UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-22016 |

|

Alpine Global Premier Properties Fund |

(Exact name of registrant as specified in charter) |

|

2500 Westchester Avenue, Suite 215, Purchase, NY | | 10577 |

(Address of principal executive offices) | | (Zip code) |

|

Alpine Woods Capital Investors, LLC

2500 Westchester Avenue, Suite 215

Purchase, New York, 10577 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (914) 251-0880 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | November 1, 2007 – October 31, 2008 | |

| | | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

Item 1. Reports to Stockholders.

INVESTOR | | |

INFORMATION | | 1(800) 617.7616 | www.alpinecef.com |

| | TABLE OF CONTENTS

|

Alpine View | 1 |

| |

Manager Commentary | 5 |

| |

Report of Independent Registered Public Accounting Firm | 13 |

| |

Schedule of Portfolio Investments | 14 |

| |

Statement of Assets and Liabilities | 18 |

| |

Statement of Operations | 19 |

| |

Statements of Changes in Net Assets | 20 |

| |

Financial Highlights | 21 |

| |

Notes to Financial Statements | 22 |

| |

Additional Information | 26 |

| | ALPINE VIEW

October 31, 2008 (Unaudited) |

Dear Investor:

We are currently afflicted by a crisis of confidence which has deflated asset values, constrained capital markets, and threatened the livelihoods of millions of Americans. Wealth and prosperity have rapidly eroded. Employment and retirement prospects are diminished. Fear of a prolonged downturn has paralyzed many corporate, municipal and individual investment initiatives. Our government’s capital injections or ‘bailouts’, have been the initial response aimed at a coherent public/private sector program which can tackle immediate problems, as well as support long term solutions. If properly designed, this could be an investment in the potential, the ingenuity and the entrepreneurial spirit of America. If rapidly deployed, it could begin to restore investor confidence, rally capital markets and commence a rational reflation of long term asset values.

The credit crisis has reduced our economy’s potential capital availability. Investors’ worst fears are largely discounted in prices of stocks and bonds alike. This reflects the inability of the world’s financial institutions to fend off the contagion of crisis on their own. Into the breach have stepped the world’s Central Banks and sovereign Treasuries to save the day, if they can! The government’s use of capital injections, perceived by the market as ‘bailouts’, have called into question the proper role of government both through regulation and ownership of our entrepreneurial free market system. Some view bailouts as a necessary intrusion into our capital market system, others view them as inappropriate in the evolution of market forces even though it might avert a depression. These desperate views appear to have created an element of paralysis evidenced by our present Administration’s inability to seize the day with a comprehensive plan. Perhaps the next Administration will be inspired to do more. We need to jump-start our Nation’s capacity to reinvigorate itself when called upon by crisis. The ability to energize our collective dynamism has been a hallmark of our society and economy, in part historically positioning the U.S. for global leadership.

What Caused the Fourth Quarter Capital Markets Meltdown?

September and October of 2008 will likely be remembered by economic historians as a time when the defenses protecting our banking system succumbed to a hundred year flood of fear and uncertainty. Globalization and excessive risk tolerance has exposed weaknesses in the structure of the global credit delivery system, both precipitating and exacerbating an erosion of confidence. While underlying problems in the U.S. have been brewing for 15 months since the sub-prime mortgage valuation problem arose, the current state of rampant risk avoidance became a global pandemic following the bankruptcy of Lehman Brothers on September 15. As a result, capital has become scarce and credit for even the most creditworthy has become very expensive. Potential corporate debt maturities and covenant limitations were scrutinized from all angles, forcing major discounts of stock prices. In effect, corporate deleveraging is being forced on many public companies by eroding share prices.

While relative stability was maintained into early 2008, there were still deflationary waves of capital erosion during which liquidity was sucked out of the global capital markets. This was most prominent as the price of oil and other commodities soared to record levels by mid-year. Commodity producing countries made plans for great expansion just as the historic 77% collapse in the price of oil forced the closure of steel mills, mines and production facilities. At the same time, the maelstrom induced by the collapse of Lehman Brothers, froze certain investments in bankruptcy proceedings, which led several major money market funds to ‘break the buck’. In turn, this induced capital flight and maximum risk avoidance by both institutional and individual investors, accelerating the de-leveraging, de-risking process. Thus, foreign currencies, emerging market equities, and financial commodities were dumped as investors around the world sought safe haven in U.S. Treasury bills, actually pushing 90-day Treasury bill yields to 0.06% two days after Lehman’s bankruptcy! Now, central banks around the world are using massive injections of capital and sovereign guarantees to stabilize money markets and induce bank lending.

Even though subprime home mortgages in the U.S. were the proverbial ‘straw which broke the camel’s back’, real estate has not been the root of the problem in the sense that excess supply has not necessarily created an overhang. Rather, excess liquidity which stimulated demand beyond historical levels is the root of the problem. Home price appreciation, slack investment standards and minimal risk premiums enabled Wall Street to engineer both the origination and distribution mechanisms which created even more liquidity. Alas, these distribution systems were interlaced into critical contact with weak links in our financial system. It is safe to assume that there will be less capital available over the near term even after a successful stabilization of the markets. This should lead to reduction in the development of new capacity or excess supply of products or even raw materials. Over time, this will likely offset diminution of demand resulting from the economic impact on business staffing or expansion. Longer term, it should be an important stimulus to price levels as growth returns to the economy in ensuing years, limiting new supply to meet rising demand.

October 31, 2008 Annual Report | 1(800)617.7616 | |

www.alpinecef.com | |

1

What Might a Recovery Look Like?

In assessing investment strategy to identify potential outperformance from these beaten down equity markets, the most important questions are, first, whether the current effort to revitalize our stricken credit delivery system will be effective; second, what long-term changes will be needed to revitalize the interbank lending system and the flawed debt-securitization process; third, what will be the impact on global liquidity over the next few years; fourth, how will this crisis impact both consumer and investor confidence over time; and fifth, how can we best position the portfolio to take advantage of opportunities created by this unprecedented global crisis?

We are confident that the current effort to stabilize the global banking system is well in hand. The recapitalization process should permit banks over the next couple of years to either dispose of, or work out of, impaired loans. Unfortunately, the prospective near term continuation of global economic weakness will likely lead to further asset devaluation and income degradation, bringing additional pressures to deliver corporate balance sheets. This may create more poor performing loans. Thus, it might be a while before we see a strong, competitive lending environment. Meanwhile, we anticipate that banks will extend credit to their largest and strongest existing relationships, amplifying the ongoing consolidation within the banking system itself. We expect banks will require higher margins with more limited lending. Thus, capital for new business creation and/or expansion will probably have to come from nontraditional financial investors who require a significantly higher return on invested capital than traditional bank debt. Clearly, risk premiums required for future capital will likely be more expensive.

Banks’ future requirement of higher net interest margins should over time permit them to take on greater risk, albeit not at the level of the past decade when they faced considerable competition from the capital markets. Over the next several years, flawed asset-backed debt securitizations will come to maturity and require refinancing. In many cases the future cost of refinancing will be much higher. The requirements for interest coverage and excess collateral value will likely be greater than has historically been the norm.

Many of the debt securitizations which dominated the real estate finance environment over the past five years will be subject to recapitalizations or workouts over the next few years. These should be not only more expensive for the issuers, but they should provide lower returns for ongoing investors in these investment vehicles. It is likely that significant investment capital will be tied up for an extended period of time with relatively low return on investment. When, or if, investment bankers can devise a new and improved debt securitization process which instills a measure of confidence in wary investors, securitization could once again offer a competitive source of capital.

Consumer and investor confidence will likely be restored over time. However, the combination of elevated risk avoidance and expensive if albeit limited, liquidity suggests that the range of returns required as investors move up the risk spectrum, will likely be significantly higher. Thus, the discount rates and growth assumptions used in assessing projected investment returns suggests that venture capital will also be constrained. Funding for major capital initiatives such as real estate development, plant expansions and new infrastructure projects should also be curtailed unless confidence inducements can be supplied, such as a governmental guarantee or the strongest of corporate covenants.

Given prospects for a world in which capital has become dear and very selectively distributed, the world of investment opportunities has narrowed. The investment decision process will probably lead to an initial market focus on large and strong companies with solid cash flow and controlled capital requirements. The handful of small companies with a good business model and important niche markets or dominant positions in regions of strong growth potential will probably attract significant capital. In between these two categories, there will likely be a range of companies in the process of transforming their business model to adapt to the emerging economic environment which could provide significant investment opportunity if they are successful. We would anticipate a number of different investment opportunities over the next few years.

Economic Prospects: Potential Scenarios from most Likely, to most Optimistic, to most Pessimistic

Given the great uncertainty over future government economic stimulus packages and housing stimulus or relief, around the world, as well as the potential impact of such capital injections or inducements upon employment, incomes, investment, lending, and currencies, we have chosen to incorporate an overview of the prospective potential for what could prove to be likely scenarios for economic activity. Our most likely base case, is for the U.S. economy to stabilize towards year-end 2009 as home prices begin to improve in certain markets, unemployment stabilizes at a level under 9%, along with the prospect of a modest lift in U.S. GDP. By then, China’s economy should have also turned the corner after a period of working down expensive inventories of raw materials and refocusing its economic activity, permitting both margin expansion and lower priced products for their export market. Then, India and Brazil should also start to see greater growth as global GDP begins to grow at a rate

2

faster than the flat to negative first six months. We anticipate considerable interest rate reductions to accelerate this trend, in the emerging markets.

Our optimistic scenario has the global economy start to pick up mid-year 2009 as a result of a tremendous boost from both fiscal and monetary stimulus to the world’s major economies. Under such a scenario, home prices should begin bottoming by late in the second quarter in the U.S., and we would expect domestic unemployment to peak below 8%. We believe the significant increase in investment flowing into the equity markets in response to the positive stimulus to the economy would in itself help to stimulate renewed capital investment patterns. All of this could provide a sustained lift for the global economy. The pressure on the new Democrat controlled government to fix our economy could lead to such a powerful stimulus plan for the traditional drivers of our economy; cars and housing, that a short-term bounce can be engineered. Similar efforts may also be made abroad.

Our least likely scenario could occur if too few or ineffective stimulus programs failed to impact the economy, resulting in a prolonged and deeper downturn with potential double-digit unemployment rates in the U.S. lasting through 2010, a negative feedback loop of declining consumption, leading to higher unemployment to increased mortgage foreclosures and business failures, could further erode our country’s capital base. Such a deflationary spiral of negative consequence would weigh on global consumption patterns, limit the recovery of the banking system and perhaps destabilize governments and trade alliances, reversing many of the benefits of globalization. We believe that this risk is apparent to pragmatists in central banks and governments around the world, so every effort will likely be made to avoid such decline.

Final Thoughts: Adjusting to a New World

During preceding sections we have discussed how this “hundred year flood” of economic distress has upended the order of things related to both the capital and credit markets. Such traumatic events often lead to investment opportunities. We would like to share our thoughts regarding some of those opportunities as we structure our investment portfolios, discussing how this event has led us, as the Funds’ managers, to initiate new efforts in an attempt to position the Fund against possible future economic tsunamis.

We believe the consolidation in the banking sector will create a selective group of large capitalization companies with strong balance sheets and entrepreneurial management teams, who have enhanced returns in the past, could be rewarded with premium share prices as well as access to capital markets.

Large companies which have poor financial structure, management team or business focus will likely be forced to restructure in an attempt to transform their business to meet current economic demands. The likelihood is that only a few will succeed, and those which fail will be forced to sell assets or portfolios, to the better capitalized premier companies. Smaller companies which have good growth opportunities and solid management may find that capital is very expensive. Some should be able to expand their portfolios in spite of higher cost capital and eventually earn premium recognition from the marketplace.

Since the structured finance markets will probably take between two to four years to restructure and, or, cleanse themselves of poor performing loans, we suspect there will not be significant low cost funding for leveraged buy-outs during this period in the U.S. and Europe. Asia and Latin America present a different scenario as we believe their economic growth rates should be sustained at higher levels than growth potential of developed markets enhancing prospective values. Furthermore, they did not receive significant capital from the structured finance underwriters on Wall Street, so there should be very little overhang in those markets. Thus, as the dust settles over the next year, we believe it will become increasingly clear to investors that emerging market trends are still intact for the long term and that development of the capital markets would be required to meet economic demand. In the U.S. and Europe, we believe it will be a slower march back, with investment potential coming from relatively cheap equity valuations and companies’ abilities to transform their business models to position themselves for capital expansion.

Given the current valuation of many real estate, industrial, commodity and financial equities at historic trough levels not seen since 1990, and in some extremes even further back towards the 1970’s, we suspect that the potential for historically strong recovery of valuations off a low basis is present. If equities prove to be cyclically attractive over the next year or two, and stock markets around the world have thoroughly discounted their decline, then we look forward to positioning our portfolios not just for a rebound, but also for long term growth.

As companies transform their business models, we believe that evolution of our management process is also important and thus we are focusing on adjustments to our existing investment methodologies. In an attempt to protect our portfolios against future extreme price movement, we would hope to reduce the sort of downside risk which has impacted our portfolios this year. Unlike previous years, broad portfolio diversification failed to cushion the downside for our international portfolios in particular. In response, we are

3

gradually concentrating portfolios to a greater degree, favoring the sort of investment opportunities which we believe might outperform during this period of uncertainty and potential transformation.

While the market is certainly closer to a bottom than just a few months ago, and may have hit its nadir on November 21st, the risk of an extended downturn remains. Thus, we will err on the side of caution, while still hunting for undervalued recovery opportunities and transformational value situations. Anticipating a two to three year investment holding period, many of the downtrodden values of today may become great recoveries or even market leaders for the future.

We appreciate your support and interest. Alpine has been investing in our people, processes and systems in an effort to invest most effectively. We look forward to enhancing results for you in the New Year.

Sincerely,

Samuel A. Lieber

President, Alpine Mutual Funds

Mutual fund investing involves risk. Principal loss is possible.

The letter and those that follow represent the opinions of Alpine Funds management and are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security.

Cash Flow measures the cash generating capability of a company by adding non-cash charges (e.g., depreciation) and interest expense to pretax income.

Please refer to the schedule of portfolio investments for fund holding information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk.

4

| MANAGER COMMENTARY

October 31, 2008 (Unaudited) |

Dear Investor:

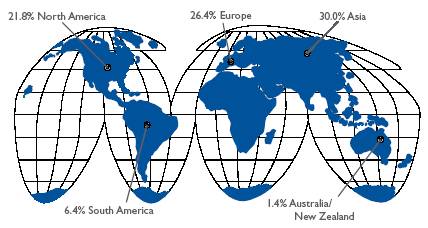

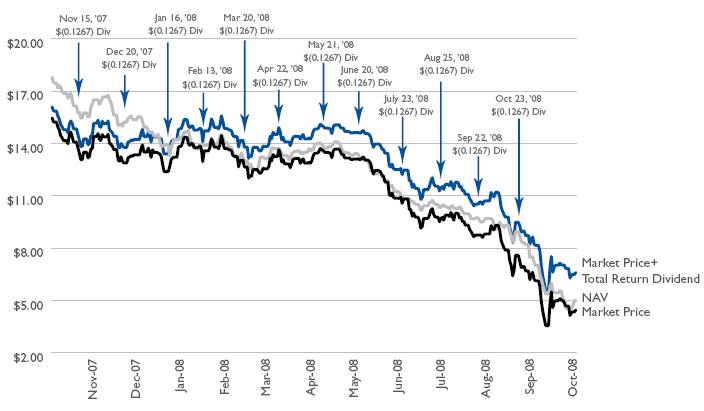

This annual report for the Alpine Global Premier Properties Fund (AWP) covers the year ended October 31, 2008. As of October 31, the net asset value per share for the Fund was $5.00. This represented a decline for the fiscal year of 67.74%. The majority of the decline occurred during the Fund’s fiscal fourth quarter, constituting the months of August, September and October, when the Fund’s net asset value per share declined by 49.20%. During the fiscal year, the Fund’s net asset value (NAV) declined from $18.04 to $5.00 per share, while the share price of AWP fell from $15.71 to $4.45, reflecting an 11.00% discount to the net asset value per share. For the year, the Fund paid a monthly dividend of 12.67¢ per share which amounted to $1.52 of distributions. This dividend represents a 13.15% yield on AWP’s average fiscal year share price of $11.56.

In this report we hope to explain what brought about the magnitude of decline in real estate shares in terms of capital markets conditions, economic conditions and the real estate cycle. We will also discuss an overview of the portfolio and key investments, a discussion of dividend prospects, as well as medium-term and long-term investment prospects. However, first we should revisit how we got here.

What Happened?

Over the past 16 months, the global credit markets have shifted from temporary paralysis toward improving liquidity, then back towards further constriction and, uncertainty as contraction from the global deleveraging process unfolded. Government intervention has tempered the downturn, yet uncertainty remains regarding the depth and duration of this financial tsunami. The crisis of confidence has limited bank lending, which is especially tough on capital intensive businesses such as real estate. The problem in the credit markets sprang from the U.S. subprime housing sector and not the broader real estate economy, per se, but the fundamental flaws of excessive leverage and structural illiquidity flows from the asset backed securitization process championed by Wall Street over the past decade.

Initially, Alpine assumed that since the asset backed securities industry had been most active in the U.S. and U.K., with less exposure in Europe and nominal presence in Asia, there would also be relatively more financial stability in countries which were less exposed. We did not appreciate how inadequate the Bush Administration’s response would be to this looming crisis and how the shockwaves would spread abroad. Last October we commented in the prior AWP annual report that we thought the Government had to respond to the mortgage problem first and foremost. They did not! When Bear Stearns all but collapsed in the spring, the stunning action of the Federal Reserve to have the company’s assets absorbed by JPMorgan signaled a pragmatic understanding of the precarious interconnectedness of the financial markets. However, the decision in September to succumb to the suasion of the moral hazard argument and permit the bankruptcy of Lehman Brothers allowed this contagion of eroding confidence to spread across sectors and continents in a matter of days. Money market funds ‘broke the buck’, banks stopped whatever lending they were still doing, capital markets froze and both consumer and investor confidence fell towards historic lows. Thus began the current phase of the cycle in which governments around the world are seeking to infuse their domestic banking systems with tremendous liquidity, fund major infrastructure and public works projects, absorb or support key industries and provide economic stimulus to stabilize, if not expand, job markets. In essence, the financial economy, which was created to enable commerce, is now undermining the productive economy.

Real Estate in a Capital Constrained World

Subsequent to the demise of Lehman Brothers, Goldman Sachs and Morgan Stanley have announced that they will become banking institutions and accede to government regulation. More significantly, this suggests that the era of investment banks operating with 30 to 40 times leverage is over. We believe both investment banks and commercial banks will return to historic levels of 8 to 12 times leverage. This will either require hundreds of billions of dollars in new equity or a reduction in loans outstanding, or a combination of the two. The relevance to real estate is that over the last decade investment banks have become a major source of debt and equity, often provided through complex capital structures, such as mortgage backed securities (CMBS) and syndications. Now, the resulting lack of credit for companies means diminished new construction or capital improvements to existing properties. Historically different types of property required annual reserves of 1% to 7% of income to provide for long-term maintenance and periodic physical improvements. In this just ended era of easy liquidity, many companies dispensed with such reserves and now must factor them into their budgeting for debt coverage and dividend analysis. As the cycle unfolds, a key factor will be the way in which debt is either refinanced or withdrawn from the market place. Existing properties may need injections of additional equity as debt levels and valuations are both adjusted. Loan to value levels may well fall from the 70% to 80% range towards 60% as both higher interest coverage from cash flow and lower cash flow multiples (capitalization rates inverted) are used. This may be very difficult in the case of CMBS financings where perhaps twenty or fifty mortgages were pooled together and then were sold to a multitude of different buyers. The ability to

5

arrive at a consensus of appropriate valuation parameters let alone coordinate a restructuring of the debt given the different needs of many lenders and borrowers may prove exceedingly difficult. We suspect that there will be a number of mortgage pools stuck in some sort of property purgatory for an extended period of time. Original investors in these pools may be forced to take substandard returns and the properties themselves may be cash starved and risk declining competitiveness.

While the debt side of the capital markets looks difficult, we suspect that this should open up opportunities for equity investors in REITs or other publicly traded real estate investors. Public companies should have greater access to capital since they utilize less debt financing than private equity investors and can use their equity as currency. It is possible that the REIT model which is now undergoing a significant stress test may emerge in a leaner and more nimble condition which will enable these companies to once again consolidate the real estate industry. For those of us who have been active investors in this sector for more than a few years, this could lead to a period similar to the 1992 through 1995 cycle in the U.S. during which ‘the modern REIT era’ evolved, providing great returns to shareholders in the wake of the S&L crisis. This scenario could unfold on a global scale as the deleveraging process continues and investors seek alternative investments for both yield and capital appreciation.

Where in the Cycle Are We?

Alpine believes that there is considerable cyclical divergence across both property types and geography. For example, the residential housing market in the U.S. began to cool in 2005; however, significant price declines on a national level only began to materialize in 2007 and accelerated into this year. We believe 2009 should see the bottom of both price and volume declines in the U.S. barring a collapse in employment levels. With home prices down between 20% to 30% for most major U.S. cities and the likelihood of mortgage rates well below 5%, prospective affordability levels and the rent versus buy cost-to-carry ratio could be stimulative. A similar pattern is unfolding in China and beginning in India, albeit, significant price adjustments are only now hitting the marketplace. The recovery in the U.K. housing market may well take a bit longer and several continental European markets, notably Spain, may take a few years before we see improvement. Brazil’s housing market may suffer from reduced supply in response to economic uncertainty during the first six months of the year; however, the potential for some modest price depreciation may not take place if the central bank starts bringing interest rates down rapidly over next year from the current level of 13.75%. Japan’s downward adjustment could bottom over the next 18 months from very low volumes. These estimates could prove conservative given the proposed stimulus packages in many countries which might accelerate recovery.

The retail sector is another area where the market is concerned regarding consumption patterns. In most countries, shopping centers have the benefit of relatively stable cash flow due to average effective lease duration of a minimum of two or three years, up to seven to ten years, with the exception of anchor tenants which are even longer. Thus, outside of bankruptcies, lease expirations are the main variable component for typically 8% to 20% of income in a given year. During a normal inflationary environment, rents should increase from expiring leases to new agreements, assuming employment levels and consumption patterns do not change materially. A major concern in the U.S. is that consumers are in the process of adjusting their household savings from a nominal level to historical patterns between 6% and 10%. It’s worth noting that even these levels are well below continental European savings rates, and even more so below the 30% to 40% range that has been the norm in Asia. Assuming a 6% to 10% savings rate will hold, we could see consumption decline by 1% to 2% per year for several years. This could have material impact on consumer spending and, hence, retail sales in the U.S. This could push ineffective retailers out of business and impact the income potential for marginal retail real estate locations. Already we have seen a rise in retail bankruptcies over the past year and would expect 2009 to be a more difficult year given the soft Christmas season. Rising unemployment will most likely compound these pressures on a global scale. We believe that investors should have a preference for community oriented; food focused shopping centers, as well as dominant regional shopping malls. A key consideration will be the sales productivity of these centers as well as the occupancy cost for tenants as a proportion of their sales revenues. Clearly the trend we have seen so far favors stores which offer a variety of merchandise at competitive prices, be they either large or small format stores offering either niche or broad market product selection. If the economy stabilizes as we move into 2010, we think this sector will respond favorably at that time.

The industrial sector has become increasingly focused on logistics, as opposed to warehousing, and should respond to the retail cycle, as well as the capital goods cycle. Again, we would expect 2009 to be the bottom for this sector unless there is a significant rise in bankruptcies amongst third-part logistics providers, which could extend the downturn of the cycle into 2010.

The office sector may face an extended period of difficulty even though office leases throughout the world typically average at least two, and often five to ten years. Thus, releasing exposure with the exception of bankruptcies is typically between 10% to 20% in most North American,

6

and 15% to 30% for Asian markets. Alpine believes that the on going contraction in the financial services sector will be most acute in cities such as New York, Frankfurt, and London; however, the credit crisis is truly global and will likely have an ongoing impact in terms of corporate staffing and expansion plans. Investors should take note that vacancy rates are historically low in many cities throughout the world as this particular up-cycle has had a rather short duration of between three to five years. This has prevented excessive new construction from over supplying many cities, which in turn should bode well for the next expansion phase of the real estate cycle. However, with regard to the cities which typically enjoy long lease duration, there could be potential supply from an explosion of sublet space as existing tenants might downsize well before lease termination. The office sector might also hold greater refinancing risk due to the relatively high proportion of commercial mortgage backed securitizations that were focused on such properties. Thus, the summation of these variables suggests that office markets around the world will not begin to see improvement in the leasing cycle before mid 2010, and with regard to some cities, this may last well into the next decade.

The other major sector of focus, the lodging sector, has come under increased pressure over the past year with the prospect for further declines into 2009 before we begin to see stabilization. The lodging sector is fundamentally dependent upon economic activity, so its observed high correlation with GDP is logical. An overlay of supply and demand characteristics shows that the rate of new room construction had been accelerating through 2007 when hotel share prices peaked in the wake of Blackstone’s purchase of Hilton. Construction financing for hotels is now virtually impossible, which will limit new supply over the next several years. Assuming economic activity picks up in 2010, so should the performance of hotel properties. The pace of improvement may be gradual; however, segmentation by category or price point could be a major differentiating factor.

The Real Estate Stock Cycle

In addition to commenting on the underlying real estate cycles, it’s important to note that the equity real estate cycle typically leads while the real estate cycle lags overall economic trends. Thus, it’s our experience that the equity markets anticipate underlying performance prospects by a range of six to eighteen months. In other words, if U.S. homebuilders stocks perform well over the first half of 2009, it does not necessarily suggest that their profitability will start to improve materially during 2009. However, it probably reflects the potential for an extended cyclical trend of rising or enhanced profitability lasting several years or more. In this context, it may be easier to understand how the shares of property securities could have fallen to such a degree over the past year or so. That is, our economy rapidly shifted from a period of economic expansion to near global recession in a matter of months! Recall that commodity prices were surging to inflationary peaks less than six months ago. With oil futures over $140 in June, some analysts were calling for prices to hit $200. Now, those same analysts are targeting $30 a barrel! Over the course of 2008, we have witnessed the psychology of the markets move from a fear of inflation, to stagflation, and now to deflation. This manic quality is part of the equity markets forward looking discounting process in assessing future corporate earnings prospects.

With this perspective, we wish to draw your attention to the following table which shows the historical performance patterns for real estate equities over this past cycle. To provide a reasonable picture of the global universe in which AWP invests, we have presented Index returns for global property stocks, global ex-U.S. (International), as well as U.K., European, Hong Kong and Japanese real estate securities indices, plus three distinct indices for the U.S., covering REITs, Homebuilders and Hotel stocks. It is worth noting that the beginning dates for most of these cycles commenced after the U.S. incursion into Iraq in 2003 and all but one peaked during 2007.

Real Estate Securities Performance

Index | | Region | | Start of Rally | | % Gain | | Last Peak | | % decline

through 11/21/08 | | 1980’s/90’s

Cycles%

+ Avg. - | |

S&P Developed Property | | Global | | 10/08/98 | | 384.2 | | 02/22/07 | | -66.9 | | 87 : -31 | |

S&P Developed ex-U.S. Prop. | | Intl. | | 03/14/03 | | 313.3 | | 05/07/07 | | -65.8 | | 93 : -37 | |

FTSE 350 Real Estate | | U.K. | | 03/14/03 | | 253.2 | | 01/02/07 | | -70.0 | | 90 : -39 | |

FTSE EPRA Euro Zone R.E. | | Euro. | | 09/21/01 | | 258.0 | | 02/21/07 | | -68.1 | | 53 : -25 | |

Hang Seng Property | | HK | | 04/14/03 | | 342.0 | | 12/05/07 | | -64.0 | | 160 : -59 | |

TOPIX Real Estate | | Tokyo | | 04/11/03 | | 537.8 | | 06/05/07 | | -75.9 | | 148 : -51 | |

MSCI U.S. REIT | | U.S. | | 02/10/99 | | 339.9 | | 02/09/07 | | -68.3 | | 84 : -28 | |

S&P Supercomposite Homebuilding | | U.S. | | 03/06/00 | | 810.2 | | 07/20/05 | | -86.8 | | 229 : -49 | |

S&P Supercomposite Hotels | | U.S. | | 03/12/03 | | 199.3 | | 07/06/07 | | -74.2 | | 403 : -48 | |

7

While it may be too early to call a bottom for the markets, it is interesting that all have bounced as of November 21st, which may have culminated the recent wave of panic selling in equity markets. It’s worth noting the relatively short period of most of these cycles, ranging from four to five years in duration on the upside, and the typical 12 to 24 month period of decline. It’s also worth noting the magnitude of decline which uniformly ranged from two-thirds to three-quarters from peak levels. This is well beyond the pattern of the overall equity market and we believe reflects the aforementioned capital intensity of real estate as an asset class. For perspective, we have included a column showing the average up and down percentage returns for cycles prior to this one, extending back at least to 1990, and even to 1980’s with available data. Note that prior cycles typically lasted half as long as this period did during the recovery phase. This leaves us with hope that the potential for capital appreciation is far greater than the potential for further falls, given the record aggregate severity of this cycle’s decline. The November 21 coincidental low also gives us some hope that the equity markets are pricing in stabilization of the real estate markets over the next year or so.

Portfolio Performance

The aforementioned 67.74% decline in the Fund’s net asset value per share reflected deteriorating conditions in almost all countries. This also reflected significant currency depreciation, most of which occurred during September and October. Historically, Alpine’s investment strategy of broad portfolio diversification in terms of the numbers of investments, the property types and geographic dispersion had an effect of smoothing out annual returns. However, after almost 20 years of investing in international real estate securities we had heretofore never experienced such a broadly sweeping market decline. There simply was no port in the storm, no where to hide, with the exception of cash. With only one market in which we had on average more than 20% of the portfolio invested (the U.S.; average 23.5%) there was really no one exposure to point a finger at as a culprit for the significant declines in the portfolio during the year. The Fund was impacted more by losses in Japanese equities which contributed 6.7% to the decline in the portfolio. The U.K. was responsible for over -5.5% of the Fund’s decline, even though we were relatively underweight in that market. Brazil was a smaller component of our portfolio, averaging a 6.7% weighting over the course of the year, yet its aggregate equity decline of 73.4% led to -5.3% of the portfolio return. France, which started the year as the fifth largest country exposure ended the year number two at 10.7% of the portfolio. However, its relatively high average weighting of 9.33% combined with an average aggregate decline of over 53% on the stock level in dollar terms led to a -4.7% reduction for the Fund’s overall returns. Similarly, Singapore with its average weighting of 7.9% of the portfolio, was down 61% at the stock level, and contributed to -5.4% losses. This totals the sources for 40% of the Fund’s 67.74%, decline in net asset value.

The smaller country exposures proved to be more troubling from management’s perspective. For example, Australian equities actually produced the lowest equity returns in the portfolio. Even though we had an average weighting of just over 4% of the Fund invested, Australia contributed almost 5% to the decline in the Fund’s NAV, due to the combination of a -28.51% decline in the Australia dollar and a collapse in the share prices of Aussie REIT’s with major international expansion efforts, whose hedged foreign currency exposure created further losses. This dramatically impacted the third quarter returns for companies such as Valad Property Group and Goodman Group. We originally started to buy Australia at the end of last year after the Centro Properties collapse had already cut share prices by more than half for most property trusts. While the market may remain fearful of ongoing international exposure for Australia stocks, the Goodman Group is still in the Fund’s portfolio because it is trading for a fraction of the value of its high quality industrial portfolio. Over the medium term Goodman could significantly benefit from its international platform of operations. While China only represented 2.4% of the of the average portfolio weighting for the year, stock declines of over 80% contributed to a - -2.7% hit to AWP’s total return. Sometimes in the case of declining markets, we start to build a position on the way down. Clearly investments made over the course of the summer were too early, and not cheap enough, as we continually caught the wrong part of the falling knife. That said, the Chinese property sector had not traded at single-digit multiples since 2003 and we believe that the stocks which we thought attractive at between eight-to-ten times earnings multiples, down from twenty-five times earnings per share, should be even more interesting at two-to-three times. We have been increasing our exposure subsequent to the Fund’s year end.

Perhaps management’s greatest disappointments were in the investments made in Austria and Norway. In Austria, we invested in Immofinance at levels considerably below stated book value and what we believed to be the company’s net asset value per share. Immofinance was the largest property company in Austria, and owned 54% of a subsidiary entity called Immoeast, which invested in both direct property and entity level equity investments in private developers throughout Eastern Europe. Given managements near 20 year experience in investing in the region, we felt comfortable with this arrangement particularly since most of Immofinance’s portfolio exposure was in high quality Austrian and German offices, apartments and logistics facilities. In October, 2007, the Fund’s position in Immofinance was at a dollar cost basis of $11.88

8

per share. That held well through April of 2008 where the shares were still trading for $11.08. Unfortunately, the price principally declined in September, and then to $1.11 at the end of October as the CEO and founder of the company suddenly left for unexplained reasons. This led to Board resignations as it became clear that the company made a $500 million Euro loan to a mysterious entity with no reportable assets or business. The monies have not been recovered and the company is currently the focus of a fraud investigation which has left a cloud over the shares and uncertainty regarding the company’s potential. This contributed to the Fund’s 2.1% portfolio decline as a result of our limited Austrian investments.

AWP’s only holding in Norway is Norwegian Properties, the owner of prime office buildings in Oslo and Stavanger, tenanted by oil companies, insurance companies and government linked entities. This stock has averaged only 1.1% of the portfolio over the past year, nonetheless contributed to 1.2% decline for the portfolio. In October of last year, the company’s shares were valued at $12.48 per share, then subsequently fell 30% to $8.72 in April, 2008 as the market grew concerned that a major acquisition had increased their debt exposure excessively (over 75%). While the company was still within its debt covenants, infighting on the board prevented the company from taking early action either through disposals or additional equity raisings which led to a mid-summer rights issue, which was poorly priced and underwritten. Alpine did not participate in the rights issue. We eventually took up the equivalent of our allotment at prices over 60% below the rights price, however, the shares ended the month of October at $1.48, a fall of 88% on the face value of our previous year’s position. Of that total, the Norwegian Krone was responsible for 29% of the fall. The Fund has subsequently invested further at similar and lower share price levels as the company has achieved several property sales at levels above the underlying net asset value. The shares themselves are trading for roughly an 80% discount to such levels.

Indeed, while many shares in the portfolio are trading at fractional valuations in the stock markets relative to what we believe could be achieved in the private real estate markets, in the current illiquid investment environment we would now expect to see significant activity to take advantage of this arbitrage either through mergers and acquisition activity or increased stock investor interest. Our estimation is that the aggregate discount in the portfolio currently stands in excess of 60% despite the overall high quality nature of the individual companies’ assets and in extreme cases, such as Norwegian Properties, could offer tremendous upside potential when liquidity returns to the capital markets.

Portfolio Strategy

We wish to highlight that only two of the Fund’s top ten holdings remain from last year. Unibail/Rodamco owns premier shopping malls throughout Europe and Accor is Europe’s major hotel owner with brands such as Sofitel and Novotel. The two actually offer reasonably defensive qualities such as the long-term leases and superior quality of the portfolio for Unibail, while half of Accor’s business is in fact linked not to the hotel industry, but rather a global corporate voucher system which many companies use to pay for employee meal expenditures. In other words, both companies have relatively stable cash flow businesses, and dominant market share, enabling them to both pay significant dividends during times of uncertainty such as we now experience. One of the new names in the top 10 holdings is Annaly Capital Management. Annaly and another portfolio holding, MFA Mortgage Investments, are REITs which invest in the mortgage securities guaranteed by Fannie Mae and Freddie Mac. Over the last few years both companies have reduced their borrowing levels from fourteen times assets to under eight, and should benefit significantly from spreads available in the current financing environment. Given the relatively high underlying yields and significant security from investments in the mortgages guaranteed by these government sponsored entities, we view both of these companies as relatively stable in this current environment and capable of producing significant cash flow in the form of dividends.

We have added to our exposure to REITs in Japan, most notably, Japan Logistics is the fund’s fifth largest holding, and the Japan Retail Fund which owns quality community shopping centers and shopping malls throughout Japan. We have taken advantage of the downturn in Brazilian shares to invest in shopping mall companies such as Multiplan and Iguatami as the market declined. AWP was also able to buy previously expensive companies focused on the development of low-income housing, subsidized by the government. These companies, MRV and PDG, both offer considerable upside even if the Brazilian economy slows significantly over the next year. By our estimation, our Brazilian investments are trading for approximately four to six times earnings, and we believe that if the Brazilian economy reaccelerates in 2010, we should benefit not only from rapidly rising earnings but significant multiple expansion.

In a nut shell, we have been able to buy both deeply discounted, high quality property portfolios on one hand, while on the other positioning ourselves in very attractively priced growth stories in the emerging markets where we believe economic growth will come back most quickly. We believe AWP’s portfolio is positioned appropriately at this stage of the real estate equity cycle, anchoring the

9

portfolio with companies producing stable cash flow and high dividends which offer attractive underlying valuations combined with the aforementioned deeply discounted growth and value situations.

Dividends

Since inception, Alpine Global Premier Properties Fund has paid monthly dividends equal to an annual rate of $1.52 per share. For 2008, these distributions reflected a dividend income collected of $1.72 less 8.4¢ withheld for foreign taxes. After deducting 17¢ for Fund operating expenses the net investment income was $1.47 per share.

At the outset of this report we discussed the impact of the credit crisis on real estate companies’ capital expenditure planning. Until recently, we have been comfortable that most companies could maintain dividend levels in dollar terms, even though share prices were declining. That is, the yields have been getting larger so AWP could still collect dividend income at a rate which sustained the Fund’s dividend payouts to shareholders. However, since the Lehman Brothers collapse, we have observed more companies reducing or altering the timing of their dividend payments. To date, roughly a quarter of REITs in the U.S. have either cut, suspended or omitted dividends. We have seen a number of listed property trusts in Australia and European companies do the same. We expect several other public companies around the world will also do so. Unfortunately, we do not as of yet have visibility on the dividend payment rates for the middle of next year. That is when we expect the majority of fiscal pressures both to conserve capital and obtain new lines of financing, to fully impact real estate company cash flows. Without visibility on that time, we cannot determine whether there will be adequate income to sustain the Fund’s current level of dividends.

Given current valuations, we believe that capital appreciation potential for many of the stocks in our universe could be greater than the potential dividend growth over the same period. We believe that the dividends will grow over time, but that the stocks will move ahead of that time in anticipation. Therefore, we are encouraged to focus on the capital appreciation potential of real estate equity total returns followed by the dividend growth potential of these stocks over time. It should be noted that by the time you receive this report a public declaration of the Fund’s prospective dividends will have been made.

Future Prospects

Given recent past performance for both real estate equities and this Fund, we realize that many investors may be upset and uncertain over the prospects for their investment. It is certainly fair to ask what happens next if there is another leg down in the economic environment. Indeed, if we were to see a depression-era climate developing, management would seek shelter in cash and remain exposed only to the most defensive situations for dividend income. However, we do not think this a likely scenario and believe that the recent decline, while more extreme than any seen in either this manager’s 23 years in the business and Alpine’s most senior manager’s 58 years of experience in the markets, still conforms to historical market cycles. We are still comforted that our traditional approach to buying value, seeking the highest quality companies with solid long-term prospects as core holdings and then attempting to position the portfolio to benefit from the economic rebound when it arrives, should be productive. This was the history of market performance during prior recoveries in 2003, 1993, 1986, 1982 and 1975. We expect the likely stock market pattern for 2009 will be volatile, but we remain optimistic with regard to the portfolio and its prospects. As such, we continue to periodically acquire shares on behalf of Alpine employees and for the Fund itself, when share price discounts relative to NAV are compelling. We remain confident of the long term prospects for the Fund!

We thank you for your interest and we look forward to building on Alpine’s long-term record as a manager of global real estate securities.

Sincerely,

Samuel A. Lieber

10

PERFORMANCE(1) as of October 31, 2008

| | Ending Value | | One | | Three | | One | | Since | |

| | as of 10/31/08 | | Month | | Month | | Year | | Inception(2)(3)(4) | |

| | | | | | | | | | | |

Alpine Global Premier Properties Fund | NAV (4) | | $ | 5.00 | | (31.81 | )% | (49.20 | )% | (67.74 | )% | (53.14 | )% |

Alpine Global Premier Properties Fund | Market Price (3) | | $ | 4.45 | | (29.68 | )% | (50.69 | )% | (67.03 | )% | (57.98 | )% |

S&P / Citigroup World Net Total Return $ US Property Index | | | | (27.45 | )% | (35.80 | )% | (51.85 | )% | (39.33 | )% |

MSCI US REIT Total Return Index | | | | (31.81 | )% | (30.32 | )% | (40.46 | )% | (37.71 | )% |

(1) | Performance information calculated after consideration of dividend reinvestment. All returns for periods of less than one year are not annualized. |

(2) | Commenced operations on April 26, 2007. |

(3) | Annualized |

(4) | IPO price of $20 used in calculating performance information. |

To the extent that the Fund’s historical performance resulted from gains derived from participation in initial public offerings (“IPOs”), there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO allocations in the future.

Performance data quoted represents past performance. Past performance is no guarantee of future results and investment returns and principle value of the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. Call 1(800)617.7616 or visit www.alpinecef.com for current month end performance.

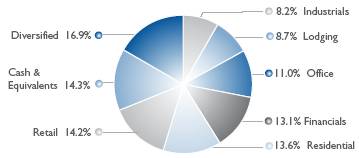

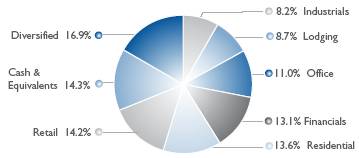

PORTFOLIO DISTRIBUTIONS v

v As a percentage of net assets

TOP TEN HOLDINGS v

Annaly Capital Management, Inc. | | 6.1 | % |

Unibail-Rodamco Co. | | 5.2 | % |

Nomura Real Estate Holdings, Inc. | | 2.7 | % |

Alexander’s, Inc. | | 2.6 | % |

Japan Logistics Fund, Inc. | | 2.3 | % |

Accor SA | | 2.2 | % |

Mack-Cali Realty Corp. | | 1.8 | % |

CapitaCommercial Trust | | 1.7 | % |

Hammerson PLC | | 1.6 | % |

Midland Holdings, Ltd. | | 1.5 | % |

Top Ten Property Holdings | | 27.7 | % |

v As a percentage of net assets

11

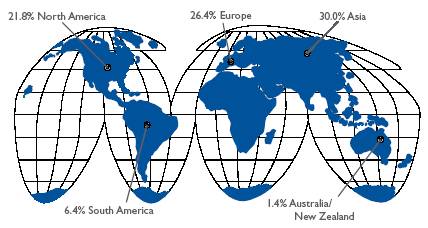

REGIONAL ALLOCATIONv

v As a percentage of net assets

Top Five Countriesv

United States | | 20.6 | % |

France | | 10.7 | % |

Singapore | | 10.7 | % |

Japan | | 8.7 | % |

United Kingdom | | 7.5 | % |

v As a percentage of net assets, excluding any short-term investments

NAV, MARKET PRICE, AND TOTAL RETURN [ Year ended 10/31/08 ]

12

| REPORT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM |

TO THE STOCKHOLDERS AND BOARD OF TRUSTEES OF ALPINE GLOBAL PREMIER PROPERTIES FUND:

We have audited the accompanying statement of assets and liabilities, including the schedule of portfolio investments, of Alpine Global Premier Properties Fund (the “Fund”), as of October 31, 2008, and the related statement of operations for the year then ended, the statement of changes in net assets and the financial highlights for the year then ended and for the period from April 26, 2007 (inception) to October 31, 2007. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2008, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Alpine Global Premier Properties Fund as of October 31, 2008, the results of its operations for the year then ended, and the changes in its net assets and the financial highlights for the year ended October 31, 2008 and for the period from April 26, 2007 (inception) to October 31, 2007, in conformity with accounting principles generally accepted in the United States of America.

Milwaukee, Wisconsin

December 19, 2008

13

| SCHEDULE OF PORTFOLIO INVESTMENTS

October 31, 2008 |

| | | | Value | |

Description | | Shares | | (Note 1) | |

| | | | | |

COMMON STOCKS (84.3%) | | | | | |

Australia (1.4%) | | | | | |

Australand Property Group | | 11,228,147 | | $ | 2,201,188 | |

Goodman Group | | 8,116,752 | | 5,043,370 | |

| | | | 7,244,558 | |

| | | | | |

Austria (1.0%) | | | | | |

Conwert Immobilien Invest SE* | | 628,653 | | 3,028,727 | |

Immofinanz AG * | | 2,102,000 | | 2,330,822 | |

| | | | 5,359,549 | |

| | | | | |

Brazil (6.3%) | | | | | |

Agra Empreendimentos Imobiliarios SA* | | 1,478,100 | | 805,058 | |

Brascan Residential Properties SA | | 1,594,900 | | 2,274,748 | |

Brasil Brokers Participacoes SA* | | 2,059,200 | | 2,613,801 | |

Cyrela Brazil Realty SA | | 903,795 | | 4,305,176 | |

Cyrela Commercial Properties SA Empreendimentos e Participacoes | | 1,481,000 | | 3,602,525 | |

Gafisa SA | | 210,700 | | 1,492,843 | |

Gafisa SA - ADR | | 120,100 | | 1,752,259 | |

Iguatemi Empresa de Shopping Centers SA | | 100,400 | | 468,054 | |

Invest Tur Brasil - Desenvolvimento Imobiliario Turistico SA* | | 21,700 | | 4,056,542 | |

MRV Engenharia e Participacoes SA | | 461,900 | | 2,389,984 | |

Multiplan Empreendimentos Imobiliarios SA* | | 905,000 | | 4,549,020 | |

PDG Realty SA Empreendimentos e Participacoes | | 601,700 | | 3,068,906 | |

Tecnisa SA | | 639,500 | | 841,253 | |

Trisul SA | | 1,150,000 | | 1,146,550 | |

| | | | 33,366,719 | |

| | | | | |

Chile (0.1%) | | | | | |

Parque Arauco SA | | 1,235,504 | | 644,691 | |

| | | | | |

China (1.3%) | | | | | |

C C Land Holdings, Ltd. | | 7,118,900 | | 1,240,058 | |

CapitaRetail China Trust | | 4,514,000 | | 1,643,668 | |

Hopson Development Holdings, Ltd. | | 4,717,600 | | 1,521,797 | |

Shui On Land, Ltd. | | 998,100 | | 221,512 | |

Sino-Ocean Land Holdings, Ltd. | | 8,899,400 | | 2,296,605 | |

| | | | 6,923,640 | |

| | | | | |

France (10.7%) | | | | | |

Accor SA | | 299,000 | | 11,564,199 | |

Club Mediterranee* | | 101,895 | | 2,025,978 | |

Eurosic, Inc. | | 93,300 | | 2,221,344 | |

Kaufman & Broad SA | | 92,767 | | 1,891,780 | |

Klepierre SA | | 114,219 | | 2,608,757 | |

Nexity SA | | 263,953 | | 2,277,574 | |

Societe Immobiliere de Location pour l’Industrie et le Commerce | | 74,715 | | 6,623,113 | |

Unibail-Rodamco Co. | | 183,911 | | 27,425,263 | |

| | | | 56,638,008 | |

| | | | | |

Germany (1.3%) | | | | | |

Dawnay Day Sirius, Ltd. | | 5,011,800 | | 1,916,338 | |

Dawnay Day Treveria PLC | | 11,057,500 | | 1,182,432 | |

DIC Asset AG | | 447,709 | | 3,863,152 | |

Eurocastle Investment, Ltd. | | 103,193 | | 53,925 | |

| | | | 7,015,847 | |

| | | | | |

Guernsey (0.2%) | | | | | |

RGI International, Ltd.* | | 1,358,561 | | 740,416 | |

| | | | | |

Hong Kong (5.1%) | | | | | |

Great Eagle Holdings, Ltd. | | 5,000,000 | | 5,599,964 | |

The Hongkong & Shanghai Hotels, Ltd. | | 6,968,450 | | 6,482,865 | |

Kowloon Development Co., Ltd. | | 9,832,000 | | 3,260,397 | |

Midland Holdings, Ltd. | | 19,800,200 | | 7,945,577 | |

NWS Holdings, Ltd. | | 3,485,000 | | 3,597,396 | |

| | | | 26,886,199 | |

| | | | | | |

14

Description | | Shares | | Value

(Note 1) | |

| | | | | |

India (1.2%) | | | | | |

Hirco PLC* | | 1,299,168 | | $ | 1,923,547 | |

Indiabulls Properties Investment Trust* | | 7,100,000 | | 670,263 | |

Unitech Corporate Parks PLC* | | 3,104,000 | | 524,518 | |

Yatra Capital, Ltd.* | | 666,500 | | 3,397,954 | |

| | | | 6,516,282 | |

| | | | | |

Italy (1.5%) | | | | | |

Pirelli & C Real Estate S.p.A | | 513,795 | | 3,601,718 | |

Pirelli & C S.p.A | | 10,500,000 | | 3,680,266 | |

Risanamento S.p.A* | | 1,514,433 | | 829,996 | |

| | | | 8,111,980 | |

Japan (8.7%) | | | | | |

Frontier Real Estate Investment Corp. | | 613 | | 3,298,041 | |

Haseko Corp. | | 1,880,300 | | 1,660,604 | |

Japan Hotel and Resort, Inc. | | 1,007 | | 1,181,699 | |

Japan Logistics Fund, Inc. | | 2,002 | | 12,356,268 | |

Japan Retail Fund Investment Corp. | | 1,872 | | 6,670,105 | |

Mitsui Fudosan Co., Ltd. | | 333,400 | | 5,648,610 | |

Nomura Real Estate Holdings, Inc. | | 747,200 | | 14,237,077 | |

Secured Capital Japan Co., Ltd. | | 2,624 | | 1,361,145 | |

| | | | 46,413,549 | |

| | | | | |

Luxembourg (0.1%) | | | | | |

ProLogis European Properties | | 173,000 | | 573,293 | |

| | | | | |

Mexico (1.2%) | | | | | |

Consorcio ARA SAB de C.V. | | 709,800 | | 286,292 | |

Corp. GEO SAB de C.V.* | | 609,600 | | 845,647 | |

Desarrolladora Homex SAB de C.V.* - ADR | | 108,800 | | 2,532,864 | |

Urbi Desarrollos Urbanos SA de C.V.* | | 1,903,800 | | 2,855,515 | |

| | | | 6,520,318 | |

| | | | | |

Norway (1.1%) | | | | | |

Norwegian Property ASA | | 3,888,150 | | 5,772,794 | |

| | | | | |

Philippines (0.6%) | | | | | |

Ayala Land, Inc. | | 10,497,600 | | 1,266,064 | |

SM Prime Holdings, Inc. | | 9,605,000 | | 1,649,264 | |

| | | | 2,915,328 | |

| | | | | |

Poland (0.3%) | | | | | |

Orco Property Group | | 133,500 | | 1,738,959 | |

| | | | | |

Russia (0.9%) | | | | | |

PIK Group*(1) - GDR | | 805,000 | | 4,821,950 | |

| | | | | |

Singapore (10.7%) | | | | | |

ARA Asset Management, Ltd. | | 17,002,000 | | 3,783,318 | |

Ascendas Real Estate Investment Trust | | 6,350,000 | | 6,765,341 | |

Ascott Residence Trust | | 6,786,000 | | 2,150,654 | |

Banyan Tree Holdings, Ltd. | | 10,655,400 | | 3,592,515 | |

CapitaCommercial Trust | | 13,568,800 | | 8,966,570 | |

CapitaLand, Ltd. | | 2,925,000 | | 5,621,207 | |

CapitaMall Trust | | 3,921,000 | | 5,023,533 | |

City Developments, Ltd. | | 1,527,800 | | 6,490,317 | |

Frasers Commercial Trust | | 6,775,000 | | 1,119,268 | |

Macquarie MEAG Prime REIT | | 20,631,400 | | 7,234,207 | |

Mandarin Oriental International, Ltd. | | 1,956,000 | | 2,503,680 | |

Parkway Life Real Estate Investment Trust | | 502,000 | | 250,492 | |

Suntec Real Estate Investment Trust | | 6,677,000 | | 3,129,140 | |

| | | | 56,630,242 | |

| | | | | |

| | | | | |

Spain (0.4%) | | | | | |

Realia Business SA | | 812,384 | | 2,257,226 | |

| | | | | |

Sweden (0.9%) | | | | | |

JM AB | | 941,457 | | 4,974,193 | |

| | | | | |

Thailand (1.7%) | | | | | |

Land and Houses PLC | | 5,390,000 | | 575,138 | |

Minor International PCL | | 25,388,400 | | 5,468,828 | |

Preuksa Real Estate PCL | | 8,940,000 | | 1,173,295 | |

SC Asset Corp. PCL | | 12,431,900 | | 1,716,702 | |

| | | | 8,933,963 | |

| | | | | |

United Kingdom (7.5%) | | | | | |

Enterprise Inns PLC | | 1,195,100 | | 1,865,631 | |

Great Portland Estates PLC | | 1,155,815 | | 5,133,896 | |

Hammerson PLC | | 764,800 | | 8,738,884 | |

Helical Bar PLC | | 772,684 | | 3,696,354 | |

Mapeley, Ltd. | | 544,372 | | 2,137,644 | |

Punch Taverns PLC | | 736,764 | | 1,867,491 | |

Regus PLC | | 6,254,783 | | 4,705,910 | |

| | | | | | |

15

Description | | Shares | | Value

(Note 1) | |

| | | | | |

United Kingdom (7.5%) | | | | | |

Segro PLC | | 1,014,119 | | $ | 4,577,955 | |

Shaftesbury PLC | | 1,102,318 | | 5,911,896 | |

Songbird Estates PLC* | | 1,570,200 | | 1,238,228 | |

| | | | 39,873,889 | |

| | | | | |

United States (20.1%) | | | | | |

Alexander’s, Inc. | | 38,870 | | 13,604,500 | |

Alexandria Real Estate Equities, Inc. | | 93,739 | | 6,516,735 | |

AMB Property Corp. | | 65,000 | | 1,561,950 | |

Annaly Capital Management, Inc. | | 2,340,000 | | 32,526,000 | |

CBL & Associates Properties, Inc. | | 198,400 | | 1,831,232 | |

Centex Corp. | | 40,000 | | 490,000 | |

DiamondRock Hospitality Co. | | 583,000 | | 3,019,940 | |

Forestar Real Estate Group LLC* | | 294,650 | | 2,578,188 | |

General Growth Properties, Inc. | | 1,479,632 | | 6,125,677 | |

Jones Lang LaSalle, Inc. | | 27,900 | | 918,468 | |

Kimco Realty Corp. | | 120,000 | | 2,709,600 | |

Lennar Corp. | | 80,000 | | 619,200 | |

Mack-Cali Realty Corp. | | 410,900 | | 9,335,648 | |

M.D.C. Holdings, Inc. | | 33,100 | | 1,113,153 | |

Meritage Homes Corp.* | | 160,000 | | 2,196,800 | |

MFA Mortgage Investments, Inc. | | 650,000 | | 3,575,000 | |

MGM Mirage* | | 50,953 | | 838,686 | |

Orient-Express Hotels, Ltd. | | 458,497 | | 5,639,513 | |

ProLogis | | 165,000 | | 2,310,000 | |

Pulte Homes, Inc. | | 100,000 | | 1,114,000 | |

Regency Centers Corp. | | 85,000 | | 3,354,100 | |

Standard Pacific Corp.* | | 75,000 | | 213,750 | |

Sunrise Senior Living, Inc.* | | 405,300 | | 1,224,006 | |

Weingarten Realty Investors | | 170,000 | | 3,476,500 | |

| | | | 106,892,646 | |

| | | | | |

TOTAL COMMON STOCKS | | | | | |

(Identified Cost $1,141,377,416) | | | | 447,766,239 | |

| | | | | |

PARTICIPATION NOTES (0.8%) | | | | | |

India (0.8%) | | | | | |

Merrill Lynch - Indiabulls Real Estate, Ltd.* | | 1,298,832 | | 3,137,421 | |

Merrill Lynch - Phoenix Mills, Ltd.* | | 850,000 | | 871,486 | |

| | | | 4,008,907 | |

| | | | | |

Taiwan (0.0%)(2) | | | | | |

Macquarie Bank Limited - Chunghwa Telecom Co., Ltd.* | | 6,500 | | 106,990 | |

| | | | | |

TOTAL PARTICIPATION NOTES | | | | | |

(Identified Cost $11,804,797) | | | | 4,115,897 | |

| | | | | |

RIGHTS (0.0%)(2) | | | | | |

Australia (0.0%)(2) | | | | | |

Goodman Group, expired 11/21/08 at .90 (Australian Dollar) * | | 2,595,152 | | 8,623 | |

| | | | | |

Brazil (0.0%)(2) | | | | | |

Agra Empreendimentos Imobiliarios SA, exercisable 10/30/08 - 12/1/08 at 1.28 (Brazilian Real) * | | 716,482 | | 23,150 | |

| | | | | |

TOTAL RIGHTS | | | | | |

(Identified Cost $0) | | | | 31,773 | |

| | | | | | |

| | Maturity | | | | Value | |

Description | | Date | | Shares | | (Note 1) | |

| | | | | | | |

EQUITY - LINKED STRUCTURED NOTES (0.4%) | | | | | | | |

Finland (0.4%) | | | | | | | |

Merrill Lynch & Co., Inc. - Sponda Oyj* | | 03/24/09 | | 458,240 | | 2,044,176 | |

| | | | | | | |

TOTAL EQUITY - LINKED STRUCTURED NOTES | | | | | | | |

(Identified Cost $5,872,121) | | | | | | 2,044,176 | |

| | | | | | Value | |

Description | | 7 Day Yield | | Shares | | (Note 1) | |

| | | | | | | |

SHORT TERM INVESTMENTS (0.2%) | | | | | | | |

Federated Treasury Obligations Money Market Fund(3) | | 0.829 | % | 1,238,285 | | 1,238,285 | |

| | | | | | | |

TOTAL SHORT TERM INVESTMENTS | | | | | | | |

(Identified Cost $1,238,285) | | | | | | 1,238,285 | |

| | | | | | | |

TOTAL INVESTMENTS (85.7%) | | | | | | | |

(Identified Cost $1,160,292,619) | | | | | | 455,196,370 | |

| | | | | | | |

TOTAL OTHER ASSETS LESS LIABILITIES (14.3%) | | | | | | 75,671,245 | |

| | | | | | | |

NET ASSETS (100.0%) | | | | | | $ | 530,867,615 | |

| | | | | | | | |

16

* | Non-income producing security. |

(1) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities have been determined to be liquid in accordance with procedures adopted by the Fund’s Board of Trustees. Securities restricted under Rule 144A comprised 0.91% of the fund’s net assets. |

(2) | Less than 0.05% of net assets. |

(3) | Investments in other funds are calculated at their respective net asset values as determined by those funds, in accordance with the Investment Company Act of 1940. |

See Notes to Financial Statements.

Common Abbreviations

AB - - Aktiebolag is the Swedish equivalent of the term corporation.

ADR - - American Depositary Receipt.

AG - - Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders.

ASA - - Allmennaksjeselskap is the Norwegian term for a public limited company.

GDR - - Global Depositary Receipt.

Inc. - - Incorporated.

LLC - - Limited Liability Corp.

Ltd. - - Limited.

Oyj. - - Osakeyhtio is the Finnish equivalent of a limited company.

PCL - - Public Company Limited.

PLC - - Public Limited Co.

REIT - - Real Estate Investment Trust.

SA - - Generally designates corporations in various countries, mostly those employing the civil law.

SA de C.V. - A variable capital company.

SAB de C.V. - A variable capital company.

SE - SE Regulation. A European Company which can operate on a Europe-wide basis and be governed by Community law directly applicable in all Member States.

S.p.A. - - Societa` Per Azioni is an Italian shared company.

17

| STATEMENT OF ASSETS AND LIABILITIES

October 31, 2008 |

ASSETS | | | |

| | | |

Investments, at value | | $ | 455,196,370 | |

Cash | | 101,646 | |

Foreign currency, at value (Cost $1,292,770) | | 1,271,157 | |

Receivable for investment securities sold | | 94,535,597 | |

Dividends receivable | | 12,268,935 | |

Interest receivable | | 4,100 | |

Prepaid and other assets | | 27,360 | |

Total Assets | | 563,405,165 | |

| | | |

LIABILITIES | | | |

| | | |

Loan payable | | 17,974,000 | |

Interest on loan payable | | 20,739 | |

Payable for investment securities purchased | | 13,682,220 | |

Accrued expenses and other liabilities: | | | |

Investment advisory fees | | 529,016 | |

Administrative fees | | 68,771 | |

Trustee fees | | 12,000 | |

Officer fees | | 12,500 | |

Other | | 238,304 | |

Total Liabilities | | 32,537,550 | |

| | | |

Net Assets | | $ | 530,867,615 | |

| | | |

NET ASSETS REPRESENTED BY | | | |

| | | |

Paid-in-capital | | $ | 1,987,861,077 | |

Overdistributed net investment income | | (850,102 | ) |

Accumulated net realized loss on investments, swap contracts and foreign currency | | (749,590,176 | ) |

Net unrealized depreciation on investments and foreign currency translations | | (706,553,184 | ) |

Net Assets | | $ | 530,867,615 | |

Net asset value | | | |

Net assets | | $ | 530,867,615 | |

Shares of beneficial interest issued and outstanding | | 106,088,607 | |

Net asset value per share | | $ | 5.00 | |

(1) Cost of Investments | | $ | 1,160,292,619 | |

See Notes to Financial Statements.

18

| STATEMENT OF OPERATIONS

For the Year Ended October 31, 2008 |

INCOME | | | |

| | | |

Dividends | | $ | 167,449,913 | |

Interest | | 463,096 | |

Miscellaneous income | | 247,173 | |

Total Income | | 168,160,182 | |

| | | |

EXPENSES | | | |

| | | |

Interest on loan | | 1,985,245 | |

Investment advisory fee | | 13,694,747 | |

Administrative fee | | 1,780,316 | |

Audit and tax fees | | 30,149 | |

Custodian fees | | 756,307 | |

Officers fees | | 50,000 | |

Insurance fees | | 4,521 | |

Legal fees | | 78,500 | |

Printing fees | | 288,705 | |

Trustee fees | | 47,421 | |

NYSE fees | | 94,134 | |

Miscellaneous fees | | 36,999 | |

Total Expenses | | 18,847,044 | |

| | | |

Net Investment Income | | 149,313,138 | |

| | | |

REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS, SWAP CONTRACTS AND FOREIGN CURRENCY | | | |

| | | |

Net realized loss on investments: | | | |

Securities transactions | | (661,487,755 | ) |

Swap contracts | | (5,970,774 | ) |

Foreign currency transactions | | (14,310,099 | ) |

Net realized loss on investments | | (681,768,628 | ) |

Change in net unrealized appreciation/(depreciation) of investments, swap contracts and foreign currency translations: | | | |

Investments | | (564,141,565 | ) |

Swap contracts | | 22,430 | |

Foreign currency translations | | (125,467,021 | ) |

Net unrealized depreciation of investments | | (689,586,156 | ) |

Net realized/unrealized loss on investments, swap contracts and foreign currency | | (1,371,354,784 | ) |

Net Decrease in Net Assets Resulting from Operations | | $ | (1,222,041,646 | ) |

* Net of foreign taxes withheld | | $ | 8,843,831 | |

See Notes to Financial Statements.

19

| STATEMENTS OF CHANGES IN NET ASSETS

|

| | For the Year Ended

October 31, 2008 | | For the Period

April 26, 2007 (Inception)

to October 31, 2007 | |

OPERATIONS | | | | | |

| | | | | |

Net investment income | | $ | 149,313,138 | | $ | 61,343,470 | |

Net realized loss on investments: | | | | | |

Securities transactions | | (661,487,755 | ) | (82,861,878 | ) |

Swap contracts | | (5,970,774 | ) | (56,272 | ) |

Foreign currency transactions | | (14,310,099 | ) | (2,697,011 | ) |

Change in net unrealized appreciation/(depreciation) of investments, swap contracts and foreign currency translations: | | | | | |

Investments | | (564,141,565 | ) | (73,037,747 | ) |

Swap contracts | | 22,430 | | 155,565 | |

Foreign currency translations | | (125,467,021 | ) | 55,915,154 | |

Net decrease in net assets resulting from operations | | (1,222,041,646 | ) | (41,238,719 | ) |

| | | | | |

DISTRIBUTIONS TO SHAREHOLDERS | | | | | |

| | | | | |

From net investment income | | (134,678,983 | ) | (59,034,114 | ) |

From tax return of capital | | (26,406,978 | ) | (7,976,683 | ) |

Net decrease in net assets resulting from distributions to shareholders | | (161,085,961 | ) | (67,010,797 | ) |

| | | | | |

CAPITAL SHARE TRANSACTIONS | | | | | |

| | | | | |

Proceeds from sales of common shares, net of offering cost | | — | | 1,906,000,000 | |

Proceeds from underwriters’ over-allotment option common shares exercised, net of offering costs | | — | | 105,130,786 | |

Common stock issued to stockholders from reinvestment of dividends and offering costs | | 7,181,723 | | 991,463 | |

Repurchase of Shares | | (1,248,334 | ) | | |

Net increase in net assets derived from capital share transactions | | 5,933,389 | | 2,012,122,249 | |

Net Increase/(Decrease) in Net Assets | | (1,377,194,218 | ) | 1,903,872,733 | |

Net Assets | | | | | |

Beginning of period | | 1,908,061,833 | | 4,189,100 | |

End of period* | | $ | 530,867,615 | | $ | 1,908,061,833 | |

| | | | | |

|

* Including overdistributed net investment income of: | | $ | (850,102 | ) | $ | (646,697 | ) |

See Notes to Financial Statements.

20

| FINANCIAL HIGHLIGHTS

(For a share outstanding throughout the year) |

| | For the Year Ended

October 31, 2008 | | For the Period Ended