|

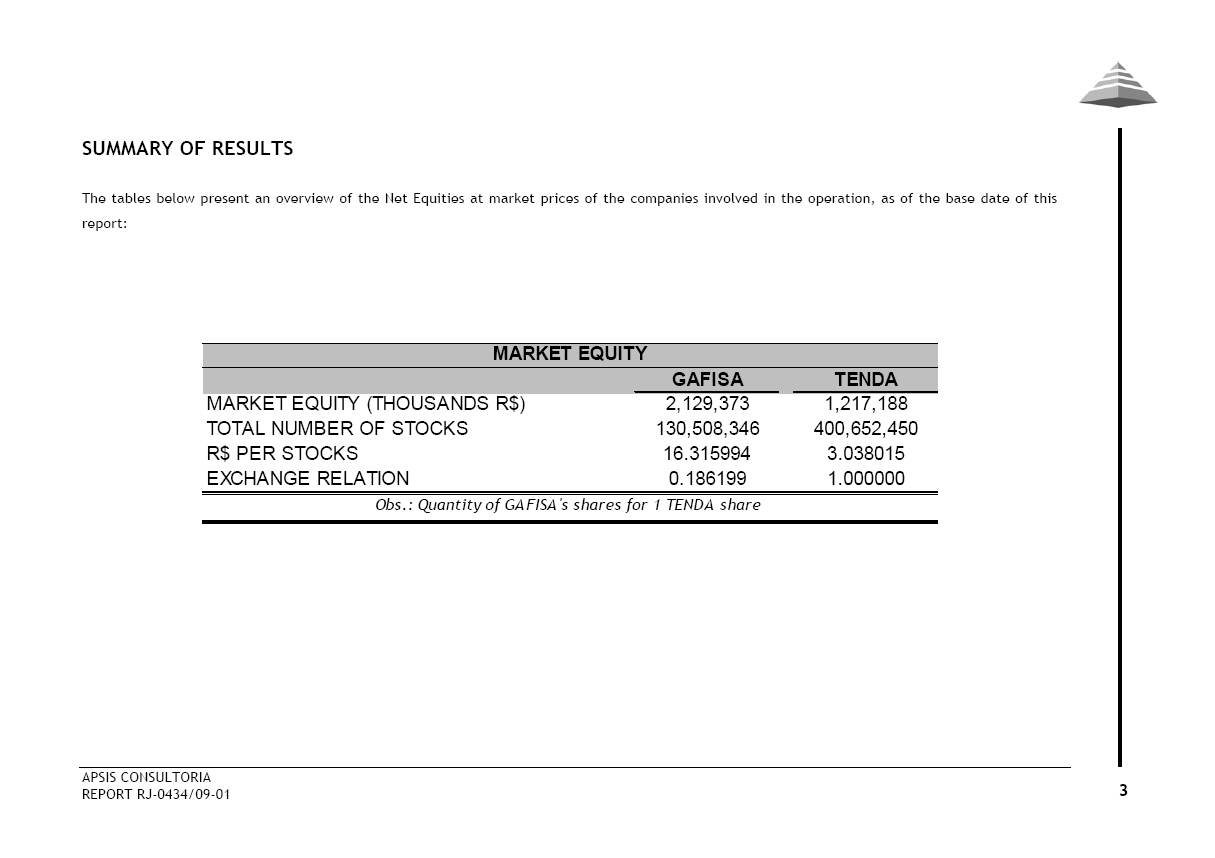

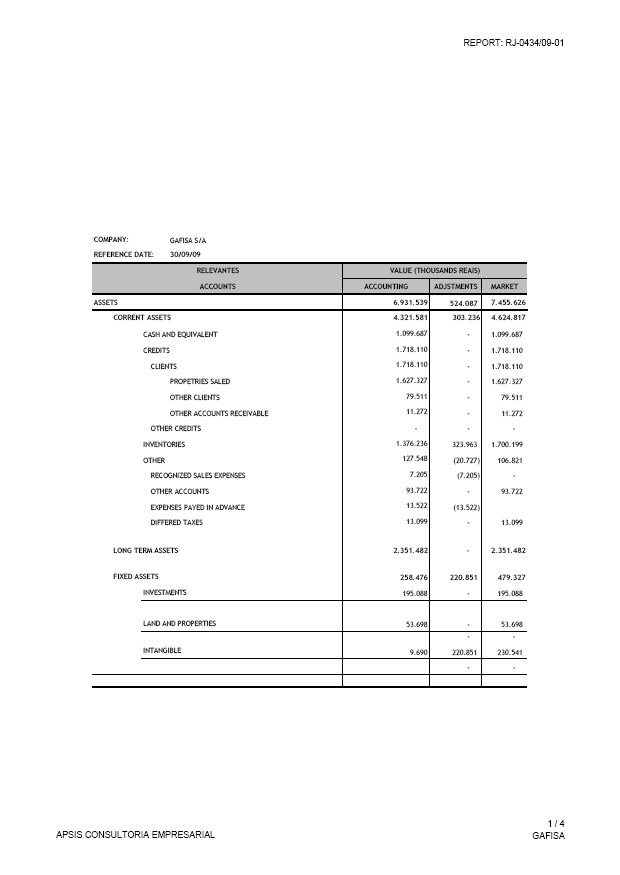

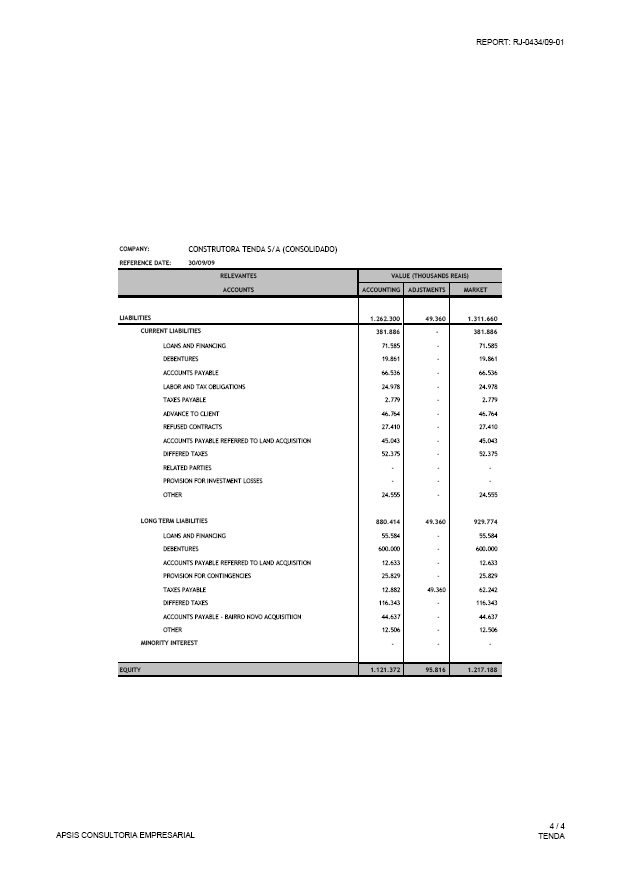

GAFISA'S SHAREHOLDERS' EQUITY AT MARKET VALUE

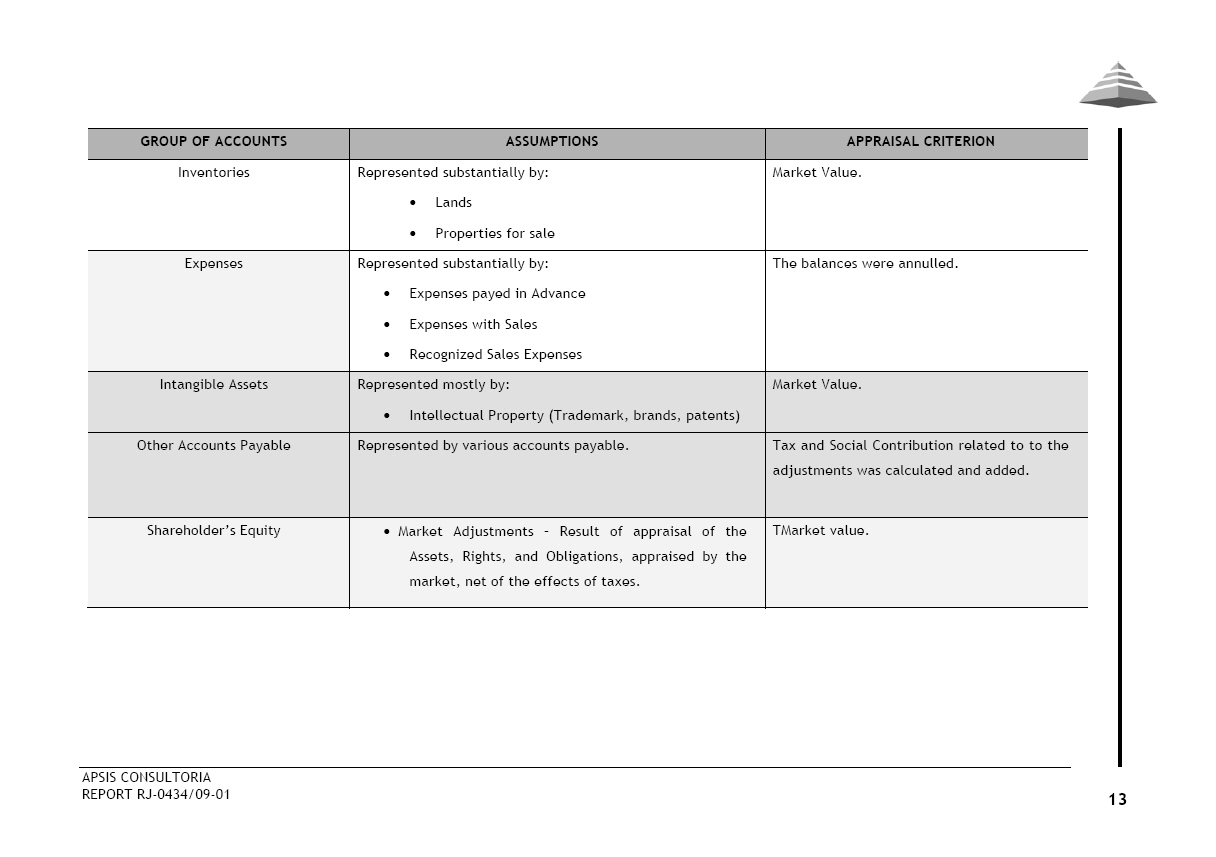

The table below presents GAFISA's Shareholders' Equity at Market Value on the base date with the

respective adjustments on the main accounts:

COMPANY: GAFISA S/A

REFERENCE DATE: 30/09/09

RELEVANTES VALUE (THOUSANDS REAIS)

ACCOUNTS ACCOUNTING ADJSTMENTS MARKET

ASSETS 6,931,539 524,087 7,455,626

CORRENT ASSETS 4,321,581 303,236 4,624,817

CASH AND EQUIVALENT 1,099,687 - 1,099,687

CREDITS 1,718,110 - 1,718,110

CLIENTS 1,718,110 - 1,718,110

PROPETRIES SALED 1,627,327 - 1,627,327

OTHER CLIENTS 79,511 - 79,511

OTHER ACCOUNTS RECEIVABLE 11,272 - 11,272

OTHER CREDITS - - -

INVENTORIES 1,376,236 323,963 1,700,199

OTHER 127,548 (20,727) 106,821

RECOGNIZED SALES EXPENSES 7,205 (7,205) -

OTHER ACCOUNTS 93,722 - 93,722

EXPENSES PAYED IN ADVANCE 13,522 (13,522)

DIFFERED TAXES 13,099 - 13,099

LONG TERM ASSETS 2,351,482 - 2,351,482

FIXED ASSETS 258,476 220,851 479,327

INVESTMENT 195,088 - 195,088

LAND AND PROPERTIES 53,698 - 53,698

INTANGIBLE 9,690 220,851 230,541

COMPANY: GAFISA S/A

REFERENCE DATE: 30/09/09

RELEVANTES VALUE (THOUSANDS REAIS)

ACCOUNTS ACCOUNTING ADJSTMENTS MARKET

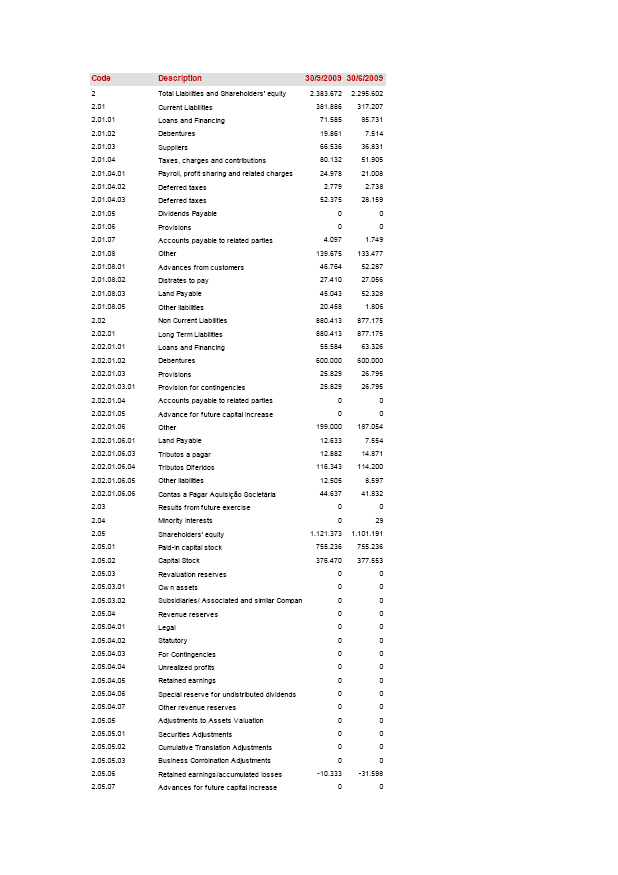

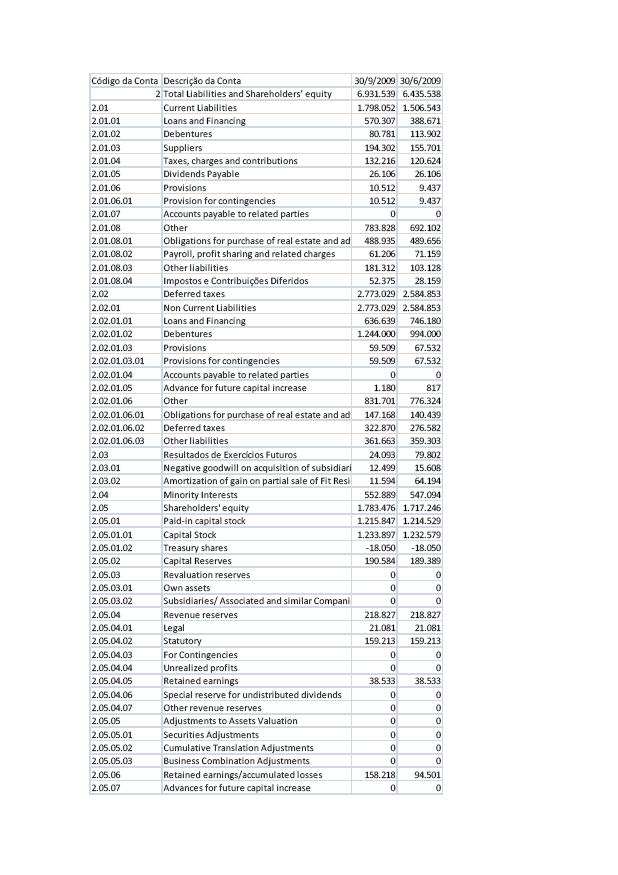

LIABILITIES 5,148,863 178,190 5,326,253

CORRENT LIABILITIES 1,798,052 - 1,798,052

LONG TERM LIABILITIES 2,797,122 178,190 2,975,312

LOANS AND FINANCING 636,639 - 636,639

DEBENTURES 1,244,000 - 1,244,000

PROVISIONS 59,509 - 59,509

PROVISION FOR CONTINGENCIES 59,509 - 59,509

RELATED PARTY DEBT - - -

ADVANCED TO FUTURE CAPITAL GROWTH 1,180 - 1,180

OTHER 831,701 178,190 1,009,891

ADVANCE TO CLIENT 147,168 - 147,168

DIFERRED TAXES AND CONTRIBUTION 322,870 - 322,870

OTHER ACCOUNTS PAYABLE 361,663 178,190 539,853

FUTURE NET PROFIT RESULT 24,093 - 24,093

GOODWILL ON ACQUISITIONS OF SUBSIDIARIES 12,499 - 12,499

GAIN ON SALES INVESTMENT 11,594 - 11,594

MINORITY INTEREST 552,889 - 552,889

EQUITY 1,783,476 345,897 2,129,373

SHARE CAPITAL 1,215,847 - 1,215,847

CAPITAL RESERVE 190,584 - 190,584

PROFIT RESERVE 218,827 - 218,827

ACCUMULATED PROFIT AND LOSSES 158,218 - 158,218

MARKET ADJUSTMENTS 245,897 345,897

APSIS CONSULTORIA

REPORT RJ-0434/09-01 16

|