|

Disclaimer

- ---------------------------------------------------------------------------------------------------

Important notices

In connection with the announced transaction between Gafisa S.A. ("Gafisa") and its 60% owned

subsidiary Construtora Tenda S.A. ("Tenda", together with Gafisa, "Companies") ("Transaction"), as

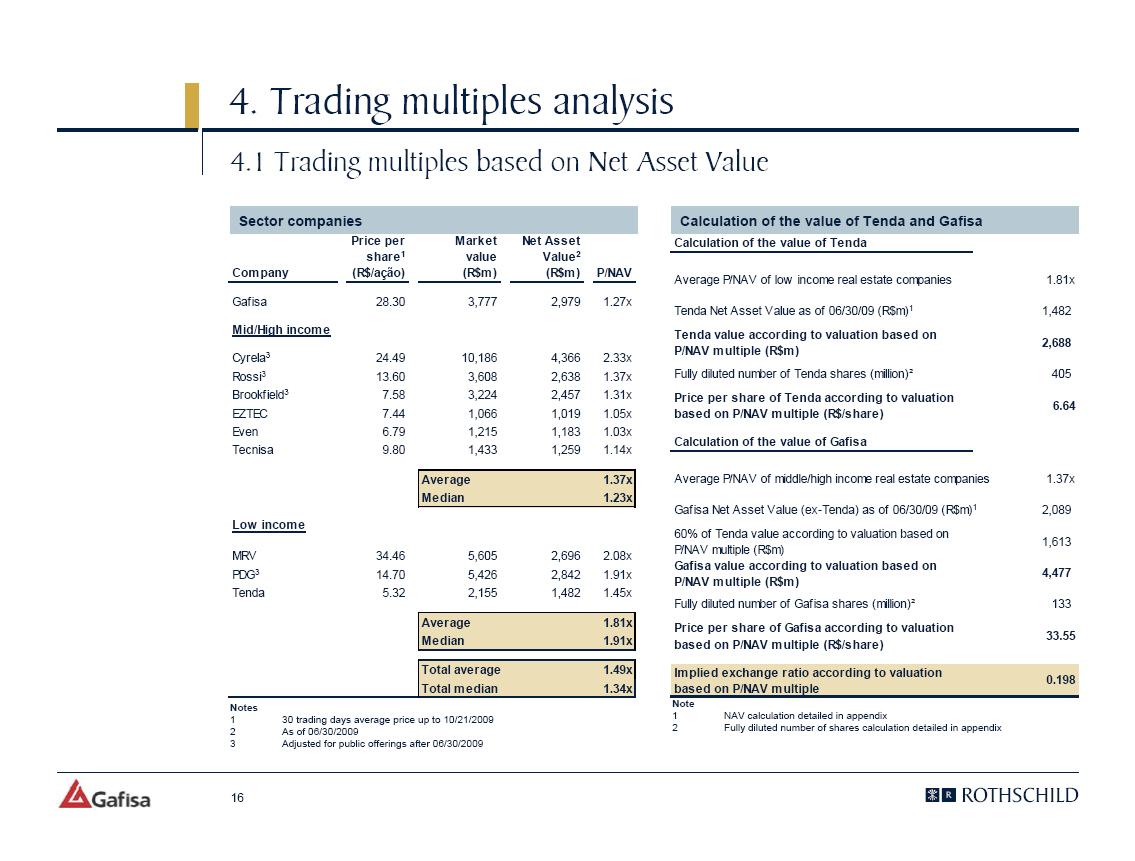

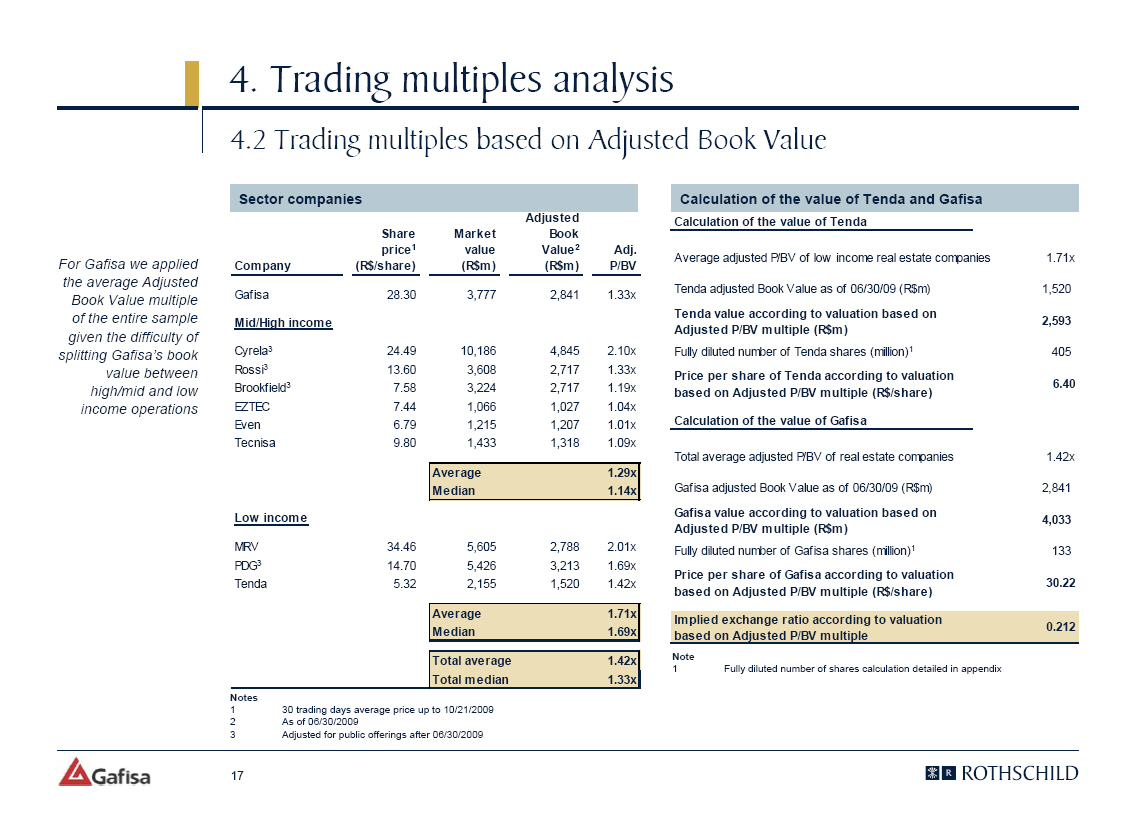

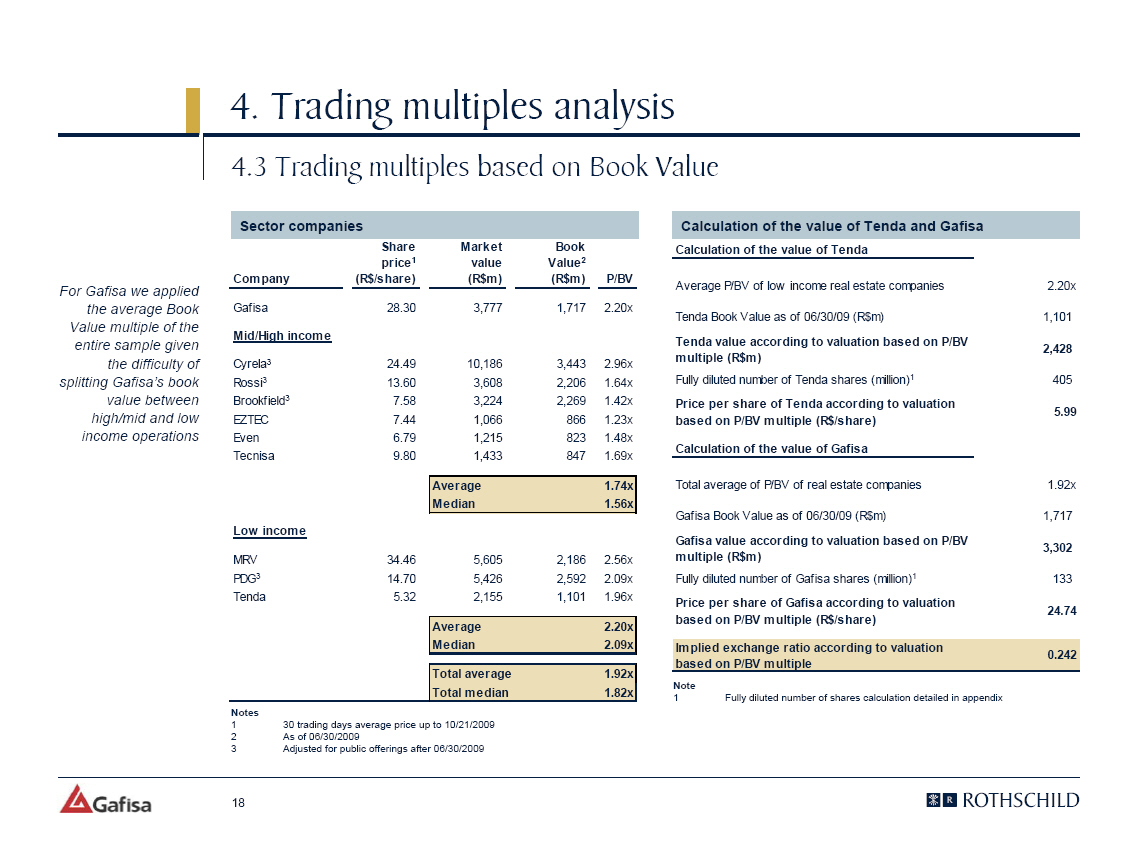

disclosed in the material fact dated 21 October 2009 ("Material Fact"), we were requested by Gafisa

to prepare a valuation of the exchange ratio between shares of Tenda and Gafisa in the proposed

merger of shares of Tenda into Gafisa ("Valuation").

The Transaction encompasses the merger of all outstanding shares of Tenda into Gafisa ("Merger of

Tenda's Shares"). Gafisa's shares received by Tenda's shareholders will be traded on BM&FBOVESPA's

Novo Mercado segment.

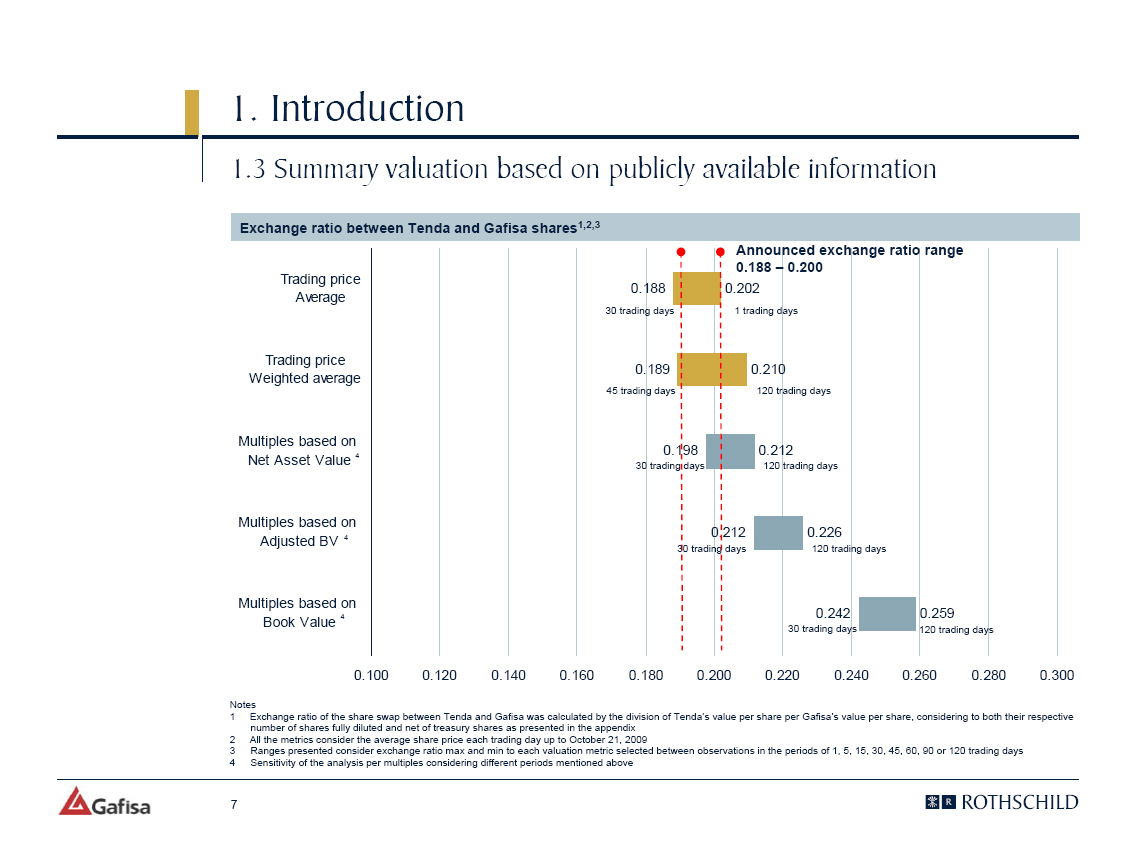

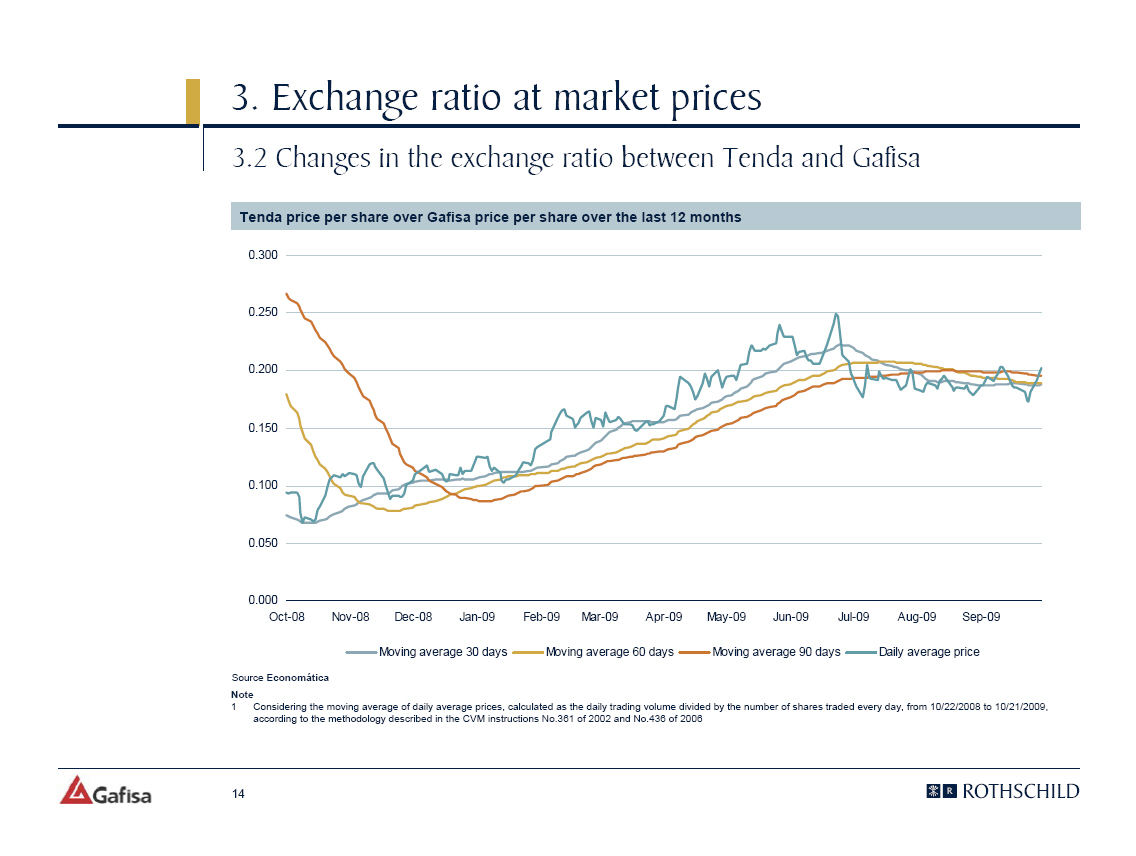

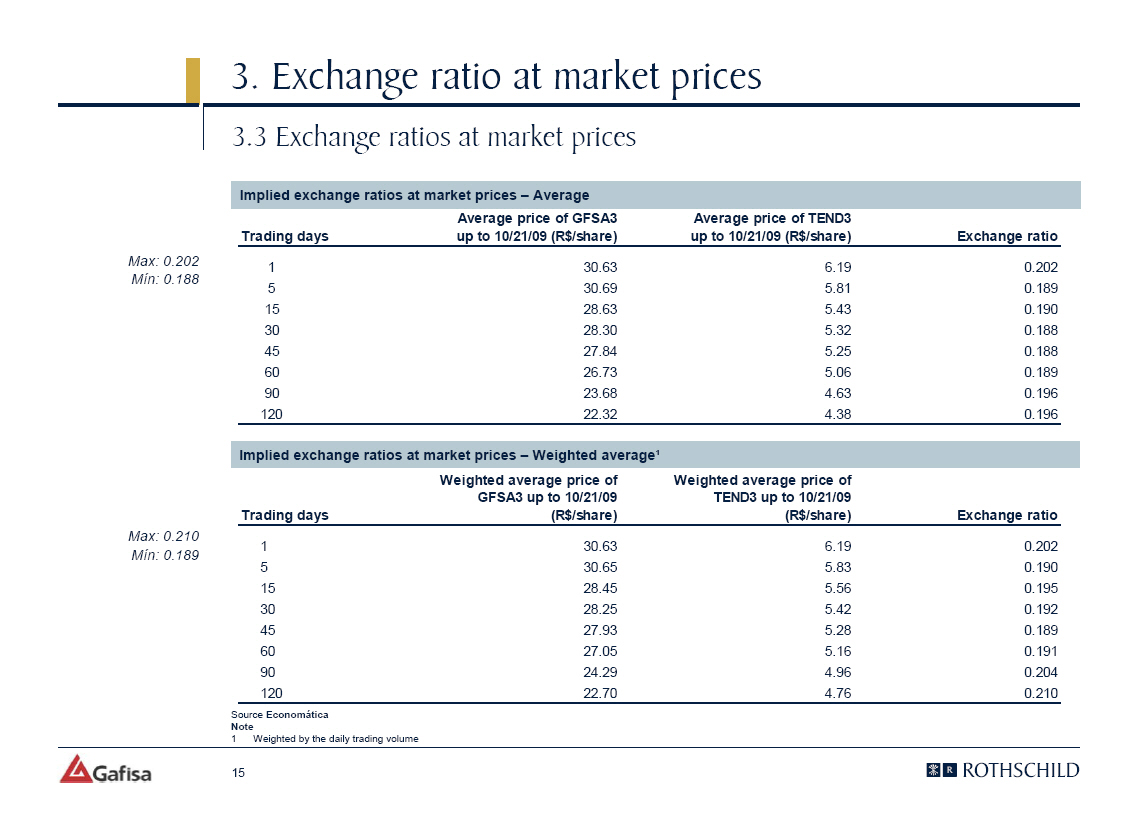

According to the Material Fact, Gafisa's management believes that an adequate exchange ratio should

range between 0.188 and 0.200 shares of Gafisa per one share of Tenda. This interval corresponds to

the high and low average ratios between the closing share prices of Tenda and Gafisa in each of the

various periods comprised between (a) the date of release of the Material Fact and the 30th day

preceding the date of the Material Fact and (b) the date of release of the Material Fact and the

180th day preceding the date of the Material Fact.

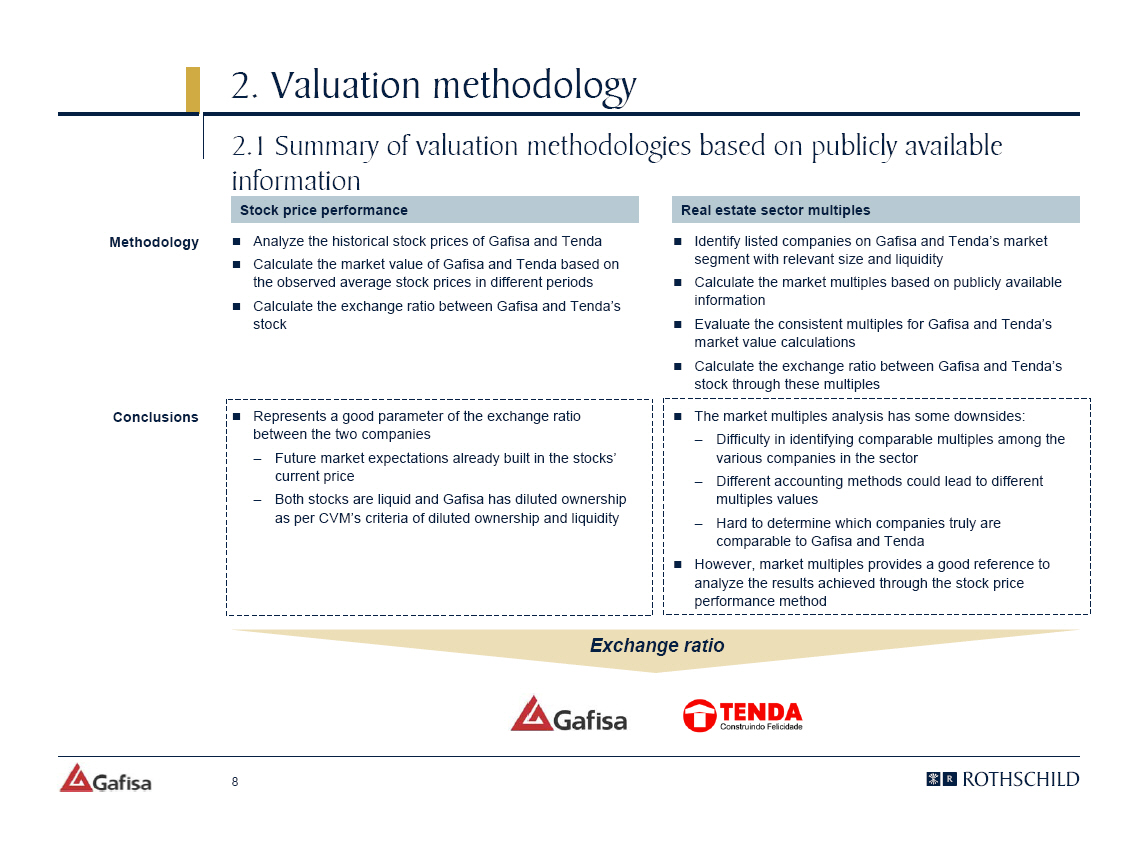

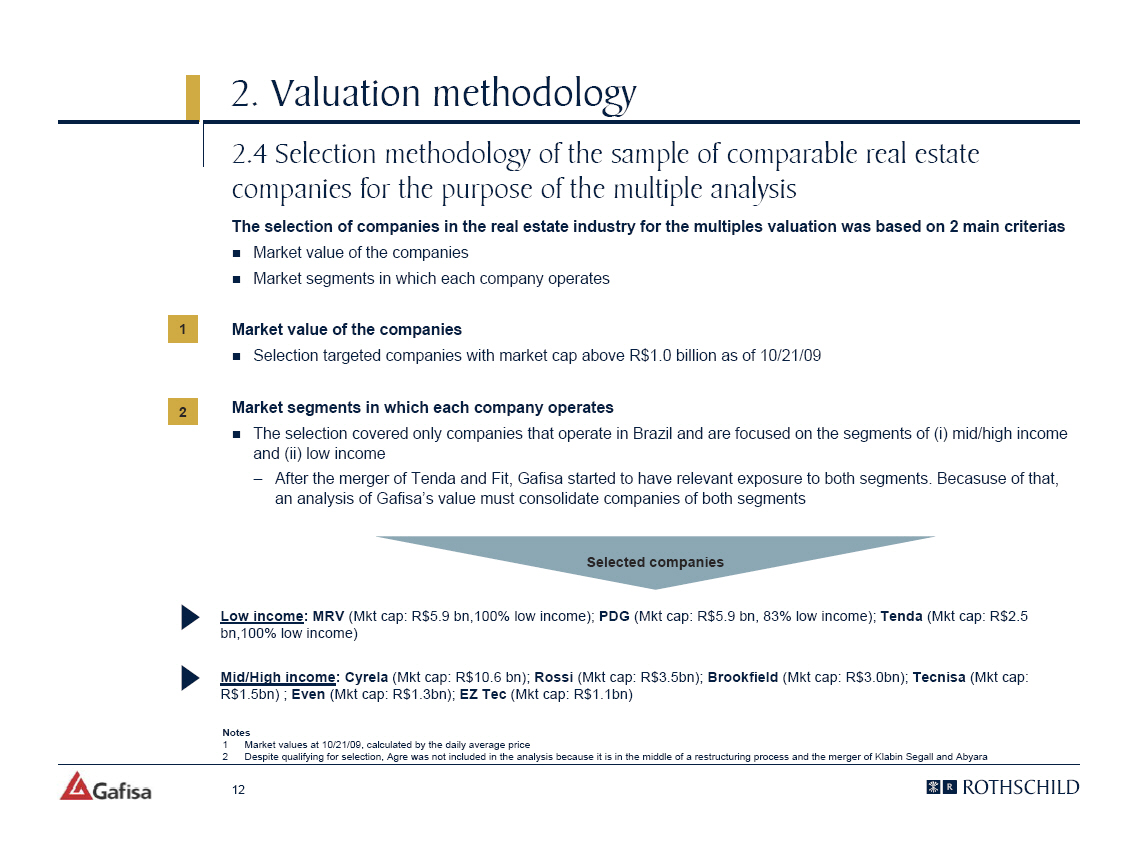

In order to prepare our valuation, as instructed by Gafisa, we based our analysis exclusively in

information publicly available as of the date of the Valuation. Therefore, we, among other things,

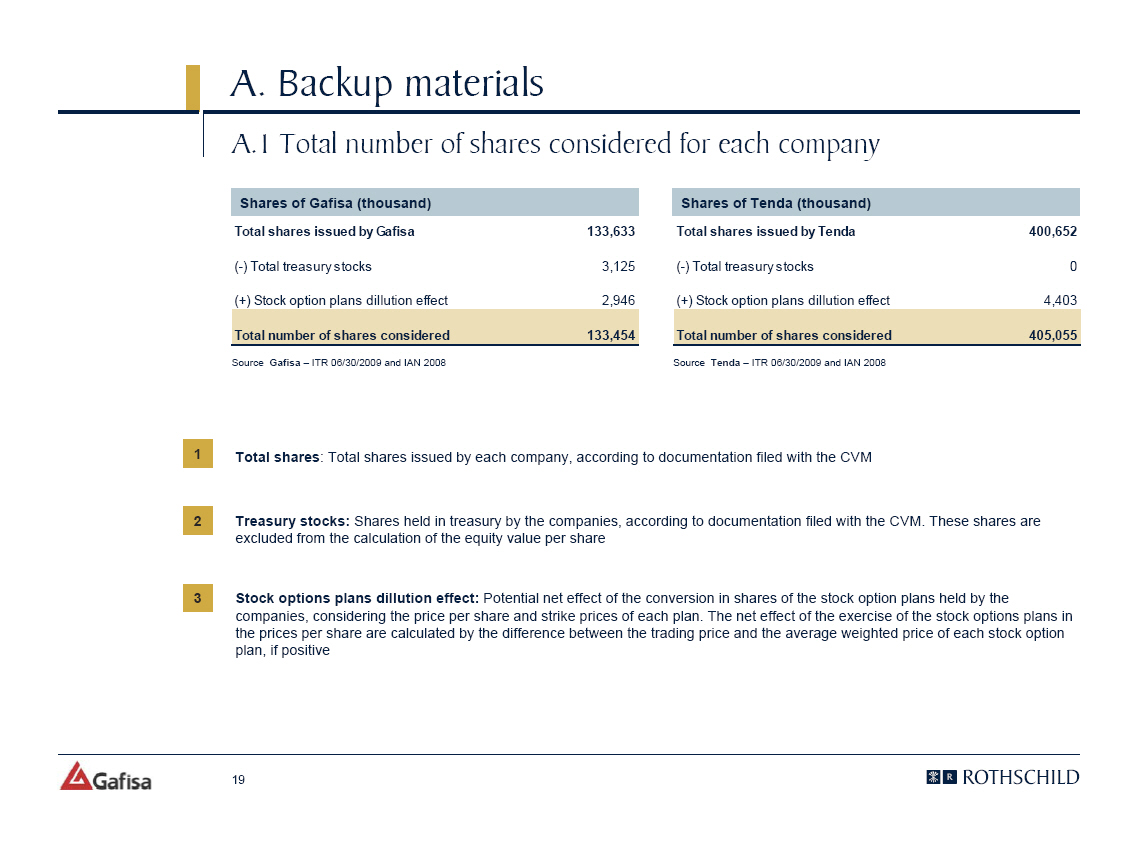

(i) reviewed certain financial and commercial information publicly available regarding the

Transaction; (ii) reviewed certain audited financial statements, publicly available, of Gafisa,

Tenda and other comparable companies in the real estate sector operating in Brazil ("Sector

Companies"); (iii) analyzed the share price of Companies in the market; and (iv) analyzed comparable

valuation metrics of the Companies and the Sector Companies.

For purposes of preparing our Valuation, we did not undertake to perform an independent verification

of any financial, legal, commercial or other information used, reviewed or considered by us for this

work, and we assumed and trusted, with Gafisa's consent and without any independent investigations,

the accuracy, content, truthfulness, consistency, completeness, sufficiency and integrality of the

financial, accounting, legal and tax information available in public domain analyzed by us. In this

sense, we based our valuation on such information, considering such information exact and complete

in all its material aspects. We have also assumed that, according to Gafisa's statement, no relevant

changes have occurred since the base date of this Valuation in connection with the assets, financial

condition, result of the transactions, business or perspectives of the Companies and in this extent

no material adverse effects have occurred with respect to Gafisa's business, financial and assets.

We did not and will not assume herein any responsibility for the independent verification of said

information or for conducting an independent verification or appraisal of any of the assets or

liabilities (contingent or otherwise) of the Companies. As a result, we do not assume any

responsibility related to the accuracy, truthfulness, integrality, consistency and sufficiency of

the information which we based the Valuation upon. Moreover, we have not undertaken to conduct, and

did not in fact conduct, any physical inspection of the properties, assets or premises of the

Companies.

GAFISA 1 ROTHSCHILD

|