UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22027

FundVantage Trust

(Exact name of registrant as specified in charter)

103 Bellevue Parkway

Wilmington, DE 19809

(Address of principal executive offices) (Zip code)

Joel L. Weiss

JW Fund Management LLC

1636 N. Cedar Crest Blvd.

Suite #161

Allentown, PA 18104

(Name and address of agent for service)

Registrant’s telephone number, including area code: 856-528-3500

Date of fiscal year end: April 30

Date of reporting period: April 30, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| | (a) | The Report to Shareholders is attached herewith. |

of

FundVantage Trust

| Class A |

| Class C |

| Institutional Class |

ANNUAL REPORT

April 30, 2024

IMPORTANT NOTICE – UPCOMING CHANGES TO EIC VALUE FUND ANNUAL & SEMI-ANNUAL REPORTS

The Securities and Exchange Commission (the “SEC”) has adopted rule and form amendments that will result in changes to the design and delivery of annual and semi-annual shareholder reports (“Reports”). Beginning in July 2024, Reports will be streamlined to highlight key information (“Redesigned Reports”). Certain information currently included in the Reports, including financial statements, will no longer appear in the Redesigned Reports but will be available online, delivered free of charge to shareholders upon request, and filed with the SEC.

If you previously elected to receive the Fund's Reports electronically, you will continue to receive the Redesigned Reports electronically. Otherwise, you will receive paper copies of the Fund's Redesigned Reports via USPS mail for all Reports transmitted after July 2024. If you would like to receive the Fund's Redesigned Reports (and/or other communications) electronically instead of by mail, please contact your financial advisor or, if you are a direct investor, please call (855) 430-6487.

This report is submitted for the general information of shareholders and is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

EIC VALUE FUND

Annual Investment Adviser's Report

April 30, 2024

(Unaudited)

Dear Fellow Shareholder,

Thank you for reviewing our annual report. In it, we discuss our perspective on the market, the EIC Value Fund’s (the “Fund”) Institutional Class performance, and some of the Fund’s recent purchase and sale activity. A listing of the Fund’s investments and other financial information follow our comments.

Perspective on the Market

Approximately one year ago, when the S&P 500® Index was some 30% lower, the Wall Street Journal ran a story titled, “Stocks Haven’t Looked This Unattractive Since 2007”. The article started with the observation that the “equity risk premium”, the excess earnings yield of stocks over bonds, at roughly 1.6%, had not been that low since 2007. Moreover, expected earnings growth for 2023 was scant, and the fear of recession and inflation continued to loom large.1 This viewpoint was common at the time. In fact, in our 2022 year-end commentary, we wrote: “In our estimation, more work remains to fully wring out the excesses of the last few years.” Though we were finding a variety of attractive investment opportunities at the time, we thought the overall market, and growth stocks in particular, were too expensive to generate good prospective returns.2

Such is the futility of trying to predict market movements, particularly in the short run. There was indeed no growth in earnings for the market in 2023. In fact, earnings conditions deteriorated throughout the year, but no recession materialized, and inflation fears temporarily abated, with talks of rate cuts on the horizon. Growth stocks, imbued with new momentum via AI-themed stocks, led the market in 2023 and again so far in 2024. This has given way to a creeping sense of valuation nihilism in the minds of many investors. Questions about the effectiveness of value investing have resurfaced, much as they did during the tech bubble of the late 1990s.

Because of the stock market’s strong performance over the last year, coupled with macro and geo-political developments, conditions today are worse for stocks than a year ago. The good news is that, for now, 2024 earnings are expected to show low double-digit growth. However, analysts are usually optimistic at the start of the year, and estimates have already drifted lower as companies gave their initial guidance.3 Moreover, inflation remains elevated, and while futures markets still predict interest rate cuts in 2024, multiple Fed officials, in a possibly coordinated effort, are cautioning increased patience with respect to cuts .4 Expectations of higher rates for longer could weigh on stock valuations in general and on growth stocks in particular.

Today, the forward earnings yield of the S&P 500 is only 21 basis points higher than current 10-year Treasury rates.5 Between materially higher interest rates and stocks near all-time highs, it’s become cheaper for some companies to raise capital by selling

| 1 | Wallerstein, Eric. “Stocks Haven’t Looked This Unattractive Since 2007.” The Wall Street Journal. April 6, 2023. https://www.wsj.com/ articles/stocks-havent-looked-this-unattractive-since-2007-78fc374c. 9 April 2024. |

| 2 | Equity Investment Corporation. All-Cap Value & Large-Cap Value 2022 Year-End Commentary, January 2023. https://www.eicatlanta. com/wp-content/uploads/2023/01/Q422-EIC-ACV-LCV-Client-Commentary-Final-23011004-0126.pdf |

| 3 | Data Source: S&P Capital IQPRO. S&P 500 Capital IQ Estimates Aggregates Bottom Up/Trends. S&P 500 EPS CY 2024. April 30, 2024. |

| 4 | Smialek, Jeanna. “Higher for Longer After All? Investors See Fed Rates Falling More Slowly.” The New York Times. April 9, 2024. https:// www.nytimes.com/2024/04/09/business/economy/interest-rates-inflation-federal-reserve.html#: 9 April 2024. |

| 5 | Data Source: S&P Capital IQPRO. S&P 500 Capital IQ Estimates Aggregates Bottom Up/Consensus Next Twelve Months Forward Earnings Yield and Market Yield on 10-Year U.S. Treasury Securities. 30 April 2024. |

EIC VALUE FUND

Annual Investment Adviser’s Report (Continued)

April 30, 2024

(Unaudited)

shares rather than borrowing in the debt markets. This could possibly jeopardize the future of share buybacks and leveraged buyouts, which have been reliable tailwinds for the equity markets.6

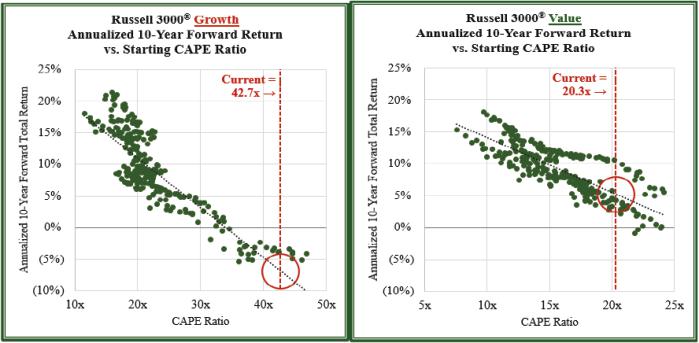

As shown below, growth stock valuations have round-tripped from year-end 2021. Moreover, profit margins remain significantly elevated relative to history. If long-term averages are used instead of recent margins, our analysis suggests that growth stocks are even more expensive today than at the peak of the tech bubble in 2000.7

Chart 1 Data Source: S&P Capital IQPRO.8 Indexes are unmanaged and cannot be invested in directly. Past performance does not guarantee future results.

| 6 | Rao, Sujata, and Lipschultz, Bailey. “Stock Market: Selling Shares Becomes Cheaper Than Issuing Debt.” Bloomberg. February 26, 2024. https://www.bloomberg.com/news/articles/2024-02-27/reddit-campari-aston-martin-turn-to-equity-markets-for-much- needed-cash. 27 February 2024. |

| 7 | Data Source: S&P Capital IQPRO. Russell 3000 Growth Margin-Normalized CAPE at each month-end from December 31, 1979 to April 30, 2024. Margin-Normalized CAPE (Cyclically Adjusted Price-to-Earnings) is the ratio of index prices to trailing 10-year index-level earnings before taxes (EBT) adjusted to reflect average trailing EBT margin over the period from December 31, 1979 to March 31, 2024, calculated on a time-weighted basis. Monthly index level margin-normalized EBT is imputed by dividing the month-end index price by an aggregated price to EBT multiple of index constituents with the resulting quotient divided by the month-end trailing EBT margin and multiplied by the long-term average trailing EBT margin. |

| 8 | Russell 3000® Growth Index modified CAPE (red line), Russell 3000® Value Index modified CAPE (green line), Russell 3000® Growth Index modified CAPE arithmetic premium over Russell 3000® Value Index modified CAPE (gray area) at each month-end January 31, 1990 to April 30, 2024. Modified CAPE is the ratio of index prices to trailing 10-year index-level EBT calculated on a time-weighted basis. Monthly index level EBT is imputed by dividing the month-end index price by an aggregated price to EBT multiple of index constituents. |

EIC VALUE FUND

Annual Investment Adviser’s Report (Continued)

April 30, 2024

(Unaudited)

From current CAPE levels, as shown in Charts 2 and 3, history suggests that growth stocks are collectively priced for poor future returns, while value stocks offer more reasonable return prospects. In fact, at current starting valuations, growth stocks have typically lost money annually over the subsequent decade, while value stocks have historically earned positive returns.

Chart 2 and 3 Data Source: S&P Capital IQPRO.9 Indexes are unmanaged and cannot be invested in directly. Past performance does not guarantee future results.

Benjamin Graham, the “father of value investing” and mentor to Warren Buffett, defined investment versus speculation in the 1934 first edition of his pioneering work, Security Analysis:

“An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative.”10

We would substitute seeks safety for promises safety, but otherwise, we think the definition is emblematic of today's growth universe. History suggests caution when growth valuations are elevated, markets are concentrated, and thematic investing is in favor.11 For now, though, hope is triumphing over experience — hope expressed in valuations and hope that current favorable

| 9 | (Left Chart) Russell 3000® Growth Index modified CAPE at each month-end from January 31, 1990 to March 31, 2014, plotted against the subsequent annualized 10-year total return of the Russell 3000 Growth for each month-end January 31, 2000 through April 30, 2024. (Right Chart) Russell 3000® Value Index modified CAPE at each month-end January 31, 1990 to March 31, 2014, plotted against the subsequent annualized 10-year total return of the Russell 3000 Value for each month-end January 31, 2000 through April 30, 2024. |

| 10 | Graham, Benjamin and Dodd, David. Security Analysis, (New York: The McGraw Hill Companies),1934, 54. |

| 11 | “Bitcoin ETFs are off to a bad start. Will things improve?” The Economist. February 1, 2024. https://www.economist.com/finance-and-economics/2024/02/01/bitcoin-etfs-are-off-to-a-bad-start-will-things-improve. April 10, 2024. |

EIC VALUE FUND

Annual Investment Adviser’s Report (Continued)

April 30, 2024

(Unaudited)

conditions will persist over the experience of normal business-cycle variability and competition. Meanwhile, we believe value stocks offer investors reasonable odds of earning decent returns; the Fund continues to be positioned accordingly.

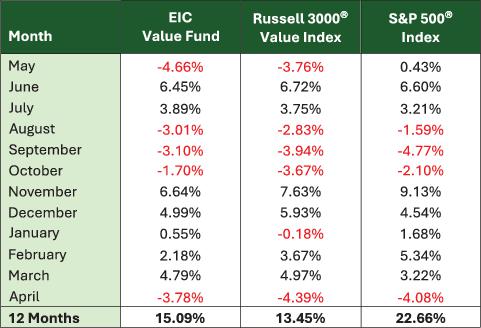

Fund Performance

Performance for the Fund’s Institutional Class shares over the twelve months ended April 30, 2024, is presented in the following table:

Table 1 Data Source: Morningstar DirectSM.12 Indexes are unmanaged and cannot be invested in directly. Past performance does not guarantee future results.

The results shown in the table are over a relatively brief period; thus, we caution against drawing sweeping conclusions. Nevertheless, the Fund performed well relative to its primary benchmark, the Russell 3000® Value Index; however, it lagged the more growth-oriented S&P 500® Index.

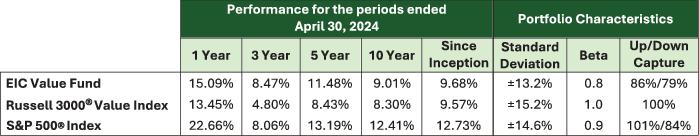

Notably, the Fund outperformed the Russell 3000® Value Index in four of the six down months but trailed it when it rose sharply. In that sense, the Fund’s monthly returns over the last fiscal year fit its long-term pattern of returns. Historically, it has declined less in down markets and recovered losses relatively quickly but lagged late cycle, especially when low-quality or momentum stocks led the way. By doing so, the Fund’s Institutional Class shares have paired above-benchmark performance with lower volatility, as shown in the next table:

| 12 | The performance data quoted represents past performance and may not be indicative of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Current performance may be lower or higher. Performance data current to the most recent month-end may be obtained by calling (855) 430-6487. Securities in the Fund do not match those in the index and performance of the Fund will differ. Indexes are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly. |

EIC VALUE FUND

Annual Investment Adviser’s Report (Continued)

April 30, 2024

(Unaudited)

Table 2 Data Source: Morningstar DirectSM.13 Indexes are unmanaged and cannot be invested in directly. Past performance does not guarantee future results.

Performance attribution for the twelve months follows. Fund results are compared to those of the Russell 3000® Value Index. The Fund’s outperformance was primarily attributable to our stock selection in the consumer discretionary and health care sectors.14

We do not target sector weightings, either in an absolute sense or relative to market indexes; instead, they are principally a by-product of stock selection. Nonetheless, it is at times instructive to see how sector allocations affected Fund returns. Over the trailing twelve months, they were positive, adding 0.5% to the Fund’s relative performance.

Ten of the stock market’s eleven sectors posted positive returns for the twelve months ended April 30, 2024. The top-performing sector was industrials, gaining 27.9%, followed closely by financials, up 26.2%. Information technology, up 20.4%, energy, up 14.3%, and communication services, up 12.7%, also performed well. Relative to the index, the Fund was overweight in financials, energy, and communication services but underweight in industrials and information technology.

In contrast, the only sector with a negative return over the trailing twelve months was health care, which fell 1.5%. Utilities, up 0.3%, real estate, up 0.8%, and consumer staples, up 1.1%, also performed poorly. Compared to its benchmark, the Fund was overweight in consumer staples but underweight in health care, utilities, and real estate.

Stock selection in the health care sector positively impacted Fund performance. The Fund’s holdings in this sector posted a collective return of 10.0%, while the index’s health care stocks lost 1.5%. Cencora Inc. was the Fund’s top performer in this sector, rising 31.7% before we sold it in January of this year.

| 13 | Performance for periods longer than one year is annualized. Annualized since inception performance beginning April 29, 2011. The performance data quoted represents past performance and may not be indicative of future results. Current performance of the Fund may be lower or higher than the performance quoted. Portfolio characteristics are since inception beginning April 29, 2011 through April 30, 2024. Standard Deviation is a statistical measure describing the degree of variability (+/-) around the return over the time period calculated. The wider the performance range, the higher the standard deviation. Beta is a measure of the volatility, or systematic risk, of the Fund in comparison to the benchmark, the Russell 3000® Value Index. Upside and Downside Capture are the measures of performance in up and down markets relative to the benchmark index. The higher the upside capture, the better the performance in a rising market. Conversely, the lower the downside capture, the better the performance in a declining market. |

| 14 | Data Source: Morningstar DirectSM. Performance attribution for the EIC Value Fund versus Russell 3000® Value Index for the year ended April 30, 2024. Fund holdings and sector allocations are subject to change. Please see the schedule of investments section for a complete list of Fund holdings.Sectors are determined using the Global Industry Classification Standard (“GICS”). GICS® was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. |

EIC VALUE FUND

Annual Investment Adviser’s Report (Continued)

April 30, 2024

(Unaudited)

Stock selection in the consumer discretionary sector also helped Fund performance. The Fund’s holdings in this sector increased a combined 41.7% versus a 7.9% gain for the index’s consumer discretionary stocks. Expedia Group Inc. performed well for the Fund, surging 43.3% over the period.

Other notable Fund holdings included Meta Platforms Inc., up 97.2% before we sold it in February, Wells Fargo & Co., up 54.0%, Oshkosh Corp., up 49.4%, American Express Co., up 47.1%, and Charles Schwab Corp., up 44.1%.

On the other hand, the Fund’s underweight position in industrials, the market’s best-performing sector, was the biggest drag on performance. Additionally, stock selection within the sector detracted from performance, as the Fund’s holdings rose a combined 23.5% versus a 27.9% advance for the index’s industrial stocks. United Parcel Services Inc. was the Fund’s worst performer in this sector, falling 14.5%.

Stock selection in the financial sector also adversely affected Fund performance. Though Fund holdings gained 23.1%, they trailed the index’s financial holdings which climbed 26.2%. The Fund’s worst-performing holding in this sector was Globe Life Inc., which dropped 29.2%.

Other notable stocks detracting from Fund performance included Dollar Tree Inc., down 23.1%, Kenvue Inc., down 16.7%, Barrick Gold Corp., down 10.1%, Johnson & Johnson, down 9.0%, and Medtronic plc, down 8.8%.

Portfolio Activity

As is typical for the Fund during periods of heightened market volatility, turnover was higher than average over the past year.15 In addition to numerous opportunistic trims and adds, we sold seven positions from the Fund: Constellation Energy Corp, FedEx Corp., Cencora, Meta Platforms, Empire State Realty Trust, Haleon plc, and Global Payments Inc.. We sold the first four stocks based on valuation; we replaced Global Payments and Haleon with what we consider to be more attractive opportunities in similar industries. We sold Empire State Realty due to concerns about the health of the office property market and the headwinds this presented to the business.

We bought four new positions for the Fund: PayPal Holdings Inc., Dollar General Corp., NNN REIT Inc., and W. P. Carey Inc.. The Fund also received a small position in Kenvue from participation in the stock tender offer by Johnson & Johnson.

We purchased a 2% position in PayPal Holdings Inc. (PYPL), a technology platform that enables digital payments on behalf of merchants and consumers worldwide, including key brands like PayPal, Venmo, Braintree, Xoom, and Zettle. The company processes over $1 trillion in transaction volumes annually and generates most of its revenue from the fees (~2% on average) it takes on those volumes. Competition from other digital wallets (e.g., Apple Pay) has created concerns about the company's future growth prospects, and PYPL's share price has been under pressure. When we bought it for the Fund, the stock had fallen approximately 80% from its high watermark in mid-2021 and 40% from pre-pandemic levels. We believe the company is attractively priced given its growth profile, trading at 19x our estimate of normalized earnings at the time of purchase.16 PayPal Holdings maintains an investment grade rating

| 15 | The Fund’s annualized turnover has averaged 27% since inception. For the year ended April 30, 2024, the Fund’s annualized turnover was 37%. |

| 16 | Normalized earnings are EIC’s estimate of a company’s annual earnings per share when adjusting for temporary, unusual, or non-recurring items (e.g., margin pressure from supply chain bottlenecks, pandemic-related revenues, unusually high or low commodity prices, etc.). |

EIC VALUE FUND

Annual Investment Adviser’s Report (Continued)

April 30, 2024

(Unaudited)

of A- from S&P and has net cash on its balance sheet.17 We paired this buy for the Fund with a sale of Global Payments, a similar business with a weaker capital structure.

We bought a 2% position in Dollar General (DG), the largest retailer in the United States by store count, operating approximately 19,500 stores in primarily rural locations across 47 states. Historically, about 75% of revenues have been generated from selling staples such as food, paper, and cleaning products, with the remainder from higher-margin seasonal merchandise, home décor, and basic apparel. After an uptick during the pandemic, sales growth has decelerated in recent quarters. Inflation pressures have had an outsized impact on lower-income consumers, who comprise most of the company’s customer base. With its customers under stress, the sales mix has shifted further toward low-margin consumable items while supply chain and labor costs have increased. As a result of these pressures, management lowered full-year earnings guidance, and shares fell nearly 50% from the prior year, trading at a very reasonable valuation on both an absolute and relative basis. The stock continued to fall after the Fund’s initial purchase in August, but we view the fundamental challenges as temporary while the long-term case for DG remains intact. It is a high-quality business with growth prospects, strong returns on equity and cash flows, and a reasonable capital structure.

We also purchased a 1.5% position in NNN REIT (NNN), a mid-cap real estate investment trust that owns approximately 3,500 single-tenant retail properties in the United States. Most properties (~70%) are acquired through sale-leaseback transactions, and the remainder (~30%) are purchased at auctions. Leases are normally triple-net — tenants are responsible for all property expenses, including utilities, taxes, insurance, and maintenance, which allows NNN to generate more predictable cash flows. Occupancy is typically quite high (99% currently; minimum 96% in 2009) due to long leases (15-20 years at inception; 10-year remaining average term) and a propensity to sell vacant properties. As a result of this model, cash earnings have been reasonably stable even in more strained economic environments. NNN has a strong balance sheet, with a 12-year weighted average debt maturity and a BBB+ credit rating from S&P.

We bought a 1.5% position in W. P. Carey (WPC), a real estate investment trust (REIT) that owns more than 1,400 single-tenant properties in the United States (63%) and Europe (37%). The company’s roster of nearly 350 tenants is diversified, with the top 10 accounting for only 21% of rental revenue. Leases are normally triple-net; however, unlike other triple-net REITs that are primarily exposed to standalone retail properties, nearly 60% of WPC's rents are generated from the industrial/warehouse sector. WPC has a strong balance sheet, with mid-5x leverage, a four-year weighted average debt maturity, and a BBB+ credit rating from S&P. Shares declined 35% from their 2023 high as the company sold and spun-off office properties (currently 5% of rent versus more than 23% in 2020), cut its dividend 20%, and faced higher interest rates. At the time of purchase, the stock traded at a 15% discount to its 10-year average valuation with a well-covered 6.1% dividend yield.

Finally, we acquired a 1.5% position in Kenvue (KVUE), the consumer products business that was spun out by Johnson & Johnson (JNJ). KVUE has approximately $15 billion in annual sales split between Self Care (40% of sales with brands such as Tylenol, Nicorette, and Zyrtec), Skin Health & Beauty (30% of sales with brands including Neutrogena and Aveeno), and Essential Health (30% of sales counting Listerine, Johnson’s, and Band-Aid brands). KVUE is the market leader in many of its product categories, and its offerings tend to have higher margins with relatively stable demand and reasonable growth prospects. JNJ spun off shares in a novel transaction that allowed existing shareholders to tender their JNJ shares for KVUE shares, with a mechanism that distributed KVUE shares tax-free at a modest discount to the existing trading price. We took this opportunity to swap some of the Fund’s more fully valued JNJ shares with a low-cost basis for KVUE shares. Shares trade at 16.4x current-year earnings, with a 4.3% dividend yield, and carry an A credit rating from S&P.18

| 17 | Data Source: S&P Capital IQPRO. All credit-quality ratings discussed in this section represent Standard & Poor’s (S&P) opinion as to the quality of the securities they rate as of April 30, 2022 unless otherwise indicated. The ratings range from AAA (extremely strong capacity to meet its financial commitments) to D (in default). Ratings are relative and subjective and are not absolute standards of quality. |

| 18 | Data Source: S&P Capital IQPRO. Current earnings (EPS) are sell-side analyst estimates for a company’s adjusted annual earning per share over the next 12 months as of April 30, 2024. After the tender, the Fund still held a small position in JNJ. |

EIC VALUE FUND

Annual Investment Adviser’s Report (Concluded)

April 30, 2024

(Unaudited)

We are still finding opportunities in, and the Fund has higher than normal exposure to, European-based global businesses that trade at more attractive prices than their U.S. counterparts despite having similar characteristics. With respect to sectors, the Fund remains overweight in financials, energy, communications services, and consumer staples relative to its benchmark index. All in all, we believe the stocks in the Fund have high-quality characteristics and trade at reasonable valuations, offering good odds of earning reasonable returns.

In January 2021, near the peak of growth stock valuations and just a few quarters before the start of value-led outperformance that would carry through year-end 2022, we wrote the following:

“The near-term direction from here is uncertain, and it’s not clear what will break the growth fever, nor when it will happen. . . . growth has had a fantastic run, but it is currently too expensive to deliver good prospective returns, while its high valuation dramatically increases its risk.”19

We find ourselves saying the same thing today. Accordingly, our mission is not to predict the direction of the capital markets nor when leadership will turn, positioning the Fund to benefit from that one outcome. Rather, our mission is to protect by positioning the Fund for a range of outcomes through the consistent application of our investment process: buying stocks with quality characteristics at valuations based on reasonable assumptions, thus increasing the Fund’s odds of earning respectable returns.20

Portfolio composition is subject to change. The current and future portfolio holdings of the Fund are subject to investment risk. Investments cannot be made directly in an Index. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect fees, expenses, or sales charges.

This letter is intended to assist shareholders in understanding how the Fund performed during the fiscal year ended April 30, 2024 and reflects the views of the investment adviser at the time of this writing. Of course, these views may change and do not guarantee the future performance of the Fund or the markets.

The above commentary is for informational purposes only and does not represent an offer, recommendation, or solicitation to buy, hold, or sell any security. The specific securities identified and described do not represent all of the securities purchased or sold and you should not assume that investments in the securities identified and discussed will be profitable.

London Stock Exchange Group plc (“LSE Group”) is the source and owner of FTSE Russell® index data. FTSE Russell® is a trading name of certain of the LSE Group companies. “Russell®” is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. FTSE Russell Index information is sourced from S&P Capital IQ PRO.

| 19 | Equity Investment Corporation, All-Cap Value & Large-Cap Value, 2020 Fourth Quarter Commentary, January 2021. |

| 20 | Mutual fund investing involves risk, including possible loss of principal. A value-oriented investment approach is subject to the risk that a security believed to be undervalued does not appreciate in value as anticipated. There can be no guarantee that the EIC Value Fund’s investment strategy will be successful. |

EIC VALUE FUND

Annual Report

Performance Data

April 30, 2024

(Unaudited)

Comparison of Change in Value of $10,000 Investment in EIC Value Fund ’s Class A vs. Russell 3000® Value Index

and S&P 500® Index

Class A of an assumed $10,000 investment is adjusted for the maximum sales charge of 5.50%. This results in a net investment of $9,450. Performance of Class C will vary from Class A due to differences in class-specific fees.

| Average Annual Total Returns for the Years Ended April 30, 2024 |

| | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| Class A (with sales charge) | 8.45% | | 6.17% | | 9.96% | | 8.13% |

| Class A (without sales charge) | 14.78% | | 8.20% | | 11.20% | | 8.74% |

| Russell 3000® Value Index | 13.45% | | 4.80% | | 8.43% | | 8.30% |

| S&P 500® Index | 22.66% | | 8.06% | | 13.19% | | 12.41% |

| Average Annual Total Returns for the Years Ended April 30, 2024 |

| | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| Class C (with CDSC charge) | 12.91% | | 7.38% | | 10.37% | | 7.93% |

| Class C (without CDSC charge) | 13.91% | | 7.38% | | 10.37% | | 7.93% |

| Russell 3000® Value Index | 13.45% | | 4.80% | | 8.43% | | 8.30% |

| S&P 500® Index | 22.66% | | 8.06% | | 13.19% | | 12.41% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the EIC Value Fund (the “Fund”) will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Current performance may be lower or higher. Performance data current to the most recent month-end may be obtained by calling (855) 430-6487.

EIC VALUE FUND

Annual Report

Performance Data (Continued)

April 30, 2024

(Unaudited)

Comparison of Change in Value of $100,000 Investment in EIC Value Fund’s Institutional Class vs. Russell 3000® Value Index

and S&P 500® Index

| Average Annual Total Returns for the Years Ended April 30, 2024 |

| | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| Institutional Class | 15.09% | | 8.47% | | 11.48% | | 9.01% |

| Russell 3000® Value Index | 13.45% | | 4.80% | | 8.43% | | 8.30% |

| S&P 500® Index | 22.66% | | 8.06% | | 13.19% | | 12.41% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the EIC Value Fund (the “Fund”) will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Current performance may be lower or higher. Performance data current to the most recent month-end may be obtained by calling (855) 430-6487.

The returns shown for Class A shares reflect a deduction for the maximum front-end sales charge of 5.50%. The returns shown for Class C shares reflect a maximum deferred sales charge of 1.00% if shares are redeemed within 18 months after initial purchase. All of the Fund’s share classes apply a 2.00% fee to the value of shares redeemed within 30 days of purchase. This redemption fee is not reflected in the returns shown above. As stated in the current prospectus dated September 1, 2023, the Fund’s “Total Annual Fund Operating Expenses” are 1.27%, 2.02% and 1.02%, and the Fund’s “Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement” are 1.21%, 1.96% and 0.96% for Class A shares, Class C shares and Institutional Class shares, respectively, of the Fund Class’ average daily net assets. The ratios may differ from the actual expenses incurred by the Fund for the period covered by this report. Equity Investment Corporation (the “Adviser”) has contractually agreed to waive or otherwise reduce its annual compensation received from and/or reimburse certain expenses of the Fund to the extent necessary to ensure that the Fund’s total operating expenses, excluding taxes, fees and expenses attributable to a distribution or service plan adopted by FundVantage Trust (the “Trust”), “Acquired Fund Fees and Expenses,” interest, extraordinary items and brokerage commissions, do not exceed 0.95% of average daily net assets of the Fund (the “Expense Limitation”). The Expense Limitation will remain in place until August 31, 2024, unless the Board of Trustees (“Board of Trustees”) of the Trust approves its earlier termination. Subject to approval by the Board of Trustees, the Adviser may recoup any expenses or fees it has reimbursed within a three-year period from the date on which the Adviser reduced its compensation and/or assumed expenses of the Fund. The Adviser is permitted to seek reimbursement from the Fund, subject to certain limitations, for fees it waived and Fund expenses it paid to the extent the total annual fund operating expenses do not exceed the limits described above or any lesser limits in effect at the time of reimbursement. No recoupment will occur unless the Fund’s expenses are below the Expense Limitation amount. Total returns would be lower had such fees and expenses not been waived and/or reimbursed.

Mutual fund investing involves risk, including possible loss of principal. Value investing involves the risk that the Fund’s investing in companies believed to be undervalued will not appreciate as anticipated. The Fund faces the risk of loss or lower investment performance as a result of incorrect estimation or other errors by the Adviser in its fundamental analysis regarding the companies in which the Fund invests.

EIC VALUE FUND

Annual Report

Performance Data (Concluded)

April 30, 2024

(Unaudited)

The Fund evaluates its performance as compared to that of the Standard & Poor’s 500 (“S&P 500®”) Index and the Russell 3000® Value Index. The S&P 500® Index is a widely recognized, unmanaged index of 500 common stocks, which are generally representative of the U.S. stock market as a whole. The Russell 3000® Value Index is an unmanaged index that measures the performance of the broad value segment of the U.S. equity value universe. It includes those Russell 3000® Index companies with lower price-to-value ratios and lower forecasted growth rates. It is impossible to invest directly in an index.

EIC VALUE FUND

Fund Expense Disclosure

April 30, 2024

(Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments (if any) or redemption fees; and (2) ongoing costs, including management fees, distribution and/or service (Rule 12b-1) fees (if any) and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

These examples are based on an investment of $1,000 invested at the beginning of the six-month period from November 1, 2023 through April 30, 2024 and held for the entire period.

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Examples for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not your Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the accompanying table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments (if any) or redemption fees. Therefore, the second line of the accompanying table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account Value

November 1, 2023 | | Ending Account Value

April 30, 2024 | | Annualized

Expense Ratio | | Expenses Paid

During Period* |

| EIC Value Fund |

| Class A | | | | | | | |

| Actual | $1,000.00 | | $1,179.90 | | 1.20% | | $ 6.50 |

| Hypothetical (5% return before expenses) | 1,000.00 | | 1,018.90 | | 1.20% | | 6.02 |

| Class C | | | | | | | |

| Actual | $1,000.00 | | $1,175.20 | | 1.95% | | $10.55 |

| Hypothetical (5% return before expenses) | 1,000.00 | | 1,015.17 | | 1.95% | | 9.77 |

| Institutional Class | | | | | | | |

| Actual | $1,000.00 | | $1,181.50 | | 0.95% | | $ 5.15 |

| Hypothetical (5% return before expenses) | 1,000.00 | | 1,020.14 | | 0.95% | | 4.77 |

| * | Expenses are equal to the Fund’s annualized expense ratio for the six-month period ended April 30, 2024 of 1.20%, 1.95%, and 0.95% for Class A, Class C, and Institutional Class shares, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent period (182), then divided by 366 to reflect the period. The Fund’s ending account values on the first line in each table are based on the actual six-month total returns for the Fund of 17.99%, 17.52%, and 18.15% for Class A, Class C, and Institutional Class shares, respectively. |

EIC Value Fund

Portfolio Holdings Summary Table

April 30, 2024

(Unaudited)

The following table presents a summary by sector of the portfolio holdings of the Fund:

| | % of Net

Assets | | Value |

| COMMON STOCKS: | | | |

| Financial | 28.1% | | $ 76,977,566 |

| Consumer, Non-cyclical | 21.2 | | 57,997,293 |

| Energy | 10.2 | | 27,814,025 |

| Communications | 10.2 | | 27,761,902 |

| Consumer, Cyclical | 6.0 | | 16,368,238 |

| Industrial | 5.6 | | 15,406,665 |

| Basic Materials | 4.2 | | 11,382,978 |

| Utilities | 3.3 | | 9,118,913 |

| Technology | 1.8 | | 4,902,126 |

| Short-Term Investment | 8.9 | | 24,386,209 |

| Other Assets in Excess of Liabilities | 0.5 | | 1,353,857 |

| NET ASSETS | 100.0% | | $273,469,772 |

Portfolio holdings are subject to change at any time.

The accompanying notes are an integral part of the financial statements.

EIC VALUE FUND

Portfolio of Investments

April 30, 2024

| | Number

of Shares | | Value |

| COMMON STOCKS — 90.6% |

| Basic Materials — 4.2% |

| Barrick Gold Corp. | 359,325 | | $ 5,979,168 |

| PPG Industries, Inc. | 41,890 | | 5,403,810 |

| | | | 11,382,978 |

| Communications — 10.2% |

| AT&T, Inc. | 581,300 | | 9,818,157 |

| Cisco Systems, Inc. | 77,025 | | 3,618,634 |

| Expedia Group, Inc.* | 33,400 | | 4,496,642 |

| Verizon Communications, Inc. | 248,885 | | 9,828,469 |

| | | | 27,761,902 |

| Consumer, Cyclical — 6.0% |

| Dollar General Corp. | 41,780 | | 5,815,358 |

| Dollar Tree, Inc.* | 53,950 | | 6,379,588 |

| Honda Motor Co. Ltd., SP ADR | 122,780 | | 4,173,292 |

| | | | 16,368,238 |

| Consumer, Non-cyclical — 21.2% |

| GSK PLC, SP ADR | 240,326 | | 9,959,109 |

| Ingredion, Inc. | 59,960 | | 6,870,816 |

| Johnson & Johnson | 5,352 | | 773,846 |

| Kenvue, Inc. | 368,214 | | 6,929,788 |

| Medtronic PLC | 95,850 | | 7,691,004 |

| PayPal Holdings, Inc.* | 104,375 | | 7,089,150 |

| Sanofi, ADR | 171,005 | | 8,418,576 |

| Unilever PLC, SP ADR | 197,975 | | 10,265,004 |

| | | | 57,997,293 |

| Energy — 10.2% |

| Coterra Energy, Inc. | 275,913 | | 7,548,980 |

| Shell PLC, ADR | 64,125 | | 4,595,197 |

| TotalEnergies SE, SP ADR | 122,125 | | 8,850,399 |

| Williams Cos., Inc. (The) | 177,775 | | 6,819,449 |

| | | | 27,814,025 |

| Financial — 28.1% |

| AGNC Investment Corp., REIT | 447,690 | | 4,096,364 |

| American Express Co. | 17,475 | | 4,089,674 |

| Charles Schwab Corp. (The) | 96,890 | | 7,165,016 |

| Globe Life, Inc. | 76,113 | | 5,797,527 |

| Hartford Financial Services Group, Inc. (The) | 67,400 | | 6,530,386 |

| Jones Lang LaSalle, Inc.* | 26,260 | | 4,745,182 |

| NNN REIT, Inc. | 93,925 | | 3,806,780 |

| PNC Financial Services Group, Inc. (The) | 45,813 | | 7,021,300 |

| Travelers Cos., Inc. (The) | 25,475 | | 5,404,776 |

| Truist Financial Corp. | 148,392 | | 5,572,120 |

| | Number

of Shares | | Value |

| COMMON STOCKS — (Continued) |

| Financial — (Continued) |

| US Bancorp | 180,040 | | $ 7,315,025 |

| Wells Fargo & Co. | 166,800 | | 9,894,576 |

| WP Carey, Inc., REIT | 101,000 | | 5,538,840 |

| | | | 76,977,566 |

| Industrial — 5.6% |

| General Dynamics Corp. | 19,250 | | 5,526,483 |

| Oshkosh Corp. | 42,500 | | 4,771,475 |

| United Parcel Service, Inc., Class B | 34,640 | | 5,108,707 |

| | | | 15,406,665 |

| Technology — 1.8% |

| Fidelity National Information Services, Inc. | 72,175 | | 4,902,126 |

| Utilities — 3.3% |

| National Fuel Gas Co. | 111,200 | | 5,904,720 |

| PPL Corp. | 117,050 | | 3,214,193 |

| | | | 9,118,913 |

TOTAL COMMON STOCKS

(Cost $189,041,207) | | | 247,729,706 |

| |

| SHORT-TERM INVESTMENT — 8.9% |

| Money Market Fund — 8.9% |

| Dreyfus Institutional Preferred Treasury Securities Money Market Fund, Hamilton Shares 5.21%(a) | 24,386,209 | | 24,386,209 |

TOTAL SHORT-TERM INVESTMENT

(Cost $24,386,209) | | | 24,386,209 |

|

| |

TOTAL INVESTMENTS - 99.5%

(Cost $213,427,416) | | | 272,115,915 |

| OTHER ASSETS IN EXCESS OF LIABILITIES - 0.5% | | | 1,353,857 |

| NET ASSETS - 100.0% | | | $273,469,772 |

| * | Non-income producing. |

| (a) | Rate disclosed is the 7-day yield at April 30, 2024. |

| ADR | American Depositary Receipt |

| PLC | Public Limited Company |

| REIT | Real Estate Investment Trust |

| SP ADR | Sponsored American Depository Receipt |

The accompanying notes are an integral part of the financial statements.

EIC VALUE FUND

Statement of Assets and Liabilities

April 30, 2024

| Assets | |

| Investments, at value (Cost $213,427,416) | $272,115,915 |

| Receivables: | |

| Investments sold | 1,498,866 |

| Capital shares sold | 309,728 |

| Dividends and interest | 813,668 |

| Prepaid expenses and other assets | 21,995 |

| Total Assets | 274,760,172 |

| Liabilities | |

| Payables: | |

| Investments purchased | 827,880 |

| Investment adviser | 184,187 |

| Capital shares redeemed | 91,671 |

| Due to custodian | 58,519 |

| Administration and accounting fees | 27,710 |

| Distribution fees (Class A and C Shares) | 8,849 |

| Shareholder servicing fees | 1,343 |

| Accrued expenses | 90,241 |

| Total Liabilities | 1,290,400 |

| Contingencies and Commitments (Note 2) | — |

| Net Assets | $273,469,772 |

| Net Assets Consisted of: | |

| Capital stock, $0.01 par value | $ 160,488 |

| Paid-in capital | 199,104,707 |

| Total distributable earnings | 74,204,577 |

| Net Assets | $273,469,772 |

| Class A Shares: | |

| Net assets | $ 23,205,065 |

| Shares outstanding | 1,362,349 |

| Net asset value, redemption price per share | $ 17.03 |

| Maximum offering price per share (100/94.50 of $17.03) | $ 18.02 |

| Class C Shares: | |

| Net assets | $ 6,450,758 |

| Shares outstanding | 390,620 |

| Net asset value, offering and redemption price per share | $ 16.51 |

| Institutional Class Shares: | |

| Net assets | $243,813,949 |

| Shares outstanding | 14,295,828 |

| Net asset value, offering and redemption price per share | $ 17.05 |

The accompanying notes are an integral part of the financial statements.

EIC VALUE FUND

Statement of Operations

For the Year Ended April 30, 2024

| Investment income | |

| Dividends | $ 8,848,261 |

| Less: foreign taxes withheld | (136,311) |

| Total investment income | 8,711,950 |

| Expenses | |

| Advisory fees(Note 2) | 1,826,154 |

| Transfer agent fees(Note 2) | 150,787 |

| Administration and accounting fees(Note 2) | 144,852 |

| Trustees’ and officers’ fees(Note 2) | 55,589 |

| Distribution fees (Class A)(Note 2) | 55,423 |

| Registration and filing fees | 48,299 |

| Distribution fees (Class C)(Note 2) | 45,035 |

| Custodian fees(Note 2) | 39,148 |

| Shareholder reporting fees | 36,677 |

| Legal fees | 36,147 |

| Audit fees | 35,667 |

| Shareholder servicing fees (Class C) | 15,012 |

| Other expenses | 22,349 |

| Total expenses before waivers and reimbursements | 2,511,139 |

| Less: waivers and reimbursements(Note 2) | (82,541) |

| Net expenses after waivers and reimbursements | 2,428,598 |

| Net investment income | 6,283,352 |

| Net realized and unrealized gain/(loss) from investments: | |

| Net realized gain from investments | 18,589,552 |

| Net change in unrealized appreciation on investments | 8,699,682 |

| Net realized and unrealized gain on investments | 27,289,234 |

| Net increase in net assets resulting from operations | $33,572,586 |

The accompanying notes are an integral part of the financial statements.

EIC VALUE FUND

Statements of Changes in Net Assets

| | For the Year

Ended

April 30, 2024 | | For the Year

Ended

April 30, 2023 |

| Net increase/(decrease) in net assets from operations: | | | |

| Net investment income | $ 6,283,352 | | $ 5,460,473 |

| Net realized gains/(losses) from investments | 18,589,552 | | (4,190,123) |

| Net change in unrealized appreciation on investments | 8,699,682 | | 3,506,318 |

| Net increase in net assets resulting from operations | 33,572,586 | | 4,776,668 |

| Less dividends and distributions to shareholders from: | | | |

| Total distributable earnings: | | | |

| Class A | (850,230) | | (1,180,466) |

| Class C | (175,406) | | (425,777) |

| Institutional Class | (8,860,634) | | (12,910,018) |

| Net decrease in net assets from dividends and distributions to shareholders | (9,886,270) | | (14,516,261) |

| Increase/(decrease) in net assets derived from capital share transactions (Note 4) | (6,208,057) | | 29,838,380 |

| Total increase in net assets | 17,478,259 | | 20,098,787 |

| Net assets | | | |

| Beginning of year | 255,991,513 | | 235,892,726 |

| End of year | $273,469,772 | | $255,991,513 |

The accompanying notes are an integral part of the financial statements.

EIC VALUE FUND

Financial Highlights

Contained below is per share operating performance data for Class A shares outstanding, total investment return, ratios to average net assets and other supplemental data for the respective period. The total returns in the table represent the rate that an investor would have earned or lost on an investment in the Fund (assuming reinvestment of all dividends and distributions). This information has been derived from information provided in the financial statements and should be read in conjunction with the financial statements and the notes thereto.

| | Class A |

| | For the

Year Ended

April 30,

2024 | | For the

Year Ended

April 30,

2023 | | For the

Year Ended

April 30,

2022 | | For the

Year Ended

April 30,

2021 | | For the

Year Ended

April 30,

2020 |

| Per Share Operating Performance | | | | | | | | | |

| Net asset value, beginning of year | $ 15.43 | | $ 16.08 | | $ 16.48 | | $ 11.75 | | $13.98 |

| Net investment income(1) | 0.38 | | 0.31 | | 0.24 | | 0.20 | | 0.23 |

| Net realized and unrealized gain/(loss) on investments | 1.85 | | (0.04) | | 1.10 | | 5.33 | | (1.42) |

| Total from investment operations | 2.23 | | 0.27 | | 1.34 | | 5.53 | | (1.19) |

| Dividends and distributions to shareholders from: | | | | | | | | | |

| Net investment income | (0.59) | | — | | (0.23) | | (0.23) | | (0.21) |

| Net realized capital gains | (0.04) | | (0.92) | | (1.51) | | (0.57) | | (0.83) |

| Total dividends and distributions to shareholders | (0.63) | | (0.92) | | (1.74) | | (0.80) | | (1.04) |

| Redemption fees | 0.00 (2) | | 0.00 (2) | | 0.00 (2) | | 0.00 (2) | | 0.00 (2) |

| Net asset value, end of year | $ 17.03 | | $ 15.43 | | $ 16.08 | | $ 16.48 | | $11.75 |

| Total investment return(3) | 14.78% | | 1.80% | | 8.39% | | 48.52% | | (9.54)% |

| Ratios/Supplemental Data | | | | | | | | | |

| Net assets, end of year (in 000s) | $23,205 | | $21,776 | | $19,522 | | $11,784 | | $8,347 |

| Ratio of expenses to average net assets | 1.20% | | 1.20% | | 1.20% | | 1.18% | | 1.15% |

| Ratio of expenses to average net assets without waivers and/or reimbursements | 1.24% (4) | | 1.26% (4) | | 1.25% (4) | | 1.32% (4) | | 1.24% (4) |

| Ratio of net investment income to average net assets | 2.38% | | 1.99% | | 1.44% | | 1.45% | | 1.67% |

| Portfolio turnover rate | 38% | | 39% | | 33% | | 41% | | 36% |

| (1) | The selected per share data was calculated using the average shares outstanding method for the year. |

| (2) | Amount is less than $0.005 per share. |

| (3) | Total investment return is calculated assuming a purchase of shares on the first day and a sale of shares on the last day of each period reported and includes reinvestment of dividends and distributions, if any. Total investment return does not reflect the impact of the maximum front-end sales load of 5.50% or any applicable sales charge. If reflected, the return would be lower. |

| (4) | During the period, certain fees were waived and/or reimbursed. If such fee waivers and/or reimbursements had not occurred, the ratios would have been as indicated (See Note 2). |

The accompanying notes are an integral part of the financial statements.

EIC VALUE FUND

Financial Highlights (Continued)

Contained below is per share operating performance data for Class C shares outstanding, total investment return, ratios to average net assets and other supplemental data for the respective period. The total returns in the table represent the rate that an investor would have earned or lost on an investment in the Fund (assuming reinvestment of all dividends and distributions). This information has been derived from information provided in the financial statements and should be read in conjunction with the financial statements and the notes thereto.

| | Class C |

| | For the

Year Ended

April 30,

2024 | | For the

Year Ended

April 30,

2023 | | For the

Year Ended

April 30,

2022 | | For the

Year Ended

April 30,

2021 | | For the

Year Ended

April 30,

2020 |

| Per Share Operating Performance | | | | | | | | | |

| Net asset value, beginning of year | $14.95 | | $15.72 | | $16.10 | | $ 11.52 | | $ 13.73 |

| Net investment income(1) | 0.25 | | 0.19 | | 0.11 | | 0.09 | | 0.12 |

| Net realized and unrealized gain/(loss) on investments | 1.79 | | (0.04) | | 1.07 | | 5.22 | | (1.41) |

| Total from investment operations | 2.04 | | 0.15 | | 1.18 | | 5.31 | | (1.29) |

| Dividends and distributions to shareholders from: | | | | | | | | | |

| Net investment income | (0.44) | | — | | (0.05) | | (0.16) | | (0.09) |

| Net realized capital gains | (0.04) | | (0.92) | | (1.51) | | (0.57) | | (0.83) |

| Total dividends and distributions to shareholders | (0.48) | | (0.92) | | (1.56) | | (0.73) | | (0.92) |

| Redemption fees | 0.00 (2) | | 0.00 (2) | | 0.00 (2) | | 0.00 (2) | | 0.00 (2) |

| Net asset value, end of year | $16.51 | | $14.95 | | $15.72 | | $ 16.10 | | $ 11.52 |

| Total investment return(3) | 13.91% | | 1.07% | | 7.56% | | 47.46% | | (10.30)% |

| Ratios/Supplemental Data | | | | | | | | | |

| Net assets, end of year (in 000s) | $6,451 | | $6,371 | | $8,933 | | $16,926 | | $17,926 |

| Ratio of expenses to average net assets | 1.95% | | 1.95% | | 1.95% | | 1.93% | | 1.90% |

| Ratio of expenses to average net assets without waivers and/or reimbursements | 1.99% (4) | | 2.01% (4) | | 2.00% (4) | | 2.07% (4) | | 1.99% (4) |

| Ratio of net investment income to average net assets | 1.63% | | 1.24% | | 0.69% | | 0.70% | | 0.92% |

| Portfolio turnover rate | 38% | | 39% | | 33% | | 41% | | 36% |

| (1) | The selected per share data was calculated using the average shares outstanding method for the year. |

| (2) | Amount is less than $0.005 per share. |

| (3) | Total investment return is calculated assuming a purchase of shares on the first day and a sale of shares on the last day of each period reported and includes reinvestment of dividends and distributions, if any. Total investment return does not reflect any applicable sales charge. |

| (4) | During the period, certain fees were waived and/or reimbursed. If such fee waivers and/or reimbursements had not occurred, the ratios would have been as indicated (See Note 2). |

The accompanying notes are an integral part of the financial statements.

EIC VALUE FUND

Financial Highlights (Concluded)

Contained below is per share operating performance data for Institutional Class shares outstanding, total investment return, ratios to average net assets and other supplemental data for the respective period. The total returns in the table represent the rate that an investor would have earned or lost on an investment in the Fund (assuming reinvestment of all dividends and distributions). This information has been derived from information provided in the financial statements and should be read in conjunction with the financial statements and the notes thereto.

| | Institutional Class |

| | For the

Year Ended

April 30,

2024 | | For the

Year Ended

April 30,

2023 | | For the

Year Ended

April 30,

2022 | | For the

Year Ended

April 30,

2021 | | For the

Year Ended

April 30,

2020 |

| Per Share Operating Performance | | | | | | | | | |

| Net asset value, beginning of year | $ 15.45 | | $ 16.06 | | $ 16.46 | | $ 11.73 | | $ 13.97 |

| Net investment income(1) | 0.42 | | 0.35 | | 0.28 | | 0.23 | | 0.26 |

| Net realized and unrealized gain/(loss) on investments | 1.85 | | (0.04) | | 1.10 | | 5.32 | | (1.42) |

| Total from investment operations | 2.27 | | 0.31 | | 1.38 | | 5.55 | | (1.16) |

| Dividends and distributions to shareholders from: | | | | | | | | | |

| Net investment income | (0.63) | | — | | (0.27) | | (0.25) | | (0.25) |

| Net realized capital gains | (0.04) | | (0.92) | | (1.51) | | (0.57) | | (0.83) |

| Total dividends and distributions to shareholders | (0.67) | | (0.92) | | (1.78) | | (0.82) | | (1.08) |

| Redemption fees | 0.00 (2) | | 0.00 (2) | | 0.00 (2) | | 0.00 (2) | | 0.00 (2) |

| Net asset value, end of year | $ 17.05 | | $ 15.45 | | $ 16.06 | | $ 16.46 | | $ 11.73 |

| Total investment return(3) | 15.09% | | 2.06% | | 8.64% | | 48.85% | | (9.36)% |

| Ratios/Supplemental Data | | | | | | | | | |

| Net assets, end of year (in 000s) | $243,814 | | $227,844 | | $207,437 | | $148,961 | | $113,292 |

| Ratio of expenses to average net assets | 0.95% | | 0.95% | | 0.95% | | 0.93% | | 0.90% |

| Ratio of expenses to average net assets without waivers and/or reimbursements | 0.98% (4) | | 1.01% (4) | | 1.00% (4) | | 1.07% (4) | | 0.99% (4) |

| Ratio of net investment income to average net assets | 2.63% | | 2.24% | | 1.69% | | 1.70% | | 1.91% |

| Portfolio turnover rate | 38% | | 39% | | 33% | | 41% | | 36% |

| (1) | The selected per share data was calculated using the average shares outstanding method for the year. |

| (2) | Amount is less than $0.005 per share. |

| (3) | Total investment return is calculated assuming a purchase of shares on the first day and a sale of shares on the last day of each period reported and includes reinvestment of dividends and distributions, if any. |

| (4) | During the period, certain fees were waived and/or reimbursed. If such fee waivers and/or reimbursements had not occurred, the ratios would have been as indicated (See Note 2). |

The accompanying notes are an integral part of the financial statements.

EIC VALUE FUND

Notes to Financial Statements

April 30, 2024

1. Organization and Significant Accounting Policies

The EIC Value Fund (the “Fund”) is a diversified, open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), which commenced operations on May 1, 2011. The Fund is a separate series of FundVantage Trust (the “Trust”) which was organized as a Delaware statutory trust on August 28, 2006. The Trust is a “series trust” authorized to issue an unlimited number of separate series or classes of shares of beneficial interest. Each series is treated as a separate entity for certain matters under the 1940 Act, and for other purposes, and a shareholder of one series is not deemed to be a shareholder of any other series. The Fund offers separate classes of shares: Class A, Class C, Institutional Class and Retail Class shares. Class A shares are sold subject to a front-end sales charge of 5.50%. Front-end sales charges may be reduced or waived under certain circumstances. A contingent deferred sales charge (“CDSC”) may be applicable to the redemption of Class A and Class C shares. A CDSC, as a percentage of the lower of the original purchase price or net asset value at redemption, of up to 1.00% may be imposed on full or partial redemptions of Class A shares made within eighteen months of purchase where: (i) $1 million or more of Class A shares were purchased without an initial sales charge, and (ii) the Fund’s principal underwriter, Foreside Funds Distributors LLC (the “Underwriter”), paid a commission to the selling broker-dealer for such sale. A CDSC of up to 1.00% is assessed on redemptions of Class C Shares made within eighteen months after the initial purchase where the broker-dealer was paid a commission for such sale. Class C shares of the Fund will automatically convert into Class A shares of the Fund after they have been held for eight years. As of April 30, 2024, the Retail Class Shares have not been issued.

The Fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board Accounting Standards Codification Topic 946.

Portfolio Valuation – The EIC Value Fund’s (the “Fund”) net asset value (“NAV”) is calculated once daily at the close of regular trading hours on the New York Stock Exchange (“NYSE”) (typically 4:00 p.m. Eastern time) on each day the NYSE is open. Securities held by the Fund are valued using the closing price or the last sale price on a national securities exchange or the National Association of Securities Dealers Automatic Quotation System (“NASDAQ”) market system where they are primarily traded. Equity securities traded in the over-the-counter (“OTC”) market are valued at their closing sale or official closing price. If there were no transactions on that day, securities traded principally on an exchange or on NASDAQ will be valued at the mean of the last bid and ask prices prior to the market close. Fixed income securities having a remaining maturity of greater than 60 days are valued using an independent pricing service. Investments in other open-end investment companies are valued based on the NAV of the investment companies (which may use fair value pricing as discussed in their prospectuses). Securities that do not have a readily available current market value are valued in good faith by the Adviser as "valuation designee" under the oversight of the Trust’s Board of Trustees. Relying on prices supplied by pricing services or dealers or using fair valuation may result in values that are higher or lower than the values used by other investment companies and investors to price the same investments. The Adviser has adopted written policies and procedures for valuing securities and other assets in circumstances where market quotes are not readily available. In the event that market quotes are not readily available, and the security or asset cannot be valued pursuant to one of the valuation methods, the value of the security or asset will be determined in good faith by the Adviser pursuant to its policies and procedures. On a quarterly basis, the Adviser’s fair valuation determinations will be reviewed by the Trust’s Board of Trustees.

Fair Value Measurements — The inputs and valuation techniques used to measure fair value of the Fund’s investments are summarized into three levels as described in the hierarchy below:

• Level 1 — quoted prices in active markets for identical securities;

• Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.); and

• Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Transfers in and out are recognized at the value at the end of the period.

EIC VALUE FUND

Notes to Financial Statements (Continued)

April 30, 2024

The following is a summary of the inputs used, as of April 30, 2024, in valuing the Fund's investments carried at fair value:

| | Total

Value at

04/30/24 | | Level 1

Quoted

Prices | | Level 2

Other

Significant

Observable

Inputs | | Level 3

Significant

Unobservable

Inputs |

| Assets | | | | | | | |

| Common Stocks* | $ 247,729,706 | | $ 247,729,706 | | $ — | | $ — |

| Short-Term Investments* | 24,386,209 | | 24,386,209 | | — | | — |

| Total Assets | $ 272,115,915 | | $ 272,115,915 | | $ — | | $ — |

| * | Please refer to Portfolio of Investments for further details on portfolio holdings. |

At the end of each quarter, management evaluates the classification of Levels 1, 2 and 3 assets and liabilities. Various factors are considered, such as changes in liquidity from the prior reporting period; whether or not a broker is willing to execute at the quoted price; the depth and consistency of prices from third-party pricing services; and the existence of contemporaneous, observable trades in the market. Additionally, management evaluates the classification of Level 1 and Level 2 assets and liabilities on a quarterly basis for changes in listings or delistings on national exchanges.

Due to the inherent uncertainty of determining the fair value of investments that do not have a readily available market value, the fair value of the Fund’s investments may fluctuate from period to period. Additionally, the fair value of investments may differ significantly from the values that would have been used had a ready market existed for such investments and may differ materially from the values the Fund may ultimately realize. Further, such investments may be subject to legal and other restrictions on resale or are otherwise less liquid than publicly traded securities.

For fair valuations using significant unobservable inputs, U.S. generally accepted accounting principles (“U.S. GAAP”) require the Fund to present a reconciliation of the beginning to ending balances for reported market values that present changes attributable to total realized and unrealized gains or losses, purchase and sales, and transfers in and out of Level 3 during the period. A reconciliation of Level 3 investments is presented only when the Fund had an amount of Level 3 investments at the end of the reporting period that was meaningful in relation to its net assets. The amounts and reasons for all transfers in and out of Level 3 are disclosed when the Fund had an amount of transfers during the reporting period that was meaningful in relation to its net assets as of the end of the reporting period.

For the year ended April 30, 2024, there were no transfers in or out of Level 3.

Use of Estimates — The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates and those differences could be material.

Investment Transactions, Investment Income and Expenses — Investment transactions are recorded on trade date for financial statement preparation purposes. Realized gains and losses on investments sold are recorded on the identified cost basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. The Fund may be subject to foreign taxes on income, a portion of which may be recoverable. The Fund applies for refunds where available. Estimated components of distributions received from real estate investment trusts may be considered income, return of capital distributions or capital gain distributions. Return of capital distributions are recorded as a reduction of cost of the related investments. Distribution (12b-1) fees and shareholder services fees relating to a specific class are charged directly to that class. Fund level expenses common to all classes, investment income and realized and unrealized gains and losses on investments are allocated to each class based upon relative daily net assets of each class. General expenses of the Trust are generally allocated to each fund under methodologies approved by the Board Trustees. Expenses directly attributable to a particular fund in the Trust are charged directly to that fund.

EIC VALUE FUND

Notes to Financial Statements (Continued)

April 30, 2024

Dividends and Distributions to Shareholders — Dividends from net investment income and distributions from net realized capital gains, if any, are declared, recorded on ex-date and paid at least annually to shareholders. Income dividends and capital gain distributions are determined in accordance with U.S. federal income tax regulations, which may differ from U.S. GAAP.

U.S. Tax Status — No provision is made for U.S. income taxes as it is the Fund’s intention to continue to qualify for and elect the tax treatment applicable to regulated investment companies under Subchapter M of the Internal Revenue Code of 1986, as amended (“Internal Revenue Code”), and make the requisite distributions to its shareholders which will be sufficient to relieve it from U.S. income and excise taxes.

Other — In the normal course of business, the Fund may enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is dependent on claims that may be made against the Fund in the future, and therefore, cannot be estimated; however, based on experience, the risk of material loss for such claims is considered remote.

2. Transactions with Related Parties and Other Service Providers

Equity Investment Corporation (“EIC” or the “Adviser”) serves as investment adviser to the Fund pursuant to an investment advisory agreement with the Trust (the “Advisory Agreement”). For its services, the Adviser is paid a monthly fee at the annual rate of 0.75% of the Fund’s average daily net assets under $500 million; 0.65% of the Fund’s average daily net assets of $500 million or more, but less than $1 billion; and 0.50% of the Fund’s average daily net assets of $1 billion and over. The Adviser has contractually agreed to waive or otherwise reduce its annual compensation received from and/or reimburse certain expenses of the Fund to the extent necessary to ensure that the Fund’s total operating expenses, excluding taxes, fees and expenses attributable to a distribution or service plan adopted by the Trust, “Acquired Fund Fees and Expenses,” interest, extraordinary items and brokerage commissions, do not exceed 0.95% of average daily net assets of the Fund (the “Expense Limitation”). The Expense Limitation will remain in place until August 31, 2024, unless the Board of Trustees of the Trust approves its earlier termination. Subject to approval by the Board of Trustees, the Adviser may recoup any expenses or fees it has reimbursed within a three-year period from the date on which the Adviser reduced its compensation and/or assumed expenses of the Fund. The Adviser is permitted to seek reimbursement from the Fund, subject to certain limitations, for fees it waived and Fund expenses it paid to the extent the total annual fund operating expenses do not exceed the limits described above or any lesser limits in effect at the time of reimbursement. No recoupment will occur unless the Fund’s expenses are below the Expense Limitation amount.

As of April 30, 2024, the amount of potential recovery was as follows:

| | Expiration |

| | 04/30/2025 | | 04/30/2026 | | 04/30/2027 | | Total |

| | $104,148 | | $151,677 | | $82,541 | | $338,366 |

For the year ended April 30, 2024, the Adviser earned advisory fees of $1,826,154 and waived fees of $82,541.

The Fund has not recorded a commitment or contingent liability at April 30, 2024.

Other Service Providers

The Bank of New York Mellon (“BNY Mellon”) serves as administrator and custodian for the Fund. For providing administrative and accounting services, BNY Mellon is entitled to receive a monthly fee equal to an annual percentage rate of the Fund’s average daily net assets and is subject to certain minimum monthly fees. For providing certain custodial services, BNY Mellon is entitled to receive a monthly fee, subject to certain minimum, and out of pocket expenses.

BNY Mellon Investment Servicing (US) Inc. (the “Transfer Agent”) provides transfer agent services to the Fund. The Transfer Agent is entitled to receive a monthly fee, subject to certain minimum, and out of pocket expenses.

EIC VALUE FUND

Notes to Financial Statements (Continued)

April 30, 2024

The Trust, on behalf of the Fund, has entered into agreements with financial intermediaries to provide recordkeeping, processing, shareholder communications and other services to customers of the intermediaries investing in the Fund and have agreed to compensate the intermediaries for providing those services. The fees incurred by the Fund for these services are included in Transfer agent fees in the Statement of Operations.

Foreside Funds Distributors LLC (the “Underwriter”) provides principal underwriting services to the Fund pursuant to an underwriting agreement between the Trust and the Underwriter.

The Trust and the Underwriter are parties to an underwriting agreement. The Trust has adopted a distribution plan for Class A and Class C shares in accordance with Rule 12b-1 under the 1940 Act. Pursuant to the Class A and Class C shares plan, the Fund compensates the Underwriter for direct and indirect costs and expenses incurred in connection with advertising, marketing and other distribution services in an amount not to exceed 0.25% and 1.00% (0.75% Rule 12b-1 distribution fee and 0.25% shareholder service fee) on an annualized basis of the average daily net assets of the Fund’s Class A and Class C shares, respectively.

Trustees and Officers

The Trust is governed by its Board of Trustees. The Trustees receive compensation in the form of an annual retainer and per meeting fees for their services to the Trust. An employee of BNY Mellon serves as the Secretary of the Trust and is not compensated by the Fund or the Trust.

JW Fund Management LLC (“JWFM”) provides a Principal Executive Officer and Principal Financial Officer to the Trust. Chenery Compliance Group, LLC (“Chenery”) provides the Trust with a Chief Compliance Officer and an Anti-Money Laundering Officer. JWFM and Chenery are compensated for their services provided to the Trust.

3. Investment in Securities

For the year ended April 30, 2024, aggregated purchases and sales of investment securities (excluding short-term investments) of the Fund were as follows:

| | Purchases | | Sales |

| Investment Securities | $86,942,667 | | $111,448,012 |

4. Capital Share Transactions

For the years ended April 30, 2024 and 2023, transactions in capital shares (authorized shares unlimited) were as follows:

| | For the Year Ended

April 30, 2024 | | For the Year Ended

April 30, 2023 |

| | Shares | | Amount | | Shares | | Amount |

| Class A | | | | | | | |

| Sales | 162,723 | | $ 2,581,322 | | 326,841 | | $ 5,075,997 |

| Reinvestments | 49,825 | | 782,747 | | 71,941 | | 1,089,899 |

| Redemption Fees* | — | | 851 | | — | | 411 |

| Redemptions | (261,512) | | (4,163,503) | | (201,732) | | (3,117,450) |

| Net increase/(decrease) | (48,964) | | $ (798,583) | | 197,050 | | $ 3,048,857 |

EIC VALUE FUND

Notes to Financial Statements (Continued)

April 30, 2024

| | For the Year Ended

April 30, 2024 | | For the Year Ended

April 30, 2023 |

| | Shares | | Amount | | Shares | | Amount |

| |

| Class C | | | | | | | |

| Sales | 80,231 | | $ 1,270,512 | | 108,951 | | $ 1,656,613 |

| Reinvestments | 10,630 | | 162,431 | | 27,557 | | 405,649 |

| Redemption Fees* | — | | 232 | | — | | 144 |

| Redemptions | (126,460) | | (1,931,583) | | (278,587) | | (4,186,873) |

| Net decrease | (35,599) | | $ (498,408) | | (142,079) | | $ (2,124,467) |

| |

| Institutional Class | | | | | | | |

| Sales | 3,148,804 | | $ 51,013,670 | | 4,735,378 | | $ 73,679,118 |

| Reinvestments | 519,398 | | 8,159,749 | | 788,658 | | 11,956,048 |

| Redemption Fees* | — | | 8,390 | | — | | 4,516 |

| Redemptions | (4,115,694) | | (64,092,875) | | (3,695,740) | | (56,725,692) |

| Net increase/(decrease) | (447,492) | | $ (4,911,066) | | 1,828,296 | | $ 28,913,990 |

| |

| Total net increase/(decrease) | (532,055) | | $ (6,208,057) | | 1,883,267 | | $ 29,838,380 |

| | | | | | | | |

| * | There is a 2.00% redemption fee that may be charged on shares redeemed which have been held 30 days or less. The redemption fees are retained by the Fund for the benefit of the remaining shareholders and recorded as paid-in capital. |

5. Federal Tax Information