UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22023

Nuveen Managed Accounts Portfolios Trust

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: July 31

Date of reporting period: July 31, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Mutual Fund

Nuveen Managed Accounts Portfolios Trust

Designed to provide dependable, tax-free income because it’s not what you earn, it’s what you keep.®

Annual Report

July 31, 2013

| | | | |

| |

| Fund Name | | Ticker Symbol | |

Municipal Total Return Managed Accounts Portfolio | | | NMTRX | |

LIFE IS COMPLEX.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund distributions and statements from your financial advisor or brokerage account.

OR

www.nuveen.com/accountaccess

If you receive your Nuveen Fund distributions and statements directly from Nuveen.

| | | | | | |

| Must be preceded by or accompanied by a prospectus. | | NOT FDIC INSURED | | MAY LOSE VALUE | | NO BANK GUARANTEE |

Table of Contents

Chairman’s

Letter to Shareholders

Dear Shareholders,

I am pleased to have this opportunity to introduce myself to you as the new independent chairman of the Nuveen Fund Board, effective July 1, 2013. I am honored to have been selected as chairman, with its primary responsibility to serve the interests of the Nuveen fund shareholders. My predecessor, Robert Bremner, was the first independent director to serve as chairman of the Board and I, and my fellow Board members, plan to continue his legacy of strong independent oversight of your funds.

The global economy has hit major turning points over the last several months to a year. The developed world is gradually recovering from their financial crisis while the emerging markets appear to be struggling with the downshift of China’s growth potential. Japan is entering a new era of growth after decades of economic stagnation and many of the Eurozone nations appear to be exiting their recession. Despite the positive events, there are still potential risks. Middle East tensions, rising oil prices, defaults in Europe and fallout from the financial stress in emerging markets could all reverse the recent progress in the global economy.

On the domestic front, the U.S. economy is experiencing sustainable slow growth. Corporate fundamentals are strong as earnings per share and corporate cash are at the highest level in two decades. Unemployment is trending down and the housing market has experienced a rebound, each assisting the positive economic scenario. However, there are some issues to be watched. Interest rates are expected to increase but significant uncertainty about the timing remains. Another potential fiscal cliff in October along with a possible conflict in the Middle East both add to the uncertainties that could cause problems for the economy going forward.

In the near term, governments are focused on economic recovery and the growth of their economies, which could lead to an environment of attractive investment opportunities. Over the long term, the uncertainties mentioned earlier could hinder the potential growth. Because of this, Nuveen’s investment management teams work hard to balance return and risk with a range of investment strategies. I encourage you to read the following commentary on the management of your fund.

On behalf of the other members of your Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

William J. Schneider

Chairman of the Board

September 23, 2013

Portfolio Manager’s Comments

This Portfolio was developed exclusively for use within Nuveen-sponsored separately managed accounts. It enables certain Nuveen municipal separately managed account investors to achieve greater diversification and return potential than otherwise might be achievable.

The Portfolio is managed by Nuveen Asset Management LLC, an affiliate of Nuveen Investments. Martin J. Doyle, CFA, serves as portfolio manager for the Portfolio. Here Martin discusses the economic and market conditions, the Portfolio’s investment strategy and its performance for the twelve-month reporting period ended July 31, 2013.

What were the general market conditions and trends during this twelve-month reporting period ended July 31, 2013?

During this reporting period, the U.S. economy’s progress toward recovery from recession continued at a moderate pace. The Federal Reserve (Fed) maintained its efforts to improve the overall economic environment by holding the benchmark fed funds rate at the record low level of zero to 0.25% that it established in December 2008. The Fed also continued its monthly purchases of $40 billion of mortgage-backed securities and $45 billion of longer-term Treasury securities in an open-ended effort to bolster growth. At its September 2013 meeting (subsequent to the end of this reporting period), the Fed indicated that downside risks to the economy had diminished since the fall of 2012, but that recent tightening of financial conditions, if sustained, could potentially slow the pace of improvement in the economy and labor market. Consequently, the Fed made no changes to its highly accommodative monetary policies at the September meeting, announcing its decision to wait for additional evidence of sustained economic progress before adjusting the pace of its bond buying program.

As measured by gross domestic product (GDP), the U.S. economy grew at an estimated annualized rate of 1.7% in the second quarter of 2013, compared with 1.1% for the first quarter, continuing the pattern of positive economic growth for the 16th consecutive quarter. The Consumer Price Index (CPI) rose 2.0% year-over-year as of July 2013, while the core CPI (which excludes food and energy) increased 1.7% during the period, staying within the Fed’s unofficial objective of 2.0% or lower for this inflation measure. Meanwhile, labor market conditions continued slowly to show signs of improvement, although unemployment remained above the Central Bank’s 6.5% target. As of July 2013, the national unemployment rate was 7.4%. The housing market, long a major weak spot in the U.S. economic recovery, also delivered some good news as the average home price in the S&P/Case-Shiller Index of 20 major metropolitan areas rose 12.1% for the twelve months ended June 2013 (most recent data available at the time this report was prepared). The outlook for the U.S. economy, however, continued to be clouded by uncertainty about global financial markets and the outcome of the “fiscal cliff.” The tax consequences of the fiscal cliff situation, which had been scheduled to become effective in January 2013, were averted through a last minute deal that raised payroll taxes, but left in place a number of tax breaks. Lawmakers postponed and then failed to reach a resolution on $1.2 trillion in spending cuts intended to address the federal budget deficit. As a result, automatic spending cuts (or sequestration) affecting both defense and non-defense programs (excluding Social Security and Medicaid) took effect March 1, 2013, with potential implications for U.S. economic growth over the next decade. In late March 2013, Congress passed legislation that established federal funding levels for the remainder of fiscal 2013, which ends on September 30, 2013, preventing a federal government shutdown. The proposed federal budget for fiscal 2014 remains under debate.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio manager as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Portfolio disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

For the majority of the reporting period, generally improving economic data and diminished systemic risk fears were supportive of risk assets in general and fixed income spread sectors specifically. The pressure to find yield continued to provide strong technical underpinnings to the market as investor flows indicated robust demand for fixed income securities for most of the reporting period. The tide quickly turned in the final month of the reporting period, however, triggered by the Fed Chairman’s comments that the economic outlook had improved enough to warrant a possible “tapering” of the Central Bank’s quantitative easing programs as soon as September of this year, earlier than the market anticipated. In response, Treasury yields rose sharply, while global risk assets including equities, spread products and growth-sensitive currencies sold off significantly. The combination of rising yields and a sell-off in risk assets in June was somewhat unusual; the two have generally been negatively correlated over the past several years. The common thread in the markets appeared to be a general “de-risking” by investors based on concerns about the Central Bank’s withdrawal of policy stimulus.

How did the Portfolio perform during the twelve-month reporting period ended July 31, 2013?

The table in the Performance and Expense Ratios section of this report provides Class I Share total returns for the Portfolio for the one-year, five-year and since inception periods ended July 31, 2013.

What strategies were used to manage the Portfolio during the twelve-month reporting period ended July 31, 2013? How did these strategies influence performance?

The Portfolio’s Class I Share total returns at net asset value (NAV) underperformed the Barclays 7-Year Municipal Bond Index during the twelve-month reporting period ended July 31, 2013.

The Portfolio uses a value-oriented strategy and looks for higher yielding and undervalued municipal bonds that offer the potential for above average total return. The Portfolio invests in various types of municipal securities, including investment grade (rated BBB/Baa or better), below investment grade (rated BB/Ba or lower) and unrated municipal securities. The Portfolio focuses on securities with intermediate to longer-term maturities. This investment strategy did not change during the reporting period.

Due to a sharp increase in municipal interest rates, the Portfolio’s diversified yield curve positioning and longer duration profile were factors that contributed to the relative underperformance versus the benchmark during the period. Throughout the period, we gradually increased our exposure to longer duration securities to utilize a comparatively steep yield curve and sought improved call protection to increase the Portfolio’s income sustainability. As a result, the Portfolio was overweight bonds due twelve years and longer, which underperformed as yields rose and the curve steepened. This was the primarily reason for underperformance during the reporting period.

Also detracting from the Portfolio’s performance was an underweight to pre-refunded bonds compared to the index. This sector performed particularly well in the rising yield environment. As a result, our underweight was a detriment. Finally, the Portfolio, by design, is overweight BBB-rated bonds which underperformed in the rising rate environment.

Selection within the below investment grade, which includes the non-rated bonds category was a positive contributor. These holdings performed better than the index as a whole and the index has a negligible exposure to these rating categories.

Risk Considerations

Mutual fund investing involves risk; principal loss is possible. Debt or fixed income securities such as those held by the Portfolio, are subject to market risk, credit risk, interest rate risk, call risk, tax risk, political and economic risk, and income risk. As interest rates rise, bond prices fall. Credit risk refers to an issuers ability to make interest and principal payments when due. Below investment grade or high yield debt securities are subject to liquidity risk and heightened credit risk. The Portfolio’s potential use of inverse floaters creates effective leverage. Leverage involves the risk that the Portfolio could lose more than its original investment and also increases the Portfolio’s exposure to volatility and interest rate risk.

Dividend Information

The Portfolio seeks to pay dividends at a rate that reflects the past and projected performance of the Portfolio. To permit a Portfolio to maintain a more stable monthly dividend, the Portfolio may pay dividends at a rate that may be more or less than the amount of net investment income actually earned by the Portfolio during the period. If the Portfolio has cumulatively earned more than it has paid in dividends, it will hold the excess in reserve as undistributed net investment income (UNII) as part of the Portfolio’s net asset value. Conversely, if the Portfolio has cumulatively paid in dividends more than it has earned, the excess will constitute a negative UNII that will likewise be reflected in the Portfolio’s net asset value. The Portfolio will, over time, pay all its net investment income as dividends to shareholders. As of July 31, 2013, the Portfolio had a positive UNII balance for tax purposes and a negative UNII balance for financial reporting purposes.

Performance, Expense Ratios and Effective Leverage

This is a specialized municipal bond Portfolio developed exclusively for use within Nuveen-sponsored separately managed accounts.

Returns quoted represent past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Some income may be subject to state and local income taxes and to the federal alternative minimum tax. Capital gains, if any, are subject to tax.

Returns may reflect a contractual agreement between the Portfolio and the investment adviser to waive certain fees and expenses; see Notes to Financial Statements, Note 7 — Management Fees and Other Transactions with Affiliates for more information. In addition, returns may reflect a voluntary expense limitation by the Portfolio’s investment adviser that may be modified or discontinued at any time without notice. For the most recent month-end performance call (800) 257-8787.

Portfolio shares have no sales charge. Portfolio returns assume reinvestment of dividends and capital gains.

The expense ratios shown reflect the Portfolio’s total operating expenses (before fee waivers and/or expense reimbursements) as shown in the Portfolio’s most recent prospectus.

Leverage is created whenever the Portfolio has investment exposure (both reward and/or risk) equivalent to more than 100% of the investment capital. The effective leverage ratio shown is the amount of investment exposure created either through borrowings or indirectly through inverse floaters, divided by the assets invested, including those assets that were purchased with the proceeds of the leverage, or referenced by the levered instrument.

Performance

Average Annual Total Returns as of July 31, 2013

| | | | | | | | | | | | |

| |

| | | Average Annual | |

| | | |

| | | 1-Year | | | 5-Year | | | Since

Inception* | |

Class I Shares | | | -3.54% | | | | 6.31% | | | | 5.48% | |

Barclays 7-Year Municipal Bond Index** | | | -0.69% | | | | 5.41% | | | | 5.42% | |

Average Annual Total Returns as of June 30, 2013 (Most Recent Calendar Quarter)

| | | | | | | | | | | | |

| |

| | | Average Annual | |

| | | |

| | | 1-Year | | | 5-Year | | | Since

Inception* | |

Class I Shares | | | 0.11% | | | | 6.64% | | | | 5.85% | |

Expense Ratios as of Most Recent Prospectus

| | | | | | | | |

| | |

| | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

Class I Shares | | | 0.12% | | | | 0.00% | |

The Portfolio’s investment adviser has agreed irrevocably during the existence of the Portfolio to waive all fees and pay or reimburse all expenses of the Portfolio, except for interest expense, taxes, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses.

Effective Leverage Ratio as of July 31, 2013

| | | | |

Effective Leverage Ratio | | | 9.47% | |

| * | Since inception returns are from 5/31/07. |

| ** | Refer to the Glossary of Terms Used in this Report for definitions. This index is not available for direct investment. |

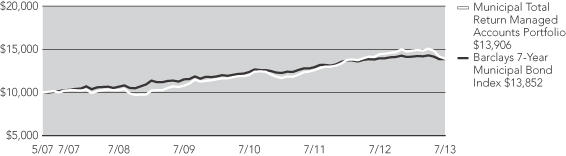

Growth of an Assumed $10,000 Investment as of July 31, 2013 – Class I Shares

The graphs do not reflect the deduction of taxes, such as state and local income taxes or capital gains taxes, that a shareholder may pay on Portfolio distributions or the redemption of Portfolio shares.

Yields as of July 31, 2013

Dividend Yield is the most recent dividend per share (annualized) divided by the offering price per share.

The SEC 30-Day Yield is a standardized measure of the Portfolio’s yield that accounts for the future amortization of premiums or discounts of bonds held in the portfolio of investments. The SEC 30-Day Yield is computed under an SEC standardized formula and is based on the maximum offer price per share. Dividend Yield may differ from the SEC 30-Day Yield because the Portfolio may be paying out more or less than it is earning and it may not include the effect of amortization of bond premium.

The Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Portfolio on an after-tax basis at a specified tax rate. With respect to investments that generate qualified dividend income that is taxable at a maximum rate of 15%, the Taxable-Equivalent Yield is lower.

| | | | | | | | | | | | |

| | | Dividend

Yield | | | SEC 30-Day

Yield | | | Taxable-

Equivalent

Yield1 | |

Class I Shares | | | 4.87% | | | | 4.51% | | | | 6.26% | |

| 1 | The Taxable-Equivalent Yield is based on the Portfolio’s SEC 30-Day Yield on the indicated date and a federal income tax rate of 28%. |

Holding Summaries as of July 31, 2013

This data relates to the securities held in the portfolio of investments. It should not be construed as a measure of performance for the Portfolio itself.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

| | | | |

| Bond Credit Quality1,2,3 | | | |

| AAA/U.S. Guaranteed | | | 7.4% | |

| AA | | | 37.1% | |

| A | | | 18.7% | |

| BBB | | | 22.6% | |

| BB or Lower | | | 5.6% | |

| N/R | | | 4.7% | |

| | | | |

| Portfolio Composition1,4 | | | |

| Education and Civic Organizations | | | 21.8% | |

| Health Care | | | 21.5% | |

| Tax Obligation/General | | | 15.5% | |

| Tax Obligation/Limited | | | 12.9% | |

| Transportation | | | 9.5% | |

| Utilities | | | 5.8% | |

| Water and Sewer | | | 5.6% | |

| Other | | | 7.4% | |

| | | | |

| States1,4 | | | |

| Texas | | | 12.3% | |

| California | | | 8.9% | |

| Illinois | | | 8.0% | |

| Florida | | | 5.7% | |

| New York | | | 4.8% | |

| North Carolina | | | 4.3% | |

| Pennsylvania | | | 3.2% | |

| Arizona | | | 3.1% | |

| Louisiana | | | 3.1% | |

| New Jersey | | | 3.0% | |

| Maryland | | | 3.0% | |

| Colorado | | | 3.0% | |

| Washington | | | 2.8% | |

| Indiana | | | 2.2% | |

| Wisconsin | | | 2.0% | |

| Massachusetts | | | 1.8% | |

| Missouri | | | 1.8% | |

| Virginia | | | 1.8% | |

| Utah | | | 1.7% | |

| Wyoming | | | 1.4% | |

| Oregon | | | 1.3% | |

| South Carolina | | | 1.3% | |

| Georgia | | | 1.3% | |

| Guam | | | 1.2% | |

| Idaho | | | 1.1% | |

| Mississippi | | | 1.1% | |

| Other | | | 14.8% | |

| 1 | Holdings are subject to change. |

| 2 | Percentages will not add to 100% due to the exclusion of “Other Assets Less Liabilities” from the table. |

| 3 | As a percentage of total investment exposure. |

| 4 | As a percentage of total investments. |

Expense Examples

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs, including up-front and back-end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Portfolio expenses. The Example below is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held through the end of the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | Actual Performance | | | Hypothetical Performance

(5% annualized return before expenses) | |

| Beginning Account Value (2/01/13) | | | | | | | | | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value (7/31/13) | | | | | | | | | | $ | 936.20 | | | $ | 1,024.79 | |

| Expenses Incurred During Period | | | | | | | | | | $ | — | | | $ | — | |

Expenses are equal to the Portfolio’s annualized net expense ratio of 0.00% for the six-month period.

Report of

Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of

Nuveen Managed Accounts Portfolios Trust:

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations, of changes in net assets, and the financial highlights present fairly, in all material respects, the financial position of Municipal Total Return Managed Accounts Portfolio (a series of the Nuveen Managed Accounts Portfolios Trust, hereinafter referred to as the “Fund”) at July 31, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at July 31, 2013 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PRICEWATERHOUSECOOPERS LLP

Chicago, IL

September 25, 2013

Portfolio of Investments

Municipal Total Return Managed Accounts Portfolio

July 31, 2013

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | National – 0.5% | | | | | | | | | | | | | | |

| | | | | |

| | | | MuniMae Tax-Exempt Bond Subsidiary Redeemable Preferred Shares, Multifamily Housing Pool: | | | | | | | | | | | | | | |

| $ | 395 | | | 5.000%, 1/31/28 (Mandatory put 1/31/18) (Alternative Minimum Tax) | | | | | 1/18 at 100.00 | | | | Ba1 | | | $ | 392,196 | |

| | 1,000 | | | 5.750%, 6/30/50 (Mandatory put 9/30/19) (Alternative Minimum Tax) | | | | | 11/13 at 100.00 | | | | Ba2 | | | | 992,630 | |

| | 1,395 | | | Total National | | | | | | | | | | | | | 1,384,826 | |

| | | | Alabama – 0.5% | | | | | | | | | | | | | | |

| | | | | |

| | 850 | | | Alabama State Board of Education, Revenue Bonds, Faulkner State Community College, Series 2009, 6.125%, 10/01/28 | | | | | 10/18 at 100.00 | | | | A1 | | | | 967,487 | |

| | | | | |

| | 500 | | | Auburn University, Alabama, General Fee Revenue Bonds, Series 2011A, 5.000%, 6/01/41 | | | | | 6/21 at 100.00 | | | | Aa2 | | | | 518,660 | |

| | 1,350 | | | Total Alabama | | | | | | | | | | | | | 1,486,147 | |

| | | | Alaska – 0.5% | | | | | | | | | | | | | | |

| | | | | |

| | | | Northern Tobacco Securitization Corporation, Alaska, Tobacco Settlement Asset-Backed Bonds, Series 2006A: | | | | | | | | | | | | | | |

| | 670 | | | 4.625%, 6/01/23 | | | | | 6/14 at 100.00 | | | | Ba1 | | | | 609,700 | |

| | 1,385 | | | 5.000%, 6/01/46 | | | | | 6/14 at 100.00 | | | | B+ | | | | 1,015,302 | |

| | 2,055 | | | Total Alaska | | | | | | | | | | | | | 1,625,002 | |

| | | | Arizona – 3.0% | | | | | | | | | | | | | | |

| | | | | |

| | 1,000 | | | Arizona Health Facilities Authority, Hospital Revenue Bonds, Banner Health Systems, Tender Option Bond Trust 3256, 18.060%, 1/01/20 (IF) (5) | | | | | No Opt. Call | | | | AA– | | | | 957,280 | |

| | | | | |

| | | | Arizona Health Facilities Authority, Hospital Revenue Bonds, Phoenix Children’s Hospital, Series 2013D: | | | | | | | | | | | | | | |

| | 1,010 | | | 5.000%, 2/01/28 | | | | | 2/23 at 100.00 | | | | BBB+ | | | | 1,017,222 | |

| | 2,000 | | | 5.000%, 2/01/33 | | | | | 2/23 at 100.00 | | | | BBB+ | | | | 1,947,760 | |

| | | | | |

| | 1,000 | | | Arizona Health Facilities Authority, Hospital System Revenue Bonds, Phoenix Children’s Hospital, Refunding Series 2012A, 5.000%, 2/01/19 | | | | | No Opt. Call | | | | BBB+ | | | | 1,125,480 | |

| | | | | |

| | 300 | | | Arizona State, Certificates of Participation, Series 2010A,

5.000%, 10/01/27 – AGM Insured | | | | | 10/19 at 100.00 | | | | AA– | | | | 317,328 | |

| | | | | |

| | 1,195 | | | Maricopa County, Arizona, Hospital Revenue Bonds, Sun Health Corporation, Series 2005, 5.000%, 4/01/25 (Pre-refunded 4/01/24) | | | | | 4/24 at 100.00 | | | | N/R (4) | | | | 1,379,974 | |

| | | | | |

| | 900 | | | Pima County Industrial Development Authority, Arizona, Charter School Revenue Bonds, Cambridge Academy-East, Inc. Project, Series 2010, 5.875%, 4/01/22 | | | | | 4/20 at 100.00 | | | | BB– | | | | 890,604 | |

| | | | | |

| | 500 | | | Salt River Project Agricultural Improvement and Power District, Arizona, Electric System Revenue Bonds, Tender Option Bond Trust 10-9W, 17.590%, 1/01/38 (IF) (5) | | | | | 1/18 at 100.00 | | | | Aa1 | | | | 556,600 | |

| | | | | |

| | 450 | | | Yavapai County Industrial Development Authority, Arizona, Education Revenue Bonds, Arizona Agribusiness and Equine Center Charter Schools, Series 2012, 4.625%, 3/01/22 | | | | | No Opt. Call | | | | BB+ | | | | 425,241 | |

| | | | | |

| | 345 | | | Yavapai County Industrial Development Authority, Arizona, Charter School Revenue Bonds, Arizona Agribusiness and Equine Center Charter School, Series 2011, 7.625%, 3/01/31 | | | | | 3/21 at 100.00 | | | | BB+ | | | | 374,739 | |

| | | | | |

| | 65 | | | Yuma County Industrial Development Authority, Arizona, Exempt Revenue Bonds, Far West Water & Sewer Inc. Refunding, Series 2007A, 6.500%, 12/01/17 (Alternative Minimum Tax) | | | | | No Opt. Call | | | | N/R | | | | 57,818 | |

| | 8,765 | | | Total Arizona | | | | | | | | | | | | | 9,050,046 | |

| | | | Arkansas – 0.6% | | | | | | | | | | | | | | |

| | | | | |

| | 1,000 | | | Boone County, Arkansas, Hospital Revenue Refunding Bonds, North Arkansas Regional Medical Center Project, Series 2013, 4.500%, 5/01/33 | | | | | 5/20 at 100.00 | | | | N/R | | | | 825,680 | |

| | | | | |

| | 1,100 | | | Conway Health Facilities Board, Arkansas, Hospital Revenue Bond, Conway Regional Medical Center, Improvement Series 2012, 4.450%, 8/01/32 | | | | | 8/22 at 100.00 | | | | BBB+ | | | | 965,965 | |

| | 2,100 | | | Total Arkansas | | | | | | | | | | | | | 1,791,645 | |

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | California – 8.6% | | | | | | | | | | | | | | |

| | | | | |

| $ | 500 | | | ABAG Finance Authority for Non-Profit Corporations, California, Revenue Bonds, Casa de Lad Campanas, Series 2010, 6.000%, 9/01/37 | | | | | 9/20 at 100.00 | | | | A | | | $ | 536,420 | |

| | | | | |

| | 700 | | | Anaheim Public Finance Authority, California, Electric Distribution Revenue Bonds, Series 1999, 5.000%, 10/01/25 – AMBAC Insured | | | | | 10/15 at 100.00 | | | | N/R | | | | 715,043 | |

| | | | | |

| | 655 | | | California Educational Facilities Authority, Revenue Bonds, Stanford University, Series 2013-U3, 5.000%, 6/01/43 | | | | | No Opt. Call | | | | AAA | | | | 750,342 | |

| | | | | |

| | 500 | | | California Educational Facilities Authority, Revenue Bonds, University of Southern California, Tender Option Bond Trust 3144,

19.602%, 10/01/16 (IF) | | | | | No Opt. Call | | | | Aa1 | | | | 630,420 | |

| | | | | |

| | 1,000 | | | California Health Facilities Financing Authority, Revenue Bonds, Catholic Healthcare West, Series 2009F, 5.625%, 7/01/25 | | | | | 7/19 at 100.00 | | | | A | | | | 1,087,300 | |

| | | | | |

| | 295 | | | California Municipal Finance Authority, Charter School Revenue Bonds, Partnerships to Uplift Communities Project, Series 2012A, 4.750%, 8/01/22 | | | | | No Opt. Call | | | | BB+ | | | | 285,348 | |

| | | | | |

| | 1,300 | | | California Municipal Finance Authority, Revenue Bonds, Eisenhower Medical Center, Series 2010A, 5.500%, 7/01/30 | | | | | 7/20 at 100.00 | | | | Baa2 | | | | 1,310,712 | |

| | | | | |

| | 755 | | | California School Finance Authority, Charter School Revenue Bonds, Coastal Academy Project, Series 2013A, 5.000%, 10/01/33 | | | | | 10/22 at 100.00 | | | | BBB– | | | | 704,060 | |

| | | | | |

| | 1,155 | | | California School Finance Authority, Educational Facility Revenue Bonds, New Designs Charter School Project, Series 2012C, 4.250%, 6/01/17 | | | | | No Opt. Call | | | | BBB– | | | | 1,158,996 | |

| | | | | |

| | 575 | | | California State Public Works Board, Lease Revenue Bonds, Department of Corrections & Rehabilitation, Series 2009H, 5.500%, 11/01/27 | | | | | 11/19 at 100.00 | | | | A2 | | | | 628,774 | |

| | | | | |

| | 450 | | | California State, General Obligation Bonds, Refunding Various Purpose Series 2012B, 0.950%, 5/01/18 | | | | | 11/17 at 100.00 | | | | A1 | | | | 452,718 | |

| | | | | |

| | 1,000 | | | California State, General Obligation Bonds, Various Purpose Series 2009, 6.500%, 4/01/33 | | | | | 4/19 at 100.00 | | | | A1 | | | | 1,171,990 | |

| | | | | |

| | 45 | | | California State, General Obligation Veterans Bonds, Refunding Series 2005CB, 5.050%, 12/01/36 (Alternative Minimum Tax) | | | | | 6/15 at 100.00 | | | | AA | | | | 43,618 | |

| | | | | |

| | 695 | | | California, Various Purpose General Obligation Bonds, Series 1997, 5.625%, 10/01/21 | | | | | 10/13 at 100.00 | | | | AA+ | | | | 701,060 | |

| | | | | |

| | 405 | | | Compton Unified School District, Los Angeles County, California, General Obligation Bonds, 2002 Election, Refunding Series 2006D, 0.000%, 6/01/22 – AMBAC Insured | | | | | No Opt. Call | | | | Aa3 | | | | 264,469 | |

| | | | | |

| | 1,000 | | | Culver City Redevelopment Agency, California, Tax Allocation Revenue Bonds, Redevelopment Project, Capital Appreciation Series 2011A, 0.000%, 11/01/21 | | | | | No Opt. Call | | | | A | | | | 682,990 | |

| | | | | |

| | 1,000 | | | Gilroy Unified School District, Santa Clara County, California, General Obligation Bonds, Series 2009A, 6.000%, 8/01/25 – AGC Insured | | | | | 8/19 at 100.00 | | | | AA– | | | | 1,206,330 | |

| | | | | |

| | | | Golden State Tobacco Securitization Corporation, California, Enhanced Tobacco Settlement Asset-Backed Revenue Bonds, Series 2005A: | | | | | | | | | | | | | | |

| | 30 | | | 4.625%, 6/01/45 | | | | | 6/15 at 100.00 | | | | A2 | | | | 26,816 | |

| | 135 | | | 4.625%, 6/01/45 – RAAI Insured | | | | | 6/15 at 100.00 | | | | A2 | | | | 120,670 | |

| | 200 | | | 5.000%, 6/01/45 | | | | | 6/15 at 100.00 | | | | A2 | | | | 190,216 | |

| | 130 | | | 5.000%, 6/01/45 – AMBAC Insured | | | | | 6/15 at 100.00 | | | | A2 | | | | 123,640 | |

| | | | | |

| | 215 | | | Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed Bonds, Series 2007A-1, 5.000%, 6/01/33 | | | | | 6/17 at 100.00 | | | | B | | | | 175,191 | |

| | | | | |

| | | | Independent Cities Finance Authority, California, Mobile Home Park Revenue Bonds, Rancho Vallecitos Mobile Home Park, Series 2013: | | | | | | | | | | | | | | |

| | 385 | | | 4.500%, 4/15/24 | | | | | 4/23 at 100.00 | | | | BBB | | | | 380,149 | |

| | 400 | | | 4.500%, 4/15/25 | | | | | 4/23 at 100.00 | | | | BBB | | | | 387,580 | |

| | 870 | | | 4.500%, 4/15/27 | | | | | 4/23 at 100.00 | | | | BBB | | | | 823,847 | |

| | | | | |

| | 50 | | | Long Beach Bond Finance Authority, California, Natural Gas Purchase Revenue Bonds, Series 2007A, 5.000%, 11/15/35 | | | | | No Opt. Call | | | | A | | | | 48,477 | |

| | | | | |

| | 1,000 | | | Los Angeles Department of Airports, California, Revenue Bonds, Los Angeles International Airport, Series 2009A, 5.250%, 5/15/29 | | | | | 5/19 at 100.00 | | | | AA | | | | 1,086,890 | |

Portfolio of Investments

Municipal Total Return Managed Accounts Portfolio (continued)

July 31, 2013

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | California (continued) | | | | | | | | | | | | | | |

| | | | | |

| $ | 500 | | | Los Angeles Department of Water and Power, California, Power System Revenue Bonds, Series 2008A-2, 5.250%, 7/01/32 | | | | | 7/18 at 100.00 | | | | AA– | | | $ | 538,820 | |

| | | | | |

| | 750 | | | Los Angeles Regional Airports Improvement Corporation, California, Lease Revenue Refunding Bonds, LAXFUEL Corporation at Los Angeles International Airport, Series 2012, 5.000%, 1/01/22 (Alternative Minimum Tax) | | | | | No Opt. Call | | | | A | | | | 821,078 | |

| | | | | |

| | 1,000 | | | Metropolitan Water District of Southern California, Water Revenue Refunding Bonds, Series 2012B-1, 0.400%, 7/01/27 | | | | | 11/14 at 100.00 | | | | AAA | | | | 999,940 | |

| | | | | |

| | 85 | | | Novato Redevelopment Agency, California, Tax Allocation Bonds, Hamilton Field Redevelopment Project, Series 2011, 6.750%, 9/01/40 | | | | | 9/21 at 100.00 | | | | BBB+ | | | | 91,537 | |

| | | | | |

| | 1,000 | | | Palm Drive Health Care District, Sonoma County, California, Certificates of Participation, Parcel Tax Secured Financing Program, Series 2010, 7.500%, 4/01/35 | | | | | 10/13 at 102.00 | | | | BB | | | | 1,019,840 | |

| | | | | |

| | 2,000 | | | San Francisco Airports Commission, California, Revenue Refunding Bonds, San Francisco International Airport, Second Series 2009D, 3.500%, 5/01/28 | | | | | No Opt. Call | | | | A+ | | | | 1,810,160 | |

| | | | | |

| | 850 | | | San Francisco City and County Public Utilities Commission, California, Water Revenue Bonds, Series 2006A, 5.000%, 11/01/25 – AGM Insured | | | | | 5/16 at 100.00 | | | | AA– | | | | 932,306 | |

| | | | | |

| | 1,925 | | | Santa Clarita Community College District, California, General Obligation Bonds, Series 2013, 3.000%, 8/01/27 | | | | | 8/23 at 100.00 | | | | AA | | | | 1,651,361 | |

| | | | | |

| | 25 | | | Stockton Unified School District, San Joaquin County, California, General Obligation Bonds, Election 2008 Series 2008A, 4.000%, 8/01/15 – AGM Insured | | | | | No Opt. Call | | | | AA– | | | | 26,400 | |

| | | | | |

| | | | Stockton Unified School District, San Joaquin County, California, General Obligation Bonds, Series 2006: | | | | | | | | | | | | | | |

| | 300 | | | 4.250%, 9/01/24 – FGIC Insured | | | | | 9/15 at 100.00 | | | | A | | | | 303,120 | |

| | 50 | | | 4.250%, 9/01/26 – FGIC Insured | | | | | 9/15 at 100.00 | | | | A | | | | 50,086 | |

| | | | | |

| | 500 | | | Twentynine Palms Redevelopment Agency, California, Tax Allocation Bonds, Four Corners Project Area, Series 2011A, 7.400%, 9/01/32 | | | | | 9/21 at 100.00 | | | | BBB+ | | | | 550,500 | |

| | | | | |

| | 750 | | | University of California, Hospital Revenue Bonds, UCLA Medical Center, Series 2004A, 5.250%, 5/15/30 – AMBAC Insured | | | | | 9/13 at 100.00 | | | | N/R | | | | 756,128 | |

| | | | | |

| | 750 | | | Western Municipal Water District Facilities Authority, California, Water Revenue Bonds, Series 2009B, 5.000%, 10/01/34 | | | | | 10/19 at 100.00 | | | | AA+ | | | | 781,020 | |

| | 25,930 | | | Total California | | | | | | | | | | | | | 26,026,362 | |

| | | | Colorado – 2.9% | | | | | | | | | | | | | | |

| | | | | |

| | 1,605 | | | Arapahoe County Water and Wastewater Public Improvement District, Colorado, General Obligation Bonds, Refunding Series 2012, 3.000%, 12/01/29 | | | | | 12/22 at 100.00 | | | | AA– | | | | 1,297,819 | |

| | | | | |

| | 1,845 | | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, National Jewish Medical and Research Center, Series 2012, 5.000%, 1/01/20 | | | | | No Opt. Call | | | | BBB– | | | | 1,991,216 | |

| | | | | |

| | 500 | | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Valley View Hospital Association, Series 2008, 5.750%, 5/15/36 | | | | | 5/18 at 100.00 | | | | BBB+ | | | | 512,225 | |

| | | | | |

| | 1,635 | | | Colorado Health Facilities Authority, Revenue Bonds, Craig Hospital Project, Series 2012, 5.000%, 12/01/28 (UB) (5) | | | | | No Opt. Call | | | | A– | | | | 1,690,966 | |

| | | | | |

| | 280 | | | Denver City and County, Colorado, Airport System Revenue Bonds, Series 1991D, 7.750%, 11/15/13 – AMBAC Insured | | | | | No Opt. Call | | | | A+ | | | | 285,684 | |

| | | | | |

| | 300 | | | E-470 Public Highway Authority, Colorado, Senior Revenue Bonds, Series 2007B-1, 5.500%, 9/01/24 – NPFG Insured | | | | | 9/15 at 100.00 | | | | A | | | | 319,656 | |

| | | | | |

| | 535 | | | Fitzsimons Village Metropolitan District 1, Aurora, Arapahoe County, Colorado, Tax Increment Public Improvement Fee Supported Revenue Bonds, Series 2010A, 7.500%, 3/01/40 | | | | | 3/20 at 100.00 | | | | N/R | | | | 548,873 | |

| | | | | |

| | 500 | | | Fossil Ridge Metropolitan District 1, Lakewood, Colorado, Tax-Supported Revenue Bonds, Refunding Series 2010, 7.250%, 12/01/40 | | | | | 12/20 at 100.00 | | | | N/R | | | | 502,690 | |

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | Colorado (continued) | | | | | | | | | | | | | | |

| | | | | |

| $ | 1,000 | | | Regional Transportation District, Colorado, Denver Transit Partners Eagle P3 Project Private Activity Bonds, Series 2010, 6.500%, 1/15/30 | | | | | 7/20 at 100.00 | | | | Baa3 | | | $ | 1,114,500 | |

| | | | | |

| | 500 | | | Three Springs Metropolitan District 3, Durango, La Plata County, Colorado, Property Tax Supported Revenue Bonds, Series 2010, 7.750%, 12/01/39 | | | | | 12/20 at 100.00 | | | | N/R | | | | 500,000 | |

| | 8,700 | | | Total Colorado | | | | | | | | | | | | | 8,763,629 | |

| | | | Connecticut – 0.3% | | | | | | | | | | | | | | |

| | | | | |

| | 670 | | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Yale University, Series 2009, Trust 3363, 13.652%, 7/01/15 (IF) | | | | | No Opt. Call | | | | AAA | | | | 775,679 | |

| | | | Delaware – 0.5% | | | | | | | | | | | | | | |

| | | | | |

| | 1,440 | | | Delaware Economic Development Authority, Revenue Bonds, Newark Charter School, Series 2012, 3.875%, 9/01/22 | | | | | 3/22 at 100.00 | | | | BBB | | | | 1,407,931 | |

| | | | District of Columbia – 0.3% | | | | | | | | | | | | | | |

| | | | | |

| | 450 | | | District of Columbia Tobacco Settlement Corporation, Tobacco Settlement Asset-Backed Bonds, Series 2001, 6.750%, 5/15/40 | | | | | 11/13 at 100.00 | | | | Baa1 | | | | 455,625 | |

| | | | | |

| | 575 | | | District of Columbia, Revenue Bonds, Association of American Medical Colleges, Series 2011A, 5.000%, 10/01/30 | | | | | 10/23 at 100.00 | | | | A+ | | | | 590,652 | |

| | 1,025 | | | Total District of Columbia | | | | | | | | | | | | | 1,046,277 | |

| | | | Florida – 5.5% | | | | | | | | | | | | | | |

| | | | | |

| | | | Atlantic Beach, Florida, Healthcare Facilities Revenue Refunding Bonds, Fleet Landing Project, Series 2013A: | | | | | | | | | | | | | | |

| | 185 | | | 5.000%, 11/15/20 | | | | | No Opt. Call | | | | BBB | | | | 203,426 | |

| | 250 | | | 5.000%, 11/15/21 | | | | | No Opt. Call | | | | BBB | | | | 271,310 | |

| | | | | |

| | 1,440 | | | Bay County, Florida, Educational Facilities Revenue Refunding Bonds, Bay Haven Charter Academy, Inc. Project, Series 2010A, 5.250%, 9/01/30 | | | | | 9/20 at 100.00 | | | | BBB– | | | | 1,332,734 | |

| | | | | |

| | 750 | | | Bay County, Florida, Educational Facilities Revenue Refunding Bonds, Bay Haven Charter Academy, Inc. Project, Series 2013A, 5.000%, 9/01/33 | | | | | 9/23 at 100.00 | | | | BBB– | | | | 663,893 | |

| | | | | |

| | | | Broward County, Florida, Port Facilities Revenue Bonds, Refunding Series 2011B: | | | | | | | | | | | | | | |

| | 1,000 | | | 5.000%, 9/01/23 – AGM Insured (Alternative Minimum Tax) | | | | | 9/21 at 100.00 | | | | AA– | | | | 1,104,290 | |

| | 1,130 | | | 4.625%, 9/01/27 – AGM Insured (Alternative Minimum Tax) | | | | | 9/21 at 100.00 | | | | AA– | | | | 1,108,372 | |

| | | | | |

| | | | Broward County, Florida, Fuel System Revenue Bonds, Fort Lauderdale Fuel Facilities LLC Project, Series 2013A: | | | | | | | | | | | | | | |

| | 700 | | | 5.000%, 4/01/25 – AGM Insured (Alternative Minimum Tax) | | | | | 4/23 at 100.00 | | | | AA– | | | | 739,956 | |

| | 475 | | | 5.000%, 4/01/38 – AGM Insured (Alternative Minimum Tax) | | | | | 4/23 at 100.00 | | | | AA– | | | | 458,646 | |

| | | | | |

| | 230 | | | Florida Housing Finance Corporation, Homeowner Mortgage Revenue Bonds, Series 2008-1, 6.450%, 1/01/39 (Alternative Minimum Tax) | | | | | 7/17 at 100.00 | | | | AA+ | | | | 253,076 | |

| | | | | |

| | 2,000 | | | Florida Ports Financing Commission, Revenue Bonds, State Transportation Trust Fund, Refunding Series 2011B, 5.125%, 6/01/27 (Alternative Minimum Tax) | | | | | 6/21 at 100.00 | | | | AA+ | | | | 2,144,360 | |

| | | | | |

| | 885 | | | Gulf Breeze, Florida, Revenue Improvement Non-Ad Valorem Bonds, Series 2007, 5.000%, 12/01/32 – AMBAC Insured | | | | | 12/17 at 100.00 | | | | N/R | | | | 842,777 | |

| | | | | |

| | 625 | | | Jacksonville Port Authority, Florida, Revenue Bonds, Refunding Series 2012, 4.500%, 11/01/32 (Alternative Minimum Tax) | | | | | 11/22 at 100.00 | | | | A2 | | | | 564,381 | |

| | | | | |

| | 2,000 | | | Hillsborough County, Florida, Solid Waste and Resource Recovery Revenue Bonds, Series 2006A, 5.000%, 9/01/25 – AMBAC Insured (Alternative Minimum Tax) | | | | | 9/16 at 100.00 | | | | AA | | | | 2,079,600 | |

| | | | | |

| | 2,000 | | | Lee County Industrial Development Authority, Florida, Charter School Revenue Bonds, Lee County Community Charter Schools, Series 2012A, 5.000%, 6/15/24 | | | | | 6/22 at 100.00 | | | | BB | | | | 1,936,320 | |

| | | | | |

| | 1,000 | | | Miami-Dade County Health Facility Authority, Florida, Hospital Revenue Bonds, Miami Children’s Hospital, Series 2010A, 5.250%, 8/01/21 | | | | | 8/20 at 100.00 | | | | A | | | | 1,112,470 | |

| | | | | |

| | 500 | | | Miami-Dade County School Board, Florida, Certificates of Participation, Series 2008B, 5.250%, 5/01/31 – AGC Insured | | | | | 5/18 at 100.00 | | | | AA– | | | | 525,460 | |

Portfolio of Investments

Municipal Total Return Managed Accounts Portfolio (continued)

July 31, 2013

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | Florida (continued) | | | | | | | | | | | | | | |

| | | | | |

| $ | 1,030 | | | Orange County Health Facilities Authority, Florida, Hospital Revenue Bonds, Orlando Health, Inc., Series 2012B, 4.000%, 10/01/42 | | | | | 4/22 at 100.00 | | | | A | | | $ | 935,147 | |

| | | | | |

| | 400 | | | Sanibel, Florida, General Obligation Bonds, Series 2006, 4.350%, 2/01/36 – AMBAC Insured | | | | | 8/16 at 100.00 | | | | N/R | | | | 378,876 | |

| | | | | |

| | 110 | | | The City of Miami, Florida, Special Revenue Refunding Bonds, Series 1987, 0.000%, 1/01/15 – NPFG Insured | | | | | No Opt. Call | | | | A | | | | 105,170 | |

| | | | | |

| | 5 | | | Tolomato Community Development District, Florida, Special Assessment Bonds, Convertible, Capital Appreciation, Series 2012A-2, 0.000%, 5/01/39 | | | | | 5/17 at 100.00 | | | | N/R | | | | 3,705 | |

| | | | | |

| | 15 | | | Tolomato Community Development District, Florida, Special Assessment Bonds, Convertible, Capital Appreciation, Series 2012A-3, 0.000%, 5/01/40 | | | | | 5/19 at 100.00 | | | | N/R | | | | 9,069 | |

| | | | | |

| | 10 | | | Tolomato Community Development District, Florida, Special Assessment Bonds, Convertible, Capital Appreciation, Series 2012A-4,

0.000%, 5/01/40 | | | | | 5/22 at 100.00 | | | | N/R | | | | 4,484 | |

| | | | | |

| | 5 | | | Tolomato Community Development District, Florida, Special Assessment Bonds, Hope Note, Series 2007-3, 6.375%, 5/01/17 (6) | | | | | No Opt. Call | | | | N/R | | | | — | |

| | | | | |

| | 5 | | | Tolomato Community Development District, Florida, Special Assessment Bonds, Non Performing Parcel Series 2007-1. RMKT, 6.375%, 5/01/17 (6) | | | | | No Opt. Call | | | | N/R | | | | 3,733 | |

| | | | | |

| | 15 | | | Tolomato Community Development District, Florida, Special Assessment Bonds, Refunding Series 2012A-1, 6.375%, 5/01/17 | | | | | No Opt. Call | | | | N/R | | | | 14,377 | |

| | | | | |

| | 35 | | | Tolomato Community Development District, Florida, Special Assessment Bonds, Southern/Forbearance Parcel Series 2007-2, 6.375%, 5/01/17 (6) | | | | | No Opt. Call | | | | N/R | | | | 14,344 | |

| | 16,800 | | | Total Florida | | | | | | | | | | | | | 16,809,976 | |

| | | | Georgia – 1.2% | | | | | | | | | | | | | | |

| | | | | |

| | 1,155 | | | Athens-Clarke County Unified Government Development Authority, Georgia, Revenue Bonds, University of Georgia Athletic Association Project, Series 2011, 5.250%, 7/01/28 | | | | | 7/21 at 100.00 | | | | Aa3 | | | | 1,240,747 | |

| | | | | |

| | 650 | | | Atlanta Development Authority, Georgia, Educational Facilities Revenue Bonds, Science Park LLC Project, Series 2007, 5.250%, 7/01/27 | | | | | 7/17 at 100.00 | | | | Aa3 | | | | 693,778 | |

| | | | | |

| | 500 | | | La Grange-Troup County Hospital Authority, Georgia, Revenue Anticipation Certificates, Series 2008A, 5.500%, 7/01/38 | | | | | 7/18 at 100.00 | | | | Aa2 | | | | 523,610 | |

| | | | | |

| | 750 | | | Private Colleges and Universities Authority, Georgia, Revenue Bonds, Emory University, Series 2008C, 5.000%, 9/01/38 | | | | | 9/18 at 100.00 | | | | AA+ | | | | 766,125 | |

| | | | | |

| | 530 | | | Tift County Hospital Authority, Georgia, Revenue Anticipation Certificates Series 2012, 5.000%, 12/01/38 | | | | | No Opt. Call | | | | AA– | | | | 529,963 | |

| | 3,585 | | | Total Georgia | | | | | | | | | | | | | 3,754,223 | |

| | | | Guam – 1.2% | | | | | | | | | | | | | | |

| | | | | |

| | 1,000 | | | Guam Government Waterworks Authority, Water and Wastewater System Revenue Bonds, Series 2010, 4.500%, 7/01/18 | | | | | No Opt. Call | | | | Ba2 | | | | 991,060 | |

| | | | | |

| | | | Guam Government, General Obligation Bonds, 2009 Series A: | | | | | | | | | | | | | | |

| | 215 | | | 5.750%, 11/15/14 | | | | | No Opt. Call | | | | B+ | | | | 219,257 | |

| | 1,515 | | | 6.000%, 11/15/19 | | | | | No Opt. Call | | | | B+ | | | | 1,567,677 | |

| | | | | |

| | 500 | | | Guam International Airport Authority, Revenue Bonds, Series 2003C, 5.375%, 10/01/19 – NPFG Insured (Alternative Minimum Tax) | | | | | 10/13 at 100.00 | | | | A | | | | 501,475 | |

| | | | | |

| | 235 | | | Guam Power Authority, Revenue Bonds, Series 2012A, 5.000%, 10/01/34 | | | | | 10/22 at 100.00 | | | | BBB | | | | 228,115 | |

| | 3,465 | | | Total Guam | | | | | | | | | | | | | 3,507,584 | |

| | | | Hawaii – 0.7% | | | | | | | | | | | | | | |

| | | | | |

| | 600 | | | Hawaii Department of Budget and Finance, Special Purpose Revenue Bonds, Hawaii Pacific University, Series 2013A, 6.250%, 7/01/27 | | | | | 7/23 at 100.00 | | | | N/R | | | | 596,658 | |

| | | | | |

| | 1,500 | | | Hawaii Department of Budget and Finance, Special Purpose Revenue Bonds, Hawaiian Electric Company Inc., Refunding Series 2007B, 4.600%, 5/01/26 – FGIC Insured (Alternative Minimum Tax) | | | | | 3/17 at 100.00 | | | | Baa1 | | | | 1,445,190 | |

| | 2,100 | | | Total Hawaii | | | | | | | | | | | | | 2,041,848 | |

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | Idaho – 1.1% | | | | | | | | | | | | | | |

| | | | | |

| $ | 750 | | | Boise-Kuna Irrigation District, Ada and Canyon Counties, Idaho, Arrowrock Hydroelectric Project Revenue Bonds, Series 2008, 7.375%, 6/01/34 | | | | | 6/18 at 100.00 | | | | A3 | | | $ | 828,278 | |

| | | | | |

| | 1,000 | | | Idaho Housing and Finance Association, Economic Development Facilities Recovery Zone Revenue Bonds, TDF Facilities Project, Series 2010A, 6.500%, 2/01/26 | | | | | 2/21 at 100.00 | | | | A | | | | 1,066,790 | |

| | | | | |

| | 15 | | | Idaho Housing and Finance Association, Single Family Mortgage Revenue Bonds, Series 2008A-1, 6.250%, 7/01/38 (Alternative Minimum Tax) | | | | | 1/17 at 100.00 | | | | AAA | | | | 15,185 | |

| | | | | |

| | | | Idaho Water Resource Board, Water Resource Loan Program Revenue, Ground Water Rights Mitigation Series 2012A: | | | | | | | | | | | | | | |

| | 430 | | | 4.750%, 9/01/25 | | | | | 9/22 at 100.00 | | | | Baa1 | | | | 432,503 | |

| | 1,070 | | | 4.600%, 9/01/27 | | | | | 9/22 at 100.00 | | | | Baa1 | | | | 1,023,166 | |

| | 3,265 | | | Total Idaho | | | | | | | | | | | | | 3,365,922 | |

| | | | Illinois – 7.7% | | | | | | | | | | | | | | |

| | | | | |

| | 1,000 | | | Berwyn, Illinois, General Obligation Bonds, Refunding Series 2004, 5.000%, 12/01/13 – AMBAC Insured | | | | | No Opt. Call | | | | N/R | | | | 1,012,950 | |

| | | | | |

| | 1,000 | | | Bourbonnais, Illinois, Industrial Project Revenue Bonds, Olivet Nazarene University Project, Series 2010, 6.000%, 11/01/35 | | | | | 11/20 at 100.00 | | | | BBB | | | | 1,045,870 | |

| | | | | |

| | 1,500 | | | Bourbonnais, Illinois, Industrial Project Revenue Bonds, Olivet Nazarene University Project, Series 2013, 5.500%, 11/01/42 | | | | | 5/23 at 100.00 | | | | BBB | | | | 1,447,395 | |

| | | | | |

| | 750 | | | Chicago, Illinois, General Airport Revenue Bonds, O’Hare International Airport, Senior Lien Refunding Series 2012A, 4.000%, 1/01/32 (Alternative Minimum Tax) | | | | | 1/22 at 100.00 | | | | A2 | | | | 646,545 | |

| | | | | |

| | 2,395 | | | Cook County Forest Preserve District, Illinois, General Obligation Bonds, Limited Tax Project & Refunding Series 2012B, 5.000%, 12/15/32 | | | | | 6/22 at 100.00 | | | | AA | | | | 2,476,358 | |

| | | | | |

| | 500 | | | Cook County, Illinois, Recovery Zone Facility Revenue Bonds, Navistar International Corporation Project, Series 2010, 6.500%, 10/15/40 | | | | | 10/20 at 100.00 | | | | B3 | | | | 513,220 | |

| | | | | |

| | 1,000 | | | Illinois Finance Authority, Charter School Revenue Bonds, Uno Charter School Network, Refunding and Improvement Series 2011A, 6.875%, 10/01/31 | | | | | 10/21 at 100.00 | | | | BBB– | | | | 1,110,740 | |

| | | | | |

| | 360 | | | Illinois Finance Authority, Revenue Bonds, Centegra Health System, Tender Option Bond Trust 1122, 17.071%, 9/01/32 (IF) (5) | | | | | 9/22 at 100.00 | | | | A– | | | | 340,049 | |

| | | | | |

| | 750 | | | Illinois Finance Authority, Revenue Bonds, Children’s Memorial Hospital, Series 2008B, 5.500%, 8/15/21 | | | | | 8/18 at 100.00 | | | | AA– | | | | 824,430 | |

| | | | | |

| | 650 | | | Illinois Finance Authority, Revenue Bonds, Elmhurst Memorial Healthcare, Series 2008A, 5.625%, 1/01/37 | | | | | 1/18 at 100.00 | | | | Baa2 | | | | 681,090 | |

| | | | | |

| | 960 | | | Illinois Finance Authority, Revenue Bonds, OSF Healthcare System, Refunding Series 2010A, 6.000%, 5/15/39 | | | | | 5/20 at 100.00 | | | | A | | | | 1,036,080 | |

| | | | | |

| | 150 | | | Illinois Finance Authority, Revenue Bonds, Palos Community Hospital, Series 2007A, 5.000%, 5/15/35 – NPFG Insured | | | | | 5/17 at 100.00 | | | | AA– | | | | 148,320 | |

| | | | | |

| | 1,205 | | | Illinois Finance Authority, Revenue Bonds, Riverside Health System, Series 2013, 5.000%, 11/15/29 | | | | | 11/22 at 100.00 | | | | A+ | | | | 1,223,256 | |

| | | | | |

| | 700 | | | Illinois Finance Authority, Revenue Refunding Bonds, Silver Cross Hospital and Medical Centers, Series 2008A, 6.000%, 8/15/23 | | | | | 8/18 at 100.00 | | | | BBB+ | | | | 765,184 | |

| | | | | |

| | 25 | | | Illinois Health Facilities Authority, Revenue Bonds, Silver Cross Hospital and Medical Centers, Series 1999, 5.500%, 8/15/19 | | | | | 10/13 at 100.00 | | | | BBB– | | | | 25,038 | |

| | | | | |

| | 665 | | | Illinois Health Facilities Authority, Revenue Refunding Bonds, Elmhurst Memorial Healthcare, Series 2002, 6.250%, 1/01/17 | | | | | 10/13 at 100.00 | | | | Baa2 | | | | 667,653 | |

| | | | | |

| | 420 | | | Illinois Toll Highway Authority, Toll Highway Revenue Bonds, Tender Option Bond Trust 4304, 18.067%, 1/01/21 (IF) (5) | | | | | No Opt. Call | | | | AA– | | | | 443,881 | |

| | | | | |

| | | | Quad Cities Regional Economic Development Authority, Illinois, Revenue Bonds, Augustana College, Series 2012: | | | | | | | | | | | | | | |

| | 400 | | | 4.000%, 10/01/19 | | | | | No Opt. Call | | | | Baa1 | | | | 422,988 | |

| | 170 | | | 4.000%, 10/01/22 | | | | | No Opt. Call | | | | Baa1 | | | | 172,934 | |

Portfolio of Investments

Municipal Total Return Managed Accounts Portfolio (continued)

July 31, 2013

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | Illinois (continued) | | | | | | | | | | | | | | |

| | | | | |

| $ | 230 | | | Regional Transportation Authority, Cook, DuPage, Kane, Lake, McHenry and Will Counties, Illinois, General Obligation Bonds, Series 1991, 6.700%, 11/01/21 – FGIC Insured | | | | | No Opt. Call | | | | AA | | | $ | 268,537 | |

| | | | | |

| | 3,100 | | | Regional Transportation Authority, Cook, DuPage, Kane, Lake, McHenry and Will Counties, Illinois, General Obligation Bonds, Series 2002A, 6.000%, 7/01/29 – NPFG Insured | | | | | No Opt. Call | | | | AA | | | | 3,605,021 | |

| | | | | |

| | 2,050 | | | Saint Charles, Illinois, General Obligation Bonds, Series 2012A, 3.250%, 12/01/32 | | | | | 12/22 at 100.00 | | | | Aa1 | | | | 1,622,042 | |

| | | | | |

| | 750 | | | Southwestern Illinois Development Authority, Local Government Program Bonds, St. Clair County Community Unit School District 19 Mascoutah, Series 2009, 5.750%, 2/01/29 – AGC Insured | | | | | 2/19 at 100.00 | | | | AA– | | | | 849,630 | |

| | | | | |

| | | | St Clair County, Illinois, Highway Revenue Bonds, Series 2013A: | | | | | | | | | | | | | | |

| | 1,500 | | | 4.250%, 1/01/38 | | | | | 1/23 at 100.00 | | | | AA– | | | | 1,278,315 | |

| | 825 | | | 5.500%, 1/01/38 | | | | | 1/23 at 100.00 | | | | AA– | | | | 832,194 | |

| | 23,055 | | | Total Illinois | | | | | | | | | | | | | 23,459,720 | |

| | | | Indiana – 2.1% | | | | | | | | | | | | | | |

| | | | | |

| | 750 | | | Columbus, Indiana, General Obligation Bonds, Series 2009, 4.500%, 7/15/23 | | | | | 7/19 at 100.00 | | | | N/R | | | | 795,165 | |

| | | | | |

| | 1,000 | | | Fishers Redevelopment District, Indiana, General Obligation Bonds, Saxony Project Series 2009, 5.250%, 7/15/34 | | | | | 1/20 at 100.00 | | | | AA | | | | 1,038,760 | |

| | | | | |

| | 830 | | | Hendricks County, Indiana, Redevelopment District Tax Increment Revenue Bonds, Refunding Series 2010B, 6.450%, 1/01/23 | | | | | 1/16 at 100.00 | | | | Baa2 | | | | 851,074 | |

| | | | | |

| | 1,500 | | | Indiana Finance Authority, Educational Facilities Refunding Revenue Bonds, Butler University Project, Series 2012A, 5.000%, 2/01/25 | | | | | 2/22 at 100.00 | | | | BBB+ | | | | 1,572,180 | |

| | | | | |

| | 525 | | | Indiana Finance Authority, Educational Facilities Revenue Bonds, Drexel Foundation For Educational Excellence, Inc., Series 2009A, 7.000%, 10/01/39 | | | | | 10/19 at 100.00 | | | | BB– | | | | 548,651 | |

| | | | | |

| | 460 | | | Indiana Finance Authority, Private Activity Bonds, Ohio River Bridges East End Crossing Project, Series 2013B, 5.000%, 1/01/19 (Alternative Minimum Tax) | | | | | 1/17 at 100.00 | | | | BBB | | | | 497,660 | |

| | | | | |

| | 900 | | | Indiana Health Facility Financing Authority, Hospital Revenue Bonds, Union Hospital, Series 1993, 5.125%, 9/01/18 – NPFG Insured | | | | | 10/13 at 100.00 | | | | Baa1 | | | | 903,267 | |

| | | | | |

| | 250 | | | Merrillville Multi-School Building Corporation, Lake County, Indiana, First Mortgage Revenue Bonds, Series 2008, 5.250%, 7/15/22 | | | | | 1/18 at 100.00 | | | | AA+ | | | | 283,603 | |

| | 6,215 | | | Total Indiana | | | | | | | | | | | | | 6,490,360 | |

| | | | Iowa – 0.9% | | | | | | | | | | | | | | |

| | | | | |

| | | | Des Moines Airport Authority, Iowa, Revenue Bonds, Refunding Capital Loan Notes Series 2012: | | | | | | | | | | | | | | |

| | 1,000 | | | 5.000%, 6/01/27 (Alternative Minimum Tax) | | | | | 6/22 at 100.00 | | | | A2 | | | | 1,025,180 | |

| | 1,000 | | | 5.000%, 6/01/28 (Alternative Minimum Tax) | | | | | 6/22 at 100.00 | | | | A2 | | | | 1,016,360 | |

| | | | | |

| | 745 | | | Des Moines, Iowa, Aviation System Revenue Bonds, Refunding Capital Loan Notes Series 2010B, 5.750%, 6/01/33 – AGM Insured (Alternative Minimum Tax) | | | | | 6/20 at 100.00 | | | | AA– | | | | 792,904 | |

| | 2,745 | | | Total Iowa | | | | | | | | | | | | | 2,834,444 | |

| | | | Kansas – 0.6% | | | | | | | | | | | | | | |

| | | | | |

| | 1,240 | | | Kansas Development Finance Authority, Health Facilities Revenue Bonds, KU Health System, Series 2011H, 5.375%, 3/01/30 | | | | | 3/20 at 100.00 | | | | A+ | | | | 1,285,806 | |

| | | | | |

| | 500 | | | Kansas State Independent College Finance Authority, Revenue Anticipation Notes, Ottawa University, Private Education Short-Term Loan Program, Series 2013C, 4.250%, 5/01/14 | | | | | No Opt. Call | | | | N/R | | | | 502,795 | |

| | 1,740 | | | Total Kansas | | | | | | | | | | | | | 1,788,601 | |

| | | | Kentucky – 0.7% | | | | | | | | | | | | | | |

| | | | | |

| | 1,570 | | | Pikeville, Kentucky, Hospital Revenue Bonds, Pikeville Medical Center, Inc. Project, Improvement and Refunding Series 2011, 5.250%, 3/01/19 | | | | | No Opt. Call | | | | A3 | | | | 1,749,639 | |

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | Kentucky (continued) | | | | | | | | | | | | | | |

| | | | | |

| $ | 500 | | | Warren County, Kentucky, Hospital Refunding Revenue Bonds, Bowling Green-Warren County Community Hospital Corporation, Series 2013, 5.000%, 4/01/35 | | | | | 4/23 at 100.00 | | | | A | | | $ | 497,020 | |

| | 2,070 | | | Total Kentucky | | | | | | | | | | | | | 2,246,659 | |

| | | | Louisiana – 2.9% | | | | | | | | | | | | | | |

| | | | | |

| | 870 | | | Caddo Parish Parishwide School District, Louisiana, General Obligation Bonds, Refunding Series 2013, 3.000%, 3/01/30 | | | | | No Opt. Call | | | | AA– | | | | 705,840 | |

| | | | | |

| | 1,000 | | | Lafayette Public Trust Financing Authority, Louisiana, Revenue Bonds, Ragin’ Cajun Facilities Inc. Project, Refunding Series 2012, 3.625%, 10/01/29 – AGM Insured | | | | | 10/22 at 100.00 | | | | AA– | | | | 886,370 | |

| | | | | |

| | | | Lafayette Public Trust Financing Authority, Louisiana, Revenue Bonds, South Louisiana Facilities Corporation Project, Refunding Series 2012: | | | | | | | | | | | | | | |

| | 1,070 | | | 3.000%, 10/01/24 | | | | | 10/22 at 100.00 | | | | AA– | | | | 981,853 | |

| | 1,085 | | | 3.125%, 10/01/25 | | | | | 10/22 at 100.00 | | | | AA– | | | | 989,151 | |

| | | | | |

| | 970 | | | Lafourche Parish, Louisiana, Road Revenue Bonds, Series 2005, 4.500%, 1/01/25 (Pre-refunded 1/01/15) – RAAI Insured | | | | | 1/15 at 100.00 | | | | N/R (4) | | | | 1,025,057 | |

| | | | | |

| | 835 | | | Louisiana Public Facilities Authority, Revenue Bonds, Archdiocese of New Orleans, Series 2007, 5.000%, 7/01/16 – CIFG Insured | | | | | No Opt. Call | | | | N/R | | | | 907,979 | |

| | | | | |

| | 50 | | | Louisiana Public Facilities Authority, Revenue Bonds, Ochsner Clinic Foundation Project, Series 2011, 6.375%, 5/15/31 | | | | | 5/21 at 100.00 | | | | Baa1 | | | | 54,740 | |

| | | | | |

| | 1,315 | | | New Orleans, Louisiana, Water Revenue Bonds, Series 2002,

5.000%, 12/01/16 – FGIC Insured | | | | | 10/13 at 100.00 | | | | BBB | | | | 1,318,682 | |

| | | | | |

| | 2,000 | | | Tobacco Settlement Financing Corporation, Louisiana, Tobacco Settlement Asset-Backed Refunding Bonds, Series 2013A, 5.500%, 5/15/30 | | | | | 5/20 at 100.00 | | | | A– | | | | 2,073,100 | |

| | 9,195 | | | Total Louisiana | | | | | | | | | | | | | 8,942,772 | |

| | | | Maine – 0.6% | | | | | | | | | | | | | | |

| | | | | |

| | 830 | | | Maine State Housing Authority, Single Family Mortgage Purchase Bonds, Series 2012A-1, 4.000%, 11/15/24 – AGM Insured (Alternative Minimum Tax) | | | | | 11/21 at 100.00 | | | | AA+ | | | | 853,124 | |

| | | | | |

| | 1,000 | | | Maine State Housing Authority, Single Family Mortgage Purchase Bonds, Series 2012A-2, 3.600%, 11/15/26 | | | | | 11/21 at 100.00 | | | | AA+ | | | | 967,440 | |

| | 1,830 | | | Total Maine | | | | | | | | | | | | | 1,820,564 | |

| | | | Maryland – 2.9% | | | | | | | | | | | | | | |

| | | | | |

| | 845 | | | Anne Arundel County, Maryland, Economic Development Revenue Bonds, Community College Project, Refunding Series 2012, 4.000%, 9/01/21 | | | | | No Opt. Call | | | | A2 | | | | 905,857 | |

| | | | | |

| | 1,000 | | | Baltimore County, Maryland, General Obligation Bonds, Consolidated Public Improvement, Series 2012, 3.000%, 8/01/27 | | | | | No Opt. Call | | | | AAA | | | | 913,170 | |

| | | | | |

| | | | Baltimore, Maryland, Senior Lien Convention Center Hotel Revenue Bonds, Series 2006A: | | | | | | | | | | | | | | |

| | 375 | | | 5.250%, 9/01/19 – SYNCORA GTY Insured | | | | | 9/16 at 100.00 | | | | BB+ | | | | 389,505 | |

| | 140 | | | 5.250%, 9/01/39 – SYNCORA GTY Insured | | | | | 9/16 at 100.00 | | | | BB+ | | | | 128,475 | |

| | | | | |

| | 500 | | | Maryland Health and Higher Educational Facilities Authority, Revenue Bonds, Adventist Healthcare, Series 2011A, 6.125%, 1/01/36 | | | | | 1/22 at 100.00 | | | | Baa2 | | | | 541,270 | |

| | | | | |

| | 2,000 | | | Maryland Health and Higher Educational Facilities Authority, Revenue Bonds, Medstar Health Issue, Series 2013B, 5.000%, 8/15/33 | | | | | 8/23 at 100.00 | | | | A2 | | | | 2,000,740 | |

| | | | | |

| | | | Maryland Health and Higher Educational Facilities Authority, Revenue Bonds, Mercy Medical Center, Series 2012: | | | | | | | | | | | | | | |

| | 1,000 | | | 5.000%, 7/01/25 | | | | | 7/22 at 100.00 | | | | BBB | | | | 1,054,770 | |

| | 1,000 | | | 5.000%, 7/01/26 | | | | | 7/22 at 100.00 | | | | BBB | | | | 1,041,960 | |

| | | | | |

| | 1,000 | | | Montgomery County, Maryland, Consolidated General Obligation Public Improvement Bonds, Series 2012A, 3.000%, 11/01/28 | | | | | No Opt. Call | | | | AAA | | | | 900,460 | |

| | | | | |

| | 1,000 | | | Prince George’s County, Maryland, General Obligation Consolidated Public Improvement Bonds, Refunding Series 2013B, 3.000%, 3/01/26 | | | | | 3/23 at 100.00 | | | | AAA | | | | 947,010 | |

| | 8,860 | | | Total Maryland | | | | | | | | | | | | | 8,823,217 | |

Portfolio of Investments

Municipal Total Return Managed Accounts Portfolio (continued)

July 31, 2013

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | Massachusetts – 1.8% | | | | | | | | | | | | | | |

| | | | | |

| $ | 1,000 | | | Massachusetts Development Finance Agency, Revenue Bonds, The Broad Institute, Series 2011A, 5.000%, 4/01/31 | | | | | 4/21 at 100.00 | | | | AA– | | | $ | 1,028,790 | |

| | | | | |

| | 750 | | | Massachusetts Development Finance Agency, Revenue Bonds, The Sabis International Charter School, Series 2009A, 8.000%, 4/15/31 | | | | | 10/19 at 100.00 | | | | BBB | | | | 867,450 | |

| | | | | |

| | 1,085 | | | Massachusetts Educational Financing Authority, Educational Loan Revenue, Series 2012J, 5.000%, 7/01/18 (Alternative Minimum Tax) | | | | | No Opt. Call | | | | AA | | | | 1,196,820 | |

| | | | | |

| | 300 | | | Massachusetts Health and Educational Facilities Authority Revenue Bonds, Quincy Medical Center Issue, Series 2008A, 6.250%, 1/15/28 (6) | | | | | 1/18 at 100.00 | | | | N/R | | | | 1,173 | |

| | | | | |

| | 535 | | | Massachusetts Health and Educational Facilities Authority, Revenue Bonds, Harvard University, Tender Option Bond Trust 2010-20W, 13.591%, 12/15/34 (IF) (5) | | | | | 12/19 at 100.00 | | | | AAA | | | | 635,767 | |

| | | | | |

| | 1,675 | | | Massachusetts State, General Obligation Bonds, Refunding Series 2012A, 0.530%, 2/01/16 | | | | | 08/15 at 100.00 | | | | AA+ | | | | 1,662,488 | |

| | 5,345 | | | Total Massachusetts | | | | | | | | | | | | | 5,392,488 | |

| | | | Michigan – 0.9% | | | | | | | | | | | | | | |

| | | | | |

| | 1,000 | | | Garden City Hospital Finance Authority, Michigan, Revenue Bonds, Garden City Hospital Obligated Group, Series 2007A, 4.875%, 8/15/27 | | | | | 8/17 at 100.00 | | | | N/R | | | | 889,880 | |

| | | | | |

| | 400 | | | Michigan Finance Authority, Hospital Revenue Bonds, Holland Community Hospital, Refunding Series 2013A, 5.000%, 1/01/33 | | | | | 1/23 at 100.00 | | | | A+ | | | | 405,836 | |

| | | | | |

| | 500 | | | Michigan Finance Authority, Public School Academy Limited Obligation Revenue Bonds, Voyageur Academy Project, Series 2011, 7.750%, 7/15/26 | | | | | 7/21 at 100.00 | | | | BB | | | | 505,460 | |

| | | | | |

| | 750 | | | Michigan Higher Education Facilities Authority, Limited Obligation Revenue Bonds, Alma College Project, Series 2008, 5.500%, 6/01/28 | | | | | 6/18 at 100.00 | | | | Baa1 | | | | 771,375 | |

| | | | | |

| | 300 | | | Michigan Tobacco Settlement Finance Authority, Tobacco Settlement Asset-Backed Revenue Bonds, Series 2008A, 6.875%, 6/01/42 | | | | | 6/18 at 100.00 | | | | BB– | | | | 289,944 | |

| | 2,950 | | | Total Michigan | | | | | | | | | | | | | 2,862,495 | |

| | | | Minnesota – 0.3% | | | | | | | | | | | | | | |

| | | | | |

| | 1,165 | | | Sauk Rapids, Minnesota, Health Care and Housing Facilities Revenue Bonds, Good Shepherd Lutheran Home, Refunding Series 2013, 4.000%, 1/01/24 | | | | | 1/23 at 100.00 | | | | N/R | | | | 1,073,489 | |

| | | | Mississippi – 1.1% | | | | | | | | | | | | | | |

| | | | | |

| | 1,500 | | | Jackson County, Mississippi, Certificates of Participation, Correctional Facility Project, Series 2012, 3.375%, 7/01/29 | | | | | 7/22 at 100.00 | | | | AA– | | | | 1,235,310 | |

| | | | | |

| | 750 | | | Medical Center Educational Building Corporation, Revenue Bonds, University of Mississippi Medical Center Facilities Expansion and Renovation Project, Series 2012A, 5.000%, 6/01/41 | | | | | 6/22 at 100.00 | | | | Aa2 | | | | 766,065 | |

| | | | | |

| | 1,190 | | | Mississippi Development Bank, Special Obligation Bonds, Harrison County, Mississippi Highway Refunding Project, Series 2013A, 5.000%, 1/01/26 | | | | | No Opt. Call | | | | AA– | | | | 1,311,047 | |

| | 3,440 | | | Total Mississippi | | | | | | | | | | | | | 3,312,422 | |

| | | | Missouri – 1.8% | | | | | | | | | | | | | | |

| | | | | |

| | 1,000 | | | Carroll County Public Water Supply District 1, Missouri, Water System Revenue Bonds, Refunding Series 2009, 5.625%, 3/01/34 | | | | | 3/18 at 100.00 | | | | A | | | | 1,041,460 | |

| | | | | |

| | 900 | | | Hannibal Industrial Development Authority, Missouri, Health Facilities Refunding Revenue Bonds, Hannibal Regional Hospital, Refunding Series 2010, 5.500%, 9/01/20 | | | | | 9/13 at 100.00 | | | | BBB+ | | | | 919,134 | |

| | | | | |

| | 1,000 | | | Missouri Development Finance Board, Independence, Infrastructure Facilities Revenue Bonds, Water System Improvement Projects, Series 2009C, 5.750%, 11/01/29 | | | | | 11/14 at 100.00 | | | | A– | | | | 1,041,160 | |

| | | | | |

| | 500 | | | Missouri State Board of Public Building, Special Obligation Bonds, Refunding Series 2012A, 3.000%, 10/01/26 | | | | | 10/20 at 100.00 | | | | AA+ | | | | 456,775 | |

| | | | | |

| | 287 | | | Saint Louis, Missouri, Tax Increment Financing Revenue Notes, Marquette Building Redevelopment Project, Series 2008-A, 6.500%, 1/23/28 | | | | | No Opt. Call | | | | N/R | | | | 196,515 | |

| | | | | |

| | 1,500 | | | Sikeston, Missouri, Electric System Revenue Refunding Bonds, Series 2012, 5.000%, 6/01/18 | | | | | No Opt. Call | | | | BBB+ | | | | 1,676,715 | |

| | 5,187 | | | Total Missouri | | | | | | | | | | | | | 5,331,759 | |

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | Nebraska – 0.2% | | | | | | | | | | | | | | |

| | | | | |

| $ | 500 | | | Douglas County Hospital Authority 2, Nebraska, Health Facilities Revenue Refunding Bonds, Children’s Hospital Obligated Group, Series 2008B, 6.125%, 8/15/31 | | | | | 8/17 at 100.00 | | | | A2 | | | $ | 527,800 | |

| | | | Nevada – 0.3% | | | | | | | | | | | | | | |

| | | | | |

| | 1,000 | | | Nevada State, General Obligation Bonds, Municipal Bond Bank Projects 84, 85 & 86, Series 2013A, 3.000%, 8/01/27 | | | | | 8/22 at 100.00 | | | | AA+ | | | | 855,610 | |

| | | | | |

| | 100 | | | Sparks Local Improvement District 3, Legends at Sparks Marina, Nevada, Limited Obligation Improvement Bonds, Series 2008, 6.750%, 9/01/27 | | | | | 9/18 at 100.00 | | | | N/R | | | | 100,247 | |

| | 1,100 | | | Total Nevada | | | | | | | | | | | | | 955,857 | |

| | | | New Hampshire – 0.2% | | | | | | | | | | | | | | |

| | | | | |

| | 580 | | | New Hampshire Health and Education Facilities Authority, Revenue Bonds, Catholic Medical Center, Series 2012, 5.000%, 7/01/27 | | | | | No Opt. Call | | | | BBB+ | | | | 598,293 | |

| | | | New Jersey – 2.9% | | | | | | | | | | | | | | |

| | | | | |

| | 1,660 | | | Florence Township School District, Burlington County, New Jersey, General Obligation Bonds, Series 2012, 4.000%, 3/01/29 | | | | | 3/22 at 100.00 | | | | AA– | | | | 1,648,529 | |

| | | | | |