SECURITIES AND EXCHANGE COMMISSION

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

(Exact name of registrant as specified in charter)

103 Bellevue Parkway

Wilmington, DE 19809

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

(a) The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Ambrus Core Bond Fund

Institutional Class | TTRBX

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about the Ambrus Core Bond Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at

https://www.ambrusfunds.com/ambrus-core-bond-fund/

. You can also request this information by contacting us at (833) 996-2101.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Ambrus Core Bond Fund

(Institutional Class / TTRBX) | $ 53 | 0.50 % |

Management's Discussion of Fund Performance

Summary of Results

Over the trailing one-year, the Ambrus Core Bond Fund returned 10.20% versus its index (the Bloomberg Intermediate U.S. Government/Credit Bond Index) returning 9.45%, for outperformance of 0.75%. Outperformance was driven by positive attribution effects across asset allocation and security selection, with yield curve positioning slightly detracting from performance.

Top Contributors to Performance

An overweight to credit-sensitive asset classes (including corporate bonds, preferreds, and taxable municipal bonds) contributed to performance, as benchmark investment-grade credit spreads compressed from a wide of +163 to a tight of +115 over the year

Security selection within every sector of the corporate bond portfolio contributed to performance, as credit spreads for corporate bonds owned in the Fund compressed more than those in the benchmark

The underweight to the energy and communication services sectors within corporate bonds contributed positively to performance

Top Detractors to Performance

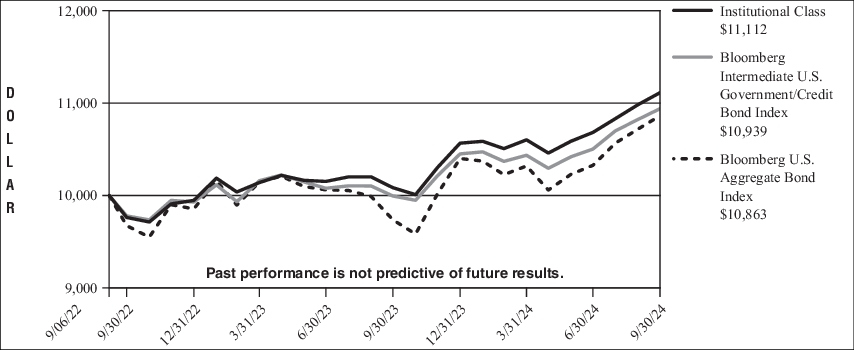

The following is a comparison of the change in value of a $10,000 investment in Ambrus Core Bond Fund’s Institutional Class vs. the Bloomberg U.S. Aggregate Bond Index

and

the Bloomberg Intermediate U.S. Government/Credit Bond Index.

Growth of $10,000

For the period September 06, 2022* through September 30, 2024

| Average Annual Total Returns | 1 Year | Since inception |

| Institutional Class | 10.20 % | 5.21 % * |

| Bloomberg U.S. Aggregate Bond Index** | 11.57 % | 4.08 % *** |

| Bloomberg Intermediate U.S. Government/Credit Bond Index | 9.45 % | 4.43 % *** |

| The Ambrus Core Bond Fund commenced operations on September 6, 2022. |

| The Fund has designated the Bloomberg U.S. Aggregate Bond Index as its new broad-based securities market index in accordance with the SEC’s revised definition for such an index. |

| Benchmark performance is from the commencement date of the Fund Class only and is not the commencement date of the benchmark itself. |

All returns represent past performance which is no guarantee of future results.

Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares.

Please visit

https://www.ambrusfunds.com/ambrus-core-bond-fund/

for performance data current to the most recent month-end.

The following table outlines key Fund

statistics that you should pay attention to.

| Fund net assets | $ 350,779,508 |

| Total number of portfolio holdings | 136 |

| Total advisory fee paid, net | $ 973,392 |

| Portfolio turnover rate as of the end of the reporting period | 32 % |

Portfolio Holdings Summary Table (as of September 30, 2024)

The following table presents a summary by sector of the portfolio holdings of the Fund as a percentage of net assets:

Sector Allocation of Corporate Bonds

| Financials | 11.2 % |

| Consumer Discretionary | 7.5 % |

| Industrials | 5.3 % |

| Technology | 4.6 % |

| Health Care | 3.5 % |

| Materials | 2.3 % |

| Consumer Staple Products | 2.2 % |

| Energy | 2.1 % |

| Utilities | 2.0 % |

| Communications | 1.8 % |

| Real Estate | 1.7 % |

| TOTAL | 44.2 % |

Material Fund changes during the period

There were no material changes to the Fund.

Changes in and Disagreements with Accountants

During the fiscal year ended September 30, 2024, there were no changes in and

/or

disagreements with Accountants.

Availability of Additional Information

You can find additional information about the Fund, including the Fund’s prospectus, financial information, holdings and proxy voting information, at

https://www.ambrusfunds.com/ambrus-core-bond-fund/

.

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same residential address. Unless we are notified otherwise, we may continue to send only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please contact the Fund at (833) 996-2101, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

Ambrus Tax-Conscious

California

Bond Fund

Institutional Class | TCCBX

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about the Ambrus Tax-Conscious California Bond Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at

https://www.ambrusfunds.com/ambrus-tax-conscious-california-bond-fund/

. You can also request this information by contacting us at (833) 996-2101.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Ambrus Tax-Conscious California Bond Fund

(Institutional Class / TCCBX) | $ 52 | 0.50 % |

Management's Discussion of Fund Performance

Summary of Results

Over the trailing one-year, the Ambrus Tax-Conscious California Bond Fund returned 8.00% versus its index (the Bloomberg California Municipal Inter-Short (1-10 Year) Index) returning 7.07%, for outperformance of 0.93%. Outperformance was driven by positive attribution effects from asset allocation, security selection, and yield curve positioning.

Top Contributors to Performance

The overweight to duration benefited performance, as the benchmark 10-year treasury yield declined from a high of 4.99% to a low of 3.62%

Within the municipal bond portfolio, positive security selection benefited performance, as the municipal bonds owned in the Fund outperformed those owned in the benchmark

Within the municipal bond portfolio, the overweight to the housing and transportation sectors and underweight to the pre-refunded sector benefited Fund performance

Fund performance benefited from positive asset allocation effects due to the overweight to treasury bonds, corporate bonds, and preferreds

Fund performance also benefited from active management between asset classes, as the Fund was underweight municipal bonds and overweight corporate bonds from December 2023 to May 2024, followed by significantly increasing ex

po

sure to municipal bonds from May 2024 to September 2024

Top Detractors to Performance

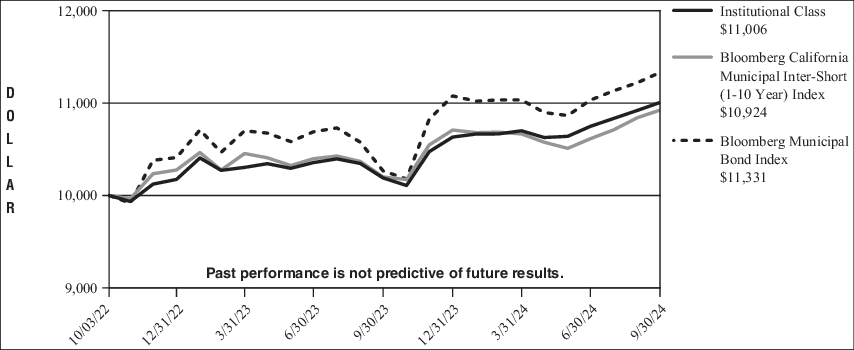

The following is a comparison of the change in value of a $10,000 investment in Ambrus Tax-Conscious California Bond Fund’s Institutional Class vs. the Bloomberg Municipal Bond Index

and

the Bloomberg California Municipal Inter-Short (1-10 Year) Index.

Growth of $10,000

For the period October 03, 2022* through September 30, 2024

| Average Annual Total Returns | 1 Year | Since inception |

| Institutional Class | 8.00 % | 4.91 % * |

| Bloomberg Municipal Bond Index** | 10.37 % | 6.30 % *** |

| Bloomberg California Municipal Inter-Short (1-10 Year) Index | 7.07 % | 4.51 % *** |

| The Ambrus Tax-Conscious California Bond Fund commenced operations on October 3, 2022. |

| The Fund has designated the Bloomberg Municipal Bond Index as its new broad-based securities market index in accordance with the SEC’s revised definition for such an index. |

| Benchmark performance is from the commencement date of the Fund Class only and is not the commencement date of the benchmark itself. |

All returns represent past performance which is no guarantee of future results.

Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares.

Please visit

https://www.ambrusfunds.com/ambrus-tax-conscious-california-bond-fund/

for performance data current to the most recent month-end.

The following table outlines key Fund

statistics that you should pay attention to.

| Fund net assets | $ 295,889,367 |

| Total number of portfolio holdings | 262 |

| Total advisory fee paid, net | $ 771,004 |

| Portfolio turnover rate as of the end of the reporting period | 39 % |

Portfolio Holdings Summary Table (as of September 30, 2024)

The following table presents a sum

mar

y by state of the Municipal Bonds of the Fund as a percentage of net assets:

| California | 64.3 % |

| Texas | 2.4 % |

| Connecticut | 2.4 % |

| Illinois | 2.3 % |

| Ohio | 1.9 % |

| Other (each less than 1.7%) | 6.7 % |

| TOTAL | 80.0 % |

Material Fund changes during the period

There were no material changes to the Fund.

Changes in and Disagreements with Accountants

During the fiscal year ended September 30, 2024, there were no changes in and/or disagreements with Accountants.

Availability of Additional Information

You can find additional information about the Fund, including the Fund’s prospectus, financial information, holdings and proxy voting information, at

https://www.ambrusfunds.com/ambrus-tax-conscious-california-bond-fund/

.

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same residential address. Unless we are notified otherwise, we may continue to send only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please contact the Fund at (833) 996-2101, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

Ambrus Tax-Conscious

National Bond Fund

Institutional Class | TCNBX

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about the Ambrus Tax-Conscious National Bond Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at

https://www.ambrusfunds.com/ambrus-tax-conscious-national-bond-fund/

. You can also request this information by contacting us at (833) 996-2101.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Ambrus Tax-Conscious National Bond Fund

(Institutional Class / TCNBX) | $ 52 | 0.50 % |

Management's Discussion of Fund Performance

Summary of Results

Over the trailing one-year, the Ambrus Tax-Conscious National Bond Fund returned 8.45% versus its index (the Bloomberg Municipal Inter-Short (1-10 Year) Index) returning 7.18%, for outperformance of

1.27

%.

Top Contributors to Performance

The active management of du

ratio

n benefited performance, as the Fund was overweight duration as interest rates declined from October 2023 to December 2023, underweight duration as rates increased through March 2024, and then overweight duration as rates declined from April 2024 to September 2024

Within the municipal bond portfolio, positive security selection benefited performance, as the municipal bonds owned in the Fund outperformed those owned in the benchmark

Fund performance benefitted from positive asset allocation effects due to the overweight to treasury bonds, corporate bonds, and preferreds

Fund performance also benefited from active management between asset classes, as the Fund was underweight municipal bonds and overweight corporate bonds from December 2023 to May 2024, followed by significantly increasing exposure to municipal bonds from May 2024 to September 2024

Top Detractors to Performance

Within the municipal bond portfolio, the underweight to the tobacco muni sector detracted from Fund performance

Within the municipal bond portfolio, security selection within the housing, pre-refunded, and hospital sectors slightly detracted from performance

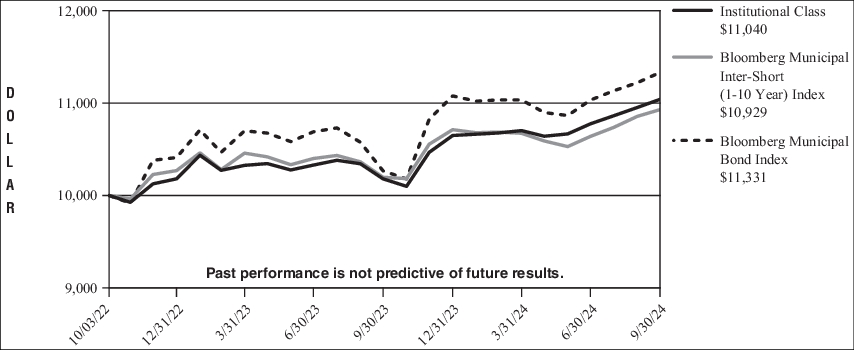

The following is a comparison of the change in value of a $10,000 investment in Ambrus Tax-Conscious National Bond Fund’s Institutional Class vs. the Bloomberg Municipal Bond Index

and

the Bloomberg Municipal Inter-Short (1-10 Year) Index.

Growth of $10,000

For the period October 03, 2022* through September 30, 2024

| Average Annual Total Returns | 1 Year | Since inception |

| Institutional Class | 8.45 % | 5.07 % * |

| Bloomberg Municipal Bond Index** | 10.37 % | 6.30 % *** |

| Bloomberg Municipal Inter-Short (1-10 Year) Index | 7.18 % | 4.56 % *** |

| The Ambrus Tax-Conscious National Bond Fund commenced operations on October 3, 2022. |

| The Fund has designated the Bloomberg Municipal Bond Index as its new broad-based securities market index in accordance with the SEC’s revised definition for such an index. |

| Benchmark performance is from the commencement date of the Fund Class only and is not the commencement date of the benchmark itself. |

All returns represent past performance which is no guarantee of future results.

Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares.

Please visit

https://www.ambrusfunds.com/ambrus-tax-conscious-national-bond-fund/

for performance data current to the most recent month-end.

The following table outlines key Fund

statistics that you should pay attention to.

| Fund net assets | $ 297,254,797 |

| Total number of portfolio holdings | 283 |

| Total advisory fee paid, net | $ 874,944 |

| Portfolio turnover rate as of the end of the reporting period | 36 % |

Portfolio Holdings Summary Table (as of September 30, 2024)

The following table presents a summary by state

of

the Municipal

Bonds of the Fund as a percentage of net assets:

| Texas | 9.5 % |

| New York | 6.4 % |

| Illinois | 5.9 % |

| Florida | 5.3 % |

| Pennsylvania | 4.1 % |

| Ohio | 3.6 % |

| Washington | 3.2 % |

| Michigan | 3.0 % |

| District of Columbia | 2.8 % |

| Connecticut | 2.6 % |

| Tennessee | 2.6 % |

| Colorado | 2.2 % |

| California | 2.2 % |

| Missouri | 2.2 % |

| New Hampshire | 2.0 % |

| Other (each less than 1.7%) | 24.5 % |

| TOTAL | 82.1 % |

Material Fund changes during the period

There were no material changes to the Fund.

Changes in and Disagreements with Accountants

During the fiscal year ended September 30, 2024, there were no changes in and/or disagreements with Accountants.

Availability of Additional Information

You can find additional information about the Fund, including the Fund’s prospectus, financial information, holdings and proxy voting information, at

https://www.ambrusfunds.com/ambrus-tax-conscious-national-bond-fund/

.

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same residential address. Unless we are notified otherwise, we may continue to send only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please contact the Fund at (833) 996-2101, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| | (a) | The registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party (the “Code of Ethics”). |

| | (c) | There have been no amendments, during the period covered by this report, to a provision of the code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the Registrant or a third party, and that relates to any element of the code of ethics description. |

| | (d) | The registrant has not granted any waivers, including an implicit waiver, from a provision of the code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, that relates to one or more of the items set forth in paragraph (b) of this item’s instructions. |

| | (f) | A copy of the Code of Ethics is filed as an Exhibit. |

| Item 3. | Audit Committee Financial Expert. |

The Audit Committee of the Board of Trustees currently is comprised of Robert J. Christian, Iqbal Mansur, Nicholas M. Marsini, Jr., Nancy B. Wolcott and Stephen M. Wynne, each of whom is considered “independent” within the meaning set forth under Item 3 of Form N-CSR. As of the end of the period covered by the report, the Registrant’s Board of Trustees has determined that Mr. Wynne is an “audit committee financial expert” as such term is defined by Item 3 of Form N-CSR.

The Registrant’s Board of Trustees has determined that Mr. Wynne acquired the attributes necessary to be considered an audit committee financial expert through his experience as a chief executive officer (and other senior-level accounting and/or financial positions) of several large financial institutions and because he has co-authored a text book on mutual fund accounting.

| Item 4. | Principal Accountant Fees and Services. |

Audit Fees

| | (a) | The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years were $99,545 for the fiscal year ending September 30, 2024 and $143,618 for the fiscal year ending September 30, 2023. |

Audit-Related Fees

| | (b) | The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item are $0 for the fiscal year ending September 30, 2024 and $0 for the fiscal year ending September 30, 2023. |

Tax Fees

| | (c) | The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning were $0 for the fiscal year ending September 30, 2024 and $880 for the fiscal year ending September 30, 2023. These fees were for Passive Foreign Investment Company (PFIC) database tax services. |

All Other Fees

| | (d) | The aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item are $0 for the fiscal year ending September 30, 2024 and $0 for the fiscal year ending September 30, 2023. |

| | (e)(1) | Disclose the audit committee’s pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X. |

The Registrant’s Audit Committee Charter requires the Audit Committee to (i) (a) approve prior to appointment the engagement of independent registered public accounting firm to annually audit and provide their opinion on the Registrant’s financial statements, (b) recommend to the Independent Trustees the selection, retention or termination of the Registrant’s independent registered public accounting firm and, (c) in connection therewith, to review and evaluate matters potentially affecting the independence and capabilities of the independent registered public accounting firm; and (ii) to approve prior to appointment the engagement of the independent registered public accounting firm to provide other audit services to the Registrant, or to provide non-audit services to the Registrant, its series, an investment adviser to its series or any entity controlling, controlled by, or under common control with an investment adviser to its series (“adviser-affiliate”) that provides ongoing services to the Registrant if the engagement relates directly to the operations and financial reporting of the Registrant. The Audit Committee will not approve non-audit services that the Audit Committee believes may impair the independence of the Registrant’s independent registered public accountant. The Audit Committee may delegate, to the extent permitted by law, pre-approved responsibilities to one or more members of the Audit Committee who shall report to the full Audit Committee.

| | (e)(2) | The percentage of services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X are as follows: |

(b) 100%

(c) 100%

(d) Not applicable

| | (g) | The aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant, and rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant for each of the last two fiscal years of the registrant were $0 for the fiscal year ending September 30, 2024 and $266,983 for the fiscal year ending September 30, 2023. |

| Item 5. | Audit Committee of Listed Registrants. |

| | (a) | The Registrant’s “Schedule I – Investments in securities of unaffiliated issuers” as of the close of the reporting period is included as part of the Annual Financials and Additional Information filed under Item 7 of this form. |

| Item 7. | Financial Statements and Financial Highlights for Open-End Management Investment Companies. |

| Ambrus Core Bond Fund |

| Ambrus Tax-Conscious California Bond Fund |

| Ambrus Tax-Conscious National Bond Fund |

of

FundVantage Trust

Annual Financials and Additional Information

September 30, 2024

This report is submitted for the general information of shareholders and is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

AMBRUS CORE BOND FUND

Portfolio of Investments

September 30, 2024

| | Par

Value | | Value |

| CORPORATE BONDS — 44.2% |

| Communications — 1.8% |

| AT&T, Inc., 7.125%, 12/15/31 | $ 500,000 | | $ 562,220 |

| Meta Platforms, Inc., 4.55%, 8/15/31 | 1,000,000 | | 1,021,926 |

| Paramount Global, 5.50%, 5/15/33 | 1,500,000 | | 1,406,406 |

| Verizon Communications, Inc., 6.48%, 5/15/25(a) | 1,000,000 | | 1,004,926 |

| Warnermedia Holdings, Inc., 4.279%, 3/15/32 | 2,500,000 | | 2,229,640 |

| | | | 6,225,118 |

| Consumer Discretionary — 7.5% |

| BorgWarner, Inc., 4.95%, 8/15/29 | 1,000,000 | | 1,017,273 |

| Brunswick Corp., 2.40%, 8/18/31 | 1,500,000 | | 1,260,397 |

| Choice Hotels International, Inc., 3.70%, 12/1/29 | 2,000,000 | | 1,898,275 |

| Darden Restaurants, Inc., 6.30%, 10/10/33 | 1,900,000 | | 2,069,987 |

| Genuine Parts Co., 4.95%, 8/15/29 | 500,000 | | 508,546 |

| Genuine Parts Co., 1.875%, 11/1/30 | 500,000 | | 429,125 |

| Hasbro, Inc., 6.05%, 5/14/34 | 1,000,000 | | 1,051,662 |

| Leggett & Platt, Inc., 4.40%, 3/15/29 | 2,500,000 | | 2,400,239 |

| LKQ Corp., 6.25%, 6/15/33 | 1,000,000 | | 1,058,696 |

| Masco Corp., 3.50%, 11/15/27 | 1,000,000 | | 977,018 |

| Polaris, Inc., 6.95%, 3/15/29 | 1,000,000 | | 1,085,357 |

| PVH Corp., 4.625%, 7/10/25 | 2,000,000 | | 1,992,351 |

| Ralph Lauren Corp., 3.75%, 9/15/25 | 1,010,000 | | 1,004,387 |

| Tapestry, Inc., 3.05%, 3/15/32 | 2,150,000 | | 1,840,226 |

| Tapestry, Inc., 7.85%, 11/27/33 | 2,000,000 | | 2,168,339 |

| Toyota Motor Credit Corp., 5.05%, 5/16/29 | 2,000,000 | | 2,074,132 |

| VF Corp., 6.00%, 10/15/33 | 2,500,000 | | 2,518,410 |

| Whirlpool Corp., 5.75%, 3/1/34 | 1,000,000 | | 1,023,858 |

| | | | 26,378,278 |

| Consumer Staple Products — 2.2% |

| Altria Group, Inc., 6.875%, 11/1/33 | 1,000,000 | | 1,129,021 |

| J M Smucker Co. (The), 6.20%, 11/15/33 | 650,000 | | 718,612 |

| Kroger Co. (The), 7.70%, 6/1/29 | 2,064,000 | | 2,340,804 |

| Philip Morris International, Inc., 3.375%, 8/11/25 | 3,000,000 | | 2,974,353 |

| Tyson Foods, Inc., 5.70%, 3/15/34 | 500,000 | | 526,543 |

| | | | 7,689,333 |

| Energy — 2.1% |

| Cheniere Energy Partners LP, 5.95%, 6/30/33 | 1,000,000 | | 1,058,981 |

| Equinor ASA, 3.625%, 9/10/28 | 2,000,000 | | 1,970,994 |

| Kinder Morgan, Inc., 7.80%, 8/1/31 | 1,500,000 | | 1,745,332 |

| | Par

Value | | Value |

| CORPORATE BONDS — (Continued) |

| Energy — (Continued) |

| Phillips 66 Co., 5.25%, 6/15/31 | $ 1,000,000 | | $ 1,033,612 |

| Tosco Corp., 7.80%, 1/1/27 | 500,000 | | 537,099 |

| Valero Energy Corp., 2.85%, 4/15/25 | 1,000,000 | | 988,527 |

| | | | 7,334,545 |

| Financials — 11.2% |

| Air Lease Corp., 3.25%, 3/1/25 | 1,300,000 | | 1,289,436 |

| American Express Co., 5.788%, 11/4/26(a) | 1,420,000 | | 1,422,526 |

| AmSouth Bancorp, 6.75%, 11/1/25 | 600,000 | | 610,652 |

| Bank of New York Mellon (The), 5.224%, 11/21/25 | 500,000 | | 500,117 |

| Bank of New York Mellon Corp. (The), 4.543%, 2/1/29 | 2,000,000 | | 2,023,298 |

| Bank of New York Mellon Corp. (The), 5.606%, 7/21/39 | 1,500,000 | | 1,573,312 |

| Broadridge Financial Solutions, Inc., 2.90%, 12/1/29 | 1,300,000 | | 1,205,396 |

| Capital One Financial Corp., 2.359%, 7/29/32 | 1,000,000 | | 818,901 |

| Citibank NA, 5.57%, 4/30/34 | 2,000,000 | | 2,131,450 |

| Discover Financial Services, 3.95%, 11/6/24 | 1,000,000 | | 998,564 |

| Discover Financial Services, 7.964%, 11/2/34 | 2,000,000 | | 2,348,744 |

| Equitable Holdings, Inc., 5.594%, 1/11/33 | 1,000,000 | | 1,046,957 |

| Fiserv, Inc., 5.45%, 3/15/34 | 500,000 | | 522,496 |

| Goldman Sachs Group, Inc. (The), 1.948%, 10/21/27 | 1,300,000 | | 1,239,404 |

| Goldman Sachs Group, Inc. (The), 6.758%, 3/15/28(a) | 500,000 | | 511,235 |

| Goldman Sachs Group, Inc. (The), 4.482%, 8/23/28 | 1,000,000 | | 1,004,979 |

| Jefferies Financial Group, Inc., 2.625%, 10/15/31 | 1,000,000 | | 867,145 |

| JPMorgan Chase & Co., 5.546%, 12/15/25 | 2,000,000 | | 2,001,253 |

| JPMorgan Chase & Co., 6.203%, 2/24/28(a) | 500,000 | | 502,728 |

| LPL Holdings, Inc., 6.00%, 5/20/34 | 3,000,000 | | 3,127,599 |

| Morgan Stanley, 4.35%, 9/8/26 | 800,000 | | 802,198 |

| Northern Trust Corp., 3.375%, 5/8/32 | 919,000 | | 894,510 |

| PNC Bank, 4.20%, 11/1/25 | 1,000,000 | | 996,224 |

| Prudential Financial, Inc., 6.50%, 3/15/54 | 4,150,000 | | 4,450,066 |

AMBRUS CORE BOND FUND

Portfolio of Investments (Continued)

September 30, 2024

| | Par

Value | | Value |

| CORPORATE BONDS — (Continued) |

| Financials — (Continued) |

| Synchrony Financial, 3.70%, 8/4/26 | $ 1,050,000 | | $ 1,030,631 |

| Synchrony Financial, 2.875%, 10/28/31 | 2,325,000 | | 1,973,426 |

| US Bancorp, 4.653%, 2/1/29 | 1,000,000 | | 1,009,436 |

| Wells Fargo & Co., 3.584%, 5/22/28 | 300,000 | | 294,150 |

| Wells Fargo Bank, 6.50%, 12/1/28 | 1,000,000 | | 1,059,104 |

| Zions Bancorp, 3.25%, 10/29/29 | 1,315,000 | | 1,171,787 |

| | | | 39,427,724 |

| Health Care — 3.5% |

| AbbVie, Inc., 2.60%, 11/21/24 | 700,000 | | 697,710 |

| Bristol-Myers Squibb Co., 2.95%, 3/15/32 | 1,000,000 | | 911,077 |

| Cigna Group (The), 3.25%, 4/15/25 | 2,890,000 | | 2,867,653 |

| DENTSPLY SIRONA, Inc., 3.25%, 6/1/30 | 1,600,000 | | 1,468,852 |

| GE HealthCare Technologies, Inc., 4.80%, 8/14/29 | 2,000,000 | | 2,037,087 |

| HCA, Inc., 5.45%, 4/1/31 | 500,000 | | 520,758 |

| Laboratory Corp. of America Holdings, 3.60%, 2/1/25 | 500,000 | | 497,070 |

| Pfizer Investment Enterprises Pte Ltd., 4.75%, 5/19/33 | 1,000,000 | | 1,020,097 |

| UnitedHealth Group, Inc., 6.50%, 6/15/37 | 2,000,000 | | 2,317,486 |

| | | | 12,337,790 |

| Industrials — 5.3% |

| 3M Co., 2.65%, 4/15/25 | 2,000,000 | | 1,977,829 |

| Boeing Co. (The), 3.25%, 2/1/35 | 6,000,000 | | 4,882,681 |

| IDEX Corp., 4.95%, 9/1/29 | 500,000 | | 511,222 |

| Jacobs Engineering Group, Inc., 5.90%, 3/1/33 | 1,300,000 | | 1,363,495 |

| Northrop Grumman Systems Corp., 7.75%, 2/15/31 | 2,000,000 | | 2,344,063 |

| PACCAR Financial Corp., 4.60%, 1/10/28 | 1,000,000 | | 1,017,289 |

| RTX Corp., 2.375%, 3/15/32 | 1,500,000 | | 1,302,317 |

| Ryder System, Inc., 1.75%, 9/1/26 | 1,000,000 | | 951,906 |

| Ryder System, Inc., 5.375%, 3/15/29 | 500,000 | | 519,000 |

| Trimble, Inc., 6.10%, 3/15/33 | 1,500,000 | | 1,618,450 |

| United Airlines Pass Through Trust, 5.875%, 10/15/27 | 1,005,892 | | 1,027,406 |

| Westinghouse Air Brake Technologies Corp., 5.611%, 3/11/34 | 1,000,000 | | 1,056,586 |

| | | | 18,572,244 |

| | Par

Value | | Value |

| CORPORATE BONDS — (Continued) |

| Materials — 2.3% |

| Albemarle Corp., 5.05%, 6/1/32 | $ 2,325,000 | | $ 2,325,165 |

| Huntsman International, LLC, 2.95%, 6/15/31 | 2,500,000 | | 2,160,960 |

| LYB International Finance III, LLC, 3.375%, 5/1/30 | 1,500,000 | | 1,373,925 |

| LYB International Finance III, LLC, 5.50%, 3/1/34 | 2,000,000 | | 2,079,849 |

| | | | 7,939,899 |

| Real Estate — 1.7% |

| American Tower Corp., REIT, 2.95%, 1/15/25 | 1,000,000 | | 993,368 |

| Hudson Pacific Properties LP, REIT, 4.65%, 4/1/29 | 500,000 | | 415,667 |

| Invitation Homes Operating Partnership LP, REIT, 5.45%, 8/15/30 | 1,000,000 | | 1,042,077 |

| Jones Lang LaSalle, Inc., REIT, 6.875%, 12/1/28 | 825,000 | | 894,583 |

| Kilroy Realty LP, REIT, 2.50%, 11/15/32 | 1,000,000 | | 801,521 |

| Vornado Realty LP, REIT, 3.40%, 6/1/31 | 500,000 | | 430,599 |

| Weyerhaeuser Co., REIT, 7.375%, 3/15/32 | 1,050,000 | | 1,215,457 |

| | | | 5,793,272 |

| Technology — 4.6% |

| Arrow Electronics, Inc., 5.875%, 4/10/34 | 2,000,000 | | 2,073,199 |

| Booz Allen Hamilton, Inc., 5.95%, 8/4/33 | 500,000 | | 534,209 |

| Concentrix Corp., 6.85%, 8/2/33 | 2,039,000 | | 2,111,301 |

| Fortinet, Inc., 2.20%, 3/15/31 | 1,000,000 | | 868,031 |

| Intel Corp., 3.90%, 3/25/30 | 2,000,000 | | 1,923,057 |

| Kyndryl Holdings, Inc., 6.35%, 2/20/34 | 1,500,000 | | 1,602,504 |

| Leidos, Inc., 7.125%, 7/1/32 | 2,400,000 | | 2,688,737 |

| Motorola Solutions, Inc., 2.30%, 11/15/30 | 1,500,000 | | 1,323,922 |

| Oracle Corp., 3.80%, 11/15/37 | 2,500,000 | | 2,209,475 |

| Teledyne Technologies, Inc., 2.75%, 4/1/31 | 750,000 | | 673,349 |

| | | | 16,007,784 |

| Utilities — 2.0% |

| Florida Power & Light Co., 5.05%, 4/1/28 | 1,850,000 | | 1,909,039 |

AMBRUS CORE BOND FUND

Portfolio of Investments (Continued)

September 30, 2024

| | Par

Value | | Value |

| CORPORATE BONDS — (Continued) |

| Utilities — (Continued) |

| NextEra Energy Capital Holdings, Inc., 6.051%, 3/1/25 | $ 500,000 | | $ 502,157 |

| PacifiCorp, 6.10%, 8/1/36 | 2,000,000 | | 2,186,289 |

| Southern California Gas Co., 5.05%, 9/1/34 | 1,000,000 | | 1,030,554 |

| Southwestern Electric Power Co., 5.30%, 4/1/33 | 500,000 | | 515,760 |

| System Energy Resources, Inc., 6.00%, 4/15/28 | 1,000,000 | | 1,049,195 |

| | | | 7,192,994 |

TOTAL CORPORATE BONDS

(Cost $149,043,671) | | | 154,898,981 |

| U.S. TREASURY OBLIGATIONS — 39.6% |

| United States Treasury Bonds, | | | |

| 3.875%, 5/15/43 | 2,500,000 | | 2,404,834 |

| 1.25%, 5/15/50 | 5,500,000 | | 2,940,566 |

United States Treasury Floating Rate Notes,

4.797%, 1/31/26(a) | 17,000,000 | | 16,999,453 |

| United States Treasury Notes, | | | |

| 4.25%, 5/31/25 | 20,000,000 | | 20,005,674 |

| 4.125%, 6/15/26 | 22,000,000 | | 22,150,391 |

| 3.625%, 5/31/28 | 41,500,000 | | 41,555,117 |

| 3.75%, 5/31/30 | 27,500,000 | | 27,667,578 |

| 3.375%, 5/15/33 | 5,500,000 | | 5,343,701 |

U.S. TREASURY OBLIGATIONS

(Cost $136,179,959) | | 139,067,314 |

| | Par Value/

Shares | |

| PREFERREDS — 6.1% |

| Consumer Discretionary — 0.4% |

| General Motors Financial Co., Inc., 5.75%, 9/30/27 | 1,550,000 | 1,521,186 |

| Energy — 0.3% |

| BP Capital Markets PLC, 6.45%, 12/1/33 | 1,000,000 | 1,055,479 |

| Financials — 5.4% |

| Bank of New York Mellon Corp. (The), 3.70%, 3/20/26 | 740,000 | 721,675 |

| Bank of New York Mellon Corp. (The), 4.625%, 9/20/26 | 1,500,000 | 1,488,283 |

| Citigroup, Inc., 4.00%, 12/10/25 | 2,400,000 | 2,357,336 |

| Citigroup, Inc., 7.625%, 11/15/28 | 1,650,000 | 1,767,109 |

| | Par Value/

Shares | | Value |

| PREFERREDS — (Continued) |

| Financials — (Continued) |

| Goldman Sachs Group, Inc. (The), 6.125%, 11/10/34 | $ 5,375,000 | | $ 5,420,381 |

| Morgan Stanley, 6.875%, 1/15/25 | 39,395 | | 999,057 |

| Northern Trust Corp., 4.60%, 10/1/26 | 1,550,000 | | 1,538,013 |

| State Street Corp., 5.35%, 3/15/26 | 20,000 | | 493,400 |

| State Street Corp., 6.70%, 9/15/29 | 1,000,000 | | 1,037,430 |

| Wells Fargo & Co., 3.90%, 3/15/26 | 300,000 | | 291,714 |

| Wells Fargo & Co., 6.85%, 9/15/29 | 2,550,000 | | 2,665,418 |

| | | | 18,779,816 |

TOTAL PREFERREDS

(Cost $20,266,613) | | | 21,356,481 |

| | Par

Value | |

| ASSET-BACKED SECURITIES — 2.8% |

| Freddie Mac Pool, 6.00%, 6/1/54 | 9,604,379 | 9,821,669 |

TOTAL ASSET-BACKED SECURITIES

(Cost $9,662,428) | | 9,821,669 |

| | Number

of Shares | |

| EXCHANGE TRADED FUNDS — 0.2% |

| SPDR Portfolio High Yield Bond ETF | 30,000 | 721,500 |

TOTAL EXCHANGE TRADED FUNDS

(Cost $712,200) | | 721,500 |

| SHORT-TERM INVESTMENT — 5.9% |

| Dreyfus Government Cash Management Fund, Institutional Shares, 4.80%(b) | 20,797,949 | 20,797,949 |

|

| |

TOTAL SHORT-TERM INVESTMENT

(Cost $20,797,949) | | 20,797,949 |

|

| |

TOTAL INVESTMENTS - 98.8%

(Cost $336,662,820) | | 346,663,894 |

| OTHER ASSETS IN EXCESS OF LIABILITIES - 1.2% | | 4,115,614 |

| NET ASSETS - 100.0% | | $350,779,508 |

AMBRUS CORE BOND FUND

Portfolio of Investments (Concluded)

September 30, 2024

| (a) | The interest rate is subject to change periodically. The interest rate and/or reference index and spread shown at September 30, 2024. |

| (b) | Rate disclosed is the 7-day yield at September 30, 2024. |

| ETF | Exchange-Traded Fund |

| LLC | Limited Liability Company |

| LP | Limited Partnership |

| PLC | Public Limited Company |

| REIT | Real Estate Investment Trust |

| SPDR | Standard & Poor's Depository Receipt |

The accompanying notes are an integral part of the financial statements.

AMBRUS TAX-CONSCIOUS CALIFORNIA BOND FUND

Portfolio of Investments

September 30, 2024

| | Par

Value | | Value |

| MUNICIPAL BONDS — 80.0% |

| California — 64.3% |

Albany Unified School District GO, Series B, Callable 08/01/26 at 100,

5.00%, 8/1/43 | $1,000,000 | | $ 1,029,950 |

Antioch Unified School District GO, Series B, OID, Callable 08/01/25 at 100,

4.00%, 8/1/40, (BAM Insured) | 635,000 | | 635,561 |

Atwater Elementary School District, Callable 12/01/34 at 100,

5.00%, 12/1/40, (AGC Insured) | 250,000 | | 287,760 |

Atwater Elementary School District, Callable 12/01/34 at 100,

5.00%, 12/1/42, (AGC Insured) | 275,000 | | 312,901 |

Atwater Elementary School District, Callable 12/01/34 at 100,

5.00%, 12/1/44, (AGC Insured) | 700,000 | | 786,424 |

Bay Area Toll Authority Revenue, Series F-2, Callable 04/01/32 at 100,

5.00%, 4/1/45 | 1,150,000 | | 1,279,642 |

Berkeley Joint Powers Financing Authority Revenue, OID, Refunding, Callable 10/31/24 at 100,

3.00%, 10/1/27 | 25,000 | | 25,006 |

Beverly Hills Unified School District GO, CAB, OID, Refunding, Callable 08/01/26 at 68,

0.00%, 8/1/37(a) | 500,000 | | 318,747 |

Cabrillo Unified School District GO, Series A, Callable 08/01/26 at 100,

5.00%, 8/1/48 | 625,000 | | 641,046 |

California Community Choice Financing Authority Revenue, Callable 05/01/29 at 100,

5.00%, 7/1/53(b) | 2,965,000 | | 3,182,713 |

California Community Choice Financing Authority Revenue, Series A-1, Callable 05/01/28 at 100,

4.00%, 5/1/53(b) | 500,000 | | 512,162 |

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| California — (Continued) |

California Community Choice Financing Authority Revenue, Series B-1, Callable 05/01/31 at 101,

4.00%, 2/1/52(b) | $1,435,000 | | $ 1,480,702 |

California Community Choice Financing Authority Revenue, Series G, Callable 01/01/30 at 100,

5.25%, 11/1/54(b) | 2,000,000 | | 2,178,182 |

California Educational Facilities Authority Revenue, Series A, Callable 10/01/28 at 100,

5.00%, 10/1/43 | 3,230,000 | | 3,409,266 |

California Educational Facilities Authority Revenue, Series A, Callable 10/01/28 at 100,

5.00%, 10/1/48 | 70,000 | | 73,237 |

California Enterprise Development Authority Revenue, Callable 11/01/27 at 100,

5.00%, 11/1/34 | 215,000 | | 227,710 |

California Health Facilities Financing Authority Revenue, Callable 02/01/27 at 100,

5.00%, 2/1/29 | 40,000 | | 42,372 |

California Health Facilities Financing Authority Revenue, Callable 11/15/24 at 100,

5.00%, 11/15/35 | 365,000 | | 365,444 |

California Health Facilities Financing Authority Revenue, Refunding, Callable 04/01/26 at 100,

5.00%, 4/1/27, (CA MTG Insured) | 5,000 | | 5,205 |

California Health Facilities Financing Authority Revenue, Refunding, Callable 11/15/27 at 100,

5.00%, 11/15/38 | 250,000 | | 262,858 |

California Health Facilities Financing Authority Revenue, Refunding, Callable 11/15/27 at 100,

5.00%, 11/15/48 | 25,000 | | 25,973 |

California Health Facilities Financing Authority Revenue, Series A, Callable 06/01/34 at 100,

5.25%, 12/1/44 | 1,030,000 | | 1,144,929 |

AMBRUS TAX-CONSCIOUS CALIFORNIA BOND FUND

Portfolio of Investments (Continued)

September 30, 2024

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| California — (Continued) |

California Health Facilities Financing Authority Revenue, Series A, Callable 06/01/34 at 100,

5.00%, 12/1/45 | $ 885,000 | | $ 992,900 |

California Health Facilities Financing Authority Revenue, Series A, Callable 06/01/34 at 100,

5.25%, 12/1/49 | 2,445,000 | | 2,749,910 |

California Health Facilities Financing Authority Revenue, Series A, Callable 08/15/26 at 100,

5.00%, 8/15/34 | 410,000 | | 425,887 |

California Health Facilities Financing Authority Revenue, Series A, Callable 10/31/24 at 100,

4.00%, 10/1/28 | 100,000 | | 100,058 |

California Health Facilities Financing Authority Revenue, Series A, Callable 11/15/27 at 100,

5.00%, 11/15/28 | 15,000 | | 16,138 |

California Health Facilities Financing Authority Revenue, Series A, Refunding,

4.00%, 10/1/26 | 65,000 | | 66,429 |

California Health Facilities Financing Authority Revenue, Series A-2, Callable 11/01/27 at 100,

4.00%, 11/1/44 | 4,000,000 | | 4,011,304 |

California Health Facilities Financing Authority Revenue, Series B-1, Callable 02/01/28 at 102,

5.00%, 11/15/61(b) | 800,000 | | 879,817 |

California Infrastructure & Economic Development Bank Revenue, Callable 05/15/28 at 100,

5.00%, 5/15/47 | 1,130,000 | | 1,188,073 |

California Infrastructure & Economic Development Bank Revenue, Callable 08/01/29 at 100,

5.00%, 8/1/44 | 1,905,000 | | 2,042,495 |

California Infrastructure & Economic Development Bank Revenue, Refunding, Callable 11/01/26 at 100,

5.00%, 5/1/28 | 20,000 | | 21,055 |

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| California — (Continued) |

California Municipal Finance Authority Revenue, Callable 09/01/32 at 100,

5.25%, 9/1/41, (CA MTG Insured) | $ 470,000 | | $ 531,641 |

California Municipal Finance Authority Revenue, Callable 09/01/32 at 100,

5.25%, 9/1/44, (CA MTG Insured) | 700,000 | | 782,730 |

California Municipal Finance Authority Revenue, Callable 09/01/32 at 100,

5.25%, 9/1/54, (CA MTG Insured) | 1,000,000 | | 1,098,049 |

California Municipal Finance Authority Revenue, Callable 11/15/28 at 100,

5.00%, 5/15/36, (BAM-TCRS Insured) | 500,000 | | 534,047 |

California Municipal Finance Authority Revenue, Refunding, Callable 10/01/28 at 100,

5.00%, 10/1/35 | 1,000,000 | | 1,051,856 |

California Municipal Finance Authority Revenue, Series A, Callable 02/01/27 at 100,

3.20%, 9/1/45, (HUD SECT 8 Insured)(b) | 1,250,000 | | 1,264,898 |

California Municipal Finance Authority Revenue, Series A, Callable 06/01/27 at 100,

5.00%, 6/1/42 | 1,000,000 | | 1,041,076 |

California Public Finance Authority Revenue, Series A, Callable 07/15/32 at 100,

5.00%, 7/15/46 | 3,000,000 | | 3,333,488 |

California State Public Works Board Revenue, Callable 10/01/26 at 100,

4.00%, 10/1/28 | 530,000 | | 542,262 |

California State Public Works Board Revenue, Callable 11/01/31 at 100,

5.00%, 11/1/46 | 570,000 | | 627,160 |

California State University Revenue, Series A, Refunding, Callable 11/01/25 at 100,

5.00%, 11/1/47 | 1,000,000 | | 1,016,608 |

AMBRUS TAX-CONSCIOUS CALIFORNIA BOND FUND

Portfolio of Investments (Continued)

September 30, 2024

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| California — (Continued) |

California State University Revenue, Series A, Refunding, Callable 11/01/28 at 100,

5.00%, 11/1/43 | $1,900,000 | | $ 2,031,027 |

California Statewide Communities Development Authority Revenue, Callable 02/01/28 at 100,

5.00%, 8/1/29 | 300,000 | | 315,411 |

California Statewide Communities Development Authority Revenue, Refunding,

5.00%, 3/1/28 | 100,000 | | 105,721 |

California Statewide Communities Development Authority Revenue, Refunding, Callable 03/01/28 at 100,

5.00%, 3/1/33 | 160,000 | | 168,355 |

California Statewide Communities Development Authority Revenue, Series A,

5.00%, 4/1/28 | 20,000 | | 21,376 |

California Statewide Communities Development Authority Revenue, Series A, OID, Refunding, Callable 03/01/26 at 100,

4.125%, 3/1/34 | 1,015,000 | | 1,018,300 |

Cathedral City Redevelopment Agency Successor Agency, Series A, Refunding, Callable 10/21/24 at 100,

5.00%, 8/1/29, (AGM Insured) | 705,000 | | 705,580 |

Chowchilla Elementary School District GO, Callable 08/01/26 at 100,

5.00%, 8/1/43 | 580,000 | | 596,745 |

City & County of San Francisco Community Facilities District No 2014-1, Series A,

5.00%, 9/1/27 | 145,000 | | 154,179 |

City & County of San Francisco Community Facilities District No 2014-1, Series A,

5.00%, 9/1/30 | 150,000 | | 166,498 |

City of Lake Elsinore, Callable 09/01/31 at 103,

5.00%, 9/1/35 | 50,000 | | 54,703 |

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| California — (Continued) |

City of Lake Elsinore, Callable 09/01/31 at 103,

5.00%, 9/1/39 | $ 100,000 | | $ 109,263 |

City of Lake Elsinore, Callable 09/01/31 at 103,

5.00%, 9/1/44 | 575,000 | | 616,529 |

Coachella Valley Unified School District, OID, Refunding, Callable 10/21/24 at 100,

3.50%, 9/1/28, (BAM Insured) | 50,000 | | 50,023 |

Coachella Valley Unified School District GO, OID, Refunding, Callable 10/21/24 at 100,

4.00%, 8/1/27, (BAM Insured) | 5,000 | | 5,004 |

Colusa Unified School District GO, Callable 05/01/25 at 100,

4.00%, 5/1/34, (AGM Insured) | 510,000 | | 511,737 |

Compton Unified School District GO, Series B, Callable 06/01/27 at 100,

4.00%, 6/1/32, (BAM Insured) | 140,000 | | 143,727 |

Concord, OID, Refunding, Callable 04/01/31 at 100,

2.00%, 4/1/38 | 920,000 | | 727,281 |

Cupertino Union School District GO, Refunding, Callable 08/01/26 at 100,

3.25%, 8/1/33 | 545,000 | | 546,005 |

Department of Veterans Affairs Veteran's Farm & Home Purchase Program Revenue, Series A,

0.75%, 12/1/24 | 300,000 | | 297,864 |

Department of Veterans Affairs Veteran's Farm & Home Purchase Program Revenue, Series A,

1.25%, 6/1/27 | 40,000 | | 37,596 |

Desert Sands Unified School District, Callable 09/01/30 at 103,

5.00%, 9/1/44, (BAM Insured) | 100,000 | | 106,696 |

Desert Sands Unified School District, Callable 09/01/30 at 103,

5.00%, 9/10/49, (BAM Insured) | 185,000 | | 194,225 |

Desert Sands Unified School District, Callable 09/01/30 at 103,

5.00%, 9/1/54, (BAM Insured) | 425,000 | | 443,194 |

AMBRUS TAX-CONSCIOUS CALIFORNIA BOND FUND

Portfolio of Investments (Continued)

September 30, 2024

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| California — (Continued) |

East Side Union High School District GO, Series A, OID, Refunding, Callable 08/01/26 at 100,

2.125%, 8/1/29 | $ 50,000 | | $ 47,558 |

East Side Union High School District GO, Series B, Refunding,

5.25%, 2/1/26, (NATL Insured) | 125,000 | | 127,053 |

Eastern Municipal Water District Financing Authority Revenue, Series B, Unrefunded portion, Callable 07/01/26 at 100,

4.00%, 7/1/35 | 250,000 | | 254,797 |

Escondido Union School District GO, Series B, Callable 08/01/27 at 100,

4.00%, 8/1/47 | 1,150,000 | | 1,145,886 |

Fillmore Wastewater Revenue, Refunding, Callable 05/01/27 at 100,

5.00%, 5/1/47, (AGM Insured) | 1,175,000 | | 1,217,104 |

Folsom Cordova Unified School District GO, Series D, Callable 10/01/26 at 100,

4.00%, 10/1/44, (AGM Insured) | 550,000 | | 550,569 |

Folsom Cordova Unified School District School Facilities Improvement Dist No 5 GO, Series A, OID, Callable 10/01/25 at 100,

4.00%, 10/1/40 | 2,325,000 | | 2,328,789 |

Folsom Cordova Unified School District School Facilities Improvement Dist No 5 GO, Series B, Callable 10/01/26 at 100,

4.25%, 10/1/41 | 1,500,000 | | 1,511,445 |

Fontana Unified School District GO, Series A, OID,

0.00%, 8/1/29, (AGM Insured)(a) | 2,500,000 | | 2,185,874 |

Fremont Unified School District/Alameda County GO, Series B, Callable 08/01/25 at 100,

4.00%, 8/1/40 | 1,875,000 | | 1,878,641 |

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| California — (Continued) |

Fresno County Financing Authority Revenue, Refunding, Callable 04/01/26 at 100,

3.00%, 4/1/29 | $ 375,000 | | $ 376,362 |

Fresno Unified School District GO, Series B, Refunding, Callable 08/01/26 at 100,

4.00%, 8/1/46 | 1,485,000 | | 1,476,658 |

Gavilan Joint Community College District GO, Series C, Callable 08/01/32 at 100,

5.00%, 8/1/43 | 1,000,000 | | 1,125,246 |

Gavilan Joint Community College District GO, Series C, Callable 08/01/32 at 100,

5.00%, 8/1/44 | 1,000,000 | | 1,119,637 |

Glendale Unified School District GO, Series B, CAB, OID, Refunding, Callable 09/01/25 at 70,

0.00%, 9/1/33(a) | 800,000 | | 540,674 |

Grossmont Healthcare District GO, Series D, Refunding, Callable 07/15/25 at 100,

4.00%, 7/15/40 | 1,500,000 | | 1,501,294 |

Hayward Unified School District, Callable 08/01/27 at 100,

5.25%, 8/1/52 | 1,000,000 | | 1,037,779 |

Hayward Unified School District GO, Refunding, Callable 08/01/28 at 100,

4.00%, 8/1/43, (BAM Insured) | 1,000,000 | | 1,008,793 |

Imperial Community College District GO, Series A, Callable 08/01/33 at 100,

5.25%, 8/1/53, (AGM Insured) | 900,000 | | 1,013,443 |

Indian Wells Redevelopment Agency Successor Agency, Series A, Refunding, Callable 09/01/26 at 100,

5.00%, 9/1/28, (NATL Insured) | 20,000 | | 20,946 |

Inglewood Unified School District GO, Series B, Callable 08/01/26 at 100,

5.00%, 8/1/38, (BAM Insured) | 1,505,000 | | 1,552,786 |

AMBRUS TAX-CONSCIOUS CALIFORNIA BOND FUND

Portfolio of Investments (Continued)

September 30, 2024

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| California — (Continued) |

Irvine Facilities Financing Authority, Series A, Callable 09/01/33 at 100,

5.00%, 9/1/48, (BAM Insured) | $1,730,000 | | $ 1,929,442 |

Irvine Facilities Financing Authority Revenue, Callable 05/01/26 at 100,

5.25%, 5/1/43 | 2,275,000 | | 2,335,934 |

Irvine Ranch Water District Water Service Corp., Callable 08/01/26 at 100,

5.25%, 2/1/46 | 2,000,000 | | 2,066,700 |

Kern High School District GO, Series E, OID,

2.00%, 8/1/27 | 100,000 | | 97,614 |

Lancaster Financing Authority Revenue, Series A, Callable 05/01/34 at 100,

5.00%, 5/1/54 | 3,000,000 | | 3,323,686 |

Live Oak Elementary School District/Santa Cruz County GO, Series A, Callable 08/01/32 at 100,

5.00%, 8/1/44, (BAM Insured) | 340,000 | | 378,935 |

Local Public Schools Funding Authority School Improvement District No 2016-1 GO, Series A, Callable 08/01/27 at 100,

4.00%, 8/1/42, (BAM Insured) | 770,000 | | 776,804 |

Lodi Unified School District GO, Series 2020, Callable 08/01/27 at 100,

4.00%, 8/1/40 | 995,000 | | 1,005,920 |

Long Beach Unified School District GO, Series E, Callable 08/01/26 at 100,

4.00%, 8/1/44, (BAM-TCRS Insured) | 875,000 | | 875,755 |

Los Angeles County Metropolitan Transportation Authority Sales Tax Revenue, Series A, Callable 07/01/28 at 100,

5.00%, 7/1/44 | 825,000 | | 877,733 |

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| California — (Continued) |

Los Angeles County Public Works Financing Authority Revenue, Series A, Callable 12/01/30 at 100,

5.00%, 12/1/45 | $ 500,000 | | $ 544,286 |

Los Angeles County Public Works Financing Authority Revenue, Series D, Callable 12/01/25 at 100,

5.00%, 12/1/32 | 150,000 | | 153,853 |

Los Angeles County Public Works Financing Authority Revenue, Series E-1, Callable 12/01/29 at 100,

5.00%, 12/1/49 | 100,000 | | 107,308 |

Los Angeles County Public Works Financing Authority Revenue, Series H, Refunding, Callable 12/01/34 at 100,

5.50%, 12/1/49 | 2,225,000 | | 2,602,868 |

Los Angeles County Public Works Financing Authority Revenue, Series H, Refunding, Callable 12/01/34 at 100,

5.50%, 12/1/53 | 400,000 | | 464,844 |

Los Angeles County Revenue,

5.00%, 6/30/25 | 2,000,000 | | 2,033,830 |

Los Angeles County Schools Regionalized Business Services Corp., Series A-3, OID, Refunding, Callable 10/31/24 at 100,

3.75%, 9/1/26, (AGM Insured) | 15,000 | | 15,014 |

Los Angeles Department of Airports Revenue, Refunding, Callable 05/15/29 at 100,

5.00%, 5/15/43 | 2,000,000 | | 2,153,381 |

Los Angeles Department of Water & Power Revenue, Callable 07/01/31 at 100,

5.00%, 7/1/51 | 85,000 | | 92,655 |

Los Angeles Department of Water & Power Revenue, Series A, Callable 01/01/27 at 100,

5.00%, 7/1/47 | 1,000,000 | | 1,034,775 |

AMBRUS TAX-CONSCIOUS CALIFORNIA BOND FUND

Portfolio of Investments (Continued)

September 30, 2024

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| California — (Continued) |

Los Angeles Department of Water & Power Revenue, Series A, Callable 01/01/29 at 100,

5.00%, 7/1/45 | $ 600,000 | | $ 638,956 |

Los Angeles Department of Water & Power Revenue, Series A, Refunding, Callable 01/01/26 at 100,

5.00%, 7/1/40 | 1,580,000 | | 1,615,632 |

Los Angeles Department of Water & Power Revenue, Series D, Refunding, Callable 07/01/29 at 100,

5.00%, 7/1/44 | 640,000 | | 688,151 |

Los Angeles Department of Water & Power Water System Revenue, Series A, Refunding, Callable 01/01/26 at 100,

5.00%, 7/1/46 | 1,755,000 | | 1,788,452 |

Los Angeles Department of Water & Power Water System Revenue, Series A, Refunding, Callable 01/01/27 at 100,

5.00%, 7/1/44 | 250,000 | | 259,045 |

Los Angeles Housing Authority Revenue, Series A,

3.75%, 4/1/34, (FNMA COLL Insured) | 1,250,000 | | 1,281,358 |

Los Angeles Housing Authority Revenue, Series A, Refunding, Callable 06/01/26 at 100,

4.00%, 6/1/27, (HUD SECT 8 Insured) | 5,000 | | 5,137 |

Los Angeles Housing Authority Revenue, Series C,

3.75%, 4/1/34, (FNMA COLL Insured) | 1,775,000 | | 1,819,528 |

Los Angeles Solid Waste Resources Revenue, Series A, OID, Callable 10/31/24 at 100,

2.25%, 2/1/25 | 250,000 | | 248,368 |

Los Angeles Unified School District GO, Series A, Callable 07/01/25 at 100,

4.00%, 7/1/40 | 3,000,000 | | 3,003,640 |

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| California — (Continued) |

Los Angeles Unified School District GO, Series B, Refunding, Callable 07/01/26 at 100,

3.00%, 7/1/32 | $1,220,000 | | $ 1,212,121 |

Lucia Mar Unified School District GO, Series A, OID, Callable 08/01/27 at 100,

4.00%, 8/1/46 | 1,500,000 | | 1,500,451 |

Lucia Mar Unified School District GO, Series B, Callable 08/01/28 at 100,

5.00%, 8/1/42 | 535,000 | | 567,362 |

Marin Healthcare District GO, Callable 08/01/25 at 100,

4.00%, 8/1/40 | 1,000,000 | | 1,002,105 |

Martinez Unified School District GO, Refunding, Callable 08/01/26 at 100,

4.00%, 8/1/28 | 20,000 | | 20,610 |

Napa Valley Unified School District GO, Series C, Callable 08/01/26 at 100,

4.00%, 8/1/44, (AGM Insured) | 555,000 | | 555,284 |

Norman Y Mineta San Jose International Airport SJC Revenue, Series B, Refunding, Callable 03/01/27 at 100,

5.00%, 3/1/42 | 755,000 | | 784,262 |

Oakland Unified School District/Alameda County GO, Refunding, Callable 08/01/26 at 100,

5.00%, 8/1/30, (BAM-TCRS Insured) | 1,100,000 | | 1,144,808 |

Oxnard Union High School District, OID, Callable 06/01/29 at 100,

2.25%, 6/1/39, (AGM Insured) | 330,000 | | 260,556 |

Oxnard Union High School District GO, Series B, Callable 08/01/28 at 100,

5.00%, 8/1/45 | 1,000,000 | | 1,057,364 |

Palomar Community College District GO, Series B, OID,

0.00%, 8/1/32(a) | 1,685,000 | | 1,330,809 |

AMBRUS TAX-CONSCIOUS CALIFORNIA BOND FUND

Portfolio of Investments (Continued)

September 30, 2024

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| California — (Continued) |

Palomar Health GO, Series B, Refunding, Callable 08/01/26 at 100,

4.00%, 8/1/33 | $ 200,000 | | $ 200,573 |

Perris Public Financing Authority, Series B, OID, Refunding, Callable 10/01/25 at 100,

3.75%, 10/1/31 | 1,620,000 | | 1,623,347 |

Piedmont Unified School District GO, Series C, OID, Callable 08/01/31 at 100,

2.125%, 8/1/41 | 455,000 | | 340,657 |

Pittsburg Successor Agency Redevelopment Agency, Series A, Refunding,

5.00%, 9/1/26, (AGM Insured) | 100,000 | | 104,359 |

Pittsburg Unified School District GO, Refunding, Callable 08/01/26 at 100,

4.00%, 8/1/34 | 580,000 | | 587,531 |

Port of Los Angeles Revenue, Series A-1, AMT, Refunding,

5.00%, 8/1/27 | 500,000 | | 527,664 |

Port of Los Angeles Revenue, Series B-2, Refunding, Callable 08/01/34 at 100,

5.00%, 8/1/44 | 250,000 | | 285,755 |

Port of Los Angeles Revenue, Series C, Refunding, Callable 08/01/34 at 100,

5.00%, 8/1/44 | 320,000 | | 365,767 |

Rancho Santiago Community College District GO, Series C, OID,

0.00%, 9/1/27, (AGM Insured)(a) | 2,040,000 | | 1,888,980 |

Ravenswood City School District GO, Callable 08/01/26 at 100,

5.00%, 8/1/29 | 300,000 | | 314,228 |

Regents of the University of California Medical Center Pooled Revenue, Series L, Refunding, Callable 05/15/26 at 100,

4.00%, 5/15/37 | 960,000 | | 966,104 |

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| California — (Continued) |

Regents of the University of California Medical Center Pooled Revenue, Series P, Callable 05/15/32 at 100,

5.00%, 5/15/42 | $1,590,000 | | $ 1,789,996 |

River Islands Public Financing Authority, Series 1, Refunding, Callable 09/01/29 at 103,

5.00%, 9/1/42, (AGM Insured) | 3,370,000 | | 3,718,721 |

Riverside Community College District, Callable 06/01/25 at 100,

5.00%, 6/1/37 | 210,000 | | 212,943 |

Riverside Community College District, Callable 06/01/25 at 100,

5.00%, 6/1/38 | 255,000 | | 258,348 |

Riverside Community College District, Callable 06/01/25 at 100,

5.00%, 6/1/39 | 325,000 | | 329,080 |

Riverside Community College District, Callable 06/01/25 at 100,

5.25%, 6/1/43 | 1,670,000 | | 1,690,006 |

Riverside Community College District, Callable 06/01/25 at 100,

5.25%, 6/1/49 | 2,000,000 | | 2,021,910 |

Riverside County Redevelopment Successor Agency, Series A, CAB, OID, Refunding, Callable 10/01/26 at 100,

5.00%, 10/1/31, (BAM Insured) | 500,000 | | 523,461 |

Riverside County Redevelopment Successor Agency, Series A, Refunding, Callable 10/01/27 at 100,

4.00%, 10/1/39, (BAM Insured) | 1,000,000 | | 1,012,003 |

Sacramento Area Flood Control Agency, Refunding, Callable 10/01/26 at 100,

5.00%, 10/1/36 | 505,000 | | 524,475 |

Sacramento Transient Occupancy Tax Revenue, Series C, Callable 06/01/28 at 100,

5.00%, 6/1/43 | 650,000 | | 680,670 |

Sacramento Transient Occupancy Tax Revenue, Series C, Callable 06/01/28 at 100,

5.00%, 6/1/48 | 800,000 | | 832,636 |

AMBRUS TAX-CONSCIOUS CALIFORNIA BOND FUND

Portfolio of Investments (Continued)

September 30, 2024

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| California — (Continued) |

San Diego Community Facilities District No 2, Refunding,

4.00%, 9/1/27 | $ 535,000 | | $ 554,426 |

San Diego County, Callable 10/01/31 at 100,

5.00%, 10/1/46 | 3,620,000 | | 3,967,492 |

San Diego County Regional Airport Authority Revenue, Series A, Callable 07/01/31 at 100,

5.00%, 7/1/46 | 1,530,000 | | 1,679,865 |

San Diego County Regional Airport Authority Revenue, Series A, Refunding, Callable 07/01/29 at 100,

5.00%, 7/1/44 | 1,170,000 | | 1,255,363 |

San Diego Public Facilities Financing Authority Revenue, Series A, Callable 08/01/28 at 100,

5.00%, 8/1/43 | 2,655,000 | | 2,819,887 |

San Diego Unified School District GO, Series I, Callable 07/01/27 at 100,

5.00%, 7/1/47 | 2,020,000 | | 2,099,703 |

San Francisco City & County Airport Comm-San Francisco International Airport Revenue, Series A, AMT, Unrefunded portion, Callable 05/01/27 at 100,

5.00%, 5/1/47 | 1,785,000 | | 1,818,261 |

San Francisco City & County Airport Comm-San Francisco International Airport Revenue, Series B, AMT, Callable 05/01/26 at 100,

5.00%, 5/1/41 | 1,100,000 | | 1,116,512 |

San Francisco City & County Airport Comm-San Francisco International Airport Revenue, Series B, Refunding, Callable 05/01/27 at 100,

5.00%, 5/1/47 | 1,600,000 | | 1,659,163 |

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| California — (Continued) |

San Francisco City & County Airport Comm-San Francisco International Airport Revenue, Series B, Refunding, Callable 05/01/33 at 100,

5.00%, 5/1/43 | $ 720,000 | | $ 814,216 |

San Francisco City & County Public Utilities Commission Power Revenue, Series A, Callable 05/01/25 at 100,

5.00%, 11/1/35 | 115,000 | | 116,241 |

San Francisco City & County Public Utilities Commission Wastewater Revenue, Series A, Callable 10/01/25 at 100,

4.00%, 10/1/39 | 1,875,000 | | 1,881,121 |

San Francisco City & County Public Utilities Commission Wastewater Revenue, Series A, Callable 10/01/25 at 100,

4.00%, 10/1/40 | 500,000 | | 501,253 |

San Francisco City & County Public Utilities Commission Wastewater Revenue, Series B, Callable 10/01/25 at 100,

4.00%, 10/1/46 | 2,650,000 | | 2,632,765 |

San Francisco City & County Redevelopment Agency Successor Agency, Series A, Refunding, Callable 08/01/26 at 100,

5.00%, 8/1/36 | 150,000 | | 154,799 |

San Jose Unified School District GO, Series C, OID,

0.00%, 8/1/30, (NATL Insured)(a) | 2,435,000 | | 2,080,201 |

San Mateo Joint Powers Financing Authority Revenue, Series A, Callable 07/15/28 at 100,

5.00%, 7/15/43 | 2,250,000 | | 2,390,044 |

Santa Clara Unified School District GO, Callable 07/01/26 at 100,

3.00%, 7/1/35 | 1,150,000 | | 1,144,641 |

AMBRUS TAX-CONSCIOUS CALIFORNIA BOND FUND

Portfolio of Investments (Continued)

September 30, 2024

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| California — (Continued) |

Santa Clarita Public Finance Authority Revenue, Series B, OID, Refunding, Callable 10/01/26 at 100,

2.00%, 10/1/27 | $ 20,000 | | $ 19,394 |

Santa Cruz City Elementary School District GO, Series C, Callable 08/01/30 at 100,

2.00%, 8/1/36 | 695,000 | | 566,863 |

Selma Unified School District GO, Series A, Callable 08/01/31 at 100,

5.25%, 8/1/48, (BAM Insured) | 350,000 | | 389,238 |

Shasta Joint Powers Financing Authority Revenue, Series A, OID, Refunding, Callable 10/31/24 at 100,

3.00%, 4/1/26, (AGM Insured) | 10,000 | | 10,003 |

Simi Valley Unified School District GO, Series D, Callable 08/01/31 at 100,

5.00%, 8/1/43 | 500,000 | | 555,461 |

South San Francisco Unified School District GO, Series C, Callable 09/01/25 at 100,

4.00%, 9/1/33 | 2,000,000 | | 2,008,717 |

Southern California Water Replenishment District Revenue, Refunding, Callable 08/01/25 at 100,

4.00%, 8/1/45 | 1,725,000 | | 1,725,178 |

State of California GO, Callable 03/01/30 at 100,

3.00%, 3/1/46, (BAM-TCRS Insured) | 280,000 | | 240,255 |

State of California GO, Callable 04/01/32 at 100,

5.00%, 4/1/47 | 1,725,000 | | 1,906,428 |

State of California GO, Callable 08/01/34 at 100,

5.50%, 8/1/54 | 1,000,000 | | 1,167,535 |

State of California GO, Callable 09/01/26 at 100,

5.00%, 9/1/45 | 250,000 | | 258,026 |

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| California — (Continued) |

State of California GO, Callable 12/01/30 at 100,

5.00%, 12/1/46 | $1,500,000 | | $ 1,636,370 |

State of California GO, Refunding, Callable 04/01/29 at 100,

5.00%, 10/1/42 | 2,500,000 | | 2,685,407 |

State of California GO, Refunding, Callable 11/01/24 at 100,

4.00%, 11/1/44 | 1,000,000 | | 996,468 |

Stockton Unified School District, Refunding, Callable 02/01/28 at 100,

5.00%, 2/1/35 | 2,060,000 | | 2,185,550 |

Stockton Unified School District GO, Series D, OID,

0.00%, 8/1/27, (AGM Insured)(a) | 350,000 | | 324,617 |

Sweetwater Union High School District GO, Refunding, Callable 02/01/26 at 100,

4.00%, 8/1/42, (BAM-TCRS Insured) | 1,500,000 | | 1,503,274 |

Town of Mammoth Lakes, Callable 06/01/34 at 100,

5.00%, 6/1/44, (BAM Insured) | 500,000 | | 560,793 |

Travis Unified School District, Refunding, Callable 09/01/25 at 100,

5.00%, 9/1/29, (AGM Insured) | 20,000 | | 20,535 |

University of California Revenue, Series AZ, Refunding, Callable 05/15/28 at 100,

5.00%, 5/15/43 | 690,000 | | 730,900 |

University of California Revenue, Series M, Callable 05/15/27 at 100,

5.00%, 5/15/42 | 1,620,000 | | 1,684,995 |

Upland Unified School District GO, Series A, OID,

0.00%, 8/1/30, (AGM Insured)(a) | 700,000 | | 592,866 |

Vacaville Unified School District GO, Series C, Callable 08/01/26 at 100,

5.00%, 8/1/42 | 785,000 | | 809,710 |

AMBRUS TAX-CONSCIOUS CALIFORNIA BOND FUND

Portfolio of Investments (Continued)

September 30, 2024

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| California — (Continued) |

Victor Valley Transit Authority, Refunding, Callable 07/01/26 at 100,

5.00%, 7/1/30 | $ 20,000 | | $ 20,873 |

Washington Township Health Care District GO, Series DT, Refunding, Callable 08/01/26 at 100,

4.00%, 8/1/29 | 10,000 | | 10,223 |

Western Placer Unified School District GO, Series B, Callable 08/01/26 at 100,

5.00%, 8/1/43 | 355,000 | | 365,632 |

Whittier Union High School District GO, CAB, OID, Refunding, Callable 08/01/26 at 85,

0.00%, 8/1/31(a) | 570,000 | | 452,927 |

Yuba Levee Financing Authority Revenue, Series A, Refunding, Callable 09/01/26 at 100,

5.00%, 9/1/29, (BAM Insured) | 20,000 | | 20,985 |

Yuba Levee Financing Authority Revenue, Series A, Refunding, Callable 09/01/26 at 100,

5.00%, 9/1/30, (BAM Insured) | 25,000 | | 26,183 |

| | | | 190,309,953 |

| Connecticut — 2.4% |

Connecticut Housing Finance Authority Revenue, Series 1, Refunding, Callable 11/15/28 at 100,

2.60%, 11/15/34 | 750,000 | | 667,202 |

Connecticut State Health & Educational Facilities Authority Revenue, Callable 07/01/25 at 100,

5.00%, 7/1/45 | 650,000 | | 651,864 |

Connecticut State Health & Educational Facilities Authority Revenue, Series L, Refunding, Callable 07/01/25 at 100,

5.00%, 7/1/45 | 1,500,000 | | 1,509,258 |

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| Connecticut — (Continued) |

State of Connecticut Special Tax Revenue, Series A, Callable 08/01/25 at 100,

4.00%, 8/1/35 | $1,800,000 | | $ 1,808,544 |

State of Connecticut Special Tax Revenue, Series A, Callable 09/01/26 at 100,

4.00%, 9/1/35 | 2,500,000 | | 2,515,898 |

| | | | 7,152,766 |

| Florida — 0.4% |

Miami-Dade Seaport Department County Revenue, Series B, Senior Series, Refunding, Callable 10/01/32 at 100,

5.00%, 10/1/37 | 1,000,000 | | 1,116,725 |

| Illinois — 2.3% |

Illinois Finance Authority Revenue, Refunding, Callable 10/31/24 at 100,

3.90%, 3/1/30 | 5,000,000 | | 4,999,842 |

Illinois Finance Authority Revenue, Series A, Callable 08/15/32 at 100,

5.00%, 8/15/52 | 400,000 | | 420,412 |

Lake County School District No 1 Winthrop Harbor GO, Refunding, Callable 02/01/26 at 100,

4.00%, 2/1/32 | 380,000 | | 384,567 |

State of Illinois GO, OID, Callable 01/14/25 at 100,

5.00%, 2/1/39 | 1,000,000 | | 1,004,628 |

| | | | 6,809,449 |

| Iowa — 0.0% |

Iowa Finance Authority Revenue, Series C, Refunding, Callable 10/21/24 at 100,

5.00%, 2/15/32 | 150,000 | | 150,943 |

| Michigan — 0.5% |

Michigan State Building Authority Revenue, Series I, Refunding, Callable 10/15/25 at 100,

5.00%, 10/15/45 | 1,500,000 | | 1,518,162 |

AMBRUS TAX-CONSCIOUS CALIFORNIA BOND FUND

Portfolio of Investments (Continued)

September 30, 2024

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| Minnesota — 0.0% |

Minneapolis Revenue, Series A, Refunding, Callable 11/15/25 at 100,

5.00%, 11/15/26 | $ 100,000 | | $ 101,679 |

| New Hampshire — 0.3% |

Dover GO, Series A, Callable 06/15/26 at 100,

3.00%, 6/15/31 | 1,000,000 | | 991,977 |

| New Mexico — 0.3% |

New Mexico Municipal Energy Acquisition Authority Revenue, Series A, Refunding, Callable 02/01/25 at 101,

5.00%, 11/1/39(b) | 1,000,000 | | 1,009,574 |

| New York — 0.9% |

Metropolitan Transportation Authority Revenue, Series D, Refunding, Callable 05/15/28 at 100,

5.00%, 11/15/32 | 785,000 | | 833,262 |

New York City Housing Development Corp. Revenue, Series 1,

3.45%, 11/1/28, (REMIC FHA 542c Insured) | 345,000 | | 353,673 |

New York City Housing Development Corp. Revenue, Series 2A, Callable 05/01/25 at 100,

3.40%, 11/1/62, (REMIC FHA 542c Insured)(b) | 350,000 | | 350,959 |

Triborough Bridge & Tunnel Authority Revenue, Series A, Callable 11/19/24 at 100,

5.00%, 11/15/44 | 1,000,000 | | 1,002,031 |

| | | | 2,539,925 |

| Ohio — 1.9% |

State of Ohio Revenue, Series A, Refunding, Callable 01/15/26 at 100,

5.00%, 1/15/41 | 1,800,000 | | 1,826,868 |

Toledo Water System Revenue, Callable 11/15/26 at 100,

5.00%, 11/15/41 | 3,575,000 | | 3,697,592 |

| | | | 5,524,460 |

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| Oklahoma — 0.9% |

University of Oklahoma/The Revenue, Series C, Callable 07/01/25 at 100,

5.00%, 7/1/38 | $2,610,000 | | $ 2,636,657 |

| Oregon — 0.5% |

Seaside School District No 10 GO, Series A, CAB, OID, Callable 06/15/27 at 51,

0.00%, 6/15/42, (SCH BD GTY Insured)(a) | 3,000,000 | | 1,375,769 |

| Pennsylvania — 0.6% |

Pennsylvania Economic Development Financing Authority Revenue, AMT, OID, Callable 12/31/32 at 100,

5.00%, 12/31/57, (AGM Insured) | 630,000 | | 663,214 |

Philadelphia GO, Refunding, Callable 08/01/27 at 100,

5.00%, 8/1/37 | 1,130,000 | | 1,188,443 |

| | | | 1,851,657 |

| South Carolina — 0.8% |

South Carolina Ports Authority Revenue, Series A, Callable 07/01/29 at 100,

5.00%, 7/1/54 | 1,250,000 | | 1,292,931 |

South Carolina Public Service Authority Revenue, Series A, Refunding, Callable 06/01/25 at 100,

5.00%, 12/1/28 | 100,000 | | 101,170 |

South Carolina Public Service Authority Revenue, Series E, OID, Unrefunded portion, Callable 10/23/24 at 100,

5.00%, 12/1/48 | 1,000,000 | | 1,000,918 |

| | | | 2,395,019 |

| Texas — 2.4% |

El Paso GO, Callable 08/15/26 at 100,

5.00%, 8/15/42 | 1,500,000 | | 1,525,690 |

Harris Toll Road County Revenue, Series A, Senior Series, Refunding, Callable 02/15/28 at 100,

5.00%, 8/15/43 | 2,815,000 | | 2,937,685 |

AMBRUS TAX-CONSCIOUS CALIFORNIA BOND FUND

Portfolio of Investments (Continued)

September 30, 2024

| | Par

Value | | Value |

| MUNICIPAL BONDS — (Continued) |

| Texas — (Continued) |

Texas Municipal Gas Acquisition & Supply Corp. III Revenue, Refunding,

5.00%, 12/15/27 | $ 500,000 | | $ 524,915 |

Texas Municipal Gas Acquisition & Supply Corp. IV Revenue, Series B, Callable 07/01/33 at 100,

5.50%, 1/1/54(b) | 1,750,000 | | 1,991,444 |

| | | | 6,979,734 |

| Washington — 1.5% |

Bellevue GO, Refunding, Callable 06/01/25 at 100,

4.00%, 12/1/31 | 2,315,000 | | 2,325,907 |

King County Sewer Revenue, Series A, Refunding, Callable 01/01/26 at 100,

4.00%, 7/1/40 | 2,000,000 | | 2,003,583 |

| | | | 4,329,490 |

TOTAL MUNICIPAL BONDS

(Cost $234,438,055) | | | 236,793,939 |

| | Par Value/

Shares | |

| PREFERREDS — 6.0% |

| Consumer Discretionary — 0.3% |

| General Motors Financial Co., Inc., 5.75%, 9/30/27 | 875,000 | 858,734 |

| Energy — 0.3% |

| BP Capital Markets PLC, 6.45%, 12/1/33 | 1,000,000 | 1,055,479 |

| Financials — 5.4% |

| Bank of New York Mellon Corp. (The), 3.70%, 3/20/26 | 850,000 | 828,951 |

| Bank of New York Mellon Corp. (The), 4.625%, 9/20/26 | 1,200,000 | 1,190,627 |

| Citigroup, Inc., 4.00%, 12/10/25 | 1,850,000 | 1,817,113 |

| Citigroup, Inc., 7.625%, 11/15/28 | 1,550,000 | 1,660,011 |

| Goldman Sachs Group, Inc. (The), 6.125%, 11/10/34 | 4,300,000 | 4,336,305 |

| Morgan Stanley, 6.875%, 1/15/25 | 41,519 | 1,052,922 |

| Northern Trust Corp., 4.60%, 10/1/26 | 1,700,000 | 1,686,853 |

| State Street Corp., 5.35%, 3/15/26 | 20,000 | 493,400 |

| | Par Value/

Shares | | Value |

| PREFERREDS — (Continued) |

| Financials — (Continued) |

| Wells Fargo & Co., 3.90%, 3/15/26 | $ 350,000 | | $ 340,332 |

| Wells Fargo & Co., 6.85%, 9/15/29 | 2,350,000 | | 2,456,366 |

| | | | 15,862,880 |

TOTAL PREFERREDS

(Cost $16,927,561) | | | 17,777,093 |

| | Par

Value | |

| CORPORATE BONDS — 5.1% |

| Communications — 0.2% |

| Paramount Global, 5.50%, 5/15/33 | 500,000 | 468,802 |

| Consumer Discretionary — 1.3% |

| Leggett & Platt, Inc., 4.40%, 3/15/29 | 1,500,000 | 1,440,143 |

| Tapestry, Inc., 3.05%, 3/15/32 | 1,000,000 | 855,919 |

| VF Corp., 6.00%, 10/15/33 | 1,500,000 | 1,511,046 |

| | | 3,807,108 |

| Financials — 1.8% |

| American Express Co., 5.788%, 11/4/26(b) | 1,200,000 | 1,202,135 |

| Discover Financial Services, 7.964%, 11/2/34 | 800,000 | 939,498 |

| JPMorgan Chase & Co., 5.546%, 12/15/25 | 1,250,000 | 1,250,783 |

| Synchrony Financial, 2.875%, 10/28/31 | 1,000,000 | 848,785 |

| Zions Bancorp, 3.25%, 10/29/29 | 1,350,000 | 1,202,975 |

| | | 5,444,176 |

| Industrials — 0.8% |

| Boeing Co. (The), 3.25%, 2/1/35 | 3,000,000 | 2,441,341 |

| Materials — 0.3% |

| Huntsman International, LLC, 2.95%, 6/15/31 | 1,000,000 | 864,384 |

| Real Estate — 0.1% |

| Hudson Pacific Properties LP, REIT, 4.65%, 4/1/29 | 500,000 | 415,667 |

| Technology — 0.6% |

| Leidos, Inc., 7.125%, 7/1/32 | 1,491,000 | 1,670,378 |

TOTAL CORPORATE BONDS

(Cost $14,464,255) | | 15,111,856 |

AMBRUS TAX-CONSCIOUS CALIFORNIA BOND FUND

Portfolio of Investments (Concluded)

September 30, 2024

| | Par

Value | | Value |

| U.S. TREASURY OBLIGATIONS — 4.4% |

United States Treasury Floating Rate Notes,

4.797%, 1/31/26(b) | $13,000,000 | | $ 12,999,581 |

U.S. TREASURY OBLIGATIONS

(Cost $13,020,381) | | 12,999,581 |

| | Number

of Shares | |

| EXCHANGE TRADED FUNDS — 0.3% |

| SPDR Portfolio High Yield Bond ETF | 30,000 | 721,500 |

TOTAL EXCHANGE TRADED FUNDS

(Cost $712,200) | | 721,500 |

| SHORT-TERM INVESTMENT — 2.3% |

| Dreyfus Government Cash Management Fund, Institutional Shares, 4.80%(c) | 6,938,234 | 6,938,234 |

|

| |

TOTAL SHORT-TERM INVESTMENT

(Cost $6,938,234) | | 6,938,234 |

|

| |

TOTAL INVESTMENTS - 98.1%

(Cost $286,500,686) | | 290,342,203 |

| OTHER ASSETS IN EXCESS OF LIABILITIES - 1.9% | | 5,547,164 |

| NET ASSETS - 100.0% | | $295,889,367 |

| (a) | Zero coupon bond. |

| (b) | The interest rate is subject to change periodically. The interest rate and/or reference index and spread shown at September 30, 2024. |

| (c) | Rate disclosed is the 7-day yield at September 30, 2024. |

| AGC | Assured Guaranty Corp. |

| AGM | Assured Guaranty Municipal Corp. |

| AMT | Alternative Minimum Tax |

| BAM | Build America Mutual |

| BAM-TCRS | Build America Mutual-Transferable Custodial Receipts |

| CA MTG | California Mortgage |

| CAB | Capital Appreciation Bond |