Exhibit (c)(16) Presentation to the Special Committee of the Board of Directors of OSLO Strictly Private & Confidential January 17, 2019Exhibit (c)(16) Presentation to the Special Committee of the Board of Directors of OSLO Strictly Private & Confidential January 17, 2019

GENERAL INFORMATION AND LIMITATIONS This presentation, and the oral or video presentation that supplements it, have been developed by and are proprietary to Sandler O'Neill & Partners, L.P. and were prepared exclusively for the benefit and internal use of the recipient. Neither the printed presentation nor the oral or video presentation that supplements it, nor any of their contents, may be reproduced, distributed or used for any other purpose without the prior written consent of Sandler O'Neill & Partners, L.P. The analyses contained herein rely upon information obtained from the recipient or from public sources, the accuracy of which has not been verified, and cannot be assured, by Sandler O'Neill & Partners, L.P. Moreover, many of the projections and financial analyses herein are based on estimated financial performance prepared by or in consultation with the recipient and are intended only to suggest estimated ranges of results. Finally, the printed presentation is incomplete without the oral or video presentation that supplements it. Sandler O’Neill & Partners, L.P. prohibits employees from offering, directly or indirectly, favorable research, a specific rating or a specific price target, or offering or threatening to change research, a rating or a price target to a company as consideration or inducement for the receipt of business or compensation. The Firm also prohibits research analysts from being compensated for their involvement in, or based upon, specific investment banking transactions. Sandler O'Neill & Partners, L.P. is a limited partnership, the sole general partner of which is Sandler O'Neill & Partners Corp., a New York corporation. Sandler O'Neill & Partners, L.P. is a registered broker-dealer and a member of the Financial Industry Regulatory Authority. Sandler O'Neill Mortgage Finance L.P. is an indirect subsidiary of Sandler O'Neill & Partners Corp. This material is protected under applicable copyright laws and does not carry any rights of publication or disclosure.GENERAL INFORMATION AND LIMITATIONS This presentation, and the oral or video presentation that supplements it, have been developed by and are proprietary to Sandler O'Neill & Partners, L.P. and were prepared exclusively for the benefit and internal use of the recipient. Neither the printed presentation nor the oral or video presentation that supplements it, nor any of their contents, may be reproduced, distributed or used for any other purpose without the prior written consent of Sandler O'Neill & Partners, L.P. The analyses contained herein rely upon information obtained from the recipient or from public sources, the accuracy of which has not been verified, and cannot be assured, by Sandler O'Neill & Partners, L.P. Moreover, many of the projections and financial analyses herein are based on estimated financial performance prepared by or in consultation with the recipient and are intended only to suggest estimated ranges of results. Finally, the printed presentation is incomplete without the oral or video presentation that supplements it. Sandler O’Neill & Partners, L.P. prohibits employees from offering, directly or indirectly, favorable research, a specific rating or a specific price target, or offering or threatening to change research, a rating or a price target to a company as consideration or inducement for the receipt of business or compensation. The Firm also prohibits research analysts from being compensated for their involvement in, or based upon, specific investment banking transactions. Sandler O'Neill & Partners, L.P. is a limited partnership, the sole general partner of which is Sandler O'Neill & Partners Corp., a New York corporation. Sandler O'Neill & Partners, L.P. is a registered broker-dealer and a member of the Financial Industry Regulatory Authority. Sandler O'Neill Mortgage Finance L.P. is an indirect subsidiary of Sandler O'Neill & Partners Corp. This material is protected under applicable copyright laws and does not carry any rights of publication or disclosure.

Table of Contents I. Current Transaction Summary II. BERLIN Overview III. OSLO Overview IV. Next Steps V. AppendixTable of Contents I. Current Transaction Summary II. BERLIN Overview III. OSLO Overview IV. Next Steps V. Appendix

I. Current Transaction SummaryI. Current Transaction Summary

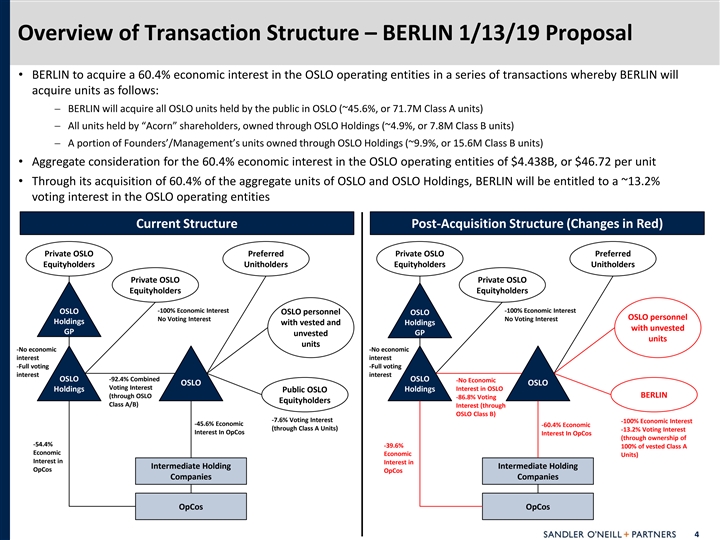

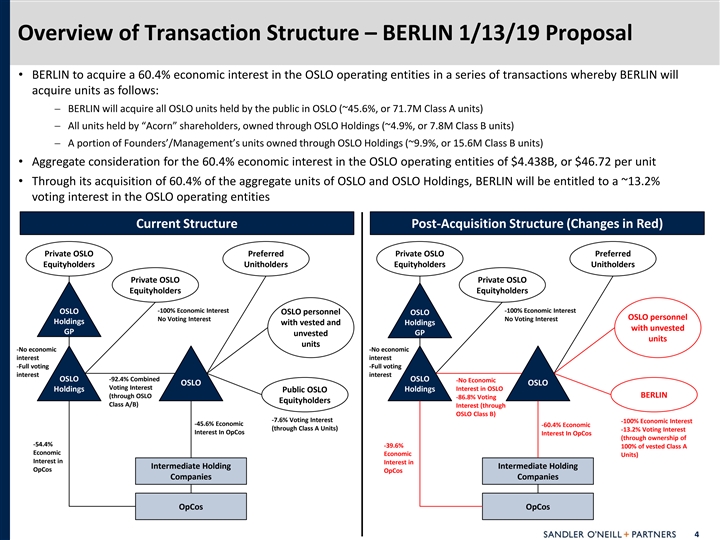

Overview of Transaction Structure – BERLIN 1/13/19 Proposal • BERLIN to acquire a 60.4% economic interest in the OSLO operating entities in a series of transactions whereby BERLIN will acquire units as follows: - BERLIN will acquire all OSLO units held by the public in OSLO (~45.6%, or 71.7M Class A units) - All units held by “Acorn” shareholders, owned through OSLO Holdings (~4.9%, or 7.8M Class B units) - A portion of Founders’/Management’s units owned through OSLO Holdings (~9.9%, or 15.6M Class B units) • Aggregate consideration for the 60.4% economic interest in the OSLO operating entities of $4.438B, or $46.72 per unit • Through its acquisition of 60.4% of the aggregate units of OSLO and OSLO Holdings, BERLIN will be entitled to a ~13.2% voting interest in the OSLO operating entities Current Structure Post-Acquisition Structure (Changes in Red) Private OSLO Preferred Private OSLO Preferred Equityholders Unitholders Equityholders Unitholders Private OSLO Private OSLO Equityholders Equityholders -100% Economic Interest -100% Economic Interest OSLO OSLO personnel OSLO OSLO personnel No Voting Interest No Voting Interest Holdings with vested and Holdings with unvested GP GP unvested units units -No economic -No economic interest interest -Full voting -Full voting interest interest OSLO -92.4% Combined OSLO -No Economic OSLO OSLO Voting Interest Interest in OSLO Holdings Public OSLO Holdings (through OSLO BERLIN -86.8% Voting Equityholders Class A/B) Interest (through OSLO Class B) -7.6% Voting Interest -100% Economic Interest -45.6% Economic -60.4% Economic (through Class A Units) -13.2% Voting Interest Interest In OpCos Interest In OpCos (through ownership of -54.4% -39.6% 100% of vested Class A Economic Economic Units) Interest in Interest in Intermediate Holding Intermediate Holding OpCos OpCos Companies Companies OpCos OpCos 4Overview of Transaction Structure – BERLIN 1/13/19 Proposal • BERLIN to acquire a 60.4% economic interest in the OSLO operating entities in a series of transactions whereby BERLIN will acquire units as follows: - BERLIN will acquire all OSLO units held by the public in OSLO (~45.6%, or 71.7M Class A units) - All units held by “Acorn” shareholders, owned through OSLO Holdings (~4.9%, or 7.8M Class B units) - A portion of Founders’/Management’s units owned through OSLO Holdings (~9.9%, or 15.6M Class B units) • Aggregate consideration for the 60.4% economic interest in the OSLO operating entities of $4.438B, or $46.72 per unit • Through its acquisition of 60.4% of the aggregate units of OSLO and OSLO Holdings, BERLIN will be entitled to a ~13.2% voting interest in the OSLO operating entities Current Structure Post-Acquisition Structure (Changes in Red) Private OSLO Preferred Private OSLO Preferred Equityholders Unitholders Equityholders Unitholders Private OSLO Private OSLO Equityholders Equityholders -100% Economic Interest -100% Economic Interest OSLO OSLO personnel OSLO OSLO personnel No Voting Interest No Voting Interest Holdings with vested and Holdings with unvested GP GP unvested units units -No economic -No economic interest interest -Full voting -Full voting interest interest OSLO -92.4% Combined OSLO -No Economic OSLO OSLO Voting Interest Interest in OSLO Holdings Public OSLO Holdings (through OSLO BERLIN -86.8% Voting Equityholders Class A/B) Interest (through OSLO Class B) -7.6% Voting Interest -100% Economic Interest -45.6% Economic -60.4% Economic (through Class A Units) -13.2% Voting Interest Interest In OpCos Interest In OpCos (through ownership of -54.4% -39.6% 100% of vested Class A Economic Economic Units) Interest in Interest in Intermediate Holding Intermediate Holding OpCos OpCos Companies Companies OpCos OpCos 4

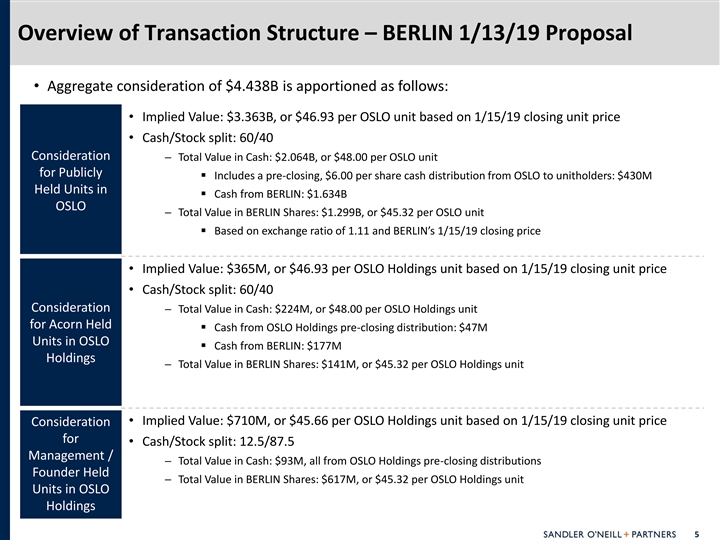

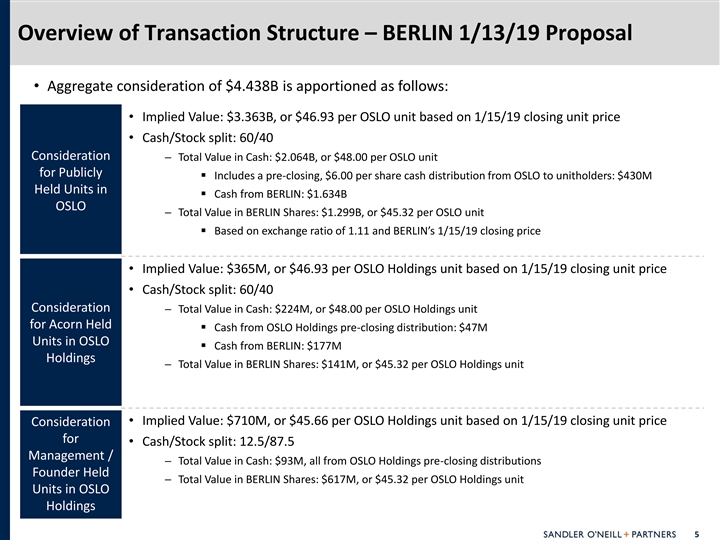

Overview of Transaction Structure – BERLIN 1/13/19 Proposal • Aggregate consideration of $4.438B is apportioned as follows: • Implied Value: $3.363B, or $46.93 per OSLO unit based on 1/15/19 closing unit price • Cash/Stock split: 60/40 Consideration - Total Value in Cash: $2.064B, or $48.00 per OSLO unit for Publicly § Includes a pre-closing, $6.00 per share cash distribution from OSLO to unitholders: $430M Held Units in § Cash from BERLIN: $1.634B OSLO - Total Value in BERLIN Shares: $1.299B, or $45.32 per OSLO unit § Based on exchange ratio of 1.11 and BERLIN’s 1/15/19 closing price • Implied Value: $365M, or $46.93 per OSLO Holdings unit based on 1/15/19 closing unit price • Cash/Stock split: 60/40 Consideration - Total Value in Cash: $224M, or $48.00 per OSLO Holdings unit for Acorn Held § Cash from OSLO Holdings pre-closing distribution: $47M Units in OSLO § Cash from BERLIN: $177M Holdings - Total Value in BERLIN Shares: $141M, or $45.32 per OSLO Holdings unit • Implied Value: $710M, or $45.66 per OSLO Holdings unit based on 1/15/19 closing unit price Consideration for • Cash/Stock split: 12.5/87.5 Management / - Total Value in Cash: $93M, all from OSLO Holdings pre-closing distributions Founder Held - Total Value in BERLIN Shares: $617M, or $45.32 per OSLO Holdings unit Units in OSLO Holdings 5Overview of Transaction Structure – BERLIN 1/13/19 Proposal • Aggregate consideration of $4.438B is apportioned as follows: • Implied Value: $3.363B, or $46.93 per OSLO unit based on 1/15/19 closing unit price • Cash/Stock split: 60/40 Consideration - Total Value in Cash: $2.064B, or $48.00 per OSLO unit for Publicly § Includes a pre-closing, $6.00 per share cash distribution from OSLO to unitholders: $430M Held Units in § Cash from BERLIN: $1.634B OSLO - Total Value in BERLIN Shares: $1.299B, or $45.32 per OSLO unit § Based on exchange ratio of 1.11 and BERLIN’s 1/15/19 closing price • Implied Value: $365M, or $46.93 per OSLO Holdings unit based on 1/15/19 closing unit price • Cash/Stock split: 60/40 Consideration - Total Value in Cash: $224M, or $48.00 per OSLO Holdings unit for Acorn Held § Cash from OSLO Holdings pre-closing distribution: $47M Units in OSLO § Cash from BERLIN: $177M Holdings - Total Value in BERLIN Shares: $141M, or $45.32 per OSLO Holdings unit • Implied Value: $710M, or $45.66 per OSLO Holdings unit based on 1/15/19 closing unit price Consideration for • Cash/Stock split: 12.5/87.5 Management / - Total Value in Cash: $93M, all from OSLO Holdings pre-closing distributions Founder Held - Total Value in BERLIN Shares: $617M, or $45.32 per OSLO Holdings unit Units in OSLO Holdings 5

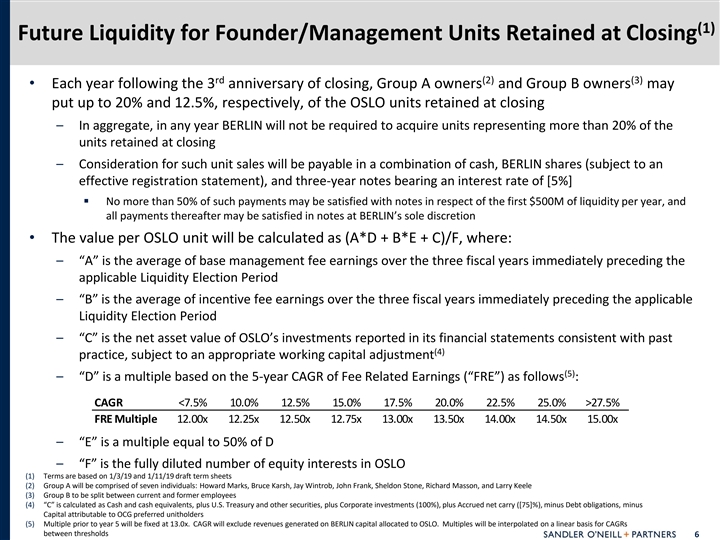

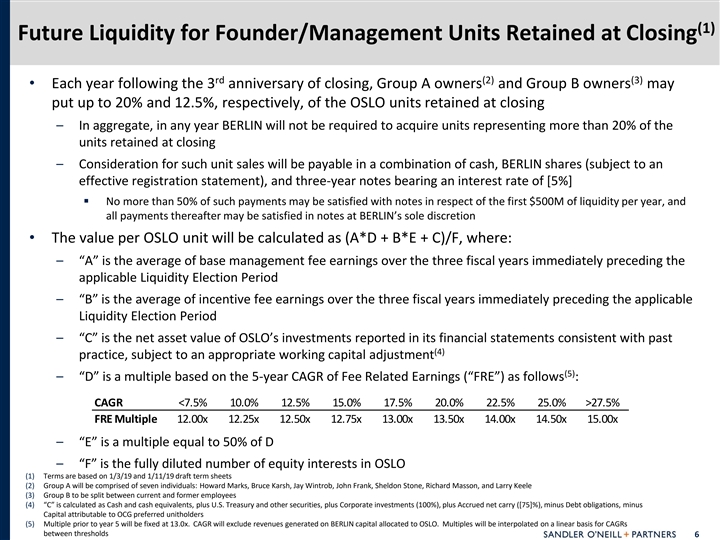

(1) Future Liquidity for Founder/Management Units Retained at Closing rd (2) (3) • Each year following the 3 anniversary of closing, Group A owners and Group B owners may put up to 20% and 12.5%, respectively, of the OSLO units retained at closing – In aggregate, in any year BERLIN will not be required to acquire units representing more than 20% of the units retained at closing – Consideration for such unit sales will be payable in a combination of cash, BERLIN shares (subject to an effective registration statement), and three-year notes bearing an interest rate of [5%] § No more than 50% of such payments may be satisfied with notes in respect of the first $500M of liquidity per year, and all payments thereafter may be satisfied in notes at BERLIN’s sole discretion • The value per OSLO unit will be calculated as (A*D + B*E + C)/F, where: – “A” is the average of base management fee earnings over the three fiscal years immediately preceding the applicable Liquidity Election Period – “B” is the average of incentive fee earnings over the three fiscal years immediately preceding the applicable Liquidity Election Period – “C” is the net asset value of OSLO’s investments reported in its financial statements consistent with past (4) practice, subject to an appropriate working capital adjustment (5) – “D” is a multiple based on the 5-year CAGR of Fee Related Earnings (“FRE”) as follows : CAGR <7.5% 10.0% 12.5% 15.0% 17.5% 20.0% 22.5% 25.0% >27.5% FRE Multiple 12.00x 12.25x 12.50x 12.75x 13.00x 13.50x 14.00x 14.50x 15.00x – “E” is a multiple equal to 50% of D – “F” is the fully diluted number of equity interests in OSLO (1) Terms are based on 1/3/19 and 1/11/19 draft term sheets (2) Group A will be comprised of seven individuals: Howard Marks, Bruce Karsh, Jay Wintrob, John Frank, Sheldon Stone, Richard Masson, and Larry Keele (3) Group B to be split between current and former employees (4) “C” is calculated as Cash and cash equivalents, plus U.S. Treasury and other securities, plus Corporate investments (100%), plus Accrued net carry ([75]%), minus Debt obligations, minus Capital attributable to OCG preferred unitholders (5) Multiple prior to year 5 will be fixed at 13.0x. CAGR will exclude revenues generated on BERLIN capital allocated to OSLO. Multiples will be interpolated on a linear basis for CAGRs between thresholds 6(1) Future Liquidity for Founder/Management Units Retained at Closing rd (2) (3) • Each year following the 3 anniversary of closing, Group A owners and Group B owners may put up to 20% and 12.5%, respectively, of the OSLO units retained at closing – In aggregate, in any year BERLIN will not be required to acquire units representing more than 20% of the units retained at closing – Consideration for such unit sales will be payable in a combination of cash, BERLIN shares (subject to an effective registration statement), and three-year notes bearing an interest rate of [5%] § No more than 50% of such payments may be satisfied with notes in respect of the first $500M of liquidity per year, and all payments thereafter may be satisfied in notes at BERLIN’s sole discretion • The value per OSLO unit will be calculated as (A*D + B*E + C)/F, where: – “A” is the average of base management fee earnings over the three fiscal years immediately preceding the applicable Liquidity Election Period – “B” is the average of incentive fee earnings over the three fiscal years immediately preceding the applicable Liquidity Election Period – “C” is the net asset value of OSLO’s investments reported in its financial statements consistent with past (4) practice, subject to an appropriate working capital adjustment (5) – “D” is a multiple based on the 5-year CAGR of Fee Related Earnings (“FRE”) as follows : CAGR <7.5% 10.0% 12.5% 15.0% 17.5% 20.0% 22.5% 25.0% >27.5% FRE Multiple 12.00x 12.25x 12.50x 12.75x 13.00x 13.50x 14.00x 14.50x 15.00x – “E” is a multiple equal to 50% of D – “F” is the fully diluted number of equity interests in OSLO (1) Terms are based on 1/3/19 and 1/11/19 draft term sheets (2) Group A will be comprised of seven individuals: Howard Marks, Bruce Karsh, Jay Wintrob, John Frank, Sheldon Stone, Richard Masson, and Larry Keele (3) Group B to be split between current and former employees (4) “C” is calculated as Cash and cash equivalents, plus U.S. Treasury and other securities, plus Corporate investments (100%), plus Accrued net carry ([75]%), minus Debt obligations, minus Capital attributable to OCG preferred unitholders (5) Multiple prior to year 5 will be fixed at 13.0x. CAGR will exclude revenues generated on BERLIN capital allocated to OSLO. Multiples will be interpolated on a linear basis for CAGRs between thresholds 6

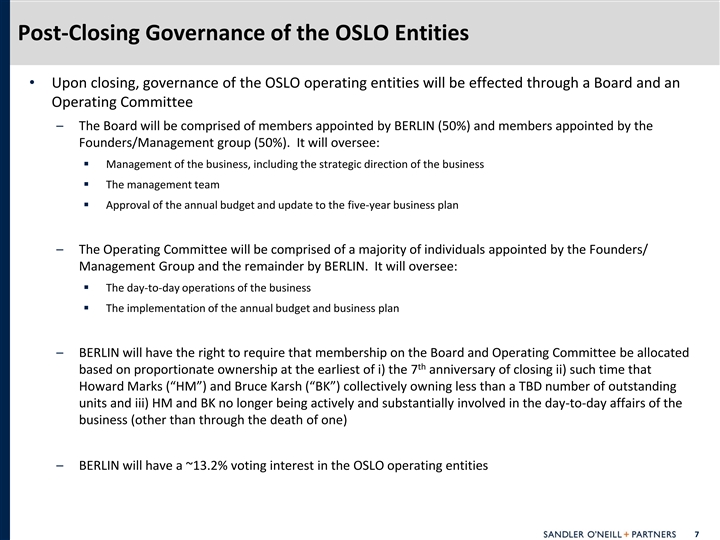

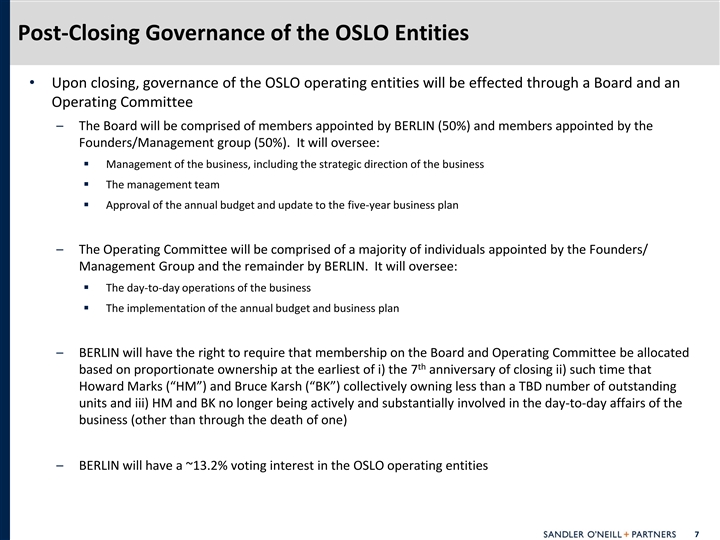

Post-Closing Governance of the OSLO Entities • Upon closing, governance of the OSLO operating entities will be effected through a Board and an Operating Committee – The Board will be comprised of members appointed by BERLIN (50%) and members appointed by the Founders/Management group (50%). It will oversee: § Management of the business, including the strategic direction of the business § The management team § Approval of the annual budget and update to the five-year business plan – The Operating Committee will be comprised of a majority of individuals appointed by the Founders/ Management Group and the remainder by BERLIN. It will oversee: § The day-to-day operations of the business § The implementation of the annual budget and business plan – BERLIN will have the right to require that membership on the Board and Operating Committee be allocated th based on proportionate ownership at the earliest of i) the 7 anniversary of closing ii) such time that Howard Marks (“HM”) and Bruce Karsh (“BK”) collectively owning less than a TBD number of outstanding units and iii) HM and BK no longer being actively and substantially involved in the day-to-day affairs of the business (other than through the death of one) – BERLIN will have a ~13.2% voting interest in the OSLO operating entities 7Post-Closing Governance of the OSLO Entities • Upon closing, governance of the OSLO operating entities will be effected through a Board and an Operating Committee – The Board will be comprised of members appointed by BERLIN (50%) and members appointed by the Founders/Management group (50%). It will oversee: § Management of the business, including the strategic direction of the business § The management team § Approval of the annual budget and update to the five-year business plan – The Operating Committee will be comprised of a majority of individuals appointed by the Founders/ Management Group and the remainder by BERLIN. It will oversee: § The day-to-day operations of the business § The implementation of the annual budget and business plan – BERLIN will have the right to require that membership on the Board and Operating Committee be allocated th based on proportionate ownership at the earliest of i) the 7 anniversary of closing ii) such time that Howard Marks (“HM”) and Bruce Karsh (“BK”) collectively owning less than a TBD number of outstanding units and iii) HM and BK no longer being actively and substantially involved in the day-to-day affairs of the business (other than through the death of one) – BERLIN will have a ~13.2% voting interest in the OSLO operating entities 7

II. BERLIN Overview II. BERLIN Overview

BERLIN Overview • BERLIN Asset Management Inc. (“BERLIN”) is a leading global alternative asset manager focused on real assets including real estate, renewable energy, infrastructure, and private equity • BERLIN generates earnings from two primary sources: – Asset Manager: Management of private funds, listed funds, and public securities portfolios totaling $141B (“Fee Bearing Capital”) – Invested Capital: BERLIN’s balance sheet capital invested in listed partnerships and other financial assets totaling $33B (“Invested Capital”) – These businesses are intertwined as BERLIN’s Invested Capital is invested, directly and indirectly, in private and public funds managed by the Asset Manager • Headquartered in Toronto, Canada with over 100 offices in more than 30 countries globally – Employ ~1,200 employees within the asset management business – Further 80,000 employees throughout the rest of the operations • Dual-listed on Toronto Stock Exchange (TSX:BAM.A) and New York Stock Exchange (NYSE:BAM) – Current Market Cap: US $40.4B – Credit Ratings: § S&P: A-, stable outlook § Moody’s: Baa2, stable outlook § DBRS: A (low), stable outlook Note: Market data as of 1/15/19 Source: Public filings, Company materials 9BERLIN Overview • BERLIN Asset Management Inc. (“BERLIN”) is a leading global alternative asset manager focused on real assets including real estate, renewable energy, infrastructure, and private equity • BERLIN generates earnings from two primary sources: – Asset Manager: Management of private funds, listed funds, and public securities portfolios totaling $141B (“Fee Bearing Capital”) – Invested Capital: BERLIN’s balance sheet capital invested in listed partnerships and other financial assets totaling $33B (“Invested Capital”) – These businesses are intertwined as BERLIN’s Invested Capital is invested, directly and indirectly, in private and public funds managed by the Asset Manager • Headquartered in Toronto, Canada with over 100 offices in more than 30 countries globally – Employ ~1,200 employees within the asset management business – Further 80,000 employees throughout the rest of the operations • Dual-listed on Toronto Stock Exchange (TSX:BAM.A) and New York Stock Exchange (NYSE:BAM) – Current Market Cap: US $40.4B – Credit Ratings: § S&P: A-, stable outlook § Moody’s: Baa2, stable outlook § DBRS: A (low), stable outlook Note: Market data as of 1/15/19 Source: Public filings, Company materials 9

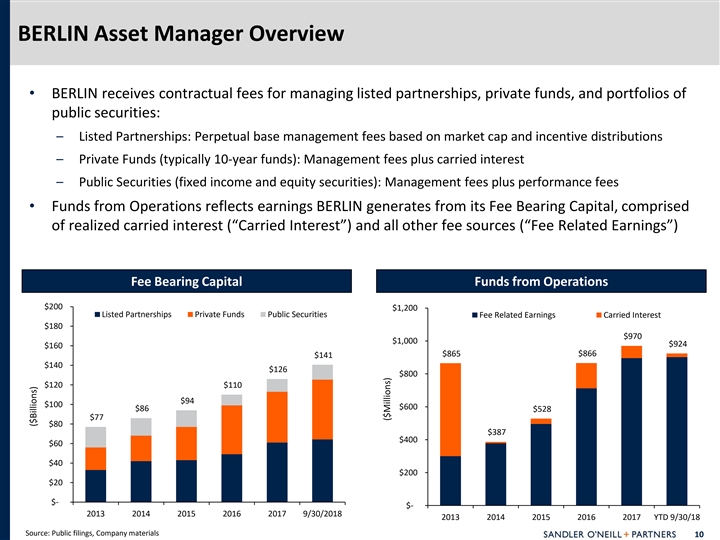

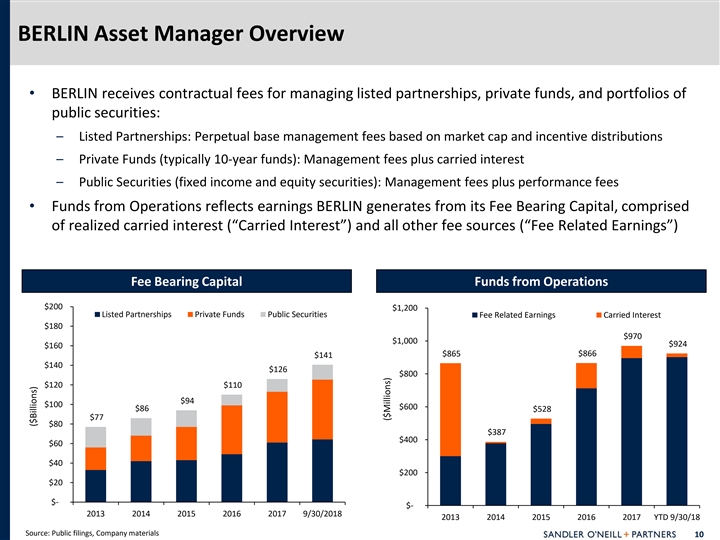

BERLIN Asset Manager Overview • BERLIN receives contractual fees for managing listed partnerships, private funds, and portfolios of public securities: – Listed Partnerships: Perpetual base management fees based on market cap and incentive distributions – Private Funds (typically 10-year funds): Management fees plus carried interest – Public Securities (fixed income and equity securities): Management fees plus performance fees • Funds from Operations reflects earnings BERLIN generates from its Fee Bearing Capital, comprised of realized carried interest (“Carried Interest”) and all other fee sources (“Fee Related Earnings”) Fee Bearing Capital Funds from Operations $200 $1,200 Listed Partnerships Private Funds Public Securities Fee Related Earnings Carried Interest $180 $970 $1,000 $924 $160 $865 $866 $141 $140 $126 $800 $120 $110 $94 $100 $600 $86 $528 $77 $80 $387 $400 $60 $40 $200 $20 $- $- 2013 2014 2015 2016 2017 9/30/2018 2013 2014 2015 2016 2017 YTD 9/30/18 Source: Public filings, Company materials 10 ($Billions) ($Millions)BERLIN Asset Manager Overview • BERLIN receives contractual fees for managing listed partnerships, private funds, and portfolios of public securities: – Listed Partnerships: Perpetual base management fees based on market cap and incentive distributions – Private Funds (typically 10-year funds): Management fees plus carried interest – Public Securities (fixed income and equity securities): Management fees plus performance fees • Funds from Operations reflects earnings BERLIN generates from its Fee Bearing Capital, comprised of realized carried interest (“Carried Interest”) and all other fee sources (“Fee Related Earnings”) Fee Bearing Capital Funds from Operations $200 $1,200 Listed Partnerships Private Funds Public Securities Fee Related Earnings Carried Interest $180 $970 $1,000 $924 $160 $865 $866 $141 $140 $126 $800 $120 $110 $94 $100 $600 $86 $528 $77 $80 $387 $400 $60 $40 $200 $20 $- $- 2013 2014 2015 2016 2017 9/30/2018 2013 2014 2015 2016 2017 YTD 9/30/18 Source: Public filings, Company materials 10 ($Billions) ($Millions)

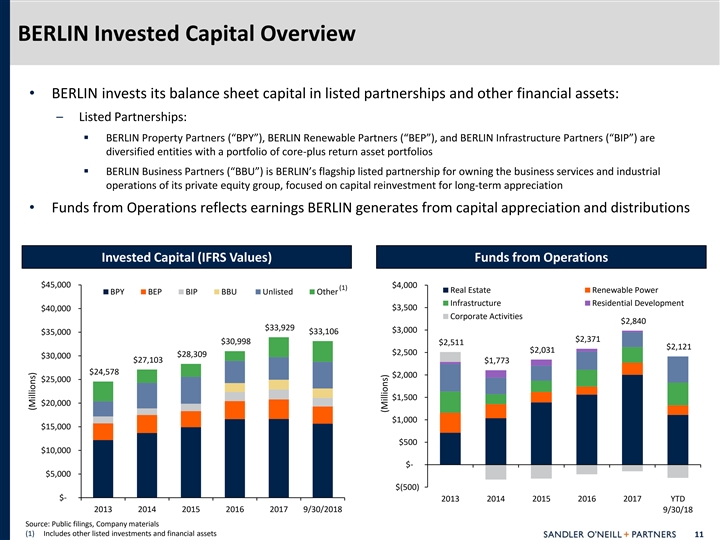

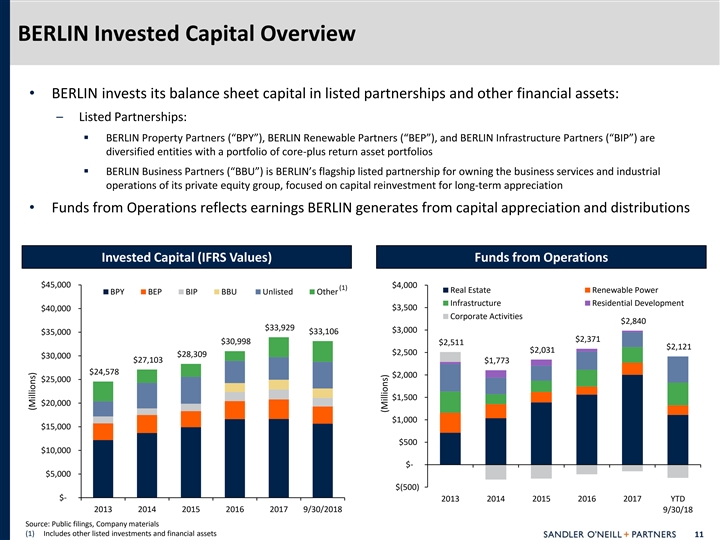

BERLIN Invested Capital Overview • BERLIN invests its balance sheet capital in listed partnerships and other financial assets: – Listed Partnerships: § BERLIN Property Partners (“BPY”), BERLIN Renewable Partners (“BEP”), and BERLIN Infrastructure Partners (“BIP”) are diversified entities with a portfolio of core-plus return asset portfolios § BERLIN Business Partners (“BBU”) is BERLIN’s flagship listed partnership for owning the business services and industrial operations of its private equity group, focused on capital reinvestment for long-term appreciation • Funds from Operations reflects earnings BERLIN generates from capital appreciation and distributions Invested Capital (IFRS Values) Funds from Operations $45,000 $4,000 (1) Real Estate Renewable Power BPY BEP BIP BBU Unlisted Other Infrastructure Residential Development $3,500 $40,000 Corporate Activities $2,840 $33,929 $3,000 $33,106 $35,000 $2,371 $30,998 $2,511 $2,121 $2,031 $2,500 $28,309 $30,000 $27,103 $1,773 $24,578 $2,000 $25,000 $1,500 $20,000 $1,000 $15,000 $500 $10,000 $- $5,000 $(500) $- 2013 2014 2015 2016 2017 YTD 2013 2014 2015 2016 2017 9/30/2018 9/30/18 Source: Public filings, Company materials (1) Includes other listed investments and financial assets 11 (Millions) (Millions)BERLIN Invested Capital Overview • BERLIN invests its balance sheet capital in listed partnerships and other financial assets: – Listed Partnerships: § BERLIN Property Partners (“BPY”), BERLIN Renewable Partners (“BEP”), and BERLIN Infrastructure Partners (“BIP”) are diversified entities with a portfolio of core-plus return asset portfolios § BERLIN Business Partners (“BBU”) is BERLIN’s flagship listed partnership for owning the business services and industrial operations of its private equity group, focused on capital reinvestment for long-term appreciation • Funds from Operations reflects earnings BERLIN generates from capital appreciation and distributions Invested Capital (IFRS Values) Funds from Operations $45,000 $4,000 (1) Real Estate Renewable Power BPY BEP BIP BBU Unlisted Other Infrastructure Residential Development $3,500 $40,000 Corporate Activities $2,840 $33,929 $3,000 $33,106 $35,000 $2,371 $30,998 $2,511 $2,121 $2,031 $2,500 $28,309 $30,000 $27,103 $1,773 $24,578 $2,000 $25,000 $1,500 $20,000 $1,000 $15,000 $500 $10,000 $- $5,000 $(500) $- 2013 2014 2015 2016 2017 YTD 2013 2014 2015 2016 2017 9/30/2018 9/30/18 Source: Public filings, Company materials (1) Includes other listed investments and financial assets 11 (Millions) (Millions)

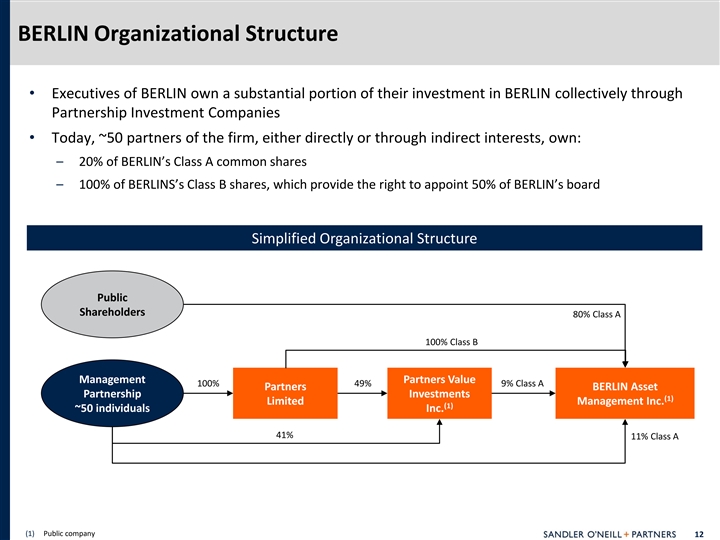

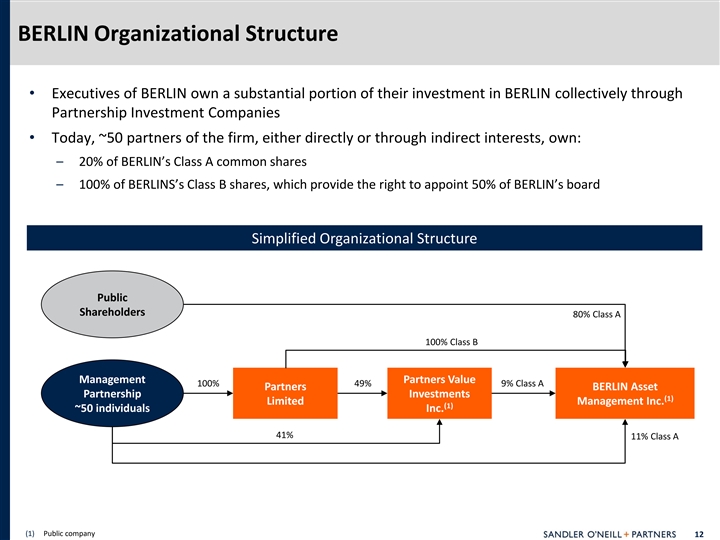

BERLIN Organizational Structure • Executives of BERLIN own a substantial portion of their investment in BERLIN collectively through Partnership Investment Companies • Today, ~50 partners of the firm, either directly or through indirect interests, own: – 20% of BERLIN’s Class A common shares – 100% of BERLINS’s Class B shares, which provide the right to appoint 50% of BERLIN’s board Simplified Organizational Structure Public Shareholders 80% Class A 100% Class B Management Partners Value 100% 49% 9% Class A Partners BERLIN Asset Partnership Investments (1) Limited Management Inc. (1) ~50 individuals Inc. 41% 11% Class A (1) Public company 12BERLIN Organizational Structure • Executives of BERLIN own a substantial portion of their investment in BERLIN collectively through Partnership Investment Companies • Today, ~50 partners of the firm, either directly or through indirect interests, own: – 20% of BERLIN’s Class A common shares – 100% of BERLINS’s Class B shares, which provide the right to appoint 50% of BERLIN’s board Simplified Organizational Structure Public Shareholders 80% Class A 100% Class B Management Partners Value 100% 49% 9% Class A Partners BERLIN Asset Partnership Investments (1) Limited Management Inc. (1) ~50 individuals Inc. 41% 11% Class A (1) Public company 12

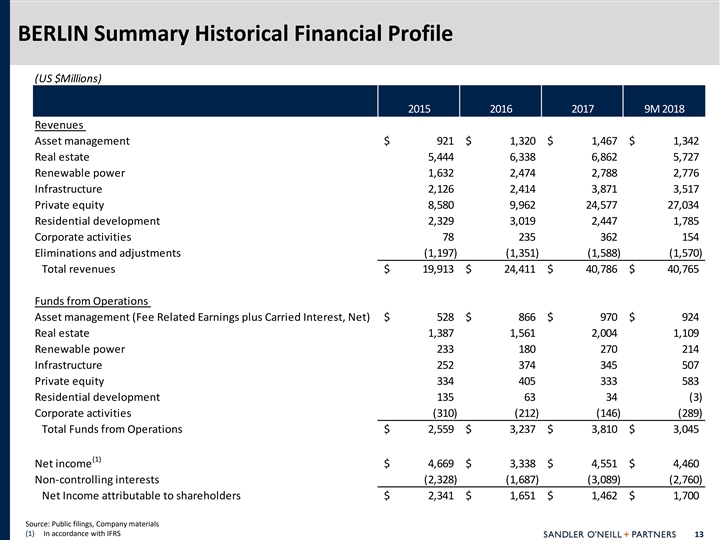

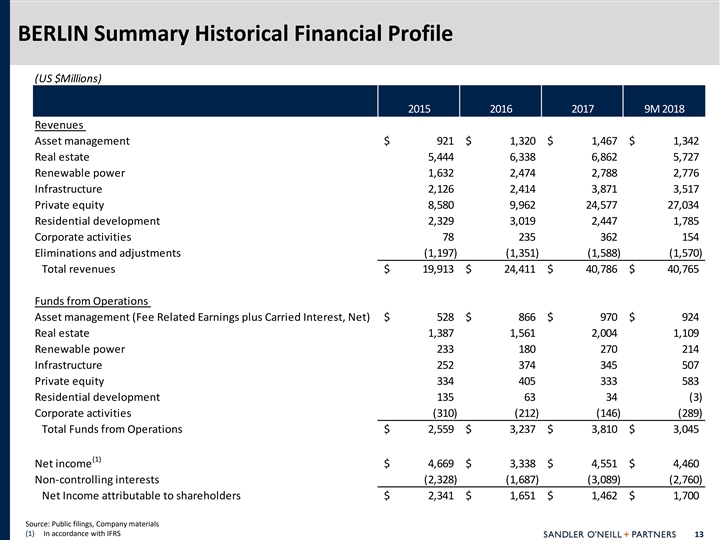

BERLIN Summary Historical Financial Profile (US $Millions) 2015 2016 2017 9M 2018 Revenues Asset management $ 921 $ 1,320 $ 1 ,467 $ 1 ,342 Real estate 5,444 6,338 6,862 5,727 Renewable power 1,632 2,474 2,788 2,776 Infrastructure 2,126 2,414 3,871 3,517 Private equity 8,580 9,962 24,577 27,034 Residential development 2,329 3,019 2,447 1,785 Corporate activities 78 235 362 154 Eliminations and adjustments (1,197) (1,351) (1,588) (1,570) Total revenues $ 19,913 $ 24,411 $ 40,786 $ 40,765 Funds from Operations Asset management (Fee Related Earnings plus Carried Interest, Net) $ 528 $ 866 $ 970 $ 924 Real estate 1,387 1,561 2,004 1,109 Renewable power 233 180 270 214 Infrastructure 252 374 345 507 Private equity 334 405 333 583 Residential development 135 63 34 (3) Corporate activities (310) (212) (146) (289) Total Funds from Operations $ 2 ,559 $ 3,237 $ 3 ,810 $ 3,045 (1) Net income $ 4 ,669 $ 3,338 $ 4 ,551 $ 4,460 Non-controlling interests (2,328) (1,687) (3,089) (2,760) Net Income attributable to shareholders $ 2,341 $ 1 ,651 $ 1,462 $ 1,700 Source: Public filings, Company materials (1) In accordance with IFRS 13BERLIN Summary Historical Financial Profile (US $Millions) 2015 2016 2017 9M 2018 Revenues Asset management $ 921 $ 1,320 $ 1 ,467 $ 1 ,342 Real estate 5,444 6,338 6,862 5,727 Renewable power 1,632 2,474 2,788 2,776 Infrastructure 2,126 2,414 3,871 3,517 Private equity 8,580 9,962 24,577 27,034 Residential development 2,329 3,019 2,447 1,785 Corporate activities 78 235 362 154 Eliminations and adjustments (1,197) (1,351) (1,588) (1,570) Total revenues $ 19,913 $ 24,411 $ 40,786 $ 40,765 Funds from Operations Asset management (Fee Related Earnings plus Carried Interest, Net) $ 528 $ 866 $ 970 $ 924 Real estate 1,387 1,561 2,004 1,109 Renewable power 233 180 270 214 Infrastructure 252 374 345 507 Private equity 334 405 333 583 Residential development 135 63 34 (3) Corporate activities (310) (212) (146) (289) Total Funds from Operations $ 2 ,559 $ 3,237 $ 3 ,810 $ 3,045 (1) Net income $ 4 ,669 $ 3,338 $ 4 ,551 $ 4,460 Non-controlling interests (2,328) (1,687) (3,089) (2,760) Net Income attributable to shareholders $ 2,341 $ 1 ,651 $ 1,462 $ 1,700 Source: Public filings, Company materials (1) In accordance with IFRS 13

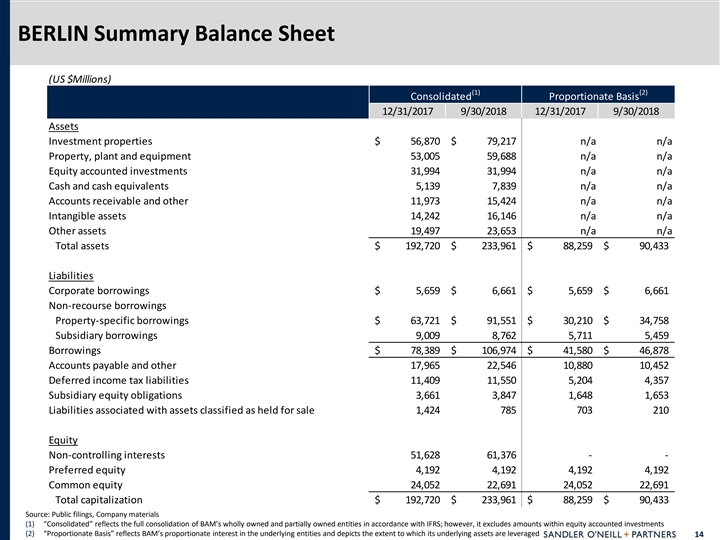

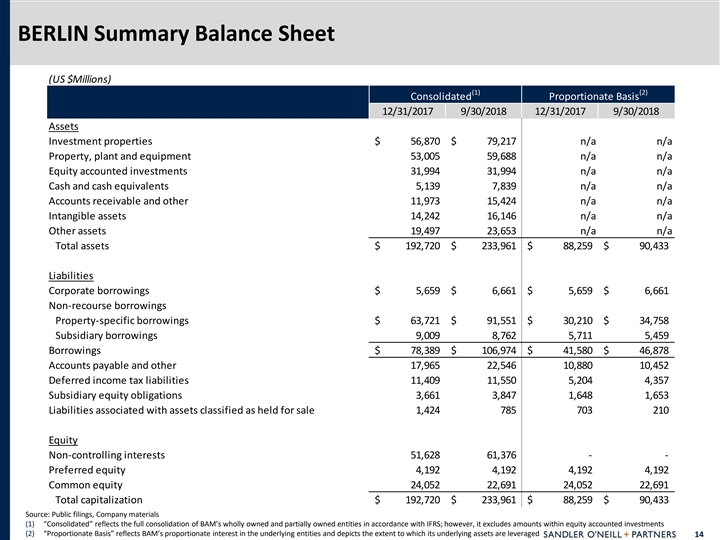

BERLIN Summary Balance Sheet (US $Millions) (1) (2) Consolidated Proportionate Basis 12/31/2017 9/30/2018 12/31/2017 9/30/2018 Assets Investment properties $ 56,870 $ 79,217 n/a n/a Property, plant and equipment 5 3,005 59,688 n/a n/a Equity accounted investments 3 1,994 3 1,994 n/a n/a Cash and cash equivalents 5,139 7,839 n/a n/a Accounts receivable and other 11,973 1 5,424 n/a n/a Intangible assets 14,242 1 6,146 n/a n/a Other assets 1 9,497 2 3,653 n/a n/a Total assets $ 192,720 $ 233,961 $ 88,259 $ 90,433 Liabilities Corporate borrowings $ 5 ,659 $ 6,661 $ 5 ,659 $ 6 ,661 Non-recourse borrowings Property-specific borrowings $ 63,721 $ 91,551 $ 30,210 $ 34,758 Subsidiary borrowings 9,009 8,762 5,711 5,459 Borrowings $ 78,389 $ 106,974 $ 41,580 $ 46,878 Accounts payable and other 17,965 2 2,546 10,880 1 0,452 Deferred income tax liabilities 11,409 1 1,550 5,204 4,357 Subsidiary equity obligations 3,661 3,847 1,648 1,653 Liabilities associated with assets classified as held for sale 1,424 785 703 210 Equity Non-controlling interests 5 1,628 6 1,376 - - Preferred equity 4,192 4,192 4,192 4,192 Common equity 2 4,052 2 2,691 2 4,052 2 2,691 Total capitalization $ 192,720 $ 233,961 $ 88,259 $ 90,433 Source: Public filings, Company materials (1) “Consolidated” reflects the full consolidation of BAM’s wholly owned and partially owned entities in accordance with IFRS; however, it excludes amounts within equity accounted investments (2) “Proportionate Basis” reflects BAM’s proportionate interest in the underlying entities and depicts the extent to which its underlying assets are leveraged 14BERLIN Summary Balance Sheet (US $Millions) (1) (2) Consolidated Proportionate Basis 12/31/2017 9/30/2018 12/31/2017 9/30/2018 Assets Investment properties $ 56,870 $ 79,217 n/a n/a Property, plant and equipment 5 3,005 59,688 n/a n/a Equity accounted investments 3 1,994 3 1,994 n/a n/a Cash and cash equivalents 5,139 7,839 n/a n/a Accounts receivable and other 11,973 1 5,424 n/a n/a Intangible assets 14,242 1 6,146 n/a n/a Other assets 1 9,497 2 3,653 n/a n/a Total assets $ 192,720 $ 233,961 $ 88,259 $ 90,433 Liabilities Corporate borrowings $ 5 ,659 $ 6,661 $ 5 ,659 $ 6 ,661 Non-recourse borrowings Property-specific borrowings $ 63,721 $ 91,551 $ 30,210 $ 34,758 Subsidiary borrowings 9,009 8,762 5,711 5,459 Borrowings $ 78,389 $ 106,974 $ 41,580 $ 46,878 Accounts payable and other 17,965 2 2,546 10,880 1 0,452 Deferred income tax liabilities 11,409 1 1,550 5,204 4,357 Subsidiary equity obligations 3,661 3,847 1,648 1,653 Liabilities associated with assets classified as held for sale 1,424 785 703 210 Equity Non-controlling interests 5 1,628 6 1,376 - - Preferred equity 4,192 4,192 4,192 4,192 Common equity 2 4,052 2 2,691 2 4,052 2 2,691 Total capitalization $ 192,720 $ 233,961 $ 88,259 $ 90,433 Source: Public filings, Company materials (1) “Consolidated” reflects the full consolidation of BAM’s wholly owned and partially owned entities in accordance with IFRS; however, it excludes amounts within equity accounted investments (2) “Proportionate Basis” reflects BAM’s proportionate interest in the underlying entities and depicts the extent to which its underlying assets are leveraged 14

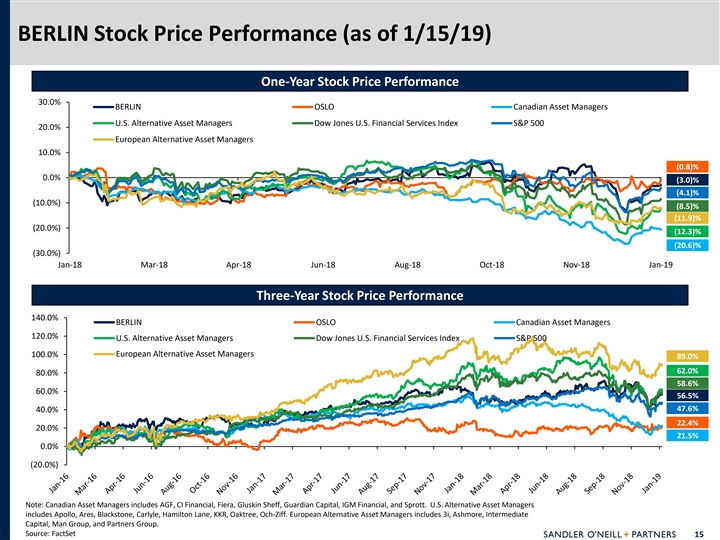

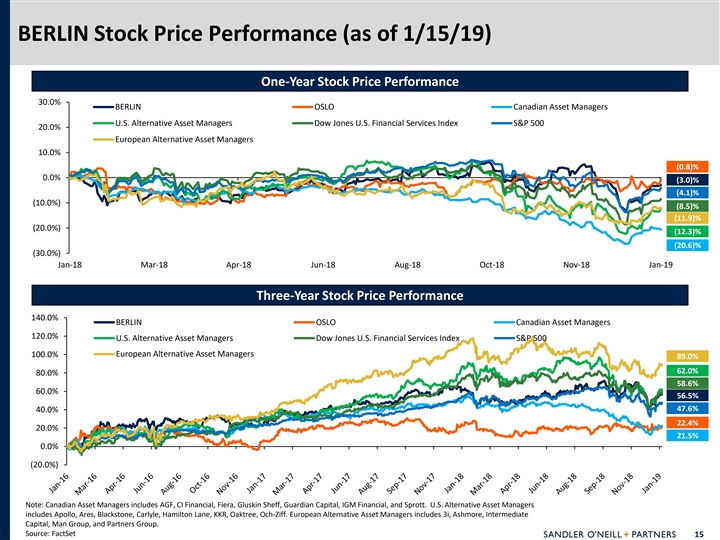

BERLIN Stock Price Performance (as of 1/15/19) One-Year Stock Price Performance 30.0% BERLIN OSLO Canadian Asset Managers U.S. Alternative Asset Managers Dow Jones U.S. Financial Services Index S&P 500 20.0% European Alternative Asset Managers 10.0% (0.8)% 0.0% (3.0)% (4.1)% (10.0%) (8.5)% (11.9)% (20.0%) (12.3)% (20.6)% (30.0%) Jan-18 Mar-18 Apr-18 Jun-18 Aug-18 Oct-18 Nov-18 Jan-19 Three-Year Stock Price Performance 140.0% BERLIN OSLO Canadian Asset Managers 120.0% U.S. Alternative Asset Managers Dow Jones U.S. Financial Services Index S&P 500 100.0% European Alternative Asset Managers 89.0% 62.0% 80.0% 58.6% 60.0% 56.5% 47.6% 40.0% 22.4% 20.0% 21.5% 0.0% (20.0%) Note: Canadian Asset Managers includes AGF, CI Financial, Fiera, Gluskin Sheff, Guardian Capital, IGM Financial, and Sprott. U.S. Alternative Asset Managers includes Apollo, Ares, Blackstone, Carlyle, Hamilton Lane, KKR, Oaktree, Och-Ziff. European Alternative Asset Managers includes 3i, Ashmore, Intermediate Capital, Man Group, and Partners Group. Source: FactSet 15BERLIN Stock Price Performance (as of 1/15/19) One-Year Stock Price Performance 30.0% BERLIN OSLO Canadian Asset Managers U.S. Alternative Asset Managers Dow Jones U.S. Financial Services Index S&P 500 20.0% European Alternative Asset Managers 10.0% (0.8)% 0.0% (3.0)% (4.1)% (10.0%) (8.5)% (11.9)% (20.0%) (12.3)% (20.6)% (30.0%) Jan-18 Mar-18 Apr-18 Jun-18 Aug-18 Oct-18 Nov-18 Jan-19 Three-Year Stock Price Performance 140.0% BERLIN OSLO Canadian Asset Managers 120.0% U.S. Alternative Asset Managers Dow Jones U.S. Financial Services Index S&P 500 100.0% European Alternative Asset Managers 89.0% 62.0% 80.0% 58.6% 60.0% 56.5% 47.6% 40.0% 22.4% 20.0% 21.5% 0.0% (20.0%) Note: Canadian Asset Managers includes AGF, CI Financial, Fiera, Gluskin Sheff, Guardian Capital, IGM Financial, and Sprott. U.S. Alternative Asset Managers includes Apollo, Ares, Blackstone, Carlyle, Hamilton Lane, KKR, Oaktree, Och-Ziff. European Alternative Asset Managers includes 3i, Ashmore, Intermediate Capital, Man Group, and Partners Group. Source: FactSet 15

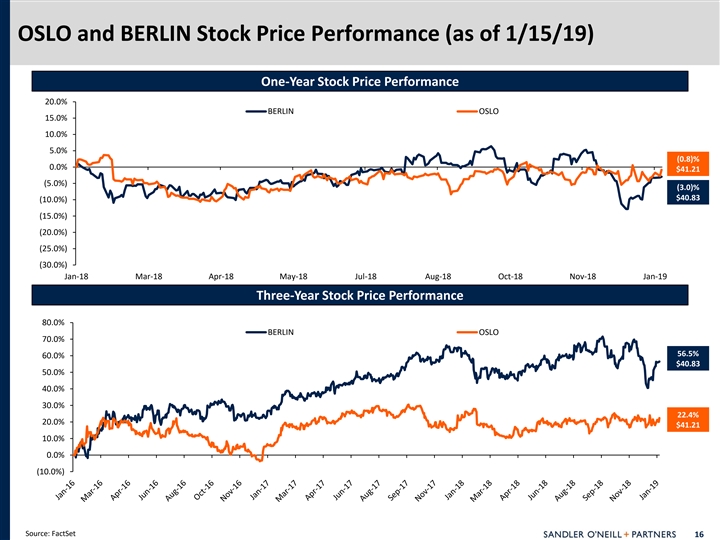

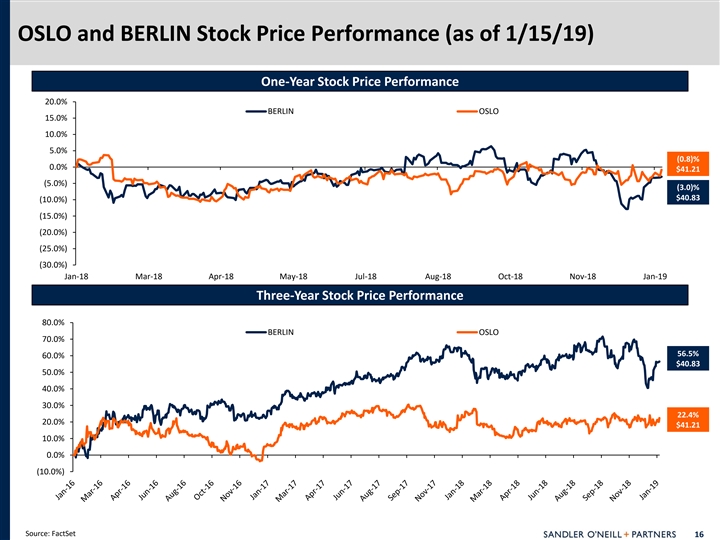

OSLO and BERLIN Stock Price Performance (as of 1/15/19) One-Year Stock Price Performance 20.0% BERLIN OSLO 15.0% 10.0% 5.0% (0.8)% 0.0% $41.21 (5.0%) (3.0)% $40.83 (10.0%) (15.0%) (20.0%) (25.0%) (30.0%) Jan-18 Mar-18 Apr-18 May-18 Jul-18 Aug-18 Oct-18 Nov-18 Jan-19 Three-Year Stock Price Performance 80.0% BERLIN OSLO 70.0% 56.5% 60.0% $40.83 50.0% 40.0% 30.0% 22.4% 20.0% $41.21 10.0% 0.0% (10.0%) Source: FactSet 16OSLO and BERLIN Stock Price Performance (as of 1/15/19) One-Year Stock Price Performance 20.0% BERLIN OSLO 15.0% 10.0% 5.0% (0.8)% 0.0% $41.21 (5.0%) (3.0)% $40.83 (10.0%) (15.0%) (20.0%) (25.0%) (30.0%) Jan-18 Mar-18 Apr-18 May-18 Jul-18 Aug-18 Oct-18 Nov-18 Jan-19 Three-Year Stock Price Performance 80.0% BERLIN OSLO 70.0% 56.5% 60.0% $40.83 50.0% 40.0% 30.0% 22.4% 20.0% $41.21 10.0% 0.0% (10.0%) Source: FactSet 16

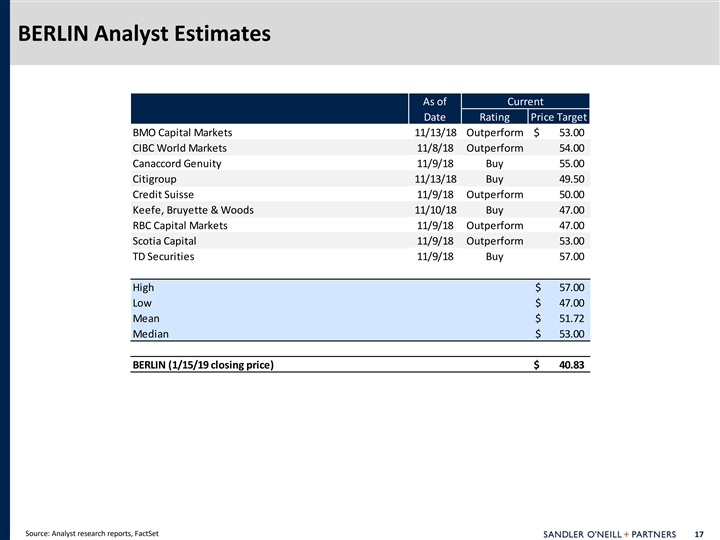

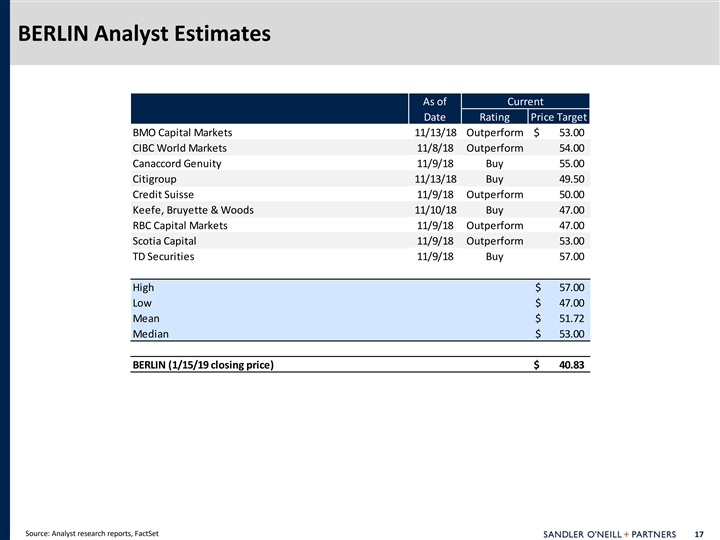

BERLIN Analyst Estimates As of Current Date Rating Price Target BMO Capital Markets 11/13/18 Outperform $ 53.00 CIBC World Markets 11/8/18 Outperform 54.00 Canaccord Genuity 11/9/18 Buy 5 5.00 Citigroup 11/13/18 Buy 4 9.50 Credit Suisse 11/9/18 Outperform 50.00 Keefe, Bruyette & Woods 11/10/18 Buy 4 7.00 RBC Capital Markets 11/9/18 Outperform 47.00 Scotia Capital 11/9/18 Outperform 5 3.00 TD Securities 11/9/18 Buy 57.00 High $ 57.00 Low $ 4 7.00 Mean $ 51.72 Median $ 5 3.00 BERLIN (1/15/19 closing price) $ 40.83 Source: Analyst research reports, FactSet 17BERLIN Analyst Estimates As of Current Date Rating Price Target BMO Capital Markets 11/13/18 Outperform $ 53.00 CIBC World Markets 11/8/18 Outperform 54.00 Canaccord Genuity 11/9/18 Buy 5 5.00 Citigroup 11/13/18 Buy 4 9.50 Credit Suisse 11/9/18 Outperform 50.00 Keefe, Bruyette & Woods 11/10/18 Buy 4 7.00 RBC Capital Markets 11/9/18 Outperform 47.00 Scotia Capital 11/9/18 Outperform 5 3.00 TD Securities 11/9/18 Buy 57.00 High $ 57.00 Low $ 4 7.00 Mean $ 51.72 Median $ 5 3.00 BERLIN (1/15/19 closing price) $ 40.83 Source: Analyst research reports, FactSet 17

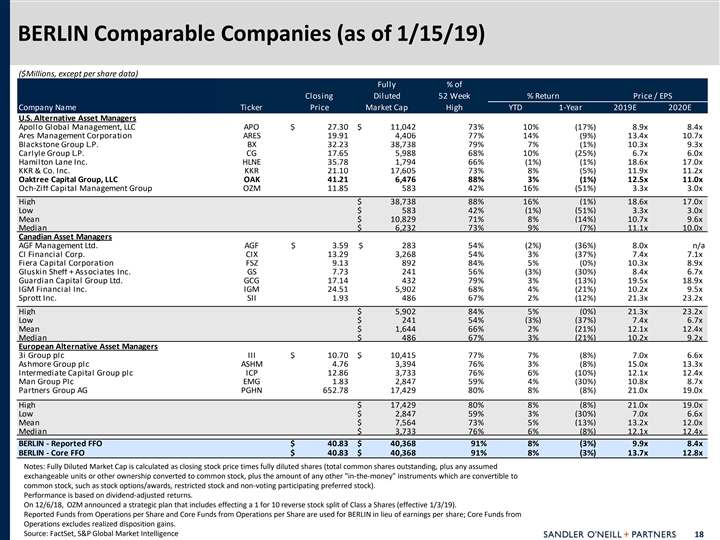

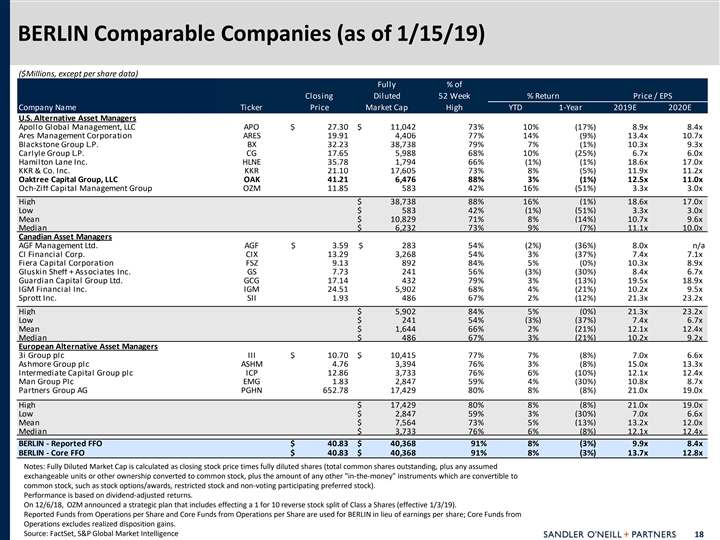

BERLIN Comparable Companies (as of 1/15/19) ($Millions, except per share data) Fully % of Closing Diluted 52 Week % Return Price / EPS Company Name Ticker Price Market Cap High YTD 1-Year 2019E 2020E U.S. Alternative Asset Managers Apollo Global Management, LLC APO $ 27.30 $ 1 1,042 73% 10% (17%) 8.9x 8.4x (1) (2) Ares Management Corporation ARES 19.91 4,406 77% 14% (9%) 13.4x 10.7x Blackstone Group L.P. BX 3 2.23 3 8,738 79% 7% (1%) 10.3x 9.3x Carlyle Group L.P. CG 1 7.65 5,988 68% 10% (25%) 6.7x 6.0x Hamilton Lane Inc. HLNE 3 5.78 1,794 66% (1%) (1%) 18.6x 17.0x KKR & Co. Inc. KKR 2 1.10 17,605 73% 8% (5%) 11.9x 11.2x Oaktree Capital Group, LLC OAK 4 1.21 6 ,476 88% 3% (1%) 12.5x 11.0x Och-Ziff Capital Management Group OZM 11.85 583 42% 16% (51%) 3.3x 3.0x High $ 3 8,738 88% 16% (1%) 18.6x 17.0x Low $ 583 42% (1%) (51%) 3.3x 3.0x Mean $ 10,829 71% 8% (14%) 10.7x 9.6x Median $ 6,232 73% 9% (7%) 11.1x 10.0x Canadian Asset Managers AGF Management Ltd. AGF $ 3 .59 $ 283 54% (2%) (36%) 8.0x n/a CI Financial Corp. CIX 1 3.29 3,268 54% 3% (37%) 7.4x 7.1x Fiera Capital Corporation FSZ 9 .13 892 84% 5% (0%) 10.3x 8.9x Gluskin Sheff + Associates Inc. GS 7.73 241 56% (3%) (30%) 8.4x 6.7x Guardian Capital Group Ltd. GCG 1 7.14 432 79% 3% (13%) 19.5x 18.9x IGM Financial Inc. IGM 24.51 5 ,902 68% 4% (21%) 10.2x 9.5x Sprott Inc. SII 1 .93 486 67% 2% (12%) 21.3x 23.2x High $ 5,902 84% 5% (0%) 21.3x 23.2x Low $ 241 54% (3%) (37%) 7.4x 6.7x Mean $ 1,644 66% 2% (21%) 12.1x 12.4x Median $ 486 67% 3% (21%) 10.2x 9.2x European Alternative Asset Managers 3i Group plc III $ 1 0.70 $ 1 0,415 77% 7% (8%) 7.0x 6.6x Ashmore Group plc ASHM 4.76 3,394 76% 3% (8%) 15.0x 13.3x Intermediate Capital Group plc ICP 12.86 3,733 76% 6% (10%) 12.1x 12.4x Man Group Plc EMG 1 .83 2 ,847 59% 4% (30%) 10.8x 8.7x Partners Group AG PGHN 652.78 1 7,429 80% 8% (8%) 21.0x 19.0x High $ 1 7,429 80% 8% (8%) 21.0x 19.0x Low $ 2,847 59% 3% (30%) 7.0x 6.6x Mean $ 7,564 73% 5% (13%) 13.2x 12.0x Median $ 3,733 76% 6% (8%) 12.1x 12.4x BERLIN - Reported FFO $ 4 0.83 $ 4 0,368 91% 8% (3%) 9.9x 8.4x BERLIN - Core FFO $ 4 0.83 $ 40,368 91% 8% (3%) 13.7x 12.8x Notes: Fully Diluted Market Cap is calculated as closing stock price times fully diluted shares (total common shares outstanding, plus any assumed exchangeable units or other ownership converted to common stock, plus the amount of any other in-the-money instruments which are convertible to common stock, such as stock options/awards, restricted stock and non-voting participating preferred stock). Performance is based on dividend-adjusted returns. On 12/6/18, OZM announced a strategic plan that includes effecting a 1 for 10 reverse stock split of Class a Shares (effective 1/3/19). Reported Funds from Operations per Share and Core Funds from Operations per Share are used for BERLIN in lieu of earnings per share; Core Funds from Operations excludes realized disposition gains. Source: FactSet, S&P Global Market Intelligence 18BERLIN Comparable Companies (as of 1/15/19) ($Millions, except per share data) Fully % of Closing Diluted 52 Week % Return Price / EPS Company Name Ticker Price Market Cap High YTD 1-Year 2019E 2020E U.S. Alternative Asset Managers Apollo Global Management, LLC APO $ 27.30 $ 1 1,042 73% 10% (17%) 8.9x 8.4x (1) (2) Ares Management Corporation ARES 19.91 4,406 77% 14% (9%) 13.4x 10.7x Blackstone Group L.P. BX 3 2.23 3 8,738 79% 7% (1%) 10.3x 9.3x Carlyle Group L.P. CG 1 7.65 5,988 68% 10% (25%) 6.7x 6.0x Hamilton Lane Inc. HLNE 3 5.78 1,794 66% (1%) (1%) 18.6x 17.0x KKR & Co. Inc. KKR 2 1.10 17,605 73% 8% (5%) 11.9x 11.2x Oaktree Capital Group, LLC OAK 4 1.21 6 ,476 88% 3% (1%) 12.5x 11.0x Och-Ziff Capital Management Group OZM 11.85 583 42% 16% (51%) 3.3x 3.0x High $ 3 8,738 88% 16% (1%) 18.6x 17.0x Low $ 583 42% (1%) (51%) 3.3x 3.0x Mean $ 10,829 71% 8% (14%) 10.7x 9.6x Median $ 6,232 73% 9% (7%) 11.1x 10.0x Canadian Asset Managers AGF Management Ltd. AGF $ 3 .59 $ 283 54% (2%) (36%) 8.0x n/a CI Financial Corp. CIX 1 3.29 3,268 54% 3% (37%) 7.4x 7.1x Fiera Capital Corporation FSZ 9 .13 892 84% 5% (0%) 10.3x 8.9x Gluskin Sheff + Associates Inc. GS 7.73 241 56% (3%) (30%) 8.4x 6.7x Guardian Capital Group Ltd. GCG 1 7.14 432 79% 3% (13%) 19.5x 18.9x IGM Financial Inc. IGM 24.51 5 ,902 68% 4% (21%) 10.2x 9.5x Sprott Inc. SII 1 .93 486 67% 2% (12%) 21.3x 23.2x High $ 5,902 84% 5% (0%) 21.3x 23.2x Low $ 241 54% (3%) (37%) 7.4x 6.7x Mean $ 1,644 66% 2% (21%) 12.1x 12.4x Median $ 486 67% 3% (21%) 10.2x 9.2x European Alternative Asset Managers 3i Group plc III $ 1 0.70 $ 1 0,415 77% 7% (8%) 7.0x 6.6x Ashmore Group plc ASHM 4.76 3,394 76% 3% (8%) 15.0x 13.3x Intermediate Capital Group plc ICP 12.86 3,733 76% 6% (10%) 12.1x 12.4x Man Group Plc EMG 1 .83 2 ,847 59% 4% (30%) 10.8x 8.7x Partners Group AG PGHN 652.78 1 7,429 80% 8% (8%) 21.0x 19.0x High $ 1 7,429 80% 8% (8%) 21.0x 19.0x Low $ 2,847 59% 3% (30%) 7.0x 6.6x Mean $ 7,564 73% 5% (13%) 13.2x 12.0x Median $ 3,733 76% 6% (8%) 12.1x 12.4x BERLIN - Reported FFO $ 4 0.83 $ 4 0,368 91% 8% (3%) 9.9x 8.4x BERLIN - Core FFO $ 4 0.83 $ 40,368 91% 8% (3%) 13.7x 12.8x Notes: Fully Diluted Market Cap is calculated as closing stock price times fully diluted shares (total common shares outstanding, plus any assumed exchangeable units or other ownership converted to common stock, plus the amount of any other in-the-money instruments which are convertible to common stock, such as stock options/awards, restricted stock and non-voting participating preferred stock). Performance is based on dividend-adjusted returns. On 12/6/18, OZM announced a strategic plan that includes effecting a 1 for 10 reverse stock split of Class a Shares (effective 1/3/19). Reported Funds from Operations per Share and Core Funds from Operations per Share are used for BERLIN in lieu of earnings per share; Core Funds from Operations excludes realized disposition gains. Source: FactSet, S&P Global Market Intelligence 18

III. OSLO OverviewIII. OSLO Overview

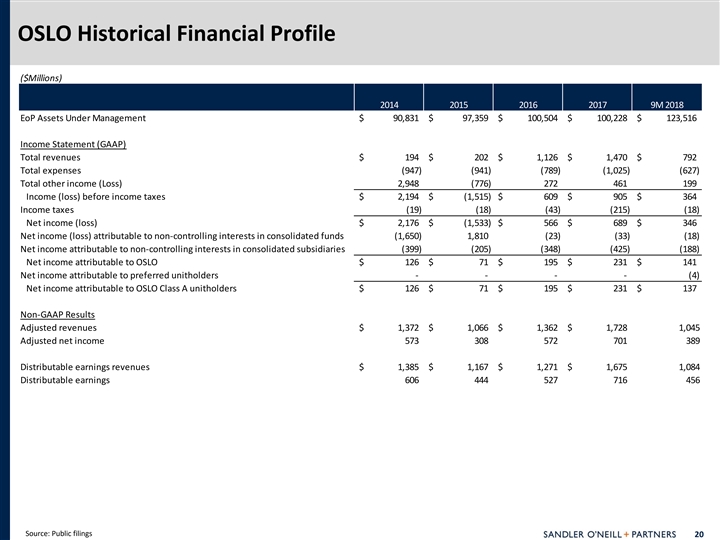

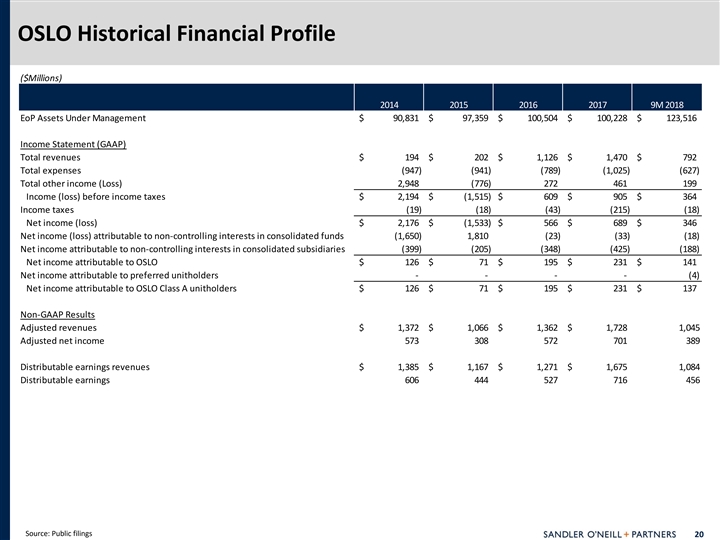

OSLO Historical Financial Profile ($Millions) 2014 2015 2016 2017 9M 2018 EoP Assets Under Management $ 9 0,831 $ 9 7,359 $ 100,504 $ 100,228 $ 123,516 Income Statement (GAAP) Total revenues $ 194 $ 202 $ 1,126 $ 1,470 $ 792 Total expenses (947) (941) (789) ( 1,025) (627) Total other income (Loss) 2,948 (776) 272 461 199 Income (loss) before income taxes $ 2,194 $ (1,515) $ 609 $ 905 $ 364 Income taxes (19) ( 18) (43) (215) ( 18) Net income (loss) $ 2,176 $ (1,533) $ 566 $ 689 $ 346 Net income (loss) attributable to non-controlling interests in consolidated funds (1,650) 1,810 ( 23) ( 33) (18) Net income attributable to non-controlling interests in consolidated subsidiaries (399) (205) (348) (425) (188) Net income attributable to OSLO $ 126 $ 71 $ 195 $ 231 $ 141 Net income attributable to preferred unitholders - - - - (4) Net income attributable to OSLO Class A unitholders $ 126 $ 71 $ 195 $ 231 $ 137 Non-GAAP Results Adjusted revenues $ 1,372 $ 1,066 $ 1,362 $ 1,728 1,045 Adjusted net income 573 308 572 701 389 Distributable earnings revenues $ 1,385 $ 1,167 $ 1,271 $ 1,675 1,084 Distributable earnings 606 444 527 716 456 Source: Public filings 20OSLO Historical Financial Profile ($Millions) 2014 2015 2016 2017 9M 2018 EoP Assets Under Management $ 9 0,831 $ 9 7,359 $ 100,504 $ 100,228 $ 123,516 Income Statement (GAAP) Total revenues $ 194 $ 202 $ 1,126 $ 1,470 $ 792 Total expenses (947) (941) (789) ( 1,025) (627) Total other income (Loss) 2,948 (776) 272 461 199 Income (loss) before income taxes $ 2,194 $ (1,515) $ 609 $ 905 $ 364 Income taxes (19) ( 18) (43) (215) ( 18) Net income (loss) $ 2,176 $ (1,533) $ 566 $ 689 $ 346 Net income (loss) attributable to non-controlling interests in consolidated funds (1,650) 1,810 ( 23) ( 33) (18) Net income attributable to non-controlling interests in consolidated subsidiaries (399) (205) (348) (425) (188) Net income attributable to OSLO $ 126 $ 71 $ 195 $ 231 $ 141 Net income attributable to preferred unitholders - - - - (4) Net income attributable to OSLO Class A unitholders $ 126 $ 71 $ 195 $ 231 $ 137 Non-GAAP Results Adjusted revenues $ 1,372 $ 1,066 $ 1,362 $ 1,728 1,045 Adjusted net income 573 308 572 701 389 Distributable earnings revenues $ 1,385 $ 1,167 $ 1,271 $ 1,675 1,084 Distributable earnings 606 444 527 716 456 Source: Public filings 20

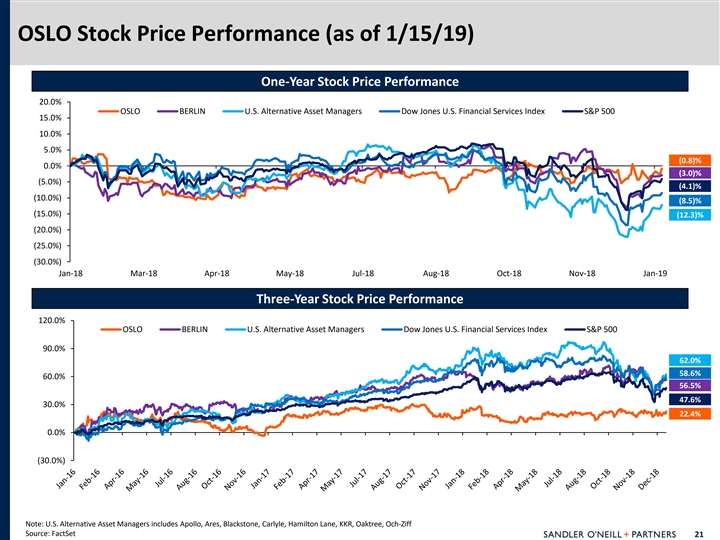

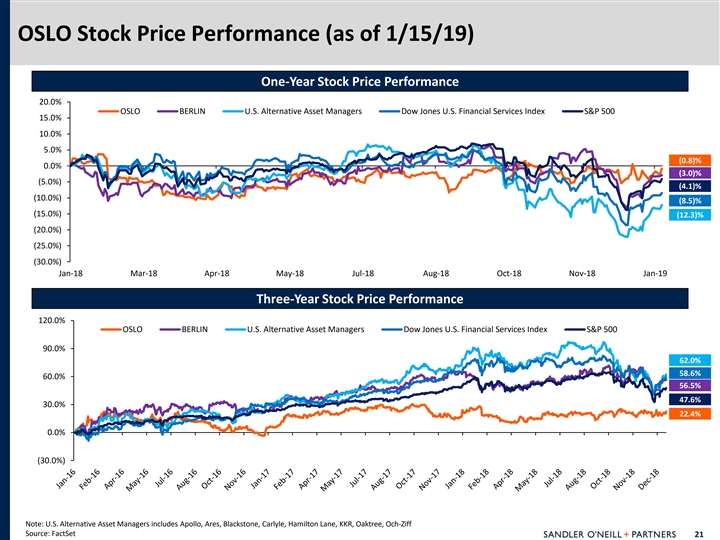

OSLO Stock Price Performance (as of 1/15/19) One-Year Stock Price Performance 20.0% OSLO BERLIN U.S. Alternative Asset Managers Dow Jones U.S. Financial Services Index S&P 500 15.0% 10.0% 5.0% (0.8)% 0.0% (3.0)% (5.0%) (4.1)% (10.0%) (8.5)% (15.0%) (12.3)% (20.0%) (25.0%) (30.0%) Jan-18 Mar-18 Apr-18 May-18 Jul-18 Aug-18 Oct-18 Nov-18 Jan-19 Three-Year Stock Price Performance 120.0% OSLO BERLIN U.S. Alternative Asset Managers Dow Jones U.S. Financial Services Index S&P 500 90.0% 62.0% 58.6% 60.0% 56.5% 47.6% 30.0% 22.4% 0.0% (30.0%) Note: U.S. Alternative Asset Managers includes Apollo, Ares, Blackstone, Carlyle, Hamilton Lane, KKR, Oaktree, Och-Ziff Source: FactSet 21OSLO Stock Price Performance (as of 1/15/19) One-Year Stock Price Performance 20.0% OSLO BERLIN U.S. Alternative Asset Managers Dow Jones U.S. Financial Services Index S&P 500 15.0% 10.0% 5.0% (0.8)% 0.0% (3.0)% (5.0%) (4.1)% (10.0%) (8.5)% (15.0%) (12.3)% (20.0%) (25.0%) (30.0%) Jan-18 Mar-18 Apr-18 May-18 Jul-18 Aug-18 Oct-18 Nov-18 Jan-19 Three-Year Stock Price Performance 120.0% OSLO BERLIN U.S. Alternative Asset Managers Dow Jones U.S. Financial Services Index S&P 500 90.0% 62.0% 58.6% 60.0% 56.5% 47.6% 30.0% 22.4% 0.0% (30.0%) Note: U.S. Alternative Asset Managers includes Apollo, Ares, Blackstone, Carlyle, Hamilton Lane, KKR, Oaktree, Och-Ziff Source: FactSet 21

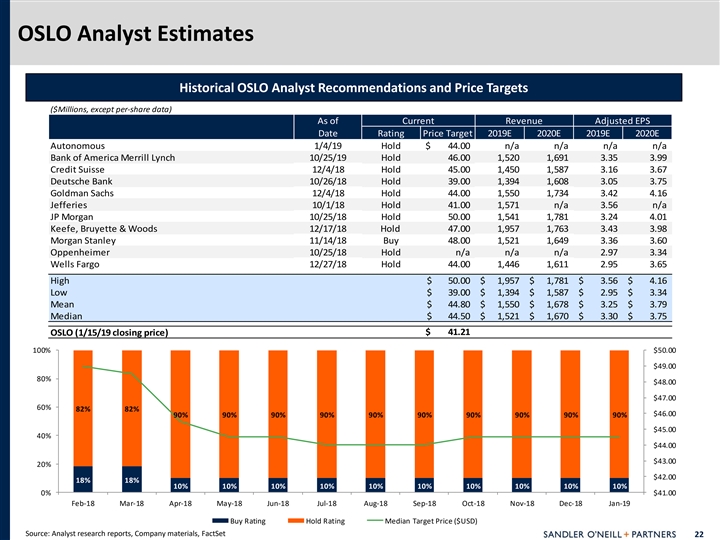

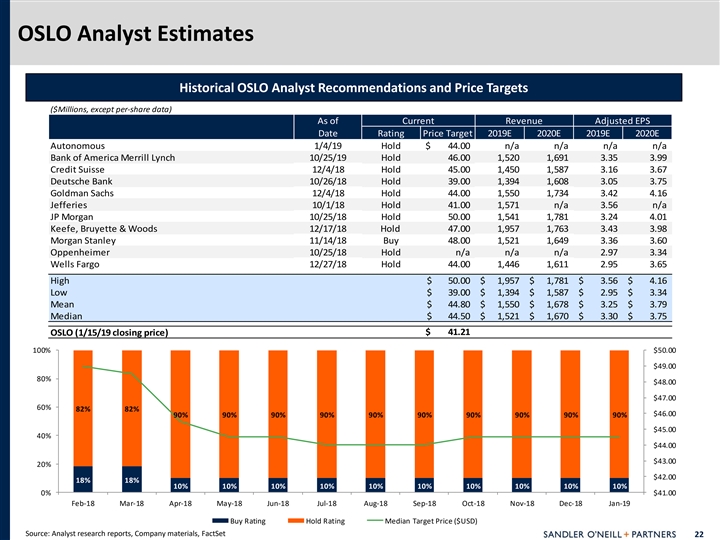

OSLO Analyst Estimates Historical OSLO Analyst Recommendations and Price Targets ($Millions, except per-share data) As of Current Revenue Adjusted EPS Date Rating Price Target 2019E 2020E 2019E 2020E Autonomous 1/4/19 Hold $ 44.00 n/a n/a n/a n/a Bank of America Merrill Lynch 10/25/19 Hold 46.00 1,520 1,691 3.35 3.99 Credit Suisse 12/4/18 Hold 45.00 1,450 1,587 3 .16 3.67 Deutsche Bank 10/26/18 Hold 39.00 1,394 1 ,608 3.05 3.75 Goldman Sachs 12/4/18 Hold 44.00 1,550 1 ,734 3.42 4.16 Jefferies 10/1/18 Hold 4 1.00 1 ,571 n/a 3.56 n/a JP Morgan 10/25/18 Hold 5 0.00 1 ,541 1,781 3.24 4.01 Keefe, Bruyette & Woods 12/17/18 Hold 4 7.00 1 ,957 1,763 3.43 3.98 Morgan Stanley 11/14/18 Buy 4 8.00 1,521 1 ,649 3.36 3.60 Oppenheimer 10/25/18 Hold n/a n/a n/a 2.97 3.34 Wells Fargo 12/27/18 Hold 44.00 1,446 1,611 2.95 3.65 High $ 50.00 $ 1,957 $ 1,781 $ 3.56 $ 4.16 Low $ 3 9.00 $ 1,394 $ 1 ,587 $ 2.95 $ 3.34 Mean $ 4 4.80 $ 1 ,550 $ 1,678 $ 3.25 $ 3.79 Median $ 44.50 $ 1 ,521 $ 1 ,670 $ 3.30 $ 3.75 $ 41.21 OSLO (1/15/19 closing price) 100% $50.00 $49.00 80% $48.00 $47.00 60% 82% 82% $46.00 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% $45.00 40% $44.00 $43.00 20% $42.00 18% 18% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 0% $41.00 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Buy Rating Hold Rating Median Target Price ($USD) Source: Analyst research reports, Company materials, FactSet 22OSLO Analyst Estimates Historical OSLO Analyst Recommendations and Price Targets ($Millions, except per-share data) As of Current Revenue Adjusted EPS Date Rating Price Target 2019E 2020E 2019E 2020E Autonomous 1/4/19 Hold $ 44.00 n/a n/a n/a n/a Bank of America Merrill Lynch 10/25/19 Hold 46.00 1,520 1,691 3.35 3.99 Credit Suisse 12/4/18 Hold 45.00 1,450 1,587 3 .16 3.67 Deutsche Bank 10/26/18 Hold 39.00 1,394 1 ,608 3.05 3.75 Goldman Sachs 12/4/18 Hold 44.00 1,550 1 ,734 3.42 4.16 Jefferies 10/1/18 Hold 4 1.00 1 ,571 n/a 3.56 n/a JP Morgan 10/25/18 Hold 5 0.00 1 ,541 1,781 3.24 4.01 Keefe, Bruyette & Woods 12/17/18 Hold 4 7.00 1 ,957 1,763 3.43 3.98 Morgan Stanley 11/14/18 Buy 4 8.00 1,521 1 ,649 3.36 3.60 Oppenheimer 10/25/18 Hold n/a n/a n/a 2.97 3.34 Wells Fargo 12/27/18 Hold 44.00 1,446 1,611 2.95 3.65 High $ 50.00 $ 1,957 $ 1,781 $ 3.56 $ 4.16 Low $ 3 9.00 $ 1,394 $ 1 ,587 $ 2.95 $ 3.34 Mean $ 4 4.80 $ 1 ,550 $ 1,678 $ 3.25 $ 3.79 Median $ 44.50 $ 1 ,521 $ 1 ,670 $ 3.30 $ 3.75 $ 41.21 OSLO (1/15/19 closing price) 100% $50.00 $49.00 80% $48.00 $47.00 60% 82% 82% $46.00 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% $45.00 40% $44.00 $43.00 20% $42.00 18% 18% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 0% $41.00 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Buy Rating Hold Rating Median Target Price ($USD) Source: Analyst research reports, Company materials, FactSet 22

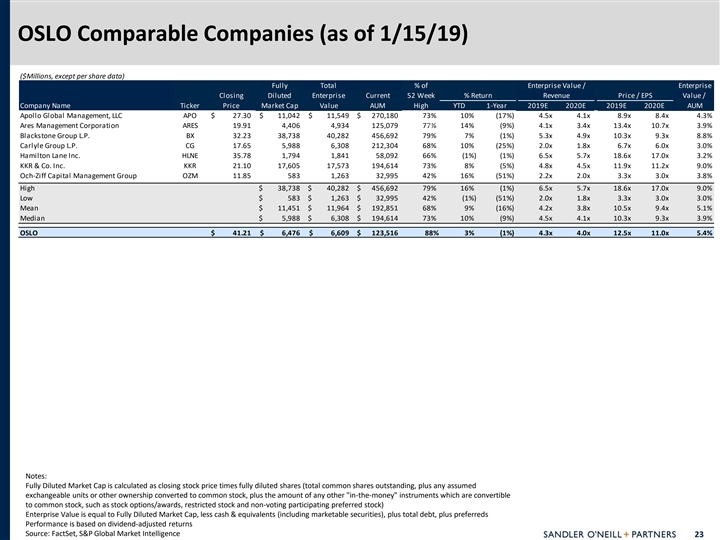

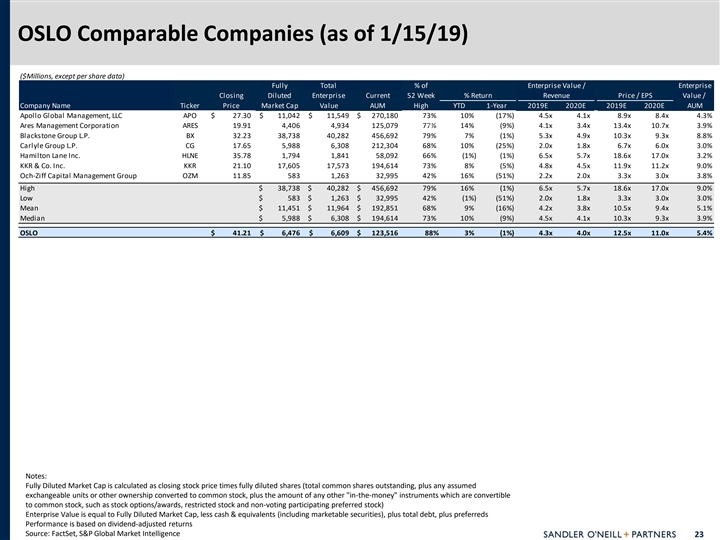

OSLO Comparable Companies (as of 1/15/19) ($Millions, except per share data) Fully Total % of Enterprise Value / Enterprise Closing Diluted Enterprise Current 52 Week % Return Revenue Price / EPS Value / Company Name Ticker Price Market Cap Value AUM High YTD 1-Year 2019E 2020E 2019E 2020E AUM Apollo Global Management, LLC APO $ 2 7.30 $ 11,042 $ 11,549 $ 2 70,180 73% 10% (17%) 4.5x 4.1x 8.9x 8.4x 4.3% (1) (2) Ares Management Corporation ARES 1 9.91 4,406 4,934 125,079 77% 14% (9%) 4.1x 3.4x 13.4x 10.7x 3.9% Blackstone Group L.P. BX 3 2.23 3 8,738 40,282 456,692 79% 7% (1%) 5.3x 4.9x 10.3x 9.3x 8.8% Carlyle Group L.P. CG 1 7.65 5 ,988 6,308 212,304 68% 10% (25%) 2.0x 1.8x 6.7x 6.0x 3.0% Hamilton Lane Inc. HLNE 35.78 1,794 1 ,841 5 8,092 66% (1%) (1%) 6.5x 5.7x 18.6x 17.0x 3.2% KKR & Co. Inc. KKR 2 1.10 1 7,605 17,573 194,614 73% 8% (5%) 4.8x 4.5x 11.9x 11.2x 9.0% Och-Ziff Capital Management Group OZM 1 1.85 583 1 ,263 32,995 42% 16% (51%) 2.2x 2.0x 3.3x 3.0x 3.8% High $ 38,738 $ 40,282 $ 4 56,692 79% 16% (1%) 6.5x 5.7x 18.6x 17.0x 9.0% Low $ 583 $ 1,263 $ 32,995 42% (1%) (51%) 2.0x 1.8x 3.3x 3.0x 3.0% Mean $ 11,451 $ 11,964 $ 1 92,851 68% 9% (16%) 4.2x 3.8x 10.5x 9.4x 5.1% Median $ 5,988 $ 6,308 $ 194,614 73% 10% (9%) 4.5x 4.1x 10.3x 9.3x 3.9% OSLO $ 4 1.21 $ 6 ,476 $ 6,609 $ 1 23,516 88% 3% (1%) 4.3x 4.0x 12.5x 11.0x 5.4% Notes: Fully Diluted Market Cap is calculated as closing stock price times fully diluted shares (total common shares outstanding, plus any assumed exchangeable units or other ownership converted to common stock, plus the amount of any other in-the-money instruments which are convertible to common stock, such as stock options/awards, restricted stock and non-voting participating preferred stock) Enterprise Value is equal to Fully Diluted Market Cap, less cash & equivalents (including marketable securities), plus total debt, plus preferreds Performance is based on dividend-adjusted returns Source: FactSet, S&P Global Market Intelligence 23OSLO Comparable Companies (as of 1/15/19) ($Millions, except per share data) Fully Total % of Enterprise Value / Enterprise Closing Diluted Enterprise Current 52 Week % Return Revenue Price / EPS Value / Company Name Ticker Price Market Cap Value AUM High YTD 1-Year 2019E 2020E 2019E 2020E AUM Apollo Global Management, LLC APO $ 2 7.30 $ 11,042 $ 11,549 $ 2 70,180 73% 10% (17%) 4.5x 4.1x 8.9x 8.4x 4.3% (1) (2) Ares Management Corporation ARES 1 9.91 4,406 4,934 125,079 77% 14% (9%) 4.1x 3.4x 13.4x 10.7x 3.9% Blackstone Group L.P. BX 3 2.23 3 8,738 40,282 456,692 79% 7% (1%) 5.3x 4.9x 10.3x 9.3x 8.8% Carlyle Group L.P. CG 1 7.65 5 ,988 6,308 212,304 68% 10% (25%) 2.0x 1.8x 6.7x 6.0x 3.0% Hamilton Lane Inc. HLNE 35.78 1,794 1 ,841 5 8,092 66% (1%) (1%) 6.5x 5.7x 18.6x 17.0x 3.2% KKR & Co. Inc. KKR 2 1.10 1 7,605 17,573 194,614 73% 8% (5%) 4.8x 4.5x 11.9x 11.2x 9.0% Och-Ziff Capital Management Group OZM 1 1.85 583 1 ,263 32,995 42% 16% (51%) 2.2x 2.0x 3.3x 3.0x 3.8% High $ 38,738 $ 40,282 $ 4 56,692 79% 16% (1%) 6.5x 5.7x 18.6x 17.0x 9.0% Low $ 583 $ 1,263 $ 32,995 42% (1%) (51%) 2.0x 1.8x 3.3x 3.0x 3.0% Mean $ 11,451 $ 11,964 $ 1 92,851 68% 9% (16%) 4.2x 3.8x 10.5x 9.4x 5.1% Median $ 5,988 $ 6,308 $ 194,614 73% 10% (9%) 4.5x 4.1x 10.3x 9.3x 3.9% OSLO $ 4 1.21 $ 6 ,476 $ 6,609 $ 1 23,516 88% 3% (1%) 4.3x 4.0x 12.5x 11.0x 5.4% Notes: Fully Diluted Market Cap is calculated as closing stock price times fully diluted shares (total common shares outstanding, plus any assumed exchangeable units or other ownership converted to common stock, plus the amount of any other in-the-money instruments which are convertible to common stock, such as stock options/awards, restricted stock and non-voting participating preferred stock) Enterprise Value is equal to Fully Diluted Market Cap, less cash & equivalents (including marketable securities), plus total debt, plus preferreds Performance is based on dividend-adjusted returns Source: FactSet, S&P Global Market Intelligence 23

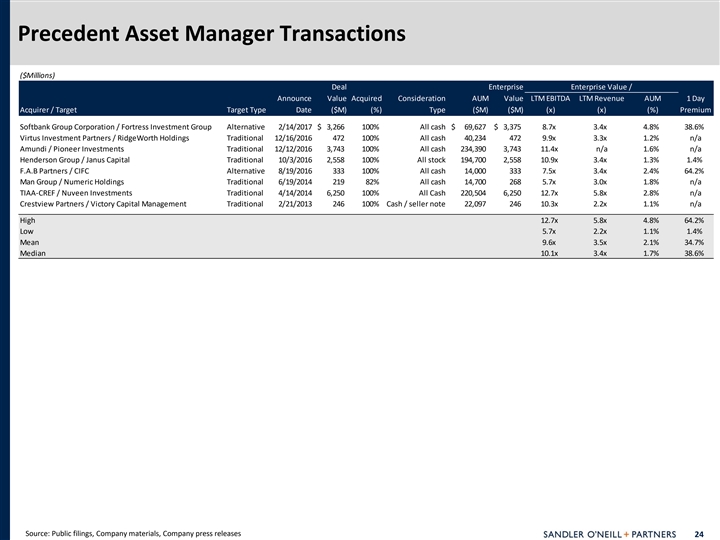

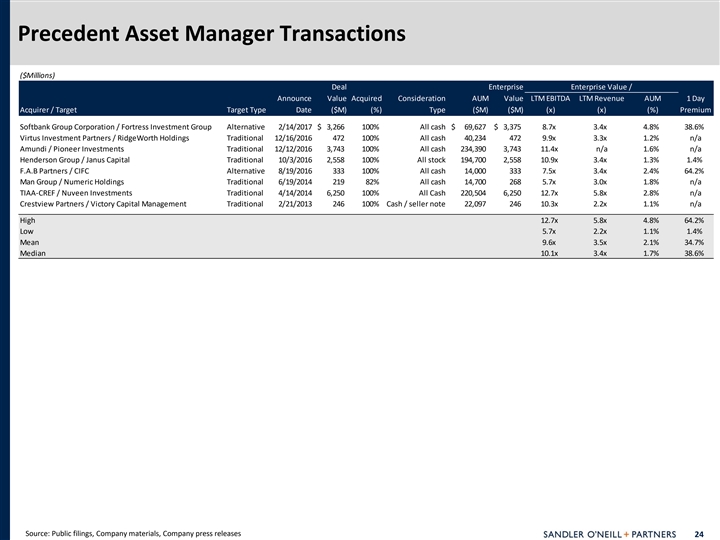

Precedent Asset Manager Transactions ($Millions) Deal Enterprise Enterprise Value / Announce Value Acquired Consideration AUM Value LTM EBITDA LTM Revenue AUM 1 Day Acquirer / Target Target Type Date ($M) (%) Type ($M) ($M) (x) (x) (%) Premium Softbank Group Corporation / Fortress Investment Group Alternative 2/14/2017 $ 3,266 100% All cash $ 69,627 $ 3,375 8.7x 3.4x 4.8% 38.6% Virtus Investment Partners / RidgeWorth Holdings Traditional 12/16/2016 472 100% All cash 40,234 472 9.9x 3.3x 1.2% n/a Amundi / Pioneer Investments Traditional 12/12/2016 3,743 100% All cash 234,390 3,743 11.4x n/a 1.6% n/a Henderson Group / Janus Capital Traditional 10/3/2016 2,558 100% All stock 194,700 2,558 10.9x 3.4x 1.3% 1.4% F.A.B Partners / CIFC Alternative 8/19/2016 333 100% All cash 1 4,000 333 7.5x 3.4x 2.4% 64.2% Man Group / Numeric Holdings Traditional 6/19/2014 219 82% All cash 14,700 268 5.7x 3.0x 1.8% n/a TIAA-CREF / Nuveen Investments Traditional 4/14/2014 6,250 100% All Cash 220,504 6,250 12.7x 5.8x 2.8% n/a Crestview Partners / Victory Capital Management Traditional 2/21/2013 246 100% Cash / seller note 22,097 246 10.3x 2.2x 1.1% n/a High 12.7x 5.8x 4.8% 64.2% Low 5.7x 2.2x 1.1% 1.4% Mean 9.6x 3.5x 2.1% 34.7% Median 10.1x 3.4x 1.7% 38.6% Source: Public filings, Company materials, Company press releases 24Precedent Asset Manager Transactions ($Millions) Deal Enterprise Enterprise Value / Announce Value Acquired Consideration AUM Value LTM EBITDA LTM Revenue AUM 1 Day Acquirer / Target Target Type Date ($M) (%) Type ($M) ($M) (x) (x) (%) Premium Softbank Group Corporation / Fortress Investment Group Alternative 2/14/2017 $ 3,266 100% All cash $ 69,627 $ 3,375 8.7x 3.4x 4.8% 38.6% Virtus Investment Partners / RidgeWorth Holdings Traditional 12/16/2016 472 100% All cash 40,234 472 9.9x 3.3x 1.2% n/a Amundi / Pioneer Investments Traditional 12/12/2016 3,743 100% All cash 234,390 3,743 11.4x n/a 1.6% n/a Henderson Group / Janus Capital Traditional 10/3/2016 2,558 100% All stock 194,700 2,558 10.9x 3.4x 1.3% 1.4% F.A.B Partners / CIFC Alternative 8/19/2016 333 100% All cash 1 4,000 333 7.5x 3.4x 2.4% 64.2% Man Group / Numeric Holdings Traditional 6/19/2014 219 82% All cash 14,700 268 5.7x 3.0x 1.8% n/a TIAA-CREF / Nuveen Investments Traditional 4/14/2014 6,250 100% All Cash 220,504 6,250 12.7x 5.8x 2.8% n/a Crestview Partners / Victory Capital Management Traditional 2/21/2013 246 100% Cash / seller note 22,097 246 10.3x 2.2x 1.1% n/a High 12.7x 5.8x 4.8% 64.2% Low 5.7x 2.2x 1.1% 1.4% Mean 9.6x 3.5x 2.1% 34.7% Median 10.1x 3.4x 1.7% 38.6% Source: Public filings, Company materials, Company press releases 24

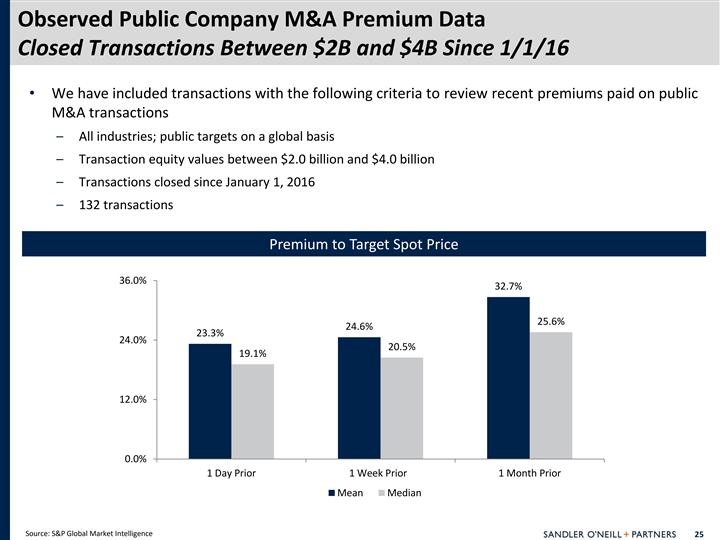

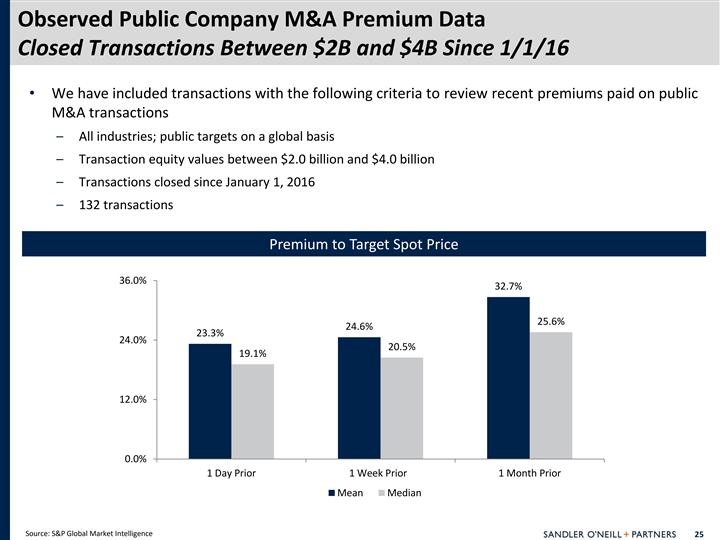

Observed Public Company M&A Premium Data Closed Transactions Between $2B and $4B Since 1/1/16 • We have included transactions with the following criteria to review recent premiums paid on public M&A transactions – All industries; public targets on a global basis – Transaction equity values between $2.0 billion and $4.0 billion – Transactions closed since January 1, 2016 – 132 transactions Premium to Target Spot Price 36.0% 32.7% 25.6% 24.6% 23.3% 24.0% 20.5% 19.1% 12.0% 0.0% 1 Day Prior 1 Week Prior 1 Month Prior Mean Median Source: S&P Global Market Intelligence 25Observed Public Company M&A Premium Data Closed Transactions Between $2B and $4B Since 1/1/16 • We have included transactions with the following criteria to review recent premiums paid on public M&A transactions – All industries; public targets on a global basis – Transaction equity values between $2.0 billion and $4.0 billion – Transactions closed since January 1, 2016 – 132 transactions Premium to Target Spot Price 36.0% 32.7% 25.6% 24.6% 23.3% 24.0% 20.5% 19.1% 12.0% 0.0% 1 Day Prior 1 Week Prior 1 Month Prior Mean Median Source: S&P Global Market Intelligence 25

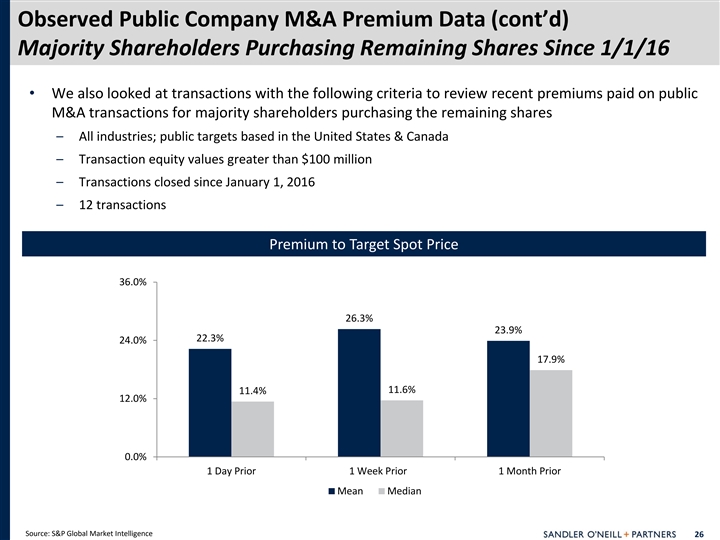

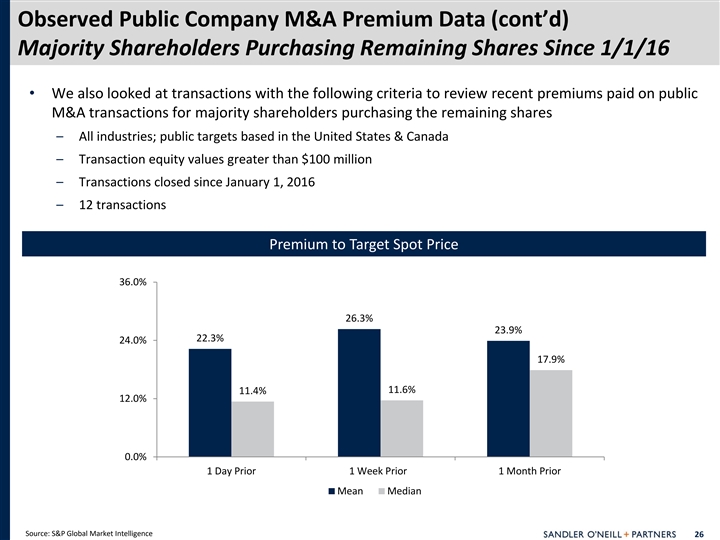

Observed Public Company M&A Premium Data (cont’d) Majority Shareholders Purchasing Remaining Shares Since 1/1/16 • We also looked at transactions with the following criteria to review recent premiums paid on public M&A transactions for majority shareholders purchasing the remaining shares – All industries; public targets based in the United States & Canada – Transaction equity values greater than $100 million – Transactions closed since January 1, 2016 – 12 transactions Premium to Target Spot Price 36.0% 26.3% 23.9% 22.3% 24.0% 17.9% 11.6% 11.4% 12.0% 0.0% 1 Day Prior 1 Week Prior 1 Month Prior Mean Median Source: S&P Global Market Intelligence 26Observed Public Company M&A Premium Data (cont’d) Majority Shareholders Purchasing Remaining Shares Since 1/1/16 • We also looked at transactions with the following criteria to review recent premiums paid on public M&A transactions for majority shareholders purchasing the remaining shares – All industries; public targets based in the United States & Canada – Transaction equity values greater than $100 million – Transactions closed since January 1, 2016 – 12 transactions Premium to Target Spot Price 36.0% 26.3% 23.9% 22.3% 24.0% 17.9% 11.6% 11.4% 12.0% 0.0% 1 Day Prior 1 Week Prior 1 Month Prior Mean Median Source: S&P Global Market Intelligence 26

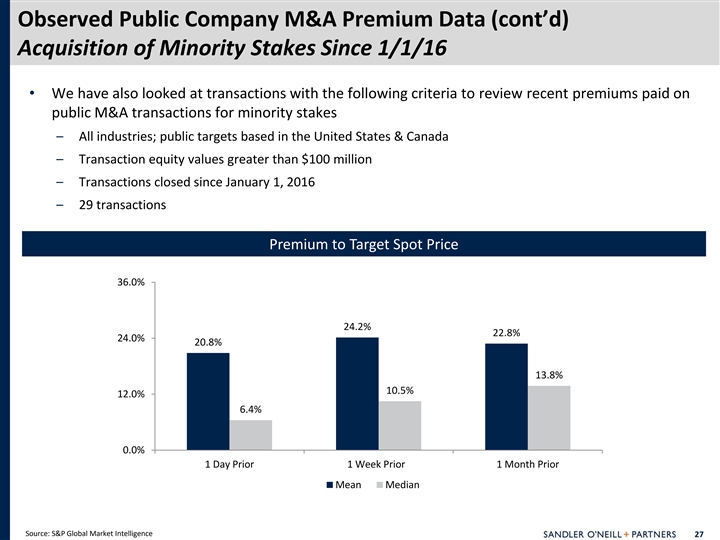

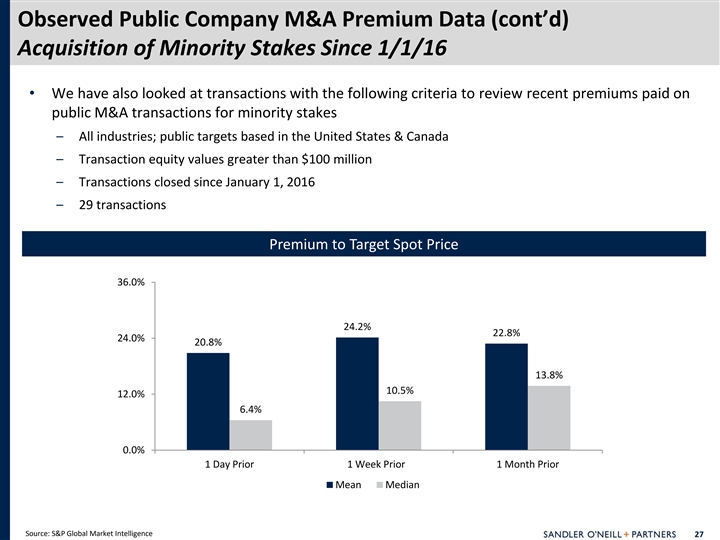

Observed Public Company M&A Premium Data (cont’d) Acquisition of Minority Stakes Since 1/1/16 • We have also looked at transactions with the following criteria to review recent premiums paid on public M&A transactions for minority stakes – All industries; public targets based in the United States & Canada – Transaction equity values greater than $100 million – Transactions closed since January 1, 2016 – 29 transactions Premium to Target Spot Price 36.0% 24.2% 22.8% 24.0% 20.8% 13.8% 10.5% 12.0% 6.4% 0.0% 1 Day Prior 1 Week Prior 1 Month Prior Mean Median Source: S&P Global Market Intelligence 27Observed Public Company M&A Premium Data (cont’d) Acquisition of Minority Stakes Since 1/1/16 • We have also looked at transactions with the following criteria to review recent premiums paid on public M&A transactions for minority stakes – All industries; public targets based in the United States & Canada – Transaction equity values greater than $100 million – Transactions closed since January 1, 2016 – 29 transactions Premium to Target Spot Price 36.0% 24.2% 22.8% 24.0% 20.8% 13.8% 10.5% 12.0% 6.4% 0.0% 1 Day Prior 1 Week Prior 1 Month Prior Mean Median Source: S&P Global Market Intelligence 27

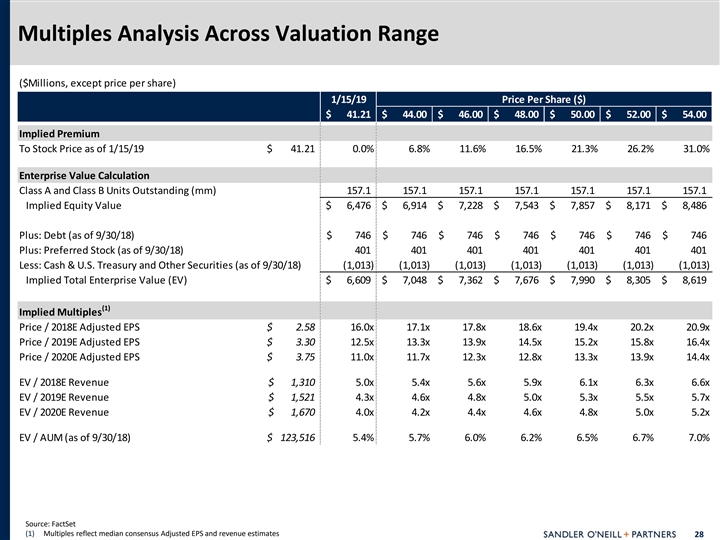

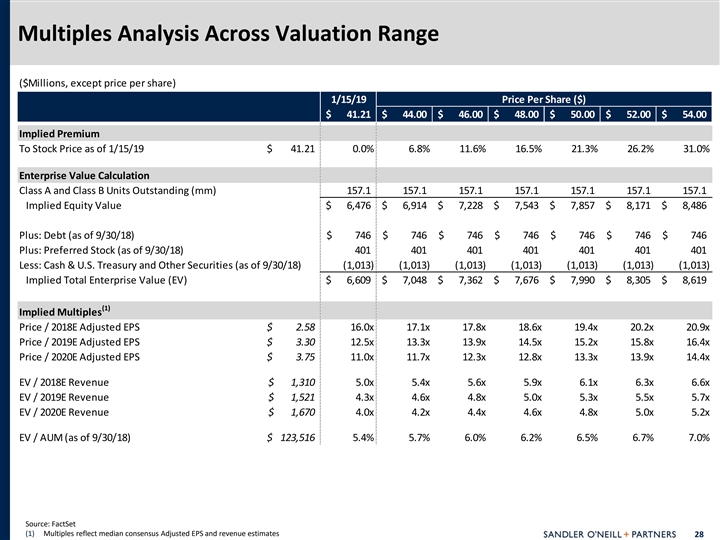

Multiples Analysis Across Valuation Range ($Millions, except price per share) 1/15/19 Price Per Share ($) $ 4 1.21 $ 44.00 $ 4 6.00 $ 4 8.00 $ 50.00 $ 5 2.00 $ 54.00 Implied Premium To Stock Price as of 1/15/19 $ 41.21 0.0% 6.8% 11.6% 16.5% 21.3% 26.2% 31.0% Enterprise Value Calculation Class A and Class B Units Outstanding (mm) 157.1 157.1 1 57.1 157.1 1 57.1 157.1 157.1 Implied Equity Value $ 6,476 $ 6,914 $ 7 ,228 $ 7,543 $ 7,857 $ 8,171 $ 8 ,486 Plus: Debt (as of 9/30/18) $ 746 $ 746 $ 746 $ 746 $ 746 $ 746 $ 746 Plus: Preferred Stock (as of 9/30/18) 401 401 401 401 401 401 401 Less: Cash & U.S. Treasury and Other Securities (as of 9/30/18) (1,013) (1,013) (1,013) (1,013) (1,013) (1,013) (1,013) Implied Total Enterprise Value (EV) $ 6 ,609 $ 7,048 $ 7 ,362 $ 7 ,676 $ 7,990 $ 8,305 $ 8 ,619 (1) Implied Multiples Price / 2018E Adjusted EPS $ 2.58 16.0x 17.1x 17.8x 18.6x 19.4x 20.2x 20.9x Price / 2019E Adjusted EPS $ 3.30 12.5x 13.3x 13.9x 14.5x 15.2x 15.8x 16.4x Price / 2020E Adjusted EPS $ 3.75 11.0x 11.7x 12.3x 12.8x 13.3x 13.9x 14.4x EV / 2018E Revenue $ 1,310 5.0x 5.4x 5.6x 5.9x 6.1x 6.3x 6.6x EV / 2019E Revenue $ 1,521 4.3x 4.6x 4.8x 5.0x 5.3x 5.5x 5.7x EV / 2020E Revenue $ 1,670 4.0x 4.2x 4.4x 4.6x 4.8x 5.0x 5.2x EV / AUM (as of 9/30/18) $ 123,516 5.4% 5.7% 6.0% 6.2% 6.5% 6.7% 7.0% Source: FactSet (1) Multiples reflect median consensus Adjusted EPS and revenue estimates 28Multiples Analysis Across Valuation Range ($Millions, except price per share) 1/15/19 Price Per Share ($) $ 4 1.21 $ 44.00 $ 4 6.00 $ 4 8.00 $ 50.00 $ 5 2.00 $ 54.00 Implied Premium To Stock Price as of 1/15/19 $ 41.21 0.0% 6.8% 11.6% 16.5% 21.3% 26.2% 31.0% Enterprise Value Calculation Class A and Class B Units Outstanding (mm) 157.1 157.1 1 57.1 157.1 1 57.1 157.1 157.1 Implied Equity Value $ 6,476 $ 6,914 $ 7 ,228 $ 7,543 $ 7,857 $ 8,171 $ 8 ,486 Plus: Debt (as of 9/30/18) $ 746 $ 746 $ 746 $ 746 $ 746 $ 746 $ 746 Plus: Preferred Stock (as of 9/30/18) 401 401 401 401 401 401 401 Less: Cash & U.S. Treasury and Other Securities (as of 9/30/18) (1,013) (1,013) (1,013) (1,013) (1,013) (1,013) (1,013) Implied Total Enterprise Value (EV) $ 6 ,609 $ 7,048 $ 7 ,362 $ 7 ,676 $ 7,990 $ 8,305 $ 8 ,619 (1) Implied Multiples Price / 2018E Adjusted EPS $ 2.58 16.0x 17.1x 17.8x 18.6x 19.4x 20.2x 20.9x Price / 2019E Adjusted EPS $ 3.30 12.5x 13.3x 13.9x 14.5x 15.2x 15.8x 16.4x Price / 2020E Adjusted EPS $ 3.75 11.0x 11.7x 12.3x 12.8x 13.3x 13.9x 14.4x EV / 2018E Revenue $ 1,310 5.0x 5.4x 5.6x 5.9x 6.1x 6.3x 6.6x EV / 2019E Revenue $ 1,521 4.3x 4.6x 4.8x 5.0x 5.3x 5.5x 5.7x EV / 2020E Revenue $ 1,670 4.0x 4.2x 4.4x 4.6x 4.8x 5.0x 5.2x EV / AUM (as of 9/30/18) $ 123,516 5.4% 5.7% 6.0% 6.2% 6.5% 6.7% 7.0% Source: FactSet (1) Multiples reflect median consensus Adjusted EPS and revenue estimates 28

IV. Next StepsIV. Next Steps

Next Steps • Await OSLO’s response to BERLIN 1/13/19 proposal • Call scheduled with OSLO’s Head of Corporate Development for Friday, January 18 to discuss process for reverse due diligence • Ongoing due diligence of BERLIN with particular focus on the following areas: – Governance structure – Cross-ownership of funds – Sensitivity to market risk / idiosyncratic risk – 5-year plan 30Next Steps • Await OSLO’s response to BERLIN 1/13/19 proposal • Call scheduled with OSLO’s Head of Corporate Development for Friday, January 18 to discuss process for reverse due diligence • Ongoing due diligence of BERLIN with particular focus on the following areas: – Governance structure – Cross-ownership of funds – Sensitivity to market risk / idiosyncratic risk – 5-year plan 30

V. AppendixV. Appendix

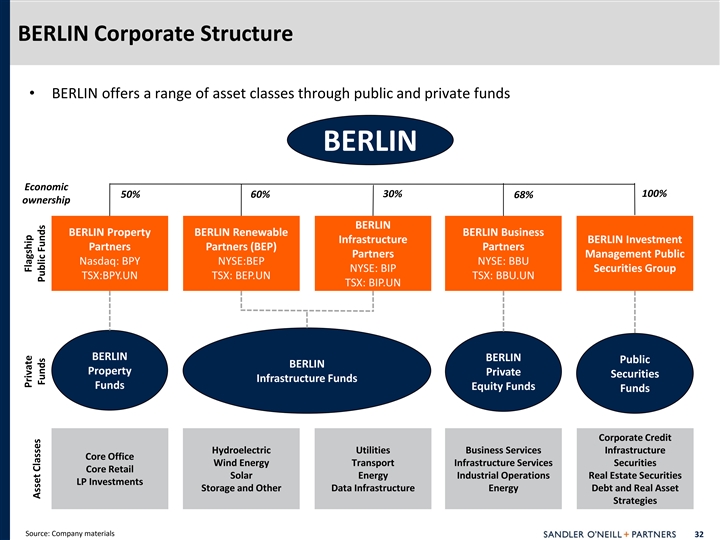

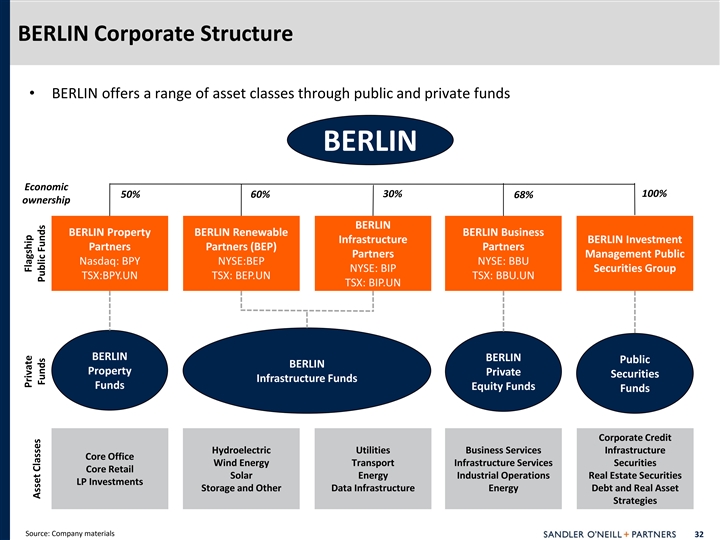

BERLIN Corporate Structure • BERLIN offers a range of asset classes through public and private funds BERLIN Economic 30% 100% 50% 60% 68% ownership BERLIN BERLIN Property BERLIN Renewable BERLIN Business Infrastructure BERLIN Investment Partners Partners (BEP) Partners Partners Management Public Nasdaq: BPY NYSE:BEP NYSE: BBU NYSE: BIP Securities Group TSX:BPY.UN TSX: BEP.UN TSX: BBU.UN TSX: BIP.UN BERLIN BERLIN Public BERLIN Property Private Securities Infrastructure Funds Funds Equity Funds Funds Corporate Credit Hydroelectric Utilities Business Services Infrastructure Core Office Wind Energy Transport Infrastructure Services Securities Core Retail Solar Energy Industrial Operations Real Estate Securities LP Investments Storage and Other Data Infrastructure Energy Debt and Real Asset Strategies Source: Company materials 32 Private Flagship Asset Classes Funds Public Funds BERLIN Corporate Structure • BERLIN offers a range of asset classes through public and private funds BERLIN Economic 30% 100% 50% 60% 68% ownership BERLIN BERLIN Property BERLIN Renewable BERLIN Business Infrastructure BERLIN Investment Partners Partners (BEP) Partners Partners Management Public Nasdaq: BPY NYSE:BEP NYSE: BBU NYSE: BIP Securities Group TSX:BPY.UN TSX: BEP.UN TSX: BBU.UN TSX: BIP.UN BERLIN BERLIN Public BERLIN Property Private Securities Infrastructure Funds Funds Equity Funds Funds Corporate Credit Hydroelectric Utilities Business Services Infrastructure Core Office Wind Energy Transport Infrastructure Services Securities Core Retail Solar Energy Industrial Operations Real Estate Securities LP Investments Storage and Other Data Infrastructure Energy Debt and Real Asset Strategies Source: Company materials 32 Private Flagship Asset Classes Funds Public Funds

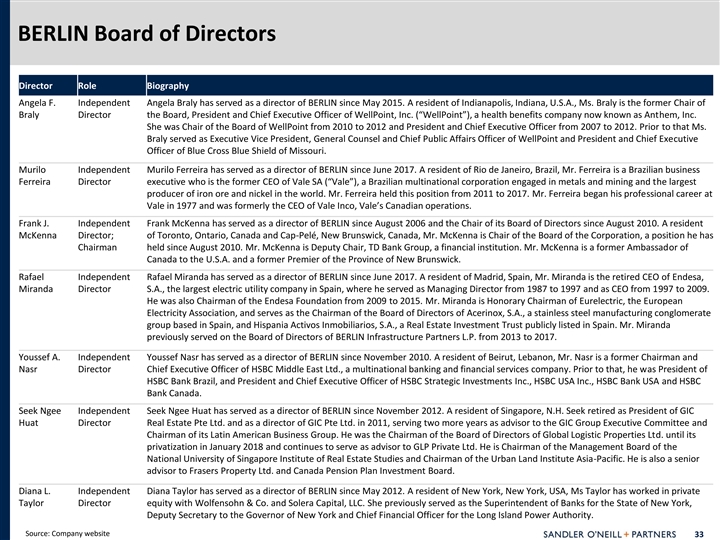

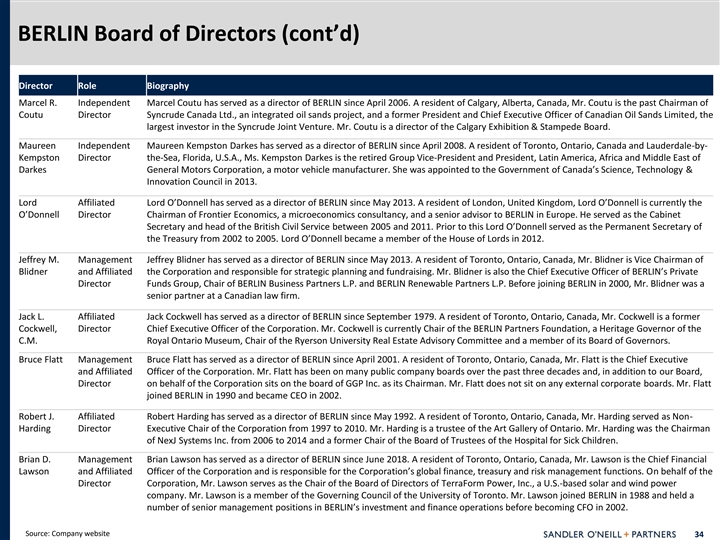

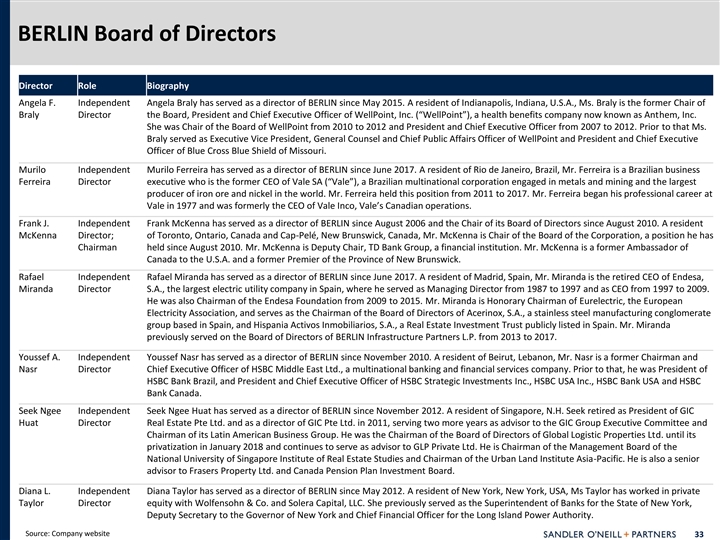

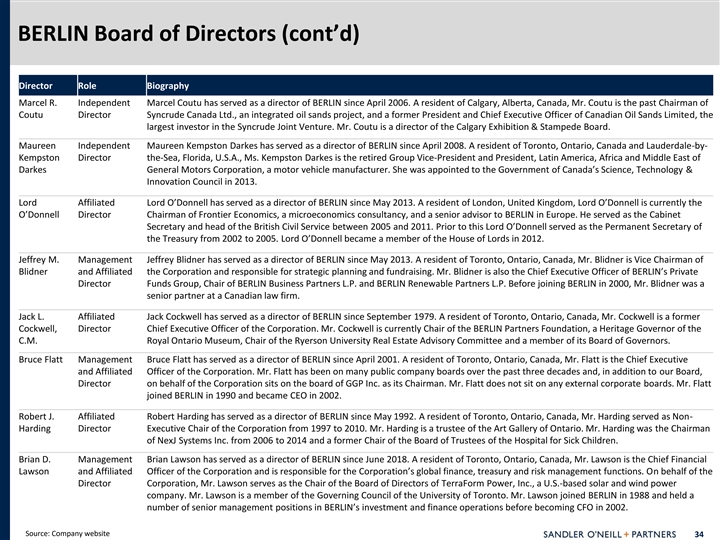

BERLIN Board of Directors Director Role Biography Angela F. Independent Angela Braly has served as a director of BERLIN since May 2015. A resident of Indianapolis, Indiana, U.S.A., Ms. Braly is the former Chair of Braly Director the Board, President and Chief Executive Officer of WellPoint, Inc. (“WellPoint”), a health benefits company now known as Anthem, Inc. She was Chair of the Board of WellPoint from 2010 to 2012 and President and Chief Executive Officer from 2007 to 2012. Prior to that Ms. (1) (2) Braly served as Executive Vice President, General Counsel and Chief Public Affairs Officer of WellPoint and President and Chief Executive Officer of Blue Cross Blue Shield of Missouri. Murilo Independent Murilo Ferreira has served as a director of BERLIN since June 2017. A resident of Rio de Janeiro, Brazil, Mr. Ferreira is a Brazilian business Ferreira Director executive who is the former CEO of Vale SA (“Vale”), a Brazilian multinational corporation engaged in metals and mining and the largest producer of iron ore and nickel in the world. Mr. Ferreira held this position from 2011 to 2017. Mr. Ferreira began his professional career at Vale in 1977 and was formerly the CEO of Vale Inco, Vale’s Canadian operations. Frank J. Independent Frank McKenna has served as a director of BERLIN since August 2006 and the Chair of its Board of Directors since August 2010. A resident McKenna Director; of Toronto, Ontario, Canada and Cap-Pelé, New Brunswick, Canada, Mr. McKenna is Chair of the Board of the Corporation, a position he has Chairman held since August 2010. Mr. McKenna is Deputy Chair, TD Bank Group, a financial institution. Mr. McKenna is a former Ambassador of Canada to the U.S.A. and a former Premier of the Province of New Brunswick. Rafael Independent Rafael Miranda has served as a director of BERLIN since June 2017. A resident of Madrid, Spain, Mr. Miranda is the retired CEO of Endesa, Miranda Director S.A., the largest electric utility company in Spain, where he served as Managing Director from 1987 to 1997 and as CEO from 1997 to 2009. He was also Chairman of the Endesa Foundation from 2009 to 2015. Mr. Miranda is Honorary Chairman of Eurelectric, the European Electricity Association, and serves as the Chairman of the Board of Directors of Acerinox, S.A., a stainless steel manufacturing conglomerate group based in Spain, and Hispania Activos Inmobiliarios, S.A., a Real Estate Investment Trust publicly listed in Spain. Mr. Miranda previously served on the Board of Directors of BERLIN Infrastructure Partners L.P. from 2013 to 2017. Youssef A. Independent Youssef Nasr has served as a director of BERLIN since November 2010. A resident of Beirut, Lebanon, Mr. Nasr is a former Chairman and Nasr Director Chief Executive Officer of HSBC Middle East Ltd., a multinational banking and financial services company. Prior to that, he was President of HSBC Bank Brazil, and President and Chief Executive Officer of HSBC Strategic Investments Inc., HSBC USA Inc., HSBC Bank USA and HSBC Bank Canada. Seek Ngee Independent Seek Ngee Huat has served as a director of BERLIN since November 2012. A resident of Singapore, N.H. Seek retired as President of GIC Huat Director Real Estate Pte Ltd. and as a director of GIC Pte Ltd. in 2011, serving two more years as advisor to the GIC Group Executive Committee and Chairman of its Latin American Business Group. He was the Chairman of the Board of Directors of Global Logistic Properties Ltd. until its privatization in January 2018 and continues to serve as advisor to GLP Private Ltd. He is Chairman of the Management Board of the National University of Singapore Institute of Real Estate Studies and Chairman of the Urban Land Institute Asia-Pacific. He is also a senior advisor to Frasers Property Ltd. and Canada Pension Plan Investment Board. Diana L. Independent Diana Taylor has served as a director of BERLIN since May 2012. A resident of New York, New York, USA, Ms Taylor has worked in private Taylor Director equity with Wolfensohn & Co. and Solera Capital, LLC. She previously served as the Superintendent of Banks for the State of New York, Deputy Secretary to the Governor of New York and Chief Financial Officer for the Long Island Power Authority. Source: Company website 33BERLIN Board of Directors Director Role Biography Angela F. Independent Angela Braly has served as a director of BERLIN since May 2015. A resident of Indianapolis, Indiana, U.S.A., Ms. Braly is the former Chair of Braly Director the Board, President and Chief Executive Officer of WellPoint, Inc. (“WellPoint”), a health benefits company now known as Anthem, Inc. She was Chair of the Board of WellPoint from 2010 to 2012 and President and Chief Executive Officer from 2007 to 2012. Prior to that Ms. (1) (2) Braly served as Executive Vice President, General Counsel and Chief Public Affairs Officer of WellPoint and President and Chief Executive Officer of Blue Cross Blue Shield of Missouri. Murilo Independent Murilo Ferreira has served as a director of BERLIN since June 2017. A resident of Rio de Janeiro, Brazil, Mr. Ferreira is a Brazilian business Ferreira Director executive who is the former CEO of Vale SA (“Vale”), a Brazilian multinational corporation engaged in metals and mining and the largest producer of iron ore and nickel in the world. Mr. Ferreira held this position from 2011 to 2017. Mr. Ferreira began his professional career at Vale in 1977 and was formerly the CEO of Vale Inco, Vale’s Canadian operations. Frank J. Independent Frank McKenna has served as a director of BERLIN since August 2006 and the Chair of its Board of Directors since August 2010. A resident McKenna Director; of Toronto, Ontario, Canada and Cap-Pelé, New Brunswick, Canada, Mr. McKenna is Chair of the Board of the Corporation, a position he has Chairman held since August 2010. Mr. McKenna is Deputy Chair, TD Bank Group, a financial institution. Mr. McKenna is a former Ambassador of Canada to the U.S.A. and a former Premier of the Province of New Brunswick. Rafael Independent Rafael Miranda has served as a director of BERLIN since June 2017. A resident of Madrid, Spain, Mr. Miranda is the retired CEO of Endesa, Miranda Director S.A., the largest electric utility company in Spain, where he served as Managing Director from 1987 to 1997 and as CEO from 1997 to 2009. He was also Chairman of the Endesa Foundation from 2009 to 2015. Mr. Miranda is Honorary Chairman of Eurelectric, the European Electricity Association, and serves as the Chairman of the Board of Directors of Acerinox, S.A., a stainless steel manufacturing conglomerate group based in Spain, and Hispania Activos Inmobiliarios, S.A., a Real Estate Investment Trust publicly listed in Spain. Mr. Miranda previously served on the Board of Directors of BERLIN Infrastructure Partners L.P. from 2013 to 2017. Youssef A. Independent Youssef Nasr has served as a director of BERLIN since November 2010. A resident of Beirut, Lebanon, Mr. Nasr is a former Chairman and Nasr Director Chief Executive Officer of HSBC Middle East Ltd., a multinational banking and financial services company. Prior to that, he was President of HSBC Bank Brazil, and President and Chief Executive Officer of HSBC Strategic Investments Inc., HSBC USA Inc., HSBC Bank USA and HSBC Bank Canada. Seek Ngee Independent Seek Ngee Huat has served as a director of BERLIN since November 2012. A resident of Singapore, N.H. Seek retired as President of GIC Huat Director Real Estate Pte Ltd. and as a director of GIC Pte Ltd. in 2011, serving two more years as advisor to the GIC Group Executive Committee and Chairman of its Latin American Business Group. He was the Chairman of the Board of Directors of Global Logistic Properties Ltd. until its privatization in January 2018 and continues to serve as advisor to GLP Private Ltd. He is Chairman of the Management Board of the National University of Singapore Institute of Real Estate Studies and Chairman of the Urban Land Institute Asia-Pacific. He is also a senior advisor to Frasers Property Ltd. and Canada Pension Plan Investment Board. Diana L. Independent Diana Taylor has served as a director of BERLIN since May 2012. A resident of New York, New York, USA, Ms Taylor has worked in private Taylor Director equity with Wolfensohn & Co. and Solera Capital, LLC. She previously served as the Superintendent of Banks for the State of New York, Deputy Secretary to the Governor of New York and Chief Financial Officer for the Long Island Power Authority. Source: Company website 33