UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the fiscal year ended December 31, 2014

or

| |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the transition period from to .

Commission File Number 001-35500

|

| | |

| | | |

Oaktree Capital Group, LLC (Exact name of registrant as specified in its charter) |

|

| |

| Delaware | 26-0174894 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

|

| | |

333 South Grand Avenue, 28th Floor Los Angeles, CA 90071 Telephone: (213) 830-6300 (Address, zip code, and telephone number, including area code, of registrant’s principal executive offices) |

| | | |

Securities registered pursuant to Section 12(b) of the Act:

|

| |

| Title of each class | Name of each exchange on which registered |

| Class A units representing limited liability company interests | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 and 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter periods that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

|

| | |

| | Large accelerated filer x | Accelerated filer ¨ |

| | Non-accelerated filer ¨ | Smaller reporting company ¨ |

| (Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the Class A units of the registrant held by non-affiliates as of June 30, 2014 was approximately $2.2 billion.

As of February 24, 2015, there were 43,771,659 Class A units and 109,974,898 Class B units of the registrant outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

TABLE OF CONTENTS

|

| | |

| | Page |

| PART I. | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART II. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART III. | | |

| | |

| | |

| | |

| | |

| | |

| PART IV. | | |

| | |

| |

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), which reflect our current views with respect to, among other things, our future results of operations and financial performance. In some cases, you can identify forward-looking statements by words such as “anticipate,” “approximately,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “outlook,” “plan,” “potential,” “predict,” “seek,” “should,” “will” and “would” or the negative version of these words or other comparable or similar words. These statements identify prospective information. Important factors could cause actual results to differ, possibly materially, from those indicated in these statements. Forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. Such forward-looking statements are subject to risks and uncertainties and assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity, including, but not limited to, changes in our anticipated revenue and income, which are inherently volatile; changes in the value of our investments; the pace of our raising of new funds; changes in assets under management; the timing and receipt of, and impact of taxes on, carried interest; distributions from and liquidation of our existing funds; the amount and timing of distributions on our Class A units; changes in our operating or other expenses; the degree to which we encounter competition; and general economic and market conditions. The factors listed in the item captioned “Risk Factors” in this annual report provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations described in our forward-looking statements.

Forward-looking statements speak only as of the date of this annual report. Except as required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

MARKET AND INDUSTRY DATA

This annual report includes market and industry data and forecasts that are derived from independent reports, publicly available information, various industry publications, other published industry sources and our internal data, estimates and forecasts. Independent reports, industry publications and other published industry sources generally indicate that the information contained therein was obtained from sources believed to be reliable. We have not commissioned, nor are we affiliated with, any of the sources cited herein.

Our internal data, estimates and forecasts are based upon information obtained from investors in our funds, partners, trade and business organizations and other contacts in the markets in which we operate and our management’s understanding of industry conditions.

In this annual report, unless the context otherwise requires:

“Oaktree,” “OCG,” “we,” “us,” “our” or “our company” refers to Oaktree Capital Group, LLC and, where applicable, its subsidiaries and affiliates.

“Oaktree Operating Group,” or “Operating Group,” refers collectively to the entities that control the general partners and investment advisers of our funds in which we have a minority economic interest and indirect control.

“OCGH” refers to Oaktree Capital Group Holdings, L.P., a Delaware limited partnership, which holds an interest in the Oaktree Operating Group and all of our Class B units.

“OCGH unitholders” refers collectively to our senior executives, current and former employees and certain other investors who hold their interest in the Oaktree Operating Group through OCGH.

“2007 Private Offering” refers to the sale completed on May 25, 2007 of 23,000,000 of our Class A units to qualified institutional buyers (as defined in the Securities Act) in a transaction exempt from the registration requirements of the Securities Act. Prior to our initial public offering, these Class A units traded on a private over-the-counter market developed by Goldman, Sachs & Co. for Tradable Unregistered Equity Securities.

“assets under management,” or “AUM,” generally refers to the assets we manage and equals the NAV (as defined below) of the assets we manage, the fund-level leverage on which management fees are charged, the undrawn capital that we are entitled to call from investors in our funds pursuant to their capital commitments, and the aggregate par value of collateral assets and principal cash held by our collateralized loan obligation vehicles (“CLOs”). Our AUM amounts include AUM for which we charge no fees. Our definition of AUM is not based on any definition contained in our operating agreement or the agreements governing the funds that we manage. Our calculation of AUM and the two AUM-related metrics described below may not be directly comparable to the AUM metrics of other investment managers.

| |

| • | “management fee-generating assets under management,” or “management fee-generating AUM,” is a forward-looking metric and reflects the AUM on which we will earn management fees in the following quarter, as more fully described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Segment and Operating Metrics—Assets Under Management—Management Fee-generating Assets Under Management.” |

| |

| • | “incentive-creating assets under management,” or “incentive-creating AUM,” refers to the AUM that may eventually produce incentive income, as more fully described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Segment and Operating Metrics—Assets Under Management—Incentive-creating Assets Under Management.” |

“consolidated funds” refers to the funds and CLOs that Oaktree consolidates through a majority voting interest or otherwise, including those funds in which Oaktree as the general partner is presumed to have control.

“funds” refers to investment funds and, where applicable, CLOs and separate accounts that are managed by us or our subsidiaries.

“initial public offering” refers to the listing of our Class A units on the New York Stock Exchange on April 12, 2012 whereby Oaktree sold 7,888,864 Class A units and selling unitholders sold 954,159 Class A units, as more fully described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Initial Public Offering” in this annual report.

“Intermediate Holding Companies” collectively refers to the subsidiaries wholly owned by us.

“net asset value,” or “NAV,” refers to the value of all the assets of a fund (including cash and accrued interest and dividends) less all liabilities of the fund (including accrued expenses and any reserves established by us, in our discretion, for contingent liabilities) without reduction for accrued incentives (fund level) because they are reflected in the partners’ capital of the fund.

“Relevant Benchmark” refers, with respect to:

| |

| • | our U.S. High Yield Bond strategy, to the Citigroup U.S. High Yield Cash-Pay Capped Index; |

| |

| • | our Global High Yield Bond strategy, to an Oaktree custom global high yield index that represents 60% BofA Merrill Lynch High Yield Master II Constrained Index and 40% BofA Merrill Lynch Global Non- |

Financial High Yield European Issuers 3% Constrained, ex-Russia Index – USD Hedged from inception through December 31, 2012, and the BofA Merrill Lynch Non-Financial Developed Markets High Yield Constrained Index – USD Hedged thereafter;

| |

| • | our European High Yield Bond strategy, to the BofA Merrill Lynch Global Non-Financial High Yield European Issuers excluding Russia 3% Constrained Index (USD Hedged); |

| |

| • | our U.S. Senior Loan strategy (with the exception of the closed-end funds), to the Credit Suisse Leveraged Loan Index; |

| |

| • | our European Senior Loan strategy, to the Credit Suisse Western European Leveraged Loan Index (EUR Hedged); |

| |

| • | our U.S. Convertible Securities strategy, to an Oaktree custom convertible index that represents the Credit Suisse Convertible Securities Index from inception through December 31, 1999, the Goldman Sachs/Bloomberg Convertible 100 Index from January 1, 2000 through June 30, 2004 and the BofA Merrill Lynch All U.S. Convertibles Index thereafter; |

| |

| • | our non-U.S. Convertible Securities strategy, to the JACI Global ex-U.S. (Local) Index; |

| |

| • | our High Income Convertible Securities strategy, to the Citigroup U.S. High Yield Market Index; and |

| |

| • | our Emerging Markets Equity strategy, to the Morgan Stanley Capital International Emerging Markets Index (Net). |

“senior executives” refers collectively to Howard S. Marks, Bruce A. Karsh, Jay S. Wintrob, John B. Frank, Stephen A. Kaplan, Larry W. Keele, David M. Kirchheimer and Sheldon M. Stone.

“Sharpe Ratio” refers to a metric used to calculate risk-adjusted return. The Sharpe Ratio is the ratio of excess return to volatility, with excess return defined as the return above that of a riskless asset (based on the three-month U.S. Treasury bill, or for our European Senior Loan strategy, the Euro Overnight Index Average) divided by the standard deviation of such return. A higher Sharpe Ratio indicates a return that is higher than would be expected for the level of risk compared to the risk-free rate.

This annual report and its contents do not constitute and should not be construed as an offer of securities of any Oaktree funds.

Part I.

Item 1. Business

Overview

Oaktree is a leader among global investment managers specializing in alternative investments, with $90.8 billion in assets under management (“AUM”) as of December 31, 2014. We emphasize an opportunistic, value-oriented and risk-controlled approach to investments in distressed debt, corporate debt (including high yield debt and senior loans), control investing, convertible securities, real estate and listed equities. Over nearly three decades, we have developed a large and growing client base through our ability to identify and capitalize on opportunities for attractive investment returns in less efficient markets.

Our founding senior executives were pioneers in the management of high yield bonds, convertible securities and distressed debt. From those roots we have developed an array of specialized credit- and equity-oriented strategies. Our 290 investment professionals include 154 senior investment professionals with an average 18 years of industry experience, who between them possess the investing, research, analytical, legal, trading and other skills, relationships and experience that are necessary for long-term success in our complex markets. Additionally, our compensation and other personnel practices foster a collaborative culture that facilitates complementary investment strategies benefiting from shared knowledge and insights.

We manage assets on behalf of many of the most significant institutional investors in the world. Our clientele has nearly doubled over the past decade, to over 2,000, including 74 of the 100 largest U.S. pension plans, 39 states in the United States, 407 corporations and/or their pension funds, 351 university, charitable and other endowments and foundations, 14 sovereign wealth funds and approximately 300 other non-U.S. institutional investors. Our 25 largest clients participate in an average of four different investment strategies, reflecting the confidence engendered by our consistent firm-wide investment approach. Approximately 14% of our AUM represents high-net-worth individuals or sub-advisory relationships with mutual funds, indicating both the broadening appeal of alternatives to individual investors and our heightened focus on that market.

Since Oaktree’s founding in 1995, our AUM has grown significantly, even as we have distributed over $70 billion from our closed-end funds. Although we limit our AUM when appropriate in order to better position us to generate superior risk-adjusted returns, we have a long-term track record of organically growing our investment strategies, increasing our AUM and expanding our client base. In 2014, we raised gross capital of $14.7 billion, our second-highest annual total ever and largest without a new Distressed Debt fund. Of the $14.7 billion, $7.6 billion represented investment strategies and products developed over the last four years.

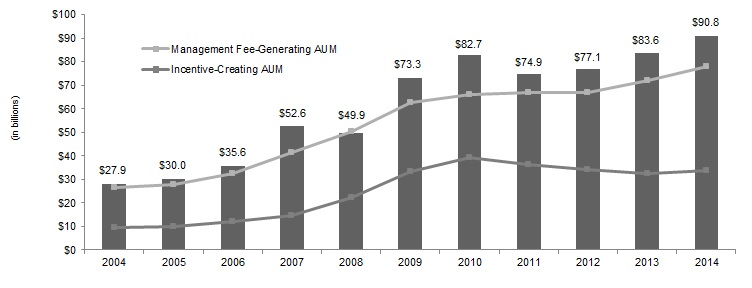

As shown in the chart below, our AUM has grown to $90.8 billion as of December 31, 2014 from $27.9 billion a decade earlier. Over the same period, management fee-generating assets under management (“management fee-generating AUM”) grew from $26.7 billion to $78.1 billion, and incentive-creating assets under management (“incentive-creating AUM”) increased from $9.3 billion to $33.9 billion.

Year-end AUM

We have systematically broadened employee ownership since our founding to help align interests among employees, our clients and other stakeholders, as well as to facilitate a smooth generational transfer of management and ownership. We have 927 employees, including 218 employee-owners, with offices in 17 cities across 12 countries, of which the largest offices are in Los Angeles (headquarters), London, New York City and Hong Kong.

Structure and Operation of Our Business

Our business is comprised of one segment, our investment management segment, which consists of the investment management services that we provide to our clients. Our segment revenue flows from the management fees and incentive income generated by the funds that we manage, as well as the investment income earned from the investments we make in our funds, third-party funds and other companies. The management fees that we receive are based on the contractual terms of the relevant fund and are typically calculated as a fixed percentage of the capital commitments (as adjusted for distributions during a fund’s liquidation period), drawn capital or net asset value (“NAV”) of the particular fund. Incentive income represents our share (typically 20%) of the investors’ profits in most of the closed-end and certain evergreen funds. Investment income refers to the investment return on a mark-to-market basis and our equity participation on the amounts that we invest in Oaktree and third-party funds, as well as in other companies.

Structure of Funds

Closed-end Funds

Our closed-end funds are typically structured as limited partnerships that have a 10- or 11-year term and have a specified period during which clients can subscribe for limited partnership interests in the fund. Once a client is admitted as a limited partner, that client is required to contribute capital when called by us as the general partner, and generally cannot withdraw its investment. Our closed-end funds have an investment period that generally ranges from three to five years, during which we are permitted to invest the committed capital of those funds. As closed-end funds liquidate their investments, we typically distribute the proceeds to the clients, although during the investment period we have the ability to retain or recall such proceeds to make additional investments. Once we have committed to invest approximately 80% of the capital in a particular fund, we typically raise a new fund in the same strategy, generally ensuring that we always have capital to invest in new opportunities. From time to time, we may provide discretionary management services for clients within our closed-end fund strategies through a separate account or a limited partnership or limited liability company managed by us with the client as the sole limited partner or sole non-managing member (a “fund-of-one”).

Our closed-end funds also include collateralized loan obligation vehicles (“CLOs”) for which we serve as collateral manager. CLOs are structured finance vehicles in which we typically make an investment and for which we earn management fees. Investors in CLOs are generally unable to redeem their interests until the CLO liquidates, is called or otherwise terminates.

Open-end Funds

Our commingled open-end funds are typically structured as limited partnerships that are designed to admit clients as new limited partners (or accept additional capital from existing limited partners) on an ongoing basis during the fund’s life. Clients in commingled open-end funds typically contribute all of their committed capital upon being admitted to the fund. These funds do not have an investment period and do not distribute proceeds of realized investments to clients. We are permitted to commit the fund’s capital (including realized proceeds) to new investments at any time during the fund’s life. Clients in commingled open-end funds generally have the right to withdraw their capital from the fund at any time on a monthly basis (quarterly for our Senior Loan strategy).

We also provide discretionary management services for clients through separate accounts within the open-end fund strategies. Clients establish accounts with us by depositing funds or securities into accounts maintained by qualified independent custodians and granting us discretionary authority to invest such funds pursuant to their investment needs and objectives, as stated in an investment management agreement. Separate account clients generally may terminate our services at any time by providing us with prior notice of 30 days or less. Most of the separate accounts we currently manage are in the open-end fund strategies.

Evergreen Funds

We use the term evergreen funds to describe funds that invest in marketable securities, private debt or equity, in certain cases on a long and short basis. As with open-end funds, commingled evergreen funds are designed to accept new capital on an ongoing basis and generally do not distribute proceeds of realized investments to clients. We also provide discretionary management services for clients through separate accounts

or fund-of-ones within our evergreen fund strategies. Clients in evergreen funds are generally subject to a lock-up, which restricts their ability to withdraw their entire capital for a certain period of time after their initial subscription.

Management Fees

We receive management fees monthly or quarterly based on annual fee rates. While we typically earn management fees for each of the funds that we manage, the contractual terms of those management fees vary by certain factors, such as fund structure. Annual management fee rates generally fall in the range of 1.25% to 1.75% for closed-end funds, 0.42% to 0.80% for open-end funds, and 1.0% to 2.0% for evergreen funds. In the case of most closed-end funds, the management fee rate is applied against committed capital during the fund’s investment period and the lesser of total funded capital or cost basis of assets in the liquidation period. However, for certain closed-end funds (such as Oaktree European Dislocation Fund, L.P., Oaktree Real Estate Debt Fund, L.P. and Oaktree Mezzanine Fund IV, L.P. (“Mezz IV”)), management fees during the investment period are calculated based on drawn capital. Additionally, for those closed-end funds for which management fees are based on committed capital, we sometimes elect to delay the start of the fund’s investment period and thus its full management fees; instead, earning management fees based only on drawn capital for the period between the first capital drawdown and the date on which we elect to start the investment period. Our right to receive management fees typically ends after 10 or 11 years from the initial closing date or the start of the investment period, even if assets remain to be liquidated. For open-end and evergreen funds, the management fee is generally based on the NAV of the fund. In the case of certain open-end and evergreen fund accounts, we have the potential to earn performance-based fees, typically in reference to a relevant benchmark index or hurdle rate. From time to time, we may in our sole discretion afford certain investors in our funds or clients of separate accounts more favorable economic terms than other investors in the same fund or separate account clients within the same or similar investment strategy, including with respect to management and performance-based fees, generally based on the aggregate size of commitments of such investor or client, as applicable, to one or more funds or accounts managed by us.

Incentive Income

We have the potential to earn incentive income from closed-end funds, most of which follow the so-called European-style waterfall, whereby we receive incentive income only after the fund first distributes all contributed capital plus an annual preferred return, typically 8%. Once this occurs, we generally receive as incentive income 80% of all distributions otherwise attributable to our investors, and those investors receive the remaining 20% until we have received, as incentive income, 20% of all such distributions in excess of the contributed capital from the inception of the fund. Thereafter, provided the preferred return continues to be met, all such future distributions attributable to our investors are distributed 80% to those investors and 20% to us as incentive income. As a result, we generally receive incentive income, if any, in the latter part of a fund’s life, although earlier in a fund’s term we may receive tax distributions, which we recognize as incentive income, to cover our allocable share of income taxes until we are otherwise entitled to payment of incentive income.

Certain of our evergreen funds pay annual incentive income equal to 20% of the year’s profits, subject to either a high-water mark or hurdle rate. The high-water mark refers to the highest historical NAV attributable to a limited partner’s account. We do not earn annual incentive income with respect to a limited partner if its year-end NAV is lower than any prior year’s NAV, excluding any contributions or redemptions.

Investment Income

We earn segment investment income from our corporate investments in funds and companies, with Oaktree-managed funds constituting the bulk of our corporate investments. Our investments in Oaktree-managed funds generally fall into one of four categories: general partner interests in commingled funds, investments in CLOs, seed capital for new investment strategies prior to third-party capital raising, and corporate cash management. In the case of general partner interests in our closed-end or evergreen funds, we typically invest the greater of 2.5% of committed capital or $20 million in each fund, not to exceed $100 million per fund. For CLOs, we generally invest no more than 10% of the total par value of each respective CLO. For strategic purposes, we also invest in a handful of third-party managed funds or companies. Our investments in companies include a one-fifth equity stake in DoubleLine Capital LP and its affiliates (collectively, “DoubleLine”), an investment manager that sought our start-up consulting and financial involvement shortly after its founding in December 2009.

Our Investment Approach

At our core, we are contrarian, value-oriented investors focused on buying securities and companies at prices below their intrinsic value and selling or exiting those investments when they become fairly or fully valued.

We believe we can do this best by investing in markets where specialization and superior analysis can offer an investing edge.

In our investing activities, we adhere to the following fundamental tenets:

| |

| • | Focus on Risk-Adjusted Returns. Our primary goal is not simply to achieve superior investment performance, but to do so with less-than-commensurate risk. We believe that the best long-term records are built more through the avoidance of losses in bad times than the achievement of superior relative returns in good times. Thus, our overriding belief is that “if we avoid the losers, the winners will take care of themselves.” |

| |

| • | Focus on Fundamental Analysis. We employ a bottom-up approach to investing, based on proprietary, company-specific research. We seek to generate outperformance from in-depth knowledge of companies and their securities, not from macro-forecasting. Our 290 investment professionals have developed a deep and thorough understanding of a wide number of companies and industries, providing us with a significant institutional knowledge base. |

| |

| • | Specialization. We offer a broad array of specialized investment strategies. We believe this offers the surest path to the results we and our clients seek. Clients interested in a single investment strategy can limit themselves to the risk exposure of that particular strategy, while clients interested in more than one investment strategy can combine investments in our funds to achieve their desired mix. Our focus on specific strategies has allowed us to build investment teams with extensive experience and expertise. At the same time, our teams access and leverage each other’s expertise, affording us both the benefits of specialization and the strengths of a larger organization. |

Our Asset Classes and Investment Strategies

We manage investments in a number of strategies within six asset classes: Corporate Debt, Convertible Securities, Distressed Debt, Control Investing, Real Estate and Listed Equities. The diversity of our investment strategies allows us to meet a wide range of investor needs suited for different market environments globally and, for certain strategies, targeted regions, while providing us with a long-term diversified revenue base. Our AUM by asset class and investment strategy as of December 31, 2014 is shown below: |

| | | | | | | | | | | | |

| | Strategy Inception | | | | | Strategy Inception | | |

| | | AUM | | | | AUM |

| | | | (in billions) | | | | | (in billions) |

| Corporate Debt: | | | | | Control Investing: | | | |

| U.S. High Yield Bonds | 1986 | | $ | 13.8 |

| | Global Principal Investments | 1994 | | $ | 5.7 |

|

Global High Yield Bonds (1) | 2010 | | 6.7 |

| | European Principal Investments | 2006 | | 6.0 |

|

| European High Yield Bonds | 1999 | | 0.6 |

| | Asia Principal Investments | 2006 | | 0.4 |

|

| U.S. Senior Loans | 2007 | | 7.8 |

| | Power Opportunities | 1999 | | 1.3 |

|

| European Senior Loans | 2009 | | 2.4 |

| | Infrastructure Investing (2) | 2014 | | 2.5 |

|

| Mezzanine Finance | 2001 | | 1.6 |

| | | | | 15.9 |

|

| Strategic Credit | 2012 | | 2.7 |

| | Real Estate: | | | |

| European Private Debt | 2013 | | 0.8 |

| | Real Estate Opportunities | 1994 | | 6.3 |

|

| | | | 36.4 |

| | Real Estate Debt | 2012 | | 1.2 |

|

| Convertible Securities: | | | | | | | | 7.5 |

|

| U.S. Convertible Securities | 1987 | | 4.8 |

| | Listed Equities: | | | |

| Non-U.S. Convertible Securities | 1994 | | 2.5 |

| | Emerging Markets Equities | 2011 | | 3.6 |

|

| High Income Convertible Securities | 1989 | | 0.9 |

| | Emerging Markets Absolute Return | 1997 | | 0.2 |

|

| | | | 8.2 |

| | Value Equities | 2014 | | 0.4 |

|

| Distressed Debt: | | | | | Others | Various | | 0.1 |

|

| Distressed Debt | 1988 | | 15.8 |

| | | | | 4.3 |

|

| Value Opportunities | 2007 | | 1.8 |

| | | | | |

| Emerging Markets Opportunities | 2012 | | 0.9 |

| | Total | | | $ | 90.8 |

|

| | | | 18.5 |

| | | | | |

| |

| (1) | This includes $2.8 billion in AUM associated with our Expanded High Yield Bond strategy, whose inception date was 1999. |

| |

| (2) | Oaktree acquired the Highstar Capital team in August 2014, which represents the inception date of this strategy. |

This array of specialized credit- and equity-oriented strategies allows us to focus on downside risk protection while at the same time creating value and the ability to realize accrued incentives, as is demonstrated by the diversified holdings of our incentive-creating closed-end and evergreen funds. Of the $33.9 billion of incentive-creating AUM, as of December 31, 2014, senior and secured debt, subordinated debt, and equities represented 24%, 6% and 70%, respectively. The latter was comprised of 33%, 49% and 18% in public, private and real estate equities, respectively.

Our most significant, longest-managed investment strategies are described below:

Distressed Debt

Our Distressed Debt team was an industry pioneer and has been one of its leaders since the inception of the strategy in 1988. The team focuses primarily on investments in distressed companies that are perceived to have substantial asset values or business franchises, and are in industries going through periods of transition or dislocation. We take an opportunistic approach to investing, with the flexibility and expertise to choose from a broad range of investments, including leveraged loans, bonds, equity securities, companies or hard assets. Building on our Distressed Debt team’s experience in the U.S., we have established a significant presence in Europe to capitalize on opportunities in that region.

Value Opportunities

We launched Value Opportunities (“VOF”) in September 2007 for investors who had expressed interest in a more liquid version of the Distressed Debt strategy. The fund is managed by the Distressed Debt team and invests mainly in distressed debt and other value-oriented investments for which there is a liquid market. Inasmuch as this strategy is intended to be opportunistic, the composition of the portfolio is designed to capitalize on changing market conditions. In general, this strategy employs similar strategies and tactics with regard to distressed investments as the Distressed Debt strategy, but it may be more aggressive and more oriented to short-term trading (and may make greater use of leverage, shorting and derivatives) with respect to its non-distressed investments.

High Yield Bonds

We view high yield bond investing as the conscious bearing of risk for potential profit, and we follow a defensive, downside-oriented strategy focused on gauging credit risk. Rather than stretching for higher yields, our primary focus is managing risk and avoiding defaults. Since the inception of the U.S. strategy in 1986, our holdings have experienced an average default rate equal to approximately one-third the high yield bond market as a whole. Our team’s analytical and investment skills also are evidenced by the fact that in each of our strategy’s 29 years, its portfolio holdings have garnered a larger percentage of rating-agency upgrades than downgrades.

We were among the first firms to establish a dedicated European High Yield Bond strategy in 1999. Over the years, many of our U.S. investors acquired units of the European fund to enhance performance and increase portfolio diversification, resulting in the Expanded High Yield Bond strategy. In 2010, we established Global High Yield Bonds, a single portfolio approach to invest in the U.S. and European markets, capitalizing on the expertise of our research teams. Rather than combining two diversified portfolios, this approach combines the best relative value opportunities within the two markets into a single account.

U.S. and European Senior Loans

In September 2007 we formed the U.S. Senior Loan strategy to capitalize on the backlog of unsold or “hung” bridge loans held by investment banks near the start of the global financial crisis. As the market environment subsequently changed, we expanded the strategy to include investing in senior bank loans. Investments include bank loans and senior debt from the middle- and upper-quality tiers of the non-investment grade debt market. In most instances, these instruments constitute the most senior position in the capital structure of the borrower. In May 2009, we capitalized on our experience in senior loans and European high yield bonds by forming the European Senior Loan strategy to take advantage of opportunities in the primary and secondary loan markets.

Mezzanine Finance

In 2001 we created the Mezzanine Finance strategy to capitalize on our expertise in credit analysis after we observed a gap in the availability of mezzanine capital to many attractive companies that were considered too small for the high yield bond market. Our strong relationships with small-cap and mid-cap private equity sponsors constitute a major advantage in our Mezzanine investment process. The strategy’s targeted investment size is $20 million to $100 million, where we believe many attractive opportunities exist to help finance leveraged buyouts,

recapitalizations, acquisitions and corporate growth. The Mezzanine Finance strategy seeks to earn a high current return and achieve long-term capital appreciation without subjecting principal to undue risk.

Principal Investments

The Global and European Principal Investment strategies typically target investments through capital infusions into distressed or “stressed” companies, acquisition of distressed securities with an expected outcome of a debt for equity conversion (“distress-for-control”), or private equity investments in targeted industries. Our team’s private equity and distressed debt experience allows us a competitive advantage in accessing distressed debt, negotiating through the bankruptcy process for control of a business and maximizing the value of an investment once we obtain control. Our European investments have focused on complex business restructurings and industries in which we have particular expertise. We have experienced in-house portfolio enhancement teams in both the U.S. and Europe that are dedicated to identifying and implementing operational, strategic and financial enhancements at portfolio companies.

Power Opportunities

Beginning in 1996, the Control Investing strategy made a number of power infrastructure investments jointly with an independent firm, GFI Energy Ventures (“GFI”). In 2009, GFI personnel joined us and, starting with Oaktree Power Opportunities Fund III, L.P. (“Power Fund III”), we became the sole manager of the strategy. The Power Opportunities funds seek to make controlling equity investments in companies providing equipment, software and services used in marketing, distribution, transmission, trading or consumption of power and other similar services. The strategy invests in proven performers and market leaders, not start-up ventures or turnarounds.

Convertible Securities

Convertible securities are part debt and part equity. Applying our risk-control investment approach to these securities, we attempt to capture most of the performance of equities in rising markets and to outperform equities in flat or down markets. Our goal is to capture the vast majority of the performance of equities over full market cycles with reduced volatility and/or substantially outperform straight bonds with similar levels of volatility. To reduce risk, we broadly diversify and focus on convertibles that provide pronounced downside protection. High income, or “busted,” convertibles offer a unique combination of high current yield and yield-to-maturity, plus the potential for significant equity-driven capital appreciation.

Real Estate

The Real Estate team targets a diverse range of global investments, including direct property investments, investments in companies with extensive real estate assets, undervalued debt and equity securities, and opportunities to develop and re-position properties in association with aligned, high-quality partners. In recent years we have developed strategic business relationships with third-party servicing companies for commercial and residential mortgage pools, which have enabled us to acquire and profitably manage portfolios of non-performing mortgage loans sold at discounted prices by banks.

Development of Newer Investment Strategies and Products

We add to Oaktree’s list of investment strategies when we identify a market with potential for attractive returns that we believe can be exploited in a risk-controlled fashion, and where we have access to the investment talent capable of producing the results we seek. Because of the high priority we place on assuring that these requirements are met, we prefer that new products represent “step-outs” from our current investment strategies into related fields that are managed by people with whom we have had extensive experience or for whom we can validate qualifications. In chronological order, strategies recently launched or developed include the following:

Emerging Markets Equities. As a step-out from our Emerging Markets Absolute Return (“EMAR”) strategy, in 2011 we added the long-only Emerging Markets Equities strategy, which we manage through funds, mutual fund sub-advisory relationships and separate accounts. The strategy invests on a long-only basis in the equities of emerging market companies in the Asia Pacific region, Latin America, Eastern Europe, the Middle East, Africa and Russia.

Enhanced Income. In 2012, we added a new product under the Senior Loan umbrella, Enhanced Income, to create a portfolio of below investment grade loans using a moderate amount of leverage. This strategy utilizes the same investment approach as our U.S. Senior Loan strategy.

Emerging Markets Opportunities. We launched this strategy in 2012 and began managing assets in September 2013 to target stressed, distressed and other value-oriented fixed income and equity investments in emerging markets. This strategy is managed by a U.S.-based group that leverages our Distressed Debt team’s experience and expertise, and employs an established, flexible external network of local advisers to enhance deal flow, access local market intelligence and address the intricacies of jurisdictional differences and industry and local regulatory developments.

Real Estate Debt. Our management of Oaktree PPIP Fund, L.P. (“PPIP”), organized pursuant to the U.S. Treasury Department’s program to address troubled real estate-related assets during the global financial crisis, spurred us to offer Real Estate Debt as a successor strategy in 2012. This strategy invests primarily in performing commercial mortgage-backed securities, first mortgages, junior secured debt, unsecured debt and mezzanine debt, both in the U.S. and Europe.

Strategic Credit. In 2012, we introduced Strategic Credit as an opportunistic credit strategy that invests in marketable securities and private debts of stressed U.S. and non-U.S. companies. The strategy seeks returns above those on high yield bonds but below those for more distress-oriented strategies.

European Private Debt. We introduced European Private Debt in 2013 to capitalize on opportunities resulting from the decline in European bank lending and our significant industry experience, knowledge and deep relationships across the continent. The strategy seeks to achieve attractive, risk-adjusted absolute returns by making primary investments in high-yielding debt or preferred equity of companies that require liquidity for acquisitions, buyout of minority investors, debt restructurings, recapitalizations or acquisitions of hard assets.

Collateralized Loan Obligations. Building on our experience in Senior Loans and Enhanced Income, we added CLOs to our product offerings in 2014. CLOs are securities backed by a diversified pool of below-investment grade loans sold to investors often seeking greater diversity and/or the potential for higher-than-average returns. Our fully-levered CLOs utilize the same investment approach as our Senior Loan strategy.

Value Equities. We launched this strategy in 2014 as a step-out from our Distressed Debt platform. Similar to our Distressed Debt and Value Opportunities strategies, Value Equities employs a bottom-up, value-oriented investment approach focused on long-term principal appreciation and preservation of capital. This strategy seeks to achieve attractive, risk-adjusted returns by opportunistically assembling and managing an unlevered, concentrated portfolio of stressed, post-reorganization and value equities that offer asymmetric return profiles.

Infrastructure Investing. In August 2014, we acquired the Highstar Capital team and certain Highstar entities (collectively “Highstar”) to facilitate the expansion of our Power Opportunities strategy to capitalize on investment opportunities created by aging infrastructure assets and the expansion of existing infrastructure to adapt to changing energy markets. This strategy seeks to capitalize on these and similar opportunities by originating, owning and operating infrastructure and related investments, primarily in North America.

Our Investment Performance

Our investment professionals have generated impressive investment performance through multiple market cycles. As of December 31, 2014, our incentive-creating closed-end funds had produced an aggregate gross IRR of 19.6% on over $68 billion of drawn capital. All 49 of the incentive-creating closed-end funds we manage that commenced before July 1, 2013 had positive gross and net IRRs as of December 31, 2014, an achievement that reflects, among many factors, our practice of sizing funds in proportion to our view of the supply of potential attractive investment opportunities.

Information regarding our most significant and longest-managed closed-end funds is shown below, as of or for the periods ended December 31, 2014. Please see “Fund Data” below for more information regarding the performance of our closed-end funds.

|

| | | | | | | | | | | | | |

| | Strategy Inception | | Total Drawn Capital | | IRR Since Inception | | Multiple of Drawn Capital |

| | | | Gross | | Net | |

| | | | (in millions) | | | | | | |

| | | | | | | | | | |

| Distressed Debt | 1988 | | $ | 38,529 |

| | 22.6 | % | | 17.1 | % | | 1.7x |

| Real Estate Opportunities | 1994 | | 6,348 |

| | 15.8 |

| | 12.3 |

| | 1.7 |

| Global Principal Investments | 1994 | | 10,094 |

| | 13.5 |

| | 10.0 |

| | 1.6 |

| European Principal Investments | 2006 | | 4,901 |

| | 14.0 |

| | 9.2 |

| | 1.5 |

| Power Opportunities | 1999 | | 1,498 |

| | 34.8 |

| | 26.7 |

| | 2.4 |

| Mezzanine Finance | 2001 | | 3,342 |

| | 13.1 |

| | 8.8 |

| | 1.4 |

| Sub-total | | | 64,712 |

| |

| |

| |

|

| Other funds | | | 3,978 |

| | | | | | |

| Total | | | $ | 68,690 |

| | | | | | |

Performance of our open-end funds is in part measured in relation to applicable benchmark returns. We have a long track record of achieving competitive returns in up markets and substantial relative outperformance in down markets. We believe this pattern of results leads to significant outperformance over full market cycles. Information regarding our open-end funds, together with relevant benchmark data, is set forth below as of or for the periods ended December 31, 2014. Please see “Fund Data” below for more information regarding the performance of our open-end funds.

|

| | | | | | | | | | | | | | | | | | |

| | Strategy Inception | | AUM | | Since Inception |

| | | | Annualized Rates of Return | | Sharpe Ratio |

| | | | Oaktree | | Relevant Benchmark (Gross) | | Oaktree Gross | | Relevant Benchmark

(Gross) |

| | | | Gross | | Net | | | |

| | | (in millions) | | | | | | | | | |

| | | | | | | | | | | | | | |

| U.S. High Yield Bonds | 1986 | | $ | 13,776 |

| | 9.7 | % | | 9.1 | % | | 8.6 | % | | 0.81 | | 0.55 |

Global High Yield Bonds (1) | 2010 | | 6,678 |

| | 8.4 |

| | 7.8 |

| | 7.4 |

| | 1.22 | | 1.15 |

| European High Yield Bonds | 1999 | | 634 |

| | 8.3 |

| | 7.8 |

| | 6.3 |

| | 0.67 | | 0.39 |

| U.S. Convertibles | 1987 | | 4,844 |

| | 9.9 |

| | 9.4 |

| | 8.4 |

| | 0.50 | | 0.36 |

| Non-U.S. Convertibles | 1994 | | 2,467 |

| | 8.7 |

| | 8.2 |

| | 5.9 |

| | 0.78 | | 0.40 |

| High Income Convertibles | 1989 | | 907 |

| | 11.7 |

| | 11.2 |

| | 8.4 |

| | 1.04 | | 0.59 |

| U.S. Senior Loans | 2008 | | 7,844 |

| | 7.0 |

| | 6.5 |

| | 5.6 |

| | 1.17 | | 0.60 |

| European Senior Loans | 2009 | | 2,423 |

| | 9.6 |

| | 9.1 |

| | 10.7 |

| | 1.72 | | 1.79 |

| Emerging Markets Equities | 2011 | | 3,633 |

| | (0.6 | ) | | (1.4 | ) | | (2.6 | ) | | (0.04) | | (0.15) |

| |

| (1) | This includes $2.8 billion in AUM associated with our Expanded High Yield Bond strategy, whose inception date was 1999. |

Synergies

We emphasize cross-group cooperation and collaboration among our investment professionals. Many of our investment strategies are complementary, and our investment professionals often identify and communicate potential opportunities to other groups, allowing our funds to benefit from the synergies created by the scale of our

business and our proprietary research. The High Yield Bond group, for instance, sometimes alerts the Distressed Debt group to issuers facing financial difficulties; alternatively, the Distressed Debt group sometimes identifies companies emerging from bankruptcy that could be attractive to the High Yield Bond group.

This cross-pollination among our investment groups occurs both formally and informally. For example, representatives of the Distressed Debt, Principal Investments and Real Estate groups typically attend each other’s meetings in order to ensure that each group keeps abreast of the others’ activities and has ready access to specialized expertise for more informed investment decisions. These groups periodically invest jointly, permitting us to make larger or more specialized investments than we could undertake in the absence of such collaboration. Our investment professionals also cooperate informally, consulting each other on a regular basis with respect to existing and proposed investments. Our culture encourages such cooperation, as does the broad ownership by all of our senior investment professionals, which gives each of them an indirect stake in the success of all of our investment strategies.

We have a shared trading desk in the U.S. for many of our strategies, which provides the benefit of our traders’ deep experience with both performing and distressed securities, facilitates communication among the groups, and allows us to combine trades for larger orders with the preferential access and pricing that sometimes comes with larger orders. Additionally, the shared nature of the trading desk allows us to pursue individual opportunities without revealing to the broader market which of our strategies may be purchasing the targeted security, providing an advantage over our competitors who invest exclusively in distressed or distress-for-control strategies, thus revealing their expectations for their investments.

The scale of our investing activities makes us a significant client of many investment banks, brokers and consultants, and thus helps each group access opportunities that might not be available were it not part of our larger organization. Finally, the scale of our activities has permitted us to create significant shared resources.

Marketing and Client Relations

Our client relationships are fundamental to our business. We strive to act with professionalism and integrity and believe our success flows from the success of our fund investors. We have developed a loyal following among many of the nation’s most significant institutional investors, and believe that their and our other investors’ loyalty flows from our superior investment record, our reputation for integrity, and the fairness and transparency of our fee structures.

As of December 31, 2014, our $90.8 billion of AUM was divided by client type and geographic origin as follows:

|

| | | | | | | | | | | | | | | |

| AUM by Client Type | AUM | | % | | AUM by Client Location | | AUM | | % |

| | (in millions) | | | | | | (in millions) | | |

| | | | | | | | | | |

| Public funds | $ | 24,007 |

| | 26 | % | | North America | | $ | 68,267 |

| | 75 | % |

| Corporate and corporate pension | 23,445 |

| | 26 |

| | Europe | | 11,798 |

| | 13 |

|

| Sub-advisory – mutual funds | 7,564 |

| | 8 |

| | Asia & Australia | | 9,173 |

| | 10 |

|

| Insurance companies | 7,320 |

| | 8 |

| | Africa & Middle East | | 1,462 |

| | 2 |

|

| Sovereign wealth funds | 6,975 |

| | 8 |

| | South America | | 131 |

| | 0 |

|

| Endowments/foundations | 5,991 |

| | 7 |

| | Total | | $ | 90,831 |

| | 100 | % |

| Private – high net worth/family office | 5,005 |

| | 6 |

| | | | | | |

| Fund of funds | 2,099 |

| | 2 |

| | | | | | |

| Unions | 1,706 |

| | 2 |

| | | | | | |

| Oaktree and other | 6,719 |

| | 7 |

| | | | | | |

| Total | $ | 90,831 |

| | 100 | % | | | | | | |

Our extensive in-house global Marketing and Client Relations group, comprised of 55 individuals dedicated to relationship management and sales, client service or sales strategy in Europe, the Middle East, Asia/Pacific and the Americas, appropriately reflects the increasingly global composition of our client base. This team is augmented by 48 dedicated marketing support, portfolio analytics and client reporting professionals.

Employees

We strive to maintain a work environment that fosters integrity, professionalism, excellence, candor and collegiality among our employees. We consider our labor relations to be good. As of December 31, 2014, we had 927 employees, categorized as follows:

|

| | | | | | | | |

| | All Employees | | Employee Owners (1) | | Employees Located Outside the U.S. |

| Investment professionals | 290 |

| | 142 |

| | 106 |

|

| Other professionals | 471 |

| | 76 |

| | 62 |

|

| Support staff | 166 |

| | — |

| | 37 |

|

| Total | 927 |

| | 218 |

| | 205 |

|

(1) Represents employees that hold OCGH units.

Competition

We compete with many other firms in every aspect of our business, including raising funds, seeking investments and hiring and retaining professionals. Many of our competitors are substantially larger than us and have considerably greater financial, technical and marketing resources. Certain of these competitors periodically raise significant amounts of capital in investment strategies that are similar to ours. Some of these competitors also may have a lower cost of capital and access to funding sources that are not available to us, which may create further competitive disadvantages for us with respect to investment opportunities. In addition, some of these competitors may have higher risk tolerances or make different risk assessments than we do, allowing them to consider a wider variety of investments and establish broader networks of business relationships. In short, we operate in a highly competitive business and many of our competitors may be better positioned than we are to take advantage of opportunities in the marketplace. For additional information regarding the competitive risks that we face, please see “Risk Factors—Risks Relating to Our Business—The investment management business is intensely competitive.”

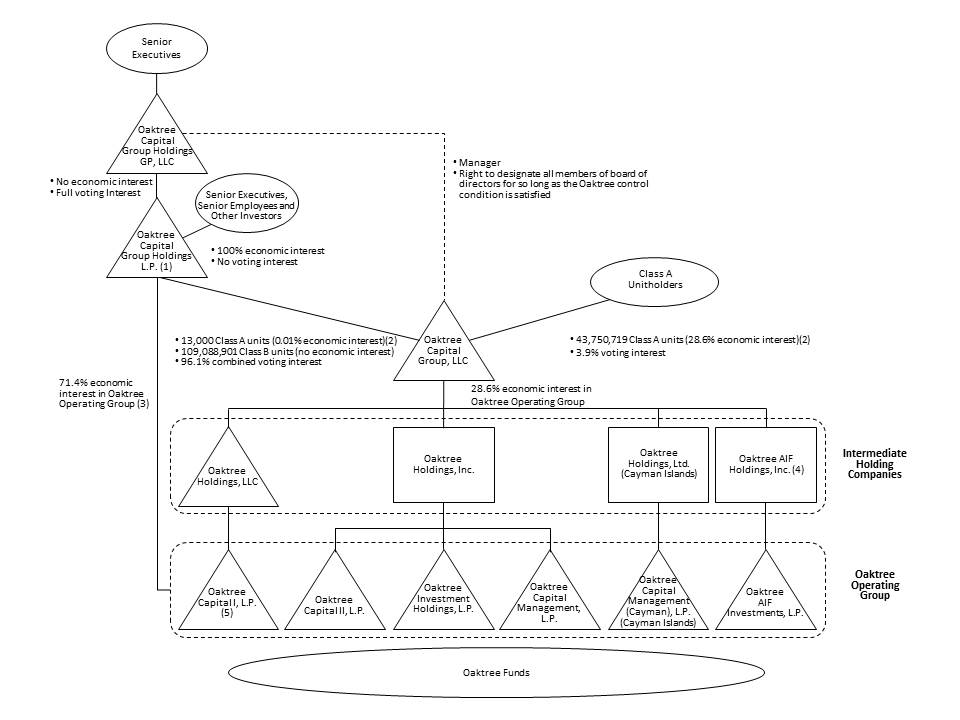

Organizational Structure

Oaktree Capital Group, LLC is a Delaware limited liability company that was formed on April 13, 2007. The Company is owned by its Class A and Class B unitholders. Oaktree Capital Group Holdings GP, LLC acts as the Company’s manager and is the general partner of Oaktree Capital Group Holdings, L.P., which owns 100% of the Company’s outstanding Class B units. OCGH is owned by the OCGH unitholders. The Company’s operations are conducted through a group of operating entities collectively referred to as the Oaktree Operating Group. OCGH has a direct economic interest in the Oaktree Operating Group and the Company has an indirect economic interest in the Oaktree Operating Group. We collectively refer to the interests in the Oaktree Operating Group as the “Oaktree Operating Group units.” An Oaktree Operating Group unit is not a separate legal interest but represents one limited partnership interest in each of the Oaktree Operating Group entities.

Class A units are entitled to one vote per unit. Class B units are entitled to ten votes per unit. However, if the Oaktree control condition (as defined below) is no longer satisfied, our Class B units will be entitled to only one vote per unit. Holders of our Class A units and Class B units generally vote together as a single class on the limited set of matters on which our unitholders have a vote. Such matters, which must be approved by a majority (or, in the case of election of directors when the Oaktree control condition is no longer satisfied, a plurality) of the votes entitled to be cast by all Class A units and Class B units present in person or represented by proxy at a meeting of unitholders, include a proposed sale of all or substantially all of our assets, certain mergers and consolidations, certain amendments to our operating agreement and an election by our board of directors to dissolve the company. The Class B units do not represent an economic interest in Oaktree Capital Group, LLC. The number of Class B units held by OCGH, however, increases or decreases with corresponding changes in OCGH’s economic interest in the Oaktree Operating Group.

Our operating agreement provides that so long as our senior executives, or their successors or affiliated entities (other than us or our subsidiaries), including OCGH, collectively hold, directly or indirectly, at least 10% of the aggregate outstanding Oaktree Operating Group units, our manager, Oaktree Capital Group Holdings GP, LLC, which is 100% owned and controlled by our senior executives, will be entitled to designate all the members of our board of directors. We refer to this ownership condition as the “Oaktree control condition.” Holders of our Class A

units and Class B units have no right to elect our manager. So long as the Oaktree control condition is satisfied, our manager will control the membership of our board of directors, which will manage all of our operations and activities and will have discretion over significant corporate actions, such as the issuance of securities, payment of distributions, sale of assets, making certain amendments to our operating agreement and other matters.

The diagram below depicts our organizational structure as of December 31, 2014.

______________________

| |

| (1) | Holds 100% of the Class B units and 0.03% of the Class A units, which together represent 96.1% of the total combined voting power of our outstanding Class A and Class B units. The Class B units have no economic interest in us. The general partner of Oaktree Capital Group Holdings, L.P. is Oaktree Capital Group Holdings GP, LLC, which is controlled by our senior executives. Oaktree Capital Group Holdings GP, LLC also acts as our manager and in that capacity has the authority to designate all the members of our board of directors for so long as the Oaktree control condition is satisfied. |

| |

| (2) | The percent economic interest represents the applicable number of Class A units as a percentage of the Oaktree Operating Group units. As of December 31, 2014, there were 152,852,620 Oaktree Operating Group units outstanding. |

| |

| (3) | The percent economic interest in Oaktree Operating Group represents the aggregate number of Oaktree Operating Group units held, directly or indirectly, as a percentage of the total number of Oaktree Operating Group units outstanding. |

| |

| (4) | Oaktree Capital Group, LLC holds 1,000 shares of non-voting Class A common stock of Oaktree AIF Holdings, Inc., which are entitled to receive 100% of any dividends. Oaktree Capital Group Holdings, L.P. holds 100 shares of voting Class B common stock of Oaktree AIF Holdings, Inc., which do not participate in dividends or otherwise represent an economic interest in Oaktree AIF Holdings, Inc. |

| |

| (5) | Owned indirectly by Oaktree Holdings, LLC through an entity not reflected in this diagram that is treated as a partnership for U.S. federal income tax purposes. Through this entity, each of Oaktree Holdings, Inc. and Oaktree Holdings, Ltd. owns a less than 1% indirect interest in Oaktree Capital I, L.P. |

Regulatory Matters and Compliance

Our business, as well as the financial services industry in general, is subject to extensive regulation in the United States and elsewhere. Our indirect subsidiary, Oaktree Capital Management, L.P., is registered as an investment adviser with the U.S. Securities and Exchange Commission (“SEC”). Registered investment advisers are subject to the requirements and regulations of the U.S. Investment Advisers Act of 1940, as amended (the “Advisers Act”). These requirements relate to, among other things, fiduciary duties to clients, maintaining an effective compliance program, solicitation agreements, conflicts of interest, recordkeeping and reporting, disclosure, limitations on agency cross and principal transactions between an adviser and advisory clients and general anti-fraud prohibitions. In addition, Oaktree Capital Management, L.P. is registered as a commodity pool operator and a commodity trading adviser with the U.S. Commodity Futures Trading Commission (“CFTC”). Registered commodity pool operators and commodity trading advisers are each subject to the requirements and regulations of the U.S. Commodity Exchange Act, as amended (the “Commodity Exchange Act”). These requirements relate to, among other things, maintaining an effective compliance program, recordkeeping and reporting, disclosure, business conduct, and general anti-fraud prohibitions. In addition, as a registered commodity pool operator and a commodity trading adviser with the CFTC, we are also required to be a member of the National Futures Association (the “NFA”), a self-regulatory organization for the U.S. derivatives industry. The NFA also promulgates and enforces rules governing the conduct of, and examines the activities of, its member firms.

In December 2014, we launched our first directly advised mutual funds, which are subject to the rules and regulations applicable to investment companies under the U.S. Investment Company Act of 1940 (as amended, the “Investment Company Act”). We are required to invest our mutual funds’ assets in accordance with limitations under the Investment Company Act and applicable provisions of the U.S. Internal Revenue Code of 1986, as amended (the “Code”). In addition, we are required to file periodic and annual reports on behalf of the mutual funds with the SEC. Furthermore, advisers to mutual funds have a fiduciary duty under the Investment Company Act not to charge excessive compensation, and the Investment Company Act grants shareholders of mutual funds a direct private right of action against investment advisers to seek redress for alleged violations of this fiduciary duty.

One of our indirect subsidiaries, OCM Investments, LLC, is registered as a broker-dealer with the SEC and in all 50 states, the District of Columbia and Puerto Rico, and is a member of the U.S. Financial Industry Regulatory Authority (“FINRA”). As a broker-dealer, this subsidiary is subject to regulation and oversight by the SEC and state securities regulators. In addition, FINRA, a self-regulatory organization that is subject to oversight by the SEC, promulgates and enforces rules governing the conduct of, and examines the activities of, its member firms. Due to the limited authority granted to our subsidiary in its capacity as a broker-dealer, it is not required to comply with certain regulations covering trade practices among broker-dealers and the use and safekeeping of customers’ funds and securities. As a registered broker-dealer and member of a self-regulatory organization, we are, however, subject to the SEC’s uniform net capital rule. Rule 15c3-1 of the Exchange Act specifies the minimum level of net capital a broker-dealer must maintain and also requires that a significant part of a broker-dealer’s assets be kept in relatively liquid form. The SEC and FINRA impose rules that require notification when net capital falls below certain predefined criteria, limit the ratio of subordinated debt to equity in the regulatory capital composition of a broker dealer and constrain the ability of a broker-dealer to expand its business under certain circumstances. Additionally, the SEC’s uniform net capital rule imposes certain requirements that may have the effect of prohibiting a broker-dealer from distributing or withdrawing capital and requiring prior notice to the SEC for certain withdrawals of capital.

Another of our subsidiaries, Oaktree Capital Management (UK) LLP, is authorized and regulated by the U.K. Financial Conduct Authority (“FCA”) as an investment manager in the United Kingdom. The U.K. Financial Services and Markets Act 2000 (“FSMA”) and rules promulgated thereunder govern all aspects of the U.K. investment business, including sales, research and trading practices, the provision of investment advice, the use and safekeeping of client funds and securities, regulatory capital, record keeping, margin practices and procedures, the approval standards for individuals, anti-money laundering, periodic reporting, and settlement procedures. Similarly, we have a number of other non-U.S. subsidiaries that are regulated by the applicable regulators in their respective jurisdictions.

The SEC and other regulators have in recent years aggressively increased their regulatory activities in respect of asset management firms. The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), among other things, imposes significant regulations on nearly every aspect of the U.S. financial services industry, including oversight and regulation of systemic market risk (including the power to liquidate certain institutions); authorizing the Federal Reserve to regulate nonbank institutions that are deemed systemically important; generally prohibiting insured depository institutions and their affiliates from conducting proprietary trading

and investing in private equity funds and hedge funds; and imposing new registration, recordkeeping and reporting requirements on private fund investment advisers. Some of these provisions are still subject to further rulemaking and to the discretion of regulatory bodies. The Dodd-Frank Act also prohibits investments in private equity and hedge funds by certain banking entities and covered nonbank companies. While certain of our subsidiaries are already registered investment advisers and registered broker-dealers and subject to SEC and FINRA examinations, compliance with any additional legal or regulatory requirements, including the need to register other subsidiaries as investment advisers, could make compliance more difficult and expensive and affect the manner in which we conduct business.

Certain of our activities are subject to compliance with laws and regulations of U.S. federal, state and municipal governments, non-U.S. governments, their respective agencies and/or various self-regulatory organizations or exchanges relating to, among other things, antitrust laws, anti-money laundering laws, anti-bribery laws relating to foreign officials, and privacy laws with respect to client information, and some of our funds invest in businesses that operate in highly regulated industries. Any failure to comply with these rules and regulations could expose us to liability and/or reputational damage. Our business has operated for many years within a legal framework that requires our being able to monitor and comply with a broad range of legal and regulatory developments that affect our activities. However, additional legislation, changes in rules or changes in the interpretation or enforcement of existing laws and rules, either in the United States or elsewhere, may directly affect our mode of operation and profitability. Please see “Risk Factors—Risks Relating to Our Business—Regulatory changes in the United States, regulatory compliance failures and the effects of negative publicity surrounding the financial industry in general could adversely affect our reputation, business and operations.”

Financial and Other Information by Segment

Financial and other information by segment for the years ended December 31, 2014, 2013 and 2012 are set forth in Note 17. “Segment Reporting” in our consolidated financial statements included elsewhere in this annual report.

Available Information

Our website address is www.oaktreecapital.com. Information on our website is not a part of this annual report and is not incorporated by reference herein. We make available free of charge on our website or provide a link on our website to our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after those reports are electronically filed with, or furnished to, the SEC. To access these filings, go to the “Unitholders” section of our website and then click on “SEC Filings.” You may also read and copy any document we file at the SEC’s public reference room located at 100 F Street, N.E., Washington, DC 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. In addition these reports and the other documents we file with the SEC are available at a website maintained by the SEC at www.sec.gov.

Investors and others should note that we use the “Investors” section of our corporate website to announce material information to investors and the marketplace. While not all of the information that we post on our corporate website is of a material nature, some information could be deemed to be material. Accordingly, we encourage investors, the media, and others interested in Oaktree to review the information that we share on our corporate website at the “Unitholders – Investor Relations” section of our website, http://ir.oaktreecapital.com/. Information contained on, or available through, our website is not incorporated by reference into this document.

Fund Data

Information regarding our closed-end, open-end and evergreen funds, together with benchmark data where applicable, is set forth below. For our closed-end and evergreen funds, no benchmarks are presented in the tables as there are no known comparable benchmarks for these funds’ investment philosophy, strategy and implementation.

Closed-end Funds

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | As of December 31, 2014 |

| | Investment Period | | Total Committed Capital | | Drawn Capital (1) | | Fund Net Income Since Inception | | Distri-butions Since Inception | | Net Asset Value | | Manage- ment Fee-gener- ating AUM | | Oaktree Segment Incentive Income Recog- nized | | Accrued Incentives (Fund Level) (2) | | Unreturned Drawn Capital Plus Accrued Preferred Return (3) | | IRR Since Inception (4) | | Multiple of Drawn Capital (5) |

| | Start Date | | End Date | | Gross | | Net |

| | (in millions) |

| Distressed Debt | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Oaktree Opportunities Fund IX, L.P. | Jan. 2014 | | Jan. 2017 | | $ | 5,066 |

| | $ | 4,053 |

| | $ | 135 |

| | $ | 2 |

| | $ | 4,186 |

| | $ | 4,966 |

| | $ | — |

| | $ | — |

| | $ | 4,349 |

| | 8.1 | % | | 3.7 | % | | 1.1x |

| Oaktree Opportunities Fund VIIIb, L.P. | Aug. 2011 | | Aug. 2014 | | 2,692 |

| | 2,692 |

| | 708 |

| | 273 |

| | 3,127 |

| | 2,547 |

| | 17 |

| | 117 |

| | 2,980 |

| | 13.4 |

| | 8.5 |

| | 1.3 |

| Special Account B | Nov. 2009 | | Nov. 2012 | | 1,031 |

| | 1,087 |

| | 588 |

| | 854 |

| | 821 |

| | 816 |

| | 15 |

| | 19 |

| | 611 |

| | 17.0 |

| | 14.3 |

| | 1.6 |

| Oaktree Opportunities Fund VIII, L.P. | Oct. 2009 | | Oct. 2012 | | 4,507 |

| | 4,507 |

| | 2,384 |

| | 3,506 |

| | 3,385 |

| | 2,433 |

| | 106 |

| | 359 |

| | 2,431 |

| | 15.7 |

| | 11.1 |

| | 1.6 |

| Special Account A | Nov. 2008 | | Oct. 2012 | | 253 |

| | 253 |

| | 304 |

| | 462 |

| | 95 |

| | 75 |

| | 41 |

| | 19 |

| | — |

| | 29.9 |

| | 24.4 |

| | 2.2 |

| OCM Opportunities Fund VIIb, L.P. | May 2008 | | May 2011 | | 10,940 |

| | 9,844 |

| | 9,159 |

| | 17,027 |

| | 1,976 |

| | 1,510 |

| | 1,394 |

| | 386 |

| | — |

| | 22.8 |

| | 17.4 |

| | 2.0 |

| OCM Opportunities Fund VII, L.P. | Mar. 2007 | | Mar. 2010 | | 3,598 |

| | 3,598 |

| | 1,477 |

| | 4,381 |

| | 694 |

| | 888 |

| | 81 |

| | — |

| | 729 |

| | 10.6 |

| | 8.0 |

| | 1.5 |

| OCM Opportunities Fund VI, L.P. | Jul. 2005 | | Jul. 2008 | | 1,773 |

| | 1,773 |

| | 1,304 |

| | 2,818 |

| | 259 |

| | 380 |

| | 123 |

| | 132 |

| | — |

| | 12.1 |

| | 8.9 |

| | 1.8 |

| OCM Opportunities Fund V, L.P. | Jun. 2004 | | Jun. 2007 | | 1,179 |

| | 1,179 |

| | 975 |

| | 2,032 |

| | 122 |

| | 128 |

| | 166 |

| | 24 |

| | — |

| | 18.6 |

| | 14.3 |

| | 1.9 |

Legacy funds (6). | Various | | Various | | 9,543 |

| | 9,543 |

| | 8,182 |

| | 17,695 |

| | 30 |

| | — |

| | 1,113 |

| | 6 |

| | — |

| | 24.2 |

| | 19.3 |

| | 1.9 |

| | | | | | | | | | | | |

| | |

| | | | | | | | | | 22.6 | % | | 17.1 | % | | |

| Emerging Markets Opportunities | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Oaktree Emerging Market Opportunities Fund, L.P. (7) (8) | Sep. 2013 | | Sep. 2016 | | $ | 384 |

| | $ | 162 |

| | $ | (29 | ) | | $ | — |

| | $ | 133 |

| | $ | 126 |

| | $ | — |

| | $ | — |

| | $ | 169 |

| | nm | | nm | | 0.8x |

Special Account F (7). | Jan. 2014 | | Jan. 2017 | | 253 |

| | 106 |

| | (20 | ) | | — |

| | 86 |

| | 85 |

| | — |

| | — |

| | 111 |

| | nm | | nm | | 0.8 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Global Principal Investments | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Oaktree Principal Fund VI, L.P. (7) | — (9) | | — | | $ | 592 |

| | $ | 24 |

| | $ | (1 | ) | | $ | — |

| | $ | 23 |

| | $ | 23 |

| | $ | — |

| | $ | — |

| | $ | 24 |

| | nm |

| | nm |

| | 1.1x |

Oaktree Principal Fund V, L.P. (10). | Feb. 2009 | | Feb. 2015 | | 2,827 |

| | 2,586 |

| | 858 |

| | 994 |

| | 2,450 |

| | 1,839 |

| | 18 |

| | 148 |

| | 2,252 |

| | 15.0 | % | | 8.6 | % | | 1.4 |

| Special Account C | Dec. 2008 | | Feb. 2014 | | 505 |

| | 455 |

| | 313 |

| | 268 |

| | 500 |

| | 395 |

| | 13 |

| | 49 |

| | 334 |

| | 18.3 |

| | 13.5 |

| | 1.8 |

| OCM Principal Opportunities Fund IV, L.P. | Oct. 2006 | | Oct. 2011 | | 3,328 |

| | 3,328 |

| | 1,756 |

| | 3,416 |

| | 1,668 |

| | 1,246 |

| | 22 |

| | 10 |

| | 1,660 |

| | 10.5 |

| | 8.0 |

| | 1.7 |

| OCM Principal Opportunities Fund III, L.P. | Nov. 2003 | | Nov. 2008 | | 1,400 |

| | 1,400 |

| | 901 |

| | 2,115 |

| | 186 |

| | — |

| | 139 |

| | 35 |

| | — |

| | 14.1 |

| | 9.7 |

| | 1.8 |

Legacy funds (6). | Various | | Various | | 2,301 |

| | 2,301 |

| | 1,840 |

| | 4,137 |

| | 4 |

| | — |

| | 236 |

| | 1 |

| | — |

| | 14.5 |

| | 11.6 |

| | 1.8 |

| | | | | | | | | | | | |

| | |

| | | | | | | | | | 13.5 | % | | 10.0 | % | | |

| Asia Principal Investments | | | | | | | | | | | |

| | |

| | | | | | | | | | | | |

| | |

| OCM Asia Principal Opportunities Fund, L.P. | May 2006 | | May 2011 | | $ | 578 |

| | $ | 503 |

| | $ | 47 |

| | $ | 177 |

| | $ | 373 |

| | $ | 332 |

| | $ | — |

| | $ | — |

| | $ | 601 |

| | 5.3 | % | | 1.6 | % | | 1.3x |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

European Principal Investments (11) | | | | | | | | | | | |

| | |

| | | | | | | | | | | | |

| | |

| Oaktree European Principal Fund III, L.P. | Nov. 2011 | | Nov. 2016 | | € | 3,164 |

| | € | 1,974 |

| | € | 608 |

| | € | 224 |

| | € | 2,358 |

| | € | 3,133 |

| | € | — |

| | € | 118 |

| | € | 2,066 |

| | 20.7 | % | | 12.1 | % | | 1.4x |

| OCM European Principal Opportunities Fund II, L.P. | Dec. 2007 | | Dec. 2012 | | € | 1,759 |

| | € | 1,685 |

| | € | 727 |

| | € | 1,300 |

| | € | 1,112 |

| | € | 1,042 |

| | € | 19 |

| | € | 59 |

| | € | 1,032 |

| | 12.6 |

| | 8.2 |

| | 1.6 |

| OCM European Principal Opportunities Fund, L.P. | Mar. 2006 | | Mar. 2009 | | $ | 495 |

| | $ | 473 |

| | $ | 430 |

| | $ | 822 |

| | $ | 81 |

| | $ | 91 |

| | $ | 30 |

| | $ | 52 |

| | $ | — |

| | 11.5 |

| | 8.6 |

| | 2.0 |

| | | | | | | | | | | | |

| | |

| | | | | | | | | | 14.0 | % | | 9.2 | % | | |

| Power Opportunities | | | | | | | | | | | |

| | |

| | | | | | | | | | | | |

| | |

| Oaktree Power Opportunities Fund III, L.P. | Apr. 2010 | | Apr. 2015 | | $ | 1,062 |

| | $ | 574 |