UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22041

Gabelli 787 Fund, Inc.

(Exact name of registrant as specified in charter)

One Corporate Center

Rye , New York 10580-1422

(Address of principal executive offices) (Zip code)

Bruce N. Alpert

Gabelli Funds, LLC

One Corporate Center

Rye , New York 10580-1422

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-422-3554

Date of fiscal year end: October 31

Date of reporting period: October 31, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Gabelli Enterprise Mergers and Acquisitions Fund

Annual Report

October 31, 2018

To Our Shareholders,

For the fiscal year ended October 31, 2018, the net asset value (NAV) per Class A Share of the Gabelli Enterprise Mergers and Acquisitions Fund decreased 0.3% compared with an increase of 7.4% for the Standard & Poor’s (S&P) 500 Index. The performance of the ICE Bank of America Merrill Lynch 3 Month U.S. Treasury Bill Index for this year was 1.7%. Other classes of shares are available. See page 4 for additional performance information for all classes.

Enclosed are the financial statements, including the schedule of investments, as of October 31, 2018.

Performance Discussion (Unaudited)

So far, 2018 has been a historically strong year for mergers and acquisition (M&A) activity. Through the first nine months of the calendar year, global deal volume totaled $3.3 trillion, which represented a 37% increase over the same period in 2017. Mega deals, or deals whose announced value is greater than $5 billion, accounted for 43% of the volume. This phenomenon helped offset the 9% year over year decline in the number of deals announced during the period. Although total volumes for 2018 have been strong, there has been a substantial slowdown in deal making activity as of late. Third calendar quarter volumes declined 32% sequentially from second quarter levels, due in part to global trade tensions.

Along with mega deals, cross-border deal activity was a major driver of 2018 volume. Cross-border M&A increased 56% year over year to $1.3 trillion, the highest level since 2007. Deal making in the U.S. and Europe also contributed to the strong deal volume seen in 2018. U.S. M&A increased 50% year over year to $1.3 trillion and European M&A increased 64% year over year to $941.2 billion.

The Energy and Power sector continued its strong start to the year and helped push deal volumes to record levels. Volumes in the sector totaled $548.1 billion through the first nine months of the calendar year, up 56% from last year. Deals in the Healthcare and Technology sectors also have made meaningful contributions to 2018 numbers as each sector accounted for 11% of announced volume. Industrials rounded out the group of top sector contributors, accounting for 10% of the deal activity announced this year.

As the Federal Reserve has continued to raise rates, it is important to recall that historically there has been a positive correlation between interest rates and arbitrage spreads. This is due to the fact that the spread is driven by the risks inherent to a particular deal as well as the risk-free rate. Typically, as the risk-free rate rises, so do annualized spreads. Corporations have had high cash balances and an appetite to grow inorganically since quantitative easing took effect in 2008. Tax reform further propelled deal making.

The Fund’s performance was negative for the fiscal year due to a combination of factors. First, the “pre-announced” stocks in the portfolio traded lower as the market declined in October and valuations decreased across the broader market. Second, during the period there have been certain “announced” deal holdings that were affected by the market volatility and idiosyncratic factors related to closing.

Selected deals that closed during the Fund’s fiscal year

Fortress Investment Group LLC (FIG) is a New York City based alternative asset manager. Fortress manages credit, real estate, equity, and private equity strategies on behalf of its clients. On February 14, 2017 FIG agreed to be acquired by SoftBank Group Corp. for $8.08 per share in cash representing a $3.3 billion valuation. The deal required regulatory and shareholder approvals and closed on December 27, 2017.

Advanced Accelerator Application SA (AAAP) is a St-Genis-Pouilly, France based pharmaceuticals company focused on nuclear medicine theragnostics. On October 30, 2017, AAAP agreed to be acquired by Novartis AG for $41 cash per ordinary share and $82 cash per ADS, valuing the company’s equity at $3.9 billion. Completion of the deal required the tender of at least 80% of AAAP shares and certain regulatory approvals. The deal closed on January 22, 2018.

Amplify Snack Brands Inc. (BETR) is an Austin, Texas based snack company with a portfolio of better-for-you brands that includes SkinnyPop, Oatmega and Lisa’s Chips. On December 18, 2017, BETR agreed to be acquired by The Hershey Company for $12 per share in cash representing $1.6 billion total enterprise value. Completion of the deal required the tender of a simple majority of BETR shares outstanding and regulatory approvals. The transaction closed on January 31, 2018.

Buffalo Wild Wings (BWLD) is a Minneapolis, Minnesota based restaurant owner and franchisor, operating 1,250 Buffalo Wild Wings Restaurants globally. On November 28, 2017, BWLD agreed to be acquired by Arby’s Restaurant Group for $157 per share in cash, valuing the company at $2.9 billion. The transaction required regulatory and shareholder approvals and closed on February 6, 2018.

Exactech, Inc. (EXAC), is a Gainesville, Florida based medical device company that develops orthopedic implant devices and other instruments used in surgery. On October 23, 2017, EXAC agreed to be taken private by TPG Capital for $42 per share in cash, which valued the company at $625 million. On December 4, 2017, EXAC entered into an amended merger agreement with TPG Capital which increased the consideration to EXAC shareholders to $49.25 per share in cash representing a $737 million total enterprise value after another bidder emerged. The transaction required regulatory and shareholder approvals and closed on February 15, 2018.

Regal Entertainment Group (RGC) is a Knoxville, Tennessee based movie theatre chain that operates one of the largest theatre circuits in the United States. On December 5, 2017, RGC agreed to be acquired by Cineworld Group PLC for $23 per share in cash representing a total transaction value of $5.9 billion. The deal required shareholder and regulatory approvals and closed on March 1, 2018.

Key Technology, Inc. (KTEC) is a Walla Walla, Washington based automation systems manufacturer of food processing technology. On January 25, 2018, KTEC agreed to be acquired by Duravant LLC for $26.75 per share in cash representing a transaction value of $175 million. Completion of the deal required the tender of a simple majority of KTEC shares outstanding and regulatory approvals. The transaction closed on March 21, 2018.

AveXis, Inc. (AVXS) is a Chicago, Illinois based gene therapy company focused on various neuroscience uses. On April 9, 2018, AVXS agreed to be acquired by Novartis AG for $218 per share in cash representing an $8.7 billion total enterprise value. The transaction required a majority of AVXS shareholders to tender and regulatory clearances and closed on May 15, 2018.

2

General Cable Corp. (BGC) is a Highland Heights, Kentucky based cable manufacturer that sells fiber optic, copper, and aluminum cables to the telecom, industrial, and construction sectors. On December 4, 2017 BGC agreed to be acquired by Prysmian Group for $30 per share in cash representing a $3 billion total enterprise value. The transaction required shareholder and regulatory approvals and closed on June 6, 2018.

Orbital ATK Inc. (OA) is a Dulles, Virginia based aerospace and defense company. On September 18, 2017, OA agreed to be acquired by Northrop Grumman Corp. for $134.50 per share in cash representing a $7.8 billion equity valuation. OA received shareholders and regulatory approvals and the transaction closed on June 6, 2018.

Abaxis, Inc. (ABAX) is a Union City, California based medical company that provides point of care products to the veterinary industry. On May 16, 2018, ABAX agreed to be acquired by Zoetis Inc. for $83 per share in cash representing a $2 billion valuation. The deal was subject to shareholder and regulatory approvals and closed on August 1, 2018.

Cotiviti Holdings, Inc. (COTV) is an Atlanta, Georgia based payments and spending management company focused on serving the healthcare sector. On June 19, 2018 COTV agreed to be acquired by Verscend Technologies, Inc. for $44.75 per share in cash representing a total enterprise value of $4.9 billion. The deal was subject to regulatory and shareholder approvals and closed on August 27, 2018.

XL Group, Ltd. (XL) is a Hamilton, Bermuda based insurance and reinsurance company. On March 5, 2018, XL agreed to be acquired by The AXA Group for $57.60 per share in cash, representing a total consideration of $15.3 billion, to expand AXA’s U.S. presence. The deal was subject to shareholder and regulatory approvals and closed on September 12, 2018.

We appreciate your continuing confidence and trust.

3

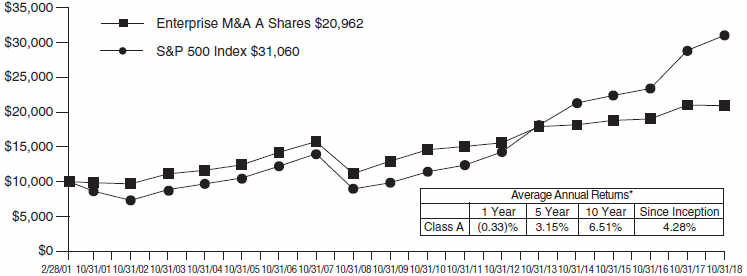

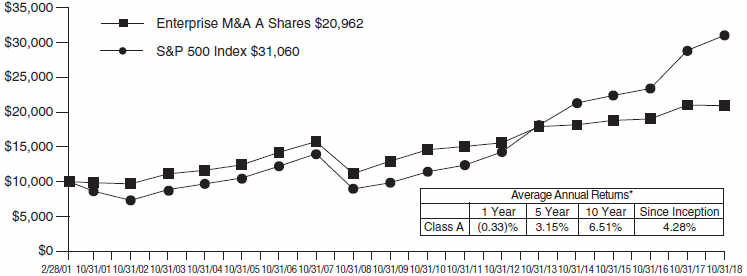

Comparative Results

Average Annual Returns through October 31, 2018 (a)(b) (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | 5 Year | | 10 Year | | Since

Inception

(2/28/01) |

Class A (EMAAX) | | | | (0.33 | )% | | | | 3.15 | % | | | | 6.51 | % | | | | 4.28 | % |

With sales charge (c) | | | | (6.06 | ) | | | | 1.94 | | | | | 5.88 | | | | | 3.93 | |

Class AAA (EAAAX) | | | | (0.12 | ) | | | | 3.37 | | | | | 6.70 | | | | | 4.38 | |

Class C (EMACX) | | | | (0.88 | ) | | | | 2.57 | | | | | 5.93 | | | | | 3.71 | |

With contingent deferred sales charge (d) | | | | (1.88 | ) | | | | 2.57 | | | | | 5.93 | | | | | 3.71 | |

Class Y (EMAYX) | | | | 0.08 | | | | | 3.62 | | | | | 7.00 | | | | | 4.75 | |

S&P 500 Index | | | | 7.35 | | | | | 11.34 | | | | | 13.24 | | | | | 6.62 | |

Lipper U.S. Treasury Money Market Fund Average | | | | 1.26 | | | | | 0.33 | | | | | 0.18 | | | | | 1.07 | |

ICE Bank of America Merrill Lynch 3 Month U.S. Treasury Bill Index | | | | 1.68 | | | | | 0.55 | | | | | 0.35 | | | | | 1.46 | |

In the current prospectuses dated February 28, 2018, the Fund’s expense ratios are 1.51%, 1.71%, 2.26%, and 1.26% for the Class AAA, A, C, and Y Shares, respectively. See page 13 for the expense ratios for the year ended October 31, 2018. Class AAA and Class Y Shares have no sales charge. The maximum sales charge for Class A Shares and Class C Shares is 5.75% and 1.00%, respectively.

| | (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.gabelli.com for performance information as of the most recent month end. The Fund imposes a 2% redemption fee on shares sold or exchanged within seven days of purchase. Investors should carefully consider the investment objectives, risks, sales charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.gabelli.com. The Class A Share NAVs are used to calculate the performance for the periods prior to the issuance of Class AAA Shares on February 26, 2010. The actual performance for the Class AAA Shares would have been higher due to lower expenses associated with the share class. The S&P 500 Index is a market capitalization weighted index of 500 large capitalization stocks commonly used to represent the U.S. equity market. The Lipper U.S. Treasury Money Market Fund Average reflects the average performance of mutual funds classified in this particular category. The ICE Bank of America Merrill Lynch 3 Month U.S. Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. At the end of the month, that issue is sold and rolled into the outstanding Treasury Bill that matures closest to, but not beyond three months from the rebalancing date. To qualify for selection, an issue must have settled on or before the rebalancing (month end) date. Dividends are considered reinvested except for the ICE Bank of America Merrill Lynch 3 Month U.S. Treasury Bill Index. You cannot invest directly in an index. | |

| | (b) | The Fund’s fiscal year ends October 31. | |

| | (c) | Performance results include the effect of the maximum 5.75% sales charge at the beginning of the period. | |

| | (d) | Assuming payment of the 1% maximum contingent deferred sales charge imposed on redemptions made within one year of purchase. | |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE GABELLI ENTERPRISE

MERGERS AND ACQUISITIONS FUND (CLASS A SHARES) AND THE S&P 500 INDEX (Unaudited)

| * | Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

4

| | |

| Gabelli Enterprise Mergers and Acquisitions Fund | | |

| Disclosure of Fund Expenses (Unaudited) | | |

| For the Six Month Period from May 1, 2018 through October 31, 2018 | | Expense Table |

We believe it is important for you to understand the impact of fees and expenses regarding your investment. All mutual funds have operating expenses. As a shareholder of a fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of a fund. When a fund’s expenses are expressed as a percentage of its average net assets, this figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The Expense Table below illustrates your Fund’s costs in two ways:

Actual Fund Return: This section provides information about actual account values and actual expenses. You may use this section to help you to estimate the actual expenses that you paid over the period after any fee waivers and expense reimbursements. The “Ending Account Value” shown is derived from the Fund’s actual return during the past six months, and the “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period” to estimate the expenses you paid during this period.

Hypothetical 5% Return: This section provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense

ratio. It assumes a hypothetical annualized return of 5% before expenses during the period shown. In this case – because the hypothetical return used is not the Fund’s actual return – the results do not apply to your investment and you cannot use the hypothetical account value and expense to estimate the actual ending account balance or expenses you paid for the period. This example is useful in making comparisons of the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees, if any, which are described in the Prospectus. If these costs were applied to your account, your costs would be higher. Therefore, the 5% hypothetical return is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. The “Annualized Expense Ratio” represents the actual expenses for the last six months and may be different from the expense ratio in the Financial Highlights which is for the year ended October 31, 2018.

| | | | | | | | | | | | |

| | | Beginning

Account Value

05/01/18 | | Ending

Account Value

10/31/18 | | Annualized

Expense

Ratio | | | Expenses

Paid During

Period* | |

Gabelli Enterprise Mergers and Acquisitions Fund | |

Actual Fund Return | | | | | | | | |

Class AAA | | $1,000.00 | | $ 995.30 | | | 1.50% | | | | $ 7.54 | |

Class A | | $1,000.00 | | $ 993.80 | | | 1.70% | | | | $ 8.54 | |

Class C | | $1,000.00 | | $ 991.00 | | | 2.24% | | | | $11.24 | |

Class Y | | $1,000.00 | | $ 995.50 | | | 1.24% | | | | $ 6.24 | |

Hypothetical 5% Return | | | | | | | | |

Class AAA | | $1,000.00 | | $1,017.64 | | | 1.50% | | | | $ 7.63 | |

Class A | | $1,000.00 | | $1,016.64 | | | 1.70% | | | | $ 8.64 | |

Class C | | $1,000.00 | | $1,013.91 | | | 2.24% | | | | $11.37 | |

Class Y | | $1,000.00 | | $1,018.95 | | | 1.24% | | | | $ 6.31 | |

| * | Expenses are equal to the Fund’s annualized expense ratio for the last six months multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184 days), then divided by 365. |

Summary of Portfolio Holdings (Unaudited)

The following table presents portfolio holdings as a percent of net assets as of October 31, 2018:

Gabelli Enterprise Mergers and Acquisitions Fund

| | | | |

U.S. Government Obligations | | | 29.2 | % |

Health Care. | | | 12.7 | % |

Financial Services | | | 5.0 | % |

Building and Construction | | | 4.5 | % |

Wireless Communications | | | 4.5 | % |

Computer Software and Services | | | 4.0 | % |

Entertainment | | | 4.0 | % |

Aerospace and Defense | | | 3.5 | % |

Containers and Packaging | | | 3.4 | % |

Food and Beverage | | | 3.1 | % |

Telecommunications | | | 2.9 | % |

Energy and Utilities | | | 2.7 | % |

Consumer Products | | | 2.3 | % |

Media | | | 2.2 | % |

Cable and Satellite | | | 2.1 | % |

Diversified Industrial | | | 1.7 | % |

Broadcasting | | | 1.6 | % |

Hotels and Gaming | | | 1.4 | % |

| | | | |

Business Services | | | 1.3 | % |

Retail | | | 1.3 | % |

Semiconductors | | | 1.1 | % |

Consumer Services | | | 1.1 | % |

Transportation | | | 1.1 | % |

Specialty Chemicals | | | 0.7 | % |

Machinery | | | 0.7 | % |

Communications Equipment | | | 0.4 | % |

Automotive: Parts and Accessories | | | 0.3 | % |

Metals and Mining | | | 0.3 | % |

Real Estate | | | 0.2 | % |

Paper and Forest Products | | | 0.2 | % |

Electronics. | | | 0.0 | %* |

Other Assets and Liabilities (Net) | | | 0.5 | % |

| | | | |

| | | 100.0 | % |

| | | | |

| * | Amount represents less than 0.05%. |

The Fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (the SEC) for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain this information at www.gabelli.com or by calling the Fund at 800-GABELLI (800-422-3554). The Fund’s Form N-Q is available on the SEC’s website at www.sec.gov and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

Proxy Voting

The Fund files Form N-PX with its complete proxy voting record for the twelve months ended June 30, no later than August 31 of each year. A description of the Fund’s proxy voting policies, procedures, and how the Fund voted proxies relating to portfolio securities is available without charge, upon request, by (i) calling 800-GABELLI (800-422-3554); (ii) writing to The Gabelli Funds at One Corporate Center, Rye, NY 10580-1422; or (iii) visiting the SEC’s website at www.sec.gov.

6

Gabelli Enterprise Mergers and Acquisitions Fund

Schedule of Investments — October 31, 2018

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Market Value | |

| | | | COMMON STOCKS — 70.2% | |

| | | | Aerospace and Defense — 3.5% | |

| | 10,000 | | | Arconic Inc. | | $ | 218,979 | | | $ | 203,300 | |

| | 4,500 | | | Esterline Technologies Corp.† | | | 520,320 | | | | 528,120 | |

| | 24,000 | | | Kaman Corp. | | | 910,375 | | | | 1,524,480 | |

| | 27,000 | | | Rockwell Collins Inc. | | | 3,680,365 | | | | 3,456,540 | |

| | | | | | | | | | | | |

| | | | | | | 5,330,039 | | | | 5,712,440 | |

| | | | | | | | | | | | |

| |

| | | | Automotive: Parts and Accessories — 0.3% | |

| | 24,000 | | | Haldex AB | | | 281,750 | | | | 203,253 | |

| | 7,800 | | | Tenneco Inc., Cl. A | | | 24,840 | | | | 268,554 | |

| | | | | | | | | | | | |

| | | | | | | 306,590 | | | | 471,807 | |

| | | | | | | | | | | | |

| | | |

| | | | Broadcasting — 1.6% | | | | | | | | |

| | 68,000 | | | Tribune Media Co., Cl. A | | | 2,647,340 | | | | 2,584,680 | |

| | | | | | | | | | | | |

| | | | Building and Construction — 4.5% | | | | | | | | |

| | 42,466 | | | Griffon Corp. | | | 360,961 | | | | 514,688 | |

| | 11,000 | | | Nobility Homes Inc. | | | 154,848 | | | | 253,000 | |

| | 4,000 | | | Norbord Inc. | | | 76,509 | | | | 102,002 | |

| | 10,000 | | | Skyline Champion Corp. | | | 47,110 | | | | 238,300 | |

| | 125,000 | | | USG Corp. | | | 5,387,166 | | | | 5,277,500 | |

| | 11,000 | | | Vulcan Materials Co. | | | 432,608 | | | | 1,112,540 | |

| | | | | | | | | | | | |

| | | | | | | 6,459,202 | | | | 7,498,030 | |

| | | | | | | | | | | | |

| | | |

| | | | Business Services — 1.3% | | | | | | | | |

| | 245,000 | | | Clear Channel Outdoor Holdings Inc., Cl. A | | | 1,447,059 | | | | 1,425,900 | |

| | 2,000 | | | Funespana SA† | | | 18,121 | | | | 16,990 | |

| | 1,111 | | | Vectrus Inc.† | | | 19,941 | | | | 29,775 | |

| | 2,000 | | | XPO Logistics Europe SA | | | 484,562 | | | | 733,953 | |

| | | | | | | | | | | | |

| | | | | | | 1,969,683 | | | | 2,206,618 | |

| | | | | | | | | | | | |

| | | |

| | | | Cable and Satellite — 2.1% | | | | | | | | |

| | 20,000 | | | AMC Entertainment Holdings Inc., Cl. A | | | 347,472 | | | | 385,200 | |

| | 22,000 | | | DISH Network Corp., Cl. A† | | | 484,844 | | | | 676,280 | |

| | 3,500 | | | Liberty Broadband Corp., Cl. A† | | | 15,669 | | | | 289,765 | |

| | 3,500 | | | Liberty Broadband Corp., Cl. C† | | | 94,710 | | | | 290,255 | |

| | 21,000 | | | Liberty Global plc, Cl. A† | | | 735,349 | | | | 538,230 | |

| | 28,000 | | | Liberty Global plc, Cl. C† | | | 994,232 | | | | 701,120 | |

| | 3,000 | | | Liberty Media Corp.- Liberty Formula One, Cl. A† | | | 7,487 | | | | 95,070 | |

| | 3,000 | | | Liberty Media Corp.- Liberty Formula One, Cl. C† | | | 9,444 | | | | 99,240 | |

| | 20,000 | | | Shaw Communications Inc., Cl. B | | | 265,164 | | | | 372,800 | |

| | | | | | | | | | | | |

| | | | | | | 2,954,371 | | | | 3,447,960 | |

| | | | | | | | | | | | |

| | | |

| | | | Communications Equipment — 0.4% | | | | | | | | |

| | 39,000 | | | Digi International Inc.† | | | 454,112 | | | | 452,400 | |

| | 1,000 | | | Harris Corp. | | | 77,319 | | | | 148,710 | |

| | 6,000 | | | Park Electrochemical Corp. | | | 87,188 | | | | 105,960 | |

| | | | | | | | | | | | |

| | | | | | | 618,619 | | | | 707,070 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Market Value | |

| | | | Computer Software and Services — 4.0% | |

| | 4,000 | | | Business & Decision† | | $ | 37,005 | | | $ | 35,837 | |

| | 119,000 | | | CA Inc. | | | 5,237,126 | | | | 5,278,840 | |

| | 1,000 | | | Dell Technologies Inc., Cl. V† | | | 46,886 | | | | 90,390 | |

| | 2,000 | | | Imperva Inc.† | | | 110,344 | | | | 110,700 | |

| | 100,000 | | | MYOB Group Ltd. | | | 256,119 | | | | 238,647 | |

| | 2,500 | | | Red Hat Inc.† | | | 422,773 | | | | 429,100 | |

| | 2,400 | | | Rockwell Automation Inc. | | | 452,809 | | | | 395,352 | |

| | | | | | | | | | | | |

| | | | | | | 6,563,062 | | | | 6,578,866 | |

| | | | | | | | | | | | |

| | | |

| | | | Consumer Products — 2.3% | | | | | | | | |

| | 190,000 | | | Avon Products Inc.† | | | 517,069 | | | | 372,400 | |

| | 2,000 | | | Bang & Olufsen A/S† | | | 20,532 | | | | 41,598 | |

| | 9,000 | | | Clarion Co. Ltd. | | | 197,401 | | | | 196,934 | |

| | 22,000 | | | SodaStream International Ltd.† | | | 3,135,612 | | | | 3,154,580 | |

| | | | | | | | | | | | |

| | | | | | | 3,870,614 | | | | 3,765,512 | |

| | | | | | | | | | | | |

| | | |

| | | | Consumer Services — 1.1% | | | | | | | | |

| | 32,000 | | | MoneyGram International Inc.† | | | 432,020 | | | | 135,680 | |

| | 1,500 | | | Rollins Inc. | | | 3,006 | | | | 88,800 | |

| | 45,000 | | | XO Group Inc.† | | | 1,552,142 | | | | 1,557,450 | |

| | | | | | | | | | | | |

| | | | | | | 1,987,168 | | | | 1,781,930 | |

| | | | | | | | | | | | |

| | | |

| | | | Containers and Packaging — 3.4% | | | | | | | | |

| | 5,200 | | | Greif Inc., Cl. A | | | 216,066 | | | | 245,960 | |

| | 1,000 | | | Greif Inc., Cl. B | | | 37,738 | | | | 51,360 | |

| | 150,000 | | | KapStone Paper and Packaging Corp. | | | 5,200,043 | | | | 5,250,000 | |

| | | | | | | | | | | | |

| | | | | | | 5,453,847 | | | | 5,547,320 | |

| | | | | | | | | | | | |

| | | |

| | | | Diversified Industrial — 1.7% | | | | | | | | |

| | 173,000 | | | Myers Industries Inc. | | | 3,185,674 | | | | 2,743,780 | |

| | | | | | | | | | | | |

| | | | Electronics — 0.0% | | | | | | | | |

| | 4,000 | | | Sparton Corp.† | | | 60,680 | | | | 49,520 | |

| | | | | | | | | | | | |

| | | | Energy and Utilities — 2.7% | | | | | | | | |

| | 7,000 | | | Alerion Cleanpower SpA | | | 19,191 | | | | 22,120 | |

| | 460,000 | | | Alvopetro Energy Ltd.† | | | 431,120 | | | | 178,206 | |

| | 7,500 | | | Anadarko Petroleum Corp. | | | 347,019 | | | | 399,000 | |

| | 4,000 | | | Avangrid Inc. | | | 155,000 | | | | 188,040 | |

| | 1,000 | | | Avista Corp. | | | 51,334 | | | | 51,420 | |

| | 3,900 | | | Connecticut Water Service Inc. | | | 268,515 | | | | 269,568 | |

| | 36,000 | | | Endesa SA | | | 997,783 | | | | 753,525 | |

| | 1,000 | | | Etablissements Maurel et Prom† | | | 4,222 | | | | 4,638 | |

| | 75,000 | | | GenOn Energy Inc., Escrow†(a) | | | 0 | | | | 0 | |

| | 180,000 | | | Gulf Coast Ultra Deep Royalty Trust | | | 129,045 | | | | 7,578 | |

| | 8,000 | | | KLX Energy Services Holdings Inc.† | | | 227,520 | | | | 231,120 | |

| | 8,000 | | | NorthWestern Corp. | | | 221,528 | | | | 470,080 | |

| | 30,000 | | | Severn Trent plc | | | 833,209 | | | | 714,386 | |

| | 1,000 | | | Southwest Gas Holdings Inc. | | | 34,833 | | | | 77,270 | |

See accompanying notes to financial statements.

7

Gabelli Enterprise Mergers and Acquisitions Fund

Schedule of Investments (Continued) — October 31, 2018

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Market Value | |

| | | | COMMON STOCKS (Continued) | |

| | | | Energy and Utilities (Continued) | |

| | 22,000 | | | Valero Energy Partners LP | | $ | 922,349 | | | $ | 923,560 | |

| | 6,250 | | | Whiting Petroleum Corp.† | | | 193,715 | | | | 233,125 | |

| | | | | | | | | | | | |

| | | | | | | 4,836,383 | | | | 4,523,636 | |

| | | | | | | | | | | | |

| | | |

| | | | Entertainment — 4.0% | | | | | | | | |

| | 3,600 | | | Discovery Inc., Cl. A† | | | 26,174 | | | | 116,604 | |

| | 10,800 | | | Discovery Inc., Cl. C† | | | 60,976 | | | | 316,548 | |

| | 180,000 | | | Dover Motorsports Inc. | | | 667,976 | | | | 387,000 | |

| | 5,000 | | | Liberty Media Corp.- Liberty Braves, Cl. A† | | | 115,468 | | | | 129,000 | |

| | 5,000 | | | Liberty Media Corp.- Liberty Braves, Cl. C† | | | 115,565 | | | | 129,500 | |

| | 8,140 | | | Lions Gate Entertainment Corp., Cl. B | | | 212,454 | | | | 144,811 | |

| | 118,000 | | | Twenty-First Century Fox Inc., Cl. B | | | 4,684,223 | | | | 5,331,240 | |

| | | | | | | | | | | | |

| | | | | | | 5,882,836 | | | | 6,554,703 | |

| | | | | | | | | | | | |

| | | |

| | | | Financial Services — 5.0% | | | | | | | | |

| | 53,976 | | | AmTrust Financial Services Inc. | | | 697,222 | | | | 774,016 | |

| | 1,610 | | | Argo Group International Holdings Ltd. | | | 28,231 | | | | 99,192 | |

| | 4,000 | | | Aspen Insurance Holdings Ltd. | | | 162,985 | | | | 167,520 | |

| | 4,000 | | | BKF Capital Group Inc.† | | | 144,080 | | | | 46,800 | |

| | 1,700 | | | BOK Financial Corp. | | | 174,699 | | | | 145,741 | |

| | 26,000 | | | FCB Financial Holdings Inc., Cl. A† | | | 1,280,756 | | | | 1,017,380 | |

| | 2,000 | | | Jardine Lloyd Thompson Group plc | | | 49,592 | | | | 48,214 | |

| | 81,000 | | | Navient Corp. | | | 740,057 | | | | 937,980 | |

| | 100 | | | Patriot National Inc.†(a) | | | 968 | | | | 2 | |

| | 100,000 | | | SLM Corp.† | | | 573,264 | | | | 1,014,000 | |

| | 1,600 | | | SLM Solutions Group AG† | | | 55,332 | | | | 27,727 | |

| | 16,000 | | | Sterling Bancorp | | | 165,751 | | | | 287,680 | |

| | 2,000 | | | The Navigators Group Inc. | | | 139,285 | | | | 138,300 | |

| | 400 | | | Topdanmark A/S | | | 11,380 | | | | 19,068 | |

| | 25,000 | | | The Dun & Bradstreet Corp. | | | 3,563,284 | | | | 3,557,000 | |

| | | | | | | | | | | | |

| | | | | | | 7,786,886 | | | | 8,280,620 | |

| | | | | | | | | | | | |

| | | |

| | | | Food and Beverage — 3.1% | | | | | | | | |

| | 4,500 | | | Flowers Foods Inc. | | | 10,669 | | | | 86,895 | |

| | 18,000 | | | GrainCorp Ltd., Cl. A | | | 206,111 | | | | 105,033 | |

| | 400 | | | Huegli Holding AG† | | | 379,550 | | | | 355,061 | |

| | 13,400 | | | Keurig Dr Pepper Inc. | | | 585,171 | | | | 348,400 | |

| | 10,000 | | | Mondelēz International Inc., Cl. A | | | 425,100 | | | | 419,800 | |

| | 630,000 | | | Parmalat SpA | | | 2,205,685 | | | | 1,940,899 | |

| | 1,965,000 | | | Premier Foods plc† | | | 1,349,724 | | | | 956,944 | |

| | 29,000 | | | Tootsie Roll Industries Inc. | | | 562,480 | | | | 915,530 | |

| | 400,000 | | | Yashili International Holdings Ltd.† | | | 167,103 | | | | 68,860 | |

| | | | | | | | | | | | |

| | | | | | | 5,891,593 | | | | 5,197,422 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Market Value | |

| | | | Health Care — 12.7% | | | | | | | | |

| | 30,000 | | | Akorn Inc.† | | $ | 562,173 | | | $ | 200,100 | |

| | 11,400 | | | Allergan plc | | | 2,252,825 | | | | 1,801,314 | |

| | 26,000 | | | AstraZeneca plc, ADR | | | 913,580 | | | | 1,008,280 | |

| | 1,500 | | | Bio-Rad Laboratories Inc., Cl. A† | | | 145,738 | | | | 409,275 | |

| | 14,000 | | | Bristol-Myers Squibb Co. | | | 512,941 | | | | 707,560 | |

| | 1,100 | | | Cigna Corp. | | | 144,841 | | | | 235,191 | |

| | 22,000 | | | Endocyte Inc.† | | | 514,476 | | | | 520,300 | |

| | 8,000 | | | Grifols SA, ADR | | | 53,680 | | | | 163,360 | |

| | 100 | | | ICU Medical Inc.† | | | 6,058 | | | | 25,473 | |

| | 10,000 | | | Idorsia Ltd.† | | | 102,950 | | | | 193,715 | |

| | 1,400 | | | Illumina Inc.† | | | 87,354 | | | | 435,610 | |

| | 170,000 | | | K2M Group Holdings Inc.† | | | 4,647,743 | | | | 4,654,600 | |

| | 7,500 | | | Kindred Healthcare Inc.†(a) | | | 67,538 | | | | 67,500 | |

| | 90,000 | | | LifePoint Health Inc.† | | | 5,802,025 | | | | 5,837,400 | |

| | 62,000 | | | Mazor Robotics Ltd., ADR† | | | 3,601,728 | | | | 3,609,640 | |

| | 6,000 | | | Mylan NV† | | | 293,980 | | | | 187,500 | |

| | 2,400 | | | NxStage Medical Inc.† | | | 67,863 | | | | 68,112 | |

| | 2,700 | | | Perrigo Co. plc | | | 247,361 | | | | 189,810 | |

| | 2,000 | | | Shire plc, ADR | | | 334,955 | | | | 363,600 | |

| | 6,000 | | | Smith & Nephew plc, ADR | | | 206,505 | | | | 197,280 | |

| | | | | | | | | | | | |

| | | | | | | 20,566,314 | | | | 20,875,620 | |

| | | | | | | | | | | | |

| | | |

| | | | Hotels and Gaming — 1.4% | | | | | | | | |

| | 34,000 | | | Belmond Ltd., Cl. A† | | | 443,424 | | | | 582,080 | |

| | 300 | | | Churchill Downs Inc. | | | 9,822 | | | | 74,883 | |

| | 2,000 | | | Eldorado Resorts Inc.† | | | 9,768 | | | | 73,000 | |

| | 20,000 | | | Ryman Hospitality Properties Inc., REIT | | | 962,057 | | | | 1,551,800 | |

| | | | | | | | | | | | |

| | | | | | | 1,425,071 | | | | 2,281,763 | |

| | | | | | | | | | | | |

| | | |

| | | | Machinery — 0.7% | | | | | | | | |

| | 2,000 | | | CIRCOR International Inc. | | | 78,057 | | | | 65,020 | |

| | 60,000 | | | CNH Industrial NV | | | 692,736 | | | | 624,268 | |

| | 7,500 | | | Xylem Inc. | | | 189,263 | | | | 491,850 | |

| | | | | | | | | | | | |

| | | | | | | 960,056 | | | | 1,181,138 | |

| | | | | | | | | | | | |

| | | |

| | | | Media — 2.2% | | | | | | | | |

| | 3,000 | | | Telegraaf Media Groep NV†(a) | | | 19,115 | | | | 20,388 | |

| | 53,000 | | | Telenet Group Holding NV | | | 2,403,424 | | | | 2,574,092 | |

| | 60,000 | | | The E.W. Scripps Co., Cl. A | | | 984,840 | | | | 1,009,200 | |

| | | | | | | | | | | | |

| | | | | | | 3,407,379 | | | | 3,603,680 | |

| | | | | | | | | | | | |

| | | |

| | | | Metals and Mining — 0.3% | | | | | | | | |

| | 38,000 | | | Alamos Gold Inc., Cl. A | | | 478,500 | | | | 151,620 | |

| | 19,000 | | | Pan American Silver Corp. | | | 298,459 | | | | 279,851 | |

| | | | | | | | | | | | |

| | | | | | | 776,959 | | | | 431,471 | |

| | | | | | | | | | | | |

| | | |

| | | | Paper and Forest Products — 0.2% | | | | | | | | |

| | 18,500 | | | Papeles y Cartones de Europa SA | | | 365,098 | | | | 349,930 | |

| | | | | | | | | | | | |

See accompanying notes to financial statements.

8

Gabelli Enterprise Mergers and Acquisitions Fund

Schedule of Investments (Continued) — October 31, 2018

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Market Value | |

| | | | COMMON STOCKS (Continued) | |

| | | | Real Estate — 0.2% | |

| | 6,000 | | | InfraREIT Inc., REIT† | | $ | 126,021 | | | $ | 126,120 | |

| | 5,000 | | | Vastned Retail Belgium NV, REIT | | | 336,691 | | | | 255,977 | |

| | | | | | | | | | | | |

| | | | | | | 462,712 | | | | 382,097 | |

| | | | | | | | | | | | |

| | | |

| | | | Retail — 1.3% | | | | | | | | |

| | 235,000 | | | Rite Aid Corp.† | | | 781,328 | | | | 282,000 | |

| | 26,000 | | | Sonic Corp. | | | 1,126,379 | | | | 1,125,280 | |

| | 4,000 | | | SpartanNash Co. | | | 52,262 | | | | 71,400 | |

| | 29,000 | | | Village Super Market Inc., Cl. A | | | 662,626 | | | | 714,560 | |

| | | | | | | | | | | | |

| | | | | | | 2,622,595 | | | | 2,193,240 | |

| | | | | | | | | | | | |

| | | |

| | | | Semiconductors — 1.1% | | | | | | | | |

| | 13,500 | | | AIXTRON SE† | | | 54,597 | | | | 169,803 | |

| | 23,000 | | | NXP Semiconductors NV | | | 2,636,459 | | | | 1,724,770 | |

| | | | | | | | | | | | |

| | | | | | | 2,691,056 | | | | 1,894,573 | |

| | | | | | | | | | | | |

| | | |

| | | | Specialty Chemicals — 0.6% | | | | | | | | |

| | 1,000 | | | GCP Applied Technologies Inc.† | | | 25,934 | | | | 25,970 | |

| | 5,000 | | | KMG Chemicals Inc. | | | 382,879 | | | | 375,100 | |

| | 2,310 | | | Linde plc | | | 248,756 | | | | 378,987 | |

| | 30,000 | | | SGL Carbon SE† | | | 521,129 | | | | 301,227 | |

| | | | | | | | | | | | |

| | | | | | | 1,178,698 | | | | 1,081,284 | |

| | | | | | | | | | | | |

| | | |

| | | | Telecommunications — 2.9% | | | | | | | | |

| | 280,000 | | | Asia Satellite Telecommunications Holdings Ltd. | | | 604,206 | | | | 191,024 | |

| | 40,000 | | | AT&T Inc. | | | 1,304,800 | | | | 1,227,200 | |

| | 75,000 | | | CenturyLink Inc. | | | 1,507,841 | | | | 1,548,000 | |

| | 21,000 | | | Cincinnati Bell Inc.† | | | 346,353 | | | | 297,990 | |

| | 200,000 | | | Koninklijke KPN NV | | | 605,309 | | | | 529,171 | |

| | 8,000 | | | Liberty Latin America Ltd., Cl. A† | | | 154,189 | | | | 143,840 | |

| | 10,000 | | | Liberty Latin America Ltd., Cl. C† | | | 218,851 | | | | 180,100 | |

| | 13,000 | | | Loral Space & Communications Inc.† | | | 566,232 | | | | 580,580 | |

| | 1,000 | | | Rogers Communications Inc., Cl. B | | | 2,955 | | | | 51,510 | |

| | | | | | | | | | | | |

| | | | | | | 5,310,736 | | | | 4,749,415 | |

| | | | | | | | | | | | |

| | | |

| | | | Transportation — 1.1% | | | | | | | | |

| | 500 | | | American Railcar Industries Inc. | | | 34,901 | | | | 34,955 | |

| | 2,000 | | | GATX Corp. | | | 91,160 | | | | 149,860 | |

| | 47,000 | | | Navistar International Corp.† | | | 885,992 | | | | 1,574,030 | |

| | | | | | | | | | | | |

| | | | | | | 1,012,053 | | | | 1,758,845 | |

| | | | | | | | | | | | |

| | | |

| | | | Wireless Communications — 4.5% | | | | | | | | |

| | 46,000 | | | Millicom International Cellular SA, SDR | | | 2,787,434 | | | | 2,598,799 | |

| | 70,000 | | | Sprint Corp.† | | | 375,113 | | | | 428,400 | |

| | 5,000 | | | Telephone & Data Systems Inc. | | | 142,092 | | | | 154,150 | |

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Market Value | |

| | 40,000 | | | T-Mobile US Inc.† | | $ | 650,000 | | | $ | 2,742,000 | |

| | 30,000 | | | United States Cellular Corp.† | | | 1,308,858 | | | | 1,433,100 | |

| | | | | | | | | | | | |

| | | | | | | 5,263,497 | | | | 7,356,449 | |

| | | | | | | | | | | | |

| | | |

| | | | TOTAL COMMON STOCKS | | | 111,846,811 | | | | 115,791,419 | |

| | | | | | | | | | | | |

| | | |

| | | | RIGHTS — 0.1% | | | | | | | | |

| | | | Health Care — 0.0% | | | | | | | | |

| | 20,000 | | | Adolor Corp., CPR, expire 07/01/19†(a) | | | 0 | | | | 0 | |

| | 13,000 | | | Ambit Biosciences Corp., CVR†(a) | | | 0 | | | | 7,800 | |

| | 5,000 | | | American Medical Alert Corp., CPR†(a) | | | 0 | | | | 50 | |

| | 75,000 | | | Innocoll, CVR†(a) | | | 45,000 | | | | 45,000 | |

| | 11,000 | | | Ocera Therapeutics, CVR†(a) | | | 2,970 | | | | 4,290 | |

| | 100 | | | Omthera Pharmaceuticals Inc., CVR†(a) | | | 0 | | | | 0 | |

| | 156,000 | | | Teva Pharmaceutical Industries Ltd., CCCP, expire 02/20/23†(a) | | | 74,375 | | | | 0 | |

| | 7,000 | | | Tobira Therapeutics Inc., CVR†(a) | | | 420 | | | | 420 | |

| | | | | | | | | | | | |

| | | | | | | 122,765 | | | | 57,560 | |

| | | | | | | | | | | | |

| | | |

| | | | Media — 0.0% | | | | | | | | |

| | 40,000 | | | Media General Inc., CVR†(a) Specialty | | | 0 | | | | 0 | |

| | | | | | | | | | | | |

| | | |

| | | | Specialty Chemicals — 0.1% | | | | | | | | |

| | 70,000 | | | A. Schulman Inc., CVR†(a) | | | 140,000 | | | | 140,000 | |

| | | | | | | | | | | | |

| | | | TOTAL RIGHTS | | | 262,765 | | | | 197,560 | |

| | | | | | | | | | | | |

| | | |

Principal

Amount | | | | | | | | | |

| | | | CORPORATE BONDS — 0.0% | |

| | | | Health Care — 0.0% | |

| | $ 7,000 | | | Constellation Health Promissory Note, PIK, 5.000%, 01/31/24(a)(b) | | | 3,010 | | | | 3,010 | |

| | | | | | | | | | | | |

| |

| | | | U.S. GOVERNMENT OBLIGATIONS — 29.2% | |

| | 48,252,000 | | | U.S. Treasury Bills, 1.980% to 2.523%††, 11/01/18 to 05/02/19(c) | | | 48,084,998 | | | | 48,081,746 | |

| | | | | | | | | | | | |

| | | |

| | | | TOTAL INVESTMENTS — 99.5% | | $ | 160,197,584 | | | | 164,073,735 | |

| | | | | | | | | | | | |

| | |

| | | | Other Assets and Liabilities (Net) — 0.5% | | | | 836,209 | |

| | | | | | | | | | | | |

| | | |

| | | | NET ASSETS — 100.0% | | | | | | $ | 164,909,944 | |

| | | | | | | | | | | | |

| (a) | Security is valued using significant unobservable inputs and is classified as Level 3 in the fair value hierarchy. |

| (b) | Payment-in-kind (PIK) security. 5.00% PIK interest income will be paid as additional securities at the discretion of the issuer. |

See accompanying notes to financial statements.

9

Gabelli Enterprise Mergers and Acquisitions Fund

Schedule of Investments (Continued) — October 31, 2018

| (c) | At October 31, 2018, $1,000,000 of the principal amount was pledged as collateral with Pershing. |

| † | Non-income producing security. |

| †† | Represents annualized yields at dates of purchase. |

| ADR | American Depositary Receipt |

| CCCP | Contingent Cash Consideration Payment |

| CPR | Contingent Payment Right |

| CVR | Contingent Value Right |

| REIT | Real Estate Investment Trust |

| SDR | Swedish Depositary Receipt |

See accompanying notes to financial statements.

10

Gabelli Enterprise Mergers and Acquisitions Fund

Statement of Assets and Liabilities

October 31, 2018

| | | | |

Assets: | | | | |

Investments, at value (cost $160,197,584) | | $ | 164,073,735 | |

Cash | | | 2,022,779 | |

Deposit at brokers | | | 63 | |

Receivable for Fund shares sold | | | 496,673 | |

Receivable for investments sold | | | 3,391 | |

Dividends receivable | | | 50,593 | |

Prepaid expenses | | | 28,771 | |

| | | | |

Total Assets | | | 166,676,005 | |

| | | | |

Liabilities: | | | | |

Payable for Fund shares redeemed | | | 299,490 | |

Payable for investments purchased | | | 1,185,116 | |

Payable for investment advisory fees | | | 133,983 | |

Payable for distribution fees | | | 46,776 | |

Payable for accounting fees | | | 7,500 | |

Other accrued expenses | | | 93,196 | |

| | | | |

Total Liabilities. | | | 1,766,061 | |

| | | | |

Net Assets | | | | |

(applicable to 11,207,994 shares outstanding) | | $ | 164,909,944 | |

| | | | |

Net Assets Consist of: | | | | |

Paid-in capital | | $ | 155,266,727 | |

Total distributable earnings(a) | | | 9,643,217 | |

| | | | |

Net Assets. | | $ | 164,909,944 | |

| | | | |

Shares of Capital Stock, each at $0.001 par value: | |

Class AAA: | | | | |

Net Asset Value, offering, and redemption price per share ($6,974,164 ÷ 472,977 shares outstanding; 100,000,000 shares authorized) | | | $14.75 | |

Class A: | | | | |

Net Asset Value and redemption price per share ($37,069,310 ÷ 2,558,299 shares outstanding; 200,000,000 shares authorized) | | | $14.49 | |

Maximum offering price per share (NAV ÷ 0.9425, based on maximum sales charge of 5.75% of the offering price) | | | $15.37 | |

Class C: | | | | |

Net Asset Value and offering price per share ($35,211,276 ÷ 2,662,555 shares outstanding; 100,000,000 shares authorized) | | | $13.22 | (b) |

Class Y: | | | | |

Net Asset Value, and redemption price per share ($85,655,194 ÷ 5,514,163 shares outstanding; 100,000,000 shares authorized) | | | $15.53 | |

| (a) | Effective October 31, 2018, the Fund has adopted disclosure requirements conforming to SEC Rule 6-04.17 of Regulation S-X and discloses total distributable earnings. See Note 2 for further details. |

| (b) | Redemption price varies based on the length of time held. |

Statement of Operations

For the Year Ended October 31, 2018

| | | | |

Investment Income: | | | | |

Dividends (net of foreign withholding taxes of $100,618) | | $ | 3,080,353 | |

Interest | | | 845,268 | |

| | | | |

Total Investment Income | | | 3,925,621 | |

| | | | |

Expenses: | | | | |

Investment advisory fees | | | 1,629,391 | |

Distribution fees - Class AAA | | | 19,850 | |

Distribution fees - Class A | | | 208,663 | |

Distribution fees - Class C | | | 372,599 | |

Distribution fees - Class T | | | 2 | |

Shareholder services fees | | | 154,122 | |

Registration expenses | | | 86,745 | |

Directors’ fees | | | 74,500 | |

Legal and audit fees | | | 62,898 | |

Shareholder communications expenses | | | 54,569 | |

Accounting fees | | | 45,000 | |

Custodian fees | | | 33,053 | |

Interest expense | | | 4,158 | |

Payroll expenses | | | 2,732 | |

Miscellaneous expenses | | | 23,307 | |

| | | | |

Total Expenses | | | 2,771,589 | |

| | | | |

Less: | | | | |

Expenses paid indirectly by broker

(See Note 6) | | | (2,494 | ) |

| | | | |

Net Expenses | | | 2,769,095 | |

| | | | |

Net Investment Income | | | 1,156,526 | |

| | | | |

Net Realized and Unrealized Gain/(Loss) on Investments, Swap Contracts, Securities Sold Short, and Foreign Currency: | | | | |

Net realized gain on investments | | | 7,431,486 | |

Net realized gain on securities sold short | | | 4,620 | |

Net realized loss on swap contracts | | | (4,825 | ) |

Net realized gain on foreign currency transactions | | | 65,964 | |

| | | | |

Net realized gain/loss on investments, securities sold short, swap contracts, and foreign currency translations | | | 7,497,245 | |

| | | | |

Net change in unrealized appreciation/depreciation: | | | | |

on investments | | | (9,006,725 | ) |

on foreign currency translations | | | (74,138 | ) |

| | | | |

Net change in unrealized appreciation/ depreciation on investments and foreign currency translations | | | (9,080,863 | ) |

| | | | |

Net Realized and Unrealized Gain/(Loss) on Investments, Swap Contracts, Securities Sold Short, and Foreign Currency | | | (1,583,618 | ) |

| | | | |

Net Decrease in Net Assets Resulting from Operations | | $ | (427,092 | ) |

| | | | |

See accompanying notes to financial statements.

11

Gabelli Enterprise Mergers and Acquisitions Fund

Statement of Changes in Net Assets

| | | | | | | | | | | | | | | |

| | | Year Ended

October 31, 2018 | | | | Year Ended

October 31, 2017 |

Operations: | | | | | | | | | | | | | | | |

Net investment income/(loss) | | | $ | 1,156,526 | | | | | | | | | $ | (698,315 | ) |

Net realized gain on investments, security sold short, swap contracts, and foreign currency transactions | | | | 7,497,245 | | | | | | | | | | 5,741,581 | |

Net change in unrealized appreciation/depreciation on investments, securities sold short and foreign currency translations | | | | (9,080,863 | ) | | | | | | | | | 11,097,583 | |

| | | | | | | | | | | | | | | |

Net Increase/(Decrease) in Net Assets Resulting from Operations | | | | (427,092 | ) | | | | | | | | | 16,140,849 | |

| | | | | | | | | | | | | | | |

| | | |

Distributions to Shareholders: | | | | | | | | | | | | | | | |

Class AAA | | | | (87,787 | ) | | | | | | | | | — | |

Class A | | | | (655,544 | ) | | | | | | | | | — | |

Class C | | | | (545,723 | ) | | | | | | | | | — | |

Class T(a) | | | | (13 | ) | | | | | | | | | — | |

Class Y | | | | (903,357 | ) | | | | | | | | | — | |

| | | | | | | | | | | | | | | |

Total Distributions to Shareholders(b) | | | | (2,192,424 | ) | | | | | | | | | — | |

| | | | | | | | | | | | | | | |

| | | |

Capital Share Transactions: | | | | | | | | | | | | | | | |

Class AAA | | | | 909,873 | | | | | | | | | | 1,679,658 | |

Class A | | | | (9,207,943 | ) | | | | | | | | | (6,922,346 | ) |

Class C | | | | (2,555,017 | ) | | | | | | | | | (9,921,139 | ) |

Class T(a) | | | | (1,041 | ) | | | | | | | | | 1,000 | |

Class Y | | | | 16,863,689 | | | | | | | | | | 3,862,479 | |

| | | | | | | | | | | | | | | |

Net Increase/(Decrease) in Net Assets from Capital Share Transactions | | | | 6,009,561 | | | | | | | | | | (11,300,348 | ) |

| | | | | | | | | | | | | | | |

| | | |

Redemption Fees | | | | 2,386 | | | | | | | | | | 139 | |

| | | | | | | | | | | | | | | |

Net Increase in Net Assets | | | | 3,392,431 | | | | | | | | | | 4,840,640 | |

Net Assets: | | | | | | | | | | | | | | | |

Beginning of year | | | | 161,517,513 | | | | | | | | | | 156,676,873 | |

| | | | | | | | | | | | | | | |

End of year | | | $ | 164,909,944 | | | | | | | | | $ | 161,517,513 | |

| | | | | | | | | | | | | | | |

| (a) | Class T Shares were liquidated on September 21, 2018. |

| (b) | Effective October 31, 2018, the Fund has adopted disclosure requirements conforming to SEC Rule 6-04.17 of Regulation S-X. See Note 2 for further details. |

See accompanying notes to financial statements.

12

Gabelli Enterprise Mergers and Acquisitions Fund

Financial Highlights

Selected data for a share of capital stock outstanding throughout each year:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Income (Loss)

from Investment Operations | | | Distributions | | | | | | | | | | | | Ratios to Average Net Assets/

Supplemental Data | |

Year Ended October 31 | | Net Asset Value, Beginning of Year | | | Net

Investment Income (Loss)(a) | | | Net Realized and Unrealized Gain (Loss) on Investments | | | Total from

Investment

Operations | | | Net Realized

Gain on

Investments | | | Total Distributions | | | Redemption

Fees (a)(b) | | | Net Asset Value, End of Year | | | Total Return† | | | Net Assets

End of Year (in 000’s) | | | Net Investment

Income (Loss) | | | Operating Expenses (c) | | | Portfolio

Turnover Rate | |

Class AAA | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2018 | | $ | 14.96 | | | $ | 0.12 | | | $ | (0.14 | ) | | $ | (0.02 | ) | | $ | (0.19 | ) | | $ | (0.19 | ) | | $ | 0.00 | | | $ | 14.75 | | | | (0.12 | )% | | $ | 6,974 | | | | 0.80 | % | | | 1.50 | %(d) | | | 159 | % |

2017 | | | 13.52 | | | | (0.04 | ) | | | 1.48 | | | | 1.44 | | | | — | | | | — | | | | 0.00 | | | | 14.96 | | | | 10.65 | | | | 6,201 | | | | (0.28 | ) | | | 1.51 | (d) | | | 113 | |

2016 | | | 13.31 | | | | 0.01 | | | | 0.20 | | | | 0.21 | | | | — | | | | — | | | | 0.00 | | | | 13.52 | | | | 1.58 | | | | 4,069 | | | | 0.07 | | | | 1.52 | (d)(e)(f) | | | 151 | |

2015 | | | 12.86 | | | | (0.07 | ) | | | 0.52 | | | | 0.45 | | | | — | | | | — | | | | 0.00 | | | | 13.31 | | | | 3.50 | | | | 4,943 | | | | (0.51 | ) | | | 1.47 | (d)(e) | | | 162 | |

2014 | | | 12.66 | | | | (0.03 | ) | | | 0.23 | | | | 0.20 | | | | — | | | | — | | | | 0.00 | | | | 12.86 | | | | 1.58 | | | | 11,315 | | | | (0.24 | ) | | | 1.46 | (e) | | | 181 | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2018 | | $ | 14.73 | | | $ | 0.07 | | | $ | (0.12 | ) | | $ | (0.05 | ) | | $ | (0.19 | ) | | $ | (0.19 | ) | | $ | 0.00 | | | $ | 14.49 | | | | (0.33 | )% | | $ | 37,070 | | | | 0.51 | % | | | 1.70 | %(d) | | | 159 | % |

2017 | | | 13.35 | | | | (0.07 | ) | | | 1.45 | | | | 1.38 | | | | — | | | | — | | | | 0.00 | | | | 14.73 | | | | 10.34 | | | | 46,887 | | | | (0.46 | ) | | | 1.71 | (d) | | | 113 | |

2016 | | | 13.17 | | | | (0.02 | ) | | | 0.20 | | | | 0.18 | | | | — | | | | — | | | | 0.00 | | | | 13.35 | | | | 1.37 | | | | 48,770 | | | | (0.13 | ) | | | 1.72 | (d)(e)(f) | | | 151 | |

2015 | | | 12.75 | | | | (0.08 | ) | | | 0.50 | | | | 0.42 | | | | — | | | | — | | | | 0.00 | | | | 13.17 | | | | 3.29 | | | | 58,039 | | | | (0.63 | ) | | | 1.67 | (d)(e) | | | 162 | |

2014 | | | 12.57 | | | | (0.06 | ) | | | 0.24 | | | | 0.18 | | | | — | | | | — | | | | 0.00 | | | | 12.75 | | | | 1.43 | | | | 93,980 | | | | (0.51 | ) | | | 1.66 | (e) | | | 181 | |

Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2018 | | $ | 13.53 | | | $ | (0.00 | )(b) | | $ | (0.12 | ) | | $ | (0.12 | ) | | $ | (0.19 | ) | | $ | (0.19 | ) | | $ | 0.00 | | | $ | 13.22 | | | | (0.88 | )% | | $ | 35,211 | | | | (0.01 | )% | | | 2.24 | %(d) | | | 159 | % |

2017 | | | 12.33 | | | | (0.13 | ) | | | 1.33 | | | | 1.20 | | | | — | | | | — | | | | 0.00 | | | | 13.53 | | | | 9.73 | | | | 38,628 | | | | (1.01 | ) | | | 2.26 | (d) | | | 113 | |

2016 | | | 12.23 | | | | (0.08 | ) | | | 0.18 | | | | 0.10 | | | | — | | | | — | | | | 0.00 | | | | 12.33 | | | | 0.82 | | | | 44,424 | | | | (0.67 | ) | | | 2.27 | (d)(e)(f) | | | 151 | |

2015 | | | 11.91 | | | | (0.14 | ) | | | 0.46 | | | | 0.32 | | | | — | | | | — | | | | 0.00 | | | | 12.23 | | | | 2.69 | | | | 53,738 | | | | (1.19 | ) | | | 2.22 | (d)(e) | | | 162 | |

2014 | | | 11.81 | | | | (0.12 | ) | | | 0.22 | | | | 0.10 | | | | — | | | | — | | | | 0.00 | | | | 11.91 | | | | 0.85 | | | | 57,616 | | | | (1.04 | ) | | | 2.21 | (e) | | | 181 | |

Class Y | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2018 | | $ | 15.71 | | | $ | 0.16 | | | $ | (0.15 | ) | | $ | 0.01 | | | $ | (0.19 | ) | | $ | (0.19 | ) | | $ | 0.00 | | | $ | 15.53 | | | | 0.08 | % | | $ | 85,655 | | | | 1.04 | % | | | 1.24 | %(d) | | | 159 | % |

2017 | | | 14.17 | | | | (0.00 | )(b) | | | 1.54 | | | | 1.54 | | | | — | | | | — | | | | 0.00 | | | | 15.71 | | | | 10.87 | | | | 69,801 | | | | (0.02 | ) | | | 1.26 | (d) | | | 113 | |

2016 | | | 13.91 | | | | 0.05 | | | | 0.21 | | | | 0.26 | | | | — | | | | — | | | | 0.00 | | | | 14.17 | | | | 1.87 | | | | 59,414 | | | | 0.33 | | | | 1.27 | (d)(e)(f) | | | 151 | |

2015 | | | 13.41 | | | | (0.03 | ) | | | 0.53 | | | | 0.50 | | | | — | | | | — | | | | 0.00 | | | | 13.91 | | | | 3.73 | | | | 77,148 | | | | (0.20 | ) | | | 1.21 | (d)(e) | | | 162 | |

2014 | | | 13.16 | | | | (0.00 | ) | | | 0.25 | | | | 0.25 | | | | — | | | | — | | | | 0.00 | | | | 13.41 | | | | 1.90 | | | | 80,672 | | | | (0.03 | ) | | | 1.21 | (e) | | | 181 | |

| † | Total return represents aggregate total return of a hypothetical $1,000 investment at the beginning of the year and sold at the end of the year including reinvestment of distributions and does not reflect the applicable sales charges. |

| (a) | Per share amounts have been calculated using the average shares outstanding method. |

| (b) | Amount represents less than $ 0.005 per share. |

| (c) | The Fund incurred interest expense during the year ended October 31, 2017. If interest expense had not been incurred during the year, the ratio of operating expenses to average net assets would have been 1.50% (Class AAA), 1.70% (Class A), 2.25% (Class C), and 1.25% (Class Y). For the years ended October 31, 2018, 2016, 2015, and 2014, there was no impact on the expense ratios. |

| (d) | The Fund received credits from a designated broker who agreed to pay certain Fund operating expenses. For the years ended October 31, 2018, 2017, 2016, and 2015, there was no impact on the expense ratios. |

| (e) | The Fund incurred dividend expense and service fees on securities sold short. If these expenses and fees had not been incurred, the ratios of operating expenses to average net assets for the year ended October 31, 2016 would have been 1.50% (Class AAA), 1.70% (Class A), 2.25% (Class C), and 1.25% (Class Y). For the years ended October 31, 2015, and 2014, there was no impact on the expense ratios. |

| (f) | During the year ended October 31, 2016, the Fund received a reimbursement of custody expenses paid in prior years. Had such reimbursement (allocated by relative net asset values of the Fund’s share classes) been included in that period, the expense ratios would have been 1.44% (Class AAA),1.64% (Class A), 2.19% (Class C), and 1.19% (Class Y). |

See accompanying notes to financial statements.

13

Gabelli Enterprise Mergers and Acquisitions Fund

Notes to Financial Statements

1. Organization. The Gabelli Enterprise Mergers and Acquisitions Fund is a series of the Gabelli 787 Fund, Inc. (the Corporation), which was organized in Maryland and commenced operations on February 28, 2001. The Fund is a non-diversified open-end management investment company registered under the Investment Company Act of 1940, as amended (the 1940 Act). Its primary objective is capital appreciation.

2. Significant Accounting Policies. As an investment company, the Fund follows the investment company accounting and reporting guidance, which is part of U.S. generally accepted accounting principles (GAAP) that may require the use of management estimates and assumptions in the preparation of its financial statements. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

New Accounting Pronouncements. The SEC recently adopted changes to Regulation S-X to simplify the reporting of information by registered investment companies in financial statements. The amendments require presentation of the total, rather than the components, of distributable earnings on the Statement of Assets and Liabilities and also require presentation of the total, rather than the components, of distributions to shareholders, except for tax return of capital distributions, if any, on the Statement of Changes in Net Assets. The amendments also removed the requirement for parenthetical disclosure of undistributed net investment income on the Statement of Changes in Net Assets. These Regulation S-X amendments are reflected in the Fund’s financial statements for the year ended October 31, 2018.

To improve the effectiveness of fair value disclosure requirements, the Financial Accounting Standards Board recently issued Accounting Standard Update (ASU) 2018-13, Fair Value Measurement Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement (ASU 2018-13), which adds, removes, and modifies certain aspects relating to fair value disclosure. ASU 2018-13 is effective for interim and annual reporting periods beginning after December 15, 2019; early adoption of the additions relating to ASU 2018-13 is not required, even if early adoption is elected for the removals under ASU 2018-13. Management has early adopted the removals set forth in ASU 2018-13 in these financial statements and has not early adopted the additions set forth in ASU 2018-13.

Security Valuation. Portfolio securities listed or traded on a nationally recognized securities exchange or traded in the U.S. over-the-counter market for which market quotations are readily available are valued at the last quoted sale price or a market’s official closing price as of the close of business on the day the securities are being valued. If there were no sales that day, the security is valued at the average of the closing bid and asked prices or, if there were no asked prices quoted on that day, then the security is valued at the closing bid price on that day. If no bid or asked prices are quoted on such day, the security is valued at the most recently available price or, if the Board of Directors (the Board) so determines, by such other method as the Board shall determine in good faith to reflect its fair market value. Portfolio securities traded on more than one national securities exchange or market are valued according to the broadest and most representative market, as determined by Gabelli Funds, LLC (the Adviser).

Portfolio securities primarily traded on a foreign market are generally valued at the preceding closing values of such securities on the relevant market, but may be fair valued pursuant to procedures established by the Board if market conditions change significantly after the close of the foreign market, but prior to the close of business on the day the securities are being valued. Debt obligations for which market quotations are readily available are valued at the average of the latest bid and asked prices. If there were no asked prices quoted

14

Gabelli Enterprise Mergers and Acquisitions Fund

Notes to Financial Statements (Continued)

on such day, the security is valued using the closing bid price, unless the Board determines such amount does not reflect the securities’ fair value, in which case these securities will be fair valued as determined by the Board. Certain securities are valued principally using dealer quotations. Futures contracts are valued at the closing settlement price of the exchange or board of trade on which the applicable contract is traded. OTC futures and options on futures for which market quotations are readily available will be valued by quotations received from a pricing service or, if no quotations are available from a pricing service, by quotations obtained from one or more dealers in the instrument in question by the Adviser.

Securities and assets for which market quotations are not readily available are fair valued as determined by the Board. Fair valuation methodologies and procedures may include, but are not limited to: analysis and review of available financial and non-financial information about the company; comparisons with the valuation and changes in valuation of similar securities, including a comparison of foreign securities with the equivalent U.S. dollar value American Depositary Receipt securities at the close of the U.S. exchange; and evaluation of any other information that could be indicative of the value of the security.

The inputs and valuation techniques used to measure fair value of the Fund’s investments are summarized into three levels as described in the hierarchy below:

| | ● | | Level 1 — quoted prices in active markets for identical securities; |

| | ● | | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.); and |

| | ● | | Level 3 — significant unobservable inputs (including the Board’s determinations as to the fair value of investments). |

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input both individually and in the aggregate that is significant to the fair value measurement. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The summary of the Fund’s investments in securities by inputs used to value the Fund’s investments as of October 31, 2018 is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Valuation Inputs | | | | |

| | | Level 1

Quoted Prices | | | | Level 2 Other Significant

Observable Inputs | | | | Level 3 Significant

Unobservable Inputs | | | | Total Market Value

at 10/31/18 |

INVESTMENTS IN SECURITIES: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ASSETS (Market Value): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Common Stocks: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Building and Construction | | | $ | 7,245,030 | | | | | | | | | $ | 253,000 | | | | | | | | | | — | | | | | | | | | $ | 7,498,030 | |

Energy and Utilities | | | | 4,523,636 | | | | | | | | | | — | | | | | | | | | $ | 0 | | | | | | | | | | 4,523,636 | |

Financial Services | | | | 8,233,818 | | | | | | | | | | 46,800 | | | | | | | | | | 2 | | | | | | | | | | 8,280,620 | |

Health Care | | | | 20,808,120 | | | | | | | | | | — | | | | | | | | | | 67,500 | | | | | | | | | | 20,875,620 | |

Media | | | | 3,583,292 | | | | | | | | | | — | | | | | | | | | | 20,388 | | | | | | | | | | 3,603,680 | |

All Other Industries (a) | | | | 71,009,833 | | | | | | | | | | — | | | | | | | | | | — | | | | | | | | | | 71,009,833 | |

Total Common Stocks | | | | 115,403,729 | | | | | | | | | | 299,800 | | | | | | | | | | 87,890 | | | | | | | | | | 115,791,419 | |

Rights (a) | | | | — | | | | | | | | | | — | | | | | | | | | | 197,560 | | | | | | | | | | 197,560 | |

Corporate Bonds (a) | | | | — | | | | | | | | | | — | | | | | | | | | | 3,010 | | | | | | | | | | 3,010 | |

U.S. Government Obligations | | | | — | | | | | | | | | | 48,081,746 | | | | | | | | | | — | | | | | | | | | | 48,081,746 | |

TOTAL INVESTMENTS IN SECURITIES – ASSETS | | | $ | 115,403,729 | | | | | | | | | $ | 48,381,546 | | | | | | | | | $ | 288,460 | | | | | | | | | $ | 164,073,735 | |

| (a) | Please refer to the Schedule of Investments for the industry classifications of these portfolio holdings. |

15

Gabelli Enterprise Mergers and Acquisitions Fund

Notes to Financial Statements (Continued)

The Fund did not have material transfers between Level 1 and Level 3 during the fiscal year ended October 31, 2018. Transfers from Level 1 to Level 3 are due to a decline in market activity, e.g., frequency of trades, which resulted in a lack of available market inputs to determine price. The Fund’s policy is to recognize transfers among Levels as of the beginning of the reporting period.

The following table reconciles Level 3 investments for which significant unobservable inputs were used to determine fair value:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Balance

as of

10/31/17 | | Accrued

discounts/

(premiums) | | Realized

gain/

(loss) | | Change in

unrealized

appreciation/

depreciation | | Purchases | | Sales | | Transfers

into

Level 3 | | Transfers

out of

Level 3 | | Balance

as of

10/31/18 | | Net change in unrealized appreciation/ depreciation during the period on

Level 3

investments still held at 10/31/18† |

INVESTMENTS IN SECURITIES: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ASSETS (Market Value): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Common Stocks (a) | | | $ | 129,863 | | | | | — | | | | $ | 42,230 | | | | $ | (10,574 | ) | | | $ | 1,305,603 | | | | $ | (1,399,279 | ) | | | $ | 20,047 | | | | | — | | | | $ | 87,890 | | | | $ | 305 | |

Rights (a) | | | | 183,390 | | | | | — | | | | | 333,770 | | | | | (102,570 | ) | | | | 142,970 | | | | | (360,000 | ) | | | | — | | | | | — | | | | | 197,560 | | | | | (3,880 | ) |

Corporate Bonds (a) | | | | 3,010 | | | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | 3,010 | | | | | — | |

TOTAL INVESTMENTS IN SECURITIES | | | $ | 316,263 | | | | | — | | | | | $376,000 | | | | $ | (113,144 | ) | | | $ | 1,448,573 | | | | $ | (1,759,279 | ) | | | $ | 20,047 | | | | | — | | | | $ | 288,460 | | | | $ | (3,575 | ) |

| (a) | Please refer to the Schedule of Investments for the industry classifications of these portfolio holdings. |

| † | Net change in unrealized appreciation/depreciation on investments is included in the related amounts in the Statement of Operations. |

The following table summarizes the valuation techniques used and unobservable inputs utilized to determine the value of certain of the Fund’s Level 3 investments as of October 31, 2018:

| | | | | | | | | | | | | | |

Description | | Balance at 10/31/18 | | Valuation Technique | | Unobservable Input | | Range |

INVESTMENTS IN SECURITIES: | | | | | | | | | | | | | | |

ASSETS (Market Value): | | | | | | | | | | | | | | |

Common Stocks(a) | | | $ | 87,890 | | | Acquisition price/Cash flow analysis/Bankruptcy plan | | Discount Range | | | | 0 | % |

Rights(a) | | | | 197,560 | | | Acquisition price/Cash flow analysis/Intrinsic value | | Discount Range | | | | 0 | % |

Corporate Bonds(a) | | | | 3,010 | | | Acquisition price/Cash flow analysis | | Discount Range | | | | 0 | % |

| | | | | | | | | | | | | | |

| | | $ | 288,460 | | | | | | | | | | |

| | | | | | | | | | | | | | |

| (a) | Please refer to the Schedule of Investments for the industry classifications of these portfolio holdings. |

| | | | |

Unobservable Input | | Impact to Value if Input Increases | | Impact to Value if Input Decreases |

Discount Range | | Decrease | | Increase |

16

Gabelli Enterprise Mergers and Acquisitions Fund

Notes to Financial Statements (Continued)

Additional Information to Evaluate Qualitative Information.

General. The Fund uses recognized industry pricing services – approved by the Board and unaffiliated with the Adviser – to value most of its securities, and uses broker quotes provided by market makers of securities not valued by these and other recognized pricing sources. Several different pricing feeds are received to value domestic equity securities, international equity securities, preferred equity securities, and fixed income securities. The data within these feeds are ultimately sourced from major stock exchanges and trading systems where these securities trade. The prices supplied by external sources are checked by obtaining quotations or actual transaction prices from market participants. If a price obtained from the pricing source is deemed unreliable, prices will be sought from another pricing service or from a broker/dealer that trades that security or similar securities.

Fair Valuation. Fair valued securities may be common or preferred equities, warrants, options, rights, or fixed income obligations. Where appropriate, Level 3 securities are those for which market quotations are not available, such as securities not traded for several days, or for which current bids are not available, or which are restricted as to transfer. When fair valuing a security, factors to consider include recent prices of comparable securities that are publicly traded, reliable prices of securities not publicly traded, the use of valuation models, current analyst reports, valuing the income or cash flow of the issuer, or cost if the preceding factors do not apply. A significant change in the unobservable inputs could result in a lower or higher value in Level 3 securities. The circumstances of Level 3 securities are frequently monitored to determine if fair valuation measures continue to apply.

The Adviser reports quarterly to the Board the results of the application of fair valuation policies and procedures. These may include backtesting the prices realized in subsequent trades of these fair valued securities to fair values previously recognized.

Derivative Financial Instruments. The Fund may engage in various portfolio investment strategies by investing in derivative financial instruments for the purposes of increasing the income of the Fund, hedging against changes in the value of its portfolio securities and in the value of securities it intends to purchase, or hedging against a specific transaction with respect to either the currency in which the transaction is denominated or another currency. Investing in certain derivative financial instruments, including participation in the options, futures, or swap markets, entails certain execution, liquidity, hedging, tax, and securities, interest, credit, or currency market risks. Losses may arise if the Adviser’s prediction of movements in the direction of the securities, foreign currency, and interest rate markets is inaccurate. Losses may also arise if the counterparty does not perform its duties under a contract, or, in the event of default, the Fund may be delayed in or prevented from obtaining payments or other contractual remedies owed to it under derivative contracts. The creditworthiness of the counterparties is closely monitored in order to minimize these risks. Participation in derivative transactions involves investment risks, transaction costs, and potential losses to which the Fund would not be subject absent the use of these strategies. The consequences of these risks, transaction costs, and losses may have a negative impact on the Fund’s ability to pay distributions.

Collateral requirements differ by type of derivative. Collateral requirements are set by the broker or exchange clearing house for exchange traded derivatives, while collateral terms are contract specific for derivatives traded over-the-counter. Securities pledged to cover obligations of the Fund under derivative contracts are noted in

17

Gabelli Enterprise Mergers and Acquisitions Fund

Notes to Financial Statements (Continued)

the Schedule of Investments. Cash collateral, if any, pledged for the same purpose will be reported separately in the Statement of Assets and Liabilities.

The Fund’s derivative contracts held at October 31, 2018, if any, are not accounted for as hedging instruments under GAAP and are disclosed in the Schedule of Investments together with the related counterparty.

Swap Agreements. The Fund may enter into equity contract for difference swap transactions for the purpose of increasing the income of the Fund. The use of swaps is a highly specialized activity that involves investment techniques and risks different from those associated with ordinary portfolio security transactions. In an equity contract for difference swap, a set of future cash flows is exchanged between two counterparties. One of these cash flow streams will typically be based on a reference interest rate combined with the performance of a notional value of shares of a stock. The other will be based on the performance of the shares of a stock. Depending on the general state of short term interest rates and the returns on the Fund’s portfolio securities at the time an equity contract for difference swap transaction reaches its scheduled termination date, there is a risk that the Fund will not be able to obtain a replacement transaction or that the terms of the replacement will not be as favorable as on the expiring transaction.

Unrealized gains related to swaps are reported as an asset and unrealized losses are reported as a liability in the Statement of Assets and Liabilities. The change in value of swaps, including the accrual of periodic amounts of interest to be paid or received on swaps, is reported as unrealized gain or loss in the Statement of Operations. A realized gain or loss is recorded upon payment or receipt of a periodic payment or termination of swap agreements. At October 31, 2018, the Fund held no investments in equity contract for difference swap agreements.

The Fund’s volume of activity in equity contract for difference swap agreements while outstanding during the fiscal year ended October 31, 2018 had an average monthly notional amount of approximately $296,899.

For the fiscal year ended October 31, 2018, the effect of equity contract for difference swap agreements can be found in the Statement of Operations under Net Realized and Unrealized Gain/(Loss) on Investments, Swap Contracts, Securities Sold Short, and Foreign Currency; Net realized loss on swap contracts.