UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22045

Wisconsin Capital Funds, Inc.

(Exact name of registrant as specified in charter)

8401 Excelsior Drive, Suite 102

Madison, WI 53717

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Thomas G. Plumb

8401 Excelsior Drive, Suite 102

Madison, WI 53717

(Name and address of agent for service)

(Name and address of agent for service)

(608) 960-4616

Registrant's telephone number, including area code

Date of fiscal year end: March 31

Date of reporting period: March 31, 2020

Item 1. Reports to Stockholders.

Plumb Balanced Fund

Plumb Equity Fund

ANNUAL REPORT

March 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary or, if you invest directly through the Fund’s transfer agent, U.S. Bank Global Fund Services (the “Transfer Agent”), from the Transfer Agent. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications electronically by contacting your financial intermediary, or, if you invest directly through the Transfer Agent by contacting the Transfer Agent.

You may elect to receive all future reports in paper free of charge by contacting your financial intermediary or, if you invest directly through the Transfer Agent, by contacting the Transfer Agent at (855) 609-3680. Your election to receive reports in paper will apply to all funds held in your account if you invest through a financial intermediary or all funds within the fund complex if you invest directly through the Transfer Agent.

www.plumbfunds.com

PLUMB FUNDS

March 31, 2020

Dear Fellow Shareholders,

The year ending March 31, 2020 was unprecedented in our lifetimes. The first calendar quarter of 2020 included the Dow Jones Industrial Average suffering its worst start of a year in its 124-year history. This decline completely offset the strong stock market returns of the previous year, putting the S&P 500 back to the levels of December 2018. The pandemic and economic shutdowns put all the worlds’ national economies, macro and micro alike, on the same downward spiral.

The response of world governments was quick, as far as government actions can be, and significant. As they shut down economic activity, they also increased both monetary and fiscal stimulus to mitigate the negative consequences of the worldwide shutdown. As we write this, we recognize that all the current Government actions are temporary in nature. Our ability to either live with, contain, or reduce the Covid-19 virus consequences is critical to reducing the cascading effect of this economic collapse. The US Government actions are meant to get us to the other side of the valley. Only a restart to private sector business will keep us from sliding back to the depths.

Though the Plumb Funds benefitted from their overweigh allocation to technology and underweight to energy, materials, and consumer cyclicals, our exposure to financial processing companies that own the receivables (such as American Express, Discover Financial and Wex. Inc) more than offset that benefit as business travel, entertainment and trucking collapsed beyond our expectations. In addition, our healthcare innovation exposure was in companies significantly affected by the shelter at home mandates. This impact was more pronounced in the relative performance of the Equity Fund than of the Balanced Fund as the Fixed Income exposure in the Balanced Fund fared better than that than its peers that relied on some more exotic instruments.

Investors ask when and if this bear market will recover. No one knows the bottom of the stock market until six to nine months after the fact. Only when all eyes are looking forward can we conclusively say that the market bottomed on such-and-such day six months ago and what the catalyst for the recovery was. Markets tend not to bottom until facts, no matter if they are bad or not so bad, replace speculation.

Having said that, the market appears to us to be in a bottoming process given the world that we currently know. We are vulnerable to shocks from here, but generally we should see selective recovery of individual stocks until the whole environment improves. When the news cycle starts to include other topics besides the pandemic, we will probably be amid a market and economic recovery.

So, when we do see a recovery, what should we expect?

Past recessions and bear markets typically resulted from some aspect of economic excesses that exceeded any reasonable economics. What we mean here is the tech bubble (1999), mortgage financial bubble (2007) and inflation and interest rate bubble (1980) all caused capital to rush into these market segments to the extent that we saw Ponzi schemes that required new capital to justify the

3

PLUMB FUNDS

valuations of these investments. These climaxes were then followed by bear markets and by a change in stock leadership for the recovery and ensuing cycle.

This time is different. What aspect of this recession and bear market will interrupt and alter the secular trends fed by the digital transformation? Will people return to the malls at the expense of Amazon? Will they revert to cash as opposed to electronic payments systems? Will companies and individuals stop using the cloud? Will pharmaceutical companies, engineers and architects turn away from artificial intelligence and virtualization?

Many analysts suggest that the next cycle will be led by emerging markets, international stocks in general, value stocks or small caps. We believe they will be wrong. We expect that the successful companies and business models last year will be the successful companies and business models coming out of this crisis.

We believe Amazon and VISA will grow at 2-3 times GNP no matter what the growth rate of the economy; cloud computing will grow even faster, benefitting Amazon, Microsoft and to a lesser extent, Google; Nvidia should be the great enabler; and software as a service, with low capital needs, subscription models will continue to be successful business plans.

For most of us there is no real advantage in trying to bet that we can pick the bottom. Selectively we are adding to some of the names above anticipating the prices we expect to see a year from now. But a green light telling us we are through the worst hasn’t appeared yet.

We hope you; your family, friends and colleagues stay safe through all of this.

Thomas G. Plumb

The Dow Jones Industrial Average is an average of the stock prices of thirty large companies and represents a widely recognized unmanaged portfolio of common stocks.

SPXT-S&P 500 Total Return Index. S&P 500 is an unmanaged index which is widely regarded as the standard for measuring large-cap U.S. stock market performance. Calculated intraday by S&P based on the price changes and reinvested dividends of SPX with a starting date of Jan 4, 1988.

It is not possible to invest directly in an index.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company, and it may be obtained on www.plumbfunds.com or by calling 1-866-987-7888. Read it carefully before investing.

Past performance does not guarantee future results.

4

PLUMB FUNDS

Opinions expressed are those of the author and are subject to change, are not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Earnings growth is the annual rate of growth of earnings from investments.

Mutual fund investing involves risk. Principal loss is possible.

The fund may invest in small and mid-sized companies which involve additional risks such as limited liquidity and greater volatility. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. Because the funds may invest in ETFs, they are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of an ETF’s shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a fund’s ability to sell its shares. The fund may also use options and future contracts, which have the risks of unlimited losses of the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of securities prices, interest rates and currency exchange rates. The investment in options is not suitable for all investors. The Plumb Balanced Fund will invest in debt securities, which typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities.

Diversification does not assure a profit nor protect against loss in a declining market.

Plumb Funds are distributed by Quasar Distributors, LLC, distributor.

5

PLUMB FUNDS

Expense Example

March 31, 2020 (Unaudited)

As a shareholder of the Plumb Funds (the “Funds”), you incur ongoing costs, including investment advisory fees; distribution (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (October 1, 2019 – March 31, 2020).

Actual Expenses

The first line of the table on the following page provides information about actual account values and actual expenses. However, the table does not include shareholder-specific fees such as the $15.00 fee charged for wire redemptions. The table also does not include portfolio trading commissions and related trading costs. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balanced or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees, which, although not charged by the Funds, may be charged by other funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

6

PLUMB FUNDS

Expense Example

March 31, 2020 (Unaudited) (Continued)

Plumb Balanced Fund

| Expenses Paid | |||

| Beginning | Ending | During the Period* | |

| Account Value | Account Value | October 1, 2019 to | |

October 1, 2019 | March 31, 2020 | March 31, 2020 | |

| Actual | $1,000.00 | $ 904.28 | $5.67 |

| Hypothetical | |||

| (5% return per | |||

| year before expenses) | $1,000.00 | $1,019.05 | $6.01 |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.19%, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the partial year period). |

Plumb Equity Fund

| Expenses Paid | |||

| Beginning | Ending | During the Period* | |

| Account Value | Account Value | October 1, 2019 to | |

October 1, 2019 | March 31, 2020 | March 31, 2020 | |

| Actual | $1,000.00 | $ 860.44 | $5.53 |

| Hypothetical | |||

| (5% return per | |||

| year before expenses) | $1,000.00 | $1,019.05 | $6.01 |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.19%, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the partial year period). |

7

PLUMB FUNDS

Plumb Balanced Fund (Unaudited)

Comparison of Change in Value of a Hypothetical $10,000 Investment

from inception of May 24, 2007 to March 31, 2020

Average Annual Rate of Return

Periods ended March 31, 2020

1 Year | 3 Year | 5 Year | 10 Year | Since Inception | |

| Plumb Balanced Fund | -6.27% | 6.27% | 5.74% | 7.16% | 4.42% |

| Bloomberg Barclays | |||||

| Capital Intermediate | |||||

| Government/Credit | |||||

| Bond Index | 6.88% | 3.79% | 2.76% | 3.14% | 3.82% |

| MSCI EAFE Index | -16.84% | -4.54% | -3.35% | -0.16% | -2.79% |

| S&P 500 Index | -6.98% | 5.10% | 6.73% | 10.53% | 6.52% |

| Blended Benchmark | -2.95% | 3.95% | 4.54% | 7.06% | 4.93% |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-866-987-7888.

The line graph and performance table do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers.

The Barclays Capital Intermediate Government/Credit Bond Index is an unmanaged index which includes nonconvertible bonds publicly issued by the U.S. government or its agencies; corporate bonds guaranteed by the U.S. government and quasi-federal corporations; and publicly issued, fixed rate, nonconvertible domestic bonds of companies in industry, public utilities, and finance.

8

PLUMB FUNDS

The MSCI EAFE Index in an index intended to reflect the performance of major developed countries’ international equity markets, besides the United States and Canada.

The Standard & Poor’s 500 Index (S&P 500) is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks.

The Blended Benchmark is made up of 55% S&P 500 Index, 35% Barclays Capital Intermediate Government/Credit Bond Index, and 10% MSCI EAFE Index.

The Fund’s portfolio holdings may differ significantly from the securities held in the relevant index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

9

PLUMB FUNDS

Plumb Equity Fund (Unaudited)

Comparison of Change in Value of a Hypothetical $10,000 Investment

from inception of May 24, 2007 to March 31, 2020

Average Annual Rate of Return

Periods ended March 31, 2020

1 Year | 3 Year | 5 Year | 10 Year | Since Inception | |

| Plumb Equity Fund | -12.07% | 9.26% | 8.51% | 9.19% | 5.30% |

| S&P 500 Index | -6.98% | 5.10% | 6.73% | 10.53% | 6.52% |

| MSCI EAFE Index | -16.84% | -4.54% | -3.35% | -0.16% | -2.79% |

| Blended Benchmark | -8.00% | 4.12% | 5.71% | 9.44% | 5.58% |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-866-987-7888.

The line graph and performance table do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers.

The Standard & Poor’s 500 Index (S&P 500) is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks.

The MSCI EAFE Index in an index intended to reflect the performance of major developed countries’ international equity markets, besides the United States and Canada.

The Blended Benchmark is made up of 90% S&P 500 Index and 10% MSCI EAFE Index.

The Fund’s portfolio holdings may differ significantly from the securities held in the relevant index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

10

PLUMB FUNDS

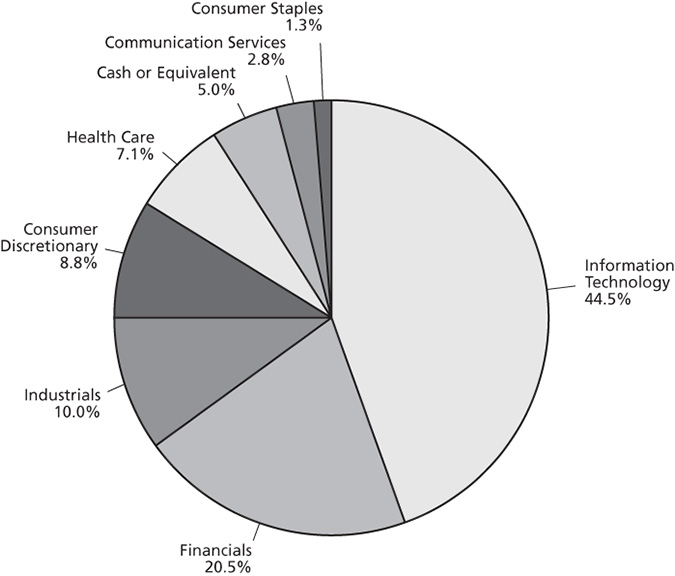

Plumb Balanced Fund

Investments by Industry Sector as of March 31, 2020

(as a Percentage of Total Investments) (Unaudited)

11

PLUMB FUNDS

Plumb Balanced Fund

Investments by Asset Allocation as of March 31, 2020

(as a Percentage of Total Investments) (Unaudited)

12

PLUMB FUNDS

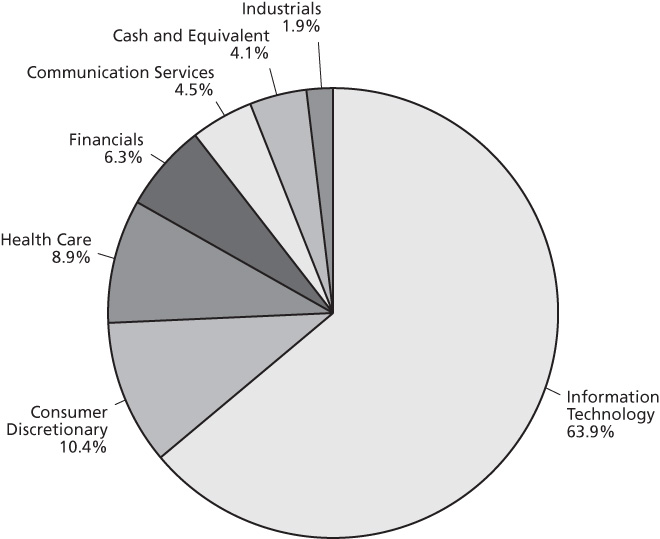

Plumb Equity Fund

Investments by Industry Sector as of March 31, 2020

(as a Percentage of Total Investments) (Unaudited)

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

13

PLUMB FUNDS

Plumb Balanced Fund

Schedule of Investments – March 31, 2020

| Shares | Value | |||||||

| COMMON STOCKS – 60.47% | ||||||||

| Banks – 1.87% | ||||||||

| JPMorgan Chase & Co. | 20,000 | $ | 1,800,600 | |||||

| Capital Goods – 0.68% | ||||||||

| Raytheon Co. | 5,000 | 655,750 | ||||||

| Diversified Financials – 3.75% | ||||||||

| American Express Co. | 23,000 | 1,969,030 | ||||||

| Discover Financial Services | 46,000 | 1,640,820 | ||||||

| 3,609,850 | ||||||||

| Health Care Equipment & Services – 2.13% | ||||||||

| Guardant Health, Inc. (a) | 15,000 | 1,044,000 | ||||||

| Stryker Corp. | 6,000 | 998,940 | ||||||

| 2,042,940 | ||||||||

| Media & Entertainment – 2.78% | ||||||||

| Alphabet, Inc. – Class A (a) | 1,900 | 2,207,705 | ||||||

| Alphabet, Inc. – Class C (a) | 400 | 465,124 | ||||||

| 2,672,829 | ||||||||

| Pharmaceuticals, Biotechnology | ||||||||

| & Life Sciences – 2.00% | ||||||||

| Ardelyx, Inc. (a) | 82,500 | 469,012 | ||||||

| Exact Sciences Corp. (a) | 25,000 | 1,450,000 | ||||||

| 1,919,012 | ||||||||

| Retailing – 7.30% | ||||||||

| Alibaba Group Holding Ltd. – ADR (a)(b) | 16,800 | 3,267,264 | ||||||

| Amazon.com, Inc. (a) | 1,550 | 3,022,066 | ||||||

| MercadoLibre, Inc. (a) | 1,500 | 732,870 | ||||||

| 7,022,200 | ||||||||

| Semiconductors & Semiconductor Equipment – 4.30% | ||||||||

| Microchip Technology, Inc. | 26,000 | 1,762,800 | ||||||

| NVIDIA Corp. | 9,000 | 2,372,400 | ||||||

| 4,135,200 | ||||||||

| Software & Services – 33.54% | ||||||||

| Adobe, Inc. (a) | 9,000 | 2,864,160 | ||||||

| ANSYS, Inc. (a) | 7,000 | 1,627,290 | ||||||

| Autodesk, Inc. (a) | 16,000 | 2,497,600 | ||||||

| Coupa Software, Inc. (a) | 7,500 | 1,047,975 | ||||||

The accompanying notes are an integral part of these financial statements.

14

PLUMB FUNDS

Plumb Balanced Fund

Schedule of Investments – March 31, 2020 (Continued)

| Shares | Value | |||||||

| COMMON STOCKS (Continued) | ||||||||

| Software & Services (Continued) | ||||||||

| Dassault Systemes SE – ADR (b) | 13,000 | $ | 1,924,000 | |||||

| Fiserv, Inc. (a) | 25,000 | 2,374,750 | ||||||

| FleetCor Technologies, Inc. (a) | 9,000 | 1,678,860 | ||||||

| Mastercard, Inc. – Class A | 14,500 | 3,502,620 | ||||||

| Microsoft Corp. | 23,000 | 3,627,330 | ||||||

| PayPal Holdings, Inc. (a) | 20,000 | 1,914,800 | ||||||

| Salesforce.com, Inc. (a) | 11,000 | 1,583,780 | ||||||

| Tyler Technologies, Inc. (a) | 7,550 | 2,239,028 | ||||||

| Visa, Inc. – Class A | 21,000 | 3,383,520 | ||||||

| WEX, Inc. (a) | 19,000 | 1,986,450 | ||||||

| 32,252,163 | ||||||||

| Technology Hardware & Equipment – 2.12% | ||||||||

| Apple, Inc. | 8,000 | 2,034,320 | ||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $53,345,955) | 58,144,864 | |||||||

| Principal | ||||||||

| Amount | ||||||||

| CORPORATE BONDS – 34.17% | ||||||||

| Air Freight & Logistics – 1.05% | ||||||||

| United Parcel Service, Inc. | ||||||||

| 3.13%, 01/15/2021 | $ | 1,000,000 | 1,007,424 | |||||

| Auto Components – 0.53% | ||||||||

| Toyota Industries Corp. (b) | ||||||||

| 3.11%, 03/12/2022 | 500,000 | 506,014 | ||||||

| Banks – 10.76% | ||||||||

| Bank of America Corp. | ||||||||

| 2.30%, (3 Month LIBOR USB +1.16%) | ||||||||

| 01/20/2023 (c) | 1,000,000 | 956,788 | ||||||

| BAC Capital Trust XIII | ||||||||

| 4.00%, (3 Month LIBOR USB +0.40%) | �� | |||||||

| 12/29/2049 (c) | 1,200,000 | 938,094 | ||||||

| Bank of the Ozarks, Inc. | ||||||||

| 5.50%, (6 Month LIBOR USB +4.43%) | ||||||||

| 07/01/2026 (c) | 1,305,000 | 1,304,713 | ||||||

The accompanying notes are an integral part of these financial statements.

15

PLUMB FUNDS

Plumb Balanced Fund

Schedule of Investments – March 31, 2020 (Continued)

| Principal | ||||||||

| Amount | Value | |||||||

| CORPORATE BONDS (Continued) | ||||||||

| Banks (Continued) | ||||||||

| Citigroup, Inc. | ||||||||

| 2.79%, (3 Month LIBOR USB +1.10%) 05/17/2024 (c) | $ | 1,500,000 | $ | 1,433,649 | ||||

| 4.70%, (6 Month LIBOR USB +3.23%) 01/30/2169 (c) | 600,000 | 515,085 | ||||||

| 3.14%, (3 Month LIBOR USB +1.35%) 04/25/2024 (c) | 500,000 | 504,146 | ||||||

| Home BancShares, Inc. | ||||||||

| 5.63%, (6 Month LIBOR USB +3.58%) 04/15/2027 (c) | 2,045,000 | 2,103,489 | ||||||

| JPMorgan Chase & Co. | ||||||||

| 6.75%, (6 Month LIBOR USB +3.78%) 01/29/2050 (c) | 2,000,000 | 2,091,390 | ||||||

| Pinnacle Financial Partners, Inc. | ||||||||

| 4.13%, (6 Month LIBOR USB +2.78%) 09/15/2029 (c) | 500,000 | 494,027 | ||||||

| 10,341,381 | ||||||||

| Capital Goods – 4.56% | ||||||||

| Carlisle Cos., Inc. | ||||||||

| 3.50%, 12/01/2024 | 500,000 | 483,418 | ||||||

| General Electric Co. | ||||||||

| 1.74%, (3 Month LIBOR USB +1.00%) 03/15/2023 (c) | 1,000,000 | 931,198 | ||||||

| Lockheed Martin Corp. | ||||||||

| 2.50%, 11/23/2020 | 1,772,000 | 1,780,794 | ||||||

| Owens Corning | ||||||||

| 4.20%, 12/15/2022 | 1,200,000 | 1,193,306 | ||||||

| 4,388,716 | ||||||||

| Diversified Financials – 0.96% | ||||||||

| Goldman Sachs Group Inc. | ||||||||

| 3.07%, (3 Month LIBOR USB +1.70%) 04/05/2026 (c) | 1,000,000 | 926,184 | ||||||

| Food, Beverage & Tobacco – 1.28% | ||||||||

| The Coca-Cola Co. | ||||||||

| 2.20%, 05/25/2022 | 820,000 | 831,868 | ||||||

| PepsiCo, Inc. | ||||||||

| 1.90%, (3 Month LIBOR USB +0.53%) 10/06/2021 (c) | 410,000 | 400,378 | ||||||

| 1,232,246 | ||||||||

| Health Care Equipment & Services – 0.27% | ||||||||

| CVS Pass-Through Trust | ||||||||

| 6.94%, 01/10/2030 | 208,347 | 259,676 | ||||||

The accompanying notes are an integral part of these financial statements.

16

PLUMB FUNDS

Plumb Balanced Fund

Schedule of Investments – March 31, 2020 (Continued)

| Principal | ||||||||

| Amount | Value | |||||||

| CORPORATE BONDS (Continued) | ||||||||

| Insurance – 1.69% | ||||||||

| Fidelity National Financial, Inc. | ||||||||

| 5.50%, 09/01/2022 | $ | 1,000,000 | $ | 1,099,095 | ||||

| Old Republic International Corp. | ||||||||

| 4.88%, 10/01/2024 | 500,000 | 528,971 | ||||||

| 1,628,066 | ||||||||

| Pharmaceuticals, Biotechnology & Life Sciences – 2.67% | ||||||||

| Amgen, Inc. | ||||||||

| 3.63%, 05/15/2022 | 1,250,000 | 1,296,857 | ||||||

| Bio-Rad Laboratories, Inc. | ||||||||

| 4.88%, 12/15/2020 | 1,250,000 | 1,267,840 | ||||||

| 2,564,697 | ||||||||

| Retailing – 0.94% | ||||||||

| Amazon.com, Inc. | ||||||||

| 1.90%, 08/21/2020 | 900,000 | 899,709 | ||||||

| Semiconductors & Semiconductor Equipment – 1.25% | ||||||||

| Intel Corp. | ||||||||

| 1.70%, 05/19/2021 | 1,200,000 | 1,200,445 | ||||||

| Technology Hardware & Equipment – 3.17% | ||||||||

| Apple, Inc. | ||||||||

| 2.25%, 02/23/2021 | 400,000 | 404,145 | ||||||

| FLIR Systems, Inc. | ||||||||

| 3.13%, 06/15/2021 | 1,405,000 | 1,407,091 | ||||||

| Motorola Solutions, Inc. | ||||||||

| 4.00%, 09/01/2024 | 1,250,000 | 1,239,924 | ||||||

| 3,051,160 | ||||||||

| Transportation – 3.64% | ||||||||

| Burlington Northern Santa Fe LLC | ||||||||

| 4.10%, 06/01/2021 | 1,645,000 | 1,679,434 | ||||||

| 3.45%, 09/15/2021 | 996,000 | 1,012,695 | ||||||

| Union Pacific Corp. | ||||||||

| 3.20%, 06/08/2021 | 800,000 | 808,060 | ||||||

| 3,500,189 | ||||||||

The accompanying notes are an integral part of these financial statements.

17

PLUMB FUNDS

Plumb Balanced Fund

Schedule of Investments – March 31, 2020 (Continued)

| Principal | ||||||||

| Amount | Value | |||||||

| CORPORATE BONDS (Continued) | ||||||||

| Thrifts & Mortgage Finance – 1.40% | ||||||||

| Flagstar Bancorp, Inc. | ||||||||

| 6.13%, 07/15/2021 | $ | 1,333,000 | $ | 1,341,274 | ||||

| TOTAL CORPORATE BONDS | ||||||||

| (Cost $33,470,665) | 32,847,181 | |||||||

| US GOVERNMENT & AGENCY ISSUES – 1.06% | ||||||||

| U.S. Treasury Notes – 1.06% | ||||||||

| 1.50%, 09/30/2021 | 1,000,000 | 1,019,629 | ||||||

| TOTAL US GOVERNMENT & AGENCY ISSUES | ||||||||

| (Cost $1,000,000) | 1,019,629 | |||||||

| Shares | ||||||||

| SHORT TERM INVESTMENTS – 3.97% | ||||||||

| Money Market Fund – 3.97% | ||||||||

| First American Government Obligations Fund – | ||||||||

| Class X – 0.45% (d) | 3,813,042 | 3,813,042 | ||||||

| TOTAL SHORT TERM INVESTMENTS | ||||||||

| (Cost $3,813,042) | 3,813,042 | |||||||

| Total Investments (Cost $91,629,662) – 99.67% | 95,824,716 | |||||||

| Other Assets in Excess of Liabilities – 0.33% | 323,526 | |||||||

| TOTAL NET ASSETS – 100.00% | $ | 96,148,242 | ||||||

Percentages are stated as a percent of net assets.

ADR – American Depositary Receipt

PLC – Public Limited Company

| (a) | Non-income producing security. |

| (b) | Foreign issued security. Foreign concentration is as follows: Cayman Islands: 3.40%, France: 2.00%, Japan: 0.53%. |

| (c) | Variable or Floating rate security based on a reference index and spread. The rate listed is as of March 31, 2020. |

| (d) | Rate shown is the 7-day effective yield. |

The accompanying notes are an integral part of these financial statements.

18

PLUMB FUNDS

Plumb Equity Fund

Schedule of Investments – March 31, 2020

| Shares | Value | |||||||

| COMMON STOCKS – 95.81% | ||||||||

| Commercial & Professional Services – 1.87% | ||||||||

| Copart, Inc. (a) | 8,500 | $ | 582,420 | |||||

| Diversified Financials – 6.25% | ||||||||

| American Express Co. | 13,500 | 1,155,735 | ||||||

| Discover Financial Services | 22,000 | 784,740 | ||||||

| 1,940,475 | ||||||||

| Health Care Equipment & Services – 4.90% | ||||||||

| Guardant Health, Inc. (a) | 11,100 | 772,560 | ||||||

| Stryker Corp. | 4,500 | 749,205 | ||||||

| 1,521,765 | ||||||||

| IT Services – 25.88% | ||||||||

| Fiserv, Inc. (a) | 11,500 | 1,092,385 | ||||||

| FleetCor Technologies, Inc. (a) | 5,250 | 979,335 | ||||||

| Mastercard, Inc. – Class A | 7,500 | 1,811,700 | ||||||

| PayPal Holdings, Inc. (a) | 14,000 | 1,340,360 | ||||||

| Visa, Inc. – Class A | 11,950 | 1,925,384 | ||||||

| WEX, Inc. (a) | 8,500 | 888,675 | ||||||

| 8,037,839 | ||||||||

| Media & Entertainment – 4.49% | ||||||||

| Alphabet, Inc. – Class A (a) | 1,200 | 1,394,340 | ||||||

| Pharmaceuticals, Biotechnology | ||||||||

| & Life Sciences – 3.99% | ||||||||

| Ardelyx, Inc. (a) | 75,000 | 426,375 | ||||||

| Exact Sciences Corp. (a) | 14,000 | 812,000 | ||||||

| 1,238,375 | ||||||||

| Retailing – 10.35% | ||||||||

| Alibaba Group Holding Ltd. – ADR (a)(b) | 7,000 | 1,361,360 | ||||||

| Amazon.com, Inc. (a) | 700 | 1,364,804 | ||||||

| MercadoLibre, Inc. (a) | 1,000 | 488,580 | ||||||

| 3,214,744 | ||||||||

| Semiconductors & Semiconductor Equipment – 6.27% | ||||||||

| Microchip Technology, Inc. | 12,000 | 813,600 | ||||||

| NVIDIA Corp. | 4,300 | 1,133,480 | ||||||

| 1,947,080 | ||||||||

The accompanying notes are an integral part of these financial statements.

19

PLUMB FUNDS

Plumb Equity Fund

Schedule of Investments – March 31, 2020 (Continued)

| Shares | Value | |||||||

| COMMON STOCKS (Continued) | ||||||||

| Software – 29.35% | ||||||||

| Adobe, Inc. (a) | 5,500 | $ | 1,750,320 | |||||

| ANSYS, Inc. (a) | 3,250 | 755,528 | ||||||

| Autodesk, Inc. (a) | 9,500 | 1,482,950 | ||||||

| Coupa Software, Inc. (a) | 3,000 | 419,190 | ||||||

| Dassault Systemes SE – ADR (b) | 8,000 | 1,184,000 | ||||||

| Microsoft Corp. | 12,000 | 1,892,520 | ||||||

| Tyler Technologies, Inc. (a) | 5,500 | 1,631,080 | ||||||

| 9,115,588 | ||||||||

| Technology Hardware & Equipment – 2.46% | ||||||||

| Apple, Inc. | 3,000 | 762,870 | ||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $23,818,517) | 29,755,496 | |||||||

| SHORT TERM INVESTMENTS – 4.06% | ||||||||

| Money Market Fund – 4.06% | ||||||||

| First American Government Obligations Fund – | ||||||||

| Class X – 0.45% (c) | 1,260,956 | 1,260,956 | ||||||

| TOTAL SHORT TERM INVESTMENTS | ||||||||

| (Cost $1,260,956) | 1,260,956 | |||||||

| Total Investments (Cost $25,079,473) – 99.87% | 31,016,452 | |||||||

| Other Assets in Excess of Liabilities – 0.13% | 39,436 | |||||||

| TOTAL NET ASSETS – 100.00% | $ | 31,055,888 | ||||||

Percentages are stated as a percent of net assets.

ADR – American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | Foreign issued security. Foreign concentration is as follows: Cayman Islands: 4.38%, France: 3.81%. |

| (c) | Rate shown is the 7-day effective yield. |

The accompanying notes are an integral part of these financial statements.

20

PLUMB FUNDS

Statements of Assets and Liabilities

March 31, 2020

| Plumb | Plumb | |||||||

| Balanced | Equity | |||||||

| Fund | Fund | |||||||

| Assets | ||||||||

| Investments, at value* | $ | 95,824,716 | $ | 31,016,452 | ||||

| Dividends and interest receivable | 315,935 | 2,988 | ||||||

| Receivable for fund shares sold | 132,915 | 65,399 | ||||||

| Receivable from Adviser (a) | — | 326 | ||||||

| Prepaid assets | 53,816 | 21,576 | ||||||

| Other assets | — | — | ||||||

| Total Assets | 96,327,382 | 31,106,741 | ||||||

| Liabilities | ||||||||

| Payable to Adviser (a) | 33,558 | — | ||||||

| Accrued distribution fee | — | 8,976 | ||||||

| Accrued audit expense | 12,996 | 12,999 | ||||||

| Administrative & accounting | ||||||||

| services fee payable | 16,329 | 10,099 | ||||||

| Accrued transfer agent fees and expenses | 10,473 | 7,258 | ||||||

| Accrued legal fees | — | 7,280 | ||||||

| Accrued printing and mailing fees | 7,405 | 2,917 | ||||||

| Payable for funds shares redeemed | 95,018 | — | ||||||

| Payable to directors | 342 | 116 | ||||||

| Accrued expenses and other liabilities | 3,019 | 1,208 | ||||||

| Total Liabilities | 179,140 | 50,853 | ||||||

| Net Assets | $ | 96,148,242 | $ | 31,055,888 | ||||

| Net Assets Consist Of: | ||||||||

| Paid in Capital | 92,153,401 | 24,329,348 | ||||||

| Total distributable earnings | 3,994,841 | 6,726,540 | ||||||

| Net Assets | $ | 96,148,242 | $ | 31,055,888 | ||||

| Capital shares outstanding, $0.001 par value | ||||||||

| (200 million shares issued each) | 3,393,722 | 1,299,583 | ||||||

| Net asset value, offering and | ||||||||

| redemption price per share | $ | 28.33 | $ | 23.90 | ||||

| * Cost of Investments | $ | 91,629,662 | $ | 25,079,473 | ||||

(a) See Note 4 in the Notes to Financial Statements.

The accompanying notes are an integral part of these financial statements.

21

PLUMB FUNDS

Statements of Operations

For the Fiscal Year Ended March 31, 2020

| Plumb | Plumb | |||||||

| Balanced | Equity | |||||||

| Fund | Fund | |||||||

| Investment Income: | ||||||||

| Dividend income (Net of foreign withholding | ||||||||

| taxes of $18,797 and $928, respectively) | $ | 621,335 | $ | 178,350 | ||||

| Interest | 1,348,454 | 14,829 | ||||||

| Total Investment Income | 1,969,789 | 193,179 | ||||||

| Expenses: | ||||||||

| Investment advisor’s fee (a) | 723,295 | 255,717 | ||||||

| Distribution fees | 262,449 | 86,477 | ||||||

| Fund administration and accounting fees | 98,401 | 61,694 | ||||||

| Transfer agent fees and expenses | 61,762 | 41,349 | ||||||

| Registration fees | 41,617 | 30,720 | ||||||

| Director fees and expenses | 38,115 | 13,650 | ||||||

| Legal fees | 31,218 | 37,914 | ||||||

| Insurance expense | 22,450 | 7,904 | ||||||

| Printing and mailing expense | 17,214 | 5,288 | ||||||

| Audit and tax fees | 16,497 | 16,497 | ||||||

| Custody fees | 8,405 | 6,941 | ||||||

| Total expenses before waiver/recoupment | 1,321,423 | 564,151 | ||||||

| Less: Fees waived/reimbursed | ||||||||

| and/or recouped by Advisor (a) | 2,764 | (95,993 | ) | |||||

| Net expenses | 1,324,187 | 468,158 | ||||||

| Net Investment Income (Loss) | 645,602 | (274,979 | ) | |||||

| Realized and Unrealized Gain (Loss): | ||||||||

| Net realized gain/(loss) on investments | (201,279 | ) | 1,425,860 | |||||

| Net realized loss on foreign | ||||||||

| currency translation | (492 | ) | — | |||||

| Net change in unrealized | ||||||||

| depreciation on investments | (8,109,086 | ) | (5,470,975 | ) | ||||

| Net realized loss on investments | (8,310,857 | ) | (4,045,115 | ) | ||||

| Net Decrease in Net Assets | ||||||||

| Resulting from Operations | $ | (7,665,255 | ) | $ | (4,320,094 | ) | ||

(a) See Note 4 in the Notes to the Financial Statements

The accompanying notes are an integral part of these financial statements.

22

PLUMB FUNDS

Plumb Balanced Fund

Statements of Changes in Net Assets

| For the | For the | |||||||

| Year Ended | Year Ended | |||||||

| March 31, | March 31, | |||||||

| 2020 | 2019 | |||||||

| Operations: | ||||||||

| Net investment income | $ | 645,602 | $ | 521,368 | ||||

| Net realized gain/(loss) on investments | (201,279 | ) | 2,921,662 | |||||

| Net realized loss on foreign | ||||||||

| currency translation | (492 | ) | (240 | ) | ||||

| Net change in unrealized appreciation/ | ||||||||

| (depreciation) on investments | (8,109,086 | ) | 2,146,680 | |||||

| Net increase/(decrease) in net assets | ||||||||

| resulting from operations | (7,665,255 | ) | 5,589,470 | |||||

| Dividends And Distributions To Shareholders: | ||||||||

| Net dividends and distributions | (2,794,939 | ) | (1,306,126 | ) | ||||

| Total dividends and distributions | (2,794,939 | ) | (1,306,126 | ) | ||||

| Capital Share Transactions: | ||||||||

| Proceeds from shares sold | 50,940,980 | 82,189,718 | ||||||

| Shares issued in reinvestment of dividends | 2,460,902 | 1,271,329 | ||||||

| Cost of shares redeemed | (43,932,544 | ) | (35,327,559 | ) | ||||

| Net increase in net assets | ||||||||

| from capital share transactions | 9,469,338 | 48,133,488 | ||||||

| Total increase/(decrease) in net assets | (990,856 | ) | 52,416,832 | |||||

| Net Assets: | ||||||||

| Beginning of year | 97,139,098 | 44,722,266 | ||||||

| End of year | $ | 96,148,242 | $ | 97,139,098 | ||||

| Change in Shares Outstanding: | ||||||||

| Shares sold | 1,584,010 | 2,712,518 | ||||||

| Shares issued in reinvestment of dividends | 75,257 | 45,453 | ||||||

| Shares redeemed | (1,401,044 | ) | (1,177,144 | ) | ||||

| Net increase | 258,223 | 1,580,827 | ||||||

The accompanying notes are an integral part of these financial statements.

23

PLUMB FUNDS

Plumb Equity Fund

Statements of Changes in Net Assets

| For the | For the | |||||||

| Year Ended | Year Ended | |||||||

| March 31, | March 31, | |||||||

| 2020 | 2019 | |||||||

| Operations: | ||||||||

| Net investment loss | $ | (274,979 | ) | $ | (223,582 | ) | ||

| Net realized gain on investments | 1,425,860 | 3,422,574 | ||||||

| Net change in unrealized appreciation/ | ||||||||

| (depreciation) on investments | (5,470,975 | ) | 525,492 | |||||

| Net increase/(decrease) in net assets | ||||||||

| resulting from operations | (4,320,094 | ) | 3,724,484 | |||||

| Dividends And Distributions To Shareholders: | ||||||||

| Net dividends and distributions | (1,654,811 | ) | (4,161,974 | ) | ||||

| Total dividends and distributions | (1,654,811 | ) | (4,161,974 | ) | ||||

| Capital Share Transactions: | ||||||||

| Proceeds from shares sold | 6,139,788 | 14,231,675 | ||||||

| Shares issued in reinvestment of dividends | 1,321,110 | 4,161,274 | ||||||

| Cost of shares redeemed | (8,017,246 | ) | (10,008,969 | ) | ||||

| Net increase/(decrease) in net assets | ||||||||

| from capital share transactions | (556,348 | ) | 8,383,980 | |||||

| Total increase/(decrease) in net assets | (6,531,253 | ) | 7,946,490 | |||||

| Net Assets: | ||||||||

| Beginning of year | 37,587,141 | 29,640,651 | ||||||

| End of year | $ | 31,055,888 | $ | 37,587,141 | ||||

| Change in Shares Outstanding: | ||||||||

| Shares sold | 211,555 | 470,058 | ||||||

| Shares issued in reinvestment of dividends | 44,738 | 171,316 | ||||||

| Shares redeemed | (282,501 | ) | (345,610 | ) | ||||

| Net increase/(decrease) | (26,208 | ) | 295,764 | |||||

The accompanying notes are an integral part of these financial statements.

24

PLUMB FUNDS

(This Page Intentionally Left Blank.)

25

PLUMB FUNDS

Plumb Balanced Fund

Financial Highlights

Per share operating performance

(For a share outstanding throughout the year)

Net asset value, beginning of year

Operations:

Net investment income(1)

Net realized and unrealized gain (loss)

Total from investment operations

Dividends and distributions to shareholders:

Dividends from net investment income

Distributions from net realized gains

Total dividends and distributions

Change in net asset value for the year

Net asset value, end of year

Total return(2)

Ratios / supplemental data

Net assets, end of year (000)

Ratio of net expenses to average net assets:

Before expense reimbursement and waivers/recoupment

After expense reimbursement and waivers/recoupment(3)

Ratio of net investment income to average net assets:

After expense reimbursement and waivers/recoupment(3)

Portfolio turnover rate

| (1) | Net investment income per share is calculated using current year ending balances prior to consideration of adjustment for permanent book and tax differences. |

| (2) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (3) | Effective December 1, 2017, the Advisor contractually agreed to cap the Funds expenses at 1.19%. Prior to December 1, 2017, the Fund’s expense cap was 1.30%. |

The accompanying notes are an integral part of these financial statements.

26

PLUMB FUNDS

Plumb Balanced Fund

Financial Highlights (Continued)

| For the Years Ended March 31, | ||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||

| $ | 30.98 | $ | 28.77 | $ | 24.75 | $ | 21.69 | $ | 22.75 | |||||||||

| 0.17 | 0.16 | 0.15 | 0.13 | 0.15 | ||||||||||||||

| (2.01 | ) | 2.51 | 4.05 | 3.05 | (1.05 | ) | ||||||||||||

| (1.84 | ) | 2.67 | 4.20 | 3.18 | (0.90 | ) | ||||||||||||

| (0.15 | ) | — | (0.18 | ) | (0.12 | ) | (0.16 | ) | ||||||||||

| (0.66 | ) | (0.46 | ) | — | — | — | ||||||||||||

| (0.81 | ) | (0.46 | ) | (0.18 | ) | (0.12 | ) | (0.16 | ) | |||||||||

| (2.65 | ) | 2.21 | 4.02 | 3.06 | (1.06 | ) | ||||||||||||

| $ | 28.33 | $ | 30.98 | $ | 28.77 | $ | 24.75 | $ | 21.69 | |||||||||

| -6.27 | % | 9.47 | % | 16.98 | % | 14.70 | % | -3.98 | % | |||||||||

| $ | 96,148 | $ | 97,139 | $ | 44,722 | $ | 33,281 | $ | 32,229 | |||||||||

| 1.19 | % | 1.18 | % | 1.50 | % | 1.68 | % | 1.65 | % | |||||||||

| 1.19 | % | 1.19 | % | 1.26 | % | 1.28 | % | 1.25 | % | |||||||||

| 0.58 | % | 0.66 | % | 0.57 | % | 0.56 | % | 0.65 | % | |||||||||

| 52 | % | 58 | % | 37 | % | 29 | % | 52 | % | |||||||||

The accompanying notes are an integral part of these financial statements.

27

PLUMB FUNDS

Plumb Equity Fund

Financial Highlights

Per share operating performance

(For a share outstanding throughout the year)

Net asset value, beginning of year

Operations:

Net investment loss(1)

Net realized and unrealized gain (loss)

Total from investment operations

Dividends and distributions to shareholders:

Dividends from net investment income

Distributions from net realized gains

Total dividends and distributions

Change in net asset value for the year

Net asset value, end of year

Total return(3)

Ratios / supplemental data

Net assets, end of year (000)

Ratio of net expenses to average net assets:

Before expense reimbursement and waivers

After expense reimbursement and waivers(4)

Ratio of net investment loss to average net assets:

After expense reimbursement and waivers(4)

Portfolio turnover rate

| (1) | Net investment loss per share is calculated using current year ending balances prior to consideration of adjustment for permanent book and tax differences. |

| (2) | Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share transactions for the period. |

| (3) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (4) | Effective December 1, 2017, the Advisor contractually agreed to cap the Funds expenses at 1.19%. Prior to December 1, 2017, the Fund’s expense cap was 1.45%. |

The accompanying notes are an integral part of these financial statements.

28

PLUMB FUNDS

Plumb Equity Fund

Financial Highlights (Continued)

| For the Years Ended March 31, | ||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||

| $ | 28.35 | $ | 28.78 | $ | 24.70 | $ | 20.40 | $ | 24.26 | |||||||||

| (0.21 | ) | (0.17 | ) | (0.21 | ) | (0.15 | ) | (0.10 | ) | |||||||||

| (2.97 | ) | 3.23 | 7.84 | (2) | 4.69 | (1.16 | ) | |||||||||||

| (3.18 | ) | 3.06 | 7.63 | 4.54 | (1.26 | ) | ||||||||||||

| — | — | — | — | — | ||||||||||||||

| (1.27 | ) | (3.49 | ) | (3.55 | ) | (0.24 | ) | (2.60 | ) | |||||||||

| (1.27 | ) | (3.49 | ) | (3.55 | ) | (0.24 | ) | (2.60 | ) | |||||||||

| (4.45 | ) | (0.43 | ) | 4.08 | 4.30 | (3.86 | ) | |||||||||||

| $ | 23.90 | $ | 28.35 | $ | 28.78 | $ | 24.70 | $ | 20.40 | |||||||||

| -12.07 | % | 12.67 | % | 31.65 | % | 22.38 | % | -5.76 | % | |||||||||

| $ | 31,056 | $ | 37,587 | $ | 29,641 | $ | 23,533 | $ | 21,423 | |||||||||

| 1.43 | % | 1.44 | % | 1.68 | % | 1.86 | % | 1.82 | % | |||||||||

| 1.19 | % | 1.19 | % | 1.36 | % | 1.43 | % | 1.40 | % | |||||||||

| -0.70 | % | -0.63 | % | -0.79 | % | -0.74 | % | -0.48 | % | |||||||||

| 46 | % | 64 | % | 69 | % | 18 | % | 41 | % | |||||||||

The accompanying notes are an integral part of these financial statements.

29

PLUMB FUNDS

Notes to Financial Statements

March 31, 2020

| 1. | ORGANIZATION |

Wisconsin Capital Funds, Inc. (the “Company”), also referred to as the “Plumb Funds”, is registered under the Investment Company Act of 1940 (the “1940 Act”) as an open-end, diversified management investment company. The Company was organized as a Maryland corporation on April 3, 2007. The Company is authorized to issue up to 2 billion shares, which are units of beneficial interest with a $0.001 par value. The Company currently offers shares of two series, each with its own investment strategy and risk/reward profile: the Plumb Balanced Fund and the Plumb Equity Fund (individually a “Fund”, collectively the “Funds”). The investment objective of the Plumb Balanced Fund is high total return through capital appreciation while attempting to preserve principal, with current income as a secondary objective. The investment objective of the Plumb Equity Fund is long-term capital appreciation. Wisconsin Capital Management, LLC (the “Advisor”) serves as the Funds’ investment advisor. As of December 31, 2014, the Advisor is owned by TGP, Inc. The Advisor is controlled by Thomas G. Plumb indirectly through TGP, Inc. Certain directors or officers of the Funds are also officers of the Advisor.

| 2. | SIGNIFICANT ACCOUNTING POLICES |

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services – Investment Companies.

In August 2018, FASB issued ASU 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”). The primary focus of ASU 2018-13 is to improve the effectiveness of the disclosure requirements for fair value measurements. The changes affect all companies that are required to include fair value measurement disclosures. In general, the amendments in ASU 2018-13 are effective for all entities for fiscal years and interim periods within those fiscal years, beginning after December 15, 2019. An entity is permitted to early adopt the removed or modified disclosures upon the issuance of ASU 2018-13 and may delay adoption of the additional disclosures, which are required for public companies only, until their effective date. The Funds have early adopted this standard effective March 31, 2019, and the changes are incorporated into the financial statements.

In March 2017, the FASB issued 2017-08, Receivables – Nonrefundable Fees and Other Costs (Subtopic 310-20): Premium Amortization on Purchased Callable Debt Securities (“ASU 2017-08”). The amendments in the ASU 2017-08 shorten the amortization period for certain callable debt securities, held at a premium, to be

30

PLUMB FUNDS

Notes to Financial Statements

March 31, 2020 (Continued)

amortized to the earliest call date. The ASU 2017-08 does not require an accounting change for securities held at a discount; which continues to be amortized to maturity. The ASU 2017-08 is effective for fiscal years and interim periods within those fiscal years beginning after December 15, 2018. Management has assessed these changes and adopted ASU 2017-08 and concluded these changes do not have a material impact on the Fund's financial statements.

Security Valuation:

The Funds have adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the year. These inputs are summarized in the three broad levels listed below.

| Level 1 – | quoted prices in active markets for identical securities | |

| Level 2 – | other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) | |

| Level 3 – | significant unobservable inputs (including the Funds’ own assumptions in determining far value of investments) |

Equity securities, including domestic common stocks and foreign issued common stocks, are valued at the last sale price reported by the exchange on which the securities are primarily traded on the day of valuation. Nasdaq-listed securities are valued at their Nasdaq Official Closing Price. Equity securities not traded on a listed exchange or not traded using Nasdaq are valued as of the last sale price at the close of the U.S. market. If there are no sales on a given day for securities traded on an exchange, the latest bid quotation will be used. These securities will generally be classified as Level 1 securities.

Investments in mutual funds, including money market funds, are generally priced at the ending net asset value (NAV) provided by the service agent of the Funds and will be classified as Level 1 securities.

Debt securities such as corporate bonds and preferred securities are valued using a market approach based on information supplied by independent pricing services. The market inputs used by the independent pricing service include: benchmark yields, reported trades, broker/dealer quotes, issuer spreads, two sided markets, benchmark securities, bids, offers, and reference data including market research publications. Debt securities with remaining maturities of 60 days or less may be valued on an amortized cost basis, which involves valuing an instrument at its cost and thereafter assuming a constant amortization to maturity of any discount or premium, regardless of the impact of fluctuating rates on the fair value of the instrument. To the extent the inputs are observable and timely, these debt securities will generally be classified as Level 2 securities.

31

PLUMB FUNDS

Notes to Financial Statements

March 31, 2020 (Continued)

Any securities or other assets for which market quotations are not readily available are valued at fair value as determined in good faith by the Advisor pursuant to procedures established under the general supervision and responsibility of the Funds’ Board of Directors and will be classified as Level 3 securities.

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The following is a summary of the inputs used, as of March 31, 2020, to value the Funds’ investments carried at fair value:

Description | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Plumb Balanced Fund | ||||||||||||||||

| Investments in: | ||||||||||||||||

| Common Stocks* | $ | 58,144,864 | $ | — | $ | — | $ | 58,144,864 | ||||||||

| Corporate Bonds* | — | 32,847,181 | — | 32,847,181 | ||||||||||||

| Government Securities | ||||||||||||||||

| & Agency Issues* | — | 1,019,629 | — | 1,019,629 | ||||||||||||

| Short-Term Investments | 3,813,042 | — | — | 3,813,042 | ||||||||||||

| Total | $ | 61,957,906 | $ | 33,866,810 | $ | — | $ | 95,824,716 | ||||||||

Description | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Plumb Equity Fund | ||||||||||||||||

| Investments in: | ||||||||||||||||

| Common Stocks* | $ | 29,755,496 | $ | — | $ | — | $ | 29,755,496 | ||||||||

| Short-Term Investments | 1,260,956 | — | — | 1,260,956 | ||||||||||||

| Total | $ | 31,016,452 | $ | — | $ | — | $ | 31,016,452 | ||||||||

| * | For detailed industry descriptions, refer to the Schedule of Investments. |

Use of Estimates:

The presentation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

32

PLUMB FUNDS

Notes to Financial Statements

March 31, 2020 (Continued)

Expenses:

Generally, expenses directly attributable to a Fund are charged to the Fund, while expenses attributable to more than one series of the Company are allocated among the respective series based on relative net assets or another appropriate basis.

Federal Income Taxes:

The Funds intend to meet the requirements of the Internal Revenue Code (the “Code”) applicable to regulated investment companies and to distribute substantially all net investment taxable income and net capital gains to shareholders in a manner which results in no tax cost to the Funds. Therefore, no federal income or excise tax provision is recorded.

As of and during the year ended March 31, 2020, the Funds did not have a liability for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statements of Operations. During the year ended March 31, 2020, the Funds did not incur any interest or penalties.

Distributions to Shareholders:

Dividends from net investment income are declared and paid at least annually. Distributions of net realized capital gains, if any, will be declared and paid at least annually. Distributions to shareholders are recorded on the ex-dividend date.

The Funds may periodically make reclassifications among certain of its capital accounts as a result of the recognition and characterization of certain income and capital gain distributions determined annually in accordance with federal tax regulations which may differ from GAAP. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Funds.

For the fiscal year ended March 31, 2020, the Funds made the following reclassifications to increase (decrease) the components of net assets:

| Distributable | Paid In | ||||||||

| Earnings | Capital | ||||||||

| Plumb Balanced Fund | $ | — | — | ||||||

| Plumb Equity Fund | $ | 260,391 | (260,391 | ) | |||||

These permanent differences relate to the reclassification of net operating losses for the Plumb Equity Fund.

33

PLUMB FUNDS

Notes to Financial Statements

March 31, 2020 (Continued)

Other:

Investment and shareholder transactions are recorded on the trade date. Gains or losses from investment transactions are determined using the specific identification method. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Discounts and premiums on securities purchased are amortized over the expected life of the respective securities using the effective interest method. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not isolate the portion of the results of operations from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Realized foreign exchange gains or losses arising from sales of portfolio securities and sales and maturities of short-term securities are reported within realized gain (loss) on investments. Net unrealized foreign exchange gains and losses arising from changes in the values of investments in securities from fluctuations in exchange rates are reported within unrealized gain (loss) on investments.

| 3. | DISTRIBUTION PLAN |

The Company has adopted a plan pursuant to Rule 12b-1 under the 1940 Act (the “12b-1 Plan”), on behalf of the Funds, which authorizes it to pay Quasar Distributors, LLC (the “Distributor”) a distribution fee up to 0.25% of the Funds’ average daily net assets for services to prospective Fund shareholders and distribution of Fund shares. During the year ended March 31, 2020, the Plumb Balanced Fund and the Plumb Equity Fund incurred expenses of $262,449 and $86,477, respectively, pursuant to the 12b-1 Plan.

Effective March 31, 2020, Foreside Financial Group, LLC (“Foreside”) acquired Quasar Distributors, LLC (“Quasar”), the Funds’ distributor, from U.S. Bancorp. As a result of the acquisition, Quasar became a wholly-owned broker-dealer subsidiary of Foreside and is no longer affiliated with U.S. Bancorp. The Board of Directors of the Funds have approved a new Distribution Agreement to enable Quasar to continue serving as the Funds’ distributor.

| 4. | INVESTMENT ADVISOR AND OTHER AFFILIATES |

The Funds have an Investment Advisory Agreement (the “Advisory Agreement”) with Wisconsin Capital Management, LLC. The Advisory Agreement provides for advisory fees computed daily and paid monthly at an annual rate of 0.65% of the Funds’ average daily net assets.

34

PLUMB FUNDS

Notes to Financial Statements

March 31, 2020 (Continued)

Under the terms of the Advisory Agreement, the Advisor has contractually agreed to limit the Funds’ expenses. Effective December 1, 2017, Wisconsin Capital Management, LLC, the investment advisor to the Funds (the “Advisor”), has contractually agreed to waive its advisory fee and/or reimburse expenses in order to limit the Total Annual Fund Operating Expenses of each of the Funds to 1.19% of such Fund’s average daily net assets. This contractual limitation is in effect until July 31, 2021, and may not be terminated without the approval of the Board of Directors of Wisconsin Capital Funds, Inc. Prior to December 1, 2017, the Plumb Balanced Fund and the Plumb Equity Fund’s expense cap was 1.30% and 1.45%, respectively. Any such waiver or reimbursement is subject to later adjustment to allow the Advisor to recoup amounts waived or reimbursed to the extent actual fees and expenses for a period are less than the current expense limitation cap and the expense limitation caps in place at the time the waiver was made, provided, however, that the Advisor shall only be entitled to recoup such amounts for a period of three years from the date such amount was waived or reimbursed. For the year ended March 31, 2020, the Advisor waived expenses for the Plumb Equity Fund of $95,993. For the year ended March 31, 2020, the Advisor recouped expenses from the Plumb Balanced Fund in the amount of $31,525 and waived expenses in the amount of $28,760.

As of March 31, 2020, the Adviser has waived and recouped fees. The following table shows the remaining amount subject to potential recoupment as of March 31, 2020 and expiring on:

Plumb Balanced Fund | Plumb Equity Fund |

| March 31, 2021. . . . . . . $122,739 | March 31, 2021. . . . . . . $110,110 |

| March 31, 2022. . . . . . . $ 11,798 | March 31, 2022. . . . . . . $ 89,091 |

| March 31, 2023. . . . . . . $ 28,760 | March 31, 2023. . . . . . . $ 95,993 |

| 5. | INVESTMENT TRANSACTIONS |

For the fiscal year ended March 31, 2020, the aggregate purchases and sales of investment securities, other than short-term investments, were as follows:

| U.S. Government Securities | Other | ||||||||||||||||

| Purchases | Sales | Purchases | Sales | ||||||||||||||

| Plumb Balanced Fund | $ | 2,000,000 | $ | 996,875 | $ | 60,419,794 | $ | 54,919,246 | |||||||||

| Plumb Equity Fund | $ | — | $ | — | $ | 17,283,571 | $ | 19,526,479 | |||||||||

| 6. | BENEFICIAL OWNERSHIP |

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund under Section 2(a)(9) of the 1940 Act. As of March 31, 2020, National Financial Services, LLC, for the benefit of its customers, owned 44.66% of the outstanding shares of the Plumb Balanced Fund and 28.69% of the outstanding shares of the Plumb Equity Fund, respectively.

35

PLUMB FUNDS

Notes to Financial Statements

March 31, 2020 (Continued)

| 7. | FEDERAL TAX INFORMATION |

As of March 31, 2020 the components of accumulated earnings (losses) for income tax purposes were as follows:

| Plumb Balanced Fund | Plumb Equity Fund | |||||||||

| Unrealized appreciation | $ | 9,913,643 | $ | 7,957,685 | ||||||

| Unrealized depreciation | (5,871,733 | ) | (2,038,067 | ) | ||||||

| Net tax unrealized | ||||||||||

| appreciation on investments | 4,041,910 | 5,919,618 | ||||||||

| Undistributed ordinary income | 645,094 | — | ||||||||

| Undistributed long-term capital gain | — | 874,570 | ||||||||

| Other accumulated losses | (692,163 | ) | (67,648 | ) | ||||||

| Total accumulated gains (losses) | $ | 3,994,841 | $ | 6,726,540 | ||||||

The tax cost of investments as of March 31, 2020 was $91,782,617 and $25,096,834 for the Plumb Balanced Fund and Plumb Equity Fund, respectively. The tax basis of investments for tax and financial reporting purposes differs principally due to the deferral of losses on wash sales.

As of March 31, 2020, the Plumb Balanced Fund had short-term capital loss carryforwards amounting to $692,163 that may be carried forward indefinitely to offset future capital gains.

As of March 31, 2020, the Funds deferred, on a tax basis, late year ordinary and post-October capital losses of:

| Plumb Balanced Fund | Plumb Equity Fund | |||||||||

| Late Year Ordinary Loss | $ | — | $ | 67,648 | ||||||

| Post-October Capital Loss | $ | — | $ | — | ||||||

| 8. | DISTRIBUTIONS TO SHAREHOLDERS |

The tax character of distributions paid during the fiscal years ended March 31, 2020 and 2019 was as follows:

| Plumb Balanced Fund | |||||||||

| Year Ended | Year Ended | ||||||||

| March 31, 2020 | March 31, 2019 | ||||||||

| Distributions paid from: | |||||||||

| Ordinary Income | $ | 1,039,880 | $ | 18,569 | |||||

| Long Term Capital Gain | 1,755,059 | 1,287,557 | |||||||

| Total Distributions Paid | $ | 2,794,939 | $ | 1,306,126 | |||||

36

PLUMB FUNDS

Notes to Financial Statements

March 31, 2020 (Continued)

| Plumb Equity Fund | |||||||||

| Year Ended | Year Ended | ||||||||

| March 31, 2020 | March 31, 2019 | ||||||||

| Distributions paid from: | |||||||||

| Ordinary Income | $ | — | $ | 649,543 | |||||

| Long-Term Capital Gains | 1,654,811 | 3,512,431 | |||||||

| Total Distributions Paid | $ | 1,654,811 | $ | 4,161,974 | |||||

| 9. | SUBSEQUENT EVENTS |

Unexpected events, such as the global outbreak of COVID-19, have caused adverse effects on many companies, sectors, regions, and the market in general, and may cause these effects for an unknown period of time and in ways that cannot be foreseen. The effects may impact the value and performance of the Funds, their ability to buy and sell fund investments at appropriate valuations and their ability to achieve investment objectives.

37

PLUMB FUNDS

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of Wisconsin Capital Funds, Inc.

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of Wisconsin Capital Funds, Inc., comprising Plumb Balanced Fund and Plumb Equity Fund (the “Funds”) as of March 31, 2020, the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, including the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds as of March 31, 2020, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of March 31, 2020, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Funds’ auditor since 2007.

COHEN & COMPANY, LTD.

Cleveland, Ohio

May 27, 2020

38

PLUMB FUNDS

Additional Information (Unaudited)

| 1. | OPERATION AND EFFECTIVENESS OF THE FUNDS’ LIQUIDITY RISK MANAGEMENT PROGRAM: |

The Funds have adopted a Liquidity Risk Management Program (the “Program”) under Rule 22e-4 under the Investment Company Act of 1940, as amended (the “Liquidity Rule”), that seeks to assess, manage, and review each Fund’s liquidity risk. The Liquidity Rule requires in part that the Board of Directors of the Funds receive a written report on a no-less-frequently-than-annual basis that addresses the operation of the Program and assesses its adequacy and effectiveness of implementation, including the operation of any highly liquid investment minimum established for a Fund and any material changes to the Program.

The Board of Directors of the Funds has appointed Wisconsin Capital Management, LLC’s Compliance Committee as the program administrator for the Program (the “Program Administrator”). At its meetings on November 8, 2019, and February 14, 2020, the Board of Directors of the Funds reviewed the Program Administrator’s initial written reports (collectively, the “Report”) relating to the operation of the Program for the period from June 1, 2019 through December 31, 2019 (the “Program Reporting Period”). The Report addressed the operation of the Program and assessed its adequacy and effectiveness of implementation, including that each Fund continues to primarily hold assets that are highly liquid investments. There were no material changes to the Program during the Program Reporting Period and no liquidity events occurring during the Program Reporting Period that affected the Funds or their ability to meet redemptions.

Based on this review, the Report concluded that the Program continues to be reasonably designed to effectively assess and manage each Fund’s liquidity risk and the Program has been adequately and effectively implemented with respect to each Fund during the Program Reporting Period.

| 2. | ADDITIONAL DISCLOSURE REGARDING FUND DIRECTORS AND OFFICERS |

| Number of | |||||

| Position(s) | Term of | Portfolios | |||

| Held with | Office and | Principal | in Fund | Other | |

| Name, | Wisconsin | Length | Occupation(s) | Complex | Directorships |

| Address and | Capital | of Time | During Past | Overseen by | Held by |

Year of Birth | Funds, Inc. | Served(1) | Five Years | Director | Director |

| Independent Directors: | |||||

| Jay Loewi | Director | Since | Chief Executive | 2 | None |

| Birth date: 1957 | May 2007 | Officer, QTI | |||

| Group (staffing | |||||

| company), since | |||||

| November 2007; | |||||

| President, QTI | |||||

| Group of | |||||

| Companies, | |||||

| since 2002. | |||||

39

PLUMB FUNDS

Additional Information (Unaudited) (Continued)

| Number of | |||||

| Position(s) | Term of | Portfolios | |||

| Held with | Office and | Principal | in Fund | Other | |

| Name, | Wisconsin | Length | Occupation(s) | Complex | Directorships |

| Address and | Capital | of Time | During Past | Overseen by | Held by |

Year of Birth | Funds, Inc. | Served(1) | Five Years | Director | Director |

| Harlan J. | Director | Since | Chief Financial | 2 | None |

| Moeckler | June 2017 | Officer and | |||

| Birth date: 1957 | Treasurer of | ||||

| TradeLink Holdings | |||||

| LLC (alternative | |||||

| investment and | |||||

| proprietary | |||||

| trading firm) | |||||

| since 2006. | |||||

| Patrick J. Quinn | Director | Since | Currently Retired; | 2 | National |

| Birth date:1949 | May 2007 | President and | Presto | ||

| Chairman of the | Industries | ||||

| Board of Ayres | since May | ||||

| Associates | 2001. | ||||

| (professional civil | |||||

| engineering firm), | |||||

| from April 2000 | |||||

| until retirement | |||||

| in December 2010. | |||||

| Roy S. | Director | Since | Currently Retired; | 2 | None |

| Schlachtenhaufen | June 2017 | Senior Portfolio | |||

| Birth date: 1949 | Manager at US | ||||

| Bancorp Investments, | |||||

| Inc. (wealth | |||||

| management firm) | |||||

| from 1991 until | |||||

| retirement in | |||||

| April 2017. |

40

PLUMB FUNDS

Additional Information (Unaudited) (Continued)

| Number of | |||||

| Position(s) | Term of | Portfolios | |||

| Held with | Office and | Principal | in Fund | Other | |

| Name, | Wisconsin | Length | Occupation(s) | Complex | Directorships |

| Address and | Capital | of Time | During Past | Overseen by | Held by |

Year of Birth | Funds, Inc. | Served(1) | Five Years | Director | Director |

| Interested Directors and Officers: | |||||

| Thomas G. | Director, | Since | President of | 2 | None |

Plumb(2)(3) | Chairman, | May 2007 | Wisconsin Capital | ||

| Birth date:1952 | President | Management, LLC, | |||

| and Chief | since January 2004; | ||||

| Executive | President and | ||||

| Officer | Principal of SVA | ||||

| Secretary | Since | Plumb Wealth | |||

| August 1, | Management, LLC | ||||

| 2017 | from March 2011 – | ||||

| March 2019; President | |||||

| of SVA Plumb Financial, | |||||

| LLC (financial and trust | |||||

| services firm) from | |||||

| March 2011 – March 2019; | |||||

| CEO of SVA Plumb Trust | |||||

| Company from March | |||||

| 2011 – March 2019. | |||||

| Nathan M. | Director | Since | Principal of Custer | 2 | None |

Plumb(3) | January | Plumb Financial | |||

| Birth date: 1975 | 2017 | Services; Chief | |||

| Operating Officer, | |||||

| Chief | Since | Vice President, and | |||

| Financial | August 1, | Corporate Secretary | |||

| Officer and | 2017 | of Wisconsin Capital | |||

| Treasurer | Management, LLC | ||||

| from January 2015 | |||||

| to December 2016; | |||||

| Portfolio Manager of | |||||

| Wisconsin Capital | |||||

| Management, LLC | |||||

| from September 2013 | |||||

| to December 2016; | |||||

| Assistant Portfolio | |||||

| Manager of Wisconsin | |||||

| Capital Management, | |||||

| LLC from 2010 to | |||||

| September 2013; | |||||

| Associate Financial | |||||

| Consultant of SVA | |||||

| Plumb Wealth | |||||

| Management, LLC | |||||

| from March 2011 | |||||

| to December 2014. | |||||

41

PLUMB FUNDS

Additional Information (Unaudited) (Continued)

| Number of | |||||

| Position(s) | Term of | Portfolios | |||

| Held with | Office and | Principal | in Fund | Other | |

| Name, | Wisconsin | Length | Occupation(s) | Complex | Directorships |

| Address and | Capital | of Time | During Past | Overseen by | Held by |

Year of Birth | Funds, Inc. | Served(1) | Five Years | Director | Director |

| Bonnie | Chief | Since | Chief | N/A | N/A |

| Romani | Compliance | August 1, | Compliance | ||

| Birth date: 1970 | Officer | 2018 | Officer, | ||

| Wisconsin | |||||

| Capital | |||||

| Management, | |||||

| LLC since | |||||

| August 2018; | |||||

| State Analyst, | |||||

| American Family | |||||

| Insurance, from | |||||

| February, 2006 | |||||

| through March, | |||||

| 2018. |

The address of each Director and Officer as it relates to the Funds is 8401 Excelsior Drive, Suite 102, Madison, WI 53717.

| (1) | Officers of the Funds serve one-year terms, subject to annual reappointment by the Board of Directors. Directors of the Funds serve a term of indefinite length until their resignation or removal, and stand for re-election by shareholders as and when required under the 1940 Act. |

| (2) | Thomas G. Plumb is an “interested person” of the Funds by virtue of his positions with the Funds and the Advisor. |

| (3) | Nathan M. Plumb is the son of Thomas G. Plumb. Nathan M. Plumb is an “interested person” of the Funds by virtue of this relationship to Thomas G. Plumb. |

42

PLUMB FUNDS

Additional Information (Unaudited) (Continued)