UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22045

Wisconsin Capital Funds, Inc.

(Exact name of registrant as specified in charter)

8020 Excelsior Drive, Suite 402

Madison, Wisconsin 53717

(Address of principal executive offices) (Zip code)

Thomas G. Plumb

8020 Excelsior Drive, Suite 402

Madison, Wisconsin 53717

(Name and address of agent for service)

(608) 960-4616

Registrant's telephone number, including area code

Date of fiscal year end: March 31

Date of reporting period: March 31, 2015

Item 1. Reports to Stockholders.

Plumb Balanced Fund

Plumb Equity Fund

ANNUAL REPORT

March 31, 2015

www.plumbfunds.com

March 31, 2015

Dear Fellow Shareholders:

We were fortunate to have an impressive fiscal year, and we would like to take this opportunity to review the investment performance of the Plumb Funds over this past fiscal year.

The Plumb Balanced Fund, comprised of stocks as well as bonds that are used to moderate volatility, was up 9.65% and led its blended benchmark* which was up 7.89% for the fiscal year. The Plumb Equity Fund, which is a diversified stock fund that favors growth companies, finished the fiscal year up 13.76%, outperforming both the S&P 500 Index, which was up 12.73% and its blended benchmark*, which was up 11.03%.

We continue to focus on investments that reflect our shared values. We believe we are doing something logical yet distinct here, attempting to identify good growth companies that have long-term secular tailwinds. We focus mainly on businesses where we feel secular and cyclical opportunities are aligned.

We believe that global health care innovation is one area with dynamic opportunities. There have been some tremendous advancement in this field, ranging from new drugs, therapies, early detection, treatment, medical devices, information systems, and robotics. Companies that fit this theme (in the Funds’ portfolios as of the end of their fiscal year) are Intuitive Surgical, Johnson & Johnson, Medtronic, Activis, Portola Pharmaceuticals, Exact Sciences, and Cerner.

The electronic financial processing of transactions is another industry that we believe has significant growth potential. Though relatively mature in the United States, it is estimated that 85% of the world’s transactions are still conducted in cash as stated on compendium.mastercard.com. This could provide a tremendous growth market for companies serving credit card processing, electronic reporting, electronic security, and internet purchasing. We believe companies like Visa, MasterCard, Discover, American Express, Synchrony Financial, Fiserv, Jack Henry, NXP Semiconductors, Priceline, Apple, and even Google all stand to potentially benefit from this trend.

For the Balanced Fund’s fiscal year, the top three contributors to performance were Allergan, the maker of Botox and Restasis that was acquired by Activis; NXP Semiconductors, which acquired its competitor Freescale to gain market share; and Constellation Brands which owns the U.S. distribution rights to Corona, Modelo, Pacifico, and Victora and beer and wine labels such as Robert Mondavi, Opus One, Kim Crawford, Rex Goliath, and Ruffino. Laggards included Las Vegas Sands, a global casino with the majority of its revenue coming from Macau that fell off rapidly among a Chinese government crackdown; Qualcomm, a semiconductor chipmaker that has now resolved issues with a Chinese antitrust lawsuit; and Alibaba, a leading Chinese online retailer that had to crack down on fake products on their website.

The Plumb Equity Fund’s top three contributors to performance were Allergan, Constellation Brands, and Exact Sciences, which had a revolutionary colon cancer

screening test approved by the Food and Drug Administration in August 2014 and whose long-term prospects we feel are very good. Laggards included Las Vegas Sands; Schlumberger, the world’s largest oilfield services company which was affected by the large drop in crude oil prices; and Alibaba.

As a reminder, even though the Plumb Equity Fund and Plumb Balanced Fund have some overlap with contributors and laggards, the weightings of these holdings are typically much larger in the Plumb Equity Fund.

We are honored and pleased that you are a shareholder of the Plumb Funds. We are pleased with our fiscal year for you, our Plumb Funds’ shareholders. We at Wisconsin Capital Management, LLC (the Plumb Funds’ advisor) are dedicated to a fundamental investment process that we believe can offer competitive returns over a market cycle. We welcome hearing from our shareholders and look forward to exploring the appropriateness of the Plumb Funds in helping to fulfill your investment goals. Please feel free to email or call Nathan Plumb with any questions that you may have at nplumb@plumbfunds.com or directly at (608) 960-4616.

|  |

| Thomas G. Plumb | Nathan M. Plumb |

Opinions expressed are those of Thomas Plumb and Nathan Plumb and are not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Must be preceded or accompanied by a current prospectus.

Past performance does not guarantee future results.

Fund holdings and sector allocations are subject to change and should not be considered recommendations to buy or sell any security. Please refer to the schedule of investments in this report for complete holdings information.

Mutual fund investing involves risk. Principal loss is possible. The Funds may invest in small and mid-sized companies which involve additional risks such as limited liquidity and greater volatility. The Funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The Balanced Fund will invest in debt securities, which typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments by the Balanced Fund in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities. Investments in Asset Backed and Mortgage Backed Securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Because the Funds may invest in ETFs, they are subject to additional risks that do not apply to conventional mutual funds, including the risks

that the market price of an ETF’s shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact the Funds’ ability to sell their shares.

The S&P 500 Index is an unmanaged market capitalization-weighted index based on the average weighted performance of 500 widely held common stocks. The Barclays Capital Intermediate Government/Credit Bond Index is an unmanaged market value weighted index measuring both the principal price changes of, and income provided by, the underlying universe of securities that comprise the index. The MSCI EAFE Index is an unmanaged market capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the US & Canada.

* The blended benchmark for the Plumb Balanced Fund is made up of 55% S&P 500 index, 35% Barclays capital intermediate government/credit bond index and 10% MSCI EAFE index. The blended benchmark for the Plumb Equity Fund is made up of 90% S&P 500 index, and 10% MSCI EAFE index. You cannot invest directly in an index.

Diversification does not assure a profit nor protect against loss in a declining market.

The Plumb Funds are distributed by Quasar Distributors, LLC.

Expense Example

March 31, 2015 (Unaudited)

As a shareholder of the Plumb Funds (the “Funds”), you incur ongoing costs, including investment advisory fees; distribution (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (October 1, 2014 – March 31, 2015).

Actual Expenses

The first line of the table on the following page provides information about actual account values and actual expenses. However, the table does not include shareholder-specific fees such as the $15.00 fee charged for wire redemptions. The table also does not include portfolio trading commissions and related trading costs. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees, which, although not charged by the Funds, may be charged by other funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Example

March 31, 2015 (Unaudited) (Continued)

Plumb Balanced Fund

| | | | Expenses Paid |

| | Beginning | Ending | During the Period* |

| | Account Value | Account Value | October 1, 2014 to |

| | October 1, 2014 | March 31, 2015 | March 31, 2015 |

| Actual | $1,000.00 | $1,049.00 | $6.49 |

| Hypothetical | | | |

| (5% return per | | | |

| year before expenses) | $1,000.00 | $1,018.60 | $6.39 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.26%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the partial year period). |

Plumb Equity Fund

| | | | Expenses Paid |

| | Beginning | Ending | During the Period* |

| | Account Value | Account Value | October 1, 2014 to |

| | October 1, 2014 | March 31, 2015 | March 31, 2015 |

| Actual | $1,000.00 | $1,073.80 | $7.29 |

| Hypothetical | | | |

| (5% return per | | | |

| year before expenses) | $1,000.00 | $1,017.90 | $7.09 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.41%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the partial year period). |

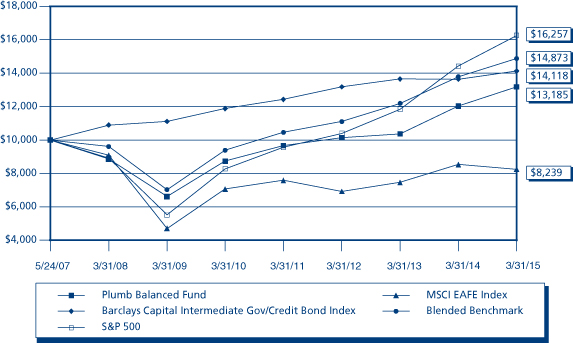

Plumb Balanced Fund (Unaudited)

Comparison of Change in Value of a Hypothetical $10,000 Investment

from inception of May 24, 2007 to March 31, 2015

Average Annual Rate of Return

Periods ended March 31, 2015

| | | | | Since Inception |

| | 1 Year | 3 Year | 5 Year | of May 24, 2007 |

| Plumb Balanced Fund | 9.65% | 9.15% | 8.60% | 3.58% |

| Barclays Capital Intermediate | | | | |

| Government/Credit Bond Index | 3.58% | 2.31% | 3.52% | 4.49% |

| MSCI EAFE Index | -3.46% | 5.98% | 3.14% | -2.44% |

| S&P 500 Index | 12.73% | 16.11% | 14.47% | 6.38% |

| Blended Benchmark | 7.89% | 10.25% | 9.64% | 5.18% |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-866-987-7888.

The line graph and performance table do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers.

The Barclays Capital Intermediate Government/Credit Bond Index is an unmanaged index which includes nonconvertible bonds publicly issued by the U.S. government or its agencies; corporate bonds guaranteed by the U.S. government and quasi-federal corporations; and publicly issued, fixed rate, nonconvertible domestic bonds of companies in industry, public utilities, and finance.

The MSCI EAFE Index is an index intended to reflect the performance of major developed countries’ international equity markets, besides the United States and Canada.

The Standard & Poor’s 500 Index (S&P 500) is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks.

The Blended Benchmark is made up of 55% S&P 500 Index, 35% Barclays Capital Intermediate Government/Credit Bond Index, and 10% MSCI EAFE Index.

The Fund’s portfolio holdings may differ significantly from the securities held in the relevant index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

Plumb Equity Fund (Unaudited)

Comparison of Change in Value of a Hypothetical $10,000 Investment

from inception of May 24, 2007 to March 31, 2015

Average Annual Rate of Return

Periods ended March 31, 2015

| | | | | Since Inception |

| | 1 Year | 3 Year | 5 Year | of May 24, 2007 |

| Plumb Equity Fund | 13.76% | 11.51% | 9.89% | 3.31% |

| S&P 500 Index | 12.73% | 16.11% | 14.47% | 6.38% |

| MSCI EAFE Index | -3.46% | 5.98% | 3.14% | -2.44% |

| Blended Benchmark | 11.03% | 15.10% | 13.32% | 5.51% |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-866-987-7888.

The line graph and performance table do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers.

The Standard & Poor’s 500 Index (S&P 500) is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks.

The MSCI EAFE Index is an index intended to reflect the performance of major developed countries’ international equity markets, besides the United States and Canada.

The Blended Benchmark is made up of 90% S&P 500 Index and 10% MSCI EAFE Index.

The Fund’s portfolio holdings may differ significantly from the securities held in the relevant index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

Plumb Balanced Fund

Investments by Industry Sector as of March 31, 2015

(as a Percentage of Total Investments) (Unaudited)

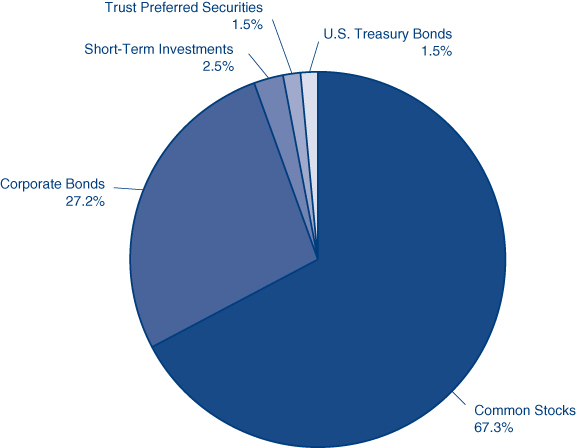

Plumb Balanced Fund

Investments by Asset Allocation as of March 31, 2015

(as a Percentage of Total Investments) (Unaudited)

Plumb Equity Fund

Investments by Industry Sector as of March 31, 2015

(as a Percentage of Total Investments) (Unaudited)

Plumb Balanced Fund

Schedule of Investments – March 31, 2015

| | | Shares | | | Value | |

| COMMON STOCKS – 68.15% | | | | | | |

| | | | | | | |

| Administrative and Support Services – 4.45% | | | | | | |

| Priceline Group, Inc. (a) | | | 600 | | | $ | 698,490 | |

| Synchrony Financial (a) | | | 28,500 | | | | 864,975 | |

| | | | | | | | 1,563,465 | |

| Beverage and Tobacco Product Manufacturing – 5.34% | | | | | | | | |

| Brown-Forman Corporation – Class B | | | 3,000 | | | | 271,050 | |

| Constellation Brands, Inc. – Class A (a) | | | 10,500 | | | | 1,220,205 | |

| Pepsico, Inc. | | | 4,000 | | | | 382,480 | |

| | | | | | | | 1,873,735 | |

| Broadcasting (except Internet) – 2.09% | | | | | | | | |

| The Walt Disney Company | | | 7,000 | | | | 734,230 | |

| | | | | | | | | |

| Chemical Manufacturing – 6.78% | | | | | | | | |

| Actavis PLC (a) (b) | | | 2,200 | | | | 654,764 | |

| Church & Dwight Company, Inc. | | | 7,000 | | | | 597,940 | |

| Johnson & Johnson | | | 6,500 | | | | 653,900 | |

| Portola Pharmaceuticals, Inc. (a) | | | 12,500 | | | | 474,500 | |

| | | | | | | | 2,381,104 | |

| Computer and Electronic | | | | | | | | |

| Product Manufacturing – 10.05% | | | | | | | | |

| Apple, Inc. | | | 6,000 | | | | 746,580 | |

| Medtronic PLC (b) | | | 7,200 | | | | 561,528 | |

| Microchip Technology, Inc. | | | 12,100 | | | | 591,690 | |

| NXP Semiconductors NV (a) (b) | | | 10,000 | | | | 1,003,600 | |

| QUALCOMM, Inc. | | | 9,000 | | | | 624,060 | |

| | | | | | | | 3,527,458 | |

| Couriers and Messengers – 1.74% | | | | | | | | |

| United Parcel Service, Inc. – Class B | | | 6,300 | | | | 610,722 | |

| | | | | | | | | |

| Credit Intermediation and Related Activities – 6.97% | | | | | | | | |

| American Express Company | | | 6,000 | | | | 468,720 | |

| Discover Financial Services | | | 12,500 | | | | 704,375 | |

| Visa, Inc. – Class A | | | 12,400 | | | | 811,084 | |

| Wells Fargo & Company | | | 8,500 | | | | 462,400 | |

| | | | | | | | 2,446,579 | |

| Data Processing, Hosting, and Related Services – 2.04% | | | | | | | | |

| Fiserv, Inc. (a) | | | 9,000 | | | | 714,600 | |

The accompanying notes are an integral part of these financial statements.

Plumb Balanced Fund

Schedule of Investments – March 31, 2015 (Continued)

| | | Shares | | | Value | |

| COMMON STOCKS (Continued) | | | | | | |

| | | | | | | |

| Food Manufacturing – 1.82% | | | | | | |

| The Hain Celestial Group, Inc. (a) | | | 10,000 | | | $ | 640,500 | |

| | | | | | | | | |

| Insurance Carriers and Related Activities – 2.59% | | | | | | | | |

| American International Group, Inc. | | | 8,000 | | | | 438,320 | |

| Berkshire Hathaway, Inc. – Class B (a) | | | 3,250 | | | | 469,040 | |

| | | | | | | | 907,360 | |

| Machinery Manufacturing – 1.41% | | | | | | | | |

| General Electric Company | | | 20,000 | | | | 496,200 | |

| | | | | | | | | |

| Miscellaneous Manufacturing – 3.66% | | | | | | | | |

| 3M Company | | | 3,500 | | | | 577,325 | |

| Intuitive Surgical, Inc. (a) | | | 1,400 | | | | 707,042 | |

| | | | | | | | 1,284,367 | |

| Other Information Services – 1.96% | | | | | | | | |

| Google Inc. – Class A (a) | | | 700 | | | | 388,290 | |

| Google Inc. – Class C (a) | | | 550 | | | | 301,400 | |

| | | | | | | | 689,690 | |

| Pipeline Transportation – 2.79% | | | | | | | | |

| Enbridge, Inc. (b) | | | 10,500 | | | | 509,250 | |

| TransCanada Corporation (b) | | | 11,000 | | | | 469,920 | |

| | | | | | | | 979,170 | |

| Professional, Scientific, and Technical Services – 6.87% | | | | | | | | |

| Cerner Corporation (a) | | | 8,800 | | | | 644,688 | |

| Exact Sciences Corporation (a) | | | 26,500 | | | | 583,530 | |

| Jack Henry & Associates, Inc. | | | 9,500 | | | | 663,955 | |

| MasterCard, Inc – Class A | | | 6,000 | | | | 518,340 | |

| | | | | | | | 2,410,513 | |

| Publishing Industries (Except Internet) – 1.26% | | | | | | | | |

| ANSYS, Inc. (a) | | | 5,000 | | | | 440,950 | |

| | | | | | | | | |

| Rail Transportation – 1.75% | | | | | | | | |

| Kansas City Southern | | | 6,000 | | | | 612,480 | |

| | | | | | | | | |

| Rental and Leasing Services – 1.19% | | | | | | | | |

| Ryder System, Inc. | | | 4,400 | | | | 417,516 | |

The accompanying notes are an integral part of these financial statements.

Plumb Balanced Fund

Schedule of Investments – March 31, 2015 (Continued)

| | | Shares | | | Value | |

| COMMON STOCKS (Continued) | | | | | | |

| | | | | | | |

| Support Activities for Mining – 1.55% | | | | | | |

| Schlumberger Limited (b) | | | 6,500 | | | $ | 542,360 | |

| | | | | | | | | |

| Transportation Equipment Manufacturing – 1.84% | | | | | | | | |

| Ford Motor Company | | | 40,000 | | | | 645,600 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $17,194,185) | | | | | | | 23,918,599 | |

| | | | | | | | | |

| | | Principal | | | | | |

| | | Amount | | | | | |

| TRUST PREFERRED SECURITIES – 1.57% | | | | | | | | |

| | | | | | | | | |

| Credit Intermediation and Related Activities – 1.57% | | | | | | | | |

| Wells Fargo & Company | | $ | 500,000 | | | | 550,000 | |

| | | | | | | | | |

| TOTAL TRUST PREFERRED SECURITIES | | | | | | | | |

| (Cost $569,970) | | | | | | | 550,000 | |

| | | | | | | | | |

| CORPORATE BONDS – 27.56% | | | | | | | | |

| | | | | | | | | |

| Administrative and Support Services – 1.50% | | | | | | | | |

| The Dun & Bradstreet Corporation | | | | | | | | |

| 4.375%, 12/01/2022 | | | 500,000 | | | | 526,006 | |

| | | | | | | | | |

| Broadcasting (except Internet) – 1.53% | | | | | | | | |

| Time Warner Cable, Inc. | | | | | | | | |

| 4.000%, 09/01/2021 | | | 500,000 | | | | 535,944 | |

| | | | | | | | | |

| Clothing and Clothing Accessories Stores – 1.53% | | | | | | | | |

| Hanesbrands, Inc. | | | | | | | | |

| 6.375%, 12/15/2020 | | | 500,000 | | | | 533,125 | |

| | | | | | | | | |

| Computer and Electronic | | | | | | | | |

| Product Manufacturing – 1.57% | | | | | | | | |

| Bio-Rad Laboratories, Inc. | | | | | | | | |

| 4.875%, 12/15/2020 | | | 500,000 | | | | 551,306 | |

The accompanying notes are an integral part of these financial statements.

Plumb Balanced Fund

Schedule of Investments – March 31, 2015 (Continued)

| | | Principal | | | | |

| | | Amount | | | Value | |

| CORPORATE BONDS (Continued) | | | | | | |

| | | | | | | |

| Credit Intermediation and Related Activities – 1.42% | | | | | | |

| Bank of America Corporation | | | | | | |

| 5.000%, 05/10/2030 (c) | | $ | 500,000 | | | $ | 498,542 | |

| | | | | | | | | |

| Electronics and Appliance Stores – 1.53% | | | | | | | | |

| Ingram Micro, Inc. | | | | | | | | |

| 5.250%, 09/01/2017 | | | 500,000 | | | | 537,927 | |

| | | | | | | | | |

| Food Services and Drinking Places – 1.46% | | | | | | | | |

| Darden Restaurants, Inc. | | | | | | | | |

| 4.500%, 10/15/2021 | | | 500,000 | | | | 513,166 | |

| | | | | | | | | |

| Funds, Trusts, and Other Financial Vehicles – 1.45% | | | | | | | | |

| Senior Housing Properties Trust | | | | | | | | |

| 4.300%, 01/15/2016 | | | 500,000 | | | | 507,592 | |

| | | | | | | | | |

| Health and Personal Care Stores – 0.96% | | | | | | | | |

| CVS Pass-Through Trust | | | | | | | | |

| 6.943%, 01/10/2030 | | | 270,941 | | | | 337,429 | |

| | | | | | | | | |

| Merchant Wholesalers, Nondurable Goods – 1.46% | | | | | | | | |

| Actavis Funding SCS (b) | | | | | | | | |

| 3.000%, 03/12/2020 | | | 500,000 | | | | 512,118 | |

| | | | | | | | | |

| Oil and Gas Extraction – 0.99% | | | | | | | | |

| Freeport-McMoRan Oil & Gas LLC | | | | | | | | |

| 6.625%, 05/01/2021 | | | 330,000 | | | | 348,975 | |

| | | | | | | | | |

| Other Information Services – 1.43% | | | | | | | | |

| Verisign, Inc. | | | | | | | | |

| 4.625%, 05/01/2023 | | | 500,000 | | | | 501,250 | |

| | | | | | | | | |

| Petroleum and Coal Products Manufacturing – 1.36% | | | | | | | | |

| Murphy Oil Corporation | | | | | | | | |

| 4.000%, 06/01/2022 | | | 500,000 | | | | 478,504 | |

The accompanying notes are an integral part of these financial statements.

Plumb Balanced Fund

Schedule of Investments – March 31, 2015 (Continued)

| | | Principal | | | | |

| | | Amount | | | Value | |

| CORPORATE BONDS (Continued) | | | | | | |

| | | | | | | |

| Pipeline Transportation – 1.00% | | | | | | |

| Copano Energy, LLC | | | | | | |

| 7.125%, 04/01/2021 | | $ | 325,000 | | | $ | 350,922 | |

| | | | | | | | | |

| Publishing Industries (Except Internet) – 1.50% | | | | | | | | |

| Symantec Corporation | | | | | | | | |

| 4.200%, 09/15/2020 | | | 500,000 | | | | 527,583 | |

| | | | | | | | | |

| Securities, Commodity Contracts, and Other Financial | | | | | | | | |

| Investments and Related Activities – 5.42% | | | | | | | | |

| Citigroup, Inc. | | | | | | | | |

| 1.606%, 04/25/2024 (c) | | | 500,000 | | | | 496,848 | |

| The Goldman Sachs Group, Inc. | | | | | | | | |

| 3.000%, 10/30/2027 (c) | | | 500,000 | | | | 490,966 | |

| Morgan Stanley | | | | | | | | |

| 5.000%, 10/15/2030 (c) | | | 500,000 | | | | 510,097 | |

| Morgan Stanley | | | | | | | | |

| 2.856%, 12/01/2017 (c) | | | 400,000 | | | | 405,188 | |

| | | | | | | | 1,903,099 | |

| Support Activities for Mining – 1.45% | | | | | | | | |

| Transocean, Inc. (b) | | | | | | | | |

| 4.950%, 11/15/2015 | | | 500,000 | | | | 510,625 | |

| | | | | | | | | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $9,522,017) | | | | | | | 9,674,113 | |

| | | | | | | | | |

| U.S. TREASURY BONDS – 1.48% | | | | | | | | |

| | | | | | | | | |

| Treasury Inflation-Protected Securities – 1.48% | | | | | | | | |

| U.S. Treasury Bonds TIPS | | | | | | | | |

| 0.125%, 01/15/2022 | | | 516,285 | | | | 521,165 | |

| | | | | | | | | |

| TOTAL U.S. TREASURY BONDS | | | | | | | | |

| (Cost $513,937) | | | | | | | 521,165 | |

The accompanying notes are an integral part of these financial statements.

Plumb Balanced Fund

Schedule of Investments – March 31, 2015 (Continued)

| | | Shares | | | Value | |

| SHORT-TERM INVESTMENTS – 2.58% | | | | | | |

| Money Market Funds – 2.58% | | | | | | |

| Invesco STIC Prime Portfolio 0.04% (c) | | | 904,671 | | | $ | 904,671 | |

| | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $904,671) | | | | | | | 904,671 | |

| | | | | | | | | |

| Total Investments | | | | | | | | |

| (Cost $28,704,780) – 101.34% | | | | | | | 35,568,548 | |

| Liabilities in Excess of Other Assets – (1.34%) | | | | | | | (470,360 | ) |

| TOTAL NET ASSETS – 100.00% | | | | | | $ | 35,098,188 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Foreign-issued security. Total foreign concentration was as follows: Canada 2.79%, Cayman Islands 1.45%, Curacao 1.55%, Ireland 3.47%, Luxembourg 1.46%, Netherlands 2.86%. |

| (c) | Variable rate security. The rate listed is as of March 31, 2015. |

The accompanying notes are an integral part of these financial statements.

Plumb Equity Fund

Schedule of Investments – March 31, 2015

| | | Shares | | | Value | |

| COMMON STOCKS – 96.43% | | | | | | |

| | | | | | | |

| Administrative and Support Services – 6.91% | | | | | | |

| Priceline Group, Inc. (a) | | | 650 | | | $ | 756,698 | |

| Synchrony Financial (a) | | | 30,000 | | | | 910,500 | |

| | | | | | | | 1,667,198 | |

| Air Transportation – 1.86% | | | | | | | | |

| Delta Air Lines, Inc. | | | 10,000 | | | | 449,600 | |

| | | | | | | | | |

| Beverage and Tobacco | | | | | | | | |

| Product Manufacturing – 6.80% | | | | | | | | |

| Brown-Forman Corporation – Class B | | | 4,000 | | | | 361,400 | |

| Constellation Brands, Inc. – Class A (a) | | | 11,000 | | | | 1,278,310 | |

| | | | | | | | 1,639,710 | |

| Broadcasting (except Internet) – 3.26% | | | | | | | | |

| The Walt Disney Company | | | 7,500 | | | | 786,675 | |

| | | | | | | | | |

| Chemical Manufacturing – 10.91% | | | | | | | | |

| Actavis PLC (a) (b) | | | 2,200 | | | | 654,764 | |

| Church & Dwight Company, Inc. | | | 7,500 | | | | 640,650 | |

| Johnson & Johnson | | | 6,500 | | | | 653,900 | |

| Portola Pharmaceuticals, Inc. (a) | | | 18,000 | | | | 683,280 | |

| | | | | | | | 2,632,594 | |

| Computer and Electronic | | | | | | | | |

| Product Manufacturing – 15.54% | | | | | | | | |

| Apple, Inc. | | | 6,300 | | | | 783,909 | |

| Medtronic PLC (b) | | | 9,000 | | | | 701,910 | |

| Microchip Technology, Inc. | | | 13,000 | | | | 635,700 | |

| NXP Semiconductors NV (a) (b) | | | 10,000 | | | | 1,003,600 | |

| QUALCOMM, Inc. | | | 9,000 | | | | 624,060 | |

| | | | | | | | 3,749,179 | |

| Couriers and Messengers – 2.81% | | | | | | | | |

| United Parcel Service, Inc. – Class B | | | 7,000 | | | | 678,580 | |

| | | | | | | | | |

| Credit Intermediation and Related Activities – 10.24% | | | | | | | | |

| American Express Company | | | 6,000 | | | | 468,720 | |

| Discover Financial Services | | | 12,500 | | | | 704,375 | |

| Visa, Inc. – Class A | | | 13,200 | | | | 863,412 | |

| Wells Fargo & Company | | | 8,000 | | | | 435,200 | |

| | | | | | | | 2,471,707 | |

The accompanying notes are an integral part of these financial statements.

Plumb Equity Fund

Schedule of Investments – March 31, 2015 (Continued)

| | | Shares | | | Value | |

| COMMON STOCKS (Continued) | | | | | | |

| | | | | | | |

| Data Processing, Hosting, | | | | | | |

| and Related Services – 2.96% | | | | | | |

| Fiserv, Inc. (a) | | | 9,000 | | | $ | 714,600 | |

| | | | | | | | | |

| Food Manufacturing – 2.39% | | | | | | | | |

| The Hain Celestial Group, Inc. (a) | | | 9,000 | | | | 576,450 | |

| | | | | | | | | |

| Miscellaneous Manufacturing – 3.14% | | | | | | | | |

| Intuitive Surgical, Inc. (a) | | | 1,500 | | | | 757,545 | |

| | | | | | | | | |

| Other Information Services – 2.97% | | | | | | | | |

| Google Inc. – Class A (a) | | | 700 | | | | 388,290 | |

| Google Inc. – Class C (a) | | | 600 | | | | 328,800 | |

| | | | | | | | 717,090 | |

| Pipeline Transportation – 3.60% | | | | | | | | |

| Enbridge, Inc. (b) | | | 10,000 | | | | 485,000 | |

| TransCanada Corporation (b) | | | 9,000 | | | | 384,480 | |

| | | | | | | | 869,480 | |

| Professional, Scientific, | | | | | | | | |

| and Technical Services – 10.67% | | | | | | | | |

| Cerner Corporation (a) | | | 10,000 | | | | 732,600 | |

| Exact Sciences Corporation (a) | | | 30,000 | | | | 660,600 | |

| Jack Henry & Associates, Inc. | | | 9,500 | | | | 663,955 | |

| MasterCard, Inc – Class A | | | 6,000 | | | | 518,340 | |

| | | | | | | | 2,575,495 | |

| Publishing Industries (Except Internet) – 2.56% | | | | | | | | |

| ANSYS, Inc. (a) | | | 7,000 | | | | 617,330 | |

| | | | | | | | | |

| Rail Transportation – 2.75% | | | | | | | | |

| Kansas City Southern | | | 6,500 | | | | 663,520 | |

| | | | | | | | | |

| Rental and Leasing Services – 1.97% | | | | | | | | |

| Ryder System, Inc. | | | 5,000 | | | | 474,450 | |

| | | | | | | | | |

| Support Activities for Mining – 2.08% | | | | | | | | |

| Schlumberger Limited (b) | | | 6,000 | | | | 500,640 | |

The accompanying notes are an integral part of these financial statements.

Plumb Equity Fund

Schedule of Investments – March 31, 2015 (Continued)

| | | Shares | | | Value | |

| COMMON STOCKS (Continued) | | | | | | |

| | | | | | | |

| Transportation Equipment Manufacturing – 3.01% | | | | | | |

| Ford Motor Company | | | 45,000 | | | $ | 726,300 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $17,030,331) | | | | | | | 23,268,143 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS – 3.61% | | | | | | | | |

| | | | | | | | | |

| Money Market Funds – 3.61% | | | | | | | | |

| Invesco STIC Prime Portfolio 0.04% (c) | | | 700,000 | | | | 700,000 | |

| Invesco STIC Treasury Portfolio 0.01% (c) | | | 170,715 | | | | 170,715 | |

| | | | | | | | 870,715 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $870,715) | | | | | | | 870,715 | |

| | | | | | | | | |

| Total Investments | | | | | | | | |

| (Cost $17,901,046) – 100.04% | | | | | | | 24,138,858 | |

| Liabilities in Excess of Other Assets – (0.04)% | | | | | | | (9,115 | ) |

| TOTAL NET ASSETS – 100.00% | | | | | | $ | 24,129,743 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Foreign-issued security. Total foreign concentration was as follows: Canada 3.60%, Curacao 2.07%, Ireland 5.62%, Netherlands 4.16%. |

| (c) | Variable rate security. The rate listed is as of March 31, 2015. |

The accompanying notes are an integral part of these financial statements.

Statements of Assets and Liabilities March 31, 2015

| | | Plumb | | | Plumb | |

| | | Balanced | | | Equity | |

| | | Fund | | | Fund | |

| Assets | | | | | | |

| Investments, at value* | | $ | 35,568,548 | | | $ | 24,138,858 | |

| Dividends and interest receivable | | | 142,316 | | | | 18,061 | |

| Receivable for fund shares sold | | | 500 | | | | 4,847 | |

| Prepaid assets | | | 22,516 | | | | 17,005 | |

| Total Assets | | | 35,733,880 | | | | 24,178,771 | |

| | | | | | | | | |

| Liabilities | | | | | | | | |

| Payable for investments purchased | | | 559,375 | | | | — | |

| Payable for fund shares redeemed | | | 4,847 | | | | 1,316 | |

| Accrued distribution fee | | | 15,778 | | | | 10,183 | |

| Payable to Advisor (a) | | | 9,291 | | | | 3,075 | |

| Administrative & accounting | | | | | | | | |

| services fee payable (a) | | | 6,013 | | | | 4,141 | |

| Payable to directors | | | 4,449 | | | | 3,060 | |

| Accrued expenses and other liabilities | | | 35,939 | | | | 27,253 | |

| Total Liabilities | | | 635,692 | | | | 49,028 | |

| Net Assets | | $ | 35,098,188 | | | $ | 24,129,743 | |

| | | | | | | | | |

| Net Assets Consist Of: | | | | | | | | |

| Paid in capital | | | 34,964,137 | | | | 16,132,266 | |

| Accumulated undistributed | | | | | | | | |

| net investment income (loss) | | | 53,724 | | | | (12,818 | ) |

| Accumulated net realized gain (loss) | | | (6,783,441 | ) | | | 1,772,483 | |

| Net unrealized appreciation on investments | | | 6,863,768 | | | | 6,237,812 | |

| Net Assets | | $ | 35,098,188 | | | $ | 24,129,743 | |

| | | | | | | | | |

| Capital shares outstanding, $0.001 par value | | | | | | | | |

| (200 million shares issued each) | | | 1,542,743 | | | | 994,484 | |

| Net asset value, offering and | | | | | | | | |

| redemption price per share | | $ | 22.75 | | | $ | 24.26 | |

| | | | | | | | | |

| * Cost of Investments | | $ | 28,704,780 | | | $ | 17,901,046 | |

| (a) | See Note 4 in the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

Statements of Operations

For the Fiscal Year Ended March 31, 2015

| | | Plumb | | | Plumb | |

| | | Balanced | | | Equity | |

| | | Fund | | | Fund | |

| Investment Income: | | | | | | |

| Dividends (Net of foreign withholding | | | | | | |

| taxes of $6,198 and $5,367, respectively) | | $ | 370,647 | | | $ | 314,784 | |

| Interest | | | 422,789 | | | | 280 | |

| Total Investment Income | | | 793,436 | | | | 315,064 | |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| Investment Advisor’s fee (a) | | | 223,788 | | | | 152,112 | |

| Distribution fees | | | 73,824 | | | | 54,744 | |

| Administrative & accounting service fees (a) | | | 68,858 | | | | 46,804 | |

| Legal fees | | | 27,731 | | | | 18,727 | |

| Administration fee | | | 11,075 | | | | 9,605 | |

| Transfer agent fees and expenses | | | 46,891 | | | | 38,014 | |

| Fund accounting fees | | | 34,575 | | | | 31,230 | |

| Registration fees | | | 11,865 | | | | 10,275 | |

| Director fees and expenses | | | 17,895 | | | | 12,088 | |

| Audit and tax fees | | | 18,270 | | | | 12,220 | |

| Custody fees | | | 6,900 | | | | 6,512 | |

| Insurance expense | | | 8,218 | | | | 5,710 | |

| Printing and mailing expense | | | 6,170 | | | | 3,842 | |

| Total expenses before waiver | | | 556,060 | | | | 401,883 | |

| Less: Fees waived/reimbursed by Advisor (a) | | | (125,699 | ) | | | (74,257 | ) |

| Net expenses | | | 430,361 | | | | 327,626 | |

| Net Investment Income (Loss) | | | 363,075 | | | | (12,562 | ) |

| | | | | | | | | |

| Realized and Unrealized Gain: | | | | | | | | |

| Net realized gain on investments | | | 3,282,396 | | | | 3,820,954 | |

| Net change in unrealized | | | | | | | | |

| appreciation on investments | | | (480,599 | ) | | | (789,568 | ) |

| Net realized and unrealized | | | | | | | | |

| gain on investments | | | 2,801,797 | | | | 3,031,386 | |

| | | | | | | | | |

| Net Increase in Net Assets | | | | | | | | |

| Resulting from Operations | | $ | 3,164,872 | | | $ | 3,018,824 | |

| (a) | See Note 4 in the Notes to the Financial Statements. |

The accompanying notes are an integral part of these financial statements.

Plumb Balanced Fund

Statements of Changes in Net Assets

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | March 31, | | | March 31, | |

| | | 2015 | | | 2014 | |

| Operations: | | | | | | |

| Net investment income | | $ | 363,075 | | | $ | 445,094 | |

| Net realized gain on investments | | | 3,282,396 | | | | 3,577,862 | |

| Net change in unrealized appreciation | | | | | | | | |

| on investments | | | (480,599 | ) | | | 916,326 | |

| Net increase in net assets | | | | | | | | |

| resulting from operations | | | 3,164,872 | | | | 4,939,282 | |

| | | | | | | | | |

| Dividends And Distributions To Shareholders: | | | | | | | | |

| Net investment income | | | (359,410 | ) | | | (469,807 | ) |

| Total dividends and distributions | | | (359,410 | ) | | | (469,807 | ) |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Proceeds from shares sold | | | 989,712 | | | | 1,676,658 | |

| Shares issued in reinvestment of dividends | | | 156,972 | | | | 206,053 | |

| Cost of shares redeemed | | | (2,264,265 | ) | | | (7,036,124 | ) |

| Net decrease in net assets | | | | | | | | |

| from capital share transactions | | | (1,117,581 | ) | | | (5,153,413 | ) |

| | | | | | | | | |

| Total increase (decrease) in net assets | | | 1,687,881 | | | | (683,938 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 33,410,307 | | | | 34,094,245 | |

| End of year* | | $ | 35,098,188 | | | $ | 33,410,307 | |

| | | | | | | | | |

| * Including accumulated undistributed | | | | | | | | |

| net investment income of | | $ | 53,724 | | | $ | 112,726 | |

| | | | | | | | | |

| Change In Shares Outstanding: | | | | | | | | |

| Shares sold | | | 44,651 | | | | 85,008 | |

| Shares issued in reinvestment of dividends | | | 7,233 | | | | 10,298 | |

| Shares redeemed | | | (102,461 | ) | | | (361,453 | ) |

| Net decrease | | | (50,577 | ) | | | (266,147 | ) |

The accompanying notes are an integral part of these financial statements.

Plumb Equity Fund

Statements of Changes in Net Assets

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | March 31, | | | March 31, | |

| | | 2015 | | | 2014 | |

| Operations: | | | | | | |

| Net investment income (loss) | | $ | (12,562 | ) | | $ | 93,641 | |

| Net realized gain on investments | | | 3,820,954 | | | | 4,678,354 | |

| Net change in unrealized appreciation | | | | | | | | |

| on investments | | | (789,568 | ) | | | 235,641 | |

| Net increase in net assets | | | | | | | | |

| resulting from operations | | | 3,018,824 | | | | 5,007,636 | |

| | | | | | | | | |

| Dividends And Distributions To Shareholders: | | | | | | | | |

| Net investment income | | | (36,913 | ) | | | (130,916 | ) |

| Realized gains | | | (220,201 | ) | | | — | |

| Total dividends and distributions | | | (257,114 | ) | | | (130,916 | ) |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Proceeds from shares sold | | | 924,793 | | | | 1,000,148 | |

| Shares issued in reinvestment of | | | | | | | | |

| dividends and realized gains | | | 239,481 | | | | 77,104 | |

| Cost of shares redeemed | | | (3,336,323 | ) | | | (18,836,129 | ) |

| Net decrease in net assets | | | | | | | | |

| from capital share transactions | | | (2,172,049 | ) | | | (17,758,877 | ) |

| | | | | | | | | |

| Total increase (decrease) in net assets | | | 589,661 | | | | (12,882,157 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 23,540,082 | | | | 36,422,239 | |

| End of year* | | $ | 24,129,743 | | | $ | 23,540,082 | |

| | | | | | | | | |

| * Including accumulated undistributed | | | | | | | | |

| net investment income (loss) of | | $ | (12,818 | ) | | $ | 36,918 | |

| | | | | | | | | |

| Change In Shares Outstanding: | | | | | | | | |

| Shares sold | | | 39,441 | | | | 51,920 | |

| Shares issued in reinvestment of dividends | | | 10,527 | | | | 3,813 | |

| Shares redeemed | | | (146,764 | ) | | | (1,002,488 | ) |

| Net decrease | | | (96,796 | ) | | | (946,755 | ) |

The accompanying notes are an integral part of these financial statements.

Plumb Balanced Fund

Financial Highlights

| | | For the Years Ended March 31, | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Per share operating | | | | | | | | | | | | | | | |

| performance | | | | | | | | | | | | | | | |

| (For a share outstanding | | | | | | | | | | | | | | | |

| throughout the period) | | | | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | | | | |

| beginning of year | | $ | 20.97 | | | $ | 18.34 | | | $ | 18.38 | | | $ | 17.82 | | | $ | 16.43 | |

| Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment | | | | | | | | | | | | | | | | | | | | |

income(1) | | | 0.24 | | | | 0.29 | | | | 0.39 | | | | 0.29 | | | | 0.31 | |

| Net realized and | | | | | | | | | | | | | | | | | | | | |

| unrealized gain (loss) | | | 1.77 | | | | 2.63 | | | | (0.01 | ) | | | 0.54 | | | | 1.44 | |

| Total from | | | | | | | | | | | | | | | | | | | | |

| investment operations | | | 2.01 | | | | 2.92 | | | | 0.38 | | | | 0.83 | | | | 1.75 | |

| Dividends and distributions | | | | | | | | | | | | | | | | | | | | |

| to shareholders: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net | | | | | | | | | | | | | | | | | | | | |

| investment income | | | (0.23 | ) | | | (0.29 | ) | | | (0.42 | ) | | | (0.27 | ) | | | (0.36 | ) |

| Total dividends | | | | | | | | | | | | | | | | | | | | |

| and distributions | | | (0.23 | ) | | | (0.29 | ) | | | (0.42 | ) | | | (0.27 | ) | | | (0.36 | ) |

| Change in net asset | | | | | | | | | | | | | | | | | | | | |

| value for the year | | | 1.78 | | | | 2.63 | | | | (0.04 | ) | | | 0.56 | | | | 1.39 | |

| Net asset value, | | | | | | | | | | | | | | | | | | | | |

| end of year | | $ | 22.75 | | | $ | 20.97 | | | $ | 18.34 | | | $ | 18.38 | | | $ | 17.82 | |

Total return(2) | | | 9.65 | % | | | 16.01 | % | | | 2.22 | % | | | 4.87 | % | | | 10.76 | % |

The accompanying notes are an integral part of these financial statements.

Plumb Balanced Fund

Financial Highlights (Continued)

| | | For the Years Ended March 31, | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Ratios / supplemental data | | | | | | | | | | | | | | | |

| Net assets, | | | | | | | | | | | | | | | |

| end of year (000) | | $ | 35,098 | | | $ | 33,410 | | | $ | 34,094 | | | $ | 49,981 | | | $ | 44,626 | |

| Ratio of net expenses | | | | | | | | | | | | | | | | | | | | |

| to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense | | | | | | | | | | | | | | | | | | | | |

| reimbursement | | | | | | | | | | | | | | | | | | | | |

| and waivers | | | 1.62 | % | | | 1.58 | % | | | 1.47 | % | | | 1.48 | % | | | 1.56 | % |

| After expense | | | | | | | | | | | | | | | | | | | | |

| reimbursement | | | | | | | | | | | | | | | | | | | | |

and waivers(3) | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.21 | % |

| Ratio of net investment | | | | | | | | | | | | | | | | | | | | |

| income to average net assets: | | | | | | | | | | | | | | | | | | | | |

| After expense | | | | | | | | | | | | | | | | | | | | |

| reimbursement | | | | | | | | | | | | | | | | | | | | |

and waivers(3) | | | 1.05 | % | | | 1.36 | % | | | 1.83 | % | | | 1.78 | % | | | 1.79 | % |

| Portfolio turnover rate | | | 53 | % | | | 46 | % | | | 64 | % | | | 72 | % | | | 85 | % |

| (1) | Net investment income per share is calculated using current year ending balances prior to consideration of adjustment for permanent book and tax differences. |

| (2) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (3) | Effective July 1, 2010, the Advisor contractually agreed to cap the Fund’s expenses at 1.25%. Prior to July 1, 2010, the Fund’s expense cap was 1.10%. |

The accompanying notes are an integral part of these financial statements.

Plumb Equity Fund

Financial Highlights

| | | For the Years Ended March 31, | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Per share operating | | | | | | | | | | | | | | | |

| performance | | | | | | | | | | | | | | | |

| (For a share outstanding | | | | | | | | | | | | | | | |

| throughout the period) | | | | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | | | | |

| beginning of year | | $ | 21.57 | | | $ | 17.87 | | | $ | 18.02 | | | $ | 17.56 | | | $ | 15.75 | |

| Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment | | | | | | | | | | | | | | | | | | | | |

income (loss)(1) | | | (0.01 | ) | | | 0.11 | | | | 0.20 | | | | 0.08 | | | | 0.07 | |

| Net realized and | | | | | | | | | | | | | | | | | | | | |

| unrealized gain (loss) | | | 2.96 | | | | 3.70 | | | | (0.14 | ) | | | 0.42 | | | | 1.86 | |

| Total from | | | | | | | | | | | | | | | | | | | | |

| investment operations | | | 2.95 | | | | 3.81 | | | | 0.06 | | | | 0.50 | | | | 1.93 | |

| Dividends and distributions | | | | | | | | | | | | | | | | | | | | |

| to shareholders: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net | | | | | | | | | | | | | | | | | | | | |

| investment income | | | (0.04 | ) | | | (0.11 | ) | | | (0.21 | ) | | | (0.04 | ) | | | (0.12 | ) |

| Distributions from | | | | | | | | | | | | | | | | | | | | |

| realized gains | | | (0.22 | ) | | | — | | | | — | | | | — | | | | — | |

| Total dividends | | | | | | | | | | | | | | | | | | | | |

| and distributions | | | (0.26 | ) | | | (0.11 | ) | | | (0.21 | ) | | | (0.04 | ) | | | (0.12 | ) |

| Change in net asset | | | | | | | | | | | | | | | | | | | | |

| value for the year | | | 2.69 | | | | 3.70 | | | | (0.15 | ) | | | 0.46 | | | | 1.81 | |

| Net asset value, | | | | | | | | | | | | | | | | | | | | |

| end of year | | $ | 24.26 | | | $ | 21.57 | | | $ | 17.87 | | | $ | 18.02 | | | $ | 17.56 | |

Total return(2) | | | 13.76 | % | | | 21.38 | % | | | 0.42 | % | | | 2.88 | % | | | 12.31 | % |

The accompanying notes are an integral part of these financial statements.

Plumb Equity Fund

Financial Highlights (Continued)

| | | For the Years Ended March 31, | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Ratios / supplemental data | | | | | | | | | | | | | | | |

| Net assets, | | | | | | | | | | | | | | | |

| end of year (000) | | $ | 24,130 | | | $ | 23,540 | | | $ | 36,422 | | | $ | 49,982 | | | $ | 17,322 | |

| Ratio of net expenses | | | | | | | | | | | | | | | | | | | | |

| to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense | | | | | | | | | | | | | | | | | | | | |

| reimbursement | | | | | | | | | | | | | | | | | | | | |

| and waivers | | | 1.72 | % | | | 1.68 | % | | | 1.46 | % | | | 1.54 | % | | | 1.85 | % |

| After expense | | | | | | | | | | | | | | | | | | | | |

| reimbursement | | | | | | | | | | | | | | | | | | | | |

and waivers(3) | | | 1.40 | % | | | 1.40 | % | | | 1.40 | % | | | 1.40 | % | | | 1.35 | % |

| Ratio of net investment | | | | | | | | | | | | | | | | | | | | |

| income to average net assets: | | | | | | | | | | | | | | | | | | | | |

| After expense | | | | | | | | | | | | | | | | | | | | |

| reimbursement | | | | | | | | | | | | | | | | | | | | |

and waivers(3) | | | -0.05 | % | | | 0.38 | % | | | 1.08 | % | | | 0.80 | % | | | 0.46 | % |

| Portfolio turnover rate | | | 52 | % | | | 52 | % | | | 84 | % | | | 69 | % | | | 111 | % |

| (1) | Net investment income per share is calculated using current year ending balances prior to consideration of adjustment for permanent book and tax differences. |

| (2) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (3) | Effective July 1, 2010, the Advisor contractually agreed to cap the Fund’s expenses at 1.40%. Prior to July 1, 2010, the Fund’s expense cap was 1.20%. |

The accompanying notes are an integral part of these financial statements.

Notes to Financial Statements

March 31, 2015

Wisconsin Capital Funds, Inc. (the “Company”) is registered under the Investment Company Act of 1940 (the “1940 Act”) as an open-end, diversified management investment company. The Company was organized as a Maryland corporation on April 3, 2007. The Company is authorized to issue up to 2 billion shares, which are units of beneficial interest with a $0.001 par value. The Company currently offers shares of two series, each with its own investment strategy and risk/reward profile: the Plumb Balanced Fund and the Plumb Equity Fund (individually a “Fund”, collectively the “Funds”). The investment objective of the Plumb Balanced Fund is high total return through capital appreciation while attempting to preserve principal, with current income as a secondary objective. The investment objective of the Plumb Equity Fund is long-term capital appreciation. Wisconsin Capital Management, LLC (the “Advisor”) serves as the Funds’ investment advisor. As of December 31, 2014, the Advisor is owned by TGP, Inc. The Advisor is controlled by Thomas G. Plumb indirectly through TGP, Inc. Certain directors or officers of the Funds are also officers of the Advisor.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Security Valuation:

The Funds have adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the year. These inputs are summarized in the three broad levels listed below.

| | Level 1 – | quoted prices in active markets for identical securities |

| | Level 2 – | other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | Level 3 – | significant unobservable inputs (including the Funds’ own assumptions in determining fair value of investments) |

Equity securities, including common stocks and foreign issued common stocks, are valued at the last sale price reported by the exchange on which the securities are primarily traded on the day of valuation. Nasdaq-listed securities are valued at their Nasdaq Official Closing Price. Equity securities not traded on a listed

Notes to Financial Statements

March 31, 2015 (Continued)

exchange or not traded using Nasdaq are valued as of the last sale price at the close of the U.S. market. If there are no sales on a given day for securities traded on an exchange, the latest bid quotation will be used. These securities will generally be classified as Level 1 securities.

Investments in mutual funds, including money market funds, are generally priced at the ending net asset value (NAV) provided by the service agent of the funds and will be classified as Level 1 securities.

Debt securities, such as corporate bonds, trust preferred securities, and U.S. Treasury bonds are valued using a market approach based on information supplied by independent pricing services. The market inputs used by the independent pricing service include: benchmark yields, reported trades, broker/dealer quotes, issuer spreads, two-sided markets, benchmark securities, bids, offers, and reference data including market research publications. Debt securities with remaining maturities of 60 days or less may be valued on an amortized cost basis, which involves valuing an instrument at its cost and thereafter assuming a constant amortization to maturity of any discount or premium, regardless of the impact of fluctuating rates on the fair value of the instrument. To the extent the inputs are observable and timely, these debt securities, trust preferred securities, and U.S. Treasury bonds will generally be classified as Level 2 securities.

Any securities or other assets for which market quotations are not readily available are valued at fair value as determined in good faith by the Advisor pursuant to procedures established under the general supervision and responsibility of the Funds’ Board of Directors and will be classified as Level 3 securities.

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Notes to Financial Statements

March 31, 2015 (Continued)

The following is a summary of the inputs used, as of March 31, 2015, to value the Funds’ investments carried at fair value:

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Plumb Balanced Fund | | | | | | | | | | | | |

| Investments in: | | | | | | | | | | | | |

| Common Stock* | | $ | 23,918,599 | | | $ | — | | | $ | — | | | $ | 23,918,599 | |

| Trust Preferred Securities* | | | — | | | | 550,000 | | | | — | | | | 550,000 | |

| Corporate Bonds* | | | — | | | | 9,674,113 | | | | — | | | | 9,674,113 | |

| U.S. Treasury Bonds | | | — | | | | 521,165 | | | | — | | | | 521,165 | |

| Money Market Funds | | | 904,671 | | | | — | | | | — | | | | 904,671 | |

| Total | | $ | 24,823,270 | | | $ | 10,745,278 | | | $ | — | | | $ | 35,568,548 | |

| | | | | | | | | | | | | | | | | |

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Plumb Equity Fund | | | | | | | | | | | | | | | | |

| Investments in: | | | | | | | | | | | | | | | | |

| Common Stock* | | $ | 23,268,143 | | | $ | — | | | $ | — | | | $ | 23,268,143 | |

| Money Market Funds | | | 870,715 | | | | — | | | | — | | | | 870,715 | |

| Total | | $ | 24,138,858 | | | $ | — | | | $ | — | | | $ | 24,138,858 | |

| * | For detailed industry descriptions, refer to the Schedule of Investments. |

The Funds did not hold any investments during the year with significant unobservable inputs which would be classified as Level 3. As of and during the fiscal year ending March 31, 2015, no securities were transferred into or out of Level 1 or Level 2. It is the Funds’ policy to consider transfers into or out of any level as of the end of the reporting period. The Funds did not hold any derivative instruments during the fiscal year ended March 31, 2015.

Use of Estimates:

The presentation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Expenses:

Generally, expenses directly attributable to a Fund are charged to the Fund, while expenses attributable to more than one series of the Company are allocated among the respective series based on relative net assets or another appropriate basis.

Notes to Financial Statements

March 31, 2015 (Continued)

Federal Income Taxes:

The Funds intend to meet the requirements of the Internal Revenue Code (the “Code”) applicable to regulated investment companies and to distribute substantially all net investment taxable income and net capital gains to shareholders in a manner which results in no tax cost to the Funds. Therefore, no federal income or excise tax provision is recorded.

As of and during the fiscal year ended March 31, 2015, the Funds did not have a liability for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statements of Operations. During the fiscal year ended March 31, 2015, the Funds did not incur any interest or penalties. The Funds are not subject to examination by U.S. taxing authorities for tax years prior to 2011.

Distributions to Shareholders:

Dividends from net investment income are declared and paid at least annually. Distributions of net realized capital gains, if any, will be declared and paid at least annually. Distributions to shareholders are recorded on the ex-dividend date.

The Funds may periodically make reclassifications among certain of its capital accounts as a result of the recognition and characterization of certain income and capital gain distributions determined annually in accordance with federal tax regulations which may differ from GAAP. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Funds.

For the fiscal year ended March 31, 2015, the Funds made the following reclassifications to increase (decrease) the components of net assets:

| | | | Accumulated | Accumulated |

| | | Paid in | Undistributed Net | Net Realized |

| | | Capital | Investment Income (Loss) | Gain (Loss) |

| | Plumb Balanced Fund | — | $(62,667) | $62,667 |

| | Plumb Equity Fund | (195) | $ (261) | $ 456 |

Other:

Investment and shareholder transactions are recorded on the trade date. Gains or losses from investment transactions are determined using the specific identification method. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Discounts and premiums on securities purchased are amortized over the expected life of the respective securities using the effective interest method. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

Notes to Financial Statements

March 31, 2015 (Continued)

The Company has adopted a plan pursuant to Rule 12b-1 under the 1940 Act (the “12b-1 Plan”), on behalf of the Funds, which authorizes it to pay Quasar Distributors, LLC (the “Distributor”) a distribution fee of 0.25% of the Funds’ average daily net assets for services to prospective Fund shareholders and distribution of Fund shares. During the fiscal year ended March 31, 2015, the Plumb Balanced Fund and the Plumb Equity Fund incurred expenses of $73,824 and $54,744, respectively, pursuant to the 12b-1 Plan. As of March 31, 2015, $15,778 and $10,183 for the Plumb Balanced Fund and Plumb Equity Fund, respectively, were accrued.

| 4. | INVESTMENT ADVISOR AND OTHER AFFILIATES |

The Funds have an Investment Advisory Agreement (the “Advisory Agreement”) with Wisconsin Capital Management, LLC. The Advisory Agreement provides for advisory fees computed daily and paid monthly at an annual rate of 0.65% of the Funds’ average daily net assets.

Under the terms of the Advisory Agreement, the Advisor has contractually agreed to limit the Funds’ expenses. The Advisor has agreed to limit annual operating expenses through July 31, 2015, to 1.25% and 1.40% of the Funds’ average daily net assets for the Plumb Balanced Fund and the Plumb Equity Fund, respectively. Any such waiver or reimbursement is subject to later adjustment to allow the Advisor to recoup amounts waived or reimbursed to the extent actual fees and expenses for a period are less than the expense limitation caps in place at the time the waiver was made, provided, however, that the Advisor shall only be entitled to recoup such amounts for a period of three years from the date such amount was waived or reimbursed. For the fiscal year ended March 31, 2015, the Advisor waived expenses for the Plumb Balanced Fund and the Plumb Equity Fund of $125,699 and $74,257, respectively. There were no expense recoupments during the fiscal year ended March 31, 2015.

The following table shows the remaining waived or reimbursed expenses subject to potential recovery as of March 31, 2015 expiring in:

| Plumb Balanced Fund | Plumb Equity Fund |

| 2016 . . . . . . . $ 94,065 | 2016 . . . . . . . $24,641 |

| 2017 . . . . . . . $108,110 | 2017 . . . . . . . $72,213 |

| 2018 . . . . . . . $125,699 | 2018 . . . . . . . $74,257 |

The Funds also have an Administrative and Accounting Services Agreement (“Agreement”) with the Advisor. Fund administration responsibilities include general fund management, compliance, financial reporting, and oversight and assistance to other providers. The Advisor’s administrative and accounting fees are 0.20% of the Funds’ average daily net assets, computed daily and paid monthly.

Notes to Financial Statements

March 31, 2015 (Continued)

| 5. | INVESTMENT TRANSACTIONS |

For the fiscal year ended March 31, 2015, the aggregate purchases and sales of investment securities, other than short-term investments, were as follows:

| | | Plumb Balanced Fund | Plumb Equity Fund |

| | Purchases: | $17,770,730 | $11,909,219 |

| | Sales: | $19,300,474 | $15,074,158 |

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund under Section 2(a)(9) of the 1940 Act. As of March 31, 2015 certain entities and their affiliates which may control or be under common control with the Advisor, including Thomas Plumb, SVA Plumb Trust Company, and SVA Plumb Wealth Management, LLC, either directly or for the benefit of their customers, owned 64.65% of the Plumb Balanced Fund and 70.53% of the Plumb Equity Fund.

| 7. | FEDERAL TAX INFORMATION |

As of March 31, 2015 the components of accumulated earnings (losses) for income tax purposes were as follows:

| | | Plumb Balanced Fund | | Plumb Equity Fund |

| | Unrealized appreciation | | $ | 7,102,804 | | | | $ | 6,409,061 | |

| | Unrealized depreciation | | | (240,904 | ) | | | | (179,965 | ) |

| | Net tax unrealized | | | | | | | | | |

| | appreciation on investments | | | 6,861,900 | | | | | 6,229,096 | |

| | Undistributed ordinary income | | | 55,534 | | | | | — | |

| | Undistributed long-term capital gain | | | — | | | | | 1,781,199 | |

| | Other accumulated losses | | | (6,783,383 | ) | | | | (12,818 | ) |

| | Total accumulated gains (losses) | | $ | 134,051 | | | | $ | 7,997,477 | |

The tax cost of investments as of March 31, 2015 was $28,706,648 and $17,909,762 for the Plumb Balanced Fund and Plumb Equity Fund, respectively. The tax basis of investments for tax and financial reporting purposes differs principally due to the deferral of losses on wash sales.

Notes to Financial Statements

March 31, 2015 (Continued)

As of March 31, 2015 the Funds had prior tax basis capital losses which may be carried over to offset future capital gains as shown below.

| | | Capital Loss Carryover |

| | | Plumb Balanced Fund | Plumb Equity Fund |

| | Expires: | | |

| | March 31, 2018 | $(6,635,648) | $ — |

Prior year capital loss carryovers of $3,433,853 and $1,787,573 for the Plumb Balanced Fund and Plumb Equity Fund, respectively, were utilized during the year.

As of March 31, 2015, the Funds deferred, on a tax basis, late year and post-October losses of:

| | | Plumb Balanced Fund | Plumb Equity Fund |

| | Late Year Ordinary | $ — | $12,818 |

| | Post-October | $145,925 | $ — |

| 8. | DISTRIBUTIONS TO SHAREHOLDERS |

The tax character of distributions paid during the fiscal years ended March 31, 2015 and 2014 was as follows:

| | | | Plumb Balanced Fund | |

| | | | Year Ended | | | Year Ended | |

| | | | March 31, 2015 | | | March 31, 2014 | |

| | Distributions paid from: | | | | | | |

| | Ordinary Income | | $ | 359,410 | | | $ | 469,807 | |

| | Total Distributions Paid | | $ | 359,410 | | | $ | 469,807 | |

| | | | | | | | | | |

| | | | Plumb Equity Fund | |

| | | | Year Ended | | | Year Ended | |

| | | | March 31, 2015 | | | March 31, 2014 | |

| | Distributions paid from: | | | | | | | | |

| | Ordinary Income | | $ | 36,918 | | | $ | 130,916 | |

| | Long-Term Capital Gains | | $ | 220,196 | | | $ | — | |

| | Total Distributions Paid | | $ | 257,114 | | | $ | 130,916 | |

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors

Wisconsin Capital Funds, Inc.

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of Wisconsin Capital Funds, Inc., comprising the Plumb Balanced Fund and the Plumb Equity Fund (the “Funds”), as of March 31, 2015, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of March 31, 2015, by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Plumb Balanced Fund and the Plumb Equity Fund as of March 31, 2015, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

COHEN FUND AUDIT SERVICES, LTD.

Cleveland, Ohio

May 27, 2015

Additional Information (Unaudited)

1.ADDITIONAL DISCLOSURE REGARDING FUND DIRECTORS AND OFFICERS

| | Position(s) Held with | Principal | Number of | Other |

| | Wisconsin Capital | Occupation(s) | Plumb Funds | Directorships |

| Name, Address | Funds, Inc. and Length | During Past | Overseen | Held by |

| and Age | of Time Served(1) | Five Years | by Director | Director |

| | | | | | |

| Independent Directors: | | | | | |

| | | | | | |

| Patrick J. Quinn | Director since | • | Currently retired | 2 | National |

| 8020 Excelsior | May 2007 | • | President and | | Presto |

| Drive, Suite 402 | | | Chairman of the | | Industries |

| Madison, WI 53717 | | | Board of Ayres | | since May |

| Birth date: | | | Associates (professional | | 2001 |

| September 1949 | | | civil engineering firm), | | |

| | | | from April 2000 to | | |

| | | | December 2010 | | |

| | | | | | |

| Jay Loewi | Director since | • | Chief Executive | 2 | None |

| 8020 Excelsior | May 2007 | | Officer, QTI Group | | |

| Drive, Suite 402 | | | (staffing company), | | |

| Madison, WI 53717 | | | since November 2007 | | |

| Birth date: | | • | President, QTI Group | | |

| March 1957 | | | of Companies, | | |

| | | | since 2002 | | |

| | | | | | |

| Jeffrey B. Sauer | Director since | • | Assistant to the | 2 | None |

| 8020 Excelsior | May 2007 | | Commissioner of | | |

| Drive, Suite 402 | | | Western Collegiate | | |

| Madison, WI 53717 | | | Hockey Association, | | |

| Birth date: | | | since 2002 | | |

| March 1943 | | | | | |

| | | | | | |

| Interested Directors and Officers: | | | | | |

| | | | | | |

Thomas G. Plumb(2)(3) | Director, Chairman, | • | President of SVA | 2 | None |

| 8020 Excelsior | President and Chief | | Plumb Wealth | | |

| Drive, Suite 402 | Executive Officer | | Management, LLC, | | |

| Madison, WI 53717 | since May 2007 | | since March 2011 | | |

| Birth date: | | • | President of SVA | | |

| July 1952 | | | Plumb Financial, LLC, | | |

| | | | since March 2011 | | |

| | | • | CEO of SVA Plumb | | |

| | | | Trust Company, | | |

| | | | since March 2011 | | |

| | | • | President of Wisconsin | | |

| | | | Capital Management, | | |

| | | | LLC, since January 2004 | | |

| | | • | CEO of Plumb Trust | | |

| | | | Company from 2001 | | |

| | | | to February 2011 | | |

Additional Information (Unaudited) (Continued)

| | Position(s) Held with | | | Other | |

| | Wisconsin Capital | | | Directorships | |

| Name, Address | Funds, Inc. and Length | Principal Occupation(s) | Held by | |

| and Age | of Time Served(1) | During Past Five Years | Director | |

| | | | | | |

| Connie M. Redman | Chief Compliance | • | Chief Compliance | N/A | |

| 8020 Excelsior | Officer since May 2007 | | Officer of SVA Plumb | | |

| Drive, Suite 402 | | | Wealth Management, | | |

| Madison, WI 53717 | Secretary | | LLC since April 2012 | | |

| Birth date: | since August 2010 | • | Vice President and | | |

| February 1966 | | | Chief Compliance Officer | | |

| | | | of Wisconsin Capital | | |

| | | | Management, LLC | | |

| | | | since March 2008 | | |

| | | • | Corporate Secretary | | |

| | | | of Wisconsin Capital | | |

| | | | Management, LLC | | |

| | | | from March 2008 to | | |

| | | | December 2014 | | |

| | | | | | |

| Donna M. Baker | Treasurer | • | Operations Manager of | N/A | |

| 8020 Excelsior | since August 2010 | | SVA Plumb Trust Company | | |

| Drive, Suite 402 | | | from March 2011 to | | |

| Madison, WI 53717 | | | August 2014 | | |

| Birth date: | | • | Chief Administrative | | |

| March 1964 | | | Officer of SVA Plumb | | |

| | | | Trust Company since | | |

| | | | September 2014 | | |

| | | • | Chief Financial Officer and | | |

| | | | Human Resource Manager | | |

| | | | of Wisconsin Capital | | |

| | | | Management, LLC, from | | |

| | | | June 2010 to February 2011 | | |

Additional Information (Unaudited) (Continued)

| | Position(s) Held with | | | Other |

| | Wisconsin Capital | | | Directorships |

| Name, Address | Funds, Inc. and Length | Principal Occupation(s) | Held by |

| and Age | of Time Served(1) | During Past Five Years | Director |

| | | | | |

Nathan M. Plumb(3) | Chief Financial | • | Chief Operating Officer, | N/A |

| 8020 Excelsior | Officer and | | Vice President, and | |

| Drive, Suite 402 | Associate Portfolio | | Corporate Secretary | |

| Madison, WI 53717 | Manager since | | of Wisconsin Capital | |

| Birth date: | January 2015 | | Management, LLC | |

| June 1975 | | | since January 2015 | |

| | Assistant Portfolio | • | Associate Financial | |

| | Manager from | | Consultant of SVA | |

| | August 2013 to | | Plumb Wealth | |

| | December 2014 | | Management, LLC | |

| | | | from March 2011 to | |

| | | | December 2014 | |

| | | • | Portfolio Manager of | |

| | | | Wisconsin Capital | |

| | | | Management, LLC | |

| | | | since September 2013 | |

| | | • | Assistant Portfolio | |

| | | | Manager of Wisconsin | |

| | | | Capital Management, | |

| | | | LLC from 2010 to | |

| | | | September 2013 | |

| (1) | Officers of the Funds serve one-year terms, subject to annual reappointment by the Board of Directors. Directors of the Funds serve a term of indefinite length until their resignation or removal, and stand for re-election by shareholders as and when required under the 1940 Act. |

| (2) | Thomas G. Plumb is an “interested person” of the Funds by virtue of his positions with the Funds and the Advisor. |

| (3) | Nathan M. Plumb is the son of Thomas G. Plumb. |

Additional Information (Unaudited) (Continued)

The Board of Directors of the Funds has an audit committee and a nominating committee. The audit committee consults with the independent auditors for the Funds on matters pertaining to their audits of the Funds’ annual financial statements, and approves all audit and non-audit services to be provided by the independent auditors. The audit committee has adopted a written charter, which is available upon request. The audit committee consists of Jay Loewi (Chair), Patrick J. Quinn and Jeffrey B. Sauer, none of whom is an “interested” person of the Funds. Jay Loewi has been determined by the Board to be an audit committee financial expert.