UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22001

db-X Exchange-Traded Funds Inc.

(Exact name of Registrant as specified in charter)

60 Wall Street

New York, New York 10005

(Address of principal executive offices) (Zip code)

Alex Depetris

db-X Exchange-Traded Funds Inc.

60 Wall Street

New York, New York 10005

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 250-4352

Date of fiscal year end: May 31, 2011

Date of reporting period: May 31, 2011

| Item 1. | Report to Stockholders. |

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

ANNUAL REPORT

May 31, 2011

db-X Exchange-Traded Funds Inc.

db-X 2010 Target Date Fund

(formerly, TDX Independence 2010 Exchange-Traded Fund)

db-X 2020 Target Date Fund

(formerly, TDX Independence 2020 Exchange-Traded Fund)

db-X 2030 Target Date Fund

(formerly, TDX Independence 2030 Exchange-Traded Fund)

db-X 2040 Target Date Fund

(formerly, TDX Independence 2040 Exchange-Traded Fund)

db-X In-Target Date Fund

(formerly, TDX Independence In-Target Exchange-Traded Fund)

db-X Exchange-Traded Funds Inc.

TABLE OF CONTENTS

This Page is Intentionally Left Blank

TO OUR SHAREHOLDERS:

Dear Shareholder,

We are pleased to present this Annual Report for db-X Exchange-Traded Funds Inc. (formerly TDX Independence Funds, Inc.), which covers the year ending May 31, 2011.

Effective June 17, 2011, the names of the funds were changed to the “db-X” brand, to make it easier for investors to identify our funds. Although the names of the funds have changed, their ticker symbols and investment strategies remain the same. This change reflects our commitment to providing outstanding products and support in order to help you reach you investment goals.

Over the past year, the funds have continued to highlight the benefits of target-date investing. During the twelve months covered by this report, the db-X 2040 Target Date Fund (formerly TDX Independence 2040 Exchange-Traded Fund) and the db-X 2030 Target Date Fund (formerly TDX Independence 2030 Exchange-Traded Fund), which have the greatest percentage allocations to equities, benefitted from strong performance in domestic and international equity markets and experienced net asset value (NAV) returns of 26.32% and 23.74%, respectively.* The db-X 2020 Target Date Fund (formerly TDX Independence 2020 Exchange-Traded Fund), with a more balanced allocation between equity and fixed income securities, experienced a NAV return of 18.71%.* For investors with a shorter investment horizon, the db-X 2010 Target Date Fund (formerly TDX Independence 2010 Exchange-Traded Fund) and the db-X In-Target Date Fund (formerly TDX Independence In-Target Exchange-Traded Fund), which allocate a large percentage of assets to less volatile fixed-income securities, experienced NAV returns of 6.09% and 7.44%, respectively.*

Deutsche Bank, a leading global banking institution, has managed and operated a successful and growing platform of exchange-traded products since 2006. Our team at Deutsche Bank values the trust that you have placed in us and we look forward to meeting your investment needs by continuing to offer innovative index-driven strategies.

Very truly yours,

|

|

Alex N. Depetris Chairman, President and Chief Executive Officer July 25, 2011 |

* Performance quoted represents past performance, assumes reinvestment of all dividends and capital gains distributions at NAV, and does not guarantee future results. The NAV return is based on the changes in a Fund’s per share NAV for the period(s) indicated. The Fund’s NAV per share is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. Current performance may be higher or lower than the performance quoted. See pages 3-12 of this report for additional performance information, including performance data based on market value. Performance data for the most recent month end may be obtained by visiting www.dbxstrategicadvisors.db.com. Investment in the Funds poses investment risk including the possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost.

1

This Page is Intentionally Left Blank

db-X Exchange-Traded Funds Inc.

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

After being range-bound for much of the summer in 2010, a six month rally spurred by the Federal Reserve’s second round of quantitative easing and improving economic conditions helped lead equity markets to strong gains for the year ended May 31, 2011 with the S&P 500 Index increasing 25.95%, the Russell 3000 Index increasing 27.04% and the NASDAQ Composite Index increasing 26.92%. International equity markets also exhibited strength, with the MSCI EAFE Index (measuring equities in Europe, Australasia and the Far East) gaining 30.41%. U.S. fixed income securities continued to be a haven for risk-averse investors, with the Barclays Capital U.S. Aggregate Bond Index increasing 5.84% during the same period.

db-X Exchange-Traded Funds Inc. (the “Funds”) had a wide range of returns during the year. (For specific performance results, please refer to the Fund Performance Section on the following pages of this report.) The wide range in the performance of the five Funds was due to the varying allocations in the funds to domestic equities, international equities and fixed income securities. The 2040 Fund, which is allocated heavily towards U.S. equities, experienced a strong gain of 26.32% during the one year period ending May 31, 2011. The 2010 Fund, which has a heavy exposure to short-term U.S. Treasury securities, returned a more modest 6.09% during the same period.

The Standard & Poor’s (“S&P”) 500 Index is a broad-based index designed to measure the performance of the domestic stock market as represented by 500 large capitalization stocks.

The Russell 3000 Index is a broad-based index representing approximately 98% of the investable U.S. equity market.

The NASDAQ Composite Index is a broad-based index of NASDAQ-listed securities commonly used as a barometer of technology stock performance.

The Morgan Stanley Capital International (“MSCI”) EAFE Index is a broad-based index representing the largest stocks by market capitalization in 21 developed countries in Europe, Australasia and the Far East.

The Barclays Capital U.S. Aggregate Bond Index is a broad-based index designed to represent the U.S. investment-grade bond universe.

One cannot invest directly in an index. Performance quoted represents past performance and does not guarantee future results.

2

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

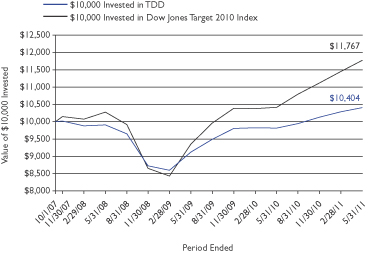

db-X 2010 Target Date Fund (TDD)

The db-X 2010 Target Date Fund (the “Fund”) commenced investment operations and its shares began trading on the NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks 2010 Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks 2010 Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

For the fiscal year ended May 31, 2011, the Fund’s net asset value increased 6.09%, compared to an increase of 6.56% for the Zacks 2010 Lifecycle Index and 13.01% for the Dow Jones Target 2010 Index. The fund’s performance benefited from favorable results in several equity sectors, in particular Energy, Information Technology and Industrials, partially offset by the Fund’s heavier weighting to fixed income securities, in particular short-term U.S. Treasury securities.

Performance as of 5/31/11

| | | | | | | | |

| Average Annual Total Return |

| | | Net Asset Value | | Market Price | | Zacks 2010 Lifecycle

Index | | Dow Jones Target 2010

Index |

One Year | | 6.09% | | 3.53% | | 6.56% | | 13.01% |

Since Inception1 | | 1.09% | | 0.35% | | 1.25% | | 4.54% |

|

| Cumulative Total Return |

| | | Net Asset Value | | Market Price | | Zacks 2010 Lifecycle

Index | | Dow Jones Target 2010

Index |

One Year | | 6.09% | | 3.53% | | 6.56% | | 13.01% |

Since Inception1 | | 4.04% | | 1.31% | | 4.64% | | 17.67% |

1 Total returns are calculated based on the commencement of trading, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.dbxstrategicadvisors.db.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio for the fiscal year ended May 31, 2010, as disclosed in the most recent prospectus dated September 28, 2010, was 2.10%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/11.

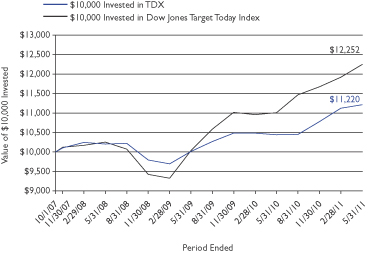

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash subindexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the Underlying Index will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

3

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db-X 2010 Target Date Fund (TDD) (Continued)

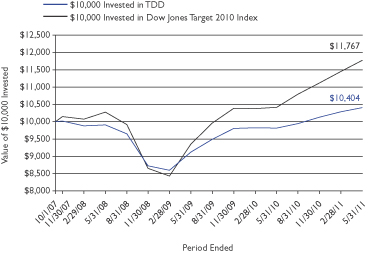

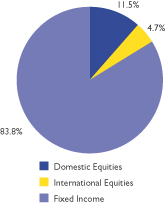

Growth of a $10,000 Investment in TDD2 as of 5/31/11

2 Based on Net Asset Value from commencement of trading 10/1/07.

Asset Class Breakdown* as of 5/31/11

* Weightings are expressed as a percentage of total investments and may change over time.

Top Ten Holdings3 as of 5/31/11

| | | | | | | | | | | | |

| |

| Top Ten Equity Holdings | |

| | | |

| Description | | Shares | | | Value | | | % of Net Assets | |

Exxon Mobil Corp. | | | 794 | | | | $66,275 | | | | 0.5% | |

Apple, Inc. | | | 150 | | | | 52,174 | | | | 0.4% | |

Chevron Corp. | | | 325 | | | | 34,096 | | | | 0.2% | |

International Business Machines Corp. | | | 199 | | | | 33,617 | | | | 0.2% | |

General Electric Co. | | | 1,662 | | | | 32,641 | | | | 0.2% | |

Berkshire Hathaway, Inc., Class B | | | 409 | | | | 32,340 | | | | 0.2% | |

Microsoft Corp. | | | 1,217 | | | | 30,437 | | | | 0.2% | |

Wal-Mart Stores, Inc. | | | 551 | | | | 30,427 | | | | 0.2% | |

Procter & Gamble (The) Co. | | | 442 | | | | 29,614 | | | | 0.2% | |

Johnson & Johnson | | | 436 | | | | 29,337 | | | | 0.2% | |

| | | | | | | | | | | | |

| |

| Top Ten Fixed Income Holdings | |

| | | |

| Description | | Principal Amount | | | Value | | | % of Net Assets | |

U.S. Treasury Bond/Note, 4.75%, 5/15/14 | | | $955,200 | | | | $1,066,690 | | | | 7.4% | |

U.S. Treasury Bond/Note, 1.38%, 4/15/12 | | | 992,900 | | | | 1,003,217 | | | | 7.0% | |

U.S. Treasury Bond/Note, 1.38%, 2/15/13 | | | 901,200 | | | | 916,620 | | | | 6.4% | |

U.S. Treasury Bond/Note, 1.38%, 5/15/12 | | | 840,000 | | | | 849,384 | | | | 5.9% | |

U.S. Treasury Bond/Note, 1.38%, 3/15/13 | | | 830,000 | | | | 844,464 | | | | 5.9% | |

U.S. Treasury Bond/Note, 1.75%, 11/15/11 | | | 768,800 | | | | 774,596 | | | | 5.4% | |

U.S. Treasury Bond/Note, 2.38%, 2/28/15 | | | 689,700 | | | | 721,706 | | | | 5.0% | |

U.S. Treasury Bond/Note, 3.38%, 7/31/13 | | | 614,900 | | | | 653,283 | | | | 4.5% | |

U.S. Treasury Bond/Note, 1.38%, 2/15/12 | | | 420,000 | | | | 423,659 | | | | 2.9% | |

Fed. Home Loan Mort. Corp., 4.50%, 1/15/13 | | | 373,000 | | | | 397,821 | | | | 2.8% | |

3 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to www.dbxstrategicadvisors.db.com.

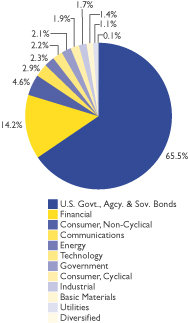

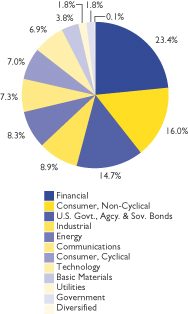

Sector Breakdown* as of 5/31/11

* Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Bloomberg industry name.

4

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db-X 2020 Target Date Fund (TDH)

The db-X 2020 Target Date Fund (the “Fund”) commenced investment operations and its shares began trading on the NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks 2020 Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks 2020 Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

For the fiscal year ended May 31, 2011, the Fund’s net asset value increased 18.71%, compared to an increase of 19.38% for the Zacks 2020 Lifecycle Index and 17.29% for the Dow Jones Target 2020 Index. The fund’s performance benefitted from favorable results in several equity sectors, in particular Energy, Information Technology and Industrials as well as strong performance in intermediate-term U.S. Treasury securities.

Performance as of 5/31/11

| | | | | | | | |

| Average Annual Total Return |

| | | Net Asset Value | | Market Price | | Zacks 2020 Lifecycle

Index | | Dow Jones Target 2020

Index |

One Year | | 18.71% | | 17.65% | | 19.38% | | 17.29% |

Since Inception1 | | 0.56% | | -0.17% | | 0.74% | | 2.60% |

|

| Cumulative Total Return |

| | | Net Asset Value | | Market Price | | Zacks 2020 Lifecycle

Index | | Dow Jones Target 2020

Index |

One Year | | 18.71% | | 17.65% | | 19.38% | | 17.29% |

Since Inception1 | | 2.07% | | -0.64% | | 2.72% | | 9.85% |

1 Total returns are calculated based on the commencement of trading, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.dbxstrategicadvisors.db.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio for the fiscal year ended May 31, 2010, as disclosed in the most recent prospectus dated September 28, 2010, was 1.90%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/11.

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash subindexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the Underlying Index will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

5

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db-X 2020 Target Date Fund (TDH) (Continued)

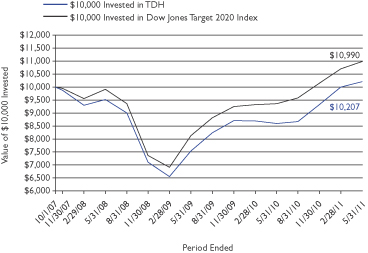

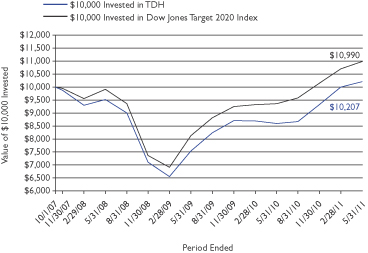

Growth of a $10,000 Investment in TDH2 as of 5/31/11

2 Based on Net Asset Value from commencement of trading 10/1/07.

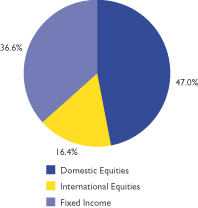

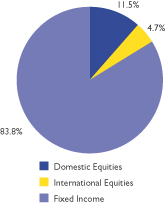

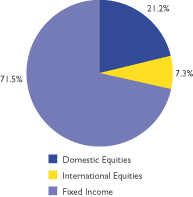

Asset Class Breakdown* as of 5/31/11

* Weightings are expressed as a percentage of total investments and may change over time.

Top Ten Holdings3 as of 5/31/11

| | | | | | | | | | | | |

| |

| Top Ten Equity Holdings | |

| | | |

| Description | | Shares | | | Value | | | % of Net Assets | |

Exxon Mobil Corp. | | | 8,219 | | | | $686,039 | | | | 1.8% | |

Apple, Inc. | | | 1,488 | | | | 517,570 | | | | 1.3% | |

International Business Machines Corp. | | | 2,060 | | | | 347,997 | | | | 0.9% | |

Berkshire Hathaway, Inc., Class B | | | 4,171 | | | | 329,800 | | | | 0.9% | |

General Electric Co. | | | 16,693 | | | | 327,850 | | | | 0.9% | |

Chevron Corp. | | | 3,099 | | | | 325,116 | | | | 0.8% | |

Wal-Mart Stores, Inc. | | | 5,874 | | | | 324,362 | | | | 0.8% | |

Johnson & Johnson | | | 4,788 | | | | 322,184 | | | | 0.8% | |

Procter & Gamble (The) Co. | | | 4,797 | | | | 321,399 | | | | 0.8% | |

Microsoft Corp. | | | 12,843 | | | | 321,203 | | | | 0.8% | |

| | | | | | | | | | | | |

| |

| Top Ten Fixed Income Holdings | |

| | | |

| Description | | Principal Amount | | | Value | | | % of Net Assets | |

U.S. Treasury Bond/Note, 4.75%, 5/15/14 | | | $1,026,300 | | | | $1,146,089 | | | | 3.0% | |

U.S. Treasury Bond/Note, 8.13%, 8/15/19 | | | 527,900 | | | | 744,916 | | | | 1.9% | |

U.S. Treasury Bond/Note, 3.13%, 1/31/17 | | | 686,700 | | | | 731,175 | | | | 1.9% | |

European Investment Bank, MTN, 4.63%, 5/15/14 | | | 625,000 | | | | 689,733 | | | | 1.8% | |

General Electric Co., 5.25%, 12/06/17 | | | 543,000 | | | | 611,242 | | | | 1.6% | |

Fed. Natl. Mort. Assoc., 5.00%, 5/11/17 | | | 485,000 | | | | 559,033 | | | | 1.5% | |

U.S. Treasury Bond/Note, 2.50%, 3/31/15 | | | 510,600 | | | | 536,649 | | | | 1.4% | |

U.S. Treasury Bond/Note, 6.25%, 5/15/30 | | | 399,200 | | | | 526,570 | | | | 1.4% | |

Goldman Sachs Group (The), Inc., 5.00%, 10/01/14 | | | 459,000 | | | | 495,442 | | | | 1.3% | |

U.S. Treasury Bond/Note, 3.63%, 2/15/20 | | | 424,700 | | | | 452,372 | | | | 1.2% | |

3 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to www.dbxstrategicadvisors.db.com.

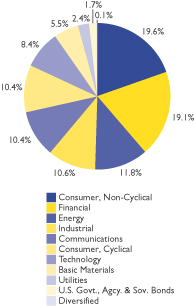

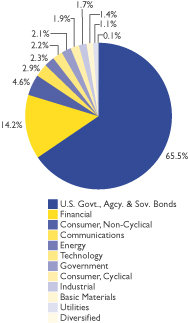

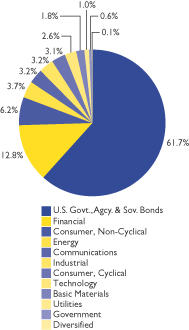

Sector Breakdown* as of 5/31/11

* Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Bloomberg industry name.

6

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db-X 2030 Target Date Fund (TDN)

The db-X 2030 Target Date Fund (the “Fund”) commenced investment operations and its shares began trading on the NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks 2030 Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks 2030 Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

For the fiscal year ended May 31, 2011, the Fund’s net asset value increased 23.74%, compared to an increase of 24.63% for the Zacks 2030 Lifecycle Index and 22.79% for the Dow Jones Target 2030 Index. The fund’s performance benefitted from its heavy weighting to equities with favorable results in several sectors, in particular Energy, Information Technology and Industrials.

Performance as of 5/31/11

| | | | | | | | |

| Average Annual Total Return |

| | | Net Asset Value | | Market Price | | Zacks 2030 Lifecycle

Index | | Dow Jones Target 2030

Index |

One Year | | 23.74% | | 27.37% | | 24.63% | | 22.79% |

Since Inception1 | | -2.23% | | -2.26% | | -2.03% | | 1.40% |

|

| Cumulative Total Return |

| | | Net Asset Value | | Market Price | | Zacks 2030 Lifecycle

Index | | Dow Jones Target 2030

Index |

One Year | | 23.74% | | 27.37% | | 24.63% | | 22.79% |

Since Inception1 | | -7.95% | | -8.05% | | -7.23% | | 5.21% |

1 Total returns are calculated based on the commencement of trading, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.dbxstrategicadvisors.db.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio for the fiscal year ended May 31, 2010, as disclosed in the most recent prospectus dated September 28, 2010, was 1.95%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/11.

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash subindexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the Underlying Index will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

7

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db-X 2030 Target Date Fund (TDN) (Continued)

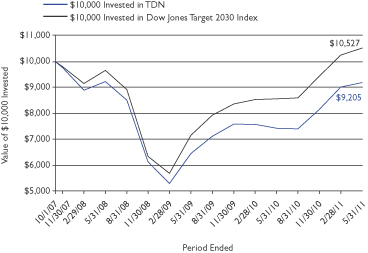

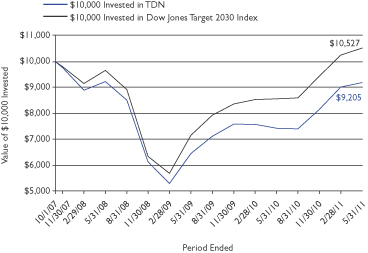

Growth of a $10,000 Investment in TDN2 as of 5/31/11

2 Based on Net Asset Value from commencement of trading 10/1/07.

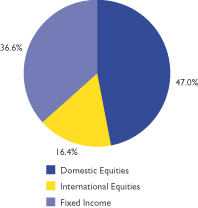

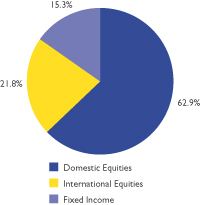

Asset Class Breakdown* as of 5/31/11

* Weightings are expressed as a percentage of total investments and may change over time.

Top Ten Holdings3 as of 5/31/11

| | | | | | | | | | | | |

| |

| Top Ten Equity Holdings | |

| | | |

| Description | | Shares | | | Value | | | % of Net Assets | |

Exxon Mobil Corp. | | | 10,062 | | | | $839,875 | | | | 2.4% | |

Apple, Inc. | | | 1,804 | | | | 627,485 | | | | 1.8% | |

International Business Machines Corp. | | | 2,560 | | | | 432,461 | | | | 1.2% | |

Wal-Mart Stores, Inc. | | | 7,325 | | | | 404,486 | | | | 1.1% | |

General Electric Co. | | | 20,565 | | | | 403,897 | | | | 1.1% | |

Berkshire Hathaway, Inc., Class B | | | 5,102 | | | | 403,415 | | | | 1.1% | |

Microsoft Corp. | | | 15,818 | | | | 395,607 | | | | 1.1% | |

Johnson & Johnson | | | 5,869 | | | | 394,925 | | | | 1.1% | |

Chevron Corp. | | | 3,758 | | | | 394,252 | | | | 1.1% | |

Procter & Gamble (The) Co. | | | 5,841 | | | | 391,347 | | | | 1.1% | |

| | | | | | | | | | | | |

| |

| Top Ten Fixed Income Holdings | |

| | | |

| Description | | Principal Amount | | | Value | | | % of Net Assets | |

U.S. Treasury Bond/Note, 4.38%, 2/15/38 | | | $304,200 | | | | $314,467 | | | | 0.9% | |

U.S. Treasury Bond/Note, 8.13%, 8/15/19 | | | 113,900 | | | | 160,724 | | | | 0.5% | |

Verizon Global Funding Corp., 7.75%, 12/01/30 | | | 124,000 | | | | 157,618 | | | | 0.4% | |

General Electric Capital Corp., Series A, MTN, 6.75%, 3/15/32 | | | 136,000 | | | | 155,873 | | | | 0.4% | |

MidAmerican Energy Holdings Co., 6.13%, 4/01/36 | | | 133,000 | | | | 147,432 | | | | 0.4% | |

Citigroup, Inc., 8.13%, 7/15/39 | | | 108,000 | | | | 141,230 | | | | 0.4% | |

U.S. Treasury Bond/Note, 1.75%, 11/15/11 | | | 139,600 | | | | 140,652 | | | | 0.4% | |

Target Corp., 7.00%, 1/15/38 | | | 110,000 | | | | 135,936 | | | | 0.4% | |

ConocoPhillips, 5.90%, 10/15/32 | | | 117,000 | | | | 130,145 | | | | 0.4% | |

Bank of New York Mellon (The) Corp., Series G, MTN, 4.60%, 1/15/20 | | | 117,000 | | | | 124,737 | | | | 0.4% | |

3 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to www.dbxstrategicadvisors.db.com.

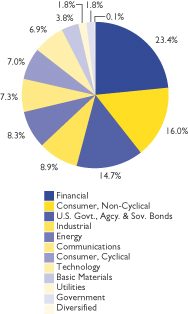

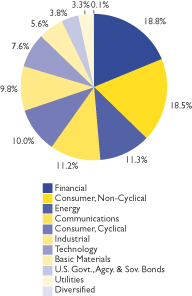

Sector Breakdown* as of 5/31/11

* Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Bloomberg industry name.

8

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db-X 2040 Target Date Fund (TDV)

The db-X 2040 Target Date Fund (the “Fund”) commenced investment operations and its shares began trading on the NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks 2040 Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks 2040 Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

For the fiscal year ended May 31, 2011, the Fund’s net asset value increased 26.32%, compared to an increase of 27.00% for the Zacks 2040 Lifecycle Index and 26.33% for the Dow Jones Target 2040 Index. The fund’s performance benefitted from its heavy weighting to equities with favorable results in several sectors, in particular Energy, Information Technology and Industrials.

Performance as of 5/31/11

| | | | | | | | |

| Average Annual Total Return |

| | | Net Asset Value | | Market Price | | Zacks 2040 Lifecycle

Index | | Dow Jones Target 2040

Index |

One Year | | 26.32% | | 30.20% | | 27.00% | | 26.33% |

Since Inception1 | | -2.88% | | -2.84% | | -2.73% | | 0.88% |

|

| Cumulative Total Return |

| | | Net Asset Value | | Market Price | | Zacks 2040 Lifecycle

Index | | Dow Jones Target 2040

Index |

One Year | | 26.32% | | 30.20% | | 27.00% | | 26.33% |

Since Inception1 | | -10.18% | | -10.03% | | -9.64% | | 3.26% |

1 Total returns are calculated based on the commencement of trading, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.dbxstrategicadvisors.db.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio for the fiscal year ended May 31, 2010, as disclosed in the most recent prospectus dated September 28, 2010, was 1.97%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/11.

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash subindexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the Underlying Index will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

9

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db-X 2040 Target Date Fund (TDV) (Continued)

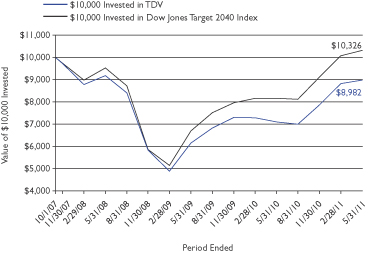

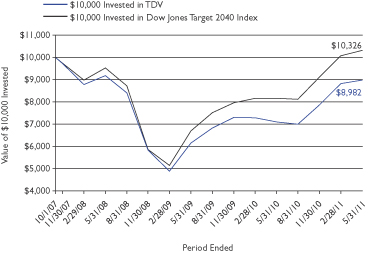

Growth of a $10,000 Investment in TDV2 as of 5/31/11

2 Based on Net Asset Value from commencement of trading 10/1/07.

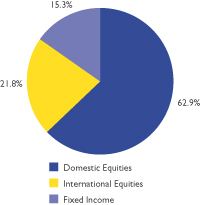

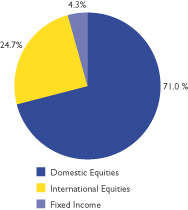

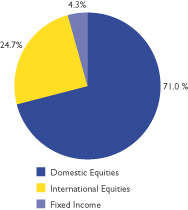

Asset Class Breakdown* as of 5/31/11

* Weightings are expressed as a percentage of total investments and may change over time.

Top Ten Holdings3 as of 5/31/11

| | | | | | | | | | | | |

| |

| Top Ten Equity Holdings | |

| | | |

| Description | | Shares | | | Value | | | % of Net Assets | |

Exxon Mobil Corp. | | | 11,239 | | | | $938,120 | | | | 2.7% | |

Apple, Inc. | | | 2,016 | | | | 701,225 | | | | 2.0% | |

International Business Machines Corp. | | | 2,872 | | | | 485,166 | | | | 1.4% | |

General Electric Co. | | | 23,220 | | | | 456,041 | | | | 1.3% | |

Berkshire Hathaway, Inc., Class B | | | 5,765 | | | | 455,839 | | | | 1.3% | |

Microsoft Corp. | | | 17,728 | | | | 443,376 | | | | 1.3% | |

Wal-Mart Stores, Inc. | | | 8,025 | | | | 443,142 | | | | 1.3% | |

Chevron Corp. | | | 4,208 | | | | 441,461 | | | | 1.3% | |

Johnson & Johnson | | | 6,484 | | | | 436,308 | | | | 1.3% | |

Procter & Gamble (The) Co. | | | 6,428 | | | | 430,676 | | | | 1.2% | |

| | | | | | | | | | | | |

| |

| Top Ten Fixed Income Holdings | |

| | | |

| Description | | Principal Amount | | | Value | | | % of Net Assets | |

U.S. Treasury Bond/Note, 4.38%, 5/15/40 | | | $115,500 | | | | $118,604 | | | | 0.3% | |

U.S. Treasury Bond/Note, 8.13%, 8/15/19 | | | 75,200 | | | | 106,114 | | | | 0.3% | |

U.S. Treasury Bond/Note, 7.63%, 2/15/25 | | | 62,700 | | | | 90,768 | | | | 0.3% | |

U.S. Treasury Bond/Note, 6.25%, 5/15/30 | | | 40,400 | | | | 53,290 | | | | 0.2% | |

Fed. Home Loan Mort. Corp., 6.25%, 7/15/32 | | | 42,000 | | | | 52,908 | | | | 0.2% | |

U.S. Treasury Bond/Note, 3.63%, 2/15/20 | | | 39,900 | | | | 42,500 | | | | 0.1% | |

U.S. Treasury Bond/Note, 4.38%, 2/15/38 | | | 40,800 | | | | 42,177 | | | | 0.1% | |

MidAmerican Energy Holdings Co., 6.13%, 4/01/36 | | | 31,000 | | | | 34,364 | | | | 0.1% | |

BellSouth Corp., 6.00%, 11/15/34 | | | 33,000 | | | | 34,353 | | | | 0.1% | |

ConocoPhillips, 5.90% 10/15/32 | | | 30,000 | | | | 33,371 | | | | 0.1% | |

3 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to www.dbxstrategicadvisors.db.com.

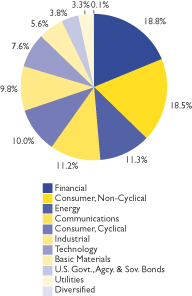

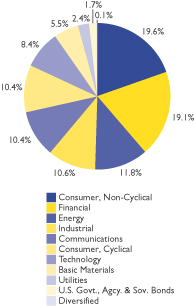

Sector Breakdown* as of 5/31/11

* Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Bloomberg industry name.

10

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db-X In-Target Date Fund (TDX)

The db-X In-Target Date Fund (the “Fund”) commenced investment operations and its shares began trading on the NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks In-Target Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks In-Target Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

For the fiscal year ended May 31, 2011, the Fund’s net asset value increased 7.44%, compared to an increase of 7.64% for the Zacks In-Target Lifecycle Index and 11.24% for the Dow Jones Target Today Index. The fund’s performance benefited from favorable results in several equity sectors, in particular Energy, Information Technology and Industrials, partially offset by the Fund’s heavier weighting to fixed income securities, in particular short-term U.S. Treasury securities.

Performance as of 5/31/11

| | | | | | | | |

| Average Annual Total Return |

| | | Net Asset Value | | Market Price | | Zacks In-Target Lifecycle

Index | | Dow Jones Target Today

Index |

One Year | | 7.44% | | 6.88% | | 7.64% | | 11.24% |

Since Inception1 | | 3.19% | | 2.51% | | 3.24% | | 5.70% |

|

| Cumulative Total Return |

| | | Net Asset Value | | Market Price | | Zacks In-Target Lifecycle

Index | | Dow Jones Target Today

Index |

One Year | | 7.44% | | 6.88% | | 7.64% | | 11.24% |

Since Inception1 | | 12.20% | | 9.52% | | 12.41% | | 22.52% |

1 Total returns are calculated based on the commencement of trading, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.dbxstrategicadvisors.db.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio for the fiscal year ended May 31, 2010, as disclosed in the most recent prospectus dated September 28, 2010, was 2.06%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/11.

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash subindexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the Underlying Index will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

11

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db-X In-Target Date Fund (TDX) (Continued)

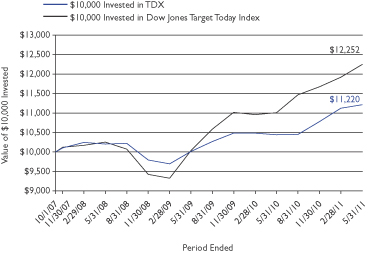

Growth of a $10,000 Investment in TDX2 as of 5/31/11

2 Based on Net Asset Value from commencement of trading 10/1/07.

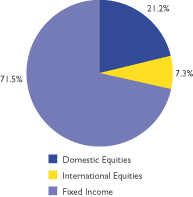

Asset Class Breakdown* as of 5/31/11

* Weightings are expressed as a percentage of total investments and may change over time.

Top Ten Holdings3 as of 5/31/11

| | | | | | | | | | | | |

| |

| Top Ten Equity Holdings | |

| | | |

| Description | | Shares | | | Value | | | % of Net Assets | |

Exxon Mobil Corp. | | | 1,531 | | | | $127,793 | | | | 0.8% | |

Apple, Inc. | | | 282 | | | | 98,088 | | | | 0.6% | |

International Business Machines Corp. | | | 375 | | | | 63,349 | | | | 0.4% | |

General Electric Co. | | | 3,193 | | | | 62,711 | | | | 0.4% | |

Microsoft Corp. | | | 2,502 | | | | 62,575 | | | | 0.4% | |

Chevron Corp. | | | 596 | | | | 62,526 | | | | 0.4% | |

Berkshire Hathaway, Inc., Class B | | | 778 | | | | 61,515 | | | | 0.4% | |

Wal-Mart Stores, Inc. | | | 1,075 | | | | 59,361 | | | | 0.4% | |

AT&T, Inc. | | | 1,796 | | | | 56,683 | | | | 0.4% | |

Procter & Gamble (The) Co. | | | 845 | | | | 56,615 | | | | 0.4% | |

| | | | | | | | | | | | |

| |

| Top Ten Fixed Income Holdings | |

| | | |

| Description | | Principal Amount | | | Value | | | % of Net Assets | |

U.S. Treasury Bond/Note, 4.25%, 9/30/12 | | | $786,900 | | | | $828,735 | | | | 5.2% | |

U.S. Treasury Bond/Note, 1.38%, 2/15/12 | | | 820,000 | | | | 827,144 | | | | 5.2% | |

U.S. Treasury Bond/Note, 4.75%, 5/15/14 | | | 727,500 | | | | 812,413 | | | | 5.1% | |

U.S. Treasury Bond/Note, 3.38%, 11/30/12 | | | 707,000 | | | | 739,561 | | | | 4.6% | |

U.S. Treasury Bond/Note, 2.88%, 1/31/13 | | | 635,500 | | | | 662,360 | | | | 4.2% | |

U.S. Treasury Bond/Note, 3.63%, 12/31/12 | | | 576,300 | | | | 606,398 | | | | 3.8% | |

U.S. Treasury Bond/Note, 4.63%, 2/29/12 | | | 553,300 | | | | 571,758 | | | | 3.6% | |

U.S. Treasury Bond/Note, 2.50%, 3/31/13 | | | 550,000 | | | | 571,313 | | | | 3.6% | |

U.S. Treasury Bond/Note, 4.50%, 11/30/11 | | | 550,800 | | | | 562,870 | | | | 3.5% | |

U.S. Treasury Bond/Note, 1.38%, 3/15/12 | | | 556,000 | | | | 561,321 | | | | 3.5% | |

3 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to www.dbxstrategicadvisors.db.com.

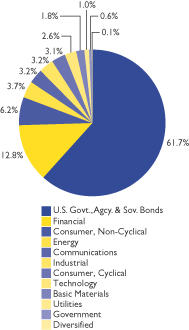

Sector Breakdown* as of 5/31/11

* Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Bloomberg industry name.

12

db-X Exchange-Traded Funds Inc.

FEES AND EXPENSES

As a shareholder of one or more of the funds of db-X Exchange-Traded Funds Inc. (each, a “Fund” and collectively, the “Funds” or “db-X Target Date Funds”), you incur advisory fees and other Fund expenses. The expense examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held through the six month period ended May 31, 2011.

ACTUAL EXPENSES

The first line in the following tables provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the following tables provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses (which is not the Funds’ actual return). The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only, and do not reflect any transactional costs. Therefore the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

December 1, 2010 | | | Ending

Account Value

May 31, 2011 | | | Annualized

Expense Ratio(1)

based on the number of

days in the period | | | Expenses Paid

During the Period(2)

December 1, 2010 to

May 31, 2011 | |

| db-X 2010 Target Date Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,027.28 | | | | 0.65 | % | | $ | 3.29 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.69 | | | | 0.65 | % | | $ | 3.28 | |

| db-X 2020 Target Date Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,094.99 | | | | 0.65 | % | | $ | 3.40 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.69 | | | | 0.65 | % | | $ | 3.28 | |

| db-X 2030 Target Date Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,127.08 | | | | 0.65 | % | | $ | 3.45 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.69 | | | | 0.65 | % | | $ | 3.28 | |

| db-X 2040 Target Date Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,141.68 | | | | 0.65 | % | | $ | 3.47 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.69 | | | | 0.65 | % | | $ | 3.28 | |

| db-X In-Target Date Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,040.79 | | | | 0.65 | % | | $ | 3.31 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.69 | | | | 0.65 | % | | $ | 3.28 | |

(1) DBX Strategic Advisors LLC (the “Advisor”), has contractually agreed to reduce its fees and/or pay Fund operating expenses (excluding, among other things, acquired fund fees and expenses, interest, taxes and extraordinary expenses) in order to limit each Fund’s net annual operating expenses for shares of each Fund to 0.65% of the Fund’s average net assets (the “Expense Cap”). The Expense Cap will remain in effect until September 30, 2011. The Advisor is permitted to be reimbursed for fee reductions and/or expense payments made in the prior three fiscal years. This reimbursement may be paid to the Advisor if the aggregate amount actually paid by a Fund toward operating expenses for such fiscal year (taking into account the reimbursement) does not exceed the Expense Cap. Ratios would have been higher if fees were not reduced by the Advisor.

(2) Expenses are calculated using the annualized expense ratio, which represents the ongoing expenses as a percentage of net assets for the period December 1, 2010 to May 31, 2011. Expenses are calculated by multiplying the Fund’s annualized expense ratio by the average account value for the period; then multiplying the result by 182 days and then dividing the result by 365.

13

db-X Exchange-Traded Funds Inc.

SCHEDULE OF INVESTMENTS

db-X 2010 Target Date Fund

May 31, 2011

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| | | | | | | | |

| COMMON STOCKS — 16.2% | | | | | | | | |

| Basic Materials — 1.0% | | | | | | | | |

Air Liquide S.A. (France) | | | 41 | | | $ | 5,690 | |

Allied Nevada Gold Corp.* | | | 150 | | | | 5,562 | |

Anglo American PLC (United Kingdom) | | | 208 | | | | 10,373 | |

ArcelorMittal (Luxembourg) | | | 132 | | | | 4,398 | |

BASF SE (Germany) | | | 136 | | | | 12,563 | |

Bayer AG (Germany) | | | 130 | | | | 10,643 | |

BHP Billiton Ltd. (Australia) | | | 289 | | | | 13,660 | |

BHP Billiton PLC (United Kingdom) | | | 337 | | | | 13,329 | |

Buckeye Technologies, Inc. | | | 150 | | | | 3,821 | |

Coeur d’Alene Mines Corp.* | | | 75 | | | | 2,068 | |

Dow Chemical (The) Co. | | | 74 | | | | 2,674 | |

E.I. du Pont de Nemours & Co. | | | 105 | | | | 5,597 | |

Freeport-McMoRan Copper & Gold, Inc. | | | 150 | | | | 7,746 | |

Metals USA Holdings Corp.* | | | 150 | | | | 2,358 | |

Newmont Mining Corp. | | | 70 | | | | 3,960 | |

Rio Tinto PLC (United Kingdom) | | | 199 | | | | 13,904 | |

Rockwood Holdings, Inc.* | | | 100 | | | | 5,259 | |

Sensient Technologies Corp. | | | 31 | | | | 1,180 | |

Sherwin-Williams (The) Co. | | | 75 | | | | 6,587 | |

Solutia, Inc.* | | | 50 | | | | 1,249 | |

Syngenta AG (Switzerland)* | | | 17 | | | | 5,871 | |

Vulcan Materials Co. | | | 150 | | | | 6,074 | |

| | | | | | | | |

| | | | | | | 144,566 | |

| | | | | | | | |

| Communications — 1.7% | | | | | | | | |

Acme Packet, Inc.* | | | 75 | | | | 5,677 | |

ADTRAN, Inc. | | | 75 | | | | 3,215 | |

Anixter International, Inc.* | | | 8 | | | | 542 | |

Arris Group, Inc.* | | | 119 | | | | 1,344 | |

AT&T, Inc. | | | 845 | | | | 26,668 | |

Calix, Inc.* | | | 150 | | | | 3,236 | |

Cisco Systems, Inc. | | | 748 | | | | 12,565 | |

Comcast Corp., Class A | | | 360 | | | | 9,086 | |

Corning, Inc. | | | 133 | | | | 2,679 | |

Deutsche Telekom AG (Germany) | | | 434 | | | | 6,445 | |

Digital River, Inc.* | | | 82 | | | | 2,669 | |

Discovery Communications, Inc., Class A* | | | 225 | | | | 9,801 | |

eResearch Technology, Inc.* | | | 193 | | | | 1,224 | |

France Telecom S.A. (France) | | | 295 | | | | 6,743 | |

Google, Inc., Class A* | | | 49 | | | | 25,921 | |

GSI Commerce, Inc.* | | | 75 | | | | 2,194 | |

Limelight Networks, Inc.* | | | 375 | | | | 2,149 | |

News Corp., Class A | | | 247 | | | | 4,530 | |

Nokia OYJ (Finland) | | | 549 | | | | 3,749 | |

NTT DoCoMo, Inc. (Japan) | | | 2 | | | | 3,737 | |

Orbitz Worldwide, Inc.* | | | 450 | | | | 1,035 | |

Rackspace Hosting, Inc.* | | | 124 | | | | 5,456 | |

Symantec Corp.* | | | 675 | | | | 13,196 | |

Telefonaktiebolaget LM Ericsson, Class B (Sweden) | | | 427 | | | | 6,305 | |

Telefonica S.A. (Spain) | | | 238 | | | | 5,774 | |

Thomson Reuters Corp. (Canada) | | | 150 | | | | 5,846 | |

TIBCO Software, Inc.* | | | 219 | | | | 6,152 | |

Time Warner, Inc. | | | 184 | | | | 6,703 | |

Verizon Communications, Inc. | | | 443 | | | | 16,360 | |

Vivendi (France) | | | 193 | | | | 5,381 | |

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| | | | | | | | |

| Communications (Continued) | | | | | | | | |

Vodafone Group PLC (United Kingdom) | | | 4,388 | | | $ | 12,202 | |

Walt Disney (The) Co. | | | 277 | | | | 11,532 | |

Windstream Corp. | | | 375 | | | | 5,044 | |

Yahoo!, Inc.* | | | 207 | | | | 3,426 | |

| | | | | | | | |

| | | | | | | 238,586 | |

| | | | | | | | |

| Consumer, Cyclical — 1.7% | | | | | | | | |

Alaska Air Group, Inc.* | | | 75 | | | | 5,065 | |

Ascena Retail Group, Inc.* | | | 50 | | | | 1,673 | |

Buckle (The), Inc. | | | 32 | | | | 1,366 | |

Callaway Golf Co. | | | 300 | | | | 2,031 | |

Carter’s, Inc.* | | | 119 | | | | 3,772 | |

Casey’s General Stores, Inc. | | | 105 | | | | 4,352 | |

Cinemark Holdings, Inc. | | | 100 | | | | 2,175 | |

Coach, Inc. | | | 300 | | | | 19,097 | |

Columbia Sportswear Co. | | | 76 | | | | 4,986 | |

CVS Caremark Corp. | | | 190 | | | | 7,351 | |

Daimler AG (Germany) | | | 126 | | | | 8,895 | |

Dana Holding Corp.* | | | 150 | | | | 2,718 | |

Deckers Outdoor Corp.* | | | 75 | | | | 6,832 | |

Dillard’s, Inc., Class A | | | 75 | | | | 4,214 | |

Dollar General Corp.* | | | 300 | | | | 10,521 | |

DSW, Inc., Class A* | | | 97 | | | | 4,865 | |

Exide Technologies* | | | 300 | | | | 2,958 | |

Ford Motor Co.* | | | 447 | | | | 6,669 | |

G&K Services, Inc., Class A | | | 75 | | | | 2,372 | |

Hennes & Mauritz AB, Class B (Sweden) | | | 153 | | | | 5,674 | |

Honda Motor Co. Ltd. (Japan) | | | 46 | | | | 1,750 | |

JetBlue Airways Corp.* | | | 152 | | | | 923 | |

Johnson Controls, Inc. | | | 75 | | | | 2,970 | |

Jones Group (The), Inc. | | | 50 | | | | 615 | |

K-Swiss, Inc., Class A* | | | 150 | | | | 1,655 | |

La-Z-Boy, Inc.* | | | 225 | | | | 2,491 | |

Liz Claiborne, Inc.* | | | 350 | | | | 2,286 | |

Lowe’s Cos., Inc. | | | 225 | | | | 5,432 | |

McDonald’s Corp. | | | 165 | | | | 13,454 | |

Mitsubishi Corp. (Japan) | | | 241 | | | | 6,102 | |

Mitsui & Co. Ltd. (Japan) | | | 300 | | | | 5,111 | |

Nike, Inc., Class B | | | 75 | | | | 6,334 | |

Nintendo Co. Ltd. (Japan) | | | 15 | | | | 3,484 | |

Nissan Motor Co. Ltd. (Japan) | | | 386 | | | | 3,868 | |

Nu Skin Enterprises, Inc., Class A | | | 75 | | | | 2,932 | |

Owens & Minor, Inc. | | | 67 | | | | 2,318 | |

Panasonic Corp. (Japan) | | | 333 | | | | 3,910 | |

Sony Corp. (Japan) | | | 181 | | | | 4,819 | |

Toyota Motor Corp. (Japan) | | | 199 | | | | 8,328 | |

Under Armour, Inc., Class A* | | | 75 | | | | 4,889 | |

US Airways Group, Inc.* | | | 50 | | | | 455 | |

Vail Resorts, Inc.* | | | 82 | | | | 3,989 | |

Walgreen Co. | | | 150 | | | | 6,545 | |

Wal-Mart Stores, Inc. | | | 551 | | | | 30,427 | |

Warnaco Group (The), Inc.* | | | 26 | | | | 1,434 | |

Watsco, Inc. | | | 66 | | | | 4,418 | |

World Fuel Services Corp. | | | 64 | | | | 2,341 | |

| | | | | | | | |

| | | | | | | 240,866 | |

| | | | | | | | |

| | | | |

| See Notes to Financial Statements. | | 14 | | |

db-X Exchange-Traded Funds Inc.

SCHEDULE OF INVESTMENTS

db-X 2010 Target Date Fund (Continued)

May 31, 2011

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| | | | | | | | |

| Consumer, Non-cyclical — 3.1% | | | | | | | | |

Abbott Laboratories | | | 224 | | | $ | 11,704 | |

Accuray, Inc.* | | | 300 | | | | 2,292 | |

Aetna, Inc. | | | 375 | | | | 16,380 | |

Amedisys, Inc.* | | | 75 | | | | 2,348 | |

American Medical Systems Holdings, Inc.* | | | 75 | | | | 2,246 | |

American Reprographics Co.* | | | 225 | | | | 2,111 | |

AMERIGROUP Corp.* | | | 42 | | | | 2,978 | |

Amgen, Inc.* | | | 150 | | | | 9,081 | |

Anheuser-Busch InBev NV (Belgium) | | | 100 | | | | 6,026 | |

AstraZeneca PLC (United Kingdom) | | | 202 | | | | 10,565 | |

British American Tobacco PLC (United Kingdom) | | | 268 | | | | 12,007 | |

Bruker Corp.* | | | 178 | | | | 3,510 | |

Catalyst Health Solutions, Inc.* | | | 32 | | | | 1,953 | |

CBIZ, Inc.* | | | 300 | | | | 2,295 | |

Coca-Cola (The) Co. | | | 371 | | | | 24,786 | |

Diageo PLC (United Kingdom) | | | 357 | | | | 7,604 | |

Ennis, Inc. | | | 75 | | | | 1,432 | |

GlaxoSmithKline PLC (United Kingdom) | | | 301 | | | | 6,540 | |

HEALTHSOUTH Corp.* | | | 150 | | | | 4,211 | |

Heidrick & Struggles International, Inc. | | | 166 | | | | 3,478 | |

Hospira, Inc.* | | | 150 | | | | 8,294 | |

Johnson & Johnson | | | 436 | | | | 29,337 | |

Kraft Foods, Inc., Class A | | | 128 | | | | 4,476 | |

Live Nation Entertainment, Inc.* | | | 225 | | | | 2,594 | |

Magellan Health Services, Inc.* | | | 11 | | | | 582 | |

Masimo Corp.* | | | 150 | | | | 4,608 | |

MasterCard, Inc., Class A | | | 30 | | | | 8,612 | |

Medifast, Inc.* | | | 75 | | | | 2,004 | |

Merck & Co., Inc. | | | 525 | | | | 19,294 | |

Molson Coors Brewing Co., Class B | | | 130 | | | | 6,065 | |

Nestle S.A. (Switzerland) | | | 325 | | | | 20,862 | |

Novartis AG (Switzerland) | | | 202 | | | | 13,026 | |

Novo Nordisk A/S, Class B (Denmark) | | | 67 | | | | 8,391 | |

Pfizer, Inc. | | | 1,283 | | | | 27,520 | |

Philip Morris International, Inc. | | | 236 | | | | 16,933 | |

Procter & Gamble (The) Co. | | | 442 | | | | 29,614 | |

Roche Holding AG (Switzerland) | | | 50 | | | | 8,794 | |

Rollins, Inc. | | | 81 | | | | 1,630 | |

Ruddick Corp. | | | 37 | | | | 1,626 | |

Safeway, Inc. | | | 362 | | | | 8,941 | |

Salix Pharmaceuticals Ltd.* | | | 75 | | | | 3,002 | |

Sanofi | | | 166 | | | | 13,130 | |

Sirona Dental Systems, Inc.* | | | 64 | | | | 3,460 | |

SonoSite, Inc.* | | | 75 | | | | 2,678 | |

Sotheby’s | | | 75 | | | | 3,192 | |

STERIS Corp. | | | 58 | | | | 2,093 | |

Takeda Pharmaceutical Co. Ltd. (Japan) | | | 136 | | | | 6,470 | |

Tesco PLC (United Kingdom) | | | 1,167 | | | | 8,049 | |

Teva Pharmaceutical Industries Ltd. (Israel) | | | 140 | | | | 7,176 | |

TreeHouse Foods, Inc.* | | | 75 | | | | 4,570 | |

Unilever NV (Netherlands) | | | 238 | | | | 7,760 | |

Unilever PLC (United Kingdom) | | | 187 | | | | 6,067 | |

UnitedHealth Group, Inc. | | | 171 | | | | 8,370 | |

Visa, Inc., Class A | | | 139 | | | | 11,267 | |

WellPoint, Inc. | | | 75 | | | | 5,863 | |

| | | | | | | | |

| | | | | | | 449,897 | |

| | | | | | | | |

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| | | | | | | | |

| Diversified — 0.0% (a) | | | | | | | | |

LVMH Moet Hennessy Louis Vuitton S.A. (France) | | | 41 | | | $ | 7,125 | |

| | | | | | | | |

| Energy — 1.9% | | | | | | | | |

Berry Petroleum Co., Class A | | | 60 | | | | 3,145 | |

BG Group PLC (United Kingdom) | | | 548 | | | | 12,686 | |

Bill Barrett Corp.* | | | 33 | | | | 1,471 | |

BP PLC (United Kingdom) | | | 2,890 | | | | 22,278 | |

Brigham Exploration Co.* | | | 150 | | | | 4,671 | |

Chevron Corp. | | | 325 | | | | 34,096 | |

ConocoPhillips | | | 188 | | | | 13,765 | |

Delek US Holdings, Inc. | | | 225 | | | | 3,395 | |

Devon Energy Corp. | | | 75 | | | | 6,305 | |

Dril-Quip, Inc.* | | | 13 | | | | 964 | |

ENI S.p.A (Italy) | | | 412 | | | | 9,868 | |

Exxon Mobil Corp. | | | 794 | | | | 66,275 | |

Hornbeck Offshore Services, Inc.* | | | 75 | | | | 2,024 | |

Occidental Petroleum Corp. | | | 127 | | | | 13,697 | |

Peabody Energy Corp. | | | 211 | | | | 12,947 | |

Royal Dutch Shell PLC, Class A (United Kingdom) | | | 301 | | | | 10,860 | |

Royal Dutch Shell PLC, Class B (United Kingdom) | | | 157 | | | | 5,683 | |

RPC, Inc. | | | 112 | | | | 2,820 | |

Schlumberger Ltd. (Netherlands Antilles) | | | 157 | | | | 13,459 | |

Southwestern Energy Co.* | | | 43 | | | | 1,882 | |

Statoil ASA (Norway) | | | 202 | | | | 5,316 | |

Total S.A. (France) | | | 192 | | | | 11,049 | |

Williams (The) Cos., Inc. | | | 425 | | | | 13,341 | |

| | | | | | | | |

| | | | | | | 271,997 | |

| | | | | | | | |

| Financial — 3.3% | | | | | | | | |

Alexander’s, Inc. REIT | | | 11 | | | | 4,314 | |

Allianz SE (Germany) | | | 70 | | | | 9,679 | |

American Campus Communities, Inc. REIT | | | 111 | | | | 3,923 | |

American Capital Ltd.* | | | 375 | | | | 3,713 | |

American Express Co. | | | 150 | | | | 7,740 | |

Apollo Investment Corp. | | | 225 | | | | 2,567 | |

Ashford Hospitality Trust, Inc. REIT | | | 225 | | | | 3,211 | |

Associated Estates Realty Corp. REIT | | | 150 | | | | 2,529 | |

Australia & New Zealand Banking Group Ltd. (Australia) | | | 278 | | | | 6,555 | |

Banco Bilbao Vizcaya Argentaria S.A. (Spain) | | | 475 | | | | 5,541 | |

Banco Santander S.A. (Spain) | | | 428 | | | | 5,085 | |

Bank of America Corp. | | | 1,437 | | | | 16,885 | |

Barclays PLC (United Kingdom) | | | 1,133 | | | | 5,159 | |

Berkshire Hathaway, Inc., Class B* | | | 409 | | | | 32,340 | |

BioMed Realty Trust, Inc. REIT | | | 150 | | | | 3,074 | |

BNP Paribas (France) | | | 124 | | | | 9,665 | |

Boston Properties, Inc. REIT | | | 120 | | | | 13,002 | |

CBL & Associates Properties, Inc. REIT | | | 150 | | | | 2,886 | |

Charles Schwab (The) Corp. | | | 168 | | | | 3,026 | |

Citigroup, Inc. | | | 442 | | | | 18,188 | |

Commonwealth Bank of Australia (Australia) | | | 193 | | | | 10,410 | |

Community Trust Bancorp, Inc. | | | 75 | | | | 2,061 | |

Credit Suisse Group AG (Switzerland)* | | | 458 | | | | 19,664 | |

Entertainment Properties Trust REIT | | | 75 | | | | 3,644 | |

Equity One, Inc. REIT | | | 109 | | | | 2,137 | |

| | | | |

| See Notes to Financial Statements. | | 15 | | |

db-X Exchange-Traded Funds Inc.

SCHEDULE OF INVESTMENTS

db-X 2010 Target Date Fund (Continued)

May 31, 2011

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| | | | | | | | |

| Financial (Continued) | | | | | | | | |

Equity Residential REIT | | | 75 | | | $ | 4,637 | |

Evercore Partners, Inc., Class A | | | 75 | | | | 2,776 | |

FirstMerit Corp. | | | 157 | | | | 2,558 | |

Franklin Resources, Inc. | | | 31 | | | | 4,017 | |

Goldman Sachs Group (The), Inc. | | | 58 | | | | 8,162 | |

Highwoods Properties, Inc. REIT | | | 81 | | | | 2,922 | |

Home Properties, Inc. REIT | | | 75 | | | | 4,643 | |

HSBC Holdings PLC (United Kingdom) | | | 1,538 | | | | 16,070 | |

Investors Bancorp, Inc.* | | | 150 | | | | 2,246 | |

JPMorgan Chase & Co. | | | 571 | | | | 24,690 | |

Kilroy Realty Corp. REIT | | | 75 | | | | 3,110 | |

LaSalle Hotel Properties REIT | | | 75 | | | | 2,099 | |

M&T Bank Corp. | | | 75 | | | | 6,623 | |

MFA Financial, Inc. REIT | | | 238 | | | | 1,961 | |

Mid-America Apartment Communities, Inc. REIT | | | 64 | | | | 4,387 | |

Mitsubishi UFJ Financial Group, Inc. (Japan) | | | 1,793 | | | | 8,276 | |

Mizuho Financial Group, Inc. (Japan) | | | 1,667 | | | | 2,626 | |

Muenchener Rueckversicherungs-Gesellschaft AG (Germany) | | | 32 | | | | 4,904 | |

National Australia Bank Ltd. (Australia) | | | 262 | | | | 7,393 | |

National Interstate Corp. | | | 75 | | | | 1,619 | |

National Retail Properties, Inc. REIT | | | 98 | | | | 2,526 | |

Nordea Bank AB (Sweden) | | | 450 | | | | 5,270 | |

Northern Trust Corp. | | | 211 | | | | 10,295 | |

OMEGA Healthcare Investors, Inc. REIT | | | 97 | | | | 2,065 | |

Pebblebrook Hotel Trust REIT | | | 75 | | | | 1,631 | |

Platinum Underwriters Holdings Ltd. (Bermuda) | | | 14 | | | | 478 | |

Potlatch Corp. REIT | | | 12 | | | | 432 | |

ProAssurance Corp.* | | | 65 | | | | 4,570 | |

Prosperity Bancshares, Inc. | | | 91 | | | | 3,981 | |

Signature Bank* | | | 75 | | | | 4,269 | |

Simon Property Group, Inc. REIT | | | 63 | | | | 7,438 | |

Societe Generale (France) | | | 71 | | | | 4,209 | |

Standard Chartered PLC (United Kingdom) | | | 288 | | | | 7,717 | |

Sumitomo Mitsui Financial Group, Inc. (Japan) | | | 121 | | | | 3,500 | |

SVB Financial Group* | | | 75 | | | | 4,454 | |

T. Rowe Price Group, Inc. | | | 225 | | | | 14,242 | |

Travelers (The) Cos., Inc. | | | 75 | | | | 4,656 | |

U.S. Bancorp | | | 300 | | | | 7,680 | |

UBS AG (Switzerland)* | | | 505 | | | | 9,675 | |

UMB Financial Corp. | | | 77 | | | | 3,284 | |

UniCredit S.p.A (Italy) | | | 2,261 | | | | 5,132 | |

Washington Real Estate Investment Trust REIT | | | 49 | | | | 1,692 | |

Webster Financial Corp. | | | 75 | | | | 1,565 | |

Wells Fargo & Co. | | | 807 | | | | 22,895 | |

Westpac Banking Corp. (Australia) | | | 391 | | | | 9,220 | |

Weyerhaeuser Co. REIT | | | 458 | | | | 9,865 | |

Zurich Financial Services AG (Switzerland)* | | | 23 | | | | 6,151 | |

| | | | | | | | |

| | | | | | | 471,609 | |

| | | | | | | | |

| Industrial — 1.7% | | | | | | | | |

AAON, Inc. | | | 75 | | | | 2,528 | |

ABB Ltd. (Switzerland)* | | | 328 | | | | 8,802 | |

Acuity Brands, Inc. | | | 75 | | | | 4,572 | |

Benchmark Electronics, Inc.* | | | 150 | | | | 2,592 | |

Boeing (The) Co. | | | 150 | | | | 11,705 | |

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| | | | | | | | |

| Industrial (Continued) | | | | | | | | |

Cascade Corp. | | | 75 | | | $ | 3,047 | |

Caterpillar, Inc. | | | 99 | | | | 10,474 | |

CLARCOR, Inc. | | | 31 | | | | 1,321 | |

East Japan Railway Co. (Japan) | | | 33 | | | | 1,925 | |

Eaton Corp. | | | 254 | | | | 13,124 | |

EMCOR Group, Inc.* | | | 76 | | | | 2,308 | |

Emerson Electric Co. | | | 130 | | | | 7,091 | |

FedEx Corp. | | | 75 | | | | 7,023 | |

General Dynamics Corp. | | | 37 | | | | 2,746 | |

General Electric Co. | | | 1,662 | | | | 32,641 | |

GrafTech International Ltd.* | | | 114 | | | | 2,410 | |

Hexcel Corp.* | | | 75 | | | | 1,550 | |

Ingersoll-Rand PLC (Ireland) | | | 300 | | | | 14,971 | |

Knight Transportation, Inc. | | | 103 | | | | 1,761 | |

Koninklijke Philips Electronics NV (Netherlands) | | | 159 | | | | 4,406 | |

Lindsay Corp. | | | 75 | | | | 5,031 | |

Metabolix, Inc.* | | | 75 | | | | 663 | |

Moog, Inc., Class A* | | | 75 | | | | 3,079 | |

Nordson Corp. | | | 150 | | | | 7,803 | |

Parker Hannifin Corp. | | | 150 | | | | 13,328 | |

Republic Services, Inc. | | | 337 | | | | 10,621 | |

Rock-Tenn Co., Class A | | | 81 | | | | 6,224 | |

Schneider Electric S.A. (France) | | | 33 | | | | 5,437 | |

Siemens AG (Germany) | | | 54 | | | | 7,220 | |

Silgan Holdings, Inc. | | | 87 | | | | 3,905 | |

Sun Hydraulics Corp. | | | 75 | | | | 3,632 | |

Thermo Fisher Scientific, Inc.* | | | 75 | | | | 4,909 | |

TriMas Corp.* | | | 150 | | | | 3,060 | |

Union Pacific Corp. | | | 66 | | | | 6,929 | |

United Parcel Service, Inc., Class B | | | 116 | | | | 8,525 | |

United Technologies Corp. | | | 159 | | | | 13,955 | |

Vinci S.A. (France) | | | 62 | | | | 3,996 | |

Woodward, Inc. | | | 75 | | | | 2,642 | |

| | | | | | | | |

| | | | | | | 247,956 | |

| | | | | | | | |

| Technology — 1.4% | | | | | | | | |

Apple, Inc.* | | | 150 | | | | 52,174 | |

Applied Materials, Inc. | | | 225 | | | | 3,101 | |

CACI International, Inc., Class A* | | | 64 | | | | 4,085 | |

Concur Technologies, Inc.* | | | 32 | | | | 1,599 | |

EMC Corp.* | | | 268 | | | | 7,630 | |

Intel Corp. | | | 825 | | | | 18,570 | |

International Business Machines Corp. | | | 199 | | | | 33,617 | |

Jack Henry & Associates, Inc. | | | 103 | | | | 3,218 | |

Microsoft Corp. | | | 1,217 | | | | 30,437 | |

Netlogic Microsystems, Inc.* | | | 75 | | | | 2,874 | |

Parametric Technology Corp.* | | | 109 | | | | 2,539 | |

Quality Systems, Inc. | | | 66 | | | | 5,681 | |

Quest Software, Inc.* | | | 128 | | | | 2,905 | |

Riverbed Technology, Inc.* | | | 142 | | | | 5,385 | |

SAP AG (Germany) | | | 139 | | | | 8,627 | |

SRA International, Inc., Class A* | | | 121 | | | | 3,745 | |

Ultratech, Inc.* | | | 75 | | | | 2,383 | |

VeriFone Systems, Inc.* | | | 75 | | | | 3,610 | |

Xerox Corp. | | | 1,100 | | | | 11,231 | |

| | | | | | | | |

| | | | | | | 203,411 | |

| | | | | | | | |

| | | | |

| See Notes to Financial Statements. | | 16 | | |

db-X Exchange-Traded Funds Inc.

SCHEDULE OF INVESTMENTS

db-X 2010 Target Date Fund (Continued)

May 31, 2011

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| | | | | | | | |

| Utilities — 0.4% | | | | | | | | |

Cleco Corp. | | | 75 | | | $ | 2,632 | |

E.ON AG (Germany) | | | 297 | | | | 8,426 | |

GDF Suez (France) | | | 181 | | | | 6,651 | |

National Fuel Gas Co. | | | 75 | | | | 5,403 | |

Nicor, Inc. | | | 24 | | | | 1,319 | |

Piedmont Natural Gas Co., Inc. | | | 85 | | | | 2,675 | |

RWE AG (Germany) | | | 71 | | | | 4,137 | |

Sempra Energy | | | 225 | | | | 12,413 | |

Southern Co. | | | 158 | | | | 6,333 | |

Tokyo Electric Power (The) Co., Inc. (Japan) | | | 180 | | | | 702 | |

WGL Holdings, Inc. | | | 33 | | | | 1,295 | |

| | | | | | | | |

| | | | | | | 51,986 | |

| | | | | | | | |

TOTAL COMMON STOCKS

(Cost $2,137,241) | | | | | | | 2,327,999 | |

| | | | | | | | |

| | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| CORPORATE BONDS — 18.3% | | | | | | | | |

| Basic Materials — 0.4% | | | | | | | | |

BHP Billiton Finance USA Ltd. (Australia)

5.50%, 4/01/14 | | $ | 47,000 | | | | 52,518 | |

| | | | | | | | |

| Communications — 1.2% | | | | | | | | |

AT&T, Inc.

5.875%, 2/01/12 | | | 86,000 | | | | 89,030 | |

Cellco Partnership/Verizon Wireless Capital LLC

5.55%, 2/01/14 | | | 62,000 | | | | 68,525 | |

Telefonica Emisiones SAU (Spain)

4.949%, 1/15/15 | | | 22,000 | | | | 23,683 | |

| | | | | | | | |

| | | | | | | 181,238 | |

| | | | | | | | |

| Consumer, Cyclical — 0.3% | | | | | | | | |

Wal-Mart Stores, Inc.

4.55%, 5/01/13 | | | 35,000 | | | | 37,600 | |

| | | | | | | | |

| Consumer, Non-cyclical — 1.5% | | | | | | | | |

Diageo Finance BV (Netherlands)

5.30%, 10/28/15 | | | 30,000 | | | | 33,861 | |

UnitedHealth Group, Inc.

4.875%, 3/15/15 | | | 47,000 | | | | 51,662 | |

WellPoint, Inc.

5.25%, 1/15/16 | | | 56,000 | | | | 62,869 | |

Wyeth

5.50%, 2/01/14 | | | 56,000 | | | | 62,395 | |

| | | | | | | | |

| | | | | | | 210,787 | |

| | | | | | | | |

| Energy — 0.4% | | | | | | | | |

Apache Corp.

5.25%, 4/15/13 | | | 32,000 | | | | 34,631 | |

BP Capital Markets PLC (United Kingdom)

3.875%, 3/10/15 | | | 22,000 | | | | 23,261 | |

| | | | | | | | |

| | | | | | | 57,892 | |

| | | | | | | | |

| Financial — 10.9% | | | | | | | | |

Bank of America Corp.

4.875%, 1/15/13 | | | 110,000 | | | | 116,010 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Financial (Continued) | | | | | | | | |

Bank of New York Mellon (The) Corp.

4.30%, 5/15/14 | | $ | 86,000 | | | $ | 93,385 | |

Berkshire Hathaway, Inc.

3.20%, 2/11/15 | | | 48,000 | | | | 50,441 | |

Boeing Capital Corp.

5.80%, 1/15/13 | | | 110,000 | | | | 118,958 | |

Boston Properties LP

6.25%, 1/15/13 | | | 2,000 | | | | 2,159 | |

Citigroup, Inc.

6.00%, 2/21/12 | | | 71,000 | | | | 73,707 | |

Goldman Sachs Group (The), Inc.

5.00%, 10/01/14 | | | 116,000 | | | | 125,209 | |

HSBC Finance Corp.

6.375%, 11/27/12 | | | 63,000 | | | | 67,861 | |

5.50%, 1/19/16 | | | 50,000 | | | | 55,814 | |

John Deere Capital Corp.

7.00%, 3/15/12 | | | 60,000 | | | | 63,121 | |

JPMorgan Chase & Co.

5.75%, 1/02/13 | | | 111,000 | | | | 118,715 | |

KFW (Germany)

3.25%, 10/14/11 | | | 52,000 | | | | 52,588 | |

Merrill Lynch & Co., Inc., Series C, MTN

5.00%, 1/15/15 | | | 78,000 | | | | 83,670 | |

MetLife, Inc.

5.00%, 6/15/15 | | | 75,000 | | | | 82,532 | |

Morgan Stanley

5.30%, 3/01/13 | | | 74,000 | | | | 78,901 | |

National Rural Utilities Cooperative Finance Corp., Series C, MTN

7.25%, 3/01/12 | | | 36,000 | | | | 37,805 | |

PNC Funding Corp.

5.25%, 11/15/15 | | | 41,000 | | | | 44,870 | |

Prudential Financial, Inc., Series B, MTN

5.10%, 9/20/14 | | | 18,000 | | | | 19,718 | |

Simon Property Group LP

5.10%, 6/15/15 | | | 33,000 | | | | 36,546 | |

Wachovia Corp.

5.25%, 8/01/14 | | | 94,000 | | | | 102,408 | |

Wells Fargo & Co.

5.00%, 11/15/14 | | | 138,000 | | | | 150,111 | |

| | | | | | | | |

| | | | | | | 1,574,529 | |

| | | | | | | | |

| Government — 2.1% | | | | | | | | |

European Investment Bank, MTN (Supranational)

4.625%, 5/15/14 | | | 192,000 | | | | 211,885 | |

Inter-American Development Bank (Supranational)

4.375%, 9/20/12 | | | 82,000 | | | | 86,223 | |

| | | | | | | | |

| | | | | | | 298,108 | |

| | | | | | | | |

| Technology — 0.8% | | | | | | | | |