UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22041

|

| Gabelli 787 Fund, Inc. |

| (Exact name of registrant as specified in charter) |

|

| One Corporate Center |

| Rye, New York 10580-1422 |

| (Address of principal executive offices) (Zip code) |

|

| Bruce N. Alpert |

| Gabelli Funds, LLC |

| One Corporate Center |

| Rye, New York 10580-1422 |

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: 1-800-422-3554

Date of fiscal year end: October 31

Date of reporting period: October 31, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Gabelli Enterprise Mergers and Acquisitions Fund

Annual Report

October 31, 2017

To Our Shareholders,

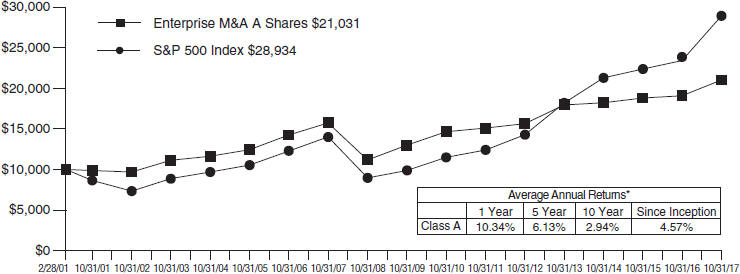

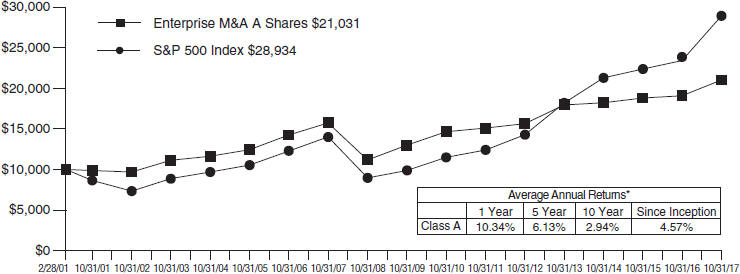

For the fiscal year ended October 31, 2017, the net asset value (“NAV”) per Class A Share of the Gabelli Enterprise Mergers and Acquisitions Fund increased 10.3% compared with an increase of 23.6% for the Standard & Poor’s (“S&P”) 500 Index. The performance of the ICE Bank of America Merrill Lynch 3 Month U.S. Treasury Bill Index for this year was 0.7%. See page 5 for additional performance information.

Enclosed are the financial statements, including the schedule of investments, as of October 31, 2017.

Performance Discussion (Unaudited)

In the first nine months of 2017, global deal activity increased 3% on a year over year basis, totaling $2.4 trillion. Overall, flat deal activity was offset by a 9% increase in the number of deals valued at more than $1 billion and an 18% increase in the number of deals announced in the United States. This was a continuation of strong volumes in the fourth quarter of 2016, when global deal volume totaled $1.2 trillion, a 50% increase over the third quarter.

Cross border merger and acquisitions (M&A) activity totaled $943.3 billion during the first nine months of 2017, the highest level reached in the first nine months of a year since 2015. This surge in cross border transaction activity was driven by outbound U.S. acquirers and regional E.U. deal making. M&A activity in Europe totaled $629.3 billion during the first nine months of the year, up 29% on a year over year basis. Although U.S. acquirers hunted the globe for asset bargains, Chinese acquirers slowed their appetite for foreign assets as China outbound M&A declined 27% compared to the first nine months of 2016.

The Energy & Power sector continued to fuel M&A activity over the first nine months of 2017. Deal activity in the space totaled $369.8 billion, up 7% on a year over year basis. The Industrials sector meaningfully contributed to M&A activity in the first nine months of 2017, accounting for 13.9% of overall merger activity. The Materials and Technology sectors experienced declines in volumes.

The robust M&A market has benefitted the Fund in that we have invested in dozens of situations across industries and globally. In addition, the buy-and-hold component of the Fund has performed well in light of an increasing number of firms undergoing various types of financial engineering and the markets recognizing the underlying value of our investments.

The Federal Reserve has been slowly raising interest rates during 2017. A deal spread is comprised of two main factors – the risk free rate and the risks inherent to the deal. Historically, rising interest rates have resulted in higher spreads.

Selected deals that closed during the Fund’s fiscal year

Rackspace Hosting Inc. (RAX) is a San Antonio, Texas based information technology company. Rackspace specializes in cloud computing technology and storage. On August 26, 2016 Apollo Global with Searchlight Capital made a $32 cash per share offer for the company. The merger valued RAX at $4.3 billion and was subject to traditional regulatory approval and a shareholder vote. The deal closed on November 3, 2016.

Cepheid (CPHD) is a medical diagnostic and testing equipment company based in Sunnyvale, California. On September 6, 2016, Danaher agreed to acquire Cepheid for $53 cash per share, or $4 billion, in order to expand its molecular diagnostics business. The merger received the necessary regulatory and shareholder approvals and closed on November 4, 2016.

NetSuite Inc. (N) is a San Mateo, California based technology company. NetSuite provides cloud-based software to enterprise clients. The software suite features products for financial management, customer relationship management, e-commerce and retail management, commerce marketing automation, professional services automation and human resources. On July 28, 2016, Oracle entered into an agreement to acquire N for $109 cash per share. This tender valued the company at $8.8 billion, and the transaction was subject to customary regulatory and shareholder approvals. The deal closed on November 7, 2016

National Interstate Corp. (NATL), based in Richfield, Ohio, operates as a property and casualty insurance company for the transportation industry. After a failed attempt in 2014, American Financial Group, NATL’s majority owner, entered into an agreement to acquire NATL for $32 cash per share plus a $0.50 special dividend. The deal came after months of negotiations. Subject to customary regulatory and shareholder approvals, the merger closed on November 10, 2016.

Cvent Inc. (CVT) is a Tysons Corner, Virginia based software company. Cvent specializes in enterprise event management through its use of cloud-based software. Vista Equity Partners made a $36 per share bid for the company on April 18, 2016. This valued CVT at $1.65 billion and was subject to customary regulatory and shareholder approvals. The deal closed on November 28, 2016.

LinkedIn Corp. (LNKD) is a Mountain View, California based business. The company operates a professional social network, which currently has over 400 million members. On June 13, 2016, Microsoft made a $196 cash per share offer to acquire the company for a total cost of $26 billion. The deal received the necessary shareholder and regulatory approvals and closed on December 8, 2016.

The Empire District Electric Company (EDE) is a regulated utility company with operations in Missouri, Kansas, Oklahoma, and Arkansas. On February 9, 2016, EDE entered into an agreement to be acquired by Algonquin Power & Utilities Corp. for $34 cash per share. This transaction valued EDE at $2.4 billion dollars, and was subject to regulatory approval and shareholder votes. The merger closed on January 1, 2017.

Media General Inc. (MRG) is a Richmond, Virginia based multimedia company. MRG provides news and entertainment through its broadcast and digital platforms. On September 28, 2015, Nexstar Broadcasting Group Inc. announced a proposal to acquire Media General for $10.50 per share in cash and a fixed ratio of 0.1249 Nexstar share per Media General share. The offer also included one contingent value right based on proceeds from the FCC spectrum auction. This deal came after Media General attempted to acquire Meredith Corporation in a merger of equals. All in, the transaction was valued at $4.6 billion and closed on January 17, 2017.

Team Health Holdings Inc. (TMH) is a Knoxville, Tennessee based healthcare facility company. The company provides professional medical staff sourcing to hospitals and other healthcare providers across the United States. On October 31, 2016, the firm entered into a deal with The Blackstone Group for a $43.50 cash per share merger. This valued TMH at $6.1 billion. The deal was subject to both regulatory and shareholder approvals, with the addition of a “go-shop” period and closed on February 7, 2017.

2

LifeLock Inc. (LOCK) is a Tempe, Arizona based provider of identity theft protection services. On November 20, 2016, LifeLock agreed to be acquired by Symantec Corp. for $24 cash per share or $2.3 billion in enterprise value. The transaction was subject to both shareholder vote and regulatory approvals and closed on February 9, 2017.

Ariad Pharmaceuticals Inc. (ARIA) is a Cambridge, Massachusetts based oncology company that develops and commercializes medicine for cancer treatment. On January 9, 2017, Ariad agreed to be acquired by Takeda Pharmaceuticals for $24.00 cash per share. The tender offer valued Ariad at $5.2 billion and was subject to regulatory approvals and other custom closing conditions. The deal closed February 16, 2017.

Columbia Pipeline Partners LP (CPPL) is a Houston, Texas based natural gas transportation and storage company. CPPL owns, operates pipeline and related midstream assets. On November 1, 2016, the partnership agreed to be acquired by Columbia Pipeline Group Inc., a subsidiary of TransCanada Corp., for $17.00 cash per unit representing an aggregate value of $915 million. The transaction was subject to shareholder vote and regulatory approval and closed on February 17, 2017.

Vascular Solutions Inc. (VASC) is a Minneapolis, Minnesota based medical device company. VASC develops and markets medical diagnostic equipment specializing in cardiovascular treatment. On December 2, 2016, the company agreed to a $56 cash per share merger with Teleflex Inc., valuing VASC at $1 billion. The deal was subject to traditional regulatory and shareholder approvals, and closed on February 21, 2017.

Clarcor Inc. (CLC) is a Franklin, Tennessee based filtration products company. On December 1, 2016, Parker Hannifin announced it would acquire Clarcor for $83 cash per share, or $4.3 billion. The merger closed on March 10, 2017 after receiving the necessary regulatory and shareholder approvals.

Harman International Industries Inc. (HAR) is a Stamford, Connecticut based consumer electronics company. Harman designs and engineers connected products. On November 14, 2016 Harman agreed to be acquired by Samsung Electronics for $112 per share in cash, representing an $8 billion equity value. The deal was subject to shareholder vote and regulatory approvals and closed on March 10, 2017.

Endurance Specialty Holdings Ltd. (ENH) is a Bermuda based holding company that underwrites specialty insurance. It operates in two segments, insurance and reinsurance. On October 5, 2016, the company agreed to be acquired for $93 cash per share by SOMPO Holdings Ltd of Japan. This valued the company at $6.3 billion. The deal was subject to regulatory approval and a shareholder vote and closed on March 29, 2017.

Joy Global Inc. (JOY), a mining equipment company based in Milwaukee, Wisconsin, manufactures mining equipment for the extraction of metals and minerals and also provides clients with the servicing of this machinery. On July 21, 2016, Komatsu entered into a $28.30 cash per share merger with Joy, valued at $2.8 billion. Shareholders approved the deal and the companies received regulatory approvals in various jurisdictions. The deal closed on April 6, 2017.

Zeltiq Aesthetics Inc. (ZLTQ) is a Pleasanton, California based medical technology company that licenses CoolSculpting, a noninvasive body sculpting procedure. ZLTQ agreed to be acquired by Allergan on February 13, 2017 for $56.50 cash per share. The deal required shareholder and regulatory approvals and closed on May 1, 2017.

InvenSense Inc. is a San Jose, California based electronic equipment company that sells motion sensor technology to its customers. InvenSense agreed to be acquired by TDK Corp. on December 21, 2016 for $13 per share or $1.3 billion. The transaction required shareholder and regulatory approvals and closed on May 18, 2017.

3

Syngenta AG (SYT) is a Basel, Switzerland based agricultural chemicals company. On February 3, 2016 Syngenta agreed to be acquired by ChemChina for $465 cash per share plus a CHF 5 special dividend. The tender offer was contingent upon SYT shareholders meeting the minimum condition and required regulatory approvals. Syngenta and ChemChina closed the deal on May 18, 2017.

Multi Packaging Solutions International Ltd. (MPSX) is a New York, New York, based paper and packaging company. On January 24, 2016, MPSX agreed to be acquired by WestRock for $18 per share in cash, representing a total enterprise value of $2.28 billion. The deal was subject to regulatory and shareholder approvals, and closed June 7, 2017.

AdvancePierre Foods Holdings, Inc. (APFH) is a Blue Ash, Ohio based food processing company that primarily distributes ready-to-eat sandwiches. APFH agreed on April 25, 2017 to be acquired by Tyson Foods, Inc. (TSN) for $40.25 in cash per share in a tender offer. The transaction required APFH shareholders to meet the minimum condition of the tender and regulatory approval. APFH and TSN completed the deal on June 8, 2017.

Mead Johnson Nutrition Co. (MJN) is a Chicago, Illinois based nutrition company focused on the distribution of pediatric products. On February 10, 2017, MJN agreed to be acquired by Reckitt Benckiser Group plc for $90 cash per share, which valued the company at $17.9 billion. The deal was subject to regulatory and shareholder approval and closed on June 15, 2017.

Actelion LTD. is an Allschwil, Switzerland based biotech company. Actelion discovers, develops, and distributes drugs targeting pulmonary arterial hypertension. On January 26, 2017, Actelion agreed to be acquired by Johnson & Johnson for $280 cash per share in a $30 billion tender. Immediately prior to the completion of the transaction, Actelion spun out its drug discovery operations into a newly created Swiss Biotech company “Idorsia” which was listed on the SIX Swiss Exchange. The transaction closed June 16, 2017.

Kate Spade & Company (KATE) is a New York, New York based apparel and accessories retailer. On May 8, 2017, KATE agreed to be acquired by Coach Inc. for $18.50 per share in cash, valuing the company at $2.4 billion. The transaction required regulatory approval and a majority of KATE shareholders to tender their shares to Coach. The deal closed on July 12, 2017.

Panera Bread Co. (PNRA) is a St. Louis, Missouri based fast casual restaurant chain. On April 5, 2017, PNRA agreed to be acquired by JAB Holding Company for $315 per share in cash, which valued the company at $7.5 billion. The deal required regulatory and shareholder approvals and subsequently closed on July 18, 2017.

Gas Natural Inc. (EGAS) is a Cleveland, Ohio based natural gas utility that distributes over 20 billion cubic feet of natural gas annually to its customers. On October 10, 2016, EGAS agreed to be acquired by First Reserve Energy Infrastructure Fund for $13.10 per share in cash, representing a $196 million total enterprise value. First Reserve Energy Infrastructure Fund was subsequently acquired by BlackRock Real Assets on June 5, 2017. After receiving the approval from EGAS shareholders, BlackRock Real Assets closed the merger on August 4, 2017.

VCA Animal Hospital Inc. (WOOF) is a Los Angeles, California based veterinary hospitals operator. On January 9, 2017, WOOF agreed to be acquired by Mars, Inc. for $93 per share in cash. Mars also operates animal hospitals. The deal valued WOOF at $7.7 billion and required regulatory and shareholder approvals. It closed on September 13, 2017.

We appreciate your continuing confidence and trust.

4

Comparative Results

| | | | | | | | | | | | | | | | |

Average Annual Returns through October 31, 2017 (a)(b) (Unaudited) | | | Since | |

| | | | | | | | | | | | Inception | |

| | | 1 Year | | | 5 Year | | | 10 Year | | | (2/28/01) | |

Class A (EMAAX) | | | 10.34% | | | | 6.13% | | | | 2.94% | | | | 4.57% | |

With sales charge (c) | | | 3.99 | | | | 4.88 | | | | 2.33 | | | | 4.20 | |

Class AAA (EAAAX) | | | 10.65 | | | | 6.34 | | | | 3.10 | | | | 10.40 | |

Class C (EMACX) | | | 9.73 | | | | 5.55 | | | | 2.37 | | | | 3.99 | |

With contingent deferred sales charge (d) | | | 8.73 | | | | 5.55 | | | | 2.37 | | | | 3.99 | |

Class T (EMATX) | | | 10.49 | | | | 6.16 | | | | 2.95 | | | | 4.57 | |

With sales charge (e) | | | 7.72 | | | | 5.62 | | | | 2.69 | | | | 4.41 | |

Class Y (EMAYX) | | | 10.87 | | | | 6.61 | | | | 3.41 | | | | 11.26 | |

S&P 500 Index | | | 23.63 | | | | 15.18 | | | | 7.51 | | | | 6.58 | |

Lipper U.S. Treasury Money Market Fund Average | | | 0.33 | | | | 0.08 | | | | 0.23 | | | | 1.06 | |

ICE Bank of America Merrill Lynch 3 Month U.S. Treasury Bill Index | | | 0.72 | | | | 0.24 | | | | 0.45 | | | | 1.44 | |

In the current prospectuses dated February 28, 2017, as amended June 30, 2017, the Fund’s expense ratios are 1.52%, 1.72%, 2.27%, 1.52%, and 1.27% for the Class AAA, A, C, T, and Y Shares, respectively. See page 14 for the expense ratios for the year ended October 31, 2017. Class AAA and Class Y Shares have no sales charge. The maximum sales charge for Class A Shares, Class C Shares, and Class T Shares is 5.75%, 1.00%, and 2.50%, respectively. | |

| | (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.gabelli.com for performance information as of the most recent month end. The Fund imposes a 2% redemption fee on shares sold or exchanged within seven days of purchase. Investors should carefully consider the investment objectives, risks, sales charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.gabelli.com. The Class A Share NAVs are used to calculate the performance for the periods prior to the issuance of Class AAA Shares on February 26, 2010 and Class T Shares on June 30, 2017. The actual performance for the Class AAA Shares and Class T Shares would have been higher due to lower expenses associated with these share classes. The S&P 500 Index is a market capitalization weighted index of 500 large capitalization stocks commonly used to represent the U.S. equity market. The Lipper U.S. Treasury Money Market Fund Average reflects the average performance of mutual funds classified in this particular category. The ICE Bank of America Merrill Lynch 3 Month U.S. Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. At the end of the month, that issue is sold and rolled into the outstanding Treasury Bill that matures closest to, but not beyond three months from the rebalancing date. To qualify for selection, an issue must have settled on or before the rebalancing (month end) date. Dividends are considered reinvested except for the ICE Bank of America Merrill Lynch 3 Month U.S. Treasury Bill Index. You cannot invest directly in an index. | |

| | (b) | The Fund’s fiscal year ends October 31. |

| | (c) | Performance results include the effect of the maximum 5.75% sales charge at the beginning of the period. | |

| | (d) | Assuming payment of the 1% maximum contingent deferred sales charge imposed on redemptions made within one year of purchase. | |

| | (e) | Performance results include the effect of the maximum 2.50% sales charge at the beginning of the period. | |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE GABELLI ENTERPRISE

MERGERS AND ACQUISITIONS FUND (CLASS A SHARES) AND THE S&P 500 INDEX (Unaudited)

| * | Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

5

| | | | |

| Gabelli Enterprise Mergers and Acquisitions Fund | | | | |

| Disclosure of Fund Expenses (Unaudited) | | | | |

| For the Six Month Period from May 1, 2017 through October 31, 2017 | | | Expense Table | |

We believe it is important for you to understand the impact of fees and expenses regarding your investment. All mutual funds have operating expenses. As a shareholder of a fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of a fund. When a fund’s expenses are expressed as a percentage of its average net assets, this figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The Expense Table below illustrates your Fund’s costs in two ways:

Actual Fund Return: This section provides information about actual account values and actual expenses. You may use this section to help you to estimate the actual expenses that you paid over the period after any fee waivers and expense reimbursements. The “Ending Account Value” shown is derived from the Fund’s actual return during the past six months, and the “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period” to estimate the expenses you paid during this period.

Hypothetical 5% Return: This section provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio. It assumes a hypothetical annualized return of 5% before expenses during the period shown. In this

case – because the hypothetical return used is not the Fund’s actual return – the results do not apply to your investment and you cannot use the hypothetical account value and expense to estimate the actual ending account balance or expenses you paid for the period. This example is useful in making comparisons of the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees, if any, which are described in the Prospectus. If these costs were applied to your account, your costs would be higher. Therefore, the 5% hypothetical return is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. The “Annualized Expense Ratio” represents the actual expenses for the last six months and may be different from the expense ratio in the Financial Highlights which is for the year ended October 31, 2017.

| | | | | | | | | | | | |

| | | Beginning | | Ending | | Annualized | | | Expenses | |

| | | Account Value | | Account Value | | Expense | | | Paid During | |

| | | 05/01/17 | | 10/31/17 | | Ratio | | | Period* | |

Gabelli Enterprise Mergers and Acquisitions Fund | | | | | |

Actual Fund Return | |

Class AAA | | $1,000.00 | | $1,019.80 | | | 1.52% | | | | $ 7.74 | |

Class A | | $1,000.00 | | $1,018.70 | | | 1.72% | | | | $ 8.75 | |

Class C | | $1,000.00 | | $1,015.80 | | | 2.27% | | | | $11.53 | |

Class T** | | $1,000.00 | | $1,012.40 | | | 1.51% | | | | $ 5.16 | |

Class Y | | $1,000.00 | | $1,020.80 | | | 1.27% | | | | $ 6.47 | |

Hypothetical 5% Return | | | | | | | | |

Class AAA | | $1,000.00 | | $1,017.54 | | | 1.52% | | | | $ 7.73 | |

Class A | | $1,000.00 | | $1,016.53 | | | 1.72% | | | | $ 8.74 | |

Class C | | $1,000.00 | | $1,013.76 | | | 2.27% | | | | $11.52 | |

Class T | | $1,000.00 | | $1,017.59 | | | 1.51% | | | | $ 7.68 | |

Class Y | | $1,000.00 | | $1,018.80 | | | 1.27% | | | | $ 6.46 | |

| * | Expenses are equal to the Fund’s annualized expense ratio for the last six months multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184 days), then divided by 365. |

| ** | Class T Shares use a beginning account value date of 06/30/17, and Class T Share expenses are equal to the Fund’s annualized expense ratio for the period since inception multiplied by the number of days since inception (124 days), then divided by 365. |

6

Summary of Portfolio Holdings (Unaudited)

The following table presents portfolio holdings as a percent of net assets as of October 31, 2017:

Gabelli Enterprise Mergers and Acquisitions Fund

| | | | |

U.S. Government Obligations | | | 30.9 | % |

Health Care. | | | 8.3 | % |

Media | | | 5.7 | % |

Wireless Communications | | | 5.3 | % |

Energy and Utilities | | | 5.0 | % |

Food and Beverage | | | 3.7 | % |

Cable and Satellite | | | 3.6 | % |

Financial Services | | | 3.5 | % |

Telecommunications | | | 3.3 | % |

Retail | | | 3.2 | % |

Diversified Industrial | | | 2.9 | % |

Transportation | | | 2.6 | % |

Aerospace and Defense | | | 2.3 | % |

Building and Construction | | | 2.3 | % |

Specialty Chemicals | | | 2.1 | % |

| | | | |

Business Services | | | 1.9 | % |

Hotels and Gaming | | | 1.9 | % |

Computer Software and Services | | | 1.8 | % |

Communications Equipment | | | 1.3 | % |

Equipment and Supplies | | | 1.3 | % |

Semiconductors | | | 1.2 | % |

Broadcasting | | | 1.0 | % |

Consumer Services | | | 1.0 | % |

Machinery | | | 0.9 | % |

Automotive: Parts and Accessories | | | 0.5 | % |

Entertainment | | | 0.5 | % |

Metals and Mining | | | 0.4 | % |

Consumer Products | | | 0.2 | % |

Containers and Packaging | | | 0.2 | % |

Other Assets and Liabilities (Net) | | | 1.2 | % |

Paper and Forest Products | | | 0.0 | %* |

| | | | |

| | | 100.0 | % |

| | | | |

| * | Amount represents less than 0.05%. |

The Fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain this information at www.gabelli.com or by calling the Fund at 800-GABELLI (800-422-3554).The Fund’s Form N-Q is available on the SEC’s website at www.sec.gov and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

Proxy Voting

The Fund files Form N-PX with its complete proxy voting record for the twelve months ended June 30, no later than August 31 of each year. A description of the Fund’s proxy voting policies, procedures, and how the Fund voted proxies relating to portfolio securities is available without charge, upon request, by (i) calling 800-GABELLI (800-422-3554); (ii) writing to The Gabelli Funds at One Corporate Center, Rye, NY 10580-1422; or (iii) visiting the SEC’s website at www.sec.gov.

7

Gabelli Enterprise Mergers and Acquisitions Fund

Schedule of Investments — October 31, 2017

| | | | | | | | | | |

Shares | | | | Cost | | | Market

Value | |

| | COMMON STOCKS — 67.7% | |

| | Aerospace and Defense — 2.3% | |

| 10,000 | | Arconic Inc. | | $ | 218,979 | | | $ | 251,200 | |

| 40,000 | | Kaman Corp. | | | 1,361,916 | | | | 2,237,600 | |

| 8,600 | | Orbital ATK Inc. | | | 1,133,032 | | | | 1,143,198 | |

| 900 | | Rockwell Collins Inc. | | | 118,267 | | | | 122,040 | |

| | | | | | | | | | |

| | | | | 2,832,194 | | | | 3,754,038 | |

| | | | | | | | | | |

| |

| | Automotive: Parts and Accessories — 0.5% | |

| 10,000 | | Federal-Mogul Holdings Corp.†(a) | | | 90,132 | | | | 100,000 | |

| 24,000 | | Haldex AB† | | | 288,867 | | | | 266,614 | |

| 7,800 | | Tenneco Inc. | | | 24,840 | | | | 453,258 | |

| | | | | | | | | | |

| | | | | 403,839 | | | | 819,872 | |

| | | | | | | | | | |

| | | |

| | Broadcasting — 1.0% | | | | | | | | |

| 40,000 | | Tribune Media Co., Cl. A | | | 1,575,978 | | | | 1,637,200 | |

| | | | | | | | | | |

| |

| | Building and Construction — 2.3% | |

| 500 | | ASH Grove Cement Co | | | 258,646 | | | | 257,500 | |

| 3,000 | | Cadus Corp.† | | | 3,615 | | | | 3,840 | |

| 52,000 | | Griffon Corp. | | | 442,000 | | | | 1,172,600 | |

| 10,000 | | Nobility Homes Inc. | | | 133,178 | | | | 172,000 | |

| 14,000 | | Norbord Inc. | | | 318,662 | | | | 504,612 | |

| 4,000 | | Polaris Materials Corp.† | | | 11,184 | | | | 10,542 | |

| 17,000 | | Skyline Corp.† | | | 92,454 | | | | 212,330 | |

| 11,000 | | Vulcan Materials Co. | | | 432,608 | | | | 1,339,250 | |

| | | | | | | | | | |

| | | | | 1,692,347 | | | | 3,672,674 | |

| | | | | | | | | | |

| |

| | Business Services — 1.9% | |

| 185,000 | | Clear Channel Outdoor Holdings Inc., Cl. A. | | | 1,298,261 | | | | 703,000 | |

| 165,000 | | Gerber Scientific Inc., Escrow†(a) | | | 0 | | | | 0 | |

| 95,000 | | The Interpublic Group of Companies Inc. | | | 1,851,011 | | | | 1,828,750 | |

| 1,111 | | Vectrus Inc.†. | | | 19,941 | | | | 33,897 | |

| 2,000 | | XPO Logistics Europe SA† | | | 484,562 | | | | 545,150 | |

| | | | | | | | | | |

| | | | | 3,653,775 | | | | 3,110,797 | |

| | | | | | | | | | |

| |

| | Cable and Satellite — 3.6% | |

| 3,000 | | AMC Entertainment Holdings Inc., Cl. A | | | 103,800 | | | | 41,700 | |

| 20,000 | | DISH Network Corp., Cl. A† | | | 386,434 | | | | 970,800 | |

| 3,500 | | Liberty Broadband Corp., Cl. A† | | | 15,669 | | | | 301,735 | |

| 5,000 | | Liberty Broadband Corp., Cl. C† | | | 99,781 | | | | 436,450 | |

| 21,000 | | Liberty Global plc, Cl. A† | | | 735,349 | | | | 647,850 | |

| 28,000 | | Liberty Global plc, Cl. C† | | | 994,232 | | | | 836,920 | |

| 8,000 | | Liberty Global plc LiLAC, Cl. A† | | | 223,265 | | | | 173,760 | |

| 10,000 | | Liberty Global plc LiLAC, Cl. C† | | | 218,850 | | | | 220,000 | |

| 3,000 | | Liberty Media Corp.- Liberty Formula One, Cl. A† | | | 7,487 | | | | 109,200 | |

| 3,000 | | Liberty Media Corp.- Liberty Formula One, Cl. C† | | | 9,444 | | | | 114,420 | |

| | | | | | | | | | |

Shares | | | | Cost | | | Market

Value | |

| 6,500 | | Liberty Media Corp.- Liberty SiriusXM, Cl. A† | | $ | 19,439 | | | $ | 271,115 | |

| 6,500 | | Liberty Media Corp.- Liberty SiriusXM, Cl. C† | | | 25,888 | | | | 270,725 | |

| 3,000 | | Scripps Networks Interactive Inc., Cl. A | | | 211,166 | | | | 249,840 | |

| 20,000 | | Shaw Communications Inc., Cl. B. | | | 265,164 | | | | 456,800 | |

| 60,000 | | Sky plc† | | | 764,324 | | | | 751,464 | |

| | | | | | | | | | |

| | | | | 4,080,292 | | | | 5,852,779 | |

| | | | | | | | | | |

| |

| | Communications Equipment — 1.3% | |

| 100,000 | | Brocade Communications Systems Inc. | | | 1,244,247 | | | | 1,165,000 | |

| 37,000 | | Digi International Inc.† | | | 435,634 | | | | 384,800 | |

| 3,000 | | exactEarth Ltd.† | | | 8,613 | | | | 2,465 | |

| 3,500 | | Harris Corp. | | | 273,843 | | | | 487,620 | |

| 6,600 | | Park Electrochemical Corp. | | | 93,217 | | | | 124,608 | |

| | | | | | | | | | |

| | | | | 2,055,554 | | | | 2,164,493 | |

| | | | | | | | | | |

| |

| | Computer Software and Services — 1.8% | |

| 4,000 | | Affecto OYJ | | | 21,205 | | | | 21,014 | |

| 18,200 | | Bankrate Inc.† | | | 252,951 | | | | 252,980 | |

| 4,000 | | BroadSoft Inc.† | | | 217,744 | | | | 219,400 | |

| 4,000 | | Business & Decision† | | | 37,005 | | | | 36,809 | |

| 4,000 | | Dalenys†. | | | 39,140 | | | | 41,422 | |

| 1,000 | | Dell Technologies Inc., Cl. V† | | | 46,886 | | | | 82,770 | |

| 70,000 | | Exa Corp.† | | | 1,694,932 | | | | 1,696,800 | |

| 30,000 | | FalconStor Software Inc.† | | | 56,565 | | | | 7,680 | |

| 13,000 | | Onvia Inc.† | | | 116,415 | | | | 116,675 | |

| 7,000 | | Planet Payment Inc.† | | | 31,360 | | | | 31,290 | |

| 20,000 | | Silver Spring Networks Inc.† | | | 323,218 | | | | 322,400 | |

| 200 | | Synchronoss Technologies Inc.† | | | 3,301 | | | | 2,266 | |

| | | | | | | | | | |

| | | | | 2,840,722 | | | | 2,831,506 | |

| | | | | | | | | | |

| |

| | Consumer Products — 0.2% | |

| 100 | | Accell Group | | | 3,366 | | | | 3,054 | |

| 100,000 | | Avon Products Inc.† | | | 608,280 | | | | 228,000 | |

| 2,000 | | Bang & Olufsen A/S† | | | 20,532 | | | | 46,335 | |

| | | | | | | | | | |

| | | | | 632,178 | | | | 277,389 | |

| | | | | | | | | | |

| |

| | Consumer Services — 1.0% | |

| 2,000 | | Funespana SA† | | | 18,121 | | | | 17,286 | |

| 30,000 | | MoneyGram International Inc.† | | | 487,864 | | | | 466,500 | |

| 30,000 | | Nets A/S† | | | 775,107 | | | | 765,938 | |

| 9,000 | | Rollins Inc. | | | 18,036 | | | | 395,190 | |

| | | | | | | | | | |

| | | | | 1,299,128 | | | | 1,644,914 | |

| | | | | | | | | | |

| |

| | Containers and Packaging — 0.2% | |

| 5,200 | | Greif Inc., Cl. A | | | 216,066 | | | | 288,756 | |

| 1,000 | | Greif Inc., Cl. B | | | 37,738 | | | | 62,850 | |

| | | | | | | | | | |

| | | | | 253,804 | | | | 351,606 | |

| | | | | | | | | | |

| |

| | Diversified Industrial — 2.9% | |

| 213,600 | | Myers Industries Inc. | | | 4,083,688 | | | | 4,613,760 | |

| | | | | | | | | | |

See accompanying notes to financial statements.

8

Gabelli Enterprise Mergers and Acquisitions Fund

Schedule of Investments (Continued) — October 31, 2017

| | | | | | | | | | |

Shares | | | | Cost | | | Market

Value | |

| | COMMON STOCKS (Continued) | | | | | |

| | Energy and Utilities — 4.9% | | | | | |

| 7,000 | | Alerion Cleanpower SpA | | $ | 19,191 | | | $ | 24,853 | |

| 485,000 | | Alvopetro Energy Ltd.† | | | 454,000 | | | | 78,947 | |

| 7,000 | | Anadarko Petroleum Corp | | | 323,159 | | | | 345,590 | |

| 4,000 | | Avangrid Inc. | | | 155,000 | | | | 206,920 | |

| 500 | | Avista Corp. | | | 26,164 | | | | 26,120 | |

| 14,000 | | Calpine Corp.† | | | 207,406 | | | | 209,160 | |

| 38,000 | | Endesa SA | | | 1,064,270 | | | | 869,793 | |

| 200 | | Etablissements Maurel et Prom† | | | 874 | | | | 848 | |

| 75,000 | | GenOn Energy Inc., Escrow†(a) | | | 0 | | | | 0 | |

| 255,000 | | Gulf Coast Ultra Deep Royalty Trust | | | 370,833 | | | | 9,180 | |

| 3,081 | | Noble Energy Inc. | | | 111,781 | | | | 85,868 | |

| 11,000 | | NorthWestern Corp. | | | 304,065 | | | | 652,080 | |

| 10,000 | | Severn Trent plc. | | | 277,722 | | | | 280,371 | |

| 1,000 | | Southwest Gas Holdings Inc. | | | 34,833 | | | | 82,390 | |

| 10,000 | | TerraForm Global Inc., Cl. A† | | | 49,425 | | | | 48,750 | |

| 87,500 | | Westar Energy Inc. | | | 4,936,945 | | | | 4,679,500 | |

| 1,000 | | WGL Holdings Inc. | | | 82,503 | | | | 85,700 | |

| 25,000 | | Whiting Petroleum Corp.† | | | 193,715 | | | | 150,250 | |

| | | | | | | | | | |

| | | | | 8,611,886 | | | | 7,836,320 | |

| | | | | | | | | | |

| |

| | Entertainment — 0.5% | |

| 3,600 | | Discovery Communications Inc., Cl. A† | | | 26,174 | | | | 67,968 | |

| 10,800 | | Discovery Communications Inc., Cl. C† | | | 60,976 | | | | 192,348 | |

| 180,000 | | Dover Motorsports Inc | | | 667,976 | | | | 351,000 | |

| 8,140 | | Lions Gate Entertainment Corp., Cl. B† | | | 212,454 | | | | 225,152 | |

| | | | | | | | | | |

| | | | | 967,580 | | | | 836,468 | |

| | | | | | | | | | |

| |

| | Equipment and Supplies — 1.3% | |

| 47,300 | | Axis Communications AB | | | 1,895,619 | | | | 2,070,733 | |

| | | | | | | | | | |

| |

| | Financial Services — 3.5% | |

| 1,400 | | Argo Group International Holdings Ltd. | | | 28,231 | | | | 88,130 | |

| 1,000 | | Aspen Insurance Holdings Ltd. | | | 43,388 | | | | 42,900 | |

| 4,600 | | BKF Capital Group Inc.† | | | 180,582 | | | | 40,250 | |

| 2,000 | | Fidelity & Guaranty Life | | | 61,350 | | | | 62,200 | |

| 318,000 | | Fortress Investment Group LLC, Cl. A | | | 2,489,110 | | | | 2,483,580 | |

| 101 | | Horizon Bancorp | | | 2,906 | | | | 2,780 | |

| 3,000 | | Kinnevik AB, Cl. A | | | 103,561 | | | | 104,316 | |

| 90,000 | | Navient Corp. | | | 849,595 | | | | 1,121,400 | |

| 100 | | Patriot National Inc.† | | | 968 | | | | 128 | |

| 100,000 | | SLM Corp.† | | | 573,264 | | | | 1,059,000 | |

| 1,600 | | SLM Solutions Group AG† | | | 55,332 | | | | 66,163 | |

| 20,025 | | Sterling Bancorp | | | 201,872 | | | | 501,626 | |

| 400 | | Topdanmark A/S† | | | 11,380 | | | | 16,443 | |

| | | | | | | | | | |

| | | | | 4,601,539 | | | | 5,588,916 | |

| | | | | | | | | | |

| | | | | | | | | | |

Shares | | | | Cost | | | Market

Value | |

| |

| | Food and Beverage — 3.7% | |

| 4,500 | | Flowers Foods Inc. | | $ | 10,669 | | | $ | 85,635 | |

| 30,000 | | GrainCorp Ltd., Cl. A | | | 341,966 | | | | 195,165 | |

| 17,000 | | Inventure Foods Inc.† | | | 67,790 | | | | 68,000 | |

| 10,000 | | Mondele¯z International Inc., Cl. A | | | 425,100 | | | | 414,300 | |

| 575,000 | | Parmalat SpA | | | 2,014,649 | | | | 2,176,813 | |

| 2,000,000 | | Premier Foods plc† | | | 1,376,332 | | | | 1,042,594 | |

| 22,500 | | Refresco Group NV | | | 524,165 | | | | 520,251 | |

| 4,650 | | Snyder’s-Lance Inc. | | | 152,288 | | | | 174,980 | |

| 1,500 | | The Hershey Co. | | | 142,995 | | | | 159,270 | |

| 30,000 | | Tootsie Roll Industries Inc. | | | 601,770 | | | | 1,068,000 | |

| 450,000 | | Yashili International Holdings Ltd.† | | | 189,692 | | | | 100,943 | |

| | | | | | | | | | |

| | | | | 5,847,416 | | | | 6,005,951 | |

| | | | | | | | | | |

| |

| | Health Care — 8.3% | |

| 12,000 | | Advanced Accelerator Applications SA, ADR† | | | 968,563 | | | | 972,000 | |

| 50,000 | | Akorn Inc.† | | | 1,661,230 | | | | 1,628,500 | |

| 6,000 | | Allergan plc. | | | 1,434,673 | | | | 1,063,380 | |

| 30,000 | | AstraZeneca plc, ADR | | | 1,089,353 | | | | 1,035,000 | |

| 3,200 | | Bio-Rad Laboratories Inc., Cl. A† | | | 314,726 | | | | 703,328 | |

| 11,000 | | Bristol-Myers Squibb Co. | | | 348,381 | | | | 678,260 | |

| 600 | | Chemed Corp. | | | 18,287 | | | | 134,058 | |

| 2,500 | | Cigna Corp. | | | 340,899 | | | | 493,050 | |

| 4,000 | | CR Bard Inc. | | | 1,227,232 | | | | 1,308,280 | |

| 7,000 | | Depomed Inc.† | | | 99,128 | | | | 33,880 | |

| 500 | | Dimension Therapeutics Inc.† | | | 2,990 | | | | 3,000 | |

| 14,000 | | Enzymotec Ltd.† | | | 165,095 | | | | 164,500 | |

| 29,000 | | Exactech Inc.† | | | 985,284 | | | | 1,213,650 | |

| 8,000 | | Grifols SA, ADR | | | 53,680 | | | | 189,200 | |

| 1,200 | | Humana Inc. | | | 215,421 | | | | 306,420 | |

| 5,700 | | ICU Medical Inc.† | | | 365,322 | | | | 1,089,270 | |

| 10,000 | | Idorsia Ltd.† | | | 102,950 | | | | 196,963 | |

| 3,000 | | Illumina Inc.† | | | 157,770 | | | | 615,570 | |

| 6,000 | | Mylan NV† | | | 293,980 | | | | 214,260 | |

| 1,000 | | NxStage Medical Inc.† | | | 29,305 | | | | 26,950 | |

| 24,000 | | Omega Protein Corp. | | | 527,503 | | | | 525,600 | |

| 3,000 | | Perrigo Co. plc. | | | 276,734 | | | | 242,970 | |

| 7,500 | | PharMerica Corp.† | | | 216,862 | | | | 219,750 | |

| 6,000 | | Smith & Nephew plc, ADR | | | 206,505 | | | | 229,560 | |

| 3,500 | | VWR Corp.† | | | 115,868 | | | | 115,850 | |

| | | | | | | | | | |

| | | | | 11,217,741 | | | | 13,403,249 | |

| | | | | | | | | | |

| |

| | Hotels and Gaming — 1.9% | |

| 20,000 | | Belmond Ltd., Cl. A† | | | 224,642 | | | | 263,000 | |

| 400 | | Churchill Downs Inc. | | | 13,096 | | | | 83,420 | |

| 2,000 | | Eldorado Resorts Inc.† | | | 9,768 | | | | 51,400 | |

| 1,000 | | Mantra Group Ltd. | | | 2,968 | | | | 2,985 | |

| 78,000 | | NYX Gaming Group Ltd.† | | | 149,526 | | | | 142,687 | |

| 38,000 | | Ryman Hospitality Properties Inc. | | | 1,354,565 | | | | 2,512,940 | |

| | | | | | | | | | |

| | | | | 1,754,565 | | | | 3,056,432 | |

| | | | | | | | | | |

See accompanying notes to financial statements.

9

Gabelli Enterprise Mergers and Acquisitions Fund

Schedule of Investments (Continued) — October 31, 2017

| | | | | | | | | | |

Shares | | | | Cost | | | Market

Value | |

| | COMMON STOCKS (Continued) | | | | | | | | |

| | Machinery — 0.9% | | | | | | | | |

| 2,500 | | CIRCOR International Inc. | | $ | 100,067 | | | $ | 109,875 | |

| 30,000 | | CNH Industrial NV | | | 270,583 | | | | 383,352 | |

| 14,000 | | Xylem Inc. | | | 356,501 | | | | 931,420 | |

| | | | | | | | | | |

| | | | | 727,151 | | | | 1,424,647 | |

| | | | | | | | | | |

| | | |

| | Media — 5.7% | | | | | | | | |

| 3,000 | | Telegraaf Media Groep NV† | | | 19,115 | | | | 19,919 | |

| 63,000 | | Telenet Group Holding NV† | | | 2,852,898 | | | | 4,357,632 | |

| 50,000 | | The E.W. Scripps Co., Cl. A† | | | 853,140 | | | | 867,000 | |

| 40,000 | | Time Warner Inc. | | | 3,686,311 | | | | 3,931,600 | |

| 2,000 | | tronc Inc.† | | | 22,980 | | | | 29,570 | |

| | | | | | | | | | |

| | | | | 7,434,444 | | | | 9,205,721 | |

| | | | | | | | | | |

| | | |

| | Metals and Mining — 0.4% | | | | | | | | |

| 40,000 | | Alamos Gold Inc., Cl. A | | | 530,476 | | | | 252,800 | |

| 17,752 | | AuRico Metals Inc.† | | | 9,447 | | | | 17,888 | |

| 3,000 | | Dominion Diamond Corp. | | | 42,188 | | | | 42,749 | |

| 19,000 | | Pan American Silver Corp. | | | 298,459 | | | | 310,457 | |

| | | | | | | | | | |

| | | | | 880,570 | | | | 623,894 | |

| | | | | | | | | | |

| | | |

| | Paper and Forest Products — 0.0% | | | | | | | | |

| 17,000 | | Tembec Inc.† | | | 54,038 | | | | 61,801 | |

| | | | | | | | | | |

| | | |

| | Retail — 3.1% | | | | | | | | |

| 4,000 | | Aaron’s Inc. | | | 113,021 | | | | 147,200 | |

| 42,500 | | Bob Evans Farms Inc. | | | 3,283,430 | | | | 3,280,575 | |

| 38,000 | | Jimmy Choo plc† | | | 114,129 | | | | 116,080 | |

| 330,000 | | Rite Aid Corp.† | | | 2,633,723 | | | | 544,500 | |

| 6,000 | | SpartanNash Co. | | | 60,130 | | | | 147,300 | |

| 29,000 | | Village Super Market Inc., Cl. A | | | 662,626 | | | | 695,710 | |

| | | | | | | | | | |

| | | | | 6,867,059 | | | | 4,931,365 | |

| | | | | | | | | | |

| | | |

| | Semiconductors — 1.2% | | | | | | | | |

| 14,800 | | AIXTRON SE† | | | 60,369 | | | | 231,013 | |

| 10,000 | | IXYS Corp.† | | | 219,496 | | | | 247,000 | |

| 1,000 | | MoSys Inc.† | | | 39,042 | | | | 660 | |

| 13,000 | | NXP Semiconductors NV† | | | 1,286,564 | | | | 1,521,650 | |

| | | | | | | | | | |

| | | | | 1,605,471 | | | | 2,000,323 | |

| | | | | | | | | | |

| | | |

| | Specialty Chemicals — 2.1% | | | | | | | | |

| 88,662 | | Calgon Carbon Corp. | | | 1,899,544 | | | | 1,923,965 | |

| 7,000 | | Ferro Corp.† | | | 98,512 | | | | 166,740 | |

| 1,500 | | Linde AG. | | | 248,756 | | | | 323,945 | |

| 4,000 | | Monsanto Co. | | | 411,181 | | | | 484,400 | |

| 32,000 | | SGL Carbon SE† | | | 597,350 | | | | 502,656 | |

| | | | | | | | | | |

| | | | | 3,255,343 | | | | 3,401,706 | |

| | | | | | | | | | |

| | | |

| | Telecommunications — 3.3% | | | | | | | | |

| 280,000 | | Asia Satellite Telecommunications Holdings Ltd. | | | 604,206 | | | | 258,415 | |

| 36,000 | | Cincinnati Bell Inc.† | | | 604,307 | | | | 687,600 | |

| 1,800 | | Gigamon Inc.† | | | 69,264 | | | | 69,300 | |

| 8,500 | | Hitachi Kokusai Electric Inc. | | | 190,555 | | | | 234,356 | |

| | | | | | | | | | |

Shares | | | | Cost | | | Market

Value | |

| 220,000 | | Koninklijke KPN NV | | $ | 657,892 | | | $ | 759,575 | |

| 50,000 | | Level 3 Communications Inc.† | | | 2,743,613 | | | | 2,681,500 | |

| 5,000 | | Loral Space & Communications Inc.† | | | 234,737 | | | | 235,750 | |

| 1,500 | | Lumos Networks Corp.† | | | 26,558 | | | | 26,940 | |

| 1,000 | | Rogers Communications Inc., Cl. B | | | 2,955 | | | | 51,900 | |

| 2,000 | | Straight Path Communications Inc., Cl. B† | | | 360,129 | | | | 363,020 | |

| | | | | | | | | | |

| | | | | 5,494,216 | | | | 5,368,356 | |

| | | | | | | | | | |

| | | |

| | Transportation — 2.6% | | | | | | | | |

| 90,000 | | Abertis Infraestructuras SA | | | 1,651,709 | | | | 1,946,813 | |

| 3,000 | | GATX Corp. | | | 118,937 | | | | 178,230 | |

| 50,000 | | Navistar International Corp.† | | | 957,947 | | | | 2,115,500 | |

| | | | | | | | | | |

| | | | | 2,728,593 | | | | 4,240,543 | |

| | | | | | | | | | |

| | | |

| | Wireless Communications — 5.3% | | | | | | | | |

| 1,000 | | DGC One AB†(a) | | | 28,852 | | | | 29,863 | |

| 46,000 | | Millicom International Cellular SA, SDR. | | | 2,787,434 | | | | 2,942,431 | |

| 58,000 | | Sprint Corp.† | | | 300,473 | | | | 379,320 | |

| 9,000 | | Telephone & Data Systems Inc. | | | 255,177 | | | | 262,350 | |

| 40,000 | | T-Mobile US Inc.† | | | 650,000 | | | | 2,390,800 | |

| 70,000 | | United States Cellular Corp.† | | | 3,221,188 | | | | 2,561,300 | |

| | | | | | | | | | |

| | | | | 7,243,124 | | | | 8,566,064 | |

| | | | | | | | | | |

| | TOTAL COMMON STOCKS | | | 96,589,854 | | | | 109,353,517 | |

| | | | | | | | | | |

| | | |

| | RIGHTS — 0.2% | | | | | | | | |

| | Energy and Utilities — 0.1% | | | | | | | | |

| 90,000 | | Dyax Corp., CVR†(a) | | | 0 | | | | 99,900 | |

| | | | | | | | | | |

| | | |

| | Health Care — 0.0% | | | | | | | | |

| 20,000 | | Adolor Corp., CPR, expire 07/01/19†(a) | | | 0 | | | | 5,200 | |

| 13,000 | | Ambit Biosciences Corp., CVR†(a) | | | 0 | | | | 7,800 | |

| 5,000 | | American Medical Alert Corp., CPR†(a) | | | 0 | | | | 50 | |

| 11,000 | | Chelsea Therapeutics International Ltd., CVR†(a) | | | 1,210 | | | | 0 | |

| 75,000 | | Innocoll, CVR†(a) | | | 45,000 | | | | 45,000 | |

| 100 | | Omthera Pharmaceuticals Inc., CVR†(a) | | | 0 | | | | 0 | |

| 250,200 | | Synergetics USA Inc., CVR†(a) | | | 25,020 | | | | 25,020 | |

| 156,000 | | Teva Pharmaceutical Industries Ltd., CCCP, expire 02/20/23†(a) | | | 74,375 | | | | 0 | |

| 7,000 | | Tobira Therapeutics Inc., CVR†(a) | | | 420 | | | | 420 | |

| | | | | | | | | | |

| | | | | 146,025 | | | | 83,490 | |

| | | | | | | | | | |

See accompanying notes to financial statements.

10

Gabelli Enterprise Mergers and Acquisitions Fund

Schedule of Investments (Continued) — October 31, 2017

| | | | | | | | | | |

Shares | | | | Cost | | | Market

Value | |

| | RIGHTS (Continued) | | | | | | | | |

| | Media — 0.0% | | | | | | | | |

| 40,000 | | Media General Inc., CVR, expire 12/31/17†(a) | | $ | 0 | | | $ | 0 | |

| | | | | | | | | | |

| | Retail — 0.1% | | | | | | | | |

| 220,000 | | Safeway Casa Ley, CVR, expire 01/30/19† | | | 39,570 | | | | 117,700 | |

| 220,000 | | Safeway PDC, CVR, expire 01/30/18† | | | 0 | | | | 3,300 | |

| | | | | | | | | | |

| | | | | 39,570 | | | | 121,000 | |

| | | | | | | | | | |

| | TOTAL RIGHTS | | | 185,595 | | | | 304,390 | |

| | | | | | | | | | |

| | | |

| | WARRANTS — 0.0% | | | | | | | | |

| | Metals and Mining — 0.0% | | | | | | | | |

| 850 | | Hudbay Minerals Inc., expire 07/20/18† | | | 962 | | | | 217 | |

| | | | | | | | | | |

Principal

Amount | | | | | | | | |

| | CORPORATE BONDS — 0.0% | | | | | | | | |

| | Health Care — 0.0% | | | | | | | | |

| $ 7,000 | | Constellation Health Promissory Note, PIK, 5.000%, 01/31/24(a)(b) | | | 3,010 | | | | 3,010 | |

| | | | | | | | | | |

| | | | | | | | | | |

Principal

Amount | | | | Cost | | | Market

Value | |

| | U.S. GOVERNMENT OBLIGATIONS — 30.9% | |

| $49,998,000 | | U.S. Treasury Bills, 0.955% to 1.248%††, 11/02/17 to 04/19/18(c) | | $ | 49,876,157 | | | $ | 49,877,320 | |

| | | | | | | | | | |

| | TOTAL INVESTMENTS — 98.8% | | $ | 146,655,578 | | | | 159,538,454 | |

| | | | | | | | | | |

| | Other Assets and Liabilities (Net) — 1.2% | | | | 1,979,059 | |

| | | | | | | | | | |

| | NET ASSETS — 100.0%. | | | | | | $ | 161,517,513 | |

| | | | | | | | | | |

| | |

(a) | | Security is valued using significant unobservable inputs and is classified as Level 3 in the fair value hierarchy. |

(b) | | Payment-in-kind (“PIK”) security. 5.00% PIK interest income will be paid as additional securities at the discretion of the issuer. |

(c) | | At October 31, 2017, $500,000 of the principal amount was pledged as collateral with Pershing. |

† | | Non-income producing security. |

†† | | Represents annualized yield at date of purchase. |

ADR | | American Depositary Receipt |

CCCP | | Contingent Cash Consideration Payment |

CPR | | Contingent Payment Right |

CVR | | Contingent Value Right |

SDR | | Swedish Depositary Receipt |

See accompanying notes to financial statements.

11

Gabelli Enterprise Mergers and Acquisitions Fund

| | | | |

| Statement of Assets and Liabilities | | | |

| October 31, 2017 | | | |

|

| |

Assets: | | | | |

Investments, at value (cost $146,655,578) | | $ | 159,538,454 | |

Foreign currency, at value (cost $2,893,489) | | | 2,967,431 | |

Cash | | | 16,351 | |

Receivable for Fund shares sold | | | 274,617 | |

Receivable for investments sold | | | 264,741 | |

Dividends receivable | | | 57,037 | |

Prepaid expenses | | | 37,439 | |

Other receivable | | | 29,250 | |

| | | | |

Total Assets | | | 163,185,320 | |

| | | | |

Liabilities: | | | | |

Payable for Fund shares redeemed | | | 172,182 | |

Payable for investments purchased | | | 1,202,922 | |

Payable for investment advisory fees | | | 128,878 | |

Payable for distribution fees | | | 52,582 | |

Payable for accounting fees | | | 15,000 | |

Payable for payroll expenses | | | 636 | |

Other accrued expenses | | | 95,607 | |

| | | | |

Total Liabilities | | | 1,667,807 | |

| | | | |

Net Assets | | | | |

(applicable to 10,895,165 shares outstanding) | | $ | 161,517,513 | |

| | �� | | |

Net Assets Consist of: | | | | |

Paid-in capital | | $ | 149,164,728 | |

Accumulated net investment loss | | | (578,435 | ) |

Distributions in excess of net realized gain on investments and foreign currency transactions | | | (25,703 | ) |

Net unrealized appreciation on investments | | | 12,882,876 | |

Net unrealized appreciation on foreign currency translations | | | 74,047 | |

| | | | |

Net Assets | | $ | 161,517,513 | |

| | | | |

| | | | |

Shares of Capital Stock, each at $0.001 par value: | | | | |

Class AAA: | | | | |

Net Asset Value, offering, and redemption price per share ($6,200,712 ÷ 414,592 shares outstanding; 100,000,000 shares authorized) | | | $14.96 | |

| | | | |

Class A: | | | | |

Net Asset Value and redemption price per share ($46,887,023 ÷ 3,182,908 shares outstanding; 200,000,000 shares authorized) | | | $14.73 | |

| | | | |

Maximum offering price per share (NAV ÷ 0.9425, based on maximum sales charge of 5.75% of the offering price) | | | $15.63 | |

| | | | |

Class C: | | | | |

Net Asset Value and offering price per share ($38,627,929 ÷ 2,854,018 shares outstanding; 100,000,000 shares authorized) | | | $13.53 | (a) |

| | | | |

Class T: | | | | |

Net Asset Value and redemption price per share ($1,012.10 ÷ 68.63 shares outstanding; 100,000,000 shares authorized) | | | $14.75 | |

| | | | |

Maximum offering price per share (NAV ÷ 0.9750, based on maximum sales charge of 2.50% of the offering price) | | | $15.13 | |

| | | | |

Class Y: | | | | |

Net Asset Value, and redemption price per share ($69,800,837 ÷ 4,443,578 shares outstanding; 100,000,000 shares authorized) | | | $15.71 | |

| | | | |

| (a) | Redemption price varies based on the length of time held. |

| | | | |

| Statement of Operations | | | |

| For the Year Ended October 31, 2017 | | | |

|

| |

Investment Income: | | | | |

Dividends (net of foreign withholding taxes of $56,613) | | $ | 1,758,691 | |

Interest | | | 300,550 | |

Other Income* | | | 3,848 | |

| | | | |

Total Investment Income | | | 2,063,089 | |

| | | | |

Expenses: | | | | |

Investment advisory fees | | | 1,545,994 | |

Distribution fees - Class AAA | | | 12,323 | |

Distribution fees - Class A | | | 230,147 | |

Distribution fees - Class C | | | 429,132 | |

Distribution fees - Class T | | | 1 | |

Shareholder services fees | | | 162,365 | |

Directors’ fees | | | 74,500 | |

Registration expenses | | | 68,827 | |

Shareholder communications expenses | | | 60,982 | |

Legal and audit fees | | | 58,302 | |

Accounting fees | | | 45,000 | |

Custodian fees | | | 31,567 | |

Interest expense | | | 18,353 | |

Payroll expenses | | | 3,201 | |

Miscellaneous expenses | | | 23,196 | |

| | | | |

Total Expenses | | | 2,763,890 | |

| | | | |

Less: | | | | |

Expenses paid indirectly by broker (See Note 6) | | | (2,486 | ) |

| | | | |

Net Expenses | | | 2,761,404 | |

| | | | |

Net Investment Loss | | | (698,315 | ) |

| | | | |

Net Realized and Unrealized Gain/(Loss) on | | | | |

Investments, Securities Sold Short, and Foreign Currency: | | | | |

Net realized gain on investments | | | 5,744,298 | |

Net realized loss on foreign currency transactions | | | (2,717 | ) |

| | | | |

Net realized gain on investments and foreign currency transactions | | | 5,741,581 | |

| | | | |

Net change in unrealized appreciation/depreciation: | | | | |

on investments | | | 10,933,870 | |

on securities sold short | | | (8,914 | ) |

on foreign currency translations | | | 172,627 | |

| | | | |

Net change in unrealized appreciation/ depreciation on investments, securities sold short, and foreign currency translations | | | 11,097,583 | |

| | | | |

Net Realized and Unrealized Gain/(Loss) on Investments, Securities Sold Short, and

Foreign Currency | | | 16,839,164 | |

| | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 16,140,849 | |

| | | | |

| * | The Fund received a reimbursement of custody expenses paid in prior years. |

See accompanying notes to financial statements.

12

Gabelli Enterprise Mergers and Acquisitions Fund

Statement of Changes in Net Assets

| | | | | | | | |

| | | Year Ended

October 31, 2017 | | | Year Ended

October 31, 2016 | |

Operations: | | | | | | | | |

Net investment loss. | | | $ (698,315) | | | | $ (190,576) | |

Net realized gain on investments, and foreign currency transactions | | | 5,741,581 | | | | 10,307,496 | |

Net change in unrealized appreciation/depreciation on investments, securities sold short, and foreign currency translations | | | 11,097,583 | | | | (8,302,711) | |

| | | | | | | | |

Net Increase in Net Assets Resulting from Operations. | | | 16,140,849 | | | | 1,814,209 | |

| | | | | | | | |

Capital Share Transactions: | | | | | | | | |

Class AAA | | | 1,679,658 | | | | (922,957) | |

Class A | | | (6,922,346) | | | | (9,998,717) | |

Class C | | | (9,921,139) | | | | (9,735,326) | |

Class T | | | 1,000 | | | | — | |

Class Y | | | 3,862,479 | | | | (18,350,000) | |

| | | | | | | | |

Net Decrease in Net Assets from Capital Share Transactions | | | (11,300,348) | | | | (39,007,000) | |

| | | | | | | | |

Redemption Fees | | | 139 | | | | 2,048 | |

| | | | | | | | |

Net Increase/(Decrease) in Net Assets | | | 4,840,640 | | | | (37,190,743) | |

Net Assets: | | | | | | | | |

Beginning of year | | | 156,676,873 | | | | 193,867,616 | |

| | | | | | | | |

End of year (including undistributed net investment income of $0 and $0, respectively) | | | $161,517,513 | | | | $156,676,873 | |

| | | | | | | | |

See accompanying notes to financial statements.

13

Gabelli Enterprise Mergers and Acquisitions Fund

Financial Highlights

Selected data for a share of capital stock outstanding throughout each period:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Income (Loss) | | | | | | | | | | | | Ratios to Average Net Assets/ | |

| | | | | | from Investment Operations | | | | | | | | | | | | Supplemental Data | |

| | | Net Asset | | | Net | | | Net Realized and | | | Total | | | | | | Net Asset | | | | | | Net Assets | | | Net | | | | | | | |

| Year | | Value, | | | Investment | | | Unrealized | | | from | | | | | | Value, | | | | | | End of | | | Investment | | | | | | Portfolio | |

| Ended | | Beginning | | | Income | | | Gain on | | | Investment | | | Redemption | | | End of | | | Total | | | Period | | | Income | | | Operating | | | Turnover | |

October 31 | | of Period | | | (Loss)(a) | | | Investments | | | Operations | | | Fees (a)(b) | | | Period | | | Return† | | | (in 000’s) | | | (Loss) | | | Expenses | | | Rate | |

Class AAA | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2017 | | | $13.52 | | | | $(0.04) | | | | $1.48 | | | | $1.44 | | | | $0.00 | | | | $14.96 | | | | 10.65% | | | | $6,201 | | | | (0.28 | )% | | | 1.51%(c)(d) | | | | 113% | |

2016 | | | 13.31 | | | | 0.01 | | | | 0.20 | | | | 0.21 | | | | 0.00 | | | | 13.52 | | | | 1.58 | | | | 4,069 | | | | 0.07 | | | | 1.52(c)(d)(e)(f) | | | | 151 | |

2015 | | | 12.86 | | | | (0.07) | | | | 0.52 | | | | 0.45 | | | | 0.00 | | | | 13.31 | | | | 3.50 | | | | 4,943 | | | | (0.51 | ) | | | 1.47(c)(d)(e) | | | | 162 | |

2014 | | | 12.66 | | | | (0.03) | | | | 0.23 | | | | 0.20 | | | | 0.00 | | | | 12.86 | | | | 1.58 | | | | 11,315 | | | | (0.24 | ) | | | 1.46(d)(e) | | | | 181 | |

2013 | | | 11.00 | | | | 0.04 | | | | 1.62 | | | | 1.66 | | | | 0.00 | | | | 12.66 | | | | 15.09 | | | | 8,671 | | | | 0.37 | | | | 1.49(d) | | | | 197 | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2017 | | | $13.35 | | | | $(0.07) | | | | $1.45 | | | | $1.38 | | | | $0.00 | | | | $14.73 | | | | 10.34% | | | | $46,887 | | | | (0.46 | )% | | | 1.71%(c)(d) | | | | 113% | |

2016 | | | 13.17 | | | | (0.02) | | | | 0.20 | | | | 0.18 | | | | 0.00 | | | | 13.35 | | | | 1.37 | | | | 48,770 | | | | (0.13 | ) | | | 1.72(c)(d)(e)(f) | | | | 151 | |

2015 | | | 12.75 | | | | (0.08) | | | | 0.50 | | | | 0.42 | | | | 0.00 | | | | 13.17 | | | | 3.29 | | | | 58,039 | | | | (0.63 | ) | | | 1.67(c)(d)(e) | | | | 162 | |

2014 | | | 12.57 | | | | (0.06) | | | | 0.24 | | | | 0.18 | | | | 0.00 | | | | 12.75 | | | | 1.43 | | | | 93,980 | | | | (0.51 | ) | | | 1.66(d)(e) | | | | 181 | |

2013 | | | 10.94 | | | | 0.02 | | | | 1.61 | | | | 1.63 | | | | 0.00 | | | | 12.57 | | | | 14.90 | | | | 109,446 | | | | 0.15 | | | | 1.69(d) | | | | 197 | |

Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2017 | | | $12.33 | | | | $(0.13) | | | | $1.33 | | | | $1.20 | | | | $0.00 | | | | $13.53 | | | | 9.73% | | | | $38,628 | | | | (1.01 | )% | | | 2.26%(c)(d) | | | | 113% | |

2016 | | | 12.23 | | | | (0.08) | | | | 0.18 | | | | 0.10 | | | | 0.00 | | | | 12.33 | | | | 0.82 | | | | 44,424 | | | | (0.67 | ) | | | 2.27(c)(d)(e)(f) | | | | 151 | |

2015 | | | 11.91 | | | | (0.14) | | | | 0.46 | | | | 0.32 | | | | 0.00 | | | | 12.23 | | | | 2.69 | | | | 53,738 | | | | (1.19 | ) | | | 2.22(c)(d)(e) | | | | 162 | |

2014 | | | 11.81 | | | | (0.12) | | | | 0.22 | | | | 0.10 | | | | 0.00 | | | | 11.91 | | | | 0.85 | | | | 57,616 | | | | (1.04 | ) | | | 2.21(d)(e) | | | | 181 | |

2013 | | | 10.33 | | | | (0.04) | | | | 1.52 | | | | 1.48 | | | | 0.00 | | | | 11.81 | | | | 14.33 | | | | 58,062 | | | | (0.39 | ) | | | 2.24(d) | | | | 197 | |

Class T(g) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2017 | | | $14.57 | | | | $(0.03) | | | | $0.21 | | | | $0.18 | | | | — | | | | $14.75 | | | | 1.24% | | | | $1 | | | | (0.63 | )% | | | 1.51%(c)(d) | | | | 113% | |

Class Y | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2017 | | | $14.17 | | | | $(0.00)(b) | | | | $1.54 | | | | $1.54 | | | | $0.00 | | | | $15.71 | | | | 10.87% | | | | $69,801 | | | | (0.02 | )% | | | 1.26%(c)(d) | | | | 113% | |

2016 | | | 13.91 | | | | 0.05 | | | | 0.21 | | | | 0.26 | | | | 0.00 | | | | 14.17 | | | | 1.87 | | | | 59,414 | | | | 0.33 | | | | 1.27(c)(d)(e)(f) | | | | 151 | |

2015 | | | 13.41 | | | | (0.03) | | | | 0.53 | | | | 0.50 | | | | 0.00 | | | | 13.91 | | | | 3.73 | | | | 77,148 | | | | (0.20 | ) | | | 1.21(c)(d)(e) | | | | 162 | |

2014 | | | 13.16 | | | | (0.00) | | | | 0.25 | | | | 0.25 | | | | 0.00 | | | | 13.41 | | | | 1.90 | | | | 80,672 | | | | (0.03 | ) | | | 1.21(d)(e) | | | | 181 | |

2013 | | | 11.41 | | | | 0.06 | | | | 1.69 | | | | 1.75 | | | | 0.00 | | | | 13.16 | | | | 15.34 | | | | 66,746 | | | | 0.48 | | | | 1.24(d) | | | | 197 | |

| † | Total return represents aggregate total return of a hypothetical $1,000 investment at the beginning of the period and sold at the end of the period including reinvestment of distributions and does not reflect applicable sales charges. Total return for a period of less than one year is not annualized. |

| (a) | Per share amounts have been calculated using the average shares outstanding method. |

| (b) | Amount represents less than $0.005 per share. |

| (c) | The Fund received credits from a designated broker who agreed to pay certain Fund operating expenses. For the years ended October 31, 2017, 2016 and 2015, there was no impact on the expense ratios. |

| (d) | The Fund incurred interest expense during the year ended October 31, 2017. If interest expense had not been incurred during the year, the ratio of operating expenses to average net assets would have been 1.50% (Class AAA), 1.70% (Class A), 2.25% (Class C), 1.50% (Class T) and 1.25% (Class Y) respectively. For the years ended October 31, 2016, 2015, 2014, and 2013, there was no impact on the expense ratio. |

| (e) | The Fund incurred dividend expense and service fees on securities sold short. If these expenses and fees had not been incurred, the ratios of operating expenses to average net assets for the year ended October 31, 2016 would have been 1.50% (Class AAA), 1.70% (Class A), 2.25% (Class C), and 1.25% (Class Y), respectively. For the years ended October 31, 2015, and 2014, there was no impact on the expense ratios. |

| (f) | During the year ended October 31, 2016, the Fund received a reimbursement of custody expenses paid in prior years. Had such reimbursement (allocated by relative net asset values of the Fund’s share classes) been included in that period, the expense ratios would have been 1.44% (Class AAA),1.64% (Class A), 2.19% (Class C), and 1.19% (Class Y), respectively. |

| (g) | Class T Shares were initially offered on June 30, 2017. |

See accompanying notes to financial statements.

14

Gabelli Enterprise Mergers and Acquisitions Fund

Notes to Financial Statements

1. Organization. The Gabelli Enterprise Mergers and Acquisitions Fund is a series of the Gabelli 787 Fund, Inc. (the “Corporation”), which was organized in Maryland and commenced operations on February 28, 2001. On June 30, 2017, the Fund began to offer for sale Class T Shares. The Fund is a non-diversified open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). Its primary objective is capital appreciation.

2. Significant Accounting Policies. As an investment company, the Fund follows the investment company accounting and reporting guidance, which is part of U.S. generally accepted accounting principles (“GAAP”) that may require the use of management estimates and assumptions in the preparation of its financial statements. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security Valuation. Portfolio securities listed or traded on a nationally recognized securities exchange or traded in the U.S. over-the-counter market for which market quotations are readily available are valued at the last quoted sale price or a market’s official closing price as of the close of business on the day the securities are being valued. If there were no sales that day, the security is valued at the average of the closing bid and asked prices or, if there were no asked prices quoted on that day, then the security is valued at the closing bid price on that day. If no bid or asked prices are quoted on such day, the security is valued at the most recently available price or, if the Board of Directors (the “Board”) so determines, by such other method as the Board shall determine in good faith to reflect its fair market value. Portfolio securities traded on more than one national securities exchange or market are valued according to the broadest and most representative market, as determined by Gabelli Funds, LLC (the “Adviser”).

Portfolio securities primarily traded on a foreign market are generally valued at the preceding closing values of such securities on the relevant market, but may be fair valued pursuant to procedures established by the Board if market conditions change significantly after the close of the foreign market, but prior to the close of business on the day the securities are being valued. Debt obligations for which market quotations are readily available are valued at the average of the latest bid and asked prices. If there were no asked prices quoted on such day, the security is valued using the closing bid price, unless the Board determines such amount does not reflect the securities’ fair value, in which case these securities will be fair valued as determined by the Board. Certain securities are valued principally using dealer quotations. Futures contracts are valued at the closing settlement price of the exchange or board of trade on which the applicable contract is traded. OTC futures and options on futures for which market quotations are readily available will be valued by quotations received from a pricing service or, if no quotations are available from a pricing service, by quotations obtained from one or more dealers in the instrument in question by the Adviser.

Securities and assets for which market quotations are not readily available are fair valued as determined by the Board. Fair valuation methodologies and procedures may include, but are not limited to: analysis and review of available financial and non-financial information about the company; comparisons with the valuation and changes in valuation of similar securities, including a comparison of foreign securities with the equivalent U.S. dollar value American Depositary Receipt securities at the close of the U.S. exchange; and evaluation of any other information that could be indicative of the value of the security.

15

Gabelli Enterprise Mergers and Acquisitions Fund

Notes to Financial Statements (Continued)

The inputs and valuation techniques used to measure fair value of the Fund’s investments are summarized into three levels as described in the hierarchy below:

| | ● | | Level 1 — quoted prices in active markets for identical securities; |

| | ● | | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.); and |

| | ● | | Level 3 — significant unobservable inputs (including the Board’s determinations as to the fair value of investments). |

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input both individually and in the aggregate that is significant to the fair value measurement. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The summary of the Fund’s investments in securities by inputs used to value the Fund’s investments as of October 31, 2017 is as follows:

| | | | | | | | | | | | | | | | |

| | | Valuation Inputs | | | | |

| | | Level 1

Quoted Prices | | | Level 2 Other Significant

Observable Inputs | | | Level 3 Significant

Unobservable Inputs | | | Total Market Value

at 10/31/17 | |

INVESTMENTS IN SECURITIES: | | | | | | | | | | | | | | | | |

ASSETS (Market Value): | | | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | | | |

Automotive: Parts and Accessories | | | $ 719,872 | | | | — | | | | $100,000 | | | | $ 819,872 | |

Building and Construction | | | 3,500,674 | | | | $ 172,000 | | | | — | | | | 3,672,674 | |

Business Services | | | 3,110,797 | | | | — | | | | 0 | | | | 3,110,797 | |

Energy and Utilities | | | 7,836,320 | | | | — | | | | 0 | | | | 7,836,320 | |

Financial Services | | | 5,548,666 | | | | 40,250 | | | | — | | | | 5,588,916 | |

Wireless Communications | | | 8,536,201 | | | | — | | | | 29,863 | | | | 8,566,064 | |

All Other Industries (a) | | | 79,758,874 | | | | — | | | | — | | | | 79,758,874 | |

Total Common Stocks | | | 109,011,404 | | | | 212,250 | | | | 129,863 | | | | 109,353,517 | |

Rights (a) | | | — | | | | 121,000 | | | | 183,390 | | | | 304,390 | |

Warrants (a) | | | 217 | | | | — | | | | — | | | | 217 | |

Corporate Bonds (a) | | | — | | | | — | | | | 3,010 | | | | 3,010 | |

U.S. Government Obligations | | | — | | | | 49,877,320 | | | | — | | | | 49,877,320 | |

TOTAL INVESTMENTS IN SECURITIES – ASSETS | | | $109,011,621 | | | | $50,210,570 | | | | $316,263 | | | | $159,538,454 | |

| (a) | Please refer to the Schedule of Investments for the industry classifications of these portfolio holdings. |

During the year ended October 31, 2017, the Fund had transfers of $92,600 or 0.06% from Level 1 to Level 3, $155,000 or 0.10% from Level 1 to Level 2, $88,000 or 0.06% from Level 3 to Level 2, and $7,821 or 0.01% from Level 2 to Level 1 of net assets as of October 31, 2017. Transfers from Level 1 to Level 3 and Level 1 to Level 2 are due to a decline in market activity, e.g., frequency of trades, which resulted in a lack of available market inputs to determine price. Transfers from Level 2 to Level 1 and Level 3 to Level 2 are due to an increase in market activity, e.g., frequency of trades, which resulted in an increase in available market inputs to determine price. The Fund’s policy is to recognize transfers among Levels as of the beginning of the reporting period.

16

Gabelli Enterprise Mergers and Acquisitions Fund

Notes to Financial Statements (Continued)

The following table reconciles Level 3 investments for which significant unobservable inputs were used to determine fair value:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Net change | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | in unrealized | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | appreciation/ | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | depreciation | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | during the | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | period on | |

| | | | | | | | | | | | Change in | | | | | | | | | | | | | | | | | | Level 3 | |

| | | Balance | | | Accrued | | | Realized | | | unrealized | | | | | | | | | Transfers | | | Transfers | | | Balance | | | investments | |

| | | as of | | | discounts/ | | | gain/ | | | appreciation/ | | | | | | | | | into | | | out of | | | as of | | | still held at | |

| | | 10/31/16 | | | (premiums) | | | (loss) | | | depreciation | | | Purchases | | | Sales | | | Level 3†† | | | Level 3†† | | | 10/31/17 | | | 10/31/17† | |

INVESTMENTS IN SECURITIES: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ASSETS (Market Value): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Automotive: Parts and Accessories | | | — | | | | — | | | | — | | | | $ 7,400 | | | | — | | | | — | | | | $92,600 | | | | — | | | | $100,000 | | | | $ 7,400 | |

Business Services | | | $ 0 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 0 | | | | — | |

Energy and Utilities | | | 0 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 0 | | | | — | |

Media | | | 628,725 | | | | — | | | | $168,321 | | | | (74,732) | | | | — | | | | $ (722,314) | | | | — | | | | — | | | | — | | | | — | |

Wireless Communications | | | — | | | | — | | | | — | | | | 1,011 | | | | $28,852 | | | | — | | | | — | | | | — | | | | 29,863 | | | | 1,011 | |

Total Common Stocks | | | 628,725 | | | | — | | | | 168,321 | | | | (66,321) | | | | 28,852 | | | | (722,314) | | | | 92,600 | | | | — | | | | 129,863 | | | | 8,411 | |

Rights (a) | | | 1,120,100 | | | | — | | | | 336,191 | | | | (159,843) | | | | 45,420 | | | | (1,070,478) | | | | — | | | | $(88,000) | | | | 183,390 | | | | (89,150) | |

Corporate Bonds (a) | | | — | | | | — | | | | — | | | | — | | | | 3,010 | | | | — | | | | — | | | | — | | | | 3,010 | | | | — | |

TOTAL INVESTMENTS IN SECURITIES | | | $1,748,825 | | | | — | | | | $504,512 | | | | $(226,164) | | | | $77,282 | | | | $(1,792,792) | | | | $92,600 | | | | $(88,000) | | | | $316,263 | | | | $(80,739) | |

| (a) | Please refer to the Schedule of Investments for the industry classifications of these portfolio holdings. |

| † | Net change in unrealized appreciation/depreciation on investments is included in the related amounts in the Statement of Operations. |

| †† | The Fund’s policy is to recognize transfers into and out of Level 3 as of the beginning of the reporting period. |

The following table summarizes the valuation techniques used and unobservable inputs utilized to determine the value of certain of the Fund’s Level 3 investments as of October 31, 2017:

| | | | | | | | | | | | |

Description | | Balance at 10/31/17 | | | Valuation Technique | | Unobservable Input | | Range | |

INVESTMENTS IN SECURITIES: | | | | | | | | | | | | |

ASSETS (Market Value): | | | | | | | | | | | | |

Rights (a) | | | $183,390 | | | Acquisition price/Cash flow analysis/Intrinsic value | | Discount Range | | | 0 | % |

Corporate Bonds (a) | | | 3,010 | | | Acquisition price/Cash flow analysis | | Discount Range | | | 0 | % |

Common Stocks (a) | | | 129,863 | | | Acquisition price/Cash flow analysis/Bankruptcy plan | | Discount Range | | | 0 | % |

| | | | | | | | | | | | |

| | | $316,263 | | | | | | | | | |

| | | | | | | | | | | | |

| (a) | Please refer to the Schedule of Investments for the industry classifications of these portfolio holdings. |

| | | | |