UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22001

db-X Exchange-Traded Funds Inc.

(Exact name of registrant as specified in charter)

60 Wall Street

New York, New York 10005

(Address of principal executive offices) (Zip code)

Alex Depetris

db-X Exchange-Traded Funds Inc.

60 Wall Street

New York, New York 10005

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 250-4352

Date of fiscal year end: May 31

Date of reporting period: May 31, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

ANNUAL REPORT

May 31, 2014

db-X Exchange-Traded Funds Inc.

db X-trackers 2010 Target Date Fund (TDD)

db X-trackers 2020 Target Date Fund (TDH)

db X-trackers 2030 Target Date Fund (TDN)

db X-trackers 2040 Target Date Fund (TDV)

db X-trackers In-Target Date Fund (TDX)

db-X Exchange-Traded Funds Inc.

TABLE OF CONTENTS

TO OUR SHAREHOLDERS: (Unaudited)

Dear Shareholder,

We are pleased to present this annual report which covers the 12-month period ended May 31, 2014.

In the second quarter of 2014, global equities rallied as investors anticipated a snapback in the U.S. economy from its weather-related malaise in the first quarter, while the accommodative monetary policies of global central banks overshadowed geopolitical risk in Iraq and Ukraine. Although a revising down of first-quarter U.S. GDP caused the U.S. Federal Reserve Board (the Fed) to reduce their 2014 GDP forecast, relatively strong U.S. manufacturing data, improving consumer confidence and a better employment picture had many forecasters looking for an acceleration in economic growth going forward. In the past year, market interest rates reacted strongly to expectations regarding the economy and the potential for the U.S. Federal Reserve Board (Fed) to begin unwinding its extremely accommodative monetary policy. Early in the period, some funds began to experience significant outflows as investors found the historically low yields on offer unappealing and sought to minimize exposure to rising interest rates. Entering 2014, markets appeared to become more comfortable with the likely pace of Fed tightening, and bond market rates generally began to drift downward. But, it’s important to note that the recent interest-rate declines that have supported bond prices may have been influenced in part by the extreme weather of this past winter, so the markets will closely monitor economic data and the direction and effectiveness of monetary policy. In addition, the European Central Bank (ECB) stepped up monetary easing by lowering its three main interest rates, and the ECB became the first major central bank in the world to cut a key policy rate to a level below zero.

We believe that these funds provide convenient, efficient and transparent access to a sophisticated target-date investment strategy. A strengthening economy boosted the domestic equity market (as measured by the S&P 500) during the 12-month period ended May 31, 2014, contributing to solid NAV returns of 18.15% and 16.14%, respectively, for the db X-trackers 2040 Target Date Fund and the db X-trackers 2030 Target Date Fund, which have the greatest percentage allocations to equities, The db X-trackers 2020 Target Date Fund, which has a more balanced allocation between equity and fixed-income securities, experienced a NAV return of 9.79%. For investors with a shorter investment horizon, the db-X-trackers 2010 Target Date Fund and the db X-trackers In-Target Date Fund, which allocate a large percentage of assets to fixed-income securities, experienced NAV returns of 3.84% and 6.12%, respectively.

Deutsche Bank, a leading global banking institution, has managed and operated a successful and growing platform of exchange-traded products since 2006. We appreciate your trust and look forward to serving your investment needs with these innovative index-driven strategies.

Sincerely,

/s/ Alex Depetris

Alex Depetris

Chairman, President and Chief Executive Officer

July 25, 2014

*************************

* Past performance is no guarantee of future results. Fund performance assumes reinvestment of dividends and capital gains distributions. A Fund’s net asset value (“NAV”) return is based on the changes in the Fund’s NAV per share for the period indicated. A Fund’s NAV per share is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. Current Fund performance may be higher or lower than the performance quoted. The most recent month end performance may be obtained by visiting www.dbxus.com.

1

An index is a statistical measure of a specified financial market or sector. An index is unmanaged and one cannot invest directly in an index. An index does not actually hold a portfolio of securities, incur expenses, or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses. In comparison, a Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

The views expressed in this report reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Current and future portfolio holdings are subject to risk. Investment in the Funds poses investment risk, including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost.

2

db-X Exchange-Traded Funds Inc.

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

The db X-trackers 2010 Target Date Fund

The db X-trackers 2010 Target Date Fund (“TDD”) seeks to track the performance, before fees and expenses, of the Zacks 2010 Lifecycle Index (“TDD Index”). TDD employs a representative sampling indexing strategy by holding equity and fixed income securities that in the aggregate are intended to approximate the characteristics of the TDD Index. Accordingly, TDD did not hold all of the securities in the TDD Index.

For the 12-month period ended May 31, 2014, TDD’s net asset value increased 3.84%, compared to an increase of 4.51% for the TDD Index and 6.45% for the Dow Jones Target 2010 Index. TDD’s performance benefited from positive return contributions from fixed income securities, both corporate and U.S. Government issued, which comprised over three-quarters of TDD’s average weight during the period. TDD further benefitted from favorable results in several equity sectors, in particular Information Technology, Health Care and Financials, which was partially offset by the TDD’s heavier weighting to fixed income securities, in particular short-term U.S. Treasuries.

The db X-trackers 2020 Target Date Fund

The db X-trackers 2020 Target Date Fund (“TDH”) seeks to track the performance, before fees and expenses, of the Zacks 2020 Lifecycle Index (“TDH Index”). TDH employs a representative sampling indexing strategy by holding equity and fixed income securities that in the aggregate are intended to approximate the characteristics of the TDH Index.

For the 12-month period ended May 31, 2014, TDH’s net asset value was 9.79%, compared to 10.54% for the TDH Index and 9.30% for the Dow Jones Target 2020 Index. TDH’s performance benefitted from favorable results in several equity sectors, which averaged approximately 53% of assets during the period, in particular Information Technology, Health Care and Financials, as well as strong performance in intermediate-term U.S. Treasuries.

The db X-trackers 2030 Target Date Fund

The db X-trackers 2030 Target Date Fund (“TDN”) seeks to track the performance, before fees and expenses, of the Zacks 2030 Lifecycle Index (“TDN Index”). TDN employs a representative sampling indexing strategy by holding equity and fixed income securities that in the aggregate are intended to approximate the characteristics of the TDN Index. Accordingly, TDN did not hold all of the securities in the TDN Index.

For the 12-month period ended May 31, 2014, TDN’s net asset value was 16.14%, compared to 16.83% for TDN Index and 12.85% for the Dow Jones Target 2030 Index. TDN’s performance benefitted from holding approximately 75% of its total assets in equities, with favorable results in several sectors, in particular Information Technology, Health Care and Financials. TDN’s 25% allocation to long-term corporate fixed income securities made a small positive contribution to returns.

The db X-trackers 2040 Target Date Fund

The db X-trackers 2040 Target Date Fund (“TDV”) seeks to track the performance, before fees and expenses, of the Zacks 2040 Lifecycle Index (“TDV Index”). TDV employs a representative sampling indexing strategy by holding equity and fixed income securities that in the aggregate are intended to approximate the characteristics of the TDV Index. Accordingly, TDV did not hold all of the securities in the TDV Index.

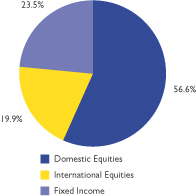

For the 12-month period ended May 31, 2014, TDV’s net asset value was 18.15%, compared to 18.67% for the TDV Index and 15.47% for the Dow Jones Target 2040 Index. TDV’s performance benefitted from allocating 94% of its assets to equities, with favorable results in several sectors, in particular Information Technology, Health Care and Financials. TDV’s 6% allocation to long-term corporate fixed income securities made a small positive contribution to returns as well.

The db X-trackers In-Target Date Fund

The db X-trackers In-Target Date Fund ( “TDX”) seeks to track the performance, before fees and expenses, of the Zacks In-Target Lifecycle Index (“TDX Index”). TDX employs a representative sampling indexing strategy by holding equity and fixed income securities that in the aggregate are intended to approximate the characteristics of the TDX Index. Accordingly, TDX did not hold all of the securities in the TDX Index.

For the 12-month period ended May 31, 2014, TDX’s net asset value was 6.12%, compared to 6.73% for the TDX Index and 5.56% for the Dow Jones Target Today Index. During the period TDX allocated approximately 34% of its assets to equities and 66% to fixed income securities. TDX’s performance benefited from favorable results in several equity sectors, in particular Information Technology, Health Care and Financials. TDX’s fixed Income allocation, also contributed positive returns as both corporate and U.S. Government issues performed well.

3

db-X Exchange-Traded Funds Inc.

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

*************************

Performance quoted above represents past performance, assumes reinvestment of all dividends and capital gains distributions at net asset value (“NAV”), and does not guarantee future results. A Fund’s NAV return is based on the changes in the Fund’s NAV per share for the period indicated. A Fund’s NAV per share is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. Current Fund performance may be higher or lower than the performance quoted. Fund performance data current to the most recent month end may be obtained by visiting www.dbxus.com. See pages 5-14 of this report for additional performance information, including performance data based on market value.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses, or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, a Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

The views expressed in this report reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Current and future portfolio holdings are subject to risk. Investment in the Funds poses investment risk, including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost.

4

This Page is Intentionally Left Blank

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db X-trackers 2010 Target Date Fund (TDD) (Unaudited)

The db X-trackers 2010 Target Date Fund (the “Fund”) commenced investment operations and its shares began trading on NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks 2010 Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks 2010 Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

For the year ended May 31, 2014, the Fund’s net asset value increased 3.84%, compared to an increase of 4.51% for the Zacks 2010 Lifecycle Index and an increase of 6.45% for the Dow Jones Target 2010 Index. The fund’s performance benefited from favorable results in short-term fixed income securities, though the bulk of the returns were the result of the fund’s exposure to domestic and international equities.

Performance as of 5/31/14

| | | | | | | | |

| Average Annual Total Returns |

| | | Net Asset Value | | Market Price | | Zacks 2010 Lifecycle

Index | | Dow Jones Target 2010

Index |

One Year | | 3.84% | | 5.45% | | 4.51% | | 6.45% |

Five Year | | 4.17% | | 3.12% | | 4.62% | | 7.57% |

Since Inception1 | | 1.70% | | 1.29% | | 2.05% | | 4.55% |

|

| Cumulative Total Returns |

| | | Net Asset Value | | Market Price | | Zacks 2010 Lifecycle

Index | | Dow Jones Target 2010

Index |

One Year | | 3.84% | | 5.45% | | 4.51% | | 6.45% |

Five Year | | 22.68% | | 16.63% | | 25.36% | | 44.00% |

Since Inception1 | | 11.91% | | 8.91% | | 14.50% | | 34.53% |

1 Total returns are calculated based on the commencement of operations, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.dbxus.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio for the fiscal year ended May 31, 2013, as disclosed in the most recent prospectus dated October 1, 2013, was 1.53%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/14.

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash sub indexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the index whose performance the Fund seeks to track will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

6

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db X-trackers 2010 Target Date Fund (TDD) (Unaudited) (Continued)

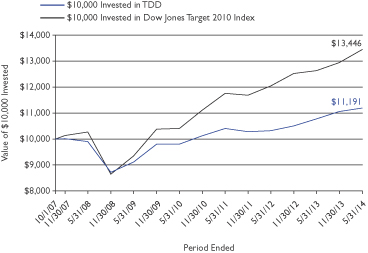

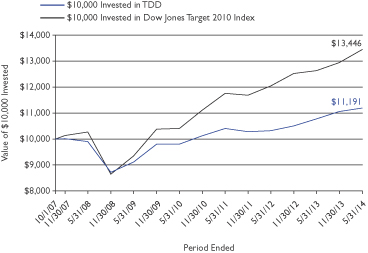

Growth of a $10,000 Investment in TDD2 as of 5/31/14

2 Based on Net Asset Value from commencement of operations 10/1/07.

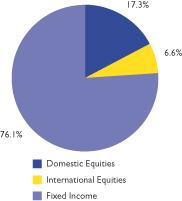

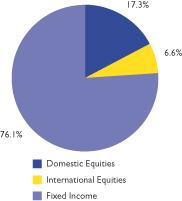

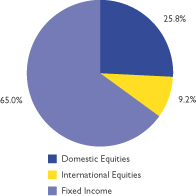

Asset Class Breakdown* as of 5/31/14

* Weightings are expressed as a percentage of total investments and may change over time.

Top Ten Holdings3 as of 5/31/14

| | | | |

| |

| Top Ten Equity Holdings | |

| |

| Description | | % of Net Assets | |

Apple, Inc. | | | 0.7% | |

Exxon Mobil Corp. | | | 0.5% | |

Microsoft Corp. | | | 0.5% | |

Google, Inc., Class A | | | 0.5% | |

Berkshire Hathaway, Inc., Class B | | | 0.4% | |

General Electric Co. | | | 0.3% | |

Johnson & Johnson | | | 0.3% | |

Wells Fargo & Co. | | | 0.3% | |

Wal-Mart Stores, Inc. | | | 0.3% | |

Chevron Corp. | | | 0.3% | |

| | | | |

| |

| Top Ten Fixed Income Holdings | |

| |

| Description | | % of Net Assets | |

U.S. Treasury Bond/Note 4.00%, 2/15/15 | | | 5.3% | |

U.S. Treasury Bond/Note 0.875%, 9/15/16 | | | 5.2% | |

U.S. Treasury Bond/Note 1.00%, 8/31/16 | | | 4.9% | |

U.S. Treasury Bond/Note 1.25%, 9/30/15 | | | 4.4% | |

U.S. Treasury Bond/Note 1.75%, 7/31/15 | | | 4.0% | |

U.S. Treasury Bond/Note 4.25%, 8/15/15 | | | 3.7% | |

U.S. Treasury Bond/Note 0.375%, 1/15/16 | | | 3.6% | |

Goldman Sachs Group (The), Inc. 5.00%, 10/01/14 | | | 3.1% | |

Merrill Lynch & Co., Inc. Series C, MTN 5.00%, 1/15/15 | | | 2.8% | |

Wells Fargo & Co. 5.00%, 11/15/14 | | | 2.8% | |

3 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to page 16.

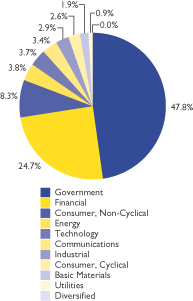

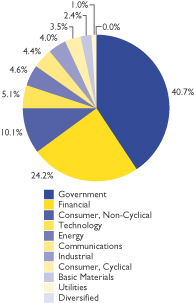

Sector Breakdown* as of 5/31/14

* Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Bloomberg industry name.

7

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db X-trackers 2020 Target Date Fund (TDH) (Unaudited)

The db X-trackers 2020 Target Date Fund (the “Fund”) commenced investment operations and its shares began trading on NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks 2020 Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks 2020 Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

For the year ended May 31, 2014, the Fund’s net asset value increased 9.79%, compared to an increase of 10.54% for the Zacks 2020 Lifecycle Index and 9.30% for the Dow Jones Target 2020 Index. The fund’s performance benefited from favorable results in domestic and international equities.

Performance as of 5/31/14

| | | | | | | | |

| Average Annual Total Returns |

| | | Net Asset Value | | Market Price | | Zacks 2020 Lifecycle

Index | | Dow Jones Target 2020

Index |

One Year | | 9.79% | | 9.88% | | 10.54% | | 9.30% |

Five Year | | 10.53% | | 10.35% | | 10.85% | | 10.18% |

Since Inception1 | | 3.33% | | 2.96% | | 3.57% | | 4.27% |

|

| Cumulative Total Returns |

| | | Net Asset Value | | Market Price | | Zacks 2020 Lifecycle

Index | | Dow Jones Target 2020

Index |

One Year | | 9.79% | | 9.88% | | 10.54% | | 9.30% |

Five Year | | 64.95% | | 63.61% | | 67.37% | | 62.39% |

Since Inception1 | | 24.44% | | 21.47% | | 26.34% | | 32.14% |

1 Total returns are calculated based on the commencement of operations, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.dbxus.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio for the fiscal year ended May 31, 2013, as disclosed in the most recent prospectus dated October 1, 2013, was 1.15%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/14.

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash subindexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the index whose performance the Fund seeks to track will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

8

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db X-trackers 2020 Target Date Fund (TDH) (Unaudited) (Continued)

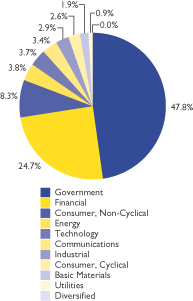

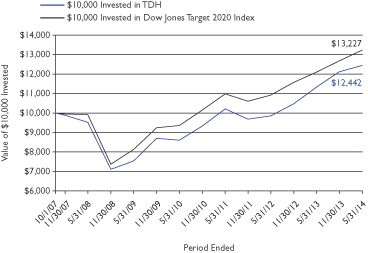

Growth of a $10,000 Investment in TDH2 as of 5/31/14

2 Based on Net Asset Value from commencement of operations 10/1/07.

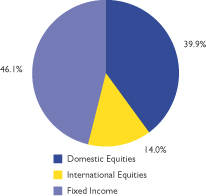

Asset Class Breakdown* as of 5/31/14

* Weightings are expressed as a percentage of total investments and may change over time.

Top Ten Holdings3 as of 5/31/14

| | | | |

| |

| Top Ten Equity Holdings | |

| |

| Description | | % of Net Assets | |

Apple, Inc. | | | 1.5% | |

Exxon Mobil Corp. | | | 1.2% | |

Google, Inc., Class A | | | 1.0% | |

Microsoft Corp. | | | 1.0% | |

Berkshire Hathaway, Inc., Class B | | | 0.8% | |

Johnson & Johnson | | | 0.7% | |

General Electric Co. | | | 0.7% | |

Wells Fargo & Co. | | | 0.7% | |

Wal-Mart Stores, Inc. | | | 0.7% | |

Chevron Corp. | | | 0.6% | |

| | | | |

| |

| Top Ten Fixed Income Holdings | |

| |

| Description | | % of Net Assets | |

U.S. Treasury Bond/Note 4.25%, 8/15/15 | | | 6.6% | |

U.S. Treasury Bond/Note 1.875%, 6/30/15 | | | 4.6% | |

U.S. Treasury Bond/Note 1.25%, 9/30/15 | | | 4.5% | |

U.S. Treasury Bond/Note 2.125%, 5/31/15 | | | 3.5% | |

U.S. Treasury Bond/Note 2.50%, 3/31/15 | | | 2.5% | |

U.S. Treasury Bond/Note 2.375%, 2/28/15 | | | 2.3% | |

Federal National Mortgage Association 5.00%, 4/15/15 | | | 2.3% | |

U.S. Treasury Bond/Note 4.00%, 2/15/15 | | | 2.3% | |

U.S. Treasury Bond/Note 2.00%, 1/31/16 | | | 2.2% | |

Oracle Corp. 5.25%, 1/15/16 | | | 1.4% | |

3 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to page 21.

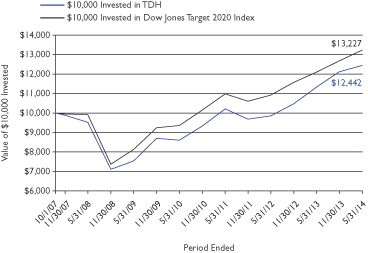

Sector Breakdown* as of 5/31/14

* Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Bloomberg industry name.

9

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db X-trackers 2030 Target Date Fund (TDN) (Unaudited)

The db X-trackers 2030 Target Date Fund (the “Fund”) commenced investment operations and its shares began trading on NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks 2030 Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks 2030 Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

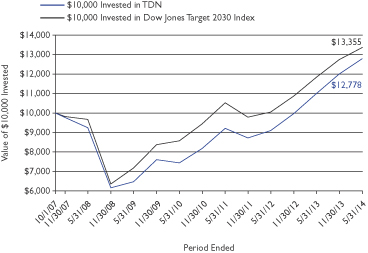

For the year ended May 31, 2014, the Fund’s net asset value increased 16.14%, compared to an increase of 16.83% for the Zacks 2030 Lifecycle Index and 12.85% for the Dow Jones Target 2030 Index. The fund’s performance benefitted from a large exposure to domestic and international equities.

Performance as of 5/31/14

| | | | | | | | |

| Average Annual Total Returns |

| | | Net Asset Value | | Market Price | | Zacks 2030 Lifecycle

Index | | Dow Jones Target 2030

Index |

One Year | | 16.14% | | 14.28% | | 16.83% | | 12.85% |

Five Year | | 14.61% | | 15.25% | | 15.29% | | 13.22% |

Since Inception1 | | 3.75% | | 3.56% | | 4.22% | | 4.43% |

|

| Cumulative Total Returns |

| | | Net Asset Value | | Market Price | | Zacks 2030 Lifecycle

Index | | Dow Jones Target 2030

Index |

One Year | | 16.14% | | 14.28% | | 16.83% | | 12.85% |

Five Year | | 97.76% | | 103.29% | | 103.72% | | 86.01% |

Since Inception1 | | 27.78% | | 26.27% | | 31.71% | | 33.51% |

1 Total returns are calculated based on the commencement of operations, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.dbxus.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio for the fiscal year ended May 31, 2013, as disclosed in the most recent prospectus dated October 1, 2013, was 1.16%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/14.

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash subindexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the index whose performance the Fund seeks to track will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

10

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db X-trackers 2030 Target Date Fund (TDN) (Unaudited) (Continued)

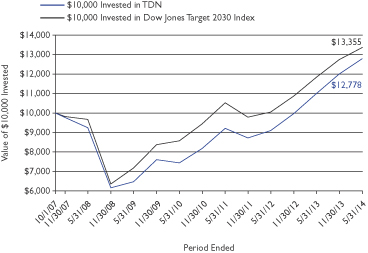

Growth of a $10,000 Investment in TDN2 as of 5/31/14

2 Based on Net Asset Value from commencement of operations 10/01/07.

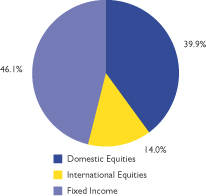

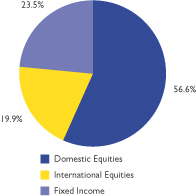

Asset Class Breakdown* as of 5/31/14

* Weightings are expressed as a percentage of total investments and may change over time.

Top Ten Holdings3 as of 5/31/14

| | | | |

| |

| Top Ten Equity Holdings | |

| |

| Description | | % of Net Assets | |

Apple, Inc. | | | 2.1% | |

Exxon Mobil Corp. | | | 1.6% | |

Microsoft Corp. | | | 1.5% | |

Google, Inc., Class A | | | 1.4% | |

Berkshire Hathaway, Inc., Class B | | | 1.1% | |

Johnson & Johnson | | | 1.0% | |

General Electric Co. | | | 1.0% | |

Wells Fargo & Co. | | | 1.0% | |

Wal-Mart Stores, Inc. | | | 0.9% | |

Chevron Corp. | | | 0.9% | |

| | | | |

| |

| Top Ten Fixed Income Holdings | |

| |

| Description | | % of Net Assets | |

Amgen, Inc. 5.65%, 6/15/42 | | | 0.9% | |

Southern California Edison Co. 6.05%, 3/15/39 | | | 0.8% | |

Shell International Finance BV (Netherlands) 6.375%, 12/15/38 | | | 0.7% | |

AT&T, Inc. 5.55%, 8/15/41 | | | 0.7% | |

U.S. Treasury Bond/Note 4.375%, 11/15/39 | | | 0.6% | |

U.S. Treasury Bond/Note 4.50%, 2/15/36 | | | 0.6% | |

Travelers (The) Cos., Inc. 5.35%, 11/01/40 | | | 0.6% | |

MetLife, Inc. 5.875%, 2/06/41 | | | 0.5% | |

Lowe’s Cos., Inc. 5.125%, 11/15/41 | | | 0.5% | |

Devon Energy Corp. 4.75%, 5/15/42 | | | 0.5% | |

3 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to page 26.

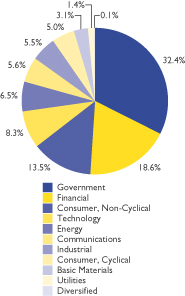

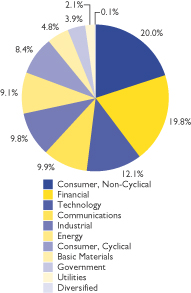

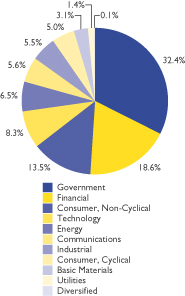

Sector Breakdown* as of 5/31/14

* Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Bloomberg industry name.

11

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

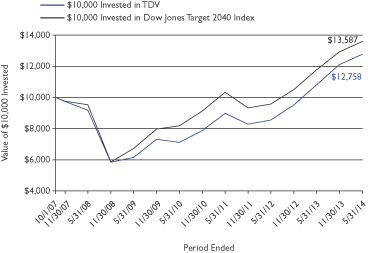

db X-trackers 2040 Target Date Fund (TDV) (Unaudited)

The db X-trackers 2040 Target Date Fund (the “Fund”) commenced investment operations and its shares began trading on NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks 2040 Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks 2040 Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

For the year ended May 31, 2014, the Fund’s net asset value increased 18.15%, compared to an increase of 18.67% for the Zacks 2040 Lifecycle Index and 15.47% for the Dow Jones Target 2040 Index. The fund’s performance benefitted from a large exposure to domestic and international equities.

Performance as of 5/31/14

| | | | | | | | |

| Average Annual Total Returns |

| | | Net Asset Value | | Market Price | | Zacks 2040 Lifecycle

Index | | Dow Jones Target 2040

Index |

One Year | | 18.15% | | 22.74% | | 18.67% | | 15.47% |

Five Year | | 15.70% | | 15.52% | | 15.75% | | 15.18% |

Since Inception1 | | 3.72% | | 3.78% | | 3.76% | | 4.72% |

|

| Cumulative Total Returns |

| | | Net Asset Value | | Market Price | | Zacks 2040 Lifecycle

Index | | Dow Jones Target 2040

Index |

One Year | | 18.15% | | 22.74% | | 18.67% | | 15.47% |

Five Year | | 107.37% | | 105.72% | | 107.78% | | 102.67% |

Since Inception1 | | 27.57% | | 28.04% | | 27.90% | | 35.99% |

1 Total returns are calculated based on the commencement of operations, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.dbxus.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio for the fiscal year ended May 31, 2013, as disclosed in the most recent prospectus dated October 1, 2013, was 1.17%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/14.

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash subindexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the index whose performance the Fund seeks to track will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

12

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db X-trackers 2040 Target Date Fund (TDV) (Unaudited) (Continued)

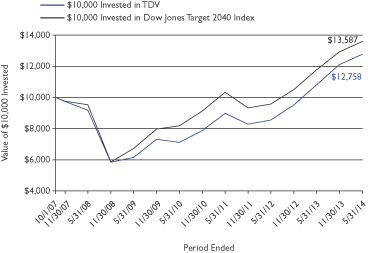

Growth of a $10,000 Investment in TDV2 as of 5/31/14

2 Based on Net Asset Value from commencement of operations 10/1/07.

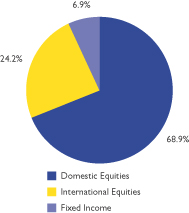

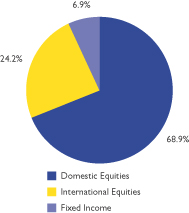

Asset Class Breakdown* as of 5/31/14

* Weightings are expressed as a percentage of total investments and may change over time.

Top Ten Holdings3 as of 5/31/14

| | | | |

| |

| Top Ten Equity Holdings | |

| |

| Description | | % of Net Assets | |

Apple, Inc. | | | 2.6% | |

Exxon Mobil Corp. | | | 2.0% | |

Microsoft Corp. | | | 1.8% | |

Google, Inc., Class A | | | 1.7% | |

Berkshire Hathaway, Inc., Class B | | | 1.4% | |

Johnson & Johnson | | | 1.2% | |

General Electric Co. | | | 1.2% | |

Wells Fargo & Co. | | | 1.2% | |

Wal-Mart Stores, Inc. | | | 1.1% | |

Chevron Corp. | | | 1.1% | |

| | | | |

| |

| Top Ten Fixed Income Holdings | |

| |

| Description | | % of Net Assets | |

US Treasury Bond/Note 4.375%, 5/15/41 | | | 0.6% | |

US Treasury Bond/Note 4.375%, 11/15/39 | | | 0.6% | |

US Treasury Bond/Note 3.125%, 2/15/42 | | | 0.5% | |

US Treasury Bond/Note 4.75%, 2/15/37 | | | 0.4% | |

US Treasury Bond/Note 4.625%, 2/15/40 | | | 0.4% | |

US Treasury Bond/Note 4.75%, 2/15/41 | | | 0.3% | |

US Treasury Bond/Note 4.375%, 5/15/40 | | | 0.3% | |

US Treasury Bond/Note 3.875%, 8/15/40 | | | 0.3% | |

US Treasury Bond/Note 4.50%, 2/15/36 | | | 0.2% | |

Tennessee Valley Authority 4.875%, 1/15/48 | | | 0.2% | |

3 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to page 32.

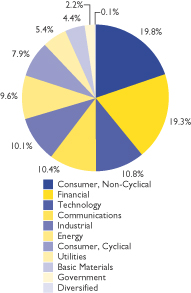

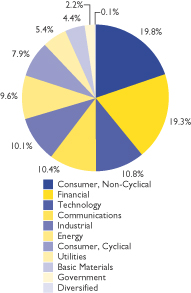

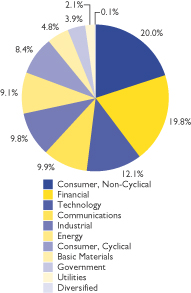

Sector Breakdown* as of 5/31/14

* Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Bloomberg industry name.

13

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

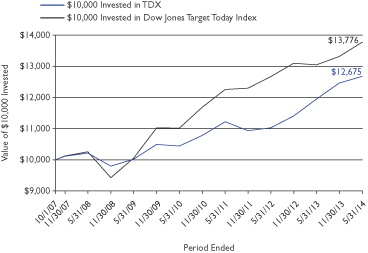

db X-trackers In-Target Date Fund (TDX) (Unaudited)

The db X-trackers In-Target Date Fund (the “Fund”) commenced investment operations and its shares began trading on NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks In-Target Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks In-Target Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

For the year ended May 31, 2014, the Fund’s net asset value increased 6.12%, compared to an increase of 6.73% for the Zacks In-Target Lifecycle Index and an increase of 5.56% for the Dow Jones Target Today Index. The fund’s performance benefited from favorable results in domestic and international equities.

Performance as of 5/31/14

| | | | | | | | |

| Average Annual Total Returns |

| | | Net Asset Value | | Market Price | | Zacks In-Target Lifecycle

Index | | Dow Jones Target Today

Index |

One Year | | 6.12% | | 8.86% | | 6.73% | | 5.56% |

Five Year | | 4.82% | | 4.91% | | 5.19% | | 6.52% |

Since Inception1 | | 3.62% | | 3.58% | | 3.90% | | 4.92% |

|

| Cumulative Total Returns |

| | | Net Asset Value | | Market Price | | Zacks In-Target Lifecycle

Index | | Dow Jones Target Today

Index |

One Year | | 6.12% | | 8.86% | | 6.73% | | 5.56% |

Five Year | | 26.51% | | 27.09% | | 28.82% | | 37.12% |

Since Inception1 | | 26.77% | | 26.40% | | 29.06% | | 37.79% |

1 Total returns are calculated based on the commencement of operations, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.dbxus.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio for the fiscal year ended May 31, 2013, as disclosed in the most recent prospectus dated October 1, 2013, was 1.47%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/14.

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash subindexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the index whose performance the Fund seeks to track will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

14

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db X-trackers In-Target Date Fund (TDX) (Unaudited) (Continued)

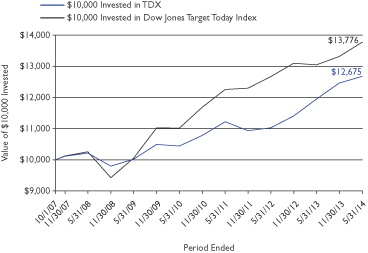

Growth of a $10,000 Investment in TDX2 as of 5/31/14

2 Based on Net Asset Value from commencement of operations 10/1/07.

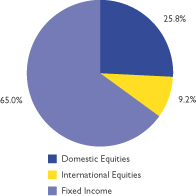

Asset Class Breakdown* as of 5/31/14

* Weightings are expressed as a percentage of total investments and may change over time.

Top Ten Holdings3 as of 5/31/14

| | | | |

| |

| Top Ten Equity Holdings | |

| |

| Description | | % of Net Assets | |

Apple, Inc. | | | 1.0 | % |

Exxon Mobil Corp. | | | 0.8 | % |

Google, Inc., Class A | | | 0.7 | % |

Microsoft Corp. | | | 0.7 | % |

Berkshire Hathaway, Inc., Class B | | | 0.5 | % |

Johnson & Johnson | | | 0.5 | % |

General Electric Co. | | | 0.5 | % |

Wal-Mart Stores, Inc. | | | 0.4 | % |

Wells Fargo & Co. | | | 0.4 | % |

Chevron Corp. | | | 0.4 | % |

| | | | |

| |

| Top Ten Fixed Income Holdings | |

| |

| Description | | % of Net Assets | |

U.S. Treasury Bond/Note 1.00%, 8/31/16 | | | 5.5 | % |

U.S. Treasury Bond/Note 0.88%, 9/15/16 | | | 4.5 | % |

U.S. Treasury Bond/Note 4.00%, 2/15/15 | | | 4.3 | % |

U.S. Treasury Bond/Note 1.25%, 9/30/15 | | | 3.4 | % |

U.S. Treasury Bond/Note 1.75%, 7/31/15 | | | 3.3 | % |

U.S. Treasury Bond/Note 0.38%, 1/15/16 | | | 3.1 | % |

Goldman Sachs Group (The), Inc. 5.00%, 10/01/14 | | | 2.7 | % |

Merrill Lynch & Co., Inc. 5.00%, 1/15/15 | | | 2.4 | % |

Wells Fargo & Co. 5.00%, 11/15/14 | | | 2.4 | % |

U.S. Treasury Bond/Note 2.38%, 9/30/14 | | | 2.2 | % |

3 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to page 38.

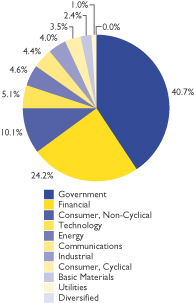

Sector Breakdown* as of 5/31/14

* Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Bloomberg industry name.

15

db-X Exchange-Traded Funds Inc.

FEES AND EXPENSES (Unaudited)

As a shareholder of one or more of the funds, you incur two types of costs: (1) transaction costs, including brokerage commissions paid on purchases and sales of fund shares, and (2) ongoing costs, including management fees and other Fund expenses. The expense examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds. In the most recent six-month period, each Fund limited these expenses; had they not done so, expenses would have been higher.

The examples are based on an investment of $1,000 made at the beginning of the period and held through the six-month period ended May 31, 2014.

ACTUAL EXPENSES

The first line in the following tables provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the following tables provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses (which is not the Funds’ actual return). The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only, and do not reflect any transactional costs. Therefore the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

December 1, 2013 | | | Ending

Account Value

May 31, 2014 | | | Annualized

Expense Ratio

based on the number of

days in the period | | | Expenses Paid

During the Period(1)

December 1, 2013 to

May 31, 2014 | |

| db X-trackers 2010 Target Date Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,011.60 | | | | 0.65 | % | | $ | 3.26 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.69 | | | | 0.65 | % | | $ | 3.28 | |

| db X-trackers 2020 Target Date Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,026.53 | | | | 0.65 | % | | $ | 3.28 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.69 | | | | 0.65 | % | | $ | 3.28 | |

| db X-trackers 2030 Target Date Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,065.06 | | | | 0.65 | % | | $ | 3.35 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.69 | | | | 0.65 | % | | $ | 3.28 | |

| db X-trackers 2040 Target Date Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,054.65 | | | | 0.65 | % | | $ | 3.33 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.69 | | | | 0.65 | % | | $ | 3.28 | |

| db X-trackers In-Target Date Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,017.06 | | | | 0.65 | % | | $ | 3.27 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.69 | | | | 0.65 | % | | $ | 3.28 | |

(1) Expenses are calculated using the annualized expense ratio, which represents the ongoing expenses as a percentage of net assets for the period December 1, 2013 to May 31, 2014. Expenses are calculated by multiplying the Fund’s annualized expense ratio by the average account value for the period; then multiplying the result by 182 days and then dividing the result by 365.

16

db-X Exchange-Traded Funds Inc.

SCHEDULE OF INVESTMENTS

db X-trackers 2010 Target Date Fund

May 31, 2014

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| COMMON STOCKS — 23.7% | | | | | | | | |

| Basic Materials — 1.2% | | | | | | | | |

Air Liquide SA (France) | | | 29 | | | $ | 4,224 | |

Air Products & Chemicals, Inc. | | | 103 | | | | 12,357 | |

Axiall Corp. | | | 100 | | | | 4,621 | |

BASF SE (Germany) | | | 91 | | | | 10,478 | |

BHP Billiton Ltd. (Australia) | | | 308 | | | | 10,608 | |

BHP Billiton PLC (United Kingdom) | | | 204 | | | | 6,388 | |

Dow Chemical (The) Co. | | | 136 | | | | 7,088 | |

E.I. du Pont de Nemours & Co. | | | 106 | | | | 7,347 | |

Freeport-McMoRan Copper & Gold, Inc. | | | 100 | | | | 3,405 | |

Glencore PLC (Switzerland)* | | | 960 | | | | 5,203 | |

Horsehead Holding Corp.* | | | 200 | | | | 3,316 | |

Linde AG (Germany) | | | 23 | | | | 4,805 | |

Materion Corp. | | | 100 | | | | 3,409 | |

Monsanto Co. | | | 61 | | | | 7,433 | |

Newmont Mining Corp. | | | 275 | | | | 6,295 | |

PolyOne Corp. | | | 100 | | | | 4,013 | |

Rio Tinto PLC (United Kingdom) | | | 147 | | | | 7,532 | |

Sherwin-Williams (The) Co. | | | 56 | | | | 11,458 | |

Syngenta AG (Switzerland) | | | 11 | | | | 4,232 | |

Wausau Paper Corp. | | | 200 | | | | 2,128 | |

| | | | | | | | |

| | | | | | | 126,340 | |

| | | | | | | | |

| Communications — 2.5% | | | | | | | | |

Amazon.com, Inc.* | | | 51 | | | | 15,940 | |

Anixter International, Inc. | | | 30 | | | | 3,090 | |

ARRIS Group, Inc.* | | | 100 | | | | 3,311 | |

AT&T, Inc. | | | 637 | | | | 22,595 | |

Bankrate, Inc.* | | | 100 | | | | 1,515 | |

BT Group PLC (United Kingdom) | | | 709 | | | | 4,718 | |

Cisco Systems, Inc. | | | 600 | | | | 14,772 | |

Comcast Corp., Class A | | | 297 | | | | 15,503 | |

Deutsche Telekom AG (Germany) | | | 290 | | | | 4,872 | |

Dice Holdings, Inc.* | | | 200 | | | | 1,412 | |

DigitalGlobe, Inc.* | | | 100 | | | | 3,036 | |

Discovery Communications, Inc., Class A* | | | 117 | | | | 9,004 | |

Entravision Communications Corp., Class A | | | 300 | | | | 1,608 | |

Facebook, Inc., Class A* | | | 202 | | | | 12,787 | |

Finisar Corp.* | | | 100 | | | | 2,375 | |

Google, Inc., Class A* | | | 80 | | | | 45,732 | |

Harte-Hanks, Inc. | | | 200 | | | | 1,422 | |

News Corp., Class A* | | | 600 | | | | 10,236 | |

Nielsen NV (Netherlands) | | | 193 | | | | 9,314 | |

SoftBank Corp. (Japan) | | | 100 | | | | 7,215 | |

Telefonaktiebolaget LM Ericsson, Class B (Sweden) | | | 268 | | | | 3,358 | |

Telefonica SA (Spain) | | | 387 | | | | 6,494 | |

Thomson Reuters Corp. (Canada) | | | 96 | | | | 3,328 | |

Verizon Communications, Inc. | | | 464 | | | | 23,182 | |

Vodafone Group PLC (United Kingdom) | | | 2,389 | | | | 8,389 | |

Walt Disney (The) Co. | | | 205 | | | | 17,223 | |

| | | | | | | | |

| | | | | | | 252,431 | |

| | | | | | | | |

| Consumer, Cyclical — 2.0% | | | | | | | | |

adidas AG (Germany) | | | 19 | | | | 2,039 | |

Alaska Air Group, Inc. | | | 48 | | | | 4,726 | |

Bayerische Motoren Werke AG (Germany) | | | 35 | | | | 4,394 | |

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| Consumer, Cyclical (Continued) | | | | | | | | |

Bloomin’ Brands, Inc.* | | | 100 | | | $ | 2,084 | |

Bob Evans Farms, Inc. | | | 100 | | | | 4,468 | |

Brunswick Corp. | | | 100 | | | | 4,310 | |

Cabela’s, Inc.* | | | 100 | | | | 6,123 | |

Cie Financiere Richemont SA (Switzerland) | | | 65 | | | | 6,848 | |

Compass Group PLC (United Kingdom) | | | 241 | | | | 4,021 | |

CVS Caremark Corp. | | | 138 | | | | 10,808 | |

Daimler AG (Germany) | | | 84 | | | | 7,981 | |

Dana Holding Corp. | | | 200 | | | | 4,428 | |

Ford Motor Co. | | | 430 | | | | 7,069 | |

Fred’s, Inc., Class A | | | 100 | | | | 1,527 | |

General Motors Co. | | | 152 | | | | 5,256 | |

Hennes & Mauritz AB, Class B (Sweden) | | | 82 | | | | 3,465 | |

Home Depot (The), Inc. | | | 172 | | | | 13,799 | |

Honda Motor Co. Ltd. (Japan) | | | 131 | | | | 4,585 | |

Inditex SA (Spain) | | | 26 | | | | 3,775 | |

Kate Spade & Co.* | | | 100 | | | | 3,641 | |

Lions Gate Entertainment Corp. (Canada) | | | 200 | | | | 5,226 | |

LVMH Moet Hennessy Louis Vuitton SA

(France) | | | 25 | | | | 4,974 | |

M/I Homes, Inc.* | | | 100 | | | | 2,281 | |

Mitsubishi Corp. (Japan) | | | 100 | | | | 1,973 | |

NIKE, Inc., Class B | | | 107 | | | | 8,230 | |

Nissan Motor Co. Ltd. (Japan) | | | 200 | | | | 1,806 | |

Republic Airways Holdings, Inc.* | | | 200 | | | | 2,104 | |

Ruby Tuesday, Inc.* | | | 300 | | | | 2,361 | |

Six Flags Entertainment Corp. | | | 100 | | | | 4,046 | |

Target Corp. | | | 82 | | | | 4,654 | |

Toyota Motor Corp. (Japan) | | | 233 | | | | 13,185 | |

W.W. Grainger, Inc. | | | 35 | | | | 9,043 | |

Walgreen Co. | | | 103 | | | | 7,407 | |

Wal-Mart Stores, Inc. | | | 379 | | | | 29,096 | |

| | | | | | | | |

| | | | | | | 201,733 | |

| | | | | | | | |

| Consumer, Non-cyclical — 4.9% | | | | | | | | |

Align Technology, Inc.* | | | 100 | | | | 5,461 | |

Alkermes PLC (Ireland)* | | | 100 | | | | 4,581 | |

Amgen, Inc. | | | 86 | | | | 9,975 | |

AmSurg Corp.* | | | 100 | | | | 4,528 | |

Anheuser-Busch InBev NV (Belgium) | | | 79 | | | | 8,670 | |

Array BioPharma, Inc.* | | | 400 | | | | 1,680 | |

AstraZeneca PLC (United Kingdom) | | | 112 | | | | 8,042 | |

Avis Budget Group, Inc.* | | | 100 | | | | 5,723 | |

Bayer AG (Germany) | | | 74 | | | | 10,703 | |

Becton Dickinson and Co. | | | 110 | | | | 12,947 | |

Brink’s (The) Co. | | | 100 | | | | 2,670 | |

British American Tobacco PLC

(United Kingdom) | | | 179 | | | | 10,803 | |

Cardinal Health, Inc. | | | 171 | | | | 12,078 | |

Coca-Cola (The) Co. | | | 522 | | | | 21,355 | |

Convergys Corp. | | | 200 | | | | 4,364 | |

CSL Ltd. (Australia) | | | 61 | | | | 4,007 | |

Danone (France) | | | 52 | | | | 3,872 | |

Diageo PLC (United Kingdom) | | | 238 | | | | 7,656 | |

Gilead Sciences, Inc.* | | | 168 | | | | 13,643 | |

GlaxoSmithKline PLC (United Kingdom) | | | 453 | | | | 12,157 | |

Humana, Inc. | | | 81 | | | | 10,081 | |

| | | | |

| See Notes to Financial Statements. | | 17 | | |

db-X Exchange-Traded Funds Inc.

SCHEDULE OF INVESTMENTS

db X-trackers 2010 Target Date Fund (Continued)

May 31, 2014

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| Consumer, Non-cyclical (Continued) | | | | | | | | |

Impax Laboratories, Inc.* | | | 100 | | | $ | 2,776 | |

Isis Pharmaceuticals, Inc.* | | | 100 | | | | 2,922 | |

Japan Tobacco, Inc. (Japan) | | | 100 | | | | 3,383 | |

Jazz Pharmaceuticals PLC (Ireland)* | | | 45 | | | | 6,384 | |

JM Smucker (The) Co. | | | 55 | | | | 5,643 | |

Johnson & Johnson | | | 329 | | | | 33,379 | |

Live Nation Entertainment, Inc.* | | | 183 | | | | 4,341 | |

L’Oreal SA (France) | | | 22 | | | | 3,839 | |

Magellan Health Services, Inc.* | | | 7 | | | | 426 | |

MasterCard, Inc., Class A | | | 140 | | | | 10,703 | |

Merck & Co., Inc. | | | 348 | | | | 20,135 | |

Molina Healthcare, Inc.* | | | 67 | | | | 2,887 | |

Mondelez International, Inc., Class A | | | 203 | | | | 7,637 | |

Monster Worldwide, Inc.* | | | 400 | | | | 2,264 | |

Nestle SA (Switzerland) | | | 285 | | | | 22,357 | |

Novartis AG (Switzerland) | | | 203 | | | | 18,203 | |

Novo Nordisk A/S, Class B (Denmark) | | | 180 | | | | 7,620 | |

NuVasive, Inc.* | | | 100 | | | | 3,334 | |

Orexigen Therapeutics, Inc.* | | | 300 | | | | 1,938 | |

Performant Financial Corp.* | | | 200 | | | | 1,898 | |

Pfizer, Inc. | | | 828 | | | | 24,534 | |

Pharmacyclics, Inc.* | | | 43 | | | | 3,820 | |

Pilgrim’s Pride Corp.* | | | 200 | | | | 5,088 | |

Procter & Gamble (The) Co. | | | 313 | | | | 25,287 | |

Raptor Pharmaceutical Corp.* | | | 200 | | | | 1,636 | |

Reckitt Benckiser Group PLC

(United Kingdom) | | | 66 | | | | 5,642 | |

Roche Holding AG (Switzerland) | | | 63 | | | | 18,538 | |

SABMiller PLC (United Kingdom) | | | 87 | | | | 4,828 | |

Sanofi (France) | | | 109 | | | | 11,655 | |

Seaboard Corp.* | | | 1 | | | | 2,695 | |

Seattle Genetics, Inc.* | | | 167 | | | | 5,573 | |

Select Medical Holdings Corp. | | | 167 | | | | 2,530 | |

Snyder’s-Lance, Inc. | | | 100 | | | | 2,718 | |

Takeda Pharmaceutical Co. Ltd. (Japan) | | | 100 | | | | 4,526 | |

Tesco PLC (United Kingdom) | | | 972 | | | | 4,946 | |

Teva Pharmaceutical Industries Ltd. (Israel) | | | 93 | | | | 4,661 | |

Theravance, Inc.* | | | 100 | | | | 2,865 | |

Unilever NV (Netherlands) | | | 159 | | | | 6,884 | |

Unilever PLC (United Kingdom) | | | 125 | | | | 5,615 | |

UnitedHealth Group, Inc. | | | 130 | | | | 10,352 | |

Whole Foods Market, Inc. | | | 180 | | | | 6,883 | |

Wright Medical Group, Inc.* | | | 100 | | | | 3,040 | |

| | | | | | | | |

| | | | | | | 501,381 | |

| | | | | | | | |

| Diversified — 0.0% (a) | | | | | | | | |

Hutchison Whampoa Ltd. (Hong Kong) | | | 198 | | | | 2,656 | |

| | | | | | | | |

| Energy — 2.4% | | | | | | | | |

Apache Corp. | | | 48 | | | | 4,475 | |

BG Group PLC (United Kingdom) | | | 336 | | | | 6,877 | |

BP PLC (United Kingdom) | | | 1,726 | | | | 14,552 | |

Cameron International Corp.* | | | 124 | | | | 7,930 | |

Chevron Corp. | | | 222 | | | | 27,259 | |

Continental Resources, Inc.* | | | 100 | | | | 14,036 | |

CVR Energy, Inc. | | | 100 | | | | 4,706 | |

Dril-Quip, Inc.* | | | 29 | | | | 2,964 | |

Eni S.p.A. (Italy) | | | 231 | | | | 5,885 | |

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| Energy (Continued) | | | | | | | | |

Exxon Mobil Corp. | | | 517 | | | $ | 51,975 | |

Gulfport Energy Corp.* | | | 100 | | | | 6,153 | |

Helix Energy Solutions Group, Inc.* | | | 100 | | | | 2,338 | |

Oasis Petroleum, Inc.* | | | 100 | | | | 4,950 | |

Pioneer Natural Resources Co. | | | 15 | | | | 3,152 | |

Royal Dutch Shell PLC, Class A

(United Kingdom) | | | 328 | | | | 12,893 | |

Schlumberger Ltd. (Netherland Antilles) | | | 149 | | | | 15,502 | |

SolarCity Corp.* | | | 100 | | | | 5,250 | |

Southwestern Energy Co.* | | | 224 | | | | 10,185 | |

Statoil ASA (Norway) | | | 154 | | | | 4,720 | |

Total SA (France) | | | 184 | | | | 12,912 | |

Valero Energy Corp. | | | 288 | | | | 16,142 | |

Woodside Petroleum Ltd. (Australia) | | | 111 | | | | 4,356 | |

| | | | | | | | |

| | | | | | | 239,212 | |

| | | | | | | | |

| Financial — 5.0% | | | | | | | | |

AIA Group Ltd. (Hong Kong) | | | 1,032 | | | | 5,171 | |

Allianz SE (Germany) | | | 40 | | | | 6,783 | |

American Express Co. | | | 128 | | | | 11,712 | |

American International Group, Inc. | | | 172 | | | | 9,300 | |

American Tower Corp. REIT | | | 45 | | | | 4,033 | |

Australia & New Zealand Banking Group Ltd. (Australia) | | | 249 | | | | 7,761 | |

AXA SA (France) | | | 152 | | | | 3,752 | |

Banco Bilbao Vizcaya Argentaria SA (Spain) | | | 514 | | | | 6,589 | |

Banco Santander SA (Spain) | | | 1,346 | | | | 13,805 | |

Bancorp (The), Inc.* | | | 100 | | | | 1,570 | |

Bank of America Corp. | | | 1,231 | | | | 18,637 | |

Barclays PLC (United Kingdom) | | | 1,249 | | | | 5,171 | |

Berkshire Hathaway, Inc., Class B* | | | 283 | | | | 36,321 | |

BNP Paribas SA (France) | | | 88 | | | | 6,162 | |

Boston Properties, Inc. REIT | | | 90 | | | | 10,861 | |

Charles Schwab (The) Corp. | | | 152 | | | | 3,832 | |

Citigroup, Inc. | | | 350 | | | | 16,650 | |

CNO Financial Group, Inc. | | | 200 | | | | 3,226 | |

Commonwealth Bank of Australia (Australia) | | | 145 | | | | 11,010 | |

Community Trust Bancorp, Inc. | | | 110 | | | | 3,775 | |

Credit Suisse Group AG (Switzerland)* | | | 128 | | | | 3,805 | |

Deutsche Bank AG (Germany) (b) | | | 93 | | | | 3,767 | |

DFC Global Corp.* | | | 100 | | | | 937 | |

Dime Community Bancshares, Inc. | | | 100 | | | | 1,512 | |

Dynex Capital, Inc. REIT | | | 200 | | | | 1,730 | |

Equity One, Inc. REIT | | | 173 | | | | 3,972 | |

First American Financial Corp. | | | 100 | | | | 2,802 | |

FirstMerit Corp. | | | 100 | | | | 1,867 | |

General Growth Properties, Inc. REIT | | | 480 | | | | 11,438 | |

Geo Group (The), Inc. REIT | | | 177 | | | | 6,020 | |

Glimcher Realty Trust REIT | | | 100 | | | | 1,102 | |

Goldman Sachs Group (The), Inc. | | | 53 | | | | 8,470 | |

Hancock Holding Co. | | | 100 | | | | 3,378 | |

Hanmi Financial Corp. | | | 100 | | | | 2,131 | |

Health Care REIT, Inc. | | | 144 | | | | 9,105 | |

Healthcare Realty Trust, Inc. REIT | | | 100 | | | | 2,493 | |

Higher One Holdings, Inc.* | | | 200 | | | | 752 | |

Highwoods Properties, Inc. REIT | | | 154 | | | | 6,249 | |

HSBC Holdings PLC (United Kingdom) | | | 1,605 | | | | 16,927 | |

ING Groep NV (Netherlands)* | | | 381 | | | | 5,336 | |

| | | | |

| See Notes to Financial Statements. | | 18 | | |

db-X Exchange-Traded Funds Inc.

SCHEDULE OF INVESTMENTS

db X-trackers 2010 Target Date Fund (Continued)

May 31, 2014

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| Financial (Continued) | | | | | | | | |

Investors Bancorp, Inc. | | | 474 | | | $ | 5,119 | |

JPMorgan Chase & Co. | | | 434 | | | | 24,118 | |

Kite Realty Group Trust REIT | | | 300 | | | | 1,863 | |

LaSalle Hotel Properties REIT | | | 50 | | | | 1,650 | |

Lexington Realty Trust REIT | | | 200 | | | | 2,270 | |

Lloyds Banking Group PLC

(United Kingdom)* | | | 3,935 | | | | 5,136 | |

MarketAxess Holdings, Inc. | | | 100 | | | | 5,335 | |

MetLife, Inc. | | | 124 | | | | 6,315 | |

Mitsubishi UFJ Financial Group, Inc. (Japan) | | | 1,200 | | | | 6,754 | |

Mizuho Financial Group, Inc. (Japan) | | | 1,913 | | | | 3,721 | |

Muenchener Rueckversicherungs-Gesellschaft AG (Germany) | | | 18 | | | | 3,990 | |

National Australia Bank Ltd. (Australia) | | | 214 | | | | 6,670 | |

Nationstar Mortgage Holdings, Inc.* | | | 100 | | | | 3,496 | |

Ocwen Financial Corp.* | | | 100 | | | | 3,507 | |

OMEGA Healthcare Investors, Inc. REIT | | | 65 | | | | 2,398 | |

Piper Jaffray Cos.* | | | 100 | | | | 4,403 | |

Prospect Capital Corp. | | | 200 | | | | 1,988 | |

Prudential PLC (United Kingdom) | | | 299 | | | | 6,944 | |

RLJ Lodging Trust REIT | | | 100 | | | | 2,771 | |

Ryman Hospitality Properties, Inc. REIT | | | 63 | | | | 2,906 | |

Sandy Spring Bancorp, Inc. | | | 100 | | | | 2,371 | |

Simon Property Group, Inc. REIT | | | 49 | | | | 8,157 | |

Standard Chartered PLC (United Kingdom) | | | 210 | | | | 4,726 | |

Starwood Property Trust, Inc. REIT | | | 150 | | | | 3,659 | |

Strategic Hotels & Resorts, Inc. REIT* | | | 200 | | | | 2,180 | |

Sumitomo Mitsui Financial Group, Inc. (Japan) | | | 81 | | | | 3,266 | |

Susquehanna Bancshares, Inc. | | | 100 | | | | 988 | |

T. Rowe Price Group, Inc. | | | 129 | | | | 10,518 | |

Travelers (The) Cos., Inc. | | | 44 | | | | 4,112 | |

Two Harbors Investment Corp. REIT | | | 300 | | | | 3,159 | |

U.S. Bancorp | | | 216 | | | | 9,113 | |

UBS AG (Switzerland)* | | | 337 | | | | 6,766 | |

United Community Banks, Inc.* | | | 100 | | | | 1,534 | |

Visa, Inc., Class A | | | 99 | | | | 21,268 | |

Washington Prime Group, Inc. REIT* | | | 25 | | | | 487 | |

Webster Financial Corp. | | | 100 | | | | 2,992 | |

Wells Fargo & Co. | | | 626 | | | | 31,788 | |

Westpac Banking Corp. (Australia) | | | 300 | | | | 9,610 | |

Zurich Insurance Group AG (Switzerland)* | | | 13 | | | | 3,901 | |

| | | | | | | | |

| | | | | | | 511,863 | |

| | | | | | | | |

| Industrial — 2.3% | | | | | | | | |

A.O. Smith Corp. | | | 100 | | | | 4,938 | |

ABB Ltd. (Switzerland)* | | | 219 | | | | 5,202 | |

Acuity Brands, Inc. | | | 9 | | | | 1,130 | |

Airbus Group NV (France) | | | 52 | | | | 3,729 | |

Boeing (The) Co. | | | 87 | | | | 11,767 | |

Caterpillar, Inc. | | | 75 | | | | 7,667 | |

Comfort Systems USA, Inc. | | | 100 | | | | 1,650 | |

CSX Corp. | | | 117 | | | | 3,440 | |

Darling Ingredients, Inc.* | | | 100 | | | | 1,999 | |

Deutsche Post AG (Germany) | | | 78 | | | | 2,893 | |

Eaton Corp. PLC (Ireland) | | | 55 | | | | 4,053 | |

Emerson Electric Co. | | | 105 | | | | 7,006 | |

Federal Signal Corp. | | | 200 | | | | 2,744 | |

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| Industrial (Continued) | | | | | | | | |

General Dynamics Corp. | | | 40 | | | $ | 4,725 | |

General Electric Co. | | | 1,265 | | | | 33,889 | |

Graphic Packaging Holding Co.* | | | 400 | | | | 4,396 | |

Hexcel Corp.* | | | 200 | | | | 8,210 | |

Hitachi Ltd. (Japan) | | | 400 | | | | 2,688 | |

Ingersoll-Rand PLC (Ireland) | | | 148 | | | | 8,854 | |

Jacobs Engineering Group, Inc.* | | | 66 | | | | 3,635 | |

Koninklijke Philips NV (Netherlands) | | | 144 | | | | 4,548 | |

Louisiana-Pacific Corp.* | | | 100 | | | | 1,420 | |

Newport Corp.* | | | 100 | | | | 1,853 | |

NL Industries, Inc. | | | 200 | | | | 1,764 | |

Norfolk Southern Corp. | | | 37 | | | | 3,728 | |

Old Dominion Freight Line, Inc.* | | | 100 | | | | 6,396 | |

PHI, Inc.* | | | 100 | | | | 4,474 | |

Rolls-Royce Holdings PLC (United Kingdom)* | | | 186 | | | | 3,242 | |

Schneider Electric SA (France) | | | 58 | | | | 5,462 | |

Siemens AG (Germany) | | | 77 | | | | 10,230 | |

Stanley Black & Decker, Inc. | | | 81 | | | | 7,079 | |

Union Pacific Corp. | | | 54 | | | | 10,760 | |

United Parcel Service, Inc., Class B | | | 107 | | | | 11,115 | |

United Technologies Corp. | | | 111 | | | | 12,901 | |

Vinci SA (France) | | | 61 | | | | 4,515 | |

Waste Management, Inc. | | | 235 | | | | 10,500 | |

Woodward, Inc. | | | 100 | | | | 4,470 | |

| | | | | | | | |

| | | | | | | 229,072 | |

| | | | | | | | |

| Technology — 3.0% | | | | | | | | |

3D Systems Corp.* | | | 100 | | | | 5,065 | |

Activision Blizzard, Inc. | | | 546 | | | | 11,346 | |

Apple, Inc. | | | 109 | | | | 68,997 | |

ASML Holding NV (Netherlands) | | | 36 | | | | 3,090 | |

Aspen Technology, Inc.* | | | 100 | | | | 4,299 | |

Canon, Inc. (Japan) | | | 200 | | | | 6,558 | |

Cognizant Technology Solutions Corp.,

Class A* | | | 280 | | | | 13,611 | |

EMC Corp. | | | 242 | | | | 6,428 | |

Fidelity National Information Services, Inc. | | | 145 | | | | 7,852 | |

First Solar, Inc.* | | | 100 | | | | 6,178 | |

InnerWorkings, Inc.* | | | 200 | | | | 1,506 | |

Intel Corp. | | | 603 | | | | 16,474 | |

International Business Machines Corp. | | | 132 | | | | 24,335 | |

Mentor Graphics Corp. | | | 200 | | | | 4,238 | |

Micron Technology, Inc.* | | | 611 | | | | 17,468 | |

Microsemi Corp.* | | | 167 | | | | 4,063 | |

Microsoft Corp. | | | 1,120 | | | | 45,852 | |

Oracle Corp. | | | 544 | | | | 22,859 | |

PDF Solutions, Inc.* | | | 100 | | | | 1,992 | |

PTC, Inc.* | | | 173 | | | | 6,366 | |

Qlik Technologies, Inc.* | | | 67 | | | | 1,455 | |

QUALCOMM, Inc. | | | 207 | | | | 16,653 | |

SAP AG (Germany) | | | 86 | | | | 6,584 | |

SciQuest, Inc.* | | | 100 | | | | 1,693 | |

SS&C Technologies Holdings, Inc.* | | | 100 | | | | 4,265 | |

| | | | | | | | |

| | | | | | | 309,227 | |

| | | | | | | | |

| Utilities — 0.4% | | | | | | | | |

Centrica PLC (United Kingdom) | | | 680 | | | | 3,825 | |

Dominion Resources, Inc. | | | 67 | | | | 4,620 | |

| | | | |

| See Notes to Financial Statements. | | 19 | | |

db-X Exchange-Traded Funds Inc.

SCHEDULE OF INVESTMENTS

db X-trackers 2010 Target Date Fund (Continued)

May 31, 2014

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| Utilities — (Continued) | | | | | | | | |

E.ON SE (Germany) | | | 169 | | | $ | 3,291 | |

GDF Suez (France) | | | 173 | | | | 4,831 | |

National Grid PLC (United Kingdom) | | | 327 | | | | 4,879 | |

NextEra Energy, Inc. | | | 50 | | | | 4,868 | |

Piedmont Natural Gas Co., Inc. | | | 54 | | | | 1,933 | |

PPL Corp. | | | 309 | | | | 10,842 | |

| | | | | | | | |

| | | | | | | 39,089 | |

| | | | | | | | |

TOTAL COMMON STOCKS

(Cost $1,911,832) | | | | | | | 2,413,004 | |

| | | | | | | | |

| PREFERRED STOCKS — 0.0% (a) | | | | | | | | |

| Consumer, Cyclical — 0.0% (a) | | | | | | | | |

Volkswagen AG (Germany) | | | 15 | | | | 3,987 | |

| | | | | | | | |

| Industrial — 0.0% (a) | | | | | | | | |

Rolls-Royce Holdings PLC, Class C (United Kingdom)* | | | 24,924 | | | | 42 | |

| | | | | | | | |

TOTAL PREFERRED STOCKS

(Cost $2,555) | | | | | | | 4,029 | |

| | | | | | | | |

| RIGHTS — 0.0% (a) | | | | | | | | |

| Communications — 0.0% (a) | | | | | | | | |

Leap Wireless International, Inc. CVR*

(Cost $732) | | | 300 | | | | 732 | |

| | | | | | | | |

| | |

| | | Principal

Amount | | | Value | |

| CORPORATE BONDS — 29.1% | | | | | | | | |

| Basic Materials — 0.7% | | | | | | | | |

BHP Billiton Finance USA Ltd. (Australia) 1.00%, 2/24/15 | | $ | 69,000 | | | | 69,385 | |

| | | | | | | | |

| Communications — 0.9% | | | | | | | | |