UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22045

Wisconsin Capital Funds, Inc.

(Exact name of registrant as specified in charter)

1221 John Q. Hammons Drive

Madison, Wisconsin 53717

(Address of principal executive offices) (Zip code)

Thomas G. Plumb

1221 John Q. Hammons Drive

Madison, Wisconsin 53717

(Name and address of agent for service)

(608) 824-8800

Registrant's telephone number, including area code

Date of fiscal year end: March 31

Date of reporting period: March 31, 2013

Item 1. Reports to Stockholders.

Plumb Balanced Fund

Plumb Equity Fund

ANNUAL REPORT

March 31, 2013

www.plumbfunds.com

March 31, 2013

Dear Fellow Shareholders:

We are pleased to present you the sixth Annual Report of the Plumb Funds. The Funds commenced operations May 24, 2007, in a very challenging investment environment. The fiscal year ended March 31, 2013, continued the third year of recovery for US stock markets, and both the Plumb Balanced Fund and the Plumb Equity Fund provided shareholders positive returns, with the Funds up 2.22% and 0.42%, respectively, for the past 12 months. For the last three years, the average annual return has been 5.89% for the Plumb Balanced Fund and 5.08% for the Plumb Equity Fund. For the last five years, the average annual return has been 3.20% for the Plumb Balanced Fund and 2.46% for the Plumb Equity Fund. Since inception (5/24/2007), the Plumb Balanced Fund and Plumb Equity Fund have averaged annual returns of 0.61% and -1.13%, respectively. The Balanced Fund’s Gross Expense Ratio as noted in the prospectus dated August 1, 2012 was 1.49%. The Equity Fund’s Gross Expense Ratio as noted in the prospectus dated August 1, 2012 was 1.56%.

Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance data current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 866-987-7888.

The Funds’ performance should be reviewed in the light of the markets that they operate in. For the last one year, three years, five years, and since the Funds’ inception, as of 3/31/2013, the Plumb Balanced Fund’s blended benchmark (55% S&P 500 Index, 35% Barclays Capital Intermediate Government/Credit Bond Index and 10% MSCI EAFE Index) had average annual returns of 7.83%, 8.43%, 4.50%, and 3.12%. The Plumb Equity Fund’s blended benchmark (90% S&P 500 Index and 10% MSCI EAFE Index) has averaged 13.37%, 11.59%, 4.85%, and 2.15% during those periods.

Our investment approach is to seek out good quality, growing companies trading at what we believe are reasonable prices. In the Balanced Fund, we generally use fixed income investments in an attempt to moderate the volatility of the stock market and to provide an income component to our total return objective. With the low interest rate environment present since the financial crisis, it has been difficult to find attractive fixed income instruments to meet that objective. In fact, at times, the dividend yield on high quality blue-chip stocks exceeded the yield of ten-year U.S. Treasury Bonds. In this environment, we have added income-generating securities that may have an equity component to the Balanced Fund’s overall asset mix. Convertible bonds, REITs, and publicly traded partnerships are examples of generally higher yielding securities that combine capital appreciation potential with the potential for high current income yields.

Absolute and relative investment returns typically are influenced by the markets we operate in, our allocation to the sectors within the market, and our individual security selection. With the S&P 500 up almost 14% but the bond market down close to 2% over the last year, as represented by the Barclays Capital

Intermediate Government/Credit Bond Index, our fixed income exposure substantially dampened our absolute returns. In addition, our relative overweight in the energy sector and relative underweight in consumer discretionary provided a headwind to our relative returns over the last year, while our stock selection in industrials improved our relative performance.

The largest positive individual contributors to our investment return over the last year were Constellation Brands, Phillips 66, Qualcomm and Visa. In the Balanced Fund, our fixed income performance was weighed down by our selection of ATP Oil and Gas preferred stock. During the year, ATP Oil and Gas declared bankruptcy, wiping out the position. The largest positive contributors were fixed income securities of Barclays, Goldman Sachs and Morgan Stanley, but their performance was not enough to offset the loss in ATP Oil and Gas. We believe that the Funds’ investments are positioned to potentially benefit from an improving worldwide economic environment while seeking to protect us from a rising interest rate scenario.

Best wishes in the coming year from all of us at the Plumb Funds.

Thomas G. Plumb

Opinions expressed are those of Wisconsin Capital Management, LLC and are not intended to be a forecast of future events, a guarantee of future results, or investment advice.

Must be preceded or accompanied by a current prospectus.

Fund holdings and sector allocations are subject to change and should not be considered recommendations to buy or sell any security. Please refer to the schedule of investments in this report for complete holdings information.

Mutual fund investing involves risk. Principal loss is possible. The Funds may invest in small and mid-sized companies which involve additional risks such as limited liquidity and greater volatility. The Funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The Balanced Fund will invest in debt securities, which typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments by the Balanced Fund in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities. Investments in Asset Backed and Mortgage Backed Securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Because the Funds may invest in ETFs, they are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of an ETF’s shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact the Funds’ ability to sell its shares.

The S&P 500 Index is an unmanaged market capitalization-weighted index based on the average weighted performance of 500 widely held U.S. common stocks. The Barclays Capital Intermediate Government/Credit Bond Index is an unmanaged market value weighted index measuring both the principal price changes of, and income provided by, the underlying universe of securities that comprise the index. The MSCI EAFE Index is an index intended to reflect the performance of major developed countries’ international equity markets, besides the United States and Canada. The Plumb Balanced Fund’s benchmark is made up of 55% S&P 500 Index, 35% Barclays Capital Intermediate Government/Credit Bond Index and 10% MSCI EAFE Index. The Plumb Equity Fund’s blended benchmark is made up of 90% S&P 500 Index and 10% MSCI EAFE Index. You cannot invest directly in an index.

The Plumb Funds are distributed by Quasar Distributors, LLC.

Expense Example

March 31, 2013 (Unaudited)

As a shareholder of the Plumb Funds (the “Funds”), you incur ongoing costs, including investment advisory fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (October 1, 2012 – March 31, 2013).

Actual Expenses

The first line of the table on the following page provides information about actual account values and actual expenses. However, the table does not include shareholder-specific fees such as the $15.00 fee charged for wire redemptions. The table also does not include portfolio trading commissions and related trading costs. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees, which, although not charged by the Funds, may be charged by other funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Example

March 31, 2013 (Unaudited) (Continued)

Plumb Balanced Fund

| | | | Expenses Paid |

| | Beginning | Ending | During the Period* |

| | Account Value | Account Value | October 1, 2012 to |

| | October 1, 2012 | March 31, 2013 | March 31, 2013 |

| Actual | $1,000.00 | $1,064.50 | $6.49 |

| | | | |

| Hypothetical | | | |

| (5% return per | | | |

| year before expenses) | $1,000.00 | $1,018.65 | $6.34 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.26%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the partial year period). |

Plumb Equity Fund

| | | | Expenses Paid |

| | Beginning | Ending | During the Period* |

| | Account Value | Account Value | October 1, 2012 to |

| | October 1, 2012 | March 31, 2013 | March 31, 2013 |

| Actual | $1,000.00 | $1,061.40 | $7.30 |

| | | | |

| Hypothetical | | | |

| (5% return per | | | |

| year before expenses) | $1,000.00 | $1,017.85 | $7.14 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.42%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the partial year period). |

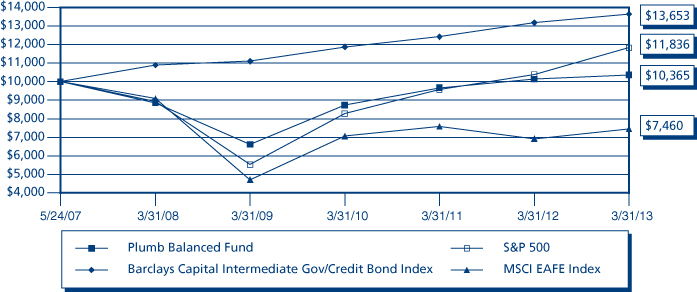

Plumb Balanced Fund (Unaudited)

Comparison of Change in Value of a Hypothetical $10,000 Investment

from Inception of May 24, 2007 to March 31, 2013

Average Annual Rate of Return

Periods ended March 31, 2013

| | | | | | | | | | | | Since Inception |

| | | 1 Year | | 3 Year | | 5 Year | | of May 24, 2007 |

| Plumb Balanced Fund | | | 2.22 | % | | | 5.89 | % | | | 3.20 | % | | | 0.61 | % |

| Barclays Capital Intermediate | | | | | | | | | | | | | | | | |

| Government/Credit Bond Index | | | -1.83 | % | | | 2.91 | % | | | 3.51 | % | | | 4.51 | % |

| MSCI EAFE Index | | | 7.87 | % | | | 1.86 | % | | | -3.86 | % | | | -4.89 | % |

| S&P 500 Index | | | 13.96 | % | | | 12.67 | % | | | 5.81 | % | | | 2.92 | % |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-866-987-7888.

The line graph and performance table do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers.

The Barclays Capital Intermediate Government/Credit Bond Index is an unmanaged market value weighted index measuring both the principal price changes of, and income provided by, the underlying universe of securities that comprise the index.

The MSCI EAFE Index is an index intended to reflect the performance of major developed countries’ international equity markets, besides the United States and Canada.

The S&P 500 Index is an unmanaged market capitalization-weighted index based on the average weighted performance of 500 widely held common stocks.

The Fund’s portfolio holdings may differ significantly from the securities held in the relevant index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

Plumb Equity Fund (Unaudited)

Comparison of Change in Value of a Hypothetical $10,000 Investment

from Inception of May 24, 2007 to March 31, 2013

Average Annual Rate of Return

Periods ended March 31, 2013

| | | | | | | | | | | | Since Inception |

| | | 1 Year | | 3 Year | | 5 Year | | of May 24, 2007 |

| Plumb Equity Fund | | | 0.42 | % | | | 5.08 | % | | | 2.46 | % | | | -1.13 | % |

| S&P 500 Index | | | 13.96 | % | | | 12.67 | % | | | 5.81 | % | | | 2.92 | % |

| MSCI EAFE Index | | | 7.87 | % | | | 1.86 | % | | | -3.86 | % | | | -4.89 | % |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-866-987-7888.

The line graph and performance table do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers.

The S&P 500 Index is an unmanaged market capitalization-weighted index based on the average weighted performance of 500 widely held common stocks.

The MSCI EAFE Index in an index intended to reflect the performance of major developed countries’ international equity markets, besides the United States and Canada.

The Fund’s portfolio holdings may differ significantly from the securities held in the relevant index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

Plumb Balanced Fund

Investments by Asset Allocation as of March 31, 2013

(as a Percentage of Total Investments) (Unaudited)

Plumb Equity Fund

Investments by Asset Allocation as of March 31, 2013

(as a Percentage of Total Investments) (Unaudited)

Plumb Balanced Fund

Schedule of Investments – March 31, 2013

| | | Shares | | | Value | |

| COMMON STOCKS – 69.36% | | | | | | |

Amusement, Gambling, and Recreation | | | | | | |

| Industries – 3.74% | | | | | | |

| Las Vegas Sands Corporation | | | 10,000 | | | $ | 563,500 | |

| The Walt Disney Company | | | 12,500 | | | | 710,000 | |

| | | | | | | | 1,273,500 | |

| Beverage and Tobacco Product Manufacturing – 3.37% | | | | | | | | |

| Constellation Brands, Inc. (a) | | | 15,000 | | | | 714,600 | |

| PepsiCo, Inc. | | | 5,500 | | | | 435,105 | |

| | | | | | | | 1,149,705 | |

| Chemical Manufacturing – 9.77% | | | | | | | | |

| Abbott Laboratories | | | 12,000 | | | | 423,840 | |

| AbbVie, Inc. | | | 18,500 | | | | 754,430 | |

| E.I. du Pont de Nemours and Company | | | 14,000 | | | | 688,240 | |

| Johnson & Johnson | | | 12,000 | | | | 978,360 | |

| Merck & Company, Inc. | | | 11,000 | | | | 486,530 | |

| | | | | | | | 3,331,400 | |

| Computer and Electronic Product | | | | | | | | |

| Manufacturing – 6.66% | | | | | | | | |

| Apple, Inc. | | | 1,300 | | | | 575,419 | |

| ION Geophysical Corporation (a) | | | 60,000 | | | | 408,600 | |

| Microchip Technology, Inc. | | | 15,000 | | | | 551,400 | |

| QUALCOMM, Inc. | | | 11,000 | | | | 736,450 | |

| | | | | | | | 2,271,869 | |

| Couriers and Messengers – 1.64% | | | | | | | | |

| United Parcel Service, Inc. – Class B | | | 6,500 | | | | 558,350 | |

| | | | | | | | | |

| Credit Intermediation and Related Activities – 9.77% | | | | | | | | |

| American Express Company | | | 10,000 | | | | 674,600 | |

| Bank of Montreal (b) | | | 6,500 | | | | 409,175 | |

| Citigroup, Inc. | | | 12,000 | | | | 530,880 | |

| Discover Financial Services | | | 8,300 | | | | 372,172 | |

| JPMorgan Chase & Company | | | 14,000 | | | | 664,440 | |

| Visa, Inc. – Class A | | | 4,000 | | | | 679,360 | |

| | | | | | | | 3,330,627 | |

| Electrical Equipment, Appliance, and | | | | | | | | |

| Component Manufacturing – 1.97% | | | | | | | | |

| Emerson Electric Company | | | 12,000 | | | | 670,440 | |

The accompanying notes are an integral part of these financial statements.

Plumb Balanced Fund

Schedule of Investments – March 31, 2013 (Continued)

| | | Shares | | | Value | |

| COMMON STOCKS (Continued) | | | | | | |

Food Manufacturing – 1.12% | | | | | | |

| Mondelez International, Inc. | | | 12,500 | | | $ | 382,625 | |

| | | | | | | | | |

| Food Services and Drinking Places – 1.75% | | | | | | | | |

| McDonald’s Corporation | | | 6,000 | | | | 598,140 | |

| | | | | | | | | |

| Insurance Carriers and Related Activities – 3.58% | | | | | | | | |

| American International Group, Inc. (a) | | | 18,000 | | | | 698,760 | |

| Berkshire Hathaway, Inc. – Class B (a) | | | 5,000 | | | | 521,000 | |

| | | | | | | | 1,219,760 | |

| Machinery Manufacturing – 2.71% | | | | | | | | |

| General Electric Company | | | 40,000 | | | | 924,800 | |

| | | | | | | | | |

| Merchant Wholesalers, Nondurable Goods – 2.67% | | | | | | | | |

| The Procter & Gamble Company | | | 6,000 | | | | 462,360 | |

| Universal Corporation | | | 8,000 | | | | 448,320 | |

| | | | | | | | 910,680 | |

| Miscellaneous Manufacturing – 4.32% | | | | | | | | |

| 3M Company | | | 7,000 | | | | 744,170 | |

| Medtronic, Inc. | | | 7,200 | | | | 338,112 | |

| Stryker Corporation | | | 6,000 | | | | 391,440 | |

| | | | | | | | 1,473,722 | |

| Other Information Services – 2.10% | | | | | | | | |

| Google Inc. (a) | | | 900 | | | | 714,627 | |

| | | | | | | | | |

| Petroleum and Coal Products Manufacturing – 6.58% | | | | | | | | |

| BP PLC – ADR | | | 12,000 | | | | 508,200 | |

| Chevron Corporation | | | 6,000 | | | | 712,920 | |

| ConocoPhillips | | | 10,000 | | | | 601,000 | |

| Phillips 66 | | | 6,000 | | | | 419,820 | |

| | | | | | | | 2,241,940 | |

| Pipeline Transportation – 2.11% | | | | | | | | |

| TransCanada Corporation (b) | | | 15,000 | | | | 718,350 | |

| | | | | | | | | |

| Professional, Scientific, and Technical Services – 0.57% | | | | | | | | |

| Exact Sciences Corporation (a) | | | 20,000 | | | | 196,000 | |

The accompanying notes are an integral part of these financial statements.

Plumb Balanced Fund

Schedule of Investments – March 31, 2013 (Continued)

| | | Shares | | | Value | |

| COMMON STOCKS (Continued) | | | | | | |

Rental and Leasing Services – 1.31% | | | | | | |

| Ryder System, Inc. | | | 7,500 | | | $ | 448,125 | |

| | | | | | | | | |

| Support Activities for Mining – 1.54% | | | | | | | | |

| Schlumberger Limited (b) | | | 7,000 | | | | 524,230 | |

| | | | | | | | | |

| Telecommunications – 2.08% | | | | | | | | |

| Vodafone Group PLC – ADR | | | 25,000 | | | | 710,250 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $17,497,387) | | | | | | | 23,649,140 | |

| | | | | | | | | |

| EXCHANGE-TRADED FUNDS – 3.40% | | | | | | | | |

Funds, Trusts, and Other Financial Vehicles – 3.40% | | | | | | | | |

| Alerian MLP ETF | | | 40,000 | | | | 708,800 | |

| SPDR S&P Homebuilders ETF | | | 15,000 | | | | 449,850 | |

| | | | | | | | 1,158,650 | |

| TOTAL EXCHANGE-TRADED FUNDS | | | | | | | | |

| (Cost $1,095,797) | | | | | | | 1,158,650 | |

| | | | | | | | | |

| | | Principal | | | | | |

| | | Amount | | | | | |

| CORPORATE BONDS – 25.59% | | | | | | | | |

Beverage and Tobacco Product Manufacturing – 1.78% | | | | | | | | |

| Lorillard Tobacco Company | | | | | | | | |

| 6.875%, 05/01/2020 | | $ | 500,000 | | | | 607,273 | |

| | | | | | | | | |

| Computer and Electronic Product | | | | | | | | |

| Manufacturing – 1.41% | | | | | | | | |

| Nokia Corporation | | | | | | | | |

| 5.375%, 05/15/2019 (b) | | | 500,000 | | | | 478,750 | |

The accompanying notes are an integral part of these financial statements.

Plumb Balanced Fund

Schedule of Investments – March 31, 2013 (Continued)

| | | Principal | | | | |

| | | Amount | | | Value | |

| CORPORATE BONDS (Continued) | | | | | | |

Credit Intermediation and Related Activities – 3.00% | | | | | | |

| General Electric Capital Corporation | | | | | | |

| 1.375%, 08/01/2017 (c) | | $ | 500,000 | | | $ | 500,676 | |

| Zions Bancorporation | | | | | | | | |

| 3.700%, 02/15/2018 | | | 523,000 | | | | 523,813 | |

| | | | | | | | 1,024,489 | |

| Funds, Trusts, and Other Financial Vehicles – 3.13% | | | | | | | | |

| Health Care Property Investors, Inc. | | | | | | | | |

| 6.000%, 03/01/2015 | | | 500,000 | | | | 544,000 | |

| Senior Housing Properties Trust | | | | | | | | |

| 4.300%, 01/15/2016 | | | 500,000 | | | | 523,478 | |

| | | | | | | | 1,067,478 | |

| Health and Personal Care Stores – 1.06% | | | | | | | | |

| CVS Pass-Through Trust | | | | | | | | |

| 6.943%, 01/10/2030 | | | 290,509 | | | | 362,197 | |

| | | | | | | | | |

| Merchant Wholesalers, Durable Goods – 1.60% | | | | | | | | |

| Ingram Micro, Inc. | | | | | | | | |

| 5.250%, 09/01/2017 | | | 500,000 | | | | 546,360 | |

| | | | | | | | | |

| Oil and Gas Extraction – 3.16% | | | | | | | | |

| Petrobras International Finance Company | | | | | | | | |

| 3.500%, 02/06/2017 (b) | | | 500,000 | | | | 517,497 | |

| Petrohawk Energy Corporation | | | | | | | | |

| 7.250%, 08/15/2018 | | | 500,000 | | | | 560,101 | |

| | | | | | | | 1,077,598 | |

| Paper Manufacturing – 1.55% | | | | | | | | |

| Sealed Air Corporation | | | | | | | | |

| 7.875%, 06/15/2017 | | | 500,000 | | | | 528,125 | |

| | | | | | | | | |

| Professional, Scientific, and Technical Services – 1.57% | | | | | | | | |

| Affiliated Computer Services | | | | | | | | |

| 5.200%, 06/01/2015 | | | 500,000 | | | | 536,182 | |

| | | | | | | | | |

| Publishing Industries (Except Internet) – 2.25% | | | | | | | | |

| BMC Software, Inc. | | | | | | | | |

| 4.500%, 12/01/2022 | | | 750,000 | | | | 766,012 | |

The accompanying notes are an integral part of these financial statements.

Plumb Balanced Fund

Schedule of Investments – March 31, 2013 (Continued)

| | | Principal | | | | |

| | | Amount | | | Value | |

| CORPORATE BONDS (Continued) | | | | | | |

Securities, Commodity Contracts, and Other Financial | | | | | | |

| Investments and Related Activities – 5.08% | | | | | | |

| The Goldman Sachs Group, Inc. | | | | | | |

| 1.301%, 07/29/2013 (c) | | $ | 500,000 | | | $ | 501,440 | |

| 3.000%, 10/30/2027 (c) | | | 1,000,000 | | | | 978,272 | |

| Morgan Stanley | | | | | | | | |

| 4.000%, 09/22/2020 (c) | | | 250,000 | | | | 251,241 | |

| | | | | | | | 1,730,953 | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $8,512,098) | | | | | | | 8,725,417 | |

| | | | | | | | | |

| MUNICIPAL BONDS – 0.73% | | | | | | | | |

West Virginia State Job Investment Trust Board – | | | | | | | | |

| Series 2003B | | | | | | | | |

| 0.000%, 06/12/2013 (a) | | | 250,000 | | | | 248,257 | |

| | | | | | | | | |

| TOTAL MUNICIPAL BONDS | | | | | | | | |

| (Cost $248,141) | | | | | | | 248,257 | |

| | | | | | | | | |

| | | Shares | | | | | |

| SHORT-TERM INVESTMENTS – 0.40% | | | | | | | | |

Money Market Funds – 0.40% | | | | | | | | |

| STIT-STIC Prime Portfolio 0.090% (c) | | | 136,896 | | | | 136,896 | |

| | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $136,896) | | | | | | | 136,896 | |

| | | | | | | | | |

| Total Investments | | | | | | | | |

| (Cost $27,490,319) – 99.48% | | | | | | | 33,918,360 | |

| Other Assets in Excess of Liabilities – 0.52% | | | | | | | 175,885 | |

| TOTAL NET ASSETS – 100.00% | | | | | | $ | 34,094,245 | |

Percentages are stated as a percent of net assets.

ADR – American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | Foreign issued security. Total foreign concentration was as follows: Cayman Islands 1.52%, Canada 3.31%, Netherlands Antilles 1.54%, Finland 1.40%. |

| (c) | Variable rate security. The rate listed is as of March 31, 2013. |

The accompanying notes are an integral part of these financial statements.

Plumb Equity Fund

Schedule of Investments – March 31, 2013

| | | Shares | | | Value | |

| COMMON STOCKS – 95.61% | | | | | | |

Amusement, Gambling, and Recreation | | | | | | |

| Industries – 4.51% | | | | | | |

| Las Vegas Sands Corporation | | | 12,000 | | | $ | 676,200 | |

| The Walt Disney Company | | | 17,000 | | | | 965,600 | |

| | | | | | | | 1,641,800 | |

| Beverage and Tobacco Product Manufacturing – 4.75% | | | | | | | | |

| Constellation Brands, Inc. (a) | | | 23,000 | | | | 1,095,720 | |

| PepsiCo, Inc. | | | 8,000 | | | | 632,880 | |

| | | | | | | | 1,728,600 | |

| Broadcasting (except Internet) – 1.69% | | | | | | | | |

| Sirius XM Radio, Inc. | | | 200,000 | | | | 616,000 | |

| | | | | | | | | |

| Building Material and Garden Equipment – 0.70% | | | | | | | | |

| Fastenal Company | | | 5,000 | | | | 256,750 | |

| | | | | | | | | |

| Chemical Manufacturing – 9.45% | | | | | | | | |

| Abbott Laboratories | | | 10,000 | | | | 353,200 | |

| AbbVie, Inc. | | | 15,000 | | | | 611,700 | |

| E.I. du Pont de Nemours and Company | | | 20,000 | | | | 983,200 | |

| Johnson & Johnson | | | 14,000 | | | | 1,141,420 | |

| Merck & Company, Inc. | | | 8,000 | | | | 353,840 | |

| | | | | | | | 3,443,360 | |

| Computer and Electronic Product | | | | | | | | |

| Manufacturing – 10.04% | | | | | | | | |

| Apple, Inc. | | | 2,500 | | | | 1,106,575 | |

| ION Geophysical Corporation (a) | | | 130,000 | | | | 885,300 | |

| Microchip Technology, Inc. | | | 12,500 | | | | 459,500 | |

| QUALCOMM, Inc. | | | 18,000 | | | | 1,205,100 | |

| | | | | | | | 3,656,475 | |

| Couriers and Messengers – 1.18% | | | | | | | | |

| United Parcel Service, Inc. – Class B | | | 5,000 | | | | 429,500 | |

| | | | | | | | | |

| Credit Intermediation and Related Activities – 13.93% | | | | | | | | |

| American Express Company | | | 15,000 | | | | 1,011,900 | |

| Bank of Montreal (b) | | | 12,000 | | | | 755,400 | |

| Citigroup, Inc. | | | 20,000 | | | | 884,800 | |

| Discover Financial Services | | | 12,000 | | | | 538,080 | |

The accompanying notes are an integral part of these financial statements.

Plumb Equity Fund

Schedule of Investments – March 31, 2013 (Continued)

| | | Shares | | | Value | |

| COMMON STOCKS (Continued) | | | | | | |

Credit Intermediation and Related | | | | | | |

| Activities (Continued) | | | | | | |

| JPMorgan Chase & Company | | | 20,000 | | | $ | 949,200 | |

| Visa, Inc. – Class A | | | 5,500 | | | | 934,120 | |

| | | | | | | | 5,073,500 | |

| Food Manufacturing – 2.52% | | | | | | | | |

| Mondelez International, Inc. | | | 30,000 | | | | 918,300 | |

| | | | | | | | | |

| Food Services and Drinking Places – 2.46% | | | | | | | | |

| McDonald’s Corporation | | | 9,000 | | | | 897,210 | |

| | | | | | | | | |

| Heavy and Civil Engineering Construction – 0.91% | | | | | | | | |

| Fluor Corporation | | | 5,000 | | | | 331,650 | |

| | | | | | | | | |

| Insurance Carriers and Related Activities – 5.49% | | | | | | | | |

| American International Group, Inc. (a) | | | 30,000 | | | | 1,164,600 | |

| Berkshire Hathaway, Inc. – Class B (a) | | | 8,000 | | | | 833,600 | |

| | | | | | | | 1,998,200 | |

| Machinery Manufacturing – 4.13% | | | | | | | | |

| General Electric Company | | | 65,000 | | | | 1,502,800 | |

| | | | | | | | | |

| Merchant Wholesalers, Durable Goods – 0.93% | | | | | | | | |

| W.W. Grainger, Inc. | | | 1,500 | | | | 337,470 | |

| | | | | | | | | |

| Merchant Wholesalers, Nondurable Goods – 1.54% | | | | | | | | |

| Universal Corporation | | | 10,000 | | | | 560,400 | |

| | | | | | | | | |

| Miscellaneous Manufacturing – 5.53% | | | | | | | | |

| 3M Company | | | 8,000 | | | | 850,480 | |

| Medtronic, Inc. | | | 13,000 | | | | 610,480 | |

| Stryker Corporation | | | 8,500 | | | | 554,540 | |

| | | | | | | | 2,015,500 | |

| Nonstore Retailers – 1.19% | | | | | | | | |

| eBay, Inc. (a) | | | 8,000 | | | | 433,760 | |

| | | | | | | | | |

| Other Information Services – 3.38% | | | | | | | | |

| Google Inc. (a) | | | 1,550 | | | | 1,230,746 | |

The accompanying notes are an integral part of these financial statements.

Plumb Equity Fund

Schedule of Investments – March 31, 2013 (Continued)

| | | Shares | | | Value | |

| COMMON STOCKS (Continued) | | | | | | |

Petroleum and Coal Products Manufacturing – 7.69% | | | | | | |

| BP PLC – ADR | | | 12,000 | | | $ | 508,200 | |

| Chevron Corporation | | | 6,500 | | | | 772,330 | |

| ConocoPhillips | | | 12,500 | | | | 751,250 | |

| Phillips 66 | | | 11,000 | | | | 769,670 | |

| | | | | | | | 2,801,450 | |

| Pipeline Transportation – 2.63% | | | | | | | | |

| TransCanada Corporation (b) | | | 20,000 | | | | 957,800 | |

| | | | | | | | | |

| Professional, Scientific, and Technical Services – 1.75% | | | | | | | | |

| Exact Sciences Corporation (a) | | | 50,000 | | | | 490,000 | |

| Global Geophysical Services, Inc. (a) | | | 60,024 | | | | 147,059 | |

| | | | | | | | 637,059 | |

| Rental and Leasing Services – 2.46% | | | | | | | | |

| Ryder System, Inc. | | | 15,000 | | | | 896,250 | |

| | | | | | | | | |

| Support Activities for Mining – 2.06% | | | | | | | | |

| Schlumberger Limited (b) | | | 10,000 | | | | 748,900 | |

| | | | | | | | | |

| Telecommunications – 2.34% | | | | | | | | |

| Vodafone Group PLC – ADR | | | 30,000 | | | | 852,300 | |

| | | | | | | | | |

| Water Transportation – 2.35% | | | | | | | | |

| Carnival Corporation (b) | | | 25,000 | | | | 857,500 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $28,131,632) | | | | | | | 34,823,280 | |

| | | | | | | | | |

| EXCHANGE-TRADED FUNDS – 4.24% | | | | | | | | |

Funds, Trusts, and Other Financial Vehicles – 4.24% | | | | | | | | |

| Schwab U.S. Small-Cap ETF | | | 15,000 | | | | 642,900 | |

| SPDR S&P Homebuilders ETF | | | 30,000 | | | | 899,700 | |

| | | | | | | | 1,542,600 | |

| TOTAL EXCHANGE-TRADED FUNDS | | | | | | | | |

| (Cost $1,442,509) | | | | | | | 1,542,600 | |

The accompanying notes are an integral part of these financial statements.

Plumb Equity Fund

Schedule of Investments – March 31, 2013 (Continued)

| | | Shares | | | Value | |

| SHORT-TERM INVESTMENTS – 0.36% | | | | | | |

Money Market Funds – 0.36% | | | | | | |

| STIT-STIC Prime Portfolio 0.090% (c) | | | 132,348 | | | $ | 132,348 | |

| | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $132,348) | | | | | | | 132,348 | |

| | | | | | | | | |

| Total Investments | | | | | | | | |

| (Cost $29,706,489) – 100.21% | | | | | | | 36,498,228 | |

| Liabilities in Excess of Other Assets – (0.21)% | | | | | | | (75,989 | ) |

| TOTAL NET ASSETS – 100.00% | | | | | | $ | 36,422,239 | |

Percentages are stated as a percent of net assets.

ADR – American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | Foreign issued security. Total foreign concentration was as follows: Canada 4.70%, Netherlands Antilles 2.06%, Panama 2.35%. |

| (c) | Variable rate security. The rate listed is as of March 31, 2013. |

The accompanying notes are an integral part of these financial statements.

Statements of Assets and Liabilities

March 31, 2013

| | | Plumb | | | Plumb | |

| | | Balanced | | | Equity | |

| | | Fund | | | Fund | |

| Assets | | | | | | |

| Investments, at value* | | $ | 33,918,360 | | | $ | 36,498,228 | |

| Cash | | | 14,825 | | | | 19,282 | |

| Dividends and interest receivable | | | 120,911 | | | | 36,755 | |

| Receivable for investments sold | | | 812,141 | | | | 24,391 | |

| Receivable for fund shares sold | | | 7,294 | | | | 34,647 | |

| Prepaid assets | | | 5,318 | | | | 5,593 | |

| Total Assets | | | 34,878,849 | | | | 36,618,896 | |

| | | | | | | | | |

| Liabilities | | | | | | | | |

| Payable for investments purchased | | | 453,924 | | | | 100,210 | |

| Payable for fund shares redeemed | | | 256,566 | | | | 25,563 | |

| Accrued distribution fee | | | 21,056 | | | | 11,267 | |

| Payable to Advisor (a) | | | 11,703 | | | | 17,876 | |

| Administrative & accounting services fee payable (a) | | | 5,904 | | | | 6,500 | |

| Accrued expenses and other liabilities | | | 35,451 | | | | 35,241 | |

| Total Liabilities | | | 784,604 | | | | 196,657 | |

| Net Assets | | $ | 34,094,245 | | | $ | 36,422,239 | |

| | | | | | | | | |

| Net Assets Consist Of: | | | | | | | | |

| Paid in capital | | $ | 41,235,131 | | | $ | 36,063,387 | |

| Accumulated undistributed | | | | | | | | |

| net investment income | | | 133,058 | | | | 71,634 | |

| Accumulated net realized loss | | | (13,701,985 | ) | | | (6,504,521 | ) |

| Net unrealized appreciation on investments | | | 6,428,041 | | | | 6,791,739 | |

| Net Assets | | $ | 34,094,245 | | | $ | 36,422,239 | |

| | | | | | | | | |

| Capital shares outstanding, $0.001 par value | | | | | | | | |

| (200 million shares issued each) | | | 1,859,467 | | | | 2,038,035 | |

| Net asset value, offering and | | | | | | | | |

| redemption price per share | | $ | 18.34 | | | $ | 17.87 | |

| | | | | | | | | |

| * Cost of Investments | | $ | 27,490,319 | | | $ | 29,706,489 | |

| (a) | See Note 4 in the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

Statements of Operations

For the Fiscal Year Ended March 31, 2013

| | | Plumb | | | Plumb | |

| | | Balanced | | | Equity | |

| | | Fund | | | Fund | |

| Investment Income: | | | | | | |

| Dividends (Net of foreign withholding | | | | | | |

| taxes of $6,304 and $8,375, respectively) | | $ | 784,381 | | | $ | 1,079,462 | |

| Interest | | | 539,198 | | | | 995 | |

| Total Investment Income | | | 1,323,579 | | | | 1,080,457 | |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| Investment Advisor’s fee (a) | | | 278,581 | | | | 282,619 | |

| Distribution fees | | | 107,147 | | | | 108,700 | |

| Administrative & accounting service fees (a) | | | 85,717 | | | | 86,960 | |

| Legal fees | | | 18,301 | | | | 18,349 | |

| Administration fee | | | 8,414 | | | | 8,401 | |

| Transfer agent fees and expenses | | | 39,005 | | | | 37,469 | |

| Fund accounting fees | | | 31,292 | | | | 28,397 | |

| Registration fees | | | 12,886 | | | | 13,423 | |

| Trustee fees and expenses | | | 15,488 | | | | 14,563 | |

| Audit and tax fees | | | 14,890 | | | | 15,713 | |

| Custody fees | | | 8,326 | | | | 8,301 | |

| Insurance expense | | | 4,684 | | | | 4,310 | |

| Printing and mailing expense | | | 5,067 | | | | 6,155 | |

| Total expenses before waiver | | | 629,798 | | | | 633,360 | |

| Less: Fees waived/reimbursed by Advisor (a) | | | (94,065 | ) | | | (24,641 | ) |

| Net expenses | | | 535,733 | | | | 608,719 | |

| Net Investment Income | | | 787,846 | | | | 471,738 | |

| | | | | | | | | |

| Realized and Unrealized Gain (Loss): | | | | | | | | |

| Net realized loss on investments | | | (1,037,757 | ) | | | (892,994 | ) |

| Net change in unrealized appreciation: | | | | | | | | |

| Investments | | | 856,473 | | | | 320,357 | |

| Options | | | (391,002 | ) | | | (366,841 | ) |

| Net realized and unrealized | | | | | | | | |

| loss on investments | | | (572,286 | ) | | | (939,478 | ) |

| | | | | | | | | |

| Net Increase (Decrease) in Net Assets | | | | | | | | |

| Resulting from Operations | | $ | 215,560 | | | $ | (467,740 | ) |

| (a) | See Note 4 in the Notes to the Financial Statements. |

The accompanying notes are an integral part of these financial statements.

Plumb Balanced Fund

Statements of Changes in Net Assets

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | March 31, | | | March 31, | |

| | | 2013 | | | 2012 | |

| Operations: | | | | | | |

| Net investment income | | $ | 787,846 | | | $ | 828,478 | |

| Net realized gain (loss) on investments | | | (1,037,757 | ) | | | 1,218,047 | |

| Net change in unrealized appreciation | | | | | | | | |

| on investments and options | | | 465,471 | | | | 648,606 | |

| Net increase in net assets | | | | | | | | |

| resulting from operations | | | 215,560 | | | | 2,695,131 | |

| | | | | | | | | |

| Dividends And Distributions To Shareholders: | | | | | | | | |

| Net investment income | | | (913,396 | ) | | | (768,145 | ) |

| Total dividends and distributions | | | (913,396 | ) | | | (768,145 | ) |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Proceeds from shares sold | | | 2,784,133 | | | | 9,694,672 | |

| Shares issued in reinvestment of dividends | | | 482,860 | | | | 407,831 | |

| Cost of shares redeemed | | | (18,456,219 | ) | | | (6,673,724 | ) |

| Net increase (decrease) in net assets | | | | | | | | |

| from capital share transactions | | | (15,189,226 | ) | | | 3,428,779 | |

| | | | | | | | | |

| Total increase (decrease) in net assets | | | (15,887,062 | ) | | | 5,355,765 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 49,981,307 | | | | 44,625,542 | |

| End of year* | | $ | 34,094,245 | | | $ | 49,981,307 | |

| | | | | | | | | |

| * Including undistributed net | | | | | | | | |

| investment income of | | $ | 133,058 | | | $ | 225,550 | |

| | | | | | | | | |

| Change In Shares Outstanding: | | | | | | | | |

| Shares sold | | | 158,696 | | | | 569,155 | |

| Shares issued in reinvestment of dividends | | | 28,122 | | | | 24,717 | |

| Shares redeemed | | | (1,046,591 | ) | | | (379,277 | ) |

| Net increase (decrease) | | | (859,773 | ) | | | 214,595 | |

The accompanying notes are an integral part of these financial statements.

Plumb Equity Fund

Statements of Changes in Net Assets

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | March 31, | | | March 31, | |

| | | 2013 | | | 2012 | |

| Operations: | | | | | | |

| Net investment income | | $ | 471,738 | | | $ | 235,974 | |

| Net realized gain (loss) on investments | | | (892,994 | ) | | | 80,412 | |

| Net change in unrealized appreciation | | | | | | | | |

| on investments and options | | | (46,484 | ) | | | 4,068,058 | |

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from operations | | | (467,740 | ) | | | 4,384,444 | |

| | | | | | | | | |

| Dividends And Distributions To Shareholders: | | | | | | | | |

| Net investment income | | | (530,427 | ) | | | (105,019 | ) |

| Total dividends and distributions | | | (530,427 | ) | | | (105,019 | ) |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Proceeds from shares sold | | | 4,771,965 | | | | 34,448,008 | |

| Shares issued in reinvestment of dividends | | | 436,144 | | | | 83,972 | |

| Cost of shares redeemed | | | (17,769,354 | ) | | | (6,151,523 | ) |

| Net increase (decrease) in net assets | | | | | | | | |

| from capital share transactions | | | (12,561,245 | ) | | | 28,380,457 | |

| | | | | | | | | |

| Total increase (decrease) in net assets | | | (13,559,412 | ) | | | 32,659,882 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 49,981,651 | | | | 17,321,769 | |

| End of year* | | $ | 36,422,239 | | | $ | 49,981,651 | |

| | | | | | | | | |

| * Including undistributed net | | | | | | | | |

| investment income of | | $ | 71,634 | | | $ | 129,331 | |

| | | | | | | | | |

| Change In Shares Outstanding: | | | | | | | | |

| Shares sold | | | 282,853 | | | | 2,142,329 | |

| Shares issued in reinvestment of dividends | | | 26,101 | | | | 5,332 | |

| Shares redeemed | | | (1,044,132 | ) | | | (360,828 | ) |

| Net increase (decrease) | | | (735,178 | ) | | | 1,786,833 | |

The accompanying notes are an integral part of these financial statements.

(This Page Intentionally Left Blank.)

Plumb Balanced Fund

Financial Highlights

| | | For the Years Ended March 31, | |

| | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Per share operating | | | | | | | | | | | | | | | |

| performance | | | | | | | | | | | | | | | |

| (For a share outstanding | | | | | | | | | | | | | | | |

| throughout the period) | | | | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | | | | |

| beginning of period | | $ | 18.38 | | | $ | 17.82 | | | $ | 16.43 | | | $ | 12.72 | | | $ | 17.52 | |

| Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income(1) | | | 0.39 | | | | 0.29 | | | | 0.31 | | | | 0.33 | | | | 0.37 | |

| Net realized and | | | | | | | | | | | | | | | | | | | | |

| unrealized gain (loss) | | | (0.01 | ) | | | 0.54 | | | | 1.44 | | | | 3.73 | | | | (4.80 | ) |

| Total from | | | | | | | | | | | | | | | | | | | | |

| investment operations | | | 0.38 | | | | 0.83 | | | | 1.75 | | | | 4.06 | | | | (4.43 | ) |

| Dividends and distributions | | | | | | | | | | | | | | | | | | | | |

| to shareholders: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net | | | | | | | | | | | | | | | | | | | | |

| investment income | | | (0.42 | ) | | | (0.27 | ) | | | (0.36 | ) | | | (0.35 | ) | | | (0.37 | ) |

| Total dividends | | | | | | | | | | | | | | | | | | | | |

| and distributions | | | (0.42 | ) | | | (0.27 | ) | | | (0.36 | ) | | | (0.35 | ) | | | (0.37 | ) |

| Change in net asset value | | | | | | | | | | | | | | | | | | | | |

| for the period | | | (0.04 | ) | | | 0.56 | | | | 1.39 | | | | 3.71 | | | | (4.80 | ) |

| Net asset value, | | | | | | | | | | | | | | | | | | | | |

| end of period | | $ | 18.34 | | | $ | 18.38 | | | $ | 17.82 | | | $ | 16.43 | | | $ | 12.72 | |

Total return(2) | | | 2.22 | % | | | 4.87 | % | | | 10.76 | % | | | 32.01 | % | | | (25.33 | )% |

The accompanying notes are an integral part of these financial statements.

Plumb Balanced Fund

Financial Highlights (Continued)

| | | For the Years Ended March 31, | |

| | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Ratios / supplemental data | | | | | | | | | | | | | | | |

| Net assets, | | | | | | | | | | | | | | | |

| end of period (000) | | $ | 34,094 | | | $ | 49,981 | | | $ | 44,626 | | | $ | 44,476 | | | $ | 34,754 | |

| Ratio of net expenses | | | | | | | | | | | | | | | | | | | | |

| to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense | | | | | | | | | | | | | | | | | | | | |

| reimbursement | | | | | | | | | | | | | | | | | | | | |

| and waivers | | | 1.47 | % | | | 1.48 | % | | | 1.56 | % | | | 1.64 | % | | | 1.57 | % |

| After expense | | | | | | | | | | | | | | | | | | | | |

| reimbursement | | | | | | | | | | | | | | | | | | | | |

and waivers(3) | | | 1.25 | % | | | 1.25 | % | | | 1.21 | % | | | 1.10 | % | | | 1.10 | % |

| Ratio of net investment | | | | | | | | | | | | | | | | | | | | |

| income to average net assets: | | | | | | | | | | | | | | | | | | | | |

| After expense | | | | | | | | | | | | | | | | | | | | |

| reimbursement | | | | | | | | | | | | | | | | | | | | |

and waivers(3) | | | 1.83 | % | | | 1.78 | % | | | 1.79 | % | | | 2.15 | % | | | 2.19 | % |

| Portfolio turnover rate | | | 64 | % | | | 72 | % | | | 85 | % | | | 54 | % | | | 63 | % |

| (1) | Net investment income per share is calculated using current year ending balances prior to consideration of adjustment for permanent book and tax differences. |

| (2) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (3) | Effective July 1, 2010, the Advisor contractually agreed to cap the Fund’s expenses at 1.25%. Prior to July 1, 2010, the Fund’s expense cap was 1.10%. |

The accompanying notes are an integral part of these financial statements.

Plumb Equity Fund

Financial Highlights

| | | For the Years Ended March 31, | |

| | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Per share operating | | | | | | | | | | | | | | | |

| performance | | | | | | | | | | | | | | | |

| (For a share outstanding | | | | | | | | | | | | | | | |

| throughout the period) | | | | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | | | | |

| beginning of period | | $ | 18.02 | | | $ | 17.56 | | | $ | 15.75 | | | $ | 11.31 | | | $ | 16.49 | |

| Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income(1) | | | 0.20 | | | | 0.09 | | | | 0.07 | | | | 0.14 | | | | 0.10 | |

| Net realized and | | | | | | | | | | | | | | | | | | | | |

| unrealized gain (loss) | | | (0.14 | ) | | | 0.41 | | | | 1.86 | | | | 4.45 | | | | (5.17 | ) |

| Total from | | | | | | | | | | | | | | | | | | | | |

| investment operations | | | 0.06 | | | | 0.50 | | | | 1.93 | | | | 4.59 | | | | (5.07 | ) |

| Dividends and distributions | | | | | | | | | | | | | | | | | | | | |

| to shareholders: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net | | | | | | | | | | | | | | | | | | | | |

| investment income | | | (0.21 | ) | | | (0.04 | ) | | | (0.12 | ) | | | (0.15 | ) | | | (0.11 | ) |

| Total dividends | | | | | | | | | | | | | | | | | | | | |

| and distributions | | | (0.21 | ) | | | (0.04 | ) | | | (0.12 | ) | | | (0.15 | ) | | | (0.11 | ) |

| Change in net asset value | | | | | | | | | | | | | | | | | | | | |

| for the period | | | (0.15 | ) | | | 0.46 | | | | 1.81 | | | | 4.44 | | | | (5.18 | ) |

| Net asset value, | | | | | | | | | | | | | | | | | | | | |

| end of period | | $ | 17.87 | | | $ | 18.02 | | | $ | 17.56 | | | $ | 15.75 | | | $ | 11.31 | |

Total return(2) | | | 0.42 | % | | | 2.88 | % | | | 12.31 | % | | | 40.66 | % | | | (30.81 | )% |

The accompanying notes are an integral part of these financial statements.

Plumb Equity Fund

Financial Highlights (Continued)

| | | For the Years Ended March 31, | |

| | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Ratios / supplemental data | | | | | | | | | | | | | | | |

| Net assets, | | | | | | | | | | | | | | | |

| end of period (000) | | $ | 36,422 | | | $ | 49,982 | | | $ | 17,322 | | | $ | 15,406 | | | $ | 10,883 | |

| Ratio of net expenses | | | | | | | | | | | | | | | | | | | | |

| to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense | | | | | | | | | | | | | | | | | | | | |

| reimbursement | | | | | | | | | | | | | | | | | | | | |

| and waivers | | | 1.46 | % | | | 1.54 | % | | | 1.85 | % | | | 2.18 | % | | | 2.14 | % |

| After expense | | | | | | | | | | | | | | | | | | | | |

| reimbursement | | | | | | | | | | | | | | | | | | | | |

and waivers(3) | | | 1.40 | % | | | 1.40 | % | | | 1.35 | % | | | 1.20 | % | | | 1.20 | % |

| Ratio of net investment | | | | | | | | | | | | | | | | | | | | |

| income to average net assets: | | | | | | | | | | | | | | | | | | | | |

| After expense | | | | | | | | | | | | | | | | | | | | |

| reimbursement | | | | | | | | | | | | | | | | | | | | |

and waivers(3) | | | 1.08 | % | | | 0.80 | % | | | 0.46 | % | | | 0.98 | % | | | 0.65 | % |

| Portfolio turnover rate | | | 84 | % | | | 69 | % | | | 111 | % | | | 73 | % | | | 83 | % |

| (1) | Net investment income per share is calculated using current year ending balances prior to consideration of adjustment for permanent book and tax differences. |

| (2) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (3) | Effective July 1, 2010, the Advisor contractually agreed to cap the Fund’s expenses at 1.40%. Prior to July 1, 2010, the Fund’s expense cap was 1.20%. |

The accompanying notes are an integral part of these financial statements.

Notes to Financial Statements

March 31, 2013

Wisconsin Capital Funds, Inc. (the “Company”) is registered under the Investment Company Act of 1940 (the “1940 Act”) as an open-end, diversified management investment company. The Company was organized as a Maryland corporation on April 3, 2007. The Company is authorized to issue up to 2 billion shares, which are units of beneficial interest with a $0.001 par value. The Company currently offers shares of two series, each with its own investment strategy and risk/reward profile: the Plumb Balanced Fund and the Plumb Equity Fund (individually a “Fund”, collectively the “Funds”). The investment objective of the Plumb Balanced Fund is high total return through capital appreciation while attempting to preserve principal, with current income as a secondary objective. The investment objective of the Plumb Equity Fund is long-term capital appreciation. Wisconsin Capital Management, LLC (the “Advisor”) serves as the Funds’ investment advisor. The Advisor is indirectly owned by SVA Plumb Financial, LLC which in turn is partially owned by TGP, Inc. The Advisor is controlled by Thomas G. Plumb indirectly through TGP, Inc.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Security Valuation:

The Funds have adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the year. These inputs are summarized in the three broad levels listed below.

| | Level 1 – | quoted prices in active markets for identical securities |

| | Level 2 – | other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | Level 3 – | significant unobservable inputs (including the Funds’ own assumptions in determining fair value of investments) |

Equity securities, including common stocks, foreign issued common stocks, and exchange-traded funds, which are traded on an exchange are valued at the last sale price reported by the exchange on which the securities are primarily traded on the

Notes to Financial Statements

March 31, 2013 (Continued)

day of valuation. Nasdaq-listed securities are valued at their Nasdaq Official Closing Price. Equity securities not traded on a listed exchange or not traded using Nasdaq are valued as of the last sale price at the close of the U.S. market. If there are no sales on a given day for securities traded on an exchange, the latest bid quotation will be used.

Investments in mutual funds, including money market funds, are generally priced at the ending net asset value (NAV) provided by the service agent of the funds and will be classified as Level 1 securities.

Debt securities, such as corporate bonds, convertible bonds, municipal bonds, and U.S. government agency issues are valued using a market approach based on information supplied by independent pricing services. The market inputs used by the independent pricing service include: benchmark yields, reported trades, broker/dealer quotes, issuer spreads, two-sided markets, benchmark securities, bids, offers, and reference data including market research publications. Debt securities with remaining maturities of 60 days or less may be valued on an amortized cost basis, which involves valuing an instrument at its cost and thereafter assuming a constant amortization to maturity of any discount or premium, regardless of the impact of fluctuating rates on the fair value of the instrument. To the extent the inputs are observable and timely, these debt securities will generally be classified as Level 2 securities.

Any securities or other assets for which market quotations are not readily available are valued at fair value as determined in good faith by the Advisor pursuant to procedures established under the general supervision and responsibility of the Funds’ Board of Directors and will be classified as Level 3 securities.

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Notes to Financial Statements

March 31, 2013 (Continued)

The following is a summary of the inputs used, as of March 31, 2013, to value the Funds’ investments carried at fair value:

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| The Plumb Balanced Fund | | | | | | | | | | | | |

| Investments in: | | | | | | | | | | | | |

| Common Stock* | | $ | 23,649,140 | | | $ | — | | | $ | — | | | $ | 23,649,140 | |

| Exchange-Traded Funds* | | | 1,158,650 | | | | — | | | | — | | | | 1,158,650 | |

| Corporate Bonds* | | | — | | | | 8,725,417 | | | | — | | | | 8,725,417 | |

| Municipal Bonds | | | — | | | | 248,257 | | | | — | | | | 248,257 | |

| Money Market Funds | | | 136,896 | | | | — | | | | — | | | | 136,896 | |

| Total | | $ | 24,944,686 | | | $ | 8,973,674 | | | $ | — | | | $ | 33,918,360 | |

| | | | | | | | | | | | | | | | | |

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| The Plumb Equity Fund | | | | | | | | | | | | | | | | |

| Investments in: | | | | | | | | | | | | | | | | |

| Common Stock* | | $ | 34,823,280 | | | $ | — | | | $ | — | | | $ | 34,823,280 | |

| Exchange-Traded Funds* | | | 1,542,600 | | | | — | | | | — | | | | 1,542,600 | |

| Money Market Funds | | | 132,348 | | | | — | | | | — | | | | 132,348 | |

| Total | | $ | 36,498,228 | | | $ | — | | | $ | — | | | $ | 36,498,228 | |

| | * | For detailed industry descriptions, refer to the Schedule of Investments. |

The Funds did not hold any investments during the period with significant unobservable inputs which would be classified as Level 3. As of March 31, 2013, no securities were transferred into or out of Level 1 or Level 2. It is the Funds’ policy to consider transfers into or out of any level as of the end of the reporting period.

Use of Estimates:

The presentation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Expenses:

Expenses directly attributable to a Fund are charged to the Fund, while expenses attributable to more than one series of the Company are allocated among the respective series based on relative net assets or another appropriate basis.

Notes to Financial Statements

March 31, 2013 (Continued)

Federal Income Taxes:

The Funds intend to meet the requirements of the Internal Revenue Code (the “Code”) applicable to regulated investment companies and to distribute substantially all net investment taxable income and net capital gains to shareholders in a manner which results in no tax cost to the Funds. Therefore, no federal income or excise tax provision is recorded.

As of and during the year ended March 31, 2013, the Funds did not have a liability for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year ended March 31, 2013, the Funds did not incur any interest or penalties. The Funds are not subject to examination by U.S. taxing authorities for tax years prior to 2009.

Distributions to Shareholders:

Dividends from net investment income are declared and paid at least annually. Distributions of net realized capital gains, if any, will be declared and paid at least annually. Distributions to shareholders are recorded on the ex-dividend date.

The Funds may periodically make reclassifications among certain of its capital accounts as a result of the recognition and characterization of certain income and capital gain distributions determined annually in accordance with federal tax regulations which may differ from GAAP. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Funds.

For the fiscal year ended March 31, 2013, the Funds made the following reclassifications to increase (decrease) the components of net assets:

| | | Paid in | | | Accumulated Net | | | Accumulated Net | |

| | | Capital | | | Investment Income | | | Realized Loss | |

| Plumb Balanced Fund | | $ | (14 | ) | | $ | 33,058 | | | $ | (33,044 | ) |

| Plumb Equity Fund | | $ | — | | | $ | 992 | | | $ | (992 | ) |

Options:

Each of the Funds may purchase call or put options on securities and indices and enter into related closing transactions. Each of the Funds may engage in transactions in options either for bona fide hedging purposes or to seek to increase total return. During the year ended March 31, 2013, the Funds invested in purchased call options in an attempt to achieve increased total returns. As a holder of a call option, a Fund pays a non-refundable premium to the seller for the right, but not the obligation, to purchase a security at a fixed price (the exercise price) during the specified period (exercise period). As a holder of a put option, a Fund pays a non-refundable premium for the right, but not the obligation, to sell a

Notes to Financial Statements

March 31, 2013 (Continued)

security at the exercise price during the exercise period. The premium that a Fund pays when purchasing a call option will reflect, among other things, the market price of the security, the relationship of the exercise price to the market price of the security, the relationship of the exercise price to the volatility of the security, the length of the option period and supply and demand factors.

The counterparty risk associated with purchased options is minimal because the options are exchange-traded, and the Options Clearing Corporation guarantees performance to selling and purchasing clearing members.

If a purchased call option is exercised by a Fund, the premium is added to the cost basis of the security purchased, which will subsequently decrease the gain or increase the loss recognized at the time of sale. If a purchased put option is exercised by the Fund, the premium is deducted from the proceeds of the sale of the underlying security in determining whether the Fund has realized a gain or loss.

The Plumb Balanced and Plumb Equity Funds did not hold any derivative instruments at March 31, 2013.

The effect of derivative instruments on the Statements of Operations for the fiscal year ended March 31, 2013 is summarized below.

The Plumb Balanced Fund and the Plumb Equity Fund did not have any realized gains or losses on purchased options – equity contracts for the fiscal year ended March 31, 2013.

The Plumb Balanced Fund and the Plumb Equity Fund had changes in unrealized depreciation of purchased options–equity contracts of $(391,002) and $(366,841), respectively, and this depreciation is reported within the Statements of Operations as “Net change in unrealized appreciation: Options.”

The option contract activity during the fiscal year ended March 31, 2013 was as follows:

| | Number of Contracts |

| | Plumb Balanced Fund | | Plumb Equity Fund |

| Options outstanding, | | | | | | | |

| beginning of period | | | 275 | | | | | 250 | |

| Options purchased | | | — | | | | | 50 | |

| Options exercised | | | (275 | ) | | | | (300 | ) |

| Options outstanding, end of period | | | — | | | | | — | |

Other:

Investment and shareholder transactions are recorded on the trade date. Gains or losses from investment transactions are determined using the specific identification method. Dividend income is recognized on the ex-dividend date

Notes to Financial Statements

March 31, 2013 (Continued)

and interest income is recognized on an accrual basis. Discounts and premiums on securities purchased are amortized using the effective interest method. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

The Company has adopted a plan pursuant to Rule 12b-1 under the 1940 Act (the “12b-1 Plan”), on behalf of the Funds, which authorizes it to pay Quasar Distributors, LLC (the “Distributor”) a distribution fee of 0.25% of the Funds’ average daily net assets for services to prospective Fund shareholders and distribution of Fund shares. During the fiscal year ended March 31, 2013, the Plumb Balanced Fund and the Plumb Equity Fund incurred expenses of $107,147 and $108,700, respectively, pursuant to the 12b-1 Plan. As of March 31, 2013, $21,056 and $11,267 for the Plumb Balanced Fund and Plumb Equity Fund, respectively, were accrued.

| 4. | INVESTMENT ADVISOR AND OTHER AFFILIATES |

The Funds have an Investment Advisory Agreement (the “Advisory Agreement”) with Wisconsin Capital Management, LLC. The Advisory Agreement provides for advisory fees computed daily and paid monthly at an annual rate of 0.65% of the Funds’ average daily net assets.

Under the terms of the Advisory Agreement, the Advisor has contractually agreed to limit the Funds’ expenses. The Advisor has agreed to limit annual operating expenses through July 31, 2014, to 1.25% and 1.40% of the Funds’ average daily net assets for the Plumb Balanced Fund and the Plumb Equity Fund, respectively. Any such waiver or reimbursement is subject to later adjustment to allow the Advisor to recoup amounts waived or reimbursed to the extent actual fees and expenses for a period are less than the expense limitation caps in place at the time the waiver was made, provided, however, that the Advisor shall only be entitled to recoup such amounts for a period of three years from the date such amount was waived or reimbursed. For the fiscal year ended March 31, 2013, the Advisor waived expenses for the Plumb Balanced Fund and the Plumb Equity Fund of $94,065 and $24,641, respectively. There were no expense recoupments during the year ended March 31, 2013.

The following table shows the remaining waived or reimbursed expenses subject to potential recovery as of March 31, 2013 expiring in:

| Plumb Balanced Fund | Plumb Equity Fund |

| 2014 . . . . . . . $147,474 | 2014 . . . . . . . $ 77,943 |

| 2015 . . . . . . . $109,061 | 2015 . . . . . . . $ 42,559 |

| 2016 . . . . . . . $ 94,065 | 2016 . . . . . . . $ 24,641 |

Notes to Financial Statements

March 31, 2013 (Continued)

The Funds also have an Administrative and Accounting Services Agreement (“Agreement”) with the Advisor. Fund administration responsibilities include general fund management, compliance, financial reporting, and oversight and assistance to other providers. The Advisor’s administrative and accounting fees are 0.20% of the Funds’ average daily net assets, computed daily and paid monthly.

| 5. | INVESTMENT TRANSACTIONS |

For the fiscal year ended March 31, 2013, the aggregate purchases and sales of investment securities (including options), other than short-term investments, were as follows:

| | Plumb Balanced Fund | Plumb Equity Fund |

| Purchases: | $26,453,367 | $35,335,752 |

| Sales: | $41,402,752 | $47,380,742 |

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund under Section 2(a)(9) of the 1940 Act. As of March 31, 2013 certain entities and their affiliates which may control or be under common control with the Advisor, including Thomas Plumb, SVA Plumb Trust Company, and SVA Plumb Wealth Management, LLC, either directly or for the benefit of their customers, owned 67.78% of the Plumb Balanced Fund and 80.98% of the Plumb Equity Fund.

| 7. | FEDERAL TAX INFORMATION |

As of March 31, 2013 the components of accumulated earnings (losses) for income tax purposes were as follows:

| | Plumb Balanced Fund | | Plumb Equity Fund |

| Unrealized appreciation | | $ | 6,502,063 | | | | $ | 7,201,841 | |

| Unrealized depreciation | | | (132,837 | ) | | | | (493,343 | ) |

| Net tax unrealized | | | | | | | | | |

| appreciation on investments | | | 6,369,226 | | | | | 6,708,498 | |

| Undistributed ordinary income | | | 133,058 | | | | | 71,634 | |

| Other accumulated losses | | | (13,643,170 | ) | | | | (6,421,280 | ) |

| Total accumulated gains (losses) | | $ | (7,140,886 | ) | | | $ | 358,852 | |

The tax cost of investments as of March 31, 2013 was $27,549,134 and $29,789,730 for the Plumb Balanced Fund and Plumb Equity Fund, respectively. The tax basis of investments for tax and financial reporting purposes differs principally due to the deferral of losses on wash sales.

Notes to Financial Statements

March 31, 2013 (Continued)

As of March 31, 2013 the Funds had prior tax basis capital losses which may be carried over to offset future capital gains as shown below.

| | | Capital Loss Carryover | |

| | | Plumb Balanced Fund | | | Plumb Equity Fund | |

| Expires: | | | | | | |

| March 31, 2017 | | $ | (4,420,496 | ) | | $ | (2,303,236 | ) |

| March 31, 2018 | | $ | (8,217,998 | ) | | $ | (3,175,337 | ) |

| Short-Term Indefinite | | $ | (912,524 | ) | | $ | (942,707 | ) |

| Long-Term Indefinite | | $ | (92,152 | ) | | $ | — | |

| 8. | DISTRIBUTIONS TO SHAREHOLDERS |

The tax character of distributions paid during the fiscal years ended March 31, 2013 and 2012 was as follows:

| | | Plumb Balanced Fund | |

| | | Year Ended | | | Year Ended | |

| | | March 31, 2013 | | | March 31, 2012 | |

| Distributions paid from: | | | | | | |

| Ordinary Income | | $ | 913,396 | | | $ | 768,145 | |

| Total Distributions Paid | | $ | 913,396 | | | $ | 768,145 | |

| | | | | | | | | |

| | | Plumb Equity Fund | |

| | | Year Ended | | | Year Ended | |

| | | March 31, 2013 | | | March 31, 2012 | |

| Distributions paid from: | | | | | | | | |

| Ordinary Income | | $ | 530,427 | | | $ | 105,019 | |

| Total Distributions Paid | | $ | 530,427 | | | $ | 105,019 | |

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors

Wisconsin Capital Funds, Inc.

We have audited the accompanying statements of assets and liabilities, including the schedules of investments of Wisconsin Capital Funds, Inc., comprising the Plumb Balanced Fund and the Plumb Equity Fund (the “Funds”), as of March 31, 2013, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of Fund management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of March 31, 2013, by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Plumb Balanced Fund and Plumb Equity Fund as of March 31, 2013, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

COHEN FUND AUDIT SERVICES, LTD.

Cleveland, Ohio

May 29, 2013

Additional Information (Unaudited)

1.ADDITIONAL DISCLOSURE REGARDING FUND DIRECTORS AND OFFICERS

| | Position(s) Held with | Principal | Number of | Other |

| | Wisconsin Capital | Occupation(s) | Plumb Funds | Directorships |

| Name, Address | Funds, Inc. and Length | During Past | Overseen | Held by |

| and Age | of Time Served(1) | Five Years | | Director |

| | | | | | |

| Independent Directors: | | | | | |

| | | | | | |

| Patrick J. Quinn | Director since | • | Currently retired | 2 | National |

| 1221 John Q. | May 2007 | • | President and | | Presto |

| Hammons Dr., | | | Chairman of the | | Industries |

| Madison, WI 53719 | | | Board of Ayres | | since May |

| Birth date: | | | Associates (professional | | 2001 |

| September 1949 | | | civil engineering firm), | | |

| | | | from April 2000 to | | |

| | | | December 2010 | | |

| Jay Loewi | Director since | • | Chief Executive | 2 | None |

| 1221 John Q. | May 2007 | | Officer, QTI Group, | | |

| Hammons Dr., | | | since November 2007 | | |

| Madison, WI 53719 | | • | President, QTI Group | | |

| Birth date: | | | of Companies, | | |

| March 1957 | | | since 2002 | | |

| | | | | | |

| Jeffrey B. Sauer | Director since | • | Assistant to the | 2 | None |

| 1221 John Q. | May 2007 | | Commissioner of | | |

| Hammons Dr., | | | Western Collegiate | | |

| Madison, WI 53719 | | | Hockey Association, | | |

| Birth date: | | | since 2002 | | |

| March 1943 | | | | | |

| | | | | | |

| Interested Directors and Officers: | | | | | |

| | | | | | |

Thomas G. Plumb(2) | Director, Chairman, | • | President of SVA | 2 | None |

| 1221 John Q. | President and Chief | | Plumb Wealth | | |

| Hammons Dr., | Executive Officer | | Management, LLC, | | |

| Madison, WI 53719 | since May 2007 | | since March 2011 | | |

| Birth date: | | • | President of SVA | | |

| July 1952 | | | Plumb Financial, LLC, | | |

| | | | since March 2011 | | |

| | | • | CEO of SVA Plumb | | |

| | | | Trust Company, | | |

| | | | since March 2011 | | |

| | | • | President of Wisconsin | | |

| | | | Capital Management, | | |

| | | | LLC, since January 2004 | | |

| | | • | CEO of Plumb Trust | | |

| | | | Company from 2001 | | |

| | | | to February 2011 | | |

Additional Information (Unaudited) (Continued)

| | Position(s) Held with | | | Other |

| | Wisconsin Capital | | | Directorships |

| Name, Address | Funds, Inc. and Length | Principal Occupation(s) | Held by |

| and Age | of Time Served(1) | During Past Five Years | Director |

| | | | | |

| Timothy R. O’Brien | Chief Financial Officer | • | Principal of SVA Plumb | N/A |

| 1221 John Q. | since May 2007 | | Wealth Management, | |

| Hammons Dr., | | | LLC since March 2011 | |

| Madison, WI 53719 | Vice President | • | Vice President and | |

| Birth date: | since August 2010 | | Portfolio Manager for | |

| June 1959 | | | Wisconsin Capital | |

| | Secretary | | Management, LLC | |

| | from January | | since 2004 | |

| | 2009 to July 2010 | | | |

| | | | | |

| | Treasurer | | | |

| | from May 2007 | | | |

| | to July 2010 | | | |

| | | | | |

| Connie M. Redman | Chief Compliance | • | Chief Compliance | N/A |

| 1221 John Q. | Officer since May 2007 | | Officer of SVA Plumb | |

| Hammons Dr., | | | Wealth Management, | |

| Madison, WI 53719 | Secretary | | LLC since April 2012 | |

| Birth date: | since August 2010 | • | Vice President, Chief | |

| February 1966 | | | Compliance Officer, and | |

| | | | Corporate Secretary of | |

| | | | Wisconsin Capital | |

| | | | Management, LLC | |

| | | | since March 2008 | |

| | | • | Vice President, Chief | |

| | | | Compliance Officer, Human | |

| | | | Resources Manager and | |

| | | | Corporate Secretary of | |

| | | | Wisconsin Capital | |

| | | | Management, LLC from | |

| | | | October 2005 to March 2008 | |

Additional Information (Unaudited) (Continued)

| | Position(s) Held with | | | Other |

| | Wisconsin Capital | | | Directorships |

| Name, Address | Funds, Inc. and Length | Principal Occupation(s) | Held by |

| and Age | of Time Served(1) | During Past Five Years | Director |

| | | | | |

| Donna M. Baker | Treasurer | • | Operations Manager of | N/A |

| 1221 John Q. | since August 2010 | | SVA Plumb Trust Company | |

| Hammons Dr., | | | since March 2011 | |

| Madison, WI 53719 | Secretary | • | Chief Financial Officer and | |

| Birth date: | from May 2007 to | | Human Resource Manager | |

| March 1964 | December 2008 | | of Wisconsin Capital | |

| | | | Management, LLC, from | |

| | | | June 2010 to February 2011 | |