earnings.

Although economic momentum is gaining traction, the capacity for rapid global growth is restrained by structural factors, including an aging population, low productivity growth and excess savings, as well as cyclical factors, like the Fed moving toward the normalization of monetary policy and the length of the current expansion. Tempered economic growth and high valuations across most assets have set the stage for muted returns going forward.

Equity markets still present opportunities, although the disparity between winners and losers is widening — a dynamic that increases both the risk and return potential of active investing. Fixed income investors are also facing challenges as many sectors are exhibiting higher valuations while rates remain at historically low levels.

In this environment, investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of April 30, 2017 | |

| | | 6-month | | | 12-month | |

U.S. large cap equities

(S&P 500® Index) | | | 13.32 | % | | | 17.92 | % |

U.S. small cap equities

(Russell 2000® Index) | | | 18.37 | | | | 25.63 | |

International equities

(MSCI Europe, Australasia,

Far East Index) | | | 11.47 | | | | 11.29 | |

Emerging market equities

(MSCI Emerging Markets Index) | | | 8.88 | | | | 19.13 | |

3-month Treasury bills

(BofA Merrill Lynch 3-Month

U.S. Treasury Bill Index) | | | 0.23 | | | | 0.40 | |

U.S. Treasury securities

(BofA Merrill Lynch

10-Year U.S. Treasury

Index) | | | (3.13 | ) | | | (2.68 | ) |

U.S. investment grade bonds

(Bloomberg Barclays U.S.

Aggregate Bond Index) | | | (0.67 | ) | | | 0.83 | |

Tax-exempt municipal

bonds (S&P Municipal

Bond Index) | | | (0.41 | ) | | | 0.57 | |

U.S. high yield bonds

(Bloomberg Barclays U.S. Corporate High Yield 2% Issuer

Capped Index) | | | 5.30 | | | | 13.29 | |

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| | | | | | | |

| 2 | | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | |

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | APRIL 30, 2017 | | 3 |

| | | | |

| Trust Summary as of April 30, 2017 | | BlackRock Credit Allocation Income Trust |

BlackRock Credit Allocation Income Trust’s (BTZ) (the “Trust”) investment objective is to provide current income, current gains and capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its assets in credit-related securities, including, but not limited to, investment grade corporate bonds, high yield bonds (commonly referred to as “junk” bonds), bank loans, preferred securities or convertible bonds or derivatives with economic characteristics similar to these credit-related securities. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objective will be achieved.

| | |

| Trust Information | | |

Symbol on New York Stock Exchange (“NYSE”) | | BTZ |

Initial Offering Date | | December 27, 2006 |

Current Distribution Rate on Closing Market Price as of April 30, 2017 ($13.41)1 | | 6.31% |

Current Monthly Distribution per Common Share2 | | $0.0705 |

Current Annualized Distribution per Common Share2 | | $0.8460 |

Economic Leverage as of April 30, 20173 | | 22% |

| | 1 | | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. Past performance does not guarantee future results. |

| | 2 | | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

| | 3 | | Represents reverse repurchase agreements as a percentage of total managed assets, which is the total assets of the Trust (including any assets attributable to any borrowings) minus the sum of its liabilities (other than borrowings representing financial leverage). For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging on page 10. |

|

| Performance and Portfolio Management Commentary |

Returns for the six months ended April 30, 2017 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | NAV | |

BTZ1,2 | | | 7.64 | % | | | 3.59 | % |

Lipper Corporate BBB-Rated Debt Funds (Leveraged)3 | | | 2.84 | % | | | 1.90 | % |

| | 1 | | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. |

| | 2 | | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on price and performance based on NAV. |

| | 3 | | Average return. Returns reflect reinvestment of dividends and/or distributions at NAV on the ex-dividend date as calculated by Lipper. |

| | | | Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. |

The following discussion relates to the Trust’s absolute performance based on NAV:

What factors influenced performance?

| • | | The largest detractors from performance included the Trust’s positions in the tobacco, food & beverage, wireline and retail industries. |

| • | | Positive contributors to performance during the period included the Trust’s exposure to capital securities (dividend-paying securities that combine some features of both corporate bonds and preferred stocks, while generally providing higher yields to compensate for being less senior in the issuer’s capital structure). In terms of industries, holdings within midstream energy, utilities and U.S. banks added to performance. Exposure |

| | | to high yield bonds also contributed positively to performance on an absolute basis. Finally, positioning with respect to duration (and corresponding interest rate sensitivity) and yield curve positioning helped generate positive performance as well. |

Describe recent portfolio activity.

| • | | The Trust tactically shortened its duration in preparation for rates moving higher as a result of the reflationary environment and anticipated pro-growth policy initiatives. The Trust kept its preference for high quality assets given the lack of value in the overall market and somewhat elevated geopolitical risks, while tactically adding shorter-maturity high yield names. At the same time, the Trust was positioned to benefit from the extended credit cycle and investment grade corporate bonds as they continue to be supported by the reflation theme. |

Describe portfolio positioning at period end.

| • | | The Trust ended the period defensively positioned despite a constructive fundamental backdrop for credit, as the investment adviser views geopolitical risks as elevated and many of the supportive factors as already reflected in tightened spreads and active investor allocations to credit. The Trust continued its positive view on pipelines and cable/telecommunications, while maintaining a more defensive stance with respect to industrials. Within high quality industrials, the Trust favored short-maturity credits given the lack of value in the current market. With respect to financials, the Trust favored longer maturities within senior credits and short-end issues within subordinate issues. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| | | | | | | |

| 4 | | SEMI-ANNUAL REPORT | | APRIL 30, 2017 | | |

| | |

| | | BlackRock Credit Allocation Income Trust |

| | |

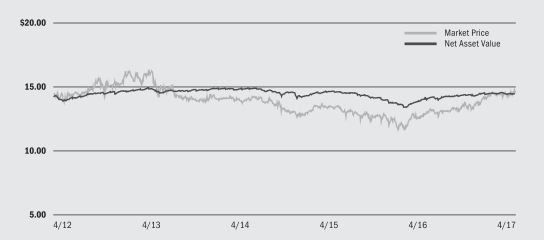

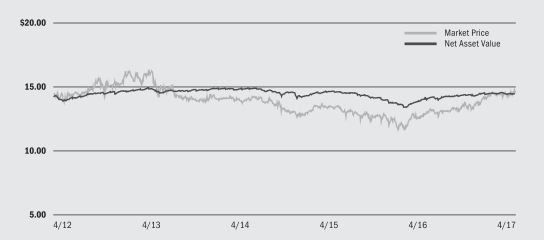

| Market Price and Net Asset Value Per Share Summary |

| | | | | | | | | | | | | | | | | | | | |

| | | 4/30/17 | | | 10/31/16 | | | Change | | | High | | | Low | |

Market Price | | $ | 13.41 | | | $ | 12.87 | | | | 4.20 | % | | $ | 13.41 | | | $ | 12.06 | |

Net Asset Value | | $ | 14.65 | | | $ | 14.61 | | | | 0.27 | % | | $ | 14.65 | | | $ | 14.14 | |

| | |

| Market Price and Net Asset Value History For the Past Five Years |

| | |

| Overview of the Trust’s Total Investments |

| | | | | | | | |

| Portfolio Composition | | 4/30/17 | | | 10/31/16 | |

Corporate Bonds | | | 72 | % | | | 71 | % |

Preferred Securities | | | 21 | | | | 17 | |

Asset-Backed Securities | | | 3 | | | | 4 | |

U.S. Treasury Obligations | | | 1 | | | | 6 | |

Municipal Bonds | | | 1 | | | | 1 | |

Foreign Agency Obligations | | | 2 | | | | 1 | |

Other1 | | | — | | | | — | |

| | 1 | | Includes a less than 1% holding in each of the following investment types: Short-Term Securities, U.S. Government Sponsored Agency Securities, Options Purchased, Options Written and Common Stocks. |

| | | | | | | | |

| Credit Quality Allocation2,3 | | 4/30/17 | | | 10/31/16 | |

AAA/Aaa4 | | | 2 | % | | | 7 | % |

AA/Aa | | | 2 | | | | 3 | |

A | | | 17 | | | | 17 | |

BBB/Baa | | | 49 | | | | 47 | |

BB/Ba | | | 18 | | | | 16 | |

B | | | 9 | | | | 8 | |

CCC/Caa | | | 1 | | | | 1 | |

N/R | | | 2 | | | | 1 | |

| | 2 | | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service (“Moody’s”) if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| | 3 | | Excludes Short-Term Securities, Options Purchased and Options Written. |

| | 4 | | The investment adviser evaluates the credit quality of not-rated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuer. Using this approach, the investment adviser has deemed U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations as AAA/Aaa. |

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | APRIL 30, 2017 | | 5 |

| | | | |

| Trust Summary as of April 30, 2017 | | BlackRock Floating Rate Income Trust |

BlackRock Floating Rate Income Trust’s (BGT) (the “Trust”) primary investment objective is to provide a high level of current income. The Trust’s secondary investment objective is to seek the preservation of capital to the extent consistent with its primary objective of high current income. The Trust seeks to achieve its investment objectives by investing primarily, under normal conditions, at least 80% of its assets in floating and variable rate instruments of U.S. and non-U.S. issuers, including a substantial portion of its assets in global floating and variable rate securities including senior secured floating rate loans made to corporate and other business entities. Under normal market conditions, the Trust expects that the average effective duration of its portfolio will be no more than 1.5 years. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

| | |

Symbol on NYSE | | BGT |

Initial Offering Date | | August 30, 2004 |

Current Distribution Rate on Closing Market Price as of April 30, 2017 ($14.68)1 | | 4.77% |

Current Monthly Distribution per Common Share2 | | $0.0583 |

Current Annualized Distribution per Common Share2 | | $0.6996 |

Economic Leverage as of April 30, 20173 | | 29% |

| | 1 | | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. Past performance does not guarantee future results. |

| | 2 | | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

| | 3 | | Represents bank borrowings outstanding as a percentage of total managed assets, which is the total assets of the Trust (including any assets attributable to any borrowings) minus the sum of its liabilities (other than borrowings representing financial leverage). For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging on page 10. |

|

| Performance and Portfolio Management Commentary |

Returns for the six months ended April 30, 2017 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | NAV | |

BGT1,2 | | | 11.29 | % | | | 3.59 | % |

Lipper Loan Participation Funds3 | | | 10.09 | % | | | 4.13 | % |

| | 1 | | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. |

| | 2 | | The Trust moved from a discount to NAV to a premium, which accounts for the difference between performance based on price and performance based on NAV. |

| | 3 | | Average return. Returns reflect reinvestment of dividends and/or distributions at NAV on the ex-dividend date as calculated by Lipper. |

| | | | Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. |

The following discussion relates to the Trust’s absolute performance based on NAV:

What factors influence performance?

| • | | The Trust’s exposure to retailers was the principal detractor from performance, as secular changes in consumer spending behavior, shifting fashion trends, excess capacity, and potential fiscal reform all weighed on the segment. |

| • | | The broad floating rate loan interest (“bank loan”) market provided a positive return for the six-month period. Among the most notable drivers of positive returns in the Trust were allocations to the technology and health care sectors. The Trust’s tactical high yield bond allocation also benefited performance, as high yield bonds outperformed bank loans over the six-month period. |

Describe recent portfolio activity.

| • | | Throughout the six-month period, the Trust maintained its focus on the higher quality segments of the loan market in terms of loan structure, liquidity and overall credit quality. The Trust concentrated its investments in strong companies with stable cash flows and high quality collateral, with the ability to meet interest obligations and ultimately return principal. This high-quality bias constrained recent performance given the outperformance by the riskier areas of the market. To capture additional momentum and benefit from a more constructive narrative surrounding commodity-related assets, the Trust selectively added to its fixed-rate high yield bond allocation early in the period, which contributed to results given that market’s outperformance versus loans. This position was reduced as the period progressed amid tighter risk premiums in the high yield market and volatility in oil prices. From a sector standpoint, the Trust added to risk within the technology and health care sectors, while reducing exposure to names in the electric and transportation services sectors. |

Describe portfolio positioning at period end.

| • | | At period end, the Trust held 92% of its total portfolio in bank loans, with the remainder primarily in corporate bonds and collateralized loan obligations. Across the credit spectrum, the Trust held most of its assets in single B-rated credits, followed by BB-rated loan names. The Trust maintained minimal exposure to CCC and below rated loan credits, and avoided what it perceives to be the riskier segments of that universe (i.e. offshore drillers, retailers, and media). Top issuer positions included Level 3 (wirelines), Altice/Numericable (cable & satellite), and First Data (technology). The Trust continued its strategy to maintain a modest stake in more conservative high yield bonds. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| | | | | | | |

| 6 | | SEMI-ANNUAL REPORT | | APRIL 30, 2017 | | |

| | |

| | | BlackRock Floating Rate Income Trust |

| | | | | | | | | | |

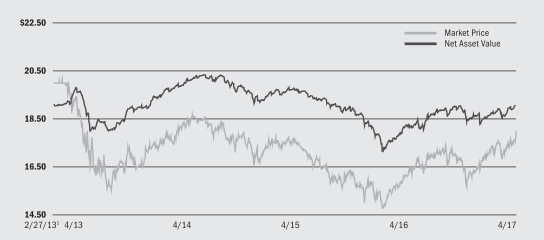

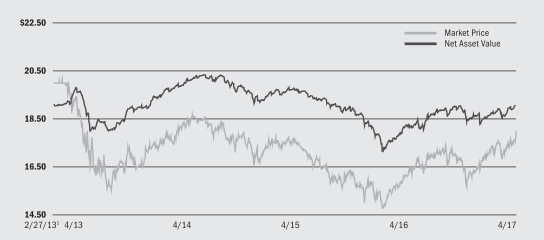

| Market Price and Net Asset Value Per Share Summary | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | 4/30/17 | | | 10/31/16 | | | Change | | | High | | | Low | |

Market Price | | $ | 14.68 | | | $ | 13.58 | | | | 8.10 | % | | $ | 14.79 | | | $ | 13.23 | |

Net Asset Value | | $ | 14.50 | | | $ | 14.41 | | | | 0.62 | % | | $ | 14.59 | | | $ | 14.30 | |

| | |

| Market Price and Net Asset Value History For the Past Five Years |

| | |

| Overview of the Trust’s Total Investments |

| | | | | | | | |

| | |

| Portfolio Composition | | 4/30/17 | | | 10/31/16 | |

Floating Rate Loan Interests | | | 92 | % | | | 92 | % |

Corporate Bonds | | | 5 | | | | 4 | |

Asset-Backed Securities | | | 1 | | | | 2 | |

Short-Term Securities | | | 1 | | | | 2 | |

Other | | | 1 | 1 | | | — | 2 |

| | 1 | | Includes a less than 1% holding in each of the following investment types: Common Stocks, Other Interests, Rights, Warrants and Options Purchased. |

| | 2 | | Includes a less than 1% holding in each of the following investment types: Non-Agency Mortgage — Backed Securities, Other Interests, Investment Companies, Warrants, Common Stocks and Options Purchased. |

| | | | | | | | |

| | |

| Credit Quality Allocation3,4 | | 4/30/17 | | | 10/31/16 | |

A | | | — | | | | — | 5 |

BBB/Baa | | | 8 | % | | | 8 | % |

BB/Ba | | | 38 | | | | 43 | |

B | | | 43 | | | | 41 | |

CCC/Caa | | | 3 | | | | 3 | |

C | | | 1 | | | | — | |

N/R | | | 7 | | | | 5 | |

| | 3 | | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P’s or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| | 4 | | Excludes Short-Term Securities and Options Purchased. |

| | 5 | | Represents less than 1% of total investments. |

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | APRIL 30, 2017 | | 7 |

| | | | |

| Trust Summary as of April 30, 2017 | | BlackRock Multi-Sector Income Trust |

BlackRock Multi-Sector Income Trust’s (BIT) (the “Trust”) primary investment objective is to seek high current income, with a secondary objective of capital appreciation. The Trust seeks to achieve its investment objectives by investing, under normal market conditions, at least 80% of its assets in loan and debt instruments and other investments with similar economic characteristics. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

| | |

| Trust Information | | |

Symbol on NYSE | | BIT |

Initial Offering Date | | February 27, 2013 |

Current Distribution Rate on Closing Market Price as of April 30, 2017 ($17.98)1 | | 7.79% |

Current Monthly Distribution per Common Share2 | | $0.1167 |

Current Annualized Distribution per Common Share2 | | $1.4004 |

Economic Leverage as of April 30, 20173 | | 39% |

| | 1 | | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. Past performance does not guarantee future results. |

| | 2 | | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

| | 3 | | Represents reverse repurchase agreements as a percentage of total managed assets, which is the total assets of the Trust (including any assets attributable to any borrowings) minus the sum of its liabilities (other than borrowings representing financial leverage). For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging on page 10. |

|

| Performance and Portfolio Management Commentary |

Returns for the six months ended April 30, 2017 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | NAV | |

BIT1,2 | | | 14.18 | % | | | 7.96 | % |

Lipper General Bond Funds3 | | | 9.59 | % | | | 6.85 | % |

| | 1 | | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. |

| | 2 | | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on price and performance based on NAV. |

| | 3 | | Average return. Returns reflect reinvestment of dividends and/or distributions at NAV on the ex-dividend date as calculated by Lipper. |

| | | | Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. |

The following discussion relates to the Trust’s absolute performance based on NAV:

What factors influenced performance?

| • | | The Trust’s positions in high yield corporate bonds, residential mortgage-backed securities (“MBS”), commercial mortgage backed securities (“CMBS”), investment grade corporates and senior loans were the largest contributors to performance. The Trust’s allocations to asset-backed securities (“ABS”) as well as foreign government and agency obligations also supported absolute returns. |

| • | | The Trust’s duration (sensitivity to interest rate movements) and yield curve positioning detracted from performance during the period. |

Describe recent portfolio activity.

| • | | The investment adviser believes that the failure to pass health care reform has marginally dampened investors’ confidence in the ability of the Trump administration to move forward with its pro-growth agenda. Consequently, the Trust’s spread duration (sensitivity to credit spreads) was decreased as spread sector exposure was rotated out of corporate bonds and into sovereign plus and non-agency MBS. The Trust largely maintained its duration exposure over the period. From a sub-sector perspective, corporate spreads have been approaching their lowest levels of the cycle and appear to be overvalued relative to MBS. The Trust reduced its exposure to investment grade financials and rotated into non-agency collateralized mortgage obligations to take advantage of this imbalance. The investment adviser also believed that sovereign plus names appeared relatively attractive versus other fixed income spread sectors and increased the Trust’s exposure to lower quality sovereign issues. |

Describe portfolio positioning at period end.

| • | | At period end, the Trust maintained a diversified exposure to non-government spread sectors, including non-agency MBS, high yield corporates, capital securities, ABS, collateralized loan obligations, CMBS and senior loans. The Trust also held marginal exposure to foreign government and agency obligations. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| | | | | | | |

| 8 | | SEMI-ANNUAL REPORT | | APRIL 30, 2017 | | |

| | |

| | | BlackRock Multi-Sector Income Trust |

| | | | | | | | | | |

| Market Price and Net Asset Value Per Share Summary | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | 4/30/17 | | | 10/31/16 | | | Change | | | High | | | Low | |

Market Price | | $ | 17.98 | | | $ | 16.76 | | | | 7.28 | % | | $ | 17.98 | | | $ | 15.53 | |

Net Asset Value | | $ | 19.18 | | | $ | 18.91 | | | | 1.43 | % | | $ | 19.18 | | | $ | 18.28 | |

| | |

| Market Price and Net Asset Value History Since Inception |

| | 1 | | Commencement of operations. |

| | |

| Overview of the Trust’s Total Investments |

| | | | | | | | |

| Portfolio Composition | | 4/30/17 | | | 10/31/16 | |

Corporate Bonds | | | 41 | % | | | 41 | % |

Asset-Backed Securities | | | 18 | | | | 19 | |

Non-Agency Mortgage-Backed Securities | | | 17 | | | | 18 | |

Preferred Securities | | | 12 | | | | 12 | |

Foreign Agency Obligations | | | 6 | | | | 4 | |

Floating Rate Loan Interests | | | 6 | | | | 5 | |

Short-Term Securities | | | — | 1 | | | 1 | |

Other | | | — | 2 | | | — | 3 |

| | 1 | | Represents less than 1% of total investments. |

| | 2 | | Includes a less than 1% holding in each of the following investment types: Common Stocks, Investment Companies, Options Purchased, Options Written, Short-Term Securities and Warrants. |

| | 3 | | Includes a less than 1% holding in each of the following investment types: Common Stocks, U.S. Treasury Obligations, Options Purchased and Options Written. |

| | | | | | | | |

| Credit Quality Allocation4,5 | | 4/30/17 | | | 10/31/16 | |

AAA/Aaa6 | | | — | 1 | | | — | 1 |

AA/Aa | | | 1 | % | | | 2 | % |

A | | | 5 | | | | 8 | |

BBB/Baa | | | 13 | | | | 18 | |

BB/Ba | | | 28 | | | | 22 | |

B | | | 23 | | | | 20 | |

CCC/Caa | | | 16 | | | | 16 | |

CC/Ca | | | 4 | | | | 5 | |

C | | | — | 1 | | | 1 | |

N/R | | | 10 | | | | 8 | |

| | 4 | | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P’s or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| | 5 | | Excludes Short-Term Securities, Options Purchased and Options Written. |

| | 6 | | The investment adviser evaluates the credit quality of not-rated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuer. Using this approach, the investment adviser has deemed U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations as AAA/Aaa. |

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | APRIL 30, 2017 | | 9 |

| | | | |

| The Benefits and Risks of Leveraging | | |

The Trusts may utilize leverage to seek to enhance the distribution rate on, and net asset value (“NAV”) of, their common shares (“Common Shares”). However, these objectives cannot be achieved in all interest rate environments.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is normally lower than the income earned by a Trust on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of the Trusts (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, the Trusts’ shareholders benefit from the incremental net income. The interest earned on securities purchased with the proceeds from leverage is paid to shareholders in the form of dividends, and the value of these portfolio holdings is reflected in the per share NAV.

To illustrate these concepts, assume a Trust’s capitalization is $100 million and it utilizes leverage for an additional $30 million, creating a total value of $130 million available for investment in longer-term income securities. If prevailing short-term interest rates are 3% and longer-term interest rates are 6%, the yield curve has a strongly positive slope. In this case, a Trust’s financing costs on the $30 million of proceeds obtained from leverage are based on the lower short-term interest rates. At the same time, the securities purchased by a Trust with the proceeds from leverage earn income based on longer-term interest rates. In this case, a Trust’s financing cost of leverage is significantly lower than the income earned on a Trust’s longer-term investments acquired from such leverage proceeds, and therefore the holders of Common Shares (“Common Shareholders”) are the beneficiaries of the incremental net income.

However, in order to benefit shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other costs of leverage exceed the Trusts’ return on assets purchased with leverage proceeds, income to shareholders is lower than if the Trusts had not used leverage. Furthermore, the value of the Trusts’ portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can influence the value of portfolio investments. In contrast, the value of the Trusts’ obligations under their respective leverage arrangements generally does not fluctuate in relation to interest rates. As a result, changes in interest

rates can influence the Trusts’ NAVs positively or negatively. Changes in the future direction of interest rates are very difficult to predict accurately, and there is no assurance that the Trusts’ intended leveraging strategy will be successful.

The use of leverage also generally causes greater changes in each Trust’s NAV, market price and dividend rates than comparable portfolios without leverage. In a declining market, leverage is likely to cause a greater decline in the NAV and market price of a Trust’s shares than if the Trust were not leveraged. In addition, each Trust may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments, which may cause the Trusts to incur losses. The use of leverage may limit a Trust’s ability to invest in certain types of securities or use certain types of hedging strategies. Each Trust incurs expenses in connection with the use of leverage, all of which are borne by shareholders and may reduce income to the shareholders. Moreover, to the extent the calculation of the Trusts’ investment advisory fees includes assets purchased with the proceeds of leverage, the investment advisory fees payable to the Trusts’ investment adviser will be higher than if the Trusts did not use leverage.

Each Trust may utilize leverage through a credit facility or reverse repurchase agreements as described in the Notes to Financial Statements.

Under the Investment Company Act of 1940, as amended (the “1940 Act”), each Trust is permitted to issue debt up to 33 1/3% of its total managed assets. BIT is permitted to use economic leverage (which includes leverage attributable to reverse repurchase agreements) of up to 50% of its total managed assets. A Trust may voluntarily elect to limit its leverage to less than the maximum amount permitted under the 1940 Act. In addition, a Trust may also be subject to certain asset coverage, leverage or portfolio composition requirements imposed by its credit facility, which may be more stringent than those imposed by the 1940 Act.

If a Trust segregates or designates on its books and records cash or liquid assets having a value not less than the value of a Trust’s obligations under the reverse repurchase agreement (including accrued interest), then such transaction is not considered a senior security and is not subject to the foregoing limitations and requirements under the 1940 Act.

| | |

| Derivative Financial Instruments | | |

The Trusts may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market and/or other asset without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the

transaction or illiquidity of the instrument. BIT may use economic leverage up to 100% of its net assets (50% of its total managed assets). The Trusts’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Trust can realize on an investment and/or may result in lower distributions paid to shareholders. The Trusts’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 10 | | SEMI-ANNUAL REPORT | | APRIL 30, 2017 | | |

| | |

Schedule of Investments April 30, 2017 (Unaudited) | | BlackRock Credit Allocation Income Trust (BTZ) (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| | | |

| Common Stocks — 0.0% | | | | | Shares | | | Value | |

| Real Estate Investment Trusts (REITs) — 0.0% | |

Ovation Acquisition I LLC, (Acquired 12/28/15, cost $45,445) (a) | | | | | | | 2,951 | | | | — | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | |

| Asset-Backed Securities (b) | | | | | Par (000) | | | | |

ALM Loan Funding, Series 2012-5A, Class BR, 4.16%, 10/18/27 (c) | | | USD | | | | 1,000 | | | $ | 1,003,336 | |

ALM XII Ltd., Series 2015-12A, Class B, 4.41%, 4/16/27 (c) | | | | | | | 1,000 | | | | 1,003,635 | |

ALM XIV Ltd., Series 2014-14A, Class C, 4.49%, 7/28/26 (c) | | | | | | | 4,500 | | | | 4,505,850 | |

ALM XVII Ltd., Series 2015-17A, Class B1, 4.56%, 1/15/28 (c) | | | | | | | 1,400 | | | | 1,408,717 | |

AMMC CLO Ltd., Series 2015-17A, Class C, 4.29%, 11/15/27 (c) | | | | | | | 1,000 | | | | 1,006,611 | |

Anchorage Capital CLO 3 Ltd., Series 2014-3A, Class C, 4.54%, 4/28/26 (c) | | | | | | | 1,000 | | | | 999,992 | |

Apidos CLO XVIII, Series 2014-18A, Class CR, 4.40%, 7/22/26 (b)(c) | | | | | | | 1,300 | | | | 1,300,000 | |

Atlas Senior Loan Fund II Ltd., Series 2012-2A, Class DR, 4.94%, 1/30/24 (c) | | | | | | | 750 | | | | 753,554 | |

Atlas Senior Loan Fund VI Ltd., Series 2014-6A, Class DR, 4.76%, 10/15/26 (c) | | | | | | | 2,500 | | | | 2,504,326 | |

Benefit Street Partners CLO VI Ltd., Series 2015-VIA, Class B, 4.21%, 4/18/27 (c) | | | | | | | 1,000 | | | | 1,005,664 | |

Bowman Park CLO Ltd., Series 2014-1A, Class D2R, 4.40%, 11/23/25 (c) | | | | | | | 1,000 | | | | 999,972 | |

Carlyle Global Market Strategies CLO Ltd., Class C (c): | | | | | | | | | | | | |

Series 2013-3A, 4.56%, 7/15/25 | | | | | | | 1,000 | | | | 1,002,838 | |

Series 2015-1A, 4.31%, 4/20/27 | | | | | | | 500 | | | | 501,928 | |

Series 2016-1A, 6.06%, 4/20/27 | | | | | | | 1,000 | | | | 1,014,774 | |

Series 2016-3A, 5.16%, 10/20/29 | | | | | | | 1,000 | | | | 1,010,654 | |

CIFC Funding Ltd., Series 2014-3A, Class C1, 3.95%, 7/22/26 (c) | | | | | | | 1,500 | | | | 1,500,834 | |

GoldenTree Loan Opportunities IX Ltd., Series 2014-9A, Class D, 4.54%, 10/29/26 (c) | | | | | | | 1,000 | | | | 1,001,654 | |

Highbridge Loan Management Ltd. (c): | | | | | | | | | | | | |

Series 4A-2014, Class B, 4.04%, 7/28/25 | | | | | | | 750 | | | | 750,846 | |

Series 6A-2015, Class C, 4.10%, 5/05/27 | | | | | | | 1,500 | | | | 1,508,178 | |

Series 8A-2016, Class D, 6.01%, 4/20/27 | | | | | | | 500 | | | | 509,158 | |

ING IM CLO Ltd., Series 2013-2A, Class C, 4.66%, 4/25/25 (c) | | | | | | | 1,000 | | | | 1,002,269 | |

LCM XVIII LP, Series 18A, Class C1, 4.31%, 4/20/27 (c) | | | | | | | 1,000 | | | | 1,004,164 | |

| | | | | | | | | | | | |

| Asset-Backed Securities (b) | | | | | Par (000) | | | Value | |

| Asset-Backed Securities (continued) | | | | |

Limerock CLO III LLC, Series 2014-3A, Class C, 4.76%, 10/20/26 (c) | | | USD | | | | 1,000 | | | $ | 999,975 | |

Madison Park Funding IX Ltd., Series 2012-9AR, Class C1R, 3.89%, 8/15/22 (c) | | | | | | | 2,000 | | | | 2,000,659 | |

Madison Park Funding XIII Ltd., Series 2014-13A, Class CR, 3.03%, 1/19/25 (c) | | | | | | | 1,000 | | | | 1,000,000 | |

Madison Park Funding XIV Ltd., Series 2014-14A, Class DR, 4.41%, 7/20/26 (c) | | | | | | | 2,000 | | | | 2,000,368 | |

Madison Park Funding XV Ltd., Series 2014-15A, Class B1R, 3.37%, 1/27/26 (c) | | | | | | | 2,000 | | | | 2,003,738 | |

Mill Creek II CLO Ltd., Series 2016-1A, Class D, 5.88%, 4/20/28 (c) | | | | | | | 1,000 | | | | 1,013,189 | |

Oak Hill Credit Partners XII Ltd., Series 2015-12A, Class C2, 4.40%, 1/23/27 (c) | | | | | | | 1,600 | | | | 1,606,400 | |

Octagon Investment Partners 26 Ltd., Series 2016-1A, Class D, 6.11%, 4/15/27 (c) | | | | | | | 500 | | | | 507,551 | |

Octagon Investment Partners XX Ltd., Series 2014-1A, Class C, 3.83%, 8/12/26 (c) | | | | | | | 750 | | | | 750,053 | |

OZLM XI Ltd., Series 2015-11A, Class B, 4.04%, 1/30/27 (c) | | | | | | | 2,750 | | | | 2,761,267 | |

Regatta IV Funding Ltd., Series 2014-1A, Class C, 4.11%, 7/25/26 (c) | | | | | | | 1,500 | | | | 1,501,767 | |

Regatta V Funding Ltd., Series 2014-1A (c): | | | | | | | | | | | | |

Class BR, 3.46%, 10/25/26 | | | | | | | 1,000 | | | | 1,000,000 | |

Class C, 4.61%, 10/25/26 | | | | | | | 1,000 | | | | 999,921 | |

Symphony CLO Ltd., Series 2016-17A, Class D, 5.96%, 4/15/28 (c) | | | | | | | 1,000 | | | | 1,016,076 | |

Symphony CLO XV Ltd., Series 2014-15A (c): | | | | | | | | | �� | | | |

Class CR, 3.22%, 10/17/26 | | | | | | | 2,500 | | | | 2,499,670 | |

Class DR, 4.37%, 10/17/26 | | | | | | | 1,000 | | | | 999,866 | |

Venture XIII CLO Ltd., Series 2013-13A, Class D, 4.66%, 6/10/25 (c) | | | | | | | 800 | | | | 802,733 | |

Vibrant CLO II Ltd., Series 2013-2A, Class C, 4.75%, 7/24/24 (c) | | | | | | | 1,000 | | | | 994,905 | |

Voya CLO Ltd., Series 2014-4A, Class C, 5.16%, 10/14/26 (c) | | | | | | | 1,000 | | | | 1,003,779 | |

Webster Park CLO Ltd., Series 2015-1A, Class B1, 4.26%, 1/20/27 (c) | | | | | | | 4,000 | | | | 4,027,106 | |

| Total Asset-Backed Securities — 3.6% | | | | | | | | | | | 56,787,977 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

|

| Corporate Bonds | |

| Aerospace & Defense — 0.6% | | | | | | | | | |

Huntington Ingalls Industries, Inc., 5.00%, 12/15/21 (c) | | | | | | | 536 | | | | 555,095 | |

KLX, Inc., 5.88%, 12/01/22 (c) | | | | | | | 725 | | | | 762,156 | |

| | | | | | | | | | |

| Portfolio Abbreviations | | | | | | | | |

| ABS | | Asset-Backed Security | | FKA | | Formerly Known As | | MYR | | Malaysian Ringgit |

| ARB | | Airport Revenue Bonds | | GBP | | British Pound | | OTC | | Over-the-Counter |

| ARS | | Argentine Peso | | JPY | | Japanese Yen | | PIK | | Payment-In-Kind |

| AUD | | Australian Dollar | | KRW | | South Korean Won | | RB | | Revenue Bonds |

| BRL | | Brazilian Real | | KRWCD | | 3-Month Certificate of Deposit Rate | | RUB | | Russian Ruble |

| BZDIOVER | | 1-Day Brazil Interbank Deposit | | LIBOR | | London Interbank Offered Rate | | TRY | | Turkish Lira |

| CLO | | Collateralized Loan Obligation | | LOC | | Letter of Credit | | TWD | | Taiwan Dollar |

| DIP | | Debtor-In-Possession | | MXIBTIIE | | Mexico Interbank TIIE 28 Day | | USD | | U.S. Dollar |

| EUR | | Euro | | MXN | | Mexican Peso | | ZAR | | South African Rand |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | APRIL 30, 2017 | | 11 |

| | |

Schedule of Investments (continued) | | BlackRock Credit Allocation Income Trust (BTZ) |

| | | | | | | | | | | | |

| Corporate Bonds | | Par (000) | | | Value | |

| Aerospace & Defense (continued) | | | | | | | | | |

Mexico City Airport Trust, 4.25%, 10/31/26 (c) | | | USD | | | | 1,350 | | | $ | 1,363,500 | |

TransDigm, Inc.: | | | | | | | | | | | | |

6.00%, 7/15/22 | | | | | | | 4,360 | | | | 4,490,800 | |

6.50%, 7/15/24 | | | | | | | 1,560 | | | | 1,602,900 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 8,774,451 | |

| Air Freight & Logistics — 0.1% | | | | | | | | | |

XPO Logistics, Inc. (c): | | | | | | | | | | | | |

6.50%, 6/15/22 | | | | | | | 1,421 | | | | 1,504,484 | |

6.13%, 9/01/23 | | | | | | | 496 | | | | 520,800 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 2,025,284 | |

| Airlines — 0.9% | | | | | | | | | |

American Airlines Group, Inc., 4.63%, 3/01/20 (c) | | | | | | | 692 | | | | 704,110 | |

Continental Airlines Pass-Through Trust: | | | | | | | | | | | | |

Series 2009-2, Class B, 9.25%, 11/10/18 | | | | | | | 1,278 | | | | 1,279,703 | |

Series 2012-3, Class C, 6.13%, 4/29/18 | | | | | | | 2,040 | | | | 2,113,950 | |

Delta Air Lines Pass-Through Trust, Series 2002-1, Class G-1, 6.72%, 7/02/24 | | | | | | | 2,885 | | | | 3,249,284 | |

Turkish Airlines Pass-Through Trust, Series 2015-1 Class A, 4.20%, 9/15/28 (c) | | | | | | | 2,700 | | | | 2,561,887 | |

United Airlines Pass-Through Trust, Series 2014-1, Class B, 4.75%, 10/11/23 | | | | | | | 3,425 | | | | 3,510,254 | |

Virgin Australia Trust, Series 2013-1, Class B, 6.00%, 4/23/22 (c) | | | | | | | 830 | | | | 846,716 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 14,265,904 | |

| Auto Components — 0.5% | | | | | | | | | |

Allison Transmission, Inc., 5.00%, 10/01/24 (c) | | | | | | | 68 | | | | 69,275 | |

Goodyear Tire & Rubber Co., 5.00%, 5/31/26 | | | | | | | 535 | | | | 549,044 | |

Icahn Enterprises LP/Icahn Enterprises Finance Corp.: | | | | | | | | | | | | |

4.88%, 3/15/19 | | | | | | | 3,950 | | | | 3,999,375 | |

6.00%, 8/01/20 | | | | | | | 3,108 | | | | 3,216,780 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 7,834,474 | |

| Automobiles — 0.5% | | | | | | | | | |

Ford Motor Co., 7.45%, 7/16/31 | | | | | | | 3,660 | | | | 4,616,746 | |

General Motors Co.: | | | | | | | | | | | | |

4.88%, 10/02/23 | | | | | | | 1,875 | | | | 1,999,031 | |

6.25%, 10/02/43 | | | | | | | 940 | | | | 1,026,930 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 7,642,707 | |

| Banks — 4.9% | | | | | | | | | |

CIT Group, Inc.: | | | | | | | | | | | | |

4.25%, 8/15/17 | | | | | | | 4,600 | | | | 4,631,050 | |

5.25%, 3/15/18 | | | | | | | 4,030 | | | | 4,158,154 | |

5.50%, 2/15/19 (c) | | | | | | | 3,967 | | | | 4,190,144 | |

5.00%, 8/01/23 | | | | | | | 660 | | | | 709,500 | |

City National Corp., 5.25%, 9/15/20 (d) | | | | | | | 2,900 | | | | 3,172,438 | |

Cooperatieve Rabobank UA, 3.95%, 11/09/22 (d) | | | | | | | 3,775 | | | | 3,917,616 | |

Credit Suisse Group AG, 6.50%, 8/08/23 (c) | | | | | | | 6,000 | | | | 6,681,228 | |

Credit Suisse Group Funding Guernsey Ltd., 4.55%, 4/17/26 (d) | | | | | | | 5,000 | | | | 5,247,150 | |

Discover Bank/Greenwood, 8.70%, 11/18/19 | | | | | | | 748 | | | | 847,401 | |

| | | | | | | | | | | | |

| Corporate Bonds | | Par (000) | | | Value | |

| Banks (continued) | | | | | | | | | |

Fifth Third Bancorp, 5.10% (b)(e) | | | USD | | | | 5,000 | | | $ | 4,975,000 | |

HSBC Finance Corp., 6.68%, 1/15/21 (d) | | | | | | | 5,150 | | | | 5,850,858 | |

Intesa Sanpaolo SpA, 5.71%, 1/15/26 (c) | | | | | | | 5,840 | | | | 5,751,752 | |

Royal Bank of Scotland Group PLC, 6.00%, 12/19/23 | | | | | | | 10,080 | | | | 10,871,401 | |

SunTrust Banks, Inc., 5.05% (b)(e) | | | | | | | 5,270 | | | | 5,270,000 | |

Wells Fargo & Co.: | | | | | | | | | | | | |

3.45%, 2/13/23 | | | | | | | 2,325 | | | | 2,366,973 | |

4.13%, 8/15/23 (d) | | | | | | | 4,000 | | | | 4,218,736 | |

5.61%, 1/15/44 (d) | | | | | | | 4,119 | | | | 4,721,189 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 77,580,590 | |

| Beverages — 0.5% | | | | | | | | | |

Anheuser-Busch InBev Finance, Inc., 4.90%, 2/01/46 (d) | | | | | | | 6,170 | | | | 6,740,435 | |

Molson Coors Brewing Co., 4.20%, 7/15/46 | | | | | | | 1,665 | | | | 1,574,809 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 8,315,244 | |

| Biotechnology — 0.4% | | | | | | | | | |

Amgen, Inc., 4.66%, 6/15/51 (d) | | | | | | | 6,709 | | | | 6,759,136 | |

| Building Products — 0.2% | | | | | | | | | |

American Builders & Contractors Supply Co., Inc., 5.75%, 12/15/23 (c) | | | | | | | 424 | | | | 451,560 | |

Building Materials Corp. of America, 6.00%, 10/15/25 (c) | | | | | | | 1,832 | | | | 1,955,660 | |

Masonite International Corp., 5.63%, 3/15/23 (c) | | | | | | | 610 | | | | 632,875 | |

Standard Industries, Inc., 5.13%, 2/15/21 (c) | | | | | | | 420 | | | | 439,425 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 3,479,520 | |

| Capital Markets — 2.8% | | | | | | | | | |

E*Trade Financial Corp., 5.38%, 11/15/22 | | | | | | | 1,348 | | | | 1,423,697 | |

Goldman Sachs Group, Inc.: | | | | | | | | | | | | |

6.25%, 9/01/17 | | | | | | | 625 | | | | 634,788 | |

7.50%, 2/15/19 (d) | | | | | | | 5,165 | | | | 5,654,936 | |

5.25%, 7/27/21 | | | | | | | 1,175 | | | | 1,292,538 | |

5.75%, 1/24/22 (d) | | | | | | | 5,500 | | | | 6,205,194 | |

6.25%, 2/01/41 (d) | | | | | | | 15,000 | | | | 18,926,505 | |

Morgan Stanley (d): | | | | | | | | | | | | |

5.63%, 9/23/19 | | | | | | | 6,770 | | | | 7,310,591 | |

5.50%, 7/28/21 | | | | | | | 2,695 | | | | 3,000,308 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 44,448,557 | |

| Chemicals — 1.0% | | | | | | | | | |

Axalta Coating Systems LLC, 4.88%, 8/15/24 (c) | | | | | | | 715 | | | | 740,468 | |

Basell Finance Co. BV, 8.10%, 3/15/27 (c)(d) | | | | | | | 6,000 | | | | 8,027,610 | |

Huntsman International LLC: | | | | | | | | | | | | |

4.88%, 11/15/20 | | | | | | | 72 | | | | 75,690 | |

5.13%, 11/15/22 | | | | | | | 2,495 | | | | 2,622,869 | |

NOVA Chemicals Corp., 5.25%, 8/01/23 (c) | | | | | | | 772 | | | | 793,230 | |

Platform Specialty Products Corp. (c): | | | | | | | | | | | | |

10.38%, 5/01/21 | | | | | | | 165 | | | | 183,769 | |

6.50%, 2/01/22 | | | | | | | 1,372 | | | | 1,406,300 | |

PQ Corp., 6.75%, 11/15/22 (c) | | | | | | | 935 | | | | 1,014,465 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 14,864,401 | |

| Commercial Services & Supplies — 2.9% | | | | | | | | | |

Aviation Capital Group Corp. (c): | | | | | | | | | | | | |

7.13%, 10/15/20 | | | | | | | 31,000 | | | | 35,452,344 | |

6.75%, 4/06/21 | | | | | | | 7,850 | | | | 8,969,905 | |

United Rentals North America, Inc., 7.63%, 4/15/22 | | | | | | | 664 | | | | 693,050 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 45,115,299 | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 12 | | SEMI-ANNUAL REPORT | | APRIL 30, 2017 | | |

| | |

Schedule of Investments (continued) | | BlackRock Credit Allocation Income Trust (BTZ) |

| | | | | | | | | | | | |

| Corporate Bonds | | Par (000) | | | Value | |

| Communications Equipment — 0.4% | | | | | | | | | |

CommScope Technologies Finance LLC, 6.00%, 6/15/25 (c) | | | USD | | | | 467 | | | $ | 497,939 | |

CommScope Technologies LLC, 5.00%, 3/15/27 (c) | | | | | | | 2,896 | | | | 2,921,340 | |

CommScope, Inc., 5.50%, 6/15/24 (c) | | | | | | | 254 | | | | 266,065 | |

Zayo Group LLC/Zayo Capital, Inc.: | | | | | | | | | | | | |

6.38%, 5/15/25 | | | | | | | 1,418 | | | | 1,533,213 | |

5.75%, 1/15/27 (c) | | | | | | | 593 | | | | 629,321 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 5,847,878 | |

| Construction & Engineering — 0.2% | | | | | | | | | |

BlueLine Rental Finance Corp., 9.25%, 3/15/24 (c) | | | | | | | 2,288 | | | | 2,390,960 | |

Weekley Homes LLC/Weekley Finance Corp., 6.00%, 2/01/23 | | | | | | | 825 | | | | 800,250 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 3,191,210 | |

| Construction Materials — 0.5% | | | | | | | | | |

Allegion US Holding Co., Inc., 5.75%, 10/01/21 | | | | | | | 1,907 | | | | 1,989,239 | |

HD Supply, Inc. (c): | | | | | | | | | | | | |

5.25%, 12/15/21 | | | | | | | 3,278 | | | | 3,470,582 | |

5.75%, 4/15/24 | | | | | | | 1,701 | | | | 1,807,313 | |

PulteGroup, Inc., 5.50%, 3/01/26 | | | | | | | 926 | | | | 976,930 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 8,244,064 | |

| Consumer Discretionary — 0.0% | | | | | | | | | |

Nielsen Co. Luxembourg SARL, 5.00%, 2/01/25 (c) | | | | | | | 475 | | | | 475,594 | |

| Consumer Finance — 1.2% | | | | | | | | | |

Ally Financial, Inc.: | | | | | | | | | | | | |

5.13%, 9/30/24 | | | | | | | 590 | | | | 602,538 | |

4.63%, 3/30/25 | | | | | | | 136 | | | | 134,215 | |

8.00%, 11/01/31 | | | | | | | 5,539 | | | | 6,591,410 | |

Capital One Bank USA NA, 3.38%, 2/15/23 (d) | | | | | | | 2,000 | | | | 2,013,726 | |

Discover Financial Services, 3.85%, 11/21/22 | | | | | | | 3,252 | | | | 3,333,576 | |

Experian Finance PLC, 2.38%, 6/15/17 (c)(d) | | | | | | | 2,550 | | | | 2,552,430 | |

Navient Corp.: | | | | | | | | | | | | |

6.63%, 7/26/21 | | | | | | | 461 | | | | 488,084 | |

7.25%, 9/25/23 | | | | | | | 996 | | | | 1,040,820 | |

Total System Services, Inc., 3.80%, 4/01/21 | | | | | | | 1,630 | | | | 1,697,291 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 18,454,090 | |

| Containers & Packaging — 0.4% | | | | | | | | | |

Ardagh Packaging Finance PLC/Ardagh Holdings USA, Inc., 6.00%, 2/15/25 (c) | | | | | | | 811 | | | | 838,371 | |

Ball Corp., 4.38%, 12/15/20 | | | | | | | 681 | | | | 716,752 | |

Reynolds Group Issuer, Inc./Reynolds Group Issuer LLC: | | | | | | | | | | | | |

5.75%, 10/15/20 | | | | | | | 2,866 | | | | 2,951,980 | |

6.88%, 2/15/21 | | | | | | | 68 | | | | 69,926 | |

7.00%, 7/15/24 (c) | | | | | | | 1,247 | | | | 1,342,084 | |

Sealed Air Corp., 6.88%, 7/15/33 (c) | | | | | | | 182 | | | | 197,925 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 6,117,038 | |

| Diversified Consumer Services — 0.4% | | | | | | | | | |

Prime Security Services Borrower LLC/Prime Finance, Inc., 9.25%, 5/15/23 (c) | | | | | | | 1,295 | | | | 1,414,787 | |

Service Corp. International, 4.50%, 11/15/20 | | | | | | | 4,382 | | | | 4,461,446 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 5,876,233 | |

| | | | | | | | | | | | |

| Corporate Bonds | | Par (000) | | | Value | |

| Diversified Financial Services — 4.9% | | | | | | | | | |

AerCap Ireland Capital Ltd./AerCap Global Aviation Trust: | | | | | | | | | | | | |

4.63%, 10/30/20 | | | USD | | | | 961 | | | $ | 1,020,268 | |

4.63%, 7/01/22 | | | | | | | 518 | | | | 551,387 | |

Air Lease Corp., 3.75%, 2/01/22 | | | | | | | 5,000 | | | | 5,176,450 | |

Aircastle Ltd., 6.25%, 12/01/19 | | | | | | | 3,937 | | | | 4,269,676 | |

Bank of America Corp.: | | | | | | | | | | | | |

5.00%, 5/13/21 (d) | | | | | | | 17,100 | | | | 18,611,845 | |

4.45%, 3/03/26 | | | | | | | 1,765 | | | | 1,825,921 | |

Citigroup, Inc., 6.68%, 9/13/43 (d) | | | | | | | 4,125 | | | | 5,270,871 | |

Ford Motor Credit Co. LLC, 5.88%, 8/02/21 | | | | | | | 9,420 | | | | 10,480,164 | |

General Motors Financial Co., Inc.: | | | | | | | | | | | | |

6.75%, 6/01/18 | | | | | | | 1,700 | | | | 1,786,328 | |

4.38%, 9/25/21 | | | | | | | 2,260 | | | | 2,380,268 | |

4.25%, 5/15/23 | | | | | | | 1,681 | | | | 1,731,018 | |

ING Bank NV, 5.00%, 6/09/21 (c)(d) | | | | | | | 8,000 | | | | 8,775,904 | |

Jefferies Finance LLC/JFIN Co-Issuer Corp., 7.38%, 4/01/20 (c) | | | | | | | 1,705 | | | | 1,743,363 | |

Leucadia National Corp., 5.50%, 10/18/23 | | | | | | | 4,000 | | | | 4,308,132 | |

Resparcs Funding LP I, 8.00% (e)(f) | | | | | | | 4,000 | | | | 900,000 | |

Royal Bank of Scotland Group PLC: | | | | | | | | | | | | |

6.10%, 6/10/23 | | | | | | | 2,500 | | | | 2,687,718 | |

5.13%, 5/28/24 | | | | | | | 5,250 | | | | 5,397,530 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 76,916,843 | |

| Diversified Telecommunication Services — 6.3% | |

AT&T, Inc.: | | | | | | | | | | | | |

5.00%, 3/01/21 (d) | | | | | | | 8,575 | | | | 9,309,483 | |

6.30%, 1/15/38 (d) | | | | | | | 12,000 | | | | 13,730,268 | |

4.30%, 12/15/42 | | | | | | | 265 | | | | 237,481 | |

4.35%, 6/15/45 | | | | | | | 367 | | | | 325,690 | |

CenturyLink, Inc.: | | | | | | | | | | | | |

6.45%, 6/15/21 | | | | | | | 1,660 | | | | 1,792,800 | |

Series Y, 7.50%, 4/01/24 | | | | | | | 1,181 | | | | 1,283,168 | |

Frontier Communications Corp.: | | | | | | | | | | | | |

6.25%, 9/15/21 | | | | | | | 980 | | | | 908,950 | |

7.13%, 1/15/23 | | | | | | | 55 | | | | 48,125 | |

7.63%, 4/15/24 | | | | | | | 1,309 | | | | 1,122,468 | |

6.88%, 1/15/25 | | | | | | | 3,964 | | | | 3,301,021 | |

Level 3 Financing, Inc.: | | | | | | | | | | | | |

5.38%, 8/15/22 | | | | | | | 2,095 | | | | 2,163,507 | |

5.13%, 5/01/23 | | | | | | | 1,183 | | | | 1,214,054 | |

5.38%, 1/15/24 | | | | | | | 754 | | | | 783,662 | |

5.38%, 5/01/25 | | | | | | | 2,003 | | | | 2,088,128 | |

SBA Communications Corp., 4.88%, 9/01/24 (c) | | | | | | | 1,658 | | | | 1,672,508 | |

Telefonica Emisiones SAU: | | | | | | | | | | | | |

3.19%, 4/27/18 | | | | | | | 6,550 | | | | 6,637,239 | |

5.21%, 3/08/47 | | | | | | | 5,000 | | | | 5,195,035 | |

Verizon Communications, Inc. (d): | | | | | | | | | | | | |

5.15%, 9/15/23 | | | | | | | 8,775 | | | | 9,711,222 | |

6.40%, 9/15/33 | | | | | | | 9,475 | | | | 11,321,535 | |

6.55%, 9/15/43 | | | | | | | 13,225 | | | | 16,230,183 | |

5.01%, 4/15/49 (c) | | | | | | | 10,578 | | | | 10,380,953 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 99,457,480 | |

| Electric Utilities — 4.7% | | | | | | | | | |

CMS Energy Corp., 5.05%, 3/15/22 | | | | | | | 9,900 | | | | 10,903,206 | |

Duke Energy Corp., 3.55%, 9/15/21 (d) | | | | | | | 3,650 | | | | 3,798,891 | |

Emera, Inc., Series 16-A, 6.75%, 6/15/76 (b) | | | | | | | 7,500 | | | | 8,259,375 | |

Great Plains Energy, Inc., 5.29%, 6/15/22 (g) | | | | | | | 5,550 | | | | 6,095,787 | |

Midland Cogeneration Venture LP, 5.25%, 3/15/25 (c) | | | | | | | 3,953 | | | | 4,091,500 | |

NiSource Finance Corp., 6.80%, 1/15/19 (d) | | | | | | | 3,075 | | | | 3,311,972 | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | APRIL 30, 2017 | | 13 |

| | |

Schedule of Investments (continued) | | BlackRock Credit Allocation Income Trust (BTZ) |

| | | | | | | | | | | | |

| Corporate Bonds | | Par (000) | | | Value | |

| Electric Utilities (continued) | | | | | | | | | |

Oncor Electric Delivery Co. LLC (d): | | | | | | | | | | | | |

4.10%, 6/01/22 | | | USD | | | | 4,150 | | | $ | 4,423,751 | |

5.30%, 6/01/42 | | | | | | | 2,750 | | | | 3,252,972 | |

Progress Energy, Inc., 7.00%, 10/30/31 | | | | | | | 12,000 | | | | 15,965,592 | |

Puget Energy, Inc.: | | | | | | | | | | | | |

6.00%, 9/01/21 | | | | | | | 275 | | | | 307,272 | |

5.63%, 7/15/22 | | | | | | | 5,550 | | | | 6,169,663 | |

Southern Co., 4.40%, 7/01/46 | | | | | | | 7,500 | | | | 7,461,330 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 74,041,311 | |

| Electronic Equipment, Instruments & Components — 0.5% | |

CDW LLC/CDW Finance Corp.: | | | | | | | | | | | | |

5.00%, 9/01/23 | | | | | | | 306 | | | | 314,415 | |

5.50%, 12/01/24 | | | | | | | 2,458 | | | | 2,617,770 | |

Jabil Circuit, Inc., 8.25%, 3/15/18 | | | | | | | 2,600 | | | | 2,743,762 | |

Sanmina Corp., 4.38%, 6/01/19 (c) | | | | | | | 1,415 | | | | 1,450,375 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 7,126,322 | |

| Energy Equipment & Services — 0.7% | | | | | | | | | |

Genesis Energy LP/Genesis Energy Finance Corp.: | | | | | | | | | | | | |

5.75%, 2/15/21 | | | | | | | 473 | | | | 478,321 | |

6.75%, 8/01/22 | | | | | | | 1,175 | | | | 1,208,781 | |

GrafTech International Ltd., 6.38%, 11/15/20 | | | | | | | 890 | | | | 772,075 | |

Halliburton Co., 5.00%, 11/15/45 | | | | | | | 6,615 | | | | 7,061,764 | |

Noble Holding International Ltd., 4.63%, 3/01/21 | | | | | | | 34 | | | | 31,280 | |

Transocean, Inc., 6.00%, 3/15/18 | | | | | | | 880 | | | | 898,700 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 10,450,921 | |

| Food & Staples Retailing — 1.6% | | | | | | | | | |

Albertsons Cos. LLC/Safeway, Inc./New Albertson’s, Inc./Albertson’s LLC (c): | | | | | | | | | | | | |

6.63%, 6/15/24 | | | | | | | 775 | | | | 792,437 | |

5.75%, 3/15/25 | | | | | | | 1,120 | | | | 1,089,200 | |

CVS Health Corp.: | | | | | | | | | | | | |

4.75%, 12/01/22 | | | | | | | 289 | | | | 316,287 | |

5.00%, 12/01/24 | | | | | | | 183 | | | | 201,620 | |

5.13%, 7/20/45 (d) | | | | | | | 3,879 | | | | 4,335,031 | |

Dollar Tree, Inc.: | | | | | | | | | | | | |

5.25%, 3/01/20 | | | | | | | 105 | | | | 108,019 | |

5.75%, 3/01/23 | | | | | | | 3,938 | | | | 4,178,218 | |

H.J. Heinz Finance Co., 7.13%, 8/01/39 (c) | | | | | | | 4,415 | | | | 5,690,683 | |

Rite Aid Corp.: | | | | | | | | | | | | |

6.75%, 6/15/21 | | | | | | | 541 | | | | 545,058 | |

6.13%, 4/01/23 (c) | | | | | | | 2,194 | | | | 2,172,060 | |

Wal-Mart Stores, Inc., 5.25%, 9/01/35 (d) | | | | | | | 5,150 | | | | 6,180,051 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 25,608,664 | |

| Food Products — 1.1% | | | | | | | | | |

Aramark Services, Inc., 5.13%, 1/15/24 | | | | | | | 815 | | | | 859,825 | |

FAGE International SA/FAGE USA Dairy Industry, Inc., 5.63%, 8/15/26 (c) | | | | | | | 465 | | | | 473,138 | |

Kraft Foods, Inc.: | | | | | | | | | | | | |

6.50%, 8/11/17 (d) | | | | | | | 4,450 | | | | 4,507,841 | |

6.13%, 8/23/18 | | | | | | | 4,840 | | | | 5,109,191 | |

Kraft Heinz Foods Co., 4.38%, 6/01/46 | | | | | | | 2,475 | | | | 2,354,807 | |

Post Holdings, Inc. (c): | | | | | | | | | | | | |

7.75%, 3/15/24 | | | | | | | 1,502 | | | | 1,669,097 | |

8.00%, 7/15/25 | | | | | | | 743 | | | | 845,162 | |

5.00%, 8/15/26 | | | | | | | 1,349 | | | | 1,342,255 | |

TreeHouse Foods, Inc., 6.00%, 2/15/24 (c) | | | | | | | 431 | | | | 459,015 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 17,620,331 | |

| | | | | | | | | | | | |

| Corporate Bonds | | Par (000) | | | Value | |

| Health Care Equipment & Supplies — 0.6% | | | | | | | | | |

DJO Finco, Inc./DJO Finance LLC/DJO Finance Corp., 8.13%, 6/15/21 (c) | | | USD | | | | 2,065 | | | $ | 1,822,362 | |

Mallinckrodt International Finance SA/Mallinckrodt CB LLC (c): | | | | | | | | | | | | |

4.88%, 4/15/20 | | | | | | | 517 | | | | 515,708 | |

5.75%, 8/01/22 | | | | | | | 1,370 | | | | 1,346,025 | |

5.63%, 10/15/23 | | | | | | | 506 | | | | 483,230 | |

Medtronic, Inc., 4.63%, 3/15/45 (d) | | | | | | | 4,565 | | | | 4,965,793 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 9,133,118 | |

| Health Care Providers & Services — 3.6% | | | | | | | | | |

Acadia Healthcare Co., Inc., 5.13%, 7/01/22 | | | | | | | 191 | | | | 193,149 | |

Amsurg Corp., 5.63%, 7/15/22 | | | | | | | 1,466 | | | | 1,512,399 | |

Centene Corp.: | | | | | | | | | | | | |

5.63%, 2/15/21 | | | | | | | 875 | | | | 919,844 | |

6.13%, 2/15/24 | | | | | | | 645 | | | | 694,988 | |

CHS/Community Health Systems, Inc.: | | | | | | | | | | | | |

6.88%, 2/01/22 | | | | | | | 1,111 | | | | 919,352 | |

6.25%, 3/31/23 | | | | | | | 1,447 | | | | 1,472,322 | |

DaVita HealthCare Partners, Inc., 5.13%, 7/15/24 | | | | | | | 1,990 | | | | 2,045,979 | |

HCA, Inc.: | | | | | | | | | | | | |

3.75%, 3/15/19 | | | | | | | 4,364 | | | | 4,456,735 | |

6.50%, 2/15/20 | | | | | | | 10,421 | | | | 11,437,673 | |

7.50%, 2/15/22 | | | | | | | 2,214 | | | | 2,546,986 | |

5.88%, 3/15/22 | | | | | | | 340 | | | | 376,975 | |

4.75%, 5/01/23 | | | | | | | 236 | | | | 247,800 | |

5.38%, 2/01/25 | | | | | | | 440 | | | | 458,150 | |

5.88%, 2/15/26 | | | | | | | 1,297 | | | | 1,378,062 | |

HealthSouth Corp.: | | | | | | | | | | | | |

5.13%, 3/15/23 | | | | | | | 512 | | | | 513,920 | |

5.75%, 11/01/24 | | | | | | | 637 | | | | 648,944 | |

Hologic, Inc., 5.25%, 7/15/22 (c) | | | | | | | 742 | | | | 781,882 | |

MEDNAX, Inc., 5.25%, 12/01/23 (c) | | | | | | | 587 | | | | 600,208 | |

MPH Acquisition Holdings LLC, 7.13%, 6/01/24 (c) | | | | | | | 829 | | | | 891,175 | |

RegionalCare Hospital Partners Holdings, Inc., 8.25%, 5/01/23 (c) | | | | | | | 1,109 | | | | 1,179,837 | |

Tenet Healthcare Corp.: | | | | | | | | | | | | |

6.25%, 11/01/18 | | | | | | | 736 | | | | 771,431 | |

4.75%, 6/01/20 | | | | | | | 1,450 | | | | 1,471,750 | |

6.00%, 10/01/20 | | | | | | | 3,645 | | | | 3,836,362 | |

4.50%, 4/01/21 | | | | | | | 73 | | | | 72,909 | |

7.50%, 1/01/22 (c) | | | | | | | 394 | | | | 421,580 | |

8.13%, 4/01/22 | | | | | | | 1,907 | | | | 1,935,605 | |

6.75%, 6/15/23 | | | | | | | 1,758 | | | | 1,678,890 | |

UnitedHealth Group, Inc., 6.88%, 2/15/38 (d) | | | | | | | 10,000 | | | | 13,779,620 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 57,244,527 | |

| Hotels, Restaurants & Leisure — 0.4% | | | | | | | | | |

ESH Hospitality, Inc., 5.25%, 5/01/25 (c) | | | | | | | 910 | | | | 921,375 | |

KFC Holding Co/Pizza Hut Holdings LLC/Taco Bell of America LLC (c): | | | | | | | | | | | | |

5.00%, 6/01/24 | | | | | | | 600 | | | | 619,500 | |

5.25%, 6/01/26 | | | | | | | 650 | | | | 666,250 | |

MGM Resorts International, 6.75%, 10/01/20 | | | | | | | 214 | | | | 238,075 | |

New Red Finance, Inc., 6.00%, 4/01/22 (c) | | | | | | | 2,215 | | | | 2,309,138 | |

Sabre GLBL, Inc. (c): | | | | | | | | | | | | |

5.38%, 4/15/23 | | | | | | | 594 | | | | 617,760 | |

5.25%, 11/15/23 | | | | | | | 294 | | | | 304,290 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 5,676,388 | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 14 | | SEMI-ANNUAL REPORT | | APRIL 30, 2017 | | |

| | |

Schedule of Investments (continued) | | BlackRock Credit Allocation Income Trust (BTZ) |

| | | | | | | | | | | | |

| Corporate Bonds | | Par (000) | | | Value | |

| Household Durables — 0.8% | | | | | | | | | |

Brookfield Residential Properties, Inc./Brookfield Residential US Corp., 6.13%, 7/01/22 (c) | | | USD | | | | 1,647 | | | $ | 1,716,997 | |

CalAtlantic Group, Inc., 8.38%, 1/15/21 | | | | | | | 3,015 | | | | 3,542,625 | |

Lennar Corp.: | | | | | | | | | | | | |

4.75%, 11/15/22 | | | | | | | 1,805 | | | | 1,877,200 | |

4.88%, 12/15/23 | | | | | | | 466 | | | | 482,310 | |

Newell Brands, Inc.: | | | | | | | | | | | | |

3.85%, 4/01/23 | | | | | | | 2,585 | | | | 2,699,252 | |

4.20%, 4/01/26 | | | | | | | 955 | | | | 1,003,766 | |

TRI Pointe Group, Inc.: | | | | | | | | | | | | |

4.38%, 6/15/19 | | | | | | | 920 | | | | 947,600 | |

5.88%, 6/15/24 | | | | | | | 625 | | | | 657,813 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 12,927,563 | |

| Household Products — 0.2% | | | | | | | | | |

Spectrum Brands, Inc.: | | | | | | | | | | | | |

6.63%, 11/15/22 | | | | | | | 1,110 | | | | 1,168,275 | |

6.13%, 12/15/24 | | | | | | | 231 | | | | 246,172 | |

5.75%, 7/15/25 | | | | | | | 1,002 | | | | 1,074,054 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 2,488,501 | |

| Independent Power and Renewable Electricity Producers — 0.6% | |

Calpine Corp.: | | | | | | | | | | | | |

6.00%, 1/15/22 (c) | | | | | | | 1,548 | | | | 1,617,660 | |

5.88%, 1/15/24 (c) | | | | | | | 823 | | | | 864,150 | |

5.75%, 1/15/25 | | | | | | | 1,064 | | | | 1,029,420 | |

Dynegy, Inc., 6.75%, 11/01/19 | | | | | | | 1,945 | | | | 1,974,175 | |

NRG Energy, Inc., 6.63%, 1/15/27 | | | | | | | 2,746 | | | | 2,718,540 | |

QEP Resources, Inc., 5.38%, 10/01/22 | | | | | | | 1,927 | | | | 1,902,913 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 10,106,858 | |

| Industrial Conglomerates — 0.0% | | | | | | | | | |

Vertiv Group Corp, 9.25%, 10/15/24 (c) | | | | | | | 623 | | | | 668,946 | |

| Insurance — 2.8% | | | | | | | | | |

American International Group, Inc., 6.40%, 12/15/20 | | | | | | | 8,710 | | | | 9,863,500 | |

Aon Corp., 5.00%, 9/30/20 (d) | | | | | | | 7,700 | | | | 8,317,409 | |

Aon PLC, 4.25%, 12/12/42 (d) | | | | | | | 6,500 | | | | 6,046,937 | |

Forethought Financial Group, Inc., 8.63%, 4/15/21 (c) | | | | | | | 3,400 | | | | 3,804,478 | |

Northwestern Mutual Life Insurance Co., 6.06%, 3/30/40 (c)(d) | | | | | | | 12,000 | | | | 15,424,080 | |

Radian Group, Inc., 5.25%, 6/15/20 | | | | | | | 1,045 | | | | 1,092,025 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 44,548,429 | |

| Internet Software & Services — 0.1% | | | | | | | | | |

Equinix, Inc., 5.88%, 1/15/26 | | | | | | | 1,061 | | | | 1,143,228 | |

Netflix, Inc., 5.50%, 2/15/22 | | | | | | | 563 | | | | 602,410 | |

Symantec Corp., 5.00%, 4/15/25 (c) | | | | | | | 347 | | | | 358,711 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 2,104,349 | |

| IT Services — 0.7% | | | | | | | | | |

Ceridian HCM Holding, Inc., 11.00%, 3/15/21 (c) | | | | | | | 1,755 | | | | 1,851,525 | |

Fidelity National Information Services, Inc., 5.00%, 10/15/25 | | | | | | | 1,935 | | | | 2,134,796 | |

First Data Corp. (c): | | | | | | | | | | | | |

5.38%, 8/15/23 | | | | | | | 764 | | | | 794,560 | |

7.00%, 12/01/23 | | | | | | | 4,908 | | | | 5,262,358 | |

5.75%, 1/15/24 | | | | | | | 720 | | | | 747,000 | |

Gartner, Inc., 5.13%, 4/01/25 (c) | | | | | | | 483 | | | | 499,905 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 11,290,144 | |

| Life Sciences Tools & Services — 0.8% | | | | | | | | | |

Life Technologies Corp., 6.00%, 3/01/20 | | | | | | | 12,000 | | | | 13,151,616 | |

| | | | | | | | | | | | |

| Corporate Bonds | | Par (000) | | | Value | |

| Media — 7.4% | | | | | | | | | |

21st Century Fox America, Inc., 6.15%, 3/01/37 (d) | | | USD | | | | 9,575 | | | $ | 11,453,040 | |

A&E Television Networks LLC, 3.11%, 8/22/19 | | | | | | | 5,000 | | | | 5,033,000 | |

Altice Financing SA, 7.50%, 5/15/26 (c) | | | | | | | 2,172 | | | | 2,345,760 | |

Altice Luxembourg SA (c): | | | | | | | | | | | | |

7.75%, 5/15/22 | | | | | | | 2,362 | | | | 2,509,932 | |

7.63%, 2/15/25 | | | | | | | 1,752 | | | | 1,870,260 | |

Altice US Finance I Corp. (c): | | | | | | | | | | | | |

5.38%, 7/15/23 | | | | | | | 2,919 | | | | 3,046,706 | |

5.50%, 5/15/26 | | | | | | | 1,211 | | | | 1,251,871 | |

AMC Networks, Inc.: | | | | | | | | | | | | |

4.75%, 12/15/22 | | | | | | | 685 | | | | 698,700 | |

5.00%, 4/01/24 | | | | | | | 432 | | | | 437,681 | |

CCO Holdings LLC/CCO Holdings Capital Corp. (c): | | | | | | | | | | | | |

5.88%, 4/01/24 | | | | | | | 1,759 | | | | 1,884,329 | |

5.75%, 2/15/26 | | | | | | | 499 | | | | 530,028 | |

5.50%, 5/01/26 | | | | | | | 1,219 | | | | 1,279,194 | |

5.13%, 5/01/27 | | | | | | | 1,961 | | | | 2,000,220 | |

Charter Communications Operating LLC/Charter Communications Operating Capital: | | | | | | | | | | | | |

6.38%, 10/23/35 | | | | | | | 479 | | | | 548,968 | |

6.48%, 10/23/45 | | | | | | | 9,584 | | | | 11,255,191 | |

6.83%, 10/23/55 | | | | | | | 3,540 | | | | 4,153,323 | |

Cinemark USA, Inc., 5.13%, 12/15/22 | | | | | | | 349 | | | | 359,470 | |

Clear Channel Worldwide Holdings, Inc., 6.50%, 11/15/22 | | | | | | | 11,711 | | | | 12,090,706 | |

Cox Communications, Inc., 8.38%, 3/01/39 (c)(d) | | | | | | | 5,000 | | | | 6,211,295 | |

CSC Holdings LLC: | | | | | | | | | | | | |

8.63%, 2/15/19 | | | | | | | 4,005 | | | | 4,411,708 | |

6.63%, 10/15/25 (c) | | | | | | | 832 | | | | 910,000 | |

DISH DBS Corp., 7.75%, 7/01/26 | | | | | | | 1,901 | | | | 2,226,546 | |

Grupo Televisa SAB, 5.00%, 5/13/45 (d) | | | | | | | 3,345 | | | | 3,151,326 | |

Hughes Satellite Systems Corp. (c): | | | | | | | | | | | | |

5.25%, 8/01/26 | | | | | | | 1,017 | | | | 1,034,797 | |

6.63%, 8/01/26 | | | | | | | 685 | | | | 705,550 | |

Intelsat Jackson Holdings SA: | | | | | | | | | | | | |

7.25%, 4/01/19 | | | | | | | 1,107 | | | | 1,064,104 | |

5.50%, 8/01/23 | | | | | | | 1,127 | | | | 962,176 | |

Interpublic Group of Cos., Inc., 3.75%, 2/15/23 | | | | | | | 6,025 | | | | 6,214,884 | |

MDC Partners, Inc., 6.50%, 5/01/24 (c) | | | | | | | 1,036 | | | | 1,010,100 | |

NAI Entertainment Holdings/NAI Entertainment Holdings Finance Corp., 5.00%, 8/01/18 (c) | | | | | | | 1,471 | | | | 1,482,032 | |

Nexstar Broadcasting, Inc., 5.63%, 8/01/24 (c) | | | | | | | 495 | | | | 507,375 | |

Outfront Media Capital LLC/Outfront Media Capital Corp.: | | | | | | | | | | | | |

5.25%, 2/15/22 | | | | | | | 249 | | | | 258,649 | |

5.63%, 2/15/24 | | | | | | | 122 | | | | 128,100 | |

SFR Group SA (c): | | | | | | | | | | | | |

6.00%, 5/15/22 | | | | | | | 4,544 | | | | 4,737,120 | |

7.38%, 5/01/26 | | | | | | | 5,843 | | | | 6,142,454 | |

Time Warner Cable, Inc., 6.55%, 5/01/37 | | | | | | | 3,519 | | | | 4,090,081 | |

Time Warner, Inc.: | | | | | | | | | | | | |

4.65%, 6/01/44 | | | | | | | 28 | | | | 26,426 | |

4.85%, 7/15/45 | | | | | | | 97 | | | | 93,891 | |

Tribune Media Co., 5.88%, 7/15/22 | | | | | | | 1,308 | | | | 1,374,080 | |

Univision Communications, Inc. (c): | | | | | | | | | | | | |

5.13%, 5/15/23 | | | | | | | 5,293 | | | | 5,379,011 | |

5.13%, 2/15/25 | | | | | | | 999 | | | | 995,254 | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | SEMI-ANNUAL REPORT | | APRIL 30, 2017 | | 15 |

| | |

Schedule of Investments (continued) | | BlackRock Credit Allocation Income Trust (BTZ) |

| | | | | | | | | | | | |

| Corporate Bonds | | Par (000) | | | Value | |

| Media (continued) | | | | | | | | | |

Virgin Media Secured Finance PLC, 5.50%, 8/15/26 (c) | | | USD | | | | 487 | | | $ | 497,349 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | 116,362,687 | |

| Metals & Mining — 3.5% | | | | | | | | | |

Alcoa Nederland Holding BV, 7.00%, 9/30/26 (c) | | | | | | | 291 | | | | 321,555 | |

Alcoa, Inc., 5.13%, 10/01/24 | | | | | | | 1,903 | | | | 1,993,392 | |

Anglo American Capital PLC, 4.45%, 9/27/20 (c) | | | | | | | 136 | | | | 141,440 | |

AngloGold Ashanti Holdings PLC, 5.13%, 8/01/22 | | | | | | | 5,000 | | | | 5,165,000 | |

ArcelorMittal: | | | | | | | | | | | | |

6.13%, 6/01/18 | | | | | | | 2,575 | | | | 2,683,897 | |

7.50%, 3/01/41 | | | | | | | 455 | | | | 511,875 | |

Commercial Metals Co., 4.88%, 5/15/23 | | | | | | | 2,194 | | | | 2,204,970 | |

Constellium NV: | | | | | | | | | | | | |

4.63%, 5/15/21 | | | EUR | | | | 490 | | | | 534,525 | |

5.75%, 5/15/24 (c) | | | USD | | | | 1,728 | | | | 1,620,000 | |

6.63%, 3/01/25 (c) | | | | | | | 1,353 | | | | 1,332,705 | |

First Quantum Minerals Ltd. (c): | | | | | | | | | | | | |

7.00%, 2/15/21 | | | | | | | 138 | | | | 142,830 | |

7.25%, 5/15/22 | | | | | | | 912 | | | | 939,360 | |

7.25%, 4/01/23 | | | | | | | 832 | | | | 847,080 | |

7.50%, 4/01/25 | | | | | | | 1,463 | | | | 1,492,260 | |

FMG Resources August 2006 Property Ltd., 9.75%, 3/01/22 (c) | | | | | | | 826 | | | | 950,416 | |

Freeport-McMoRan, Inc.: | | | | | | | | | | | | |

2.38%, 3/15/18 | | | | | | | 4,664 | | | | 4,640,680 | |

4.00%, 11/14/21 | | | | | | | 500 | | | | 490,625 | |

3.55%, 3/01/22 | | | | | | | 236 | | | | 221,840 | |

3.88%, 3/15/23 | | | | | | | 5,360 | | | | 4,971,400 | |

5.40%, 11/14/34 | | | | | | | 2,250 | | | | 1,996,875 | |

5.45%, 3/15/43 | | | | | | | 1,542 | | | | 1,314,555 | |

Novelis Corp. (c): | | | | | | | | | | | | |

6.25%, 8/15/24 | | | | | | | 2,862 | | | | 3,012,255 | |